- What is Interactive Brokers?

- Interactive Brokers Pros and Cons

- Regulation and Security Measures

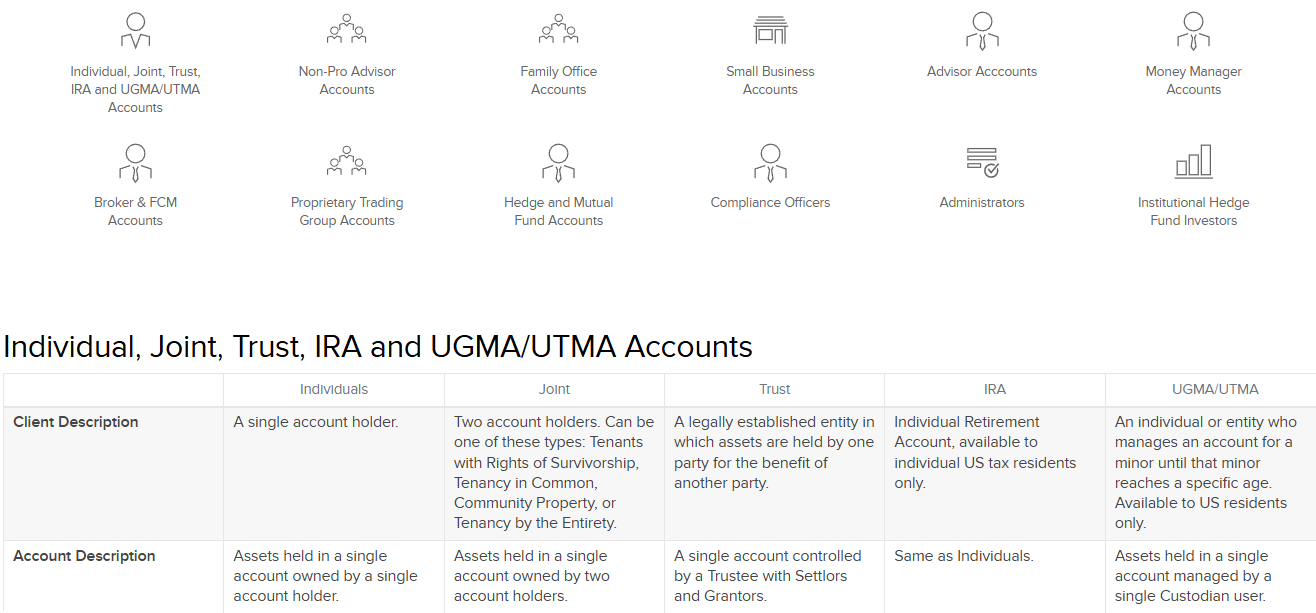

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

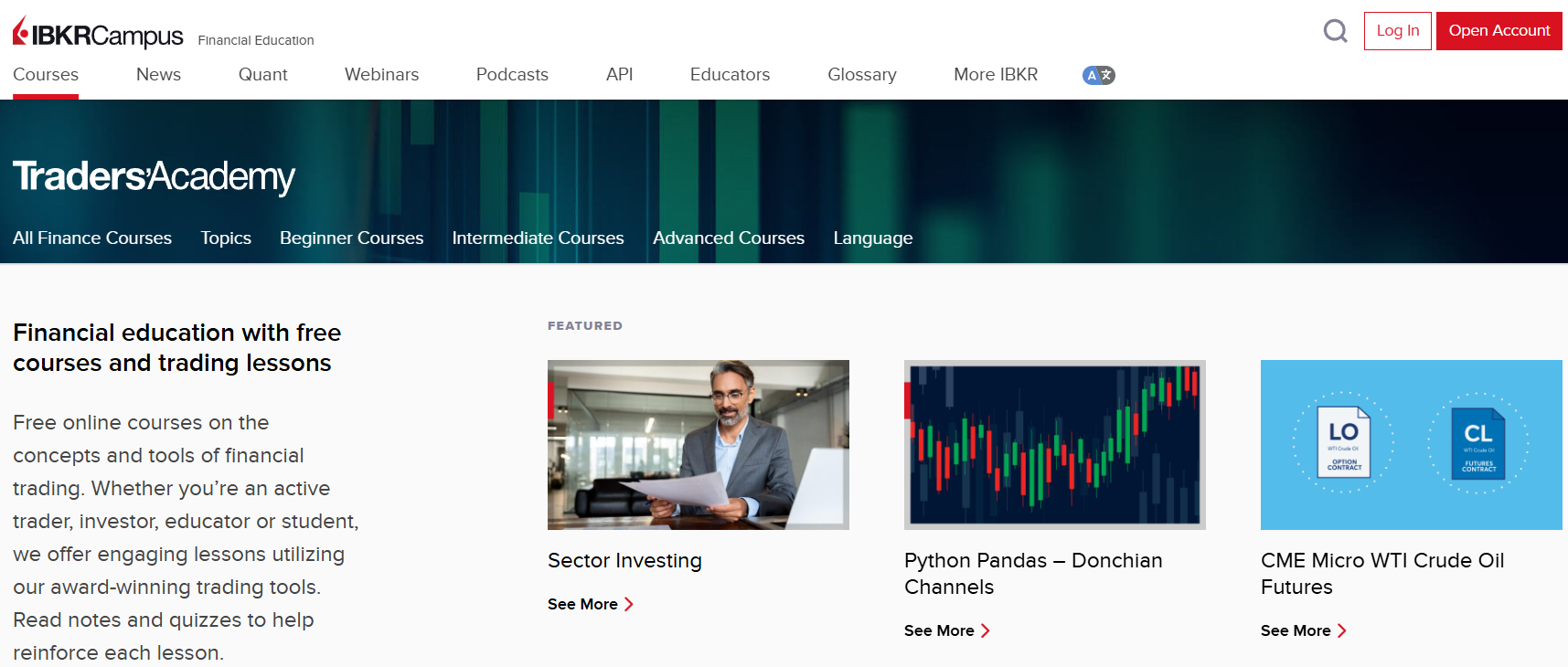

- Research and Education

- Portfolio and Investment Opportunities

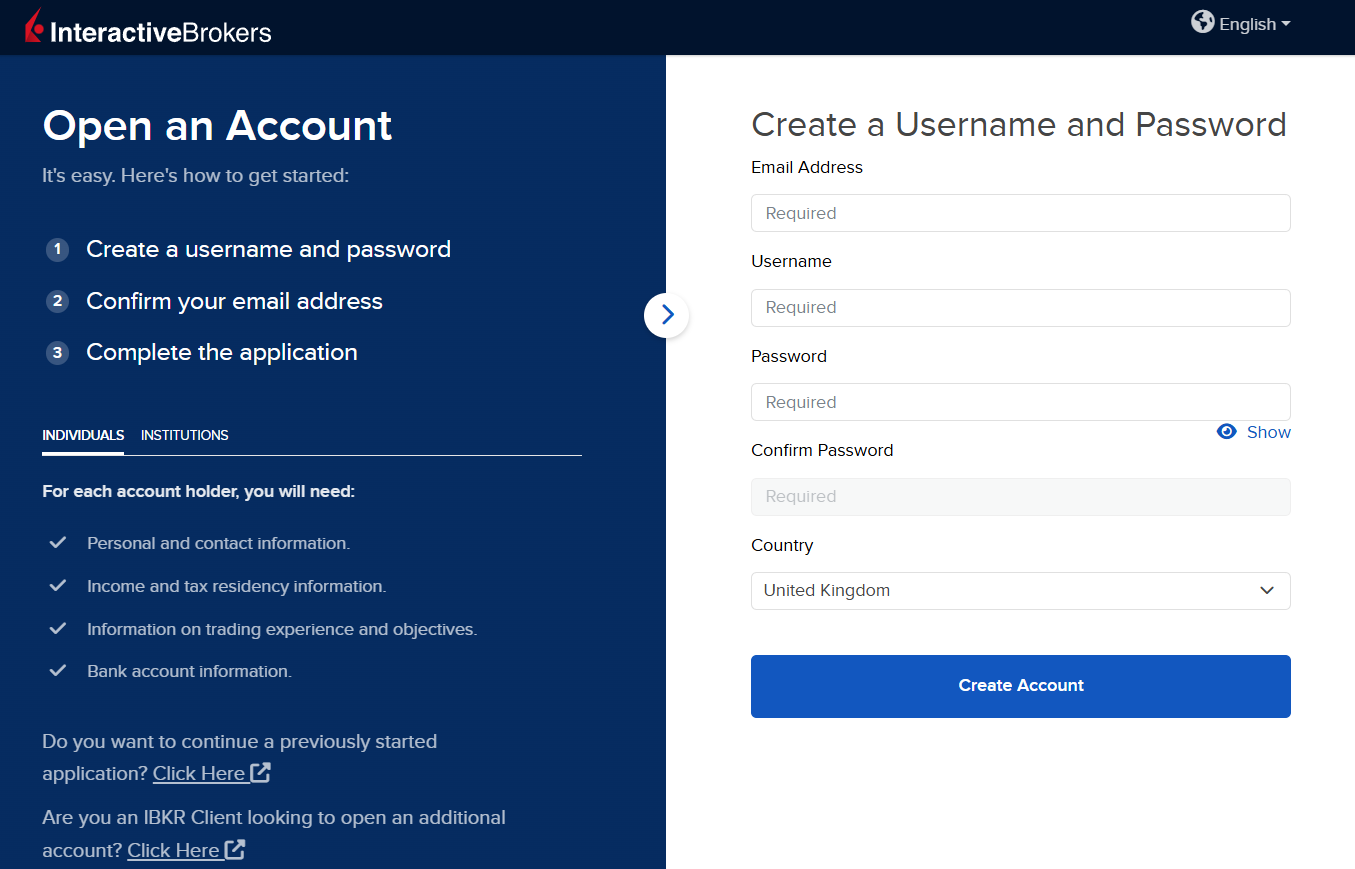

- Account Opening

- Additional Tools And Features

- Interactive Brokers Compared to Other Brokers

- Full Review of Broker Interactive Brokers

Overall Rating 4.7

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.7 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.8 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.7 / 5 |

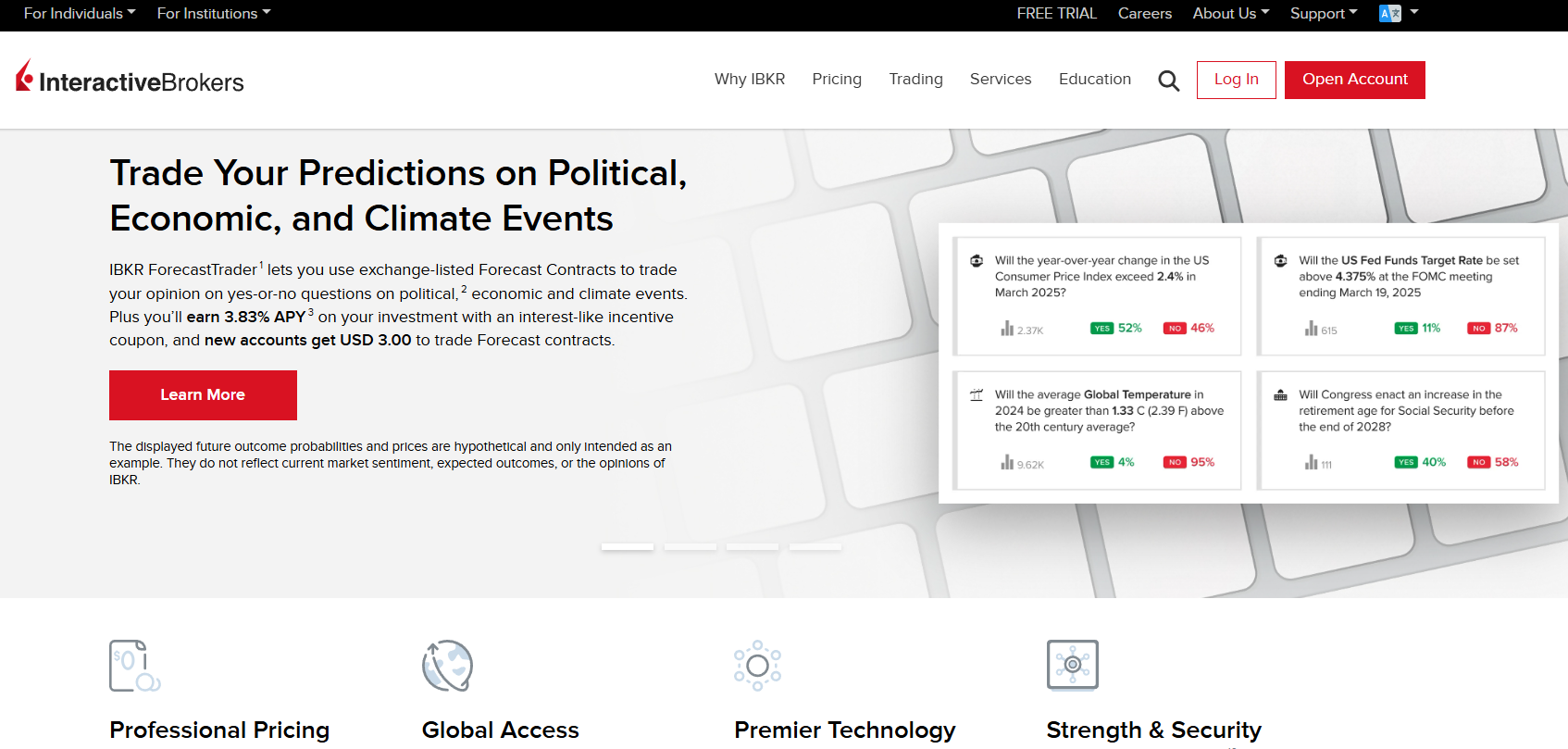

What is Interactive Brokers?

Interactive Brokers is one of the world’s Biggest Trading brokers with sophisticated and powerful trading technology developed by the Broker and is ranked as #1 for Professional Traders access to trade real Futures, Stocks, ETFs, Options, Forex, and many more instruments.

The company’s history started back in 1978 when Chairman Thomas Peterffy brought a seat on the American Stock Exchange (AMEX) and became a trading member as an individual market maker in equity options. Since then, through many years of development and integration, Interactive Brokers or IB has conducted its broker or dealer business on over 120 world market destinations and is truly one of the biggest trading providers worldwide that adhere to the trading technology development.

- So why did the Interactive Brokers gain their highest rankings and a great reputation among the traders’ community? Firstly, the general broker’s offerings are directed to competitive, client-oriented proposals through a transparent policy, low commissions, financing rates, and price executions that minimize the costs, but deliver the highest level of trading technology.

The interactive Brokers management office is headquartered in Greenwich, Connecticut, and serves its additional entities in the USA, Switzerland, Hong Kong, UK, Australia, Hungary, Russia, Japan, India, China, and Estonia.

What Type of Broker is Interactive Brokers?

In its broker-dealer or agency business model, IB provides direct access trade execution and clearing services to institutional and retail traders for a wide variety of products including stocks, options, futures, forex, bonds, CFDs, and funds worldwide. In fact, in 2017 IBKR was among the first brokers offering clients access to Bitcoin futures trading on the Cboe Futures Exchange (CFE) and the CME.

Apart from the retail client’s solution, the broker focuses on broad offerings to connect and conduct trading business solutions through Investors’ Marketplace, an online service that comprises service providers, advisors, hedge funds, research analysts, business developers, and administrators. As well as introduces a new Order Management System (OMS) for Institutional clients.

Is Interactive Brokers Good for Beginners?

Yes, it is. Interactive Brokers has always been a great choice for beginner traders due to its rich educational resources offering test trade and honing their trading skills. The broker offers also low-fee trading which is a great plus. Also, beginner traders can sign up for a demo account before risking their own money.

Is Interactive Brokers Stock Broker?

Yes, Interactive Brokers is a well-known Real Stock trading brokerage firm. Interactive Brokers Group, Inc. is a financial services company that provides online brokerage services to individual and institutional investors. It offers a wide range of financial products and services, including the ability to trade stocks, options, futures, Forex, and other securities on various global exchanges. The broker is known for its low-cost trading and sophisticated trading platforms, making it a popular choice among active traders and investors.

Interactive Brokers Pros and Cons

From what our experts found, Interactive Brokers is one of the best and most well-regulated brokers worldwide with an excellent reputation. The account opening is smooth, technological base, trading platform and range of available instruments are also some of the best available in the industry in addition to some of the lowest commissions and spreads.

- Education section, the range of available tools, customer support, and funding methods are also on the highest level.

From the negative side, we would only admit the advanced level of all proposals overall, plus a quite high deposit for some accounts that makes IB more suitable for seasoned or professional traders, as well as institutions.

| Advantages | Disadvantages |

|---|

| Long history of operation and strong establishment | Conditions and offering vary depending on the entity and regulations |

| Excellent reputation, company trusted by leading organizations | Minimum deposit is high for some accounts |

| No minimum deposit | No 24/7 customer support |

| Great trading tools and trading technology | |

| Stock Trading and Investment | |

| Proprietary awarded software | |

| Low fees and commissions | |

| International large proposal with numerous opportunities | |

| Broker is one of the best option for futures, Stocks and Index trading | |

| Might be more suitable for trading professionals and traders of bigger size | |

Interactive Brokers Features

Interactive Brokers (IBKR) is a leading global brokerage firm known for its comprehensive range of trading services, low-cost fees, and powerful platform designed for both professional and retail traders. Below is a comprehensive list of its key features:

Interactive Brokers Features in 10 Points

| 🏢 Regulation | US SEC & CFTC, ASIC, FCA, CBI, SFC, NSE, BSE, FSA |

| 🗺️ Account Types | Individual, Joint, Trust, IRA, UGMA/UTMA Accounts |

| 🖥 Trading Platforms | IBKR Platform, Trader Workstation (TWS), Client Portal |

| 📉 Trading Instruments | Forex, CFDs, Stocks, Options (Incl. Futures Options), Futures, Cryptocurrencies, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | $0.0005 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, JPY, AUD |

| 📚 Trading Education | Traders' Academy, IBKR Campus, Podcasts, Webinars, Glossary, and more |

| ☎ Customer Support | 24/5 |

Who is Interactive Brokers For?

Interactive Brokers is designed for a wide range of traders and investors. Its platform is best suited for individuals who have a solid understanding of the financial markets and are looking for advanced trading tools and low-cost execution. Based on our findings and Financial Expert Opinions Interactive Brokers is Good for:

- Beginning Traders

- Professional Traders

- US Traders

- International Traders

- Direct Market Access trading

- Futures Trading or Index Trading

- Real Stock Trading

- API Trading

- Algorithmic Trading

- Powerful technically packed platform

- Powerful Trading Tools

- Currency Trading and CFD Trading

- Running various Strategies

- Running Robots

- Excellent Research

- Trading Education

Interactive Brokers Summary

Overall, regulated globally in numerous financial centers Interactive Brokers is known for its competitive commission rates, a very advanced range of markets and technology to trade, also its nonstop development and availability of products like Bitcoin trade through the CFD. What we should strongly admit is that IB’s great offering to the broker is its technical development.

A variety of platforms and tools are covering the most demanding needs while bringing both performance and ease of use. The comprehensive proposals to traders of every type, including various level traders or diverse institutions bring the best possible technologies to the potential benefit of both parties.

55Brokers Professional Insights

Interactive Brokers stands out in the trading market by offering some of the best conditions and proposals for active and professional traders. With a broad selection of instruments, including Stocks, CFDs, and Forex, and access to real trading options through Direct Market Access (DMA), IBKR provides a unique edge for those seeking depth in their trading.

The platform is equipped with advanced features like sophisticated charting tools, risk management options, and customizable strategies that cater to various types of traders, including retail investors, institutional clients, and experienced professionals.

IBKR’s global reach makes it particularly appealing to European, African, and Asian traders, while its multi-platform availability and diverse strategies cater to both beginners and seasoned traders looking for robust technical trading solutions.

While the broker’s platform offers impressive flexibility and low-cost pricing, its complexity might present a learning curve for new traders. Additionally, its higher margin requirements and account minimums may not be ideal for every investor. However, Interactive Brokers remains a top choice for those who prioritize competitive conditions, low fees, and cutting-edge trading tools.

Consider Trading with Interactive Brokers If:

| Interactive Brokers is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Low fees and commissions.

- Access to robust proprietary trading platforms.

- Stock Trading and Investment.

- Excellent trading tools and trading technology.

- Access to Virtual Private Server (VPS).

- Providing services worldwide.

- Offering popular financial products.

- Providing diverse trading tools, and trading strategies.

- Excellent educational materials, and customer support.

|

Avoid Trading with Interactive Brokers If:

| Interactive Brokers might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with industry-known MT4/MT5, or cTrader.

- Providing Copy Trading.

- Offering MAM/PAMM accounts.

|

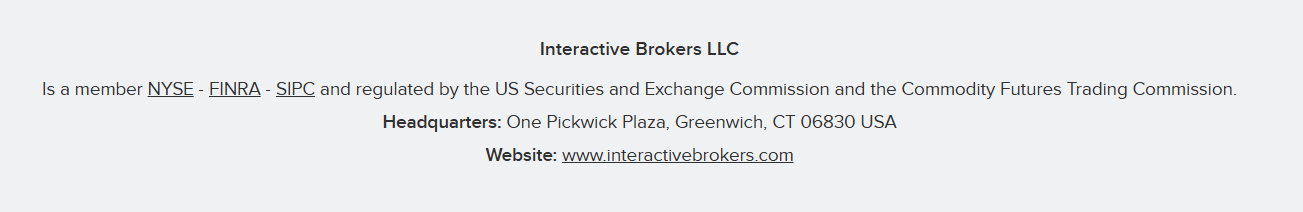

Regulation and Security Measures

Score – 4.8/5

Interactive Brokers Regulatory Overview

Interactive Brokers is a highly regulated global broker with a strong reputation for adhering to stringent regulatory standards across multiple jurisdictions. In the United States, IBKR is regulated by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), ensuring compliance with U.S. securities and commodities laws.

The broker is also authorized by major financial authorities, including the Australian ASIC, the FCA in the UK, and the Central Bank of Ireland (CBI). Internationally, IBKR holds licenses with the SFC in Hong Kong and is registered with the NSE and BSE in India, further demonstrating its extensive global reach.

In Japan, IBKR is regulated by the Financial Services Agency (FSA). These multiple licenses and regulatory affiliations give IBKR a high level of credibility, ensuring client protection and adherence to international financial standards.

How Safe is Trading with Interactive Brokers?

Trading with Interactive Brokers is considered very safe due to the broker’s robust regulatory oversight, strong financial standing, and advanced security measures.

IBKR is regulated by top-tier financial authorities such as the U.S. SEC, CFTC, the FCA in the UK, ASIC in Australia, and others across various regions, ensuring that the broker adheres to strict standards for client protection, transparency, and fair trading practices.

The firm is a member of SIPC (Securities Investor Protection Corporation) in the U.S., providing up to $500,000 in protection for securities and cash in case of insolvency, with an additional private insurance policy covering up to $30 million.

Furthermore, IBKR employs industry-leading cybersecurity protocols, including two-factor authentication and encryption, to safeguard clients’ personal and financial data. While no investment is completely risk-free, IBKR’s combination of regulatory adherence and technological safeguards makes it a secure choice for traders.

Consistency and Clarity

IBKR has built a solid reputation as one of the most reliable and established brokers in the financial industry. Known for its consistency in delivering low-cost, high-quality trading services, IBKR has garnered favorable reviews from professional traders and institutional clients worldwide.

The broker is consistently ranked among the top brokers in terms of trading fees, execution speed, and range of financial instruments. However, some traders note that its platform, while feature-rich, can be complex for beginners, and its customer support has received mixed feedback.

Despite these drawbacks, IBKR remains a preferred choice for advanced and active traders. Over the years, Interactive Brokers has received numerous industry awards for its innovative approach, low-cost structure, and advanced trading solutions. Additionally, the broker is actively involved in the financial community through sponsorships and partnerships, further strengthening its presence in the global market.

Account Types and Benefits

Score – 4.7/5

Which Account Types Are Available with Interactive Brokers?

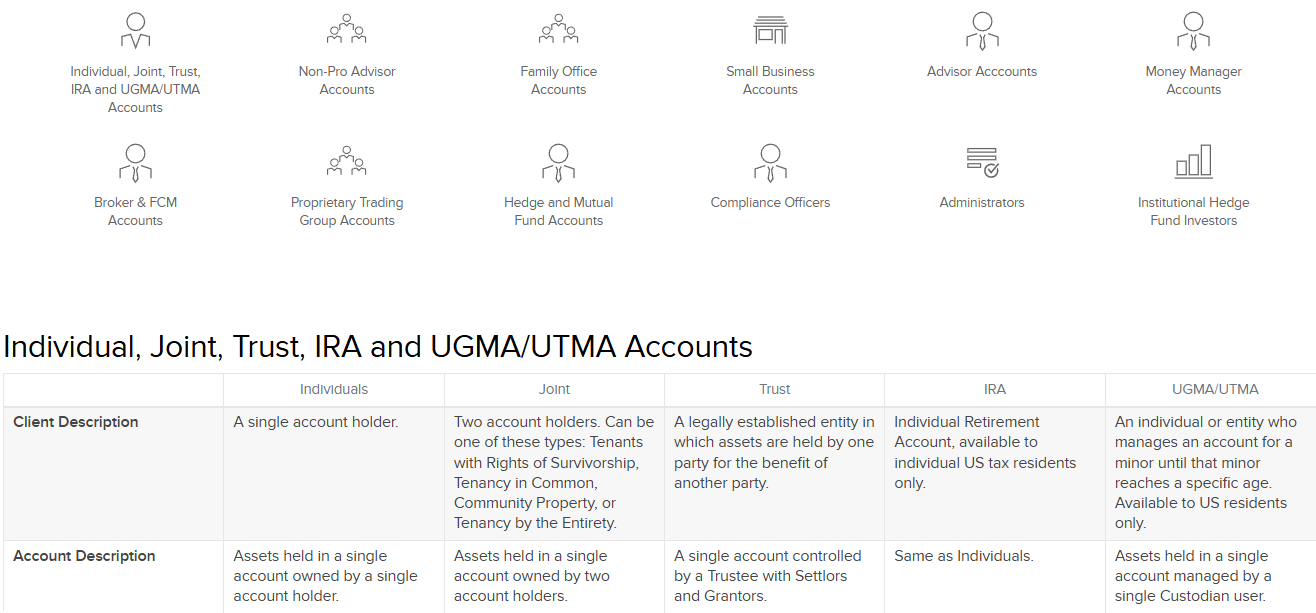

The range of accounts is designed specifically to meet each one’s needs, while every specification is taken into consideration for both parties’ good and includes Individual, Joint, Trust, IRA, and UGMA/UTMA Accounts.

- Even though IB has a huge selection of account types, which vary according to the client’s preference and type, the account is not just a simple account available via the client portal, as it includes integrated investment management that allows borrowing, earning, spending, and investing funds worldwide.

Also, there are options for trading for IBKR lite and IBKR pro conditions which are designed either for experienced traders and day trading with selected order types or allowing commission-free trading which is considered one of the best online trading opportunities.

Individual Account

An Individual Account with Interactive Brokers is designed for single traders who wish to manage their investments. This account offers access to a wide range of asset classes, with competitive commissions and low spreads.

IBKR’s commissions vary depending on the instrument being traded, with stock commissions starting as low as $0.0005 per share (for U.S. stocks) and options trading commissions starting at $0.15 per contract.

The minimum deposit for an individual account is $0 for U.S. residents, although IBKR recommends a higher deposit for active traders to ensure adequate margin. With an Individual Account, users get access to IBKR’s comprehensive suite of trading platforms, including Trader Workstation (TWS), WebTrader, and mobile apps.

Joint Account

A Joint Account is for two or more individuals who want to trade together and share the same portfolio. Similar to an Individual Account, the commissions and spreads remain competitive, with options starting at $0.15 per contract and stock trading commissions as low as $0.0005 per share.

Joint accounts also benefit from access to IBKR’s robust trading platforms. The minimum deposit for a Joint Account is generally the same as an Individual Account, with no specific minimum requirement for U.S. residents, although IBKR recommends sufficient capital for margin trading.

Trust Account

A Trust Account is designed for individuals or entities who wish to manage their investments for estate planning or wealth transfer purposes. Trust Accounts offer the same low commission structure and access to IBKR’s trading platforms, but they provide added flexibility for managing assets according to the terms of the trust agreement.

The commission fees are comparable to Individual Accounts, with stock commissions starting as low as $0.0005 per share and options commissions beginning at $0.15 per contract. The minimum deposit for a Trust Account is typically higher, as IBKR requires a minimum of $10,000 for non-U.S. clients (with variations depending on the region and asset class).

These accounts provide tax-efficient ways to manage investments for beneficiaries, with features such as portfolio management and performance tracking.

IRA Account

An IRA (Individual Retirement Account) with IBKR is designed for U.S. residents who wish to invest for retirement while taking advantage of tax-deferred growth.

The key benefit of an IRA Account is the tax-advantaged status, allowing earnings to grow without being taxed until withdrawal (traditional IRA) or with tax-free withdrawals (Roth IRA).

The minimum deposit for an IRA account is $0, though IBKR recommends a higher deposit to maintain sufficient margin and investment opportunities.

UGMA/UTMA Account

A UGMA/UTMA (Uniform Gifts to Minors Act / Uniform Transfers to Minors Act) Account is designed for U.S. clients who want to invest on behalf of a minor. These accounts allow gifts of financial assets to minors, who will gain full control of the account once they reach the age of majority in their state.

The minimum deposit for UGMA/UTMA accounts is typically around $2,000, but this may vary. These accounts are an excellent way to help minors begin their investment journey while benefiting from the tax advantages that apply to minors.

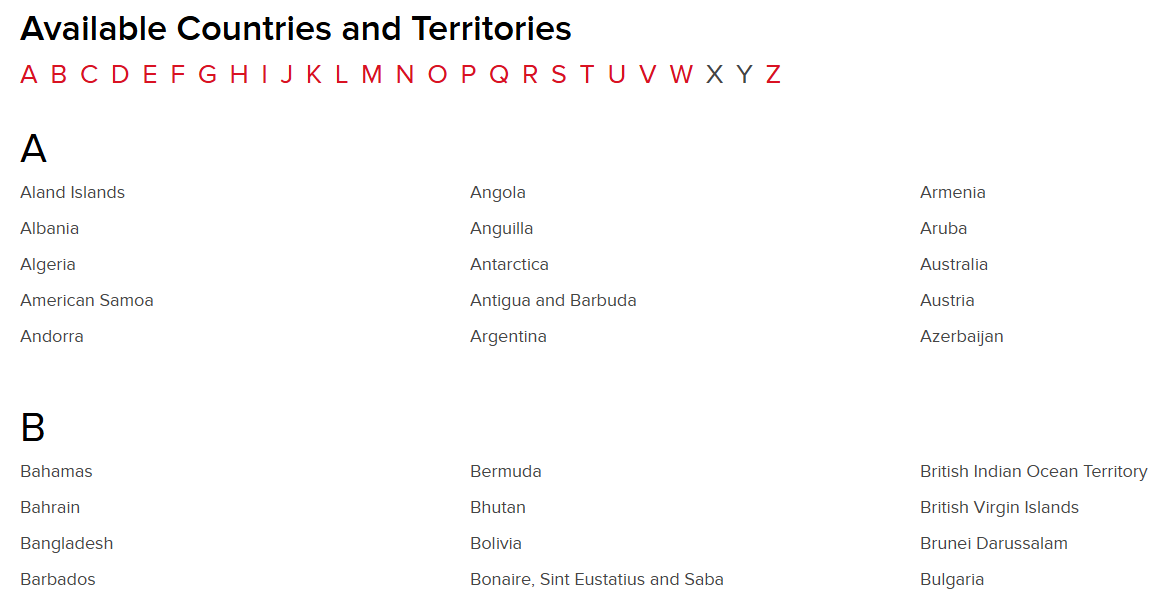

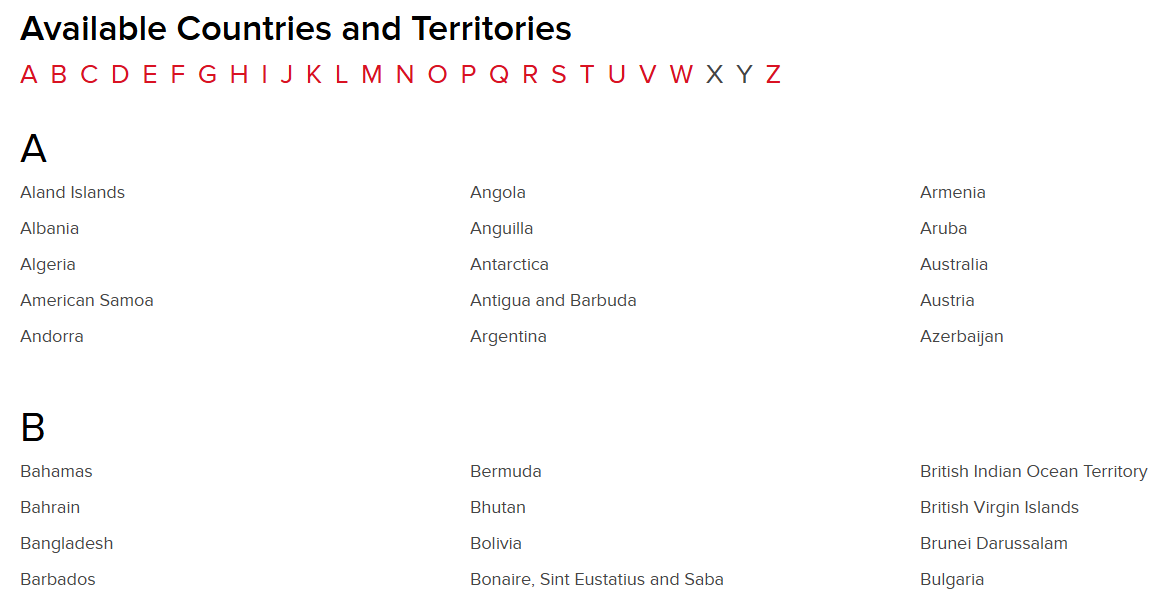

Regions Where Interactive Brokers is Restricted

Interactive Brokers operates globally, but there are certain regions and countries where its services are restricted due to regulatory limitations, local laws, or political factors. The broker is highly regulated in many major jurisdictions, but here are some regions where access may be limited or restricted:

- Cuba

- Iran

- North Korea

- Syria

- Sudan

- Other Sanctioned Regions

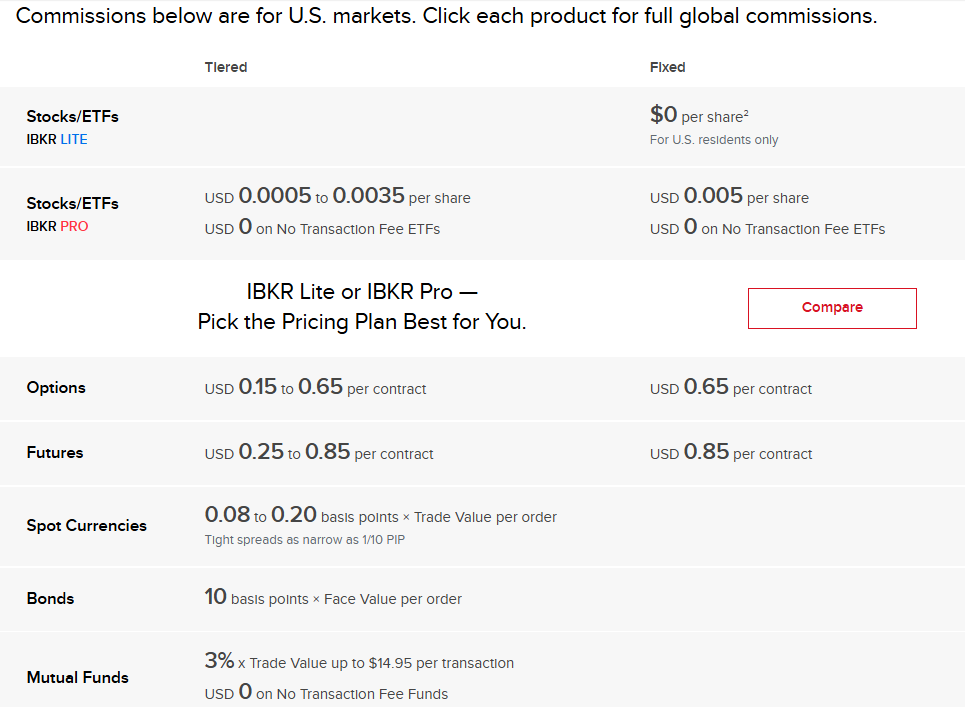

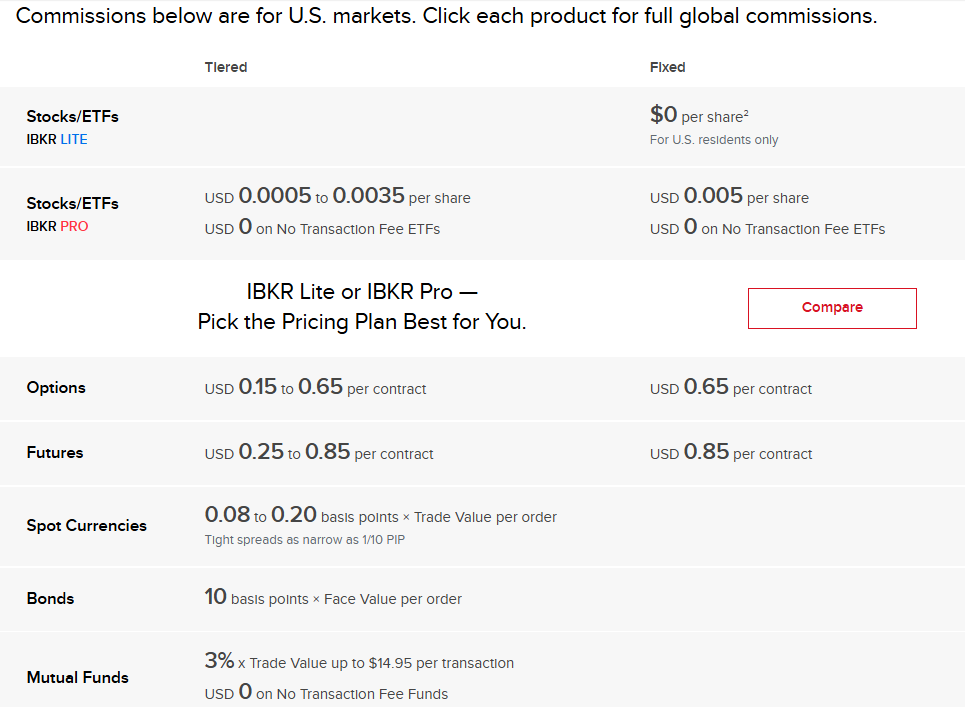

Cost Structure and Fees

Score – 4.6/5

Interactive Brokers Brokerage Fees

Interactive Brokers’s model of the trading fee is based on the charge of the commission per trade also ranging on the product you trade, hence the prices are quite competitive since they do not include spreads and allow you to easily calculate.

The broker’s pricing is among the most competitive ones, even though the commissions or various additional fees system seem to be quite complicated with its possible fees in changing positions or so. The general outcome is still pleasant, especially while trading Stocks, Futures, or EFPs.

The pricing is either Fixed or Tiered commission with a choice remaining to you, either to stick to the fixed price with all regulatory fees or low broker commission depending on traded volume through tiered rates as a rebate.

- Interactive Brokers Spreads

The broker offers spreads for various financial instruments, though it is primarily operates on a commission-based pricing structure rather than offering a traditional spread markup.

For Forex trading, Interactive Brokers provides very tight spreads, especially on major currency pairs like EUR/USD, where spreads can be as low as 0.1 pips under normal market conditions.

- Interactive Brokers Commissions

IBKR offers a highly competitive commission structure that caters to different types of traders. For stocks, commissions begin at $0.0005 per share (with a minimum of $1 per order) for U.S. equities, and this can decrease with higher trading volumes.

Options commissions start at $0.15 per contract for U.S. options, and again, these rates can drop for traders who engage in high-frequency trading. Futures commissions are similarly competitive, starting at $0.25 per contract.

For traders who prefer simplicity, IBKR also offers a fixed-rate commission model, where a flat fee is charged per trade, which may be advantageous for less active traders.

- Interactive Brokers Rollover / Swaps

The broker offers rollover rates (or swap rates) for positions held overnight in Forex and other leveraged instruments. The rollover rates are applied based on the interest rate differentials between the currencies being traded, as well as market conditions.

These rates may vary daily and are calculated at the end of each trading day, with long positions receiving a positive rollover or short positions incurring a negative rollover, depending on the direction of the trade.

How Competitive Are Interactive Brokers Fees?

Interactive Brokers offers competitive fees across a wide range of financial instruments. The broker’s fee structure is designed to cater to different types of traders, with low commissions, tight spreads, and minimal additional costs, especially for high-volume traders.

With access to global markets and multiple asset classes, IBKR’s cost-effective approach allows traders to execute strategies efficiently while keeping trading expenses low, further enhancing its appeal in the competitive brokerage landscape.

| Asset/ Pair | Interactive Brokers Commission | PhillipCapital Commission | Lightspeed Commission |

|---|

| Stocks Fees | $0.0005 | $3,88 | From $0,50 |

| Fractional Shares | $0.01 | No | No |

| Options Fees | $0.15 | $3,88 | From $0,20 |

| ETFs Fees | $0.0005 | $3,88 | From $0,50 |

| Free Stocks | Yes | No | No |

Interactive Brokers Additional Fees

The broker does not charge an inactivity fee, which is a significant advantage for traders who may not engage in frequent trading. However, there are some additional fees to be aware of. Wire transfer fees are $10 for domestic and $20 for international transfers, while currency conversion fees typically range from 0.20% to 0.30%.

Access to market data may incur extra costs, depending on the subscription level. For margin accounts, interest charges start at around 1.5% to 2.5% depending on the borrowed amount. Overall, IBKR maintains low and transparent fees.

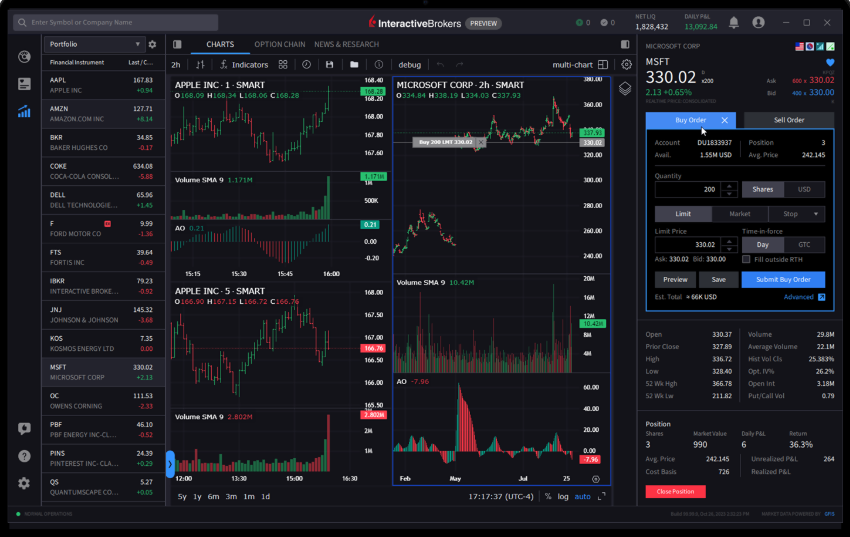

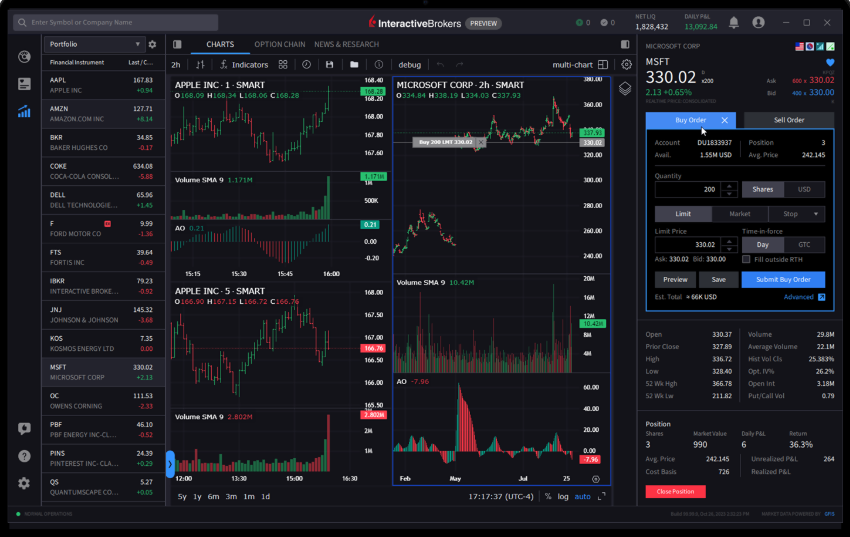

Trading Platforms and Tools

Score – 4.5/5

Interactive Brokers offers various platforms and tools to cater to different trading needs. The flagship Trader Workstation (TWS) is a powerful desktop platform for active traders and professionals, providing advanced charting, risk management, and direct market access.

IBKR Desktop is another comprehensive platform with full access to trading and analysis tools, which is ideal for serious traders. For those on the go, IBKR Mobile offers a convenient app that enables trading, portfolio management, and real-time data access from smartphones and tablets.

IBKR GlobalTrader simplifies global stock trading through a mobile app, designed for retail investors. The Client Portal is a web-based interface that allows easy account management and trade execution, perfect for those seeking simplicity.

Additionally, IBKR APIs provide integration options for developers and institutional clients, enabling automated trading and custom solutions. IBKR ForecastTrader delivers predictive analytics for traders focused on forecasting market trends, and IMPACT is a mobile app tailored for sustainable investing, helping users align their investments with social and environmental goals.

Trading Platform Comparison to Other Brokers:

| Platforms | Interactive Brokers Platforms | HYCM Platforms | Tickmill Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Interactive Brokers Web Platform

The broker offers a robust web-based platform called Client Portal, which provides traders with easy access to their accounts and trading features from any browser without the need to download software.

This platform allows users to manage their portfolios, view account balances, track trade history, and execute trades efficiently. The Client Portal is designed for simplicity and accessibility, making it ideal for casual traders and investors who prefer a streamlined interface.

Additionally, IBKR ForecastTrader is another web-based tool designed to assist traders with market forecasting by offering predictive analytics and trend insights, helping traders make informed decisions. Together, these web platforms provide flexibility and convenience, enabling traders to manage their investments without the need for software downloads.

Main Insights from Testing

Testing Interactive Brokers’ web platforms reveals a strong emphasis on user accessibility and functionality. The Client Portal stands out for its simplicity, offering an intuitive interface for account management and trade execution, making it ideal for casual traders.

IBKR ForecastTrader provides advanced predictive tools, helping traders anticipate market movements with trend analysis and forecasting capabilities. While both platforms are easy to navigate, they offer a range of features that cater to different trading preferences, with ForecastTrader providing more advanced tools for those seeking to forecast market trends.

Interactive Brokers Desktop MetaTrader 4 Platform

The broker does not offer the MT4 platform, which is a popular choice among retail forex traders. Instead, IBKR provides its platforms, such as Trader Workstation and IBKR Desktop, which offer various trading tools and features suitable for professional and active traders.

These platforms support a wide range of asset classes and provide direct market access, but they do not include the MT4 environment, known for its user-friendly interface and automated trading capabilities.

Interactive Brokers Desktop MetaTrader 5 Platform

Interactive Brokers does not offer the MetaTrader 5 platform, which is a popular choice for traders seeking advanced charting and automated trading features. Instead, IBKR provides its proprietary platforms, which cater to a wide range of trading needs, from stocks and options to Forex and futures.

However, traders who prefer the MT5 experience will need to look for alternative brokers, as Interactive Brokers does not support this platform.

Interactive Brokers Trader Workstation Platform

TWS provides a comprehensive suite of functionalities, including sophisticated charting, real-time market data, technical analysis tools, risk management capabilities, and direct market access to a wide range of asset classes.

It supports multiple order types, customizable layouts, and advanced trading strategies. With its high level of customization and robust features, TWS enables users to analyze markets deeply, manage risk efficiently, and execute trades quickly. The platform is available for desktop use and offers a seamless experience for traders seeking to optimize their trading performance.

Interactive Brokers MobileTrader App

The IBKR Mobile app provides Interactive Brokers clients with the ability to manage their accounts and execute trades on the go. It offers access to a wide range of asset classes, allowing traders to monitor market movements, place orders, and manage positions from their smartphones or tablets.

The app features real-time data, advanced charting tools, and customizable watchlists, enabling traders to stay updated and make informed decisions at any time.

Trading Instruments

Score – 4.6/5

What Can You Trade on Interactive Brokers’s Platform?

Interactive Brokers provides access to over 150 global markets, offering a comprehensive range of trading products, including Forex, CFDs, Stocks, Options (Incl. Futures Options), Futures, Cryptocurrencies, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads.

However, conditions and applicable laws in certain jurisdictions may result in variations in the available offerings.

Main Insights from Exploring Interactive Brokers’s Tradable Assets

Interactive Brokers stands out for its extensive variety of tradable assets, offering access to a range of asset classes that enable traders to build highly diversified portfolios.

With support for global markets, users can seamlessly trade a mix of traditional and modern financial instruments. This broad selection ensures flexibility and adaptability, catering to traders of all experience levels who are looking to expand their investment opportunities.

Margin Trading at Interactive Brokers

The Interactive Brokers offers margin rates that generally apply to all customers, while in various jurisdictions, local regulators require different or higher margin rates. If the local margin rates are higher than the IB margin rates, then the margin rates required by local regulators will apply.

In addition, the multiplier depends on the trading instrument, and the country of your residence since regulation restricts high risks involved in leverage. For this reason for easier understanding, IB provides an online tool to check on all applicable margins at your glance so you can choose trading best conditions.

Interactive Brokers leverage varies according to the instrument, region, and IB entity you trade with:

- UK, Australian, and European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- Maximum of 1:50 available on Forex for US traders.

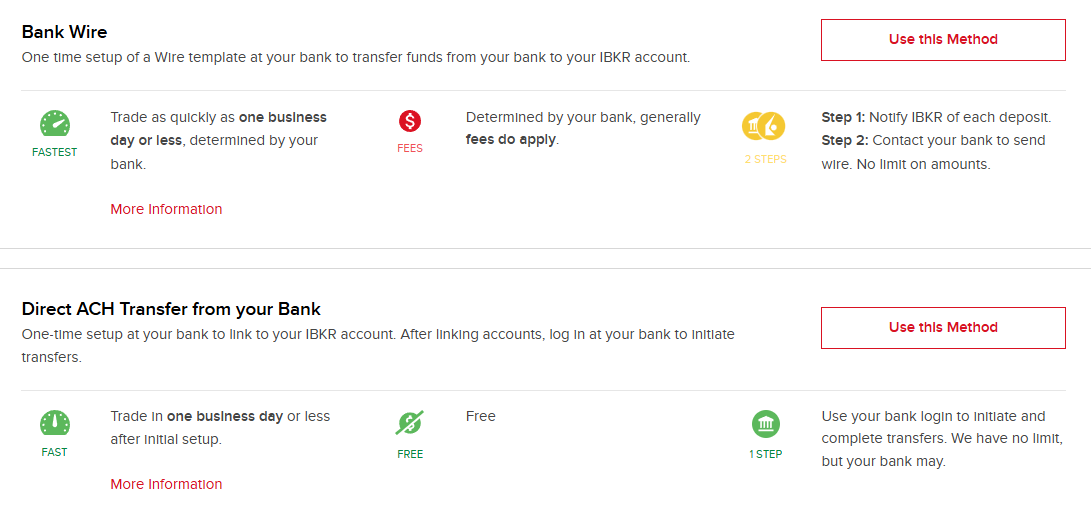

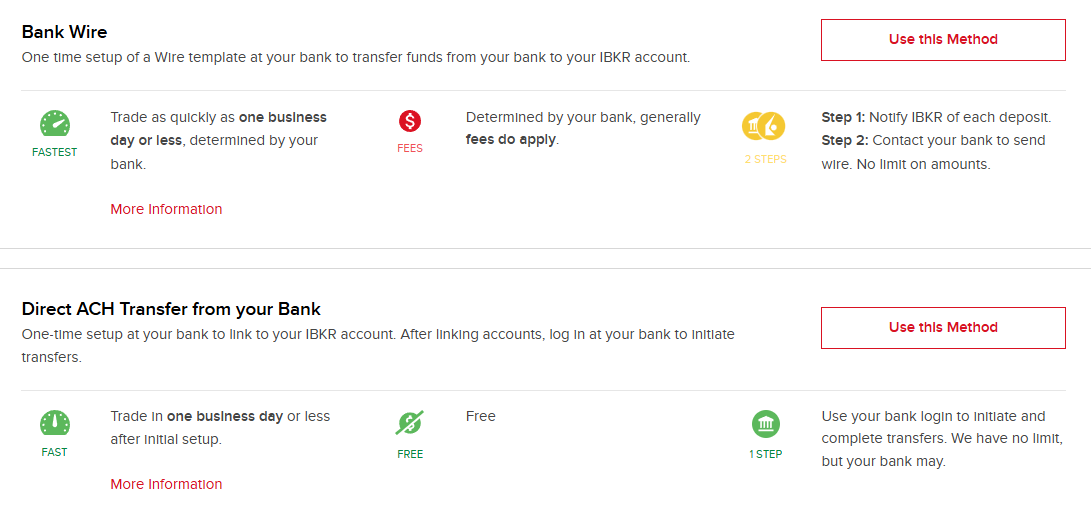

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Interactive Brokers

The broker provides a variety of deposit options to cater to its global clientele, including:

- Bank Wire Transfers

- ACH Initiated

- US Automated Clearing House (ACH) transfer Initiated

- Check or online bill payment

- BPAY

- Canadian Bill

- EFT

- Direct Rollover (IRA only) and more

Interactive Brokers Minimum Deposit

Interactive Brokers does not have a fixed minimum deposit requirement for most accounts, making it accessible for a wide range of traders. However, for standard accounts, the broker typically suggests a minimum of $10,000 to ensure clients have enough margin for trading and to access certain account features.

For accounts that are classified as “cash accounts” or “IRA accounts,” the minimum deposit requirement can be lower. The broker may also impose minimum deposit requirements based on the type of account and regulatory region.

Withdrawal Options at Interactive Brokers

The withdrawal of funds is performed via a withdrawal request on the Fund Transfers page which you should complete in Account Management. The pleasant thing is that IB allows one free withdrawal every month with no need to pay a withdrawal fee, also withdrawal options are widely available depending on the region.

Further on, if you wish to withdraw funds again within a current month, IB will charge fees for any subsequent withdrawal.

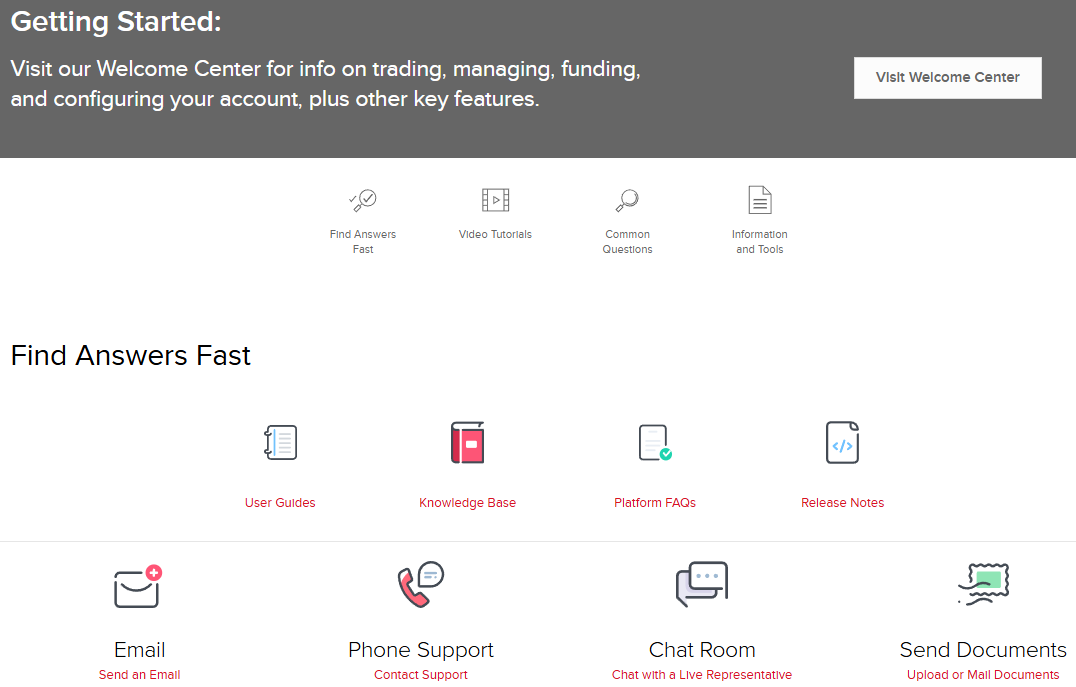

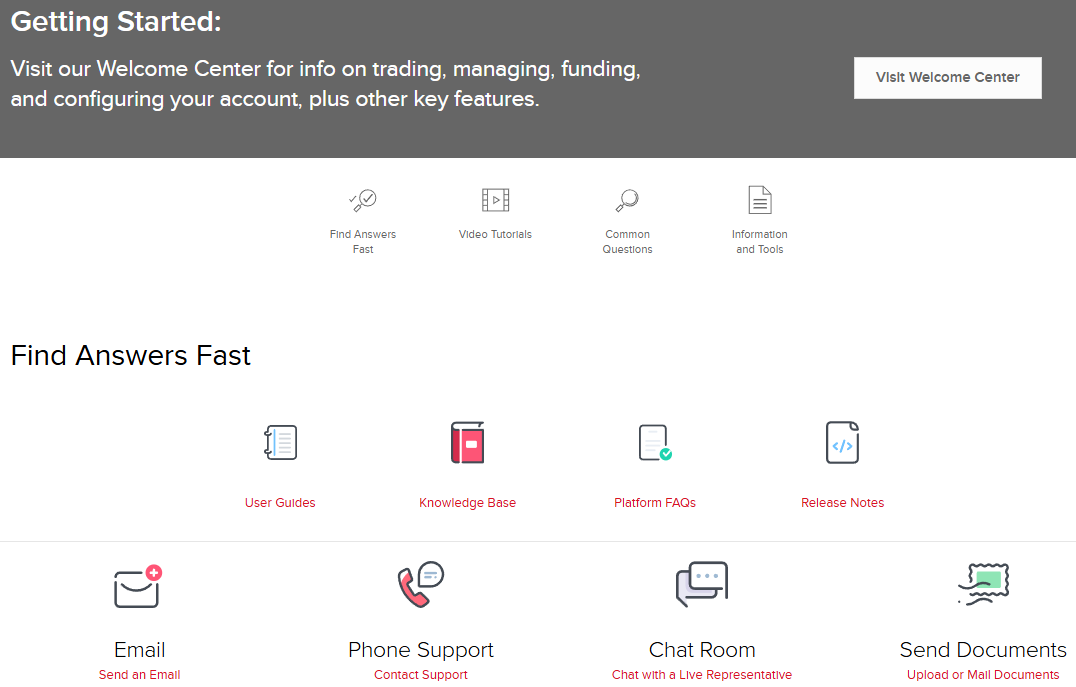

Customer Support and Responsiveness

Score – 4.5/5

Testing Interactive Brokers’s Customer Support

The broker’s global presence also provides multiple support options to benefit traders, with professional and well-established support centers. Customer support is tailored to the type of investor, whether individual traders or institutional clients.

Regular traders have easy access to 24/5 phone support, a live chat room, contact search, the ability to report problems, send general feedback, and access a feature poll for requests for new features.

Contacts Interactive Brokers

Interactive Brokers provides multiple contact options for customer support. Traders can reach them by phone at their U.S. office at +1 (877) 442-2757 or internationally at +1 (203) 618-4070.

Additionally, clients can contact the support team via email at help@interactivebrokers.com for general inquiries or account-related issues. Interactive Brokers also offers an online contact form through the website for specific questions and requests, allowing traders to get personalized assistance quickly and efficiently.

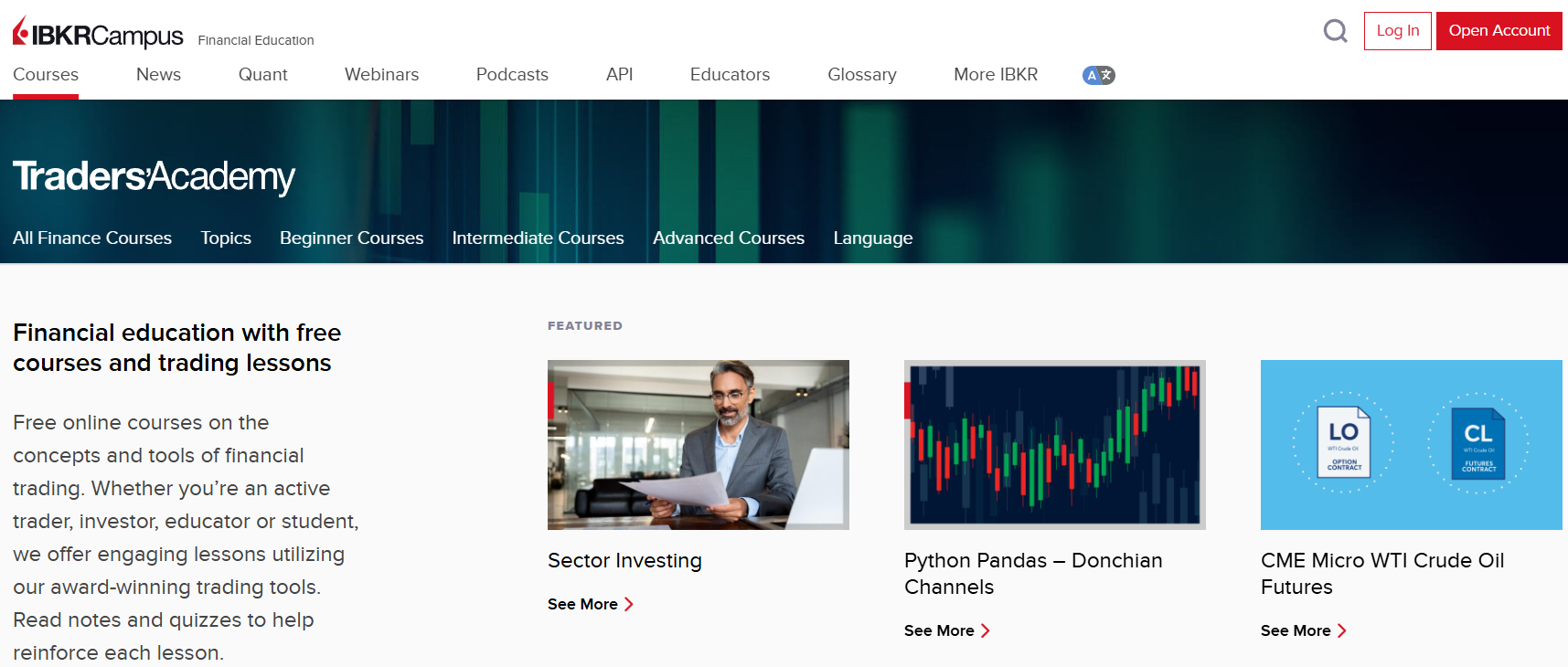

Research and Education

Score – 4.7/5

Research Tools Interactive Brokers

Interactive Brokers offers a comprehensive range of research tools both on its website and within its trading platforms.

- On the website, traders can access a variety of market data, news feeds, economic calendars, and research reports. These resources are provided by well-known sources like Reuters, Morningstar, and other market experts, helping traders stay updated on global market trends and economic events.

- Within the platforms, such as Trader Workstation (TWS) and the IBKR Mobile app, traders benefit from advanced charting tools, technical analysis indicators, backtesting features, and risk management tools.

- Additionally, IBKR offers tools like the IBKR Market Scanners, which allow users to filter stocks, options, and other instruments based on specific criteria.

- IBot is a chat/voice-based trading interface for traders on the go that understands native languages and is available on TWS Desktop and Mobile.

- IB APIs feature easy-to-use tools for those who want to write their trading software or automated trading programs. An application can be built either through Interactive Brokers API programming languages or as a choice by FIX CTCI.

- QuickTrade brings access to the IB account with a simplified trading interface, where you can quickly place orders for a variety of asset types from within Account Management, and works the same way as the Order Management Panel in WebTrader.

Education

The range of learning materials, insights, and technology solutions for better trading, including numerous apps, widgets, and progressive software, is also available. Additionally, as one of the largest global trading platforms, Interactive Brokers provides high-quality educational materials through its established Traders’ Academy.

Traders can also access courses on trading tools, investment products, and risk analysis, along with videos, webinars, traders’ insights, news, and recent updates.

Portfolio and Investment Opportunities

Score – 4.8/5

Investment Options Interactive Brokers

Interactive Brokers is primarily a Stock and Investment broker, offering a broad array of investment solutions across multiple asset classes. These include stocks, options, futures, ETFs, mutual funds, bonds, commodities, structured products, and physical metals, providing clients with the ability to build a highly diversified portfolio.

With its focus on both long-term investments and short-term trading opportunities, Interactive Brokers is well-suited for a variety of strategies and risk profiles. The platform also offers direct market access (DMA), which is particularly advantageous for professional traders executing large trades with minimal slippage.

By supporting investments in global markets, the broker ensures clients can trade across multiple exchanges worldwide, reinforcing its position as a comprehensive investment broker.

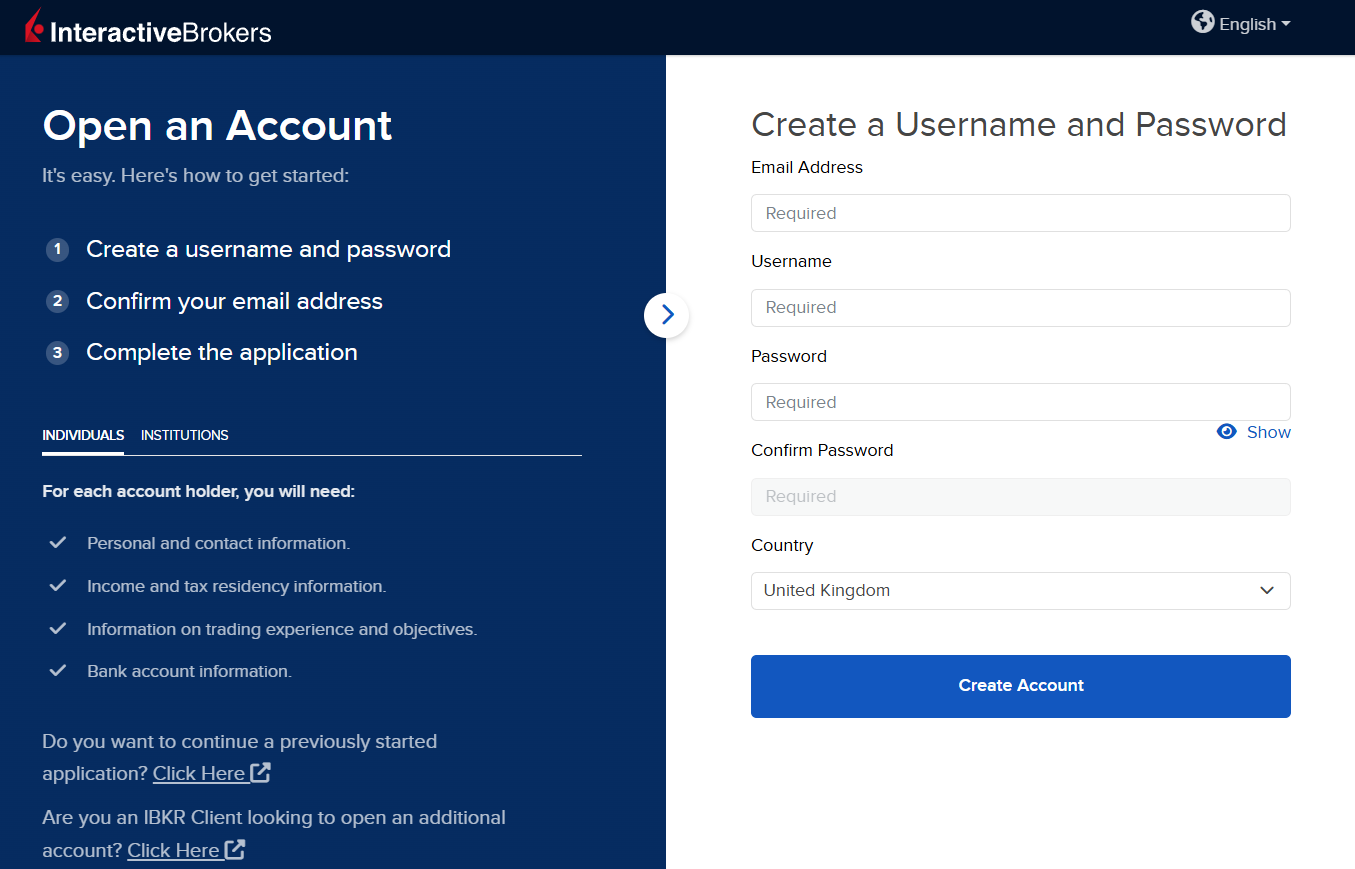

Account Opening

Score – 4.4/5

How to Open Interactive Brokers Demo Account?

Demo accounts are a great way to familiarize yourself with the platform’s tools and features before moving on to a live trading account. Opening a demo account with Interactive Brokers is a straightforward process. Here is how to do it:

- Go to the Interactive Brokers website and navigate to the “Sign Up” or “Open Account” section.

- During the registration process, select the option for a demo account (also known as a paper trading account). This will allow you to practice trading with virtual funds without risking real money.

- Fill out the required personal details, such as name, email, and country of residence. You may need to provide some basic information for identity verification, but for a demo account, the process is typically simpler.

- Once your demo account is set up, you will receive login credentials. You can use these credentials to log into Interactive Brokers’ trading platforms, such as Trader Workstation (TWS) or IBKR Mobile, and begin trading with virtual funds.

- With your demo account active, you can explore various features, test trading strategies, and get familiar with the platform without financial risk.

How to Open Interactive Brokers Live Account?

To open a live account with Interactive Brokers, first visit the official website and click on the “Open Account” button. You will be prompted to create an account by providing your personal information, including your name, address, contact details, and financial background.

Additionally, you will need to complete identity verification by submitting documents such as a government-issued ID, proof of address, and possibly financial statements, depending on the type of account you’re opening.

Once your information is verified, you will need to fund your account with the minimum required deposit, which varies depending on the account type. After funding, you can access the Interactive Brokers trading platforms to start trading with real funds. The process is generally straightforward, but it may take a few days for the account to be fully verified and active.

Additional Tools and Features

Score – 4.7/5

Interactive Brokers offers a variety of additional tools and features to enhance the trading experience for its users.

- One notable tool is Trading Central, which provides expert analysis, technical indicators, and charting tools to help traders make informed decisions.

- For those requiring low-latency execution, the platform also offers a VPS (Virtual Private Server) service, which ensures stable performance and uninterrupted trading.

- Additionally, TradingView integration allows traders to use advanced charting tools and social trading features.

- Interactive Brokers also provides Trading Signals, which can help identify potential trading opportunities based on market analysis.

- The Interactive Brokers Reporting Integration Tool enables traders to easily track their transactions, generate reports, and streamline their trading activities.

These features, combined with the platform’s powerful trading tools, help traders manage their strategies effectively and enhance their overall experience.

Interactive Brokers Compared to Other Brokers

Interactive Brokers stands out as a versatile and well-regulated trading company, offering a range of competitive features for traders of all levels.

As a stock broker, it differs from its competitors by providing solutions that are tailored to stock trading alongside other financial instruments, which may appeal to those looking for more sophisticated trading and investment strategies.

While brokers like Spreadex and CMC Markets provide a broader array of assets, Interactive Brokers offers a unique balance of low spreads, minimal commissions, and access to some of the most advanced trading tools available, such as Trader Workstation and its integrated client portal.

Additionally, its regulatory compliance across multiple jurisdictions, including the US, UK, and several other global markets, ensures a high level of trust and security for traders.

Interactive Brokers excels in offering cutting-edge technology and a comprehensive trading environment suited for those looking for in-depth market analysis and robust trading options. Its client support and educational materials, while solid, are generally more tailored for active traders and professionals.

| Parameter |

Interactive Brokers |

Spreadex |

Tickmill |

HYCM |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

The average EUR/USD spread for Forex is 0.2 pips |

Average 0.6 pips |

Average 0.1 pips |

Average 1 pip |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

Stocks commissions begin at $0.0005 per share |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.0 pips + $3 |

0.1 pips + $4 |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

IBKR Platform, Trader Workstation (TWS), Client Portal |

Spreadex Web Platform, TradingView |

MT4, MT5, Tickmill Trader |

MT4, MT5, HYCM Trader |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

150+ global markets |

10,000+ instruments |

180+ instruments |

300+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

US SEC & CFTC, ASIC, FCA, CBI, SFC, NSE, BSE, FSA |

FCA |

FCA, CySEC, FSCA, FSA |

FCA, DFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$100 |

$20 |

$50 |

$0 |

$0 |

Full Review of Broker Interactive Brokers

Interactive Brokers is a highly regarded broker known for its advanced trading platforms and tools, comprehensive market access, and competitive pricing.

Offering over 150 global markets and a vast array of tradable products such as stocks, options, futures, Forex, and bonds, it caters to both individual and institutional traders. The broker provides a range of powerful tools, ensuring flexibility for users.

With low commissions and a diverse set of account types, Interactive Brokers delivers a robust trading experience. It is regulated by major authorities like the US SEC, FCA, and ASIC, providing strong security and trust for clients worldwide.

Additionally, the broker offers comprehensive educational resources and research tools and targets more active and professional traders due to its feature-rich setup and focus on technical solutions.

Share this article [addtoany url="https://55brokers.com/interactive-brokers-ib-review/" title="Interactive Brokers"]

Does your firm offer PAMM accounts for Forex trading?

where is your office and support 24/7 located country coming from and the official offices also ……..how long being there as an established office

what is your fax and phone numbers who owns your company what and who are the CEOs names and details of who and where they live

im new to tradeing and as being its my money to invest i want to insure beyond advertising what you do with it and what it will cost me to do the various trading and do you have the MT4 platform and if not why how can i get a recommendations on your company in fact how reliable are you to offer services to your investing clients at 100%

e

How does one become a member of IB

Hola como están quiero saber si alguien me puedes ayudar en mi situación invertí mi capital con alguien autorizado por la compañía el cual desapareció y no se nada de él y por tal motivo quisiera saber como puedo hacer para recuperar asi sea la inversión muchas gracias.

IB is a dangerous place for people to put money in! I just got screwed up by their policy of not protecting their customers’ funds from online frauds. I lost $3400 USD ($4400 AUD) on my Interactive Brokers Canada trading portal two months ago and IB didn’t get my money back from the hacker after more than 10 weeks, and then said they will not compensate my loss either. So what a horrific picture here! Imagine, if you lost a large amounts of your money on your IB online site (portal) due to a fraud, say, in my case a hacker hacked into my IB trading account and stole my money, IB will not responsible. Put in another words, IB could do whatever it likes to do with your money on their site and you, as their customer, have to bear the result. So don’t go with IB!

I would like. To open a trading account with you.

Comment want to.kmow more about IBm