Forex Trading: Why Avoid FSC Brokers from Belize

- What is Belize FSC?

- Why not trade with an FSC-registered broker?

- FSC registration requirements and its “regulation”

- Is there a way to submit a complaint to FSC?

- List of Belize FSC Brokers

- Conclusion on Belize FSC

Introduction to Belize FSC

| 📚 Formed: | January 1, 1999 |

| 🏦 Jurisdiction: | Belize |

| 🏢 Headquarters: | Belmopan |

| 🖥 Website: | www.belizefsc.org.bz |

| 🛡️ Is SVG Broker Offshore or Top-tier Jurisdiction? | Offshore |

| 🔒 Is Offshore Broker safe to trade? | No |

| ⛔️ Type of License for Brokers to Avoid | Offshore License |

What is Belize FSC?

The financial services sector of Belize, in particular, international Forex and trading services companies, is a relative newcomer within the financial industry, yet recently expanded Belize economy to a world-recognized hub. The growing demand led to the establishment of Belize FSC, the regulatory body responsible for overseeing and regulating the financial services industry in Belize.

- Belize as an English-speaking country in the heart of Central America obtained its independence in 1981 and since then approaches to diversify its portfolio through various opportunities to international investors and for instance included an attractive offering to firms operating financial services.

- So what makes Belize an attaractive hub for Forex Broker is the possibility, which is based on the offshore concept allows investors to engage in a variety of activities, obtain official status, run brokerage accounts, operate trading services, commission arrangements, and other commercial transactions with lower requirements and lower costs too.

- While developing and through its enlargement of potential, many online forex brokers used a Belizean IBC as a perfect opportunity to run international brokerage service and make authorized financial transactions. Therefore, through its growing demand Belize established independent local authority with the purpose to carry out financial regulation responsibilities including licensing of financial market participants and exchanges, and the supervision of their activities itself. The International Financial Service Commission or IFSC Belize started its operation in 1999 as a government agency to protect the reputation of Belize as an offshore financial center.

- The FSC was initially known as the International Financial Services Commission (IFSC) but underwent a name change to the Financial Services Commission in line with the passage of the Securities Industry Act, 2021.

- Even though, FSC being a self-regulatory body operates through a set of international rules and is in charge of licensing all international financial service providers through a set of requirements designed to ensure compliance. In addition, FSC is powered to impose administrative sanctions and disciplinary penalties for brokerage or investment firms that come under the relevant Belize financial acts, nevertheless, the conditions offered by FSC are far from this strict rules like top-tier authorities provide, therefore can not provide the same level of customer protection alike (Read more about the Core Functions of FSC)

Is FSC Broker Safe or Scam?

In fact, we can say Brokers that are only FSC Belize regulated are safe enough, there is high risk to fall into Scams. Belize serves as a tax haven with strong privacy laws, while these laws legally protect the confidentiality of organization information, preventing disclosure to governmental agencies or other influential countries worldwide. The stringent privacy regulations, coupled with a zero tax regime for foreign income, create an appealing business environment conducive to enhancing profitability and maximizing financial outcomes for companies operating in the region, therefore there are so many Forex Brokers based in Belize.

- FSC promotes its role in identifying and addressing broker scams and unethical practices by companies making false claims. However, there are many concerns regarding the overall effectiveness of these efforts, since they are rather promoting than effective, and in fact many Scammers are operating through Belize

- While the FSC have some limitations in its sharpness or regulation, it still offers certain advantages compared to brokers operating without zero regulation. To enhance trader protection, the FSC publishes public warnings, notices, press releases, and other relevant information on its online platform, so is good at list to check those alerts too.

- The effectiveness of penalties imposed by the FSC in deterring fraudulent activities among FSC Forex brokers has been a subject of concern. The imposed penalties may not be sufficiently stringent to discourage such irregularities, leading to a perception that some brokers may escape significant consequences for their actions. See our list of offshore and Unregulated Broker to Avoid, or Read more about Why Trade with FCA UK Brokers which shows that protective measures taken by the UK regulations which are quite serious and sharp compared to very low provided by FSC.

Why not trade with an FSC-registered broker?

Due to the low setup requirements and limited transparency associated with Belize FSC, along with the perception that regulated companies may face less severe penalties for irregularities and lack features like fund segregation, negative balance protection, or compensation in case of insolvency, it is difficult to confidently assert the safety of FSC brokers. Although, there still can be found companies that offer high-quality trading services through their Belize entity

- Belize is a gorgeous tourist destination, while also tax heaven with a zero tax structure that established its own regulation for financial investment and Forex firms licensing due to high demand and necessity of regulation. Ever since Belize became a known offshore zone and Forex hub, as a destination, attracted thousands of brokerages seeking an opportunity to be legitimate firms, yet to skip complicated and costly establish procedures.

- Therefore, the development of a perfect business environment attracted numerous enthusiasts and made Belize an investor-friendly economy that enables business growth, however, those firms and individuals that are seeking an opportunity to enable easy fraud process were allured to Belize as well. Definitely, it’s a very profitable chance to open a brokerage firm in a destination that saves establishment costs and allows enjoying almost unlimited profits, yet from the perspective of the trader or a client it is necessary to choose Brokerage or Company that is reliable, and unfortunatelly Belize alone can not gurantee this demand

FSC Registration Requirements

So getting back to the point, why an offshore broker or investment firm is not a recommended option to any trader, let us look closely what are the requirements to become a licensed FSC company, also compared to top-tier Regulations like CFTC in US imposes:

- Setting up a Forex brokerage in Belize is known for its relatively low costs, making it an attractive option for brokers with limited initial capital. The minimum capital requirements are typically lower than the industry standard, and the regulatory system is often characterized as less stringent. This leniency allows brokers to operate with greater freedom in many financial markets, so can lead to petential frauds too

- First of all the firm should maintain its minimum operating capital depending on the service from $10,000 to $100,000, then pay an international financial service provider fee of $1,000 only! The annual license fee varies on various kinds of financial services that also include Forex, trading securities, derivatives, and financial instruments, while a fee is either $2,500, $5,000, or $25,000.

- Yet, if compared to reputable regulatory supervision, these rates are extremely low, while the costs of setting up are considered to be one of the lowest worldwide. Meaning, the company is not able to operate or guarantee the safest trading environment with such a lack of capital, which even more, brings uncertainty to brokers' performance.

- Moreover, there is no strict requirement for a company to segregate clients' funds from the company ones, a meaning broker can use a trader’s investment for their own purposes, like heavy advertising for example. The broker is not either shall establish a physical branch or office in a destination, while the directors and management would be only slightly checked in terms of their proficiency.

- In regards to audit and control of how the Forex broker or company operates, the FSC does not implement comprehensive reporting demand, so the company can easily hide its true nature of performance.

- Although FSC makes its best to regulate and restrict firms by imposing fines, most FSC brokers get out of unlikely situations quite easily, as fewer standards allow them to enjoy almost free operation in financial markets.

In comparison to trusted authorities in the EU, the US, or other jurisdictions, the regulated broker catered and demanded detailed commitment in regards to trader protection, while FSC companies still operate in an environment sufficiently to fraudulent activities.

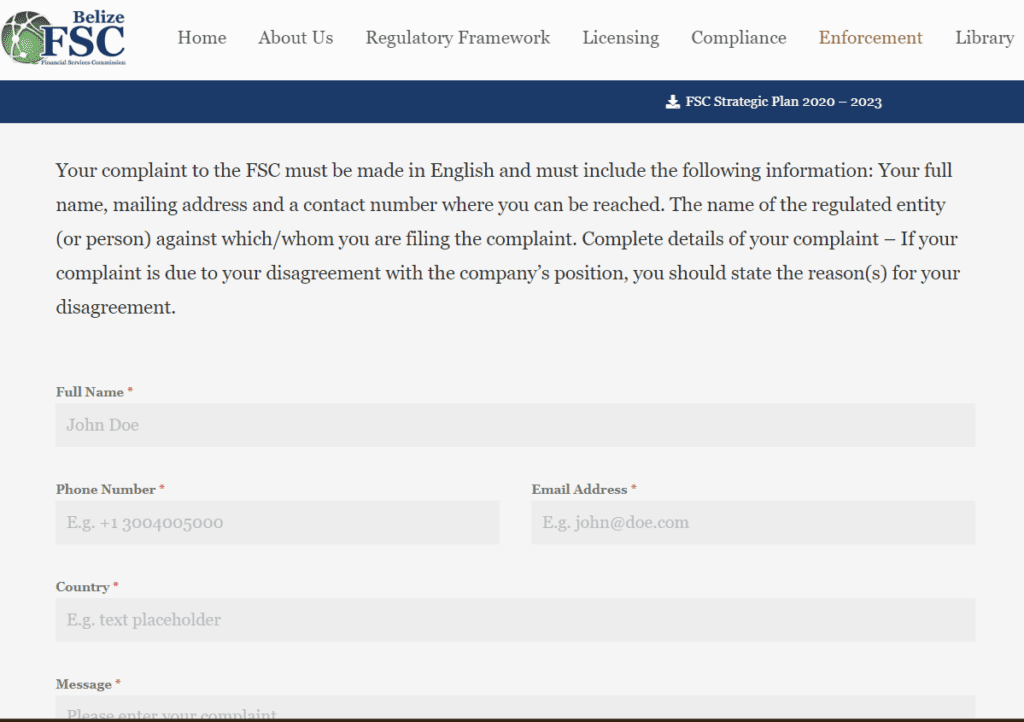

Complaints and Trading Scams

While the main duties of the FSC about the provision of effective services and registration of international companies, and accepting complaints from foreign traders there are many limitations in place, and the complaint process is not so organized like FCA in UK via Ombudesmall Provides (See How to CompLain in FCA website). The trader should first contact his service provider and try to resolve an issue through the company, yet in case you are not satisfied with the handling result move further and contact the authority. The transfer of the complaint to FSC should include detailed data with information on the company complaining, as well as evidence documentation.

Submit a complaint by filling out the form on the website www.belizefsc.org.bz/complaints

Based on the findings, FSC may impose a statement to the company with a requirement for compensation. However, the FSC is not responsible for further compensation, therefore quite often the dishonest brokers disappeared or didn’t take stated action, as the authority can do nothing about it. This means, the trader will remain on his own to resolve the issue further and can only submit a case to the court for appeal.

List of Belize Forex Brokers:

About 50 Belize Forex Brokers were reviewed by us, in fact, most of them appeared in the list of Brokers to avoid as the implemented safety measures do not allow us to trust them. Thus we do not recommend trading with them and advise you to consider only those that hold additional licenses or are regulated by trusted jurisdictions. (Check Scope Markets)

- As for the Belize Trading Brokers we do not advise trading with solely Belize Regulated Brokers, as risks are very high. We strongly recommend conducting thorough research before engaging with any broker. It is crucial to carefully assess the broker's regulatory status, review their authorization claims, stay updated on relevant news, and consider the reputation of the broker by reading reviews and verifying their legitimate documentation.

- However, currently, there are international brokers that do hold multiple licenses, including FSC one, and are regulated by other respected jurisdictions, which allows them to deliver good environment for trading and offer services internationally. Therefore, is better to choose a broker and forex trading provider among existing testimonials and consider only those that are regulated. Check out our recent articles about FCA, or other serious authorities to see the difference between the implemented regulations. Sign in only with trustworthy brokers, such as FP Markets, HFM, or recommended brokers by the link.

Besides, FSC provides by itself a list of licensed service providers are regularly update it through an official website and available for verification at all times. Check the list of licensed service providers on FSC website, see note from FSC below:

“Investors and other users are warned not to deal with any entity whose name does not appear on the list for the service or business in question. It should also be noted that under the laws of Belize, a separate license is required for each kind of service or activity.”

Conclusion on FSC Regulation

Forex trading witnessed thousands of scams and numerous malpractices that were taken by unethical brokers, while in fact the majority of them were indeed located in an offshore zone and known heavens with zero taxes. The most dishonest ones always seek the easiest way to establish an alleged legal firm, through a license that does not implement strict regulation or reporting.

- The fraudulent activities are carried out in a most sophisticated way and it’s been hard to detect where the offering coming from. Therefore, traders should always be aware of these firms that corrupted the image of Forex trading and trust only well-regulated brokers incorporated and heavily regulated by known authorities like the UK’s FCA, Australian ASIC, and similar.

- Considering the fact that FSC has not implemented the strictest standardization that may guarantee the trustable provision of Forex or trading service delivery, we do not recommend choosing among FSC companies. Although, a newly implemented increase of the capital requirement definitely assists in a further decrease of new suspicious brokerages establish and those firms that seeking an easy solution to skip regulation.

Скажите пожалуйста что такое belize ifsc

Can you tell me if Tdtrade is licensed or regulated here

Hello, Ok kindly wish to know if the Crypto company- Royal Crypto Investment is regulated by your company.

Been scammed by global trade atf operated by bayline trading. Wanted me to deposit more and more and lost everything. My question to all banks. Why do they allow fraudulent businessesin Berlize to have a registered bank account. The banks should also be the ones trying to keep these guys out to protect clients

I have been scammed by InvestMarkets.com broker company licensed by IFSC from Belize”, I lost in one week ogmf joining them and doing their broker’s instructionson their robot trade system lost alot of money, they force you to deposit more and more… please advice me what to do .

Wrote to their support team, no reply , which I am not surprised about.

Please advice me what I can do to recover my money, meanwhile they continue cheating more and more people.

Bit fx investment management company. Is it regulated. Is it safe to to invest to it.