- What is LMAX?

- Is LMAX Safe or a Scam?

- Account Types

- Spread

- Deposits and Withdrawals

- Trading Platforms

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, regulations and licenses, fees, and platforms, contacted customer service, and placed traders to see trading conditions and give expert opinions about LMAX.

What is LMAX?

LMAX Global is a brokerage firm that provides traders worldwide with access to various trading instruments, including Forex, metals, commodities, cryptos, and CFDs.

LMAX Exchange Group, the parent company of LMAX Limited and LMAX Broker Limited, is a financial technology firm incorporated in London that operates under the LMAX Exchange brand name.

Based on our research, LMAX Exchange Group has a global presence, with offices in nine countries and clients around the world. Located in London, New York, Tokyo, and Singapore, the company has developed its own exchange infrastructure with a focus on high performance and ultra-low latency.

LMAX Pros and Cons

LMAX is a reputable broker that offers competitive and transparent trading conditions, along with advanced MetaTrader trading platforms and 24/7 customer support.

For the Cons, the minimum deposit amount is above average and the trading conditions might vary based on the entity.

| Advantages | Disadvantages |

|---|

| FCA license and overseeing | Conditions might vary based on the entity |

| Regulated broker with competitive trading conditions | The initial deposit amount is above average |

| Access to MetaTrader trading platforms | |

| 24/7 customer support | |

LMAX Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA, CySEC, FSP |

| 📉 Instruments | Forex, CFDs, metals, commodities, cryptos, equity indices |

| 🖥 Platforms | LMAX Exchange Proprietary Platform, MT4/MT5 bridges |

| 💰 EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Base Currencies | GBP, USD, EUR |

| 💳 Minimum Deposit | $10,000 |

| 📚 Education | Provided |

| ☎ Customer Support | 24/7 |

Overall LMAX Ranking

We found in our research that LMAX is a well-regulated broker that offers traders competitive trading conditions. The company provides various trading opportunities with low spreads and fees, which can be attractive to traders of all levels.

- LMAX Overall Ranking is 8.9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | LMAX | BP Prime | Pacific Financial Derivatives |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Spreads | Trading Conditions | Trading Instruments |

LMAX Alternative Brokers

While LMAX offers competitive trading solutions at low costs, there are other brokerage firms in the market that provide similar services. Therefore, we have created a list of some of the top alternatives to LMAX that traders may consider:

Awards

Over the last years, LMAX has received recognition from several reputable industry organizations within Europe, North America, and Asia-Pacific. For its achievements, LMAX has been also recognized by prestigious rankings that demonstrate innovative achievements.

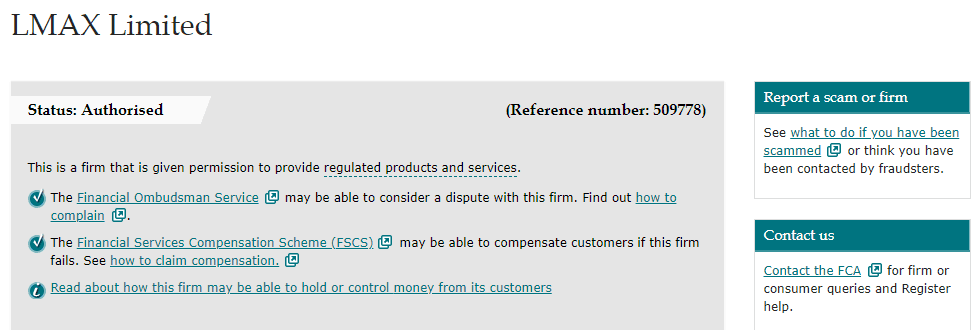

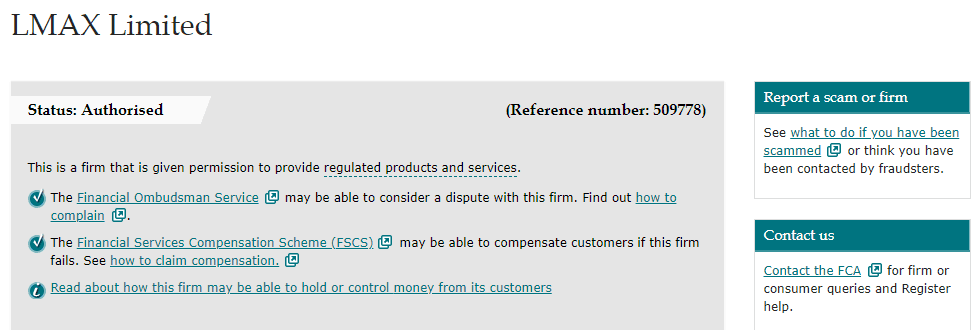

Is LMAX Safe or Scam?

No, LMAX is not a scam. LMAX Exchange is a trading name of LMAX Limited and LMAX Global, while both companies operate as a trading facility authorized and licensed by the Financial Conduct Authority (FCA).

Is LMAX Legit?

Yes, LMAX is a legit and regulated broker. As we got in our test trade the following regulation adheres to the strict guidelines of operation, capital demands, client’s funds’ segregation, and scheme participation, which overall ensures the protection of investments under any circumstances.

See our conclusion on LMAX Reliability:

- Our Ranked LMAX Trust Score is 8.9 out 0f 10 for the good reputation and services provided.

| LMAX Strong Points | LMAX Weak Points |

|---|

| Compensation scheme | Regulatory standards and protection vary based on the entity |

| Segregated accounts | |

| Funds protection | |

How Are You Protected?

Due to its regulations and complied requirements, LMAX provides the utmost level of security to its investors and clients, along with full compliance with applicable laws and best protective strategies.

Moreover, the funds are protected by segregated, separate accounts within top-tier banks. This means the company can never use the client’s money for its own good, besides the money is always protected and covered by the UK’s Financial Services Compensation Scheme (FSCS).

Leverage

LMAX provides traders with the option to use leverage, which is a borrowed amount from the broker that can amplify potential profits, but it should be used cautiously as it also increases the possibility of risks.

LMAX leverage is offered according to FCA, CySEC, and FSP regulations:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs.

- European traders can use a maximum of up to 1:30 for major currency pairs.

- International traders are eligible to use a maximum of up to 1:500.

Account Types

As we found, LMAX Exchange offers only one account type which is based on the investor’s profile. Institutional or Professional clients with a strong financial background are the ones who can benefit from the superior technology provided by LMAX Exchange. The reason for this is that LMAX Exchange caters to larger traders who require advanced technology, and as a result, the account opening balance is set at a relatively high level of $10,000.

Additionally, new traders can sign up for a free demo account to practice trading with trial trades.

| Pros | Cons |

|---|

| Fast account opening | The initial deposit amount is above average |

| Demo account available | |

| Account base currencies GBP, USD, EUR | |

How to Open LMAX Live Account?

Opening an account with LMAX is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Start Application” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

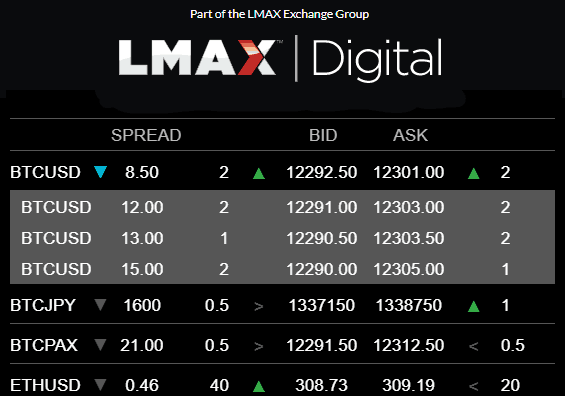

Based on our findings, LMAX provides access to trade over 100 instruments in popular asset classes including Forex, CFDs, metals, commodities, cryptos, and equity indices.

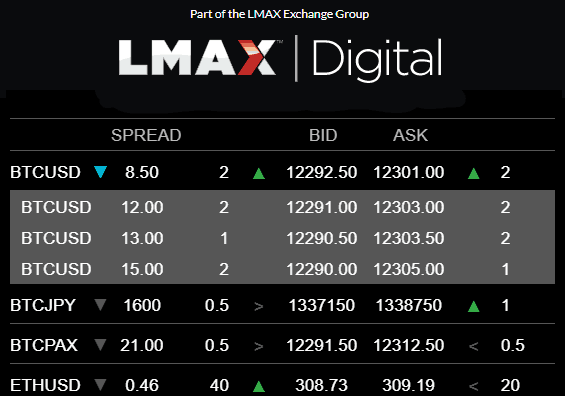

Moreover, Cryptocurrency institutional trading is enabled through a separate brand within the group LMAX Digital that enables to trade of Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple among institutions admitted to trading. The trading technology is based on the proprietary LMAX Exchange and is a custodian solution on a tiered system with increased security.

- LMAX Markets Range Score is 8.2 out of 10 for wide trading instrument selection. On the other hand, stocks, shares, futures, bonds, and other asset classes are not available to trade.

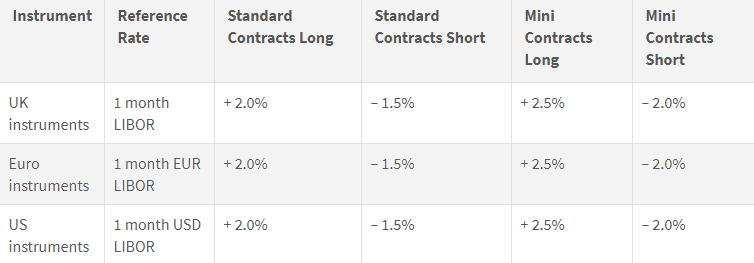

LMAX Fees

Our research has revealed that LMAX does not charge any deposit fees or withdrawal fees. The broker offers a competitive fee model based on commissions and spreads.

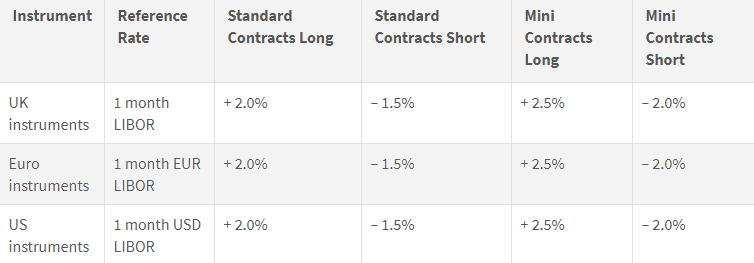

Another cost, which you should take into consideration is an overnight fee or swap rate which is paid in case the position is held longer than a day.

- LMAX Fees are ranked low or average with an overall rating of 8.5 out of 10 based on our testing, and compared to over 500 other brokers.

| Fees | LMAX Fees | BP Prime Fees | Pacific Financial Derivatives Fees |

|---|

| Deposit fee | No | No | Yes |

| Withdrawal fee | No | No | Yes |

| Inactivity fee | Yes | No | Yes |

| Fee ranking | Low/Average | Low/Average | Low/Average |

Spreads

As we found LMAX offers variable spreads, with a typical spread of 0.2 pips for the EUR/USD, and a competitive commission rate structure depending on the level of activity.

- LMAX Spreads are ranked low with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | LMAX Spread | BP Prime Spread | Pacific Financial Derivatives Spread |

|---|

| EUR USD Spread | 0.2 pips | 0.3 pips | 0.5 pips |

| Crude Oil WTI Spread | 4 | 0.01 | - |

| Gold Spread | 25 cents | 0.01 | 14.5 pips |

Deposit and Withdrawals

LMAX Global currently offers accounts denominated in GBP, EUR, USD, AUD, CHF, JPY, PLN, SEK, SGD, HKD, and HUF. As for the payment methods, the broker supports several options including Bank Transfers and Credit/Debit Cards operations.

- LMAX Funding Methods we ranked good with an overall rating of 8.2 out of 10. Fees are low, and also you can benefit from various account-based currencies.

Here are some good and negative points for LMAX funding methods found:

| LMAX Advantage | LMAX Disadvantage |

|---|

| Multiple account base currencies | Methods and fees might vary in each entity |

| Fast digital deposits, including Credit/Debit Cards | |

| No fees for deposits and withdrawals | |

Deposit Options

In terms of funding methods, LMAX offers the following payment methods:

- Bank Wire,

- Credit/Debit cards,

- Neteller,

- Skrill, etc.

LMAX Minimum Deposit

LMAX minimum deposit is $10,000 or an establishment amount, which will allow you to engage in trading with LMAX.

LMAX minimum deposit vs other brokers

|

LMAX Exchange |

Most Other Brokers |

| Minimum Deposit |

$10,000 |

$500 |

LMAX Withdrawals

LMAX does not impose fees for deposit or withdrawal transactions, and traders can choose from Bank Wire and Credit Card options. However, it is important to confirm with the payment provider or bank if any fees apply.

How Withdraw Money from LMAX Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

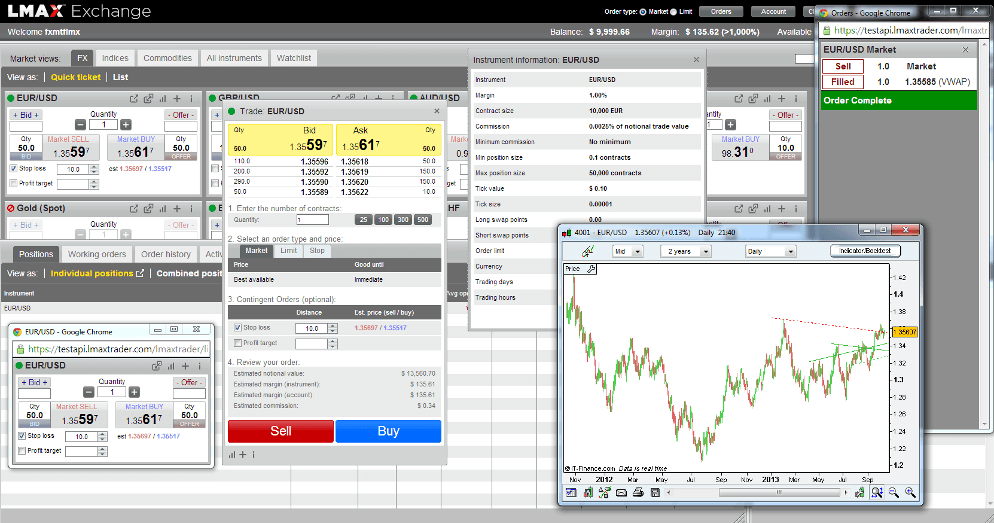

Trading Platforms

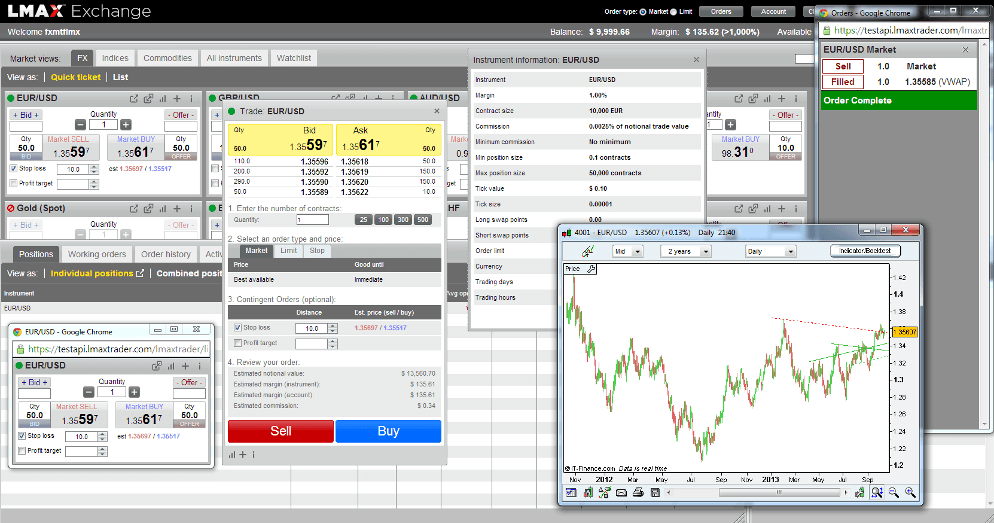

We found that LMAX offers its proprietary trading platform as well as access to LMAX Global either via FIX 4.4, API (Java, .NET), Web GUI, Mobile Application (LMAX Global Trading, LMAX Exchange News, LMAX Exchange VWAP) and MT4/5 Bridges (for Brokers).

Trading Tools

Based on our research, LMAX Exchange technology offers low latency execution, and real-time streaming market and trade data available to all participants regardless of status, size, or activity levels. All bring real-time updates, quality execution speed, capabilities to use various strategies, also by PAMM and MAM features, and ultimate-level analysis tools with full market depth.

- LMAX Platform is ranked good with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers a professional trading platform as well as access to popular MT4/MT5 bridges.

Trading Platform Comparison to Other Brokers:

| Patforms | LMAX Platforms | BP Prime Platforms | Pacific Financial Derivatives Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Customer Support

According to our finds, LMAX provides 24/7 customer support through Phone Lines and Email. The support team at the broker is composed of trading experts who are able to assist traders with a variety of matters such as technical support, analysis advice, general inquiries, and operational issues.

- Customer Support in LMAX is ranked good with an overall rating of 8.5 out of 10 based on our testing. We got fast and knowledgeable responses, and also easy to reach during the working days and weekends.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| 24/7 customer support | No live chat |

| Quick responses | |

| Relevant answers | |

| Availability of phone lines and email | |

LMAX Education

LMAX provides an economic calendar, market data access, and a blog, however, our research indicates that the broker does not offer any educational resources, such as webinars, seminars, or learning materials, which may be useful for novice traders.

- LMAX Education ranked with an overall rating of 5 out of 10 based on our research. The broker does not provide seminars, webinars, insights, etc. For beginner traders, we recommend getting the necessary learning materials from other well-known brokers.

LMAX Review Conclusion

Overall, the review of LMAX Exchange shows that the company provides advanced solutions for experienced traders and institutions. While the broker may not be suitable for beginners due to its technology and high financial requirements, its offerings are competitive and robust.

Although there is limited information available about the broker’s accounts and platforms, the overall proposal is comprehensive and can be customized to meet specific needs. However, we recommend doing your own research before choosing to sign up with LMAX to ensure it is the right choice for you.

Based on Our findings and Financial Expert Opinions LMAX is Good for:

- Traders from UK

- European traders

- Traders from New Zealand

- International traders

- Professional traders

- Investors

- Institutional trading

- CFD and currency trading

- Competitive spreads and fees

- Good customer support

Share this article [addtoany url="https://55brokers.com/lmax-exchange-review/" title="LMAX Exchange"]