Forex Trading: Why Trade with Cyprus Securities and Exchange Commission CySEC Brokers

- What is CySEC?

- Why trade with a CySEC-regulated broker?

- CySEC Brokers Requirements and Regulation

- Regulatory Complaint

- List of Regulated Forex Brokers

- Conclusion to CySEC

Introduction to CySEC

| 📚 Formed: | 2001 |

| 🏦 Jurisdiction: | Republic of Cyprus |

| 🏢 Headquarters: | Nicosia, Cyprus |

| 🖥 Website: | www.cysec.gov.cy |

| 🛡️ Is CySEC Broker Offshore or Top-tier Jurisdiction? | Top-tier |

| 🔒 Is Top-tier Jurisdiction safe to trade? | Yes |

What is CySEC?

Cyprus Securities and Exchange Commission (CySEC) was launched in 2001 as an interdependent public corporate body to regulate leveraged foreign exchange transactions and investment services market in the Republic of Cyprus (Read our article about Cyprus Brokers). As of 2004 Cyprus participate in the European Union, therefore CySEC became a respected part of European MiFID regulation.

- Besides the fact that Cyprus has an ideal location, it is also a tax haven with its lower tax rates, as well significant background in the financial business. In addition, the MiFID harmonization law allows Cyprus-registered investment firms and brokerages to access all European markets.

- In particular, establishing the Cyprus securities market as one of the safest and most attractive investment destinations a significant number of Forex Brokers, as well as a vast of Binary Options firms obtained CySEC licenses and establish their operational offices in Cyprus.

- Cyprus is a known hub of Binary Brokers, as many firms found their benefits from the CySEC authorization since most other European jurisdictions and regulators strictly prohibit binary trading. However, a significant move happened in 2012 once the board made an announcement regarding binary options classification and categorize them as a financial instrument. All binary options providers were obliged to restructure offerings and clearly state to every customer the highest risk in binary trading as well as to operate fairly towards the traders. Yet, Cyprus remains as first and one of the leading trading centres that proclaimed binary options as an investment instrument and give access to the Eurozone. (Beware of Binary Options Scams)

- Considering the essential growth of the industry, CySEC's role becoming even more valuable, as authority ensures investor protection and healthy development of the trading offer through its effective supervision of the securities market.

Why Trade with a CySEC-regulated Broker?

Given the fact that the Forex market is an OTC market, which has no specific regulations or jurisdiction, it is necessary to understand who is a trustful broker and who is not, to protect investors, as well as to control the market to function smoothly. And that is the purpose why responsible Regulators were established by various jurisdictions.

- In turn, the responsibilities of CySEC include the issuance of licenses to brokers operating in the foreign exchange and stock markets, their subsequent control and audit to ensure compliance with the laws, detection of violations with further imposes of penalties, disciplinary actions or case processing through the state bodies.

- In recent years, CySEC became a very active authority in terms of inspection of Forex Brokers and suspicious activities, as there were issues and cases in operational history with some of the Cyprus-regulated brokers. The latest announces were issued for non-compliance with the applicable laws, e.g. include suspend and withdrawal of AnyOption broker and Fenix Capital Markets Trading licenses or imposing a fine of a total €130.000 the InstaForex and ForexMart. Therefore, CySEC has been changing its position so now acting more sharply towards the brokers whose service does not meet reporting requirements and breaches obligatory policy. The imposing of sanctions for violations includes announcements of the CIF license withdrawal, slapping fines and more frequent check-ups to make sure compliance with new measures.

- In the scenario and unlikely event that a CySEC regulated Broker goes insolvent, the clients are covered by the Investor Compensation Fund for IF Clients (“ICF”). The purpose of the ICF is to secure the claims of covered clients against the ICF members through the payment of compensation if the necessary preconditions are fulfilled with the maximum amount of compensation of up to €20,000 per client.

- Apart from the main role to regulate and supervise forex brokers, CySEC accurately reviews and amends the new products offered, such as current trends around Cryptocurrencies, Binary Trading, etc. The Cyprus Authority when necessary updates investment advice, undertakes training to prevent fraud and financial abuse (Read more about Forex Trading Scams), including checking issues of money laundering and other threats, as well as educates publicity through regular courses and publications.

CySEC Brokers Requirements and Regulation

To become a licensed broker regulated by CySEC (Cyprus Securities and Exchange Commission), certain requirements need to be met. These requirements are in place to ensure the integrity, transparency, and stability of the financial markets. Here are some key requirements for CySEC brokers:

- The grant of license and before any forex company becomes an official CIF (Cyprus Investment Firm) a broker should comply with the set of standards that diverts to the company's history and its business model of operation. The CySEC will examine the application while the broker should have a physical office in Cyprus, operate at least for 3 years, have the specified type of activities and financial service, as well properly enable customer protective tools through fund segregation, join schemes and more.

- The minimum initial capital requirement for CIFs depends on the services provided, ranging from €50,000 to €1,000,000. Additional capital requirements may apply based on the broker's activities and risk profile. The broker should also establish a high operation fund subject and depending on the content of an application, thus the STP applicant capital requirement is at least €200,000, while the Market Maker brokerage model has to confirm its capital adequacy ratio of at least €1 million.

- The individuals who hold key positions within the broker's organization, such as directors, senior management, and shareholders with significant influence, must meet the "Fit and Proper" criteria. This means they should possess integrity, competence, and sound financial standing.

- Brokers must have robust systems and controls in place to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. They should establish appropriate policies and procedures to detect and prevent money laundering and terrorist financing activities.

- Brokers must maintain accurate and up-to-date records of their activities, transactions, and financial statements. They should submit regular reports to CySEC and comply with their reporting obligations.

- CySEC-regulated brokers have ongoing obligations, including regular reporting, risk management, compliance monitoring, and internal audit. They must also cooperate with CySEC during inspections and provide any requested information promptly.

Once the broker is an official CySEC Regulated Broker the firm then can operate in the stock, forex and CFD markets and what is important mandatory follows all the guidelines set by MiFID (the Markets in Financial Instrument Directive). Besides that, the CySEC continues to work closely with every regulated broker and inspects operations daily.

CySEC Education

CySEC also provides education and training programs related to financial markets and regulatory compliance. CySEC offers various educational initiatives and resources to promote an understanding of financial markets and enhance the knowledge and skills of professionals operating within the regulated sectors. These initiatives may include:

- Training seminars and workshops: CySEC organizes training events, seminars, and workshops on topics such as regulatory compliance, risk management, investment services, and market supervision. These events aim to educate professionals and enhance their understanding of the regulatory framework.

- Online resources: CySEC provides educational materials, guidelines, and publications on its website, which are freely accessible to the public. These resources cover a wide range of topics, including investor protection, financial reporting, and legal obligations.

- Certification programs: CySEC may establish certification programs that aim to recognize and validate the competence of individuals working in the financial industry. These programs can provide participants with a comprehensive understanding of regulatory requirements and best practices.

Here's the link to CySEC Financial Education Hub: https://www.cysec.gov.cy/en-GB/investor-protection/financial-education/

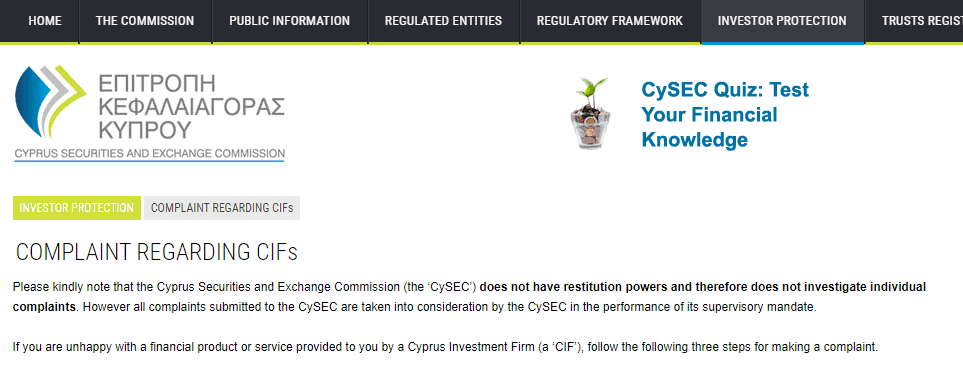

Regulatory Complaint

Even though the Cyprus Securities and Exchange Commission does not have restitution powers and therefore does not investigate individual complaints, if you have a complaint, it is best to first ask the CIF involved to put things right, while CIFs are required to respond in writing within five days. The traders also recommended checking the issue with the office of the Financial Ombudsman, if not satisfied with the firm’s response, they rejected your complaint or you do not have the answer. The Financial Ombudsman is an independent service for settling disputes between CIF and their clients.

- How to submit a complaint: www.cysec.gov.cy/en-GB/complaints/how-to-complain/

- The Financial Ombudsman website: www.financialombudsman.gov.cy

What is also precisely, the complaints received from clients about unscrupulous brokers or fraud companies will be resolved by the Commissions as soon as possible. At the same time, the CySEC publishes its official listing of warnings, a list of non-approved domains that help to prevent scams, while the information about unprincipled brokers is open and transferred to other financial regulators.

List of Regulated Forex Brokers

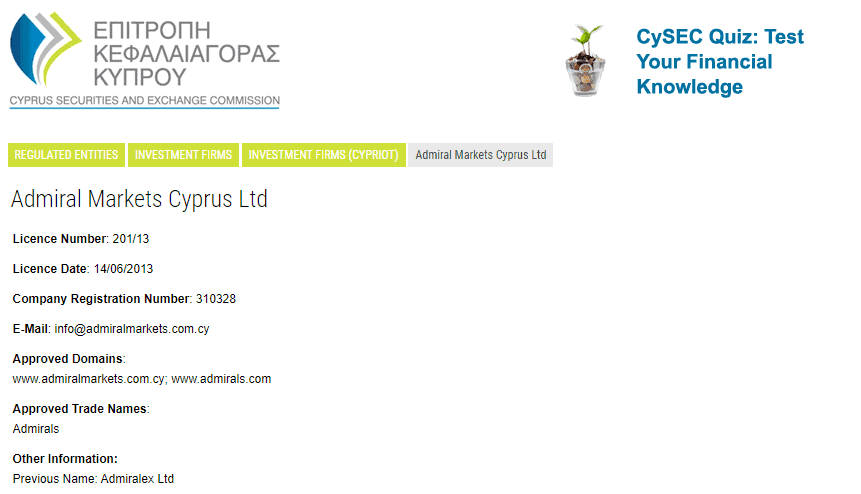

To help traders to verify information about CySEC forex broker license, the official website publishes a list of regulated entities. The CySEC broker's website also displays on the footer or regulation page its CySEC license number, which consists of 5 digits in the format 111/11. Here you can see TriumphFX CySEC authorized broker

Here you can search for CySEC listed entities: https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/

As well, you can always check on CySEC Broker Reviews with updates and news from the broker. Currently, Cyprus regulated brokers' list on our website includes 50 CySEC Regulated Brokers and growing. While in total there are more than 200 investment firms regulated by the Cyprus Securities and Exchange Commission.

Here's a snapshot of Admiral Markets CySEC license:

Conclusion to CySEC

Of course, CySEC has much potential to become at the level of a reputable authority like the UK’s FCA and implement the more strict requirements to set up financial investment or trading companies (Read Why Trade with UK FCA Regulated Brokers). Yet, Cyprus itself continues its growth and remains a popular Forex Broker destination. There are many more regulated forex brokers in Cyprus rather than in any other European or even world jurisdictions.

Since the majority of Europe’s Forex brokers are regulated by the CySEC, the imposed authority along with the MiFID guidelines and European control establish a strong impact on the industry and of course traders’ protection. The transparent and fair manner of operation acts towards traders as the contractual obligations fulfilled by the regular reporting, along with the constant eye on the broker’s operation, as the financial company may impose a risk to have sanctions and penalties, which are not that rare among CySEC brokers.