- What is FP Markets?

- FP Markets Pros and Cons

- Awards

- Is FP Markets safe or a scam?

- Leverage

- Account types

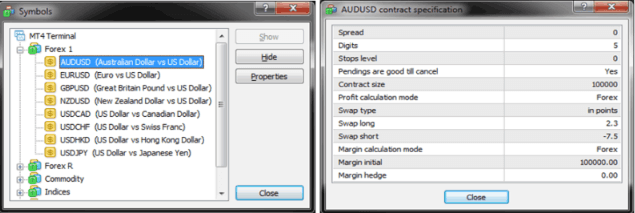

- Instruments

- Fees

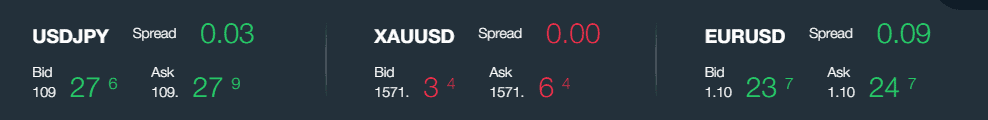

- Spreads

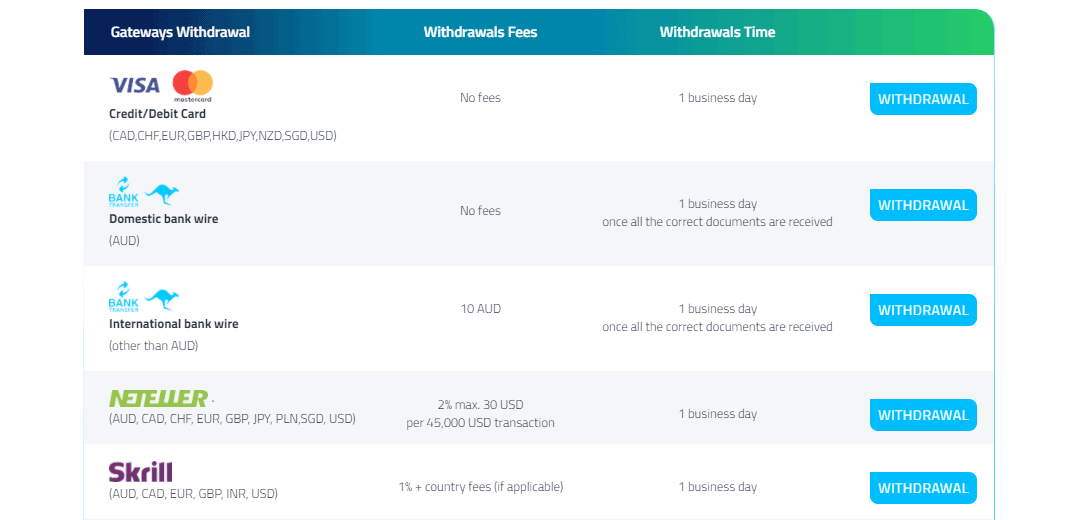

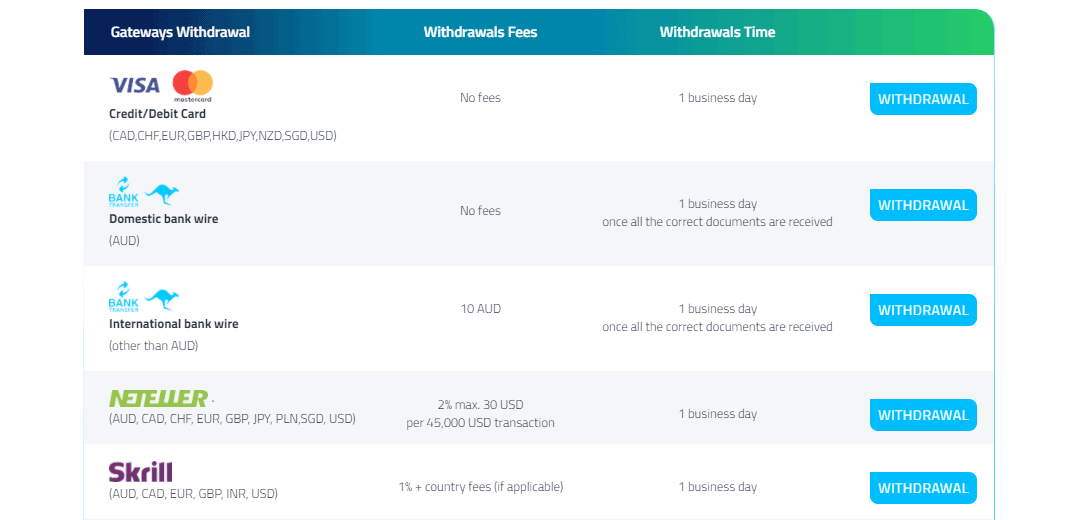

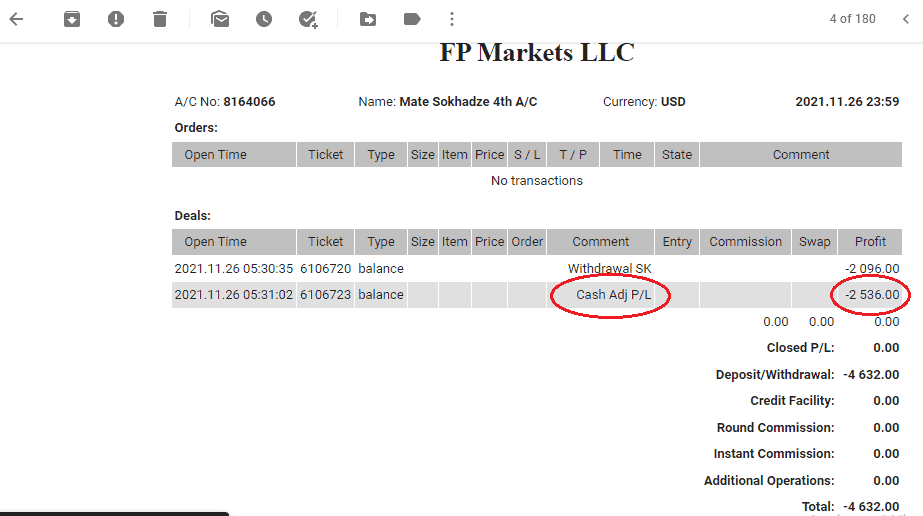

- Deposits and Withdrawals

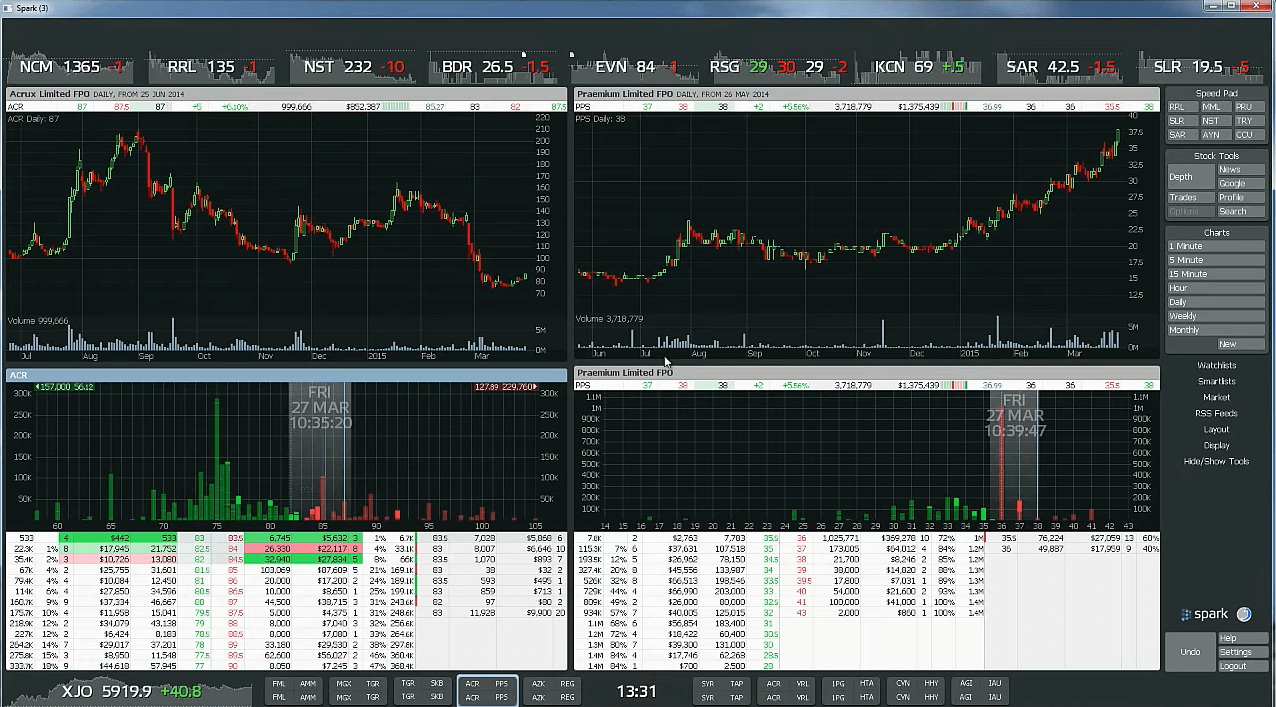

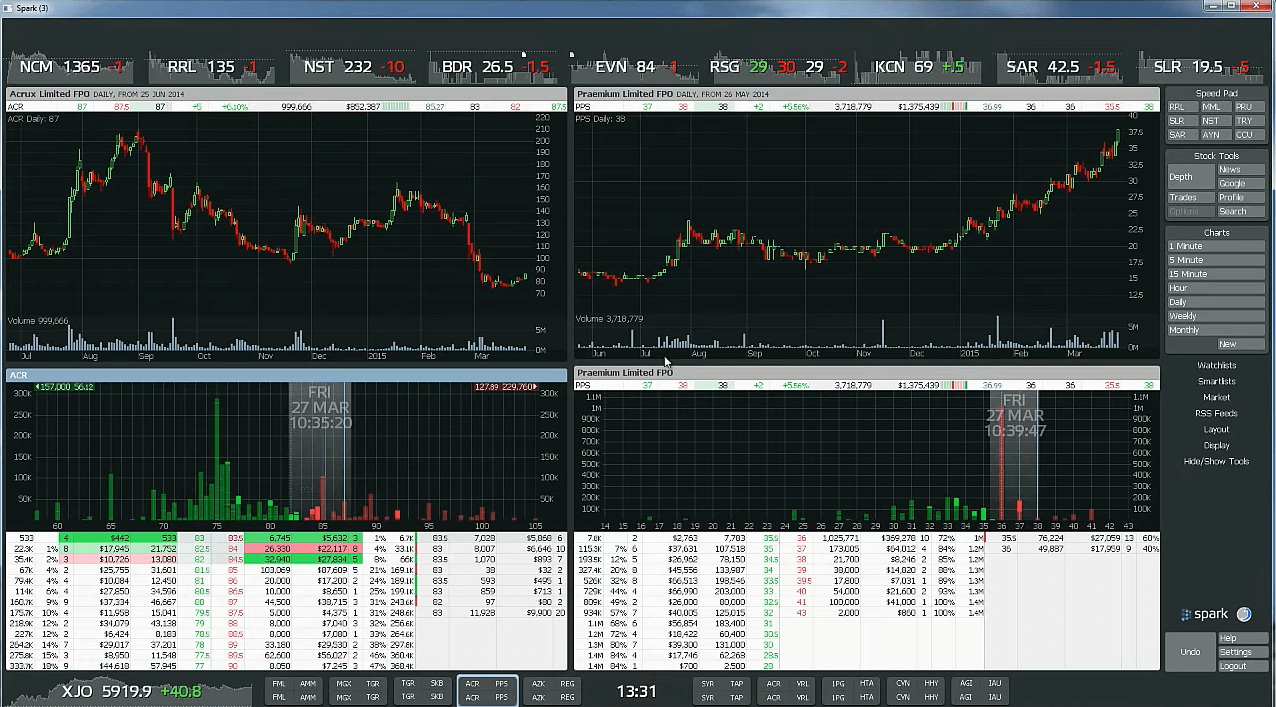

- Trading Platforms

- Customer Support

- Education

- Conclusion

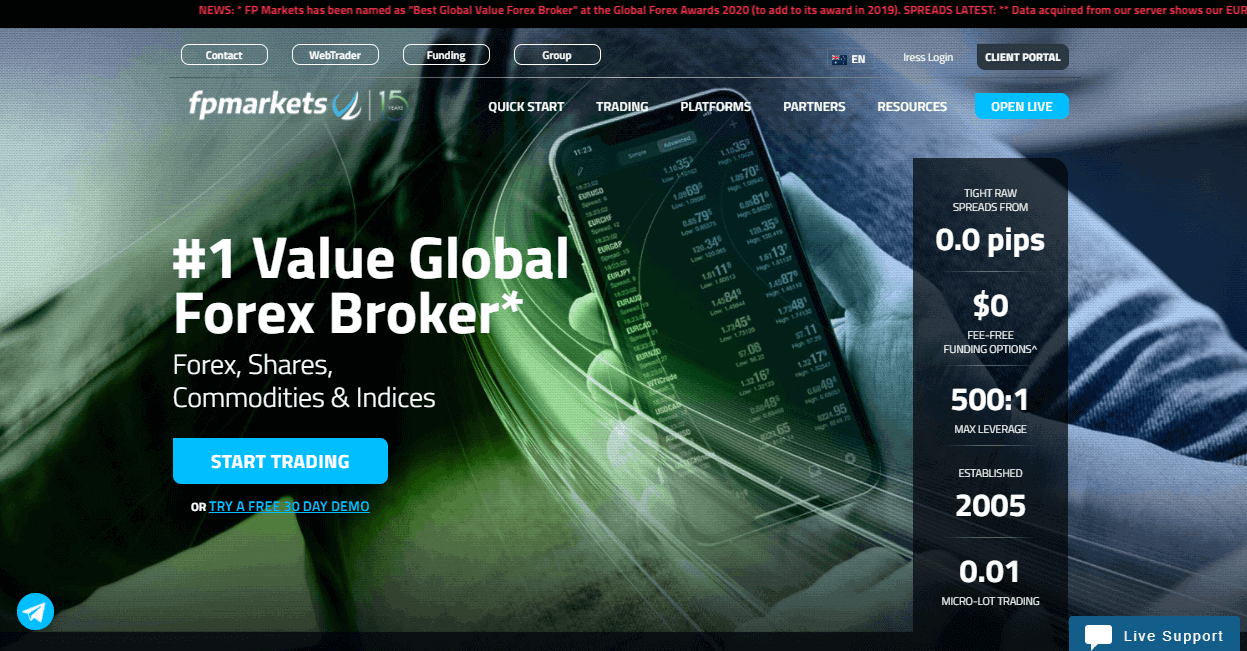

What is FP Markets?

FP Markets is a popular and large Forex Broker operating professional trading experience for a quite long time since the broker was established in 2005 and ever since serves over 12,000 clients worldwide. One of the main strengths is that FP Markets uses ECN electronic bridges and enhance its proposal with powerful trading technology, also investing in its innovation.

Where is FP Markets based?

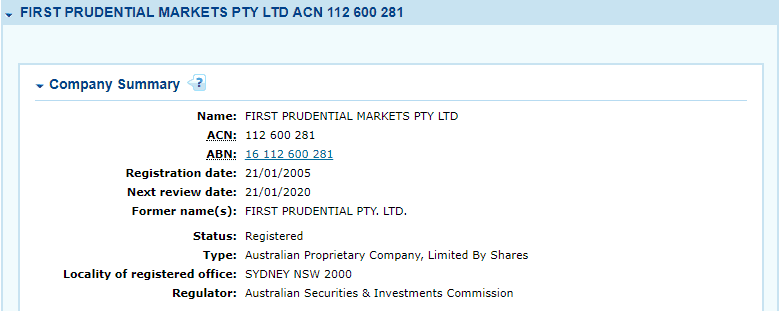

First of all, a good broker is a safe broker. The proof of its safe trading environment is also confirmed by necessary legislation obligation and sharp obligation, while FP Markets is an Australian brokerage company headquarters in Sydney, Australia while ASIC regulation ensures trustable cooperation as well as full compliance with guidelines. Moreover, quite recently FP Markets enlarged its proposal and opened European Cyprus entity thus eligible for trading proposal within EEA zone. Also, FP Markets (PTy) Ltd is now a Financial Services Provider authorised and regulated by the Financial Sector Conduct Authority in South Africa.

Is FP Markets a true ECN broker?

Another strong point of FP markets proposal is developed ECN technology that provides direct access to the liquidity providers without dealer intervention through Equinix NY4 Data Centers, and executes order through the best possible price within offering for the particular asset.

This technology currently is the leading solution that provides extremely fast execution speeds and the most favorable quotes with spreads from 0.0 pips allowing you to benefit from it.

FP Markets Pros and Cons

FP Markets is a well-regulated broker with good trading environment suitable for beginners and experienced traders too, the points to admit are low pricing, good trading proposal with selection of platforms and ECN trading environment also excellent trading education. Besides, Broker constantly growing and we see good development not only in the proposal but to its global coverage too, while before FP Markets was just an Australia-based broker, now its truly global one.

For the flip side Spreads for Stocks are higher, also some withdrawals add on commission, also is worth checking the conditions under the entity of FP AMrkets you would trade since they are different.

| Advantages | Disadvantages |

|---|

| Founded in Australia and Regulated by the ASIC | Trading Conditions or proposal may vary according to entity rules or regulations |

| Numerous industry awards and high rankings | Some withdrawal methods add on fee |

| Powerful trading technology and ECN environment | High Stocks trading Spread |

| Low Deposit Requirement | |

| Suitable for beginners and professionals | |

| Excellent education through Traders Hub | |

| Tight Spreads | |

FP Markets Review Summary in 10 Points

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, CySEC, St. Vincent & Grenadines, FSP, CMA |

| 🖥 Platforms | IRESS, MT4, MT5, cTrader |

| 📉 Instruments | 10,000+ products Forex, Indices, Commodities, Metals, Cryptocurrencies, Equity CFDs , Bonds, ETFs, 70+ Forex pairs |

| 💳 Minimum deposit | 100$ |

| 💰 EUR/USD Spread | 0.0 pips |

| 🎮 Demo Account | Available |

| 💰 Base currencies | 10 Base Currencies |

| 📚 Education | Learning materials and research through Traders Hub, News, Market Outlook, video tutorials, eBooks |

| ☎ Customer Support | 24/7 |

Overall FP Markets Ranking

With our Expert finds on FP Markets review we consider quite good trading conditions, there are many points that mark FP Markets in front including low fees, global exposure available for all traders and good platforms provided.

- Our Overall Ranking is 9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | FP Markets | BlackBull Makets | Orbex |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | ECN trading | Low Fees | Platfroms |

FP Markets Alternative Brokers

Yet, besides to its great offeringg we found some Cons too, like instrument offering is differentt based on entity, also Stocks are traded as CFDs and are slightly higher costs. Even though, spreads, education and platform solutions are really good at FP Markets it good to consider other brokers too, see our selection of Alternative Brokers below:

Awards

In fact, FP Markets gained its reputable position in the market and is recognized multiply by various publications and reputable editions. The excellence of the service they offer, as well as trading conditions along with high regard from the traders, is truly a good proof of trust and great establishment.

Yet, we see FP Markets continues to acquire new awards, which are a result of the dedicated and client-oriented policy of the broker. Quite recently FP Markets was awarded the Best Global Forex Value Broker, Best Forex Broker Australia, Outstanding Value CFD Provider, Best Forex Partners Programme in Asia, also, Best Trade Execution and Most Transparent Broker at Ultimate Fintech Awards APAC 2023.

In addition, FP Markets informs about newer awards. It claimed a Hat-Trick for a second time in a row at the Global Forex Awards 2023 for ‘Best Value Broker – Global’, ‘Best Broker – Europe’ and ‘Best Partners Programme – Asia’.

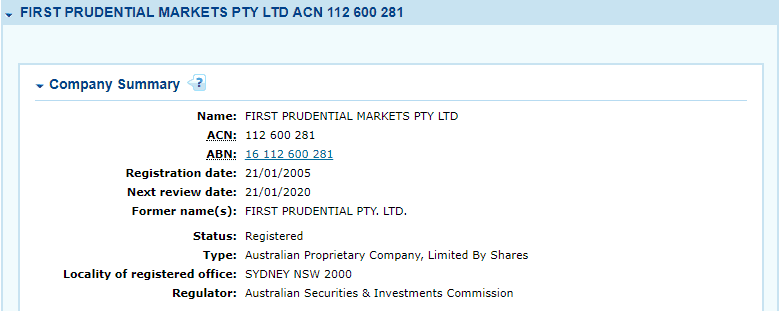

Is FP Markets safe or scam?

Yes, FP Markets is safe to trade, it is an established Australian broker that respectively complied operations according to the world-known regulation Australian Securities and Investments Commission (ASIC), learn more why trade with ASIC Brokers by the link.

Besides, Brorker growing its presente and there is entity in Cyprus also regulated and set according to CySEC regulatory obligations and compliant to MiFID European directive.

See our conclusion on FP Markets Reliability:

- Our Ranked Trust Score is 8 out 0f 10 for good quality regulated service along the years, and regulated environment in eeach region it operates. However, the only point is International trading available via the offshore entity.

| FP Markets Strong Points | FP Markets Weak Points |

|---|

| Regulated by several authorities | Not listed on Stock Exchange |

| Australian ASIC and Cyprus CySEC

| International proposal done by SVG |

| Negative balance protection for European clients | |

| Segregated Accounts and excellent long history of operation | |

How are you protected on FP Markets?

The regulatory status is indeed the most important measure, as in simple words it means a client is treated fairly according to international laws and requirements. SO being regulated broker traders funds are segregated from the company funds, while held in selected top-tier banks, such as National Australia Bank and the Commonwealth Bank of Australia with daily fund reconciliation and application of the standard covers under investment protection. See our check of license below:

- However, different authorities apply adjusted regulation according to its legislation and particular laws, in a result may diverge from the entity or regulator or another. Likewise, FP markets Cyprus entity also apply negative balance protection to the clients accounts, as well as participates retail accounts to the compensation scheme, but it is not a case oof SVG entity. So always make sure to learn better under which entity you trade and what protection conditions and privacy policy applicable to you.

What Leverage FP Markets offer?

In fact Leverage levels depending on the entity you will open an account with, since Leverage is one of the first regulated parts, see some of our find below.

Being an Australian broker, FP Markets complies with the ASIC set of rules and significantly lowered levered too now, before it was available 1:500. Also, in its other entity in EU, FP Markets obliges to another regulatory restriction set by ESMA, while international branch has other legislations that why leverage might be higher for some instruments offered.

- European traders can use a maximum of 1:30

- South African traders can open positions on more than 70 forex pairs with spreads from 0 pips and a leverage amount up to 1:500

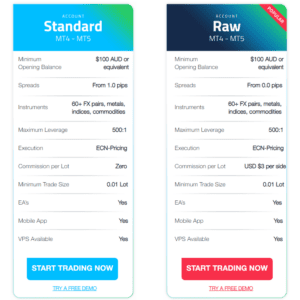

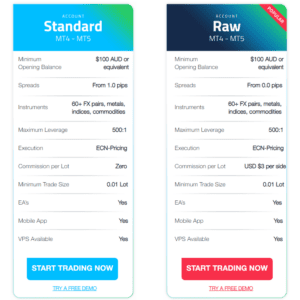

Account types

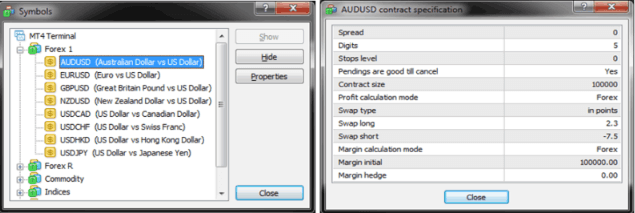

FP Markets offers two account types with STP and ECN execution models, accordingly available through MT4 or MT5 platforms. Also, there are three IRESS account types that cover the need of those traders who prefer to use this particular software. Also, FP markets offer MAM and PAMM accounts, while copy trading is available on each of the accounts offered. You can also see other brokers that have Islamic forex accounts.

However, as we notice along with some diversification between the proposal, some differences between the pricing model may take place as well, so be sure to check the most suitable one for your need.

See our negative and positive points below, and accounts comparison:

| Pros | Cons |

|---|

| Fast Account Opening, fully Digital | None |

| 2 Account types with ECN and Standard execution for MT4 MT5 platforms | |

| Separate account for IRESS platform | |

| Low Minimum deposit | |

| Free deposit | |

How to open Demo Account

The account opening process is digital and easy to follow, you can sign for Demo account almost instantly and in order to switch to Live Account FP Markets confirms the application either in the same day or within 1-2 days maximum so that you’re able to access the trading experience smoothly.

Actually, you should follow next steps that would be your FM Markets account opening process.

- Enter your name, email, country of residence

- Provide proof of information and upload your documents, ID, proof of address, etc

- Select the account type and trading platform as your preference

- Fill the questionnaire to prove your financial experience

- Once account it confirmed follow with first deposit and start trading

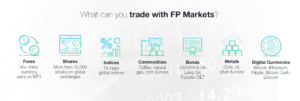

Trading Instruments

Trading with FP Markets you may access to trade 10,000+ products ranging from Forex, Indices, Commodities, Metals, Bitcoin, Equity CFDs. FP Markets offers quite competitive spreads, enable access to more than 70+ forex pairs, and provides other assets as we will see below in our FP markets review.

Traders and investors are now also able to trade the Mexican Peso (MXN), Brazilian Real (BRL), and South African Rand (ZAR) against the US Dollar through the MT4 & MT5 Trading Platforms. The additional offering increases the total number of currency pairs available to trade at FP Markets.

Also, each instrument defines its trading conditions, proposing flexible leverage throughout one account, and require specified margins that you may always check through FP markets platform.

- FP Markets Instrument Score is 8 out 0f 10 for quite good trading instrument range covering popular Markets to trade, yet proposal mainly consists of Forex and CFDs, also the range is different based on entity

Fees

For FP Markets fees, there are some specified conditions between FP markets pricing that may occur in different account types, alike IRESS account charges based on a commission plus percentage from trade basis according to the instrument. Therefore, according to your trading style and the volumes you trade, there is an option to select suitable one, also we consider deposit and withdrawal fees to see full fee picture.

- FP Markets Fees are ranked low with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Overall with our opinion, FP Markets proposes very competitive offering among the market, there is no fees charged for withdrawals also other fees are good. See fee table below and consider full pricing offering.

| Fees | FP Markets Fees | AvaTrade Fees | XM Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

Rollover

In addition to main fees, always consider rollover or swap rate as a trading cost, since the broker charges a small fee for the position being held longer than a day and is defined by the instrument. Moreover, there is an option for Muslim trader to trade through Swap-Free account, which is suitable for followers of belief and tailored according to the strictest rules.

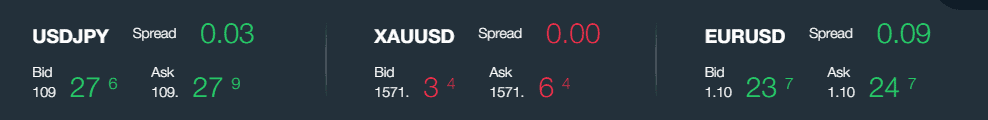

FP Markets Spreads

FP Markets spread is defined by the account type too, thus the STP account EUR/USD floating spread is averaged 0.7 and the ECN proposes only 0.1 for the same pair. However, ECN account charges commission to every order, which is defined by the instrument and is 3$ for Forex instruments, 3.5$ for Metals and offers 0$ commission on commodities or cryptocurrencies. As well you can compare fees with another popular broker BDSwiss.

- FP Markets Spreads are ranked low/ average with overall rating 8 out of 10 based on our testing comparison to other brokers. We see Forex spread much lower than the industry average of 1.2 pips for EURUSD, yet we found fees for Stocks slightly higher than average. For instance, see below a comparison of the most traded instruments

| Asset/ Pair | FP Markets Spread | AvaTrade Spread | XM Spread |

|---|

| EUR USD Spread | 0.7 pips | 1.3 pips | 1.6 pips |

| Crude Oil WTI Spread | 3 pips | 3 pips | 5 pips |

| Gold Spread | 16 cents | 40 | 35 |

| BTC USD Spread | 62 | 0.75% | 60 |

Deposit and Withdrawal Methods

For FP markets payment methods that allow you to proceed with account funding, some of methods including fees and another is free of charge. Generally, trading accounts are available at 10 base currencies, hence you can choose the best suitable option and transfer fund accordingly which is a great saving and easier money transfer for you.

- Funding Methods we ranked Good with overall rating 9 out of 10. Good thing Fees are either none or very small also allowing to benefit from various account base currencies, also FP markets process our test withdrawal free of charge

Here are some good and negative points for Fp Markets funding methods found:

| FP Markets Advantage | FP Markets Disadvantage |

|---|

| Minimum deposit – 100$ | Some withdrawal methods may add on processing fee |

| Wide range of deposit options and base currencies supported | Condition vary by entity rules |

| Free deposits | |

| Withdrawal offer 0$ fee policy | |

Deposit Options

As for the deposit options you may choose between the most common ones, also request support team to advise what is the best option for you according to your residence.

- Bank wire transfer,

- Various e-wallets including Neteller and Skrill

- Credit Cards or Debit cards

- Virtual Pay (African Payment Method) that supports KES, UGX, and TSH currencies.

For fund transferring fees, FP Markets does not waive transfer fees for deposits via Bank Trnsfer and Broker to Broker, also FPM covers International fees up to 50$ for deposit greater than 10,000$, which is a good plus with our opinion. You may request to perform the transfer from other brokers in case you would like to transfer funds between the accounts and from other brokers.

FP Markets Minimum deposit

Minimum deposit amount for The Standard account is 100$ ECN account set also 100$

FP Markets minimum deposit vs other brokers

|

FP Markets |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Withdrawal

The FP Markets withdrawal fees are different from the option to another, some require no fees and another will add on a small mark up as per policy applied, withdrawal options are wide including Wire transfers still most used among traders, e-wallets and cards, see table below.

How long does it take to withdraw money from FP Markets?

Typically FM Markets confirm and process the withdrawal request within 1-2 business days, see snapshot with our finds below.

Trading Platforms

There is a comprehensive choice between the platforms on FP Markets proposal, thus powerful capabilities provided that is definitely a big plus, with the choice between MT4, MT5 and IRESS platforms as well MAM and PAMM account possibility for money managers.

Moreover, FP Markets is now offering cTrader, a leading multi-asset Forex and CFD trading platform, boasting advanced charting, advanced order types, level II pricing, powerful trading tools and superior execution.

- FP Markets Platform are ranked Excellent with overall rating 10 out of 10 compared to over 500 other brokers. We mark it as excellent for good offering inlcuding market leading software, also alternative options, besides FP Markets provides quite good Copy Trading and technology solutions too provided with excellent tools

Trading Platform Comparison to Other Brokers:

| Platforms | FP Markets Platforms | BlackBull Markets Platforms | eToro Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

Platforms available as a Web Trading platform and supporting other versions too. While MT4 and its newer version MT5 platforms do not require an introduction, as platforms give a dynamic feature through detailed insights and one of the best in industry options for automated trading via EAs, so both can be accessible via Browser.

Desktop Trading Platform

There are MetaTrader versions that suit any device either PC or MAC, so you can follow with installation and enjoy great customization capabilities of MT4 or 5.

In addition, IRESS world known platform that suite products for global equities, indices, and futures CFD trading remains as your trading possibility with comprehensive, unparalleled trading and transparent pricing from market depth. Furthermore, the platform enhanced with automated order options also and complex order types, which definitely worth serious consideration. See our Review snapshot below.

Mobile Trading Platform

FP Markets offers MetaTrader 4, MetaTrader 5 and IRESS Mobile as mobile trading platforms for both iOS and Android with alerts, push notifications and full control over your trading and account right from your mobile.

Research Trading Tools

For the research tools, the platform enables one-click trading, algorithmic rules, indicators, Autochartist and social trading functions that allowing to participate to the active trader community. Also, the MT5 brings one of the best, extended inbuilt indicators and graphical objects via pending orders and displayed currency market depth.

- Another good addition we found, FP Markets gives back to their clients, by reimbursing VPS purchase. The client can sign-up to a chosen VPS provider trade minimum of 10 lots on RAW FX and get a cash payment back into the trading account with a maximum of up to 50$ a month.

Customer Support

Another good point in its client-oriented philosophy we found at FP Markets is a competent customer service which is available through various methods including Online Live Chat, Phone, emails, etc. Apart from the positive and high regard from the clients, FP Markets supports a range of languages, so you may count on quality help.

In addition, there are established centers in the Asia region, Europe and Australia so the time zones and accessibility are counted, this is why customer service is available 24/7.

- Customer Support in FP Markets is ranked Excellent with overall rating 9 out of 10 based on our testing. We got fast and knowledgeable respond, also quite easy to reach with our tests done

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Customer oriented handling | None |

| Live Chat | |

| Support of international Phone lines and range of languages | |

| 24/7 support | |

| Fast and appropriate answers | |

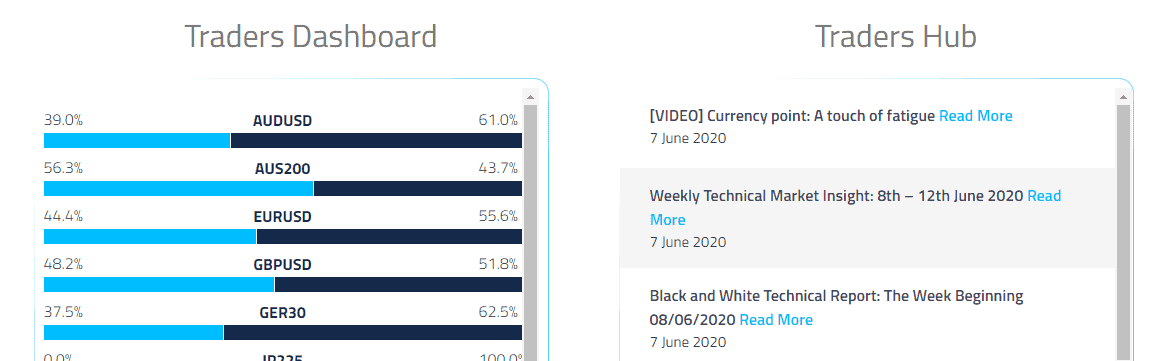

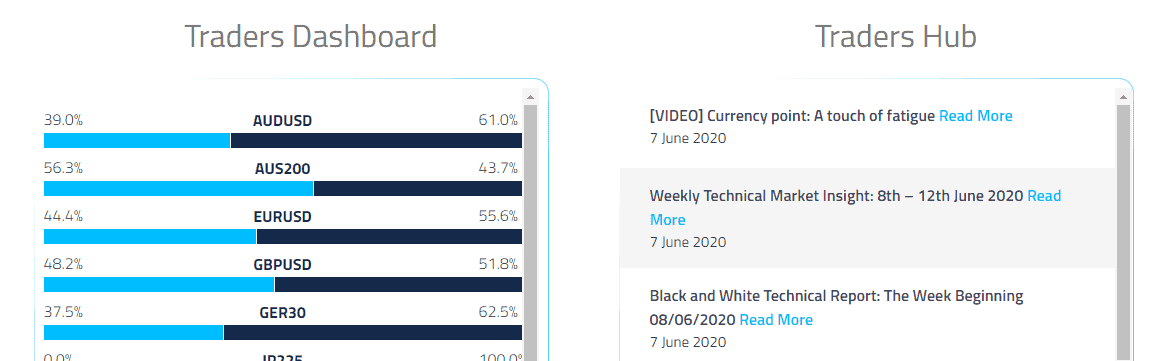

Education

In fact, those who have information obtain advance among others while trading, hence learning is an endless task, and the good news is that FP Markets supports personal strives and provides with learning materials, analysis and guides.

- FP Markets Trading Series presents three sections that help to become a better trader that diverse to a different level of traders, through the established Traders Hub.

- There are numerous Trading Videos, Trading Info, Webinars, Events and Podcasts available via FP Markets Education

- Also, FP Markets provides great research tools with comprehensive analysis suitable for beginning traders and also supporting everyday trading, while features including market outlooks, news feeds, trading ideas, also including great tools like Trading Alerts and provide third party tools like Autochartist.

Is FP markets a good broker for beginners?

Yes, FP Markets is definitely a good choice for beginners, there is good range of platforms, also educational materials, research and analysis are one of the best provided by the Brokers based on our research.

- FP Markets Education ranked with an overall rating 9 out of 10 based on our finding and opinion. We found very good quality Education Materials and numerous research tools, also Broker cooperates with providers of data which is a great plus for traders

FP Markets Review Conclusion

Overall, we found FP Markets as one of the most awarded CFD and FX trading providers with good quality trading environment. FP Markets established direct access to markets through sophisticated technology and provides a wide range of instruments to trade with competitive pricing and excellent selection of trading platforms suitable for various styles. So in our conclusion, FP Markets is suitable for traders of different size and expertise while FP Market is a reliable brokerage good for long term cooperation and different type of investors welcome.

Based on Our findings and Financial Expert Opinion FP Markets is Good for:

- Beginning Traders

- Professional Traders

- ECN trading

- Currency Trading and CFD Trading

- Traders who prefer MT4, MT5, cTrader or IRESS platform

- Copy Trading options with myfxbook

- MAM and PAMM Trading

- EAs running

- Suitable for a Variety of Trading Strategies

Share this article [addtoany url="https://55brokers.com/fp-markets-review/" title="FP Markets"]

lmao, none advantages? funny.. what i think about ironfx is that its one of the most solid shops out there good mix of trading options, educational resources, and some neat features for automated and copy trading.

Hello Goodmorng do u accept clients from Dubai because l want to start but l don’t know how do u have legit brokers

Hello Lilian,

Thank you for choosing FP Markets.

Please be infored that FP Markets does offer its services to client from Dubai.

For more information or guidance on how to proceed, please reach out to our Customer Support team via email at supportteam@fpmarkets.com or via the live chat window at fpmarkets.com

We remain at your disposal for any further assistance.

Kind regards,

FP Markets

Hi, I am from Australia, and wanted to ask if your platform/s in particular raw account and zero spread account freeze, or don’t allow retail trader to open/close trades notably NY session, and specifically around 3am during week days, such as on Mon/Tuesdays. I have found Think Markets whom i really liked alot, however they tend to freeze or close platform to retail traders around 3am until 5am especially start of the week. I prefer trading from NY session until about 3 or 4am as intraday trader so best trends occur more often for couple hours during this time period. I would be most gratefull for your response. Yours Gratefully, May

Dear Mary,

Thank you for your question.

Kindly not that the Raw account spreads start from 0.00

However, please note that we do not offer fixed spreads and the Raw account conditions would only apply on Forex and Metals.

With regards to freezing the prices prior markets opening and specifically the NY session, this is not the case with FP Markets.

Should you have any further questions, please feel free to reach out.

Kind regards,

FP Markets

Do you accept client from Nigeria

Dear Chinonye,

Thank you for your qeustion.

Please note that FP Markets does accept client from Nigeria, under it’s International entity.

Should you need any further information, please do not hesitate to reach out to us.

Best regards,

FP Markets

Hi.. i am from malaysia, how much leverage offer for malaysian with swap free account. It is possible max leverage to be lowered i.e 1:30 or 1:50

Dear Yusuf,

Thank you for your questions.

Kindly note that Swap free account are only offered to client who profess Muslim faith.

With regards to the leverage, yes you may lower it to 1:30 or 1:50, this will completely depend on your trading style and preferences.

Should you have any further questions, please do not hesitate to reach out to us via email at: supportteam@fpmarkets.com

Best regards,

FP Markets

Dear Amine,

Thank you for your message.

FPMarkets does provide services to clients residing in the Philippines under our international entity: https://www.fpmarkets.com

To register your trading account you can refer to the following link: https://portal.fpmarkets.com/register

Further to that you will be able for proof of identity and proof of residency documents in order to verify your trading account.

As ID we can accept a passport, National ID card or driving license. As proof of residence we can accept a utility bill or a bank statement issued in the past 6 months.

Should you have any further questions, please do not hesitate to contact our Support team at: supportteam@fpmarkets.com

HI I AM FROM MOROCCO,CAN I OPEN AN ACCOUNT ON UR BROKER ?

Dear Stephanie,

Thank you for your message.

FPMarkets does provide services to clients residing in the Philippines under our international entity: https://www.fpmarkets.com

To register your trading account you can refer to the following link: https://portal.fpmarkets.com/register

Further to that you will be able for proof of identity and proof of residency documents in order to verify your trading account.

As ID we can accept a passport, National ID card or driving license. As proof of residence we can accept a utility bill or a bank statement issued in the past 6 months.

Should you have any further questions, please do not hesitate to contact our Support team at: supportteam@fpmarkets.com

This is good. Highly recommend.

Hi,

Do you accept clients from Philippines?

Do you guys accept US clients

Dear Nana,

Thank you for you question.

I regret to inform you that FP Markets does not provide services to clients from USA.

Thank you for choosing FP Markets.

Best regards,

Hello Tamunoemi,

Thank you for your question.

I regret to inform you that FP Markets does not offer spread betting.

We offer two account types: Standard account and Raw account. We do not charge a commission on Standard account but instead, there is a mark up on the spread by 1 pip. Our Raw account shows the raw spread received from our liquidity providers, on this account we charge a commission of 6 USD per lot.

Therefore, we do provide services to client from Nigeria.

Should you have any further questions, please do not hesitate to contact our 24/7*support team at: supportteam@fpmarkets.com

Kind regards,

FP Markets

Hello,

Do you accept clients from Pakistan ? And do you allow more than one payment method for them each time ?

Dear Tamunoemi,

Thank you for your question.

Please be informed that FP Markets does provide services to clients from Nigeria, under its Global entity.

The account types that we offer are Raw and Standard. We do not charge a commission on Standard account but instead, there is a mark up on the spread by 1 pip. Our Raw account shows the raw spread received from our liquidity providers, on this account we charge a commission of $6 per lot.

Furthermore, you can have up to 10 live accounts under your profile.

Should you have further questions, please do not hesitate to contact our customer support via email at: supportteam@fpmarkets.com or directly at our 24/5 live chat channel.

Kind regards,

FP Markets

Dear Tamunoemi,

Thank you for you question.

We offer two account types: Standard account and Raw account.

We do not charge a commission on Standard account but instead, there is a mark up on the spread by 1 pip.

Our Raw account shows the raw spread received from our liquidity providers, on this account we charge a commission of 6 USD per lot.

You can view our spreads on average at the following link: https://www.fpmarkets.com/forex-spreads/#forextable

Kindly note that the spreads are variable and not fixed.

Feel free to drop us an email at supportteam@fpmarkets.com if you have any other questions.

Kind regards,

FP Markets

Bad Experience. I uploaded an image of my credit card and someone shortly thereafter tried to buy something online. My bank new it was foul play and cancelled the card. FP markets were not very forthcoming when I complained. Customer service people at “front” was nice but compliance department very difficult to deal with.

In the end I ended up withdrawing my funds and selecting another broker.

My advice: do not upload image of your card as that is not what is needed.

I’d like to know if theres a spread betting account for Nigerians, and a multiplier account. Do you have us

Hello Catherine,

Thank you for you question.

I regret to inform you that this is not the case with FP Markets and we do not trade on clients behalf.

However, FP Markets Copy Trading allows you to find, follow and copy successful traders automatically. There is no need to build your own trading strategy or conduct research on forex markets.

Please refer to our Social Trading page for more information: https://www.fpmarkets.com/int/social-trading/

Feel free to drop us an email at supportteam@fpmarkets.com if you have any other questions.

Kind regards,

I don’t want to trade because I don’t know. I just want to deposit money and track my account and profit on the account. Is this possible?

Are you offering it to me ??

Please recommend!

thanks

Dear Catherine,

Thank you for your message.

FP Markets Copy Trading allows you to find, follow and copy successful traders automatically. There is no need to build your own trading strategy or conduct research on forex markets.

Please refer to our Social Trading page for more information: https://www.fpmarkets.com/int/social-trading/

Feel free to drop us an email at supportteam@fpmarkets.com if you have any other questions.

I’m from Curacao is there any restrictions with you guys for my country

Hello Marc,

Thank you for your message.

FPMarkets does provide services to clients residing in Curacao under our international entity: https://www.fpmarkets.com/int/

To register your trading account you can refer to the following link: https://portal.fpmarkets.com/register

Should you have any further question or require detailed information before your registration, please do not hesitate to contact our dedicated support team which is available 24/5 at: supportteam@fpmarkets.com

Kind regards,

I am from the Philippines and interested to trade with FPmarkets. Can i trade? And how?

Dear Ramon,

Thank you for your message.

FPMarkets does provide services to clients residing in the Philippines under our international entity: https://www.fpmarkets.com/int/

To register your trading account you can refer to the following link: https://portal.fpmarkets.com/register

Further to that you will be able for proof of identity and proof of residency documents in order to verify your trading account.

As ID we can accept a passport, National ID card or driving license. As proof of residence we can accept a utility bill or a bank statement issued in the past 6 months.

Should you have any further questions, please do not hesitate to contact our Support team at: supportteam@fpmarkets.com

Do you allowed Canada to trade?

Dear Client,

Thank you for your message.

Yes, we accept clients from Canada (except Ontario or British Columbia) under our international entity: https://www.fpmarkets.com/int/

Kindly notify us should you need any other information.

Dear James,

Thank you for your interest in FP Markets.

We do not offer robots and automated trading, however FP Markets Copy Trading allows you to find, follow and copy successful traders automatically. There is no need to build your own trading strategy or conduct research on forex markets.

Please refer to our Social Trading page for more information: https://www.fpmarkets.com/int/social-trading/

Feel free to drop us an email at partners@fpmarkets.com if you have any questions on how to get started.

I am from Nigeria and interested in trading with FPMarkets, but no time to spare in trading and no experience. Can I open my account, fund it and profit from making use of your artificial intelligence service in trading? Is $100 deposit enough to start my kind of proposed trading?

I decided to close with FP Markets as the Customer Service is more busy asking for reviews than giving assistance. Even the Italian market manager asked me in his welcome letter if I could do a review on Trustpilot. A nightmare. If I contacted support 3 times they asked me for three reviews. For me FP Markets is overestimated. Assistance is very important both for beginners and skilled trading.

Dear Giovanni,

I regret that we provided you with a poor customer experience — it is the exact opposite of what we pride ourselves on. We value our customers and understand how important it is to offer exceptional service.

We did some research and could not find any recent interactions between you and our team, nor requests to write a review. Nevertheless, we love to hear our clients genuine feedback on our services, and we apologize if any requests from our side caused you inconveniences.

Kind Regards,

FP Markets

GOOD DAY.

I AM ONLY INTERESTED IN PAMM ACCOUNT. DO YOU ALSO OFFER THAT OPTION?

Dear Manwana,

Thank you for your message.

Yes, we offer PAMM accounts. Please complete the form below and our Partners team will get back to you with more information:

https://www.fpmarketspartners.com/money-managers/

Kind Regards,

FP Markets

Hi I am from Canada and no knowledge about forex trading. My question is, can I open an account and let a forex trading robot take charge of the rest? How soon can I start and is CDN $1000 sufficient enough for a sart? Thanks

Dear Cesar,

Thank you for your interest in FP Markets.

Yes, you can open a live account under our international entity: https://www.fpmarkets.com/int/ and use an Expert advisor (robot) instead of manual trading.

A deposit of 1000 CAD is sufficient.

We also offer excellent educational material for you to read:

https://www.fpmarkets.com/int/education/ebooks/

https://www.fpmarkets.com/int/education/video-tutorials/

https://www.fpmarkets.com/int/education/glossary/

https://www.fpmarkets.com/int/past-webinars/

https://www.fpmarkets.com/blog/

Kindly notify us should you need any other information.

Kind Regards,

FP Markets

Hello, I’m from Phiippines. I’m interested to trade. Is this available for Philippines? Can I ask a question? If there’s a commission fee in order for you withdraw your income in trading? Thank you.

Dear Ahmed,

Thank you for your interest in FP Markets.

Yes, you can register an account under our international entity: https://www.fpmarkets.com/int/.

You can use Perfect Money to deposit and withdraw, the deposit will be instant.

Kindly notify us should you need any other information.

Welcome fp marketfp market Do you accept clients from Algeria and can I deposit with Perfect Money and how long does it take for the deposit to be processed

Can you provide the opportunity for the clients from Uganda also.

Geoffrey,

Uganda.

Dear Geoffrey,

Thank you for your interest in FP Markets.

Unfortunately, we are not able to accept clients from Uganda.

Kind Regards,

FP Markets

Good day, I would like to know if you accept client form Botswana

Dear Karabo,

Thank you for your interest in FP Markets.

Unfortunately, we do not accept clients from Botswana.

Kind Regards,

FP Markets

Dear Maiky,

Thank you for your interest in FP Markets.

Unfortunately, we do not accept clients from Japan.

Kind Regards,

FP Markets

Hii im maiky from japan i want to trade here

Hi

do you accept the Iraqi and his residency is Iraq?

how about iraqi one and his residency in Jordan ?

Dear Ali,

Thank you for your interest in FP Markets.

Yes, you can register an account with a passport issued in Iraq and a recent proof of residence (dated in the past 6 months) issued in Jordan.

Here is the registration link: https://portal.fpmarkets.com/int-EN/register.

Kindly notify us should you need any other information.

Dear Koma,

Thank you for your feedback!

Good broker

Dear Rajeev Kumar,

Thank you for your message.

You can contact our international entity via the Contact Us page: https://www.fpmarkets.com/int/contact/

We look forward to hearing from you.

I don’t want to trade because I don’t know. I just want to deposit money and track my account and profit on the account. Is this possible?

Are you offering it to me ??

Please recommend!

thanks

Dear Branko,

Thank you for your message.

FP Markets Copy Trading allows you to find, follow and copy successful traders automatically. There is no need to build your own trading strategy or conduct research on forex markets.

Please refer to our Social Trading page for more information: https://www.fpmarkets.com/int/social-trading/

Feel free to drop us an email at supportteam@fpmarkets.com if you have any other questions.

Hiii i m kiel from indonesia but now im in japan i want to trade with you and this my first time to trade what should i do ? ,

– can I make a withdrawal later at a Japanese bank ?

– i just want to deposit money, do trading and make profit

Hi

I am interested in opening an account but I have a few questions.

Do you offer micro lot trading?

Do you have a free charting package or do I need to pay for this?

Do you offer interest on the account balance? (Worth a try!)

Do you allow scalping traders?

I live in Spain, so the maximum leverage i am allowed is 1:30, is that correct?

If I choose the ‘Raw” account, so an ECN account, what are the commission costs for a micro lot order?

Finally, do you allow hedging trades?

Sorry for all the questions but I am doing my due diligence!

Kind regards

Stuart

Dear Stuart,

Thank you for your interest in FP Markets.

Please find the requested information below:

Yes, we offer micro lot trading.

We do not have our own charting packages, however we provide Traders Toolbox and Autochartist:

https://www.fpmarkets.com/tools/traders-toolbox/

https://www.fpmarkets.com/autochartist/

There is no interest on the account balance.

We allow scalping, hedging, and other strategies.

FP Markets is part of a group of companies. Please refer to this link in order to learn the trading conditions for each entity: https://www.fpmarkets.com/fp-markets-group/.

The commission for a micro lot is 0.06 USD.

Kindly notify us should you need any other information.

How to contact your company

Does fp markets offers 1 pip per dollar with Us 30 THE WALLSTREET?

Dear Rhaul,

Thank you for your message.

Yes, we do. Please contact us at sales@fpmarkets.com should you be interested to find out more.

Kind Regards,

FP Markets

Is Botswana Allowed to trade

Dear Lorato,

Thank you for your message.

Unfortunately, we do not accept clients from Botswana.

Kind Regards,

FP Markets

Dear Finn,

Thank you for your message.

We accept clients from Norway. You can register an account here: https://portal.fpmarkets.com/register.

The maximum leverage we offer for Metals is 1:500.

Kindly notify us should you need any other information.

Hi, Im from norway. can i get membership? and how high can you sett leverage on gold and silver, platinum`? 30? need max on those, gold may have higher than silver i guess.

Dear Ben,

Thank you for your message.

Please refer to this blog post on how to manage funds with MAM/PAMM like a trading expert:

https://www.fpmarkets.com/blog/how-to-manage-funds-with-mam-pamm/

You can apply for a MAM account here and one of our team members will get back to you with the requirements: https://www.fpmarketspartners.com/money-managers/

Hi,

I’m a resident of Australia and keen on using and wanted to learn how to use a MAM account. Do you have any qualifications needed for obtaining it?

Warm regards

Dear Richard,

Thank you for your message.

Unfortunately, we do not accept clients from Ontario or British Columbia.

Kind Regards,

FP Markets

Do you accept client from Ontario Canada?

Please I want to find out if residents of Nigeria can register and trade with FP Markets

Dear Jonah,

Yes, we accept clients from Nigeria. You can register an account under our international entity: https://www.fpmarkets.com/int/.

Kind Regards,

FP Markets

Hi,

Does FP Markets provide free VPS?

Regards,

Kim

Dear Kim,

Thank you for your message.

Yes, we do provide free VPS upon meeting specific criteria. Please refer to our VPS page for more details: https://www.fpmarkets.com/virtual-private-server/.

Let us know if you need anything further.

Dear Esau,

Thank you for your message.

Yes, we accept Namibian clients under our International entity: https://www.fpmarkets.com/int

Please let us know if you have any other questions.

hello I’m from Tanzania can I trade with FP market????

Hello Al Rawahy,

Yes, you can register an account under the FP Markets international entity https://www.fpmarkets.com/int/

Please let us know if you have any other questions.

Hi there, I am from Namibia. The latter is a neighbouring country on the northwestern side with South Africa. Namibia’s currency, the Namibia Dollar (N$). Is pegged on a 1:1 basis with South African Rand (ZAR). Is Namibian citizens allowed to trade on FPmarkets?

Hello, please may know if you have an office in Lagos Nigeria. Thanks. Patrick – +2348144433447

Dear Patrick,

Thank you for your message.

We do not have an office in Nigeria, however we accept Nigerian clients under our International entity: https://www.fpmarkets.com/int

Please let us know if you have any other questions.

Please does fpmarket allow islamic account?

Dear Sanusi,

Thank you for your message.

Yes, we offer Islamic accounts: https://www.fpmarkets.com/islamic-trading-accounts/

Kindly notify us should you need any other information.

Dear Donald,

Thank you for your interest in FP Markets.

You can deposit funds with your prepaid VISA card, if the card allows refunds.

We do not offer USD/GBP.

You will have an account manager who will be more than happy to assist you and guide you.

We are regulated by the Australian Securities and Investments Commission (ASIC AFS License No: 286354).

Please let us know if you need further information.

Dear Sirs

I want to trade with your organisation, and I want to deposit funds with my prepaid visa card is this okay?

Also can i trade US/GBP ?

would I be assigned an account Manager once I oped my account.

Can you confirm your license and regulatory body.

Kind regards

Donald

Do you brief your client what is happening on the market daily working hours? If so, how do you reach them?

Hoping to trade with you any moment after reply.

Samuel from South Africa

Dear Samuel,

Thank you for your message.

Besides daily technical and fundamental analysis we post on our blog here https://www.fpmarkets.com/blog/, we also offer daily market reports on any trading opportunity (3x per day) in more than 24 languages and in any market of your choice, plus live trading opportunities updated 96 times a day on multiple timeframes on all assets.

Kindly notify us should you need any other information.

Hello, i am from Tanzania, do you accept Tanzania clients.

Dear Mohamed,

Thank you for your message.

Yes, we accept clients from Tanzania under our international entity: https://www.fpmarkets.com/int/

Kindly notify us should you need any other information.

Hi, do you accept United States residents?

Dear Craig,

Thank you for your message.

Unfortunately, we do not accept US residents.

Do you accept clients from canada alberta

Dear Lijo,

Thank you for your message.

Yes, we accept clients from Canada (Alberta) under our international entity: https://www.fpmarkets.com/int/

Kindly notify us should you need any other information.

Hi I am a Taiwanese and would like to know 1) if you accept credit / debit card issued from Taiwan local bank for deposit 2) My Visa credit card have my name on it but, my Visa debit card do not have my name on it. Can I still used my Visa debit card to fund my deposit if I intend to open an account with you?

Dear Paul,

Thank you for your interest in FP Markets.

We accept clients from Taiwan, and you can use a credit/debit card issued in Taiwan.

You can use your Visa debit card to deposit and withdraw, even if your name is not mentioned on the card.

Kindly notify us should you need any other information.

I am in New Zealand. Can I open an trading acount with you.

Dear Andre,

Thank you for your message.

Unfortunately, we do not accept clients from New Zealand.

Hi! Do you accept traders from Armenia?

Dear Erica,

Thank you for your message.

Yes, we accept clients from Armenia under our International entity:

https://www.fpmarkets.com/int

Kindly notify us should you need any other information.

Sir, i want to trade with you. My contact and WhatSsApp 0244404129

Dear Peter,

Thank you for your interest in FP Markets.

Please send us an email at sales@fpmarkets.com and one of our team members will guide you through the process of opening an account.

We look forward to hearing from you.

Can I trade from Japan

Dear Minh,

Thank you for your message.

Unfortunately, we do not accept clients from Japan.

Do you people accept Nigerians and payment through Bitcoin?

Dear God’stime Ordu,

Thank you for your message.

We accept clients from Nigeria under our International entity: https://www.fpmarkets.com/int/

Please do not hesitate to contact us if you have further questions.

Dear God’stime Ordu,

We do not offer Bitcoin deposits, unfortunately.

do you accept clients from New Zealand

Dear Philip,

Thank you for your message.

Unfortunately, we do not accept clients from New Zealand.

i am from Sri Lanka . My country is not listed . Can i still register

Dear Sasanka,

Thank you for your message.

We do not accept clients from Sri Lanka, unfortunately.

Good day; Im fm Philippines. Regarding the min.deposit, is it 100 usd ? Or 100 AUD ?

My best regards.. randolph

Dear Randolph,

It depends on the base currency of your account.

If you have an AUD trading account – you will deposit 100 AUD.

If you have an USD trading account – you will deposit 100 USD.

Please do not hesitate to contact us if you have further questions.

Do you have an option for auto trading?

Dear Kenisia,

Yes, we do. AutoTrade is a trading system provided through Myfxbook.com.

We also allow Expert Advisors (EAs).

Dear Evagelos,

Thank you for your interest in trading with FP Markets.

Our Clients get a dedicated account manager and 24 hour support for any queries they have.

Please do not hesitate to email us at support@fpmarkets.com if you have further questions.

hi , i’m from the UK and want to invest $10,000 with 400/1 leverage. Is this ok

Dear Trevor,

We accept UK clients. Please reach out to our support team for more information about leverage and regulation.

Thank you.

Hi if i invest with you will i have personal consultant to speak with ?

I am from Ghana.

i tried creating account but Ghana was not included in the drop-down list of countries.

Please is that an omission or we actually can’t have account with FP markets.

Dear Abraham,

Thank you for your interest in FP Markets.

Unfortunately, we do not accept clients from Ghana.

Do you accept United States customers. Do you offer indicies?

Dear Justin,

I’m afraid we do not accept US clients.

We offer index CFDs, please view the available instruments here: https://www.fpmarkets.com/indices

Thank you.

Using this company for 9 months. Good trading performance so far and low spreads.

Slowly trading myself back up after a hard 2019. Liking the market updates.

Dear Gary,

Thank you for your feedback!

We are available 24/5 via email or our Live Chat should you require anything.

Kind Regards,

FP Markets

Hi. I was open an account with fpmarket and can I fund my account using local bank transfer from Malaysia

Dear Awangku Ismail,

You can trade with FP Markets from Malaysia.

We do not offer local bank transfers, unfortunately, however you can find our bank details for international transfers here: https://www.fpmarkets.com/bank-wire-transfer#el-e09ac800

Kind Regards,

FP Markets

Dear fpmarkets

I am from Indonesia can i register on fpmarkets?

Dear Budi,

Yes, you can trade with FP Markets from Indonesia.

Kind Regards,

FP Markets

Halo Om, sma sya dri RI, Apakah Anda masih menggunakan FP Markets saat ini??

I am pleased to finally find a Broker that is worth the money spent and i have been trading for several years now and used multiple brokers and currently i just stuck with FP Markets, good spreads mate, and the execution is better than the other brokers as well. Good work keep it going and FP Markets will always stick on the top of other brokers.

Dear Alan,

We deeply appreciate your feedback.

The industry-renowned ‘Investment Trends CFD Report’ has awarded FP Markets with the ‘Most Satisfied Traders’ in the industry for 5 years running.

Thank you for being a part of our long list of satisfied clients!

Dear Kevin,

Your satisfaction is a great compliment!

FP Markets’ spreads are among the lowest across all major and minor currency pairs.

You can view our live spreads here: https://www.myfxbook.com/en/forex-broker-spreads

Feel free to contact us at support@fpmarkets.com if you have any questions.

Hi there guys, I read some comments and several are asking about the server if its available in their country, FP Markets is a Global Trader, so it covers mostly all over and its opening balance is cheaper than other brokers.

I am using FP Market for a year and so, its good and reliable beoker.

Dear Joshua,

Thank you for your comments.

Indeed, FP Markets has been regulated since 2005 in the financial markets, and is a trusted global CFD and Forex broker. The minimum deposit at FP Markets is only $100.

Kind Regards,

FP Markets

I am a beginner, i traded between FP Markets and IC Markets and found FP Market is better than IC, not to criticize them but FP has better spreads compared to IC and also the Minimum opening in FP cost cheaper than IC.

Hi, I just wanted to thank FP Market for its services and customer support since they helped me when ever i had an issue.

Hi, I just wanted to thank FP Market for its services and customer support since they helped me when ever i had an issue, i am happy to use FP Market and its good to see that the spreads are lower than other users.

Dear Craig,

Thank you for your kind feedback!

At FP Markets, our goal is to provide the most satisfying trading experience to every client.

Please feel free to contact us at support@fpmarkets.com at any time, should you need assistance.

Hello, Do you also accept Nigeria clients?

Dear Emmanuel,

Yes, we accept clients from Nigeria. You can register under our international entity: https://www.fpmarkets.com/int/ or ASIC entity: https://www.fpmarkets.com/.

Kind Regards,

FP Markets

Hello, Do you also accept Iran clients?

Dear Ashok Kumar,

Yes, you can trade with FP Markets from India under our international website: https://www.fpmarkets.com/int/.

Kind Regards,

FP Markets

HI I AM FROM INDIA, CAN I TRAD WITH YOU?

Hi I m from india.can I trade with u

Dear Varsha,

Yes, you can trade with FP Markets from India under our international website: https://www.fpmarkets.com/int/.

Kind Regards,

FP Markets

Hi , I am Sai Luknarsh and I am from Malaysia . Can I trade with you?

Dear Sai Luknarsh,

Yes, you can trade with FP Markets from Malaysia.

Kind Regards,

FP Markets

Do you guarantee forex stop entries under any market conditions without gap?

Do you increase spreads just before major forex news releases (eg NFP Payroll)?

Dear Georgios,

Since we offer ECN pricing we are not able to guarantee execution – all orders are filled at the first available price in the market once they have been triggered.

Spreads tend to be wider around news announcements due to high volatility, however if you trade during normal market conditions, you will notice that we offer one of the lowest spreads in the market. Please refer to this page to view our competitive spreads: https://www.myfxbook.com/en/forex-broker-spreads.

Dear Peter K King’ora,

Yes, you can register an account from the FP Markets international website https://www.fpmarkets.com/int/

Based on your country selection, your account will be registered with FP Markets LLC and you will be redirected to FP Markets website. FP Markets LLC is a registered company of Saint Vincent’s and the Grenadines.

I am in Kenya and would like to trade, train and invest.Possible?

Hi i’m moroccan but i’m living in France ,can i trade with you !?

Dear,

Yes, FP Markets accepts clients that are residents of France and clients that are residents of Morocco.

Thank you,

FP Markets Team

hy boys. do oyu accept italy clients?

happy Kristmass.

Dear Gianvittorio

Yes, FP Markets accepts clients that are residents of Italy.

Thank you,

FP Markets Team

Hello do you guys accept us costumers?

Dear Mauricio,

Yes, FP Markets do accept UK customers.

Hi I’m from Tanzania,am I allowed to start trading with you

Hello Dickson Peter,

Yes, you can register an account from the FP Markets international website https://www.fpmarkets.com/int/

Thank you,

FP Markets Team

Dear Peter,

You can open an account from Tanzania, however, there are some different conditions for the residents of your country. Based on your country selection, your account will be registered with FP Markets LLC and you will be redirected to FP Markets website. FP Markets LLC is a registered company of Saint Vincent’s and the Grenadines. So basically, you will be onboarded with the offshore branch of FP Markets.

I am in dubai and want zero spread accaount

Dear Salim,

Please, check our list of the Zero Spread Forex Brokers https://55brokers.com/zero-spread-forex-brokers/ and choose those that would suit your needs.

Hello Niño,

Yes, you are able to trade with FP Markets if you are a resident of Dubai.

Thank you,

FP Markets Team

Hi FPM Team,

I am a Filipino and is currently living in Dubai, Can I trade using FP Markets?

Dear Lincon,

Unfortunately we are not able to accept clients that are residents of Belgium at the moment due to regulations. This may change in the future. Until further regulations change it is possible to open a demo account if you would like.

Thank you,

FP Markets Team

Hi, I am from Belgium, Can people from Belgium use fpmarkets?

how much do i need to deposit to open a zero spread account?

Dear Colin Minford,

Our raw account spreads start from 0.0 pips.

The minimum deposit for an MT4/5 raw account is 100 AUD.

Thank you,

FP Markets Team

Hey there, I’m from Ghana and am I allowed to trade with you?

And as a bignner how can I do this?

Dear John Annas,

FP Markets accepts clients from Ghana.

Thank you,

FP Markets Team

Please, if fpmarkets accept clients in Ghana, then why is Ghana not among the country list.

I tried to register in Ghana but the country name is not there.

FP markets does not offer cent accounts. You need to update your list

Hi I’m from South Africa,am I allowed to start trading with you

Dear Lincon,

FP Markets accepts clients from South Africa.

Thank you,

FP Markets Team

Do you accept clients from Canada?