Forex trading is very profitable but also highly risky and prone to fraud. In a market as vast as the forex, with little regulation and oversight, how long will it take for fraudsters to create new means of robbing innocent traders? Today’s article outlines some ways of preventing forex frauds. This article aims at helping you understand how to identify forex frauds, what they involve such as pyramid schemes, signal service scam or fake trading robots, and ways of avoiding such frauds. In addition, we cannot forget the importance of trustworthy brokers who keep your investment safe. Moving on well-informed about the aforementioned factors will make your journey in the forex market confident and safe.

How To Detect Forex Scam

In order to keep your investments safe and have a trading experience that is secure, it is important that you can recognize when someone is trying to scam you in the foreign exchange market. Deception of traders by fraudsters using highly sophisticated methods is very common. However, being keen with some tips can help one identify potential forex fraud so that they do not become a victim. There is no legit scam brokers forex list because scammers appear and disappear every day and it is impossible to monitor such a vast market. That’s why we prepared some tips. This is how you can identify forex scams:

1. Check the Broker’s Regulatory Status

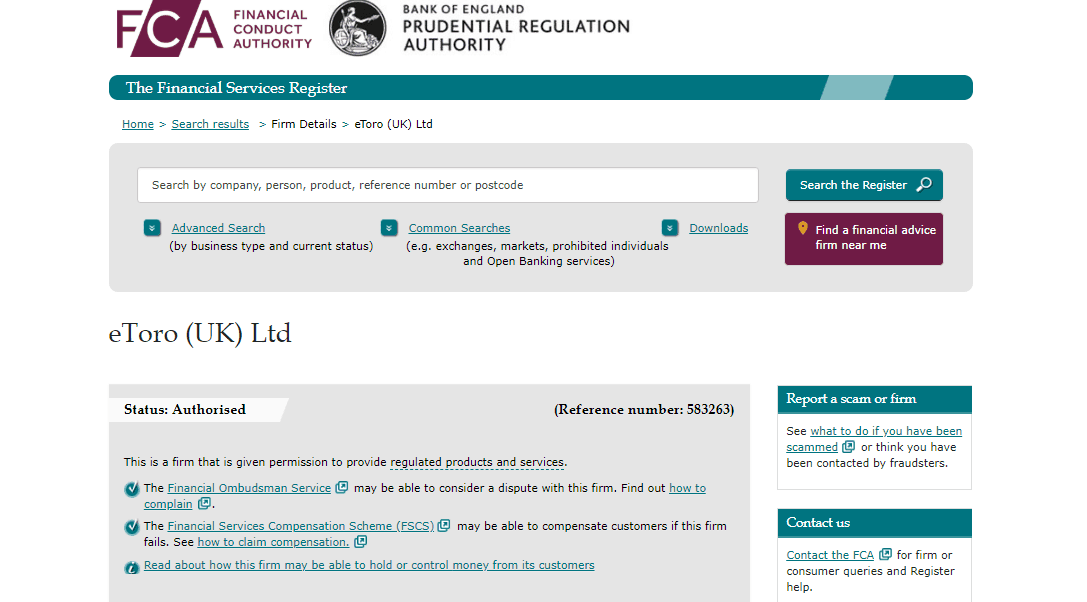

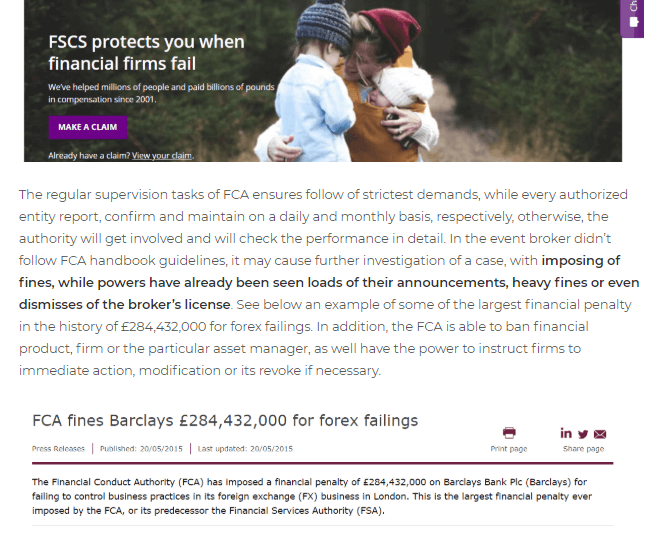

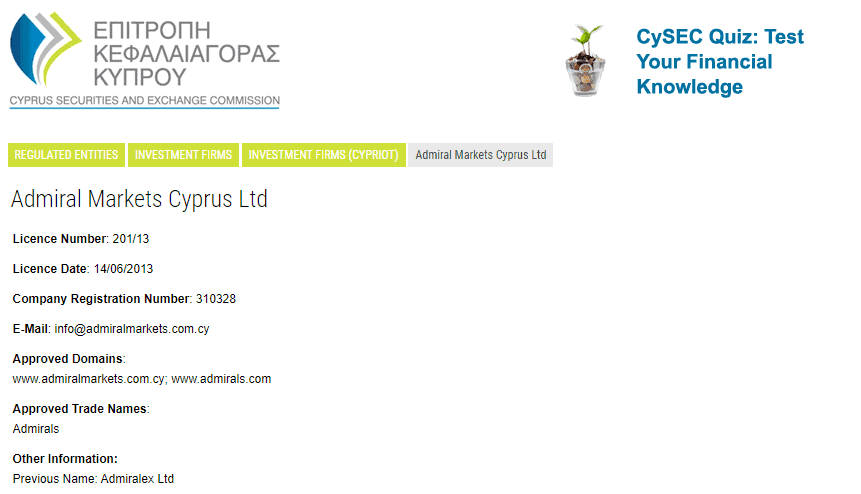

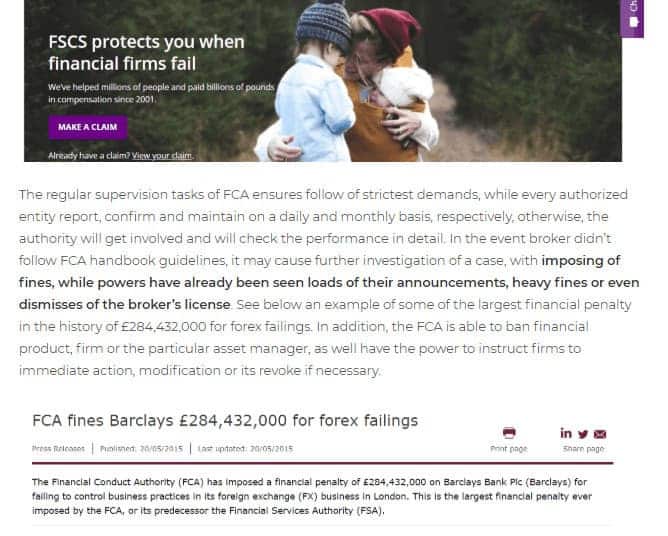

To detect a forex scam, one must initially confirm whether the broker is under some regulation or not. A legitimate forex brokerage is one that is regulated by well-known financial regulators that have put in place stringent measures for the protection of traders. Some examples of such authorities are The Financial Conduct Authority (FCA) located within the UK, Commodity Futures Trading Commission (CFTC) in US and Australian Securities and Investments Commission (ASIC) situated in Australia.

- How to Check: Visit site of the regulatory body and use their search tool to verify the broker's license. If a broker claims to be regulated but does not appear in the regulator's database, it is likely a scam.

2. Thoroughly Examine the Broker’s Website

A broker’s website can provide several clues about its legitimacy. Scammers often create websites that look professional but lack substance and transparency.

Red Flags to Look For:

- Lack of Contact Information: Legitimate brokers will provide clear contact details, including a physical address, phone number, social media and customer support channels.

- No Regulatory Information: On a good broker’s website, there should be a display of the license numbers and regulatory data. Failure to find such information is a serious indicator of scam.

- Too-Good-To-Be-True Promises: Be cautious of websites that promise guaranteed profits with little or no risk. Forex trading is inherently risky, and no legitimate broker can guarantee 100% profits.

3. Review the Trading Conditions

Unrealistic trading conditions like very low spreads, high leverage and overly generous bonuses are some of the bait used by forex fraudsters to attract traders.

What to Check:

- Spreads and Commissions: Compare the broker's spreads and commissions with industry standards. Extremely low or zero spreads might indicate a scam.

- Leverage: Trading with high leverage increases the possibility of high profits as well as high losses. It is a common strategy for forex scammers to provide unreasonably high leverages with the aim of attracting traders.

- Bonuses and Promotions: It is important to be cautious when a broker provides huge bonuses or promotions as they may not be what they seem. Such rewards usually come with some terms and conditions that are meant to make you lose your money in the end.

4. Research the Broker’s Reputation

The forex trading community is vast, and other traders' experiences can provide valuable insights into a broker's legitimacy.

How to Research:

- Online Reviews and Forums: Look out for reviews at independent websites, forums as well as social media. Be particularly wary of repeated complaints, especially about issues like withdrawal problems, account manipulation, or poor customer service. Also there might be a broker offering or a list of trustworthy brokers.

- Scam Alerts: Ensure that there are no warnings or scam alerts from the authorities and consumer rights organizations. It is common for many regulatory bodies to publish a scam brokers forex list

- Community Feedback: Be part of trading communities or forums which enable you to inquire about other peoples’ encounters with given brokers.

5. Analyze the Broker’s Communication

A broker’s communication is very important in determining if they are real or just out to get your money. Scammers often use high-pressure tactics to push you into making quick decisions.

What to Watch For:

- Unsolicited Calls or Emails: Be cautious if you receive unsolicited calls, emails, or messages urging you to invest quickly. Honest brokers are not known for using such high pressure sales tactics.

- Pressure to Deposit Funds: A broker is not to be trusted under any circumstances where he/she forces you to deposit more funds urgently or take advantage of the “limited time offer”.

- Complex or Confusing Language: Fraudulent brokers usually employ complex and incomprehensible language in their terms and conditions so that traders would not be able to see through hidden charges or unfavorable terms.

6. Test the Broker’s Platform

Before investing a lot of money, it is advisable to test the broker’s trading platform using a demo account or by making a small initial deposit. By doing this, you will be able to see if the platform functions well and if the broker can be trusted.

Things to Test:

- Ease of Use: A legitimate broker’s platform should be user-friendly and responsive.

- Execution Speed: Check how quickly trades are executed. Delays in trade execution can indicate price manipulation or poor platform performance.

- Withdrawal Process: Test the withdrawal process with a small amount to see if you encounter any issues. Scammers often make it difficult or impossible to withdraw funds.

7. Be Wary of Signal Services and Managed Accounts

Signal services or managed accounts are some of the ways that forex scammers often use. They claim to be offering trade signals or trading on your behalf in such accounts.

Key Considerations:

- Performance Claims: Be skeptical of any service that claims guaranteed profits or consistently high returns. These are often fabricated results designed to lure in victims.

- Transparency: Legitimate signal services or managed accounts should provide clear, verifiable performance data and be willing to explain their strategies.

- Regulation: Managed accounts should be operated by individuals or firms regulated by a recognized authority. Unregulated services are a significant risk.

The Most Common Forex Scams

Pyramid Schemes

The promise of huge returns is used to trap people into giving money for nothing in a pyramid scheme which is just one form of financial fraud. This plan works in a very simple way: a person will be asked to give a little amount as an investment and then bring in other people who will also give out money under the same pretense. The cash that the new entrants deposit is then apportioned as profits among the first investors, appearing that there are profits in the investment. Nonetheless, such schemes cannot last long because they depend on continuously bringing in new members to operate. This is where most participants lose out once again; at some point, the whole system collapses due to slow recruitment and fails to work any longer.

Within the foreign exchange market, pyramid schemes portray themselves as genuine trading chances or investment plans. Fraudsters can describe this as a managed forex account, an elite trading circle, or high-yield investment program. Normally, participants have to put some money into it at the beginning but they expect that they will also earn very well when they bring others onboard.The emphasis is typically on recruitment rather than actual forex trading, with returns being paid out of new participants' investments instead of profits from trading activities.

Signal Service Scam

Signal services offer trading recommendations that traders can use to make decisions. However, some signal services are forex scams designed to exploit traders. These scams often charge high fees for access to their "exclusive" signals, which are either ineffective or completely fabricated. The victims end up in a situation whereby they make continuous payments for signals that result in more losing trades than gains. Moreover, scam brokers on the forex list may partner with these fraudulent signal services to further exploit traders, making forex scam recovery even more challenging.

Managed Forex Account Scams

Managed forex account scams involve individuals or companies offering to trade on your behalf, promising high returns in exchange for a fee or a share of the profits. While managed accounts can be legitimate, many scams exist in this space. Scammers may fabricate their trading results, use clients' funds for personal gain, or simply disappear with the money. Because these scams often involve large sums of money, forex scam recovery can be particularly difficult, especially when dealing with unregulated or offshore entities.

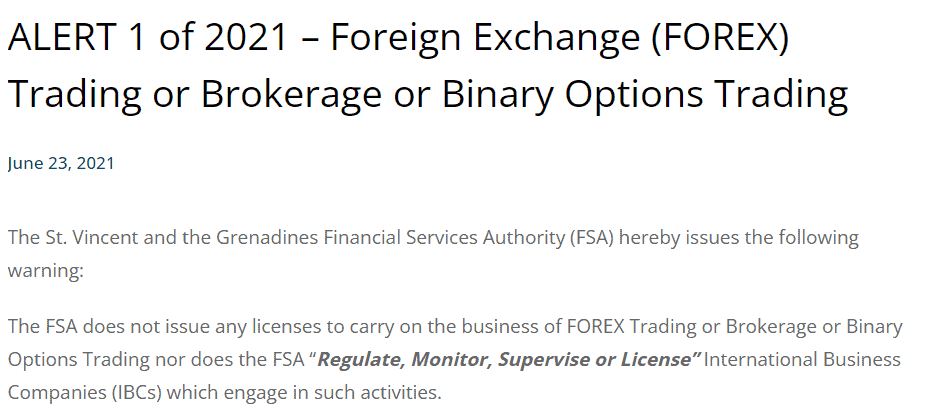

Unregulated Forex Brokers

Operating without the oversight of any financial regulator, unregulated forex brokers pose a great danger to traders. The rules which are supposed to guard on traders like pricing transparency, trade execution ethics, and customer fund safety do not apply with these brokers. Most unscrupulous practices are carried out by unregulated brokers. These actions may include changing prices, denying withdrawal of funds or just simply running away with client’s money. Due to the fact that they do not follow any regulations, it is extremely difficult to recover funds in case of a forex fraud committed by one of these unregulated brokers. So be careful and watch your funds.

Social Media Scam

Forex scams thrive on social media. The so-called get-rich-quick schemes which are publicized through Facebook, Twitter or Instagram by scammers nowadays come along with a very interesting element; it will never be complete if such posts fail to show the fake lifestyles which they fund through trading in forex and which their followers must also identify. They lure victims with promises of high returns and minimal effort, often directing them to scam brokers on the forex list. Once victims deposit their money, they quickly find out that the profits were an illusion, and forex scam recovery becomes a daunting task.

Fake Trading Robots

Forex traders widely use automated trading systems known as “robots”. Despite their popularity among traders, many fraud cases in the forex market are related to fictitious robots with which one can make money easily without doing anything. Such robots turn out to be just one of the many ways through which people are deceived into parting with their funds by being promised that they will earn more money. Those who fall prey under such circumstances soon realize that either the robot is underperforming and losing their investment or it does not even function. As with other scams, forex scam recovery from a fake trading robot is difficult, especially if the scammer has disappeared with the funds.

How To Avoid Forex Scams?

Avoiding forex scams requires a combination of due diligence and skepticism. We have already given detailed instructions on how to detect a forex scam. Unfortunately, we can’t provide you here with scam brokers forex list because new players in this sphere appear every day. We can only give you a piece of advice.

1. Research and Choose a Reputable Broker

The first line of defense against forex scams is selecting a reputable, regulated broker. The legitimacy of your broker is crucial to ensuring that your trading experience is secure.

Steps to Take:

- Check Regulation: Make sure that you always select a broker who is under the regulation of known financial bodies e. g. FCA, ASIC, or CFTC.

- Review Online Feedback: Seek independent reviews and feedback from other traders. Pay more attention to any repeated complaints about withdrawal issues, poor customer service, or suspicious trading practices.

- Avoid Unregulated Brokers: Unregulated brokers do not follow most laws, so it may be almost impossible to get your money back if anything goes wrong. Steer clear from non-transparently regulated brokers at all times.

2. Be Skeptical of Unrealistic Promises

Forex scams often lure victims with promises of guaranteed profits, high returns, or risk-free trading. No legitimate trading operation can guarantee profits, as forex trading is inherently risky.

Steps to Take:

- Question High Returns: If an investment service or brokerage offers very high profits at low risks, then you should be cautious about it. When something sounds too good to be true, it probably isn’t true.

- Avoid Pressure Sales Tactics: Don’t let scammers push you into hasty decisions by using high-pressure tactics. Reputable brokers and services should provide you with enough time to decide on different options available without forcing your hand.

- Seek Transparency: Indicate clearly the risks that come with forex trading. Stay away from brokers or services that underestimate the risks involved or guarantee too much.

3. Test the Broker with a Small Deposit

It is advisable to make a small deposit first and foremost before you decide to invest a lot of money with a broker. By doing this, one can assess the services offered by the broker, the trading platform provided as well as the ease of withdrawal.

Steps to Take:

- Open a Demo Account: The majority of good brokers have demo accounts that you can use to assess their platforms without putting your capital at risk. First familiarize yourself with the platform and determine its trustworthiness.

- Make a Small Initial Deposit: After getting comfortable, put a small deposit and observe how the broker treats your funds. Pay attention to trading conditions, speed of execution, as well as simplicity of fund withdrawal.

- Test Withdrawals: Attempt a small withdrawal to ensure that the process is straightforward and that the broker does not impose unnecessary delays or fees.

4. Educate Yourself Continuously

Education is a vital instrument that can be used to mitigate forex fraud. If you are well knowledgeable on matters concerning forex trading and various modes applied by fraudsters, then you will have a better chance at recognizing and avoiding such things.

Steps to Take:

- Read Reputable Forex Books: Take some time to go through books and materials written by trusted writers or professionals in forex trading. Understanding the market, its strategies, and risks will help you make smart and profitable decisions.

- Follow Reputable Sources: Follow business news on reliable media in order not to miss anything important. It’s advisable to rely on data from reputable financial newspapers, blogs and forums.

- Learn to Spot Red Flags: Familiarize yourself with common forex scam tactics, such as fake trading robots, signal service scams, and unregulated brokers. Knowing what to look for can help you avoid these traps.

5. Use Trusted Payment Methods

The payment method you choose can also protect you from scams. Some payment methods offer more security and recourse in the event of fraud.

Steps to Take:

- Use Credit Cards or Reputable Payment Services: Paying by credit card often provides some level of fraud protection. Reputable payment services like PayPal may also offer buyer protection.

- Avoid Wire Transfers to Unknown Entities: t is almost impossible to find or return money sent via wire transfer. Do not send money via wire transfer to any broker or service that you have not investigated thoroughly.

- Check for Secure Payment Channels: Ensure that the broker's payment methods are secure and that they use encryption for online transactions.

6. Stay Away from Unsolicited Offers

As we already mentioned, unsolicited emails, phone calls, or social media messages offering forex trading opportunities are often scams. Reputable brokers will never call you or write persistent emails.

Steps to Take:

- Ignore Unsolicited Contacts: In case you get some unrequested proposal, it is better to pretend that you did not hear anything about it. Honest brokers don’t call up out of the blue or post mails to people who could become clients.

- Verify the Source: If the offer seems legitimate, do your own research. Verify the authenticity of the broker or service independently before taking any action.

- Report Suspicious Activity: Whenever you come across suspicious messages, let the relevant regulatory authorities know about them. Reporting such acts will prevent other people from being defrauded too.

7. Keep Records and Documentation

Keeping thorough records of all your transactions, communications, and agreements with your broker can be invaluable if you need to pursue forex scam recovery.

Steps to Take:

- Save All Correspondence: Keep a record of all emails, chat messages, and communication with your broker or service provider.

- Document Transactions: Keep records of receipts, transaction logs, and account statements linked to your trade.

- Monitor Your Account Regularly: Take time to go through your account statements as well as transaction history to check for any unauthorized or suspicious activities.

8. Trust Your Instincts

Finally, it is important to always rely on your gut feeling. If a situation appears odd or sounds too perfect, then it possibly is. Being careful and overlooking some chances is better than becoming a victim to a forex scam.

Steps to Take:

- Pause and Reflect: If you’re feeling pressured or uncertain, take a step back and reassess the situation. Don’t rush into decisions based on fear of missing out.

- Seek Advice: If you’re unsure about a broker or service, seek advice from a trusted financial advisor or experienced trader before proceeding.

- Be Cautious: When in doubt, it’s always safer to keep out of it. Protecting your capital is more important than taking unnecessary risks.

Most Trusted Forex Brokers

After the previous part of the article, we can conclude that choosing the right forex broker is a critical decision for any trader, as it can significantly impact your trading experience and success. Due to its vast nature with little regulation in many places, the forex market requires traders to rely on trustworthy, honest brokers that follow strict rules. Below is a review of some of the most trusted forex brokers, known for their robust platforms, strong regulatory frameworks, and excellent customer service.

1. IG Group

Established for over four decades now, IG Group remains among the most reputable firms in foreign exchange trading. It is under the regulation of some of the topmost regulatory bodies including FCA in the UK ensuring that it is a good choice for traders’ safety.

Key Features:

- Wide Range of Markets: IG offers access to over 17,000 markets, including forex, indices, commodities, and cryptocurrencies.

- Educational Resources: The broker provides comprehensive educational materials, including webinars, tutorials, and a demo account for beginners.

- User-Friendly Platform: IG’s trading platform is intuitive and packed with advanced charting tools, making it suitable for both novice and experienced traders.

Regulation: FCA (UK), ASIC (Australia), and other global regulators.

2. OANDA

OANDA is a well-known forex broker with a reputation for transparency and integrity. Founded in 1996, OANDA is regulated in multiple jurisdictions and is praised for its fair trading practices and customer support.

Key Features:

- Transparent Pricing: OANDA is known for its transparency in pricing and does not charge commissions, making it appealing for cost-conscious traders.

- Flexible Trading Options: The broker offers flexible trade sizes, including the ability to trade micro-lots, which is ideal for beginners.

- Advanced Trading Tools: OANDA’s platform is equipped with advanced trading tools, including API trading, which allows for the integration of custom algorithms.

Regulation: CFTC (USA), FCA (UK), ASIC (Australia), and others.

3. Forex.com

Forex.com is a globally recognized broker that offers a comprehensive trading experience with a focus on forex markets. As part of GAIN Capital, Forex.com benefits from the stability and resources of a large financial group.

Key Features:

- Wide Range of Forex Pairs: Forex.com offers over 80 currency pairs, making it one of the most extensive offerings in the industry.

- Powerful Trading Platforms: The broker provides access to both the MetaTrader 4 (MT4) and its proprietary Advanced Trading Platform, catering to traders of all experience levels.

- Great Research Tools: Forex.com offers a branch of research tools, including daily market analysis, trading signals, and economic calendars.

Regulation: CFTC (USA), FCA (UK), ASIC (Australia), and others.

4. CMC Markets

Having been in operation since 1989, CMC Markets is a well-regulated broker that provides various trading instruments and is recognized for being dependable and innovative.

Key Features:

- Next-Generation Trading Platform: CMC’s proprietary trading platform is famous for being highly developed and having more than 80 technical indicators and automated trading capabilities.

- Extensive Range of Instruments: CMC Markets offers over 10,000 trading instruments, including forex, indices, commodities, and shares.

- Educational Resources: The broker provides a wealth of educational resources, including regular webinars and market analysis, making it a great choice for traders looking to improve their skills.

Regulation: FCA (UK), ASIC (Australia), MAS (Singapore), and others.

5. Saxo Bank

Saxo Bank is a Danish investment bank known for its premium trading services and extensive range of financial products. The broker is particularly popular among high-net-worth individuals and professional traders.

Key Features:

- Wide Range of Asset Classes: Saxo Bank offers over 40,000 instruments, including forex, stocks, bonds, ETFs, and options, providing unparalleled diversification opportunities.

- Advanced Trading Platforms: SaxoTraderGO and SaxoTraderPRO are highly regarded for their powerful features and customizability.

- Global Reach: With a presence in multiple countries, Saxo Bank provides global market access and strong regulatory compliance.

Regulation: FSA (Denmark), FCA (UK), ASIC (Australia), and others.

While the forex market offers significant opportunities for profit, it also comes with the risk of falling victim to scams. It is important to know how one can identify and prevent such fraudulent activities so as to keep safe all the money put into investment. As we already mentioned, there’s no established scam brokers forex list, so always be skeptical of offers that seem too good to be true, and trust your instincts when something doesn’t feel right. Remember, the best defense against forex scams is education and vigilance.