- What is JustMarkets?

- JustMarkets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- JustMarkets Compared to Other Brokers

- Full Review of Broker JustMarkets

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.8 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.7 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is JustMarkets?

JustMarkets is a global Forex and CFD trading company that has been in operation since 2012. According to our findings, the broker provides a diverse range of financial products, which include CFDs on various instruments such as Forex, Gold, Oil, Indices, Metals, Cryptos, and Shares.

JustForex is the previous name of the JustMarkets Broker, which operated for quite a long time also via offshore zones only, however after rebranding from JustForex, JustMarkets acquired respected licenses from the Financial Sector Conduct Authority (FSCA) in South Africa and the Cyprus Securities and Exchange Commission (CySEC). As a result, this great step allowed the broker to be considered as a secure broker to trade and has now established itself as a reliable option for traders, ensuring their safety and security.

Overall, for now JustMarkets provides competitive trading conditions, including low spreads and fast execution, as well as access to the MetaTrader trading platforms, which are widely used and trusted by traders worldwide.

JustMarkets Pros and Cons

Per our research, there are both positive and negative aspects to consider when choosing JustMarkets as your broker. For the pros, the broker offers the industry-popular MT4 and MT5 trading platforms suitable for different trading strategies and cater to traders of various sizes. Another advantage is the competitive spreads starting from 0 pips, as well as the opportunity to select very high leverage up to 1:3000, although this may vary depending on the specific entity. JustMarkets also provides competitive educational resources and research which are crucial for both beginners and advanced traders

For the cons, the trading conditions may vary depending on the regulation. Additionally, the limited range of trading instruments based on entities are also drawback to consider. Besides, since the company operated for a long time via offshore zones only it is good to make your own research and see whether the offering is suitable for you.

| Advantages | Disadvantages |

|---|

| Competitive spreads | Trading conditions might vary based on the entity |

| MT4 and MT5 trading platforms | Financial instruments might vary depending on the regulation |

| Multiregulated | |

| Different strategies available | |

| MAM (Multi Account Manager) | |

| Available for European and international traders | |

| 24/7 customer support | |

| Good learning materials | |

JustMarkets Features

JustMarkets as a Forex and CFD Trading broker provides a safe and high-standard trading environment, offering a large selection of assets that makes the broker suitable for all types of traders who want to have a profitable and quality experience in Forex trading. Here we have compiled JustMarket’s main features in 10 aspects of trading to help traders have a quick look at the broker’s offerings on Trading Platforms, Account Conditions, Trading Product Range, Fees and other important points that define the quality of trading:

JustMarkets Features in 10 Points

| 🗺️ Regulation | FSCA, CySEC, FSA, FSC |

| 🗺️ Account Types | Standard, Standard Cent, Pro, and Raw Spread |

| 🖥 Trading Platforms | MT4, MT5, JustMarkets App |

| 📉 Trading Instruments | CFDs on Forex, Gold, Oil, Indices, Metals, Shares, Cryptocurrency |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | From 0.3 pips on Standard account |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is JustMarkets For?

Based on Our findings and Financial Expert Opinions JustMarkets is Good for traders from Europe, as well as international brokers, as JustMarkets accepts traders from over 160 countries. The broker offers both beginner and experienced traders great opportunities equally, inlcuding competitive fees and popular trading platforms, and is equipped with innovative and advanced features. JustMarkets is good for the following:

- Traders from Europe

- International traders

- Traders from African Region like Namibia, Zambia, etc

- CFD and currency trading

- Traders who prefer the MT4 and MT5 platforms

- Beginners

- Advanced traders

- Muslim trading

- Market Making execution

- Competitive fees and low spreads

- EA/Auto trading

- Good trading tools

- Copy Trading

- Comprehensive learning materials

- Supportive 24/7 customer support

JustMarkets Summary

JustMarkets is a good option for Forex and CFD trading with a secure and competitive trading environment. The broker now operates with good licenses and has expanded its brand globally, becoming a safe choice. Also, JustMarkets trading provides a range of popular instruments with the availability of popular trading platforms like MT4 and MT5, catering to the diverse needs of traders.

While there may be some drawbacks such as varying trading conditions on different entities, JustMarkets is still considered a competitive choice for traders at all skill levels. The broker’s transparent fee structure, quick withdrawal process, 24/7 customer support, and extensive educational resources, including webinars, articles, and market research, contribute to its overall appeal. However, you should conduct your research as well, and consider personal trading needs, before selecting JustMarkets as your preferred broker.

55Brokers Professional Insights

JustMarkets equipped with good trading conditions and features mainly based on most popular and most traded instruments and platforms. Previously we had concerns about Broker since it operate only via offshore enity, but for now Broker provide a secure and reliable trading environment due to regulations, also conditions are indeed a good quality. The broker has a good account offering, enabling to choose the option most suited to your trading need, also good there is Centt account not so often available these days. At the same time offering provide competitive fees, spreads starting just from 0.3 pips at standard account which is very low, but on popular trading hours and market opening we see fees are on average with industry too. Better fees, are on PRO account and you can be Pro only with 100which is definitely great.

On the flip side, we see instruments and platforms are only most popular choices, the extensive range and some unique proposals then accommodated by other Brokers like BalckBull as example. Also research, is mainly offered that is included in the platforms, no really third- party providers with additional tools, but available bonuses and Daily markets forecasts we did enjoy.

Consider Trading with JustMarkets If:

| JustMarkets is an excellent Broker for: | - Looking for broker with European or SA regulation

- Need Flexible account types

- Prefer high leverage up to 1:3000

- Competitive spreads from 0.3 pips

- Copy trading availability

- Need access to Automated Trading

- Broker suitable for beginner traders

- Mobile and Social trading availability

- Want 24/7 customer support

- MT4 and MT5 platforms

- Looking for Webinars and Educational materials

|

Avoid Trading with JustMarkets If:

| JustMarkets might not be the best for: | - If you are from restricted regions for trading

- Look for broker with extensive Trading Instruments

- Prefer other platforms different from MetaTrader

- Need extensive research tools and additional tools

- Look for Real Investment opportunities in Stocks

|

Regulation and Security Measures

Score – 4.4/5

JustMarkets Regulatory Overview

JustMarkets is a reliable Forex trading broker that operates under the regulation of the reputable South African FSCA, and European CySEC, and also holds additional licenses. This regulatory body enforces strict rules and guidelines to ensure that the broker operates in a trustworthy manner.

Compliance with the regulatory requirements set by CySEC, and FSCA enhances the safety and confidence of traders who choose to trade with JustMarkets.

How Safe is Trading with JustMarkets?

Our research showed that at JustMarkets there are various protection rules applied to safeguard clients’ funds as per the regulatory requirement applied, including segregation from the firm’s accounts and refraining from using them for operational purposes. Moreover, the broker offers negative balance protection, which safeguards traders’ accounts from going into negative balance during times of market volatility or unexpected events.

JustMarkets focus on delivery of transparent and reliable services shows application of safety measures to protect its clients’ investments, such as the protection of the Negative balance, Data storage protection, application of a Multilevel system of servers, and other measures that make sure the traders are protected. All these levels of safety make JustMarkets a trustworthy choice for traders who want to explore the market without worry.

- The company follows the PCI DSS security standard, which involves a complex approach to the information security of the client’s data.

Consistency and Clarity

Over the years JustMarkets has strengthened its regulations and consistency, while previously operated only via offshore further on reliable licenses obtained, enlarging the regulatory oversight and expansion alike. In a result, achieving good scores for safety and clarity of its proposal resulting in a favorable trading environment and over 2 million clients’ loyalty.

The company grwoth shows good consistency and transparency alike, traders from various regions marked in their Reviews good conditions and we haven’t find serious issues with company operation, all in all showing us JustMarkets as a reliable firm suitable for long-term trading.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with JustMarkets?

JustMarkets offers four main trading accounts – Standard, Standard Cent, Pro, and Raw Spread. The conditions JustMarkets offers for its account types are favorable with their fee structure, offered platforms, and other features, which makes the offering suitable for different types and levels of traders, or employ different trading strategies. Besides, JustMarkets does not put any limits on the number of trading accounts clients can open.

Below is the comparison of the available account types, with details and most important aspects to consider:

Standard Account

The standard account is available on both platforms MT4 or MT5 and is good for versatile traders looking for a low-cost entry into the market with a variety of currency options. JustMarkets’ Standard account offers traders commission-free, swap-free trading, with a minimum funding opportunity of only $10. The spreads for this account type start as low as 0.3 pips, although they are floating and might change based on the market changes. By offering the most traded instruments, including Forex, Indices, Commodities, Shares, and Crypto, this account type is the most popular account that suits all types of trading strategies. Traders can use leverage as high as 1:3000 which enables them to make the most profit of their investments.

Standard Cent Account

Traders at JustMarkets have the option to sign up for a Standard Cent account which is available only on MT4 platform and offer 100 times reduced denomination good for either testing strategies, trading with lower risk or beginners. The minimum deposit for this account is $10 too, and spreads are competitive start from 0.3 pips. In addition to spreads, there is no commission for this account type. The account currency is USC.

Pro Account

Pro account comes with zero commission and lower spread, starting from o.1 pips. The minimum deposit is slightly higher for this account type, requiring $100, although it is still considered a low offering. With this account, traders may trade various instruments offered by broker and range of available currencies is great allowing t save conversion fees, range includes USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN. Overall, this is a good offering for traders who seek quick execution, and different available trading strategies with competitive fees. The Pro account is best for experienced traders who look for advanced trading conditions, tighter spreads, and a variety of instruments.

Raw Spread Account

The Raw Spread account enables trading with a fixed commission per lot. The spreads start from o pips and the commission is $3 for each side per lot, considered on average level among competitors, while the minimum requirement of funding is $100. This account type gives access to all markets offered, also with various based currencies available, this account is especially suited for intraday trading and scalping strategies.

Regions Where JustMarkets is Restricted

JustMarkets provides information about its service restrictions in certain areas. The restrictions are due to regulatory requirements, and include the following locations:

- Australia

- Canada

- The EU

- The EEA

- Japan

- The United Kingdom

- The United States of America

- Countries sanctioned by the EU

Cost Structure and Fees

Score – 4.8/5

JustMarkets Brokerage Fees

Generally, there are a number of factors that determine the broker’s fees and costs. JustMarket’s fees are largely dependent on the traded instrument, and the entity by which the trader is registered, also, the chosen account type, and some other conditions as well. We have reviewed JustMarket’s cost structure, putting a special focus on the offered spreads, commissions, and swaps, also, reviewed other additional fees that might be incurred while trading.

Spreads largely depend on the chosen account type, and of course, on the instrument traded. For the Standard account and Cent Account spreads begin from 0.3 pips, for Pro accounts, spreads are even lower and start from an impressive 0.1 pips. For the Raw Spread account fees are built into commission while spreads are from o pips. Based on the instruments traded the most popular instrument spreads as we find are as follows – EURUSD 1 pip, XAUUSD 1.8 pip, which are considered low/average, and BTCUSD 273, which is higher than average.

JustMarkets imposes commissions only for one of its account types – Raw Spread accounts. The commission is $3 for each side per lot, which is among indsytry average level for similar offering. For this account spreads start from 0 pips. For Standard, Standard Cent, and Pro accounts no commissions are included.

- JustMarkets Rollover/Swaps

Swaps or the Rollover fee is also included in the JusttMarkets fee structure. Swaps are the fee applied for holding overnight positions, and in the case of JustMarkets, they are -6.94 for EUR/USD for long positions and 0 for short ones. Swaps also depend on the instrument traded, thus the fee might differ from instrument to instrument and from one account type to another.

How Competitive Are JustMarkets Fees?

In fact, JustMarkets fees are one of the most impressive and attractive aspects of the broker’s offerings. The fee structure is highly competitive, spreads are very low compared to other brokers especially on Pro account where spreads are from o.1 pips olny, while commission based fees are applied only for Raw Spread accounts and are on average level. As we review, only fees for Bitcoin Trading are slightly higher than average.

| Asset/ Pair | JustMarkets Spread | HFM Spread | Eightcap Spread |

|---|

| EUR USD Spread | 1 pips | 0.6 pips | 1 pips |

| Crude Oil WTI Spread | 0.6 pips | 4 cents | 3 pips |

| Gold Spread | 1.8 pips | 0.16 | 1.2 pips |

| BTC USD Spread | 273 | 36 | 170 |

JustMarkets Additional Fees

Like any other broker, JustMarkets also applies some extra fees, in addition to the common costs like spreads, commissions, and rollover fees. One of the common additional fees that many brokers charge is the Inactivity fee. However, in the case of JustMarkets, no inactivity fee is applied, instead, all the accounts which have no funds and haven’t had trading and non-trading activities for more than 90 days will be archived without prior notice.

Withdrawal Fees

As we found, JustMarkets does not impose any fees on deposits or withdrawals. Yet, traders should note that some banks and electronic payment systems may charge their transaction fees.

Trading Platforms and Tools

Score – 4.4/5

JustMarkets enables traders to conduct their trading on the MetaTrader4, and MetaTrader5 popular platforms, and the broker offers its own JustMarkets Trading App. Besides, traders have access to copy trading, which diversifies their trading opportunities even further.

| Platforms | JustMarkets Platforms | VPFX Platforms | NCM Investment Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | No |

| Mobile Apps | Yes | Yes | Yes |

JustMarkets Web Platform

JustMarkets’ web-based trading comes with a lot of advantages, allowing traders to access the market directly from a web browser, with no requirements for software installation. This is especially comfortable for those, who have difficulties in installing software on their devices. Besides the web-based terminal is more secure because all data is stored on the broker’s server, which minimizes the risks associated with data loss on a local device. Those who trade through the web platform should be aware of some differences between MT4 and MT5 feature availability.

MT5 allows more features that are unavailable on the MetaTrader4, like Economic Calendar, Market depth, order type variety, larger availability of built-in indicators (38), and 21 timeframes.

Main Insights from Testing

All in all, the Web platform provides the most essential features, standing out for its efficiency, simple interface, and availability of charting tools. The good point is that there is no need for installations and hustle with setups. The only downside is the comparative restrictions of tools compared to the desktop platform, which enables more opportunities.

JustMarkets Desktop MetaTrader 4 Platform

MetaTrader 4 is actually one of the favorite platforms of traders of different levels for its versatility of features and tools, including flexible trading systems, algorithmic trading, and more, designed for traders of all skill levels. MT4’s user-friendly interface allows traders to navigate the platform easily, using trading functions, charting tools, and technical analysis indicators without complication. Traders are free to develop and test Expert Advisors, which allows for 24/7 trading without manual intervention.

On the JustMarkets MT4 platform traders can reach CFDs on over 100 currency pairs, including major pairs, minor pairs, and exotic pairs, CFDs on metals and energies, Stock CFDs from different industries, and trade CFDs on major stock indices from the US, UK, Germany, Japan, and China.

JustMarkets Desktop MetaTrader 5 Platform

JustMarkets MetaTrader 5 platform offers enhanced functionality and features, more than 80 technical indicators, 21-time frames, and various charting options for implementing complex strategies. MT5 is great for algorithmic trading and development, testing, and automated trading strategies. The platform also has an integrated economic calendar that provides real-time updates on important economic events and gives access to a news feed for financial news and analysis.

Moreover, Through the MT5 platform, trades can access CFDs on over 100 currency pairs, metals and energies, stock CFDs, and indices from the US, UK, Germany, Japan, and China.

JustMarkets MobileTrader App

JustMarkets App is an excellent tool for on-the-go trading. It enables traders to easily create and manage orders, access various instruments, and get 1K+ indicators and instruments to analyze historical data. Traders can use a calendar of macroeconomic events, conduct a detailed fundamental analysis right from their mobiles, manage their accounts easily, and get 24/7 support whenever needed. Trades can also set up push notifications to be alerted about market movements, price levels, and trading signals.

Main Insights from Testing

JustMarkets Mobile App is a perfect solution for those who do not want to stick at their computers at all times. The app enables traders to be in full control of their trades 24/7, navigate with ease, analyze charts, and execute trades quickly. The app can be downloaded on both iOS and Android devices which certainly makes the app more accessible among traders.

The application grants easy access to the market, important indicators and analysis tools, and real-time price updates, enabling traders to quickly react to the changes that take place in the market.

Trading Instruments

Score – 4.2/5

What Can You Trade on JustMarkets Platform?

We found that JustMarkets offers all the popular market assets, however, the available range is limited to about 260 instruments, which is considered good since including most popular instruments, but is rather modest offering if compared to other brokers. Among the offered markets, Forex is the most traded that offers exceptional liquidity and the advantage of very low spreads. However, the availability of trading instruments may differ depending on the specific entity. JustMarkets’ trading products are mainly on a CFD basis and include the following:

- Forex

- Commodities

- Stocks

- Indices

- Crypto

Main Insights from Exploring JustMarket’s Tradable Assets

Overall, we found that JustMarkets provides its clients access to a range of trading assets, enabling trading for all kinds of traders based on preferences, however we find Instruments mainly consistent of most popular products traded by most. So if you look for an extensive range with thousands instruments then other broker is you preference then, since JustMarkets range is considered quite a limited selection. Many popular asset classes, such as futures, and bonds are not available to trade.

However, despite some limitations, JustMarkets still gives many opportunities to its clients to make the most out of trading, such as copy-trading, and certain investment opportunities through MAM accounts.

Leverage Options at JustMarkets

Leverage is a valuable tool that allows traders to enter the Forex market with limited capital and expand their market exposure. However, it operates in both directions, which means it can result in substantial profits or losses alike. Therefore, it is strongly recommended to have a comprehensive understanding of leverage before engaging in any trading activities that involve its use.

JustMarkets leverage is offered according to the FSCA, CySEC, FSA, and FSC regulations:

- European traders are eligible to use a maximum of up to 1:30 for retail clients and up to 1:300 for professional clients for major currency pairs.

- International traders are allowed to use leverage as high as 1:3000

- Besides, the margin requirement for the account is tied to the amount of leverage traders use. A change in leverage will cause a change in margin requirements.

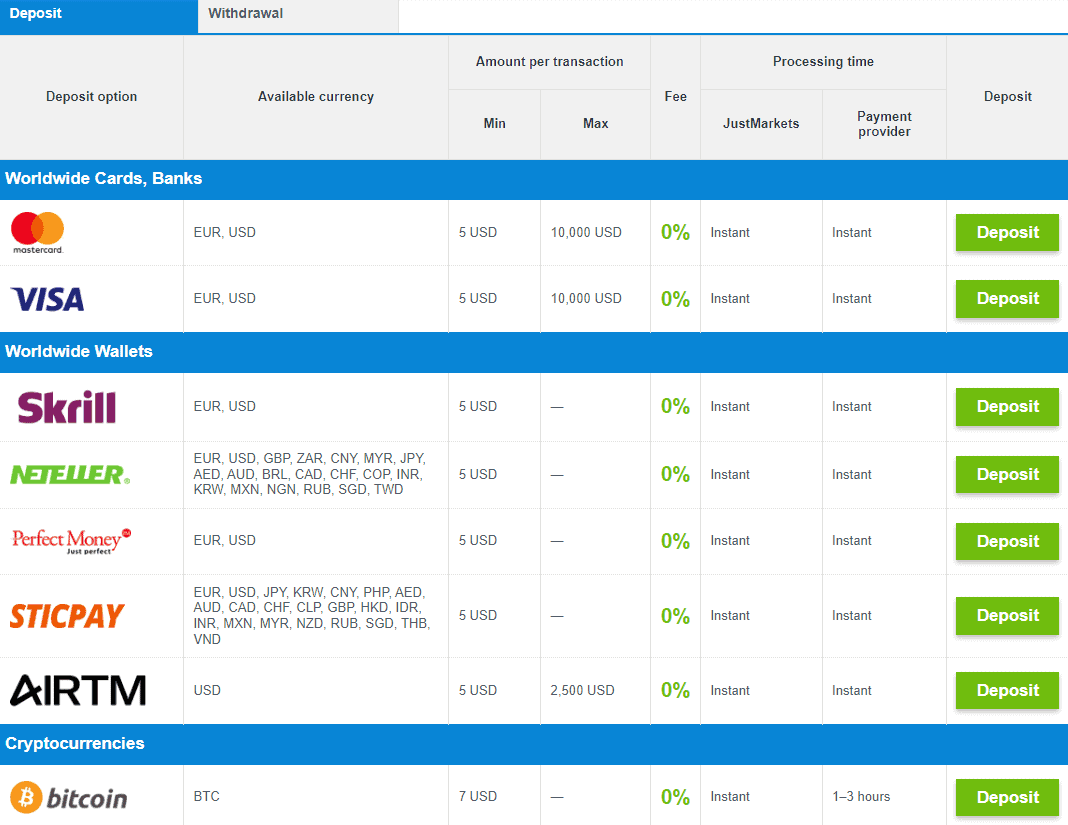

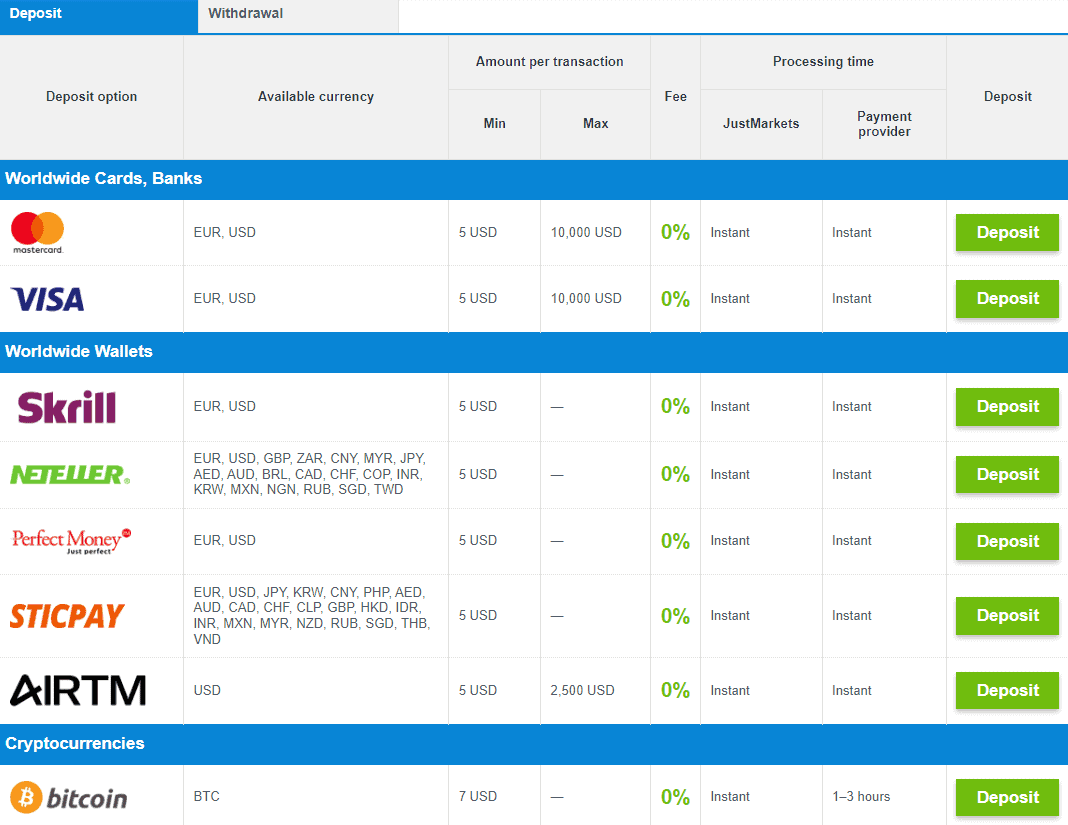

Deposit and Withdrawal Options

Score – 4.7/5

Deposit Options at JustMarkets

For funding methods, the broker offers various options for traders to deposit funds into their trading accounts. However, specific requirements and limitations for each funding method may vary depending on the financial institution and the country of residence. Below see the list of available deposit methods with the broker:

- Bank wire transfers

- Credit/debit cards

- Skrill

- Neteller

- Perfect Money

JustMarkets Minimum Deposit

The minimum deposit for JustMarkets Standard and Standard Cent accounts is $10. For the Pro and Raw Spread accounts, the minimum required deposit is $100. A $10 minimum deposit is considered a very good offering, enabling traders to start with such low financial inputs. Also, be aware, that some deposit options might not be available based on the location of the trader and the entity he is trading with.

Withdrawal Options at JustMarkets

Traders can expect an easy and quick withdrawal process with JustMarkets, enabling them to access their funds efficiently. As we found, the withdrawal requests are typically processed almost instantly for most withdrawal methods. Each withdrawal transaction is carefully reviewed by the financial team to prevent unauthorized access to accounts.

How long does it take to withdraw money from JustMarkets?

Our findings show that JustMarkets provides instant withdrawals. The broker warns that the company provides instant withdrawals and deposit processes from their side (within 1 minute) and all the possible delays might be from the provider’s side.

Customer Support and Responsiveness

Score – 4.7/5

Testing JustMarkets’ Customer Support

JustMarkets provides 24/7 customer service, providing support through various options. JustMarkets supports a large list of languages, including English, Indonesian, Malaysian, Spanish, Portuguese, and Vietnamese making it accessible to various traders.

Clients can reach the customer team through excellent variety of methods like phone line, Live chat, a Callback service, or an email. In addition, JustMarkets connects with its clients through different messengers, such as Telegram, WhatsApp, iMessage, Instagram, Viber, Messenger, Line, and Live Chat, so the accesibility of customer support is on a great level as we review.

Contacts JustMarkets

JustMarkets customer support provided is of high quality, supporting different languages, and enabling clients to reach through multiple messengers, which makes the broker easy to reach. For urgent requests or issues, the broker also has a phone line (+248 4632027, +230 52970330). At last, requests can be sent to JustMarkets by email (support@justmarkets.com), or immediately via the Live Chat. Besides, the broker has a very informative Help Center, where traders can find many detailed answers to their questions.

Research and Education

Score – 4.2 /5

Research Tools JustMarkets

JustMarkets offers good research, which is both included in its Trading platforms (MT4/MT5) and also in the research section with different available features. Market Overview and Daily Forecast provide insight into the market and the latest events, keeping traders updated. JustMarkets also provides an Economic Calendar, listing all the important economic events, and a Currency Converter, which also comes in handy for traders.

Education

We checked if the broker offers comprehensive educational materials on its website and found numerous resources including webinars, Forex articles, educational videos, and Trading Glossary. There are also guides and articles on how to manage risk effectively, with topics about position sizing, stop-loss orders, and balanced trading approaches to protect capital. JustMarkets educational section successfully empowers traders with essential practical knowledge to be able to navigate the market with ease. Of course, this is far from being a Trading Academy, yet the education is on quite a decent level, providing adequate materials for all levels of traders.

- Moreover, JustMarkets offers a demo account which is another good feature that enables traders to practice their trading strategies in a risk-free environment without using real money.

Is JustMarkets a good broker for beginners?

JustMarkets is a favorable choice for beginner traders with its trading conditions, account types designed for different trading needs, a competitive fee structure, and, of course, educational and research resources that will support starters at the beginning of their trading journey. Compared to other brokers with extensive educational materials, JustMarkets’ offerings are moderate; still, to the question of whether it is a good broker for beginners, the answer is positive.

Portfolio and Investment Opportunities

Score – 4.1/5

Investment Options JustMarkets

JustMarkets offers its trading products based on CFDs. This means that traders cannot make investments with the broker in the traditional sense of it, like buying real stocks or shares and holding ownership. Moreover, JustMarkets does not offer bond trading. In this sense, traders do not have investment opportunities with the broker.

- However, JustMarkets offers copy trading to its clients, enabling to register on the platform both as a trader who allows other clients to copy their trades and as investors who, without much trading experience, can automatically copy a trader and benefit without active participation in the trading process. JustMarkets does not offer additional platforms for copy trading, and the feature is included in its MetaTrader platforms.

- Another offering that is seen as an investment option is the introduction of the MAM (Multi Account Manager) software, which allows portfolio managers to manage a large number of trading accounts simultaneously using one trading account. Those clients who prefer to provide the funds to be managed by the Account Managers will be able to check the investment status, having full access to observe the trading process conducted by the account manager. Another advantage the MAM solution gives the investors is that they can have several accounts connected to different money managers.

Account opening

Score – 4.5/5

How to open JustMarkets Demo Account?

Demo accounts are designed to teach Forex trading. The difference between a demo and a real account is that clients trade virtual money, not real. So they don’t need to make deposits, and risk nothing. The opening of a Demo account with JustMarkets is an easy process, with several simple steps to follow:

- Log in to your Personal Area and if you don’t have an account yet – Sign Up

- Click on the “My Accounts” tab

- On the “Demo” tab choose “Open a new account”

- Select the account type and the preferred platform in the “Open new account” section and click “Try demo”

- Select the currency, and define the leverage

- Set the password

- Define the desired balance of your Demo account and click the “Create Account” button

How to open JustMarkets Live account?

Opening a live account with JustMarkets is quite easy. You can open an account within minutes, just proceeding with the guided steps:

- Select and Click on the “Open an Account” button

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4/5

JustMarkets provides several few more features and tools to its clients to enhance their trading further, yet we find range not so comprehensive like other Brokers would provide, so if you look for various additional features maybe is better to opt to tother Broker. The following is available for traders:

- Deposit Bonus enables traders to multiply their deposits with a 50% deposit bonus. The deposit bonus size is determined by the amount deposited. For deposits starting just from $10, traders get a 50% bonus. To activate this opportunity traders need to check the “Get a bonus on deposit” checkbox in the Deposit form. Before activating the Deposit Bonus feature, clients are encouraged to read the bonus rules.

- Daily Forecast is an essential tool JustMarkets provides to summarize the overall market conditions, the key economic events, and news that might impact trading for the day. Also, it provides overall daily analysis, which gives insights into the market and helps make better decisions. All in all, the Daily Forecast is a tool that serves as a good resource for traders in making their decisions, helping them to eliminate emotional bias and trade based on facts.

JustMarkets Compared to Other Brokers

Comparing JustMarkets to other brokers, we found that the broker has quite a good standing among others, offering good trading conditions and a transparent environment. One of the first aspects we view is reliability and regulation, while other Brokers might be more consistent and with top-tier licenses, JustMarkets is still well established now. Another aspect we consider is the fee structure. When we compared JustMarkets to over 500 other brokers, we discovered that its spreads are among the lowest, starting at just 0.3 pips, lower than spreads for RoboForex and FP Markets, yet the spread we find on Standard account for popular instruments is similar. The range of offered accounts is good, also including MAM accounts, which give traders investment opportunities—another good point compared to others, like FXGT.com, which at the moment does not have MAM. Another good point is its low minimum deposit of $10 when the market average is $100 to $500 (for instance, FP Markets offers a $100 initial deposit).

However, the available trading instrument range is limited to 260+ compared to RoboForex (12.000+) or BlackBullMarkets (26.000+). Also, JustMarkets also offers mainly MetaTrader software, while other Brokers provide additional platforms like cTrader too. Lastly, we find research and additional tools are also very modest, Brokers like FP Markets and BlackBull provide much better selection. In terms of education, JustMarkets has an average standing, offering good education with webinars, articles, and Forex glossary, while we found that FBS has a more extensive education section.

| Parameter |

JustMarkets |

FP Markets |

RoboForex |

FBS |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread Based Account |

From 0.3 pip |

From 1 pip |

Average 1.3 pip |

Average 0.7 pip |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission Based Account |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $4 |

0.0 pips+$3 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Low |

Low/ Average |

Average |

Low |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5, JustMarkets App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, R StocksTrader |

MT4, MT5, FBS App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

260+ instruments |

10,000+ instruments |

12,000+ instruments |

550+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

FSCA, CySEC, FSA, FSC |

ASIC, CySEC, FSCA, CMA |

FSC |

ASIC, CySEC, FSC |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$10 |

$100 |

$10 |

$5 |

$0 |

$100 |

$5 |

Full Review of Broker JustMarkets

Concluding JustMarkets Review, we can state that the broker is a good option for Forex and CFD trading, with its secure and competitive trading environment, licenses from well-regarded regulatory authorities, and global exposure, offering its services to the impressive number of traders, residents of over 160 countries, with 2+ million active traders. JustMarkets trading provides a range of popular instruments with the availability of popular trading platforms like MT4 and MT5, catering to the diverse needs of traders. The only drawback is the offering of limited instruments, which limits those traders who want to diversify their trading with thousands of products available.

Also, there might be varying trading conditions due to the different entities the broker is registered with, yet JustMarkets is still a competitive choice for traders at all skill levels. The broker’s transparent fee structure, quick withdrawal process, 24/7 customer support, and good educational resources make it an attractive choice. Besides, JustMarkets has some great features, like copy trading, the availability of MAM accounts, and a deposit bonus of 50%, which add to the overall appeal of the broker.

Share this article [addtoany url="https://55brokers.com/justforex-review/" title="JustMarkets"]

I’m KJ

I’m Karzan from Iraq, the JustMarkets is best broker for me and for my clients, I created a team (JMarkets IRAQ) for supporting JustMarkets Clients at Iraq, also my Manager at JustMarkets called Mr, YASSER MANSOUR is best Manager.

Justforex is a good broker. Fast withdrawals and all. The regulation part makes it risky to use in the long run

I complained today coz they went against my trade which we took same time with my brother using fxm and me just forex that’s when I realized what I’m dealing with…..

Guys, be sure this is a SCAM broker! They banned me because of sanctions and my money without letting me know about that! Plus sanctions don’t include that. They will find a way to scam you!

Have been using justforex for 2 years and to be honest, its the best broker ive used in terms of spread, execution, deposits and withdrawals. All no problems. Sadly its not regulated😔

You are satisfy with justforex withdrawal arrive on time or not

thats how all brokers operate, trades are opened above the price line, thats how brokers make their money

It looks he dindt know how brokers operate. He wants to make money himself without the broker !!!

Yesterday was trading on justforex what i have noticed is all my trades they were opened above price line they went straight losing i tried sending emails no response even now they quiete or they think i dont know anything

I have been trading on JustForex for 10 years and until last year there was no problem. There’s no way to withdraw money faster than here. But something has changed for clients from Europy.I have never lost money and trade here you can trade here with lower amounts – just in case ,Peter