- What is FXCM?

- FXCM Pros and Cons

- Awards

- Is FXCM safe or a scam?

- Leverage

- Accounts

- Fees

- Spreads

- Market Instruments

- Deposits and Withdrawals

- Platforms

- Customer Support

- Education

- Conclusion

Our Review Method

- Our experts at 55Brokers with 10+ years of experience in the Forex Market have thoroughly examined the offerings of FXCM including fees, platforms, conditions, verified licenses, and placed live trades to see conditions and give an expert opinion on the broker.

What is FXCM?

FXCM is an online trading provider of Forex and CFDs trading of Stocks, Commodities, Indices, Cryptocurrencies, and spread betting (available for UK and Ireland residents only). FXCM has been around since 1999 and is still going strong today. The company headquarters are in London, UK where they’re regulated by both The Financial Conduct Authority (FCA) as well as many other strict regulatory authorities around the world including Australia (ASIC) and South Africa (FSCA).

The company provides global traders with access to the world’s largest liquid market through innovative trading tools, and the support of excellent trading educators while all operating under strict financial standards.

In January 2015, Leucadia has become the economic owner of FXCM. Leucadia National Corporation is a holding company that withholds an excellent reputation and invests in a diverse array of businesses, mainly in financial services and investments.

FXCM Pros and Cons

Our experts find FXCM a good reliable broker with lots of benefits and appealing conditions. The broker has a worldwide reputation for offering an extensive range of trading conditions. The company platform offers one of the best selections in terms of tight spreads and low prices, which are balanced through your single account with them. For some entities, it offers a low minimum deposit and trading on leverage. They also provide professional education and research sections available for free.

On the negative side, which we think are not so many, there is a withdrawal fee for Bank Wire transfers in some regions and the support is not available on a 24/7 basis. Also, the broker might not be suitable for futures and options traders due to the lack of these assets.

| Advantages | Disadvantages |

|---|

| Founded in the UK and known worldwide as one of the best Forex Brokers | Withdrawal fee for Bank Wire

|

| Regulated by the UK, Australia and South Africa authorities | No 24/7 support |

| Numerous industry awards | |

| Tight Spreads are low | |

| One of the best trading platforms selection | |

| Balanced trading condition through a single account | |

| Professional free education | |

FXCM Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, ASIC, FSCA |

| 🖥 Platforms | MT4, Trading Station, Zulutrade, TradingView, NinjaTrader, Capitalise AI |

| 📉 Instruments | Forex, Indices, Shares, Commodities, Cryptocurrencies, and Spread Betting available for UK and Ireland residents |

| 💰 EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $50 and 300 GBP for UK and EU clients |

| 💰 Base currencies | USD, GBP and EUR |

| 📚 Education | Professional free education and research resources |

| ☎ Customer Support | 24/5 |

Overall FXCM Ranking

Based on our Expert finds, FXCM provides great trading conditions for Forex and CFDs. They offer a global platform that is suitable to trade internationally, including European clients as well as beginning traders looking for technical solutions.

- FXCM Overall Ranking is 7.9 out of 10 based on our testing and compared to other brokers due to its great conditions, see our Ranking below compared to other popular and industry Leading Brokers.

| Ranking | FXCM | BDSwiss | XM |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Platforms | Currency Trade | Low Deposit |

FXCM Alternative Brokers

Besides all the benefits provided by this broker, we noticed that the range of instruments offered might be not enough for some traders, also the availability of certain assets depends on the entity. Also, for some entities, the minimum deposit might be high.

See detailed Alternative Broker Reviews:

Awards

The FXCM has been a successful and legitimate broker since its inception in 1999. They are regularly nominated by leading financial institutions for their contribution to progress in the industry, which speaks volumes about this company’s credibility with clients. After our thorough examination, we believe that the broker deserved the awards. Here are some of the awards FXCM got during its decades of operation:

- MOST TRANSPARENT FOREX BROKER (GLOBAL) – Global Forex Awards 2022

- BEST FOREX TRADING PLATFORM (MENA) – Global Forex Awards 2022

- BROKER OF THE YEAR – Ultimate Fintech Awards 2022

Is FXCM safe or scam?

No, FXCM is not a scam. Our experts find FXM a highly reputable broker since it’s authorized and regulated by some of the most rigorous regulators FCA and ASIC. It is considered low risk since these regulators offer compensation schemes and secure transactions.

Where is FXCM Based?

The FXCM Group is headquartered in London (UK), offering dedicated customer support service regardless of clients’ location through a global chain of offices situated in Germany, Australia, France, and Italy. Additionally, through the various affiliated offices, the broker provides access to the residents in Greece, Israel, and South Africa, thus becoming a truly global broker.

How FXCM regulated?

The FXCM LTD is headquartered and regulated in the UK by the Financial Conduct Authority. According to FCA regulations, the broker must follow strict financial standards, including capital adequacy requirements, present transparency of business practices accordingly, as well as to keep clients’ funds under protection while held in segregated accounts.

For the globally presented offices, each of them as a branch of Forex Capital Markets Limited follows the country’s financial authority and is licensed accordingly. Hence, FXCM Australia Pty. Limited is regulated by the ASIC, FXCM Germany is partially regulated by BaFin, and FXCM Italy is subject to the control of CONSOB and FSCA (Check out the FSCA Regulated Infinox Capital Review) authorization in South Africa.

- We ranked FXCM Trust Score 7.9 out of 10 for its good reputation serving top-tier entities and lack of offshore regulations. The only point is that the compensation scheme may not be included for some entities.

Our Conclusion on FXCM Reliability:

| FXCM Strong Points | FXCM Weak Points |

|---|

| Regulated by several reputable authorities | Negative Balance Protection not Available for some Entities |

| Licenses from FCA, ASIC, FSCA in South Africa | |

| Negative balance protection | |

| Good reputation

| |

FXCM Leverage

FXCM allows leverage trade of Forex and CFDs, this tool brings an advantage even on the smallest market moves. In simple words, leverage is a credit shoulder that is given by the broker to your trading account with the purpose to multiply the trading size of your positions.

In fact, leverage can dramatically increase your potential gains, but in reverse may increase your losses too, thus we urge you to use leverage very smartly, do not jump into high leverage levels but define the correct size for each instrument.

FXCM Leverage levels are based on the traders’ account funds, as well as the regulation in which particular residents or accounts may fall in:

- 1:30 for Australian clients

- 1:30 for the UK and Europe clients

- 1:100 for South Africa

Otherwise, due to regulatory restriction in Europe under ESMA, the level up to 30:1 on Forex products will be applied, 20:1 for non-major currency pairs, gold, and major indices, 10:1 for commodities other than gold and non-major equity indices, 2:1 for cryptocurrencies.

Accounts

There is a single account at FXCM you are able to trade a range of trading instruments that are included in the offering. You can open a live forex trading account quickly and relatively easily, where firstly you can sign in for a Demo account and then upon confirmation of your residence and compliance with the application start Live trading.

- Yet, there is another attractive opportunity through FXCM’s Active Trader account that is designed for high-volume investors. As an Active Trader, you can benefit from premium services and custom solutions, as well as discounted pricing on your spread costs based on the volume you trade.

| Pros | Cons |

|---|

| Fast Account Opening, fully Digital | None |

| Single Account | |

| Low Minimum deposit

| |

| Free deposit | |

| Active Trader account for high volume trading | |

FXCM Fees

With FXCM, you pay only the floating spread to trade indices and commodities, while enhanced index CFDs allow you to trade without stop and limit restrictions or re-quotes. See below the average spread costs on CFDs, and other fees like funding fees, yet for the most accurate data check the official website or FXCM platform.

- We ranked FXCM fees 8 out of 10 based on our research in comparison with the other 500 brokers we tested. Fees might vary depending on the entity you are registering your account with. The pricing of forex trading with FXCM is lower than the industry average.

| Fees | FXCM Fees | FXTM Fees | XM Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | Yes | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

We found that FXCM fees are quite a pleasant proposal with the lower annd average spread around 1.3 pips for EUR USD for some instruments compared to the competition, however, always note Spreads are variable and are subject to delay.

Also, always count overnight fees or swaps (check out swap-free forex brokers) as a trading fee in case you follow a swing or long-term trading strategy, while active traders will get discounted pricing as well which is always good.

- We gave FXCM Spread a ranking of 8 out of 10 based on our testing and comparison to other brokers we tested. The spreads for all assets are lower than the industry average. There are no commissions for trading and the conditions are better in comparison to some other brokers.

Comparison between FXCM fees and similar brokers

| Asset/ Pair | FXCM Spread | FXTM Spread | XM Spread |

|---|

| EUR USD Spread | 1.3 pips | 1.5 pips | 1.6 pips |

| Crude Oil WTI Spread | 0.04 | 4 pips | 5 pips |

| Gold Spread | 0.76 | 9 | 35 |

| BTC USD Spread | 27.13 | 20 | 60 |

What Can You Trade On FXCM?

The range of products available to you will depend on the entity of your trading account. The advanced range of market instruments offered by FXCM includes popular markets and other exotic pairs, as well as offering Forex, Indices, Commodities, Cryptocurrencies, and Spread Betting that is available for UK and Ireland residents. Cryptocurrency trading is available at FXCM through CFDs, but not available through exchange trading the underlying asset.

- FXCM Instrument Score is 7 .7out of 10. The selection of instruments is good, yet some market instruments like options and futures are missing. Also, the selection of the instruments might vary based on the entity you are registered with.

Deposits and Withdrawals

FXCM indeed conducts a very convenient way for account opening, so you can set up a free practice account, which allows testing the platform and experiencing account benefits.

- Overall, we ranked FXCM Deposits and Withdrawals 8 out of 10. For some entities, the minimum deposit is quite low. The fees are either very little or no fees at all depending on the entity. On top of that, the range of funding methods is quite wide.

Here are some good and negative points on FXCM Deposits and Withdrawals found:

| FXCM Advantage | FXCM Disadvantage |

|---|

| Minimum deposit – 50$ for Australian and South Africa clients | Bank wire withdrawal costs 40$ |

| Wide range of deposit option including Credit Card | |

| Free deposit | |

| Some withdrawal methods 0$ fee | |

Deposit Options

Once the account type is settled up, you should continue with the fund deposit that will allow starting live trading. In these terms, FXCM offers a range of funding options that usually process quick and safe transactions, which includes

- Credit and Debit Cards,

- EFT & Bank Wire,

- e-payment via Skrill.

What is the minimum deposit for FXCM account?

FXCM minimum deposit is $50. However, this is defined according to the FXCM’s entity, likewise, UK and EU clients would need GBP300 at the start.

Withdrawals

Further on, when you wish to withdraw funds, you may use the same payment methods. There are no fees for withdrawals by credit card or debit card, however, a $40 withdrawal fee will be charged for international Bank Wire requests.

How long does it take to withdraw from FXCM?

From the moment you submit and confirm the request to withdraw money from your account the accounting department typically processed and confirms withdrawal within 2 business days. Nevertheless, allow your payment provider to add on some working days to process the transaction as well.

How do I withdraw money from FXCM?

Once you decide to withdraw money from your account you obviously should submit an online request and follow the required procedure. To make it short you simply should follow the following steps

- Login to your account and go to Withdraw page

- Select the withdrawal method and required amount and click ‘Withdraw’

- Complete the withdrawal request

- Confirm withdrawal and Submit

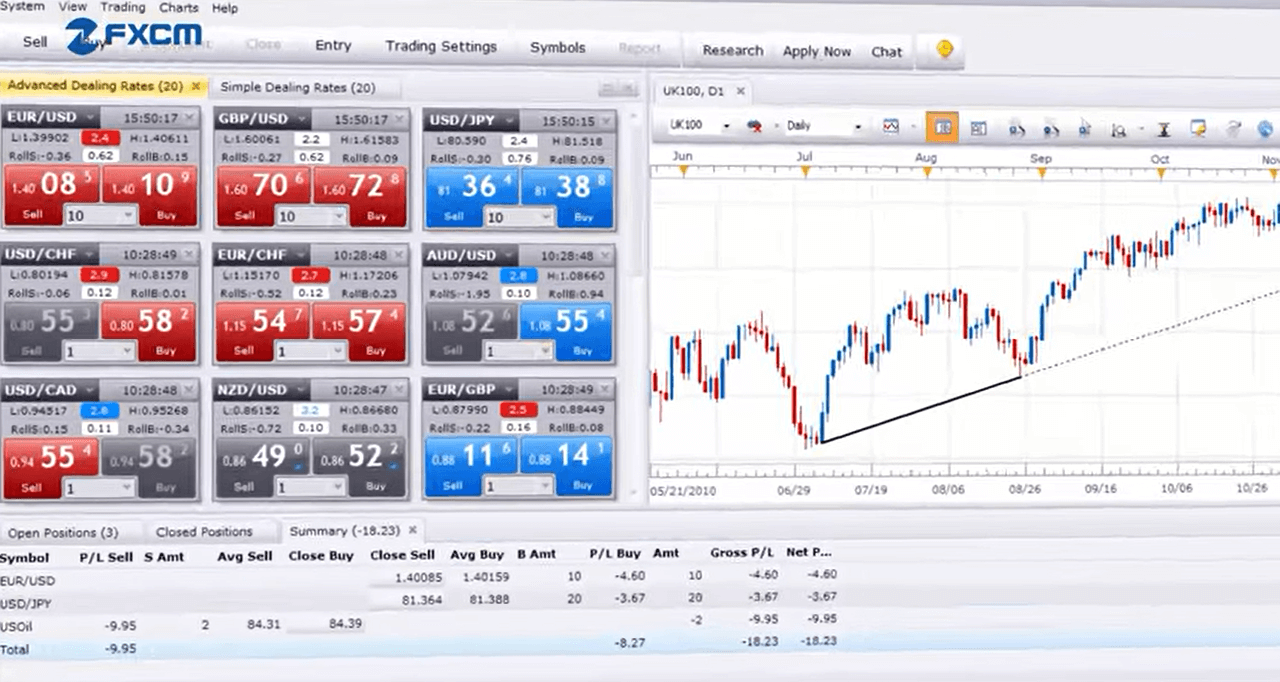

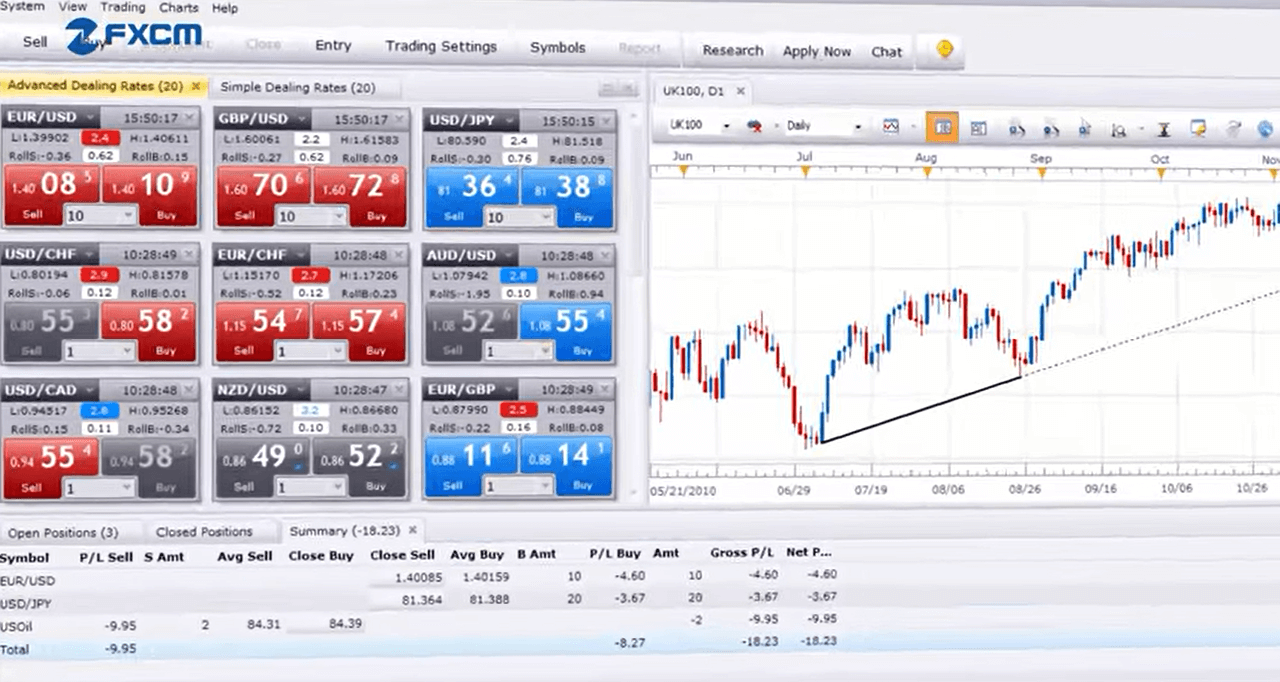

FXCM Trading Platforms

Our financial experts note that FXCM offers a great variety of trading platforms including both industry-leading MT$ and MT5 platforms, as well as more sophisticated, Trading Station, NinjaTrader, TradingView, Zulutrade, and Capitalise AI.

The FXCM software suite includes unique market access, with multiple order types, advanced charting enhanced by powerful utilizing tools and FXCM’s exclusive Real Volume indicator, automated trading strategies with testing and optimization capabilities, and more.

- We ranked FXCM Platforms Score 9 out of 10. We mark it as excellent since there is a great choice between industry popular platforms like MT4 and MT5, also Zulutrade, Trading View, and NinjaTrader. As well as it developed its own proprietary platform. The conditions on each platform, however, might vary depending on the entity.

Trading Platform Comparison to Other Brokers:

| Platforms | FXCM | BDSwiss | Plus500 |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Platform

There are a few options of trading software to choose from including Trading Station and Ninja Trader, FXCM’s award-winning proprietary platform, which features great innovation and functionality available on the Web, Desktop, and Mobile.

Web Platform will be more suitable for regular-size traders as usually web versions are less comprehensive in terms of analysis tools, drawing features, and other advanced capabilities since the platform is solely based online and accessible via any browser.

Desktop Platform

So desktop platforms are available for all offers as well, while Trading Station is often the preferred choice among active traders, however, is the product with no matter of experience as it has a clear market vision and friendly interface.

You still can use the famous MetaTrader 4, yet with FXCM’s integrated and developed features that include EAs, scalping, and 0.01 lot sizes with Free VPS enhancement, but within the average trade of 500k.

Mobile Platform

Beyond core platforms, the broker offers integration to FXCM’s acclaimed execution of specialty FXCM Apps offering an online marketplace where you can customize the trading experience. And to include an additional application for news, trends, and range traders, apps for new trading features and smooth trading process, EAs and automation, indicators, scripts, Standalone apps, and many more.

Social Trading

Beginner traders can count on company tool support while building their own strong trading strategy. Indeed, beginning traders face numerous challenges, yet time and even capital loss due to emotion-based trading are the main barriers to success. Based on our research, we found that FXCM supports the functionality of Autotrading through market-leading ZuluTrade and NinjaTrader platforms delivering best practices for social trading helping beginners to hone their skills.

Customer Support

Another good point that 55Brokers experts found is the client-oriented approach of FXCM that complements its good trading proposal, and customer service available through various ways including Web Live Chat, Phone, emails, and dedicated lines specifically for the African region due to FXCM’s focus on Africa in particular. These lines include South Africa, Kenya, and Nigeria lines together with other ones as well available on working days.

Actually, FXCM gained positive and high regard from the clients in terms of its good trading conditions and support, which is definitely a plus to our FXCM Review.

- We rank FXCM Customer Support 8 out of 10. The support is helpful. The answers are provided quickly through every communication channel. The variety of methods is wide. The main problem is that the support is not available 24/7

| Pros | Cons |

|---|

| Customer oriented policy and good quality support | No 24/7 customer service |

| Live Chat and fast answers | |

| Support of international Phone lines and languages | |

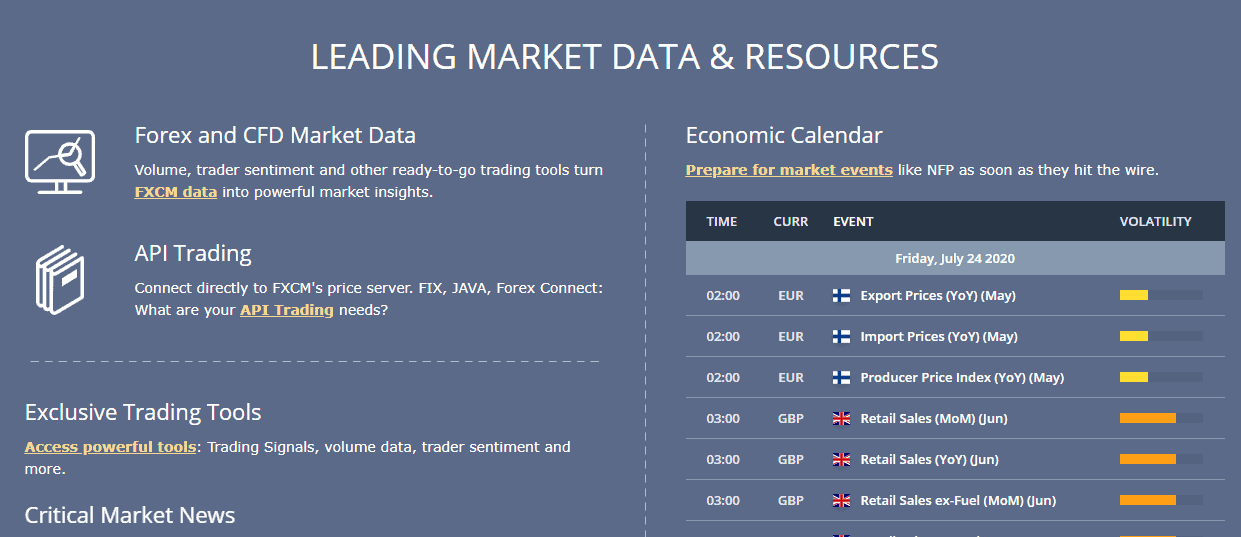

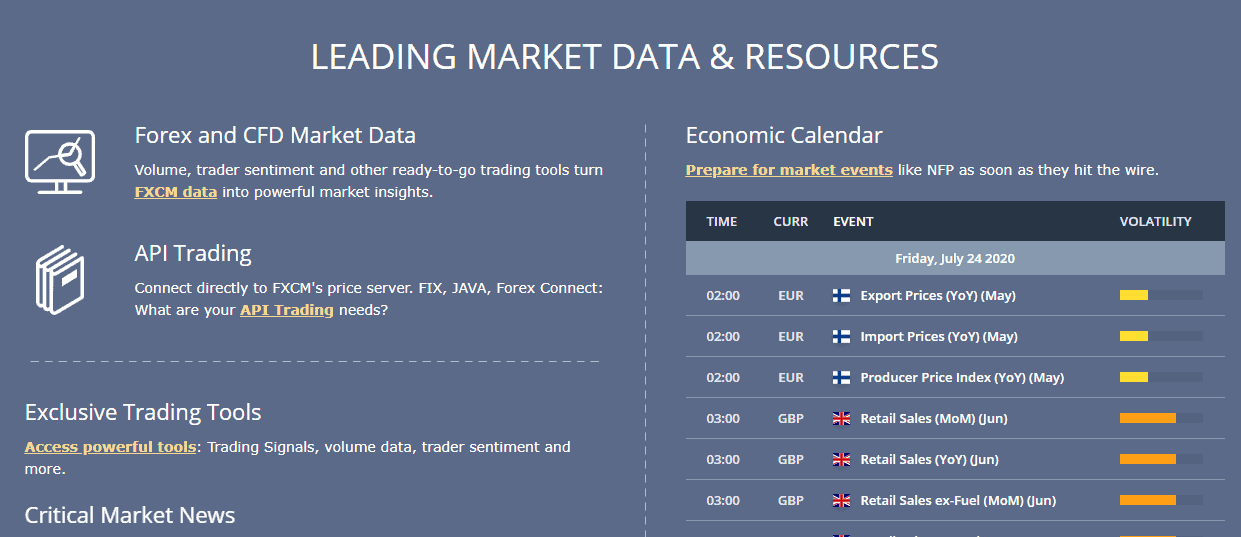

Education

FXCM hosting regular educational events in various cities around the world with a great focus on African region education since enlarging its activity. FXCM understands deeply the necessity of good quality education and that materials and knowledge are the keys to potential success.

- Therefore, with FXCM we found numerous educational materials with ongoing courses, webinars, seminars, platform tutorials, trading tools, research tools, superb glossary, Forex news, Economic Calendar, Market outlooks, and Analyst analysis.

Free research, insights, and strategies outlook, along with greatly designed FXCM tools with FXCM Plus, Market Scanner, and Trading signals with technical levels all at your disposal. Besides, Free Online Live Classroom is available for all those who are interested, which all in all enlarges and creates fantastic opportunities for individuals interested in trading and gives a good way to start from the right way.

- We ranked FXCM education 8.2 out of 10. The broker provides state-of-the-art educational resources available in multiple formats including webinars, news, seminars, etc. Moreover, the broker provides outstanding research and analytical tools for free.

Who Is FXCM Review Recommended For?

We strongly recommend FXCM broker for both beginner and professional traders. Seeing that the broker has suitable and favorable offers for both trader categories, all clients can benefit by signing with FXCM.

FXCM Review Conclusion

Overall, due to the strong background of the broker, years of successful operation, and reputation in the financial world our financial experts find FXCM broker a reliable and safe trading environment. Active or high-volume traders can enjoy their benefits with various available interfaces, good and competitive value spreads, or offerings with advanced technical features.

If you are a beginning trader, FXCM is an option too as there is no need for big deposits to start trading, supportive customer managers always remain on hand, along with unique educational technics with an absolutely impressive choice of tools to start, from Autotrading to the diversity of comprehensively supported indicators.

FXCM is a great option for various traders, but it’s important to check the trading conditions and regulations in your country before deciding on this broker.

Based on Our findings and Financial Expert Opinions FXCM is Good for:

- Beginning Traders

- Professional Traders

- Traders who prefer MT4 and MT5 platforms

- Currency Trading and CFD Trading

- Running various Strategies

- High Leverage Trading

- EAs trading

- Social Trading

- Excellent Research

Share this article [addtoany url="https://55brokers.com/fxcm-review/" title="FXCM"]

Terrible experience with this company they almost fleeced me to the last dime but I finally found help from an expert recovery agent (drewwake. jtbtech(at) 9Ma 1L . C om. ) trust and contact them if you need assistance.

Hi,

I got per Whatsapp offers for a forex trading service from you.

They advise signals.

Is this official from you or is it fake?

Thx.

BR

Jörg

Hi,

Do you take clients from Kenya?

Thanks

I had a very bad ending experience with this broker. i traded with them (account number: 92102075) for about a year during which i managed to withdraw all my deposit as refund by debit card but when I decided to take all my profit for summer break, the money was deducted from my trading account and I was informed that the withdrawal has been processed. The fund never showed up in my bank account, I contacted them and they were very responsive but depite all the assistance which included sending a wire transfer confirmation attachment to me. My bank still couldn’t track the fund and that was how the fund was lost till date.

http://www.fxcmtrad.com be cearfull they a scamers, do similar website like oficial.

so what is the official website, i am not able to withdraw my USDT they are asking for personal tax then I deposited 80K not they again asking for 47K please advise. I have invested 3 laks so far.

do you charge overnight fees

Hi there I m Lauren from South Africa Johannesburg,how long does your trading take,weeks,monthly,yearly…thank you

Drop your WhatsApp number let me guide you on the process we do accept clients from SA

Perfect money deposit method pammm setup and fixed spread swap free account available

I am resident of Canada. Is it legal to open an acct.?

do you accept clients from Nigeria ?

I am from Namibia,can I start?

Hello

im from INDIA IS IT LEGAL TO OPEN A TRADING ACCOUNT BY AN INDIAN

I HAVE A CAPITAL OF $ 15000

my amount is stuck 3 lakhs please advise

Hi,

Do you take clients from Kenya?

Thanks

NEED TO START A TRADING ACCOUNT