- What is Tickmill?

- Tickmill Pros and Cons

- Awards

- Is Tickmill Safe or a Scam?

- Leverage

- Accounts

- Fees

- Spreads

- Trading Instruments

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Tickmill.

What is Tickmill?

Tickmill is the trading name of Tickmill Ltd, a member of Tickmill Group, a Forex and CFD broker providing premium trading products and services with transparency and innovative technology. The broker offers over 180 trading instruments including Forex, Stock, Indices, Metals, Bonds, Cryptocurrencies, and more.

The company was established in 2014 with its headquarters in London, UK as well as offices in Seychelles. Tickmill strives to innovate a unique trading experience for its clients while understanding traders’ rights as the major part of the trade, for this purpose company, continuously facilitates trading conditions.

Tickmill Pros and Cons

Tickmill is a heavily regulated Broker with a good reputation. The company is globally recognized and offers good trading conditions for Professional or regular-size traders. Tickmill has one of the best learning and research materials and is great for EA trading.

For the Cons, proposals vary according to the entity and there is no 24/7 support, spreads for Forex are a little higher than average.

| Advantages | Disadvantages |

|---|

| Fully regulated broker | Conditions vary according to regulation and entity |

| Globally recognized and multiple awarded broker | No 24/7 customer support

|

| Standard and Pro trading conditions | |

| Competitive trading costs and commissions | |

| Excellent support, learning, and research tools

| |

Tickmill Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, FSA, CySEC, FSCA |

| 📉 Instruments | 62 Forex currency pairs, Cryptocurrencies, Bonds, CFDs, Precious Metals, Stock indices, and more |

| 🖥 Platforms | MT4, MT5 WebTrader, Mobile App |

| 💰 EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Base Currencies | USD, GBP, EUR |

| 💳 Minimum deposit | $100 |

| 📚 Education | Professional education center with seminars, webinars, video tutorials, and more |

| ☎ Customer Support | 24/5 |

Overall Tickmill Ranking

Tickmill is considered a good broker with safe and very favorable trading conditions with transparency and innovative technology. The broker offers a range of trading services designed for all level traders with low initial deposit amounts. As one of the good advantages, Tickmill covers almost the globe, so traders from various countries can sign in, also with the lowest spreads.

- Tickmill Overall Ranking is 8.9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Tickmill | FxPro | AvaTrade |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Platforms | Deep Liquidity | Trading Conditions |

Tickmill Alternative Brokers

Tickmill offers a range of trading instruments, good trading conditions, and also low trading spreads and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to Tickmill:

- AvaTrade – Good Instruments and CopyTrading

- Pepperstone – Low Spreads and Competitive Trading Conditions

- XM – Wide Range of Trading Opportunities

Awards

Tickmill has grown rapidly throughout the years and has been awarded by industry leaders many times, which is definitely great for the building of a successful portfolio.

Along with that Tickmill constantly runs a range of fascinating promotions, which helps to boost trading and enhance even beginners’ possibilities.

Is Tickmill Safe or Scam?

No, Tickmill is not a scam. It is a secure broker with a good reputation and a low-risk Forex and CFD trading environment. The broker is regulated and licensed by the top-tier financial authority FCA (UK).

Is Tickmill Legit?

Tickmill is a multiply regulated broker in various jurisdictions, thus considered a safe broker to trade with. Tickmill trading name of Tickmill UK Ltd and Tickmill Ltd Seychelles is regulated as a Securities Dealer.

- The broker is authorized and regulated by two major FCA (UK) and FSA (Seychelles), hence either entity includes strict regulations.

In addition, Tickmill Europe Ltd is authorized and regulated by CySEC (Cyprus) and is a Member of the Investor Compensation Fund (ICF).

See our conclusion on Tickmill Reliability:

- Our Ranked Tickmill Trust Score is 9.2 out of 10 for good reputation and service over the years, also for a reliable top-tier license, and for serving regulated entities in each region it operates. The only point is that regulatory standards and protection vary based on the entity.

| Tickmill Strong Points | Tickmill Weak Points |

|---|

| Heavily regulated broker with a strong establishment | Additional offshore entity |

| FCA license and overseeing | |

| Negative balance protection | |

| Global expansion and CySEC license with European cross-border authorization

| |

How Are You Protected?

To ensure the security and transparency of transactions Tickmill keeps clients’ funds in segregated accounts with trusted financial institutions, as per FCA regulations. In addition, clients are covered by the FSCS with investments up to £50,000.

Leverage

Being a UK and European-based regulated broker Tickmill follows strict guidelines set by the European authority ESMA. The European regulator set a limitation towards maximum offered leverage levels, as ESMA recognized a potential risk in case very high leverage is used.

See Tickmill Leverage below:

- Clients of Tickmill Europe may use leverage up to 1:30 for Forex products, 1:5 for CFDs, and 1:10 for Commodities.

- International traders, since Tickmill serves entities through Seychelles and other entities as well, with the opened account under this jurisdiction may enjoy a high level of leverage.

Account Types

There are 3 main Account types in TIckmill’s proposal, where you can choose either account based on spread only Classic Account or with commission per trade Pro Account. The third account is designed for high-volume traders and is named VIP Account where conditions are tailored and defined as per agreement.

Additionally, the broker offers a free Demo Account and an Islamic or Swap-Free Account. These accounts comply with the Sharia law, which has exactly the same trading conditions and terms, but there is no swap or rollover interest on overnight positions, which is against the faith.

| Pros | Cons |

|---|

| Fast account opening | Account types and proposals may vary according to jurisdiction |

| Low minimum deposit | |

| Access to a wide range of financial instruments | |

| Islamic and Demo accounts are available | |

| Account base currencies USD, GBP, EUR | |

How to Open Tickmill Live Account?

Opening an account with Tickmill is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Create Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

Tickmill Europe Ltd is licensed to provide the investment services of Agency Only Execution offering over 180 high-grade trading instruments including 62 Forex currency pairs, Cryptocurrencies (opportunity to trade CFD on Bitcoin, with a margin of 20% and 0 Commission per side, per 1 CFD), Stock Indices and Oil, Bonds, Precious Metals, and Futures.

- Tickmill Markets Range Score is 8.9 out of 10 for wide trading instrument selection among Forex, Futures, Bonds, Cryptos, and more.

Tickmill Fees

Tickmill fees are built into the spreads. The broker does not charge fees for deposits and withdrawals, however intermediary banks or eWallets may do so, which is beyond the broker’s control. Based on our findings, Tickmill also does not apply non-trading fees.

However, fee conditions always vary according to the regulatory rules the authority imposes and the broker obliges to. So be sure to verify specific conditions as well. The overnight fee should be considered as well, e.g., EUR USD swap for a long position is -11.742 while for short is $6.693.

- Tickmill Fees are ranked low or average with an overall rating of 8.9 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, Tickmill overall fees are considered good.

| Fees | Tickmill Fees | FxPro Fees | XM Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | No | Yes | Yes |

| Fee ranking | Low | Low, Average | Average |

Spreads

Tickmill offers low spreads across all platforms with some commission per trade. and high leverage on CFD currencies, stocks, commodities, indices, bonds, options, metals, and more. While the average for EUR USD pair is 0.3 pips which is a very good offering among industry comparison, see our finds below.

- Tickmill Spreads are ranked low with an overall rating of 9.2 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | Tickmill Spread | FxPro Spread | XM Spread |

|---|

| EUR USD Spread | 0.3 pips | 0.9 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 | 88 | 5 |

| Gold Spread | 20 | 1619 | 35 |

| BTC USD Spread | 12 | 20155 | 60 |

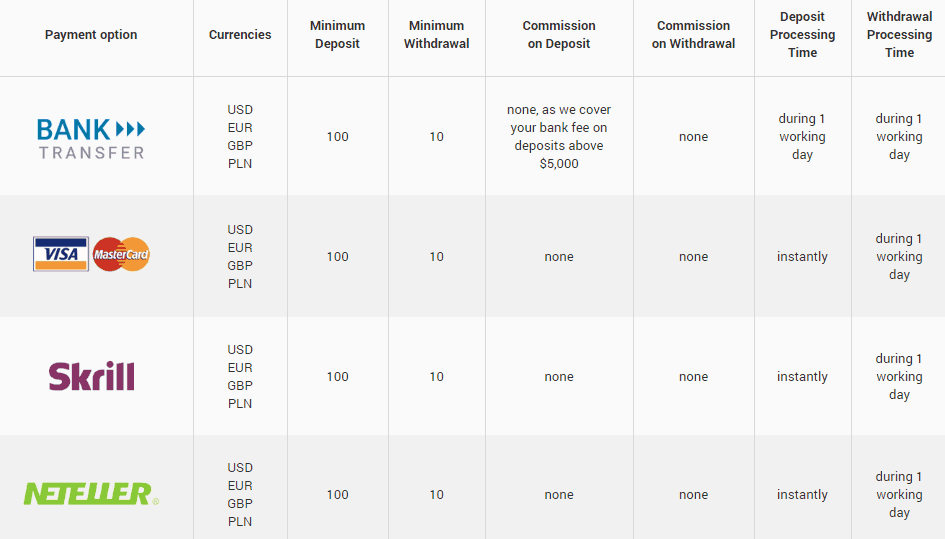

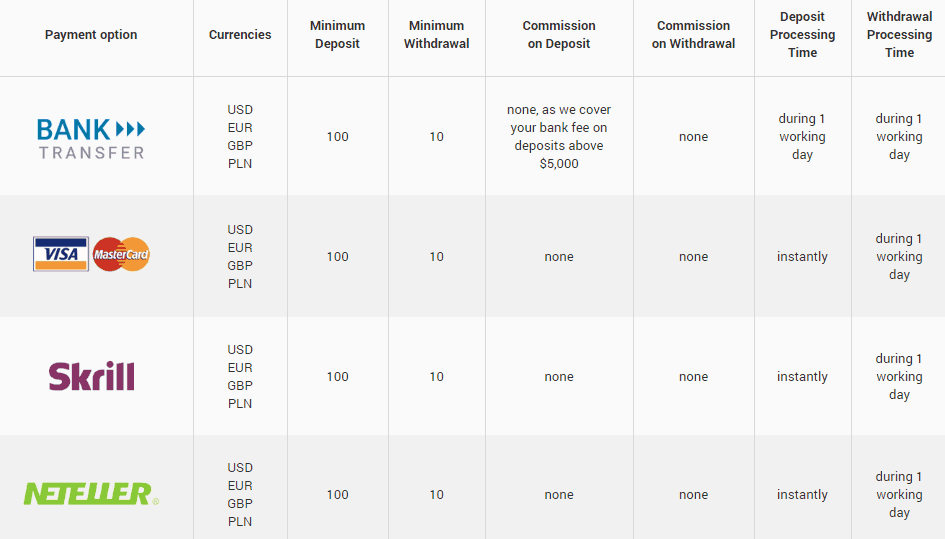

Deposits and Withdrawals

For the Deposit or Withdrawal options, Tickmill uses convenient methods to perform payments with ease and diversity. However, some options are only available to residents of certain countries.

- Tickmill Funding Methods we ranked good with an overall rating of 9 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for Tickmill funding methods found:

| Tickmill Advantage | Tickmill Disadvantage |

|---|

| $100 is a first deposit amount | Conditions may vary according to entity rules |

| Fast digital deposits including Skrill, Neteller, and Credit Cards | |

| No internal fees for deposits and withdrawals | |

| Multiple account base currencies | |

| Withdrawal requests confirmed within 1 working day | |

Deposit Options

In terms of funding methods, Tickmill offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- UnionPay, and more

Tickmill Minimum Deposit

The Tickmill minimum deposit is $100, which is a great opportunity for traders of even very small sizes. However, to get a VIP account, you have to reach a minimum balance of $50,000.

Tickmill minimum deposit vs other brokers

|

Tickmill |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Tickmill Withdrawals

Tickmill has a zero-fee policy, where no charges or fees are applicable to monetary transactions. All deposits from $5,000 also include a zero-fee policy and all fees up to $100 will be covered. The broker typically processes withdrawal requests within 1 working day.

How Withdraw Money from Tickmill Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

Tickmill offers highly secured and powerful trading platforms MetaTrader 4 and MetaTrader 5 available via desktop, web, and mobile versions.

- Tickmill Platform is ranked good with an overall rating of 9 out of 10 compared to over 500 other brokers. We mark it as good being one of the best proposals we saw in the industry and a great range including MT4 and MT5 for professional trading. Also, all are provided with good research and excellent tools.

Trading Platform Comparison to Other Brokers:

| Platforms | Tickmill Platforms | FxPro Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

The web platform is very useful for any size of trade since does not require any installations, but is reachable right from your browser. Yet, this platform is rather limited with tools and drawing instruments so for comprehensive analysis you would definitely need a desktop version.

Desktop Platform

Tickmill desktop platforms have been enhanced with a variety of useful tools including Autochartist, Myfxbook AutoTrade, One Click Trading, Tickmill VPS, Forex Calendar, Forex Calculators, etc.

Tickmill strives to reach success trading among their client, hence they do not impose restrictions on profitability and allow all trading strategies including hedging, scalping, and arbitrage. Nevertheless, be sure to verify cond

itions with particular entity regulatory restrictions as those may apply.

Customer Support

Tickmill has a professional team available 24/5 and supports international languages via Live Chat, Email, and Phone Lines in various regions including the UK and internationally as well.

Since customer service isn’t available during the weekends, you can leave your request via the contact form to be advised.

- Customer Support in Tickmill is ranked good with an overall rating of 8.9 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Supporting numerous languages | |

| Live chat, phone lines, and email

| |

Tickmill Education

Another good point to note in Tickmill proposal and offering is the established Learning Center along with a professional Trading Blog where traders can find recent updates, various educational materials, and educational programs designed to develop skills and knowledge.

Online webinars, live market analysis, technical analysis, regularly held seminars, and traders community of minded traders are all at a very good level and available for all.

- Tickmill Education ranked with an overall rating of 9 out of 10 based on our research. The broker provides very good quality educational materials, and excellent research also cooperates with market-leading providers of data.

Tickmill Review Conclusion

Concluding the Tickmill review, we admit a broker that invites clients with its attractive features such as a low minimum deposit, technical solutions, a great range of instruments, and interesting promotional campaigns.

Also, we found some of the low spreads for Forex trading. In addition, Tickmill provides expanded trading strategies and a certain way of dealing with markets and traders.

Based on Our findings and Financial Expert Opinions Tickmill is Good for:

- Beginners

- Advanced traders

- Traders who prefer MT4 and MT5 trading platforms

- Currency and CFD trading

- Copy Trading

- Low Spread Trading

- Variety of trading strategies

- Algorithmic or API traders

- EA trading

- Good customer support

- Excellent educational materials

Share this article [addtoany url="https://55brokers.com/tickmill-review/" title="Tickmill"]

Hi I’m interested in opening a Pro Account I’m looking for a broker managed account that will give me hourly updates on my managed account and information regarding stop losses how do that work?

What are the requied documents for withdrawal