- What is Tickmill?

- Tickmill Pros and Cons

- Regulation and Security Measures

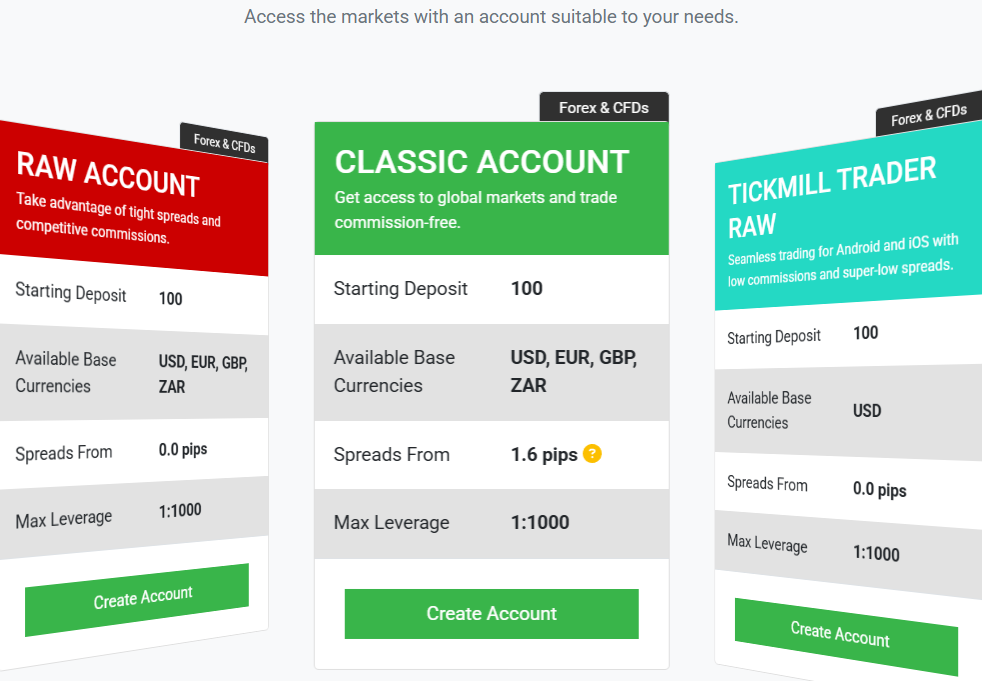

- Account Types and Benefits

- Cost Structure and Fees

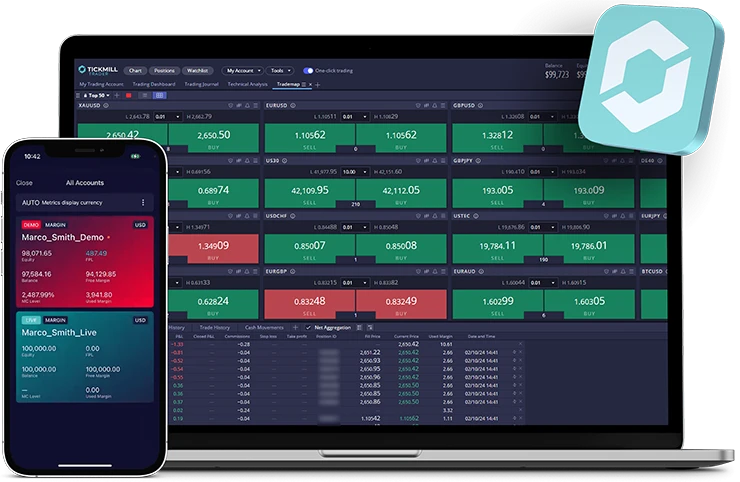

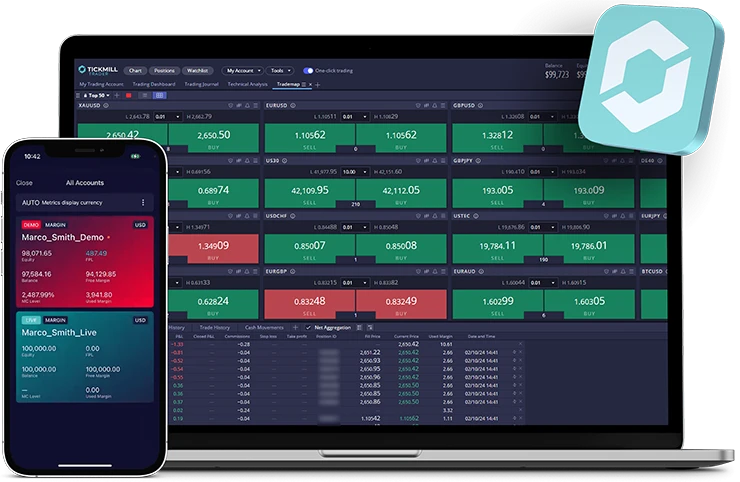

- Trading Platforms and Tools

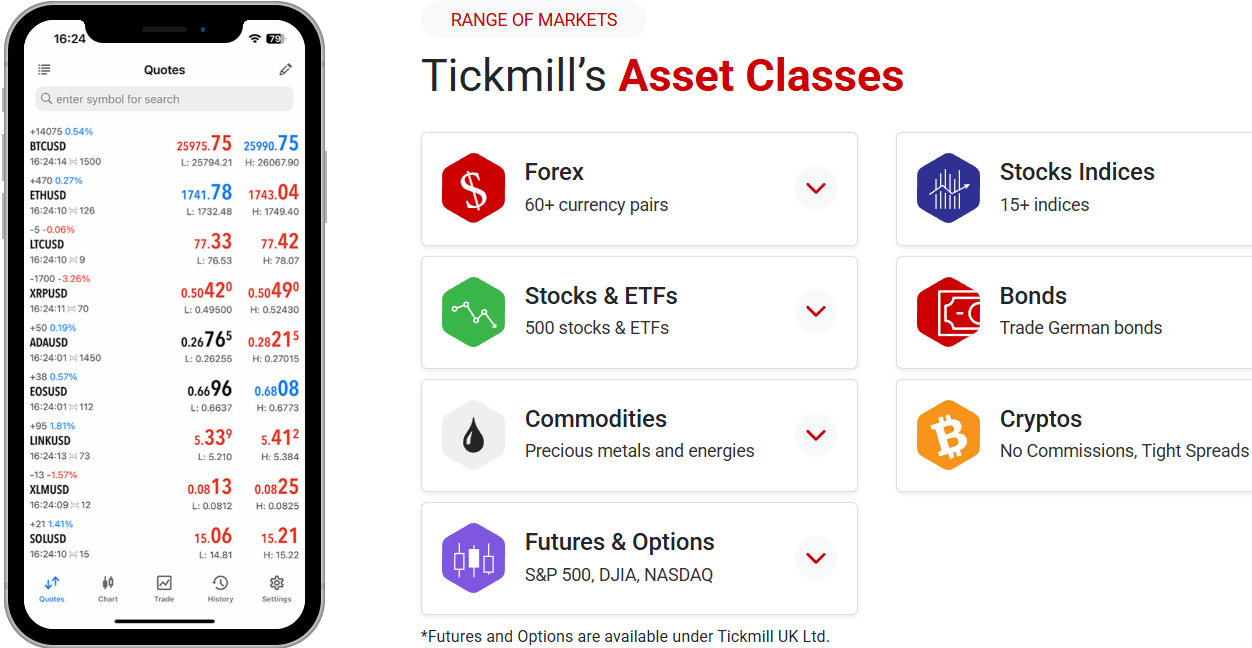

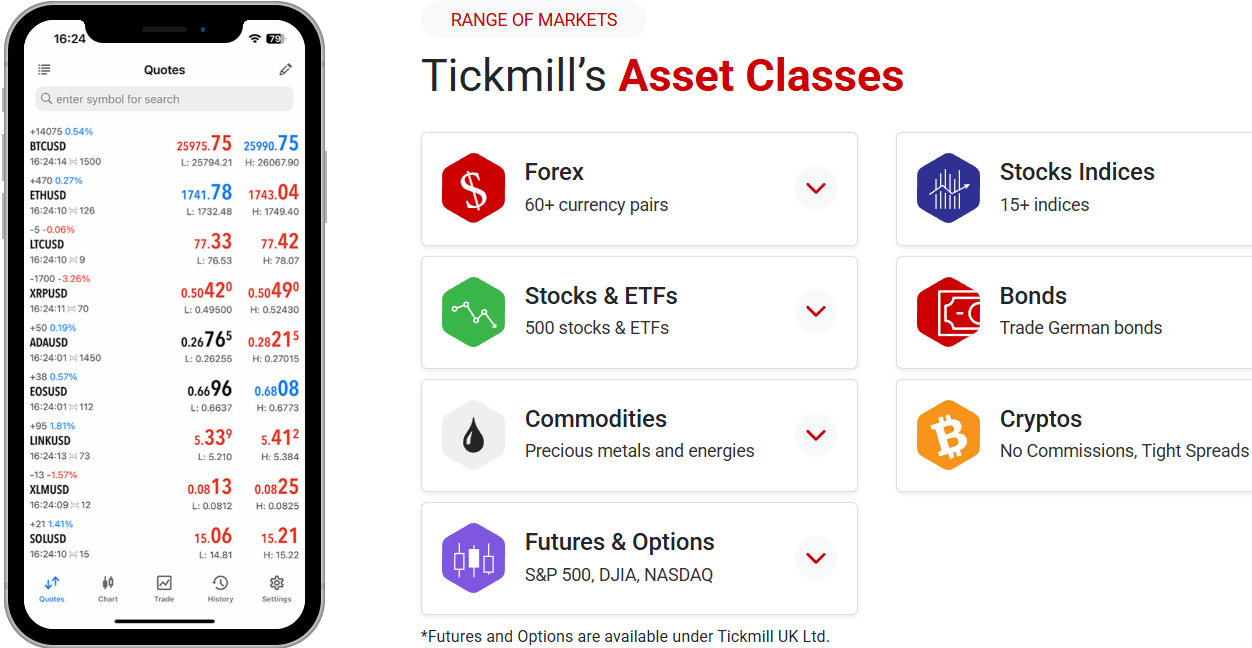

- Trading Instruments

- Deposit and Withdrawal Options

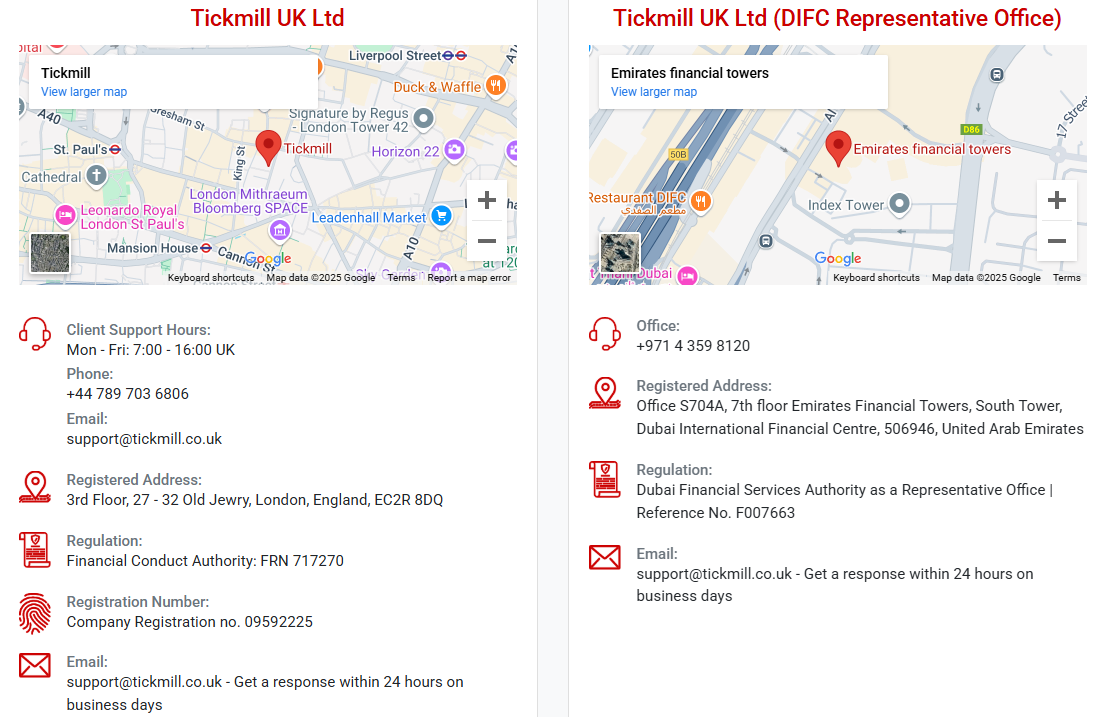

- Customer Support and Responsiveness

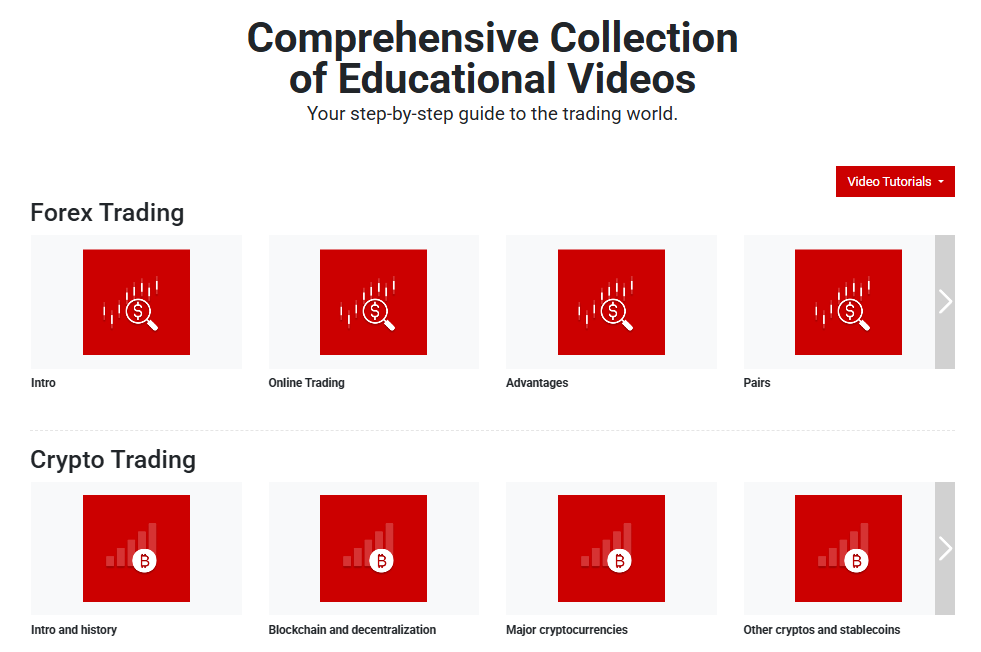

- Research and Education

- Portfolio and Investment Opportunities

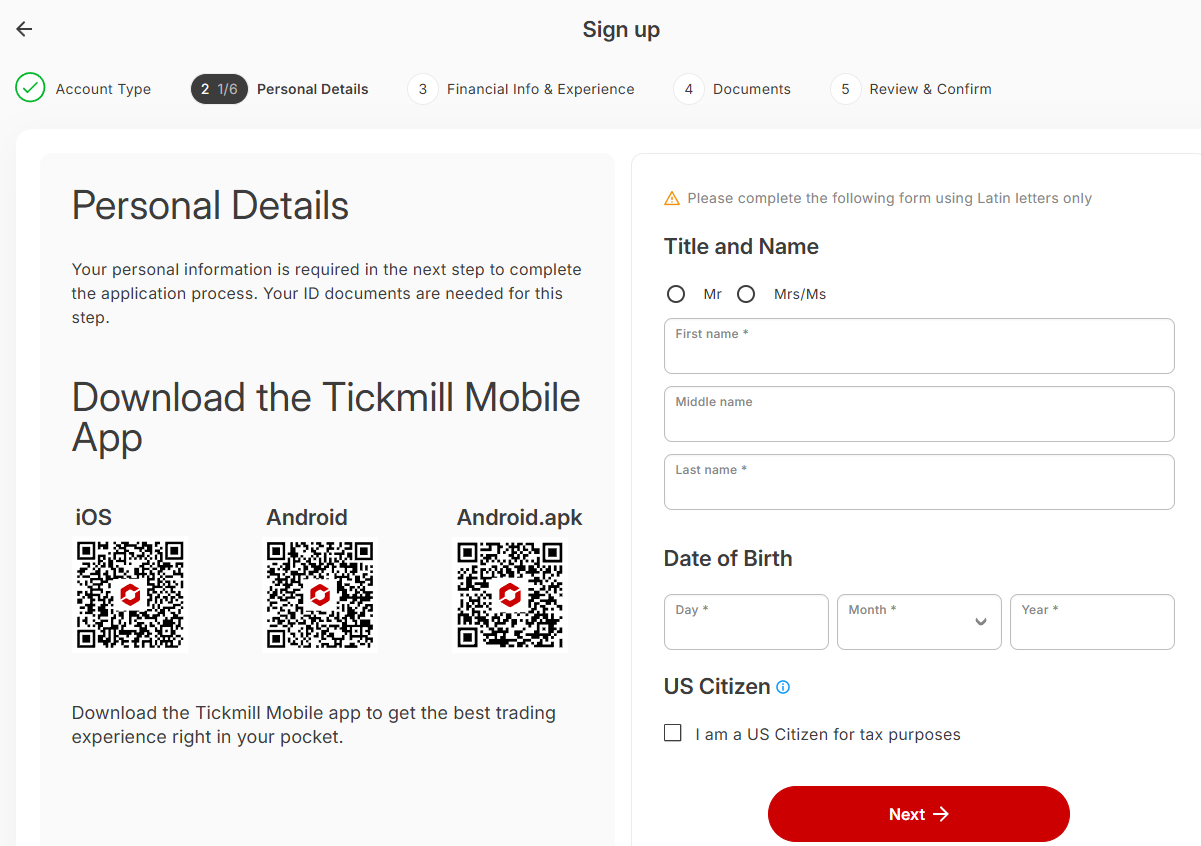

- Account Opening

- Additional Tools And Features

- Tickmill Compared to Other Brokers

- Full Review of Broker Tickmill

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.6 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Tickmill?

Tickmill is the trading name of Tickmill Ltd, a member of Tickmill Group, a Forex and CFD broker providing premium financial products and services with transparency and innovative technology. The broker offers over 180 instruments including Forex, Stock, Indices, Metals, Bonds, Cryptocurrencies, and more.

The company was established in 2014 with its headquarters in London, UK as well as offices in Seychelles. Tickmill strives to innovate a unique experience for its clients while understanding traders’ rights as the major part of the trade, for this purpose company, continuously facilitates trading conditions.

Tickmill Pros and Cons

Tickmill is a heavily regulated Broker with a good reputation. The company is globally recognized and offers good conditions for Professional or regular-size traders. Tickmill has one of the best learning and research materials and is great for EA trading.

For the Cons, proposals vary according to the entity and there is no 24/7 support, spreads for Forex are a little higher than average.

| Advantages | Disadvantages |

|---|

| Fully regulated broker | Conditions vary according to regulation and entity |

| Globally recognized and multiple awarded broker | No 24/7 customer support

|

| Standard and Pro trading conditions | |

| Popular trading instruments | |

| Competitive trading costs and commissions | |

| Excellent support, learning, and research tools

| |

Tickmill Features

Tickmill is a globally recognized broker known for offering a seamless experience, competitive conditions, and industry-known platforms. Below is a comprehensive list of its key features:

Tickmill Features in 10 Points

| 🏢 Regulation | FCA, CySEC, FSCA, FSA |

| 🗺️ Account Types | Classic, Raw, Tickmill Trader Raw, Futures Accounts |

| 🖥 Trading Platforms | MT4, MT5, Tickmill Trader |

| 📉 Trading Instruments | Forex, CFDs on Stock Indices, Commodities, Bonds, Cryptocurrencies, Stocks, Futures, Options |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, ZAR |

| 📚 Trading Education | Webinars, Seminars, eBooks, Video Tutorials, T-Shows, Forex Glossary, etc. |

| ☎ Customer Support | 24/5 |

Who is Tickmill For?

Tickmill is designed to cater to traders of all experience levels seeking advanced conditions. Based on our findings and financial expert opinions Tickmill is Good for:

- Beginners

- Advanced traders

- Traders who prefer MT4 and MT5 platforms

- Currency and CFD trading

- Copy Trading

- Low Spread Trading

- Variety of strategies

- Algorithmic or API traders

- EA trading

- Good customer support

- Excellent educational materials

Tickmill Summary

Concluding the Tickmill review, we acknowledge a broker that attracts clients with its compelling features, such as a low minimum deposit, advanced technical solutions, a popular range of instruments, and engaging promotional campaigns. The broker stands out with its low spreads for Currency trading, offering excellent value for cost-conscious traders.

Moreover, Tickmill supports a wide array of strategies, including scalping and algorithmic trading, making it suitable for traders with varying approaches. With its strong regulatory framework, educational resources, and efficient customer support, Tickmill provides a well-rounded and reliable experience for traders of all levels.

55Brokers Professional Insights

Tickmill is a reputable broker offering safe and highly favorable conditions with transparency and innovative technology mostly suited for traders beginners and regular traders too. The broker provides a range of services designed for traders of all levels, with low initial deposit requirements. One of its key advantages is its global reach, allowing traders from various countries to sign up, along with offering some of the lowest spreads available.

The broker trading technology is good, and showed good performance on our tests during volatile conditions. The instruments selection is based on popular instruments, so if you are looking for more diverse and minor popular instruments and seek greater variety in the portfolio might be good to check other Brokers. With widely used platforms like MT4 and MT5, along with tools such as Autochartist for technical analysis, Tickmill equips traders with the necessary resources to develop and implement the strategy of their choice, yet if other platforms are your preference again Tickmill is not a fit.

Additionally, we regard highly Tickmill’s educational offerings, including webinars and market analysis, support continuous learning for traders which is of great quality. However, while the broker offers competitive spreads and low commissions, fees on certain withdrawal methods may apply. Also, the trading conditions vary according to regulation and entity. Despite these small drawbacks, Tickmill remains a reliable and attractive option for traders seeking a solid, cost-effective brokerage with a wide range of opportunities.

Consider Trading with Tickmill If:

| Tickmill is an excellent Broker for: | - Need a well-regulated broker.

- UK traders.

- Offering popular instruments.

- Suitable for both beginners and professional traders.

- Who prefer higher leverage up to 1:1000.

- Providing competitive fees and spreads.

- Need a broker with excellent education and research tools.

- Broker with a variety of strategies.

- Providing proprietary platform.

- Providing services worldwide.

- Get access to MT4, and MT5 platforms.

- Providing copy trading.

- Need broker with access to VPS Hosting.

- Offering MAM trading.

|

Avoid Trading with Tickmill If:

| Tickmill might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with cTrader.

- Looking for fixed spreads.

- Offering PAMM accounts. |

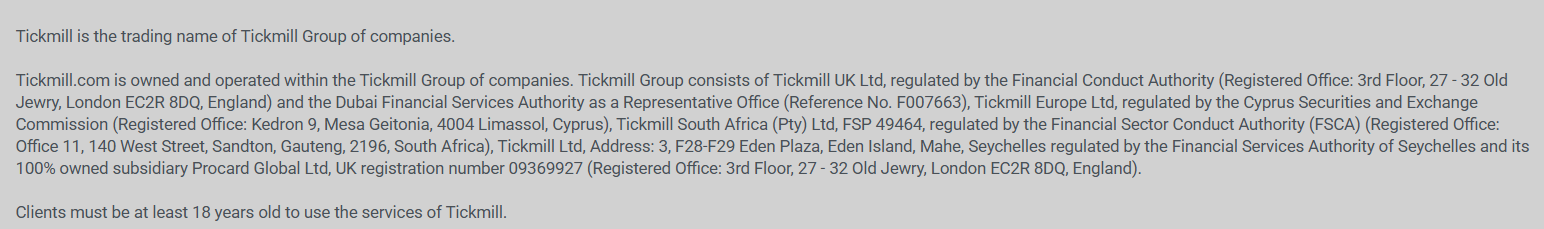

Regulation and Security Measures

Score – 4.6/5

Tickmill Regulatory Overview

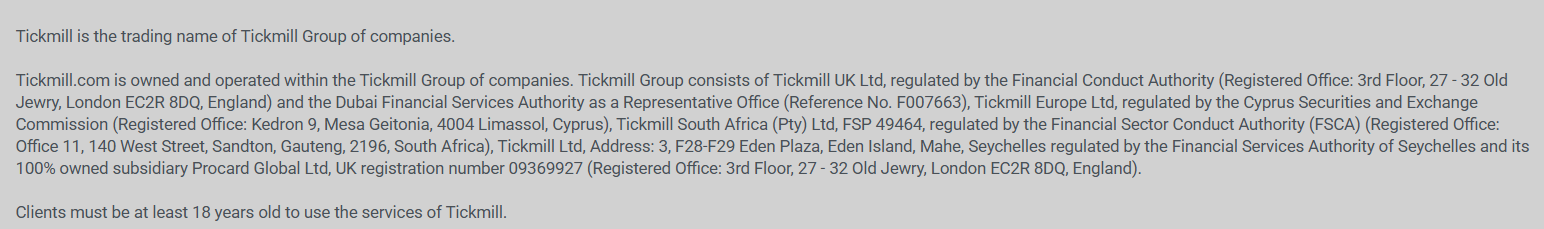

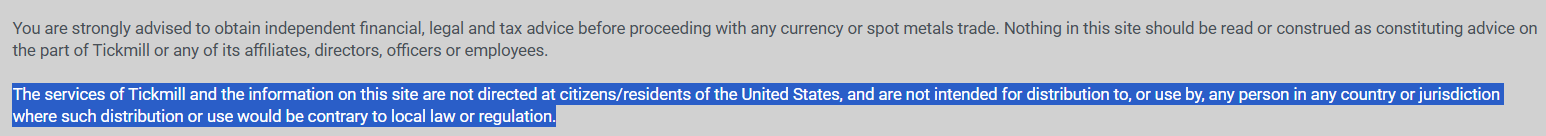

Tickmill operates under a robust regulatory framework, ensuring transparency and security for its clients. It is regulated by top-tier authorities such as the FCA in the UK and CySEC in Cyprus, offering compliance with stringent international standards, including MiFID II. Additionally, Tickmill is licensed by the FSCA in South Africa, providing reliable oversight for traders in that region.

For its international operations, Tickmill is also regulated by offshore authorities, including the FSA in Seychelles and the FSA in Labuan, Malaysia. These jurisdictions allow the broker to provide more flexible conditions, such as higher leverage, to cater to a global client base.

However, clients should be aware that trading under offshore jurisdictions may involve different levels of investor protection compared to stricter regulatory environments like the FCA, and CySEC.

How Safe is Trading with Tickmill?

Trading with Tickmill is considered safe due to its strong regulatory framework and commitment to transparency. The broker is regulated by top-tier authorities, which ensures a low-risk Forex and CFD trading environment. To safeguard client funds, Tickmill maintains segregated accounts with trusted financial institutions, in compliance with FCA regulations.

Additionally, UK-based clients are covered by the Financial Services Compensation Scheme (FSCS), which protects investments up to £50,000. With its good reputation, regulatory oversight, and focus on secure conditions, Tickmill offers a reliable and trustworthy platform for traders worldwide.

The only gap is the international trading executed through an offshore entity, which may raise concerns for some traders regarding regulatory protection.

Consistency and Clarity

Tickmill has built a solid reputation in the financial community, earning high scores for its transparency, reliability, and trader-friendly conditions. Trader reviews frequently highlight its competitive spreads, fast execution, and robust customer support as key advantages. However, some reviews also point out drawbacks, such as limited funding methods in certain regions and fees on specific withdrawal options.

Since its establishment in 2014, the broker has also received numerous accolades, which further solidified its standing in the industry. Beyond trading, Tickmill actively engages in social activities, including sponsorships and charitable initiatives, showcasing its commitment to making a positive impact on society.

This combination of operational excellence, industry recognition, and community involvement positions Tickmill as a trustworthy and socially responsible broker.

Account Types and Benefits

Score – 4.5/5

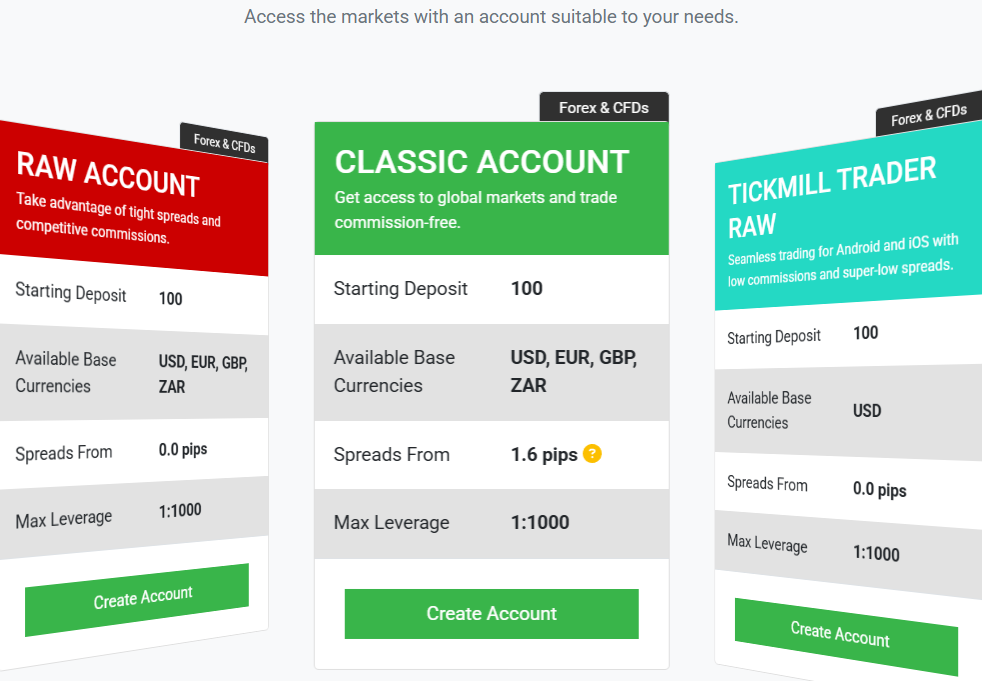

Which Account Types Are Available with Tickmill?

Tickmill offers a variety of account types to cater to different trading styles and experience levels, including Classic, Raw, Tickmill Trader Raw, and Futures Accounts. The Classic Account is ideal for beginners, offering commission-free trading with slightly higher spreads, while the Raw Spread Account is designed for more advanced traders, featuring ultra-tight spreads with a small commission per trade.

For professional traders, the Tickmill Trader Raw Account provides enhanced features tailored to meet sophisticated financial needs. Additionally, Tickmill offers a Futures Account, which is available exclusively under its UK entity, allowing access to futures trading.

To accommodate diverse trader requirements, the broker also provides Demo Accounts, enabling users to practice trading in a risk-free environment, and Swap-Free Accounts for traders who follow Islamic finance principles, ensuring no interest is charged on overnight positions. This range of accounts ensures flexibility and suitability for all levels of traders.

Classic Account

The Classic Account is ideal for beginner traders, offering slightly higher spreads, starting from 1.6 pips. This account type is designed for simplicity, providing a straightforward experience without additional fees, making it an excellent choice for those new to the markets.

The minimum deposit amount is $100 to open the account. The account is available on all platforms, ensuring access to advanced tools and a user-friendly interface.

Raw Account

The Raw Account is tailored for experienced traders seeking tighter spreads and lower overall costs. Spreads start as low as 0.0 pips, with a competitive commission of $3 per side per lot traded.

This account type is perfect for scalpers and high-frequency traders who require precision and low transaction costs.

Futures Account

The Futures Account, available under Tickmill’s UK entity, is tailored for traders looking to access futures markets. This account requires a minimum deposit of $1,000, making it suitable for more advanced or professional traders.

With commissions starting from $0.85 per contract and market-driven spreads, the Futures Account ensures competitive pricing and transparency. The spreads are market-driven and vary depending on the futures contract.

Regions Where Tickmill is Restricted

Tickmill is restricted in several regions due to regulatory constraints. Specifically, the broker is not available in countries including:

Cost Structure and Fees

Score – 4.6/5

Tickmill Brokerage Fees

Tickmill fees are built into both spreads and commissions, offering transparency and flexibility for traders. The broker does not charge fees for deposits or withdrawals, but traders should be aware that intermediary banks or eWallet providers may apply their fees, which are beyond Tickmill’s control. Additionally, Tickmill does not impose non-trading fees, ensuring a cost-effective environment.

However, fee conditions can vary depending on the regulatory framework governing the entity under which the trader registers, so traders should verify specific conditions for their region. Traders should also account for overnight fees (swap rates), which apply to positions held overnight.

By maintaining a transparent fee structure and offering competitive rates, Tickmill ensures a favorable environment for its clients.

Tickmill offers competitive floating spreads, appealing to traders across all experience levels. For the Classic Account, spreads start from 1.6 pips, while the Raw Account provides ultra-tight spreads starting from 0.0 pips.

Notably, the average EUR/USD spread is just 0.1 pips, making Tickmill a standout choice for Currency traders seeking low costs. Additionally, spreads are market-driven for the Futures Account, varying based on the specific futures contracts.

Tickmill offers a transparent and competitive commission structure tailored to suit different needs. For the Raw Account, commissions are set at $3 per lot per side, while the Tickmill Trader Raw Account charges $3.5 per lot per side, offering flexibility depending on the platform used.

For traders on the Futures Account, commissions start from $0.85 per contract, making it a cost-effective option for accessing futures markets. These clearly defined commissions ensure traders can accurately calculate their costs and plan their strategies effectively.

- Tickmill Rollover / Swaps

Tickmill applies rollover or swap fees for positions held overnight, which are calculated based on the difference in interest rates between the two currencies being traded. These fees can either be a cost or a credit, depending on the direction of the trade (long or short) and the currency pair.

For example, the swap rate for the EUR/USD pair is approximately -11.742 for long positions and 6.693 for short positions, though these rates are subject to market conditions and may vary. Traders should be mindful of these overnight fees, as they can impact overall costs, particularly for long-term strategies.

How Competitive Are Tickmill Fees?

Overall, Tickmill offers competitive fees, making it an attractive option for traders looking to minimize their costs. The broker provides a transparent fee structure with low commissions and tight spreads, which are essential for traders seeking efficient and cost-effective conditions.

Tickmill’s fees are particularly appealing to Forex traders, with low costs for both small and large volumes, enabling traders to execute strategies without significant impact on their profitability. Additionally, the broker does not charge deposit or withdrawal fees, and inactivity fees, further enhancing its cost-effectiveness.

| Asset/ Pair | Tickmill Spread | CMC Markets Spread | ActivTrades Spread |

|---|

| EUR USD Spread | 0.1 pips | 0.5 pips | 0.5 pips |

| Crude Oil WTI Spread | 0.04 | 2.5 | 0.03 |

| Gold Spread | 0.09 | 0.2 | 0.25 |

| BTC USD Spread | 24.9 | 75.00 | 55 |

Tickmill Additional Fees

Tickmill does not impose additional non-trading fees, however, certain third-party fees may apply, such as fees charged by intermediary banks or eWallet services for deposits and withdrawals, which are beyond Tickmill’s control.

Additionally, traders should be aware of overnight swap or rollover fees, which may vary depending on the currency pair and the position held. While Tickmill strives to keep its fee structure simple and competitive, traders should review the specific conditions related to withdrawals, swaps, and other potential fees that could impact their trading activity.

Trading Platforms and Tools

Score – 4.7/5

Tickmill offers a range of robust platforms, including the widely-used MT4 and MT5, as well as the Tickmill Trader web platform, providing traders with diverse options to suit their needs. These platforms are known for their user-friendly interfaces, diverse charting tools, and customizable features, making them suitable for all levels of traders.

However, the platform range may vary depending on the regulatory entity under which a trader’s account is held. Tickmill also ensures ultra-fast execution speeds, with an average order execution time of just 0.15 seconds, enabling traders to take advantage of market opportunities without delay.

Trading Platform Comparison to Other Brokers:

| Platforms | Tickmill Platforms | CMC Markets Platforms | ActivTrades Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Tickmill Web Platform

The Tickmill Trader web platform offers an intuitive experience, providing access to a range of robust features. Traders can benefit from leverage of up to 1:1000, allowing them to amplify their positions and manage risk effectively.

With over 80 technical indicators, the platform enables comprehensive market analysis, helping traders identify trends and make informed decisions. It also includes Market Depth for improved insight into market liquidity and order flow. Traders can set pre-configured Stop Loss (SL) and Take Profit (TP) levels, streamlining trade management and ensuring better risk control.

Additionally, the platform allows users to manage their trading plans and strategies, offering a flexible and customizable environment for both new and seasoned traders.

Tickmill Desktop MetaTrader 4 Platform

The MT4 platform offers an all-in-one solution for traders looking to engage in a wide variety of markets. Traders can access CFDs on Forex, Stock Indices, Commodities, Bonds, and Cryptocurrencies, allowing for diverse portfolio management and a range of opportunities.

The platform ensures no partial fills on orders, thanks to Tickmill’s deep liquidity, delivering fast and reliable execution. For automated trading, users can take advantage of EA trading facilities by using Tickmill’s VPS services, ensuring minimal latency and uninterrupted trading.

Various technical analysis tools, including 50+ indicators and customizable charting options, allow traders to perform detailed market analysis. Additionally, the platform supports 39 languages, making it accessible to a global audience. The signals are integrated with a system, helping traders stay informed and act quickly on market movements.

Main Insights from Testing

Testing the MT4 platform reveals its robust and reliable performance for traders of all levels. The platform’s intuitive interface, combined with quick order execution and seamless navigation, provides a smooth experience.

Its strong charting capabilities and integration of automated features like Expert Advisors make it an excellent choice for those looking to implement advanced strategies. Moreover, the platform’s stability and fast execution speeds, even during high volatility periods, ensure that traders can take advantage of market opportunities without delay. Overall, MT4 offers a solid and versatile environment.

Tickmill Desktop MetaTrader 5 Platform

The MetaTrader 5 Platform offers an enhanced experience with support for all types of trade orders, including 6 pending orders, such as Limit, Stop, and Stop-Limit orders, providing flexibility for executing various strategies.

The platform is ideal for algorithmic traders, offering superior applications like EAs, Robots, and Copy Trading to automate and optimize trading. With over 38 integrated indicators and 21 timeframes, MT5 allows in-depth market analysis and multiple customizable charts to suit individual preferences.

The platform also includes a built-in Economic Calendar, informing traders about crucial economic events and helping them make more informed decisions. Overall, MT5 provides a comprehensive suite of technical and algorithmic tools.

Tickmill MobileTrader App

The Tickmill MobileTrader App offers a convenient and flexible experience for traders on the go. Available for both iOS and Android devices, it provides access to the popular MT4 and MT5, allowing users to trade across a wide range of instruments with full functionality.

The app includes all the essential features of the desktop versions, such as real-time market analysis, and secure order execution. In addition, the Tickmill Trader mobile app is also available, offering a user-friendly interface and access to tools, account management, and the ability to monitor market movements from anywhere. Both apps ensure that traders can stay connected to the markets and manage their positions efficiently, no matter where they are.

Trading Instruments

Score – 4.3/5

What Can You Trade on Tickmill’s Platform?

On Tickmill’s platform, traders can access over 180 instruments, including Forex, CFDs on Stock Indices, Commodities, Bonds, Cryptocurrencies, Stocks, Futures, and Options. This diverse selection provides diverse opportunities for traders to engage with different asset classes, catering to various strategies and preferences.

However, the available range of instruments may differ depending on the regulatory entity under which the trader operates.

Main Insights from Exploring Tickmill’s Tradable Assets

Exploring Tickmill’s tradable assets reveals several advantages for traders seeking variety and flexibility in their strategies. The broker offers a diverse range of instruments across multiple asset classes, from Forex to Commodities and Cryptocurrencies. One notable advantage is the inclusion of popular crypto pairs such as BTC/USD, ETH/USD, and XRP/USD, which provide traders with the opportunity to capitalize on the volatility of the cryptocurrency market.

However, a potential drawback is that the range of assets is somewhat limited compared to other brokers, and may vary depending on the regulatory entity under which a trader is registered. This could restrict access to certain instruments, especially in the case of specific markets or asset classes. Overall, Tickmill’s selection provides ample opportunities, but traders should be mindful of regional restrictions when selecting their instruments.

Leverage Options at Tickmill

Leverage levels offered by Tickmill depend on the entity traders open an account with. It is a useful tool that enables traders to enter the market with limited capital, yet its use can lead to both substantial profits and losses. As such, traders should have a comprehensive understanding of how multiplier works and its possible consequences before engaging in any trading activities that involve leverage.

See Tickmill leverage below:

- UK and European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- Leverage of 1:1000 is available through international entities.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Tickmill

In terms of funding methods, Tickmill offers numerous payment methods which are a very good plus, yet check according to its regulations whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- UnionPay, and more

Tickmill Minimum Deposit

The minimum deposit for Tickmill is $100, making it an excellent opportunity for traders with even small account sizes. However, for the Futures account, the minimum deposit is $1,000.

Withdrawal Options at Tickmill

Tickmill offers a variety of withdrawal options to suit traders’ preferences, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Withdrawals are processed efficiently, typically within 1-3 business days, depending on the method chosen.

While Tickmill does not charge fees for withdrawals, third-party charges, such as those imposed by intermediary banks or e-wallet providers, may apply. Additionally, the available withdrawal methods may vary depending on the trader’s location and regulatory entity under which they are registered, so traders should verify the specific options in their region.

Customer Support and Responsiveness

Score – 4.6/5

Testing Tickmill’s Customer Support

Tickmill offers reliable 24/5 customer support available through various channels, including live chat, email, and phone. The support team is responsive and ready to assist traders with any issues or inquiries they may have, ranging from account management to technical assistance.

Tickmill’s customer support is available in multiple languages, ensuring that traders from different regions can receive the help they need. Additionally, the broker provides a comprehensive FAQ section on their website to address common queries and help clients troubleshoot independently. While the support is generally efficient, response times may vary based on the volume of inquiries, so you should reach out during business hours for the fastest assistance.

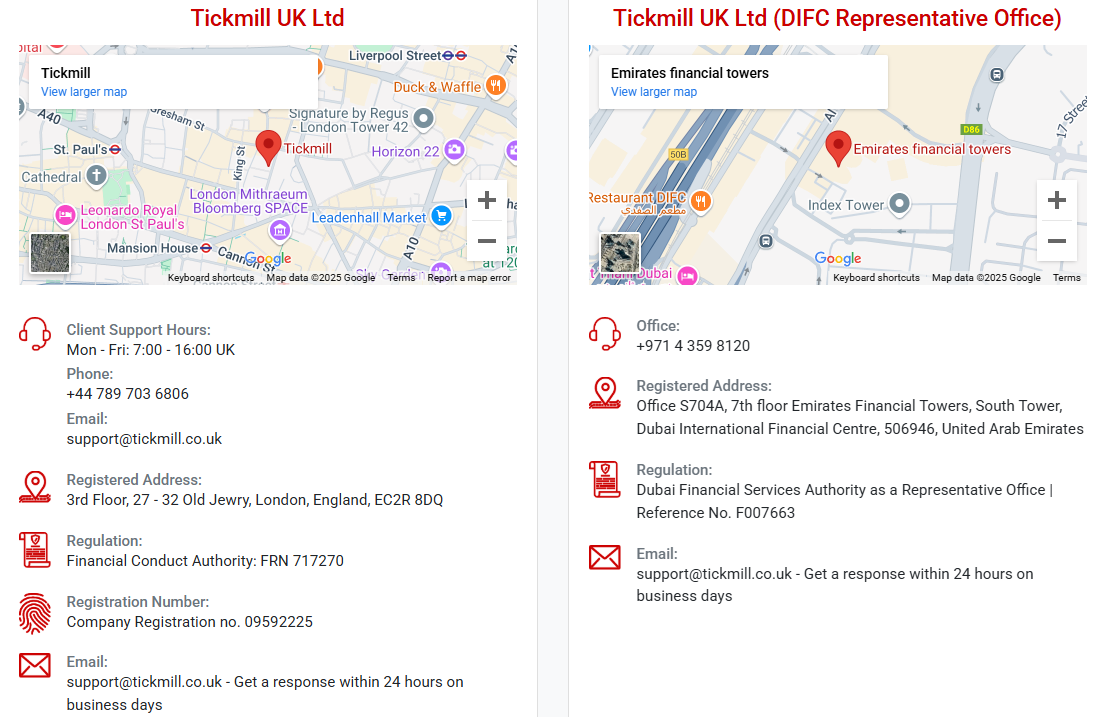

Contacts Tickmill

To get in touch with Tickmill’s customer support, you can reach them through various channels. For clients based in the UK, the contact phone number is +44 789 703 6806, and you can also email them at support@tickmill.co.uk for assistance.

Tickmill’s support team is available to help with account-related inquiries, technical issues, and general questions. Additionally, the broker provides dedicated contact options for clients in other regions, so you can visit their websites for region-specific details.

Research and Education

Score – 4.8/5

Research Tools Tickmill

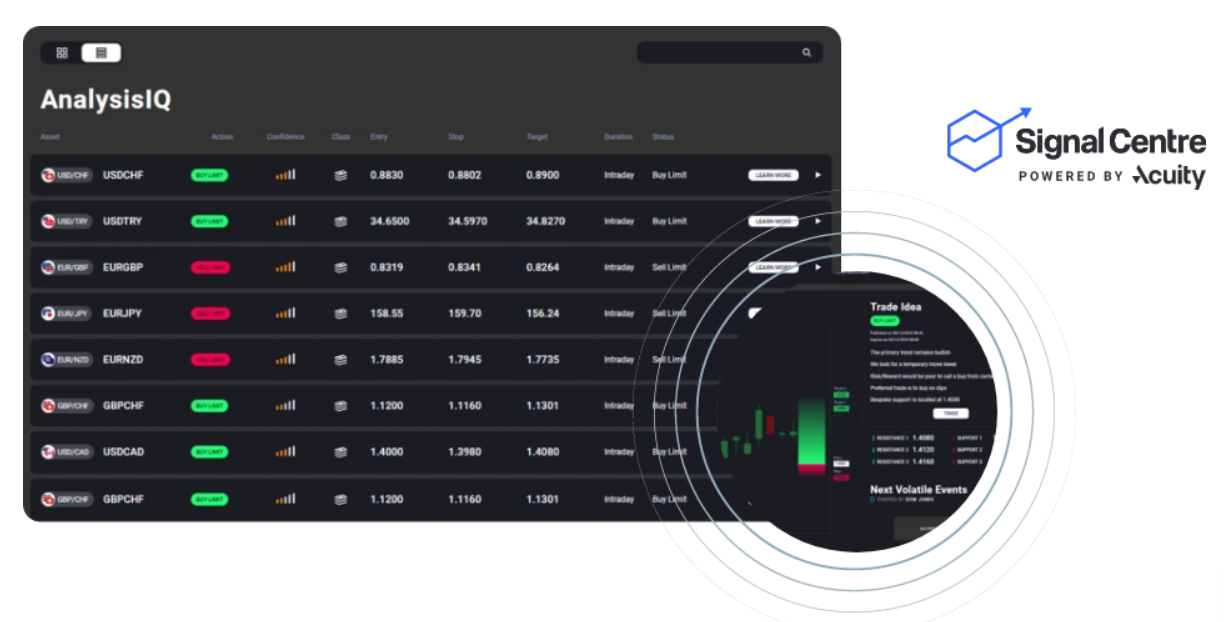

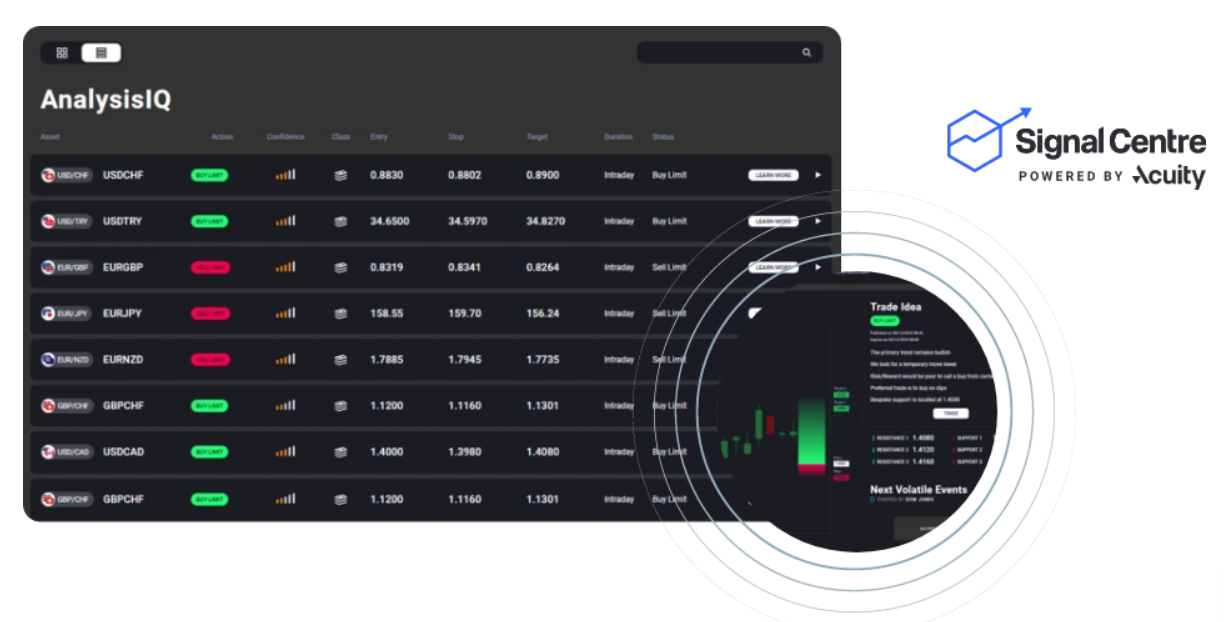

Tickmill provides a comprehensive suite of research tools to assist traders in making well-informed decisions.

- On the website, traders can access an economic calendar to track upcoming market events, a Forex calculator to assess potential trades, and an earnings calendar for tracking corporate earnings reports.

- The Acuity tool offers sentiment analysis based on real-time news, while the market sentiment tool shows an overall view of traders’ positioning.

- Additionally, Tickmill provides Capitalise.ai, an AI-driven platform that enables traders to automate their strategies without needing coding knowledge.

- On the platforms, traders have access to Autochartist for automated pattern recognition, as well as a wide range of technical indicators, advanced charting options, and Expert Advisors (EAs).

Education

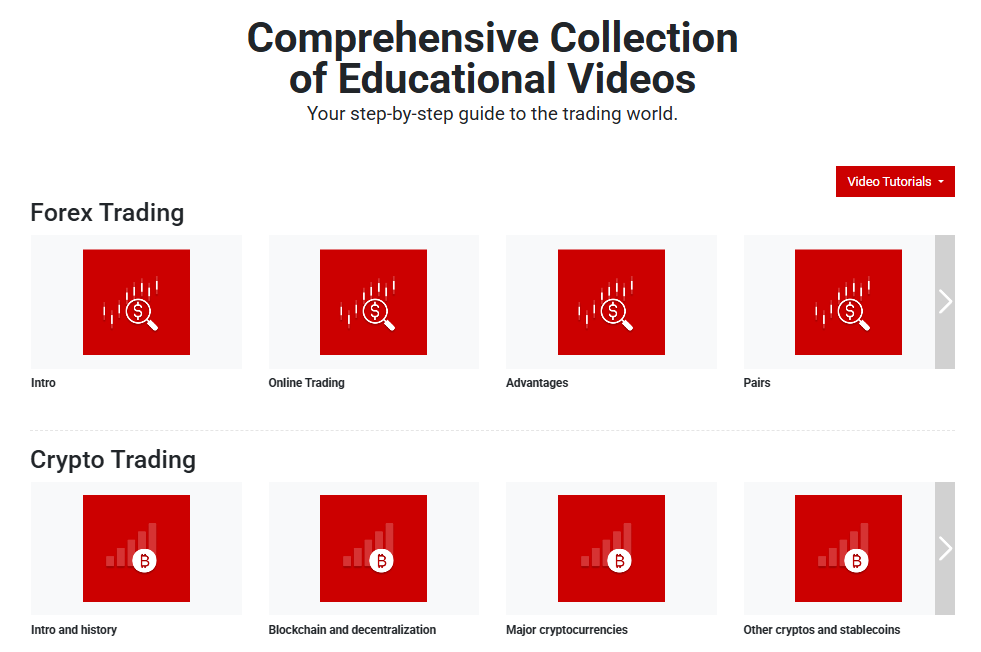

Tickmill offers a comprehensive range of educational resources to support traders of all skill levels. Traders can benefit from webinars and seminars that cover various financial topics, from market analysis to advanced strategies, hosted by industry experts.

Additionally, eBooks and video tutorials are available to help traders build a solid foundation in trading concepts and techniques. For those looking for a more interactive experience, Tickmill also offers T-Shows, which are insightful video presentations on key topics.

The Forex Glossary on the website provides clear definitions of important financial terms, ensuring that traders have the knowledge they need to navigate the markets confidently. These educational tools are designed to enhance traders’ skills and knowledge, empowering them to make informed decisions.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options Tickmill

Tickmill primarily operates as a Currency and CFD broker. While its main focus is on these markets, the broker also offers additional investment solutions, such as MAM accounts and copy trading. These features cater to investors who prefer to manage multiple accounts or follow experienced traders using automated strategies.

Additionally, under its UK entity, Tickmill offers Futures and Options trading, providing more advanced investment options for professional traders seeking to diversify their portfolios.

Account Opening

Score – 4.6/5

How to Open Tickmill Demo Account?

A demo account gives you access to the same platforms and market conditions as a live account but with virtual funds, making it an ideal way to get acquainted with Tickmill’s features and tools. Here is how you can get started:

- Go to the official Tickmill website.

- On the homepage, you will typically find an option to open a demo account. Click on this option to start the registration process.

- Provide the required information, such as your name, email address, phone number, and country of residence.

- Select the type of demo account you want to open (Classic, Raw, etc.) and the platform (MT4, MT5, or Tickmill Trader). Choose the leverage you wish to use.

- Read and accept Tickmill’s terms and conditions and privacy policy.

- Once all details are filled in, click submit to create your demo account.

- You will receive login credentials via email. Use these details to log in to your platform and begin practicing with virtual funds.

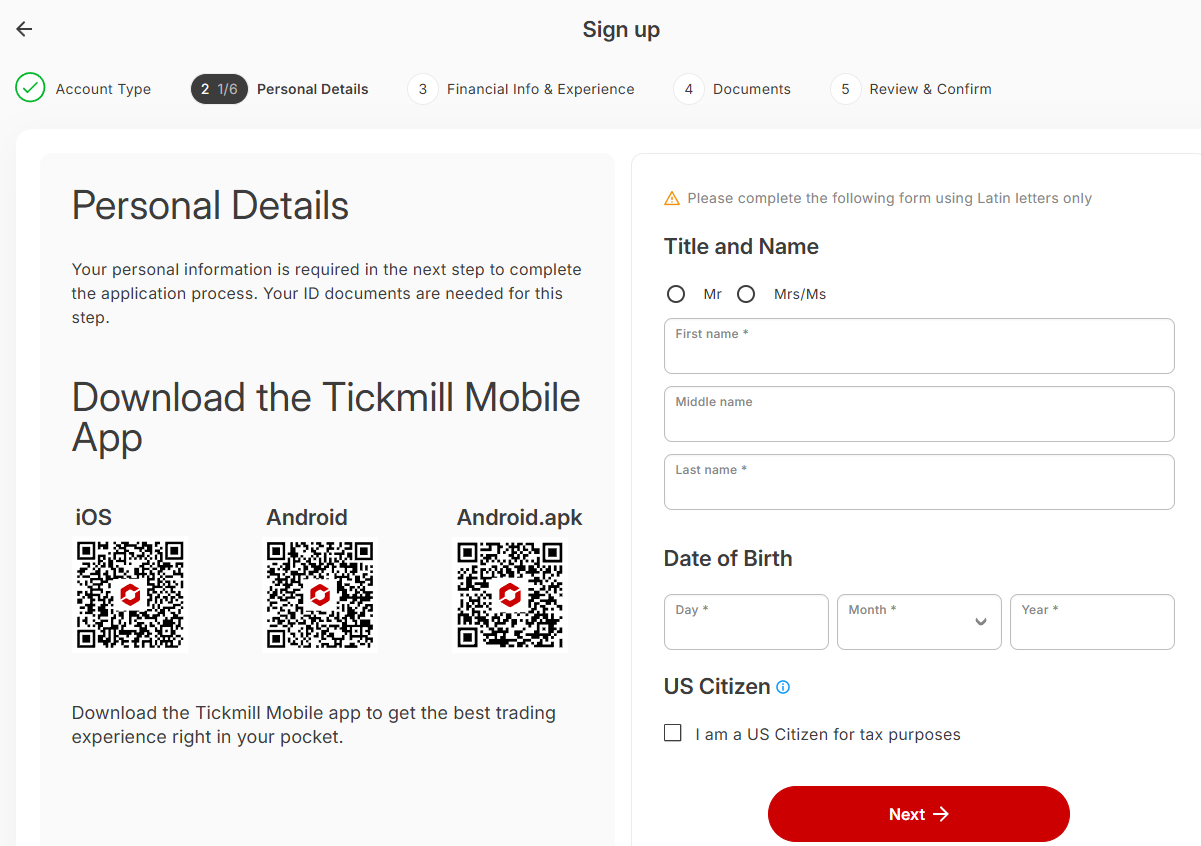

How to Open Tickmill Live Account?

Opening a Tickmill live account is a simple process that allows you to start trading with real funds. To begin, you will need to visit the Tickmill website and complete the account registration form, providing your details, such as your name, email, and phone number.

After that, you will need to upload relevant documents for identity verification, such as a government-issued ID and proof of address. Once your account is verified, you can fund your account using one of the available payment methods and start trading on the platform of your choice.

Additional Tools and Features

Score – 4.4/5

Tickmill offers a few additional tools to further enhance the experience.

- Tickmill offers a Virtual Private Server (VPS) service, which provides traders with uninterrupted connectivity to the platform for stable and reliable execution, especially for automated strategies. This ensures that traders can maintain optimal performance even with an unstable internet connection.

- Additionally, Tickmill provides the Signal Centre tool, which delivers actionable signals to help traders make informed decisions based on market analysis and expert insights. These tools contribute to a more efficient and effective experience.

Tickmill Compared to Other Brokers

Tickmill stands out among its competitors by offering a streamlined approach with a focus on competitive pricing, robust platforms, and excellent research and educational resources. The broker provides access to popular platforms such as MT4, MT5, and its proprietary Tickmill Trader, ensuring a broad range of tools and strategies.

While some of its competitors offer a significantly larger range of assets, Tickmill still provides access to over 180 instruments, which should be sufficient for most traders. Tickmill’s regulatory compliance across multiple jurisdictions, including the FCA and CySEC, provides solid reassurance of its reliability and safety.

In terms of fees, Tickmill offers competitive commission structures, especially for commission-based accounts, with low commissions and tight spreads. Additionally, the broker excels in its educational offerings, providing an excellent range of resources including webinars, video tutorials, and a comprehensive Forex glossary, which sets it apart from many competitors with more limited educational content.

Compared to competitors with larger asset variety, Tickmill offers a more streamlined approach with a focus on competitive pricing and robust platforms.

| Parameter |

Tickmill |

Spreadex |

Forex.com |

OANDA |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.1 pips |

Average 0.6 pips |

Average 1.3 pips |

Average 1 pip |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $3 |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.0 pips + $5 |

0.1 pips + $5 commission per 100,000 traded |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, Tickmill Trader |

Spreadex Web Platform, TradingView |

MT4, MT5, Forex.com Web Trader, TradingView |

OANDA Web Platform, MT4, MT5, TradingView, fxTrade |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

180+ instruments |

10,000+ instruments |

6000+ instruments |

100+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, CySEC, FSCA, FSA |

FCA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

CFTC, NFA, FCA, ASIC, IIROC, MFSA, MAS, FFAJ, BVI FSC |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$100 |

$0 |

$50 |

$0 |

$0 |

Full Review of Broker Tickmill

Tickmill is a well-regulated Currency and CFD broker, offering competitive conditions for traders of all levels. With a strong focus on low-cost trading, Tickmill provides tight spreads starting from 0.1 pips and low commission fees on its commission-based accounts.

Traders have access to robust platforms, including MT4, MT5, and the Tickmill Trader web platform, all known for their ultra-fast execution speeds and powerful tools.

Additionally, Tickmill’s educational resources are extensive and ideal for both novice and experienced traders. The broker also provides advanced tools like VPS services, actionable signals through the Signal Centre tool, and Autochartist.

Although Tickmill’s range of instruments may be somewhat limited, it still provides a good selection of popular options. Overall, Tickmill is a reliable choice for traders seeking competitive pricing, excellent execution, and strong educational support.

Share this article [addtoany url="https://55brokers.com/tickmill-review/" title="Tickmill"]

Hi I’m interested in opening a Pro Account I’m looking for a broker managed account that will give me hourly updates on my managed account and information regarding stop losses how do that work?

What are the requied documents for withdrawal