One of the leading FCA regulated FX brokers LMAX Exchange approved its purchase of Cyprus Broker – CB Capital Business Ltd in conclusion bringing better global expand for LMAX offering.

LMAX is an already well known professional trading service broker that builds its strong position within the industry and now together with accomplished deal broadens its presence to even further global covering. Learn more about established LMAX Broker Europe CySEC license by the link.

This important provision will bring not only better possibilities for regions like Middle East, Southern Europe and further, but also bring enhanced liquidity to brokers and market participants to better market access. LMAX Exchange Group already serves clients from over 100 world countries through its eleven world offices and makes all the necessary steps to efficient trading conditions even through Brexit or other possible outcomes ensuring LMAX clients remain unaffected. LMAX has always been strong with industry innovation, strict pricing and timing priority for orders, of course, fantastic execution and ultra-low latency, so still clients may benefit from comprehensive access to markets under any conditions.

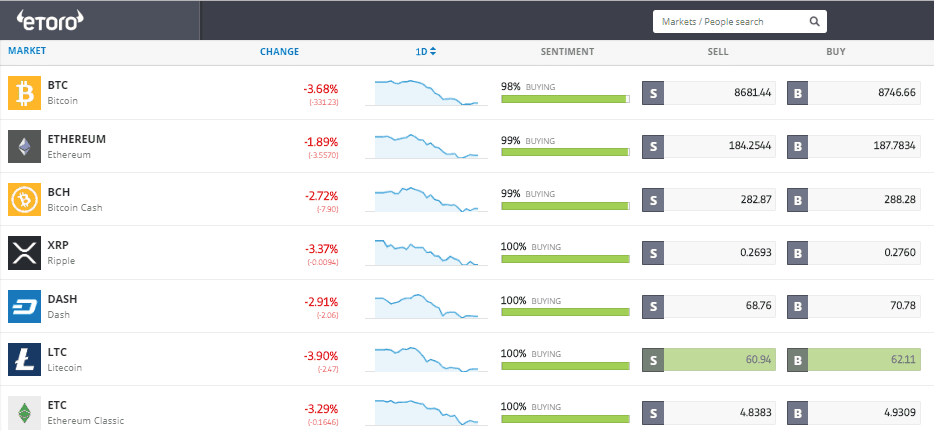

Moreover, LMAX being one of the biggest global institutional exchanges and liquidity providers shows its constant growth in various directions and recently LMAX starts to publish its daily trading volumes on Cryptocurrency exchange. As LMAX said, it is an obvious surge in crypto trading activity across platforms that transact solid turnover and making new records, in reverse bringing higher volatility due to growing demands. So to get offering even better LMAX Digital is now placing market information about trading volumes and sizes in real time.

Generally, LMAX is a part of the global LMAX Exchange Group multiply regulated and awarded broker for its high standards and professional ability to trade through a central limit book. It means you will get tight lowest spreads and utmost liquidity due to proprietary trading platforms and companies LMAX work with. You may read full LMAX Exchange Review by the link and get to know about their offering in a detail in reverse proposing your professional trading solutions.