- What is XM?

- 55brokers Professional Insights

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account opening

- Additional Tools and Features

- XM Compared to Other Brokers

- Full Review of XM

Overall Rating 4.6 / 5

| Regulation and Security Measures | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.8 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.9 / 5 |

| Additional Tools and Features | 4.7 / 5 |

What is XM?

XM is a large Forex Broker that is celebrating its 15th anniversary in 2025, and so far serves clients from over 196 countries with a support staff speaking in 30 languages. XM is among the most trusted Regulated Brokers with good trading conditions and overall offering.

The main branch is located in Cyprus, regulated by CySEC, yet offices truly cover global needs and serve through Australia, the UK, Belize, Greece also authorized in Dubai and the MENA region.

Is XM good broker?

There are about 1.5 Million Traders and investors at XM that select broker proposals and services, there are many advanced trading solutions, yet suitable for beginning traders. So yes, we can conclude XM is a good broker with good trading conditions and reputation since XM aims to provide one of the best user experiences in the industry to its clients.

Generally, all procedures from account opening, managing, depositing/ withdrawing, and trading are straightforward, simple and transparent, which we will see in detail further within XM broker review.

XM Pros and Cons

XM is a broker with a great reputation and numerous regulations and a very wide range of trading instruments which we mark as its main benefits. Besides, the offering is user-friendly and XM has one of the lowest deposit requirements among the industry, XM the account can be opened regardless of a net of capital with only 5$. CFD costs we found average and platforms are very friendly to all types of traders. XM supports with one of the best education including webinars and research materials, allowing to engage and start trading carer for complete beginners in trading.

On the other hand, as we noticed XM has a limited portfolio for EU clients, and outside EU clients there is no good investor protection.

| Advantages | Disadvantages |

|---|

| Multiply regulated broker with a strong establishment

| Europe clients may trade only CFDs, Forex and Crypto products |

| Wide range of trading opportunities | |

| Global expands including ASIA, MENA, Africa regions | |

| Excellent Education and Research | |

| Low minimum Deposit | |

| Competitive trading conditions | |

XM Features

XM is a prominent broker known for its diverse offerings and user-friendly trading environment. Here are the main features that set XM apart:

XM Features in 10 Points

| 🏢 Regulation | CySEC, FSC, DFSA, FSCA |

| 🗺️ Account Types | Standard Account, XM Ultra-Low Account, Shares Account |

| 🖥 Trading Platforms | MT4, MT5, XM WebTrader, XM App |

| 📉 Trading Instruments | 1,000+ products Stocks, CFDs, Forex, Commodities, Portfolios, Metals, Thematic Indices, Turbo Stocks, Cryptocurrencies (not available to all Entities of the Group) |

| 💳 Minimum deposit | 5$ |

| 💰 Average EUR/USD Spread | 1.6 pips on Standard Account |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | 10 Base Currencies |

| 📚 Trading Education | Professional Education with webinars and Seminars |

| ☎ Customer Support | 24/7 |

Who is XM For?

With our analysis and Financial Expert Opinion XM is good Broker for various traders, either beginners or professionals, also due to multiple entities available for the International Trading community. Here we mark what XM is Good for:

- Beginning Traders

- Traders who prefer MT4 and MT5 platform

- Currency Trading and CFD Trading

- Trading Investors

- Suitable for a Variety of Trading Strategies

- Long term Trading

- Professional Trading

- Forex Education

- Trading with Low Deposit Requirement

XM Summary

In conclusion XM Review is a well-regulated broker with numerous highly respected licenses that delivers truly transparent conditions and is an extremely customer-friendly broker. No re-requotes and no hidden fees or commissions policy, as well Negative balance protection definitely a plus. So all in all, we had very comfortable as well the good real-time market execution, making XM very welcomed among trading offerings and suitable for various type of traders, including beginners and small accounts.

So overall we conclude XM has one of the most Comfortable proposals in terms of costs, trading conditions and opportunities overall before broker had much lower trading instruments in its range, but now it is one of the strongest points due to the wide range offered.

55brokers Professional Insights

XM is indeed a good Broker for beginning traders, also Traders with experience who prefer MT4 or MT5 platforms and run various strategies looking for a stable Broker. The conditions are rather average with quality product offering, software, and tools, also choice of accounts is valuable if you prefer separate account for ultra low fees or separately if you like speculation on Shares but not buying asset itself XM might be good choice. Since there is specifically designed account for Shares trading with tailored solution, yet the deposit needed is rather very high also at other Broker bigger range of Shares might be available.

The instrument selection is favorable too for those who prefer good diversification, not thousands like competitors, but still good. Fees across all offered asset classes we find similar to other brokers who mainstay on average Fee conditions. What is truly remarkable is great education section and we value professional tools XM offer, so for great selection of quality tools and excellent reputation with quality of service we admit XM a suitable choice for most traders who look for quality. Potential negatives, meanwhile, include inactivity fees, a small product range, and unavailability for American traders.

Consider Trading with XM If:

| XM is a Good Broker for: | - Looking for Reputable Firm

- Need Low minimum deposit

- Value Large range of Assets

- Good for Shares CFDs

- Prefer High Leverage access

- User-Friendly trading platforms based on MetaTrader

- Good Range of Tools and Insights from industry professionals

- Looking for excellent Social Trading and Copy Trading

- Need Broker with Professional Education- Free VPS access

- Trading Contests and Programs

- Appreciate quality Trading Conditions |

Avoid Trading with XM If:

| XM is not the best for: | – Investment Options are limited

– PAMM or MAM accounts are absent

– No wide selection of CFD Shares like thousands at other Broker

– Prefer other than MetaTrader Platforms

– Traders from certain regions like USA

– Trading on Shares Account require high deposit |

Regulation and Security Measures

Score – 4.5/5

XM Regulatory Overview

XM Group servs as a group of entities operating under the trading name XM, Trading Point of Financial Instruments Ltd established in 2009 is regulated by the Cyprus Securities and Exchange Commission (CySEC). Another entity, Trading Point of Financial Instruments was established in 2015 in Australia and is regulated by the Australian Securities and Investments Commission (ASIC). Read more, why trade with Australian Brokers by the link so the regulatory obligations are covered at a sustainable level as we see through our XM trading Review.

However, the point to consider is that – global operation enabled by XM Global Limited established in 2017 is regulated by the Financial Services Commission, allowing to offer its services across the globe. Despite the fact that IFSC is an offshore license, that does not actually implement strict overseeing of the trading processes, yet additional heavy regulation of the XM makes it an acceptable choice.

How Safe is Trading with XM?

The main idea of the regulation is that the trader can trade securely, knowing that clients’ funds collaborate according to the strictest rules with minimized risks of fraud or unfair use. XM Broker operates its trading environment according to the regulatory measures making it a reliable and safe broker.

Client funds are kept in investment grade banks and use segregated accounts, falling under the Investor Compensation Fund that ensures recovery of funds up to €20,000 in case the broker goes insolvent (note that the coverage scheme depends on the particular entity). Besides, one of the advantages you will get as a trader is Negative Balance Protection, so there is no risk of losing more than the available balance.

Consistency and Clarity

Although XM has a strong reputation for regulatory control under agencies such as ASIC and CySEC, prospective customers should still be wary of fraud and confirm the broker’s legitimacy prior to trading. For many traders, XM is a trustworthy option since it shows overall financial stability and openness, also is stable along the years Broker operation, we haven’t find breaches of law or heavy penalties. Besides, XM is one of the Brokers that operates more than a decade and is quite well-established and known for transparency brand in trading environment.

Customer reviews show positive feedback of XM’s operation overall also quick withdrawal procedures and attentive customer care; many users especially value the simplicity of deposits and withdrawals. The proposal is clear, there are no hidden fees or uncertain conditions offered which is another plus showing Broker is good for long-term trading.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with XM?

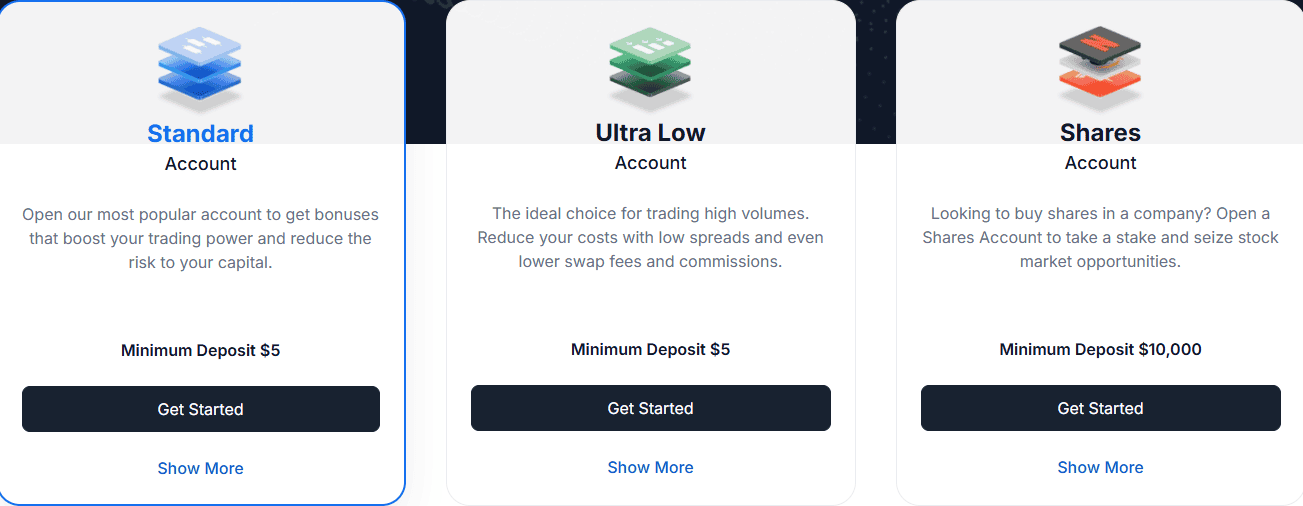

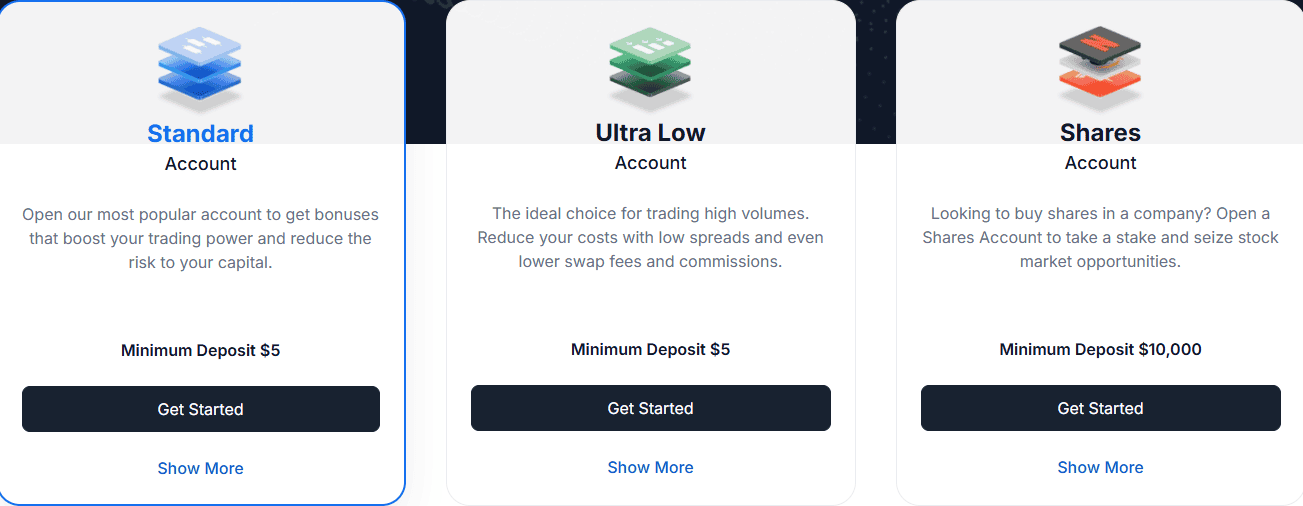

XM offers various account types, including three main options: the standard account, the XM Ultra-Low account, and an additional Shares account designed for shares trading. You may choose a preferred trading strategy, like pattern trading or another, and also a trading preference, and adjust account selection based on that. The deposit requirement for the Standard and Ultra-Low accounts is $5, and for the Shares account, the deposit requirement is much higher, $10,000.

- The Standard account is spread-based, with spreads from 1.6 pips for the EUR/USD pair.

- The Ultra Low Account provides lower fees. It is also based on spreads only, with spreads starting from 0.8 pips, yet this account is mainly used for intraday trading.

- Lastly, the Shares Account is specifically for share trading, where fees are based on the underlying exchange fees, either spread or commission. However, XM shares are provided on CFDs, so it does not allow investing in real shares.

See our snapshot of XM Account offerings below, yet note that the availability of the account types depends on each entity of XM, so it’s good to verify conditions applicable to you fully.

Regions Where XM is Restricted

XM does not provide services to residents of several countries due to regulatory restrictions. Specifically, the broker is restricted in the following regions:

Cost Structure and Fees

Score – 4.2/5

XM Brokerage Fees

XM operates with variable spreads, just like the interbank forex market and imposes no restrictions on trading during news releases. XM fixed spreads are higher than a variable ones, as well are more flexible to different trading strategies. That means all trading costs are calculated into a spread with no hidden fees and tight spread offering.

Also, while selecting the broker it is advisable to check not only the spread but also consider non-trading fees, withdrawal fee or other charges which applicable so that you will see the full picture, compare some fees below based on our finds. Here’s a brief overview of the key fees:

Spreads at XM are based on the account settings, you may find spread as low as 0.6 pips on its Ultra Low account, suitable for intraday trading. On accounts like Micro and Standard, spreads are higher, starting from 1.6 pips, with the EUR/USD average spread 1.7 pip. Trade instruments and the market situation will affect spreads too, while overall rate is higher than the industry average of 1.2 pips.

XM does not charge commissions on main account types; however, for Shares accounts, there are commissions since Shares trading is connected through the Exchange, so underlying asset fee conditions will be applicable.

XM overnight fee or the fee that a trader pays in case the position is opened longer than a day and is agreed through a swap contract that comes as a cost. Every currency has a different interest rate, which comes as a calculation. As an example assume that the interest rates in Japan and the US are 0.25% p.a. and 2.5% p.a. respectively, with an open position, you can either gain USD 6.16 per day or lose USD 6.16 per day, as the rollover calculated as an interest to borrowed currency or earned on the purchased currency. XM uses a 3-day rollover on Wednesdays for positions kept over the weekend to adjust for weekends. Also, Ultra Low Account does not provide swaps or rollover.

How Competitive Are XM Fees?

XM Fees are ranked average based on our testing and compared to over 500 other brokers. Fees might be different based on entity, also majority of currency pairs are on an average level for spreads across all offered asset classes and we find them similar to many other brokers, yet higher than Brokers ranked with very low fee structure. Yet, Ultra-Low account spreads are better and among low level. Also additional fees like funding fees, rollover are good, since no funding fees applied, while inactivity and rollover is something typicall all Brokers charge.

| Asset/ Pair | XM Spread | FXTM Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 1.6 pips | 1.5pips | 0.9 pips |

| Crude Oil WTI Spread | 3 cents | 9 cents | 3 cents |

| Gold Spread | 0.27 pips | 36 | $0.27 |

| BTC USD Spread | 95 | 270 | 0.10% |

XM Additional Fees

XM levies many non-trading fees, of which traders should be advised. First, following one year of no account activity, there is an inactivity cost of $15; if the account continues inactive, a monthly charge of $10 follows. This charge helps pay administrative expenses and motivates aggressive trading.

Furthermore, clients may pay costs from payment processors for transactions even when XM does not impose withdrawal fees. For trades involving instruments denominated in a different currency than the base currency of the account, there also are currency conversion fees. XM keeps a clear charge schedule overall, but traders should take these extra expenses into account while running their accounts.

Score – 4.5/5

In terms of trading software, XM clients access to make transactions and trades throughout well-known and perfectly-developed trading platforms MetaTrader4 and MetaTrader5 and its own XM WebTrader Platform too.

Trading Platform Comparison to Other Brokers:

| Platforms | XM Platforms | FXTM Platforms | AvaTrade Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

XM Web Platform

Directly accessible from the XM Member account the platform is based on Web, so integrated with a site of technical analysis, indicators and tools, stop or trailing orders. So you may access XM trading just by the use of the browser and login to XM Web Trading, valuable for traders who prefer simlicity and clear layouts.

Main Insights from Testing

The XM web platform combines strong trading features together with a simple UI. Expert Advisors (EAs) supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), arming traders with superior charting tools, technical indicators, and automated trading powers. Beneficial in rapidly moving markets, the platform features a one-click trading capability that lets trades be quickly executed. XM’s web platform offers traders looking for a consistent trading experience an attractive option since it combines utility and simplicity of use accessible from any device and does not require installation or laptop hevy resources.

XM Desktop MetaTrader 4 Platform

With its array of features that improve the trading experience, the XM Desktop MetaTrader 4 (MT4) platform is a valuable software for traders looking for comprehensive features. To enable versatile trading strategies, the platform supports market, limit, and stop orders as well as other order types. With over 50 technical indicators and many chart layouts, users can personalize their workplace to support in-depth market research.By means of Expert Advisors (EAs), MT4 also offers automated trading, therefore enabling traders to apply strategies free from regular monitoring. The platform provides fast execution speeds and dependability we marked highly on our trading test, assuring trades are carried out immediately. XM is a common choice in the forex market since its MT4 offers a complete trading environment fit for new and expert traders.

XM Desktop MetaTrader 5 Platform

With its sophisticated characteristics, the XM Desktop MetaTrader 5 (MT5) platform a newer version is also a choice for XM traders with all available accounts and trading instruments XM offers for full trading experience. With over 80 built-in technical indicators and 21 periods, MT5 gives great charting capacity for in-depth market research, besides XM enhanced platform with some extra tools for research and deeper analysis. Expert Advisors (EAs) are supported too, with difference VPS is already inbuilt in platform so EAs may run around the clock, so offer automatic trading alternatives so customers may apply techniques without continual observation.

MT5 overall provides effective trading even with huge volatility since fast order execution times average less than one second. For both new and experienced traders trying to maximize their trading techniques, XM’s MT5 platform combines usefulness and user-friendliness.

XM MobileTrader App

Of course, you are able to use your mobile for trading as well, XM MT4 Android and iOS third-party apps, along with XM MT5 apps will give you access to a trading account with full account functionality. MT4 and MT5 apps also offer great charting with 3 Chart Types, over 30 technical indicators in their package, and a full trading history journal.

Main Insights from Testing

Users of both Android and iOS devices can enjoy flawless trading with the XM MobileTrader app. The app lets traders run orders, track positions, and access real-time market data on the go, therefore preserving all vital aspects of the desktop platforms. Advanced charting tools, technical indicators, and customized notifications keep users informed about changes in the market. MetaTrader is known for its clean and good feel while trading, also its Charting are among the most powerful offerings in the industry. So, the same as we do, you will enjoy its look and functions offered.

The tool provided quick execution speeds and a user-friendly UI throughout testing, thus making it accessible for various traders. Some users, in the meantime, pointed out that the analytical powers of the app are not as strong as those of the desktop version, which is of course fact due to limited capabilities of phone screens mainly. XM MobileTrader is a dependable choice overall for traders looking for convenience and flexibility in their trading operations and is non-replaceable on the go.

Trading Instruments

Score – 4.6/5

What Can You Trade on XM’s Platform?

A range of trading markets as XM Products available from a single multi-asset account that offers 9 Asses Classes and includes over 50 currency pairs with a total over 1000+ trading instruments. you are able to trade XM Forex or CFDs on stock indices, commodities, stocks, metals, energies and Cryptocurrencies at XM all available from the same trading account. Yet, the trading instrument range is different based on entity conditions, alike under its XMGlobal brand, Broker provides a selection of 60 cryptocurrency pairs for trading.

Main Insights from Exploring XM’s Tradable Assets

XM Markets range offers diverse variety of products so you can enjoy a great choice that meets different expectations and preferences. Besides, we see dramatic growth in instrument offering compared to previous years, adding more Cryptocurrencies and CFDs to the list, also recently added Thematic Indices like AI Index etc.

This wide spectrum helps traders to create diverse portfolios and profit from several market trends, covering most of the popular asset classes, also some less popular too. XM does not provide ETFs or options; hence, some investors may have less opportunities if prefered. For traders looking for diversity in their investment methods, XM’s wide range of tradable assets makes it a strong option overall.

Leverage Options at XM

Depending on the account type and the entity under which the XM follows regulatory obligations, you can use leverage on a scale from 1:1 to 1000:1. So important to understand which leverage level you are entitled to use, therefore always refer to the conditions of your residency. This leverage is not available to all the entities of the Group, alike maximum leverage for clients registered under the EU and AU-regulated entities of the Group is 30:1.

As various XM entities apply different conditions due to regulatory obligations here are the leverage offered according to entity rules, also note that leverage depends on the financial instrument traded:

- XM offers leverage up to 30:1 applied to the EU-regulated entity, yet they are not available to all Entities of the Group

- XM Australian entity and its regulation allows up to 30:1

- International entity offers high leverage of 1000:1

Deposit and Withdrawal Options

Score – 4.8/5

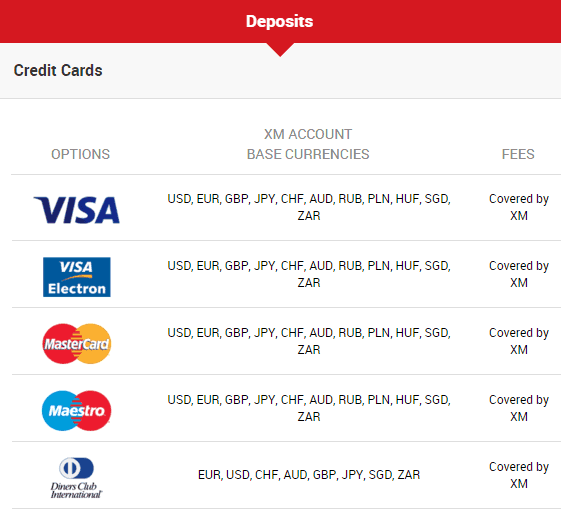

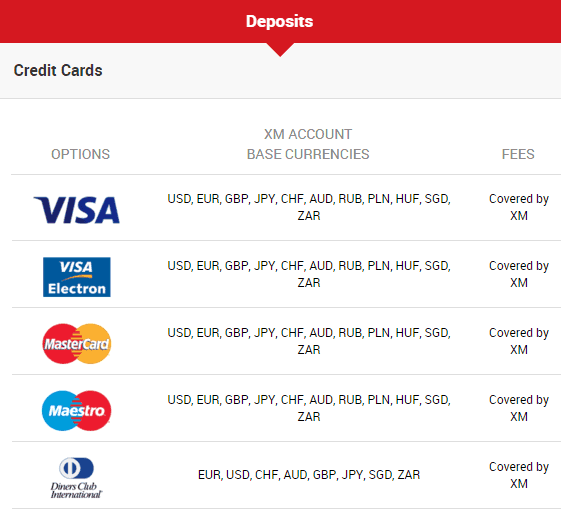

Deposit Options at XM

The funds transaction at XM is managed in a customer-oriented way, and traders have a choice of multiple payment methods supported in all countries. Various payment options, including commonly used ones, also XM introduced a local bank transfer option, which is definitely a plus for many countries since it enables funding the account through local banks and currency with no conversion charges.

- Credit/Debit Card

- Wire Transfer

- Skrill

- Neteller

- Wire Transfer

- Perfect Money

- Apple Pay

- Google Wallet

- Bank wire and Local Bank Transfer (available in some regions)

Minimum Deposit

XM broker minimum deposit amount is $5 for all offered accounts, including Micro Account, Standard Account, and XM Ultra Low Account. Yet, if you wish to trade Stocks, there is a separate Shares account demanding 10,000$ as a start which is quite high. However, the amount you may transfer varies according to the chosen payment method you can read and find all the necessary info in the XM Members Area.

Withdrawal Options at XM

XM withdrawal options are the same as the deposit ones, including Bank Wire transfers, e-wallets and Credit Debit cards. XM applied 0% Withdrawal Fee and offers zero fees on both deposits & withdrawals. Very pleasant addition indeed, as the XM company got all the transfer fees covered including e-wallets, major credit cards, instant account funding, and wire transfers with no hidden fees or commissions.

Moreover, while the majority of brokers still charge for wire withdrawals, XM deposits and withdrawals above 200 USD processed by wire transfer are also included in the Company’s zero fees policy. Most withdrawal methods have a minimum withdrawal value of $5. Usually handled in 24 hours, withdrawal requests vary in the time it takes to get money, depending on the method. While e-wallet transactions usually happen on the same day, bank wire and card withdrawals might take two to five business days. Overall, XM offers a quick and easy withdrawal mechanism for its users.

Customer Support and Responsiveness

Score – 4.7/5

Testing XM’s Customer Support

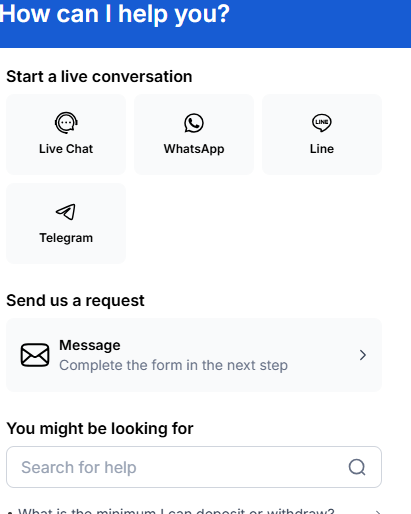

As for XM support and service, we find XM globally covers trading needs while the customer service team is available in international locations and speaks more than 30 languages, including Chinese, Russian, Hindi, Arabic, Portuguese, Thai, Tagalog, and more.

You can reach out to the customer support team 24/7. The broker is available through email, phone, or live chat. Also, we found that the service is of good quality with reliable and relevant answers, which confirms XM’s client-oriented policy.

Customer Support in XM is ranked 4.7 out of 5 based on our testing. Support is knowledgeable, fast answers are received on Live Chat, also quite easy to reach.

Contacts XM

XM provides multiple channels for customer support and communication:

- Live Chat: Available 24/7 on the XM website for instant assistance from a support agent. The live chat is the fastest way to get in touch with XM.

- Email: XM offers email support at [support@xmglobal.com] for less urgent inquiries. Emails are typically answered within 24 hours.

- Phone: Telephone support is available 24/7 at +357 25029933 for clients in Cyprus, +612 8607 8385 for Australia, and +501 223-6696 for Belize.

- Social Media: XM maintains active social media profiles on Facebook, Twitter, and Instagram for updates and limited support.

Research and Education

Score – 4.8/5

Research Tools XM

In terms of research tools and Market materials, it is in good order at XM too. Along with News Feed, Technical Summaries and Technical Analysis, XM provides Fundamental Analysis and Trade Ideas suitable for beginning or advanced traders.

We do really like the way XM organizes its research tools, as you will find in one place everything that is required for your smarter trading decisions along with Forex Calculators, MQL5 and more. Also, exclusive technical indicators compatible with both platforms available for subscribers making it possible to perform algorithmic trading.

To enable traders make informed decisions, XM also offers useful tools, including daily market research, an economic calendar, and trading signals. With its extensive teaching tools and language support, also Price alerts let traders react quickly to developments in the market. These instruments give traders insightful analysis and enhance their capacity for making decisions, therefore empowering them.

Education

Along with good customer service, every client can access numerous educational materials through XM Learning Center, full of trading data and other necessary information that brings trading to a better level. In this regard, XM went also far and developed truly wide education support throughout various regions with the purpose of educating traders, which is a great plus for all traders.

With XM you may count on quality learning, as we found based on our tests, defined also by your level, which includes Live Education offerings, Educational Videos, Forex Webinars, and regularly held Forex Seminars in various destinations. In addition, there are very well-organized tutorials, videos and tools at your disposal.

Is XM a good broker for beginners?

For newbies, XM is one of best broker because of its easy-to-use platforms, a low minimum deposit of just $5, and wealth of professional Forex Education and materials. XM also offers a virtual fund trial account so newcomers may practice free from danger with Demo Trading. Lastly, XM offers a conducive environment for inexperienced traders to grow their abilities and confidence in the market by including negative balance protection and 24/7 multilingual customer assistance.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options XM

XM provides a range of investing options, mostly emphasizing active trading above passive investment choices. XM does not offer long-term investing possibilities, including bonds or ETFs, Shares investment which would restrict options for those looking for conventional asset classes. The broker offers no specific long-term investing plan; their products are designed for short-term trading strategies and dedicated to trading mainly on CFDs. For Broker with classic Investment Options we would suggest checking other Brokers.

However, there are available Copy Trading capabilities XM offers, which are quite comprehensive and on a good level that may be considered as type of investment opportunity. Also, Broker does not provide passive investment services like PAMM or MAM accounts for multi account management, where professional money managers trade on behalf of investors.

Account opening

Score – 4.9/5

Account opening at XM is a straightforward and transparent enough process, you may get started with Demo account almost within minutes since no verification of Identity is required and once ready get to Live account, which was quite smooth process in our test too.

How to open XM Demo Account?

- Visit the XM Website: Go to the XM demo account registration page.

- Fill Out Personal Details: Enter your email address and set a password. No additional personal information is required.

- Verify Email: Check your email for a verification link from XM and click it to confirm your registration.

- Choose Account Settings: Select your preferred trading platform (MT4 or MT5), account type, leverage, base currency, and investment amount.

- Open Additional Accounts (Optional): If desired, log into the XM Member Area to open up to 5 demo accounts with different settings.

- Start Trading: Once set up, use the provided login information to access your demo account on the trading platform.

How to open XM Live account?

- Visit the XM Website: Go to the official XM website and click on the “Open an Account” button.

- Fill in Personal Details: Enter your name, email address, country of residence, and phone number.

- Choose Account Type: Select your preferred trading platform (MT4 or MT5) and account type (Standard, Micro, Zero).

- Set Password: Create a secure password for your account.

- Verify Email: Check your email for a verification link from XM and click it to confirm your registration.

- Complete Personal Information: Provide additional personal details such as date of birth and address.

- Upload Identification Documents: Submit proof of identity (passport or ID card) and proof of address (utility bill or bank statement).

- Account Verification: Wait for XM to verify your documents, which typically takes up to 24 hours.

- Make Initial Deposit: Fund your account with the minimum deposit (usually $5) to start trading.

- Start Trading: Once verified and funded, log into your account and begin trading on the platform of your choice.

Score – 4.7/5

In addition, we found numerous XM’s add-ones and additional tool allowing you to enjoy extra benefits that the platform offers with regular resrarch or tools.

- This includes XM VPS, Rapid Trade Execution and remote connection to a Virtual Private Server(VPS). The XM VPS brings non-stop work without your monitoring or even having the computer on. Clients that maintain a minimum amount of $5,000 or equivalent, are eligible to request a Free VPS, for the ones’ that can’t meet the requirement, still can request a tool with a monthly cost – $28.

- Trading Central offer actionable suggestions based on technical analysis, daily market analysis reports provide both technical and fundamental information.

- Data on market sentiment reflects the proportion of long or short position traders, so supporting sentiment analysis.

- XM Competitions – XM brokerage firm also runs its “Social Area” platform. This addition enables traders to connect, gain knowledge, and challenge one another. Features highlighted on XM’s site include competitions, where traders can vie for prizes and managerial roles. Through Copytrade, novices can mimic expert trades, and with a community of over 10 million, the platform fosters global interaction among trading enthusiasts.

- XM Loyalty Program – in addition Broker run various seasonal programs with certain calendar events and occasions available for limited periods of time, granting trading bonuses or other programs. Bonuses are only available for global traders. We advise checking the relevant one available currently on the official XM website.

XM Compared to Other Brokers

XM is definitely winning as Broker for Beginning Traders the Education quality and available seminars/ webinars are excellent, yet some similar Brokers also provide a great education. Also, the minimum deposit is only 5$ while others even suggest from 0$, still all are very competitive. The platform selection is basic with MT4 and MT5 available, while similar Brokers like AvaTrade also include professional COpy Trading and proprietary softwaare to diversify more. Also fees we find within the average and slightly higher at times too for Standard account, Brokers like Exness offer much lower spreads with similar conditions.

Instruments range is great at XM too, not with several thousands of instruments but are very competitive product range too. Lastly, XM is among those Brokers with excellent reputations and long-history of operation which is appealing in terms of reliability, similar like AvaTrade and HFM too

| Parameter |

XM |

IC Markets |

Exness |

AvaTrade |

HFM |

eToro |

| Spread Based Account |

1.6 pips |

From 1 pip |

From 0.2 pips |

From 0.9 pips |

Average 1 pip |

Average 1 pip |

| Commission Based Account |

Only on Shares Account |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

For Professional Account only |

0.0 pips + $3 |

Available at US eToro Crypto |

| Fee Ranking |

Average |

Low/ Average |

Low |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5, XM WebTrader, XM App |

MT4, MT5, cTrader |

MT4, MT5 |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5, HFM App |

Proprietary |

| Asset Variety |

1,000+ Instruments |

1,000+ Instruments |

200+ Instruments |

250+ Instruments |

500+ Instruments |

2,000+ Instruments |

| Regulation |

ASIC, CySEC, FSC, DFSA |

ASIC, CySEC, FSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

| Customer Support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

| Education |

Excellent |

Good |

Fair |

Excellent |

Good |

Good |

| Minimum Deposit |

$5 |

$200 |

$10 |

$100 |

$0 |

$200 |

Full Review of XM

Operating since 2009, XM is a reputable broker known for its Forex and CFD trading offerings. Under control of several agencies, including ASIC and CySEC, XM guarantees a safe trading environment, also is a reputable firm operating for many years with excellent ranking and reviews from traders. To suit different trading tastes, the broker provides over 1,000 trading products, including stock CFDs, precious metals, and 55 currency pairs. XM stands out as a trusted platform, offering a secure trading environment backed by its status and conditions favorble to trading preferences, flexibility of platforms and available extra features.

Given a minimal initial commitment of just $5, XM appeals especially to beginners. Through MetaTrader 4 and 5, the platform offers easy-to-use interfaces; additional exceptionally well-designed and performed educational tools like webinars and market analysis round out this aspect. XM also offers traders better security by means of various trading protections, schemes and securitty applied.Focusing primarily on active trading techniques, it lacks long-term investment options such as bonds and ETFs, aslo available Shares Trading is for trading purposes only. For both new and seasoned traders, XM is a good option because it offers affordable costs, first-rate customer service, and strong instructional tools combined.

Share this article [addtoany url="https://55brokers.com/xm-trading-review/" title="XM"]

Now, I think it’s better to stick to their standard accounts, despite lower spreads on ultra low. Hard decision, but for me their new 15 birthday bonus that they launched recently looks much more beneficial than counting on spreads.

$30 deposit bonus? Hey, it’s not a lot but I’ll take it!

XM is one of the biggest names in the markets and that’s why I joined them. As far as I am concerned, they’re regulated by multiple financial entities. Like how narrow spreads and zero swap commissions they provide on the ultra low standard account. Trading with them is a real pleasure. I didn’t notice any suspicious actively. So far I’m focused on three major currencies to trade cuz of bull trend

Their support team actually listens to customers’ requests. I had a minor problem with account verification, and they answered quickly and explained everything clearly. I like that they dont use any scripts and all their answers are helpful. It gives me confidence that if I have a serious problem in the future, I won’t be left without assistance. The level of services matters for me.

XM mobile app is surprisingly user friendly. You don’t need to download any other files to trade on this app, just downloaded it from the App Store. All key features are just a few clicks away. From opening trades to using advanced features, everything feels intuitive. Gotta say this is much better than trading on common mt4 and mt5 terminals. I like convenience and how it is easy to use.

The varieties of asset makes it a top pick for profitable trading most especially with the stock market.

In terms of realistic spread i mean it is not so tight but its pretty good here, low enough to make a decent profit.

XM offers too many features for traders, feels like they are spoiling us. There is copy trading, ultra low accounts, competitions, bonuses… And i just got the email that hey have already launched some kind of a promo. Looks pretty good, i will try to trade those necessary lots in order to withdraw them.

First impression of Xm Wasn’t really nice especially with the support so I had my doubts but I got to see the broker for what it really was as I got to experience a good trading environment and nice array of assets.

I do not have much to say about this broker, everything is already written in the review. Personally, I found their trading conditions suitable for my trading style. I trade mostly at hourly timeframe forex and gold. Spreads were okay, execution was timely. Just a small note, it’s much better to perform day trading at their ultra low account. Same deposit requirement, much better spreads.

Xm for me is first of all copy trading ,then trading. Idk if you count it as real trading, but I like copying from experts because they surely know more than me lol

Right now I am learnign from it as well so I can see what is their risk management, and I am trading myself a little bit too, but not much.

Their edu content is definitely one of the most informative I’ve seen so far. And the trading central thingy is pretty neat, lets me focus on important things instead of doing hardcore analysis all day

XM has been very easy to use. Trades go through quickly, the spreads are not bad , and the platform feels so easy. No delays on deposits or withdrawals either, which makes things a lot smoother. Judging from my time trading on here, everything works as expected.

XM offers pretty favourable trading conditions. When I was trading on the forex market with 2-3 lots during the publication of CPI report, I was surprised to see how spreads remain tight even with such conditions and volatility. I didn’t lose a lot on spreads and captured most of the profits.

If you asked me for who this broker is the best fit, that would be traders who prefer a simple trading platform, excellent service, and clear trading conditions… everything works like a well-oiled machine here. I was surprised how reliable its platform is… the execution is always fast, the platform is always stable, withdrawals are always processed without issues…

There is an account type for every kind of trader, depending on your level of knowledge or even the assets you want to trade. For example here there is an account dedicated to trading stocks exclusively which has amazing conditions.

The educational materials especially with the trading glossary and terminology makes it very easy for beginners to get started. It sure helped me when I was learning trade.

I’m not sure why people can even go for a standard account, when the ultra low account offers such tight spreads and absent commissions – all for the same price of a 5$ min deposit. The choice was a no brainer for me, as the spreads for eur usd were lower than 1 pips.

I think the account selection is very well balanced, I can even open a demo account with virtual money and practice there for as long as I want. Many trading instruments too…

Plenty of everything is on the xm platform. I didn’t require much, still it was nice to know that the trading service was full and had something to offer. I liked how they worked in their personal area. Well-built user-friendly interface for instant access to the markets. The same can be said for their mobile app. I mainly used it to track my orders, a comfortable one.

Xm is quite a decent choice in forex trading. Costs are fair, with some reasonable spreads. Payments are done on-time, with no obstacles to withdraw. And in general, it looks like having all necessary features for a normal smooth trading, without something super big.

They do not metnion it a lot, but the bonuses I got for depositing were helpful in growing my accout size, which is my main goal for trading with XM.

Their live education center is exactly what I needed. It’s a pleasure to learn from the best of the best. I found how important it is to understand how central banks influence the forex market by their decisions and announcements.

As a whole, xm has what any trader, I mean mediocre needs for the trading. Lower spreads, balanced leverage, timely execution, MT software and of course payments without obstacles. I could see all of these qualities, while trading with them. Other stuff is more about tastes and special trading requirements.

For me I first sign up because they have low minimum deposit it was only like $5. I wanted to try trading forex and some shares too see what is it. Then it got interesting for me and I opened another account ultra low and deposited more money now I am trading there mainly. XM is good service for trading I think – I dont had problems trading with them.

Broker is good. spreads are sometimes wider than usual when a macroeconomic report is published.

Tried XM recently and the experience has been decent. The platform runs smoothly, order execution is okay, and it’s easy to navigate. I haven’t had any major issues so far. The bonuses are also true just got a sweet bonus for referring my friends to join and trade.

If you are looking for a broker with a great trading condition then you’ve come to the right place. I started trading with Xm a while again and while it’s not perfect the most important things I need I am able to get them and that’s low fees and tight spreads!

This platform is well regulated and has great account types; the minimum deposit on the shares account is affordable when compared to other platforms. I chose the ultra low account it is swap free and has no commissions.

I had a feeling that xm has everything that the average average trader needs. Payments without delays, trading terms that didn’t affect the profits in a negative way, good choice of assets and platforms. I found it enough for daily simple trading at CFD markets.

I thought it’s just another broker with the same trading terms, but it’s not like that. XM happened to be an excellent broker for my trading style. Why? Because there is no swap fee on their Ultra low account and this is not an islamic account, just for your information. Anyone can have it. Great for traders like me who keep trades open for a week or more

My trading experience was just good there. I have no sign of a problem with any broker’s service.

Both desktop and mobile versions of the MT5 provided by XM are excellent choices for trading. None of them ever froze or lagged for considerable amounts of time, everything is smooth and upright. The market sentiment is there with you so you can trade on the go and do not waste time looking for news somewhere else. Love it.

I think everything is alright with xm broker, nothing to suspect. Regulations are at place, fair conditions, my personal XP with withdrawals was pretty good. Decent trading platform, overall.

Every day and some times on weekened I trade crypto currencies with XM and it’s mostly popular like Shiba Inu and Avalanche and SOlana.

Nice review! I would agree with most of the points except that the spreads are average. Maybe if you compare them with what other brokers PROMISe, yes. But in reality, spreads differ by quite a lot. I find trading conditions at XM better than other brokers I’ve tried, even more so for assets besides forex

XM offers a good line of various account. Which one will be best for scalping?

Essentially you have to look for account with lower spreads, as you are going to open multiple positions each day. Wide spreads = lower profit for scalpers.

So, because of that, i would recommend the ultra low account option. The spread are almost cut in half compared to standart option, which is veryyy beneficial for scalper traders. Furthermore,the minimum deposit is just $5 so it’s not like those deluxe or premium accountts that require a $10,000 min depo.

XM offers many different accounts and I bet my bottom dollar that everyone will be able to find something useful here. I chose an ultra low standard account with zero swap fees on major currencies and narrow spreads.

When I first started with XM, did it bcause of 1000x leverage, was the standout feature at the time. Obviously, learned a lot in these years. Nowadays, I know that there are brokers that offer 3000x even 10000x. But I stay with XM because I have deposits here and don’t want to transfer money around, so much can go wrong.

Xm has a really good support experience that makes it easy for anyone to join the platform. Either as a beginner or experienced trader it’s a great application to use for a all trading activities.

Trading with xm, was nice and flawless. All I needed was simple trading without any problems and they could give me that.

I think XM is good, I like tournaments here as well for demo. I am usually trade turbo stocks and stock derivative but also I take part in tournaments because its fun and for demo its free.

It looks like an ordinary trading service. And from some perspective, xm is quite simple without something special. But, if I talk about my own xp with them, I’d say that with simplicity, comes the convenience. I could focus mainly on trading, not getting distracted by other things. The MT platform and nice trading conditions helped me in this process.

Everyday I trade with XM on my computer in the morning I make some trades on forex and stocks then I go to work. At work I usually check my trades from my phone and see if I need to take profit or maybe move my SL or close my trades. I Like the comfort here, seems like I get all control over my trades 🙂 Thanks xm for app and trading services.

I trade with XM because I liked the XM app. When I was in goodge play I searched for trading app and XM first came out so I downloaded it. Then it was comfortable because it was easy to open trading account here I have ultra low. I paid with my visa card and then I am trading forex and some stocks.

The broker that has trading conditions, without any unnecessary fee. It was both affordable and comfortable to trade with xm. For now, I can’t tell about any nitpicks and complaints about this broker.

A little bit of this and that makes the difference. Lol , I am speaking of their various asset types, when I trade one like forex and trade the next like stocks it makes a huge difference in my profit ratio. The customer service is also cool..,

Good broker with reasonable trading conditions. It was challenging to find the service that is good in pricing and suitable for me by its trading software. Here, I think, it’s okay, MT+normal spreads.

XM provides a solid and reliable platform. The interface is easy to navigate, and customer support is always helpful. With a range of trading tools and assets, it’s a good choice for those looking to get into trading. I’ve had no major issues, and the overall experience has been smooth.

the amount of licenses this has… astounding.

Why the investment opportunities are only 4/5 btw? The real stocks they have are a great investment. PAMM is no better than copy trading (that they have, and its one of the better ones, just because the traders are good). I really don’t agree with investment score there. The rest yeah, solid points!

Trading wit h XM is going super well, and mainly for the fact thaat I am getting better with every trade in here. Education is the main reason for that,. I like how they conduct live tv and they even answered my questions the other day😁 Trading with ultra account and now swaps so I can do intraday and carry my trade and don;t pay any swap fees adn this is very convenient

One thing I definitely like about this broker is the variety of payment methods that are being offered to the clients, here there are different ways deposit and withdrawals can be made like through bank wire transfer, card methods, E-wallets and other ways but this makes the platform efficient.

good broker with no real issues when trading with it, unlike most others out there

It’s a good way to learn on demo , listening to videos and watching tutorials. But at the same time, it’s a great way to practice on real account with comfortable leverage (X1000), low deposit threshold, excellent spreads… in parallel, you receive accurate trading signals from trading central that is a great addition to mt4 and mt5 in the way it is implemented by xm.

good experience, nothing feels lacking. got my money in less than ten minutes, even if it was just a test withdrawal, I’m happy.If they offered more options specific to scalping, I wouldn’t be opposed to that too. Like maybe ctrader in the future, or anything to add to the account they have for it, and addons for MT5.

The experience with xm was quite okay, no problems with their services at all. Since, there were no issues from their side, I think this broker deserves the trust and credits from my side, as a just good broker.

Only good words! As you feel safe trading here under the regulated platform. I did not experience requotes altoiugh I must admit my whole record with xm is within 3 weeks or so. Anyway i could withdraw twice for this period already and never had problems with approval of my withdrawal applications. It matters more than diversity of tools – however, you enjoy many tools here too.

Last week, I finally finalised the process of opening an account. Yes, it took me a while, much longer than I initially expected, but guess what… I am not even mad or disappointed… I’ll tell you why…

The registration procedure is pretty simple and standard. It took me like 5 min and the uploaded documents were approved pretty quickly and my account was ready to be deposited… but here I encountered a problem. I couldn’t deposited… regardless how many tries I made, the same error message appeared – the transfer coudn;t be completed.

Luckily , I received an email from an account manager once my account was approved, and decided instead to contact the customer support to ask her what seemed to be the problem. Got an immediate response, the country I entered didn’t correspond with the country of the bank card. Yes, they were different.

I appreciate that this problem was solved in the beginning… in the past I had a similar experience with a broker, but in that case they didn’t have a problem with depositing, but when I made a withdrawal request, they say they are not able to process it.

This time, I am sure all my banking details are set in place even before depositing my account. Feels good and reassuring.

This is a pretty fresh review… last updated in January 2025 and quite comprehensive as well… I recommend this article to everyone considering XM as his future broker.

What I did was the following… opened up the XM website and started filling out the registration form according to my jurisdiction. Simultaneously, I followed this article to see if everything aligns with the actual situation on their website.

The article seems accurate, and I couldn’t spot any mistakes or aspects that are not depicted as they were on their website.

Just one thing… regarding the brokerage fees… you gave them 4.2 points out of 5. I would give them 5/5 in this category due to the XM ultra low account, which is one of the most cost-effective you can find out there!

wasn’t expecting as much year ago, but now I’m liking it a lot. 2025 was a huge year for stocks and forex already, so many huge moves. I guess slow 2023-2024 was just not as fun for me. Big moves with XM pay off very well, and they don’t increase spread during news events, at least if you choose the acc right. The end result is good profit for me, so can’t complain, at least this year.

Fair trading conditions that they provided me for trading forex pairs. Nothing is overwhelming or lacking, just good spreads and a golden middle average. That`s more or less suits me.

This is a great, thorough and objective review of XM. I recently started to trade on this platform and this article helped me understand better how XM is doing compared to other brokers.

There is just one thing that I want to add, that is not mentioned in the article – regarding the deposit bonus.

It’s interesting that XM has included a 100% deposit bonus, especially since this is more common with what I call “work-in-progress” platforms, not for established and already popular brokers. So, I would add these aspects as another positive trait to be considered when evaluating the platform.

Is there any reliable way to win the trading competitions here, or at least come up top-10? I find those really fun, but always fall short, even if I’m profitable during trading. Should I use the leverage to the max and take risk management less seriously maybe, or is it possible with lower risk still?

They provide probably the best conditions, if you look at it generally. I wanted to get some analytics, and saw that they are collabing with Trading Central and there are so many materials! The insights you can get are a lot, and all filled to the rim with useful info and tips about the upcoming market moves😏 The only thing needed is to use them correctly

The process of registration was simple actually there. I found out about xm broker after noticing them in the list of top 20 brokers. As soon as I opened the ultra low standard account, I needed to pass a full verification to make deposits and withdrawals hassle-free. It turned out they have cryptos for transactions and I’m not sure if this is possible to use in all regions but at least in the global jurisdiction everything is fine.

What I particularly notice about trading with xm broker, it`s the simple and convenient way of trading. Really, all the services were easy to understand, so there were some sort of unexpected things to face, in the important processes, such as trades placement or payments,full transparency of services, indeed.

This broker was the right choice for my first trading experience. I like the variety, as well as the quality of provided services that could make me more experienced and knowledgeable traders.

I think for anybody trader , trading with XM is convenient, they have good conditions.

I have a few tips for those considering XM broker.

I don’t believe that anyone would face any trouble assessing the trading terms once they are displayed clearly and everything you need to know is provided. Hence, I suggest you go with the Ultra-low account type since there is no minimum deposit requirement,and the terms are much better compared to those on the standard account.

The educational resources are just fine if your intention is to trade and learn simultaneously. There are frequent webinars that are useful and practical. No need to explore other platforms if you are a beginner or let’s say, intermediate trader.

And one more thing, when you open an account, you will be contacted by an agent, which is somehow a dedicated customer support agent to you… so you know where to call if you need clarification.

One month ago, I opened an account with XM, and even though it’s been a relatively short time since I started trading here, I can see the potential of this platform. Its reliability and professional support is a stand out feature. It is always good to work with professionals. Regarding the trading terms, the thing that stands out is the platform’s overall low trading costs.

It doesn’t take long to get your money after withdrawals. At Least you get it that same day. Also the wide varieties of assets makes it easy to have a diversified portfolio.

I am working with XM stably for like several years in a row and I can’t say that there is nothing that repels me for real from the company. The platform has a very dynamic, flexible and versatile trading environment which means that you can continually learn and grow here + earn money if you have managed to create a good strategy that brings you income. The broker always supports you if needed, whether these are educational materials or just aid from the support team who you you apply to.

Besides, they have copy trading functionality which is also a very attractive way to multiply money.

My experience with xm broker has gone with no flaws and in general it was comfortable. Hopefully, they provide options to choose between, on assets, platforms, payment methods. Actually, I started on demo accounts and after decided to switch ultra low accounts, which has tight spreads, great choice, for someone, who prefers cheaper prices, unless you`re bonus lover, that`s not for me.

Xm broker is obviously a broker that provides good trading conditions and tools. The best thing that I liked about my personal experience with them, is the functional and stable working platform.

In the first place I liked the trading terms and its reputation, and this was the main reason I decided to trade here.

However, after opening an account, I found features that I was not aware of. Such as the the wallet, which simplifies the transactions between accounts, the contest, which are great for sharpening your trading skills and more.

they indeed care about the comfortability of customers. When i signed up, after a few hours one of their support guys called me and we had a little talk. I felt special and understood I chose righlty.

Anything I need they got is, simple as that. If you come to think of it, XM built a whole empire with everything in it, and the amount of offered services is almost overwhelming,

You get multiple platforms for nearly every modern device there is, and the selection of accounts is well thought without any supoer deposit requirements. Education is just another topic, enough info to learn something new every day. And the tournaments, arguably the best organizers of demo contests is XM – and they are regular🏆

The ultra-low account on this platform is the best one to choose. The minimum deposit requirement for this account and for the standard account is the same – $10, so it makes no sense to trade with the standard account since, for the same investment, you can get improved trading terms and lower trading costs.

Additionally, I would recommend this platform for its payment system. I had no troubles with depositing, and most importantly when withdrawing from my account. Works like swiss watch😀

Just right after I opened an account and deposited funds I received a call from XM and had a pleasant conversation with one of their agents. She shared her contacts and told me that for everything I need to feel free to contact, she will be providing help to me 😀

Nice touch and highly professional from their side 👍

The broker is one that is regulated by reputable bodies, secured with the clients money and has a good usability of the platform. The withdrawal methods vary and the one I have had good experiences with is the card method.

I am trading forex and cryptos with Xm, got an ultra low acc and imho it’s a big and robust platform that has big experience in trading. spreads are tight, execution is lightning fast

I reckon it’s difficult to find a better platform from the point of convenience of navigation, comprehensiveness of eductionalt section and reliabilitty, of course.

These are parameters that I have already evaluated, and I have many more of them to assess in the future.

I am a beginner trader, so this is the reason why educational section is crucial for me and this is what I paid attention to at first.

Ofc, registration, verification, these stages were easy as well.

As for reliability that I mentioned, then just check awards, licenses and tier lists. XM is almost on the top.

I was looking for a broker that would provide long-term investments stocks for a long time.

Almost all of them offer only cfds but after all I found xm and their “shares” trading account attracted my attention. As soon as i deposited my funds, the supp got in touch with me and we had a little talk. I wanted to sign w-8 ben form to avoid double taxes from investing in US stocks. I’m good rn

ultra low standard is a nice choice for me since usually i hold positions for several weeks. in other words, i hate paying for swap commissions and luckily, xm broker offers this account that doesn’t charge any commissions for swaps. It’s definitely a profitble deal for me! 👍👍

This broker has a good reputation among traders. And this influenced my decision to open trading account here

I deposited my trading account with convenient sum for myself, since minimum deposit is only $5.

Therefore, I easily and without problems gained access to a real trading account.

I chose MetaTrader4 trading platform. It has user-friendly and multifunctional interface. And I can use any trading strategies on it.

The withdrawal with this platform has been cool, it works seamlessly and everything is fine… there are various payment options that allows you choose conveniently. The platform also has great tools and everything you need to make cool profits.

well, if you’re asking me, then i had some hesitation about their reputation to be honest and when i came across XM broker in the list of top 20 brokers around the world, I didn’t trust them anyway.

Nevertheless, i changed my mind after seeing how many financial licenses they have and it was a key factor why i decided to join them. So far i’m trading pretty good with xm.

Hm… 2009? I thought it was founded earlier.

Anyway, this means that the broker is reliable, cause it’s been over 15 years since it has started to work in the market and I am sure that the question about broker’s reliability isn’t on the agenda for traders. You just google “XM”, check when the company was founded and head to registration form right away.

How you found this broker?

wanna share my experience of working with this broker because I am sure for some traders it will be a valuable outlook.

i trade here forex pairs, eur/usd, gbp/usd, gbp/jpy and sometimes check if smth tasty can be caught on blue chips like tesla, amazon, apple, alibaba group.

spreads are fine, execution doesn’t let me down, like if I want to long GBP/jpy at $190 level I send pending order and it’s executed right after the price touches it without slippages.

by the way, guys, have you ever faced lags, requotes or other unpleasant things out here?

I will not redistribute any material from the Website.

As soon as I pasesd a full verification of my acconut, I got a welcome deposit bonus of 30$. After that one of their guys got in touch with me by making a phone call but I wasn’t able to answer it and he contacted me by sending gmail sms. It was good actually!

guys, gold times for the CRYPTO market is beginning. Finally, we got a president of the USA who is not going to prohibit crypto currencies.

The day when Trump won the presidential race, I was in a long position on bitcoin at 67000$ price. It was pumped by 13% and reached 76000$ of price. 🚀🚀 Glad that Xm brokER provides a high leverage for crypto pairs, used 1:80 leverage on that day. 🤑

The pric on accounts are very fair, traders who are new or can’t afford a lot can get the most affordable accounts. I am just glad that XM considered all levels of traders to use their products.

I am super comfortable with the ultra low account for now.

I decided to choose ultra low standadrr accnt because it’s popular. Conditions are really okay, no swaps on the major of forex pairs, so it’s a favoorable place for positinal traders. Besides they offer nice leverage that you can choose on your own All in all, no commplaints, XM broker is a cool.

i opened a trading account there, by the way my choice was the ultra low standard account cuz many traders were mentioning about this account thousands of times.

what i can say is that their mobile trading platform is modern and it has a lot of widgets and simple tools, even though i have never used it before, it was quite easy to understand how to use it. 🧐

I joined XM broker because some colleagues at work who are also involved in the trading industry told me about how much they like this company.

In particular, they were talking about the xm ultra low standard account, well, i wanted to check out what was special about this broker. I was surprised by tight spreads which start from 0,8 pips averagely. Now I totally understand why they were speaking highly about XM! So far I’m enjoying my trading experience. 🤪

I was profitable for many years now, even if its not fulltime, but still found the research sectrion here entertaining. XM live is good too, a bit overly long usually but still.

In my opinion, one of the advantages of XM that almost no one talks about… is that all 3 types of accounts for forex trading have low limit on opening trading account.

For Micro Account, Standard Account and XM Ultra Low Account, broker set a minimum deposit limit of only $5!

Do you think it is good for a trader to trade with small amounts?

I think that with proper trading, even a small amount can be traded successfully.

Minimum lot size in XM is 0.01 and, the leverage largest for currency pairs.

Therefore, my recommendation for those who want to trade such a small amount is to choose EURUSD currency pair and use the smallest lot. Use only one order in trading. This way you can make such trading much safer.

As for my attitude towards such a minimum amount for opening account.

I’m sure that XM wanted to show that they accept all clients regardless of their experience and trading level.

XM has a reputation as one of the solid brokers. And therefore, some beginners may doubt that such a company is suitable for novice traders. XM shows its loyalty to newcomers with such a deposit size

I first tried the standard account which was quite good but when I had to change to the zero account I saw the difference in spreads. But the only minor issue I faced is the response time of the customer service tends to be slower at peak times. Who can I channel my complaints to make changes?

Wow, buddy, take it easy.

I think you should focus more on trading. And you can also ask questions about broker on forums and online sites.

Btw, XM has trading platform that almost every trader knows how to use. Therefore, you can get answers to any question from the community of traders.

As for support service, I have a very positive experience so I am sure they are doing everything they can…

I’ve traded just about every asset pool, but trading gold with XM has me feeling like Midas himself! 😀

the execution is great, spreads are tight, and scalping is allowed… me is happy 😀

When I signed up I got a bonus, very interesting. I don’t really need it beacuase I have my own capital for trading, but it is just pleasant surprise and addtition😁 I cant withdraw the bonus, but I guess I can now risk less of my own capital and trade with the bonus , this way XM has taken care of some of my losses🤣 Doing my thing on MT5 at the moment, not super different from MT4 tbh, but still some innovation I guess, not that bad, but hype was too big.

Starting out in the trading business, you get to hear a lot of opinions and there are various trading platforms available. My mentor in the business once told me that finding the right platform is key and every other thing falls in place. With recommendations of trusted people and research of my own i decided to give XM a try. I am learning to trade crypto on this platform and even though I have been for a while but I feel its a continous learning game. The spreads are nice and the accounts are set up for the traders profitability.

XM broker provides many crypto pairs – BTC, ETH, altcoins, and even memecoins. The volatility is high so a very big opportunity to make a profit sometimes even up to 500% gains. But if you are still new you have to be careful

a bit dissappointed in myself that I didn’t get to financial freedom yet.. always thought im great at math and geometry (charts are basically geom) but for some reason this is harder than I expected. Learned a lot from XM webinars and usually I trade in profit, but sometimes something crazy happens with markets and everything drops, and idk how to hedge vs that.

for broker itself – didnt see anything bad, the payouts are always on time, spread is ok. No swaps acc is helping to hold positions a lot

I started using them not long ago and so far I enjoyed the competitive spreads per account type readily available and therefore giving cheaper trading options. They don’t apply hidden charges which are very much discouraging to someone who is just getting into trading.

Also, they have the demo account option ,especially for anyone who wants an opportunity to freely practice trading.

Word up, bro.

Spreads are competitive for real, while demo account comes in handy to many traders evne me and prolly you too.

As for hidden fees, then I also didn’t notice smth liek this, especially when I was depositing the acc fro the first time, it turned out the cover all costs which is generous of’em. NGL, good guys.

Even after I opened trading account with XM, I was still interested in learning as much as possible about this broker, features of its services, and how each tool works.

So, to get the most accurate answers to my questions, of course, I contacted support service

There I wanted to get the most detailed answers to my questions. To do this, I asked in my messages that support guys give as much detailed information as possible

I’m glad that my requests were fulfilled and I’m completely satisfied with what I received from support service

In this review, I want to thank them for their help

I have been on this platform for some months now and while I’m no expert, I can say I speaking as a trader with some experience, the services they offer include fast depositing and withdrawal of money which is even more commendable. When you have any queries their support will have it all sorted

Xm has an appreciated price level meaning that everyone can afford their services.

An excellent and useful review of XM. However, I have noticed that the company has multiple entities, all of them mentioned in this article. How do I know which one I should choose? Which one would you recommend for opening an account with a $200 deposit?

The entity you get depends on your region and its jurisdiction… you don’t get to choose anything

Gotta tell you this, XM app is much better than anyone might expect. MT for mobile is something that looks kinda old and boring. Moreover, it’s hard to trade from it.

XM app on the other hand has a better inferface (at least for me), and trades open really fast there. Also, thanks for adding some options for customization, trading from the phone is now also comfortable👌

Also, the section with news and market research right on my phone is nice, I don’t need to cruise around various websites to get the info I need, I can just do it all from the phone.

So far I have not experienced issues with unreasonable widening of spread in the middle of my trading activities with XM broker. My experience with other brokers has been scarred by this. I would like to commend XM for keeping to their words.

I noticed how many traders pay attention to how many licenses any brokerage companies have but to be honest it doesn’t matter for me because the main criteria when it comes to choosing a reliable broker is how long they have been running the business.

So I chose the XM broker because they were launched in 2009 and it has been for over 15 years which means the company is capable of experiencing various economic turmoil and there is no need to worry about the safety of my funds. I mean, if something bad happens then the probability of the XM going bankrupt is probably 0% percent! Longevity!

I think this review does Xm justice as it’s arguably one of the best forex brokers that a trader can find.

And it’s definitely the best value for money for sure.

I have been trading currencies here positionally with zero swaps and I must say that none other broker could provide me with this possibility.

Sometimes the brokers offer positive swaps at best or islamic accounts with limited days of zero swaps

XM has long attracted my attention because it has such a good reputation among traders.

But what influenced my decision to open trading account was that I started using new trading strategy.

So I needed special trading conditions that I saw in XM

I thought it was a great combination. Reliable company that is respected by traders. Favorable trading conditions for application of my trading strategy. And of course, high quality of all tools.

Any trader wants to get high-quality and reliable tools.

I know that XM has licenses and some reputable resources put this broker in the first place in their ratings.

But does XM have any non-obvious evidence of its good reputation?

I always refer to awards, history and reviews when it comes to non-obvious evidence of the broker’s reputation.

Number of awards is countless, seriously, I ain’t even wanna head to the website and count them all, just do it on your own.

Reviews are in bulk positive, I would say ~75-85% are positive, others are neutral and negative.

And history of the broker… It’s very rich, they have been in the business for a long time, you can track it as well and check all the milestones.

I find This broker to be very affordable because all its accounts have minimum deposits of $5 except the shares account and it provides good trading conditions. Even though I’m an experienced trader I don’t trade shares so I’d like to understand what makes that account different in terms of minimum deposits?

U mean why the min. deposit so big for this account or what? If this is what you wanna know, then it’s prolly because of absence of leverage.

Other accounts can be chosen if you deposit at least $5 and leverage cna be up to x1000. In case of Shares account, you deposit a big sum right away and trade without any leverage obviously because your position size is anyway big. I guess this is fair.

Even though I’ve seen a lot, I never faced a broker that would offer such a big array fo ways how to reach out to the support.

Well, I can’t say that I require this, because the XM platform is simple in terms of navigation and I didn’t have troubles registering an account here, verifying it, installing the platform and logging into it.

But, it was just curious to test Viber and I made a request. The responded quickly, not as fast as in the Live chat, but anyway.

BTW, have you tried these exotic ways to contact support, or just used live chat?

Oh yes, I agree

It seems that XM provides really many opportunities to get high-quality customer support.

I also have a positive experience of interacting with support service of this broker and therefore fully agree that you praise their work

Btw, I used Telegrams. But they also have whatsapp and viber

My question to this customer support service was about those assets that are available on platform and about specifics of trading conditions.

And you know, I didn’t expect to get such a detailed answer to my question.

Now I know everything about financial instruments on my platform.