- What is Plus500?

- Plus500 Pros and Cons

- Awards

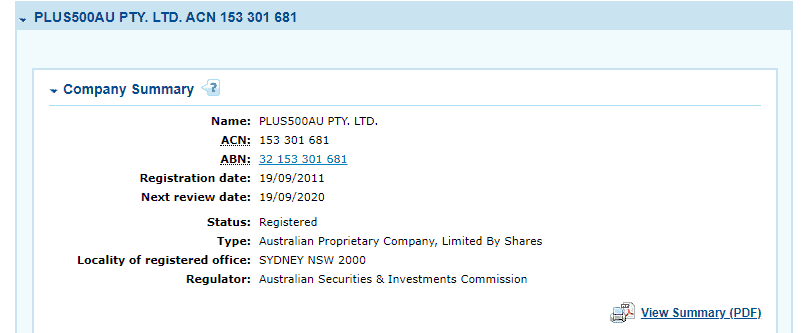

- Safe or a Scam?

- Leverage

- Accounts

- Fees

- Spread

- Deposits and Withdrawals

- Trading Instruments

- Trading Platforms

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Plus500.

What is Plus500?

Plus500 is a leading CFD provider that truly established a strong foundation for its professional trading environments and further growth. Plus500 was founded in 2008 in Israel and now operates numerous entities worldwide through Cyprus, the UK, Australia, Singapore, and more.

Based on our Exper research, Plus500 is also a listed regulated financial CFD provider and the real size of the company is visible by the official number, serving over 304+ thousand active clients.

What Type of Broker is Plus500?

Plus500 is a top-tier regulated global CFD and Forex broker offering over 2800 trading instruments to over a million clients. Plus500 has a premium listing on the Main Market of the London Stock Exchange.

Plus500 Pros and Cons

Plus500 is a reputable brokerage company with numerous traders worldwide, carrying top-tier licenses from FCA, and ASIC. The broker is also listed in Stock Exchange for extra transparency. Plus500 is one of the best brokers for CFD trading with easy to use trading platform and mobile app.

For the Cons, there is no proper education or good research tool, so the proposal might not be suitable for beginners and the product offering is solely based on CFDs. Also, there is no wide selection of trading platforms while trading with Plus500.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | Only CFDs products |

| Listed in London Stock Exchange | Limited research tools and educational materials |

| Global expansion in over 50 countries | No MT4/MT5 trading platforms |

| One of the best CFDs proposals including CFDs on Indices, Forex, Commodities, and more | |

| Great technical solutions, tools, and competitive trading conditions

| |

| 24/7 customer support | |

Plus500 Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | CFD provider regulated in the UK, Cyprus, Singapore, Australia, New Zealand, South Africa, and Seychelles |

| 🖥 Platforms | Plus500 Platform |

| 📉 Instruments | Some of the greatest CFD product range including Cryptocurrency |

| 💰 EUR/USD Spread | variable |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $100 |

| 💰 Base currencies | 10 base currencies offered |

| 📚 Education | A rather limited range of educational materials and no trading course in general or live webinars |

| ☎ Customer Support | 24/7 |

How Does Plus500 Work?

We learned that Plus500 enables retail and professional accounts to trade CFDs on a range of assets offering more than 50 countries with advanced support in 16 languages 24/7 and truly global coverage of the enabled operation. Eventually, Plus500 provides financial investment opportunities by giving world traders access to financial markets through its developed trading technology based on CFDs.

While also firm is a listed official CFD provider which gives an extra level of security and more benefits to its traders.

In addition, Plus500 shows an understanding of the importance of innovation thus constantly improving trading services, generously rewarding clients with fair trading conditions. As well as developing various trading programs or add-ons to enhance capabilities, which became award-winning programs suitable for large communities, affiliates, and traders.

Overall Plus500 Ranking

Based on our Expert findings, Plus500 is considered a good broker with safe and very favorable trading conditions. The broker offers one of the best CFDs proposals including CFDs on Indices, Forex, Commodities, and more. As one of the good advantages, Plus500 covers almost the globe, so traders from various countries can sign in, also with the lowest spreads.

- Plus500 Overall Ranking is 9.3 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Plus500 | Pepperstone | AvaTrade |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | CFDs | Platforms | Trading Conditions |

Plus500 Alternative Brokers

We learned that Plus500 offers a range of trading instruments, good trading conditions, and also low trading spreads and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to Plus500:

- AvaTrade – Good Instruments and CopyTrading

- Pepperstone – Low Spreads and Competitive Trading Conditions

- XM – Wide Range of Trading Opportunities

Awards

Apart from its comprehensive activity, Plus500 is a worldwide recognized CFD platform by various independent organizations and exhibitions. Plus500 also builds strategic points through numerous initiatives. Constantly increasing its trading volumes, and expanding to new jurisdictions, the broker continues leadership through the development and support of various social activities and sponsorships.

- Plus500 is the sponsor of the Chicago Bulls, the NBA’s Living Legends

- Main Sponsor of Legia Warsaw, Poland’s 2019-2020 Champions

- Main Sponsor of Atalanta B.C., one of Italy’s top football teams

- The broker is the Main Sponsor of BSC Young Boys, Swiss Super League’s 2019-2020 Champions

- Plus500 was the Main Sponsor of Club Atletico de Madrid, 2016-2018 Champions League finalists and 2013-2014 “La Liga” champions

- Plus500 Group signed a major sponsorship deal with the “Plus500 Brumbies”, 2017 Super Rugby Australian Conference Champions

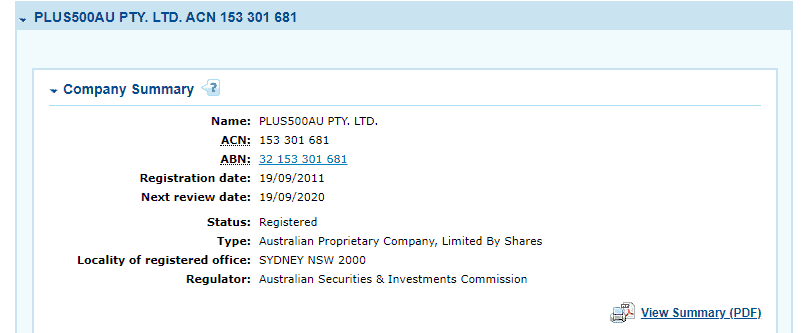

Is Plus500 Safe or Scam?

No, Plus500 is not a scam. Based on our Expert research, we found that Plus500 is a safe broker to trade with. It is regulated and licensed by several top-tier financial authorities including FCA and ASIC. The broker has an eligible status to offer CFD trading and various underlying products through the application of the strictest guidelines.

Is Plus500 legit?

We learned that the trading experience and performance offered by Plus500 are fully legit and set according to safety rules applied by world-known and respected regulatory bodies.

- Registration within the world’s respected jurisdiction provides you with a state company that is constantly overseen and established under high standards in reverse guaranteeing its sustainability.

- In addition, Plus500 Ltd is listed on the Main Market of the London Stock Exchange with a solid financial background bringing an additional level of trust toward them.

See our conclusion on Plus500 Reliability:

- Our Ranked Plus500 Trust Score is 9.5 out of 10 for good reputation and service over the years, also reliable top-tier licenses, and serving regulated entities in each region it operates. The only point is that regulatory standards and protection vary based on the entity.

| Plus500 Strong Points | Plus500 Weak Points |

|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity Regulated by top-tier authorities |

| Regulated by top-tier authorities | |

| Listed in London Stock Exchange | |

| Global expands more than 50 countries | |

| Negative balance protection | |

How Are You Protected?

We found, that in accordance with the FCA, ASIC, CySEC, and other respected regulations, CFD provider strongly complies with numerous client protective tools.

Regulators oblige to afford maximum protection of funds under various rules, as well as to apply safety measures under any or various circumstances in order to guarantee day traders’ safety. The clients’ funds are always paid into a segregated trust account, so the CFD provider uses its own funds for hedging or any other business purposes.

In addition, all clients’ accounts are protected with Negative balance protection, which means customers cannot lose more than the funds they have in their account. More details you may verify through the regulators’ official website.

Leverage

Based on our Expert findings, the residents of various countries fall under particular jurisdiction rules.

So before you get started you should verify and clear what level you are entitled to use, as traders will face some differences between the leverage levels offered due to regulations. Also according to your level of experience, as professionals may access high-leverage ones the status is proven.

- European CySEC, ASIC, and FCA-regulated traders will enjoy maximum leverage of 1:30.

- MAS traders are allowed to get a multiplication of Plus500 leverage up to 1:50.

- South African traders will be offered to use 1:20 for Shares, 1:300 for Forex and Indices, and 1:30 for Crypto assets.

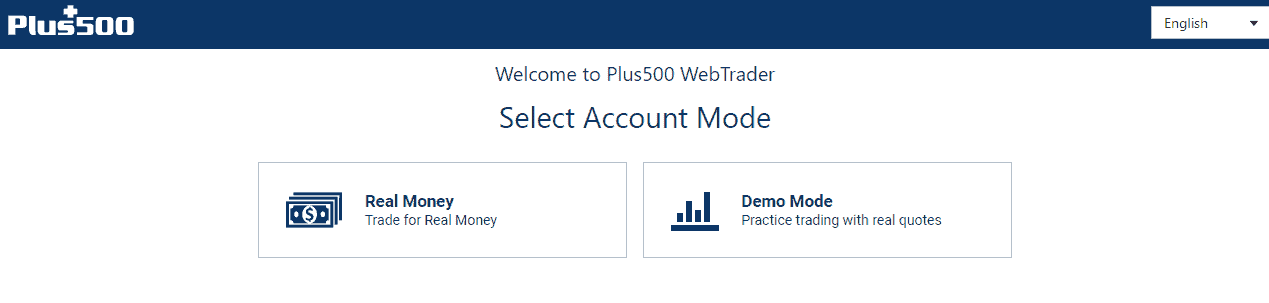

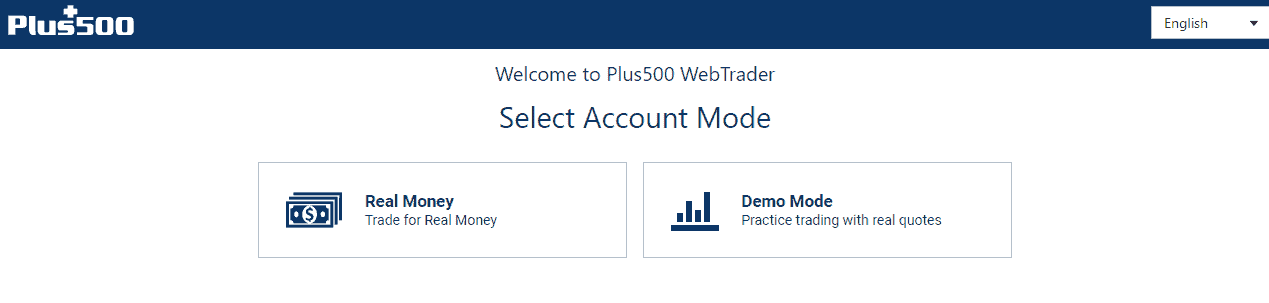

Account Types

We learned that Plus500 offers Real Money and Demo accounts to all clients. You may simply proceed with account activation along with a minimum deposit to convert your Demo account to a live one. In addition, you can choose a free unlimited Demo account, which is easily opened and further can be converted to the real trading.

| Pros | Cons |

|---|

| Fast digital account opening | Account types and proposals may vary according to jurisdiction |

| Access to a wide range of financial instruments

| |

| Low minimum deposit | |

| No deposit charges | |

How to Open Plus500 Live Account?

Opening an account with Plus500 is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Follow Plus500 Sign-In or create an account link

- Enter your personal data (Name, email, phone number, etc.)

- Verify your account and identity by upload of confirmation documents (residential proof like a utility bill, copy of your ID, bank statement, etc.)

- Complete the online quiz form to confirm your trading experience

- Once an account is activated and proven, which may take up to 2 business days follow with the money deposit and enjoy trading

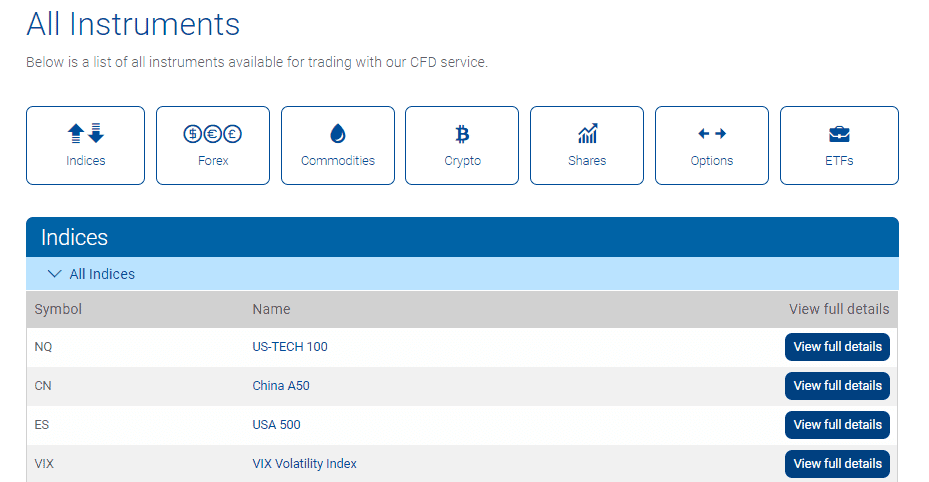

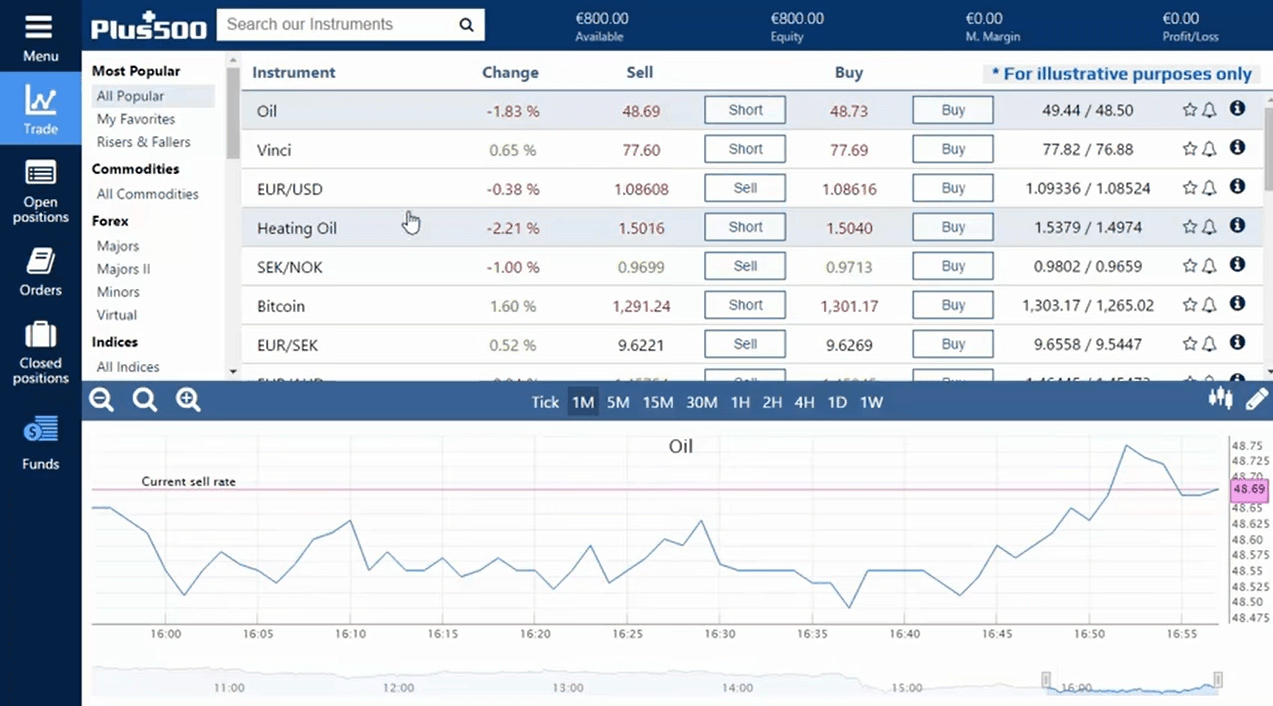

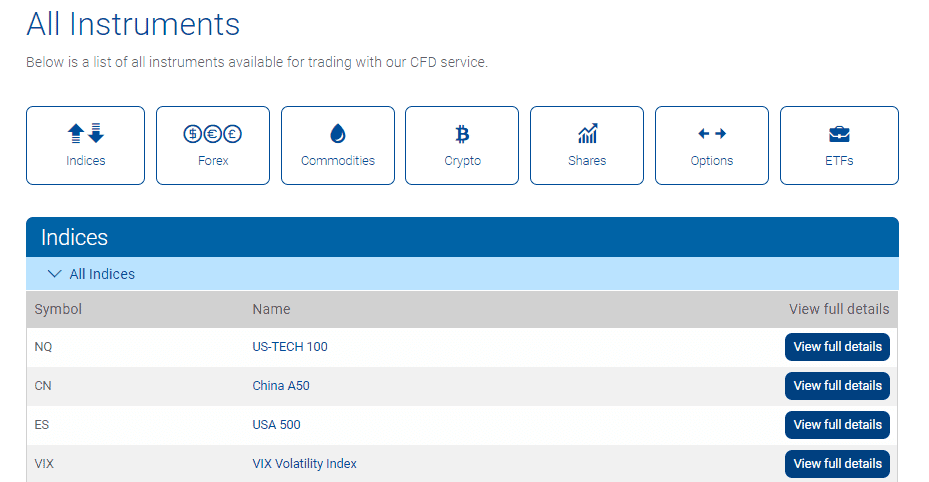

Trading Instruments

Based on our research, Plus500 offers a truly great portfolio with over 2800 instruments, so you surely will find the right portfolio to trade. The CFD provider enables you to trade and speculate on movements in the price alongside innovative trading technology.

The proposal itself offers indices, shares, commodities, currency pairs, ETFs, and options on CFD instruments basis. In addition, Plus500 also offers quite an advanced capability of crypto trading while adding more and more instruments to its list.

CFDs and Forex via CFDs trading offer a great advantage to you as a trader, as it means you are not buying or selling the underlying instrument but speculating on its movement. Also, CFDs are traded as leveraged products with the possibility to access higher options if you are a professional trader which magnifies your possibilities as well as your losses when using leverage. Therefore, you need to use them smartly.

- Plus500 Markets Range Score is 9.2 out of 10 for wide trading instrument selection among Forex, Indices, Cryptos, and more on CFD basis.

Can I Trade Cryptocurrency on Plus500?

We found that Cryptocurrency trading is available on Plus500. Since Crypto trading is now a market “boom”, Plus500 included this opportunity too.

The range of instruments is also quite comprehensive, as you are able to trade Bitcoin, Ethereum/Bitcoin, Bitcoin Cash, Ethereum, Litecoin, NEO, Ripple, IOTA, and Monero based on CFDs.

Plus500 Fees

We learned that Plus500 applies a transparent fee structure with no surprises, all costs are essentially built into the competitive spread. The broker charges no withdrawal or deposit fees. However, some additional fees like a $10 inactivity fee are charged in case your account remains inactive with no trades for the period of three months

Always note fees are always changing as Plus500 offers fixed and dynamic spreads. They are constantly adjusted to the market conditions, therefore here we provide spreads and rates for reference only that was actually at the time of the writing.

- Plus500 Fees are ranked average with an overall rating of 8.9 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, Plus500 overall fees are considered good.

| Fees | Plus500 Fees | AvaTrade Fees | Pepperstone Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | No |

| Fee ranking | Low | Average | Low |

Spreads

Based on our findings, Plus500 charges are built into the spread basis, as well as the majority of CFD fees that broker offers, also with no additional charges or commissions. We learned that Plus500 spreads are among the tightest spreads and average or actually competitive ones in the industry.

- Plus500 Spreads are ranked low with an overall rating of 8.9 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | Plus500 Spread | AvaTrade Spread | Pepperstone Spread |

|---|

| EUR USD Spread | 0.6 pips | 0.9 pips | 0.77 pips |

| Crude Oil WTI Spread | 2 pips | 88 | 2.3 pips |

| Gold Spread | 29 | 1.65 | 0.13 |

| BTC USD Spread | 0.35% | 20.5 | 31.39 |

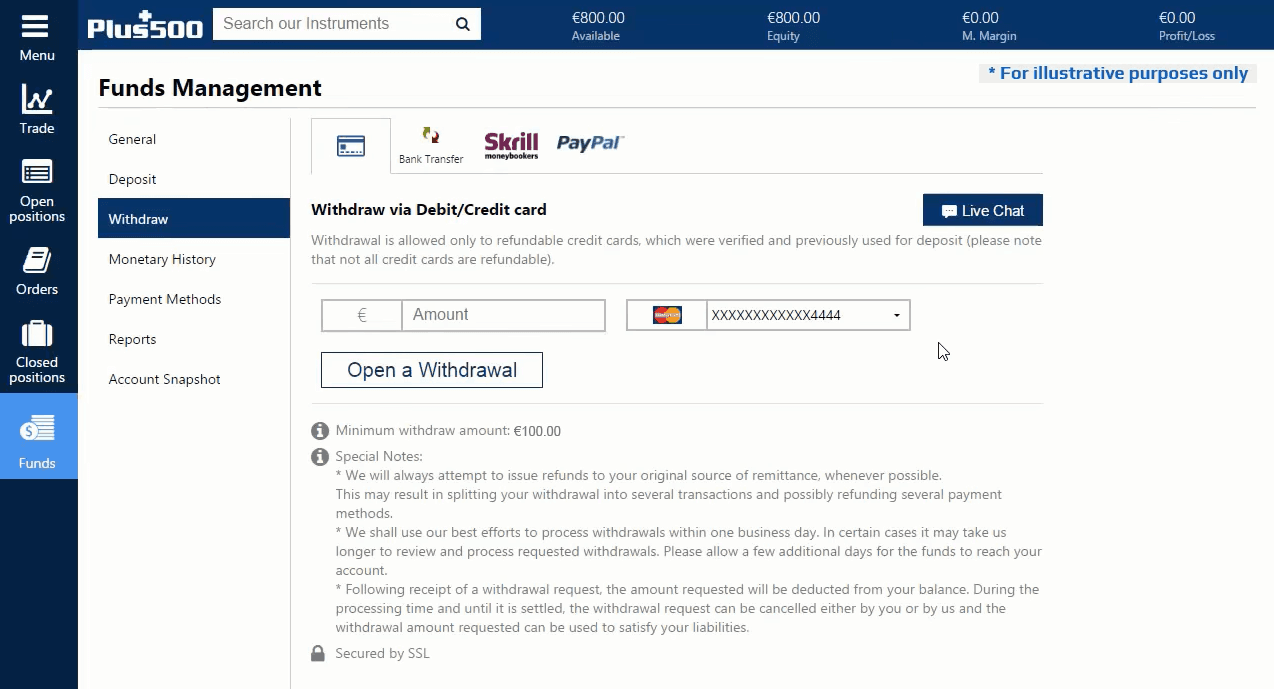

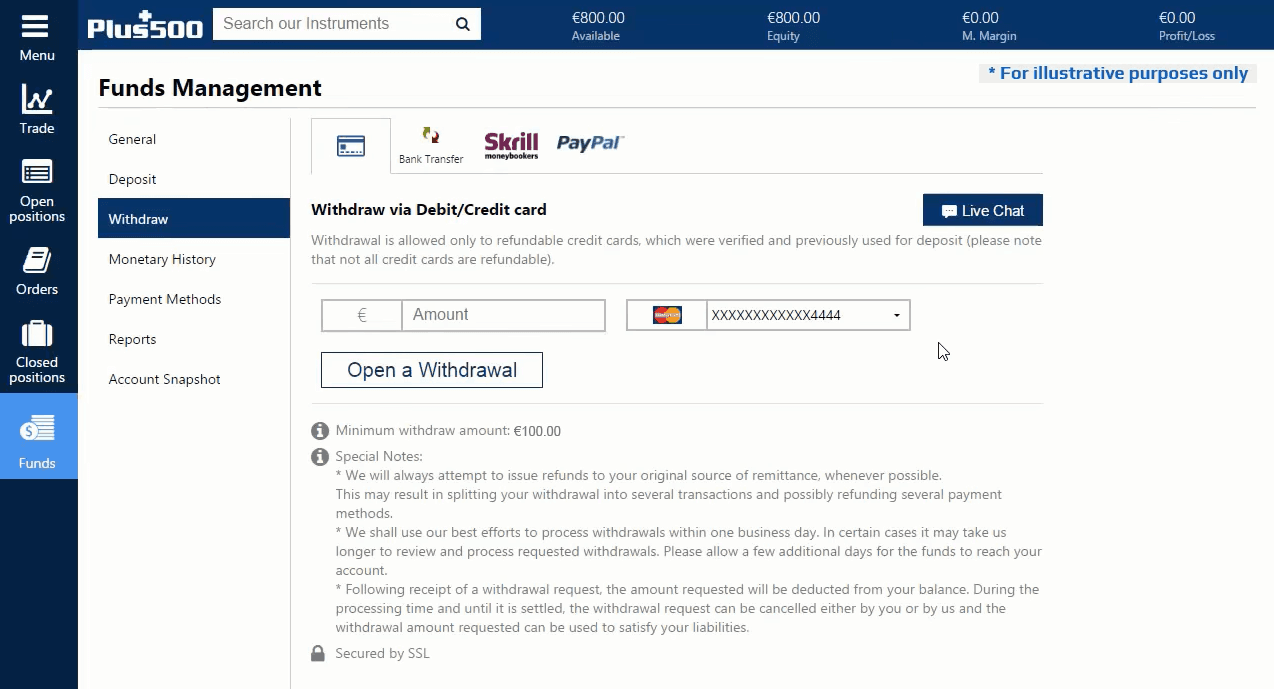

Deposits and Withdrawals

The number of payment methods to fund the trading account will allow you to transfer funds quickly by the use of Bank Wire transfers, Credit/Debit cards, PayPal, Skrill, and more.

Plus500 subsidiaries are authorized and regulated in the jurisdictions in which they operate, therefore with its compliance with client money rules and high level of protection you may transfer funds to or from trading accounts conveniently.

- Plus500 Funding Methods we ranked good with an overall rating of 8.5 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for Plus500 funding methods found:

| Plus500 Advantage | Plus500 Disadvantage |

|---|

| $100 is a first deposit amount | Methods and fees vary in each entity |

| No internal fees for deposits and withdrawals | |

| Fast digital deposits, including Skrill, PayPal, and Credit Cards | |

| Multiple Account Base Currencies | |

| Withdrawal requests confirmed within 1-3 business days | |

Deposit Options

In terms of funding methods, Plus500 offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank Wire

- PayPal

- Skrill

Plus500 Minimum Deposit

Plus500 minimum deposit is $100 but varies according to the jurisdiction under which the trading account is opened. It is important to note, each method has its own minimum deposit requirement too.

Plus500 minimum deposit vs other brokers

|

Plus500 |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Plus500 Withdrawals

Plus500 does not charge any fees or commissions on deposits/withdrawals, however, you may be subject to fees from banks involved in the case of bank transfers. We learned that the broker typically processes withdrawal requests within 1-3 business days.

How Withdraw Money from Plus500 Step by Step:

So in order to withdraw money from your trading account you should follow the next steps

- Login to your account and select “Withdraw Funds” in the menu

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the withdrawal request along with necessary requirements

- Confirm withdrawal and Submit

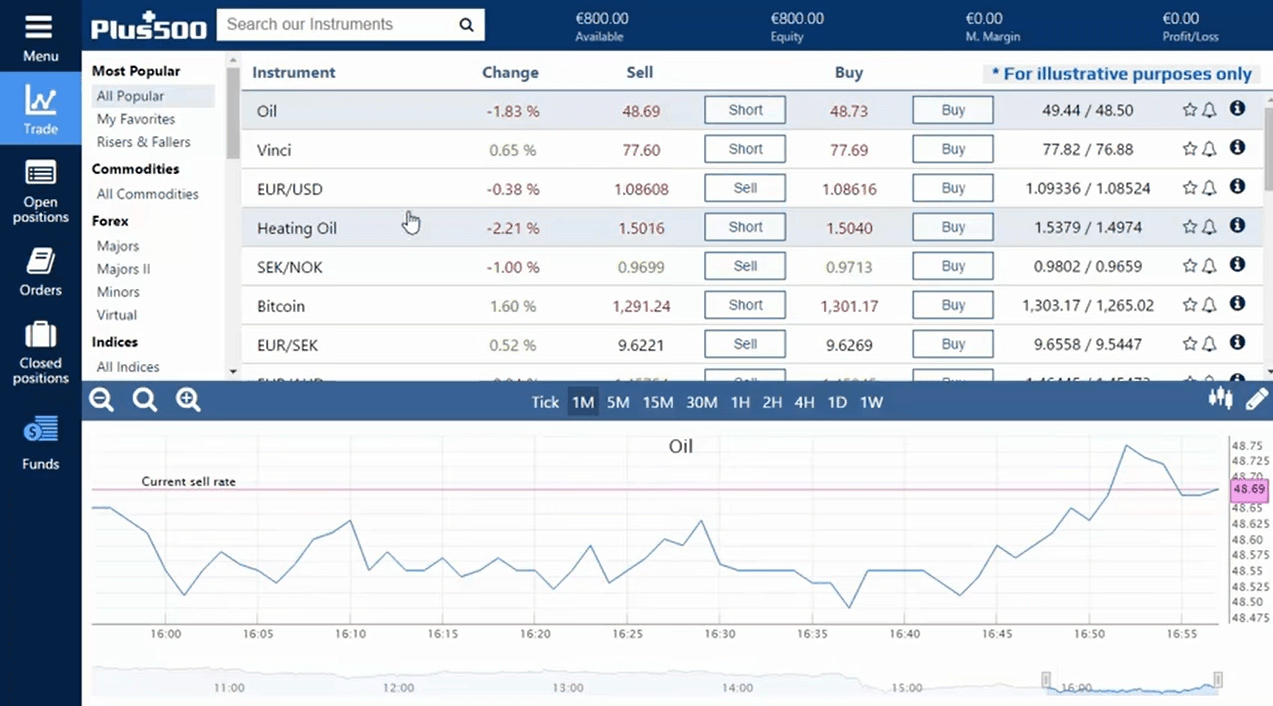

Trading Platforms

Based on our Expert research, Plus500 has a simple, intuitive, and easy-to-use platform interface for CFDs that is a Plus500 proprietary trading platform. The platform is solely based online.

- Plus500 Platform is ranked good with an overall rating of 8.2 out of 10 compared to over 500 other brokers. We mark it as good being one of the best proposals we saw in the industry, suitable for professional trading. Also, all are provided with good research and excellent tools.

Trading Platform Comparison to Other Brokers:

| Platforms | Plus500 Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

We found that the trading software is simple to use and understand, while everything happens right through the website. Once you log in, you will see a clean and understandable interface with a watchlist and full control over your account, with search, portfolio settings, and fee reports along with statistics.

Plus500 web trading platform is easy to navigate and use, with a nice and clean design and great charts, also with well-defined product search functions. Even seeing the platform for the first time you get around quickly, as simple to navigate and analyze interface will definitely complement your strategy.

Desktop Platform

Plus500 WebTrader platform is a desktop-based platform via a web browser. This means you don’t have to download or install specific software onto a PC, you just need an internet connection. In order to get started, you should log in with security settings to your account and may use either your existing Google or Facebook account.

Mobile Trading Platform

Along with WebTrader you may use great mobile trading especially well designed suitable for Android iPhone or iPad. Actually, it gained one of the highest ratings as the best mobile platform as a CFD trading mobile app on Apple’s App Store and Google Play. Plus500 mobile trading platform is also packed with necessary tools and full control over your account or positions, which brings you great accessibility on the go.

Customer Support

We learned that another great point of Plus500 is its customer support service available 24/7 offering WhatsApp support, live chat through chat support, and email support. So when ether question or inquiry you may have you should contact the support team as its service is good and professional.

Plus500 gladly assists traders in various ways and truly relevant answers, with reliable and quick guidelines or help you should request, which is fantastic and important for you as a client. Also considering the great range of languages they support and availability 24/7 with live chat rewards the broker even more, as this level of support is quite rare among other brokers.

- Customer Support in Plus500 is ranked Excellent with an overall rating of 9.5 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, also quite easy to reach during both working days and weekends.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses and relevant answers | None |

| 24/7 customer support | |

| Supporting numerous languages | |

| Availability of Live Chat | |

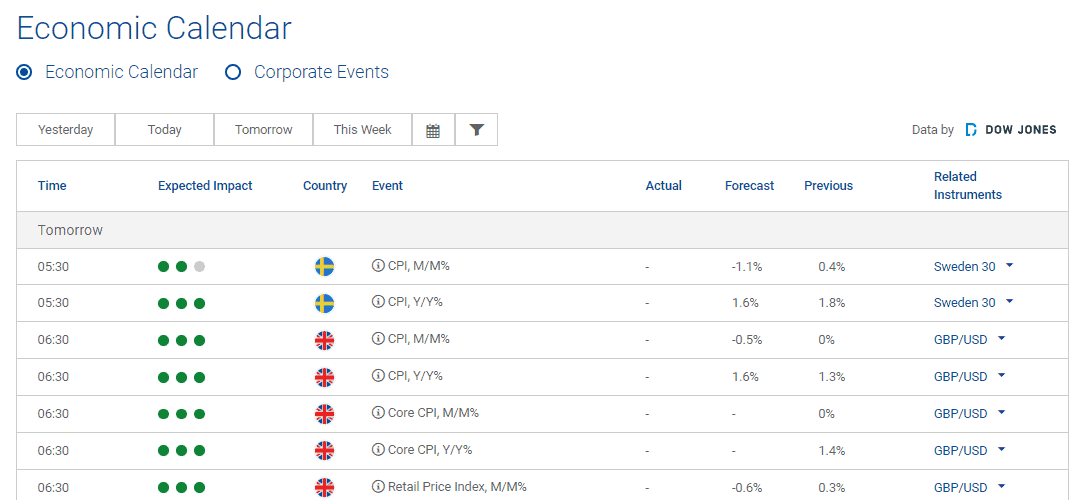

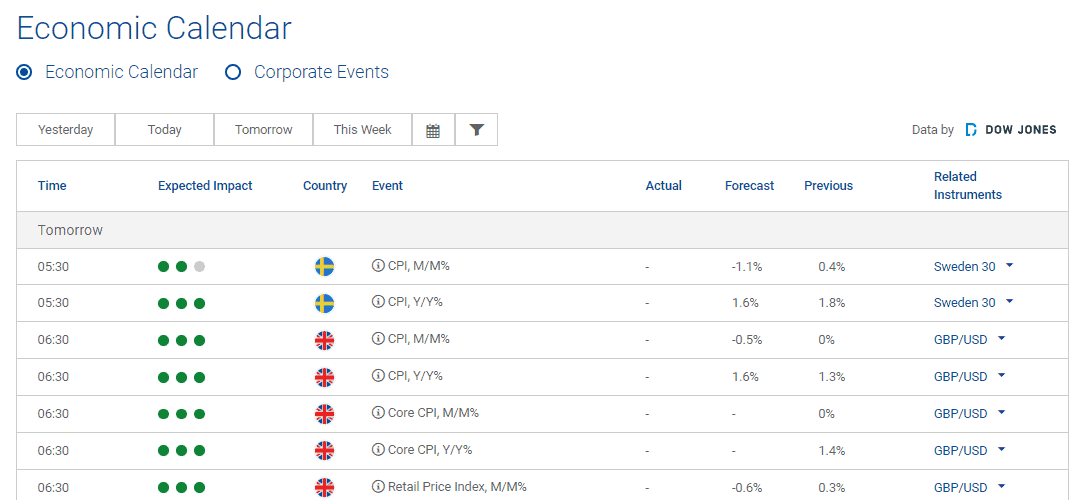

Plus500 Education

We found that Plus500 provides a rather limited range of educational materials and no trading course in general or live webinars. There are some course videos known as Plus500 Trade’s Guide which is just a guide on how to use a proprietary trading platform.

The platform itself offers great charting tools alongside with economic calendar, a built-in news feed, and alert systems which are useful. But there is no provided technical analysis or other materials with research purposes to support your everyday trading.

- Plus500 Education ranked with an overall rating of 7.5 out of 10 based on our research. The broker provides a limited range of educational materials, however, offers some good research tools like an economic calendar, charting tools, and more.

Plus500 Review Conclusion

Concluding the Plus500 review, we admit a trusted CFD broker with an extensive variety of instruments, provided by OTC operation. For the quality of service, we witness the good ability to cover various trading demands, easy to use a simple trading environment, good apps with great spread offering, and a balance between trading conditions. While in fact Plus500 is among largest Brokers worldwide and is one of the best for CFD Trading overall.

Based on Our findings and Financial Expert Opinions Plus500 is Good for:

- CFD Trading

- Professional traders

- Variety of trading strategies

- Competitive trading conditions

- Great technical solutions and tools

- Algorithmic or API traders

- Competitive spreads

- Supportive customer support

Share this article [addtoany url="https://55brokers.com/plus500-review/" title="Plus500 – CFD Service"]

Do you also have an acc manager and a trade on us initial trade upon trading?

Comment Sorry to compare you, but is there a risk free zone to trade like some other brokers? If there is, pls enlighten me. The risk is too much

Comment I am interested in opening PAMM accounts and what are the conditions?Area