- What is RoboForex?

- RoboForex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

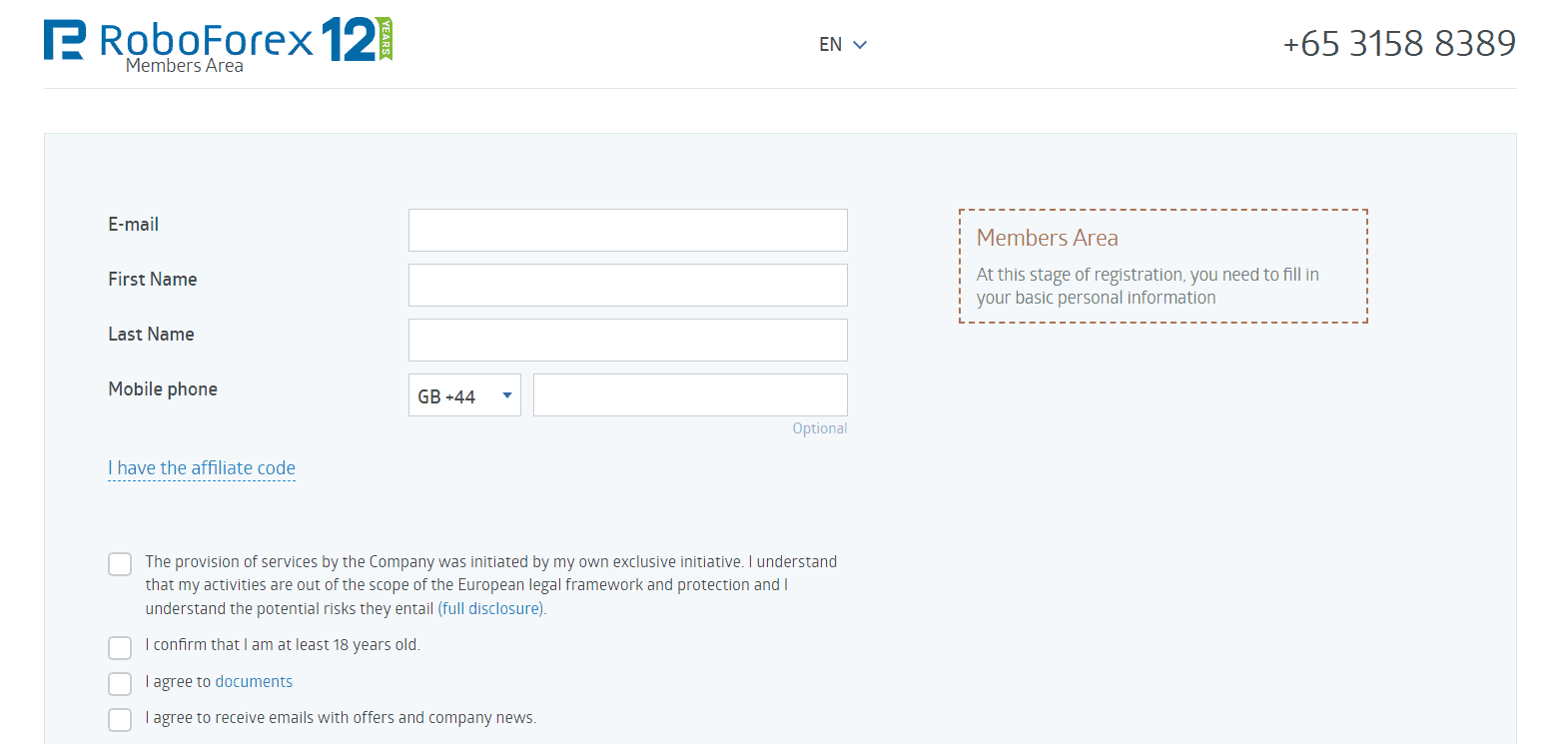

- Account Opening

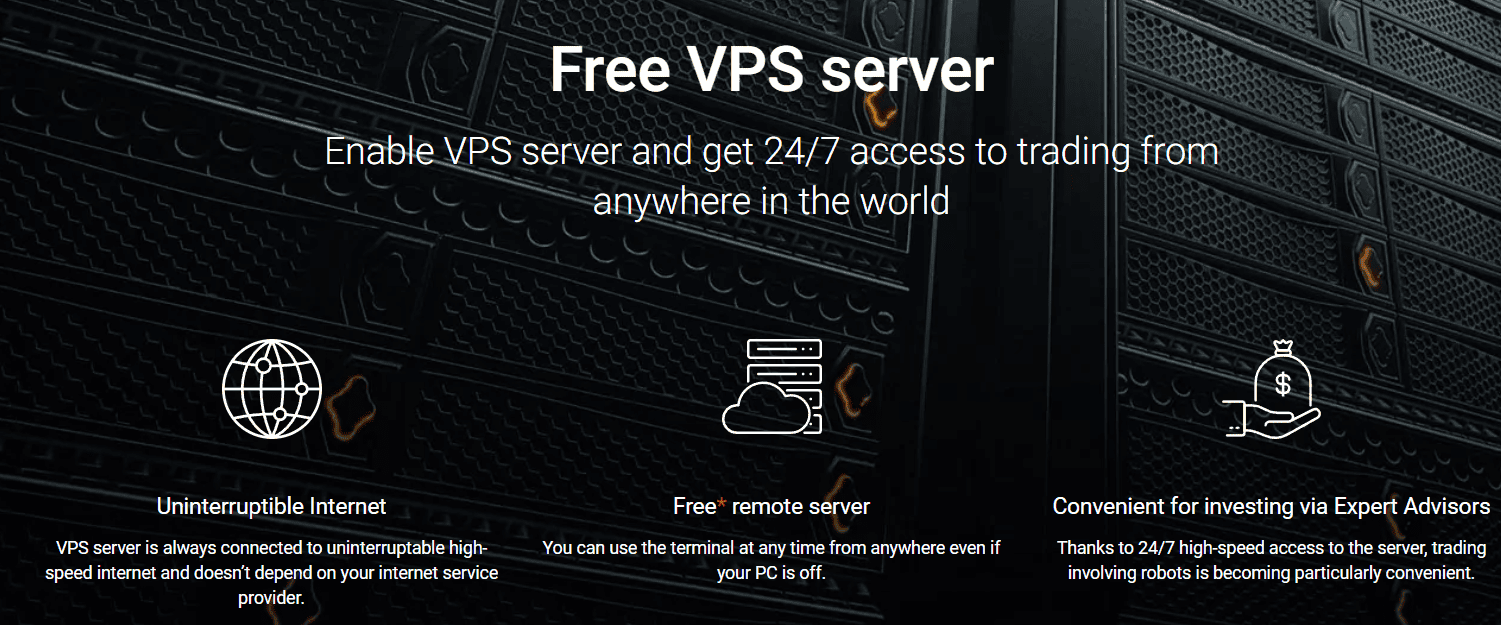

- Additional Tools And Features

- RoboForex Compared to Other Brokers

- Full Review of Broker RoboForex

Overall Rating 4.3

| Regulation and Security | 4 / 5 |

| Account Types and Benefits | 4.8 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.7/ 5 |

| Deposit and Withdrawal Options | 4.5/ 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is RoboForex?

RoboForex is a popular International Forex Broker recognized by the experts in the Financial Market, while operating since 2009 with service around the world. Throughout the history of its operation, the broker has served numerous clients around the world and gained recognition for its advanced trading proposal, also for its tailored conditions suitable for various styles, trading sizes, and portfolios.

Also, one of the greatest things RoboForex offers is a good range of trading software or platforms where you can select between industry-powerful MT5, MT4, or R Stock Trader.

- There are numerous developed technologies offering good solutions for trading found, RoboForex conducts CopyFX – a copy trading project. Where Contests on demo accounts are held weekly and monthly while prizes are deposited to real trading accounts allowing to start a great trading carer.

What Type of Broker is RoboForex?

Based on our research, we found that RoboForex is a Belize-based Forex and CFD broker working with STP Tradingmodel and execution, offering 8 asset types and more than 12,000 instruments for trading. Along with the most popular platforms in the industry, Robo provides many terminals for comfortable trading.

RoboForex Pros and Cons

RoboForex is considered safe for trading through an international entity. The broker has a long history of operation with an excellent reputation. At RoboForex, there is a good range of account types, trading platforms, free exclusive trading signals, and research tools, also powerful trading capabilities suitable also for advanced traders.

On the flip side, the trading fees may vary depending on the platform used and the account type, which might seem comlex. However, the company’s website contains detailed information on its conditions, enabling the analysis on your own. Also, RoboForex is based in Belize so we recommend verifying all safety rules since it is not top-tier regulation.

| Advantages | Disadvantages |

|---|

| Long regulated history of operating | Trading conditions may vary depending on the platform used

|

| Good reputation | |

| Powerful trading capabilities and advanced software proposal MetaTrader, R SocksTrader | |

| Wide range of trading platforms | |

| Free trading signals and research tools | |

| Competitive trading conditions | |

| Good quality educational materials, and excellent research | |

| Quality customer support with live chat and fast response | |

RoboForex Features

RoboForex is a well-regarded broker known for providing safe and highly favorable trading conditions. The low deposit amount and the wide range of trading instruments offered make Broker an appealing option both for beginner and advanced traders. In the table below we have compiled the key features of the broker, including Trading Platforms, Fees, Available Instrument Range, Minimum Deposits, Education, etc.

RoboForex Features in 10 Points

| 🗺️ Regulation | FSC |

| 🗺️ Account Types | Prime, ECN, R Stocks Trader, ProCent, Pro |

| 🖥 Trading Platforms | MT4, MT5, R StocksTrader |

| 📉 Trading Instruments | 8 Asset Classes with Forex, Stocks, Indices, ETFs, Futures, Soft Commodities, Energies, and Metals |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 1.3 pips on Standard Account |

| 🎮 Demo Account | Available with Demo Contests |

| 💰 Account Base currencies | USD |

| 📚 Trading Education | Good education with research and analytics |

| ☎ Customer Support | 24/7 |

Who is RoboForex For?

Based on Financial Expert Opinion and our findings, RoboForex is a great choice for both beginner and advanced traders, mainly those who are interested in trading Currencies and CFDs. Besides, the broker is suitable for those who want to test different trading strategies. Broker supports international trading, despite residency and level of trading experience. RoboForex is Good for:

- Beginners

- Advanced traders

- Traders who prefer MT4/MT5 platforms

- Slection of various platforms and tools

- Currency and CFD trading

- Trading of Shares on CFDs

- Variety of trading strategies including News Trading

- High Leverage Trading

- Algorithmic traders

- Broker with good educational and research materials

RoboForex Summary

Overall, we found that RoboForex is a safe broker that offers quality trading solutions. RoboForex provides expanded trading strategies and a certain way of dealing with markets and traders that gained a reliable and respected reputation.

RoboForex’s flexibility in terms of platforms, currency pairs, and a number of provided solutions is another key advantage to its positive side. The broker offers good educational materials and research tools suitable for traders of different levels.

55Brokers Professional Insights

RoboForex as an international broker is definitely good choice for traders from various regions and almost all over the globe. The selection between platforms offers good flexibility either your preference is on industry known software based on MetaTrader or you would like Robo own software, we did like the pplatform Broke designed with good choice of account types and advanced trading tools alike. Our special regard goes to RStocks separate platform for CFDs on Shares Stocks, which is quite remarkable for Forex broker. Traders with need of wide selection of thousands of Instruments and Portfolio diversification also will find it a good match. Fees we mark on average levels at most, while some accounts mainly based on commission are more favorable, also might be better for traders with experience or prefer trading with commission rather than spread, so is quite attractive for high-frequency traders, scalpers and algorithmic strategies. Lastly, High Leverage and well-established copy trading platform (CopyFX) of RoboForex with favorable educational resources make it suitable for new traders.

On the other hand, due to its Belize regulation, RoboForex is not a suitable choice for those who are concerned Broker hold top-tier license. Also, the costs are good yet Spreads are not at lowest spread level as some other Brokers provide, so overall Robo is quite steady for various trading needs choice, also ranked well for trading of Stock CFDs and ETFs.

Consider Trading with RoboForex If:

| RoboForex is an excellent Broker for: | - Need a broker to begin trading

- You are an advanced trader looking for a selection of trading platforms and tools

- Looking for access to a wide range of assets, including Forex, CFDs and commodities

- Trading thousands of CFDs on Stocks prefered with specialized platform for Stocks Trading

- Prefer tight spreads and high leverage options

- Need a broker with an automated trading through Expert Advisors (EAs) or algorithmic strategies

- Interested in copy trading, and want to experiment different trading strategies

- Prioritize 24/7 customer support and multilingual assistance

- Require a broker with global accessibility and flexible account offerings

- You are comfortable with trading with a broker regulated by the FSC |

Avoid Trading with RoboForex If:

| RoboForex might not be the best for: | - You are looking for a broker regulated by top-tier authorities

- Prefer fixed spreads, as RoboForex offers floating spreads

- Offering in-depth market analysis

- Look for Broker with Real Stocks or Futures Trading

- Lowest Industry Spreads on Standard Account

- Advanced Trading Academy with Courses |

Regulation and Security Measures

Score – 4/5

RoboForex Regulatory Overview

RoboForex Ltd is an international forex brokerage registered by the FSC, Belize under the number 000138/32, so is a legit firm with relevant licenses on each jurisdiction Broker operates.

Although the broker operates only with a license from Belize, it has received the Verify My Trade (VMT) execution quality certificate, confirming its compliance with the strict requirements of the Financial Commission for its broker members. RoboForex protects its clients’ funds from negative balances and has segregated bank accounts to secure their money. The broker is regulated and guarantees the security of clients’ funds, so it can be considered a safe choice to trade with.

How Safe is Trading with RoboForex?

RoboForex pays attention to the fund protection of its clients, keeping them separate from the Company’s funds, thereby guaranteeing that they are protected from unlawful use. The company is also a participant of The Financial Commission’s Compensation Fund which is used in the unlikely event of the Company’s failure to fulfill its obligations.

- In addition, RoboForex implemented a Civil Liability insurance program for a limit of 5m EUR, which includes market-leading coverage against fraud, errors, negligence, and, or other risks that may lead to financial losses of clients.

Consistency and Clarity

When it comes to consistency, Broker performs well in delivering stable trading experiences across its platforms. Although RoboForex does not hold a license from a top-tier regulatory body, such as FCA, ASIC, or CySEC, it still has good regulatory oversight and provides a safe trading environment.

RoboForex has instilled a sense of dependability among investors due to its consistent and stable trading conditions and transparent operations operating for many years, also with no serious issues or concerns detected in its operation along years, proving Broker stability. Throughout its services, Broker remains a trusted online trading platform with a major emphasis on security in trading conditions and transparency in pricing policies. Most of the Real Traders reviews are positive, marking the excellence of the trading environment and overall trading experience. These findings show that RoboForex is a reliable, solid broker suitable for long-term cooperation and investment.

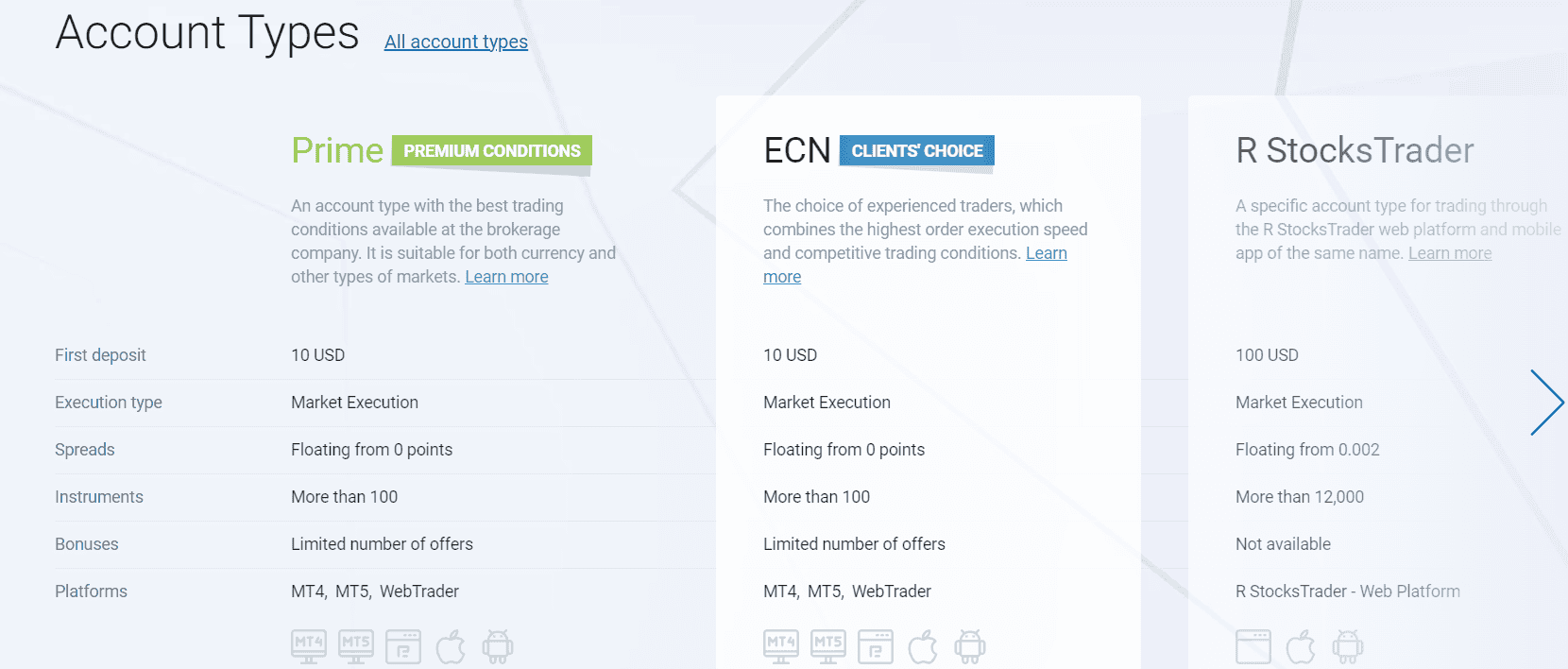

Account Types and Benefits

Score – 4.8/5

Which Account Types Are Available with RoboForex?

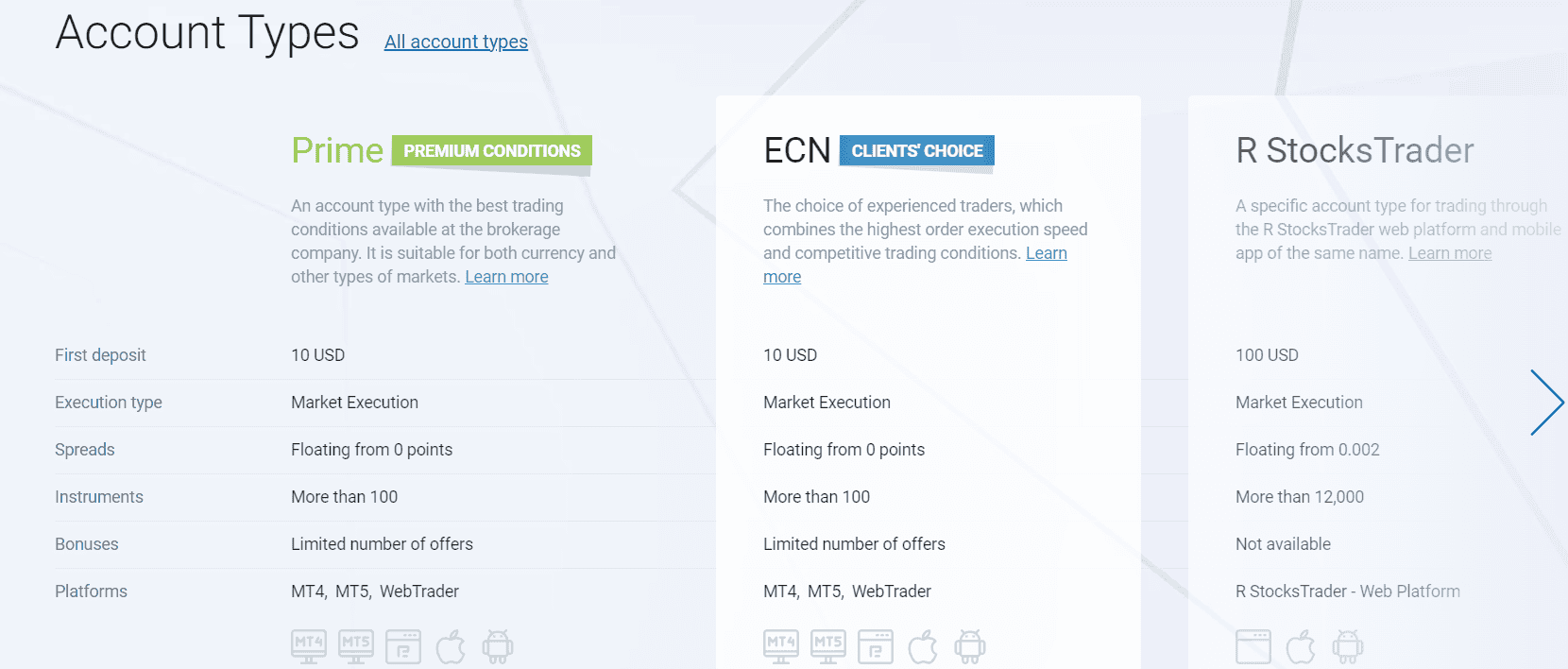

RoboForex provides a wide selection of account types in order to suit the different needs and requirements of its clients, so you may choose most suitable for you based on fee model or execution. The list of available account types includes Prime, ECN, R Stocks Trader, ProCent, Pro accounts. In our opinion, both beginning or trading professionals will find the conditions with RoboForex suitable as good diversification provided with low deposit and with Islamic traders who are able to apply for swap-free accounts. See our comparison below with the main difference in accounts featured by pricing models:

Pro Account

The Pro account is one of the most widely-used options suitable for traders who prefer Spread based account, mainly regarded as Standard account in industry. It offers floating spreads starting from 1.3 pips with no commission fees on trades with 1:2000 leverage and access to a wide range of trading instruments available on popular platforms like MetaTrader 4 and MetaTrader 5. The minimum deposit for a Pro account is 10 USD so is accessible for all.

Prime Account

The RoboForex Prime account is more designed for professional traders and is good for high-frequency traders and scalpers since fees are based on commission. Spreads from 0.0 pips and commissions are charged based on trading volume like for 1 million USD traded is 10 USD, considered very competitive. The account also provides access to all offered trading instruments with leverage up to 1:300. The minimum deposit for this account is 10 USD too, so is good to all alike.

ECN Account

The RoboForex ECN account is great, especially for high-frequency traders, scalpers or Algo Traders who need to have direct market access and fast execution. The spreads start from 0.0 pips with a commission of about 4$ a lot. It is especially suitable for those traders who value precision and liquidity because this account type is directly connected to the interbank markets. The broker’s ultra-high-speed trading execution and leverage up to 1:500 with all instruments in place is another plus while the minimum deposit for an ECN account is also 10 USD so still all based on your own trading preference.

R Stocks Trader Account

The RoboForex R StocksTrader account is for traders especially interested in stocks and ETFs trading, offering clients a sophisticated web-based trading platform called R Stocks Trader. Some of the key features of this account include very competitive access to over 12,000 instruments including shares, indices, ETFs, Futures and commodities all traded as CFDs. Also, on several asset classes is available commission-free trading and good fees. The platform enables access to both manual and automated trading, also flexibility and simplicity of the account that suits traders of different expertise.

ProCent Account

The RoboForex ProCent account is another great feature for beginners who want to test new strategies with minimal risks. The balance of the account is measured in cents, so traders can start very small, from $10. Key features of the Cent account with floating spreads from 1.3 pips, leverage up to 1:2000 with all trading instruments available across all Robo platforms MetaTrader 4, MetaTrader 5, and the R WebTrader platforms.

Regions Where RoboForex is Restricted

According to the information on RoboForex’s website, the broker does not accept clients from the following countries due to regulatory and legal requirements, or as per the entity conditions applied.

- USA

- Canada

- Japan

- Australia

- Bonaire

- Brazil

- Curaçao

- East Timor

- Indonesia

- Iran

- Liberia

- Saipan

- Russia

- Sint Eustatius

- Tahiti

- Turkey

- Guinea-Bissau

- Micronesia

- Northern Mariana Islands

- Svalbard and Jan Mayen

- South Sudan

- Ukraine

- Belarus

Cost Structure and Fees

Score – 4.3/5

RoboForex Brokerage Fees

RoboForex offers a flexible cost structure with quite transparent conditions clear to understand and choose, allowing to select fee model more suiotbale for your trading style. The commissions or spreads depend on the account type and trading instruments alike. For a closer look here are some of the main costs we find:

Based on our Expert findings RoboForex spreads depend on the account type you choose, so be sure to check out the trading conditions. Broker offers several account types with various fee models. With floating spreads are Pro Standard and ProCent accounts with spreads from 1.3 pips; considered to be on average among competitors. While ECN and Prime accounts fees are based on commission. Spreads on the R StocksTrader account start from 0.01 USD. Also, spread depends on the market conditions and differ based on volatility.

RoboForex’s commission structure is competitive and transparent based on our review, but varying by account type alike. The Pro and ProCent accounts are commission-free, with spreads-only fees. Traders who prefer Broker fees based on commission the ECN and Prime accounts feature interbank quotes from 0.0 pips spread and commissions of $20 and $10 per $1 million traded respectively.

- RoboForex Rollover/ Swaps

The rollover or overnight fee should be considered as a cost too, which is added for positions held longer than a day. As example rollover fees at RoboForex are about -0.6 for short positions on USD and -0.052 for long ones held longer than a day.

How Competitive Are RoboForex Fees?

RoboForex’s fees are considered competitive but among the industry average levels. Broker fees are suitable for traders across different experience levels and are regarded since offering various fee models, so you may choose most appropriate for you. Accounts based on commission we find more competitive, also ECN account provided better execution speeds. While the broker does charge overnight swap fees and withdrawal fees, these are generally in line with industry standards, maintaining the broker’s overall competitiveness in fee structure.

| Asset/ Pair | RoboForex Spread | AvaTrade Spread | BlackBull Markets Spread |

|---|

| EUR USD Spread | 1.3 pips | 0.9 pips | 0.8 pips |

| Crude Oil WTI Spread | 6.1 cents | 3 cents | 7․3 pips |

| Gold Spread | 1.8 pips | $0.27 | 1.2 pips |

RoboForex Additional Fees

Besides the spread and commissions, depending on the account type there might be other fees RoboForex charges so is good to review all to understand clear all fees involved in your trading activity. Some of the common additional fees include:

Withdrawal Fees

The fees to be charged on withdrawal vary based on the method of withdrawal. For instance, Credit card withdrawals may charge between 1 and 2.5%, while for e-wallets, like Skrill or Neteller, it can be about 1%.

Inactivity Fee

Generally, RoboForex inactivity fee is charged if an account is kept dormant for a long period, such as 12 months. It is about $10 per month, which again would depend upon the account type.

Currency Conversion Fee

Currency Conversion Fee is incurred if you trade in a currency different from your account’s base currency. So if you trade or make deposit withdrawal in different currency auto conversion fees will be applicable too, we advise to select most appropriate base currency then for you to avoid these extra fees.

Trading Platforms and Tools

Score – 4.4/5

As a technology-driven broker, RoboForex offers a range of platforms to choose from, that allows traders to advance and suit any trading demands and comply with their style. The main offering known for its productivity are industry popular software – MT4 and MT5 platforms, while traders can also select RoboForex-developed exclusive platform R Web Trader and R Mobile Trader.

Trading Platform Comparison to Other Brokers:

| Platforms | RoboForex Platforms | FxPro Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

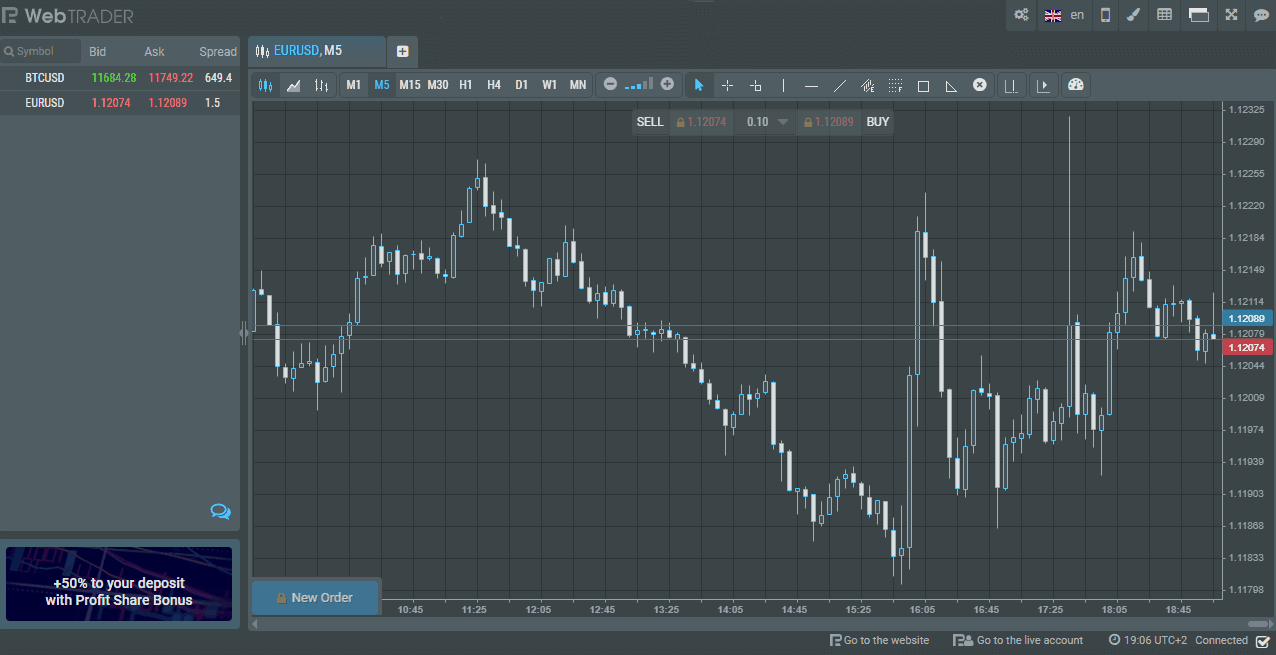

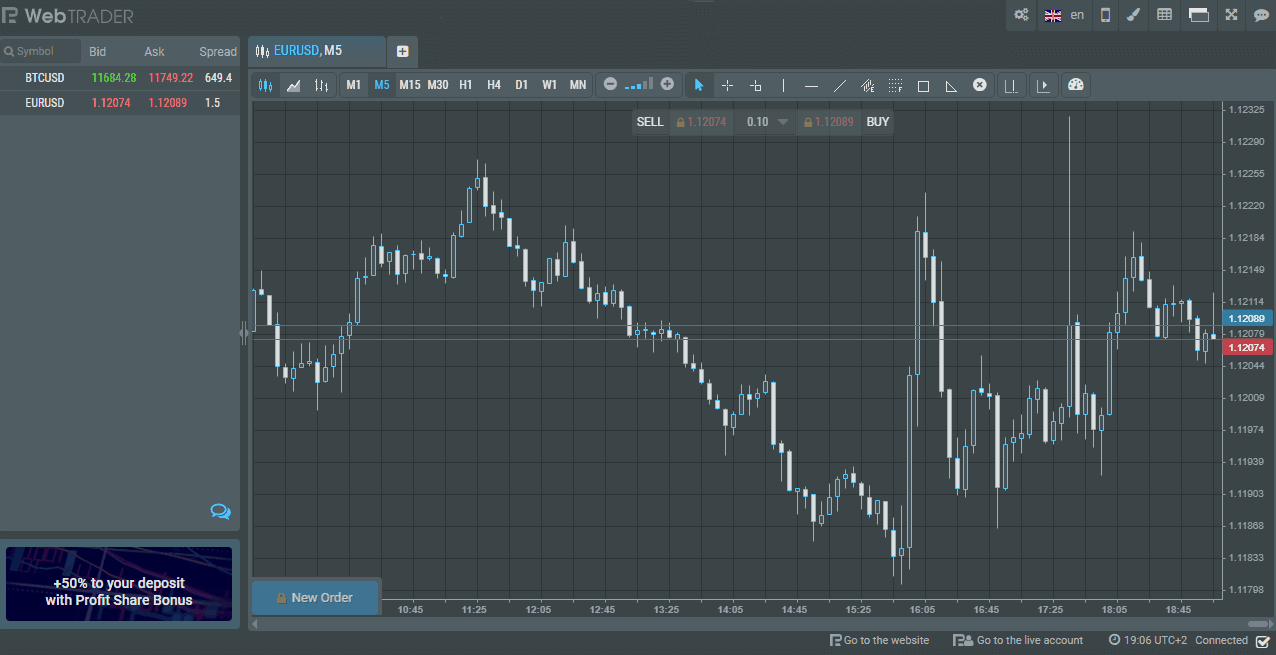

RoboForex Web Platform

RoboForex Web Trading provides smooth browser-based trading without any need for installation. It gives access to the most popular instruments Broker offers, also Web platforms enable real-time market data, charts that are customizable with technical indicators, one-click trading, and a secure, user-friendly interface great for traders who value flexibility and simplicity.

Main Insights from Testing

We found RoboForex’s web trading platform quite user-friendly, with a customizable interface, fast trade execution, real-time data, and access to full range of assets. Besides, it is compatible across devices and suitable for all traders, the charting tools are a little limited compared to desktop platforms, and some features, such as automated trading are more comprehensive in the platform desktop versions of MetaTrader 4/5 than in the web platform.

RoboForex Desktop MetaTrader 4 Platform

RoboForex MT4 desktop platform is very popular with its advanced charting options together with a great variety of robots and indicators to back any trading strategy. The broker provides 3 types of order execution, 50 indicators for technical analysis, graphic analysis tools, and an option of programming own trading robot. The significant differences between the web platform and the desktop version of MT4 include a much larger number of features related to automated trading with EAs. In other words, RoboForex’s MT4 desktop platform is excellent for traders who seek advanced functionality and in-depth analysis.

RoboForex Desktop MetaTrader 5 Platform

RoboForex MetaTrader 5 Desktop Platform is the newest version of the software, thus it includes an impressive number of new functions and enhanced tools, which helps to take trading to a more advanced level. Besides, this platform allows traders to work with both netting and hedging systems, and provides four execution types, enabling them to implement almost all sorts of trading strategies. The MT5 platform also includes comprehensive tools of analysis, 4 types of order execution, 6 types of pending orders, and technical indicators. Besides, the platform provides market-depth information on liquidity and order flow. Due to its functionality, MT5 is ideal for those who want to take their trading strategies to the next level.

RoboForex MobileTrader App

With RoboForex, mobile traders have access to MT4 and MT5 Mobile Apps through the applications. The apps provide an easy-to-use system for account management, order placement, and access to a wide range of tools directly from a mobile. Both MT4 and MT5 mobile versions provide good charting options and real-time market data and enable price alerts, so they are very handy on the go. The apps are available for both iOS and Android and provide security, using encryption and secure logins.

Main Insights from Testing

The RoboForex MobileTrader software offers a full range of trading tools, various order types, advanced charting, and technical indicators. The interface is intuitive and easy to use. Trade execution is fast, enabling traders to quickly react to market changes. Both the MT4 and MT5 apps are available for iOS and Android devices. However, it should be noted that certain automated trading features are more advanced in the desktop versions of MetaTrader.

RStocks Trader

The R StocksTrader platform, developed by RoboForex designed too the needs of Stocks trading. The platform offers comprehensive trading with a user-friendly interface, advanced charting tools, and an immense number of technical indicators that provide traders with in-depth technical analysis. R Stocks Trader stands out for Charting from Exchanges and its great Strategy Builder feature – a free, easy-to-use tool that enables traders to automate their strategies using no programming skills. This makes it simple for both novice and professional traders to optimize their trading performances.

RoboForex CopyTrader

Lastly, Robo offers a robust Copy Trading service through its CopyFX platform, enabling users to benefit from the expertise of seasoned traders. With CopyFX, investors can follow and copy the trades of over 9,000 experienced traders which is an impressive number and is recommended by us to give it a try too, since is indeed good quality.

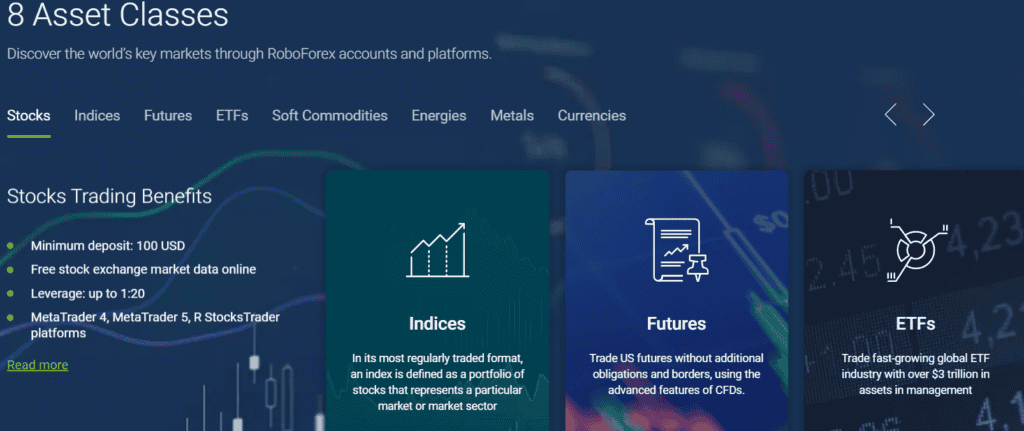

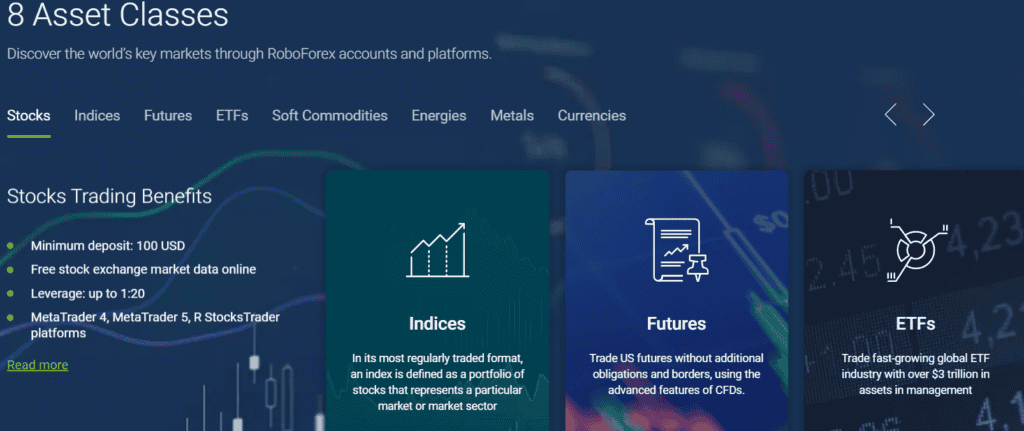

Trading Instruments

Score – 4.7/5

What Can You Trade on RoboForex Platform?

Based on our research, RoboForex enables trading the world’s key markets with 8 asset classes, granting traders access to 12.000 Instruments, one of the widest selections available, allowing traders to diversify trading portfolios greatly. The available trading products at RoboForex include the following, while all are mainly offered on a CFD basis:

- Forex

- Stocks

- Indices

- Metals

- Commodities

- ETFs

- CFD on Indices

- CFD on Oil

- CFDs on Futures

- CFD on US stocks

- CFDs on Metals

Main Insights from Exploring RoboForex’s Tradable Assets

Investigating RoboForex’s tradable assets, we have found one of the widest ranges of financial instruments great for different trading strategies and preferences. The platform enables access to the most popular and traded asset classes and instruments. Additionally, RoboForex provides a unique feature: a separate platform RStocks for Stock and Share trading consistent with popular shares from around the world, yet all are provided on a CFD basis alike.

Either for short-term trading or for long-term investment, Robo accommodates different types of traders, from beginners to professionals, with its wide selection of tradable assets and almost anything traded available. All in all, the availability of large amounts of tradable assets at RoboForex enables traders to diversify and explore the market further.

Leverage Options at RoboForex

If you plan to use high leverage to multiply your profits, RoboForex is indeed a good choice. While most brokers permit the maximum leverage of 1:500, Robo enables traders access to leverage as high as 1:2000. High leverage allows traders to increase significantly the potential returns. The leverage enables traders to increase the size of their positions, however, leverage should be used with great caution and wisely.

- RoboForex provides flexible leverage options of 1:400, 1:500, and up to 1:2000, depending on the asset class and account types.

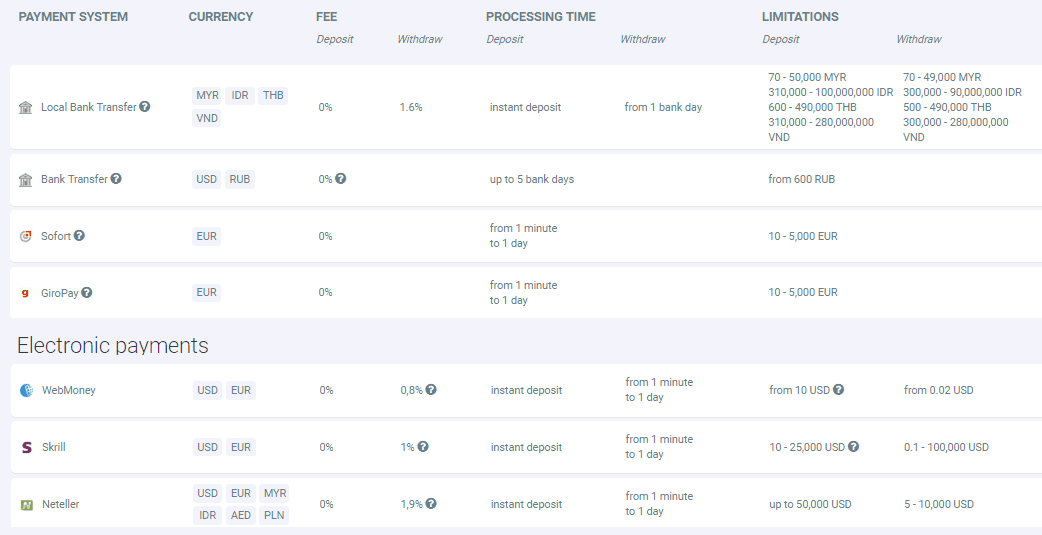

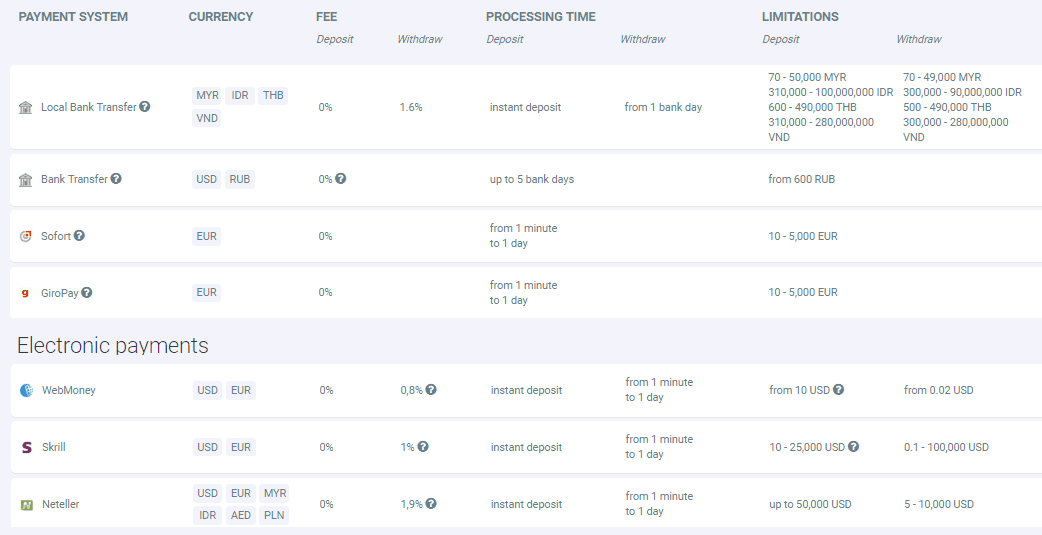

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at RoboForex

In terms of funding methods, RoboForex offers over 20 options of payment methods, which is very convenient since allowing to transfer money to or from the trading account and suitable for traders almost from every region. Supported Trading Deposit Methods include:

- Bank transfers

- Card payments

- Vast selection of e-wallets like Skrill, Neteller, POLi, FasaPay, and more

RoboForex Minimum Deposit

The minimum deposit to open an account with RoboForex is very low, also most of accounts are accessible so you choose based on conditions your prefer not by the requirements, which is great. It depends on the account type chosen. For Prime, ECN, and ProCent accounts the minimum deposit is 10 USD. For ProR Stocks Trader account the minimum deposit is 100 USD.

- However, of course, make sure to verify margin requirements and conditions for the instrument you are willing to trade, as at some point $10 simply may not be enough for your strategy.

Withdrawal Options at RoboForex

We learned that RoboForex implements a 0% commission policy for deposits and many of withdrawals where all expenses are covered by the broker. Robo withdrawal options are good and include Bank Wire or Credit Cards.

- Yet, check carefully since some of the methods apply an additional fee for withdrawal, e.g. Skrill and AdvCash add on a 1% processing fee, while Visa withdrawal adds 2.6% +1.3USD.

How long does it take to withdraw money from RoboForex?

Our findings show that the withdrawal time in RoboForex depends on the method of withdrawal:

- Bank Transfers generally take up to 3-5 business days, considering banks may take some extra time to process.

- Credit/Debit Cards process withdrawals in 1-3 business days.

- E-Wallets usually process withdrawals almost instantly or take a few hours.

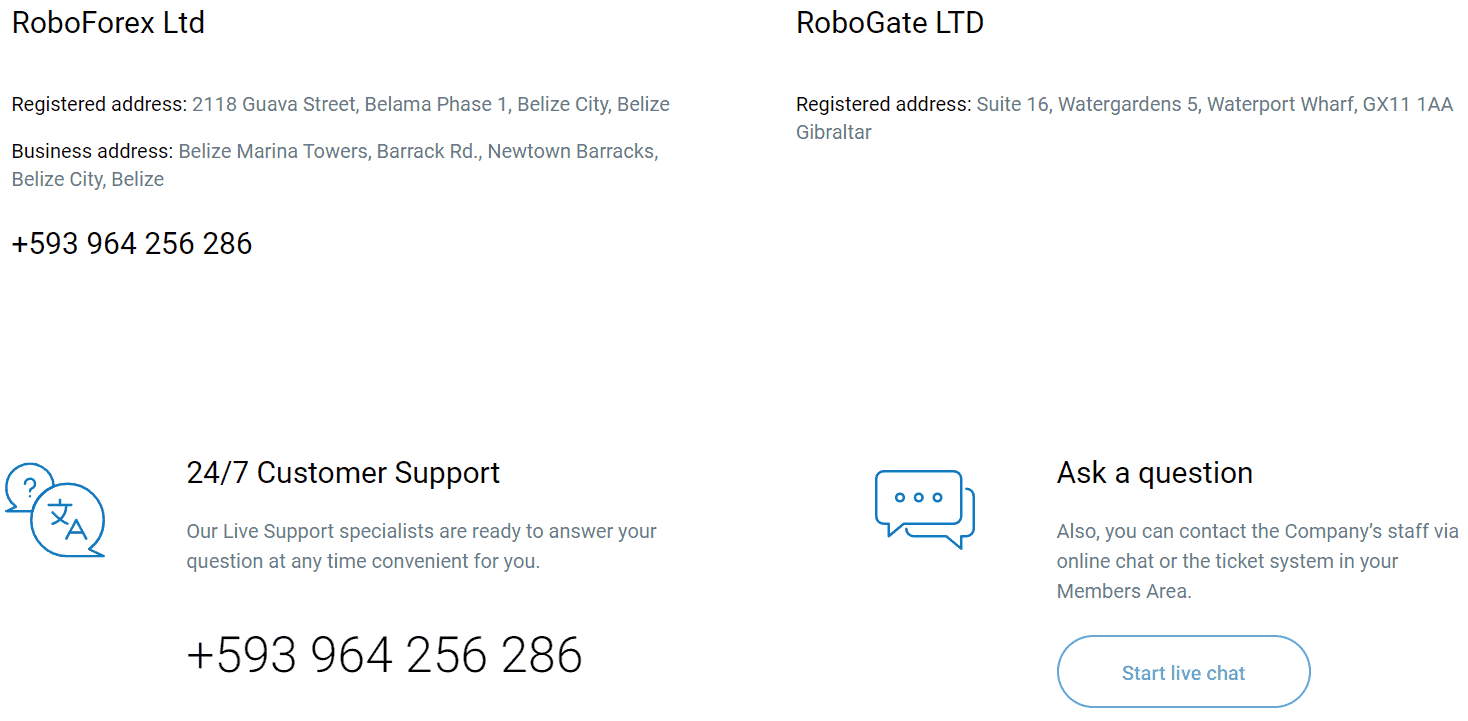

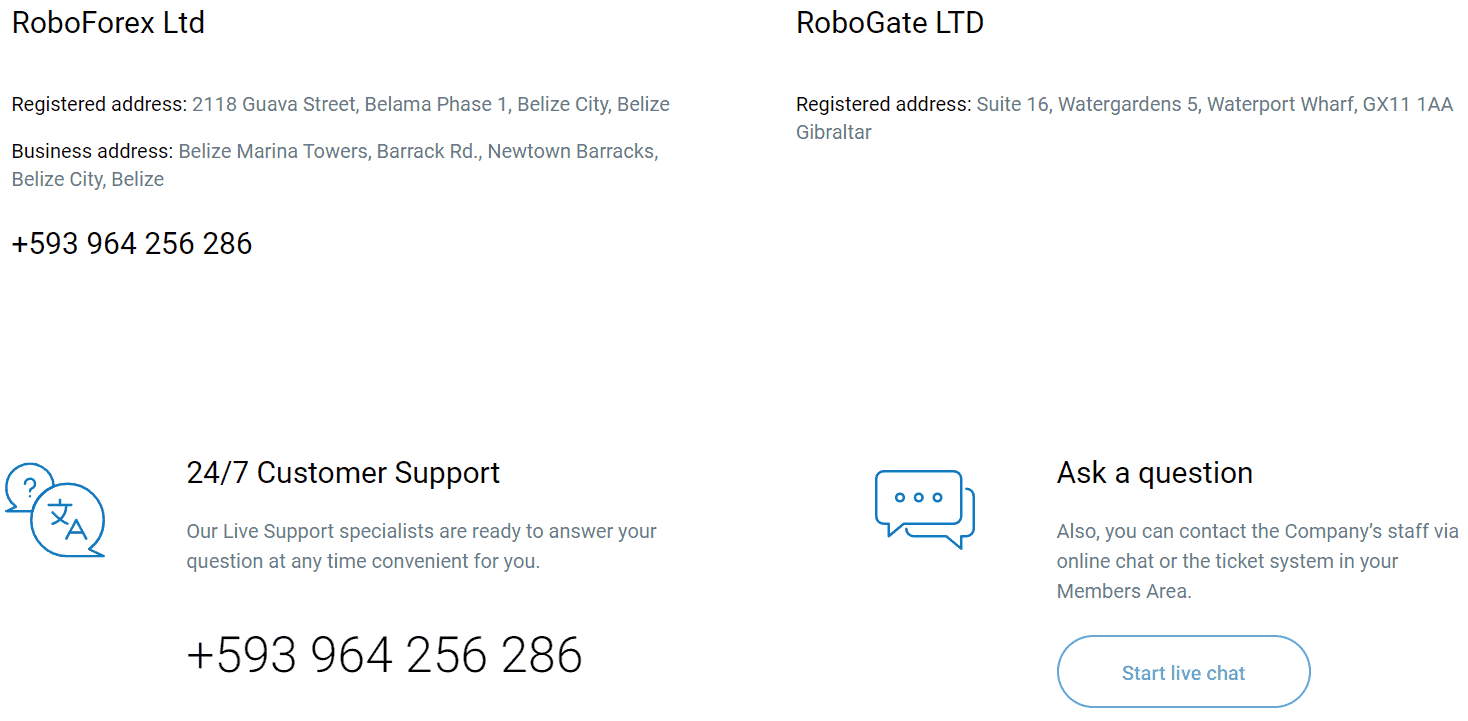

Customer Support and Responsiveness

Score – 4.7/5

Testing RoboForex’s Customer Support

RoboForex offers 24/7 customer support available via Live chat, emails, and international phone lines, also proposing callback service and providing support in more than 10 languages. Robo always tries to answer customer inquiries efficiently. On live chat support, usually, responses are instant, and on email support, it might take more depending on the issue’s complexity. Besides the mentioned channels of support, RoboForex has also a vast FAQ section on its website, where many issues and questions have been addressed.

Contacts RoboForex

Customers have various options to reach RoboForex Service Desk. Quick responses are especially important in cases of urgent issues. Customers can send a quick message right from the RoboForex website, stating their name, email, and the request itself. Other than that, it is possible to reach the broker live via phone line at any time convenient for the customer (+593 964 256 286). Another option to contact the broker is the live chat that provides almost instant answers.

Research and Education

Score – 4.2 /5

Research Tools RoboForex

We found that Broker offers quuality research tools and materials mainly available though the offered platforms. which MT4 and MT5 are quite famous for, especially essential for beginners but for traders at any stage too. The broker offers Market analysis, technical analysis, professional trading analytics, and a range of trading tools are available via the Members Area.

- RoboForex traders get access to transaction and trading history for up to 1 year and great research tools including a news feed, calculators, a strategy builder, trading ideas and tools inbuilt in platforms, also availability of extra tools on MarketPlace.

Education

As for the Education, we found that education is good at RoboForex, yet is not Trading Academy like some other broker offer with Trading Courses, Seminars and Webinars. So mainly Robo education is designed to enhance capabilities and provide research materials, therefore traders have access to various educational resources and polish their skills further. In addition, Broker publishes educational articles on topics ranging from technical and fundamental analysis to trading psychology and specific trading strategies.

One of the great points are available trading contests, which increases level of expertise and allows to develop skills, also gain valuable prizes.For available RoboForex Contest we advise to check official site, since availablity vary.

Is RoboForex a good broker for beginners?

RoboForex is considered a suitable broker for beginners due a number of features. The demo account allows new traders to start trading with non-real funds, low minimum deposit requirement, responsive customer support, and a range of available account types designed for different trading needs also with Cent trading are great for beginners. Yet, the education we mark rather basic and good for traders who already have ssome trading experience. For complete beginners we would advise or to opt for Brokers with good Courses or check separate Forex education too.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options RoboForex

RoboForex Investment Options are favorable, yet as the broker main focus is on CFD trading it differs from classic Investment Options. Provided trading of Stocks is also based on CFDs, so important to note you do not own the asset but rather trade it.

RoboForex offers CopyFX is yet considered as investment product, allowing trading opportunities for those who do not have sufficient market experience and skills, simply invest desired amount for particular account and replicate all automatically. It opens wide possibilities for investors to increase their capital by following skilled traders and their performance analytics.

Account opening

Score – 4.6/5

How to open RoboForex Demo Account?

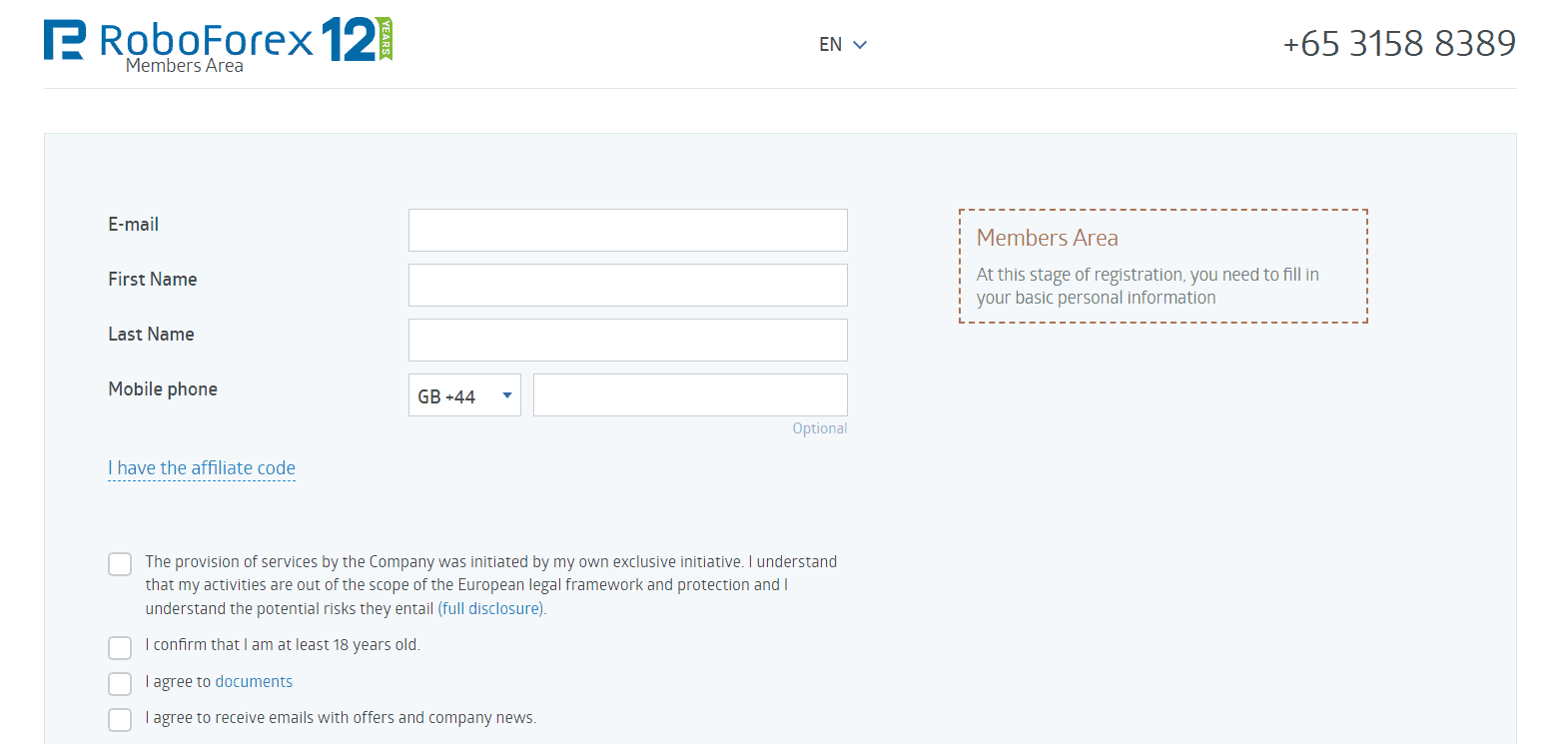

Opening a Demo account with RoboForex is quite an easy and straightforward process. Here is a step by step guide on how to open a Demo account:

- On the official website of the broker choose the “Open Demo Account” option in the account types section.

- You will need to fill in a registration form with relevant information. It is essential to provide valid information.

- You will be required to choose the desired trading specifications, such as the type of account, trading platform, leverage, and even the virtual deposit amount.

- To get acquainted with the general rules of the Demo account, traders need to agree with the terms and conditions to complete the creation of the account.

- When the registration is completed, the demo account credentials are sent to the trader via email.

How to open RoboForex Live account?

Opening an account with Broker is quite straight forward and not confusing process too. You should follow the opening account or sign-in page and proceed with the guided steps similar to demo account with difference you need to verify your data and Documents.

- Select and Click on RoboForex Open an account page.

- Enter the required personal data (Name, email, etc.)

- Verify your personal data.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

By providing additional tools and features that what makes offering different from other Brokers. In case of RoboForex it intends to improve its customers’ trading experience with tools designed to enhance capabilities and provide something extra to traders. Some of the main additional tools and features of RoboForex are listed below:

- RoboForex Strategy Builder is especially regarded by us since enables traders to create automated trading strategies with no programming skills. Based on pre-set rules, RoboForex strategy builder helps traders automate their trading, making the execution of complex strategies easier.

- The VPS hosting solution offered by RoboForex is free, which is great as most of Brokers charge fee for it. This is a great solution for traders who want Trading robots and Expert Advisors (EAs) be active 24/7, even when the computer is offline.

- AutoChartist is an advanced pattern recognition tool—another additional offering by Robo that is designed to automatically identify chart patterns and market key price levels.

- RoboForex offers its clients who are interested in copy trading a specifically designed copy trading platform, CopyFX, where traders can follow the strategies of professional traders. This is also a good offering for beginner traders.

RoboForex Compared to Other Brokers

RoboForex stands out for its wide selection of trading products and some of the highest leverage options compared to other brokers, up to 1:2000 for certain accounts. Besides the popular MT4/MT5 platforms, the broker also offers its proprietary R StocksTrader platform designed for Stock trading particularly, what makes proposal different too. Compared to OANDA and Pepperstone, RoboForex enables an impressive selection of 12.000 Trading Instruments, which is considerably a more attractive offering for those who want to diversify their portfolios.

As compared to other good-standing brokers, such as FP Markets or IC Markets, the Robo minimum deposit starts at 10 USD, which is very low compared to industry standards, enabling traders to start with minimum financial inputs. However, while RoboForex is a well-known broker with good standing, it does not hold a top-tier license. In this respect, HFM and AvaTrade have the advantage of being heavily regulated, also Education is rather basic and complete beginners might find HFM and FP Markets Education more suitable.

| Parameter |

RoboForex |

FP Markets |

IC Markets |

Pepperstone |

BlackBull Markets |

HFM |

OANDA |

| Spread Based Account |

Average 1.3 pip |

From 1 pip |

From 1 pip |

Average 0.7 |

From 0.8 Pips |

Average 1 pip |

From 0.8 Pips |

| Commission Based Account |

0.0 pips + $4 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

0.1 pips + $3 |

0.0 pips + $3 |

0.1 pips + $4 |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Low |

Low |

Low/ Average |

Low |

| Trading Platforms |

MT4, MT5, R StocksTrader |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5,cTrader |

MT4, MT5,cTrader, TradingView |

MT4, MT5, cTrader, TradingView |

MT4, MT5, HFM App |

MT4, MT5, OandaTrade |

| Asset Variety |

12,000+ instruments |

10,000+ instruments |

1,000+ instruments |

1,200+ instruments |

26000+ instruments |

500+ instruments |

500+ instruments |

| Regulation |

FSC |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FMA, FSA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

FCA, CFTC, NFA, MAS, ASIC, IIROC, FFAJ |

| Customer Support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$10 |

$100 |

$200 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker RoboForex

RoboForex is a flexible broker, suitable mainly for all types of traders. The company holds a license from the FSC, yet it has good standing in the market and enjoys a great reputation among traders. RoboForex suitable for different categories of traders with good offering of account types: Prime, ECN, R Stocks Trader, ProCent, and Pro accounts. Besides, traders can choose from more than 12 thousand instruments making Broker among leading for product selection. Along with extensive products, fees are considered average where you may choose fee structure either based on spread or commissions.

Robo trading platforms are noted for their features, simple and user-friendly interface, with a choice of industry standards like MT4 or 5, also Brokers own software with great trading tools, and functionality. Another great tool offered by RoboForex is its CopyFX platform with additionally offers Strategy Builder for auto trading strategies, which is also a rare feature among brokers.

Besides, RoboForex offers substantial customer support through live chats, phone lines, and emails. Funding methods supported by Broker are also various, ensuring smooth and comfortable deposits and withdrawals. Overall, RoboForex offers a comprehensive trading environment providing flexibility and innovation, that make it a good choice for investors.

Share this article [addtoany url="https://55brokers.com/roboforex-review/" title="RoboForex"]

I’ve been trading with RoboForex for over a year now and I couldn’t be more satisfied. The platform is incredibly user-friendly, especially for someone like me who started with minimal trading experience. The spreads are tight, order execution is fast, and withdrawals have always been processed on time.

The spreads are competitive, and withdrawals have always been processed quickly. I’ve had no complaints.

Dear Lowrence,

Thank you for taking the time to share your experience and highlight our services. We truly appreciate your feedback and remain committed to supporting your goals as a trusted forex broker. Your trust inspires us to keep improving, and we look forward to exceeding your expectations in the future.

We wish you success in trading!

Regards,

The RoboForex Team

I consider, that you commit an error. Let’s discuss it.

Dear descargar betcha,

Could you please specify the exact error you are referring to? We strive to provide accurate and reliable services, and if there is any issue that requires our attention, we would greatly appreciate more details. Have you already reached out to our support team regarding this matter?

Looking forward to your response.

Regards,

The RoboForex Team

RoboFx is a very good broker i used them for more than one decade never have any issue with them

Dear Mohser,

We are glad you have been trading with us for over a decade, and your experience has been very smooth. It is our pleasure to serve you, and we look forward to meeting your future expectations.

Thanks for your trust and support.

Regards,

RoboForex

i am very confused i read on site and also contacted support to know what account tipe offer fixed spread on GOLD?

Dear Goldtrader,

At our company, all of our account types offer a floating spread. You can find more detailed information at this link:

https://roboforex.com/forex-trading/trading/specifications/.

If you need more further assistance, please contact our Support Team. We will be happy to help!

Regards,

RoboForex

is my 50k euro investment is safe with what regulation

MastaCard withdraw possible on everymonth free withdrawl on my credit card?

Dear akunmat,

You can withdraw funds from your account with no commissions twice a month!

More detail is available at this page – https://roboforex.com/clients/funds/free-withdrawal/.

To get advice on the best way to withdraw funds, please contact the Company’s Payment department via a ticket from your Members Area.

Regards,

RoboForex

why i can not participate in the new year contests

Dear Cantaxt,

The ContestFX project all contests has been stopped. If you have any questions or require further information, please do not hesitate to reach out to our customer support team.

Regards,

RoboForex

is currencies market opned for trading now

Dear mjisee,

You can find all the necessary information about trading schedule changes during the Christmas and New Year holidays at this link: https://roboforex.com/about/company/news/show/8022-schedule-trade-changes-24122023/

If you have any further questions, please don’t hesitate to ask our Support Service.

Regards,

RoboForex

is the spread increase in coming days due to low volaitility in the market or will it stay same as usual

Dear navey,

Feel free to contact our Live Support if you have any questions about your cooperation with our company. You can reach us in any way that is specified on the “Contacts” page of our website.

We’ll be very happy to help you!

Regards,

RoboForex

Dear Huesn,

The ContestFX project all contests has been stopped. If you have any questions or require further information, please do not hesitate to reach out to our customer support team.

Regards,

RoboForex

why i am not able to participate in the contests

Ich möchte den RoboForex-Anmeldebonus von 30 $ ohne Einzahlung erhalten, aber warum gibst du mir das nicht?

Hallo Joslit,

Vielen Dank für die Aufmerksamkeit, die Sie den Aktivitäten unseres Unternehmens schenken.

Wenn Sie Fragen haben, wenden Sie sich bitte auf die für Sie geeignete Weise an den Support-Service, wie auf der Seite „Kontakte“ unserer Website angegeben. Wir helfen Ihnen gerne weiter!

Mit freundlichen Grüßen

Ihr RoboForex

RoboForex offers a wide range of educational resources, including webinars, video tutorials, and analytical materials. This helps me improve my skills and evolve as a trader

Dear Jamie,

We are glad to know that you are highly satisfied with our services and that our educational material helped you to grow in the financial markets. We will try hard to meet your future expectations.

We wish you good luck!

Regards,

RoboForex

The leverage of up to 1:2000 makes trading more profitable, while the platforms MT4, MT5, StocksTrader, and WebTrader provide all the necessary tools for developing and implementing various trading strategies.

Dear Sophia,

We sincerely appreciate your valuable feedback, as such messages serve as an encouragement for us to enhance and excel in our services. It is our pleasure to serve you, and we look forward to meeting your future expectations.

Regards,

RoboForex

I opened an account but whenever i logged into my client cabinet that the site speed becomes slow

Dear Hreybs,

For a detailed study of your query, please contact our round-the-clock Support Service for assistance or you can also send an email to mailto:info@roboforex.com with a detailed description of the situation you experienced and all the necessary details for its consideration – screenshots, videos, etc. We’re seeking to find out the reasons of what happened and hoping for your cooperation in resolving this matter.

Regards,

RoboForex

How to increase the leverage of the account which is already used or decrease the leverage is it possible for the already in use account?

Dear Prehuns,

You can change the account leverage from the Personal Member Area, seamlessly without disrupting your trading operations. You can find detailed information on our website page at https://roboforex.com/clients/services/2000-up-leverage/.

If you still have any questions or need assistance, do not hesitate to contact our Support Team. We will be happy to assist you!

Regards,

RoboForex

Visa or Mastercard if i make deposit, which currency of the base accounts will be marked?

Dear Dilkhan,

To get a detailed answer regarding your query, we recommend reaching out to our dedicated Support Service.

We will be happy to help you!

Regards,

RoboForex

I can not connect to the contest day i register says invalid nickname or already used what to do with this

Dear Hureeha,

You can send your request to contestfx@robforex.com with more details on this situation, or you can also write to our Customer Support Service for immediate answer.

Regards,

RoboForex

One of the standout features for me is the exceptionally high leverage available on RoboForex, reaching up to a staggering 1:2000. This allows me to optimize my potential profits, although I always exercise caution and risk management when using such high leverage levels.

Dear Limor,

We sincerely appreciate your recognition of the services we provide to our valued clients. Your feedback means a great deal to us, and we are truly grateful for your support. Rest assured, we are committed to maintaining the highest standards of service excellence for our clients in the future.

Regards,

RoboForex

RoboForex is the best broker I’ve ever used for trading in the Forex market. The platform is very user-friendly and helps me analyze the market and execute trades efficiently. The ability to open accounts in different currencies is a big plus, and customer support is always ready to respond to all my inquiries.

Dear Sofia,

Thank you for your kind words and feedback. We truly value your appreciation, as it encourages us to strive for excellence in our services.

Regards,

RoboForex

I worked with the Robo Forex broker for several years, and at the beginning this broker seemed fair and reasonable to me, but over time, the working conditions changed for me, considering that I am a trader with more than 5 years of experience.The sudden changes in the spread and the amount of the spread that could be seen in reality at the time of the transaction are unfortunately significantly different from what the broker declares.For example, when a spread of 3 points is given on the MetaTrader 4 platform, but in real trading, this spread is hidden more than what is displayed on the chart.I personally call this process the hidden spread, and it is one of the issues that causes a trader’s profit to drop and in some cases huge losses to her.For this reason, I do not see the ReboForex broker, which provides services to some countries through the offshore regulator, as eligible to receive a star and have priority among selectable brokers.

Dear mehrdad taheri,

Our company is committed to provides all clients with equal opportunity for performing trading operations. In case you have any complaints about order execution or trading platform operations, you can address them to the Company’s Dealing department and describe your issue in a ticket.

Regards,

RoboForex

I am using Iphone i download the application, now when i try to log in the screen stuck whereas on my other machine working fine what is the casuing such problem

Dear PaulCollin,

For a detailed study of your query, please contact our round-the-clock Support Service for assistance, or you can also email to: info@roboforex.com with a detailed description of the situation you experienced and all the necessary details for its consideration – screenshots, videos, etc. We’re seeking to find out the reasons of what happened and hoping for your cooperation in resolving this matter.

Regards,

RoboForex

Famous and old forex brokers. I feel safe with them. My funds are insured. And broker doesn’t interfere in the trades. Execution is fast and fair.

Dear George Burns,

We’d like to thank you for your positive review of our operations and activities and hope to live up to your expectations in the future.

We wish you successful trading!

Regards,

RoboForex

So far I have good experince with them. I can recommend this btoker.

Dear Benedict Lloyd,

We sincerely appreciate your kind feedback regarding our interface. We will keep working hard to deliver the best services to our clients. Your trust in us is greatly valued, and we look forward to continuing to meet and exceed your expectations.

Regards,

RoboForex

Currently, there are hundreds of brokers and dealing centers working on the forex market, and it is hard to find the reliable one. Basically, all companies are similar to each other by their trading conditions, but there are several top brokers with good and fair conditions. Roboforex is one among them, I recommend this company. They provide world class services.

Dear Jayson Sherman,

We genuinely value your appreciation of our company’s services and operation. Our relentless pursuit is to consistently enhance our services and deliver exceptional experiences to our esteemed clients.

We wish you success!

Regards,

RoboForex

These people are being conned out of their hard-earned money. Don’t put money into the scheme. Your money will never be refunded. They are pulling the investor in to make a forex investment. I’ve sent multiple emails, but no one has responded. They disallowed my withdrawal as well.

Dear nina,

The situation you describe can’t have any concerns with our Company. RoboForex is a regulated broker that operates in strict adherence to all legislative and regulatory documents, which eliminate any possibilities of non-performance of financial obligations owed to our clients.

We highly recommend refraining from adhering to the suggestions presented in the message. In case of any questions relating to cooperation with our Company, please contact our 24/7 Live Support. We’ll be very happy to help you!

Regards,

RoboForex

The crypto pair if traded, then weekend comes in can i control the position over the weekend?

Dear Nheru,

Thank you for your question and your interest in our company. RoboForex clients have an opportunity to invest in cryptocurrencies 24/7. If you have any more questions, please reach out to our Support Service.

We’ll please to assist you!

Regards,

RoboForex

RoboForex caters to different trading preferences with its variety of account types. Whether you’re a beginner or a professional trader, they have an account that suits your needs. I love the flexibility this provides and the ability to switch account types as my trading skills progress.

Dear Randolf Lawrence,

We’d like to thank you for your positive review of our operations and activities and hope to live up to your expectations in the future.

Regards,

RoboForex

Withdrawals at RoboForex are quick and hassle-free. I’ve never encountered delays or any issues when withdrawing my profits. This kind of efficiency is what sets them apart from other brokers I’ve used in the past

Dear Richard Shepherd,

We genuinely value your appreciation of our company’s services and operation. Our relentless pursuit is to consistently enhance our services and deliver exceptional experiences to our esteemed clients.

We wish you success!

Regards

RoboForex

I recently faced an issue with my account, and the customer support team at RoboForex was quick to respond and resolve the problem. Their support agents were friendly, and knowledgeable, and went above and beyond to assist me. It’s reassuring to know that I can rely on their support whenever I need it.

Dear Marta,

Thank you for your kind words and feedback. We truly value your appreciation, as it encourages us to strive for excellence in our services.

We wish successful trading!

Regards

RoboForex

i am indian, now resident of UK, i am very confused in which RoboForex i should register an account, can i choose RoboMarkets to trade or can use both at the same time?

Dear Jagjeet,

If you have any questions regarding your cooperation with our company, please contact our 24/7 Live Support.

Our specialist will assist you accordingly to your needs.

Regards

RoboForex

RoboForex has been my go-to broker for several years now, and I couldn’t be happier with their service. They offer a wide range of trading instruments, competitive spreads, and fast execution. What I appreciate the most is their transparent approach, with no hidden fees or surprises. Highly recommended for both new and experienced traders.

Dear Mark,

Thanks to you for choosing us as your esteemed partner broker and placing your trust in the range of services we provide. We are genuinely appreciative of the encouraging comment you shared with us.

We wish you successful trading!

Regards,

RoboForex

Dear Mark,

Thanks to you for choosing us as your esteemed partner broker and placing your trust in the range of services we provide. We are genuinely appreciative of the encouraging comment you shared with us.

We wish you successful trading!

Regards,

RoboForex

union pay card is it applicateto deposit the funds and how much fees is charged on first of the month

Dear Zoye,

In order to fully understand your inquiry and provide a comprehensive response, please contact the Payment Department of our company through a ticket from your Personal Member Area.

Regards,

RoboForex

The overnight commission how it can be free so i dont have to pay swwap

Dear Kashier,

If you need guidance on trading conditions of RoboForex offered trading accounts or have any queries, please don’t hesitate to reach out to our 24/7 Support Service. You can contact us through various convenient methods listed on the “Contacts” page of our website.

We will be happy to help!

Regards,

RoboForex

Dear Dima,

You can check the availability and status of our licence on this page of the regulator’s website: https://www.belizefsc.org.bz/license-verification-2/?wdt_search=roboforex&submit=Submit

If you have further questions, please contact Customer Support in any way convenient for you. We’ll be happy to assist you.

Regards,

RoboForex

Why i can not lookup your regitration number 000138 on regulation site?

My c trader hang when i placed an order to be placed and i even updated to latest still hangs

Dear Agencee,

For a detailed study of your query, please contact our round-the-clock Support Service via a ticket from your Personal Account for assistance or you can also send an email to info@roboforex.com with a detailed description of the situation you experienced and all the necessary details for its consideration – screenshots, videos, etc. We’re seeking to find out the reasons of what happened and hoping for your cooperation in resolving this matter.

Regards,

RoboForex

When i log into the site and try to access the COPYFX service but that option possibility not appear i want to see copyfx investment

Dear Elminatio,

If you have any questions about working with our company, please do not hesitate to contact the RoboForex Support Service in any way convenient for you, mentioned on the “Contacts” page of our website.

We will be happy to help!

Regards,

RoboForex

Dear Elminatio,

If you have any questions about working with our company, please do not hesitate to contact the RoboForex Support Service in any way convenient for you, mentioned on the “Contacts” page of our website.

We will be happy to help!

What kind of NDD type services based trading account Roboforex is offering

Dear Mahtem,

Thanks for your question, we’d like to inform you that RoboForex offers several types of trading accounts for the online trading, you can get familiar the best suits to you by clicking on this link

https://roboforex.com/forex-trading/trading/trading-accounts/

If you have any doubts, please contact our round-the-clock Support Service for assistance, or you can also send an E-mail to info@roboforex.com.

Regards,

RoboForex

Dear Asaan,

At this platform, it is difficult to find out all the details of the situation you describe and answer at length. If you have any questions, do not hesitate to contact our Support Service through the contacts listed on the official RoboForex website. We will be happy to help!

Regards,

RoboForex

I am using different account types of the system i want to know about fastest execution for several trades at once, if i oen lets say 8 trades i want to close with one click is it possible?

Dear wawe,

ECN trading with RoboForex is an opportunity for traders who want to perform trades on the best possible trading conditions. The main differences between advanced ECN and standard accounts are tight spreads, from 0 pips, and the commission for performed forex transactions, which depends on their volume. Several types of assets are available for ECN trading, such as currency pairs, metals, and other instruments popular with traders. You can trade with the high speed of order execution through MetaTrader 4/5 and cTrader platforms. Complete information about trading on ECN can be found in “Trading accounts” section – https://roboforex.com/forex-trading/trading/trading-accounts/.

If need further assistance, you are free to write back to our Support.

Regards,

RoboForex

do you offer multi trading obe click platform facility to manage multiple trades opened and closing

Good day, Trickie.

It’s great to hear that you’ve decided to join the world of trading!

To get started, you need to register on our website using this link: https://my.roboforex.com/en/register/.

In case you still have any questions, our Live Support is always glad to help you.

Regards,

RoboForex

I want to open STP account with robforex how i can available this opportunity ?

Do you have any lot calclutoar like if i want to just 10%risk how uh to calclulte dpends upon the load and what freuncy orders gets completed?

Run away from this roboforex they are scammers. I deposited my hard earn money on their platform $2,580, when I was done with trade. I decided to withdraw my money. They started asking me source of fund which I provided my Company registration document together with my bank statement. They didn’t respond me for complete two weeks after the two weeks they told me Kindly wait for further details in the ticket 1347597. Another mail is this. Hello!

Please be informed that according to the Client Agreements, clause 13.15 ‘The Company has the right to deduct the amount of compensation paid to the Client from the account if there is not enough trading turnover on it, or not to compensate for additional costs when replenishing the account by the Client if they arose during the conversion of funds or are a fee for using the services of the payment method on the Clients side’.

The amount of the commission compensated has been withdrawn from your trading account.

We officially notify you that the Company has decided to terminate the cooperation with you in accordance with the c. 4.15 of the Client Agreement:

“4.15 The Company has the right to terminate this Agreement immediately provided that the Company informs the Client in writing about it.”

Please create a withdrawal request only to your AstroPay account, after the request will be executed, your members area will be blocked.

I didn’t receive any compensation from them or any bonus but they deducted $1,593.67 from my deposit out of my $2,580. They left me with just $987.51 from my hard earn money. I even paid for withdrawal fees. They are scammers stay away from them

After I started trading on the RoboForex platform, I was pleasantly surprised by the fast work of orders, high-quality training materials and analytics from this broker. This site has a pretty simple registration and verification process! Most of all, I was pleased with the quality support and the withdrawal of earnings without a commission! I first learned about this broker from a review on the Revieweek site – https://revieweek.com/review/roboforex/, I advise you to read it before you start trading on this site!

我来自台湾,我正在尝试开设一个帐户,但从最近两天开始网站无法正常加载我正在尝试这个

Guten Tag GrimiVilla!

Bitte geben Sie Ihre Kontonummer oder die Ticketnummer an, die Sie an unseren Live-Support gesendet haben.

Mit freundlichen Grüßen,

Ihr RoboForex

Ich habe vor zwei Tagen Geld über die Bank hinzugefügt, der Betrag beträgt 2000 $, aber das Guthaben wird nicht angezeigt. Ich habe ein Ticket geöffnet.

Estimado saparto,

Para obtener consejo sobre, por favor, póngase en contacto con el Departamento de pagos de la Compañía a través de un ticket desde su Área de miembros.

Atentamente,

RoboForex

¿Puedo depositar dinero en eth y retirar en bitcoin?

Hallo Huhains,

Für eine detaillierte Untersuchung Ihrer Anfrage wenden Sie sich bitte an unseren rund um die Uhr verfügbaren Support-Service oder senden Sie eine E-Mail an info@roboforex.com mit einer detaillierten Beschreibung der situatie, die Sie erlebt haben, und allen notwendigen Einzelheiten für deren Prüfung – Screenshots, Videos usw. Wir versuchen, die Gründe dafür herauszufinden, was passiert ist, und hoffen auf Ihre Mitarbeit bei der Lösung dieser Angelegenheit.

Mit freundlichen Grüßen,

Ihr RoboForex

Ich habe einen Fehler auf der Website, wenn ich sie verwende, sie wird nicht richtig geladen

Dear youtuber,

All RoboForex clients can take part in competitions that are offered by the ContestFX platform. For more detailed answers, you can write your questions on our official forum or send an email to mailto:contestfx@roboforex.com

Regards,

RoboForex

EU member can take part into the demo conetsts you offer at ContestFx

Dear Kojiees,

Over 12,000 instruments are available for trading in our multi-asset R StocksTrader terminal – real stocks, Indices, Cryptocurrencies, Forex, ETFs, CFDs on stocks, oil and metals. Trading conditions and a list of all available instruments can be found at our website at https://roboforex.com/forex-trading/platforms/stock-market/

If you have any questions, please contact our 24/7 Support Service. We will be happy to help you!

Regards,

RoboForex

I want to trade in shares like Tesla do you have it in the trading instruement?

Dear Mkiys David,

You can select and download the best suitable trading platforms or terminals according to your requirements at the “Trading” => “PLATFORMS” section of our site. We recommend you to pay attention to a more advanced version of the classic terminal which provides a set of unique features – MetaTrader 5, a platform for professional traders that provides direct STP access to the international currency market – cTrader and a new generation web platform that allows you to trade the most “advanced” instruments: ETFs and others.

If you have any further questions or need our help kindly contact our Support Service. We will be happy to help you.

Regards,

RoboForex

which platform or terminal less lag while working with? I see problem with mt4

Dear Rome Escabillas,

Unfortunately, it is not possible for us to comment on your claims, because its do not contain the data that is necessary for having a closer look at them.

Could you please explain the reasons of your negative attitude? What facts are there to back up your opinion? Have you contacted our Live Support to learn more of the situation, which triggered your negative statements? Please, specify your account number or the ticket number that you sent to our Live Support.

Regards,

RoboForex

so, you’ve been scamming people since 2009. and you don’t go to the US because you are afraid to be persecuted. now I know we must request to have a global red tag on this broker. of which my lawyer is contacting Interpol and my lawyer asked me to contact this Mr. Tem B. who poses my manager but is useless.

BE AWARE, ROBOFOREX IS A SCAM, and the manager Mr. Tem B. is a scammer, for those who are scammed, let’s collaborate for a mass case against ROBOFREX.

亲爱 Ming shin,

如果您在使用我们的网站时遇到任何问题

https://roboforexn.org,请写信给我们 info@roboforex.com

问候,

RoboForex

我正在尝试访问该网站,但该网站页面从未加载

Hallo Noah,

Um Problem zu lösen und Ihre Fragen zu beantworten, senden Sie bitte eine detaillierte Nachricht mit Screenshots oder erforderlichen Daten an info@roboforex.com.

Mit freundlichen Grüßen,

RoboForex

Ich bin wirklich verwirrt, ich bin in Frankfurt und bekomme keine deutsche Versionsseite

Dear sayeen,

RoboMarkets Ltd (ex. RoboForex (CY) Ltd) is a European broker regulated by the CySEC, license No. 191/13.

RoboMarkets Ltd provides financial services only to the residents of the EU/EEA countries.

RoboForex Ltd is an international broker regulated by the IFSC, license No. 000138/210, reg. number 128.572.

If you need more detailed answers, please contact our Support Service through one of the methods mentioned on the Contacts page of our website.

Regards,

RoboForex

is roboforex regulated by Cysec or Robomarkets i am looking for strict regulatory

I swear with the name of God , for few people that will believe me roboforex is a big scam, someone deposited 13$ by July 6 midnight Nigeria time and later withdrew over 2000$ instantly , to be surprised no withdraw email notifications until processing done and lost everything to roboforex

Dear Etherium ,

The number of trading instruments will depend on the type of account you choose to trade. A complete and up-to-date list of assets available for trading for all types of accounts can be found on the page of our website in the “Trading” => “Contract Specifications” section. If you have any questions, do not hesitate to contact our 24/7 Customer Support. We will be happy to help!

Regards,

RoboForex

Dear Peliys,

All related and up to date information about the company is posted on our official website.RoboForex is an international broker with the official license IFCS Belize “Trading in financial and commodity-based derivative instruments and other securities”, No. 000138/210. You can verify this information yourself on the Regulator’s website.

Regards,

RoboForex

Can i do spot trading for any cryptos pair for the trading ?

IFSC/60/271/TS/17 is true license?

Hello!

You said you are regu;ated broker so i went to IF site to make sure you have running license but i could not see you IFSC/60/271/TS/17 there! So what does it shows to me? Tell me about

Dear Mijalis,

The lowest weighted-average spread among all account types RoboForex at Prime-account. Complete detailed information is available in the “Contract Specifications” on the page of our website. If you have any more questions, do not hesitate to contact our Support Service.

Regards,

RoboForex

Whats the lower spread on the xAUUSD i am scalper so i need lowest one.

Dear Amir,

In case you have questions about the execution of orders or the operation of the trading platform, then kindly contact the company’s Dealing Department through a ticket from your Personal Account. Response to tickets are provided on a high priority basis, within the time frame established by the regulations.

Regards,

RoboForex

Message: Roboforex is the worst and manipulating broker I ever used. Anyway my ID is 9319050. Get Margin call with Gold today (9 August 2021) while the price is not reach the standart price as other broker. Why the price action for gold not same as any broker? All broker price action only 1678.00-1687.00 ( Hextra Prime, Bold Prime, Tradingview and etc) but your price action is 1610؟؟؟؟?

For your information, my Procent account should not margin call if your price action same as other. Please give me your answer as soon as possible or I will make report to FINRA.

Dear Levan,

In our company, several types of accounts and various trading platforms are available for trading. For professional traders, RoboForex offers Prime accounts. If you’ve any further questions, kindly don’t hesitate to contact our 24/7 Customer Service. We will be happy to help!

Regards,

RoboForex

Roboforex is the worst and manipulated broker I ever use. Get Margin call with Gold today (9 August 2021) while the price is not reach the standart price as other broker.Why the price action for gold not same as any broker? All broker price action only 1678.00-1680.00 ( Hextra Prime, Bold Prime, Tradingview and etc) but your price action is 1666.00-1638.00 (around 120-400 Pips differences) ? For your information, my Procent account should not margin call if your price action same as other. Please give me your answer as soon as possible or I will make report to FINRA and http://www.econsumer.gov.

do you offer NDD services, i tried stp one and did not find them good one

Dear Chuanli,

If you have any complaints about order execution or trading platform operations, you can address/write them to our Company’s Dealing department and describe your issue in a ticket.

Sincerely,

RoboForex

I have pplaced a pending on the friday before market and price hit + spread but the order did not trigger!!

504 gateway error from last 5 hours what’s going on?

Dear Rasheed,

There were no such error recorded/found by our side. We’d very grateful if you email a message to info@roboforex.com and provide a detailed description of what happened when you visit site. Thank you for your cooperation!

Sincerely,

RoboForex

Dear Chung,

You can use any method available in your Personal Account at your convenience. If you need personal advice, kindly contact the company’s Payments Department using a ticket from your Personal Account. We will be happy to help you!

Sincerely,

RoboForex

I am from Hongkong so advised me which payment charged less

Dear Wang Yong,

RoboForex clients have the opportunity to take advantage of different bonuses offers when replenishing their deposits – Profit Share and Classic Bonus.

More detailed information about the conditions of provision the bonus can be found on our website. If you think professional advice is necessary, contact our Live Support in the chat.

Sincerely,

RoboForex

Can i take advantage of deposit for one time or many times i want to ?

Dear trueknow,

RoboForex Ltd and its affiliates don’t work on the territory of the USA.

Sincerely,

RoboForex

if you are regulated broker then why not provide service to US citizen

Dear Zeshan,

RoboForex offers two types of bonuses and traders can receive them when making a deposit.

1. Classic bonus.

You have an opportunity to receive up to 120% of the deposited sum on all RoboForex standard and cent accounts. The complete conditions for getting the Classic bonus can be found here – https://roboforex.com/clients/promotions/forex-bonus-deposit/rules/.

2. Profit Share Bonus.

You have an opportunity to receive up to 60% of the deposited sum on all RoboForex standard and cent accounts. The complete conditions for getting the Profit Share bonus can be found here -https://roboforex.com/clients/promotions/profit-share/rules/

In case of any additional questions, contact our 24/7 Live Support at https://my.roboforex.com/en/livesupport

Sincerely,

RoboForex

@ManagerRF do you have any deposit bonus i visit your site but still want to know the highest one you are offering!

Dear RAMASUBRAMANIAN L,

RoboForex is an international broker with the official license IFCS Belize “Trading in financial and commodity-based derivative instruments and other securities”, No.000138/210. The Company has been providing services since 2009 and performing its obligations owed to clients in full.

Sincerely,

RoboForex

dear sir.

Maximum of traders give the Robo Forex is scam,is it true

Dear sonny hernandez,

RoboForex offers you to create test and optimize a trading robot on your own using StrategyQuant – a designer(maker) of trading robots for MT4.

Read more about this here – https://roboforex.com/forex-trading/trading/strategy-quant-ea-constructor/

For the R Trader trading platform, we offer a “Trading Strategy Builder”. With its help, you can automate your trading for free with a few clicks, without writing code and downloading additional programs.

See https://roboforex.com/beginners/trading-tools/strategy-builder/ for details.

Feel free to contact our Live Support in case you have any questions about your cooperation with our company. Contact us in any way that is specified on the “Contact” page of our website. We’ll be very happy to help you!

Sincerely,

RoboForex

Dear Me Myself,

In case you have any complaints about order execution or trading platform operations, you can write them to the Company’s Dealing department and describe your issue in a ticket.

Sincerely,

RoboForex

how to use robot if I start trading. where I can get this robot do I rent this or what. thank you!!

Dear new trader,

I stronglyadvice you NOT open an account in RoboForex. Since they are using the price chart of kraken.com which are manupuled by them. You can see this ETHBTC pair on Ferbruary 22, 2021. Just look at the daily lowest price at kraken.com and any other trading platform’s prices (investing etc) you abviously see the difference. They arrange the prices in order to blow out you money within seconds.This happend to me.

In short DO NOT TRADE with RoboForex.

wow this is a nice site and I would like to have one account for my self

Dear Anthony,

Thank you for rating our so high!

In case of any questions about cooperation with our company, submit them to our 24/7 Live Support. We’ll be very happy to help you!

Sincerely, RoboForex

Trading since 1 month by roboforex. The only disadvantage, and huge one, is that you MAY (can be declined anytime without any explaination by roboforex) have chance 2 times per month for a free withdraw, and the amount is strictly limited. For example only 50 thousand and 1% by bank transfer. Considering almost every broker allows unlimited free withdraw. This makes me really nervous and I am seriously considering moving away from roboforex.

Dear Anujin Erdenetsogt,

Thank you for your feedback. We always strive to increase the efficiency of our operations and activities and valid criticism only helps with that. Отправьте, пожалуйста, подробную информацию с вашими замечаниями на info@roboforex.com and to get advice on the best way to withdraw funds, please contact the Company’s Payment department via a ticket from your Members Area.

Sincerely, RoboForex

I’m using Roboforex for 3 years.

This broker used to be really reliable, like internet say trusted but….

For a year ago, things started to happen, Visa/Mastercard deposit and withdraw is changing all the time.

I think those have changed like 4-5 times. Even more of that; now there is no option to deposit and withdraw.

Think about that CFD broker with no Visa/Mastercard option???

It is pretty shame that 10 years of experience and not solving Card Methods… I can’t even say a word.

Anyway, that is not a main part. Support is completely dead. They are really not that experienced or something. They just answer you in like 15-30 minutes later.

Ticket… Again. Very unprofessional answers and services…

Yet, withdrawal options were great!!!

Prime account is superior for retail traders.

I have been institutional trader (corporate) and retail too. So Roboforex is maybe the leader in the world.

So here is my suggestion. This broker is definitely not scam but I can’t say for real sure because of visa methods.

Since visa or master heavily regulated and Roboforex is failing on Visa side requirements.

For 3 years of feeling, this broker is just dying out of market. Lack of support and unprofessional feedback to clients.

By the way, their withdraw system is the one you can find on internet. I mean for retailers. I remember that my card withdraw transacted in 3 seconds. In my bank account only in 3 seconds not 2 days or something.

So again this broker is not scam at all. Only concern arise when they change something without notice and unprofessional feedback to clients.

That is it. Hope I helped people and goodluck with trading. Always follow trend.

Dear Finix,

If you encountered any difficulties when working with our company, please contact our Live Support in any way that is convenient for you specified on the “Contacts” page of our website. We’ll be very happy to help you!

Sincerely,

RoboForex

I am trying to register your site but while doing so i getting error all the time. i press create account then page goes down.