- What is HFM?

- HFM Pros and Cons

- Awards

- Is HFM safe or a scam?

- Leverage

- Accounts

- Fees

- Spreads

- Deposits and Withdrawals

- Trading Platform

- Customer Service

- Education & Research

- Conclusion

Our Review Method

- 55Brokers leading financial experts with over 10 years experience in Forex Trading check trading offering in detail including fees, platforms, verified licenses, contacted customer service and placed traders to see trading conditions and give expert opinion about HFM

What is HFM?

HFM (previously know as HotForex) is a multi-asset award winning Forex broker that offers Forex, Metals, Energies, Indices, Stocks, Bonds, ETFs, Cryptocurrencies and Commodities trading with 1:2000 leverage, ultra-fast execution, quick deposits & withdrawals and swap free accounts.

HFM offers 5 account types Cent, Zero, Pro, Premium and Top-up Bonus with tight spreads averaging EUR USD 0.1 also operating unrestricted liquidity. Which is allowing any size or profile trader choose between various spreads and liquidity providers via automated trading platforms and perform any strategy, including News trading.

- The brokerage firm itself was established in 2010 with its headquarter in Cyprus, yet in addition serves several global offices including Dubai, South Africa also offshore entities in St Vincent and the Grenadines.

- While indeed HFM shows great interest and impacts mainly in Africa (see Ghana Brokers), Asian and MENA regions which bring some of the great opportunities to global residents and plus to International proposals overall.

Besides, HFM offers its trading service along with the applicable licenses in each region it operates that regulate the Forex industry, therefore delivers service trustworthily.

HFM Pros and Cons

HFM is a broker with a good reputation and regulations based on our finds. The offering is user friendly, we mark large portfolios for Forex and CFDs instruments, while fees are considered low compared to other popular brokers, besides minimum deposit is among lowest in industry allowing any size of traders to sign. Also, there is truly remarkable education section suitable for beginning traders and one of the best ranges our financial experts saw of webinars and seminars performed globally.

On the other hand, HFM has limited portfolio for EU clients, with only Forex and CFDs are offered. Also, international trading is done via offshore branches with lower requirements, however HFM has good reputation so is considered to sign in.

| Advantages | Disadvantages |

|---|

| Multi-asset regulated, global broker licensed from CySEC, FCA, DFSA, FSCA, FSA, CMA | International offering done via offshore |

| 1:2000 Leverage | |

| Swap free Accounts | |

| $0 min. deposit | |

| 500+ instruments to trade | |

| 24/5 online support | |

HFM Review Summary in 10 Points

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC, FCA, DFSA, FSCA, FSA, CMA |

| 🖥 Platforms | MT4, MT5, HFM Trading App |

| 📉 Instruments | 17 trading tools with Forex, Indices, Metals, Energies, Shares, Commodities, Bonds, ETFs, DMA Stocks, and Cryptocurrencies |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0 US$ |

| 💰 EUR/USD Spread | 1 pips |

| 💰 Base currencies | Several currencies available |

| 📚 Education | Trading Academy, Webinars Seminars, Numerous Tools |

| ☎ Customer Support | 24/5 |

Overall HFM Ranking

Based on our Expert finds, HFM provides good trading conditions that might be some of the best for Forex trading and CFDs trading, also available in a global scale for international trading. HFM is suitable for various traders including European clients, Africa and Asia traders, also beginning traders and experienced looking for good technical trading solutions.

- HFM Overall Ranking is 9 out of 10 based on our testing and compared to 500 other brokers, see Our Ranking below compared to other popular and industry Leading Brokers.

| Ranking | HFM | BalckBull Markets | Pepperstone |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Education | Spreads | Platforms |

HFM Alternative Brokers

Yet, we found not very wide range of trading instruments for European clients, it might be the case of regulations, but yet is good to check other industry proposals too. Besides DMA access to Futures or Indices trading is not available too.

See detailed Alternative Broker Reviews:

Awards

Besides its looks to us an attractive trading proposal at first look, there are some confirmations about its trustworthy business due to official figures and numbers, as well as numerous industry awards that HoForex holds and counting. We also saw great development of HFM along the ttime, before broker mainly operate in Europe and now is one of the trully global brokers with great coverage of regions.

- Until now there are more than 500,000 Live accounts opened with the HFM, along with multiple Industry awards and sponsorship HFM prestigious titles recognize as Best Clients Funds Security Broker, Best Forex Provider, Top 100 Companies etc, see our snapshot find below.

Is HFM scam or safe Broker?

No, HFM is not a scam, we consider HFM a safe broker due to being licensed by several top authorities including FCA, FSCA and CySEC.

In simple terms it means the broker is regulated and authorized to offer its trading service along with necessary safety measures and controls applied.

Where is HFM located?

HFM is authorized and Regulated by CySEC, Financial Conduct Authority FCA, FSCA South Africa, and CMA in Kenya.

Also, there are HFM entities that are registered in offshore zones alike Mauritius, SVG and Seychelles. While our general recommendation is not to trade with offshore brokers as they simply do not regulate Forex trading, due to HFM multiple parallel regulations it is considered to be safe to trade with them.

See our conclusion on HFM Reliability:

- Our Ranked HFM Trust Score is 9 out 0f 10 for good reputation, excellent service for years and constant growth and reaches to more jurisdictions. HFM holds reliable top-tier licenses, is one of the biggest Brokerages worldwide, while the only point is International trading available via the offshore entity.

| HFM Strong points | HFM Weak points |

|---|

| Authorized and Regulated by CySEC, Financial Conduct Authority FCA, FSCA South Africa | Three entities based in offshore zones |

| Negative balance protection | |

| Constant enlarging of licenses | |

| Global reach with available access of Asia, Africa regions | |

| Additional Civil Liability Insurance | |

How are you protected?

For the funds protection, which is an important part of the regulated broker, HF Markets (Europe) Ltd. is a member of the Cyprus Investor Compensation Fund. It constitutes a claim of the covered clients against investment firms. Clients’ deposits are protected under the requirements of the regulators.

While in addition to that HFM safeguard traders with a Civil Liability insurance program for a limit of €5,000,000, which includes coverage against errors, omissions, negligence, fraud and various other risks that may lead to financial loss, giving extra layer of protection and another good point to our HFM Review. However, according to applicable laws and regulations, the conditions vary from one entity to another, see our snapshot of HFM licenses below.

Leverage

While trading with HFM we founf availabilitty of fixed or floating leverage, which is indeed a very useful tool, especially for traders of smaller size. Leverage brings an opportunity to increase your potential gains through its possibility to multiply balance in a particular number of times. Yet remember that leverage may work in reverse too, defining also your risks, that is why it’s so important to understand how to use tool smartly.

- HFM offers various leverage levels from the “modest” one as determined by European regulations allowing 1:30 for Forex instruments, and up to very high ratios of 1:2000 available via international branch. Yet, again always make sure to learn about high risks of leverage, as retail trading accounts lose money rapidly due to high leverage.

Therefore, your leverage levels are firstly settled according to the regulatory requirement in the region or another also your prof level in finance, so make sure to verify with the customer support team which one you entitled to.

-

- European entities that oblige to ESMA regulation, the maximum leverage ratio is set to a 1:30 on Forex instruments, 1:25 Spot Metals, etc.

- South Africa residents may access leverage of up to 1:2000

- Higher leverage ratios like 1:400, 1:500 or even 1:2000 are offered through HFM offshore entities since a particular registration does not limit offering and allows high leverage levels.

Account types

HFM provides a variety of account options with 5 different accounts based on specific requirements. The range offers Cent, Zero, Pro, Premium, Top-up Bonus, Copy Trading and PAMM account with Swap Free Trading, also you can select the Islamic Account suitable for traders from the MENA region or beyond.

- From the very beginning, you may sign in for Demo Account and then transfer it to a Live one just by depositing money.

- Each of the account types brings good flexibility and allowing to choose based on your trading strategy, allowing either beginning traders, investors or professionals to find its own way in trading.

- Another good point we admit is the opportunity to trade Micro lots, use Cent or Nano account, or specify account for Copy Trading. You may see below in our HFM Review snapshot below details of each, also negative and positive points to consider:

| Pros | Cons |

|---|

| Ultra-fast execution with quick deposits & withdrawals | Accounts and offer depends on the entity |

| Various Account Types with low Spreads | Some conditions are not available in some regions |

| $0 min. deposit | |

| Leverage up to 1:2000 | |

| Swap Free Trading | |

How to open HotForex Demo Account?

To open a Demo account is pretty easy since there is no verification is needed at this step, we were able to open demo account in minutes. While you should simply follow the process of risk-free account opening on HFM website and get access to either MT4 or MT5 platforms with unlimited demo funds. So here is the step by step process of Demo Account opening:

Opening Trading Account step by step:

1. Go into HFM Demo Account Sign In page

2. If you are a new client enter your personal data First and Last Name, Country of residence, email, phone, etc. Or in case you’re existing client follow sign in

3. Fill in all required information for the first register of myHF

4. An account will be approved almost immediately, where through your client area you can get access to New Demo Account, next you can follow with Live Account submit to manage your funds

How to open HotForex Live account?

Once you ready or decided to start Live Trading you can submit for a Live account where HFM may ask you for confirmation of your documents including identity, residency and other proof before you start. In both cases, you will get access to myHF client area where you can manage all your accounts and finances.

What Instruments I can trade in HFM?

One of the HFM Pros also is offered market range that includes 17 trading tools and 150+ trading products with access to global markets. These include Indices, Metals, Energies, Shares, Commodities, Bonds, ETFs, DMA Stocks, and included for last years offering to trade Cryptocurrencies with Bitcoin, Ethereum, Litecoin, Ripple and more.

HFM Fees

HFM trading costs mainstays at the tight spread offering in general andl bringing some of the most attractive spread opportunities among the industry as we conclude based on our research, also proposing spreads from 0 pips on some accounts. However, is good to check on the additional, non trading fees and charges for deposits or withdrawals all in all concluding your trading costs, see fee table below:

- HFM Fees are ranked average, low with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Fees are different based on entity, yet traders can use free deposits and withdrawals mainly worldwide

Overview of the Non Trading Fees

Important to consider, there is a fee charged in case you didn’t use your account and show no activity for 6 months or more. After this your account entitled to 5$ HFM inactivity fee per month.

Despite this, there are no deposit fees or some of the withdrawals are free as well, which we will see in our HFM review further.

| Fees | HFM Fees | FXTM Fees | XM Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

HFM fees are built in a transparent manner while the only charge is variable spread, which is a difference between bid and ask price, also HFM does not offer fixed spread (Find fixed spread brokers list here). HFM does not charge additional fees or commission, thus your calculation of the position is quite seamless and easy despite the level of trader you are, see our spread finds below:

- Spreads fees defined by the account type you use, thus Micro Account spread starting from 1 pip and Zero Account offers 0 fee which averages on 0.2 pips most often.

- However, the difference between trading costs also defined by the margin requirements, which increase almost double in case you wish to trade with 0 spread. So make sure to verify account conditions in detail before you sign in.

Below you may see a comparison of the most popular instruments, the typical spread based on Standard conditions, as well for your information compare fees to another broker FP Markets.

- HFM Spreads are ranked average/ low with overall rating 8 out of 10 based on our testing comparison to other brokers. We found Forex spread lower than the industry average of 1.2 pips for EURUSD which is great plus

Comparison between HFM fees and similar brokers

| Asset/ Pair | HFM Spread | FXTM Spread | XM Spread |

|---|

| EUR USD Spread | 1 pips | 1.5 pips | 1.6 pips |

| Crude Oil WTI Spread | 5 pips | 9 pips | 5 pips |

| Gold Spread | 19 | 9 | 35 |

| BTC USD Spread | 30 | 20 | 60 |

Overnight Fee

As well always consider overnight or rollover fees as trading costs in case you holding an open position longer than a day. This fee is defined by each instrument separately and you will see it directly from the platform or upon the opening of the trade, see below example with Cryptocurrencies.

However and unless you trading through swap-free accounts designed to traders following Sharia rules, as these accounts restricted from any interest rates or swaps.

Fee conditions upon opening of trade

Deposits and Withdrawals

There are multiple ways to fund trading accounts supported by HFM. Besides broker issue its very own HFM MasterCard for a straight transaction and the ability to make safe online payments.

- HFM Funding Methods we ranked Excellent with overall rating 10 out of 10. Minimum deposit is among lowest in industry, also Fees are either 0 or very small, besides range of supported funding methods is good, but be sure to verify conditions with entity you trade

Here are some good and negative points on XM funding methods found:

| HFM Advantage | HFM Disadvantage |

|---|

| $0 Minimum Deposit on Cent, Zero, Premium and Top-up bonus Accounts | Methods and conditions vary based on entity |

| Wide range of deposit option including Credit Card, Bitcoin, WebMoney and fasapay | |

| Free deposit and withdrawals | |

Deposit Methods

One of the great points in we found is that HFM offers over 14 methods to deposit or withdraw money, also along the time adding more methods based either on new offerings like Crypto Deposits or enlarging accessibility to local transfers or payment methods available at the regions. Those methods include:

- major credit and debit cards

- wire transfers and domestic transfers available at some regions

- vast of e-wallets, including Cryptocurrency Deposit, fasapay, WebMoney, and more.

How do I deposit money on HFM?

So in order to deposit money on HFM you simply need to select the payment provider of your preference, as well as the one that is available in your region, and proceed with the payment. HFM will process your withdrawal within a short time and is available 24/5.

What is the minimum deposit for HotForex?

HFM minimum deposits start from 0$, yet, if you just make a first deposit check out preferences on a minimum requirement according to the account type as well, also determined by the payment method you would choose.

HFM Withdrawal Review

HFM withdrawal options including cards, bank transfer by far most used option and various ewallets. And the last point withdrawal fee, which is actually 0$ is amazing news that allows you not to worry about extra fees. However, Wire Transfer may involve some correspondent fees according to your bank and international policies.

How do I withdraw money from HFM?

In order to proceed with the Withdrawal, you should access your myHF area and submit a Fund Withdrawal request.

HFM Broker Review Withdrawal step by step

- Access your myHF page and account area

- Select ‘Fund Withdrawal’

- Chose the appropriate withdraw method and amount

- Confirm necessary data and processing time/ fees

- Submit

- Follow up and check on the process or confirmations through your page

How long does it take to withdraw money from HFM?

Various payment methods will process withdraw money in slightly different time. HFM accounting team confirms transactions quite quickly as we had on our trade test, yet the matter might take longer due to payment providers. Alike Wire transfer will take 2-10 working days, also depending on your bank and international policy processing, while ewallets will load the request Instant.

Trading Platforms

HFM provides an award-winning MT4 Platform as its main trading software and its newer version MetaTrader 5. It is not a surprise choice, as platforms enable one-click trading along with numerous tools and access to institutional quality technology through advanced configuration, also offering a good choice between platforms so whether you are a very beginner or an advanced trading veteran the software might be suitable well.

Web Trading Platform

MT4 and MT5 HFM terminals available in various versions that suit your personal needs and allows efficient trading through the Desktop Platform, WebTerminal which is compatible with any browser. Or by the use of MT4 MultiTerminal with access to manage multiple accounts simultaneously, however desktop version still remains the most complete with all features and add-ons available there.

- HFM FIX/API is ideal for clients that want to use the FIX protocol.

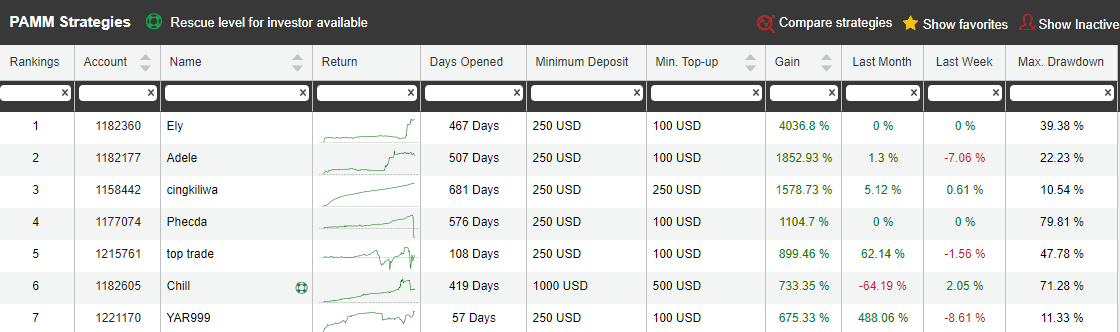

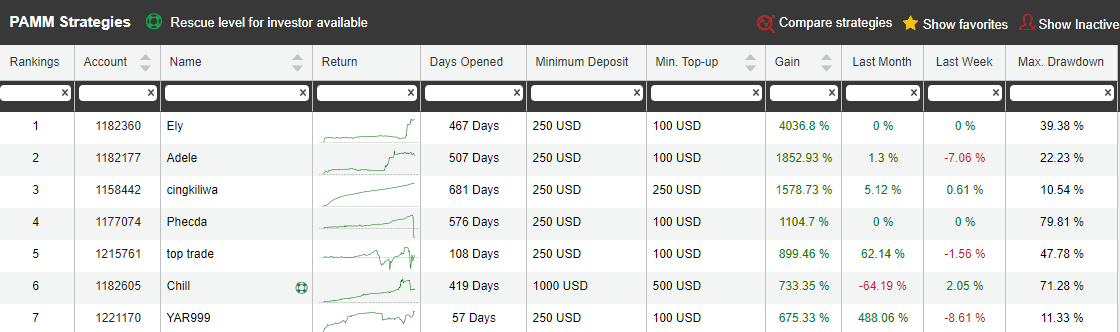

- Also, there is a possibility to copy trade or become a professional master to be copied through an advanced PAMM technology designed by HFM.

Mobile Trading Platform

HFM has developed a new mobile application – HFM Trading App or HFM Mobile Application . The app is available for both Android and iOS users. MT4 and MT5 mobile trading are actually known for its advanced capabilities and interactive charts with almost the same productivity as its full versions, while the app takes the trading experience trully great with over 30 technical indicators and 24 analytical objects, so mobile capabilities are very good, and we enjoyed testing it too. See our ranking and comparison to other brokers below:

- HFM Platform Selection ranked Excellent with overall rating 9 out of 10 compared to over 500 other brokers. We mark it as excellent since there is a choice between industry popular platforms like MT4 and MT5, also HFM has its own trading apps packed with tools and excellent research. HFM technology overall might be suitable for day trading, long or short trading, copy trading, Robot Trading, EAs all with quality execution.

Trading Platform Comparison to Other Brokers:

| Platforms | HFM | FXTM Platforms | Plus500 |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

HFM Platform Look and Feel:

Does HFM allow scalping?

Yes, HFM allows scalping and places no restrictions on the strategies, however various entities and regulations may apply some conditions so you better always check terms and conditions.

Particularly about scalping, there is no restriction and HFM range of accounts alike with Zero spread may assist you even better to trade this strategy.

How do I manage my risk?

While placing an order you should manage your risks smartly while tools like Limit Order and Stop loss orders will assist you, since they are the most basic risk management toos. Stop loss will set a particular position to be automatically closed at the predetermined price, sot that you won’t lose more than you define. Also, HFM provides good calculators and trading journal to keep track on your performance and is highly advised by us for use too.

Placing Trading Orders

Customer Service

Another important point while choosing the broker and within our HFM Review is customer service. Eventually, the broker provides support in 27 languages which is an impressive number that covers almost all world most used languages, and allowing traders from almost any country to join trading and get quality support.

- Customer Support in HFM is ranked Good with overall rating 9 out of 10 based on our testing. As we check the traders’ reviews and tried HFM Customer Service Live Chat for our tests too, the satisfaction statistics is good, and HFM provides a good level of customer support along with support materials, see our Ranking breakdown below:

| Pros | Cons |

|---|

| Customer oriented policy | No 24/7 customer service |

| Live Chat | |

| Supporting 27 languages | |

| Good ranking of Support | |

| Fast answers | |

HFM Research and Education

Education is another strong point of HFM since the broker concentrates and puts efforts on Africa and Asia regions so its allows various traders to join in. We found very well-designed and explained Trading courses, Live Webinars, Video Tutorials, Daily Analysis and Market Outlooks along with News Feeds all provided in impressive number of languages, so with HFM you have all potential to become a better trader whether you’re a beginner or a professional one.

Trading Research Tools

For Research HFM provides an excellent range of analytical and research tools. This includes Analytical Objects, Economic Calendar, Autochartist and Trader’s Board for comprehensive analysis, as well as additional Premium Trading Tools. In addition, there is a VPS Hosting available, while free VPS packages provided to those who deposit from 5,000$

- HFM Education ranked with overall rating 10 out of 10 based on our research. HFM Trading Academy, Webinarsm Video and Analytics are at very very good level, we might rank with our over 10 years of Trading experience as one of the best education Brokers among the industry

Is XTB good for beginners?

Based on our research, we can recommend XTB for beginners since it did a great job incorporating state-of-the-art educational resources and research tools. XTB’s trading platform is quite user-friendly and the spreads are lower than the industry average. Another great aspect is that it doesn’t have a minimum deposit requirement making it favorable amongst newbies.

HFM Review Conclusion

Overall, HFM is a well-established customer-oriented broker with secure, regulated trading environment suitable for almost every trader. The services and products are tailored to specific requirements and bring very good range of choices including accounts, platforms, tools, and instruments with the ability to choose a suitable strategy with almost no restrictions.

So in our financial review though either you wish to join copy traders or to use EAs, perform scalping or become a partner etc. there is an option for all. As well, HFM pricing is one of the lowest rates in the industry.

Based on Our findings and Financial Expert Opinion HFM is Good for:

- Beginning Traders

- Traders withh Experience

- Investors

- Copy Trading

- Trading Education

- Traders who prefer MT4 and MT5 platforms

- Currency Trading and CFD Trading

- Running various Strategies

- EAs trading

- PAMM Trading

- Excellent Research

Share this article [addtoany url="https://55brokers.com/hotforex-review/" title="HFM"]

HFM, it is that broker that I will never leave. I am offered trading conditions that are second to none.

Initially I was on the Cent account , but then chagned to the Pro account.

Even thouhg on the fomer there is no min deposit limit, the latter has benefits like lower spreads. I allowes me to approach the market with scalping tecqhnique and no need to be worried about costs. Just yeterday I opened a position on eur/usd and all went smoothly.

Also, trading using MT5 platform is great. I use its powerfulk tools and charting indicators.

Try the broker guys, u wont regret

Using the trader’s board tool, I was able to identify the biggest currency movements, keeping up to date with market news. I utilized a wide range of trading calculators to make more informed trading decisions. I was never wrong in any calculation! In addition, I use the autochartist tool, which a perfect utility tool that scan my watchlist and notifies me of chart opportunities instantly. A great exprience!

Whatever class you like trading, HFM has it, no doubt. Markets from currency pairs to commodities and more are there for you.

Pay attention to PAMM as well. You can invest and let skillful traders manage the allocated funds.

I have been trading with HFM for quite some time already.

The broker is an excellent destination for traders.

The trading platforms are available on iOS, Android, desktop, and web.

Spreads are so thin that they make trading transactions almost non existent.

Another aspect is the leverage that is offered. It is stratospheric. Use it with great care, though.

And when it comes to security, do not be worried! The broker is audited by a reputable firm.

they offer very good services, almost every account for a variety of traders, (Note: forex trading is risky, pls stick to demo if unsure.). very good withdrawal and deposit options, make sure to get fully verified before anything else, they can be a bit strict with documentation which is good. good execution, web and mobile platforms available, options for pamm accounts with good account manager, i am yet to try e-wallet withdrawals but its a good option ion my opinion, over all trading exp is 3 years live account during the pandemic. im pleased with hfm

I have Zero account and I am happy with trading conditions I got after opening it.

These conditions are favorable and it is obvious even to novice traders.

For example, my leverage is 1:2000. This is enough for my profit to be large enough to gradually increase the size of the deposit and withdraw part of the profit from the account.

My spreads are so narrow that for currency pairs it is from 0.

By the way, I didn’t need large amount of money to open account. As far as I understand there are no restrictions on the minimum deposit.

HFM is a very peucliar platform, but with a positive sense. First things first, it’s a super regulated one. According to my knowledge, the broker possesses really enviable number of reguations, thus it can easily operate in many jurisidctions.

Secondly, the suplus of instruments is something that I was looking for. I question the usefulness of all, but maybe it’s because of my experience.

Multi-regulated and multi-faceted broker. With its offerings, it elevated my trading statistics. I came here with a little bit of money, and it required me just a few bucks of minimum deposit and i was able to start trading. Couldn’t get the premium account yet but its allright. leverage up to a few hundred times, thousands of assets, great charting, good regulation, I wasnt asking for much but I already got more than I thought I could from the side of the broker. the feel of security and availability of tons on indicators on top of that. that’s what I call a great package.

How can you assess the vps server on the hfm platform? Is it worth trying or maybe it’s not mandatory to work with the broker to use it?

I use it every day.

You know, of course on the net you can find separate services that provide VPS servers, but I like to buy everything in one place, I guess, you know what I mean.

I’m confident in reliability of my broker and therefore I don’t worry about how server will work. And if some problems with it, it’s easier to solve them with my broker than with some unknown company.

As for characteristics of their VPS, I’m completely satisfied.

HFM broker is the one that I just respect. You know, it’s not a love, passion or admiration. It’s more about respect.

The company has managed to establish itself as a proper mediator for many traders across the globe as it has several regulations and offers quality conditions.

Here is a good account types selection alongside industry-leading trading platforms such as MetaTrader, plus it also grants access to its custom solution. Other than that, the range of methods how to deposit and withdraw funds is also big and no fees are levied.

Building such an infrastrcture deserves a big respect!

I should confess that I devoted a lot of time for a comprehensive examination of this platform to define whether it suits my trading style or not.

It turned out that the company is quite relevant and acceptable from the point of delivered trading conditions. The array of tradable assets is cool enough to jump from this to that asset without any second thoughts. Whatever you wish to trade – trade it.

There’s also a moderate number of instruments for analysis. I hate excessive number of functions and features cuz I see no practical sense in all of them. All in all, I put the broker solid 4/5.

I am investing in some PAMM accounts on this broker. I knew this broker a pretty long time ago and figured out it features PAMM. I got both profit and loss with PAMM but it’s worth researching and investing in. Some PAMM accounts generate steady profits!

This is kind of a place where endless opportunities in assets meets very good trading conditions to take advantage of them. They have a great reputation too.

HFM has competitive spreads and low fees. Depending on the account type you choose, you can enjoy fixed or floating spreads, as well as commission-free or commission-based trading. The average spread for the EUR/USD pair is 1.2 pips on the Premium account, which is lower than the industry average. HFM also does not charge any deposit or withdrawal fees. And also, they do not have fees for premium; maybe they even do not have fees for other accounts. I do not know; I am using premium only. HFM has a rich educational section and a dedicated customer support team as well, I must mention that.

I liked this borker from what I have seen as their offering on its website and decided to start trading with them.

However, the porcess of opening an account was a bit complicated. They asked for proof of address and that’s fine. But I was able to access a fully operational real account three days after I started the reistration process. It’s a bit lengthy process in my opinion….

I am a newbie in forex trading and hope to find the broker with the lowest spread/commission, micro account ($5) that can be traded on mt5, no inactivity chargep and regulated. Can you recommend one please?

Awesome broker for trading and investing simultaneously.The amount of features for generating profits and the conditions on them is what distinguish this broker in a very positive way from the others.

Of course you can have a good broker with solid conditions for trading. Or you can have a decent investing platform. But almost never the two endeavors combined in a very contemporary manner.Plus you don’t have to have big bucks to do so.The entry bar is really affordable.

I am trading gold for quite some time with hotforex broker. They give good execution levels for trading. Spreads and leverage is also good even though i am trading with small amount. I also withdraw my profits regularly without any complaints.

To be honest, I do not think I have see a broker with these many tools for traders before. And all of them are free; the broker has no fee attached to some of the most exclusive tools and features in the industry. But yeah, I have enjoyed trading here. Totally worth it.

HFM is like a beacon of being able to follow the most recent trends in the industry whilst complying to the regulatory framework of like a hundred different authorities. They’re great

HFM is a trading platform that offfers a host of trading tools to help traders succeed in the market. One of its standout tools is the Autochartist, which scans the markets for potential trades and gives you signals to act on. With this tool, you can be confident that you have a couple of extra ttrades that you might not have cought yourself.

HFM also offers a wide range of educational resources to help you stay up-to-date on the latest market trends and investment strategies.

I like the levergae of the broker. For some traders 1:2000 will seem pretty dang high, and it is pretty dang high.

Nevertheles if you know how to handle it then you won’t have any issues. and if you don’t, then start learnin.

I wonder what other traders think of HFM leverage level?

Well, I am sure that the 2000x level is for very special and concentrated situations.

No trader in the world, I think, can constantly handle 2000x leverage.

Let’s put it this way, if you are using 100x leverage. It will take the asset to move %1 to the wrong side to wipe your entire position out. You might thing that is okay, since it is hard for some stocks for example or FX pairs to move 1% in a day.

2000x means it’ll take the asset to move %0.05 to the wrong side to wipe you out. Still think its hard? But you can use it with earnings plays if you are sure.

It is still great to have that

This broker’s concern for me as a customer seemed excessive to me.

It’s strange to complain about it, though. Clients of other companies probably dream of such care.

As for trading, everything is not bad. The tools work without any errors. I make nice profits.

I joined the broker a month ago. I trade on a zero spread account. I chose the account from the very beginning. The trading conditions on that account are optimal for me – 1:500 leverage, good spreads and a minimum trading deposit that I find democratic – $200.

I’m absolutely satisfied with manual trading with the broker. Now I want to try copy-trading here. What conditions for this do you offer?

It depends on what end you want to execute copy trading. If it’s from copying other people’s strategies, then you’ll need to have at least $100 to do so.

But if you want to be a strategy provider, then you’ll need $500. Strategy providers also are allowed to have not more than 1:400 leverage and not more than 300 simultaneously opened positions. But 300 positions is more than enough, trust me.

Uhm… Gotta be objective, as I saw some people tend to be sooo subjective that it’s not really correct.

All modern trading instruments are ensured here without a doubt, but on the other hand, transactions are processed only 5 days in a week, that maybe not so convenient for some people.

HFM is a really cool broker. The features are many; numerous I tell you. The accounts available are really interesting. There is an account for literally every type of trader. All the accounts are really affordable too with the premium going for only $10.I have a question tho. Can I have multiple account types here? Like the premium and the HFCopy, for instance.

Yes, you can! There is nothing wrong with that, and the broker does not stop traders who would like to run those two operations together.

I opened trading account with this company half a year ago and am ready to share my impressions.

First thing I have noticed is the high speed of execution of orders. Maybe broker uses some special technology. Or maybe they do their job well.

The only thing that disappointed me was that there were no cryptocurrencies I wanted to trade.

You can trade cryptocurrencies at HANTEC MARKETS

I like it when brokers go the traditional way when choosing a trading platform.

In my opinion, there are no more versatile and convenient platforms than MetaTrader4 and MetaTrader5. They both have great functionality and a lot of built-in tools. In addition, the platforms can be supplemented with custom tools.

I have a question. Which MetaTrader platform do you prefer and why?

I prefer HFM MT4 because I’m too conservative by nature. I think I trade with it for three years or so.

Somebody will say that it has limited functionality and obsolete technology behind, but as long as the platform does the work for you, who cares?

MT4 one love!

That’s so good that this broker is absolutely compatible with me. It generally meets my expectations. It’s pointless to talk about fraud here because if anything was I would run away long ago.

Do HFM accept clients from the US because there is no US in the country slot

Have been trading from almost 2 months and i must say this platform is really good.

Does Hot Forex accept deposit via Paypal?

Unfortunately, I do not remember whether this broker has Paypal. HFM has a large list of payment systems through which you can deposit your account.

Look at the official site. Maybe Paypal is among them.

Withdrew many times and trade forex/cfds also invest some in PAMM with this broker. A decent and vast services broker

Is hotforex an STP or ECN broker ?

My name is Newton Dennis Mugisa from Uganda, some months ago I invested $100 with HOT FOREX GROUP and I was sent a note by someone called Chris Powel to pay taxes worth $400 in order for my profit to be sent to my mobile money. I have now paid $300 through some Kenyan phone code number. Yestarday he asked me to pay what I have and he will top up for me with $100 and send my profit today. But today, he asked me instead to clear up the $100 taxes. Which got me very confused and very worried because the money that I sent for tax yestarday I borrowed from someone whom I promised I would pay back the following day which is today.

I just want to be sure, do you know/ have someone by the name of Chris Powel working with you in HOT FOREX GROUP?

Do you have an investor by the name of NEWTON DENNIS MUGISA?

When someone has invested in HOT FOREX GROUP, do they pay taxes to get their profit?

Please kindly help me confirm.

Thank you.

Thats simply a scammer next time firstof all send a mail to HFM customer support. You don’t need to oay any tax to take your money if you needed to it will reflect the message from HFM direct mail or on your dashboard

I would like to open a FX trading acct, but I have the following questions:

1- Do you accept client from Afghanistan?

2- Can I fund acct from my another broker which is located in London ( One Financial Markets)

3- Do you accept Perfect Money for my banking?

( this is the only reason I switch broker bcz my existing broker can’t accept Perfect Money.

Hope to hear from you soon.

Kind Regards

do you have office in malaysia n how to contact them.

Do you have a broker named Maria Esteel?

Does this broker allow western union deposit and withdrawals?

Hi, do you accept Perfect Money?

hello everyone, I’m thinking to open an account using hotforex as I have smaller capital I want to make sure about few things like have lower spreads, smoother withdrawal process and also if anyone have information about Shewraj as he is my account manager.

Beware:

Scammed minor regions

Ok so, i was working with this broker for few years, i had a trading account which i used trading spot Metals in there, ummm, i kinda created a portfolio which i don’t think that would be a problem because you pay the commission and Swap for your trading positions.

suddenly they informed me that they would no longer work with my region and closed my portfolio with current market price against my will and caused me a loss of $2700 USD

And the most important thing was they didn’t at least notify me a month or two earlier so i could at least have time to adjust my portfolio and withdraw my savings

so i emailed customer support staff detailing that if you’re no longer work with my region then you should be responsible for my investment because i trusted this broker by throwing my earnings into it and you closed my trades at a bad time, and i want my money back because your broker was responsible by closing my trades against my will

so they didn’t listen and they’re response was:

‘Sorry for any inconvenience’

( i will attach the conversations in here if needed)

So they closed my trades against my will and caused me a huge loss and they response was sorry for any inconvenience

They ‘re not responsible for your hard worked money they will take it away and throw you out at anytime they want

Where are you from? I see hot forex platform is very good. Gove me some knowledge. Please i am from india

I join please suggest me

How must $ to start trading

How must minimum $ to place trading.thank

Morning

I have a HotForex account which I’m confused on and maybe you can help me to understand.

I was referred to a particular account manager. Was told that if I invested $1000.00 I could make $10,000.00; however when that time came for me to withdraw I received an email (generic) stating that my account was upgraded and in order to receive payout I would need to invest another $5000.00 then I would receive $17,000.00, is this a normal process?

I refused to give additional money so they are not going to release funds.

Please advise

Sounds like the same scam Fxpipsbase pulled on me. Invested $91, supposedly earned “64k”, transferred their broker fees of 10% of the total earned to the platform just to be told that the funds came a day late and now my account is dormant until I cough up another 10k. Huge scam, if you ask me. You basically lost your investment

You have been scammed

Those are not hotforex those are people who want to scam you

Trading with hotforex for more than one year now. I have evaluated their performance on the basis of certain parameters like account opening time, spreads, leverage and withdrawal processing time and i have found out that they deserve five stars ratings.

trading is going well, mostly on eurusd, keeping an eye on the next move for the gbp if there is a chance with everything thats going on, hotforex is a good broker, stable fast executions, good spread price on usd eur pairs. no issue with withdrawals at all.

I have to agree with this, note that 3nd money processing companies might be your fastest way to withdraw, skrill and neteller are really good. if im not mistaken bank transfer for withdrawals might take up to 12 working days. another good option to look at is metal trading xau and xag are good options to trade too.

they are a decent broker (hotforex), quiet well known with a good reputation and decent services. I have traded with them for a year now and im pretty pleased with how things are going, an easy recommendation.

I have been trading with this reliable broker for the past two years. The execution is smooth and swift. The profit payouts are hassle free with less processing time. I am happy with the services so far.

Best platform with worst services as far as withdrawals are concerned.

Also very poor at customer care when it comes to getting back the funds, customer care on Good during deposit time.

Your regulators should check you keenly, 50% legit- 50% scam.

A gentleman broker offering a wide range of products for trading and earning online money even in the lock down. Payments went through hassle free. The leverage and spreads are realistic too.

Two years of trading live account with this broker. Started with small amount in the beginning. Did added some more funds later because I wasn’t aware fo the FOMC volatility. Since these funds are growing, did made many withdrawals as well. All went smooth. I have nothing to complaint about. They are decent broker in my opinion.

8 months into live trading and i dont see anything out of the ordinary, broker keeps up as advertised, good trading instruments, good process, withdrawal takes up to 24 hrs (except bankwire) I wish there would be more withdrawal options. but over all they are really good.

You are never profitable with this company

When you make your first deposit and began trading, no matter how weak your strategies are you’ll make profit. Once you made first withdrawal you are finished. No matter how smart you are the company will start taking from you. You will loose everything including your capital.

Do not trade with this Scam broker

They will finish your money

The withdrawal process never failed me once in the last 9 months trading a premium live account. I got my investment back in less than 6 months, and tbh its a blessing to be able to trade forex during this time. good job by hotforex for keeping an excellent service

Trading for a year and withdrew more than 10k$ to my Skrill account. Reliable broker with decent withdrawal process. I recommend this broker for any trader.

great broker, they offer very good services and they are secured with excellent platform stability, I am yet to try crypto trading, but as far as scalping eurusd, its really great

Trading for last consecutive year on a part time basis. Trading is convenient however i found out that you need to learn it first before you start making money with trading. They have multiple choices of assets, commodities, currency pairs etc with little spreads. Based on my experience I recommend this broker.

Their headquarters is not Cyprus. It’s St Vincent and the Grenadines. check their app on Google play. It says so when you try to register.

Great services all together. It is recommended broker for every type of trader. My personal experience with this broker as of now is one year.

Hi

Plz let me know doeas hot forex allow to trade with Islamic account (interest free) ???

good broker over all. tight spreads on major pairs, crypto enabled and can use both mt4 and mt5. good reputation and i have no complaints.

Bitpay by skrill is integrated with this broker and i also think that we can deposit other cyrpto assets like Ripple, ltc etc directly but btc can be added by using the bitpay.

Does this broker allow deposit or withdraw by crypto, anyone advise?

Yes it’s the best

Hi do we get help if there is any problem

A broker that is easy to recommend, just made another withdrawal last week and processed with ease, hope the market becomes a bit gentler but over all the broker is doing an awesome job.

Does hotforex provide boom&crash, volatility indices ant step indices ?

Is there a tutorial that shows how to open up a demo and live account?

I can confirm that this broker has great earning potential if you know how to trade forex. I am trading with hotforex. Its been one year now since I am with this broker. Execution is easy and smooth. They also send weekly emails regarding webinars which are helpful in learning new strategies.

Does this broker have stock trading or a special service for advanced trader?

Hello, I have a premium account (live) with hot forex.i would live to know if Hotforex offers Islamic trading opportunity. If yes, I would need a guide on how to create an Islamic trading account and migrate to it from my premium account. Thanks