-

Updated:

Forex Trading: Why Avoid Brokers from St Vincent & The Grenadines

- What is SVG FSA?

- Why not trade with an SVG FSA registered broker?

- SVG registration requirements and its “regulation”

- Is there a way to submit complaint to SVG FSA?

- List of SVG Forex Brokers

- Conclusion on SVG FSA

Introduction to SVG FSA

| 📚 Formed: | November 12, 2012 |

| 🏦 Jurisdiction: | St. Vincent and the Grenadines |

| 🏢 Headquarters: | Kingstown |

| 🖥 Website: | www.svgfsa.com |

| 🛡️ Is SVG Broker Offshore or Top-tier Jurisdiction? | Offshore |

| 🔒 Is Offshore Broker safe to trade? | No |

| ⛔️ Type of License for Brokers to Avoid | Offshore License/ No License |

What is SVG FSA?

St. Vincent & the Grenadines or SVG through increasing demand for the financial sector and offshore zones itself created the Financial Services Authority FSA with a responsibility to regulate non-bank, certain entities in the financial sector and control the international financial services industry.

- SVG FSA was established in November 2012, with a mission as the authority mentions on its official website - to develop, regulate and supervise St. Vincent and the Grenadines as a secure and competitive financial center in the international and the financial sector in accordance with best practices.

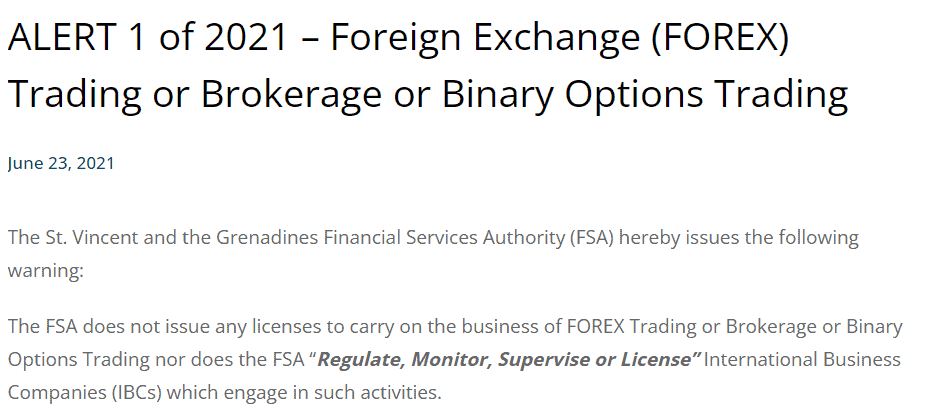

- However, Forex Trading or Brokerage activity, which is the main topic in the financial investment world and also rapidly growing in its demand, does not have a solution for the regulation of Forex, CFD, and Binary Options in SVG.

- The regulation or even licensing of the Forex business is not a part of the SVG FSA activity, as stated by the official warning.

- “There are financial institutions out there that falsely claim they are registered or licensed in our jurisdiction. Their purpose for doing this is more than likely for illicit reasons and potential customers should be very cautious about conducting business with them.

FSA, St Vincent and the Grenadines. (Learn more about SVG FSA Function Role)

Is SVG Broker Scam or Safe?

St Vincent and the Grenadines of SVG is an island in the Caribbean, which became quite a known location for its tax haven offering out of the international companies. St Vincent is indeed an attractive solution among financial companies and those businesses that for one reason or another choose to operate through an offshore company.

- Since the jurisdiction itself offers easy-to-achieve setup demands through a very quick, simplified process, while the firm does not necessarily need to operate an office in SVG, allows to maintain low initial capital, no strict establishment rules or requirements, yet allows running a global business.

- Furthermore, there is no sharp regulation or overseeing of the company operation implemented and Forex Business itself is not regulated, see a snapshot from FSA SVG website below.

- Therefore, Forex business established in SVG is not well regulated in St Vincent, the SVG broker can run its activity, provide trading environments and accept Forex payments through credit cards, but is not overseen well in comparison to the top tier authorities, for this reason, is not safe enough to trade or recommended to sign in. See our list of offshore and Unregulated Broker to Avoid, or Read more about Why Trade with FCA UK Brokers)

Why not trade with an SVG FSA Registered broker?

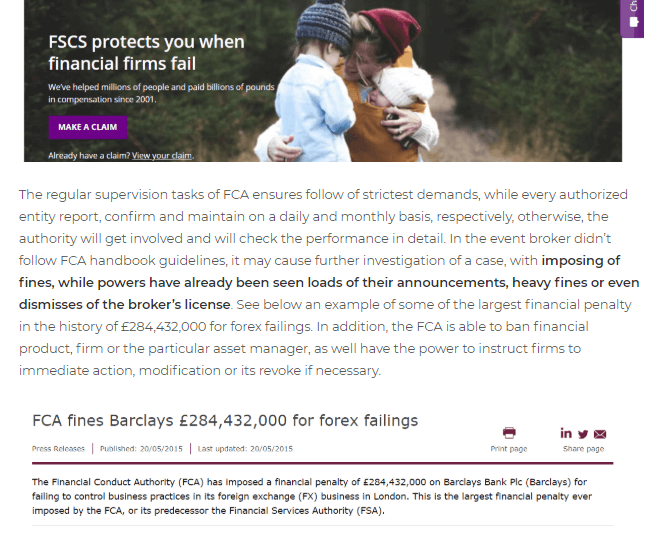

Considering the fact that SVG FSA enables low setup requirements with No business planning, No management interview, or check of the company background. While the registered company operates with No Handbook, No Regulatory Reporting, No Impose of Fines in case of its malicious service and there is no protection implied like Fund Segregation, Negative Balance Protection, or Compensation in case of insolvency. We can not conclude SVG Broker is safe to trade and better advise to avoid them.

- Therefore, apart from beautiful seaside beaches, the SVG with its offshore environment became a known hub of financial firms, while the legal environment can be quite loose towards the Forex business and brokerage itself. For a better understanding check out the UK FCA Authority and its sharp regulation, overseeing of the brokerages, and heavy fines in case of the company fail to obligations, see the snapshot of UK FSCS protection applied too, while SVG Brokers apply none.

SVG Registration Requirements

Obviously, the investment and trading service is a popular trend, however in order not to fall under the scams and frauds, which are in fact growing daily, you should carefully choose a company before any funding is done. Forex and derivatives trading as a decentralized market can be a highly risky opportunity if the company delivers trading service without strict overseeing from the industry authority.

- For that reason, we always advise choosing among the most reputable and of course heavily regulated brokers and to protect yourself from potential scammers. For instance, as an example learn and compare eToro offering and heavy regulation.

- To get more knowledge, you can also read our article Forex Trading Scams and know how to protect yourself, with a deeper understanding of how frauds work.

- In addition, most often an offshore broker alike SVG Brokers are associated with other companies while the offering varies slightly from the majority of frauds, yet the result is equally disappointing. The major concern about lack of regulatory oversight places SVG companies much under the recommended safety line, in essence, you only get the honest word of the company.

Complaints and scams to SVG FSA

We have received many user reviews, while the majority of them are obviously negative. What are the Complaints about? Mainly - Rejects client withdrawal, meaning a client who puts money cannot get profits or funds back. See popular Broker - Olymp Trade and read comments from real traders below.

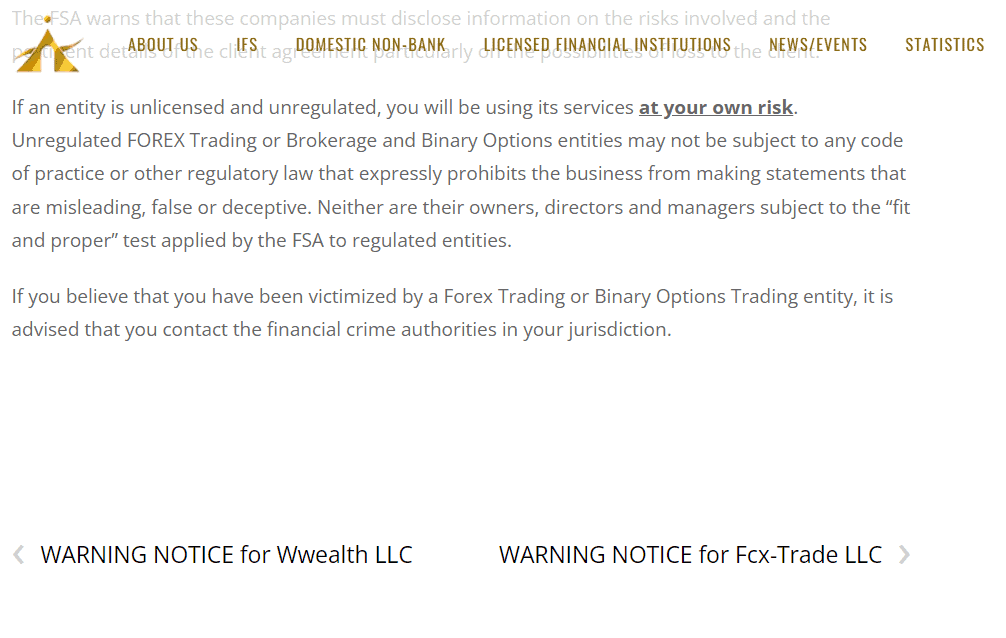

- In case you have negative scenario or behavior from the Broker in SVG, SVG FSA will not be able to assist through customer protection, to advise or take action further, the trader stands completely alone at that point. Therefore, there is no way to complain or receive any support from the authority. See snapshot from SVG FSA about risks involved.

Fake Trading Brokers

In addition, there are many fake brokers stating their address, regulation or registration at SVG, while pretending to be a legit firm but in fact are not.

- SVG authority recognized the risky potential and just warn traders that in case of trading with an unlicensed and unregulated company the trader using the services at his own risk. As an unlicensed or offshore broker most often not subject to any supervision of practice or regulatory laws the company may easily mislead or false any information or the service providing itself.

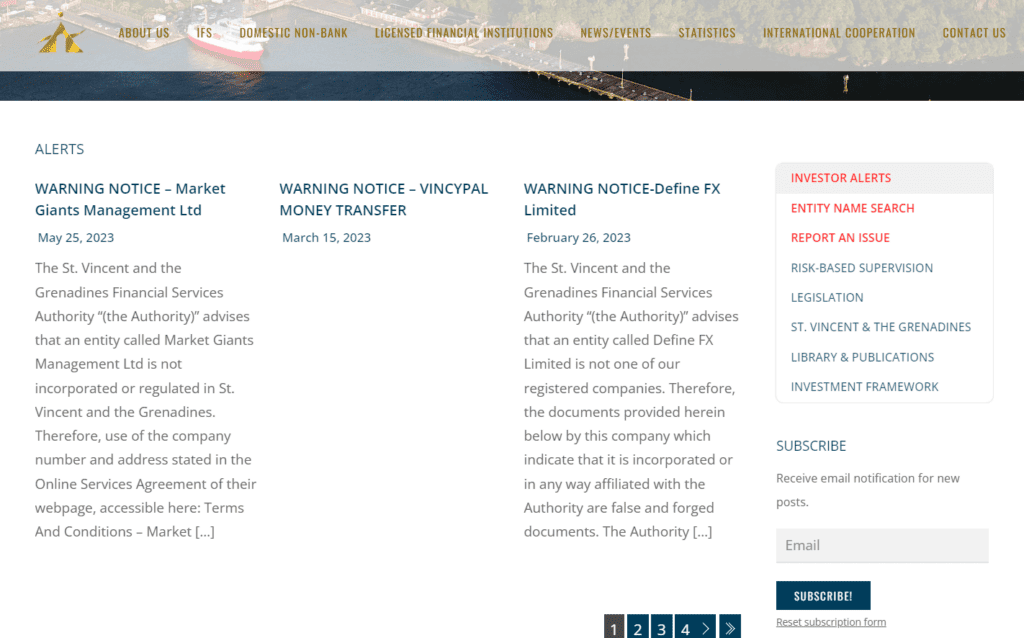

The only way the SVG FSA tries its attempt to protect clients is to place an advise and list entities at the alert area as of the false license claims in the SVG jurisdiction, yet the protection “actions” are ending just by that. SVG FSA - Investor Alerts

List of St Vincent and the Grenadines Forex Brokers

Currently, we have reviewed many Forex Brokers from St. Vincent and the Grenadines, while none of them were included into the list of trusted or brokers with a recommendation of safe trading. The only companies that may be trusted are those brokerages that hold additional licenses from reputable authorities and at the same time run business in SVG for international access, check GO Markets Broker.

- We suggest check on the broker carefully before any sign in is done, revise the broker’s regulation status, its authorization claims, news and reputation by reading reviews and checking on the legit documentation.

- As well, you can find and verify company you concerned about at our regularly updated list of Brokers to avoid or submit your inquiry. Then if you found a broker at the list you better stay away from any cooperation or trading with them at all cost, as listing consists of mainly non-regulated and offshore firms which are not recommended or safe.

Conclusion on SVG regulation

The final thoughts conclude that traders and investors should ensure a clear understanding of the procedures and risks involved while the company or another offering the forex trading opportunity and not properly licensed, or in other words is offshore Broker like SVG Brokers are.

- As of the recent growth of international trend of Forex, trading investors are urged to exercise caution before any sign in or acceptance of the offering. Any broker declares its regulation by FSA SVG, in substance, made a false claim. As it became clear now, why the SVG incorporated firms disclose information on the risks, in particular, the possibilities of loss, therefore we recommend avoiding offering from the brokers mentioning their SVG FCA regulated status.

In order to become a trustable company in providing financial and trading service, the Broker should be sharply regulated and retain a sufficient level of reputation through its operational history. Definitely, it is not a gaining point towards trust to the brokerage that is an offshore-based company and was established with a low registration requirement while none of the protective principles followed.

The security of funds always stands first, therefore, you better consider brokerages from other jurisdictions that maintain a sustainable level of financial and investment services and forex trading in particular through a protective set of rules. For this, we advise finding a broker with licenses from top-tier authorities, such as FCA, ASIC, or CySEC. Sign in only with trustworthy brokers, such as FP Markets, HFM, or recommended brokers by the link.

Anycoin Capital is another scam company. Fortunately I only lost $261, USD

Stay away from them Maya & Max are the two front people used to convince me to open an account & make the deposit from my credit card.

Be away from TRY WIN TRADERS. not allowing client’s fund withdrawal. Cheated me of usd 3000. their email id support@trywintraders.com

What do you say about Omegapro.world? Is it a scam or not?

What do you say about OmegaPro? Is it a scam?

Thanks for your useful information.

Is OmegaPro to be trusted?

AlphaFx Markets limited mentioned in their websites as licenced with St Vincent and the Grenadines with IBC license number 26001 BC 2020. in india especially tamilnadu they make clients. If withdrawal request given they can provide reasons like bank problem, etc etc. So no one opened account with then especially in india

Another name to add here – Tradiso Broker by Nick Nechanicky is a total scam, also only registered in grenadines / st vincent. Don’t trust that firm! friend of mine was completley ripped off by previous trading scams and later blocked by the owner…

Please advise Sapphire Markets, company number 78896548 (trading as CFX GOOBAL)

hola hice un deposito en el broker GRAMMARKET con sede en san vicente y las granadinas y dice estar regulado por la FCA. despues de Rrealizar alguanas operaciones no me deja retirar los fondos.. de dice que debo invertir hast 5000 dolares.. que el analista no cobrará ninguna comision sino llego a ese monto de inversion. quiero retirar 3600.. me estafaron.. se puede hacer algo que no sea desde lo legal sino desde la billetera electronica?

I want to know about expert option, they claim to be operating under wo labs computing company. Is this expert option legit!???

FXprime.io is a total scam. I lost 85.000 euro. Ryan Reid was my contactperson.

Protradersfx is licensed in St. Vincent and it is a total scam led by one JonasHelman in the UL. I lost $356816 EU.

Now I am broke & need to refinance my house at age 73.

These people need to be caught and pay dearly for their crimes

What the METAFX GLOBAL is scam?

Is Metafx Global LLC with License Number 704 LLC 2020

Is Registered in FSA SVG

Pls advise as they claim the Same

The investmentcentre is based there they are a total scam, do not under any circumstance invest with them.

You will never see your money because they don’t trade on their fake platform.

Fxtime es una estafa,se quedan con tú inversión inicial y todos los beneficios. Son Ana, Rebeca y Victoria, son las estafadoras. Puedo adjuntar documentación

What can you say about lexatrade and their withdrawal tactics

Hi, i just wanto to know that a broker named Meta FX Global working in Pakistan claims registration from SVG..! Is it valid & trustworthy to work/invest in this broker’s given platefor..?

Please I what to know if legacyfx is registered htoker

luxeeforex.com is the same scam – they don’t make withdrawals without next deposit

omegapro.world is scam

Reason?

Mentorfx allegedly based in St Vincents and the Grenadines. I have had nothing but problems with this company, bonuses given without consent, explanation of rules or contracts. Then refusal to allow withdrawal of funds on multiple occasions. I have again stupidly fallen foul of them when they told me I had money in my account but it was locked away unless I paid tax on the trading. I considered it for a day then paid the tax on the understanding that I would then receive the balance back. Now they are saying no and that £15k bonus was applied to my account with a rule that the money had to be doubled. Is there anything I can do to recover my money from this company?

I deposited around $10,000 USD with a lady named Lilly at TraderKing & they’ve been showing me big profitable trades made by her growing my account to $35,808 USD.

Yet Lilly won’t let me withdraw ANY of my funds, at all without 1st having me deposit a further $10,000 USD into their account.

Then after doing this she says within 24 hours they will return the whole total amount of $45,808 into my personal bank account.

Can someone please let me know if they have enjoyed BIG PROFITS returned into their personal Bank Accounts from TraderKing by following this exact practiced method please?

I’M IN THE SAME PROBLEM AS :: TRADERKING; THE DIFFERENCE IS THAT I DO NOT TRUST TO SUBMIT THE CASH FOR A POSSIBLE WITHDRAWAL WHICH I CONSIDER FOR SOME TIME SCAM.

I have had men named Kevin & Andrew (an Australian) calling me from INVCentre showing me big profits from the money I’ve deposited with them yet they won’t let me withdraw ANY of my funds, at all!

Can someone please tell me if they have been RIPPED-OFF by INVCentre or on the other hand, please let me know if they have enjoyed BIG PROFITS returned into their personal Bank Accounts from INVCentre.

I have a gentleman named Jud calling me from Inquot offering meet big profits.

Can someone please tell me if they have been RIPPED-OFF by Inquot or on the other hand, please let me know if they have enjoyed BIG PROFITS returned into their personal Bank Accounts from Inquot.

Thanking you kindly

Please I also want to know if Inquot.com Exist registration number 124 LLC 2019. LLC INQUOT

Is Lexatrade genuine brokers

Can someone help me please want to know if

inquot.com exist as i don’t know to check licence number:25593NYACC3545X

Pls advise CUBE GLOBAL BROKERS LTD IS REGISTERED WITH FSA IN st.vincent and grenadines as they claim same.