Forex Trading: Why Trade with Australian ASIC Brokers

- What is ASIC Australia?

- Why Trade with an ASIC-regulated broker?

- ASIC Application Process

- ASIC Complaint procedure

- List of ASIC-Regulated Forex Brokers

- Conclusion on ASIC Regulation

ASIC Regulator Introduction

| 📚 Formed: | July 1, 1998 |

| 🏦 Jurisdiction: | Australia, New South Wales |

| 🏢 Headquarters: | Sydney |

| 🛡️ Is ASIC Broker Offshore or Top-tier Jurisdiction? | Top-tier |

| 🔒 Is Top-tier Jurisdiction safe to trade? | Yes |

What is ASIC?

The Australian Securities and Investments Commission (ASIC) is an integrated regulator in Australia established in 1998 and is one of the Top-tier Regulatory authorities with strict procedures and excellent oversight. As a non-governmental organization, ASIC's responsibilities include regulating and overseeing leveraged foreign exchange transactions, financial service markets, and the protection of retail clients.

It ensures fair, strong, and efficient financial trading opportunities provided by independent organizations. ASIC carries out daily supervision of the retail foreign exchange market, with a focus on combating misconduct within the financial markets while fostering trust, improving performance, and upholding integrity. (Read our article about Australian Brokers)

- ASIC is responsible for regulating companies and businesses operating in Australia. It administers the Corporations Act 2001, which sets out regulations and requirements for corporate governance, financial reporting, disclosure, and compliance. ASIC also registers companies, manages company records, and investigates breaches of corporate laws.

- ASIC has the power to investigate and take legal action against individuals and entities that breach financial laws. It can impose penalties, and sanctions, and enforce civil and criminal proceedings. ASIC works closely with other regulatory agencies, such as the Australian Prudential Regulation Authority (APRA) and the Australian Competition and Consumer Commission (ACCC), to ensure regulatory cooperation and effectiveness.

Australia ASIC Regulation of Forex Trading Brokers

The whole concept of the ASIC is concerned with trader protection, smooth market operation, and regulation of unconscionable conduct that affects all financial products or services to ensure traders are dealing with safe providers. Important to note regulation worldwide is indeed different so offshore firms might claim to be regulated too, yet their procedures are rather poor compared to top-tier regulators like ASIC.

As a market and trader credit regulator, ASIC supervises and licenses companies that participate in Forex and CFD trading by the Australian license AFSL (Australian Financial Services License). In order to become an ASIC-licensed forex broker, the firm should prove and confirm the uncompromised professionalism that covers various aspects and urges brokers to be an orderly and transparent organization.

- In case the broker managed to obtain an ASIC license, the trader can be ensured the financial broker acts transparently, by the operation through an ASIC’s guideline. The ASIC regulation of brokers' trading services and operations is monitored on a daily basis, as the broker submits reports about every transaction or service provided, which ensures the integrity between the market offerings and unparalleled protection.

Why trade with an ASIC-regulated broker?

So along with the abovementioned strict rules ASIC applies towards the Brokers or companies, and besides the monitoring of brokers’ procedures, ASIC effectively assesses how the financial service firm complies with its legal obligation, as well as investigated law breaches. That may cause ASIC to take further actions like infringement notices, issues of fines, official claims, a ban on credit activities, or even company dismissal.

- An example of ASIC's active role and launches towards unscrupulous brokers shows the cancellation of a license of Melbourne-based forex and CFD broker, as the broker failed to comply with a number of requirements. (Please check the News by the link).

- Moreover, it is not the only issue that the fines or cases were imposed on the company itself, the managing director is banned too. Since the director was involved in the contravention of a financial services law or is not adequately competent, the ASIC regulator respectively takes necessary actions.

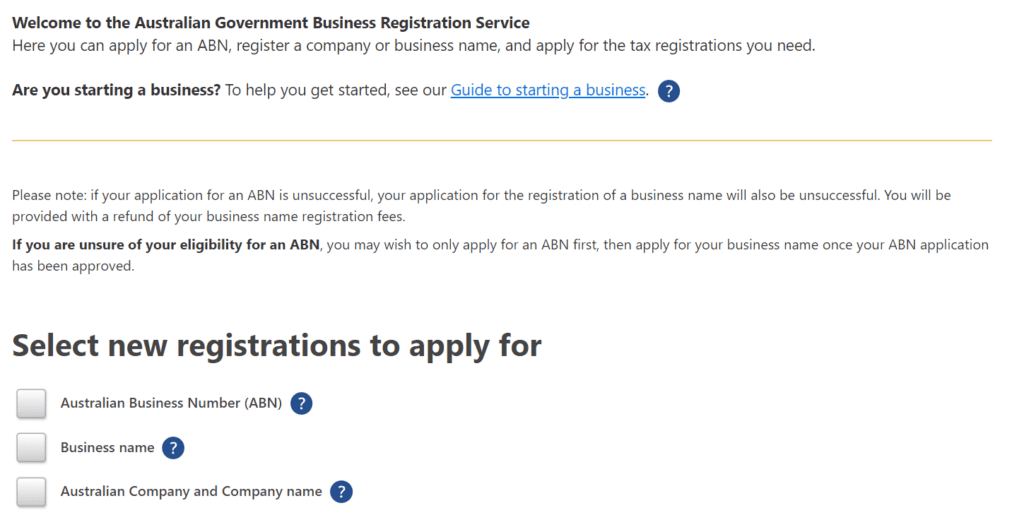

ASIC Application Process

The ASIC application process is accurate to the detail and accepts applications only from physical Australian entities with a sharp business plan, precise detail about the trading operating model, and details of liquidity providers. As well includes interviewing of responsible manager with appropriate skill and experience, while in fact, the broker’s manager can be dismissed due to the lack of necessary proficiency or any issues that appeared in the history. The broker should also establish a high operation fund of at least $1 million, implement client safety measures with the strictest fund management, and fully segregate clients' funds at all times with top-tier banks.

ASIC Complaint Procedure

To lodge a complaint with ASIC, Australia's regulatory body, follow these steps: First, attempt to resolve the issue with the financial service provider directly. If unsuccessful or if serious misconduct is involved, submit your complaint online through ASIC's website, contact their Infoline, or mail a letter to their designated address. Provide a clear description of the issue and include supporting documents. Maintain communication with ASIC, respond to any inquiries, and await the outcome of their investigation, which may involve mediation or enforcement actions.

Note that ASIC's role is regulatory, and seeking legal advice may be necessary for legal matters or compensation.

See How to complain to ASIC moneysmart.gov.au/how-to-complain

Overall, ASIC has established a sharp procedure for every situation the financial brokerage firm or retail trader might go through, which also includes the clients’ compensation by the Australian Restructuring Insolvency & Turnaround Association if the broker falls under insolvency.

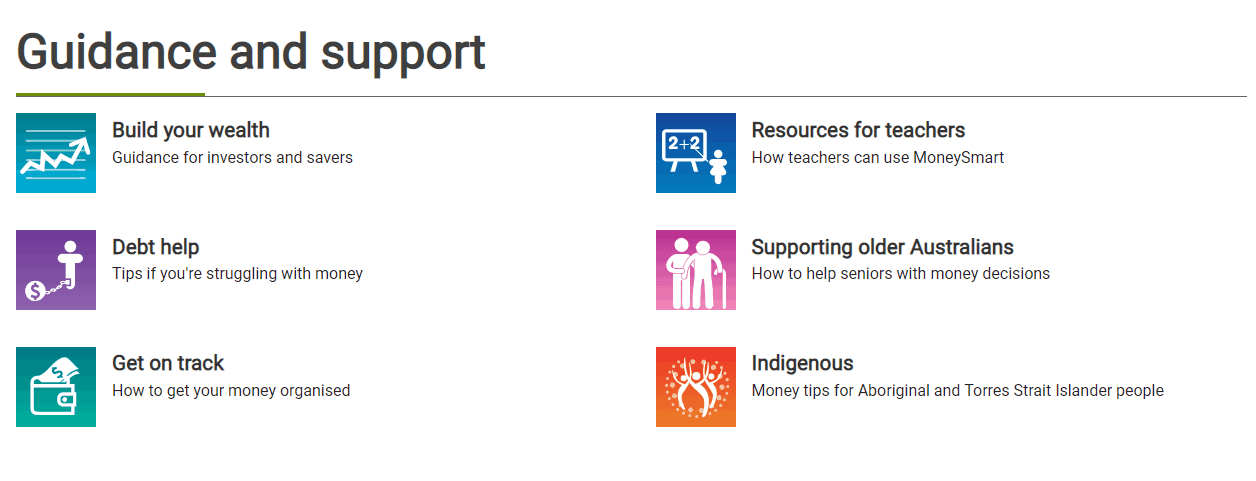

ASIC Education

Apart from the main role of the forex broker regulation and supervision, ASIC promotes confidence in all market players through public education and open sources that allow investors to obtain accurate information.

For that reason, ASIC operates the financial advice and strategy website www.moneysmart.gov.au which provide guidance on investment issues. The service includes advisory on financial knowledge and management, various trading or investment opportunities, exchange risks, fundamental consultation, how to skip scams, and more.

In addition, the ASIC authority constantly improves legislation as studies the behavior of the market, and monitors the decision marking of consumers along with recognition of new trends. For the protection of trader’s rights, ASIC refers to preventing market manipulation, fraud, or unfair service delivery, so the trader can submit a complaint against the ASIC-registered company, complaint ASIC, or even can get compensation through appropriate channels.

List of ASIC-Regulated Forex Brokers

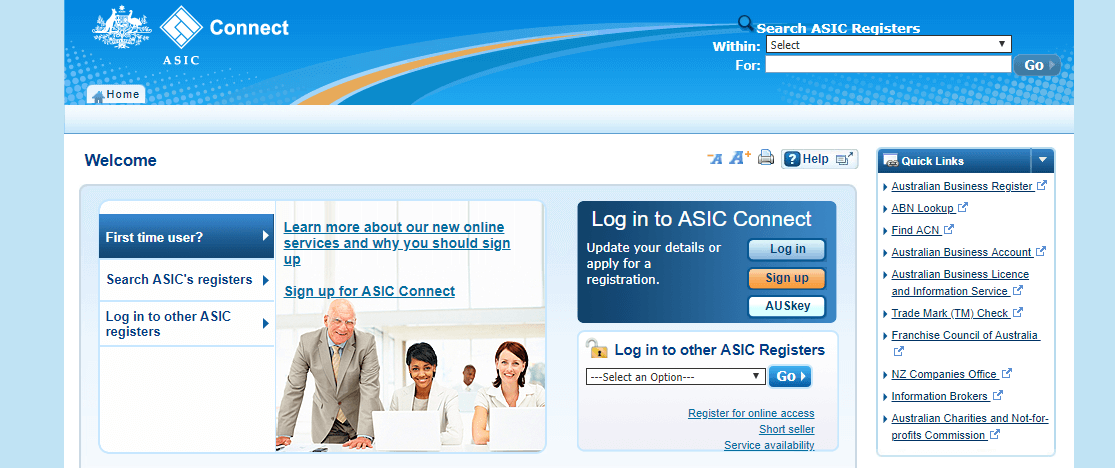

Any trader can search for information about ASICs forex broker license directly through an official site, or to check the regulated broker website, as most websites show on the footer or regulation page its Australian Business Number (ABN) and Australian Financial Services License (AFSL).

Also, you can check on ASIC Brokers Reviews, as currently the Australian regulated brokers' list at our website includes 40 ASIC Regulated Brokers, and growing.

Conclusion on ASIC regulation

Australia became one of the financial hubs that attract vast Forex brokers to set up their overseas operations and apply for the AFSL license, since ASIC is a top-tier authority also provides great protection to the trader too. In fact, ASIC Brokers are now among the most demanded and reputable (such as XM broker), while the advanced regulatory guidelines ensure the business of trading regulation adheres to strictest follow of rules.

Insurance of fair, orderly and transparency is a goal that was achieved by the ASIC authority which monitors not only the trading environment provided, the clients’ funds management, but also carefully check on the broker’s responsible management while some of the directors might be banned to run forex brokers. Therefore the potential traders and investors can choose among the ASIC Regulated brokers with a clear statement the firm acts according to the strictest supervision tools, as ASIC took all necessary step to ensure the best possible provision of the trading and financial investment services.

Helo I withdraw money mt4 account

Xm is not legit thy manipulate signals

I have evidence

I would like to trade with your company. I’m based in Uganda.