- What is FXTM?

- FXTM Pros and Cons

- Awards

- Safe or a Scam?

- Leverage

- Accounts

- Fees

- Spreads

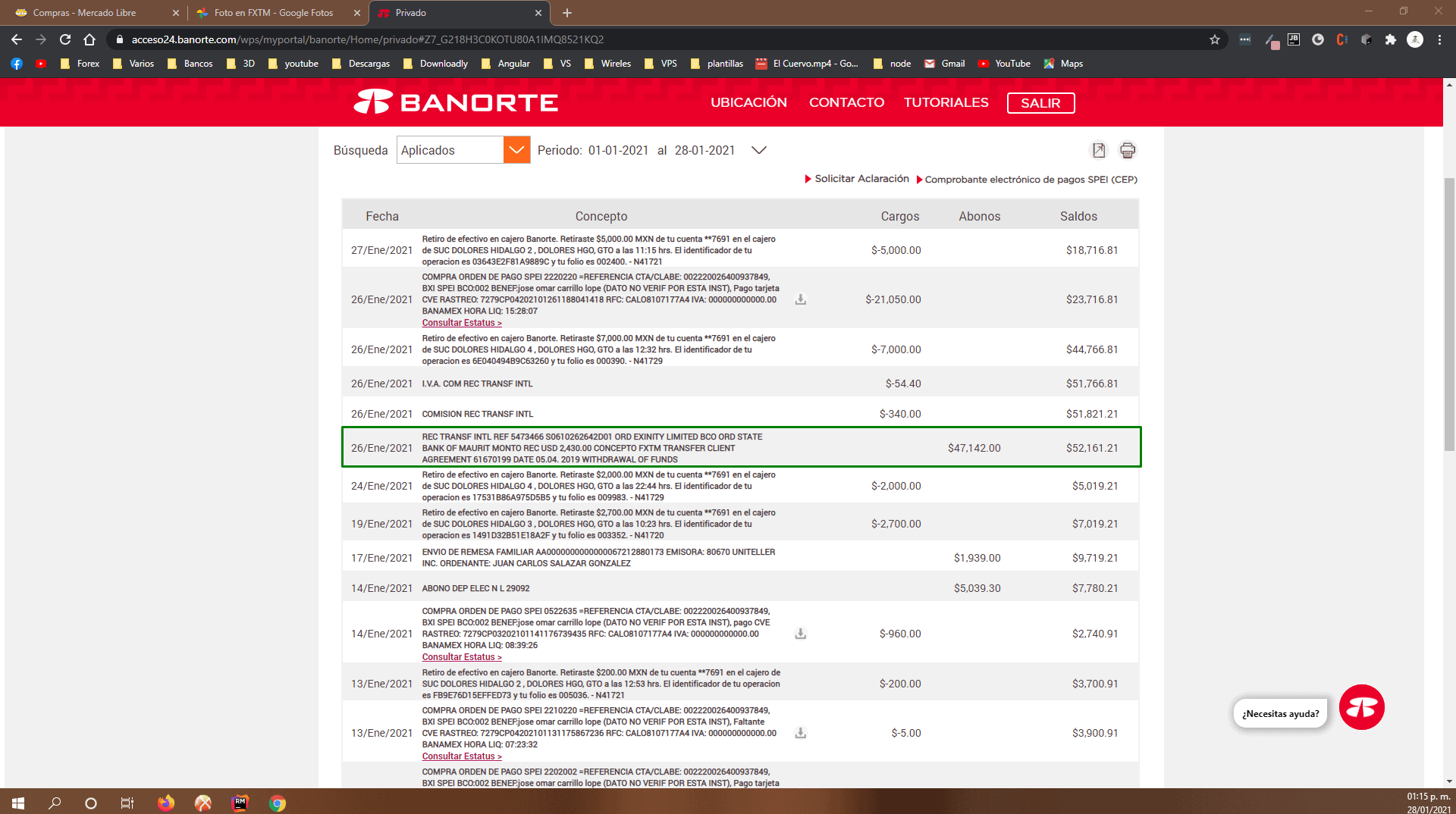

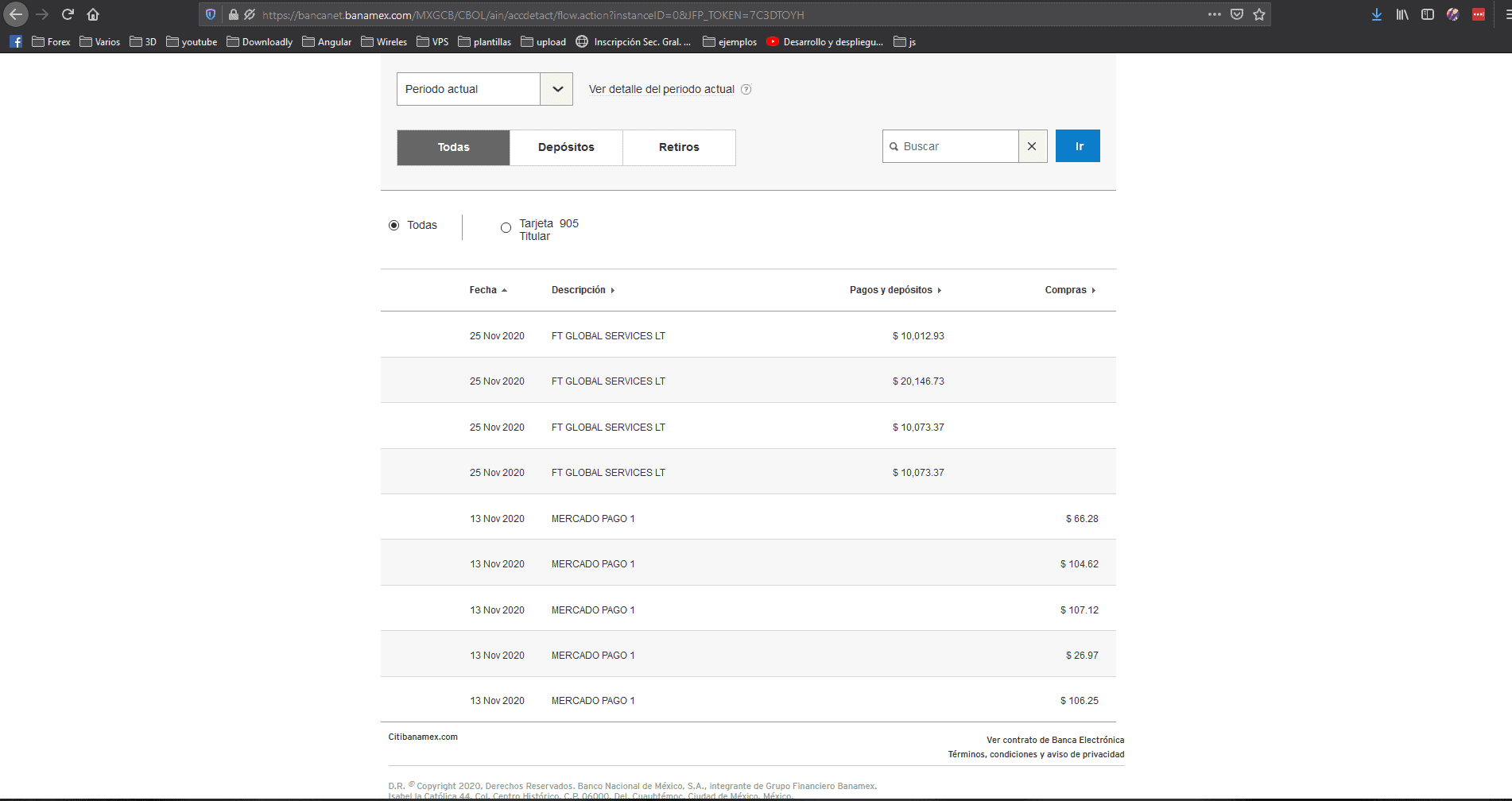

- Deposits and Withdrawals

- Market Instruments

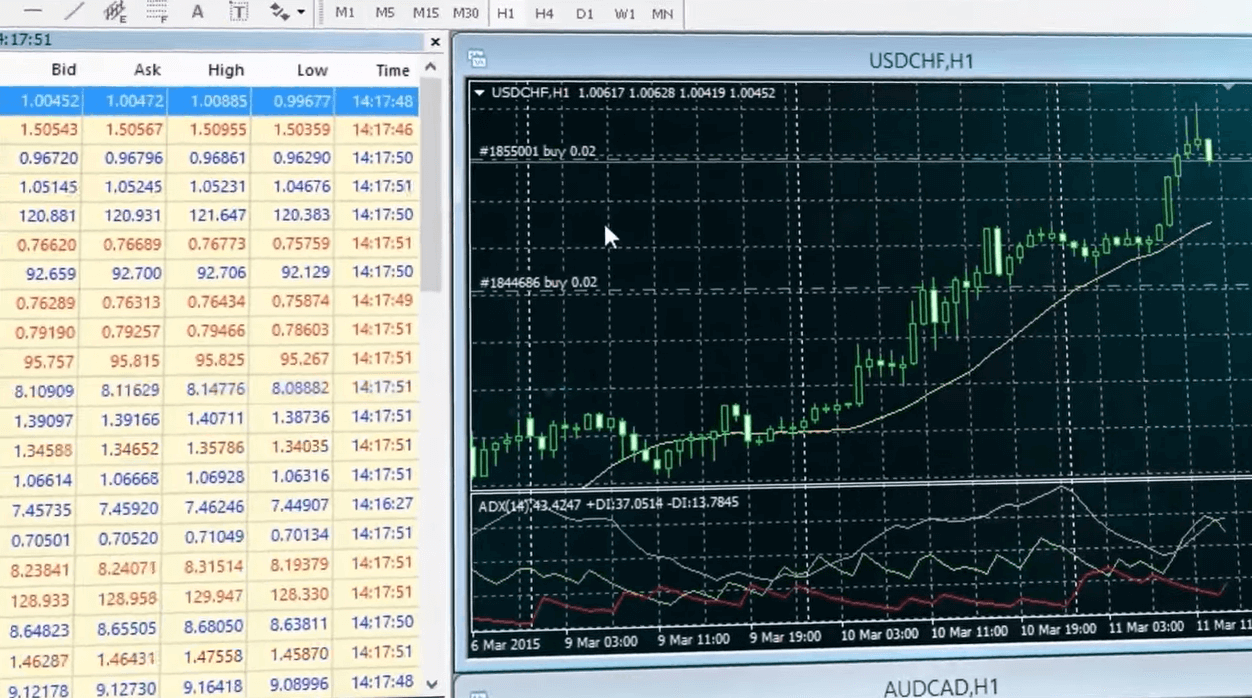

- Trading Platforms

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about FXTM.

What is FXTM?

FXTM or Forex Time has been named as one of the world’s fastest-growing and best Forex and CFD brokers, with a large number of clients and quality offering overall. The broker establishes its core on reliable trading conditions and detailed education and brings trading across the world with its accessible trading globe, regardless of the trader’s knowledge.

The company launched in 2011 with its headquarters in Cyprus (Limassol). The chain of FXTM offices is also established around Europe, located in the UK, and maintains an entity in South Africa. Also authorized by Financial Conduct Authority and other regulators, In a relatively short time, the firm showed great and rapid growth within Europe and beyond through its focus on Africa and Asia regions.

What Type of Broker is FXTM?

Based on our findings, FXTM is a global Forex and CFD broker providing access to more than 1000 instruments including Currencies, Stocks, Indices, Commodities, Share Baskets, and more, with ultra-low spreads and lightning-speed execution.

Where is FXTM Located?

FXTM is located in Limassol, Cyprus. The broker serves a global audience from over 150 countries, with a global network of offices, spanning Europe, Africa, and Asia.

FXTM Pros and Cons

FXTM is a good broker well-known and regulated worldwide, there are numerous regulated entities of FXTM. Account opening is easy, FXTM has one of the lowest deposit requirements and trading conditions are good with low spreads and excellent customer service, and Forex education. In fact, FXTM is one of the leading industry Forex Brokers with great service established worldwide, numerous traders from various countries including Africa region can trade and access excellent Education established by FXTM.

For the Cons, there is a withdrawal fee, and Stock spreads are rather higher, also condiitons vary on each entity.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | Withdrawal fee |

| Wide range of trading platforms and competitive trading conditions | High stocks trading spread |

| Numerous industry awards | No 24/7 support |

| Low deposit requirement | |

| Tight spreads | |

| Quality customer support and educational materials | |

FXTM Review Summary in 10 Points

| 🏢 Headquarters | Cyprus and entities around the world |

| 🗺️ Regulation | CySEC, FCA, FSCA, FSC, CMA |

| 🖥 Platforms | MT4, MT5 |

| 📉 Instruments | 1000+ financial instruments, over 50 currency pairs, CFDs on Cryptocurrencies, Spot metal, Shares, Commodities and Indices. |

| 💰 EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $100 |

| 💰 Base currencies | Various base currencies |

| 📚 Education | Professional FXTM Education Center |

| ☎ Customer Support | 24/5 |

Overall FXTM Ranking

Based on our Expert findings, FXTM is considered a good broker with safe and very favorable trading conditions. The broker offers a range of trading services designed for both beginner traders and professionals with low initial deposit amounts. As one of the good advantages, FXTM covers almost the globe, so traders from various countries can sign in, also with the lowest spreads.

- FXTM Overall Ranking is 9.3 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | FXTM | Pepperstone | AvaTrade |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Spreads | Platforms | Trading Conditions |

FXTM Alternative Brokers

We learned that FXTM offers a range of trading instruments, good trading conditions, and also low trading spreads and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to FXTM:

- AvaTrade – Good Instruments and CopyTrading

- Pepperstone – Low Spreads and Competitive Trading Conditions

- XM – Wide Range of Trading Opportunities

Awards

From the fast client approval to the general trading process, comprehensive learnings, and available features, FXTM proves its high ranking among the traders’ community with more than 90% of positive feedback.

The numbers are actually confirmed by the large community of traders with about 750,000+ active accounts that growing, numerous attractive opportunities, and gained vast awards for excellence in trading.

FXTM also proudly takes an active social role while supporting and sponsoring various world Sports like Sahara Force India Formula 1 team and regularly reveals in the media.

Is FXTM Safe or Scam?

No, FXTM is not a scam, it is a well-regulated broker operating as ForexTime Ltd, ForexTime UK Ltd, and Exinity Limited three entities under the FXTM brand that provides trading services to more than 10,000 clients from over 135 countries around the world. And important to note that comply with the necessary regulatory guidelines in every region FXTM operates, which gains a high score from us in terms of its trust.

This question is indeed the most crucial one, as investor accounts lose money and if you trade with an unregulated entity the high risk to lose funds is dramatically high.

Is FXTM Legit?

Based on our findings, FXTM is a legit broker, as each of the entities and brands that it serves is authorized and regulated by various global jurisdictions.

The main entity ForexTime Ltd is regulated by CySEC of Cyprus, authorized by FSCA of South Africa, and by additional offshore authority FSC in Mauritius. Also, the FXTM UK brand is licensed by the Financial Conduct Authority known as sharp regulator, which has principals built by European MiFID and ICF allowing cross-broker activity.

See our conclusion on FXTM Reliability:

- Our Ranked FXTM Trust Score is 9.3 out of 10 for good reputation and service over the years, also reliable top-tier licenses, and serving regulated entities in each region it operates. The only point is that regulatory standards and protection vary based on the entity.

| FXTM Strong Points | FXTM Weak Points |

|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity regulated by top-tier authorities |

| Regulated by top-tier authorities | |

| Compensation scheme | |

| Negative balance protection | |

How Are You Protected?

Since the FXTM license means its compliance with all the strict regulatory requirements, the trader’s investment is considered to be safe, as the broker completely segregates funds from the operational funds of the FXTM while keeping in leading and reputable EU banks.

In addition, FXTM is a member of the Investor Compensation Fund that compensates in case of the company insolvency, as well as protected by the negative balance protection and other requirements that are audited on a regular basis by the authority.

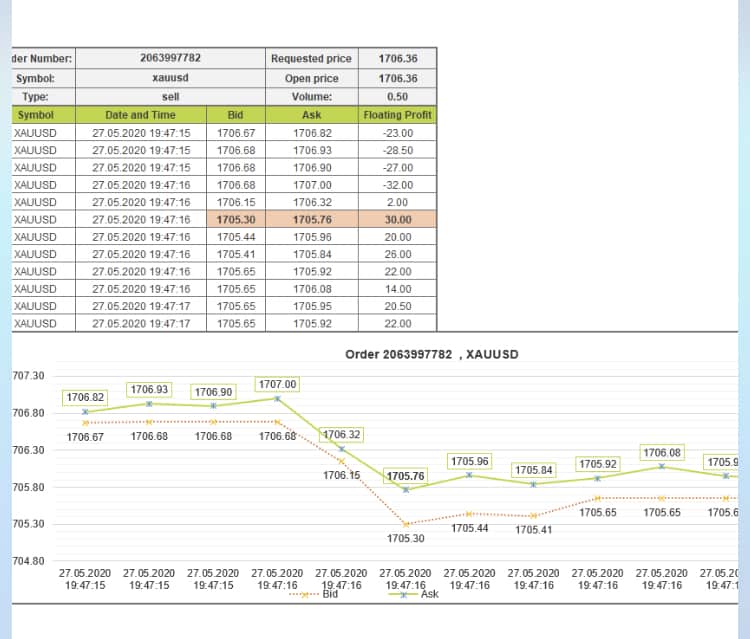

Leverage

We found that when you trade with FXTM you are able to operate with fixed or floating leverage. The leverage is indeed a very useful tool, especially for traders of smaller size, as it may increase your potential gains timely due to its possibility to multiply initial account balances a particular number of times.

FXTM leverage is determined by various measures and firstly set according to the regulatory requirement in one region or another. And then is also based on the trader’s experience and knowledge, so always check with the customer support team first which one is applicable to you.

- So if you would like to operate under higher leverage ratios like 1:400, 1:500 or even 1:1000 you may open an FXTM account under a particular entity that allows such high leverage levels, which is offered by the global brand.

Otherwise, if you are a resident of Europe or the UK, as well as holding an account under a European entity that obliges to ESMA regulation, the maximum current leverage ratio is the following:

- 1:30 on Forex instruments

- 1:20 Spot Metals, 1:10 XAG USD

- 1:20 Minor Currency Pairs

- 1:5 Shares

Accounts Types

We learned that FXTM offers separate accounts for Forex trading and Invest Accounts. Then there is a further split to your preference of the trading transactions, instrument, and the trading size, which all in all offers you 3 Account types – Micro, Advantage, and Advantage Plus.

| Pros | Cons |

|---|

| Fast and fully digital account opening | Account types and proposals may vary according to jurisdiction |

| Low minimum deposit | |

| Access to a wide range of financial instruments | |

| 3 accounts available | |

| Free deposit | |

How to Trade in FXTM?

Starting to trade with FXTM, you will first need to open an account and deposit funds. The process is simple and can be done entirely online. Once your account has been approved, you can then make a deposit using one of the many methods available. Based on our research we found out that FXTM offers a user-friendly platform with all the tools and resources you need to trade successfully.

How to Open FXTM Live Account?

FXTM accepts clients from almost every country in the world, however, there might be some restrictions due to regulations alike implemented for residents of Japan, the USA, etc.

Opening an account with FXTM is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Access FXTM Sign-In page

- Enter your personal data First and Last Name, Country of residence, email, phone, etc.

- Answer an online questionnaire about your trading knowledge and expectations

- Select the account type

- Verify your account by upload of your identity confirmation. These may include residential proof, a copy of your ID, a bank statement, etc.

- Once an account is activated and proven you may follow with the money deposit

Trading Instruments

Based on our findings, FXTM offers a good range selection of markets and account features among the industry brokerage offering.

The trading markets include 1000+ financial instruments, and Forex products with over 50 currency pairs including attractive FXTM CFDs on Cryptocurrencies such as Bitcoin, ETH, Litecoin, and Ripple. Also, you may select spot metal CFDs, share CFDs on over 170 major companies, CFDs on Commodities, and CFDs on Indices.

- FXTM Markets Range Score is 8.9 out of 10 for wide trading instrument selection among Forex, Commodities, Indices, Cryptos, and more.

FXTM Fees

We learned that FXTM fees are mainly built into a spread also defined by the account type you use. In addition, you should always consider other fees like non-trading fees like, and withdrawal fees which we will see in detail further.

Generally, FXTM offering is built through tight floating spreads while Standard MT4 spreads start from 1.6 Pips and from 0.1 pips for ECN accounts available on both platforms MT4 or MT5 but will add on a commission charge per order.

- FXTM Fees are ranked average with an overall rating of 8.8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, FXTM overall fees are considered good.

| Fees | FXTM Fees | Pepperstone Fees | XM Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | Yes | No | No |

| Inactivity fee | Yes | No | Yes |

| Fee ranking | Average | Low | Average |

Spreads

Forex fees are offered by FXTM spread only with no commission in case you use Advantage Plus and Micro Account. This type of fee brings you the simplicity of the calculation and is the best suitable option for many traders despite the strategy. FXTM’s three Accounts offer various fee conditions, so the standard spread starts from 1.5 pips for USD / EUR / GBP / NGN.

- FXTM Spreads are ranked low with an overall rating of 8.9 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | FXTM Spread | Pepperstone Spread | XM Spread |

|---|

| EUR USD Spread | 1.5 pips | 0.77 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 pips | 2.3 pips | 5 pips |

| Gold Spread | 9 | 0.13 | 35 |

| BTC USD Spread | 20 | 31.39 | 60 |

Deposits and Withdrawals

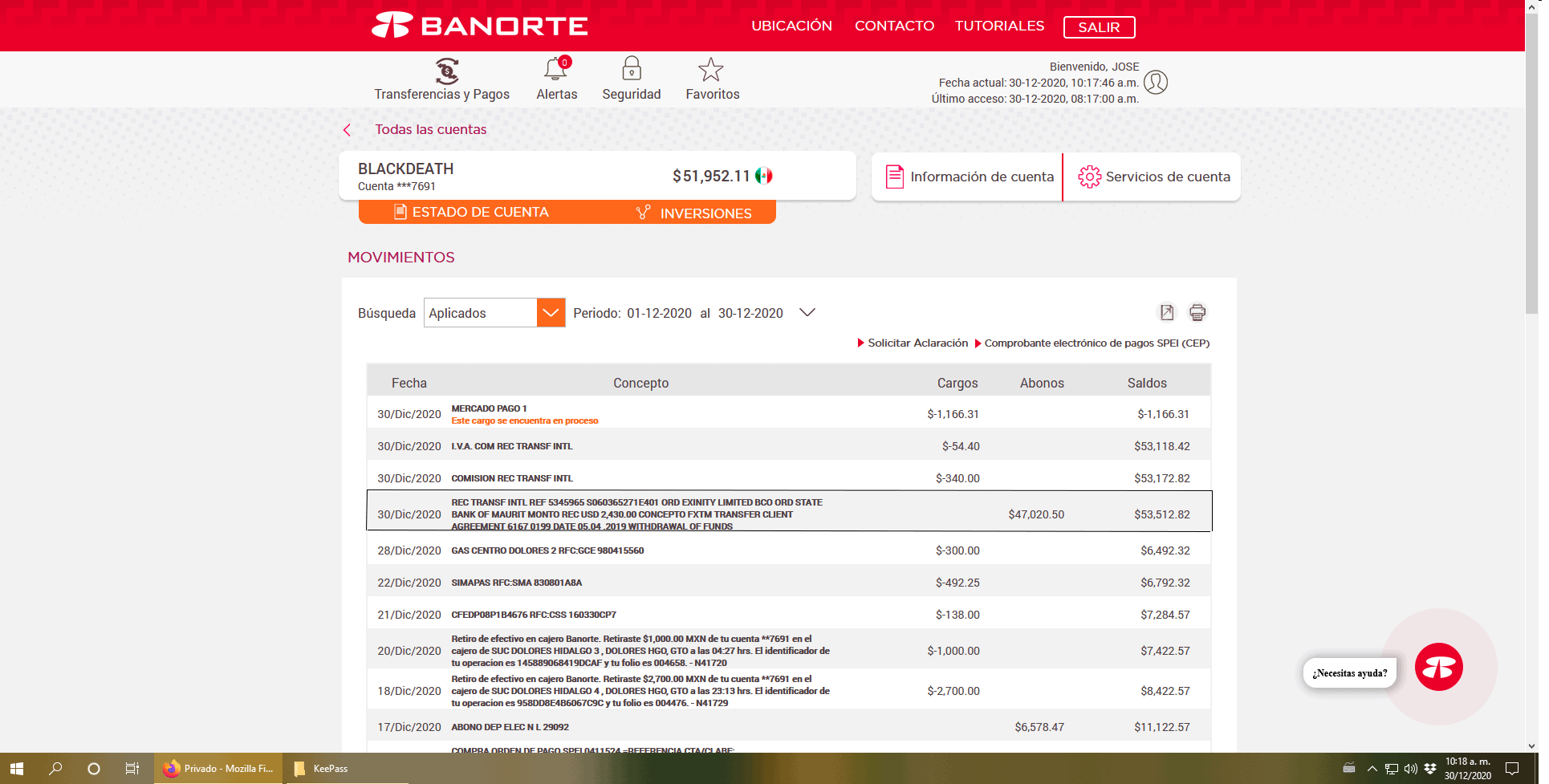

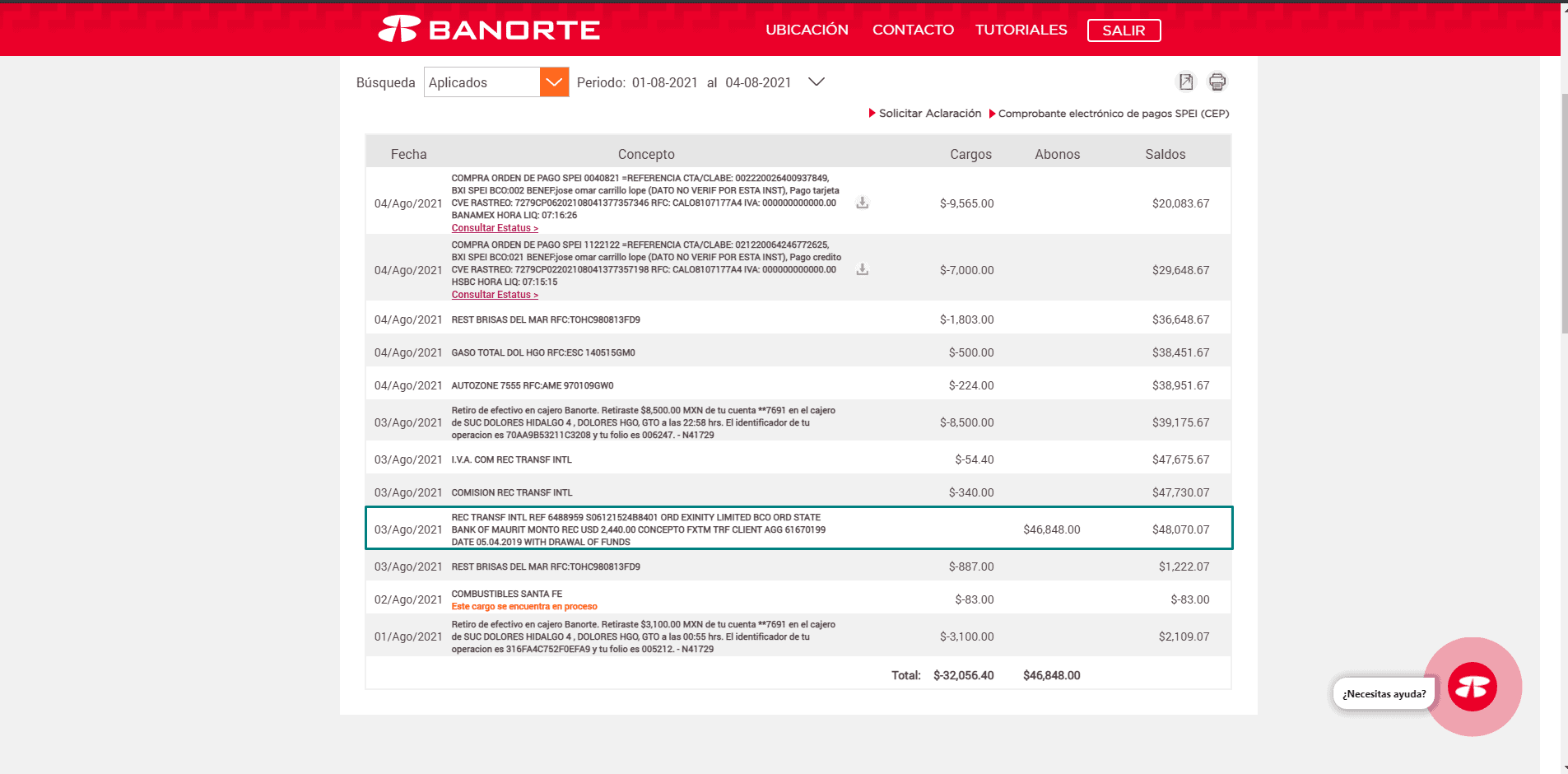

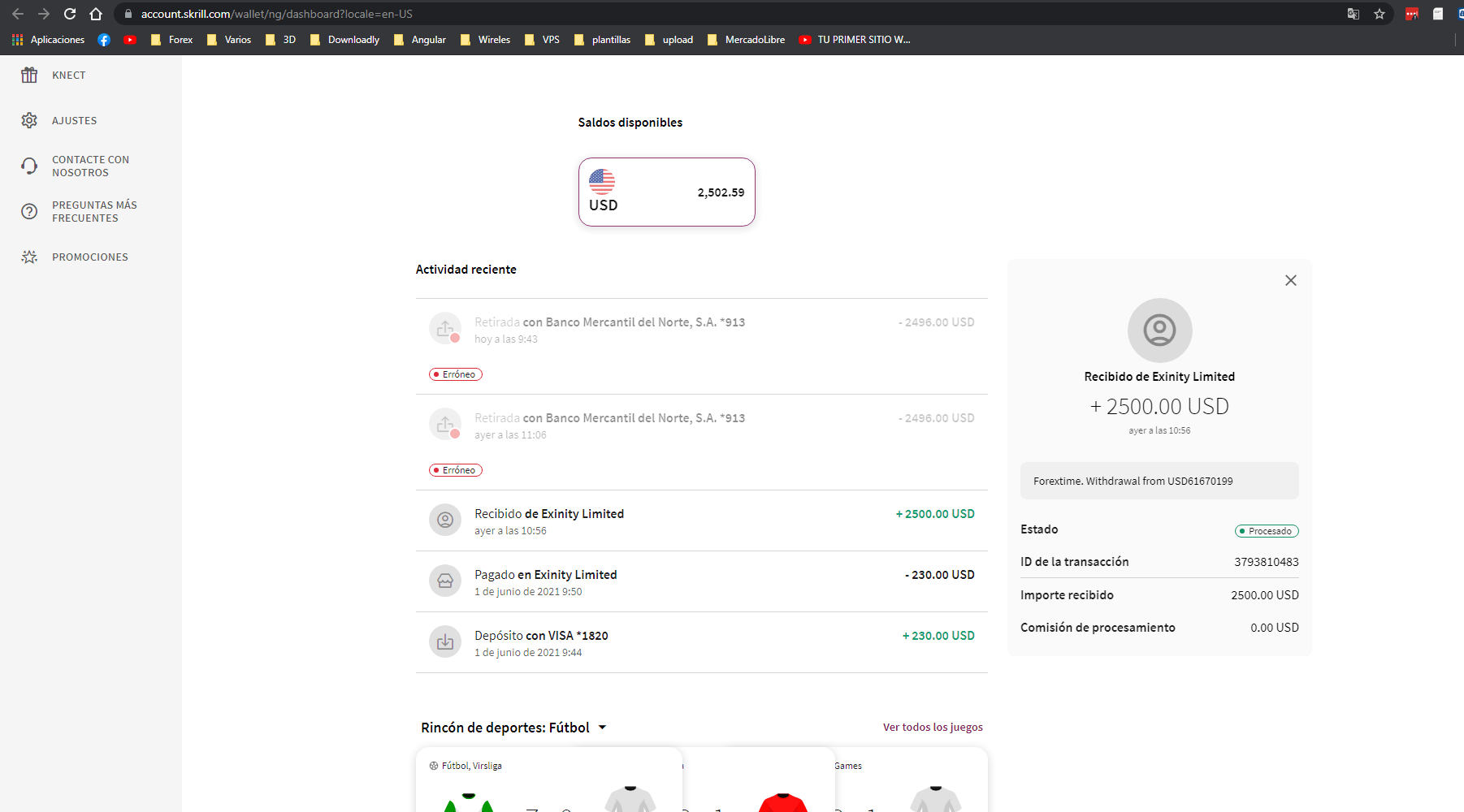

In terms of the funding methods, FXTM made it quite a simple and straightforward process with a truly wide range of funding options that will assist you to find a suitable money transfer provider. The number of payment methods to fund the trading account will allow you to transfer funds quickly by the use of bank transfers, credit cards, and some electronic wallets.

- FXTM Funding Methods we ranked good with an overall rating of 9.3 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for FXTM funding methods found:

| FXTM Advantage | FXTM Disadvantage |

|---|

| Fast digital deposits, including Skrill, Neteller, and Credit Cards | Majority of withdrawal methods still add on commission |

| $100 is a first deposit amount | Methods and fees vary in each entity |

| Free deposit | |

| Multiple Account Base Currencies | |

| Withdrawal requests confirmed within 2 business days | |

Deposit Options

In terms of funding methods, FXTM offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- GlobePay, and more

FXTM Minimum Deposit

FXTM minimum deposit requirement is $/€/£ 100 for Account Standard and only $10 for a Cent Account. Also, all deposit fees are covered by the company which is great for your smart money management.

FXTM minimum deposit vs other brokers

|

FXTM |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

FXTM Withdrawals

We found that FFXTM withdrawal options are widely available including bank transfers, e-wallets, and cards. The withdrawal fee varies from one option to another. As an example, Credit Cards withdrawal features a $3 fee, while Bank Transfer will cost $30, and WebMoney will charge 2% above the requested amount. However, these withdrawal fees are still considered to be on a low level compared to other industry offerings. applied to some of the payment methods, while others may be provided with 0% commission.

How Withdraw Money from FXTM Step by Step:

Once you decide to withdraw money from your account you obviously should submit an online request and follow the required procedure. To cut it short, here are the main steps to follow:

- Login to your account in MyFXTM and go to Withdraw page through My Money

- Select the withdrawal method, required amount and click “Withdraw”

- Complete the withdrawal request along with the PIN that will be sent to your email or phone via SMS

- Confirm withdrawal and Submit

Trading Platforms

Based on our findings, FXTM trading technology and toolbar use the industry’s leading software third-party providers, which doesn’t require a presentation, as these platforms are MT4 and MT5. However, the progressive technology of the MetaTrader was combined with FXTM’s unparalleled trading services that allow smooth operation and enhance your trading capabilities all in all making trading a powerful process.

- FXTM Platform is ranked good with an overall rating of 8.9 out of 10 compared to over 500 other brokers. We mark it as good being one of the best proposals we saw in the industry, and a great range including MT4, and MT5 suitable for professional trading. Also, all are provided with good research and excellent tools.

Trading Platform Comparison to Other Brokers:

| Platforms | FXTM Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

Since the FXTM platform is MT4 or MT5 software, both offer various versions available either as WebTrading platforms or the one that can be installed directly on any device. Web trading software is a great option if you are a beginner or regular-size trader, as the platform is accessible right from the browser, does not require any installation, easy save and navigated.

Desktop Platform

If you require more tools along with powerful customization you better choose the Desktop version. MetaTrader supports all kinds of devices including PC, and MAC as well as an accessible Multi Terminal that is useful for money managers. Hence you will always have access to your account at your personal convenience.

All necessary and useful tools are also included in the package, from risk management to analysis, as well as a uniquely developed trading tool like – Pivot points strategy and trading signals. Along with converters, calculators that designed to make trading to the trader of any level more professional.

Customer Support

Another good point in its client-oriented philosophy of FXTM operation is competent customer service that is available through various sources including Online Live Chat, Phone, emails, Messenger applications, etc.

Apart from the positive and high regard from the clients in terms of its good reputation, FXTM also supports a great range of languages, so you always may count on help whenever you needed it.

There are established centers in the Asia region including Indonesia, Malaysia, Thailand, and China, as well as Africa region, Europe, and more, so it is true to state that FXTM covers the global needs of traders.

- Customer Support in FXTM is ranked good with an overall rating of 8.9 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer service |

| Relevant answers | |

| Support of international Phone lines and a range of languages | |

| Availability of Live Chat | |

FXTM Education

Based on our research, FXTM hosts regular educational events in various cities around the world while satisfying the demand to start the trading journey and supporting with learning material for everyone who would like to engage in trading.

There are webinars, seminars, platform tutorials, trading tools, research tools, a superb glossary, Forex news, Economic Calendar, Market outlooks, and Analyst analysis all remaining at your disposal.

- FXTM Education ranked with an overall rating of 8.3 out of 10 based on our research. The broker provides very good quality educational materials, and excellent research also cooperates with market-leading providers of data.

FXTM Review Conclusion

Concluding the FXTM review, we admit that FXTM gives quality trading potential for both beginners and experienced traders or investors and FXTM is one of the leaders in Forex Trading. Moreover, there are other numerous advantages with FXTM too, alike great global coverage with a good focus on Africa region with Nigeria and Kenya trading opportunities.

The account variety is very impressive which allows any trader the best suitable option either with flexible or floating leverage. We learned that the broker also provides tight spreads from 0.1 pips, and low deposit requirements, besides education is one of the best provided. So overall, FXTM is very trustable and quiality choice for Forex traders of any size.

Based on Our findings and Financial Expert Opinions FXTM is Good for:

- Beginning Traders

- Advanced traders

- International Traders

- Traders who prefer MT4/MT5

- EAs Traders

- Currency and CFD trading

- Variety of trading strategies

- Tight spreads

- Algorithmic or API traders

- Quality customer support

- Excellent educational materials

Share this article [addtoany url="https://55brokers.com/forextime-fxtm-review/" title="FXTM"]

Are you giving $2,500 gifts using Cash App? If not this company is being used to scam people on Facebook. Take a look:

I’m an affiliate of the FXTM in conjunction with cash app and using Facebook as a social platform .This social give away has been doing the round lately

Michele

Michele Ban

If $2500 was deposited into your CashApp now

What bill will you cover?

Hi there Tery! Thanks for flagging this and no, this is not related to us in any way! There is only one FXTM and this is our official English website: https://www.forextime.com/ and this is our official Facebook Page: https://www.facebook.com/fxtmglobal

Keep in mind that we do not have agents approaching clients directly through Social Media to promote our services or promising cash/profits. Always make sure to refer to our Official Website and our Official Social Media Pages for any information related to us.

You can proceed to Report/Block this Individual as a “Scam”. Please also share the details of this Individual to us by “Raising a Request” through our website and we’ll report this Individual from our side too.

I invested with FXTMTRADE my name is Motseki George cutshwa id number 5611115707084 and my cellphone is 067 920 8907. I have been scammed by this trader.Today I was supposed to get my profit but now I was told to pay tax of about R13000.will you kindly assist. I will send all the communications and the vlips

Hello George. The ID number listed is not associated with any of our records and we do not ask our clients to pay/deposit more funds in order to withdraw their profits. FXTM is a Regulated & Licensed Broker and we have more than a million clients trading with us from around the world. Please confirm if you Registered through our official website here: https://www.forextime.com/ You can share all the details you mentioned by Raising a Request here: https://get.fxtm.help/hc/en-gb/requests/new and we will investigate this for you.

Lousy Broker. Will not allow more than 5 demo accounts to practice while learning. Trying to figure out how to trade is very difficult, and restricting people to 5 demo accounts is not practical.

Hello.Have FXTM Usdt any updates.I can’t withdraw my earning.Can you help me.

People keep falling for cryptocurrency scam and it’s more prevalent in investment scams where companies promise you large returns of investment. Investment scams often promise you can “make lots of money” with “zero risk,” and often start on social media or online dating apps or sites. These scams can, of course, start with an unexpected text, email, or call, too. And, with investment scams, crypto is central in two ways: it can be both the investment and the payment. The best way of tracking down these scammers is through carrying a background check on them first before trusting them because their reviews on their website is not to be trusted as they know how to manipulate it so carrying out a a background check to see if anyone has reported them to dionysius_helios on Instagram is the best way to spot their scams fast. For those who don’t know how to carry out a background check you will need to contact vravmo00 on Instagram and see how they’ll save you from getting scammed.

Hello fxtm,

Thought I’d let you know a few people are currently running a scam of giving people money of $1,500 in the us. One of them goes by lane Rhodes on Facebook thought I’d let you know.

I had issues over investing huge sum of funds on my account but unable to make withdrawals from the platform but manage to recover my lost funds through the help of www, Expertapexrefund . Co m, you guys should reach out to them I’m certain they can help out with your case.

funny fxtm

im using deposit via web service fxtm which using local trf bank already send all document related still rejected and dont wanna pay out

scma maybe not but they not allow you to make withdrawal

support@fxtm.com

12:44 AM (16 hours ago)

Dear suhandi handoko, Thank you for contacting us. In order to verify bank account, please provide bank statement showing: – your name – your bank account numbe

suhandi handoko

4:55 PM (2 minutes ago)

to support@fxtm.com

told u already im using fxtm web service already send fxtm deposit but u rejected already send acc statement which trf to exchanger but u refused no more to provide anymore i know now fxtm is not willing to pay tq for cooperation because there no transaction to fxtm directly im using ur web local transfer how i explain again and again which fxtm deposit is very clear from my acc 0200716663 bca acc indonesia via trust 88 to my acc in fxtm is that not clear enough i dont get it anymore how to provide documen u want it

Good day,

What is the investment duration? And what is the percentage look like? And I will like to know the withdrawal options.

I’m afraid to open an account with FXTM after reading a few bad review here.

I have an account with Jimmy French and done the same.He lock my account and ask for 1200 to open it and I gave him the money now he wants 5k to realize the money I have in my account.

I also got scammed by John Eric

I have multiple account with different broker my fxtm account alwys hit stop loss more than that of other.. So Once i bought on eurusd in two different account and put my stop loss in same pips.. What i saw was that fxtm account hit my stop loss whereas other account was in profit..

I am confused can anyone help me out

John Eric is a scammer they have a group name fxtm in telegram please avoid loses. They will lock your account and will not help to withdraw the amount..they ask money and charge bonus to withdraw they took my finance account and change everything in the name of getting more profit weekly.john Eric is a scammer.they also charge 25dollar for late withdrawal and will not be able to withdraw

I have1200. from what I thought was the the Real FXTM website and now someone from their support link is saying I have to pay 1200. to be given a swipe code to withdraw my money. I was not informed about this and I have been unable to find any evidence to show that I have to pay this money to get out my remaining money.. Is there anyway to confirm if a website is legit?

FOR ALL PLANNING TO TRY THIS! PLS. DONT. AT FIRST YOU WILL EARN A DECENT AMOUNT THEN THE COPY MANAGER WILL DELIBERATELY TAKE LARGE LOSSES IN THE ACCOUNT DISSOLVING YOUR COPY ACCOUNT. AT FIRST I DIDNT BELIEVE THE REVIEWS OF OTHER BUT I EXPERIENCED IT TWICE.

I think their website is http://www.forextime.com nut you can confirm this first so that it won’t be I directed you to another website. I know this through Google search. Please once again, try to CONFIRM PLEASE. Thanks

Dear

With regards to this i already trade in your company, then supposedly the time withdrawing the money i recieved an email stated that my account is at stop level limit and you need an account upgrade and signal service upgrade and i should pay about $1500.

Is it neccesary to pay that or i have the right to have my profit without paying it.

Need a good and reasonalble feedback from your management as im funding and trading my money to your company.

did you receive any replay on this

Dear sirs

I am inexperienced but want to start forex trading .

Which fully automatic robot or EA you recommend with yr accounts?

Awaiting yr reply to open account

Thank you

Emiel

Most likely $100 is it tuition fees. There won’t be any profits

good one!!

Social trading

In addition to its powerful functionality and clear ability to monitor the markets, the FXTM platform also enables automated trading which consists of automatically executing orders according to the implemented strategy.

“Or you can use the powerful ability of Social Trading by becoming an investor, this option allowing you to follow ranked” strategy managers that you can choose through many criteria or filters to follow.

This option interests me GREATLY, because not being a tarding professional, I want to place 50,000 USD for 6 months as an investor and sign a performance contract for a specific amount with FXTM.

What should I do? what type of contract would you offer me?

Can I withdraw to my profits to paypal

What is the real site then?

I don’t want to trade because I don’t know. I just want to deposit money and track my account and profit on the account. Is this possible?

Are you offering it to me ??

thanks

I have started with only 100$. In the beginning i was sceptic, as i was scammed a lot. What i liked is the fact that there is a safety button, which secures you from losses, plus i have made a deposit to a broker, which unknowingly the minimum deposit was more than 610$, i clicked withdraw, and it was back in my wallet instantly! Online help was quite helpful and fast! i can definitely recommend FXTM . Just make sure when you pick a broker, to check out his trading days, P/L daily, etc.

May I know your broker sir.

Sou de Portugal, Europa CEE, posso abrir conta PADRÃO na FXTM com alavancagem de

Forex1: 2000

Ouro e prata1: 1000

CFD1: 1000

Óleo1: 1000

Futuros1: 1000

Criptomoedas1: 3

agradeço a vossa melhor atenção

celestino Amaro

https://fxtmglobalmarket.com/ someone mislead me to join through these link and after swindling my investment they have me hard to withdraw even my capital I don’t know if the links belong to the same company they need to protect us from these hungry tigers

Hello, same here, did you recover your money?

This is not the real FXTM website… I have been trade with them on and off for 5 years. I never have problem with withdrawal.

Worst spread..very wide and they make it difficult for you to make money

I don’t even care for the trade profit anymore! It was the shady way they both swindled me out of 3721.22 and my trade profits are being held hostage! Can you imagine what a loss of this much money is at a time like this? I’m hoping someone can help me with either a refund or release of my trade profits.

https://fxtmbinaryinvestment.com employs scammers!

TraderJoel1 and Expert_Adams are con artist thieves!!! They get your money and don’t deliver! Sad to say but they swindled me out of 3721.22 !

I wait for your reply.

sir, how much get profit in invest 100$ in 30 working days.

You should let aspiring traders know that you delay withdrawals for more than two weeks.

Sir, I want to trade with you

hi, i am interested in trading, but i dont know how to, i have also done a little research and there are many scams and complaints about brokers/trading comapnies, you look trustworthy and i would like to try trading and investing, can you assit me please

I am interested in investing and trading

Please, follow this link https://www.forextime.com/register/open-account?myfxtm=open-account to open account with FXTM and start trading.

I want to invest and trade how should I do it

You need to go to the registration page on the FXTM website https://www.forextime.com/register/open-account?myfxtm=open-account and fill in all the needed information to proceed. Also, if you would like to get more knowledge about trading you can go and check our FXTM webinars https://55brokers.com/forex-webinars/

I don’t want to trade but I want to invest , so FXTM do you fo that ?

pleasr please give me call on 0738523820 I want trade with you thanks

Hai sir this broker can I run ea arbitrage for news and withdraw.

I tried FXTM, good customer service however useless as they were not able to simply run MT5 on a mac and tried to solve the problem with really childish advice. So what all these good about this broker when you can not trade??