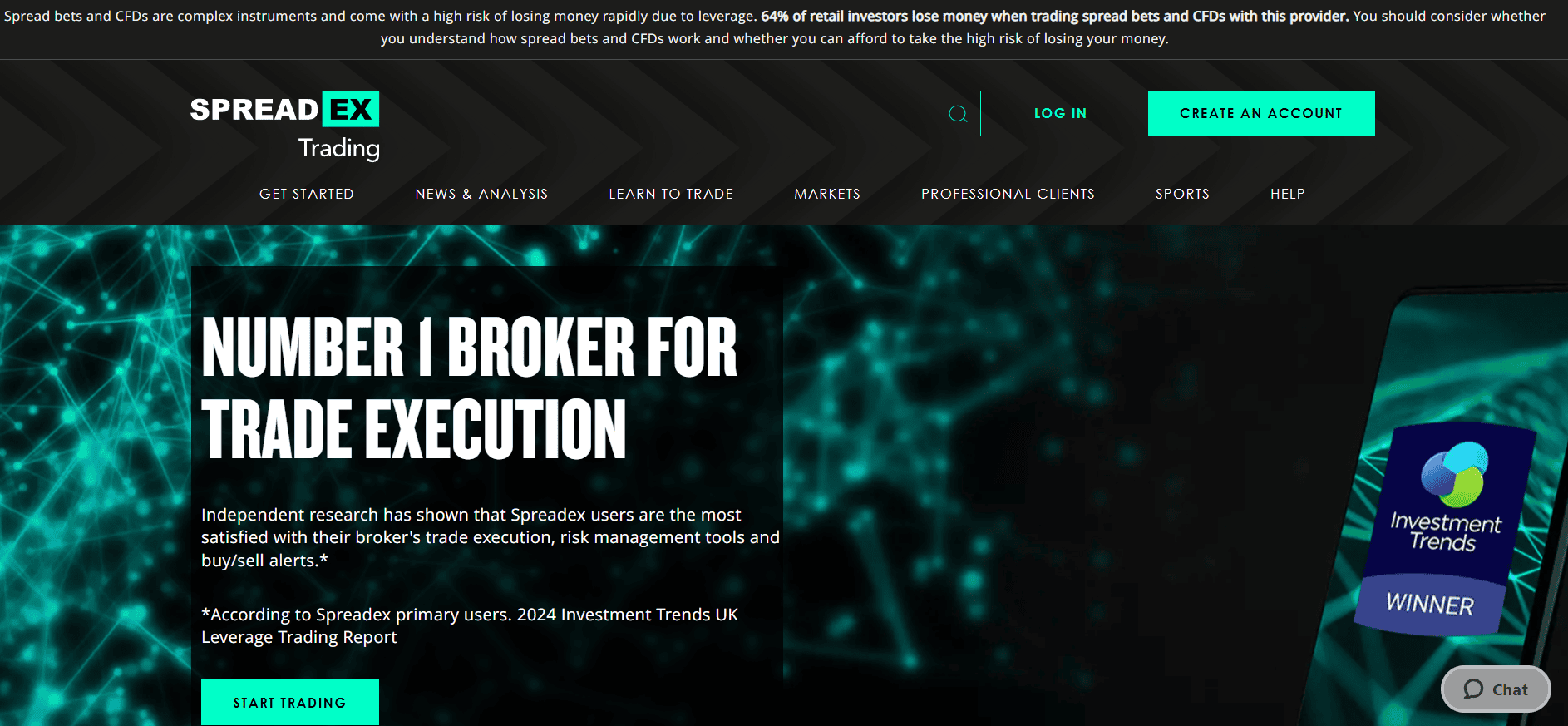

- What is Spreadex?

- Spreadex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

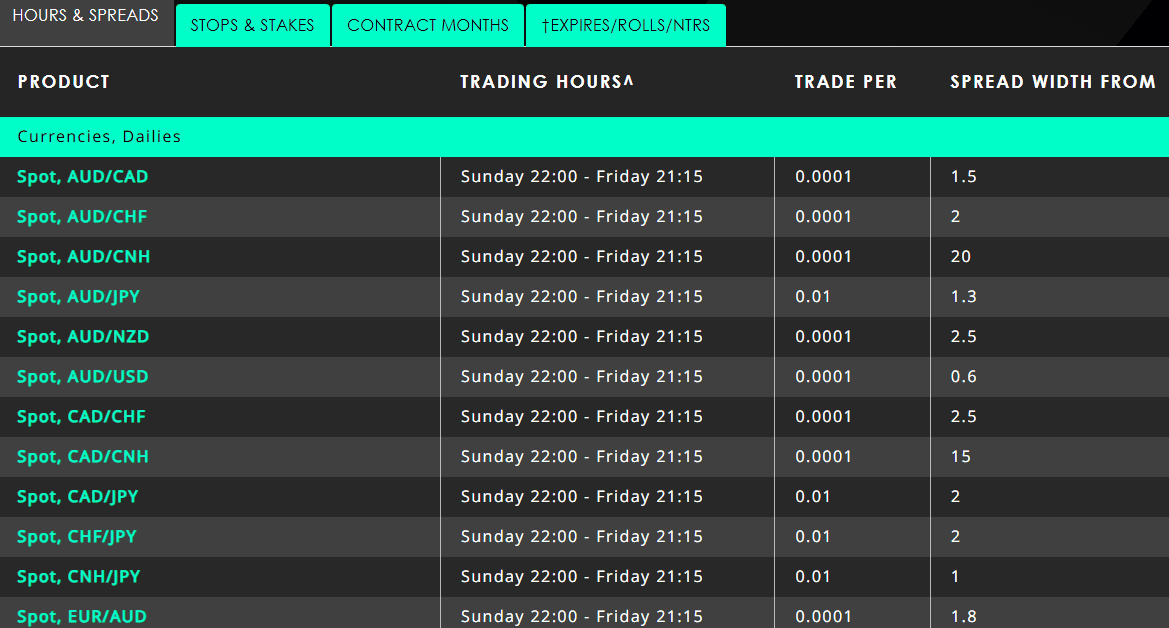

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

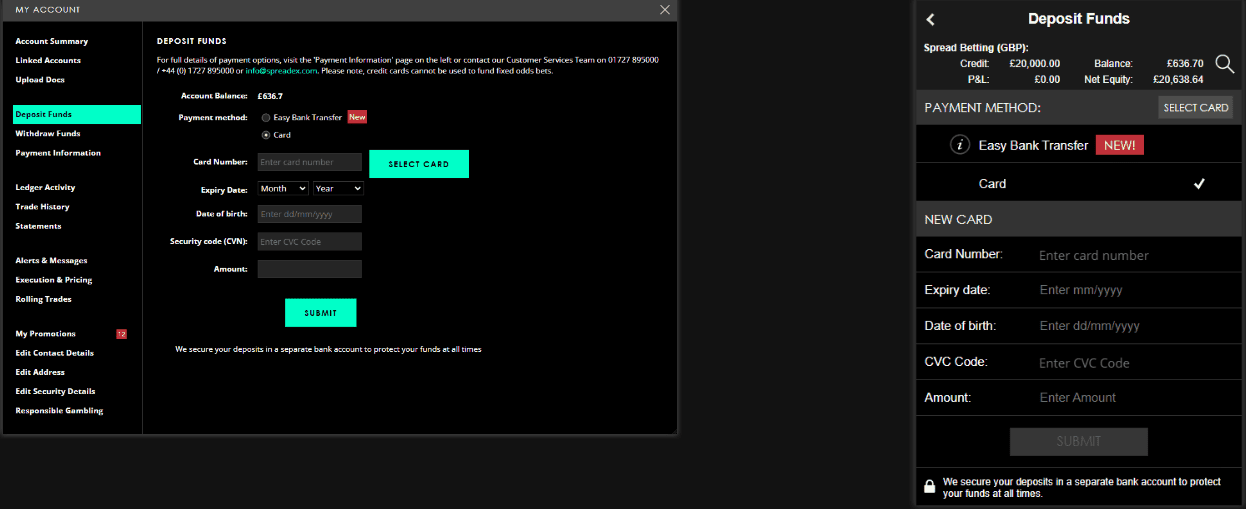

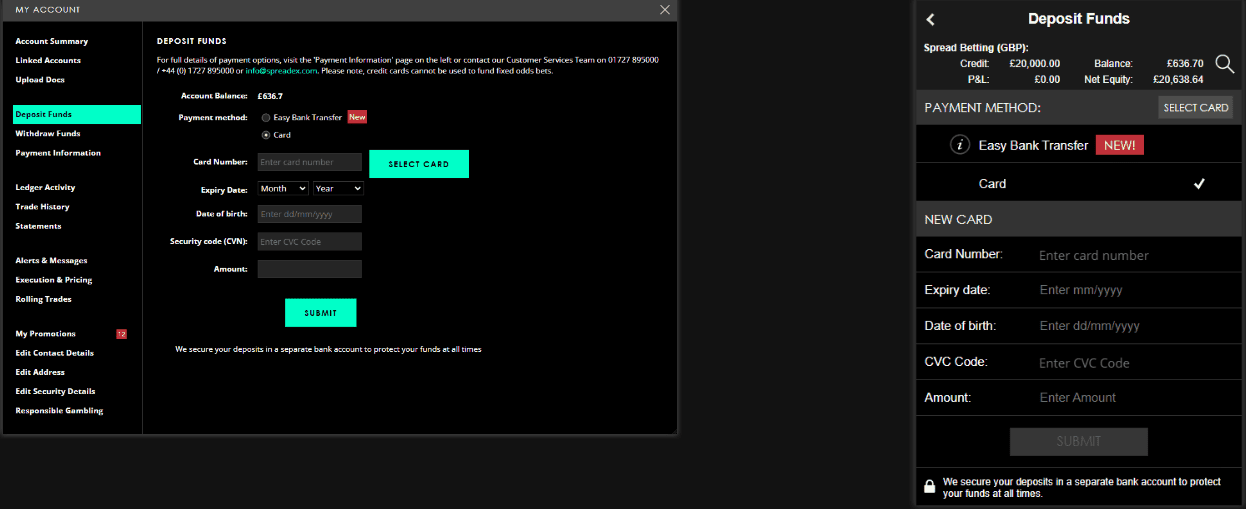

- Deposit and Withdrawal Options

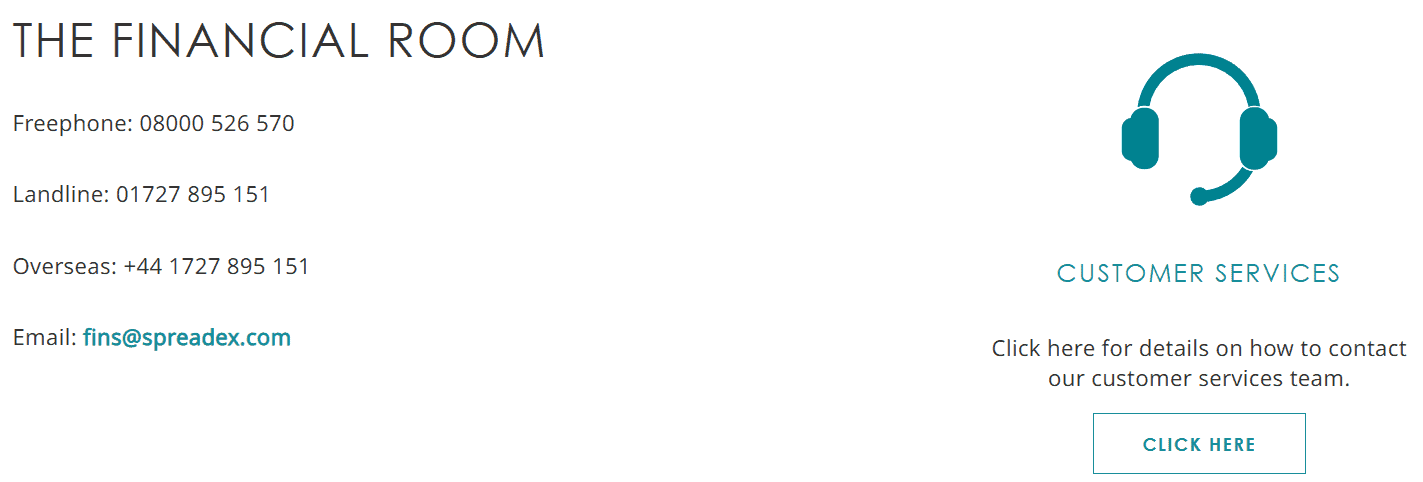

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

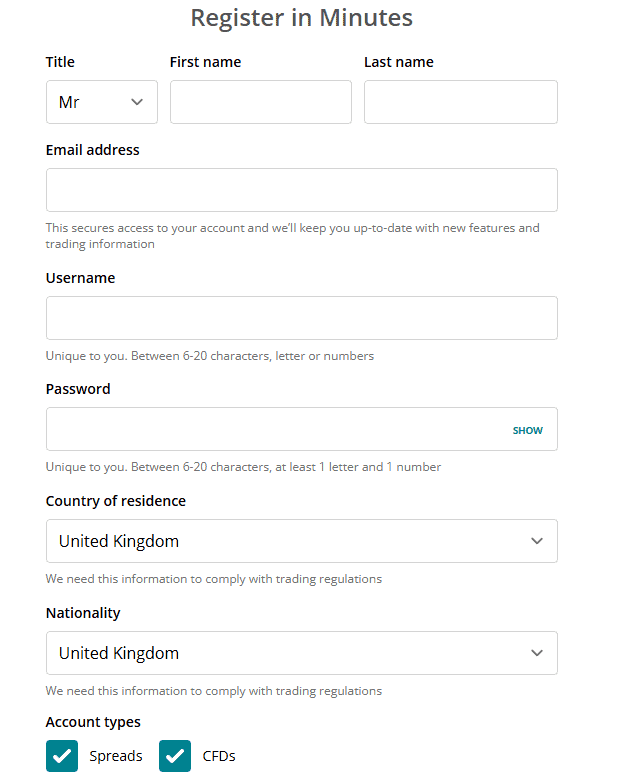

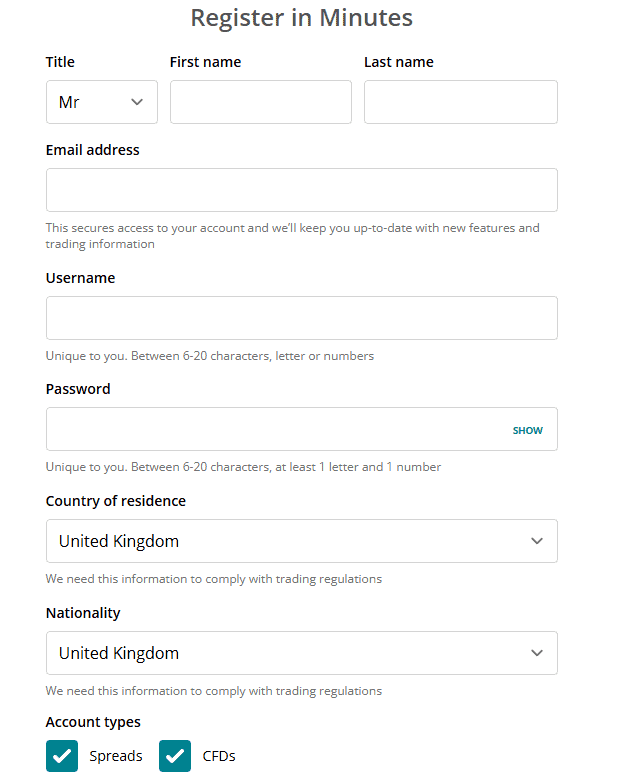

- Account Opening

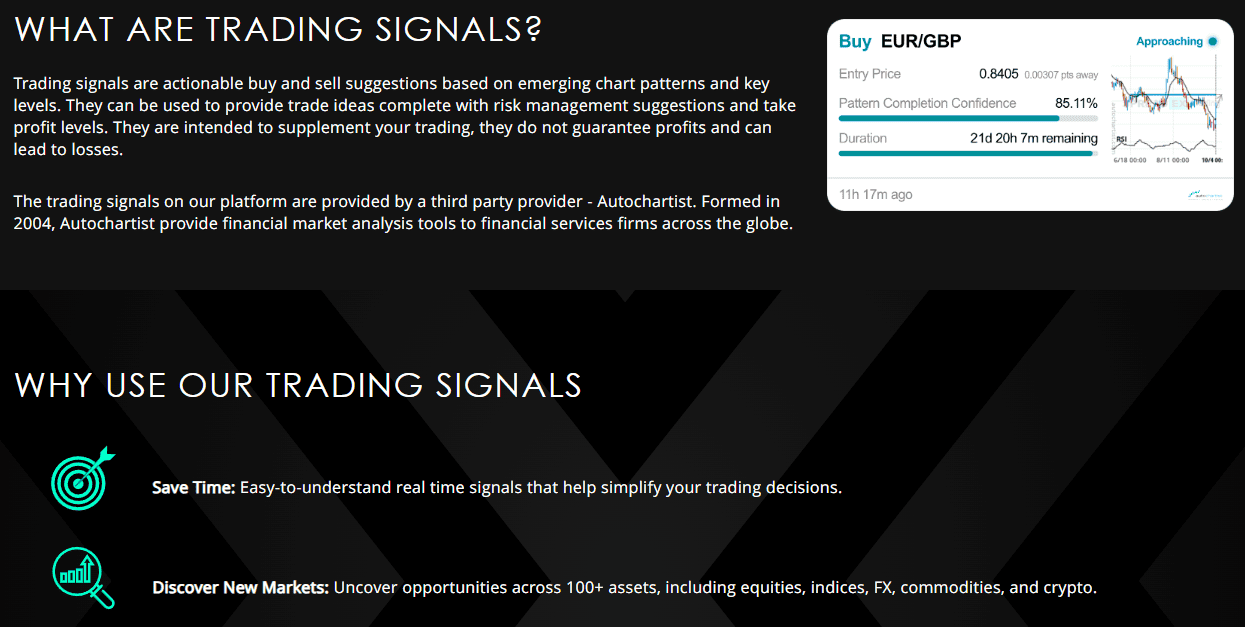

- Additional Tools And Features

- Spreadex Compared to Other Brokers

- Full Review of Broker Spreadex

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.2 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 3.9 / 5 |

| Customer Support and Responsiveness | 4.2 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3 / 5 |

| Account Opening | 4.3 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Spreadex?

Spreadex is an online FX broker established in 1999 and focused on providing a financial service, spread betting, and sports betting through its maintained office in London. First, Spreadex launched an online sports betting service in 2006, followed by a financial online platform. Generally, the company shows its positive growth and strives in terms of quality service delivery and presents itself as one of the biggest spread betting firm brokers within the UK.

- The company base of clients is counted over 60,000 account holders, who choose to trade with attractive Spreadex conditions and access to over 10,000 global markets including indices, shares, Forex (also with Bitcoin), commodities, bonds, options, Exchange Traded Funds, and interest rates. Moreover, the company offers the widest selection of AIM stocks in the industry starting with a low 20% margin.

- Eventually, by its continuous development of trading offering that walks together with the technology development and necessity to access trading with the latest developments, Spreadex shows its various enhancements and additional specifications.

Thus, in 2012 Spreadex revamped its online platform to include advanced features like one-click trading, standard/ pairs view, and customizable trading windows. A few years later, Spreadex released also its new financial fixed odds markets, referred to as “Speed Markets”, allowing it to place fixed-risk bets on financial markets.

Spreadex Pros and Cons

Our Experts consider Spreadex a good and reliable broker that has proved its integrity throughout several years of proper operation with good regulation. The broker provides excellent conditions for CFD traders with access to spread betting for its UK clients. The broker also provides a user-friendly platform with good support and video tutorials.

For the Cons, the broker’s instruments offering is limited to FX and CFDs, there is no 24/7 support and fees are higher for fixed spreads.

Another disadvantage is the absence of a demo account and popular platforms such as MT4, and/or MT5.

| Advantages | Disadvantages |

|---|

| FCA regulated | No 24/7 support |

| Good reputation | No demo account |

| Low spreads | Only FX and CFD instruments |

| Competitive trading conditions | Limited platform offer |

| Client protection | |

| Professional trading | |

| Popular trading instruments | |

| Good learning materials | |

Spreadex Features

Spreadex offers a variety of features that cater to both financial trading and sports betting clients. Below is a comprehensive list of its key features:

Spreadex Features in 10 Points

| 🏢 Regulation | FCA |

| 🗺️ Account Types | Standard, Pro, Spread Betting Accounts |

| 🖥 Trading Platforms | Spreadex Web Platform, TradingView |

| 📉 Trading Instruments | Forex, Share, Indices, Commodities, Bonds, ETFs, Cryptocurrencies, Interest Rates, Options, IPOs |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | GBP, USD, EUR |

| 📚 Trading Education | Education Hub, Glossary, Video Training Center |

| ☎ Customer Support | 24/5 |

Who is Spreadex For?

Spreadex is a great choice for individuals who value a dual-purpose platform offering financial trading and sports betting, combined with competitive spreads, tax advantages, and ease of use. Based on our findings and Financial Expert Opinions Spreadex is Good for:

- Professional traders

- Traders from UK

- Traders with various strategies

- Spread Betting

- Currency and CFD Trading

- CFD shares trading

- Traders who prefer a proprietary platform

- Low spreads

- Competitive conditions

- Good learning materials

Spreadex Summary

The Spreadex review presents a company, which showed significant growth within the UK market for its achievement in spread betting and sports betting services. The range of financial instruments and markets is widely presented, along with convenient fees and the possibility of enlarging the trading portfolio.

A proprietary platform is also a powerful software that is packed with tools and capabilities through OTC execution. Overall Spreadex is an interesting combination for those who are interested in Spread betting, however, clients from other countries (apart from the UK) should check the trading possibility according to their country of residence as it may vary.

55Brokers Professional Insights

Spreadex is a among trusted brokers known for offering favorable conditions and provide good protection. There is variety of instruments available, spreads are low spreads along with overall fees, while broker is great for traders from UK since it caters to both financial traders and sports betting enthusiasts with its dual-purpose platform.

However, Spreadex operates solely on a CFD and Forex basis with a proprietary platform, which may lack the versatility of industry-standard platforms like MT4 or MT5. Additionally, it does not offer a demo account for practice trading or more extensive educational resources such as webinars, limiting its appeal to beginner traders seeking hands-on learning. While Spreadex is a strong choice for experienced traders and UK residents benefiting from tax-free spread betting, traders should consider alternative brokers for a broader market range, advanced platforms, or educational and research tools.

Consider Trading with Spreadex If:

| Spreadex is an excellent Broker for: | - Need a well-regulated broker.

- UK traders.

- Spread betting trading.

- Looking for broker with no minimum deposit requirement.

- Offering low leverage up to 1:30.

- Suitable for professional traders.

- Providing competitive fees and spreads.

- Quality educational video materials.

- Offering popular instruments.

- Secure environment.

- Providing proprietary platform. |

Avoid Trading with Spreadex If:

| Spreadex might not be the best for: | - Who prefer 24/7 customer service.

- Looking for industry-known platforms.

- Beginner traders who look for Demo Account.

- Providing Copy Trading.

- Need broker with access to VPS Hosting. |

Regulation and Security Measures

Score – 4.5/5

Spreadex Regulatory Overview

Spreadex is a fully regulated broker, authorized and overseen by the UK Financial Conduct Authority (FCA), one of the most respected financial regulators globally. The FCA ensures that Spreadex adheres to strict standards for transparency, client fund protection, and operational integrity.

However, the broker’s regulatory reach is limited to the jurisdictions where FCA oversight applies, which may not cater to traders in regions outside the UK.

How Safe is Trading with Spreadex?

Spreadex’s compliance with FCA regulations guarantees a secure environment, making it a trustworthy option for traders, particularly those in the UK. Client funds are held in segregated accounts, ensuring they are protected from the company’s operating capital.

Additionally, as part of regulatory requirements, every client is eligible to participate in the FSCS (Financial Services Compensation Scheme), which provides compensation of up to £50,000 in the unlikely event of the company’s insolvency.

Overall, the broker’s stable and profitable track record, combined with adherence to sufficient capital requirements, underscores the company’s reliability.

Consistency and Clarity

Spreadex has built a solid reputation since its establishment in 1999, earning recognition for its consistency, transparency, and innovative approach to trading and sports betting. The broker has received several industry awards, including accolades for its proprietary platform and customer service, reflecting its commitment to delivering a user-friendly and reliable experience.

The broker also actively engages in social and community activities, such as sponsorships of professional sports teams, enhancing its visibility and credibility within the trading and betting communities. Traders often praise the broker for its competitive spreads, tax-free spread betting for UK residents, and dual-platform functionality, allowing seamless access to financial trading and sports betting.

However, reviews also highlight certain drawbacks, such as the absence of popular platforms like MT4/MT5, the lack of a demo account, and webinars, which may deter some beginners. Despite these limitations, Spreadex’s long-standing presence and positive industry reputation make it a trusted choice for many traders.

Account Types and Benefits

Score – 4.2/5

Which Account Types Are Available with Spreadex?

Spreadex offers Standard Accounts, Professional Accounts, and Spread Betting Accounts. The Standard Account is suitable for most traders, offering access to a wide variety of markets and competitive spreads. The Professional Account is tailored for experienced traders who meet eligibility criteria, providing benefits such as higher leverage and reduced margin requirements.

For UK and Ireland residents, the Spread Betting Account offers a tax-efficient option, as profits from spread betting are free from Capital Gains Tax. However, a notable drawback is that Spreadex does not offer a demo account, which could be a disadvantage for beginners seeking to practice trading. Additionally, the absence of swap-free accounts makes the broker less accommodating to traders requiring Sharia-compliant options.

Standard Account

The Spreadex Standard Account is designed to meet the needs of most traders by providing access to a wide range of financial markets. The account features tight spreads, with major Currency pairs like EUR/USD having spreads of 0.6 pips, ensuring cost-effective trading. Spreadex does not charge commissions on most trades, as the costs are incorporated into the spreads. The account has no minimum deposit requirement, making it accessible to traders with varying budget sizes.

The account also includes risk management tools, such as Guaranteed Stop-Loss Orders, available for an additional fee. While the account is versatile and competitive, it lacks access to popular platforms like MT4/MT5 and does not offer features such as a demo account.

Pro Account

The Spreadex Pro Account is designed for experienced traders, offering enhanced conditions such as leverage of up to 1:200 for major Currency pairs, with a minimum margin rate of 0.5%. Like the Standard Account, it has no commissions on most trades, as costs are embedded in the spreads.

Pro account holders also benefit from crypto trading access, expanding their trading options.

Spread Betting Account

The Spread Betting Account offered by Spreadex allows traders to speculate on a wide variety of markets without owning the underlying assets. It is particularly popular in the UK due to its tax advantages, as profits from spread betting are exempt from Capital Gains Tax.

This account type is ideal for traders looking to take advantage of price movements in markets like Forex, stocks, and indices, all while benefiting from leveraged positions. However, it is only available to residents of the UK and Ireland.

Regions Where Spreadex is Restricted

Spreadex’s trading services are primarily available to clients in the UK and EEA, as it is regulated by FCA. However, its services are restricted in several regions due to regulatory and legal reasons. Key regions where Spreadex does not offer trading services include:

- USA

- Canada

- Japan

- Australia

- South Africa

- Middle Eastern countries (e.g., Saudi Arabia, UAE)

- Certain countries in Africa and Asia

Cost Structure and Fees

Score – 4.5/5

Spreadex Brokerage Fees

Spreadex operates with a transparent fee structure, where most costs are built into the spread. Additionally, the broker does not charge any deposit or withdrawal fees, making transactions straightforward and cost-effective.

While there is no inactivity fee, traders should be aware of other potential charges, such as funding fees that may apply.

Spreadex offers fixed tight spreads for indices, shares, and commodities, ensuring that traders can benefit from predictable costs on these instruments. This fixed spread structure is ideal for those looking for consistency in their costs.

For Forex instruments, spreads are variable, meaning they may fluctuate based on market conditions and liquidity, including major pairs like EUR/USD, which typically have a spread of 0.6 pips.

Spreadex does not charge commissions on most trades, as the costs are incorporated into the spread. However, for certain instruments, such as stock CFDs, Spreadex may apply a commission in addition to the spread. For example, trading individual stocks like Apple through CFDs may involve a commission of 0.15% of the trade value, with a maximum of 3.5 points.

- Spreadex Rollover / Swaps

Spreadex charges rollover fees, also known as swap fees, for positions that are held overnight. These fees are based on the interest rate differential between the two currencies in a Currency pair or the financing cost of a commodity or stock position.

The rollover fee can either be a credit or a debit, depending on the direction of the trade and the market conditions.

How Competitive Are Spreadex Fees?

Spreadex offers overall competitive fees, particularly for traders who prefer spread betting. While there are no deposit or withdrawal fees, traders should be aware of additional costs.

Overall, Spreadex’s fee structure is quite competitive, especially for experienced traders who can navigate variable spreads and additional charges for certain services. However, traders should consider the potential costs involved with Currency trading and other specific instruments to ensure that the overall fees align with their strategy.

| Asset/ Pair | Spreadex Spread | OneRoyal Spread | Tradeview Spread |

|---|

| EUR USD Spread | 0.6 pips | 1 pip | 0.3 pips |

| Crude Oil WTI Spread | 2.8 pips | 0.6 pips | 0 pip |

| Gold Spread | 3 pips | 3.2 pips | 3.8 pips |

| BTC USD Spread | 40 | 1321.6 | 31.3 pips |

Spreadex Additional Fees

Spreadex does not charge fees for most deposit or withdrawal options, which is a significant advantage for traders. However, there are additional fees to consider, such as those for guaranteed stop-loss orders, which incur an extra cost to secure a position against extreme market volatility.

Rollover or swap fees are also charged for positions held overnight, based on the interest rate differential between currencies in Currency pairs or the financing cost for other instruments. Additionally, while there are no inactivity fees, traders should be aware that certain instruments, like stock CFDs, may attract commission fees on top of the spreads. Traders should review the broker’s market information to fully understand the additional costs associated with each instrument or trading service.

Trading Platforms and Tools

Score – 4/5

Spreadex offers a proprietary platform that is fully customizable, catering to both web and mobile users. This platform provides traders with diverse charting tools, price alerts, watchlists, and award-winning execution. The broker also integrates with TradingView, allowing traders to enhance their analysis with modern charting and technical tools.

However, one limitation is the absence of widely used platforms like MT4 and MT5, which some traders may prefer for their familiarity and third-party tool integrations. This may prompt traders seeking these industry-standard platforms to consider alternative brokers.

Trading Platform Comparison to Other Brokers:

| Platforms | Spreadex Platforms | OneRoyal Platforms | Tradeview Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Spreadex Web Platform

Spreadex’s web platform is a reliable proprietary solution designed for seamless trading. The platform allows traders to execute spread bets and CFDs from a single account. Additionally, it features a customizable interface, a variety of charting tools with automated pattern recognition and Pro Trend lines, and sophisticated drawing tools. Traders benefit from award-winning execution, advanced order types like Force Opens, and price alerts via text, push notifications, or email.

The platform also offers access to over 10 years of extensive price history, a wide range of technical indicators, macroeconomic data, and customizable templates to save and edit strategies. These features make the Spreadex web platform a good choice for traders seeking flexibility and comprehensive tools.

Main Insights from Testing

Testing the Spreadex web platform revealed a user-friendly and highly customizable interface designed for efficient trading. The platform stands out for its charting capabilities, seamless execution, and intuitive navigation, catering well to all levels of traders. Its unique features, such as automated trend lines and macro-data integration, make it a reliable option for those seeking a proprietary trading solution.

Spreadex Desktop MetaTrader 4 Platform

Spreadex does not offer the MT4 platform, a widely used industry standard for trading. While this may be a drawback for traders accustomed to MT4’s advanced features and extensive third-party tools, the broker compensates by providing its proprietary platform, which includes customizable features, charting tools, and seamless execution for both spread betting and CFD trading. However, traders seeking the familiarity and versatility of MT4 may need to consider alternative brokers.

Spreadex Desktop MetaTrader 5 Platform

Spreadex does not offer the MetaTrader 5 platform, which is popular among traders for its advanced tools, multi-asset support, and enhanced analytical capabilities. This may be a limitation for traders who rely on MT5’s features or prefer its interface. Traders specifically seeking MT5 functionality may need to explore other broker options.

Spreadex MobileTrader App

The MobileTrader App is designed to provide traders with a seamless and efficient experience on the go. Available for both iOS and Android devices, the app allows users to access their accounts, execute trades, and manage positions anytime, anywhere.

With features such as price alerts via push notifications, and a fully customizable interface, the app ensures flexibility and control for traders. While the app delivers a user-friendly experience, it may lack the extensive functionalities found in industry-standard platforms like MT4 or MT5.

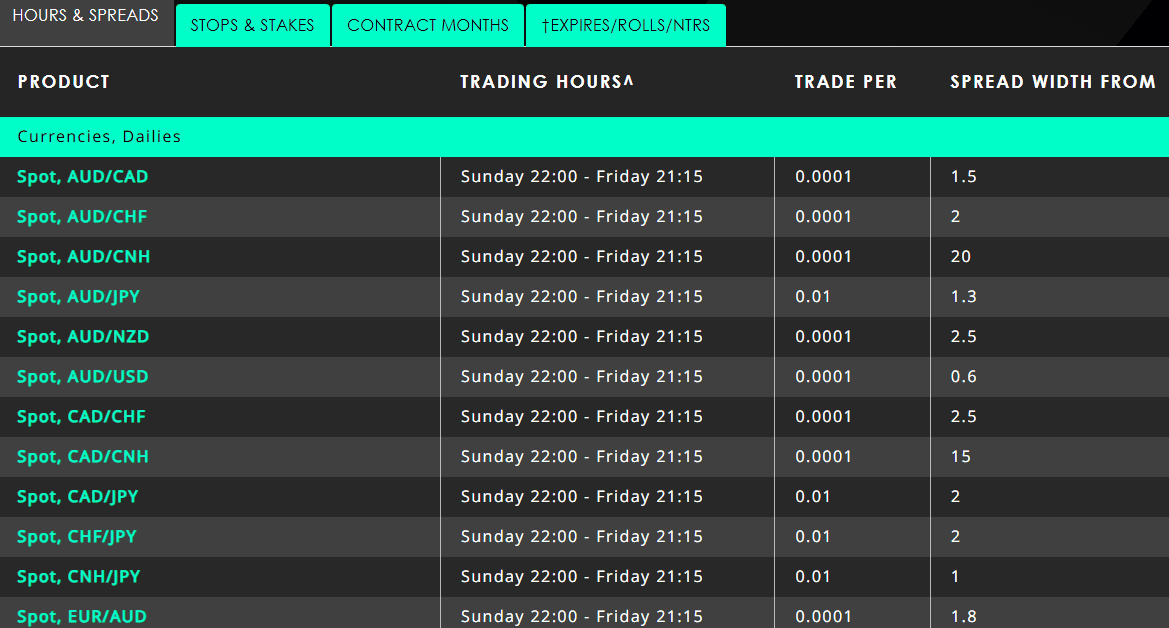

Trading Instruments

Score – 4.6/5

What Can You Trade on Spreadex’s Platform?

Spreadex provides access to over 10,000 instruments, primarily on a CFD basis. These include Forex, Share, Indices, Commodities, Bonds, ETFs, Cryptocurrencies, Interest Rates, Options, and IPOs. However, crypto trading is available exclusively to professional traders due to regulatory restrictions.

As a UK-based broker, Spreadex also offers spread betting, a tax-efficient option for clients in the UK. This diverse range of instruments allows traders to explore opportunities across multiple asset classes, catering to various strategies and preferences.

Main Insights from Exploring Spreadex’s Tradable Assets

Spreadex offers several advantages in its tradable asset range, particularly with its extensive selection of Forex pairs, indices, shares, and commodities. The availability of both spread betting and CFD trading across these markets makes it appealing to a wide range of traders.

The broker also offers access to crypto trading for professional clients, with popular pairs like BTC/USD and ETH/USD, which is a key benefit for those looking to trade digital currencies.

However, the restriction on crypto trading for retail clients limits access to this popular asset class, and the absence of traditional investment options, like direct stock trading, maybe a downside for some traders. Moreover, the platform’s focus on CFDs and spread betting may not be suitable for investors seeking a more traditional approach with lower leverage or physical asset ownership.

Leverage Options at Spreadex

As a UK brokerage firm, Spreadex is obligated to adhere to regulatory restrictions on how the company operates, including the leverage levels it offers.

- The maximum offering available for retail traders goes to 1:30 for major currency pairs and lower for other instruments.

As for the professionals, they may access higher multiplier ratios once the status is confirmed, along with specified conditions towards the spread betting and trading service Spreadex may provide.

Deposit and Withdrawal Options

Score – 3.9/5

Deposit Options at Spreadex

Spreadex offers a variety of deposit options for its clients, making it easy to fund their accounts and start trading. The base currencies are available in GBP, USD, or EUR. Here are the deposit options available at Spreadex:

- Credit/Debit Cards

- Bank Wire

- Apple Pay and Google Pay

Spreadex Minimum Deposit

The Spreadex account has no minimum deposit requirement, no obligation to trade, or joining fees. However, traders should check the margin requirements for the instruments they intend to trade.

Withdrawal Options at Spreadex

Spreadex withdrawals are cleared with a minimum of £50 with the rule to withdraw only onto the card that was used to deposit funds (as per the regulatory). The CHAPS same-day transfers are also available at the charge of £25. Spandex does not charge for making payments using UK cards, yet, a 2% administration fee for all credit card payments is applicable, along with a 2.5% flat fee on all card transactions that are not in sterling.

Customer Support and Responsiveness

Score – 4.2/5

Testing Spreadex’s Customer Support

Spreadex provides 24/5 customer support to assist traders during market hours. Support is available through multiple channels, including phone, email, and live chat. This ensures that clients can quickly resolve any issues or get answers to their inquiries throughout the trading week.

Additionally, the broker has a comprehensive FAQ section on its website, providing answers to common questions regarding account management, trading, deposits, and more. The FAQ section can be a helpful first step for traders seeking immediate information.

Contacts Spreadex

If you need to get in touch with Spreadex, you can reach them through various contact methods. The broker offers a freephone number for UK clients: 08000 526 570. Alternatively, you can call their landline at 01727 895 151 or use the overseas number at +44 1727 895 151.

For email inquiries, you can contact them at fins@spreadex.com. The customer support team is available to assist with any queries you may have regarding your account or trading.

Research and Education

Score – 4.4/5

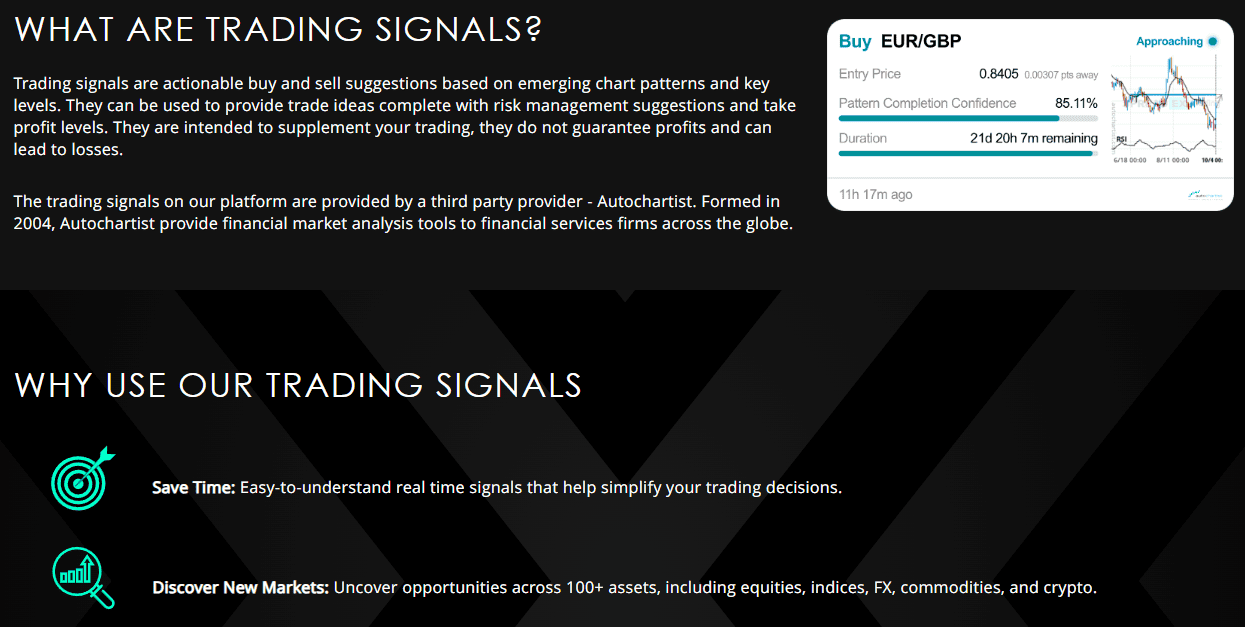

Research Tools Spreadex

Spreadex offers a variety of research tools to help traders stay informed and make better decisions.

- On the website, traders can access resources like the Economic Diary, Financial Trading Blog, Weekly Update, Spreadex Market Update, and Weekly Technical Analysis. These tools provide up-to-date information on market movements, trends, and economic events.

- Additionally, the Spreadex platform offers various charting tools, technical indicators, and price alerts, which assist traders with in-depth technical analysis and real-time market monitoring. These platform-based tools complement the website resources, providing traders with a comprehensive suite of research tools for both fundamental and technical analysis.

Education

Spreadex offers a range of educational resources to help traders improve their skills and understanding of financial markets. The Education Hub provides access to a variety of materials that cover the basics of spread betting, CFD trading, and more advanced strategies.

For those looking to familiarize themselves with key terms, the Spread Betting Glossary is a helpful tool, offering clear definitions of common terms.

Additionally, the Video Training Center provides instructional videos, catering to traders of all levels, and is a valuable resource for visual learners looking to enhance their knowledge. These educational resources aim to empower traders with the knowledge they need to navigate the markets confidently.

Portfolio and Investment Opportunities

Score – 3/5

Investment Options Spreadex

Spreadex is primarily a Currency and CFD broker and does not offer traditional investment options, as its focus remains on speculative trading. It allows traders to take positions in the financial markets through CFDs and spread betting, rather than long-term investments. Therefore, if you are looking for traditional investment options, Spreadex may not be the right choice.

Account Opening

Score – 4.3/5

How to Open Spreadex Demo Account?

Spreadex does not offer a demo account for new or potential clients. Traders interested in testing the platform or its features will need to open a live account, as the broker does not provide a risk-free simulated environment for practice.

How to Open Spreadex Live Account?

To open a live account with Spreadex, simply visit the broker’s website and complete the registration process. You will need to provide personal information, such as your name, address, contact details, country of residence, etc. Once your details are submitted, you will need to verify your identity by submitting the necessary documents, such as proof of identity and proof of address.

After the verification process is complete, you can fund your account and begin trading. Spreadex does not have a minimum deposit requirement, but traders should check the margin requirements for the instruments they intend to trade.

Additional Tools and Features

Score – 4.4/5

Spreadex offers several additional features to enhance the trading experience.

- One notable tool is their “Force Opens” feature, which allows traders to set up orders that automatically open a position when certain conditions are met. This can help streamline trading and ensure timely entry into the market.

- Additionally, Spreadex integrates TradingView, offering powerful charting tools and a wide range of technical indicators, advanced screeners, and financial reports. Traders also benefit from access to up-to-date community ideas and scripts, which can assist in making informed decisions.

- Moreover, the platform offers signals to guide traders on potential market movements, enhancing their ability to execute effective strategies.

Spreadex Compared to Other Brokers

Compared to its competitors, Spreadex offers a competitive range of features but also has some drawbacks. One of its advantages is its low spreads on spread-based accounts, with an average of 0.6 pips, which can be beneficial for active traders looking for tighter pricing. The broker’s integration with TradingView also gives traders access to powerful charting and analysis tools, enhancing their experience. Additionally, Spreadex stands out with its no minimum deposit requirement, making it more accessible for traders with smaller budgets.

However, when compared to brokers like Markets.com or Forex.com, which provide a broader variety of platforms such as MT4 and MT5, Spreadex may be limited for traders seeking advanced features and tools. Moreover, brokers like Xtrade and Tradeview offer a wider range of asset classes, while Spreadex’s focus remains largely on Currency and CFDs. Additionally, some competitors provide more robust educational resources or additional features, such as social trading, which might be appealing to beginners or those seeking more guidance. While Spreadex excels in offering low fees and fast execution, its product offering and platform variety might be more limited compared to other brokers.

| Parameter |

Spreadex |

Markets.com |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread Based Account |

Average 0.6 pips |

Average 1 pip |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission Based Account |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Low/ Average |

Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

Spreadex Web Platform, TradingView |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

10,000+ instruments |

2,200+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

FCA |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$0 |

$100 |

$100 |

$0 |

$50 |

$250 |

$1000 |

Full Review of Broker Spreadex

Spreadex is a UK-based Forex and CFD trading broker that offers a fully customizable and reliable proprietary platform, accessible via web and mobile devices. It provides competitive spreads, fast execution, and a wide range of instruments, including Forex, indices, commodities, and CFDs. Traders can access advanced charting tools through TradingView integration and utilize features like price alerts and advanced order types.

Spreadex also offers a flexible approach to trading, with no minimum deposit required and a focus on both spread betting and CFDs. The broker also provides competitive spreads, averaging 0.6 pips on spread-based accounts.

While Spreadex delivers a solid experience with competitive fees, it does not offer popular platforms like MT4 and MT5, and it lacks a demo account, which limits options for both advanced traders and beginners seeking a more comprehensive environment.

Share this article [addtoany url="https://55brokers.com/spreadex-review/" title="Spreadex"]