- What is Dubai DFSA?

- Why trade with a DFSA-regulated broker?

- DFSA Brokers Requirements and Regulation

- DFSA Customer Support Service

- List of Regulated Forex Brokers

- Conclusion on DFSA

Introduction to DFSA

| 📚 Formed: | 2004 |

| 🏦 Jurisdiction: | Dubai International Financial Centre (DIFC) |

| 🏢 Headquarters: | Dubai, United Arab Emirates |

| 🖥 Website: | www.dfsa.ae |

| 🛡️ Is DFSA Broker Offshore or Top-tier Jurisdiction? | Top-tier |

| 🔒 Is Top-tier Jurisdiction safe to trade? | Yes |

What is Dubai DFSA?

The Dubai Financial Services Authority (DFSA) is an independent financial regulatory agency established in conjunction with the creation of the Dubai International Financial Centre (DIFC) in Dubai, United Arab Emirates (Read our article about UAE Brokers). The DIFC, established in 2004, was designed to facilitate an environment where the economy and finance could flourish under its own civil and commercial laws, serving as a prominent business hub for the Middle East. Given the region's conservative approach to business and governance, there was a need to establish an area where Sharia laws could be adhered to while accommodating global firms and entrepreneurs seeking to establish an international business presence.

- This strategic move has proven to be highly successful, with the DIFC experiencing remarkable growth and contributing to Dubai's overall development across various sectors. It is important to note that the DIFC operates separately from the UAE's federal Securities and Commodities Authority, which oversees the regulation of the entire UAE economy. However, within the DIFC, the DFSA ensures the implementation of regulatory standards on an international level.

- The DFSA's regulatory framework mandates financial firms operating within the DIFC to obtain financial service authorization. This requirement applies to a range of entities, including banks, brokers, trading dealers, asset managers, wealth managers, corporate financiers, and insurance companies. Companies established within the DIFC are permitted to have foreign ownership and are subject to a civil, commercial, and regulatory environment like the legislation in the United Kingdom. The DFSA operates a regime similar to the Markets in Financial Instruments Directive (MiFID) and provides protective measures that enable market participants to engage in professional market activities or, if endorsed, conduct retail business or trading.

Why Trade with a DFSA-regulated Broker?

Dubai holds a significant position in the financial world, serving as a major financial centre and attracting wealthy traders, investors, and businessmen. As an Islamic State, Dubai operates under Sharia laws, which also apply to business models and money management. Although Sharia laws are known for their strict nature, Dubai has made progress by allowing certain advancements that were previously unavailable. The option of foreign ownership in Dubai provides companies with favourable conditions such as low taxes and extensive business opportunities while experiencing minimal government interference.

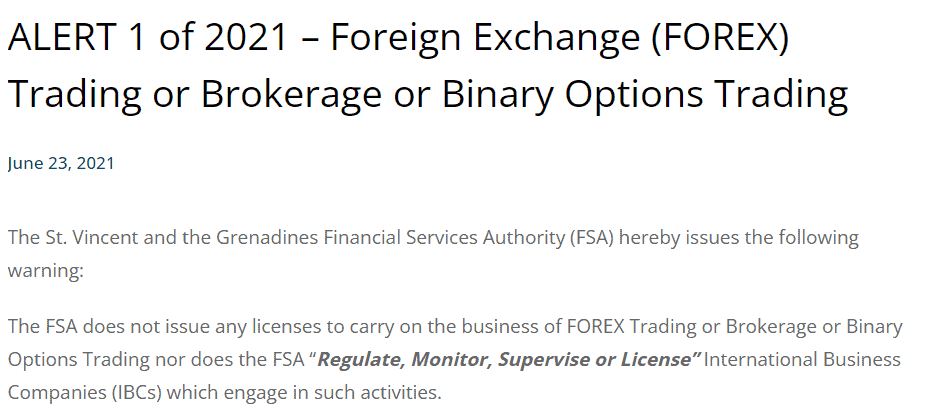

So, what does this mean for Forex Brokers? Dubai has welcomed international investors, offering them the chance to establish businesses and gain access to some of the world's most affluent investors. Consequently, numerous brokerages have either set up branches or strengthened their presence in the region. However, there have been instances where companies have chosen not to acquire the necessary regulatory status to become authorized brokers in Dubai, thereby creating a trading environment according to their own preferences. This approach carries significant risks as it exposes traders to potentially fraudulent or scam operations, which unfortunately still exist in the Middle East, including Dubai.

- The Dubai Financial Services Authority (DFSA) is a reputable financial regulatory authority that aims to protect investors and maintain market integrity. By choosing a DFSA-regulated broker, you can have confidence in the broker's adherence to stringent regulatory standards and their commitment to safeguarding client funds.

- DFSA-regulated brokers must comply with international standards and best practices in the financial industry. This includes robust risk management procedures, transparent pricing, fair trading practices, and adequate capitalization, which contribute to a more secure and reliable trading environment.

- DFSA-regulated brokers are subject to regular audits, inspections, and ongoing supervision by the DFSA. This oversight ensures that brokers operate in a transparent manner, with accurate reporting and disclosure of information to clients. As a result, you can make more informed trading decisions and have confidence in the integrity of the market.

- In the event of any disputes or conflicts between traders and DFSA-regulated brokers, the DFSA provides a platform for fair and impartial resolution. This can help protect your rights as an investor and provide a recourse mechanism in case of any issues that may arise during your trading journey.

- DFSA-regulated brokers are required to meet certain capital adequacy requirements to ensure their financial stability. This helps to mitigate the risk of broker insolvency and provides additional assurance that your funds are held with a financially sound institution.

DFSA Brokers Requirements and Regulation

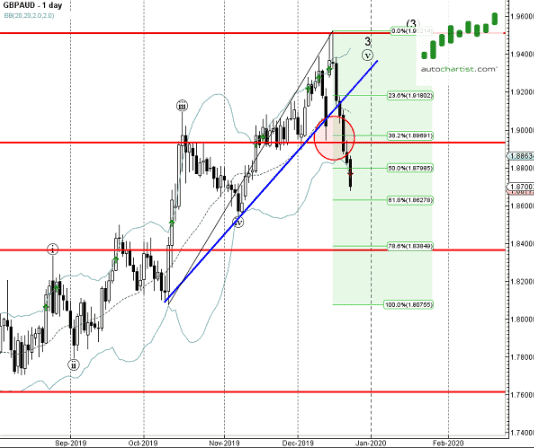

Let's take a closer look at the requirements for companies to become authorized DFSA brokers and how the regulatory authority aims to enhance professionalism and efficiency in the trading environment. The DFSA possesses the power to govern the activities and conduct of market participants, with a specific focus on brokers. Initially, when the DFSA began regulating the market, the emphasis was on professional clients, which influenced the requirements and operating model of the authority. However, as the number of retail investors grew significantly over the years, the DFSA made substantial changes to adapt the regulations accordingly. These changes included a requirement for companies to have over $1 million in liquid assets, excluding the local currency (UAE Dirham). If a company caters to retail clients, additional endorsements are necessary to ensure clear and transparent offerings, fostering fair competition and imposing restrictions on marketing or misrepresentation of facts.

- Naturally, the high requirements were not warmly received by brokers, resulting in many operating without proper authorization. Recognizing the risks associated with retail offerings and the growing demand, the DFSA implemented new requirements and introduced additional measures and controls. Recently, the application fee has varied depending on the financial service, ranging from $15,000 to $17,000. The accreditation process now focuses on assessing the essential skills and professionalism of staff and top management. Moreover, strict compliance is enforced regarding brokers' money management. It is imperative for companies to strictly segregate clients' funds and provide risk disclosure statements under the supervision of the respective regulatory body.

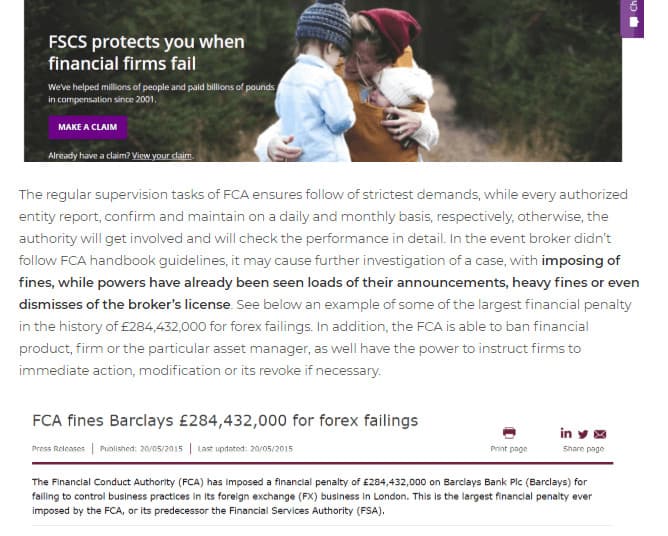

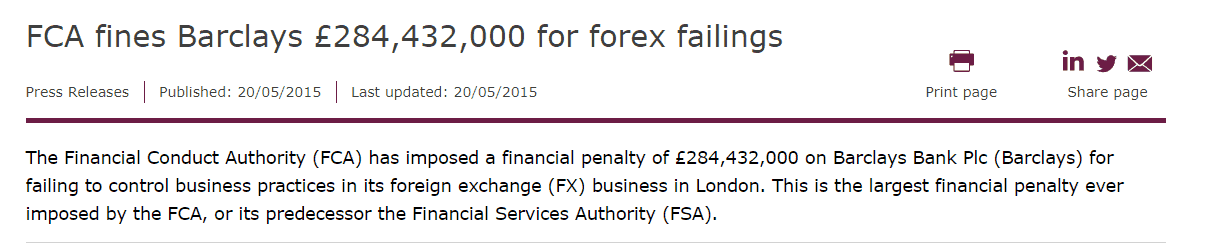

- The DFSA's regulatory framework shares similarities with that of the United States, particularly with the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). This close alignment with international jurisdictions allows the DFSA to cooperate effectively. Brokers can choose to follow regulatory guidelines adopted by the United Kingdom, the United States, or Cyprus. However, the DFSA maintains certain trading restrictions, such as offering SWAP free accounts for Islamic traders in adherence to Sharia laws and implementing higher minimum margin requirements (ranging between 2% and 5%), thereby reducing potential leverage. Furthermore, regulated brokers are obligated to provide regular reports on audits and performance, maintain transaction records, and ensure compliance with DFSA guidelines. Failure to comply may result in fines, penalties, or even dismissal.

- Consequently, the implemented regulations and requirements highlight the DFSA's commitment to improving its services and positioning Dubai and the Middle East in the global trading and financial markets. In 2017, the DFSA conducted a review focused on financial crimes to identify areas that required improvement. The review highlighted the need for better analysis and management of money laundering risks, the application of robust systems and controls for transaction monitoring, and the implementation of stricter policies and procedures for client interactions. Based on these findings, the DFSA initiated several actions and increased its focus on financial compliance in line with international standards. The regulator emphasizes the importance of implementing efficient processes, actively participating in development initiatives, fostering internal procedural enhancements, and continuously improving requirements and making amendments when necessary.

- Additionally, the updates reveal that Dubai authorities have entered into an agreement with the Monetary Authority of Singapore (MAS) to foster cooperation and develop an environment conducive to the sustainable growth of financial services through technology. This agreement aims to promote innovation and the application of fintech solutions on a global scale between the two markets. In simple terms, this cooperation mechanism will facilitate business interactions, and encourage the adoption of cutting-edge technologies like digital payments, blockchain, and flexible platforms. The general trend indicates that international regulatory authorities from respected markets and jurisdictions are increasingly engaging in cooperation and joint planning to enhance overall financial stability and integrity across markets. Such collaborations foster long-term relationships between parties, provide a solid foundation of protective tools and measures for investors and traders, and promise further improvements in services.

Read more about DFSA and MAS agreement: https://www.dfsa.ae/news/dfsa-and-monetary-authority-singapore-sign-fintech-agreement

DFSA Customer Support Service

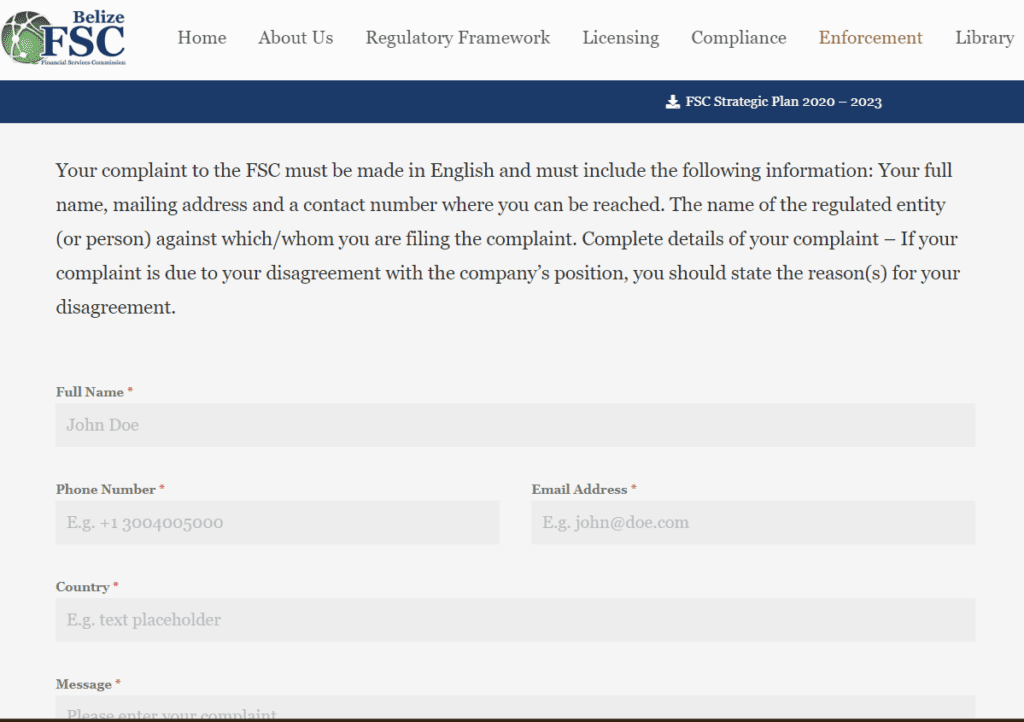

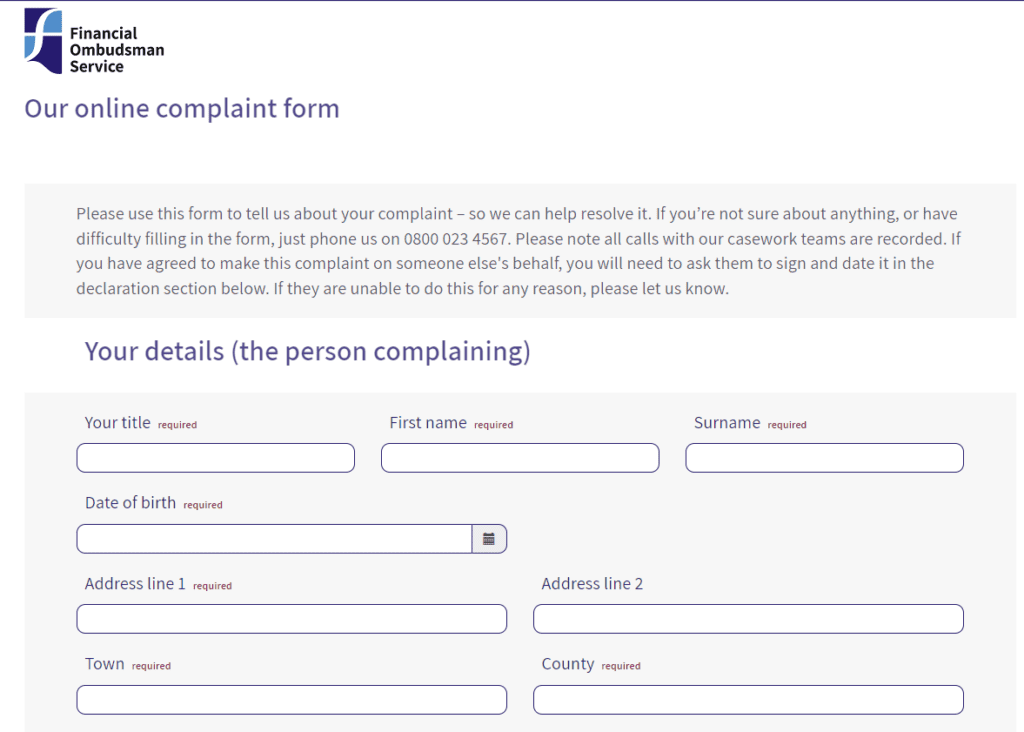

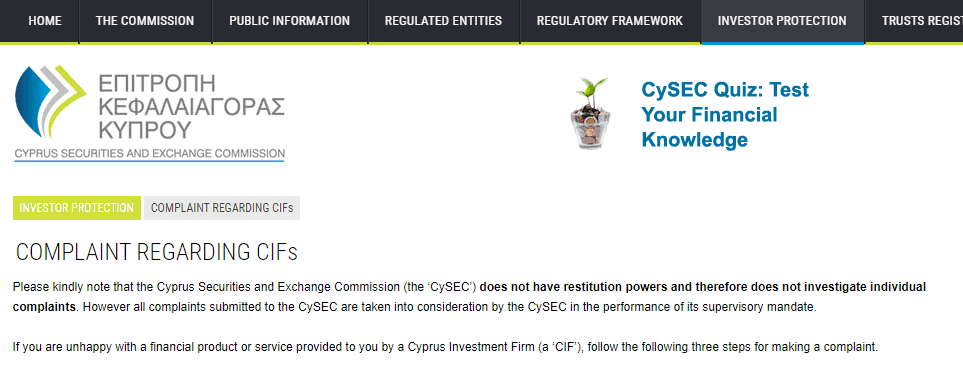

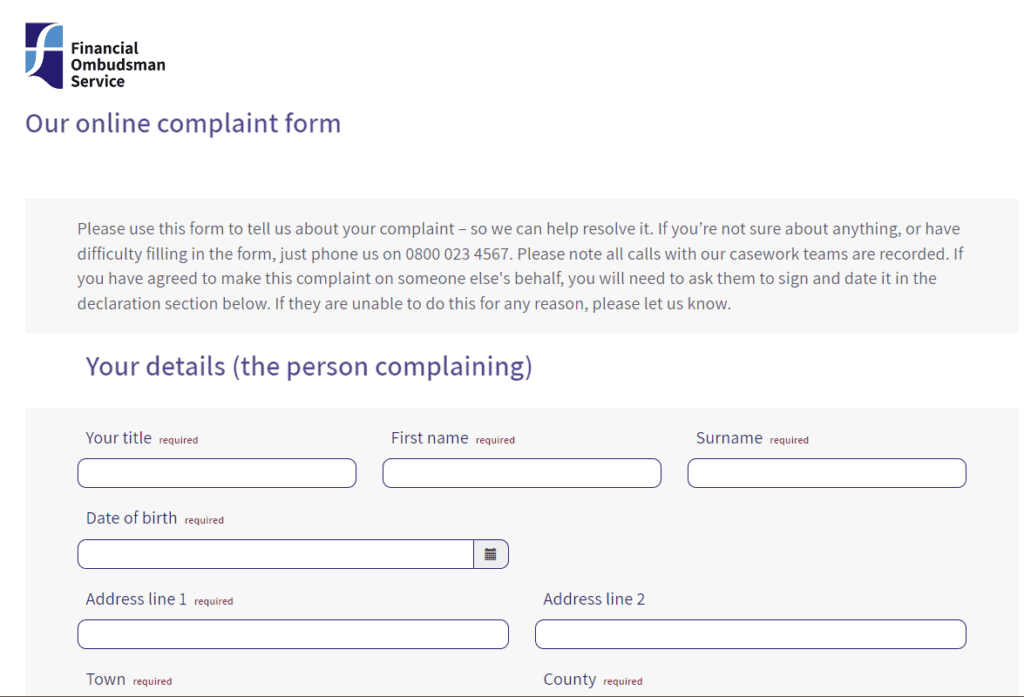

The DFSA regulated brokers surely do have a procedure to resolve client disputes, yet investors can go further and submit a complaint. With all regulatory guidelines, if a trader or investor believes in unfair trading experience with the broker, or reach out the fraudulent activity, violation of the laws they can file a complaint directly to the DFSA. The trader should describe what has accrued, provide evidence of events, attach documents if applicable and include details of the situation or another, while DFSA will investigate the case further.

Submit the complaint about DFSA broker or company: https://www.dfsa.ae/Consumer/Complaints

DFSA also gives direct input to the traders through the official website and served sources, to promote understanding of the financial market and necessity of regulation, with an aim to maintain confidence in the DIFC industry. The permanent support of DFSA allows one to check on the latest regulatory news, understand the basics of investing, provides guidelines on how to avoid frauds, as well as gives advice in order to resolve complaints or disputes.

The traders can also contact authority directly to verify or consult on supervised firm, as well to receive an answer to an appeared question. The DFSA online form: https://www.dfsa.ae/Contact-us/Supervised-Firm

List of Regulated Forex Brokers

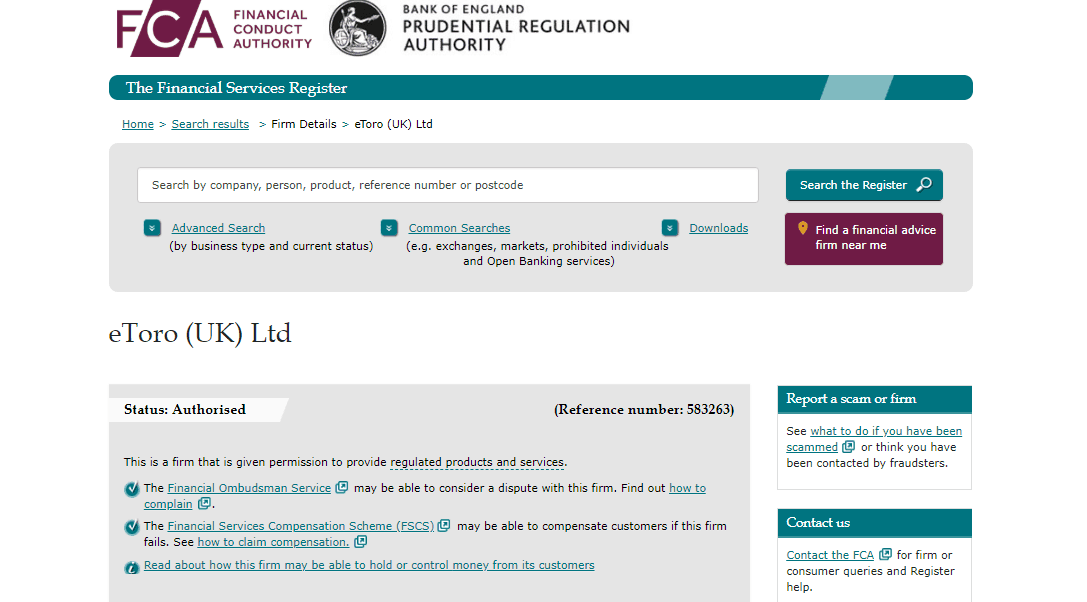

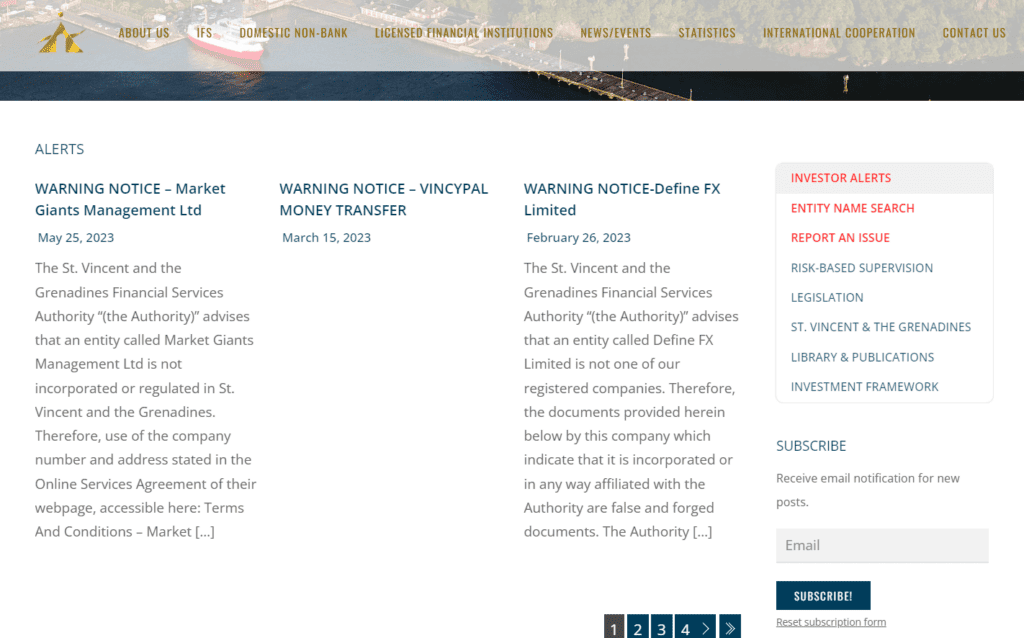

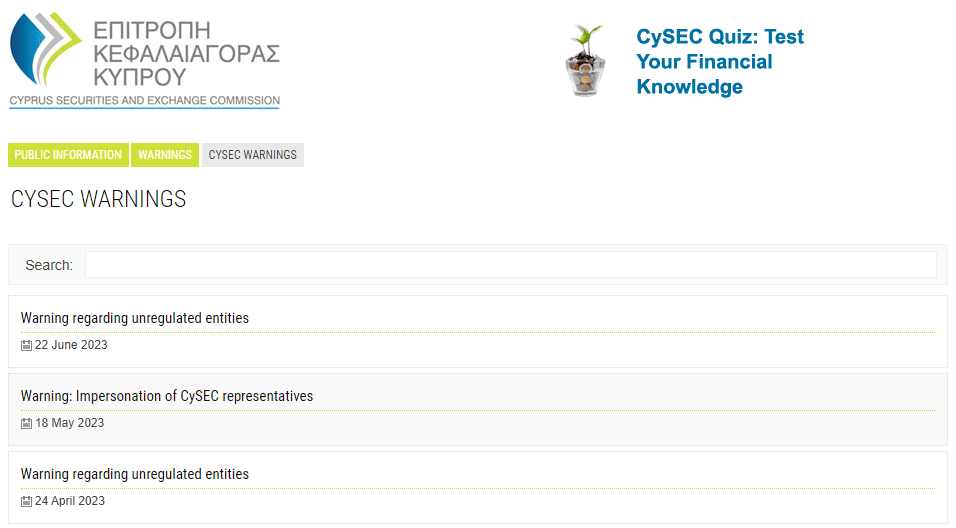

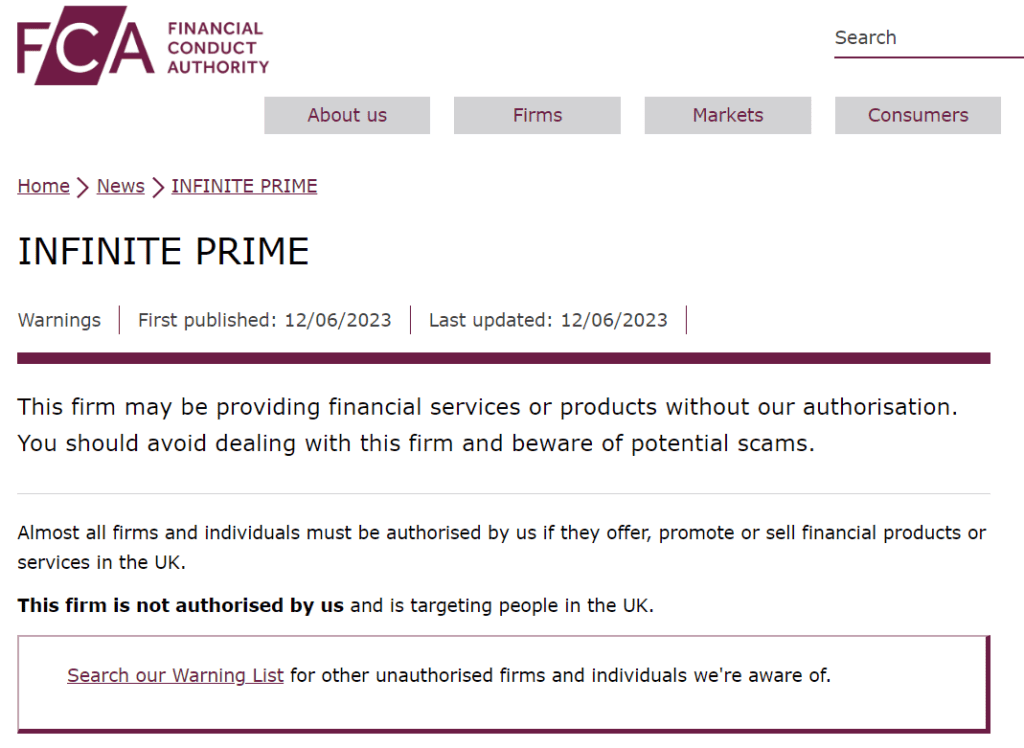

As the fraudulent activity of forex brokerages and investment firms in Dubai still remains at the high level, the potential investor should stay attentive to common scam signals like unfamiliar calls with incredible opportunities or complex investment as well as not trust in everything said. And of course to avoid by any mean unlicensed or unregulated brokers.

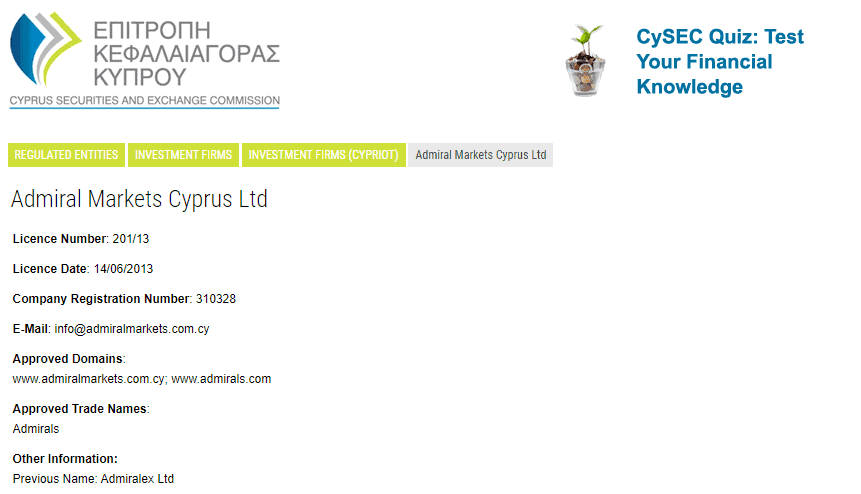

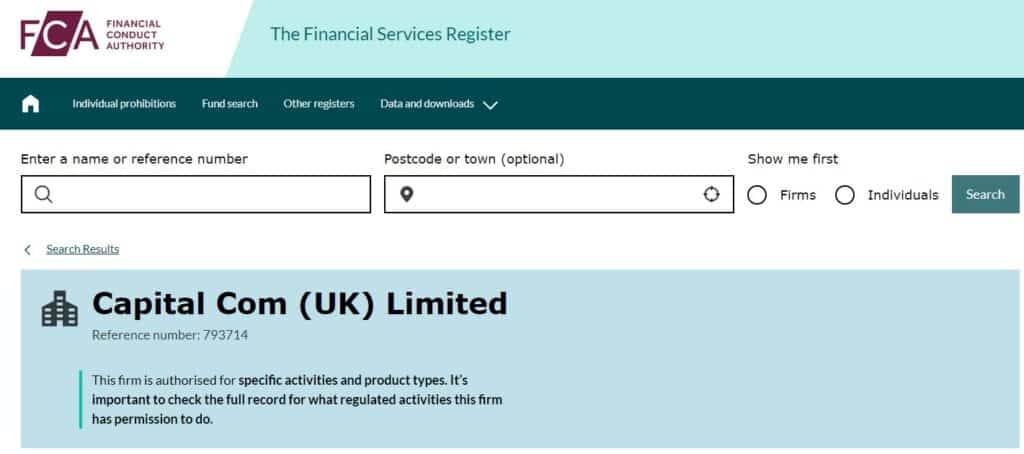

In order to check on the company or another, which is the necessary step, the DFSA online listing carefully appears the forex broker license details and information, which is available on the DFSA Public Register.

In general, DFSA oversees over 600 entities and authorized hundreds of brokers, while also is responsible to regulate financial and ancillary services, supervise and enforce anti-money laundering (AML) and counter-terrorist financing (CTF) requirements applicable in the DIFC.

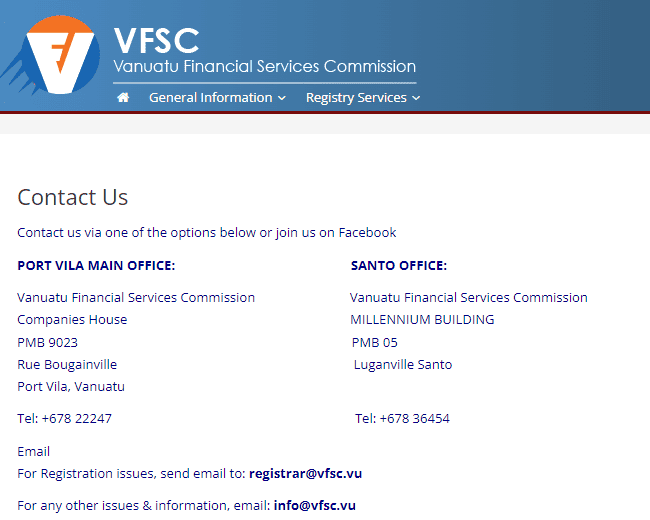

In order to choose on the best broker or to check the company, you should also read DFSA Brokers Reviews and get updated information from the engaged traders and other participants. For instance, our website designed to assist in market data includes hundreds and growing of Regulated Brokers Reviews along with Brokers to Avoid, and other useful data (Read Why you should avoid brokers from Vanuatu).

Conclusion on DFSA

As Dubai investors face some problems and fall victims of numerous frauds due to a possibility to enable brokerage firms without DFSA regulation, it is advised to choose only those firms that hold the necessary operation license and are authorized. Important to mention, the issues appeared only with non-regulated firms operating in Dubai.

As Dubai Financial Services Authority ensures highest quality services to the customers through its strict regulation and constant, very promising improvement, high liquidity proposal, software quality and reliability, safety data and banking, as well as customer care standards. At instance the protection by the applicable laws usually available only with the DFSA regulated brokers. Therefore, DFSA truly helps Dubai and Middle East markets to progress in the industry and make the necessary steps in order to facilitate strong position and a transparent possibility of the international offering towards investors and traders.