- What is ICM Capital?

- ICM Capital Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

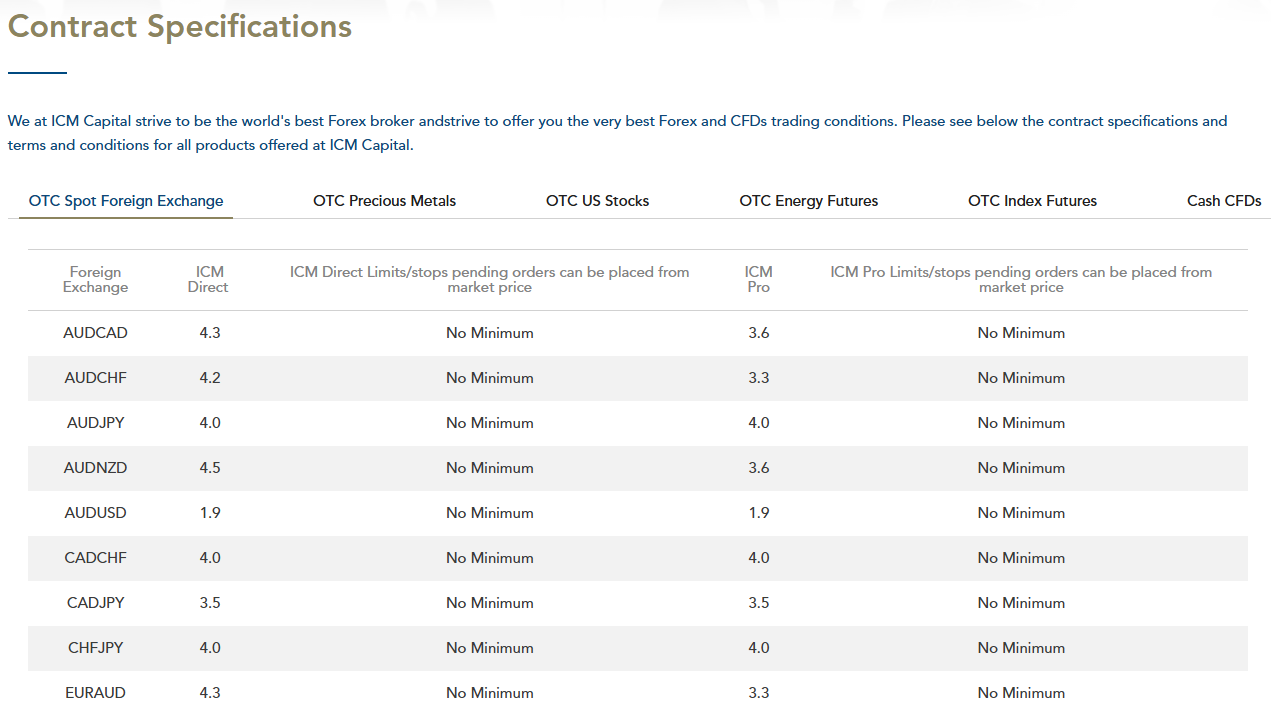

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- ICM Capital Compared to Other Brokers

- Full Review of Broker ICM Capital

Overall Rating 4.7

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.7 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.7 / 5 |

What is ICM Capital?

ICM Capital Broker is an international online Forex and CFD firm offering access to a diverse range of products, including Currency and CFDs on Indices, Commodities, Cryptos, Futures, and more.

ICM Capital Limited is a London-based broker that operates as a wholly-owned subsidiary of ICM Holding SARL (Luxembourg). Additionally, support and operation offices have been established in Dubai and Shanghai.

ICM Capital Pros and Cons

ICM Capital is considered a reliable broker with ECN trading technology and good technical solutions. The Spreads are low and average and there is a good education section, also offering is suitable for various sizes of traders and available almost all around the globe which is a great advantage.

For the Cons, the instruments are limited to CFDs and OTC assets, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Well-regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| Globally recognized and awarded | No 24/7 customer support |

| Competitive trading costs and spreads | |

| Industry-known trading platform | |

| ECN technology | |

| Suitable for beginners and professionals | |

| Popular trading instruments | |

| Quality customer support | |

ICM Capital Features

ICM Capital is a globally recognized online broker offering a range of financial instruments. With a strong regulatory framework and a client-centric approach, ICM Capital aims to deliver a secure and efficient environment for traders of all levels. Below you can find the main points to consider while choosing ICM Capital as your Forex broker.

ICM Capital Features in 10 Points

| 🏢 Regulation | FCA, FSCA, FSC, FSA, ARIF, SCAB, QFC |

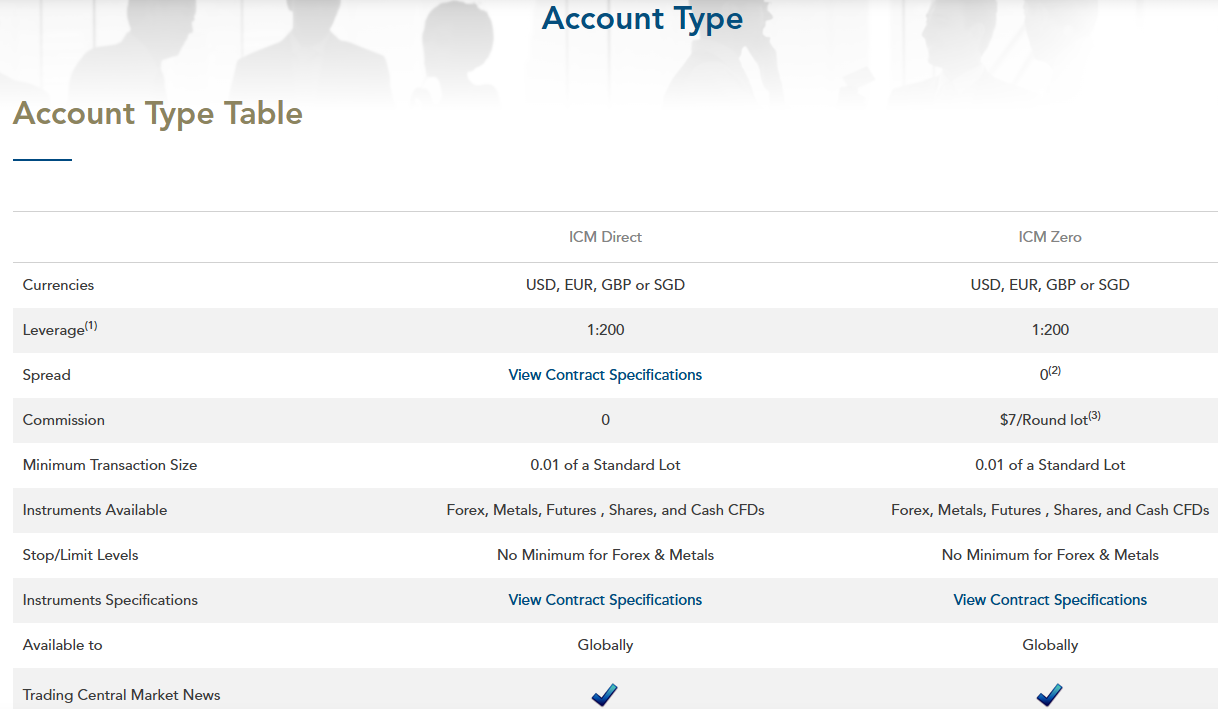

| 🗺️ Account Types | ICM Direct, ICM Zero Accounts |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

| 📉 Trading Instruments | OTC Spot Foreign Exchange, OTC Precious Metals, OTC US Stocks, OTC Energy Futures, OTC Index Futures, Cash CFDs, ICM Securities, Cryptocurrency CFDs |

| 💳 Minimum Deposit | $200 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | GBP, USD, EUR |

| 📚 Trading Education | Trading Central, Learning Materials, Trading Glossary, Analysis |

| ☎ Customer Support | 24/5 |

Who is ICM Capital For?

ICM Capital is designed for traders of all experience levels seeking a straightforward experience, advanced tools, and competitive conditions. Based on our findings ICM Capital is Good for:

- Beginners

- Advanced traders

- Malaysia Traders and International Trading

- Professional trading

- Investing

- Traders from Europe and the UK

- Currency and CFD trading

- STP/OTC execution

- ECN trading

- EA trading

- Competitive fees and spread

- Tight spreads

- Global coverage

- Supportive customer support

- Trading central

ICM Capital Summary

Overall, ICM Capital is a reliable and trustworthy broker. As regulated by FCA, the broker maintains secure trading as well as upholds additional insurance of $1 million coverage. The account with the quite small deposit requirement of $200 should be considered by the beginning traders, as well platform’s extended features support in the beginning.

ICM trading technology demonstrates great trade execution and allows all trading styles. For the client’s benefit, the company offers smart spreads calculation through ECN deep liquidity providers starting from 0 pips.

55Brokers Professional Insights

ICM Capital we mark as a reliable broker suitable for traders of large capital or investors looking for a reliable firm to trade through. The offering overall is safe and brings quality conditions with a high level of transparency. The broker provides a range of services with competitive costs and is available in many countries, making it accessible to traders worldwide.

ICM Capital stands out as a trusted broker for ECN technology, ensuring ultra-fast trade execution, deep liquidity, and tight spreads as we marked it on our test trades. One of its key advantages is access to Trading Central, a leading provider of market insights and technical analysis, helping traders make informed decisions.

The broker supports popular platforms, providing a seamless and advanced trading experience. With a strong regulatory framework, negative balance protection, and competitive conditions, ICM Capital caters to both retail and institutional traders looking for a secure and efficient environment.

Consider Trading with ICM Capital If:

| ICM Capital is an excellent Broker for: | - Need a well-regulated broker.

- Providing competitive fees and spreads.

- Offering popular instruments.

- Secure environment.

- Access to advanced platforms.

- Who prefer higher leverage up to 1:200.

- Need broker offering copy trading.

- Access to VPS hosting.

- Providing MAM Program.

- Supports a variety of strategies.

- Looking for quality customer support with live chat and fast response.

- Beginners and professional traders.

- Providing services worldwide. |

Avoid Trading with ICM Capital If:

| ICM Capital might not be the best for: | - Who prefer 24/7 customer service.

- Prefer PAMM trading.

- Looking for broker offering webinars.

|

Regulation and Security Measures

Score – 4.7/5

ICM Capital Regulatory Overview

ICM Capital was previously authorized by the UK’s FCA but has applied to cancel its authorization, though it must still meet FCA standards in dealing with its customers.

The broker is also regulated by the FSCA in South Africa, SCAB in Sweden, and QFC in Qatar, and is a member of ARIF in Switzerland, ensuring a strong regulatory foundation.

Additionally, ICM Capital holds international but offshore registrations in Mauritius, Labuan, and Saint Vincent and the Grenadines, which provide expanded global access but may require traders to carefully review the specific regulatory protections in these jurisdictions.

How Safe is Trading with ICM Capital?

Trading with ICM Capital is generally considered safe, as the broker operates under multiple regulatory authorities. While it has applied to cancel its FCA authorization, it still adheres to FCA standards in dealing with customers.

The broker also offers negative balance protection, ensuring that clients cannot lose more than their deposited funds. Additionally, ICM Capital maintains segregated client accounts, keeping traders’ funds separate from company assets. However, traders should be attentive to the regulatory differences in the international entities to fully understand the level of investor protection provided.

Consistency and Clarity

ICM Capital has built a reputation as a reliable broker with competitive conditions, with multiple licensees including sharp Swiss regulation and other top-tier regulations, which are considered among safest options. Although, like many brokers, it receives mixed reviews from traders. Advantages highlighted by traders include fast execution, low spreads, access to advanced platforms like MetaTrader 4, and the availability of ECN technology.

Drawbacks often noted include its offshore regulations in regions like Mauritius, Labuan, and Saint Vincent and the Grenadines, which can raise concerns about the level of investor protection. The broker has also been recognized in the industry with awards for service excellence, reinforcing its standing in the market.

ICM Capital is active in the trading community, sponsoring financial events and engaging in partnerships, further enhancing its visibility and credibility in the industry. Overall, ICM Capital maintains a solid presence in the industry with a focus on delivering advanced tools and global access, balanced with considerations regarding its regulatory structure.

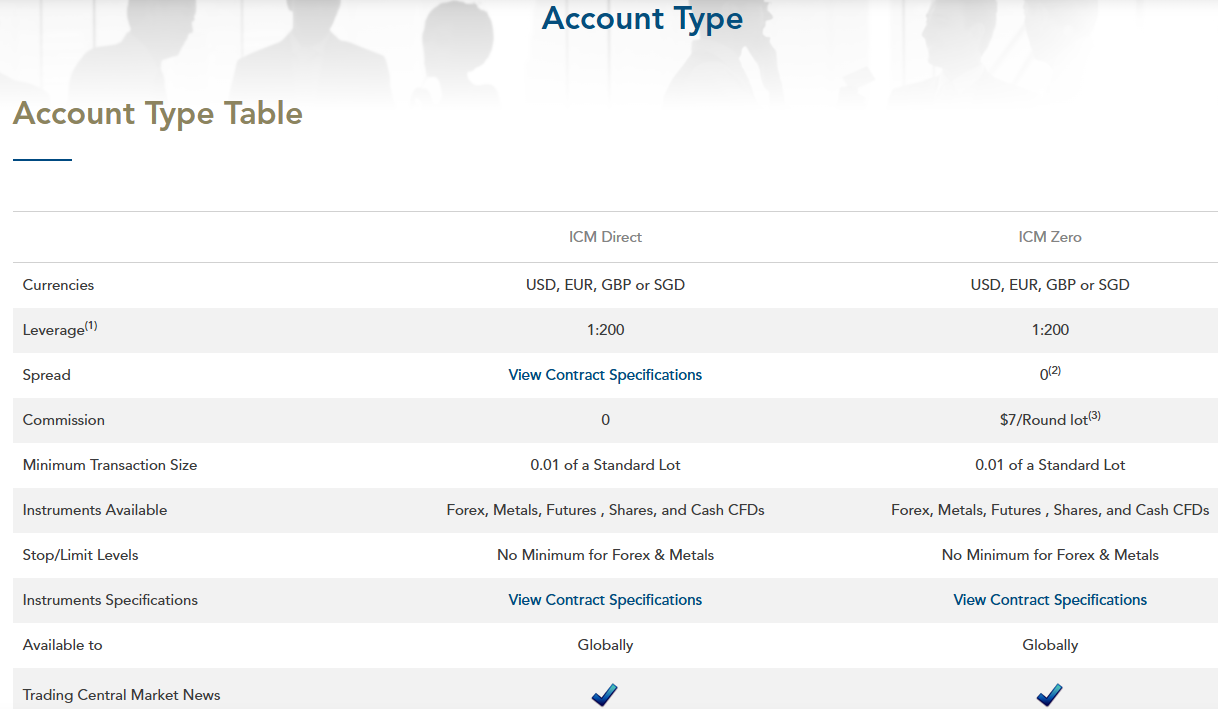

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with ICM Capital?

ICM Capital offers two account types designed to suit different trading styles and preferences. The ICM Direct, also known as the ECN Account, provides direct access to the interbank market with tight spreads, fast execution, and no dealing desk intervention, making it ideal for active traders seeking transparent pricing and deep liquidity.

The ICM Zero account caters to those looking for even tighter spreads with a commission-based structure, typically favored by more experienced traders. The broker also provides a Demo Account for beginners to practice trading without risking real funds, and a Swap-Free Account, designed for traders who cannot participate in swap-based transactions due to religious reasons.

ICM Direct Account

The ICM Direct Account is designed for traders seeking direct market access with competitive pricing. This account offers tight spreads starting from 0.0 pips, ensuring that traders get the best possible prices without the intervention of a dealing desk.

The account is ideal for active traders who need fast execution speeds, deep liquidity, and the ability to execute large orders without slippage. The minimum deposit amount is $200 to open the account.

ICM Zero Account

The ICM Zero Account is tailored for traders who prefer tight spreads with a commission-based structure. This account offers spreads starting from 0.0 pips, with a $7 commission charged per trade.

Ideal for active traders and those with more experience, the ICM Zero Account provides excellent liquidity and fast execution, ensuring optimal conditions for high-frequency strategies. To open an ICM Zero Account, the minimum deposit required is $200, making it accessible to traders without a large initial investment.

Regions Where ICM Capital is Restricted

ICM Capital is restricted in several regions due to regulatory limitations or local laws. The broker is not available in countries including:

- UK

- North Korea

- China, etc.

Cost Structure and Fees

Score – 4.6/5

ICM Capital Brokerage Fees

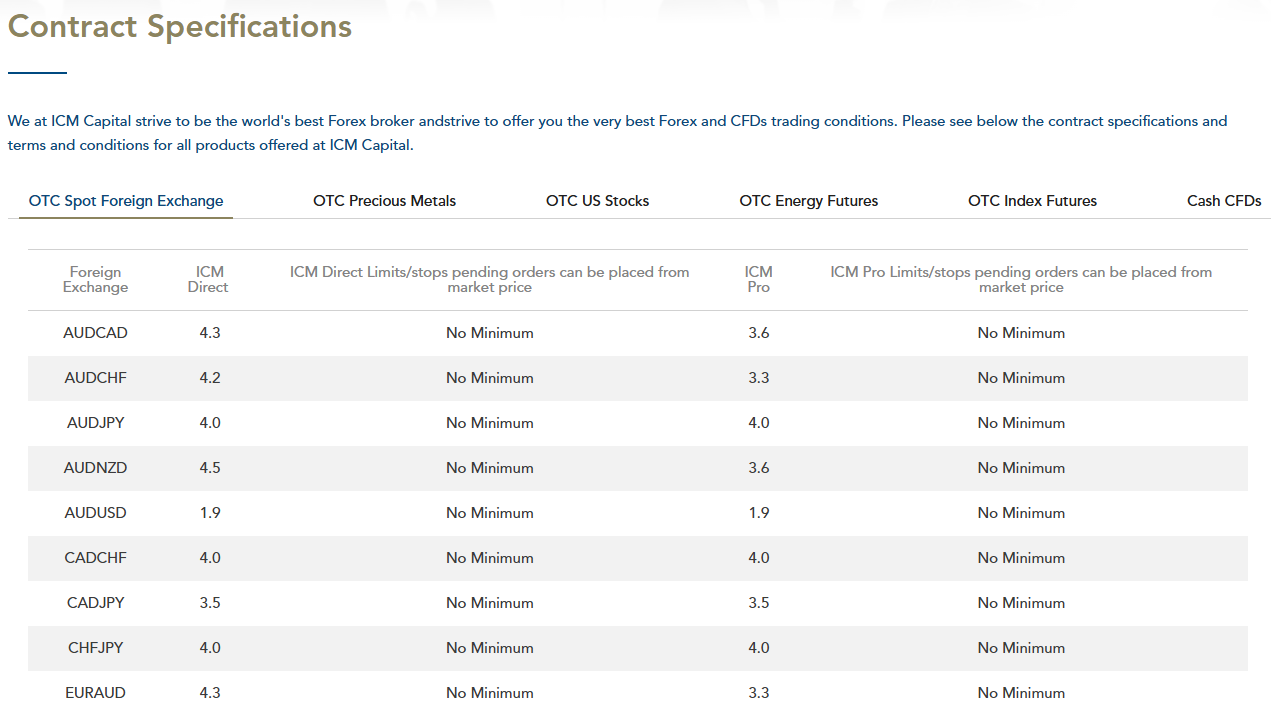

ICM Capital’s fees are competitive and depend on the account type and trading activity. The ICM Direct Account offers tight spreads starting from 0.0 pips. The ICM Zero Account also provides tight spreads from 0.0 pips but with a $7 commission per trade.

Fees for other services, such as withdrawals and inactivity, may apply, though they are typically low and transparent. Overall, ICM Capital is known for offering low costs, ensuring that traders can maximize their profits while benefiting from direct market access, fast execution, and advanced tools. However, traders should review the fee schedule carefully to understand all applicable charges.

ICM Capital offers variable spreads across its account types, providing flexibility based on market conditions. The average EUR/USD spread is 1.3 pips, which is competitive in the industry, especially for retail traders.

Spread levels can vary depending on factors such as market volatility and liquidity. This ensures that traders have access to favorable pricing during optimal market conditions.

ICM Capital charges commissions on its commission-based account type. For the ICM Zero Account, the commission is fixed at $7 per round lot. These transparent commissions allow traders to manage their costs effectively while benefiting from tight spreads and fast execution.

The commission structure is designed to cater to active and professional traders seeking a cost-efficient way to trade.

- ICM Capital Rollover / Swaps

ICM Capital applies rollover fees to positions held overnight, which are charged based on the interest rate differential between the two currencies in a currency pair.

The swap rates can vary daily depending on market conditions and the direction of the position (long or short). For traders who prefer to avoid swaps due to religious reasons or personal preferences, ICM Capital offers Swap-Free Accounts, which do not incur overnight rollover fees.

Traders should review the daily swap rates on their platform, as these can impact the cost of holding positions over extended periods.

How Competitive Are ICM Capital Fees?

ICM Capital offers competitive fees that are designed to cater to both retail and professional traders. The broker provides low spreads and transparent commission structures, ensuring that traders can manage their costs effectively.

With a focus on ECN technology and direct market access, ICM Capital offers tight pricing. Additionally, the broker’s fee structure is designed to accommodate high-frequency traders and those with larger trading volumes, with competitive commission rates and low overall costs. Traders should consider their trading style and need to fully understand the cost-effectiveness of ICM Capital’s fees.

| Asset/ Pair | ICM Capital Spread | Dukascopy Spread | HYCM Spread |

|---|

| EUR USD Spread | 1.3 pips | 0.28 pips | 1 pip |

| Crude Oil WTI Spread | 4 | 4.41 | 2 |

| Gold Spread | $0.35 | 52.60 | 20 |

| BTC USD Spread | 20 Cents | 77.73 | 90 |

ICM Capital Additional Fees

ICM Capital maintains a transparent fee structure, primarily focusing on spreads and commissions. The broker does not charge fees for deposits or withdrawals, allowing traders to manage their funds without additional costs.

However, the broker imposes an inactivity fee of $50 after 12 months of inactivity on an account. This fee is charged to accounts that have not executed any trades or had any activity for a full year.

Trading Platforms and Tools

Score – 4.7/5

ICM Capital offers a range of powerful platforms to suit various trading preferences. MT4 is available across all entities, providing traders with a user-friendly interface, advanced charting tools, and automated options through Expert Advisors.

For those seeking more advanced features, MetaTrader 5 and cTrader are available under ICM Capital’s international entities, offering enhanced functionality, including additional timeframes, more order types, and superior charting capabilities.

These platforms are designed to cater to traders, ensuring access to reliable execution, customizable tools, and comprehensive market analysis for a seamless experience.

Trading Platform Comparison to Other Brokers:

| Platforms | ICM Capital Platforms | Dukascopy Platforms | HYCM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

ICM Capital Web Platform

ICM Capital provides traders with access to web-based platforms for convenient and flexible trading. The web terminals for MetaTrader 4, MetaTrader 5, and cTrader offer a seamless experience without the need to download or install software.

These platforms are designed to work directly in web browsers, allowing traders to access their accounts from any device with internet connectivity. The web versions of these platforms offer core features like advanced charting tools, real-time market data, and order execution, ensuring that traders can manage their positions and analyze the markets efficiently, whether at home, on the go, or in the office.

ICM Capital Desktop MetaTrader 4 Platform

MT4 is a highly professional platform that not only allows you to actively trade, but also has powerful technical analysis, charting, and modeling tools. Also, all clients can benefit from auto trading with the use of an Expert advisor in the terminal.

Those programs are written in MetaQuotes Language 4 and allowing to analyze and trade in the automatic mode. ICM Capital MT4 is suited for all devices, the trader can access the financial environment by PC, Mac, mobile, or tablet.

Main Insights from Testing

Testing the MetaTrader 4 platform reveals its reputation for reliability and ease of use, especially for currency traders. One of the standout features is its fast execution speeds, even during volatile market conditions, ensuring that trades are executed quickly and efficiently.

The platform offers a wide array of customizable charting tools and technical indicators, enabling traders to perform in-depth technical analysis. However, some users may find its interface slightly dated compared to newer platforms, and the lack of advanced features like additional timeframes or order types (available in MT5) may be limiting for more advanced traders.

ICM Capital Desktop MetaTrader 5 Platform

MetaTrader 5 platform offers advanced features designed for professional traders. ICM Capital MT5 provides enhanced functionality compared to its predecessor, MetaTrader 4, with additional timeframes, more order types, and improved charting tools.

The platform supports multi-asset trading, allowing users to access a wider range of instruments, also integrates economic calendars, advanced technical indicators, and automated capabilities through EAs. With faster execution speeds and the ability to handle larger volumes of data, MT5 is a powerful platform ideal for traders who require sophisticated tools for in-depth analysis and efficient execution.

ICM Capital cTrader Platform

ICM Capital cTrader Platform is powered by True ECN technology, offering traders competitive spreads and low commissions for enhanced cost efficiency. With servers hosted in the LD5 IBX Equinix Data Centre, cTrader ensures ultra-fast execution speeds and reliable connectivity.

The platform provides Depth of Market (Level II) pricing, giving traders a detailed view of market liquidity and the ability to make more informed decisions. cTrader also supports multiple order types, detachable charts, and an expanded symbol display, allowing for a highly customizable experience.

Real-time reports and one-click trading further enhance the platform’s functionality, making it a powerful tool for both professional and active traders seeking precision and speed in their trades.

ICM Capital MobileTrader App

The ICM Capital Mobile App provides traders with the flexibility to manage their accounts and execute trades on the go. Available for MT4, MT5, and cTrader, all of these platforms come with mobile versions designed to offer a seamless experience.

The app allows users to access real-time market data, execute trades, and view charts from their smartphones or tablets, ensuring traders can stay connected and make informed decisions, regardless of location. With user-friendly interfaces and customizable features, the mobile versions of these platforms ensure that traders can manage their portfolios effectively and maintain full control of their trading activities while on the move.

Trading Instruments

Score – 4.4/5

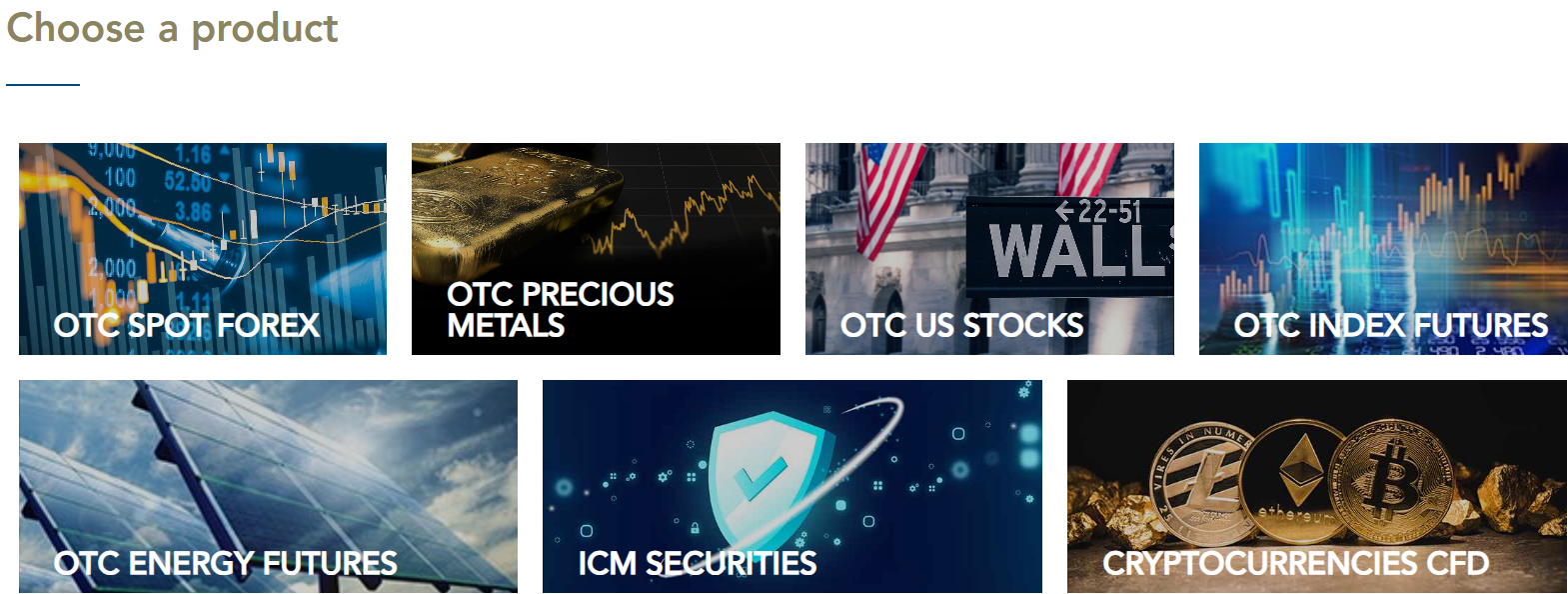

What Can You Trade on ICM Capital’s Platform?

ICM Capital offers a range of instruments, with over 1,000 assets available across multiple asset classes. Traders can access OTC Spot Foreign Exchange, including major, minor, and exotic currency pairs, as well as OTC Precious Metals like gold and silver.

The broker also provides OTC US Stocks, OTC Energy Futures for commodities like oil and natural gas, and OTC Index Futures to trade major stock indices.

Additionally, ICM Capital offers Cash CFDs, allowing traders to speculate on price movements without owning the underlying asset, and ICM Securities for exposure to stocks and bonds. For those interested in the digital asset market, Cryptocurrency CFDs are also available.

However, the range of instruments may differ depending on the regulatory entity, so traders should confirm availability based on the trader’s region.

Main Insights from Exploring ICM Capital’s Tradable Assets

Exploring ICM Capital’s tradable assets reveals a broad and diverse selection that caters to various preferences. The platform’s offerings allow traders to access both traditional and alternative markets, from Forex and precious metals to cryptocurrency CFDs.

The wide range of assets ensures that traders can implement different strategies, from short-term speculative trading to longer-term investments. With the inclusion of energy futures and stock indices, ICM Capital provides opportunities to engage with major global markets.

The ability to trade in both established and emerging markets, alongside competitive spreads and low commissions, positions ICM Capital as a versatile option for traders seeking diversity and flexibility in their portfolios.

Leverage Options at ICM Capital

ICM Capital follows strict guidelines set by the regulatory authorities. Leverage levels fall under a particular set of rules, alike UK and European regulators set a limitation towards maximum offered multiplier levels.

- UK traders are eligible to use low leverage up to 1:30 for Forex products.

- While other non-European traders under international entities may apply for leverage up to 1:200 for ICM Direct and ICM Zero account types.

Deposit and Withdrawal Options

Score – 4.7/5

Deposit Options at ICM Capital

In terms of funding methods, ICM Capital offers a few payment methods which are a very good plus, yet check according to its regulations whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

- PayPal, and more

ICM Capital Minimum Deposit

ICM Capital’s minimum deposit is $200, which is an additional pleasant feature for various traders, which allows starting from an initially small amount.

Withdrawal Options at ICM Capital

The withdrawal or deposit fee varies according to the payment method you choose. Yet, the broker covers the transfer fees for deposits above $500 in case of Bank transfers, while other methods’ fees vary, see the specification table below.

Visa or Mastercard (will include a fee of 1.75% above) are taxable by fees too. However, for the withdrawals, the company covers fee expenses for Visa and Neteller options.

Customer Support and Responsiveness

Score – 4.7/5

Testing ICM Capital’s Customer Support

ICM Capital offers robust customer support to ensure a seamless experience for its users. The support team is available 24/5 through various channels, including live chat, email, and phone, providing timely assistance for any queries or issues.

The team is dedicated to resolving concerns quickly and efficiently, offering multilingual support to cater to a global client base. Additionally, ICM Capital’s website includes a comprehensive FAQ section, which addresses common questions about trading, accounts, and platform usage.

Contacts ICM Capital

For those looking to get in touch with ICM Capital, their customer service is readily accessible. In the United Kingdom, you can reach their support team by phone at +44 207 634 9770 or via email at clientservices@ICMCapital.co.uk.

These contact options ensure that traders can easily reach out for assistance, whether for account inquiries, issues, or general support.

Research and Education

Score – 4.5/5

Research Tools ICM Capital

ICM Capital provides a range of research tools both on its website and within its platforms to support traders in making informed decisions.

- On the website, traders can access the Economic Calendar, which highlights key upcoming economic events, and Market News for the latest updates on global financial markets.

- Additionally, VPS Hosting is available through the website for those who need reliable performance for automated trading.

- Within the platforms, traders can benefit from advanced charting tools, including a variety of indicators and drawing tools available on MT4, MT5, and cTrader.

- These platforms also offer features like Depth of Market (Level II) pricing, one-click trading, and real-time price feeds, allowing traders to execute trades quickly and analyze market trends with precision. These tools combine to offer a well-rounded research and trading experience for both novice and professional traders.

Education

ICM Capital offers a comprehensive range of educational resources to help traders enhance their skills and knowledge.

- Trading Central, a leading provider of market analysis and insights, is available to provide traders with educational content, charts, and forecasts, helping them make informed decisions.

- Additionally, ICM Capital provides a variety of learning materials, and market reports, designed to cover both basic and advanced concepts.

- The Trading Glossary on the website is an excellent resource for beginners, offering definitions of key terms.

- Moreover, the broker also provides in-depth market analysis, including daily updates and market commentaries, to keep traders informed on the latest market trends and events.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options ICM Capital

ICM Capital primarily focuses on Forex and CFD trading, offering a range of instruments across various markets, including currency pairs, commodities, indices, and stocks.

In addition to these core offerings, the broker also provides MAM (Multi-Account Manager) programs, which are designed for money managers and institutional clients looking to manage multiple accounts with ease. For traders seeking a more hands-off investment approach, copy trading is available, allowing users to replicate the trades of more experienced investors.

These investment solutions, make ICM Capital a versatile option for those looking to diversify their investment strategies beyond traditional Currency and CFD trading.

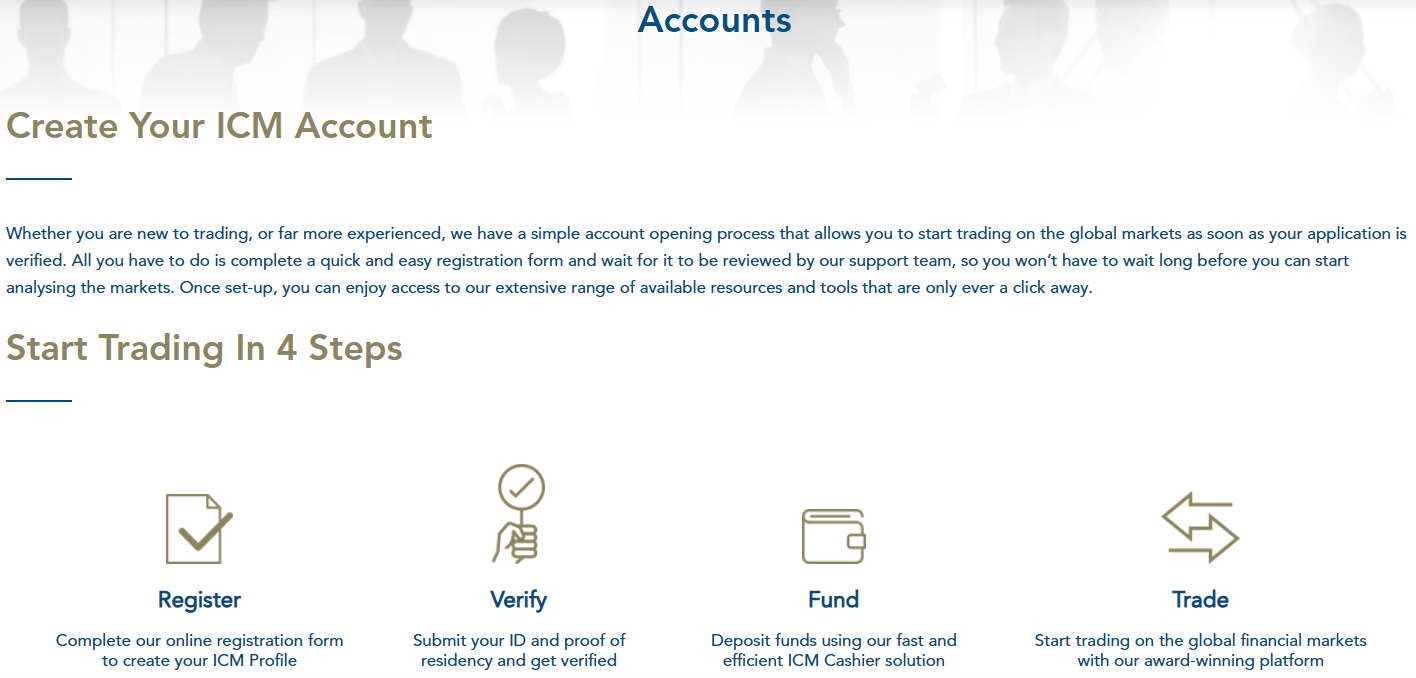

Account Opening

Score – 4.5/5

How to Open ICM Capital Demo Account?

Opening an ICM Capital Demo Account is a simple process designed to help traders practice and familiarize themselves with the platform before trading with real capital. To get started, follow these steps:

- Visit the ICM Capital website and locate the demo account registration section.

- Fill out the registration form with your details, including name, email address, phone number, and country of residence.

- Choose the platform you would like to use for the demo account (MT4, MT5, or cTrader).

- Select your desired account type and leverage options for the demo account.

- After submitting the form, you will receive your demo account credentials (username and password) to access the platform.

- Download the platform on your computer or mobile device, and log in with the provided credentials.

Once your demo account is set up, you can begin practicing with virtual funds and explore the full range of features offered by ICM Capital’s platforms.

How to Open ICM Capital Live Account?

Opening an account with ICM Capital is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Create Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

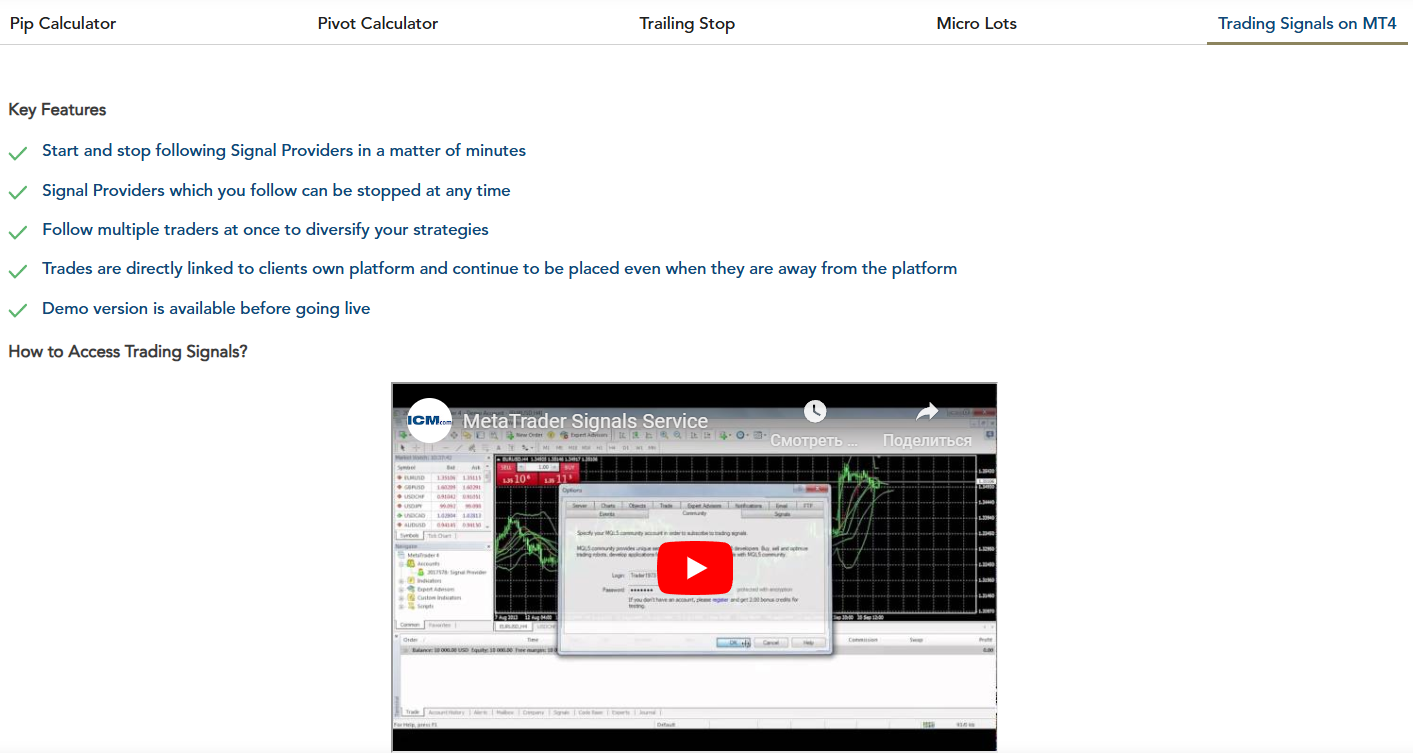

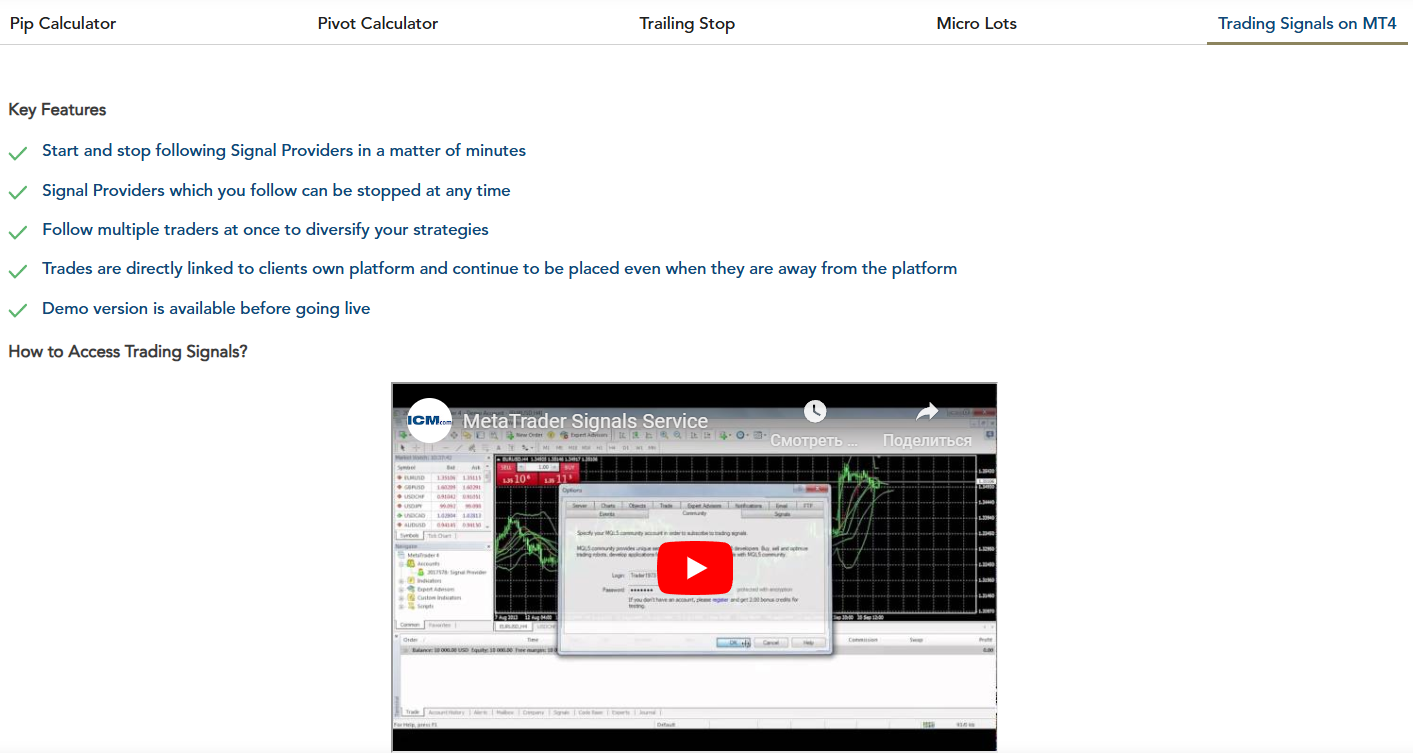

Additional Tools and Features

Score – 4.6/5

ICM Capital offers several additional tools to enhance traders’ experience and decision-making.

- In addition to the core tools, the broker provides signals to help traders make informed decisions. These signals are based on technical indicators and expert analysis, offering timely recommendations on when to enter or exit positions.

- The Pip Calculator helps traders calculate the value of a pip in different currencies and trading positions, making it easier to manage risk and position size.

- The Pivot Calculator is another valuable tool, assisting traders in determining key support and resistance levels based on pivot points, which are essential for technical analysis.

- For more advanced risk management, ICM Capital provides a Trailing Stop feature, allowing traders to lock in profits by automatically adjusting stop-loss orders as the market moves in their favor.

- Additionally, traders can take advantage of Micro Lots, which provides more flexibility in trading smaller positions, making it ideal for those with limited capital or those who prefer lower-risk trades.

- Other noteworthy features include Real-Time Price Alerts, which notify traders of significant price movements, and Market News, which keeps clients updated on the latest global economic and financial events. With access to these supplementary tools, traders can stay ahead of market trends, manage risks effectively, and optimize their strategies.

ICM Capital Compared to Other Brokers

ICM Capital stands out among its competitors by offering a well-rounded trading environment with access to multiple platforms, including MT4, MT5, and cTrader, making it a strong choice for traders who value platform flexibility.

While it provides a commission-based account with tight spreads, some competitors offer lower commissions or more competitive pricing structures. In terms of asset variety, ICM Capital provides a decent selection, though some brokers in the comparison offer a significantly broader range of instruments.

ICM Capital holds multiple global licenses, ensuring trader security, but some competitors operate under even stricter financial authorities. Additionally, while its educational resources are solid, some competitors, like HYCM, excel in this area with more extensive learning materials.

Overall, ICM Capital offers a competitive trading experience, but traders looking for lower costs, a wider asset range, or more comprehensive educational resources may find better alternatives among its competitors.

| Parameter |

ICM Capital |

Spreadex |

HYCM |

Dukascopy |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.3 pips |

Average 0.6 pips |

Average 1 pip |

Average 0.28 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $3.5 |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.1 pips + $4 |

$5 per $1 million traded in MT4/MT5 Accounts |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, cTrader |

Spreadex Web Platform, TradingView |

MT4, MT5, HYCM Trader |

JForex, MT4, MT5, Binary Trader |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

1,000+ instruments |

10,000+ instruments |

300+ instruments |

1200+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, FSCA, FSC, FSA, ARIF, SCAB, QFC |

FCA |

FCA, DFSA |

FINMA, FCMC, JFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$200 |

$0 |

$20 |

$100 |

$50 |

$0 |

$0 |

Full Review of Broker ICM Capital

ICM Capital is a multi-regulated broker offering a range of instruments, including Forex and CFDs on commodities, indices, stocks, and cryptocurrencies. The broker provides access to popular platforms like MT4, MT5, and cTrader, with various account types and swap-free options.

Spreads are competitive, starting from 0.0 pips on commission-based accounts, while standard accounts have an average EUR/USD spread of 1.3 pips. ICM Capital also offers robust tools such as VPS hosting, signals, and calculators.

The broker provides supportive customer service and features a selection of research and educational resources, including Trading Central. However, traders should note that the availability of certain instruments and features may depend on their chosen entity.

Share this article [addtoany url="https://55brokers.com/icm-capital-review/" title="ICM Capital"]

I want join in pamm accu

Having difficulty in downloading the mobile platform on my phone. Techno android. How do I go about it?