- What is eToro?

- eToro Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

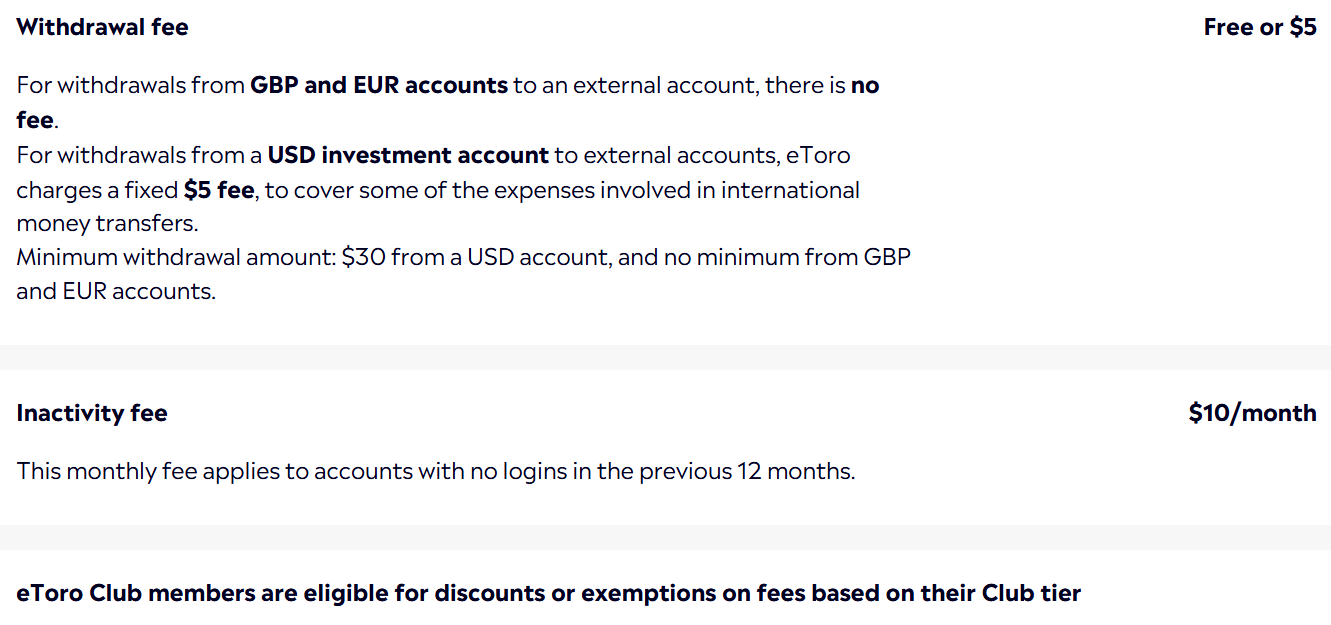

- Cost Structure and Fees

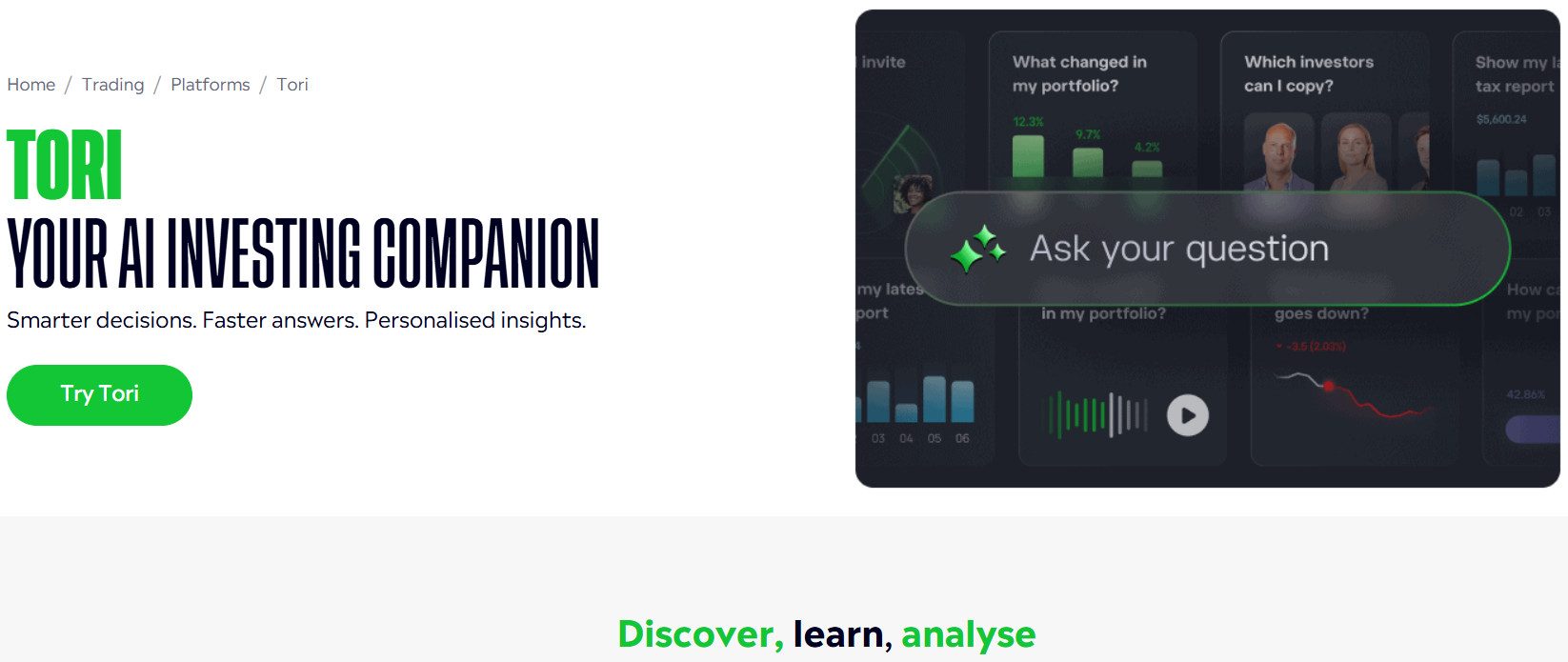

- Trading Platforms and Tools

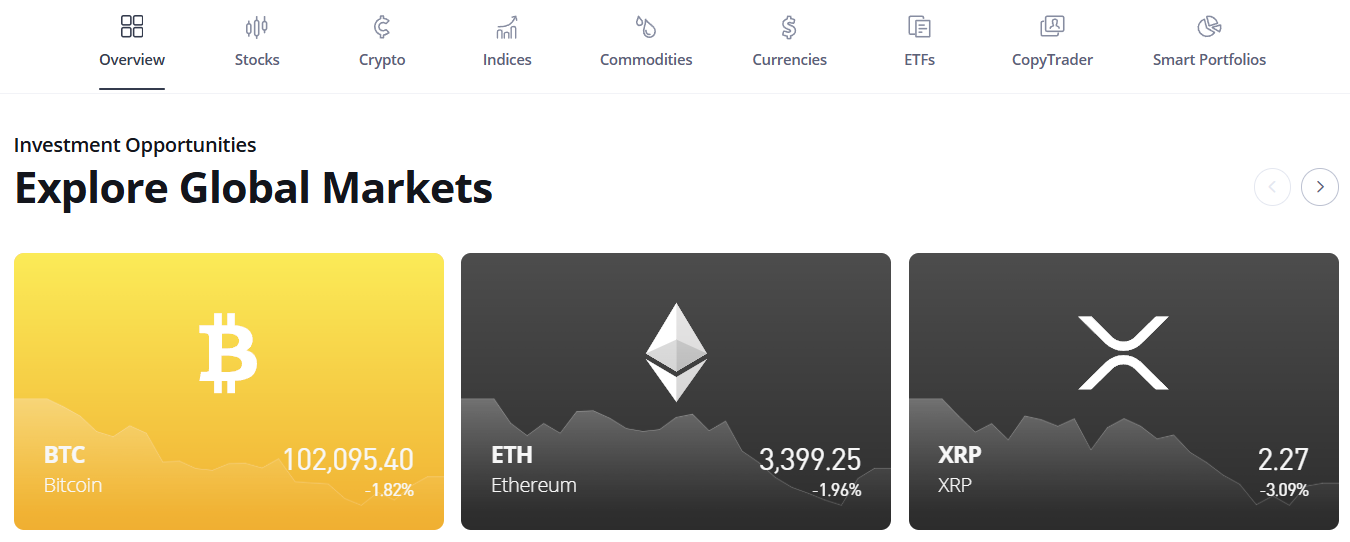

- Trading Instruments

- Deposit and Withdrawal Options

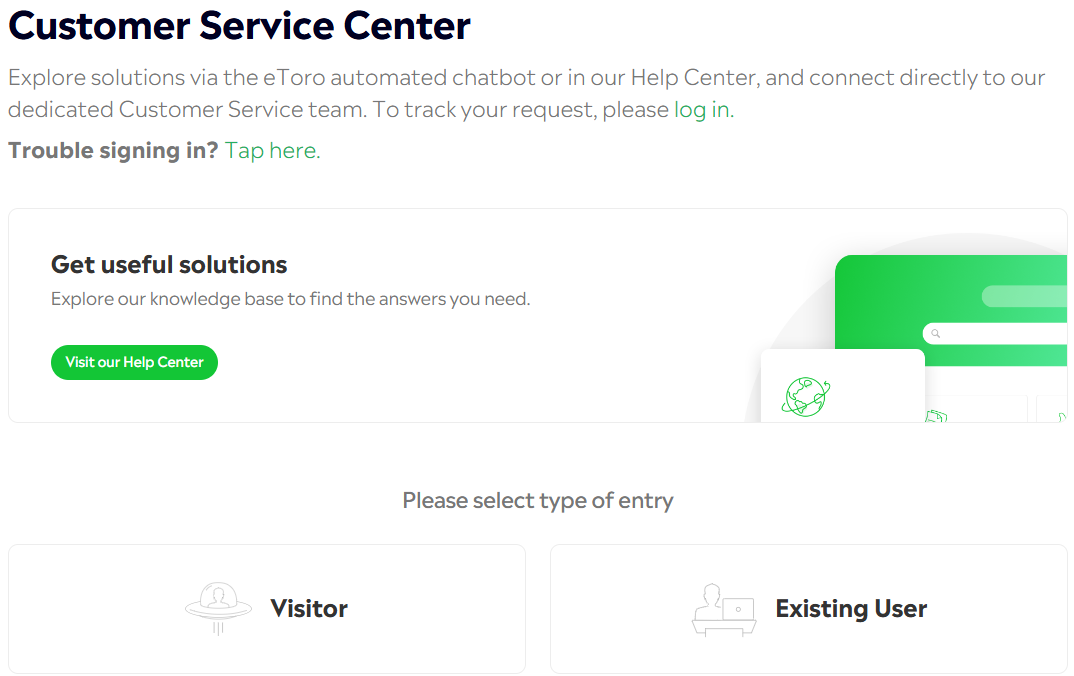

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- eToro Compared to Other Brokers

- Full Review of Broker eToro

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is eToro?

eToro is one of the world’s leading Forex Brokers and the largest social trading network, serving more than 40 million users across 75 countries. eToro was founded in 2006 by three partners who aimed to create a financial platform suitable for traders of all levels, offering easy and convenient tools.

The broker specializes mainly in CFD asset trading and operates as a social trading community. It is also a fully regulated broker, licensed by reputable authorities such as the FCA in the UK and ASIC in Australia.

- Since its launch, eToro has gone on a path of innovation, creation, and introduction of features that moved investment technology and online trading to a new level.

The brokerage firm uses modern technology to execute orders and provide live quotes from world exchanges, enabling a trading solution for international traders, despite its size and experience. Eventually, eToro platform, with its social trading capabilities, acts as a market maker and profits from the spread charges.

eToro Pros and Cons

eToro has a long history of operation and is a heavily regulated Broker with an excellent reputation. The account opening is easy, the platform is seamless and easy to use with numerous instruments available, also eToro is number one for copy trading for the number of traders and available portfolios.

For the Cons, the platform is rather basic, spreads for some instruments are high, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on entity |

| Good reputation | No 24/7 support |

| Fully audited financial services | |

| Competitive trading conditions | |

| Great technical solutions and tools | |

| Negative balance protection | |

| Quality customer support with live chat and fast response | |

eToro Features

eToro is a good broker with safe and very favorable conditions. The broker offers a range of financial services designed for all levels of users with low initial deposit amounts. Here are the main features that the broker offers:

eToro Features in 10 Points

| 🏢 Regulation | FCA, ASIC, CySEC, FSA, FSRA |

| 🗺️ Account Types | Personal, Professional, Corporate |

| 🖥 Trading Platforms | Proprietary web-based software |

| 📉 Trading Instruments | Stocks, CFDs, Forex, Commodities, Portfolios, Metals, Cryptocurrencies, ETFs |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | eToro Academy, News and Analysis |

| ☎ Customer Support | 24/5 |

Who is eToro For?

eToro is ideal for users who want a simple, social, and interactive way to access global financial markets. Whether you are a beginner looking to learn from experienced investors or a professional seeking a platform to share and monetize your strategies, the firm offers tools for both. Based on our findings, eToro is Good for:

- UK clients

- Social trading

- Beginners

- Advanced traders

- Investment Portfolios

- Currency and CFD trading

- European traders

- International trading

- Variety of strategies

- Supportive customer support

- Good learning materials

eToro Summary

Overall, eToro is a safe broker with reliable solutions. The firm offers advanced strategies and a distinctive approach to the markets, attracting users who have built a reliable and respected reputation.

However, eToro does not provide flexibility in terms of platforms or any other platforms like MT4 or cTrader. The broker uses its own technology only all based on Web Version; however, its great Social Trading and Copy Trading capabilities are truly outstanding and made eToro the number one Social Trading Broker worldwide, with one of the best Copy Trading Portfolios selection overall.

Also, currency pairs and some provided solutions are other key advantages on its positive side. The broker offers competitive costs and good educational materials, and research suitable for users of different levels.

55Brokers Professional Insights

eToro stands out as one of the most solid and popular Brokers for years it has been operating. We mark it as innovative brokers in the financial industry, combining traditional investing with the power of social networking and is among top Brokers being pioneers for copy and social trading.

What truly sets the broker apart is its Copy Trading feature, which allows users to automatically replicate the trades of top-performing investors, making it especially appealing to beginners. While eToro been one of the Brokers who stand at the beginning of this technology, the range of portfolios and the system itself is very solid and well developed, there are thousands of accounts to choose from, follow with numerous parameters, which is very useful.

The platform offers access to a wide range of assets overall, which is good for diversification yet all mainly based on CFDs, stocks, cryptocurrencies, ETFs, indices, and commodities, all within a single, user-friendly interface. However, there is eToro crypto exchange that operates under US entity so there is direct access to cryptotrading established, yet the conditions and offerings there is very much different; we advise checking it well.

In addition, we mark eToro’s transparent fee structure, strong regulatory framework under authorities, and its commitment to security and innovation make it a trusted choice for millions of clients worldwide. The only point is that the technology provided by broker is its own establishments, in case you look for popular third party platforms that might not be your broker.

Consider Trading with eToro If:

| eToro is an excellent Broker for: | - Need broker with great reputation and Top-Tier licenses.

- Selecting broker with popular instruments.

- Get good learning materials.

- Competitive conditions.

- Low fees and spreads

- Providing services worldwide.

- Need broker offering copy trading features.

- Beginner or advanced traders.

- Supports a variety of strategies.

- Need broker with fast execution.

- Looking for quality customer support with live chat and fast response.

- Need a broker with a variety of funding methods.

- Offering a variety of account types.

- Need good research tools.

|

Avoid Trading with eToro If:

| eToro might not be the best for: | - Who prefer industry-known platforms.

- Looking for 24/7 customer support.

- PAMM and MAM accounts are absent.

- Looking for broker with access to VPS Hosting. |

Regulation and Security Measures

Score – 4.7/5

eToro Regulatory Overview

eToro operates under a strong and transparent regulatory framework, ensuring a high level of trust and security for its global client base. The broker is authorized and regulated by several top-tier financial authorities, including the Financial Conduct Authority in the United Kingdom, the Australian Securities and Investments Commission in Australia, and the Cyprus Securities and Exchange Commission in the European Union.

Additionally, eToro is licensed by the Financial Services Authority in Seychelles and the Financial Services Regulatory Authority in Abu Dhabi, allowing it to serve clients across multiple regions in compliance with local regulations.

How Safe is Trading with eToro?

eToro maintains a strong commitment to trader safety through strict compliance, financial transparency, and advanced protection systems.

The broker partners only with well-regulated financial institutions and follows industry best practices to safeguard client assets. In addition to regulatory oversight, eToro continuously invests in cybersecurity infrastructure to defend against potential threats, ensuring that user data and funds remain secure.

The platform’s risk management policies, negative balance protection, and clear disclosure of conditions provide traders with added confidence when operating in global markets.

Consistency and Clarity

eToro has built a solid reputation as one of the most recognizable and trusted brokers in the global trading community. Since its establishment in 2007, the company has maintained consistency in its operations, delivering a transparent, innovative, and user-friendly environment.

With millions of registered users worldwide, eToro continues to receive strong ratings and positive feedback for its Copy Trading features, diverse asset offerings, and modern interface, although some traders note drawbacks such as higher spreads or limited customization options on advanced tools.

The broker has also earned multiple industry awards for excellence in fintech innovation and social trading, reinforcing its credibility. Beyond trading, eToro actively engages in social initiatives and sponsorships, partnering with major sports teams and global events to strengthen its community presence.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with eToro?

eToro offers several account types to meet the needs of different clients. The Personal Account is the standard option, providing access to all features, including CFDs and social trading tools. For experienced traders who meet specific criteria, eToro also offers a Professional Account, which allows for higher leverage and more flexible conditions while maintaining strong risk management standards.

Businesses and institutions can apply for a Corporate Account, enabling company-level trading with dedicated support and compliance documentation. Additionally, eToro provides a Demo Account, allowing users to practice trading with virtual funds in a risk-free environment, as well as a Swap-Free Account designed to comply with Islamic finance principles.

This range of account types ensures that both individual and institutional traders can find a suitable option aligned with their goals and ethical preferences.

Personal Account

The Personal Account is eToro’s standard and most commonly used account type. It provides full access to the platform’s wide range of assets, including CFDs, stocks, ETFs, cryptocurrencies, commodities, and indices. With a minimum deposit starting from $50, users can begin trading or investing right away.

This account type also includes access to Copy Trading, CopyPortfolios, and eToro’s active social trading community, allowing clients to connect, share insights, and follow experienced investors.

Regions Where eToro is Restricted

eToro operates globally, but due to regulatory restrictions and compliance requirements, its services are not available in certain regions and countries:

- Afghanistan

- Cuba

- Iran

- North Korea

- Syria

- Sudan

- Venezuela

- Belarus

- Libya

- Yemen, and more

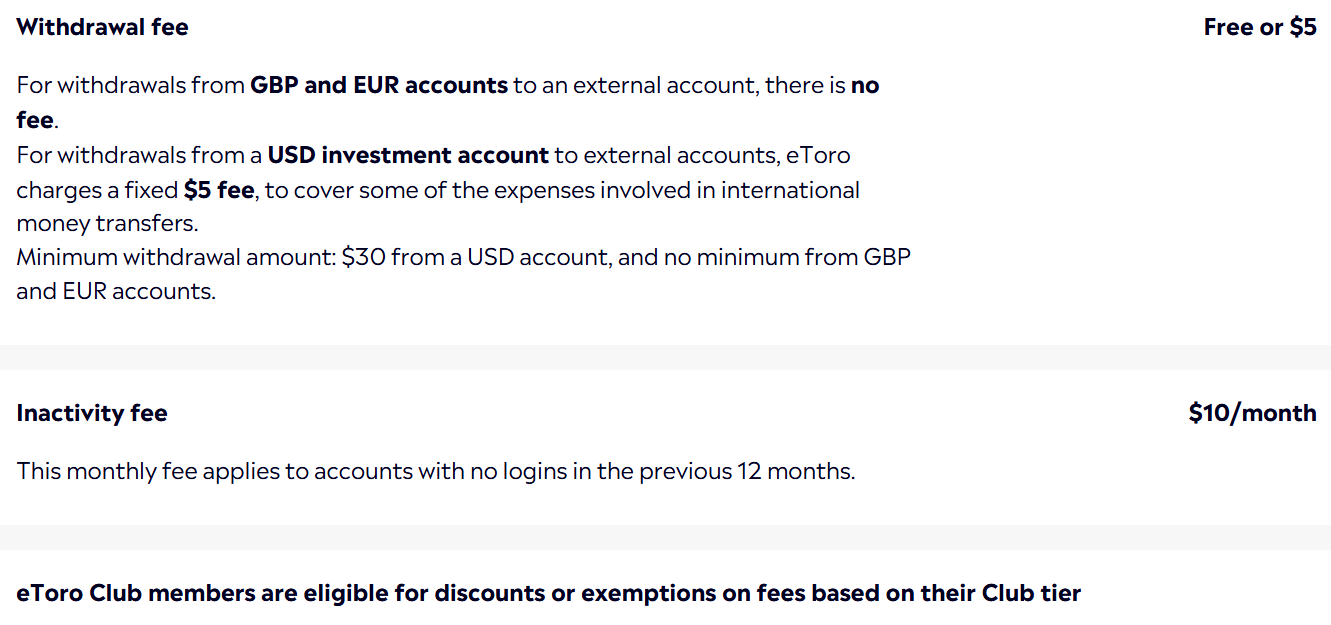

Cost Structure and Fees

Score – 4.5/5

eToro Brokerage Fees

eToro CFD and Forex fees are average. To get the full picture of eToro fees, you should check additional fees like a commission for deposits or withdrawals, as well as non-trading fees. Typically, CFD Brokers and eToro, among them, charge no commissions; the fees are generated and built into a dealing spread.

Additionally, eToro charges an inactivity fee; if you do not trade in 12 consecutive months, a $10 monthly inactivity fee will be charged on any remaining available balance. There are no account charges if you remain active, also additional costs will be charged as deposit fees and withdrawal fees.

eToro offers competitive and transparent spreads across its range of tradable instruments. The average spread for the EUR/USD currency pair is around 1 pip, which is in line with industry standards for retail Currency trading.

Spreads may vary depending on market conditions, asset type, and account type, but eToro ensures that all fees are clearly displayed before executing a trade.

eToro is known for commission-free trading on most of its tradable assets, meaning users can buy and sell these assets without paying a direct commission.

However, a commission fee of $1 or $2 may apply when opening or closing a stock position, depending on your country of residence, and a 1% commission is charged each time you buy or sell a crypto asset on eToro.

eToro applies rollover or swap fees to positions held overnight on leveraged instruments, including CFDs and certain forex trades. These fees are calculated based on the size of the position, the instrument, and the duration it is held past the market close

In addition to standard costs, eToro charges a few additional fees to cover operational and administrative services. These include a withdrawal fee for transferring funds out of the account, currency conversion fees when depositing or trading in a currency different from the account base, and occasional inactivity fees if an account remains dormant for an extended period.

All fees are clearly outlined on the platform, allowing traders to plan and manage their costs effectively. Overall, eToro maintains a transparent fee structure, so users can understand the total costs associated with their activities.

How Competitive Are eToro Fees?

eToro’s fee structure is generally considered competitive within the online trading industry. The platform combines low entry requirements with access to a wide range of markets, making it attractive for both beginner and experienced traders.

While certain specialized instruments or regions may incur standard industry charges, eToro’s overall pricing remains transparent and straightforward.

| Asset/ Pair | eToro Spread | Purple Trading Spread | Ultima Markets Spread |

|---|

| EUR USD Spread | 1 pip | 1.3 pips | 1 pip |

| Crude Oil WTI Spread | 5 pips | 0.03 | 1 |

| Gold Spread | 45 | 0.09 | 0.3 |

| BTC USD Spread | 1% | - | 11 |

Trading Platforms and Tools

Score – 4.4/5

eToro offers its own eToro investing platform and app, with an easy-to-use, intuitive interface. The platform is ideal for trading 7,000+ financial instruments across various classes, and also for Social trading. The CopyTrader platform is also available while trading with eToro.

Trading Platform Comparison to Other Brokers:

| Platforms | eToro Platforms | Purple Trading Platforms | Ultima Markets Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

eToro Web Platform

The eToro Web Platform is a user-friendly, browser-based environment designed to provide seamless access to global financial markets without the need to download software.

It features an intuitive interface with real-time market data, advanced charting tools, and integrated social trading functions that allow users to follow and copy top investors directly from the platform. Traders can manage portfolios, execute trades, and monitor performance across multiple asset classes, including stocks, ETFs, cryptocurrencies, commodities, and indices.

The web platform also includes educational resources, news feeds, and risk management tools, making it suitable for both beginners and experienced traders who want a versatile and accessible experience from any device with internet access.

Main Insights from Testing

Testing eToro’s web platform reveals a smooth and responsive experience with quick order execution and minimal lag. Navigation is straightforward, with clear menus and easily accessible account settings.

The platform’s social trading features, such as viewing other traders’ performance and engaging in discussions, are seamlessly integrated, enhancing the community-driven experience. Overall, it offers a stable and reliable environment for executing trades, monitoring markets, and managing investments efficiently.

eToro Desktop MetaTrader 4 Platform

If you prefer to use industry leader MetaTrader4, you should find another broker available from the list, as eToro does not offer MetaTrader4 as a platform.

eToro Desktop MetaTrader 5 Platform

eToro does not offer the MetaTrader 5 platform either. Instead, it relies on its proprietary web and mobile platforms to provide all functionalities, including advanced charting, technical analysis, and social trading features.

eToro MobileTrader App

eToro mobile trader, which has been integrated through WebTrader, allows you to stay connected at any time through one single application, eToro App. All features available: checking real-time feeds, copying other traders, or performing any permitted actions by the platform. Both Android and iOS devices are supported, which is a great way to trade at any time and under any conditions.

AI Trading

eToro is increasingly embracing AI within its platform. Among its developments is an AI-powered investing assistant called Tori, which can answer user questions, offer tailored insights on portfolios, and guide users through the platform.

The broker has also launched “Alpha Portfolios”, which utilize machine-learning models built on eToro’s own retail-trading data to create quant-style investment strategies.

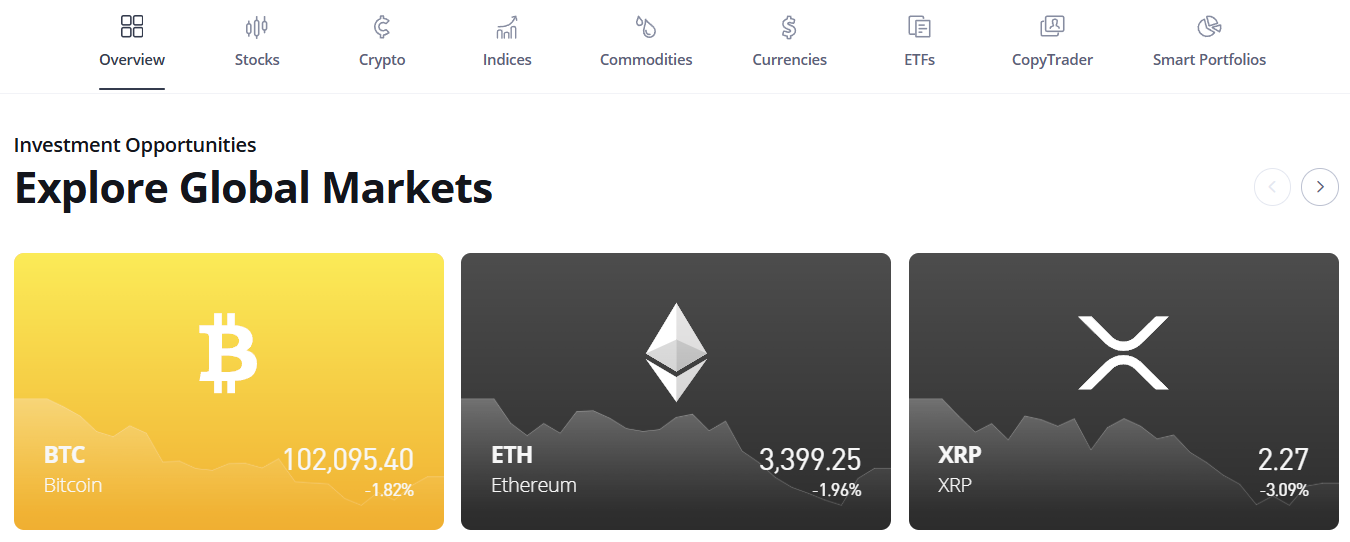

Trading Instruments

Score – 4.6/5

What Can You Trade on eToro’s Platform?

eToro market range is generally among the most advanced in the industry, as it offers a truly wide range of products through thousands of different financial multi-asset platform, which offers categories with flexible eToro market hours. Each class has its own characteristics and can be traded by a strategy suitable to your style or through a choice of the successful strategy to follow using eToro copy trading.

eToro’s over 7000 products range includes Forex, Commodities, eToro Gold, investing in Stocks, Indices, ETFs, eToro CFD, and a recent growing trend of eToro Bitcoin or other cryptocurrencies as well, based on CFDs.

Main Insights from Exploring eToro’s Tradable Assets

Exploring eToro’s tradable assets highlights the platform’s emphasis on diversity, accessibility, and flexibility. Users can easily switch between markets and instruments from a single account, enabling a more efficient portfolio management experience.

The platform’s structure encourages both short-term trading and long-term investing, supported by clear asset information, real-time data, and social insights.

Leverage Options at eToro

Leverage, known as a loan given by the broker to the trader, is another important point in our eToro Review, as the multiplier enables trading with a larger size than the initial invested capital. As the leverage significantly increases the potential for higher gains, in reverse, it does increase the risk of losing money too.

- Traders from the UK and Europe are eligible to use a maximum of up to 1:30 for major currency pairs.

- Australian clients can use a maximum leverage of 1:30.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at eToro

The money management and funding methods at eToro are quick and simple, which is very pleasant and important for your account management convenience. eToro withdrawal options offer popular bank transfers, credit cards, and some electronic wallets.

Money transfers may be performed through the following methods, while all transactions are made as securely as possible and protected by SSL technology. However, methods may vary according to the regulatory obligations in one region or another.

- Credit Card or Debit Card

- Bank Wire Transfer

- eToro Money

- Payment systems: PayPal, Skrill, Neteller

- Online banking

- iDEAL

- Przelewy24

eToro Minimum Deposit

The minimum deposit depends on the clients’ region and country regulations and varies from $10 to $10,000. In many European countries, the minimum deposit for the investment starts from $50. So this is the most common minimum deposit amount for eToro.

Withdrawal Options at eToro

eToro withdrawal requests are subject to a $5 fee, while it does not charge a deposit fee. In addition, eToro Club members of the Platinum tiers and above pay no withdrawal fees.

Upon confirmation, you will receive a notification about the withdrawal request along with updated statuses in your email. The broker will process the withdrawal transaction request within a few business days. In addition, you should allow your payment provider to process funds into your account, which also takes a few days and depends on international laws or requirements.

Customer Support and Responsiveness

Score – 4.4/5

Testing eToro’s Customer Support

Customer support is available 24/5 in various languages, with live chat, help center, and a support ticket system. eToro created a web-based ticketing system so that whatever concern or question you may have, customer service remains at your disposal.

Contacts eToro

eToro primarily provides customer support through its Help Center and support ticket system, rather than direct phone or email contact. Users can access assistance by logging into their eToro account and submitting a request via the Customer Service Center.

Research and Education

Score – 4.6/5

Research Tools eToro

eToro provides a comprehensive suite of research and analysis tools designed to help users make informed decisions.

- On both the website and platform, clients can access real-time market data, technical charts, and sentiment indicators showing the percentage of buyers and sellers for each asset.

- The platform also offers analyst price targets, news feeds, economic calendars, and earnings reports for deeper market insight.

- Additionally, eToro’s Copy Trading and Smart Portfolios features allow users to analyze and learn from the performance of top traders. Combined, these tools make eToro a well-rounded platform for both technical and fundamental analysis.

Education

eToro provides a rich collection of educational materials through eToro Academy, including online courses for both beginners and advanced traders, webinars, fundamental analysis, technical analysis, video tutorials, and more.

Portfolio and Investment Opportunities

Score – 4.4/5

Beyond Forex and CFD trading, eToro also offers a range of investment solutions tailored for long-term investors. Through its Smart Portfolios, users can invest in professionally managed, theme-based portfolios covering sectors like technology, renewable energy, or cryptocurrencies.

The platform also allows direct investment in real stocks and ETFs, providing diversification without leverage. These features give investors the flexibility to build balanced portfolios that align with their risk tolerance and financial goals, making eToro suitable not only for active traders but also for those focused on sustainable, long-term investing.

Account Opening

Score – 4.5/5

How to Open eToro Demo Account?

Opening a demo account with eToro is simple and takes only a few minutes. New users can sign up on the official eToro website by providing basic personal information and verifying their email address.

Once registered, they automatically gain access to a virtual portfolio funded with $100,000 in virtual money, allowing them to practice trading without any financial risk.

The demo account mirrors real market conditions, enabling users to explore the platform, test strategies, and become familiar with eToro’s features before switching to a live account.

How to Open eToro Live Account?

Opening an account with eToro is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the Sign In page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your personal data by upload of documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

In addition to its research and tools, eToro offers several innovative features that enhance the overall user experience.

- One of its standout tools is Tori, an AI-powered assistant that helps users navigate the platform, track performance, and access personalized insights.

- The platform includes social features, such as comment threads and news feeds, where users can discuss market trends and share opinions. Furthermore, tools like risk scoring, performance tracking, and customizable watchlists make portfolio management more transparent and efficient for traders of all levels.

eToro Compared to Other Brokers

Compared to its competitors, eToro positions itself as a highly accessible and socially engaging platform suitable for a broad range of users.

Unlike traditional brokers that primarily focus on MetaTrader-based environments, eToro differentiates itself with its proprietary platform centered around social and copy trading features, making it particularly appealing for beginners and community-oriented investors.

While its fees and spreads are generally average within the industry, eToro stands out for its extensive asset selection and strong regulatory coverage across multiple jurisdictions, including top-tier authorities.

The broker also excels in education quality and ease of use, though some professionals may prefer the more advanced technical tools and customizability offered by MetaTrader or TradingView-supported brokers. Overall, eToro delivers a well-balanced experience with an emphasis on innovation, transparency, and user engagement, making it a strong choice for modern traders looking beyond conventional trading setups.

| Parameter |

eToro |

GBE Brokers |

Ultima Markets |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1 pip |

Average 0.8 pips |

Average 1 pip |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

A fee of $1 or $2 may apply when opening or closing a stock position |

0.0 pips + $3.5 per side |

0.0 pips + $2.5 per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

eToro Platform |

MT4, MT5, TradingView |

MT4, MT5, MT4 WebTrader, Mobile App |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

7000+ instruments |

1000+ instruments |

250+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, ASIC, CySEC, FSA, FSRA |

CySEC, BaFin, FSA |

FCA, CySEC, FSC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Excellent |

Good |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$50 |

$1,000 |

$50 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker eToro

eToro is a globally recognized online broker that combines traditional trading with innovative social and copy trading features. The platform offers a user-friendly interface, making it accessible for all levels of users, while providing a wide range of investment opportunities, including stocks, ETFs, cryptocurrencies, commodities, and indices.

eToro is fully regulated by multiple top-tier authorities, ensuring a secure environment. It also offers demo accounts, swap-free accounts, and AI-assisted tools to support informed decision-making.

With strong educational resources, active community engagement, and transparent operations, eToro stands out as a versatile platform for both trading and long-term investing.

Share this article [addtoany url="https://55brokers.com/etoro-review/" title="eToro"]

Hello! I started investing with eToro a few months ago. I probably sent around 30k to eToro in several transfers. Few weeks ago, for reasons out of my control, one of the transfers I sent was returned to my bank. I asked eToro about what should be done, and right after that they limited my account. They said I should proceed with the transfer once again, but the support manager probably was in a huge confusion as my account was still limited for both … deposits and withdrawals.

By the way, I’m a Platinum member and I’m supposed to get priority support assistance, but that’s just a huge lie. It’s just a marketing trick. No priority and actually no Support at all.

Although my account was fully verified and I provided them with every document they asked for, I’m waiting for around 3 weeks for some assistance in this matter, with no success.

My account is limited, with over $19,000 in balance, with no option to withdraw my money in any way. Not even to trade.

You’ll probably ask me about support assistance???? Or even about Support Manager and Priority (as advertised)??????

That will be a good question, as I can say that even if I asked to close my account or to leave me to cash out my money in some way, there is SILENCE. I only receive some template messages asking me to wait and to thank me for understanding. WHAT?????? Are you kidding with me?

Is there any reason for them to hold my money for that long? I owe them anything? The funds are just in my Dollars balance. They are using my money to make profit and there is no sign about getting my money back.

INCREDIBLE!!!!!!!! Right???????

STAY AWAY from eToro if you want to use your money. Is easy to send them the money in the first place but it becomes impossible to get your money back.

I’m begging them for my money. That’s not “cool” AT ALL.

Comment do you guys have a option of a scalping account?