- What is AAAFx?

- AAAFx Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- AAAFx Compared to Other Brokers

- Full Review of Broker AAAFx

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 3.8 / 5 |

What is AAAFx?

AAAFX is an ECN-style Forex and CFD broker established in 2007. Despite its long operation history, the broker did not hold serious licenses at the start of its journey, positioning itself in the market as an offshore broker. At present, AAAFx holds a serious license from the respected FSCA in South Africa. It is also registered with the Hellenic Capital Market Commission in Greece, which allows access to the EU financial framework and ensures compliance with MiFID II rules and guidelines.

AAAFx stands out for its extensive proposal and favorable features. The broker enables access to the market through the popular MT4 and MT5 platforms, and offers its clients the opportunity to diversify their trading through over 500 tradable products across Forex, commodities, indices, stocks, and cryptocurrencies. Clients also have access to free VPS hosting, and MAM and PAMM programs.

Traders are free to choose one of the five available account types with the broker. The minimum deposit for most of the accounts is $100.

AAAFx Pros and Cons

AAAFx is a reliable broker headquartered in Greece, offering its services to clients in the EU and South African regions. The broker stands out for its favorable and extensive features, suitable for both novice and professional clients.

The diverse selection of tradable products across various financial markets and the availability of the popular and demanded MT4 and MT5 platforms allow traders to expand their portfolios in a safe and advanced environment. Another key advantage is that AAAFx supports alternative investment options, including the MAM and PAMM programs.

For the cons, there are certain limitations in research and learning materials. Besides, conditions vary based on the entity and the respective regulatory standards. Also, the customer support is available only 24/5.

| Advantages | Disadvantages |

|---|

| Regulated broker with safe trading conditions | Conditions vary based on the entity |

| Competitive trading costs and spreads | No 24/7 customer support |

| EU supervision | Previous regulatory concerns |

| South African regulation | |

| Popular trading instruments | |

| MT4/MT5 trading platforms | |

| Suitable for beginners and professionals | |

| Multiple account types | |

AAAFx Features

AAAFx is a reliable broker with a license from a respected authority. There is a wide selection of account types with favorable conditions suitable for diverse traders. The range of tradable products across various financial assets is also quite good. Below, see the details on the main aspects of trading with AAAFx.

AAAFx Features in 10 Points

| 🗺️ Regulation | FSCA, HCMC |

| 🗺️ Account Types | ECN, ECN Zero, ECN Plus, Islamic, US Cent |

| 🖥 Trading Platforms | MT4, MT5, ZuluTrade |

| 📉 Trading Instruments | Forex, indices, commodities, stocks, cryptocurrencies |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, CAD, AUD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is AAAFx For?

Our findings revealed that AAAFx meets various needs and expectations. The broker caters to beginner and experienced traders, providing well-tailored accounts, popular and innovative platforms, and attractive features. All in all, AAAFx is good for the following:

- European traders

- Beginners and Professionals

- MT4/MT5 platform enthusiasts

- CFD and Currency traders

- Those looking for a diversity of products

- ECN execution

- Competitive spreads

- Different account types

- Good trading tools and conditions

- South African clients

AAAFx Summary

AAAFx is a licensed Forex broker with regulation in Greece and South Africa. The broker has a secure environment and provides its clients with competitive conditions, a wide range of financial instruments, and advanced platforms. The pricing and overall trading charges are favorable, along with some of the tightest spreads in the market, starting from 0 pips. The available platforms are equipped with powerful tools and features, ensuring a successful outcome. In addition, clients can engage in MAM and PAMM programs, diversifying their opportunities.

Overall, the broker offers a competitive environment that caters to traders of various skill levels. However, the broker’s educational resources are limited for beginners who prioritize extensive learning resources. Another point for consideration is the absence of 24/7 customer support.

55Brokers Professional Insights

We have reviewed AAAFx from various aspects and angles and have drawn a final conclusion on the broker’s services. As we found, AAAFx stands out for its competitive costs in the financial industry, with tight spreads starting from 0.0 pips and reasonable commissions of $2.50 per side that are lower than the average offering in the market. The broker is a good choice for cost-conscious traders who want to engage in trading with smaller investments.

Clients of AAAFx can choose from the five account types. The initial deposit requirement is $100, which makes the broker a cost-efficient choice. Only the ECN Plus account has a high deposit requirement that starts from $5,000.

Another advantage, especially for MT4 and MT5 platform enthusiasts, is the broker’s advanced platforms, equipped with extensive technical indicators, charts, and trading alerts.

When it comes to the broker’s overall trust and reliability, we emphasize its past regulatory inconsistencies. The reputable authority in Cyprus, CySEC, published a warning statement about the broker for providing unauthorized services. However, the broker’s present regulation from the respected FSCA and HCMC ensures transparent practices.

Consider Trading with AAAFx If:

| AAAFx is an excellent Broker for: | -Beginner traders

- Professional traders

- Cost-conscious clients

- EU and South African residents

- Traders looking for MAM and PAMM features

- Clients looking for very low spreads

- Traders looking for a selection of accounts

- MT4/MT5 platform enthusiasts

- Currency traders |

Avoid Trading with AAAFx If:

| AAAFx is not the best for: | - Investors looking for real stocks

- Long-term investors

- Clients looking for 24/7 support

- Beginner traders favoring extensive educational resources |

Regulation and Security Measures

Score – 4.3/5

AAAFx Regulatory Overview

AAAFx is a tightly regulated broker that holds serious licenses from respected regulatory authorities. The broker’s compliance with strict laws ensures transparency and fair practices.

- AAAFx is headquartered in Greece and holds a license from the Hellenic Capital Market Commission (HCMC) under the Triple A Experts Investment Services S.A. The license provides compliance with MiFID II rules and guidelines, ensuring that the broker is secure for European clients.

- Another strict regulation is ensured by the South African FSCA license, making the broker a favorable choice for traders from the South African region. In South Africa, the broker operates under the Sikhula Venture Capital (Pty) Ltd.

How Safe is Trading with AAAFx?

As we have found, AAAFx adheres to strict industry standards and applies several safety measures to protect its clients. It includes client fund protection and segregation from company funds. Another essential step towards protecting its clients is the negative balance protection, which ensures that losses do not exceed the account balance.

- However, we recommend carefully reviewing the broker’s documentation and legal agreements to have a better understanding of AAAFx’s security polices.

Consistency and Clarity

To estimate a broker and assess its consistency and transparency, we have researched the broker from the beginning of its journey. AAAFx has been in the market since 2008; however, it started off as an offshore broker, with no compliance with serious laws and guidelines.

Because of this, the broker has been listed as an unregulated and offshore broker and has been estimated as an untrustworthy trading choice. Previously, we have also placed the broker on our list of unregulated brokers.

Yet, the broker has improved its regulations and now assures a reliable environment for its European and South African clients. It holds licenses from the FSCA in South Africa and HCMC in Greece.

We have compared AAAFx’s customer feedback over time and found a noticeable improvement in client opinions. However, despite the present compliance with strict laws and positive reviews, we still recommend that our readers consider the broker’s previous status and the path of development from an unregulated broker to a regulated one.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with AAAFx?

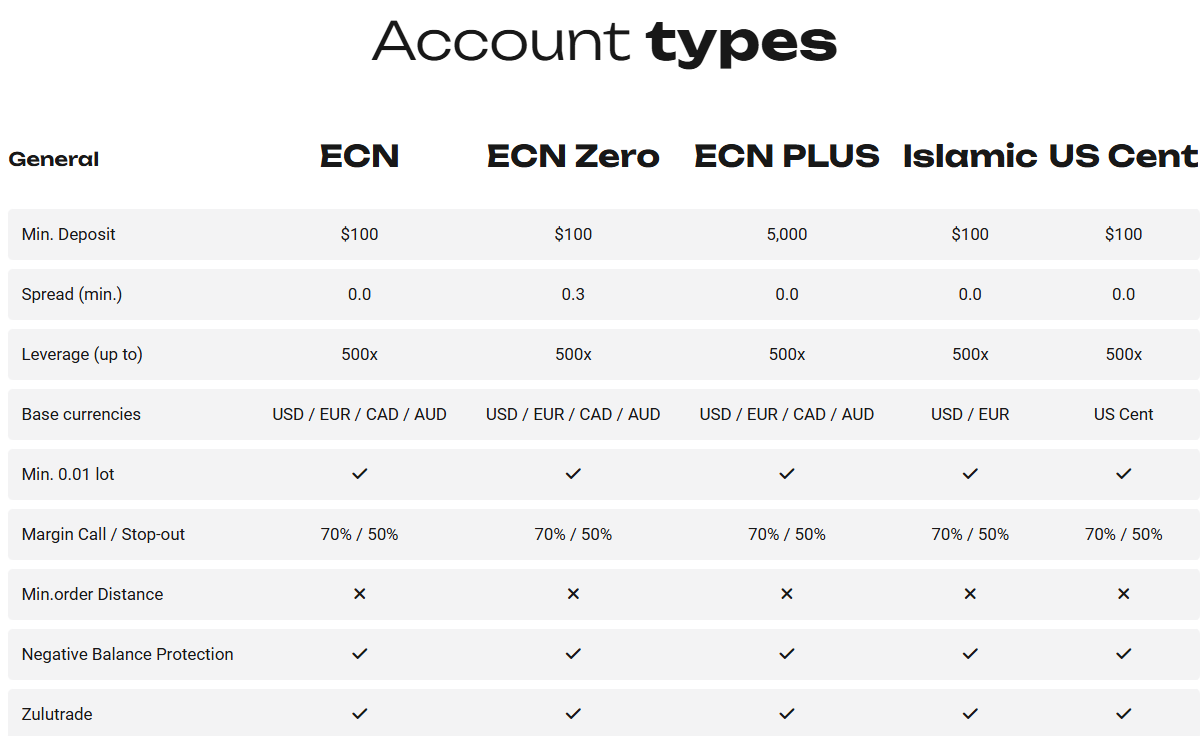

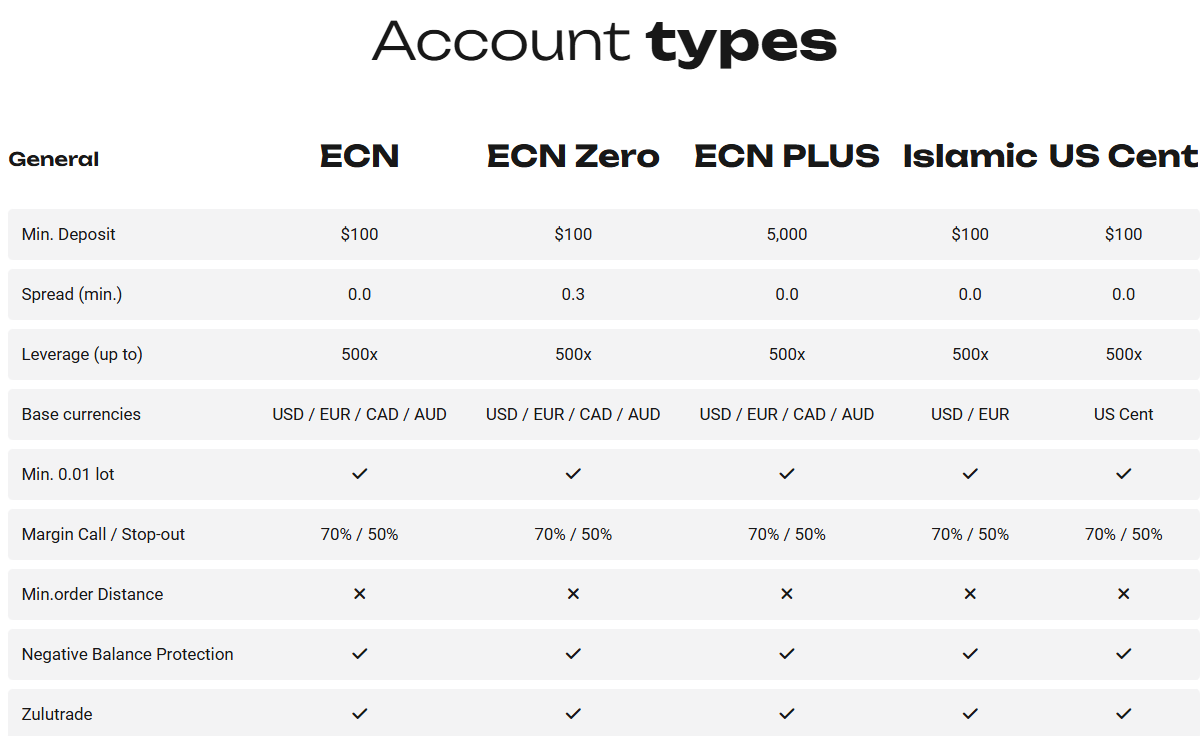

AAAFx offers a wide range of account types, tailored for different traders and different styles. All the accounts come with favorable conditions, tight spreads, and reasonable transaction fees for the commission-based structure.

The minimum deposit is affordable and starts from $100 for the ECN, ECN Zero, Islamic, and US Cent accounts. The ECN Plus account is suitable for more professional clients and has a higher deposit requirement, starting from $5,000. The leverage is 1:500 for all the account types; however, there might be differences based on the jurisdiction. All the accounts ensure the security of trades, providing negative balance protection.

- The only spread-based account is ECN Zero with no transaction fees, yet with tight spreads, typically 0,3 pips for the popular EUR/USD pair.

- All the other account types have a commission-based structure. Commissions applied are usually lower than the market average and depend on several factors, including the instrument traded and the chosen account.

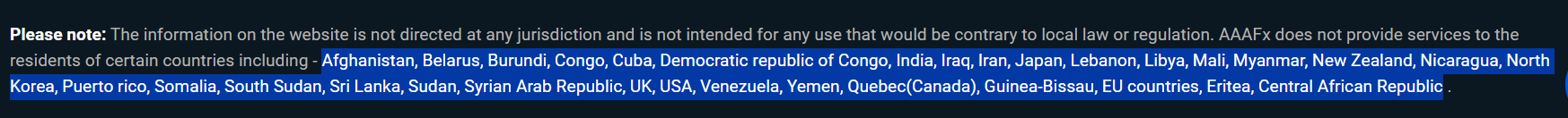

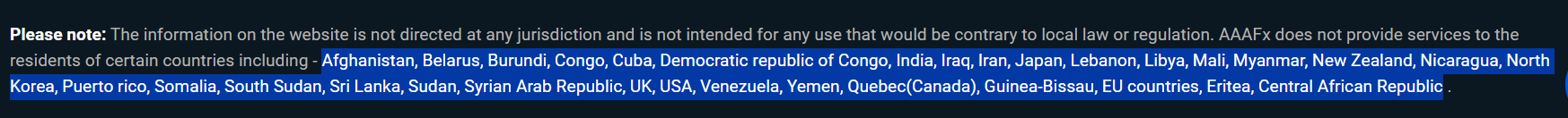

Regions Where AAAFx is Restricted

AAAFx does not provide services in many countries due to regulatory restrictions. We also found that different AAAFx entities may offer varying conditions.

Below you can see the list of regions where AAAFx is not able to take clients from:

- Afghanistan

- Belarus

- Burundi

- Congo

- Cuba

- Democratic Republic of Congo

- India

- Iraq

- Iran

- Japan

- Lebanon

- Libya

- Mali

- Myanmar

- New Zealand

- Nicaragua

- North Korea

- Puerto Rico

- Somalia

- South Sudan

- Sri Lanka

- Sudan

- Syrian Arab Republic

- UK

- USA

- Venezuela

- Yemen

- Quebec(Canada)

- Guinea-Bissau

- Eritea

- Central African Republic

Cost Structure and Fees

Score – 4.3/5

AAAFx Brokerage Fees

Based on our research, AAAFx provides competitive and transparent pricing. The broker’s spreads and commissions depend on the account type. In addition to the common spreads and commissions, there are also a few extra fees added to the overall costs. It is essential that traders fully understand the applicable charges and their potential impact on trading activities before opening an account.

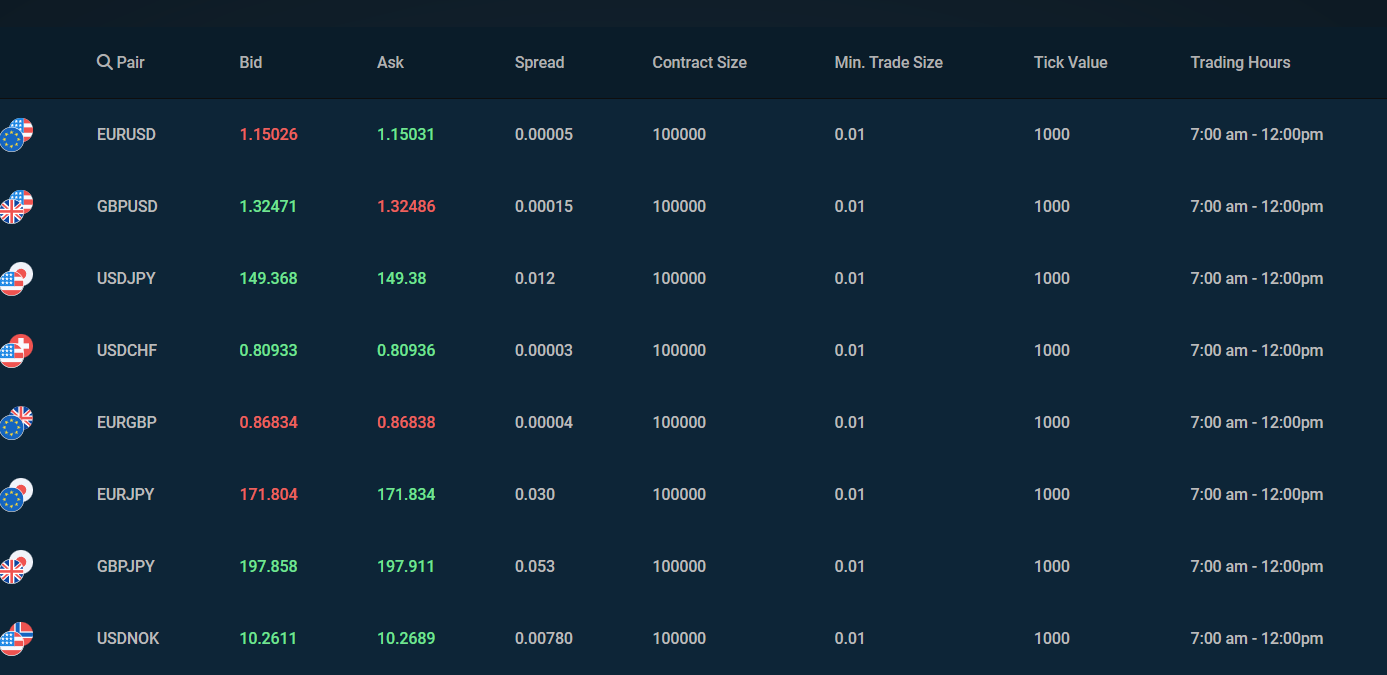

AAAFx offers floating spreads for all of its account types. The broker offers only one spread-based account, the ECN Zero account. The average spread for the EUR/USD pair is 0.3 pips. However, the no-commission policy for this account applies to Forex, indices, and commodities. For stocks and cryptos, there are small transaction fees, combined with spreads. All the other account types are commission-based, combined with tight spreads.

Based on our research, most of the AAAFx account types are commission-based. Each account features a distinct pricing structure, enabling clients to select the most suitable option for their trading needs. For the ECN, Islamic, and US Cent accounts, the average commission is $2.50 per side per lot, which is considered lower than most brokers in the market offer. The ECN Plus account offers considerably lower commissions, $1 per side per lot, combined with spreads starting from 0.0 pips. For Stocks and cryptocurrencies, the commissions differ. For each account type, there are different transaction fees applied.

How Competitive Are AAAFx Fees?

Our research of the broker’s pricing and cost structure revealed competitive and transparent fees. The broker discloses the trading costs for each instrument and each account type, making the offering as clear and transparent as possible. The available spreads are some of the lowest in the market, starting from 0.0 pips, combined with fixed commission fees.

For the spread-based account, the average spread is 0.3 pips, which is again lower than the market norm. The commissions are fixed; however, for stocks and cryptos, the pricing is different. All in all, AAAFx provides favorable conditions for traders, enabling them to access the global market with low fees and secure conditions.

| Asset/ Pair | AAAFx Spreads | SimpleFX Spreads | IQ Option Spread |

|---|

| EUR USD Spread | 0.3 pips | 0.9 pips | 0.8 pips |

| Crude Oil WTI Spread | 30 pips | 30 pips | 0.38% |

| Gold Spread | 23 pips | 42 pips | 0.01% |

AAAFx Additional Fees

We have found that AAAFx applies very few additional fees, which is another advantage in addition to the already low pricing provided. We found that there are no deposit or withdrawal fees with AAAFx. However, there might be processing fees, so check beforehand.

- There is also a no-inactivity fee policy with AAAFx; however, the broker might block dormant accounts after a period of inactivity.

Score – 4.4/5

AAAFx clients have a selection of platforms to conduct their trades, including the industry-popular MT4/MT5 platforms. It also offers access to Zulutrade. All the platforms are available via web, mobile, and desktop, providing traders with flexibility and easier access.

| Platforms | AAAFx Platforms | SimpleFX Platforms | IQ Option Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platform | No | Yes | Yes |

| Mobile Platform | Yes | Yes | Yes |

AAAFx Web Platform

AAAFx offers a web-based version of its MT4 and MT5 platforms. There is no need for installations or downloads, as clients can access the web platform straight from the broker’s official website. The interface is simple and easy to navigate, yet the features and functionality are the same as for the desktop platform. AAAFx’s clients can benefit from built-in indicators, extensive charting tools, various timeframes, and other advanced features. The execution is fast and efficient, enabling users to take advantage of market changes and movements.

AAAFx Desktop MetaTrader 4 Platform

The MT4 desktop platform provides an impeccable trading experience for all types of traders. The platform comes with customisable charts, over 30 built-in indicators, and 31 charting tools for technical analysis. The platform also offers 9 timeframes, supports EAs, Hedging, and Scapling, and is suitable for social trading.

The innovative features, the economic calendar, news feeds, trading calculators, and a wide range of analytical tools allow traders to make informed decisions quickly and effectively. Due to its flexibility and reliability, the platform is used by millions of traders worldwide.

AAAFx Desktop MetaTrader 5 Platform

The newer version of the MetaQuotes Software, MT5, provides its clients with a more versatile trading experience. The platform is rich with innovative features, offering enhanced technical analysis tools and features. Traders gain access to over 21 timeframes, 38 built-in indicators, and 44 charting tools. The platform supports multiple strategies, provides trading alerts, advanced order types, and more. The platform is available for download for Windows.

AAAFx MobileTrader App

With AAAFx, mobile traders can download the MT4 and MT5 apps on their Android or iOS devices and conduct trades on the go. The apps are equipped with the essential tools for profitable trading. Traders can use integrated charting, one-click trading, real-time prices, trading indicators, and various timeframes. Besides, the economic calendar, calculators, and other powerful features are available to conduct trades with efficiency and flexibility.

AAAFx ZuluTrade Platform

AAAFx partners with one of the most demanded social trading platforms, ZuluTrade. The broker’s clients are able to link their MT4 and MT5 accounts to ZuluTrade without extra fees and engage in social trading.

ZuluTrade enables traders to monitor all the copied trades in real-time, adjust settings, or pose the auto-trading anytime, and view performance metrics.

Main Insights from Testing

Our testing left us satisfied with the broker’s platforms. AAAFx allows trading through the advanced MT4/MT5 platforms, accessible through web, desktop, and mobile versions. The platforms offer in-depth analysis tools and capabilities. AAAFx also partners with ZuluTrade, allowing clients to access one of the most popular social trading features. Overall, the platforms are excellent for both beginner and experienced traders, promising a great outcome for trades.

AI Trading

As we found, there are no built-in AI tools with AAAFx. What AAAFx offers is an integrated API and support of algorithmic strategies through its MT4 and MT5 platforms.

Trading Instruments

Score – 4.4/5

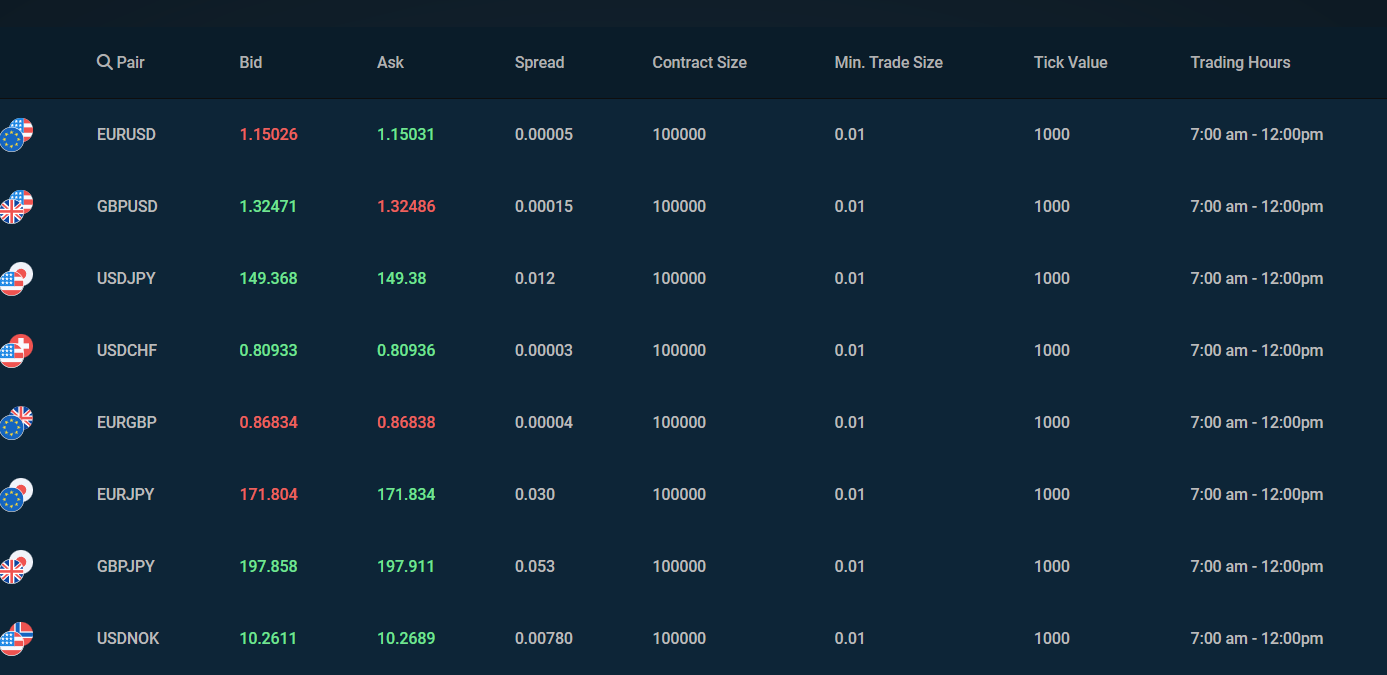

What Can You Trade on the AAAFx Platform?

AAAFx offers essential products across Forex, commodities, indices, stocks, and cryptocurrencies. As we found, the total number of instruments does not exceed 200, which is considered a limited offering in the market. However, for currency traders, the broker’s offering is favorable, with 70 major, minor, and exotic pairs available. We strongly recommend checking the availability of specific trading instruments based on the entity.

- In addition, all the products are CFD-based; thus, clients cannot engage in long-term investments.

Main Insights from Exploring AAAFx Tradable Assets

Our research revealed that AAAFx provides a total of 200 tradable products across multiple markets. Currency traders can benefit from the extensive range of forex pairs, as well as some of the best-known global indices, and commodities (including gold and silver. Although the range of products is not extensive, it includes all the popular products with low spreads and good conditions.

AAAFx clients can also access the most demanded cryptocurrency CFDs, including Bitcoin, Ethereum, Dogecoin, and others.

It is essential to consider the differences between the broker’s entities, including instrument availability, prices, and other essential conditions.

Leverage Options at AAAFx

Leverage is a useful tool that enables its users to enter the market with limited resources. However, it is essential to carefully learn how to use leverage, since the multiplier can work against them, too.

- The EU clients under the HCMC entity are entitled to up to 1:30 leverage.

- For the FSCA clients, the broker offers high leverage that can reach up to 1:500.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at AAAFx

AAAFx offers various deposit and withdrawal methods to make the funding process smooth and quick. The broker does not charge extra fees for deposits and withdrawals. However, we recommend that traders check if there are transaction fees on the side of the payment provider.

Below are the main deposit methods offered by AAAFx:

- Bank transfers

- Credit/debit cards

- Neteller

- Skrill

- Fair Pay

- Crypto

Minimum Deposit

AAAFx has an affordable deposit requirement for most of its account types. The minimum funding starts at $100. The only account with a higher funding requirement is the ECN Plus account ($5,000).

Withdrawal Options at AAAFx

Withdrawals are processed through the same funding methods as deposits are made. Withdrawals can be instant or take up to 24 hours based on the funding method used.

- However, we have found a few reports from fellow traders about withdrawal delays with AAAFx from several days to weeks.

Customer Support and Responsiveness

Score – 4.5/5

Testing AAAFx Customer Support

AAAFx provides 24/5 customer support via Live Chat and Email. The broker also includes a helpful FAQ section, where the broker has compiled answers to the most common trading-related questions.

- The broker is also active on social media platforms, keeping its clients informed about the current market events and its operations.

Contacts AAAFx

We have tested AAAFx customer support to see how helpful the broker’s team is. As a result, we found dedicated and prompt assistance. With AAAFx, clients can choose one of the following options to seek help:

- The live chat provides the quickest and detailed answers almost instantly.

- Clients can also use the email address provided by the broker to direct their inquiries, concerns, and suggestions: contactus@aaafx.com.

- In addition, AAAFx’s presence on social platforms, including Facebook, X, LinkedIn, YouTube, and Instagram, allows traders to stay updated.

Research and Education

Score – 4/5

Research Tools AAAFx

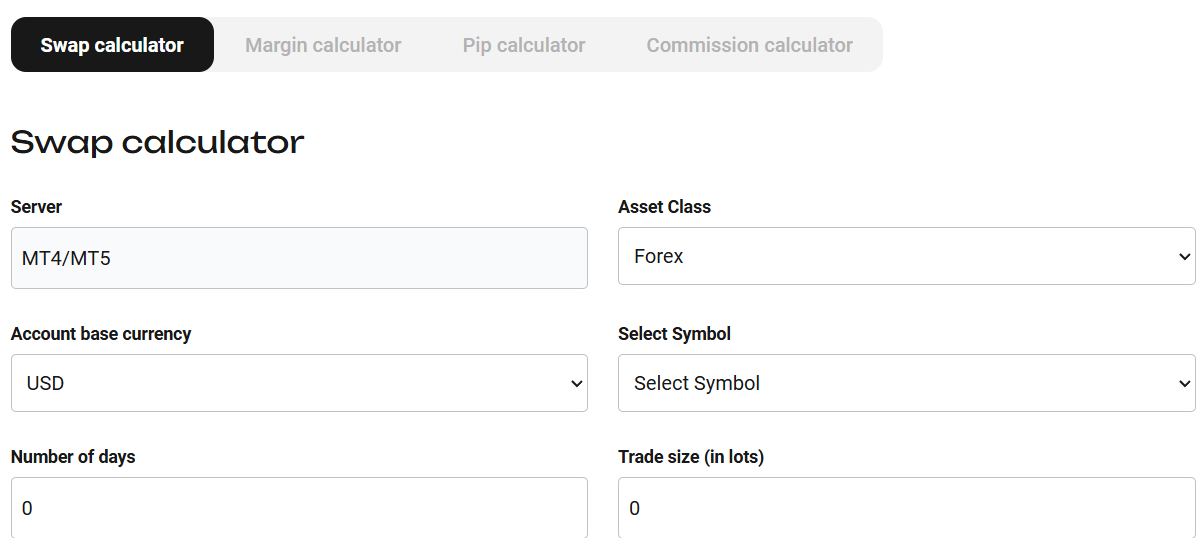

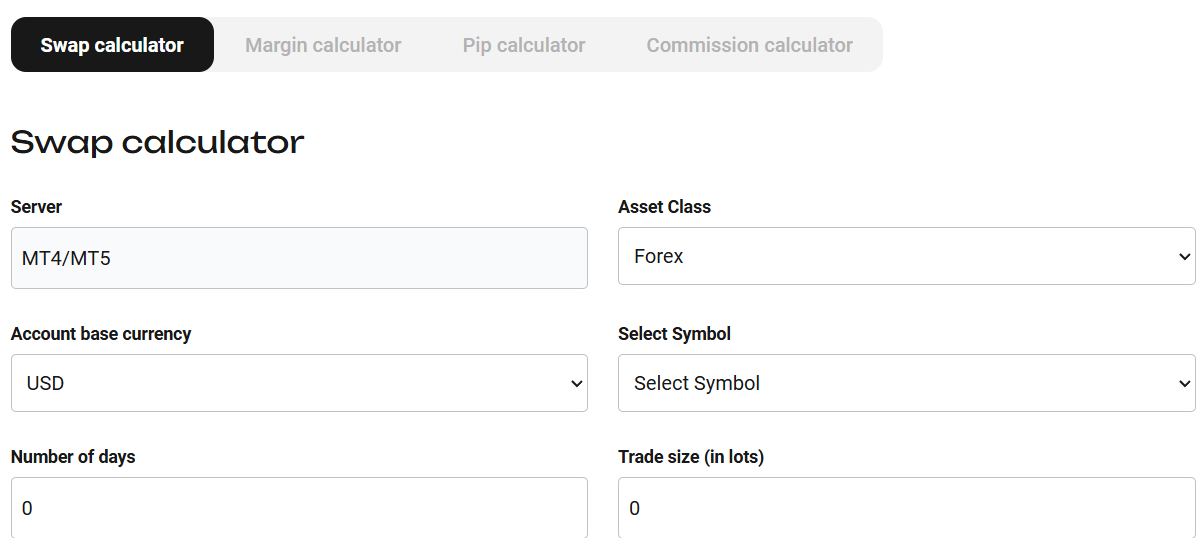

The analysis of the broker’s research section revealed advanced research tools and features on its MT4 and MT5 platforms. Traders can use multiple technical analysis tools directly from the broker’s platforms. AAAFx also offers a few additional tools directly from the broker’s website.

- We find the broker’s Economic calendar an excellent tool to stay informed about the approaching market changes and events.

- Trading calculators allow traders to calculate swaps, pips, and margin values.

Education

Finally, the broker lacks a dedicated section on its website for learning materials, webinars, seminars, or tutorial videos. This absence of a dedicated education section can be seen as a drawback since educational resources play a substantial role, especially for beginner traders, in improving their knowledge and skills.

Is AAAFx a Good Broker for Beginners?

AAAFx offers many advantages to its clients, including competitive conditions and a safe environment. The availability of different account types tailored for beginners, intermediate traders, and professionals can meet various trading needs. It also provides a minimum deposit requirement of $100, very low spreads, and affordable commissions.

The broker also offers a demo account, various funding methods, and helpful research tools. However, the education section is not comprehensive enough for novice traders. As a final note, the broker can be a favorable choice for many. However, it is essential to weigh AAAFx’s advantages and drawbacks before opening an account.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options AAAFx

Based on our research, AAAFx’s clients can access only 200 tradable products, all based on CFDs. The CFD products allow traders to speculate on price movements rather than own real assets. Thus, AAAFx clients will not be able to engage in long-term trading or traditional investments.

- However, the broker allows its clients to engage in MAM or PAMM programs, expanding opportunities and market exposure.

- Those clients who favor Social trading can access one of the most popular social trading platforms, ZuluTrade, which is linked to the broker’s platforms.

Account Opening

Score – 4.5/5

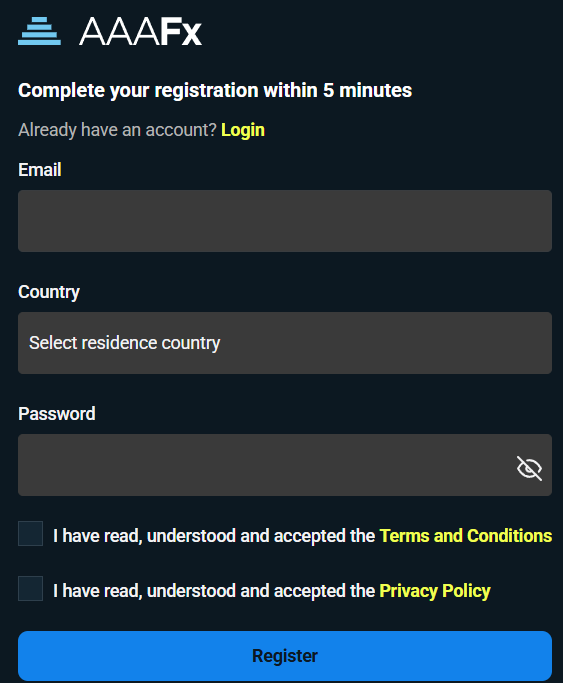

How to Open an AAAFx Demo Account?

Traders can also benefit from a demo account. They can access the market in a risk-free environment and practice without initial financial inputs. Demo accounts remain active for 30 days.

- To open a demo account, traders first need to create a user account by accessing the broker’s official website.

- After registering with the broker, traders automatically gain access to the demo account.

How to Open an AAAFx Live Account?

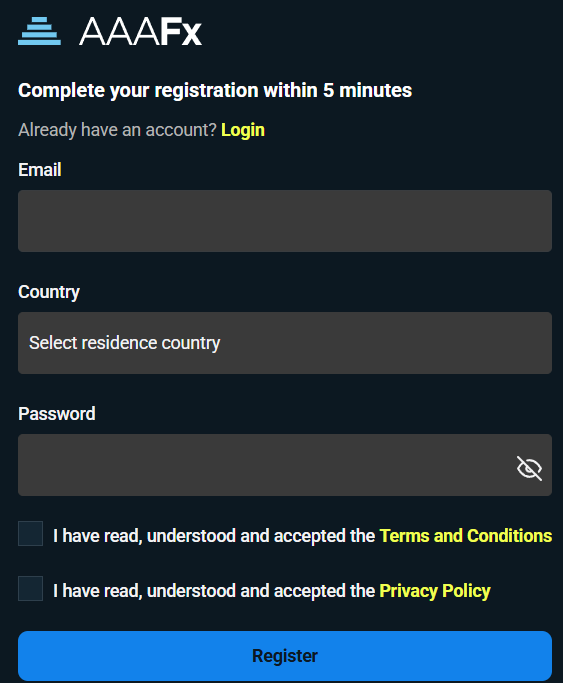

Opening an AAAFx live account is possible within five minutes. The process is easy and without any complications. Traders just need to follow the steps below:

- Go to the broker’s official website.

- Fill out the registration form with the requested information.

- Upload a valid ID and proof of address.

- Choose the account specifications (account type, currencies, etc).

- Receive account credentials through the provided email address.

- Access the MT4 or MT5 trading platforms.

- Make a deposit and start trading.

Score – 3.8/5

We have already mentioned all the available features and tools that the broker offers in the research section. In addition to the Economic calendar, calculators, and all the tools included in the broker’s advanced platforms, there are no extra possibilities with AAAFx. However, clients can also benefit from the Free VPS Hosting.

- The Free VPS Hosting allows its users to benefit from lower latency and uninterrupted trading. VPS supports the endless operation of the platform, and is especially beneficial for traders who use trading robots and signals.

AAAFx Compared to Other Brokers

We find it essential to compare a broker to other brokers to see how it follows the market norms and standards. After reviewing the various aspects of trading with AAAFx, we compared these aspects to those of other brokers one by one.

First, AAAMarkets is regulated in Greece and South Africa, serving brokers from Europe and South Africa. When we reviewed EC Markets’ regulation, we found that the broker adheres to the rules and guidelines of multiple top-tier and well-respected authorities, such as the FCA, ASIC, FSCA, FSA, FSC, and FMA, providing additional layers of safety and reliability.

We also compared the brokers’ trading charges to other brokers, such as Axi and FXCM, and noticed that AAAFx’s fees are much lower, with average spreads of 0.3 pips, whereas other brokers offer spreads from 1 to 1.3 pips on average.

Trades are conducted on AAAFx’s MT4 and MT5 platforms, allowing traders access to 200 tradable products across multiple financial assets. AAAFX also links its MT4 and MT5 platforms to the popular social trading platform, ZuluTrade. We noticed that most of the brokers we reviewed also offer either the MT4 or MT5 platforms, or both.

As a last note, AAAFx does not offer educational materials, while FXCM and FxPro include comprehensive educational resources.

| Parameter |

AAAFx |

FXTM |

Forex.com |

EC Markets |

Axi |

FXCM |

FxPro |

| Spread-Based Account |

Average 0.3 pips |

Average 1.5 pips |

Average 1.3 pips |

From 1.1 pip |

Average 1.2 pips |

Average 1.3 pips |

Average 1.4 pips |

| Commission-Based Account |

0.0 pips +$2.50 |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $2.5 |

0.0 pips + $7 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, ZuluTrade |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

200+ instruments |

1000+ instruments |

6000+ instruments |

150+ instruments |

220+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

FSCA, HCMC |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, FSCA, FSA, FSC, FMA |

ASIC, FCA, CySEC, DFSA, FSA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Limited |

Good |

Excellent |

Good |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$100 |

$200 |

$100 |

$10 |

$0 |

$50 |

$100 |

Full Review of Broker AAAFx

During our review, we have carefully analyzed all the aspects of trading with AAAFx and summarized its proposal. As we found, AAAFx is regulated by the FSCA in South Africa and the HCMC in Greece. It also adheres to the rules and guidelines of MiFID II.

As we revealed, AAAFx’s conditions, combined with security standards, competitive prices, and good features, make it a favorable choice for multiple trading strategies and clients of various experience levels.

AAAFx does not have an extensive offering of tradable products. It offers 200 instruments across Forex, indices, commodities, stocks, and cryptocurrencies. Because of this modest range of instruments, the opportunities for expanding portfolios are limited. However, the broker offers alternative investment solutions, such as social trading, MAM, and PAMM programs.

With AAAFx, traders gain access to the market through the popular MT4 and MT5 platforms and engage in social trading through ZuluTrade. The initial deposit requirement is $100 for most of its account types. However, the account tailored for professionals requires $5,000 or more. Clients can fund their accounts through numerous methods, but their availability depends on the entity.

Finally, although the broker offers a few research materials, it is not a fit for beginner traders who favor comprehensive learning materials.

Share this article [addtoany url="https://55brokers.com/aaafx-review/" title="AAAFx"]

hey, is aaafx safe to trade?

they are under greece regulation. so it’s safe.

After few years no problems with aaafx. good broker to trade. they accept ea and news trading.

After few years no problems with aaafx. good broker to trade. they accept ea and news trading.

do they have bonuses for new traders?

They offer 100% deposit bonus. but you can’t withdraw the bonus. only profit and your initial deposit.

I think, the updated personal area and client dashboard on AAAFX is more user-friendly. Transferring funds between my various accounts, whether it’s from ZuluTrade to my personal AAAFX accounts, has become much more straightforward. The improved user interface is a definite plus compared to the previous version. I also experimented with copy trading on another platform and encountered less favorable results with higher commissions. In my view, it’s advisable to start with AAAFX and then connect to ZuluTrade to avoid getting charged more commision at Zulutrade.

I lean towards forex trading, particularly on their ECN Plus account, which has a reasonable minimum deposit. Yes the ECN spreads can vary, but I’ve noticed that significant widening isn’t a common issue. I enjoy trading the Chinese Yuan against the US Dollar. The flexibility in the Yuan’s trading environment, where it’s allowed to move freely, lets me make forecasts based on exchange rate fluctuations. Another perk I’ve experienced is AAAFX crediting my account with positive slippage on a couple of occasions, which is a nice bonus.

Because I trade frequently, I cannot overstate how much I rely on the ZuluTrade platform provided by AAAFx. The platform’s automated trading feature has been an absolute lifesaver for me, freeing up countless hours that I would otherwise have spent glued to my screen.

Thanks to this feature, I can take a more hands-off approach to my trades, confident that my strategies are being executed with precision and efficiency.

I recommend the ZuluTrade platform to anyone looking to streamline their trading process.

are they trusted? real reviews?

Trading here for long time, no concerns for now. one of the good broker.

any thoughts regarding zulu? safe copy trading?

You can check the stats, try with 100$ but choose carefuly , not all of the masters have strategy for low deposits.

easy to withdraw my funds from AAAFx. With free withdrawals within 12 hours and no restrictions on amount or frequency.

Besides thin spreads, They offer institutional-grade liquidity at super-low cost. Their commission rates are also quite competitive, and I’m glad that I can trade at AAAFX without commission charges on all forex pairs with my ECN plus account.

I have been thoroughly impressed with this platform, as it has provided me with valuable insights and helped me to enhance my trading strategy. The statistical analysis of top traders is a standout feature, allowing me to make informed decisions based on the performance of others.

AAAfx broker has a lot of advantages that put this broker in the top-tier list of companies worth trading with.

But my main highlight of this broker is that everyone can be involved in the copy trading activity. And not just ordinary copy trading, but copy trading with the renowned Zulutrade platform.

Fortunately enough you don’t have to deposit lots of money to be able to do so.

I already hase some results with Zulutrade copy and AAAfx broker.

Starting from how easy it is to register and put your first deposit here, getting your first deposit bonus, choosing your account type,

Moving on to installing your trading platform, logging in, getting your first trades with tons of tier-1 liquidity and super fast levels of connection, competitive cost of trading, everything.

It was really impressive to find this broker for me. Because I knew this broker but did not know a lot about them. Turns out, they have been operating for more than 15 years, so they are not newbies in this game, therefore, it is actually understandable that they would be a time-tested broker with all the popular features that every trader would like to see in their trading platform.

AAAFx’s VPS service is reliable and efficient, with solid connectivity to the platform. The server is stable and well-optimized for fast execution. The setup process could be made simpler.

I see that the broker offers different types of accounts for traders with varying budgets. That’s good. Has anyone tried the ECN plus one? Is it worth depositing $1000? What’s the point of it, does it offer lower cost to trade?

I am a regular trader on the AAAfx platform and I can assure you of the quality of the ECN plus account. Minimum deposit equals $1k, so one may claim it’s a rather high entrance threshold, but at the same time it’s definitely helpful for creating proper risk management. You don’t have a huge need to use high leverage, because your ordinary position size equals $50 approximately. You can easily boost your deposit.

Cost of trading is lowered in case you trade FX, because commission is literally $0. Other assets also don’t imply a big one.

The platform’s innovative approach, combined with its reliable and efficient technology, make it an ideal partner for traders of all levels of experience. But providing education could go a long way.

This broker has an excellent reputation, which minor flaws cannot affect. That’s why I opened a trading account hre in spite of these flaws.

Of course I joined not because of the company’s reliability or brilliant perfect conditions, but due to the deposit bonus. I simply had no idea about regulatory base of this company, quality of its conditiosn, because was lazy enough to read overviews and actually spend time in vain.

Nevertheless, after trading here for a while I realized that it’s the most suitable broker for my needs. Lots of tradable assets, exquisite array of trading platforms, modern tools and other stuff made me become convinced of the right chocie of mine. The broker has done a great job developing services…

Basically, AAAFx broker sutis me in many regards, starting from the multitude of offered trading platforms, ending with some pretty enticing bonus system. There are no traders who would mind to get some extra cash that can be quickly capitalized.

Other than that, there is an access to the virtual private server that can help you to automize trading.

Love the ECN Plus account here. But more important than that, I love that there are different choices and an Islamic account available for traders here. Islamic trader community is wider than you think, and people are struggling to find decent accounts even in the most proper brokers. AAAFx clearly knows the deal on how to cater to some of the biggest trading communities online!

This is a pretty good broker. Their website design could be better but they handle the needs of their clients professionally.

Honestly, I gotta disagree with that negative review. I’ve been using this broker for a while now and I’ve had nothing but good experiences. And I’m not the only one – I know plenty of other traders who feel the same way! This broker has some seriously solid features, like their platform which is super easy to use and their customer support team who are always there to help you out. Plus, they’re totally legit and have all the right regulations in place to keep your money safe. And they even have this cool feature where you can copy other traders who know what they’re doing. I think somewhere in this review, it says the broker doesn’t.

I’ve traded with AAAFx for a year and am pleased with their quality services. Their user-friendly trading platform offers an extensive range of financial trading instruments. The tight spreads have boosted my profits.

To sum up, AAAFx offers competitive pricing with tight spreads and fast execution speeds, as well as a variety of ECN account types to choose from. Their exceptional customer support team can always assist and guide when needed. These features make AAAFx an ideal option for traders who want to maximize their profits while minimizing risks in the fast-paced market environment.

usdt deposit \ withdrawal accepted?

Initially I was confused of what account to choose, but I realized that no commission for withdrawing funds is levied, and it doesn’t really matter which one to pick.

All of them are cool.

So far I’ve been trading on a demo account, and I’m going to start real trading soon.

I see that the name of the account has ECN in it. I heard it’s something cool but I don’t know what it is. I read on the internet that it has something to do with the execution of orders. But it is written in unclear words. Can someone tell me in simple words what it means?

I’ve been trading with this broker for about several days and still haven’t examined all the conditions precisely. Everything is because the company possesses lots of interesting features and it’s super challenging to research it inside out.

So, I have a question, have you tried copy trading via ZuluTrade software here?

Yes, who doesn’t? I mean don’t worry lol, you are not late to the party, but we’ve been making some gains here with friends. We still trade our money manually here, but the direct integration to ZuluTrade can make the things truly interesting and lucrative. I have got some good results out of it.

The broker has nothing excessive to be honest. All the features are thought through and appealing for traders. Whether it’s direct NDD execution or the lowest commission on the forex market. It all works well together.

Maybe I would like to see some educational materials for beginners.

Quite an informative review of the broker.I hope that it corresponds to reality. I recently opened a trading account here, so I can’t say that the broker is perfect. But nevertheless I didn’t have any problems yet.

Once you dig deep and do some research before deciding to join this broker as a client, you understand that, they offer prety much everything on the table, and they are not bragging about it! I don’t know whether they are trying to keep a low profile, but more people must hear about this broker and the things they provide.

Minimum deposit equals just $100. Surely, there are those who consider this sum as an excessive one, but believe me, it’s nothing to commence trading especially if you aren’t planning to use leverage. Anyways, the broker cares about those having a restricted budget and it’s commendable.

Moreover, spreads are pretty narrow and it’s appealing.

There is not a single trait that the broker did wrong. It has a presence and regulation globally. It basically means that all the clients of AAAFx can trade safely.

The company provides accounts only with excellent ECN execution, which is great news for scalpers. But not only, execution affects all the aspects of trading, so everybody would make an advantage of it.

Considering the lowest trading costs on the market, this broker is an elite one.

AAAFx started to support the withdrawal of deposits in cryptocurrency?

did they started to support crypto deposit withdrawals?

Excellent trading conditions and high speed of order execution is the formula by which this broker works.

I have been looking at my choices, and what I can do here If I signed up to become a client here. Conditions are appealing, the broker certainly hits the notes for the necessary trust and safety issues, no problem there either. What I am curious about is if they can do something else to have me as a client. Do they offer any sign-up bonus, or first-time deposit bonus or something like that?

I know exactly about the deposit bonus. They double the deposit. This is very cool because the money earned in this case can be withdrawn from the account. That is, the potential income is doubled.

AAAfx is the minimalistic broker. It has all the important aspects that are really crucial for the majority of traders and nothing superfluous.I like this kind of approach cuz I don’t have to wade through the seas of unnecessary information.

It seems to me that the peculiarity of this broker is high reliability. This is my opinion.

is it a good broker? real clients there

I have been using AAAfx for 7 years and appreciate their focus on helping traders participate in the market longer.

aaafx is a standart ecn broker like many others. trading here long time, no problems so far.

From which point?

In fact, all brokers have both downsides and upsides, and there is nothing bad in it.

I’ve changed over 10 brokers for the whole period I’ve been in trading, and this one continues to be my best choice.

I discovered acttrader due to it and by today I have completely forgotten about MetaTrader. The platform works fastly and what is more important it’s innovative and fresh.

I always wondered if i could trade and I decided to open an account at AAAFx.Well everything looks alright for now. I like the amount of tradable assets, trading platfrom is really handy and I have almost mastered it. The support service is very friendly and helpful, I had many questions and they solved them all. By the way, i would like to know if broker provides some educational resources?

Not the educational resources in a usual understanding of it. You can get the benefit for the trading calculator I guess, or Economic calendar. But the main source of trading knowledge I consider is the broker’s demo account.

You know the saying “A picture is worth a thousand words.” It’s exactly the case with AAAFx. You better trade a couple of months on a demo to know all the specifications of this company, rather than spend hundreds of hours reading articles. Practice makes perfect bruv.

Of course, the economic calendar and calculator are necessary, but a demo account is not the major text book for a newbie. Only when trading on a real account, you can learn to trade. Thus, you can learn the market, which is impossible to do on a demo account and you will also learn how to overcome yourself and cope with touch psychological challenges.

none bad I can say about broker, only pros can be mentioned. that’s why want to draw your attention to trading platforms that are presented here.

undoubtedly, MT4 and MT5 are mastodons of the market and many traders wish to choose them. and, actually, it’s not for a reason.

you can hedge, scalp, use EAs, and bunch of other features are proposed for free.

also i should point out acttrader. Only started to use it and seems promising. It’s good to have not only old-fashion MTs 😀

good for fx trading, nice ecn broker

is it safe to trade here?

I’ve been trading with AAAFX Broker for a year now, no problems for now. I am also very happy about their services, which keep getting better every time. Definitely recommend them!

This broker says it does not charge commissions on withdrawals and deposits but when I withdrew via visa I got slightly less than what I withdrew this is because the bank (third party) did charge me.

this broker does not offer good educational material, no peer-to-peer trading, and no spot trading. However, the broker does have good safety features like SSL encryption for the site and negative balance protection which is quite important these days. I cant say I have experienced anything astounding about this broker.

fast order execution but no market insights on the platform. I can trade on the go but without information on the platform it defeats the purpose of trading on the go. I think the broker should do better in this department.

This broker has no commission but high leverage for non-EU clients.

AAAFx offers cheap deposits, withdrawals and great services. They also offer global clients fast trading with a maximum leverage of 1:500, but on their website they only indicated 1:30. I think they should have mentioned it somewhere on their platform. Risks are increasing – be careful when trading here.

Every forex broker has a risk disclaimer on the official website, but the particluar details like leverage can vary depending on regulation and which couttry you are trading from. On top of that you need to do some education beforehand, especially if you want to take trading seriously.

Leverage and margin requirements are one of the most crucial pieces of information that every newbie should learn about right from the start.

Broker reimburses my offsite VPS cost

When I started with this broker, I already had my offsite VPS, and when I informed them the support volunteered to reimburse part of my monthly cost. This is a great move by aaa Forex

Raw spreads and transparency is what I require and receive from AAAFX.

hey, is that broker regulated? crypto withdrawals are accepted or not?

regulated broker, based in Greece. no crypto but better ask support chat

This one is by far the best, they have the best support and withdrawal process is the quickest I have experienced

They have lower spreads on exotic usdzar pairs compared to other brokers.

No fees deposit / withdrawal

Is it allow to trade news here?

Of course

I started trading with them one year back and their services just keep getting better. Happy and satisfied client!

Is it allow to trade news here?

The good broker to trade news. I’ve added fast VPS and now trade a few month

The good broker to trade news. I’ve added fast VPS and now trade a few month. NFP is going without issues (the result depends only of my fortune)

Registration was fast; it took less than 3 minutes. The KYC verification process was also easy. My withdrawals have been smooth. I made two quick withdrawals just to test the speed and cost. It is free and it is also granted on the same day. This is only my second month, and I wish to find a home here

I have been trading many varieties of forex and stocks. The trading conditions seem okay for now. Withdrawals have also been fast so far. Not to jump to a quick conclusion, I will wait for a few more months to see how the service would continue to be

I want to share my impression of trading with AAAFx. It’s been only 6 months but I can tell that they are just good at what they do. Low on cost, solid support and multiple trading platforms. I really recommend it.

Thin spreads, low commissions. A good broker overall.

tight spreads, withdrawals to the card are supported, but as i undestand usdt withdrawals are not accepted for now. overall recommend

tight spreads, withdrawals to the card are supported, but as i undestand usdt withdrawals are not accepted for now. overall recommend

The spread for the EUR/USD pair typically hovers around 0.3 points. When I am scalping, the tight spreads have proven to be an effective tool in assisting me in having better trade entries. The spreads are tight on average, and the commission rate is approximately $2.5 per 100k trade volume