- What is Dukascopy?

- Dukascopy Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

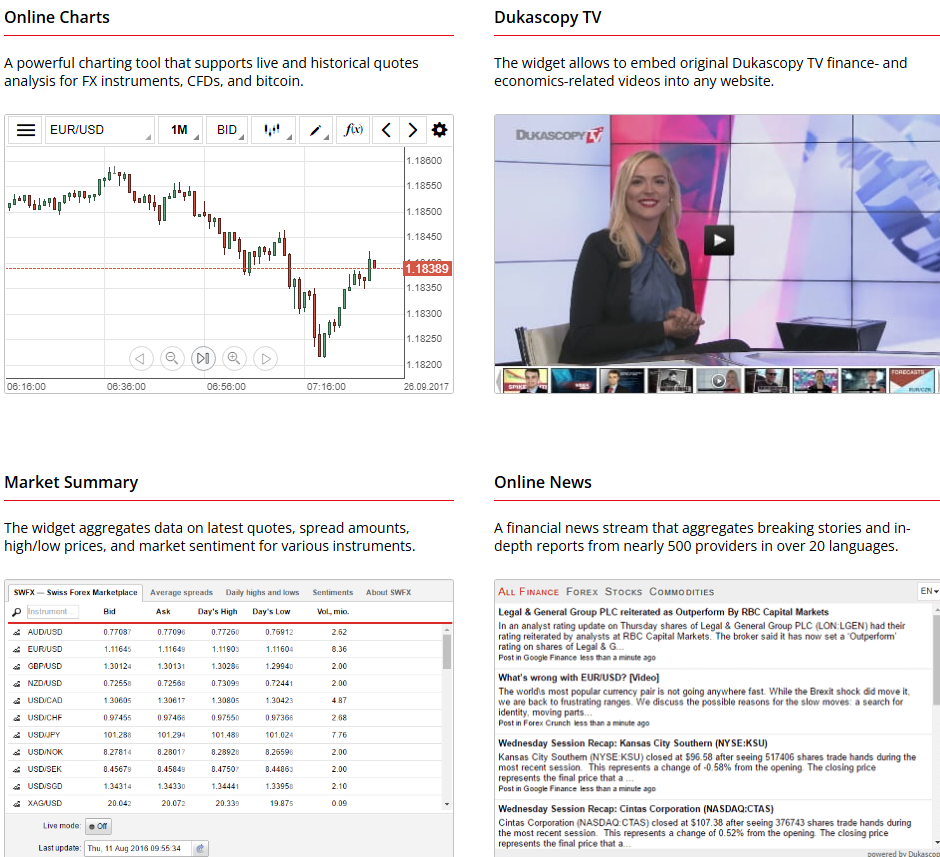

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

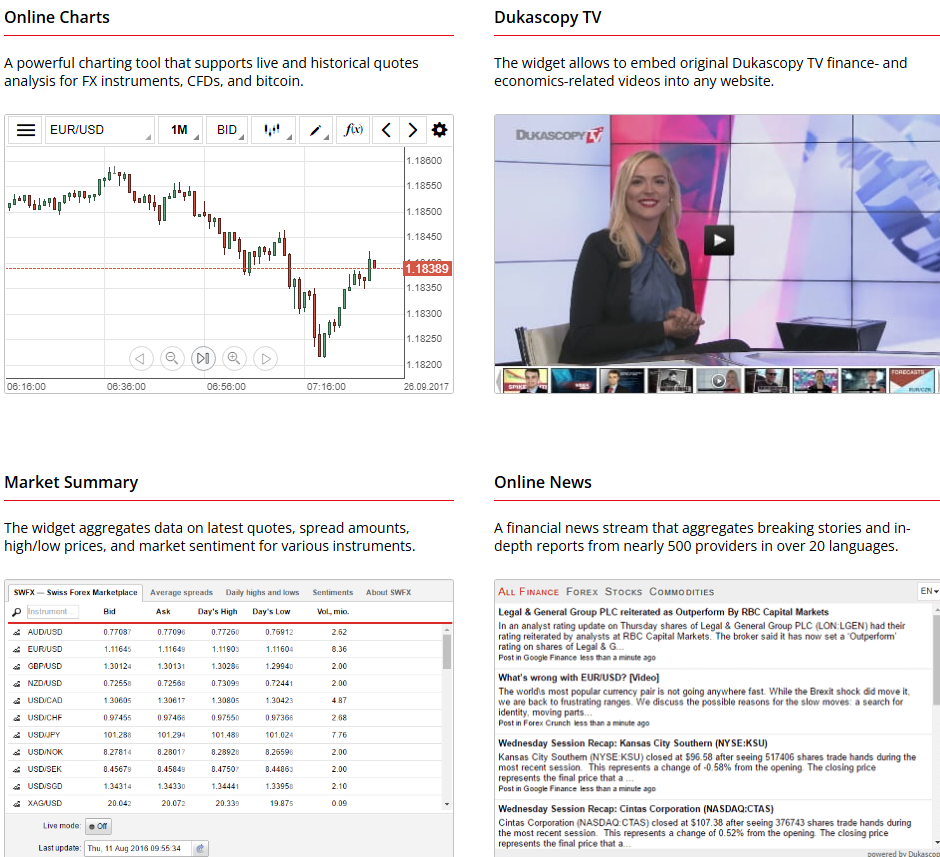

- Additional Tools And Features

- Dukascopy Compared to Other Brokers

- Full Review of Broker Dukascopy

Overall Rating 4.7

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Dukascopy?

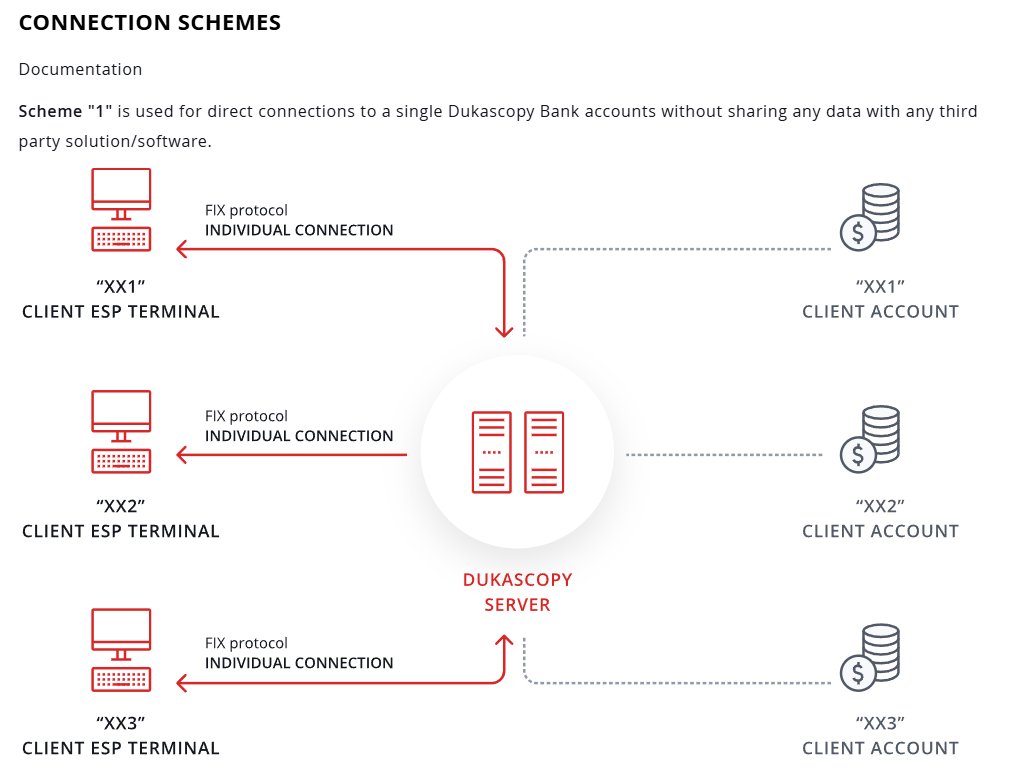

Dukascopy is an innovative Swiss online bank offering Forex and CFD trading, banking, and other financial services through developed technological solutions. The main technology used by the broker is SWFX – Swiss FX Marketplace, Dukascopy’s ECN proprietary technological solution, and registered trademark.

The bank is based in Switzerland and has been operating since 2004. Dukascopy brand name fully owns Dukascopy Europe IBS AS a European licensed brokerage company based in Riga and the SIA Dukascopy Payments licensed payment and e-money company, a Type-1 licensed broker located in Tokyo operated as Dukascopy Japan.

- In addition to Geneva Headquarters, the bank operates offices in Zürich, Riga, Kyiv, Moscow, Kuala Lumpur, Hong Kong, and Dubai.

Dukascopy Pros and Cons

Dukascopy is a highly secure and trusted broker. It is a regulated Swiss Bank with an excellent reputation. The account opening is easy, there are numerous opportunities, an ECN account, access to high leverage, a great range of tools, and user-friendly platforms. Education, support, and funding methods are also outstanding.

- In addition, apart from the trading services, Dukascopy Bank provides highly competitive conditions for currency exchange through current accounts that offer e-banking facilities, credit cards, and an increasing range of banking products.

This means traders can receive competitive solutions and enjoy banking services from the leading Swiss bank.

For the Cons, proposals vary according to the entity, and higher deposits might suit more advanced traders.

| Advantages | Disadvantages |

|---|

| Strong establishment with regulated headquarter in Switzerland | Conditions vary based on the entity |

| Worldwide coverage | |

| Forex and CFD instruments, Cryptocurrencies, and more | |

| Wide range of trading platforms | |

| Competitive trading conditions | |

| Wealth management opportunity | |

| ECN technological solution | |

| Good quality educational materials, and excellent research | |

| Quality customer support | |

Dukascopy Features

Dukascopy is a Swiss-based brokerage and banking institution known for its deep liquidity, competitive conditions, and innovative financial services. Below are the key points to consider when choosing Dukascopy as your broker.

Dukascopy Features in 10 Points

| 🏢 Regulation | FINMA, FCMC, JFSA |

| 🗺️ Account Types | JForex, MT4, MT5, Binary Options, Managed Accounts |

| 🖥 Trading Platforms | JForex, MT4, MT5, Binary Trader |

| 📉 Trading Instruments | Forex, Metals, Energy, CFDs on Cryptocurrencies, Indices, Bonds, Shares, ETFs, Binary Options, etc. |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.28 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, CHF, EUR, GBP, AUD, CAD |

| 📚 Trading Education | Video Tutorials, Forex Trading Guide, Dukascopy Academy |

| ☎ Customer Support | 24/7 |

Who is Dukascopy For?

Dukascopy is ideal for traders and investors seeking a secure, technology-driven environment with deep liquidity and competitive spreads. With its multi-currency banking solutions and cryptocurrency offerings, it also appeals to those looking for integrated financial services. Based on financial expert opinions Dukascopy is Good for:

- Beginners

- Advanced traders

- Investors and Stock Trading

- Reliable Swiss Broker

- Broker Banking

- Traders who prefer the MT4 and MT5 platforms

- Currency and CFD trading

- Variety of strategies

- Algorithmic and automated trading

- Supportive customer support

- Good research materials

Dukascopy Summary

Concluding the Dukascopy review, we admit that the bank brings a reliable and competitive offer to the market while including truly competitive spreads, along with general pricing and various programs.

The platform solution, optimization of the strategy, and automated capabilities create a powerful technical scope. Traders of any level will find their benefit in the company. There is great support not only from its multiple teams around the world but by plenty of research sources, diverse learning, and analytical data.

55Brokers Professional Insights

Dukascopy stands out as a Swiss-regulated broker offering institutional-grade conditions, deep liquidity, and direct market access through its ECN model. Besides to very well established operation, there are numerous additional benefits are for Dukascopy traders inlcuding avaalability to open Dukascopy Bank account and follow with investments too. So all in all, our opinion about Dukascopy is highly good, it is great choice for traders looking for real safe Broker, along with good conditions and extra benefits. As a standout feature is its multi-currency banking services, which allow clients to manage funds across different currencies within a Swiss banking framework.

Its proprietary JForex platform is a key advantage that we highly reccomend to use, with advanced charting tools, clean design and access, algorithmic capabilities, and seamless API integration, making it a top choice for professional traders and quants. The broker also supports MetaTrader 4 and 5, catering to those who prefer a more traditional trading experience, which is a good plus too.

Additionally, Dukascopy offers cryptocurrency trading and staking, expanding its appeal to digital asset investors and ooffering high leverage. The broker’s transparency, competitive spreads, and advanced technology make it a strong competitor for serious traders looking for a secure and professional environment, which might suit many traders, the only gap is that not every trader from all the corner of the world will be able to open account, so w advise to check this point first.

Consider Trading with Dukascopy If:

| Dukascopy is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- European traders.

- Secure environment.

- Offering popular instruments.

- Providing competitive fees and spreads.

- ECN trading.

- Good support and research materials.

- Providing PAMM solution.

- Offering Copy Trading.

- Providing services worldwide.

- Professional traders and institutions.

- Who prefer higher leverage up to 1:200.

- Access to robust proprietary and industry-known platforms.

- Providing diverse strategies.

|

Avoid Trading with Dukascopy If:

| Dukascopy might not be the best for: | - Looking for cTrader platform.

- Traders who prefer simplicity.

- Looking for MAM trading. |

Regulation and Security Measures

Score – 4.8/5

Dukascopy Regulatory Overview

Dukascopy is a highly regulated broker, ensuring strong financial security and compliance with international standards. It is primarily regulated by the Swiss Financial Market Supervisory Authority (FINMA) as a bank and securities dealer, offering clients the security of Swiss banking laws.

In addition, its European subsidiary, Dukascopy Europe IBS AS, is licensed by the FCMC of Latvia, allowing it to serve clients within the European Economic Area. The broker also extends its reach to the Asian market through Dukascopy Japan K.K., which is authorized and regulated by the Japan Financial Services Agency (JFSA).

These multiple regulatory licenses reinforce Dukascopy’s commitment to transparency, investor protection, and strict compliance with global financial standards.

How Safe is Trading with Dukascopy?

Trading with Dukascopy is considered highly safe due to its strong regulatory framework, Swiss banking license, and strict compliance measures considered one of the sharpest worldwide, so Dukascopy is one of the most well regulated Brokers along with another tight overseeing by Japan authoritites. As a FINMA-regulated Swiss bank, Dukascopy adheres to stringent capital requirements, risk management protocols, and client protection policies.

Client funds are held in segregated accounts, reducing counterparty risk, and eligible deposits are protected under Swiss banking deposit insurance up to CHF 100,000. Additionally, Dukascopy’s European and Japanese entities are regulated by FCMC and JFSA, ensuring adherence to high financial security standards in those regions.

The broker also employs advanced security features, including two-factor authentication and encrypted transactions, to safeguard client data and funds. While no broker is entirely risk-free, Dukascopy’s strong regulatory oversight and banking-grade security make it a trusted choice for traders seeking a secure and transparent environment.

Consistency and Clarity

Dukascopy has built a strong reputation in the industry, backed by its Swiss banking license, regulatory compliance, and advanced technology provided along the years and high ranking of customer satisfaction.

Established in 2004, the broker has gained recognition for its transparent ECN model, deep liquidity, and professional-grade conditions. Trader reviews highlight its tight spreads, reliable execution, and security. However, some users mention that the JForex platform requires time to master due to its advanced features, and the account verification process can be complex.

Dukascopy has received multiple industry awards, including recognition for its platforms, banking services, and innovative financial technology. Beyond trading, the broker is active in social engagement, sponsoring various events and maintaining a strong online presence through financial news updates, contests, and educational initiatives.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Dukascopy?

Dukascopy offers a variety of account types tailored to meet the diverse needs of traders. Clients can choose from accounts compatible with the JForex, MT4, and MT5 platforms, each providing unique features and access to a range of instruments.

For those interested in binary options, Dukascopy provides specialized accounts through a dedicated platform. Additionally, the broker offers Managed Accounts, including PAMM solutions, catering to investors seeking professional portfolio management. Dukascopy also provides demo accounts for all platforms, allowing traders to practice and test strategies in a risk-free environment. Moreover, it offers swap-free accounts, designed for traders who require Islamic-compliant conditions.

However, the fees may vary depending on the chosen platform and account type, with MT4/MT5 accounts typically incurring higher fees compared to JForex accounts.

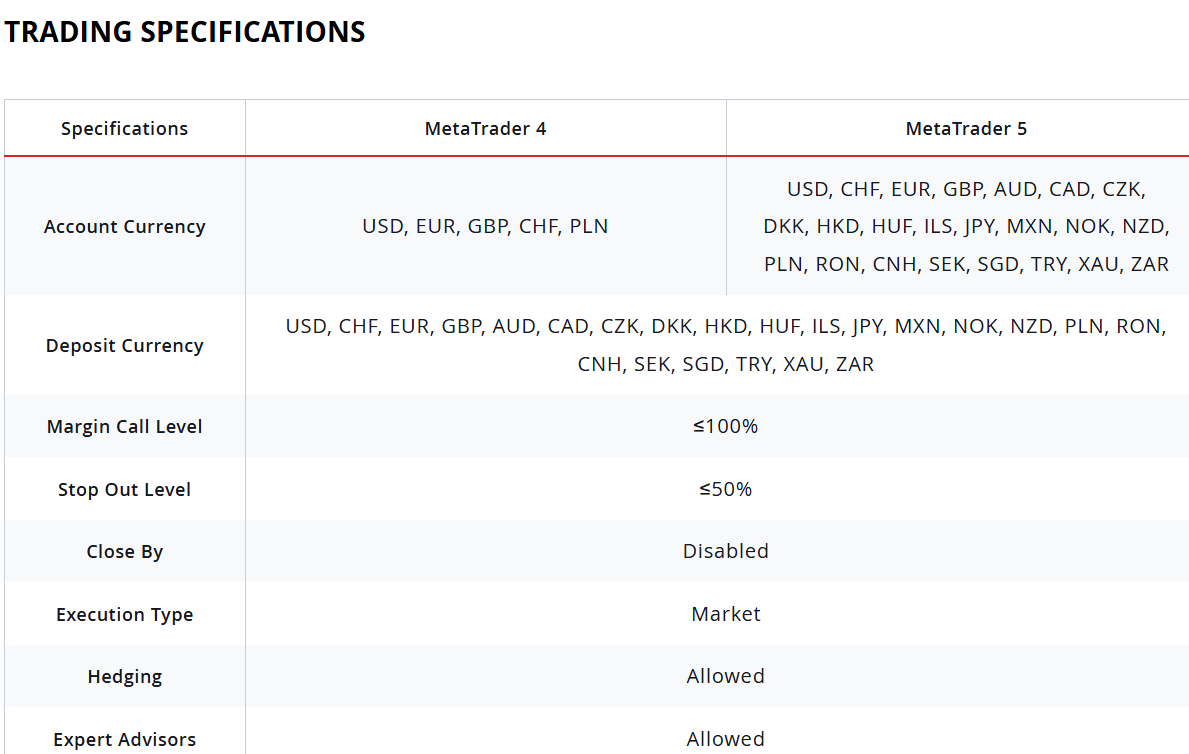

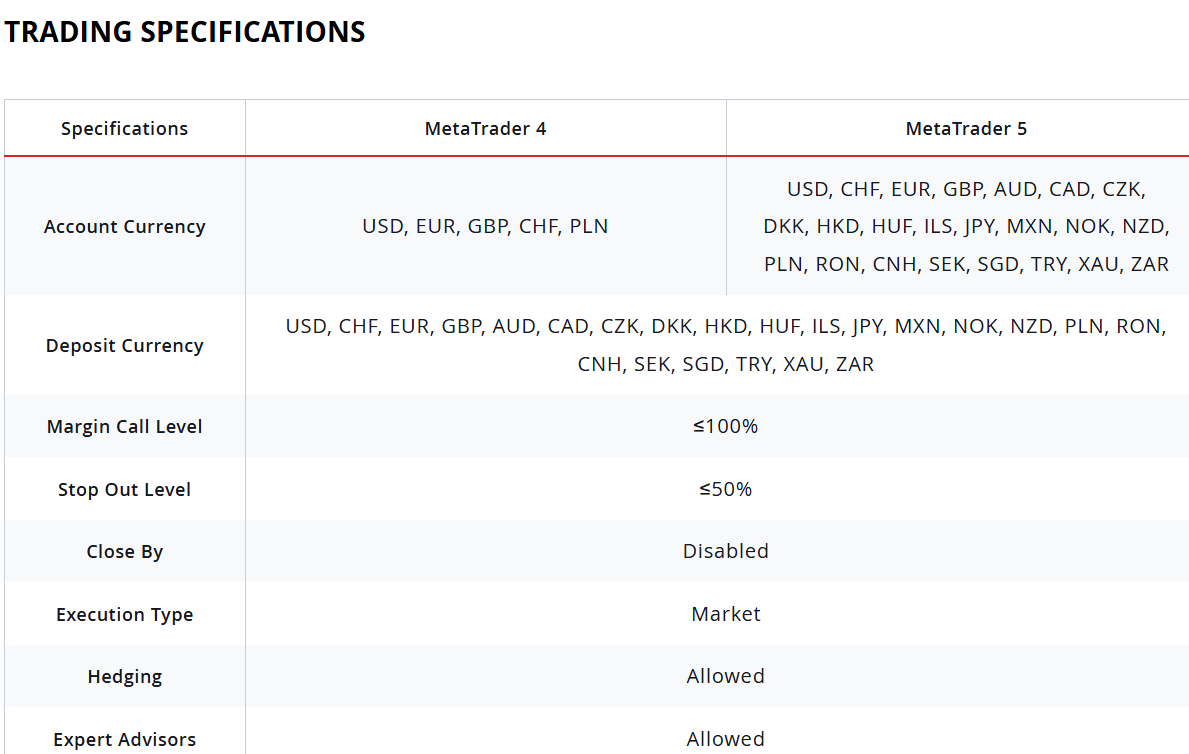

MT4 and MT5 Accounts

Dukascopy offers MetaTrader 4 and MetaTrader 5 accounts with a minimum deposit requirement of $100. Spreads for these accounts start from 0.1 pips, providing competitive pricing for traders.

In addition to standard volume-based commissions, an extra fee of $0.5 per 1 MT4/MT5 lot (equivalent to $5 per $1 million traded) is applied. For MT4 accounts, the volume commission is calculated for a round-turn transaction and is charged only on opening trades, while for MT5 accounts, commissions are charged separately upon opening and closing each trade.

Leverage of up to 1:100 is available for both MT4 and MT5 accounts.

JForex Account

Dukascopy’s JForex account is designed for traders seeking advanced tools and direct market access. The minimum deposit requirement for a JForex account is $100.

Spreads are variable, starting from 0.1 pips, depending on market conditions. Commissions are volume-based and start at $7.00 per 1.0 standard round lot, with potential reductions based on trading volume and account equity. The maximum leverage offered is 1:200.

Regions Where Dukascopy is Restricted

Dukascopy maintains a list of countries and regions where it does not offer services, primarily due to regulatory restrictions and international sanctions. As of the latest information, residents of the following countries are restricted from opening accounts with Dukascopy:

- UK

- Belgium

- Israel

- Russian

- Turkey

- Canada

Cost Structure and Fees

Score – 4.5/5

Dukascopy Brokerage Fees

Dukascopy’s pricing and fee structure vary depending on the instruments you wish to trade, as the broker categorizes fees into Forex, CFDs, Binary Options, and Cryptocurrencies, each with its structure.

Generally, fees are incorporated into the total commission, known as the Volume Commission, which is determined by factors such as Net Deposit, Account Equity, and Trading Volume.

Another cost to consider is the rollover or overnight fee, which differs based on Regular, Advanced, and Premium rollover policies, each offering different rates to accommodate higher trading turnover, resulting in better conditions for active traders.

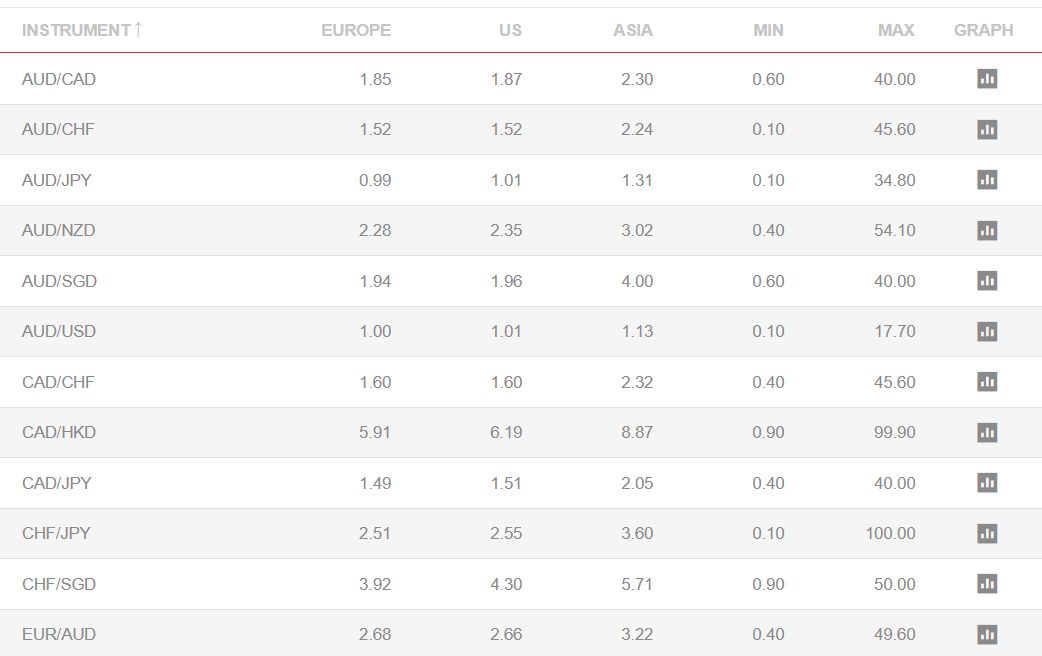

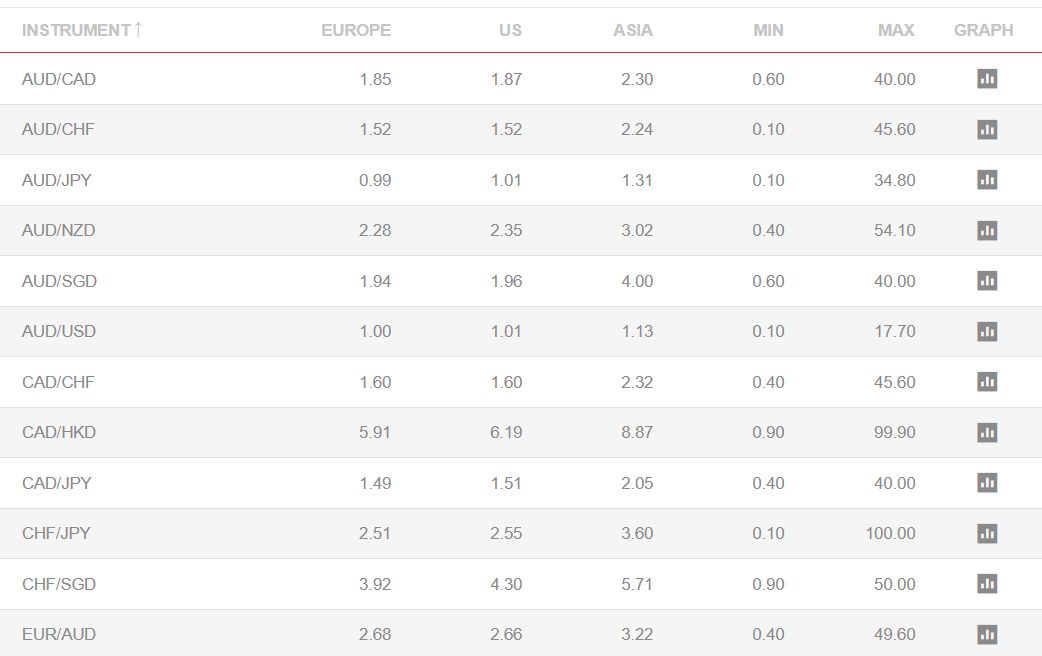

Dukascopy offers competitive spreads across various instruments. Spreads can vary depending on market conditions, liquidity, and trading sessions.

For instance, during the European and U.S. sessions, the average spread for EUR/USD is 0.28 pips, while in the Asian session, it tends to widen to about 0.41 pips. These variable spreads reflect the broker’s ECN pricing model, which aggregates liquidity from multiple providers to offer tight bid-ask differentials.

Dukascopy’s commission structure is transparent and adaptable to various volumes and account balances. The Volume Commission is calculated based on factors such as Net Deposit, Account Equity, and Traded Volume.

For instance, if your account equity is less than $5,000, the commission rate is $35 per $1 million traded. As your equity increases, the commission rate decreases, with a minimum of $10 per $1 million traded for accounts with equity of $10 million or more.

Additionally, Dukascopy offers a Volume Trading Commission Discount Program, allowing clients to receive up to a 20% discount on volume trading commissions by meeting specific volume criteria within a year. This program is designed to reward active traders with more favorable commission rates.

- Dukascopy Rollover / Swaps

Dukascopy’s rollover (swap) rates vary depending on the instrument and market conditions. These rates are based on the interest rate differential between the two currencies involved in a trade, as well as the broker’s costs.

Rollover rates are applied for positions held overnight, and traders are either credited or debited depending on the direction of their trade and the applicable interest rates. Dukascopy uses a Premium, Advanced, and Regular rollover policy with varying rates for each category, catering to different needs.

- Dukascopy Additional Fees

Dukascopy implements an inactivity fee for accounts that remain dormant for extended periods. If no trading activity occurs for 180 consecutive calendar days after the initial 180-day grace period following account opening, a maintenance fee of up to €50 is charged.

This fee is applied every 180 days of inactivity and is capped at €50 per client, regardless of the number of accounts.

How Competitive Are Dukascopy Fees?

The broker offers competitive fees across various asset classes, making it an appealing choice for active traders. The fee structure is transparent, with charges based on volume, account type, and instrument selection.

As an ECN broker, Dukascopy provides tight spreads and a commission-based model. The broker’s use of variable spreads allows for better pricing during periods of higher liquidity, especially during key market hours.

For those seeking more advanced options, the commission rates are generally low, and the broker offers potential discounts based on trading activity. Overall, Dukascopy’s fees are in line with industry standards, catering to both retail traders and professional investors.

| Asset/ Pair | Dukascopy Spread | HYCM Spread | Tickmill Spread |

|---|

| EUR USD Spread | 0.28 pips | 1 pip | 0.1 pips |

| Crude Oil WTI Spread | 4.41 | 2 | 0.04 |

| Gold Spread | 52.60 | 20 | 0.09 |

| BTC USD Spread | 77.73 | 90 | 24.9 |

Trading Platforms and Tools

Score – 4.7/5

Dukascopy offers a range of robust platforms and tools designed to meet the needs of various traders. The JForex platform is the broker’s flagship, providing advanced charting tools, algorithmic capabilities, and high-speed execution.

For those seeking more popular platforms, MT4 and MT5 are also available, offering a user-friendly interface and compatibility with a wide range of strategies and expert advisors. In addition, Dukascopy offers Binary Trader, a specialized platform for trading binary options, providing a simple yet effective way to engage with these high-risk, high-reward instruments.

Each platform is equipped with comprehensive charting features, market analysis tools, and a seamless experience, ensuring that traders can trade efficiently across different asset classes.

Trading Platform Comparison to Other Brokers:

| Platforms | Dukascopy Platforms | HYCM Platforms | Tickmill Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Dukascopy Web Platform

The JForex Web Platform is a robust and versatile online solution offered by Dukascopy, allowing traders to access their accounts and execute trades directly from a browser.

This platform provides many powerful features, including advanced charting tools, real-time market analysis, and the ability to implement algorithmic trading using the JForex SDK.

With a highly intuitive interface, the web platform offers seamless execution and customizable layouts. It provides traders with fast and reliable access to the markets without the need for downloads or installations, making it a convenient choice for those who prefer a browser-based solution.

The JForex Web platform ensures that traders have the flexibility and functionality they need, whether for manual trading or for utilizing automated strategies in a highly responsive environment.

Main Insights from Testing

Testing the JForex Platform reveals a highly efficient and feature-rich experience for traders. The platform offers smooth navigation, fast trade execution, and comprehensive charting tools that can be customized to individual preferences.

It stands out with its seamless integration of algorithmic trading and automated strategies. However, it may take some time to fully master the advanced features, especially for those new to Dukascopy’s ecosystem. Overall, the platform delivers solid performance, reliability, and a user-friendly interface, ensuring a smooth experience across various market conditions.

Dukascopy Desktop MetaTrader 4 Platform

The desktop MetaTrader 4 platform provides traders with direct access to the SWFX Swiss Marketplace, ensuring fast execution and competitive pricing for trades.

MT4 supports the use of Expert Advisors (EAs) in MQL4, allowing traders to automate their strategies for more efficient trading. With leverage up to 1:100, it offers flexibility for traders to manage their positions. The platform also includes Dukascopy’s most popular Currency pairs, giving traders access to high-liquidity markets.

Over 50 built-in tools and indicators allow for detailed technical analysis, while 9 timeframes provide comprehensive market insights for traders to fine-tune their strategies.

Dukascopy Desktop MetaTrader 5 Platform

The MetaTrader 5 is an enhanced version of the popular MT4 platform, offering additional features for more advanced trading. MT5 supports more order types and additional timeframes, offering traders greater flexibility in managing their positions.

It provides access to a wider variety of financial instruments, allowing for a more diversified portfolio. The platform includes improved charting tools, with advanced technical analysis features, built-in indicators, and multiple charting windows for in-depth market analysis.

Dukascopy Binary Trader

Binary Trader is a specialized platform designed for binary options, offering a straightforward and user-friendly experience for those seeking high-risk, high-reward opportunities. It allows traders to speculate on the price movements of various assets, with fixed payouts based on whether the price will rise or fall within a set time frame.

The platform provides real-time charts, customizable expiration times, and a simple interface, making it easy to place trades. While binary options carry inherent risks, Dukascopy’s Binary Trader platform offers a seamless and efficient way for traders to engage with these instruments. It caters to traders who prefer a more simplified, yet strategic approach to trading, with the potential for high returns.

Dukascopy MobileTrader App

The Mobile App offers dedicated mobile versions for each of its platforms, providing traders with flexibility and convenience. The JForex Mobile App allows users to access their JForex accounts, offering real-time market data, charting tools, and the ability to execute trades on the go.

The MT4 Mobile App provides a mobile version of the popular MetaTrader 4 platform, supporting advanced charting, order management, and the use of EAs for automated trading. For traders using MetaTrader 5, the MT5 Mobile App offers similar functionality, with enhanced features like more timeframes, additional order types, and the ability to trade a wider range of instruments.

Each app is optimized for iOS and Android devices, ensuring seamless trading from anywhere with easy access to Dukascopy’s instruments range.

Trading Instruments

Score – 4.5/5

What Can You Trade on Dukascopy’s Platform?

On Dukascopy’s platform, traders can access over 1200+ instruments, including Currency pairs (major, minor, and exotic currencies), precious metals such as gold and silver, energy commodities like oil and natural gas, CFDs on cryptocurrencies like Bitcoin, Ethereum, and others, indices that track global stock markets, government, and corporate bonds, shares of publicly traded companies, ETFs for diversified portfolios, and binary options for high-risk, high-reward strategies.

However, for binary options, it is important to fully understand the applied conditions and the risks involved, as this instrument may be unavailable to certain individuals.

Main Insights from Exploring Dukascopy’s Tradable Assets

Exploring Dukascopy’s tradable assets reveals a broad spectrum of opportunities across various markets. The selection caters to a variety of strategies, from short-term speculation to long-term investment, as well as allows for portfolio diversification and the flexibility to implement different strategies across global markets.

Whether you are looking to trade high-risk, high-reward instruments like binary options or prefer more stable assets, Dukascopy provides ample opportunities to match every trader’s preferences and risk tolerance.

Leverage Options at Dukascopy

Dukascopy multiplier offers a unique opportunity to access higher ratios, yet defined by the instrument you use since it is a Swiss Broker that still allows higher leverage ratios:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- However, the broker allows a leverage level up to 1:200 for Forex instruments.

Leverage levels that allow trading through multiple amounts of the account balance open vast opportunities yet may hide some higher risks of losing funds too. Therefore, traders should carefully learn how to use it smartly.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Dukascopy

Dukascopy offers numerous payment methods, which is a significant advantage, however, traders should check the availability of each method based on the broker’s regulations.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller, and more

Dukascopy Minimum Deposit

The minimum deposit required to open an account with Dukascopy depends on the account type and the platform used. For standard JForex, MT4, and MT5 accounts, the minimum deposit is typically around $100, making it accessible for most traders.

However, for managed accounts or binary options, the minimum deposit might be higher, depending on the specific terms of the account.

Withdrawal Options at Dukascopy

As Dukascopy serves its business as a leading Swiss bank, the traders are also able to enjoy the benefits of banking while all payments can be made through Dukascopy Bank SA.

In another way, for incoming transfers, Dukascopy covers all applicable fees, yet the withdrawal of funds for outgoing transfers or withdrawal may incur charges that depend on the currency.

E.g. the USD account will require a $50 fee for SEPA payments or $10 for payments in Bitcoins to crypto-wallets, so be sure to verify those applicable conditions.

Customer Support and Responsiveness

Score – 4.6/5

Testing Dukascopy’s Customer Support

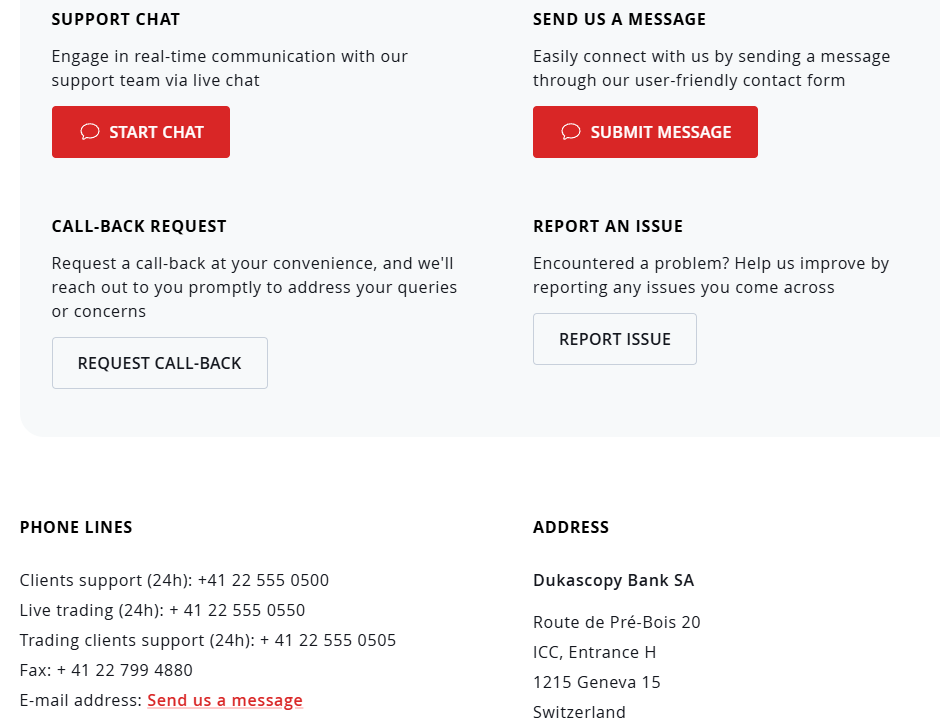

Dukascopy’s customer support is known for being efficient and responsive, offering 24/7 assistance through multiple channels, including live chat, email, and phone support. The platform assists in multiple languages, making it accessible to a broad range of international clients.

The customer service team is knowledgeable and able to assist with a variety of queries, from technical platform issues to account-related inquiries. For more complex or account-specific matters, traders can also contact their personal account managers. However, response times may vary depending on the channel and the complexity of the issue.

Contacts Dukascopy

Dukascopy offers multiple ways for clients to get in touch with their support team. For general client support, you can reach them 24/7 at +41 22 555 0500.

For assistance with live trading, the dedicated line is +41 22 555 0550, available around the clock. Traders seeking help with specific trading-related queries can contact client support at +41 22 555 0505, also available 24/7.

These direct phone numbers ensure clients can quickly access the assistance they need, no matter the time zone. Additionally, the broker also offers support via live chat and email for those who prefer alternative methods of communication.

Research and Education

Score – 4.7/5

Research Tools Dukascopy

Dukascopy offers a wide range of research tools and market analysis to help traders make informed decisions.

- On the website, users can access real-time market news, economic calendars, market analysis, and price alerts, which provide valuable insights into current market conditions.

- Additionally, traders can access valuable tools such as Online Charts, the Currency Index, CoT Charts, and the SWFX Sentiment Index, which offer insights into market trends and trader sentiment.

- Other useful features include Pivot Point Levels, Market Watch, Daily Highs/Lows, and Average Spreads, allowing traders to track market movements and volatility.

- Also, FX Market Signals, and Movers & Shakers Forex provide timely information on key market drivers, while Calendars and Technical Indicators help with strategy development and decision-making.

- On the platforms, traders can take advantage of a range of advanced charting tools, including technical indicators, drawing tools, and price alerts.

- For those interested in deeper market analysis, Dukascopy also provides professional research reports and analytics, offering clients essential insights to guide their strategies.

Education

Dukascopy offers a variety of educational resources to help traders develop their skills and enhance their market knowledge.

The broker provides comprehensive Video Tutorials that cover everything from the basics of trading to more advanced strategies. The Forex Trading Guide is another valuable resource, offering in-depth insights into currency trading, market analysis, and strategies.

For more structured learning, traders can access the Dukascopy Academy, available on YouTube, which provides a range of educational videos aimed at traders of all levels.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Dukascopy

While Dukascopy is primarily known for its Currency and CFD services, it also offers a few investment options for traders seeking alternative ways to grow their portfolios. The broker provides a PAMM solution (Percentage Allocation Management Module), which allows investors to allocate funds to professional traders who manage their portfolios for a share of the profits.

Additionally, Copy Trading is available, enabling traders to automatically copy the trades of successful investors. These investment solutions cater to those looking to benefit from market opportunities without the need to actively manage their trades, making them ideal for investors looking for a more hands-off approach to investing.

Account Opening

Score – 4.4/5

How to Open Dukascopy Demo Account?

Opening a Dukascopy Demo Account is a straightforward process that allows traders to practice their skills without risking real money. To start, visit the Dukascopy website and navigate to the account registration page. Select the option for a Demo Account and fill in the required personal information, such as your name, email address, and preferred account settings.

Once registered, you will receive your demo account credentials to access platforms like JForex, MT4, or MT5. The demo account comes with virtual funds, enabling you to explore market conditions, test strategies, and familiarize yourself with Dukascopy’s features in a risk-free environment.

How to Open Dukascopy Live Account?

Opening an account with Dukascopy is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on “Open Live Account.”

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.5/5

Dukascopy offers a few other features to enhance the experience mainly provided on the platform :

- These include the JForex Strategy Builder, which allows traders to create, backtest, and optimize automated trading strategies without needing programming skills.

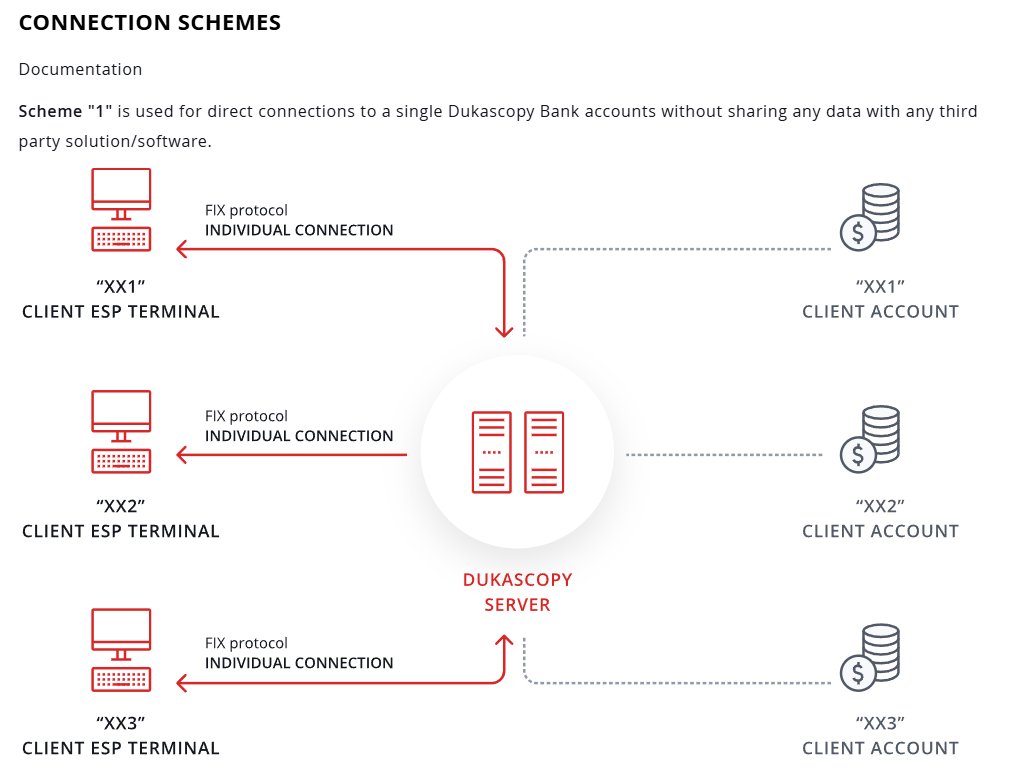

- The Dukascopy Connect API provides a connection for algorithmic trading, enabling users to develop custom trading solutions and integrate third-party applications.

- In addition, traders may benefit from opening Banking account with Dukascopy Bank and use its robust services highly ranked worldwide. Being on of the safest option for any money transactions Dukascopy Banking also is great solution to transfer money to or from the account and follow with investment plans.

Dukascopy Compared to Other Brokers

Dukascopy stands out in several ways when compared to its competitors in the industry. It offers a solid range of platforms including JForex, MT4, and MT5, catering to both beginner and experienced traders with a focus on sophisticated tools and a variety of account types, such as commission-based and spread-based accounts.

Additionally, Dukascopy is heavily regulated by top-tier authorities such as FINMA, FCMC, and JFSA, ensuring a high level of security and compliance.

However, while Dukascopy provides a good range of educational and research resources, it may not be as beginner-friendly as some of its competitors. Some brokers like OANDA and HYCM offer lower minimum deposit requirements and a greater focus on beginner education and user-friendly platforms. Additionally, while Dukascopy offers competitive spreads, some competitors such as Spreadex and CMC Markets provide access to more instruments and a broader range of platforms, which might appeal to traders looking for diverse options.

Overall, Dukascopy offers a strong package with low fees, reliable customer support, and a good selection of instruments, but it may be better suited for more experienced traders who appreciate advanced tools and a robust regulatory framework. For those seeking an entry-level experience with a variety of assets and platforms, brokers like Spreadex and CMC Markets may provide more appealing options.

| Parameter |

Dukascopy |

Spreadex |

HYCM |

OANDA |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.28 pips |

Average 0.6 pips |

Average 1 pip |

Average 1 pip |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

$5 per $1 million traded in MT4/MT5 Accounts |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.1 pips + $4 |

0.1 pips + $5 commission per 100,000 traded |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

JForex, MT4, MT5, Binary Trader |

Spreadex Web Platform, TradingView |

MT4, MT5, HYCM Trader |

OANDA Web Platform, MT4, MT5, TradingView, fxTrade |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

1200+ instruments |

10,000+ instruments |

300+ instruments |

100+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FINMA, FCMC, JFSA |

FCA |

FCA, DFSA |

CFTC, NFA, FCA, ASIC, IIROC, MFSA, MAS, FFAJ, BVI FSC |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$20 |

$0 |

$50 |

$0 |

$0 |

Full Review of Broker Dukascopy

Dukascopy is a well-established Swiss brokerage offering comprehensive experience with a strong regulatory framework under FINMA. It provides access to over 1,200 instruments, including Forex, metals, energy, indices, shares, ETFs, bonds, and CFDs on cryptocurrencies.

Traders can choose from multiple platforms, including JForex, MT4, MT5, and Binary Trader, each catering to different styles and strategies. Dukascopy is known for its competitive pricing, offering low spreads and commission-based accounts. The broker also supports investment solutions like PAMM accounts and Copy Trading.

Additionally, it provides a wide range of research tools, advanced charting, and automated trading capabilities. The educational resources include video tutorials, a Forex guide, and the Dukascopy Academy YouTube channel. While the broker is best suited for experienced traders due to its advanced features, it remains a solid choice for those seeking a secure and professional environment.

Share this article [addtoany url="https://55brokers.com/dukascopy-review/" title="Dukascopy"]

THIEFS & SCAMMERS, STAY AWAY!

Week ago I got notified from Dukascopy that my card is suspended due to decision of Corner Bank to stop issuance and support of all client’s cards issued in frame of partnership with Dukascopy. They also stated that my money is safe my account at Dukascopy Bank. What a lie! Money is cleared from my Dukascopy card on 24th March, it was not transferred to my Dukascopy account, I do not have any access to it, it simply disappeared and support is not replying at all.