- What is BDSwiss?

- BDSwiss Pros and Cons

- Awards

- Is BDSwiss safe or a scam?

- Leverage

- Accounts

- Fees

- Spreads

- Market Instruments

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Research

- Conclusion

Our Review Method

- 55Brokers Financial experts with over 10 years experience in Forex Trading check full trading offering including fees, instruments, platforms, verified safety, contacted customer service and placed traders to see trading conditions to give expert opinion about BDSwiss

What is BDSwiss?

BDSwiss is an international CFD Broker and a brokerage firm established in 2012, which fastly approached Markets and became one of the largest trading groups, and now serves as one of the leaders. The current clients’ base of BDSwiss counts more than a 1.6 million registered clients from over 186 countries, as well as serving exclusive Member club.

Since the approach of the company establishment comes from Switzerland, it has strong basis of the environment as well as providing online trading services as a worldwide operating group. See more details in our BDSwiss Review and summary section.

BDSwiss Pros and Cons

BDSwiss has a good reputation with a long history of operation, which is a plus, and user-friendly trading conditions, there is a good choice between trading platforms, account opening is fast and customer service is of great quality with education and research tools suitable for beginners or to advance trading knowledge.

On the other hand, we notice BDSwiss trading proposal depends on the entity, and instruments are limited to CFDs, so is worth reconsidering in case the proposal is suitable for you.

| Advantages | Disadvantages |

|---|

| Worldwide coverage through entities in Mauritius, Seychelles, South Africa, and Mwal. | Support not available 24/7 |

| Wide range of CFD instruments | |

| Powerful trading technology and ultra-fast execution of trades

| |

| Choice between MT4, MT5, Mobile App and Proprietary platform | |

| Fast account opening | |

| Suitable for Beginners and Professionals | |

| Quality customer support | |

BDSwiss Review Summary in 10 Points

| 🗺️ Regulation | FSC, FSA, FSCA, MISA |

| 🖥 Platforms | MT4, MT5, BDSwiss Webtrader and Mobile App |

| 📉 CFD Instruments | Commodities, Forex, Metals, Indices, Cryptocurrencies, and Shares |

| 💰 EUR/USD Spread | 0.0 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $10 |

| 💰 Base currencies | USD, EUR, GBP, ZAR |

| 📚 Education | Learning Academy with Forex Courses + Live Webinars, Forex Glossary, Educational Videos, eBooks |

| ☎ Customer Support | 24/5 |

Overall BDSwiss Ranking

Based on our review and Expert Opinion in Forex Trading, BDSwiss is a trustable broker with good reputation for years of its operation and quality trading conditions, also with a good technical trading offering. However, there are some gaps due to operation via International branches only.

- BDSwiss Overall Ranking is 9 out of 10 based on our testing and compared to 500 other brokers, see Our Ranking below compared to other popular and industry Leading Brokers.

| Ranking | BDSwiss | AvaTrade | Plus500 |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Currency Trade | Education | CFDs Trading |

BDSwiss Alternative Brokers

Being available for international traders the proposal is covering many points and BDSwiss might be suitable for wide range of traders. Yet, for Alternative Brokers with some better regulatory status and wider proposals like Instrument range and some strategies see our Ranking below compared to other popular Brokers:

See detailed Alternative Broker Reviews:

- HFM – Good for Currency trading

- FP Markets – Good for CopyTrading

- XM – Good for Trading on MT4

Awards

BDSwiss in fact earned not only good reviews from the world trading community but also numerous industry awards for its successful operation and trading technology they heavily invest in. We saw before BDSwiss establishment, and not few only few years it is one of the largest proposals, while BDSwiss was rewarded for its excellent service and trading technology and also recognized for its Trading App along with Trade Execution, here are some of the awards:

- Broker of the Year at the Mindanao Traders Expo 2023

- BEST FX Educational Broker 2023 at the Forex Expo Dubai Awards

- Best Global Partnership Programme at UF AWARDS GLOBAL 2023

- Best Forex Research & Education Provider at UF AWARDS GLOBAL 2023

- Best IB/Affiliate Programme – APAC at UF AWARDS 2023

- Fastest Growing Forex Brokes Dubai at Global Banking & Finance Awards 2023

Is BDSwiss safe or a scam?

No BDSwiss is not a scam, it is a broker with long years of operation and good reputation of operation.

Is BDSwiss UK Regulated broker?

BDSwiss is regulated globally, holding registrations with the Financial Services Commission (FSC) in Mauritius, the Mwali International Services Authority (MISA), Seychelles’ Financial Services Authority (FSA), and South Africa’s Financial Sector Conduct Authority (FSCA), ensuring adherence to stringent financial standards. So we found and Review BDSwiss is not UK Regulated.

However, as we always recommend check on the regulation carefully and never sign in with only offshore registered brokers (read more why avoid trading with offshore brokers).

How are you protected?

According to the Broker, the security of funds along with client protection delivered in multiple ways that ensure a safe trading environment and investors’ legal compliance including segregation of funds and participation to some customer protection organizations. However, we would advise to double-check security layers too if it is suitable for you personally.

See our conclusion on BDSwiss Reliability:

- Our Ranked BDSwiss Trust Score is 7 out 0f 10 for good reputation and years off its successful operation, yet the gaps are top-tier regulations with compensation schemes and other protective measures. Yet, in case of BDSwiss since company has many years of establishment and a good reputation so it is worth considering in our opinion.

See our conclusion on BDSwiss Reliability:

| BDSwiss Strong points | BDSwiss Weak points |

|---|

| Regulated international broker | None |

| Strong education section | |

| Global coverage | |

| Good reputation and long years of operation | |

| Negative Balance Protection applied | |

What Leverage does BDSwiss offer?

Leverage, known as a loan given by the broker to the trader enables you to trade through the multiplied volume that may raise your potential gains, yet in reverse increases high risks too. So firstly you should learn how to use tools smartly, also various regulatory standards and restrictions set a particular allowed level of leverage that is considered to be safe.

- BDSwiss offers traders the option to use higher leverage, enabling traders to gain a much larger exposure with relatively little capital. BDSwiss clients can trade with a maximum leverage of 1:400 through the firm’s default leverage and up to 1:2000 using Dynamic leverage offered by the broker. It is important to note that Dynamic leverage is available to clients in certain jurisdictions.

Yet, for the most accurate data check on the official BDSwiss platform and verify its allowance with your residual status, also make sure to check each instrument separately as it varies according to the asset as well besides to using precisely reasonable levels to keep you risks low, see examples below.

BDSwiss Account types

BDSwiss offers four account types which are Classic, Vip, Zero Spreads, and Cent, created to cater to the needs of different Forex traders with either lower costs according to trading sizes or advanced services once size increases. While Classic and Vip account are based on the spread-only model, Zero Spread account features interbank spreads and commission charge per lot, which gives good flexibility to choose accountn you would need the most, see account comparison snapshot below.

| Pros | Cons |

|---|

| Fast account opening | None |

| 4 Account types are offered | |

| Ultra-fast execution of trades | |

| Selection between four base currencies | |

| Demo Account and Live Account | |

| Daily Analysis and Exclusive Webinars for clients | |

- Also, we found one more account – StockPlus Account, available only under FSC entity. BDSwiss’ StockPlus account enables BDSwiss clients to build a diversified portfolio with over 1000+ world-leading stocks and ETFs. The account features 0% commissions for unleveraged investing in stocks and the option to use up to 1:5 leverage to trade stocks and ETFs at DMA.

When opening your trading account there is an option to choose the desired base currency through the selection between the Euro (€), US Dollar ($), the South African Rand (ZAR), and the British Pound (£), which is definitely great as it means you will not be charged for currency conversion, while the account balance can’t fall below zero due to the applied negative balance protection.

Demo Account

BDSwiss also offers a Forex or CFD “Demo Account” and gives new traders the opportunity to put their skills to the test on free Demo accounts with adjustable virtual balances of up to 1,000,000€/$/£/ZAR. BDSwiss clients can open any type of account offered by BDSwiss including Classic, Zero-Spread, VIP and Cent. A demo account is also offered so that traders can test the tools, conditions and spreads offered, which is definitely a big plus.

How to open Trading Account?

- Load BDSwiss Sign In page.

- Enter your personal data (Name, email, phone number, etc)

- Upload your documents to verify the account. It is a legal procedure to check proof of your residents, through utility bill, your ID or similar.

- Complete questioner about your trading experience and expectations

- Once your account is activated you will get access to your account area.

- Next, once you learn all risks and benefits involved, you may proceed with funding.

- Almost instantly you will be able to start trading through BDSwiss platforms.

Fees

BDSwiss trading fees are mainly based on spreads, for each underlying asset you will be charged for we will find the usual applicable spread, while the rollover for short and long positions is also an additional charge if you held positions overnight, as well as the margin requirement. Full BDSwiss pricing including funding fees and Administration fee for non-use account, see the table below on our finds.

- BDSwiss Fees are ranked average, low with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity, also majority of currency pairs are on an average level for spreads, additional fees like funding fees, rollover

| Fees | BDSwiss Fees | AvaTrade Fees | Plus500 Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | 10 USD for bank wires under 100 USD | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Low |

Does BDSwiss have inactivity fee?

In case the account remains inactive for over 90 days there is an inactivity fee of 30 EUR/GBP/USD per month.

BDSwiss Spreads

BDSwiss Classic and VIP account fees are all included in the spread spreads and commissions charged when conducting trade and vary according to the account type you select. If you are a trader of bigger size and prefer commission basis then Zero-Spread Account is your choice. The zero-spread account offers an interbank spread averaging 0.0 for EURUSD and commission paid per transaction opening which is 6$.

To get a closer look, check below the comparison of most popular assets applicable to the BDSwiss Classic Account type, while the broker himself mentions that Classis spread are starting from 1.3 pips and VIP feature lower conditions with a spread from 1 pip. Finally, spreads on the Zero-Spread account start from 0.0 pips while on the Cent Account from 1.6 pips. Also, you may compare BDSwiss fees to its peer BlackBull markets and other popular brokers listed below.

- BDSwiss Spreads are ranked average with overall rating 8 out of 10 based on our testing comparison to other brokers. We found Forex spread on industry average for standard account, and conditions might be better for commission based account, compared to other brokers in industry

| Asset/ Pair | BDSwiss Spread | AvaTrade Spread | Plus500 Spread |

|---|

| EUR USD Spread | 1 pips | 1.3 pips | 0.6 pips |

| Crude Oil WTI Spread | 6 | 3 | 2 |

| Gold Spread | 0.3 | 40 | 29 |

| BTC/USD Spread | 26.65 | 0.75% | 0.35% |

The above are the average spreads on BDSwiss

Trading Instruments

BDSwiss provides access to trade a great range of 250+ underlying assets, while you may choose from Indices, Forex, Commodities, Shares, and Cryptocurrencies based on CFDs Trading. However, the range of instruments depends on the account type or BDSwiss entity you use.

Therefore, with access to most liquid and popular markets you may choose the desired and most understanding instrument according to your trading need and use BDSwiss portal to make these choices, which we should admit as user-friendly.

- BDSwiss Instrument Selection Score is 8 out 0f 10 for good trading instrument selection, yet selection of instrument might be different based on the platform you use or entity of BDSwiss you sign with

Can I trade Cryptocurrencies?

Yes, you can trade Cryptocurrencies based on CFDs as presented on the BDSwiss proposal, besides we found quite good costs and spreads for Crypto Trading too. See snapshot on our finds on available Markets:

Funding Methods

BDSwiss works with a variety of payment service providers that covers a wide range of deposit methods in a particular country.

BDSwiss clients can choose preferred deposit method right before funding trading accounts and enjoy $0 fees on all deposits. BDSwiss accepts introductory deposits, and processes withdrawals, in the form of instant transfers, e-wallets, bank transfers or credit card transactions, however note – with outgoing credit card payments typically take between two to seven business days to process.

- BDSwiss Deposits and Withdrawals we ranked Excellent with overall rating 10 out of 10. Minimum deposit is low, also Fee condtions are good either with no fees or very small based on thhe funding method you use, besides range of methods is very wide

Here are some good and negative points on BDSwiss Deposits and Withdrawals found:

| BDSwiss Advantage | BDSwiss Disadvantage |

|---|

| Fast digital deposits, including Credit Card, Debit Card, Electronic Wallet | None |

| User-Friendly Customer Portal | |

Deposit methods

The methods including a wide range of payment options yet may vary according to the country regulations and your residence so always good to verify this information with the support center as well.

- credit/debit cards

- bank transfers

- Skrill, NETELLER, Astropay, PIX, LATAM APMs, Crypto, Online Banking, EFTpayment, Ozow, Mobile Money, Open Banking, Globepay, UPI, GCash, PayMaya, QR Codes

BDSwiss Minimum deposit

BDSwiss minimum deposit is 10$ for Classic account, which is an attractive opportunity to many traders for a Classic account. Also, BDSwiss does not charge any fees on credit card/electronic wallet deposits as well.

BDSwiss minimum deposit vs other brokers

|

BDSwiss |

Most Other Brokers |

| Minimum Deposit |

$10 |

$500 |

Withdrawals

BDSwiss arranges withdrawal options with good range of supported payment methods, while the minimum withdrawal amount depends on the payment method used, in most cases the withdrawals processed free of charge. Yet in case you would like to withdraw less than the required minimum amount the broker may add on a fixed processing fee of 10$.

How long does it take to withdraw money from BDSwiss?

As the broker mentions it always aims to give withdrawal service within 24 hours, yet this is applicable towards working business days, as on weekends or holidays it may take longer to proceed. As well, always give additional days for your payment to proceed with the transaction once it is already confirmed and done by BDSwiss, while we got withdrawal pretty quickly.

How do I withdraw money from BDSwiss?

You should login to your Client Portal and submit a withdrawal request by following of the required procedure. You can check the exact steps by following this link.

Trading Platforms

The software solution offered by the BDSwiss mainstays at the popular choice of MetaTrader4 platform, which provides a comprehensive trading feature and vast of solutions. MT4 is a known industry intuitive platform, even though might be with little outdated layouts, still is widely used platform.

Besides, Traders will definitely enjoy numerous add-ons as we did, that are available on the market to make trading process a pleasant one. Moreover, there are plenty of strategies to choose from since broker does not impose strict restrictions, so news trading or other strategies are available.

The available platform versions suited to various devices so traders can us any device, which is a good plus. This includes PC, Mac, Applications or Web platform that requires no installations. See some of our finds for benefits and disadvantages of the platform below.

- BDSwiss Platform are ranked Excellent with an overall rating 10 out of 10 compared to over 500 other brokers. The high ranking is deserved with good range of platforms including popular MT4 and MT5, also developed its own platform with good research and tools

Trading Platform Comparison to Other Brokers

| Platforms | BDSwiss | AvaTrade | Plus500 |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

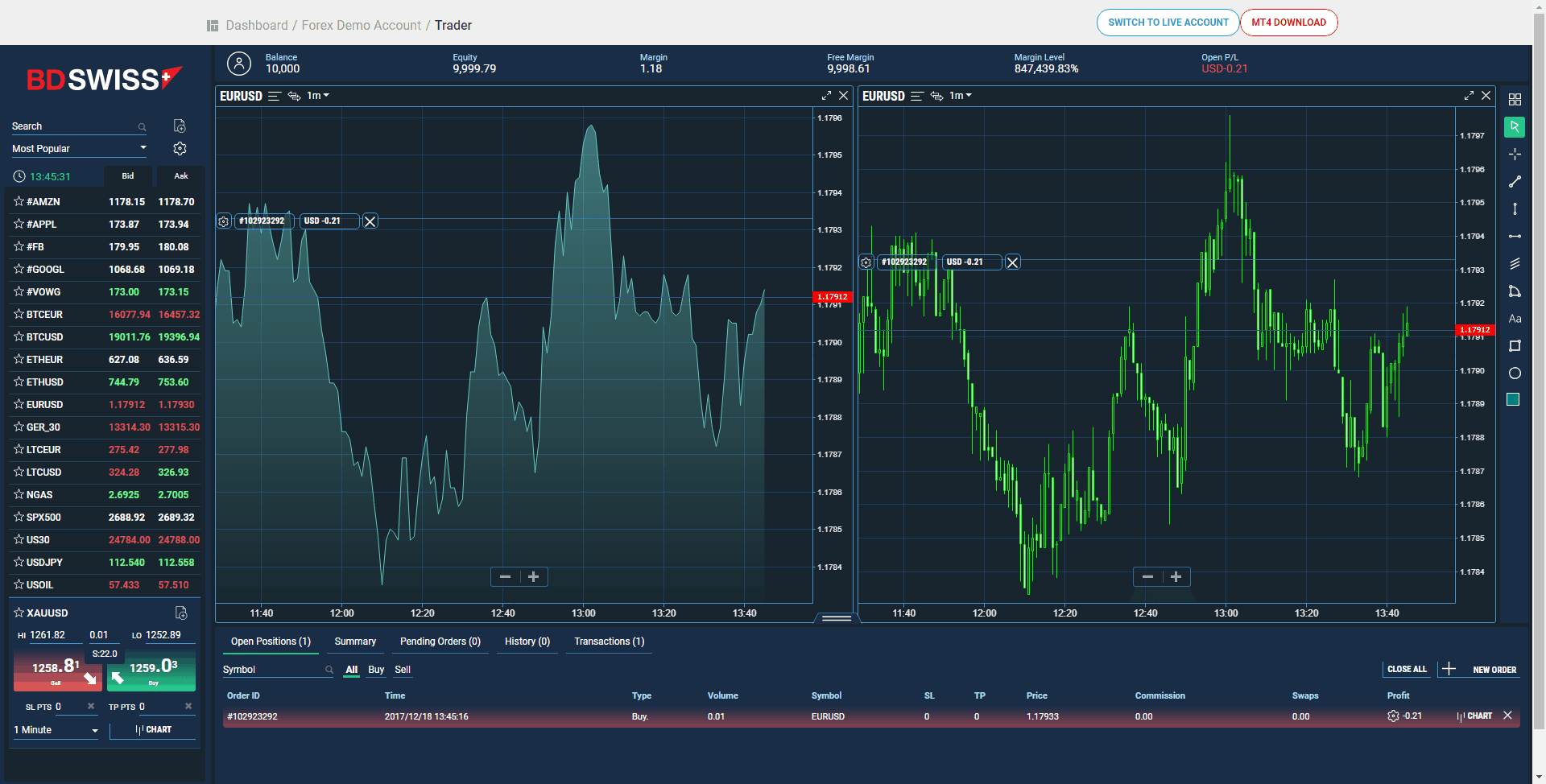

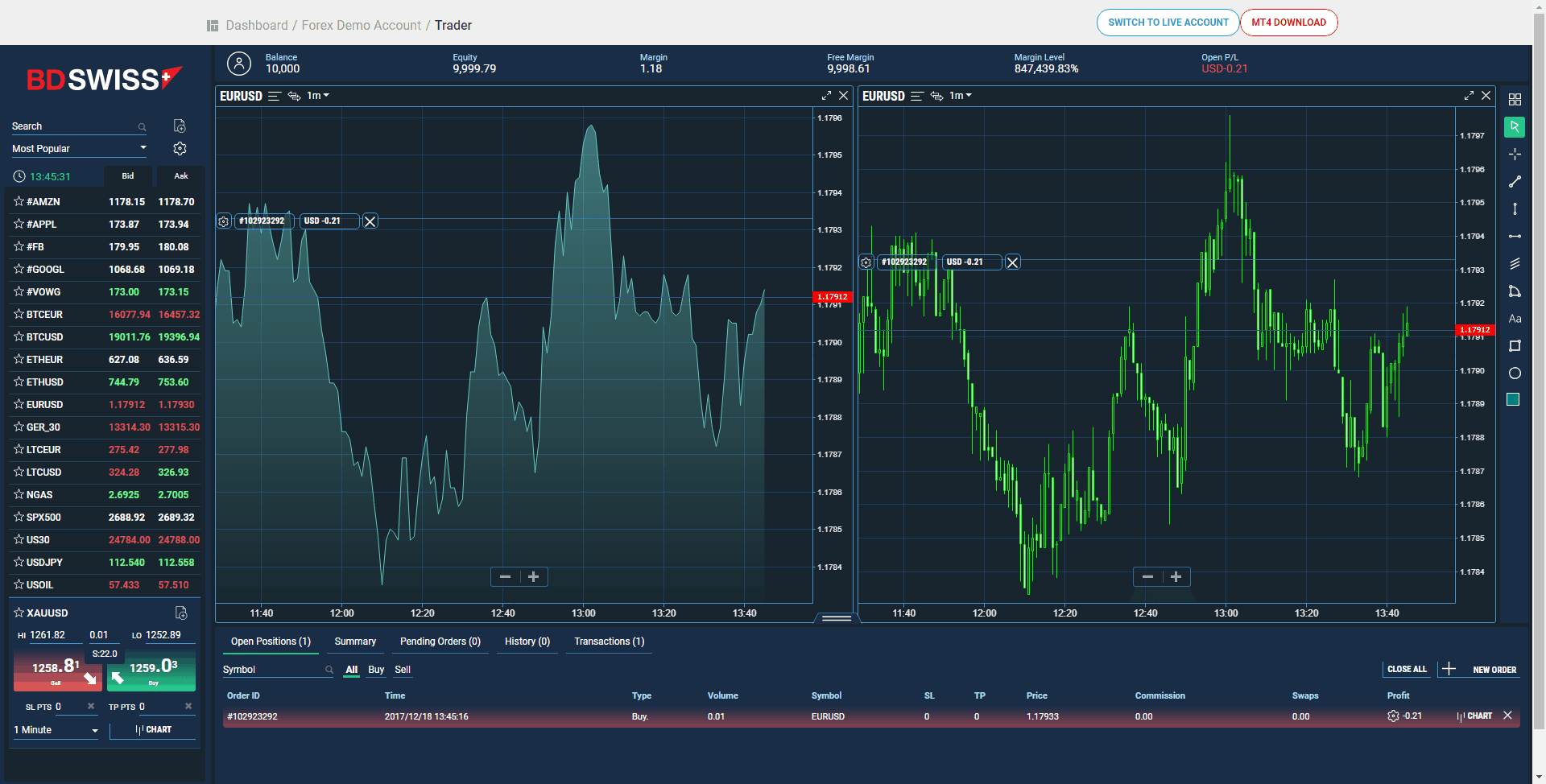

Web Trading

Proprietary BDSwiss WebTrader is fully based online, so you don’t need any downloads or installation and may access trading right from your browser. The platform has a clean view and quite comprehensive and powerful analysis features including technical analysis and risk management tools. So even by the use of WebTrader you can make full out of trading, see trading snapshot below.

Desktop Platform

The available versions of both MetaTrader4 and MetaTrader5 suited to various devices and including PC, Mac, Applications or Web platform that requires no installations. Yet you can download the desktop version for those platforms and use its full capability, which is more required by active or professional traders.

MT5 being a newer version also gained great popularity and features even more developed tools and comprehensive analysis options, loved either by beginners or professionals. Moreover, there are plenty of strategies to choose from, that are useful for every trader, novice or experienced either with manual trading or automated trading through EAs.

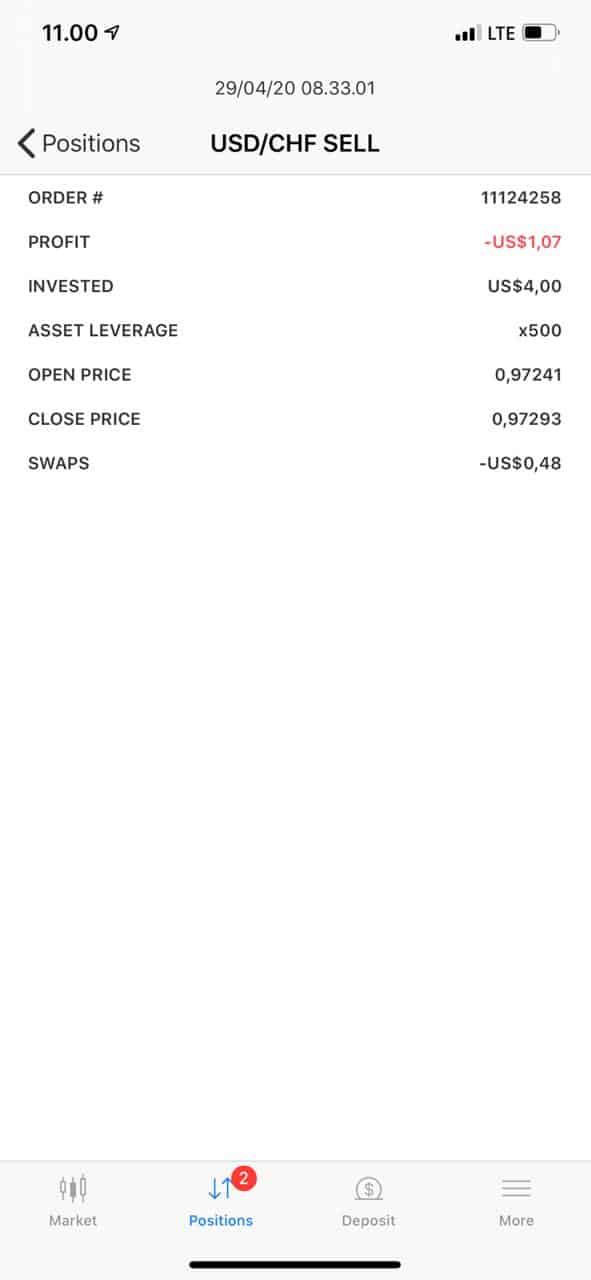

Mobile Trading Platform

Of course, BDSwiss developed its Mobile App as well, which actually is highly rewarded by traders and publications. All the most important features are available there, so being on the go you still may perform analysis, check on the open positions, manage them and access your account management, which deserves good regard from us too.

BDSwiss Customer Support

One of the other great points we should admit is Customer Support. BDSwiss multilingual support is available with service the trader requires daily which is also on a very sustainable and professional level. Even though you can Live Chat, or Email them within working hours 24/5 we still remain happy with its quality level.

- Customer Support in BDSwiss is ranked Good with overall rating 8 out of 10 based on our testing. Support is knowledgeable, fast answers are received on Live Chat, also quite easy to reach during the working days

Education

By maintaining optimum support and assistance, BDSwiss also educates its clients through its Trading Academy. Educational resources covering useful information on how to operate in markets, develop own trading strategy with accredited courses and webinars, we found it quite hahndy and very well organized making them suitable for beginners.

- In BDSwiss you will find educational materials provided by Forex Courses, defined by the level of expertise, Webinars and Seminars.

- There are good Daily Webinars provided, which is a great option for all traders (especially for beginners to expand their Forex knowledge. You will also access useful information with market alerts, trading information and analysis through the Research & Analysis Section, which is definitely good and necessary for any trader especially beginners.

In addition, the company runs an active blog and community of traders, which allows sharing the experience to get better knowledge about the markets and trading itself.

See our Conclusion of Research and Education Service Quality

- BDSwiss Education ranked with rating 9 out of 10 based on our Expert research. BDSwiss provides outstanding Education Materials, with quality research, constant webinars and quality materials covering various topics, also its Trading Academy is good organized

| Pros | Cons |

|---|

| Deep research tools | Comprehensive Research available for VIP and Zero-Spread account holders only |

| Economic Calendar, Market Analysis | |

| Autochartist and Price Alerts | |

| Well-built education section | |

| Performance Statistics and Fee Reports | |

| Daily Analysis and Exclusive Webinars for VIP clients | |

Research

BDSwiss offers great research tools and supports traders with unique materials making you a better trader. Besides general and popular tools like Economic Calendars, quality market Analysis provided by BDSwiss Analyst team, there is also access to Authochartist and Trading Alerts available to all clients.

- In addition, BDSwiss offers all Trading Central and Autochartist market analysis tool. Where, Trading Central is a comprehensive suite of trading tools that offer traders the latest market insights created via a combination of AI indicators, automated pattern recognition, and analyst research.

- There is also another amazing and helpful tool that can be find in the BDSwiss Research Portal – Daily Market Analysis, which provides 24/5 market coverage and leading financial commentary through daily previews, video briefs and special reports.

However, the level of depth in the research tool in depended on the client portfolio or account types, alike VIP and Zero-spread account holders will benefit from deeper research materials including Exclusive Webinars, Performance Stats, VIP Trading Alerts, and more.

BDSwiss Review Conclusion

An overall BDSwiss review concludes us a company that managed to increase client portfolio to over 1.6 million customers. There are stable trading conditions, proven over time, also what we saw along the history of BDSwiss development, with a global proposal suited to worldwide clients, the range of accounts and education provided is good, research we would rank as outstanding, which is super big plus for any trader.

So BDSwiss might be a good match to various size traders, yet would be good to check all trading conditions and regulations and define if it is suitable for you, since for now BDSwiss operates only via International entities. Here you can also read our article about Islamic forex brokers.

Based on Our findings and Financial Expert Opinion BDSwiss is Good for:

- Beginning Traders

- Traders who use MT4 and MT5 platform

- Currency Trading and CFD Trading

- Traders looking for Good Research Tools

- Various of Trading Strategies

- High Leverage trading

Share this article [addtoany url="https://55brokers.com/bdswiss-review/" title="BDSwiss"]

Hello,

I have not been able to log into my account since last year. Can you help, please. Not sure if this is the right forum to ask.

Thank you.

I have not been able to log into my account since last year. Can someone help, please. Not sure if this is the right forum to ask.

Thanks

I have ocean market trading same if the bd swiss this verry qorst if trading flatform i deposite 1500 usd but untill i didnt widrew my money…

No deposit bonus

best brokers

My experience so far with bdswiss is bad. From deposit issues to withdrawal issues to suspension of account to deduction of inactivity fee after they suspended account by themselves o. They are the worst brokers I’ve ever had experience with.

Hi Mj, we are sorry to hear that you feel this way about your BDSwiss Experience so far. As we are unable to identify your BDSwiss account through your 55Brokers username we cannot investigate this further for you. If you wish to have this matter looked into, please provide us with your account details. Alternatively you can always contact our support team directly for further assistance.

Thank you,

The BDSwiss Team

I was not able to withdraw my funds

hi, do you plan to ban smn from russia or belarus?

Hi Grigor, thank you for your question. Everyone is welcome to join our Trading community from any country unless specific restrictions are in place.

Have a great day!

The BDSwiss Team

HI, I came across a company called Forex Mania, it says it offers copy trading via BDswiss broker. I would like to confirm if you do offer such services.

Hi Vusiwe, thank you for your question. Copy Trading is only available to specific countries and jurisdictions, therefore it would be best to contact our Customer Support Team through the relevant channels for more information. Thanks again and have a great day!

The BDSwiss Team

Do you accept Visa card for payment method?

Hi Catherine, thank you for your questions.

Yes, Credit/Debit cards are accepted for deposits as well as Bank Wire transfers, Skrill, Neteller and many more depending on the the country of residence. If you would like to find which payment methods are available for your country of residence please contact us through the relevant channels and our Team will be happy to assist you further.

Have a great day!

The BDSwiss Team

Hi, do you accept paypal deposits?

Hi bodhi, thank you for your question. PayPal deposits are available for specific regions. In order to assist you further with this query please contact us directly either via email, phone or live chat and our Team will be able to advise accordingly.

Thanks again and have a great day!

The BDSwiss Team

Are BDSwiss Global and BDS Swiss Markets the same company? The spread is always the same. I use the same server.

Thank you for your comment. Please contact us directly at support@bdswiss.com for more information regarding the spreads of your account and our Team will be able to assist you further.

Thanks again.

The BDSwiss Team

hello

I wanna get registered from Pakistan don’t know if BDswiss work or accept client from Pakistan?

if accept clients from Pakistan is there and digital or E-wallet for deposit?

Hi MountainPablo, thank you for your comment. Yes, you should be able to register with us from Pakistan. At the moment customers from Pakistan can use Skrill and/or Neteller. If you require any further information before you register with us, please feel free to contact us at support@bdswiss.com or via live chat through our main website and a member of our Team will be happy to assist you.

Thanks again,

The BDSwiss Team

Hi Wayne, thank you for you question. Please contact our support Team directly either via live chat through the BDSwiss website or via email at support@bdswiss.com and a member of our Team will be able to assist you further with your query.

Thank you :slightly_smiling_face:

The BDSwiss Team

Hello, I need an MT5 Account to run my Algo and Signal trading? Do you allow these Algo and Signal trading types.

Hi Wayne, thank you for you question. Please contact our support Team directly either via live chat through the BDSwiss website or via email at support@bdswiss.com and a member of our Team will be able to assist you further with your query.

Thank you :slightly_smiling_face:

The BDSwiss Team

Hi Alex,

Thanks for providing the above details. We have passed this internally for further investigation and a member of our Team will be in contact with you soon.

Thank you for your patience and understanding.

The BDSwiss Team

Signed up to a site to trade crypto that is powered and supported by BDSwiss and am having huge issues withdrawing my BTC to my coinbase wallet. I have emailed support and tried chatting with them live and have received no help or answers. How can I get something done?

Hi Alex, thanks for your message, would it be possible provide the name or URL of the site you are referring to? Also, could you provide us with your BDSwiss account number, if you have one?

Thank you.

The BDSwiss Team

The site is GLprimetrading. It says that your the support team taking care of that site. I opened a ticket with you guys and have received nothing back after that. Ticket #1019671. Trying to send by BTC to another wallet and it just not moving. Thank you for any help you can provide.

is done?

Site is GLPRIMETRADING. It says your group is the one running support for them. I’m trying to transfer out my BTC to another wallet and it’s not letting me. Opened a ticket with you guys but have not received any info. Ticket number is 1019671. Appreciate any help you can provide.

Why are there many complaints about Withdraw process? Why can’t you positively review your Withdraw policy so that customers get satisfied with your service?

Thank you for your comment Norman.

Withdrawal delays could be caused from several factors. Our withdrawal procedure is dictated by various anti money laundering laws and regulations to ensure client-funds safety. These, may sometimes delay the withdrawal process especially when customer documentation is not in line with what’s required. In addition, as BDSwiss operates globally, offering a wide range of withdrawal solutions, sometimes, delays may occur due to the customer’s country of origin, financial institution and the choice of the means of withdrawal and processing provider. Usually, withdrawals are processed by our Team with 24hours.

If you require any further assistance or clarification please contact us at support@bdswiss.com and our Team will assist you further.

Thanks again,

The BDSwiss Team

I wish to use Automated Trading when I open the account. However, Ten Times Profit which I thought I would use no longer posts trading results since 15th July. What happened? What minimum deposit do I require to make for the Automated Account. Can u copy your reply via my Email account?. Thanks

Hi Norman,

To be able to assist you further with your inquiry we would would like to invite you to contact us at support@bdswiss.com where our Team will be able to provide you with more information which is specific to your account and personal requirements.

Thank you for your understanding.

The BDSwiss Team

Hi Ali, thank you for your comment. To assist you with this query further we would like to kindly invite you contact us directly at support@bdswiss.com and our Team will happily provide you with more details.

Have a great day!

The BDSwiss Team

I have a question I have a demo account with I trade with a leverage of 1:500 if I open a real account can I trade directly with a leverage of 1:500??

Hi Tom, usually, a withdrawal request is processed by BDSwiss within 24 hours given that all the necessary documentation is provided and approved by our team. If you have any pending withdrawal issues that you would like us to investigate or if you have any questions or require any assistant or clarifications, please do not hesitate to provide us with your BDSwiss account information and our Team will happily look into these further for you. Alternatively, you can always reach out to us at support@bdswiss.com.

The BDSwiss Team

Traders at BDSwiss.com only can withdraw profits if they can deposit and withdraw via bank wire with IBAN number.

This is from the CLIENT AGREEMENT TERMS & CONDITIONS FOR FOREX AND CFDs

April 2021 – Version 15, in the small print:

18.2.7 Withdrawals should be made using the same method used by the Client to fund his trading account and to the same remitter.

18.2.9 All the Profits generated can be withdrawn by the Clients only via bank wire, after providing a bank statement with the name and account number or using any other method as may be specified and available from time to time by the Company on the client dashboard.

Country like USA, Australia, Canada, India, Russia, China, New Zealand and many more …………. do not use IBAN bank numbers and people from this countries will have a problems to withdraw via bank wire.

Good luck

Hi Naso, there are various ways which you can use to withdraw your profits and funds from your BDSwiss account, based on the country you reside, whether you have an IBAN or not. To assist you further with this query or if you like us to assist you with any clarifications, please provide us with your BDSwiss account details in your next reply. Alternatively, feel free to contact us at support@bdswiss.com and our Team will be able to guide and advise you accordingly.

Have a great day!

The BDSwiss Team

I have been trading here since 3/4 months and I withdraw $ 2000.00 from fund that I never received and now I am not able to log on my account. I do not know what happened. Is this a fraud company. I have been scammed and never receive my fund in my wallet.

There have been many complaints from users online regarding withdrawals. These users have been upset by the difficulty they faced when attempting to withdraw their funds. Some say that they faced substantial delays when trying to withdraw, some for several months. The users further complain that accounts are still susceptible to inactivity fees during this time, losing money because they are unable to withdraw.

Hi Tom, usually, a withdrawal request is processed by BDSwiss within 24 hours given that all the necessary documentation is provided and approved by our team. If you have any pending withdrawal issues that you would like us to investigate or if you have any questions or require any assistant or clarifications, please do not hesitate to provide us with your BDSwiss account information and our Team will happily look into these further for you. Alternatively, you can always reach out to us at support@bdswiss.com.

The BDSwiss Team

Do you have broker on Canada cause Someone call me an ask me 100$ to apply?? Is this a scam???

Hi Kim, thank you for your comment, yes BDSwiss is operating in Canada under BDS Ltd whish is authorized and regulated by the Financial Services Authority (FSA) Seychelles under license number SD047. If you have any concerns about the call you received, you can contact us at support@bdswiss.com and share with us some more information and our Team will happily investigate this for you.

Thank you,

The BDSwiss Team

Does BDSwiss allow Crypto CFD’s for Canadian traders?

Hi Niketh, thank you for reaching out. To assist you further with your query please contact us at support@bdswiss.com. Our Team would be able to respond to any questions or clarifications you may have. Have a great day!

The BDSwiss Team

May I ask if how can I convert dollars when withdrawing from trading account into my local currency which is php? Does depositing local currency automatically convert into dollars?

Hi Marc, thank you for your comment. To assist you further with your query please contact us at support@bdswiss.com. Our Team would be able to respond to any questions or clarifications you may have.

Have a great day!

The BDSwiss Team

Hi Otuata, we are sorry to see that this delay has affected your BDSwiss Experience. Please note that your withdrawal was processed on the 14th of April. BDSwiss does not have any control of the funds once they are processed and the time needed for the funds to be transferred to the client’s account may vary, depending on the payment method.

Should you require any further assistance or clarification please contact us at support@bdswiss.com, our team is always at your disposal.

Thank you for your patience.

The BDSwiss Team

What I’m currently experiencing with BDSWISS as regard withdrawal is very appalling

I signed up with them with a view of trading with a bot someone recommended but few days later i found the bot’s performance not in line with my risk and money management techniques i then disable the bot and place a withdrawal for $181 on April 13 2021

They requested for additional document since i deposited via bitcoin

I submitted the document and the withdrawal was approved on April 14th and my trading account was debited immediately

As i write this now April 20th my money is yet to reflect on my account

I have written to support all i got was just an acknowledge of my mail

I have chatted with their live agent all i get is promises that i will be paid

I must say this is the worst experience i have had in my over 14 years of trading

Paying withdrawals promptly is one of the hallmarks of a good broker

They better state it in their website that withdrawing is not easy so that people know what they’re getting into from the very beginning

Hey bro i am a new trader and i want to know more about trading. Please kindly text me on my email so we can discuss more about that…

hey bro im also a new trader and I want know more about rating have you found any person wh can help you can you share with me information thank you for your help

Hi just register with your site guy by helo of Megen.

What I just need to know is that is legitimate site to work with?

Kindly please check using my name or email to see that am registered on your system for security check

Hi Ahmadre, thank you for your comment. BDSwiss does indeed accept customers from Iran. However, at the moment, BDSwiss does not accept any customers from the US. For more information regarding this particular restriction please visit: https://www.bdswiss.com/help-center/general-account/do-you-accept-us-citizensresidents/

You don’t accept customer from Iran!!!!also USA!!!the value of both countries is less than others?!! Compare with African countries!!!or Yemen or Afghanistan Pakistan indi…hey …are you kidding me?!

hello, can i use bd swiss in Nigeria. also what is the leverage for indices for my region. can i fund my account via crypto btc?

Hi Edna, thank you for your comment. To receive a more comprehensive response regarding your question, please contact us at support@bdswiss.com to provide and our team will be happy to assist you further.

Have a great day!

The BDSwiss Team

Hello. I am thinking about using you as a broker, but wanted to know if you are regulated in the UK where I live?

do you accept clients from the US?

Hi Kevin and thank you for your comment.

Unfortunately, BDSwiss does not accept US citizens/residents for tax purposes.

For more information you can visit our Help Centrer at https://www.bdswiss.group/help-center/general-account/do-you-accept-us-citizensresidents/ . Alternatively, if you require any further clarification you can also contact our Support Team at support@bdswiss.com or through our Live Chat at https://www.bdswiss.group/help-center

Kind regards,

The BDSwiss Team

Hello BDSwiss,

Do you accept US National?

Looking open cent accounts

Live trade

I m. New

Hi Mahesh,

We don’t offer cent accounts. Our lowest minimum deposit is 100EUR/USD/ GBP for a classic account. For more information about what types of accounts BDSwiss is currently offering, please visit https://www.bdswiss.group/forex/account-types/

Have a great day!

The BDSwiss Team

Hello

I want to know that is there any connection between eu.bdswiss.com and http://www.bdswiss.com website because I am really confused and do not know which one is regulated?

Best Regards

Last week i made the deposit of R3000 to. bdswiss and the guy who was helping me he demand me to deposit another R15000 so that my account to be activated ,my question to him how can i deposit another amount when i already do .how many deposit there have to do when u joining (so i want my money back )

BDSwiss, please respond to this comment..

Is he still responding to your messages?

Tell me Is he still responding to your messages?

Have you previously sent me emails? Wanting to know if I’m getting scammed or not.

Spoke to someone called Hannah Mccurry, if you could confirm whether she works for you that would be grateful

Hiii….I want to know is the http://www.bdswiss-id.com also regulated?

Hi Desri,

This is a domain which is no longer in use.

Pleaase note that our main website https://www.bdswiss.group/ will redirect you accordingly to the relevant entity based on your location when choosing to open an account.

For more information about our different entities feel free to reach out to us at support@bdswiss.com

Thanks!

The BDSwiss Team

How has your experience been with BDSwiss? Are you able to get your money out quickly?

Do you accept US customers to trade Forex.

Where are u located in dubai

BDswiss.com

This broker take swap fee ( over night charges,,,,

This is the link,

Check this page

You will understand

/trading-products/forex/