- What is AETOS?

- AETOS Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

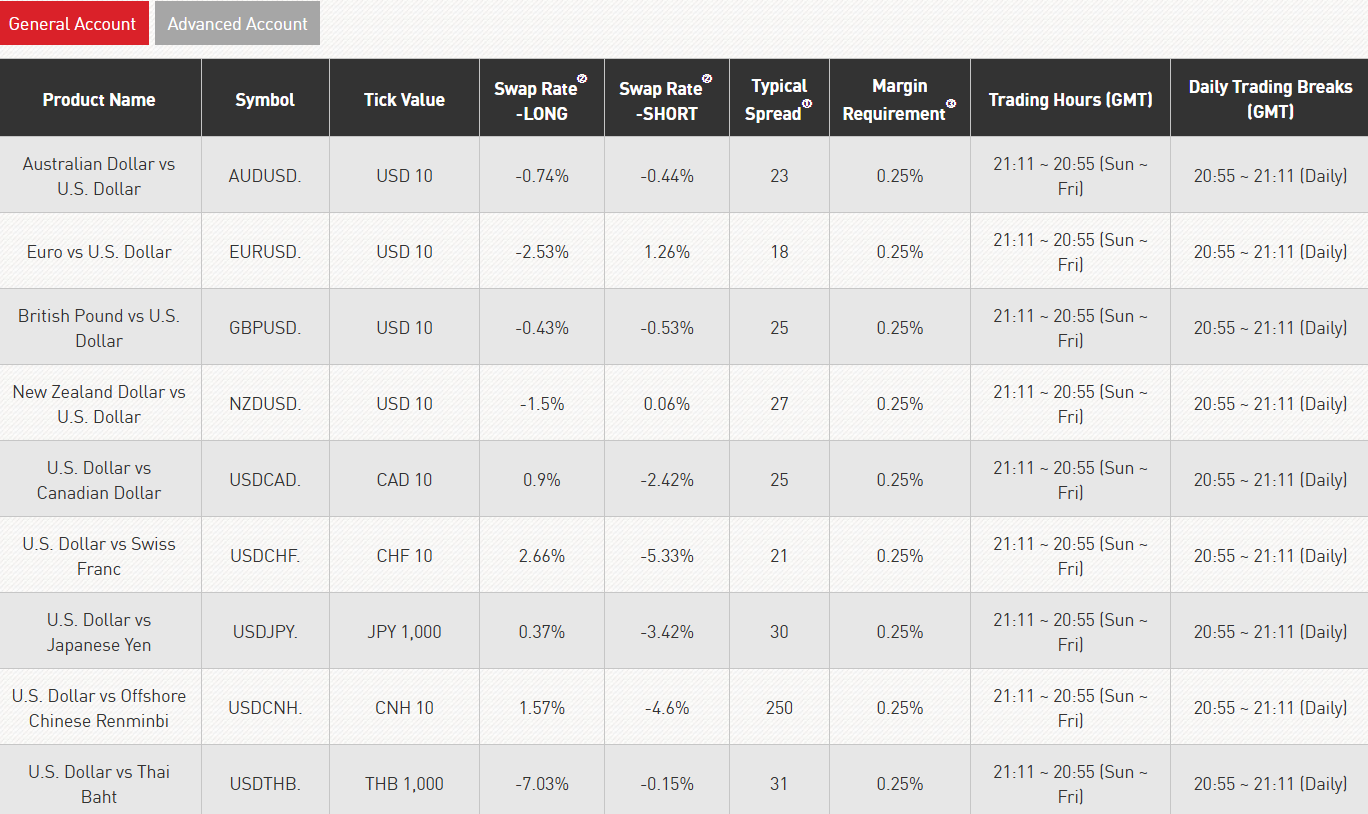

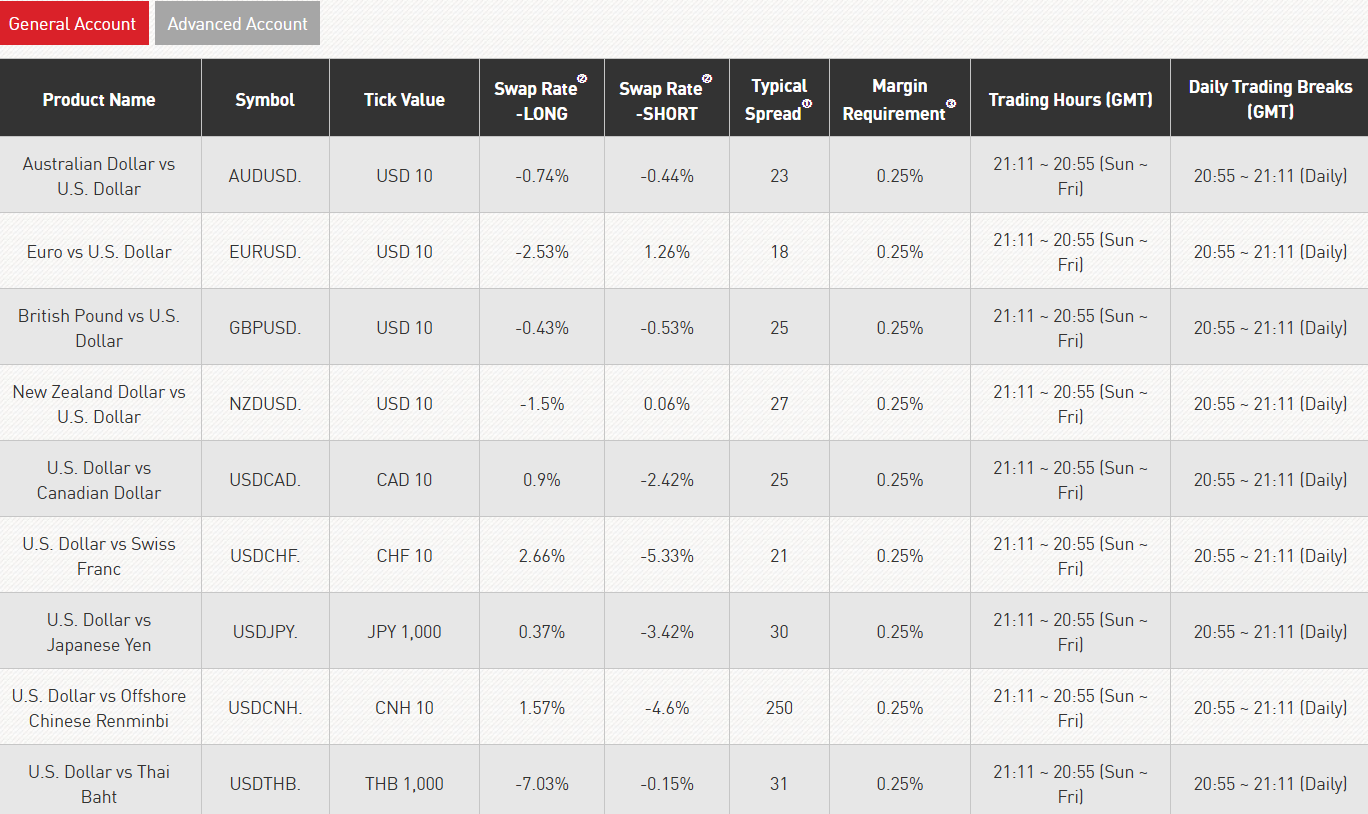

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

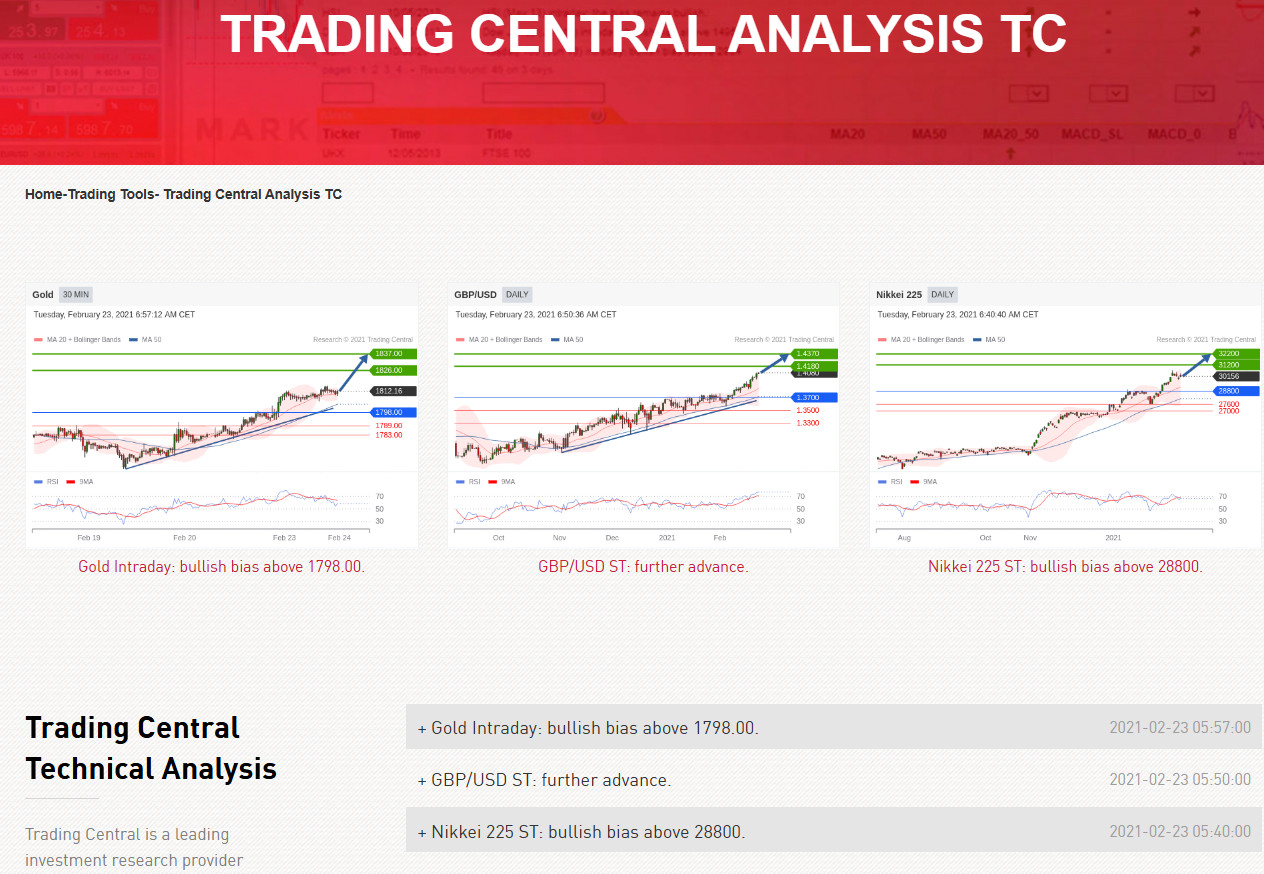

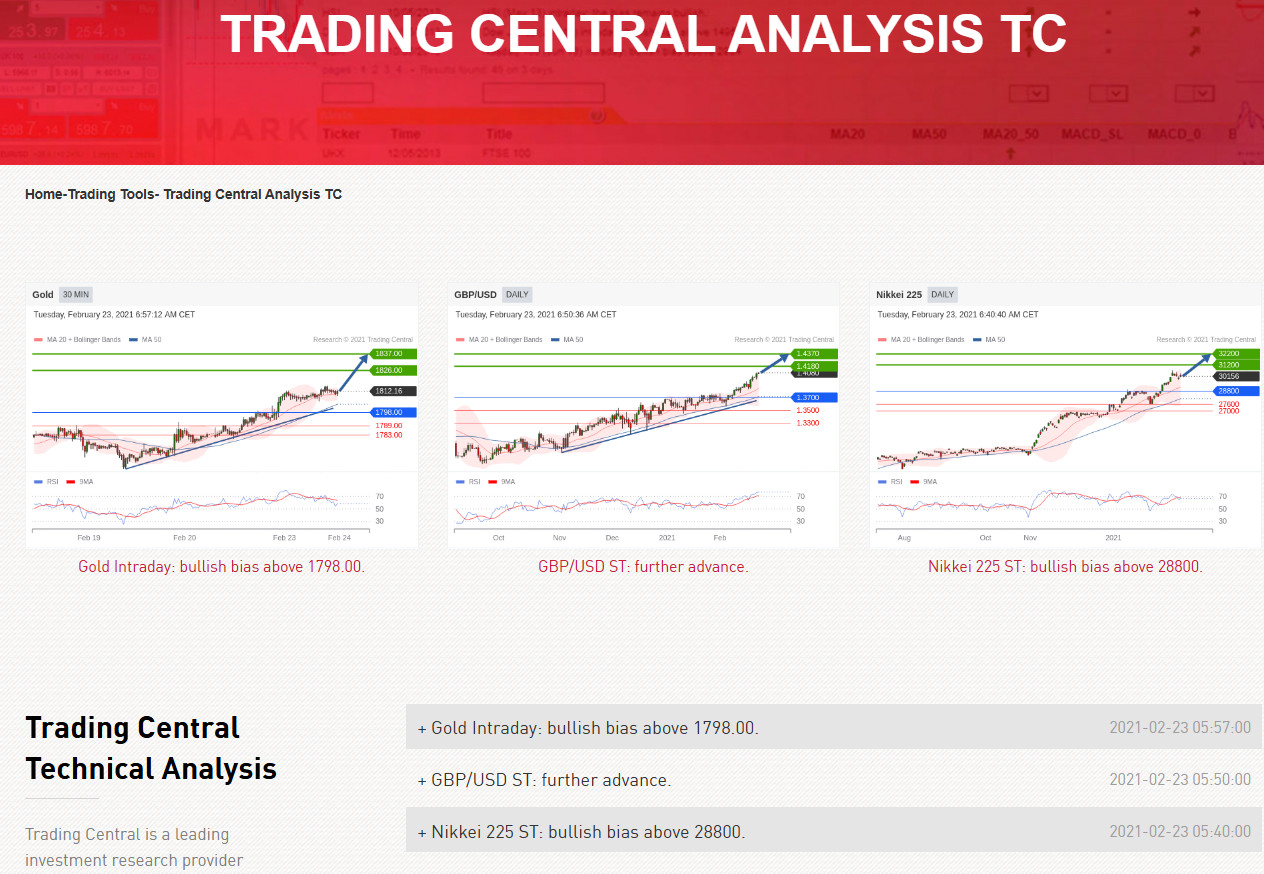

- Research and Education

- Portfolio and Investment Opportunities

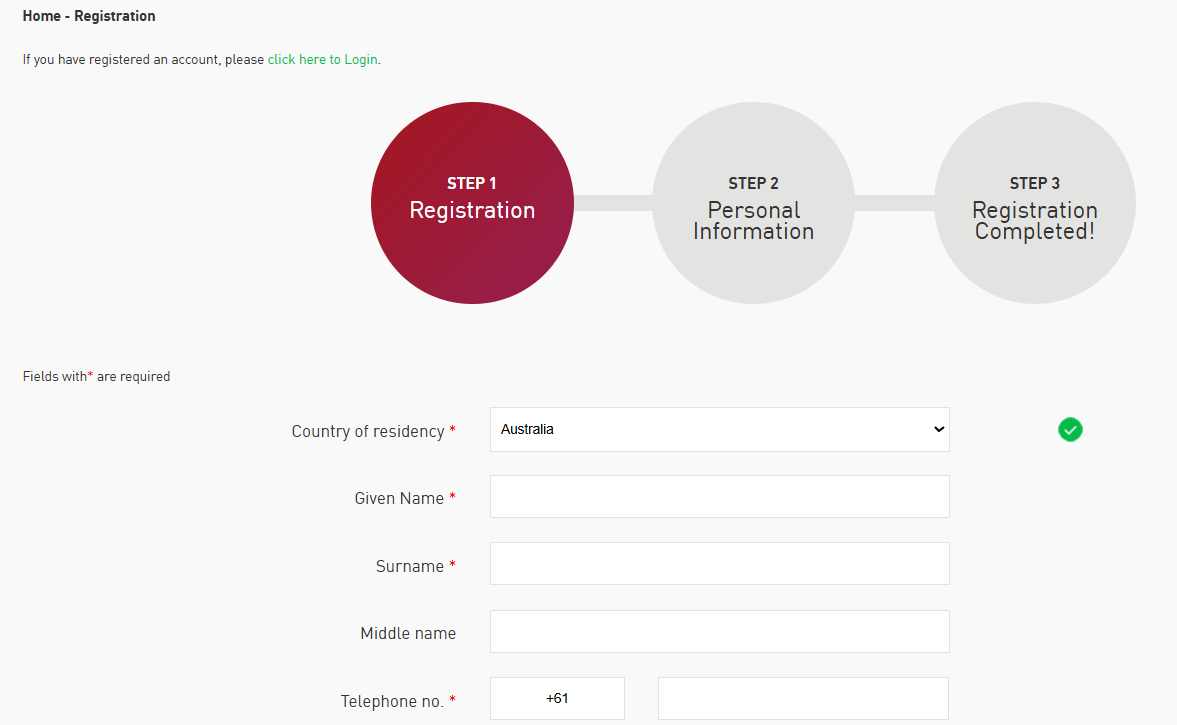

- Account Opening

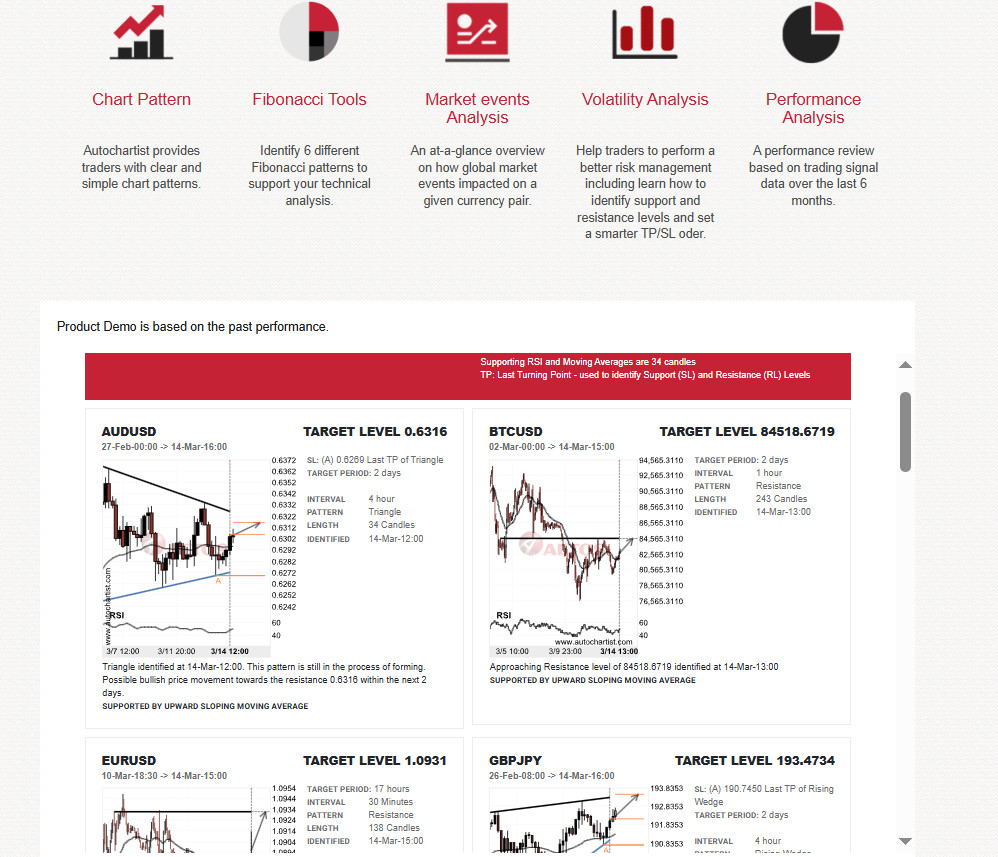

- Additional Tools And Features

- AETOS Compared to Other Brokers

- Full Review of Broker AETOS

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

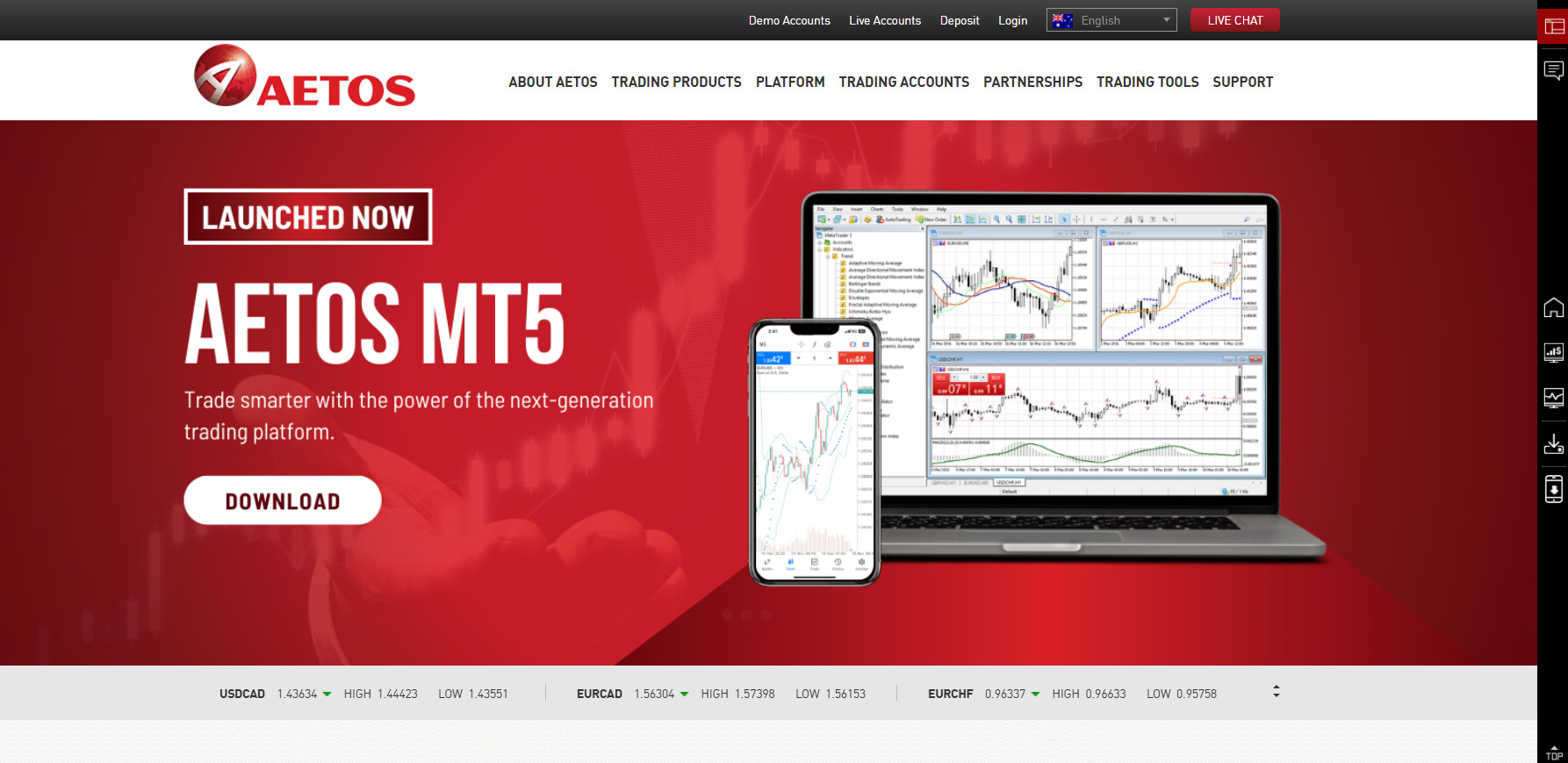

What is AETOS?

AETOS is a global Forex and CFD provider offering traders access to a wide range of markets including Forex, indices, share CFDs, precious metals, and commodities.

Founded in 2007, AETOS Capital Group is a non-banking financial institution in Australia that provides trading services to clients from over 100 countries. The company offers its solutions via different subsidiaries regulated across several jurisdictions in Australia, Mauritius, Vanuatu, and the Cayman Islands.

AETOS Pros and Cons

Aetos is a well-regulated brokerage company with an easy account opening, a good range of funding methods, and a professional trading environment.

For the Cons, the company does not provide profound learning materials that are suitable for beginning traders. However, the free technical analysis covering all markets from leading investment research providers is the cornerstone of good trading strategies. Also, there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Competitive trading costs and spreads | Conditions may vary according to regulation and entity |

| ASIC licensed broker with a strong establishment | No 24/7 customer support |

| MT4, MT5 trading platforms | |

| Popular trading instruments | |

| Suitable for beginners and professionals | |

| Quality customer support | |

| Research tools | |

AETOS Features

Aetos is considered a reliable broker with safe and favorable trading conditions and transparency. The broker offers a range of trading services designed for all level traders. Below is a comprehensive list of its key features:

AETOS Features in 10 Points

| 🏢 Regulation | ASIC, VFSC, FSC, CIMA |

| 🗺️ Account Types | General, Advanced Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, Energy, Index, Metal, Share CFDs, Cryptocurrencies |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, AUD, CAD |

| 📚 Trading Education | Educational Videos |

| ☎ Customer Support | 24/5 |

Who is AETOS For?

Aetos is a Forex and CFD broker designed for traders seeking a regulated trading environment, competitive spreads, and access to global financial markets. Based on our research Aetos is good for:

- International traders

- Investors

- Professional trading

- Australian traders

- CFD and currency trading

- Copy Trading

- STP/NDD execution

- Beginners

- Advanced traders

- Institutional trading

- Competitive spreads and pricing

- Good research and analysis

AETOS Summary

Concluding Aetos review, we admit a reliable and safe broker with transparency, being regulated by the top-tier authority. The broker offers competitive spreads and pricing which is a good opportunity for beginner traders too.

Aetos provides solutions not only to retail and professional traders but institutional clients as well, offering partnership programs like Introducing Broker (IB), and White Label.

55Brokers Professional Insights

AETOS is a globally presented Forex and CFD broker known for its strong compliance framework and a good reputation within traders. Broker offers a stable trading environment with access to major financial instruments, including Forex, indices, metals, and commodities, mainly offering popular assets, but not diversing to thousands of instruments.

A key advantage is its user-friendly MetaTrader 4 and 5 platforms, providing advanced charting tools and automated trading capabilities. However, while the broker caters well to experienced traders with good spreads, which we find mainly of the average line, mainly professional accounts will find Aetos a good fit. Also traders with larger trading capital and strategies like swing, pattern trading or long holding, since its educational resources and materials are relatively limited compared to some industry leaders.

Consider Trading with AETOS If:

| AETOS is an excellent Broker for: | - Need a well-regulated broker.

- Providing competitive trading conditions.

- Get access to MT4, and MT5 trading platforms.

- Broker with a variety of trading strategies.

- Offering MAM/PAMM trading.

- Who prefer higher leverage up to 1:400.

- Beginners and professional traders.

- Providing copy trading.

- Access to VPS.

|

Avoid Trading with AETOS If:

| AETOS might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with cTrader.

- Looking for fixed spreads. |

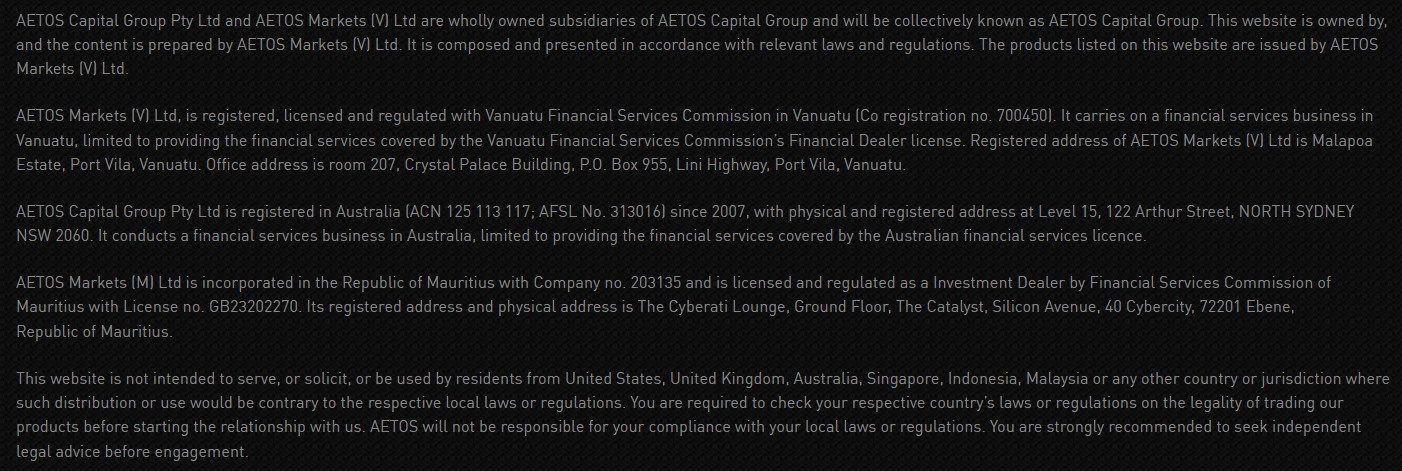

Regulation and Security Measures

Score – 4.5/5

AETOS Regulatory Overview

Aetos is a multi-regulated Forex and CFD broker operating under several financial authorities. It is primarily regulated by the Top-Tier Australian ASIC. AETOS Capital Group Pty. Ltd. is registered in Australia and is a wholly-owned subsidiary of AETOS Capital Group Holdings Ltd.

The broker also holds additional international offshore licenses from the Vanuatu Financial Services Commission (VFSC), the Mauritius Financial Services Commission (FSC), and the Cayman Islands Monetary Authority (CIMA).

Previously, Aetos was also licensed by the FCA in the UK, but the broker has applied for the cancellation of this license. While Aetos remains a well-regulated entity, traders should consider the differences in regulatory protections across jurisdictions when choosing an account.

How Safe is Trading with AETOS?

Trading with Aetos is generally considered safe due to its multi-jurisdictional regulatory framework. The broker is primarily regulated by ASIC, ensuring strict compliance with financial standards, client fund segregation, and negative balance protection.

Additionally, AETOS holds offshore licenses, which provide operational flexibility but may offer lower levels of investor protection. Traders should be aware that regulatory protections vary depending on the entity under which they open an account, with ASIC regulation offering the highest level of security.

Consistency and Clarity

AETOS has built a solid reputation in the Forex industry, backed by its regulatory compliance and years of operation. Established in 2007, the broker has gained recognition for its secure trading environment and professional services. It has received industry awards for excellence in trading execution and brokerage services, further enhancing its credibility.

Traders highlight advantages such as competitive spreads, user-friendly MetaTrader platforms, and strong customer support. However, some traders point out drawbacks, including limited educational resources and withdrawal processing times. Beyond trading, Aetos actively engages in corporate social responsibility initiatives, including sponsorships in sports and community projects, reinforcing its presence in the global financial landscape.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with AETOS?

Aetos offers a range of account types tailored to different trading needs. Traders can choose between the General Account, designed for beginners and casual traders, and the Advanced Account, which provides lower spreads and enhanced trading conditions suited for more experienced traders.

The broker also provides MAM trading tool, which in turn offers two accounts: a Master Account and an Investor Account.

Additionally, the broker offers a Demo Account, allowing users to practice trading with virtual funds before committing real capital. For traders following Islamic finance principles, a Swap-Free Account is also available, ensuring compliance with Sharia law by eliminating overnight interest charges.

General Account

The General Account is for traders seeking a competitive and accessible trading environment. It offers tight spreads, real-time stable execution without re-quotes, and a low minimum deposit of just $50, making it ideal for beginners and casual traders.

With access to a wide range of markets, this account provides a solid foundation for those looking to start their trading journey with a regulated broker.

Advanced Account

The Advanced Account caters to more experienced traders who require enhanced trading conditions. It features a typical spread of 1.2 pips on major FX pairs and 26 cents on XAU/USD, offering cost-effective trading opportunities.

With a minimum deposit of $50, traders can access leveraged trading with a 1:400 margin on all FX pairs, allowing for greater market exposure. This account is ideal for those looking to optimize their strategies with tighter spreads and improved trading efficiency.

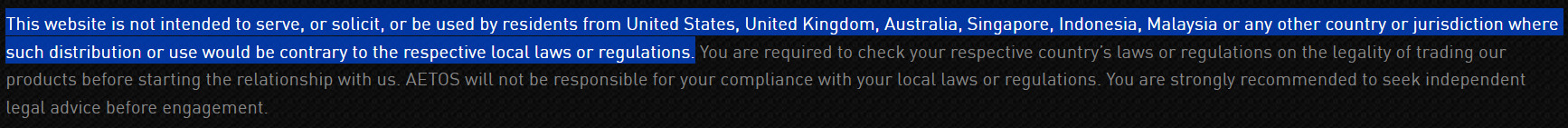

Regions Where AETOS is Restricted

AETOS does not offer its services in certain regions due to regulatory restrictions and compliance requirements, including:

- USA

- UK

- Singapore

- Indonesia

- Malaysia

Cost Structure and Fees

Score – 4.4/5

AETOS Brokerage Fees

Aetos trading fees are relatively low or average and are built into a variable spread. Traders should also consider other non-trading fees like funding fees and inactivity fees, and also swap or rollover rates which are charged in case the position is open longer than a day.

Aetos spreads are quite competitive for the range of products as we found by our research. E.g. the average spread for EUR/USD is 1.8 pips. The broker diversifies its features to cater to different types of clients, meeting their needs with floating spreads, and various programs.

AETOS operates primarily on a spread-based pricing model, meaning traders are charged based on the difference between the bid and ask prices rather than paying a separate commission fee. However, for certain instruments, such as Share CFDs, the broker applies a commission.

For example, trading Australian shares involves a 0.07% commission of the contract value, with a minimum fee of 7 AUD per trade. Commission rates may vary depending on the instrument and account type, so traders should review the specific details on AETOS’s platform.

The broker applies rollover fees to positions held overnight, which are charged based on the interest rate differential between the two currencies in a Forex trade. These fees can either be positive or negative, depending on the direction of the trade and the interest rates of the respective currencies.

Aetos offers swap-free accounts for clients adhering to Islamic finance principles, which eliminates overnight interest charges and ensures compliance with Sharia law.

How Competitive Are AETOS Fees?

Aetos offers competitive fees across its trading accounts, with tight spreads and no hidden charges for most instruments. The broker’s fee structure is transparent, and traders can benefit from low-cost trading conditions.

While the fees are generally affordable for retail traders, more active traders may find value in the broker’s advanced account types, which cater to those seeking lower spreads and more efficient trading. However, traders should always consider the overall cost of trading, including potential fees for specific instruments, to determine if the broker meets their needs.

| Asset/ Pair | Aetos Spread | LCG Spread | MEX Exchange Spread |

|---|

| EUR USD Spread | 1.8 pips | 0.8 pips | 1.5 pips |

| Crude Oil WTI Spread | 6 | 3 pips | 0.03 |

| Gold Spread | 36 | 3 | 0.25 |

| BTC USD Spread | 5000 | - | 58 |

AETOS Additional Fees

In addition to standard trading fees, Aetos charges additional fees under certain conditions. These include an inactivity fee of $25 per month for accounts that remain dormant for an extended period.

The broker may also apply withdrawal fees depending on the payment method and region. Additionally, Aetos charges a conversion fee for deposits or withdrawals made in currencies other than the account’s base currency. Traders should carefully review AETOS’s fee schedule and terms and conditions to understand all potential additional fees before opening an account.

Trading Platforms and Tools

Score – 4.5/5

Aetos provides a popular trading platform MetaTrader 4, and the latest version of MetaTrader 5.

MT4 and MT5 trading platforms are indeed among the most advanced and efficient trading platforms worldwide, providing a wide range of indicators and the ability to combine skills or analyze the market efficiently with the help of market quotes, chart analysis, prompted alarm, and newsletters.

Based on our finds, the technology team of the company developed a wide range of essential functions on its MT4 platform and website, along with mobile platforms, MT4 plug-ins, and API development.

Trading Platform Comparison to Other Brokers:

| Platforms | Aetos Platforms | LCG Platforms | MEX Exchange Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

AETOS Web Platform

Aetos does not offer a web trading platform for its clients. Instead, the broker provides desktop versions of MetaTrader 4 and MetaTrader 5, which need to be downloaded and installed on a PC.

AETOS Desktop MetaTrader 4 Platform

The MT4 platform offers a comprehensive suite of features designed for both novice and professional traders. With 30 technical indicators, traders can perform detailed market analysis to help identify trends, entry, and exit points. The platform also includes 31 graphical objects, allowing users to visually mark and analyze price movements with a variety of drawing tools.

In addition, MT4 provides 9 timeframes, enabling traders to view price action across different periods for better decision-making. The platform supports automated trading through Expert Advisors and features advanced charting tools, real-time market data, and customizable layouts, making it a popular choice for traders who prioritize flexibility in their strategies.

AETOS Desktop MetaTrader 5 Platform

The MT5 offers an advanced trading experience with a wide range of tools and features. It includes 38 technical indicators, providing traders with enhanced analytical capabilities to spot trends, momentum, and potential reversals. The platform also supports 44 graphical objects, giving traders the flexibility to visually mark charts with various shapes, lines, and channels for more detailed analysis.

With 21 timeframes, traders can analyze price movements across a broad spectrum of time intervals, allowing for a more precise understanding of market behavior. Additionally, MT5 includes advanced charting tools, automated trading with EAs, and access to a variety of asset classes, making it ideal for both retail and professional traders seeking greater depth in their trading strategies.

Main Insights from Testing

Testing the MetaTrader 5 platform reveals a highly robust and versatile trading environment, offering seamless execution and a wide array of customization options. It provides an intuitive interface, multi-market access, and improved order management compared to its predecessor, MT4.

MT5 supports more complex trading strategies, with features like depth of market (DOM), enhanced charting, and economic calendar integration. The platform’s ability to handle both manual and automated trading strategies, combined with its superior performance for multi-asset trading, makes it a preferred choice for traders looking to access global markets with advanced tools.

AETOS MobileTrader App

The broker offers traders the flexibility to trade on the go with access to both MT4 and MT5 platforms. Available for both iOS and Android devices, the apps provide a user-friendly interface and a range of powerful tools that allow traders to execute trades, monitor their accounts, and analyze markets from anywhere.

Trading Instruments

Score – 4.4/5

What Can You Trade on AETOS’s Platform?

Aetos offers a diverse range of over 200 trading instruments across multiple asset classes, providing ample opportunities for traders to diversify their portfolios. On the platform, you can trade Forex on 29 currency pairs, including major, minor, and exotic pairs, and energy commodities like oil and natural gas.

The broker also offers access to indices representing global stock markets, precious metals like gold and silver, and Share CFDs, allowing traders to speculate on individual stock price movements. Additionally, the broker offers cryptocurrency, including popular digital assets such as Bitcoin and Ethereum, to those interested in the growing crypto market.

Main Insights from Exploring AETOS’s Tradable Assets

Exploring the broker’s tradable assets reveals a well-rounded offering, designed to cater to a range of trading preferences and strategies. The broker provides access to a diverse set of markets, from Forex to commodities, and equity indices to cryptocurrencies, allowing traders to diversify their portfolios and explore different trading opportunities.

Aetos’s platform is structured to accommodate both short-term traders and long-term investors, with competitive spreads and flexible trading conditions.

Leverage Options at AETOS

Leverage is a quite well-known instrument, which multiplies the initial capital you trade and can be a very useful tool to magnify your potential gains, but in case you use it smartly.

Each jurisdiction operates under specific rules and laws, meaning that the multiplier levels and trading conditions vary based on the trader’s country of residence.

- Australian traders may use 1:30 for Forex instruments.

- The high leverage up to 1:400 is available under the international entities’ traders.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at AETOS

Aetos offers its clients the most common funding methods including wire transfers, Credit/Debit cards, and e-wallets. You should log in to Aetos BizCentre and choose your preferred deposit method to fund your account at any time.

In terms of funding methods, Aetos offers the following payment methods:

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

- PayTrust

- POLi (for AU clients)

AETOS Minimum Deposit

Aetos’s minimum deposit amount is $50, which is great for many reasons. Yet, make sure you read carefully about the necessary margins on a trading instrument you choose to trade.

Withdrawal Options at AETOS

The majority of payment methods do not require a transaction fee, yet the Card payment will add on 3%. The Withdrawal may be processed through wire transfer only and under regular conditions costs $25 if there is no trading activity before the withdrawal request is submitted. However, the company does often subsidiary promotions which you may check with customer service.

Customer Support and Responsiveness

Score – 4.4/5

Testing AETOS’s Customer Support

The broker provides 24/5 customer support through multiple channels, including Live Chat, Email, Phone Lines, and Fax. Response times are generally quick, with the live chat feature offering the fastest support for urgent inquiries.

The support team is knowledgeable and professional, addressing a wide range of trading-related questions. While the availability of multiple contact methods is a plus, the lack of 24/7 support may be a drawback for traders in different time zones or those needing assistance over the weekend.

Contacts AETOS

For traders looking to get in touch with Aetos, the broker offers multiple contact options for customer support. Clients can reach out via phone or email, depending on their preference. For assistance, traders in Australia can contact the support team at +61(2)99292100, while email inquiries can be sent to cs_markets@aetoscg.com.

Research and Education

Score – 4.6/5

Research Tools AETOS

Aetos provides a variety of research and trading tools to help traders make informed decisions and enhance their strategies.

- Available both on the website and trading platforms, these tools include Trading Central Analysis, offering expert insights, technical indicators, and market forecasts.

- The broker also supports PAMM and MAM trading tools, enabling professional traders to manage multiple accounts efficiently.

- For traders looking to automate and optimize their trading experience, VPS hosting ensures seamless execution with minimal latency.

- Additionally, Copy Trading allows users to follow and replicate the strategies of experienced traders.

- Alongside these, the broker offers economic calendars, market news, advanced charting tools, and risk management features, ensuring a well-rounded trading environment for all types of traders.

Education

The broker provides educational video materials, covering key trading concepts, technical analysis, and platform tutorials to help traders enhance their knowledge and skills.

Additionally, Aetos offers market insights, and trading guides, allowing traders to stay updated on market trends and refine their strategies.

Portfolio and Investment Opportunities

Score – 4.4/5

Investment Options AETOS

AETOS primarily focuses on Forex and CFD trading, offering a range of tradable assets for active traders. However, for those looking for more passive investment options, the broker also provides Copy Trading and MAM/PAMM accounts, which are considered valuable investment tools.

Copy Trading allows users to follow and replicate the strategies of experienced traders, making it an accessible option for beginners or those who prefer a hands-off approach. Meanwhile, MAM and PAMM accounts enable professional traders and money managers to handle multiple accounts efficiently. These investment tools make Aetos a suitable choice for both self-directed traders and those looking for managed trading solutions.

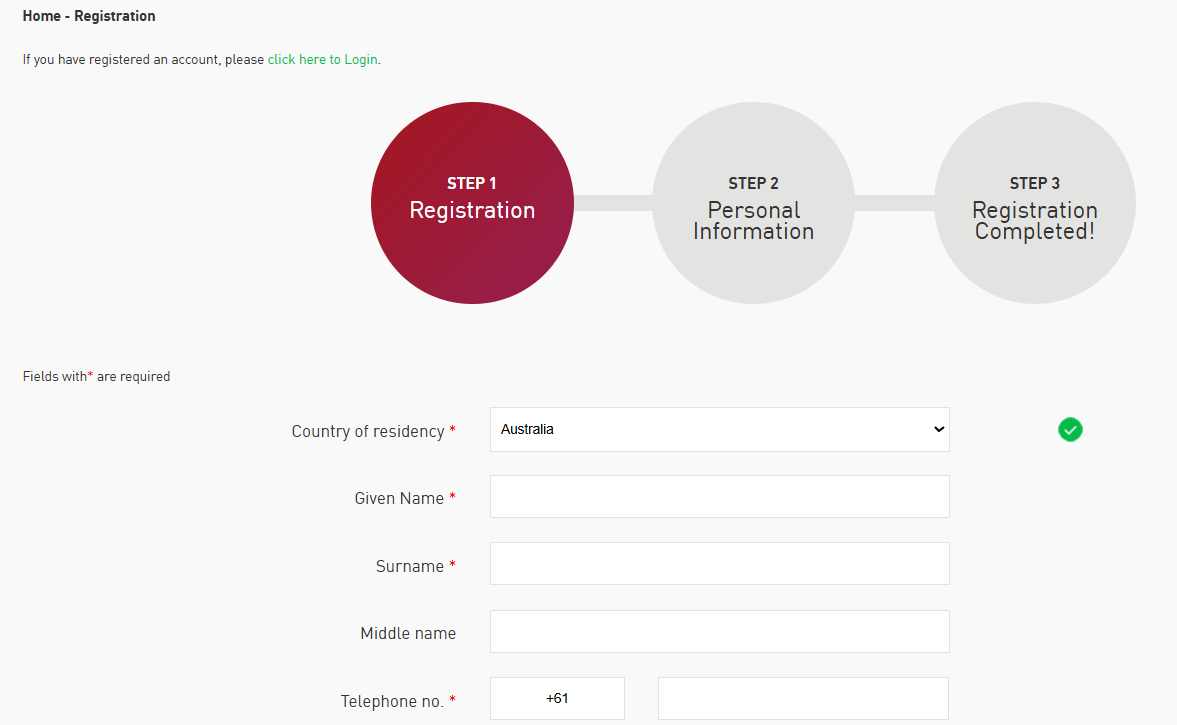

Account Opening

Score – 4.5/5

How to Open AETOS Demo Account?

Opening a demo account with Aetos is a straightforward process, allowing traders to practice trading in a risk-free environment. Here is how you can do it:

- Go to the official Aetos website and navigate to the Demo Account registration page.

- Provide basic details such as your name, email, phone number, and preferred trading platform.

- Choose your preferred account type, leverage, and virtual balance to simulate real trading conditions.

- After submitting the form, the broker will send your demo account credentials via email.

- Install MetaTrader 4 or MetaTrader 5 on your desktop or mobile device.

- Use the provided credentials to access your demo account and start practicing in real market conditions.

A demo account is an excellent way to familiarize yourself with AETOS’s trading environment, test strategies, and gain confidence before transitioning to a live account.

How to Open AETOS Live Account?

Opening a live account with Aetos is a simple process that allows traders to access real-market trading opportunities. To get started, visit the broker’s website and navigate to the Live Account registration page.

Fill out the online application form by providing personal details, financial information, and trading experience. Next, choose your account type, preferred trading platform, and leverage settings. To comply with regulatory requirements, you will need to submit identity verification documents, such as a passport or ID card, along with proof of address (utility bill or bank statement).

Once your documents are approved, you can fund your account using one of the available payment methods. After depositing, log in to your trading platform and start trading in the live markets.

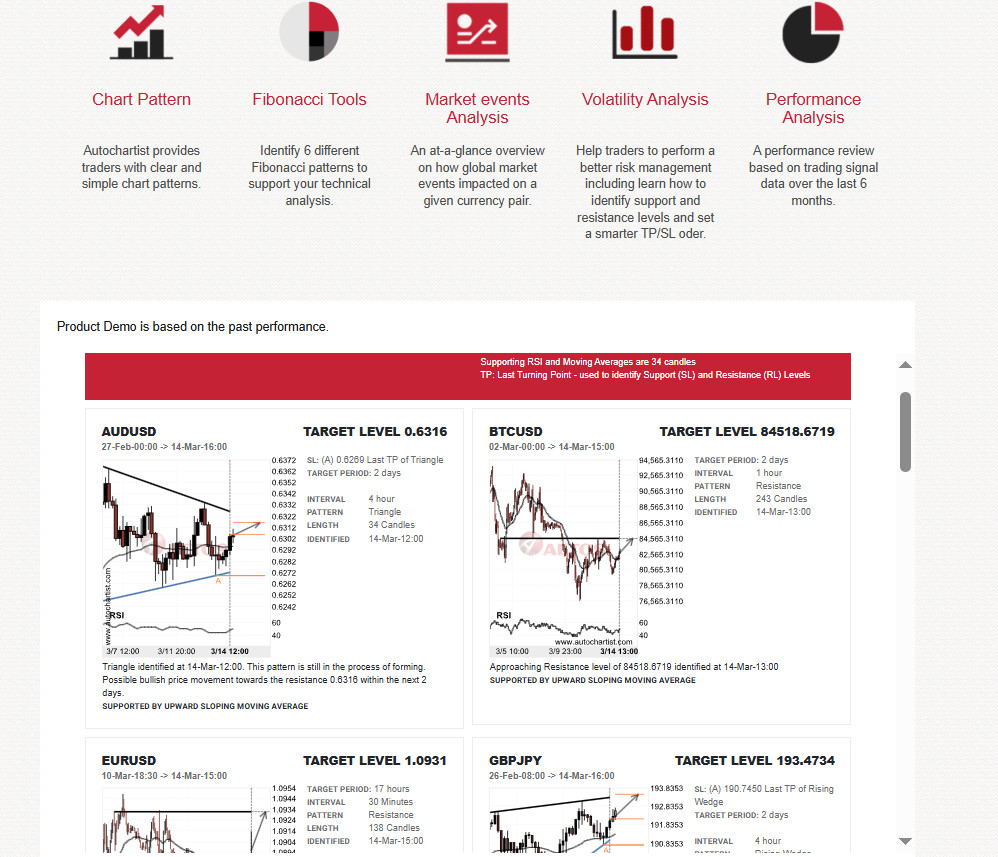

Additional Tools and Features

Score – 4.4/5

In addition to its core research tools, Aetos provides several additional trading tools and features to enhance the trading experience.

- One of the standout tools is Autochartist, which offers automated technical analysis, pattern recognition, and market alerts to help traders identify trading opportunities.

- The broker also provides real-time market news, and sentiment analysis to keep traders informed about key financial events and market movements.

- Moreover, one-click trading and customizable charting options on MT4 and MT5 allow for a more efficient trading workflow.

AETOS Compared to Other Brokers

When comparing Aetos to its competitors, several key differences stand out. Aetos offers a more limited range of trading instruments compared to larger brokers like Saxo Bank and City Index, which provide access to thousands of markets.

In terms of trading fees, its spreads are slightly higher than some low-cost competitors like CMC Markets and City Index, but it remains competitive with brokers like Swissquote. Aetos supports MT4 and MT5, widely used platforms favored by traders, whereas other brokers offer proprietary platforms with additional features.

Regulatory coverage is decent but less extensive compared to multi-regulated firms such as Saxo Bank and X Open Hub. With a low minimum deposit of $50, Aetos is more accessible than brokers requiring a higher initial investment, making it a suitable option for newer traders.

| Parameter |

AETOS |

LCG |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.8 pips |

Average 0.8 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

For Australian shares with a 0.07% commission of the contract value, (minimum fee of 7 AUD per trade) |

0.0 pips + $30 per $1,000,000 traded |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

LCG Trader, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

200+ instruments |

7,000+ instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC, VFSC, FSC, CIMA |

FCA, SCB |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$50 |

$100 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker AETOS

Aetos is a globally regulated Forex and CFD broker that offers access to a variety of trading instruments, including Forex, indices, metals, energies, shares, and cryptocurrencies. The broker provides MT4 and MT5 platforms for desktop and mobile trading, ensuring advanced charting tools, automated trading, and a user-friendly experience.

AETOS operates under the oversight of multiple regulators, including the top-tier ASIC, ensuring a high level of security for traders. The broker offers copy trading, MAM/PAMM accounts, and VPS hosting, as well as a variety of trading tools like Trading Central and Autochartist, catering to both retail and professional traders.

Share this article [addtoany url="https://55brokers.com/aetos-review/" title="AETOS"]

Dear team,

I live in Indonesia, could I be member of your trading platform or not.

I would like to ask if crm.setosprime belongs to your group and at which association is this trader.tegistered.

Thsnk you

B.regards

Dr Tio Heng Tie