- What is Velocity Trade?

- Velocity Trade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

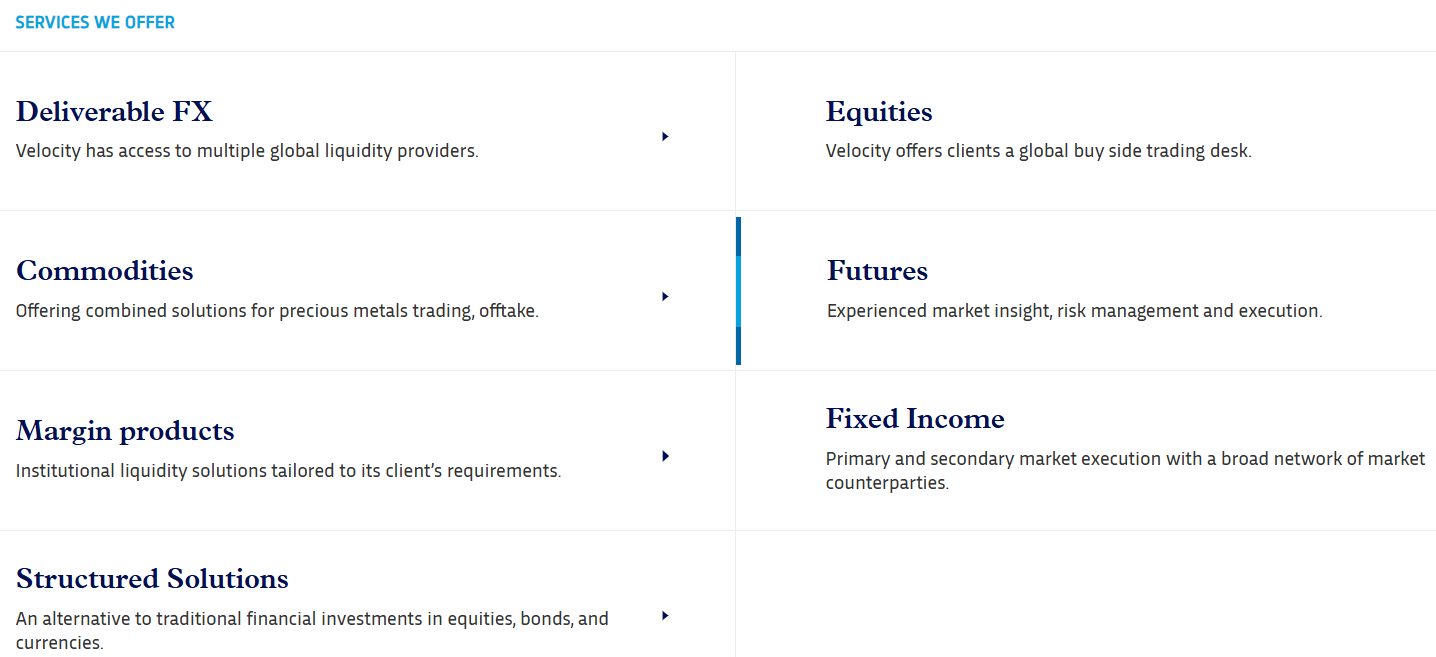

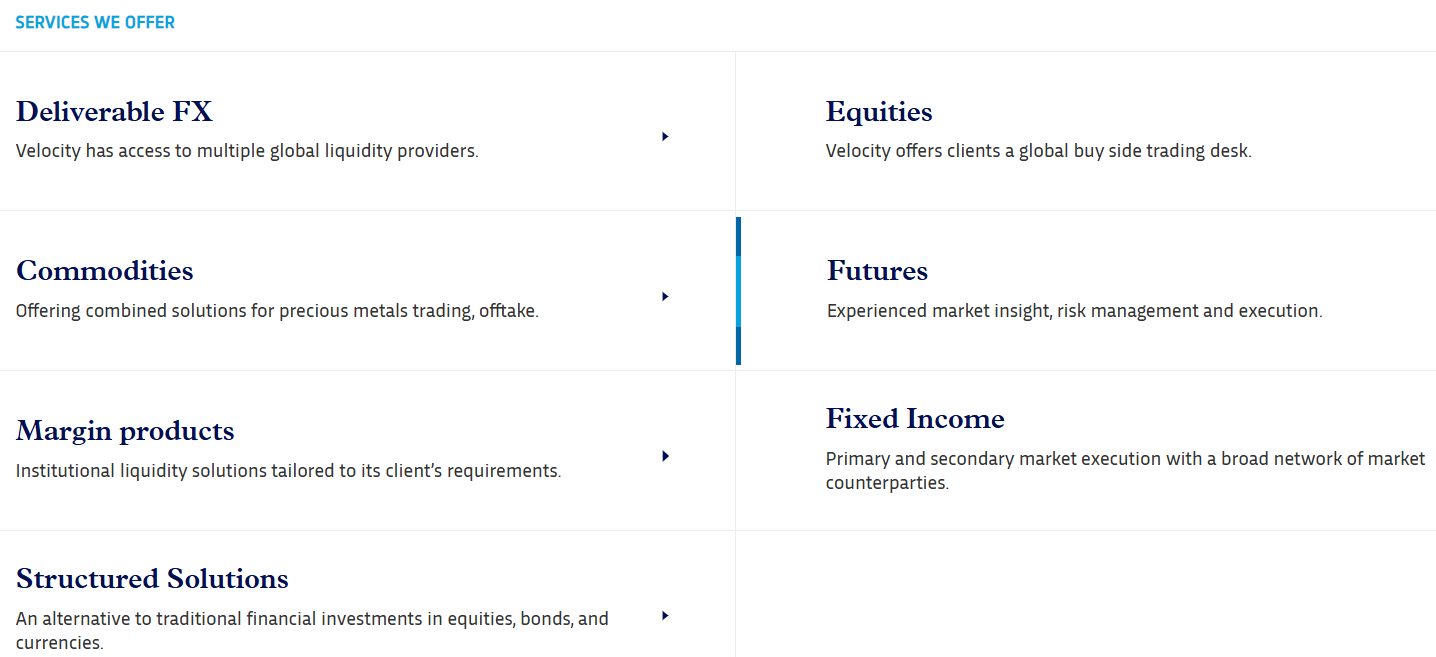

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Velocity Trade Compared to Other Brokers

- Full Review of Broker Velocity Trade

Overall Rating 4.4

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.1 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.3 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Velocity Trade?

Velocity Trade is a global brokerage firm that offers comprehensive brokerage solutions, access to the market, and commission management to corporate clients and delivers its trading environment and opportunity through a range of global entities located in some of the main jurisdictions around the world.

- The broker was established back in 2007, it maintains powerful trading capability and ever since serves as a trusted partner to numerous traders and institutions.

These entities include offerings designed across Australia, Canada, South Africa, Oceania, the UK, Europe, and more, which also may be slightly different due to regulatory requirements.

What Type of Broker is Velocity?

Velocity is a broker-dealer that focuses on a combination of market execution and robust technology offering solutions to institutional clients. The execution model is performed through STP which gives independence to investment through technology and unparalleled performance.

Velocity Trade Pros and Cons

Velocity Trade provides quality conditions and transparent trading due to regulation and DMA access. There are various exchanges available for trading and various assets available to trade, as well as the technology is good.

For the negative points, costs might be higher compared to industry, education is lacking and the instruments are limited to CFD and FX. Spreads are higher than the industry average and there are no demo accounts.

| Advantages | Disadvantages |

|---|

| Multiply Regulated Broker | No demo account |

| Global coverage | No 24/7 support |

| Good Instrument Range | Conditions vary based on jurisdiction |

| Great Conditions | |

| Good Client Protection | |

Velocity Trade Features

Velocity Trade is a global brokerage firm specializing in institutional trading solutions across multiple asset classes. Its platform provides seamless access to global markets with robust risk management tools and personalized solutions. Below is a comprehensive list of its key features:

Velocity Trade Features in 10 Points

| 🏢 Regulation | FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

| 🗺️ Account Types | Standard, Advisory Accounts |

| 🖥 Trading Platforms | V Trader |

| 📉 Trading Instruments | Forex, Equities, Commodities, Futures, Margin Products, Fixed Income, Structured Solutions |

| 💳 Minimum Deposit | $500 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | Analysis and Tools |

| ☎ Customer Support | 24/5 |

Who is Velocity Trade For?

Velocity Trade is designed for institutional clients, professional traders, and corporate investors who require advanced solutions and access to global markets. Based on our findings Velocity Trade is Good for:

- Professional Traders

- Corporate Clients

- Traders from the UK, Europe, and Australia

- Investments

- Currency and CFD Trading

- Hedge Funds and Asset Managers

Velocity Trade Summary

Overall, the company is a reputable brokerage firm. It is not only regulated by a single entity but also in various world-leading financial hubs, which confirms its strong foundation.

It is also clear that Velocity Trade mainly serves institutions and corporations due to its highly developed procedures and specifically designed products. From our perspective, Velocity Trade might be an interesting opportunity for larger-scale traders or those already experienced in Forex. Beginners, however, may want to consider other brokers.

55Brokers Professional Insights

Velocity Trade stands out as a premier brokerage firm suitable mainly for tailored solutions for institutional clients, professional traders, and corporations. What truly sets Velocity Trade apart is its advanced infrastructure, delivering seamless access to global markets and deep liquidity across multiple asset classes, including Forex, equities, and fixed income. Making them most suitable for those purposes and might be not that good fit just for beginning traders, or smaaller size trading.

We mark greatt commitment of personalized, high-level services for larger-scale traders, as Broker truly ensure that clients receive unparalleled market execution and risk management strategies, whichh is a good match for those looking for this type of the solutions. Therefore, making Velocity Traded an ideal choice for those seeking institutional-grade capabilities.

Consider Trading with Velocity Trade If:

| Velocity Trade is an excellent Broker for: | - Need a well-regulated broker.

- UK, European, and international traders.

- Secure environment.

- Providing proprietary platform.

- Offering popular instruments.

- Institutional and professional traders.

- Corporate clients. |

Avoid Trading with Velocity Trade If:

| Velocity Trade might not be the best for: | - Beginner traders.

- Looking for broker with 24/7 customer support.

- Looking for popular platforms.

- Need broker with Copy Trading.

|

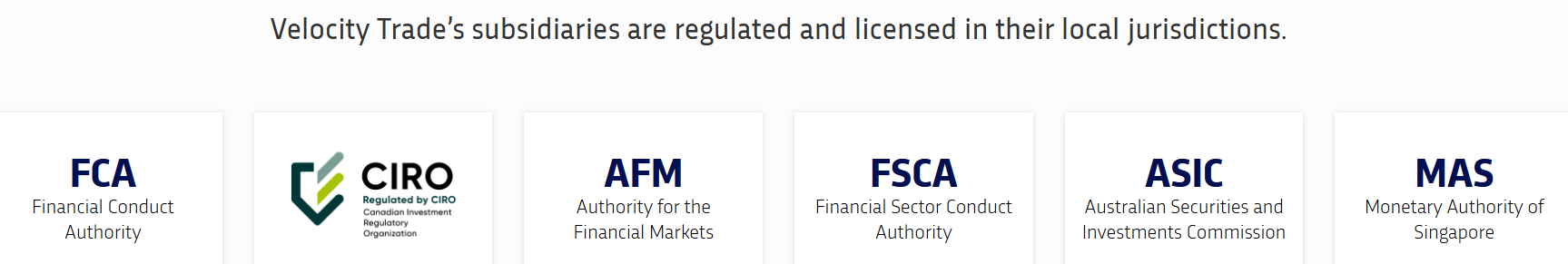

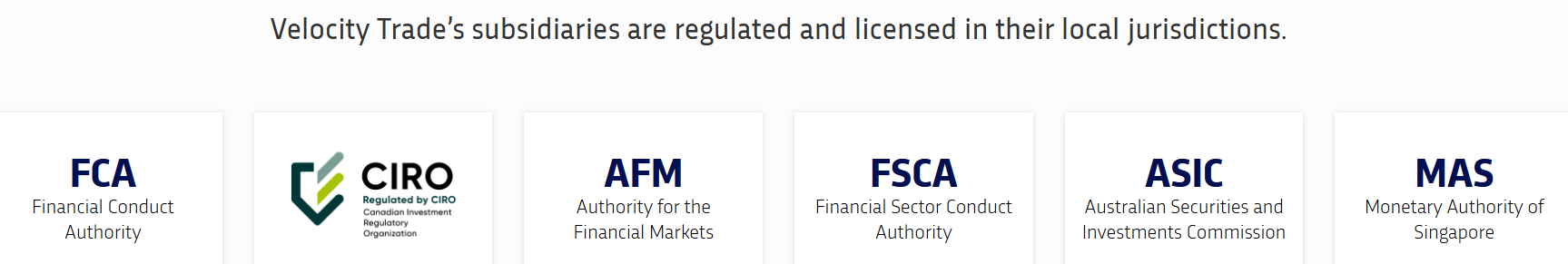

Regulation and Security Measures

Score – 4.7/5

Velocity Trade Regulatory Overview

Velocity Trade is a highly regulated brokerage firm with licenses from several Top-Tier financial authorities across the globe, ensuring a secure and compliant environment for its clients.

The firm is regulated by the FCA in the UK, the FMA in New Zealand, and ASIC in Australia, offering clients in these regions the highest standards of financial security and market integrity.

Additionally, Velocity Trade is governed by the IIROC in Canada, the AFM in the Netherlands, the FSCA in South Africa, and the MAS in Singapore, further solidifying its global presence and commitment to adhering to rigorous regulatory frameworks. These licenses enhance trust and confidence for both institutional and corporate clients seeking reliable and well-regulated services.

How Safe is Trading with Velocity Trade?

Trading with Velocity Trade is considered safe due to its strong regulatory framework across multiple global financial authorities. These regulatory bodies enforce strict standards, ensuring the broker operates with transparency and client protection.

Additionally, the broker employs advanced security protocols to safeguard clients’ funds and personal information, providing a secure environment for institutional and professional traders to execute their strategies with confidence.

Consistency and Clarity

Velocity Trade has built a solid reputation in the trading industry, backed by its robust regulatory framework and a long-standing presence in key financial markets. Traders’ reviews often highlight the broker’s advantages, including deep liquidity, competitive spreads, and advanced technology, while some mention areas for improvement, such as the broker’s focus on larger-scale traders rather than retail clients.

Velocity Trade has also garnered attention for its active participation in the financial community, including sponsorships and partnerships with prominent industry events, further solidifying its standing in the market.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Velocity Trade?

Velocity Trade offers Standard Accounts, which provide access to a broad range of financial instruments and markets with efficient execution. The broker also offers Advisory Accounts, ideal for clients seeking personalized strategies and expert guidance from professionals.

However, Velocity Trade does not provide a demo account, which may limit the opportunity for new traders to practice and familiarize themselves with the platform before trading with real capital. Despite this, the broker’s focus on professional-grade services makes it more suitable for experienced traders and institutional clients.

Standard Account

Velocity Trade offers a Standard Account designed for institutional clients, professional traders, and corporations. This account provides access to a range of financial instruments, including currencies, shares, commodities, and indices. The minimum deposit required to open a Standard Account is $500.

The fee structure is competitive, with commissions varying based on trading volumes and the specific instruments being traded. The Standard Account is ideal for experienced traders seeking a reliable platform with flexible conditions, though it does not offer a demo account for practice.

Advisory Account

The Advisory Account at Velocity Trade is specifically tailored for clients seeking expert guidance and personalized strategies, particularly for trading Futures contracts and Exchange Listed Options on Futures contracts. In an Advisory Account, the client remains responsible for investment decisions but can rely on advice provided by a Registered Representative.

The Registered Representative is responsible for delivering suitable and unbiased investment recommendations, meeting a high standard of care when offering advice. The minimum deposit required for an Advisory Account varies based on the chosen advisory package. Fees are also based on the level of advisory service selected, with additional costs for personalized guidance.

Regions Where Velocity Trade is Restricted

Velocity Trade operates globally, but like many brokers, it faces restrictions in certain regions due to regulatory requirements and legal constraints. The broker does not provide services to residents in countries where it is not authorized or licensed to operate, including:

- USA

- Japan

- Iran

- North Korea

- Syria

Cost Structure and Fees

Score – 4.4/5

Velocity Trade Brokerage Fees

Velocity Trade fees are mainly built into a commission charge. The broker’s spreads are defined by the region you are trading through, as various exchanges may apply slightly different conditions. Velocity Trade also does not charge other non-trading fees, making it a desirable option for clients.

Velocity Trade offers competitive spreads, with an average spread of 1 pip on the EUR/USD pair, making it an attractive choice for professional and institutional traders who require tight pricing for efficient execution. These low spreads allow for better cost control and can enhance trading opportunities, particularly in high-frequency or high-volume environments.

Additionally, the spread may vary depending on the account type, conditions, and market volatility.

- Velocity Trade Commissions

Velocity Trade charges commissions based on the specific account type and instruments. For its standard accounts, the broker offers commission fees typically starting from $3 per side per 100,000 units traded.

However, the exact commission rate can vary depending on the account type, trading volume, and the financial instruments being traded.

- Velocity Trade Rollover / Swaps

Velocity Trade applies rollover or swap fees to positions held overnight, which vary depending on the currency pair, trading instrument, and market conditions.

These fees are charged or credited based on the interest rate differential between the two currencies in the pair being traded. Swap rates can fluctuate daily and are calculated based on market liquidity and prevailing interest rates.

How Competitive Are Velocity Trade Fees?

Velocity Trade’s fees tend to be on the higher side compared to some other brokers in the industry. While the broker provides a robust and professional environment with competitive spreads, the commission rates and overall costs can be more substantial, especially for smaller or retail traders. This may make it less appealing for those seeking low transaction costs.

However, for institutional traders and clients who require specialized services, advanced features, and access to a broad range of financial instruments, the higher fees may be considered reasonable given the value provided.

| Asset/Pair | Velocity Trade Spead | Z.com Forex Spread | Aetos Spread |

|---|

| EUR USD Spread | 1 pip | 1 pip | 1.8 pips |

| Crude Oil WTI Spread | 4 | - | 6 |

| Gold Spread | 40 | - | 36 |

| BTC USD Spread | - | - | 5000 |

Velocity Trade Additional Fees

In addition to the standard fees, Velocity Trade may apply additional charges, including an inactivity fee of R 100.00 on accounts that have been inactive for 90 days or more. If an account shows no trading activity for several months, the broker may charge a fee to cover administrative costs.

Traders should also be aware that other potential fees could include withdrawal charges, depending on the payment method used. Always check with the broker to ensure full awareness of any applicable additional fees.

Trading Platforms and Tools

Score – 4.2/5

Velocity Trade offers its clients access to its proprietary V Trader platform, a powerful and versatile solution designed for professional traders. V Trader provides advanced charting tools, real-time market data, and a customizable interface to meet the needs of experienced traders.

It is known for its fast execution speeds, allowing traders to take advantage of market opportunities without delays.

Trading Platform Comparison to Other Brokers:

| Platforms | Velocity Trade Platforms | Z.com Forex Platforms | Aetos Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Velocity Trade Web Platform

The V Trader platform offered by Velocity Trade is a comprehensive web-based solution designed to meet the needs of professional traders. Accessible directly through a web browser, V Trader provides a seamless and intuitive experience without the need for downloads or installations.

The platform offers advanced charting tools, real-time market data, and customizability, allowing traders to tailor their environment to their specific preferences. V Trader’s powerful execution capabilities and quick order processing make it an ideal choice for those engaging in high-frequency trading or complex strategies.

Main Insights from Testing

Testing the V Trader web platform reveals a robust and user-friendly interface designed for professional traders. Customization options allow traders to tailor the interface to their specific needs, and the platform’s intuitive design ensures that even complex strategies can be executed smoothly.

Overall, V Trader provides a solid web-based solution for traders seeking a reliable and feature-rich experience without the need for additional downloads or installations.

Velocity Trade Desktop MetaTrader 4 Platform

Velocity Trade does not provide the MetaTrader 4 platform for its clients. Unlike many brokers who offer MT4 as a popular option, the broker focuses on providing its proprietary platform, V Trader, along with other institutional-grade tools.

Velocity Trade Desktop MetaTrader 5 Platform

Similarly, Velocity Trade does not offer the MetaTrader 5 platform. While MT5 is known for its expanded features, such as additional timeframes, advanced charting tools, and improved order management, Velocity Trade focuses on providing its proprietary V Trader platform to cater to the needs of experienced traders and institutions.

Velocity Trade MobileTrader App

The V Trader mobile app offers traders the flexibility to manage their trades and monitor the markets on the go. Available for both iOS and Android devices, the app provides access to a wide range of features, including real-time market data, advanced charting tools, and customizable alerts.

With its user-friendly interface, V Trader mobile allows traders to execute orders quickly, manage positions, and stay updated with the latest market movements from anywhere.

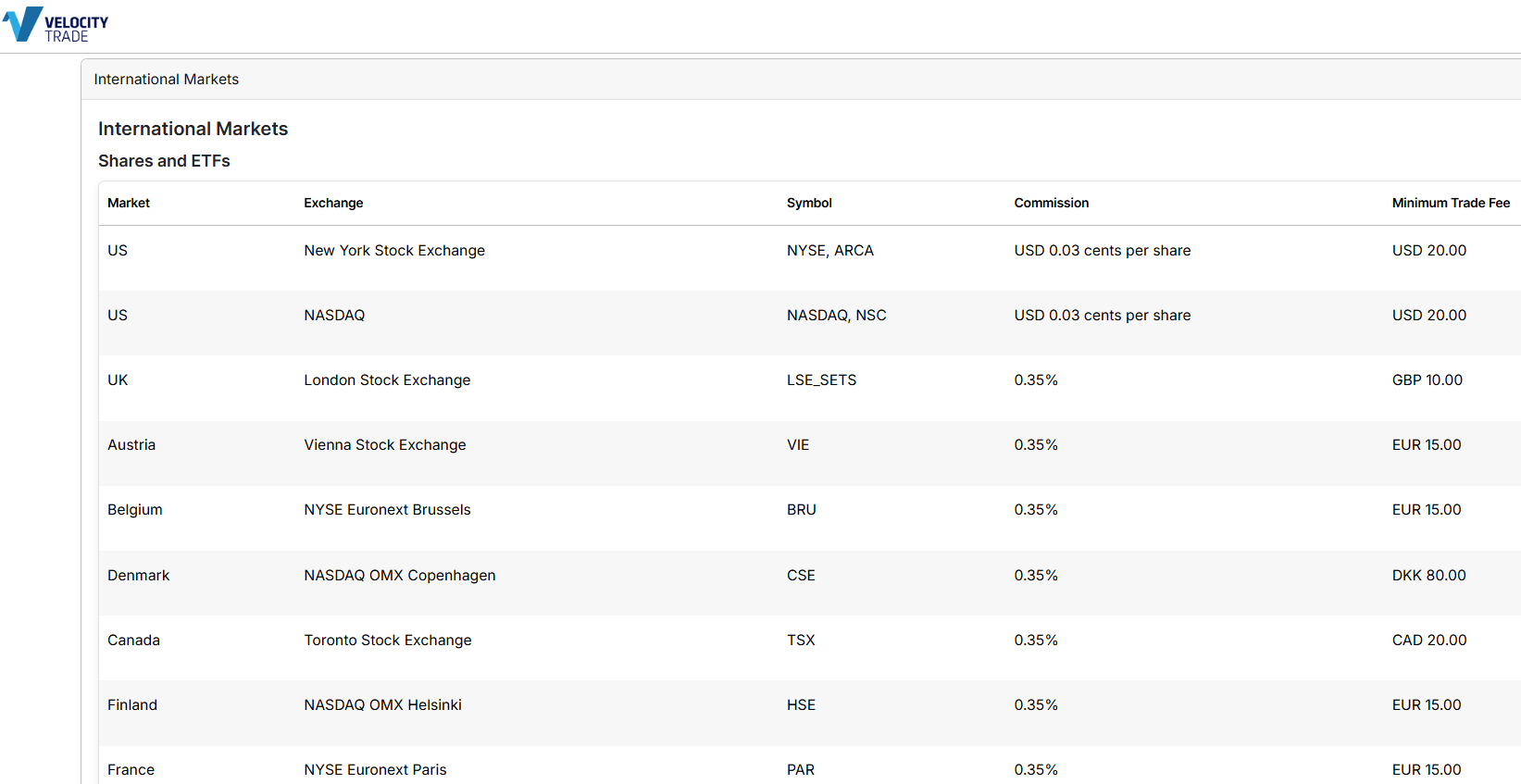

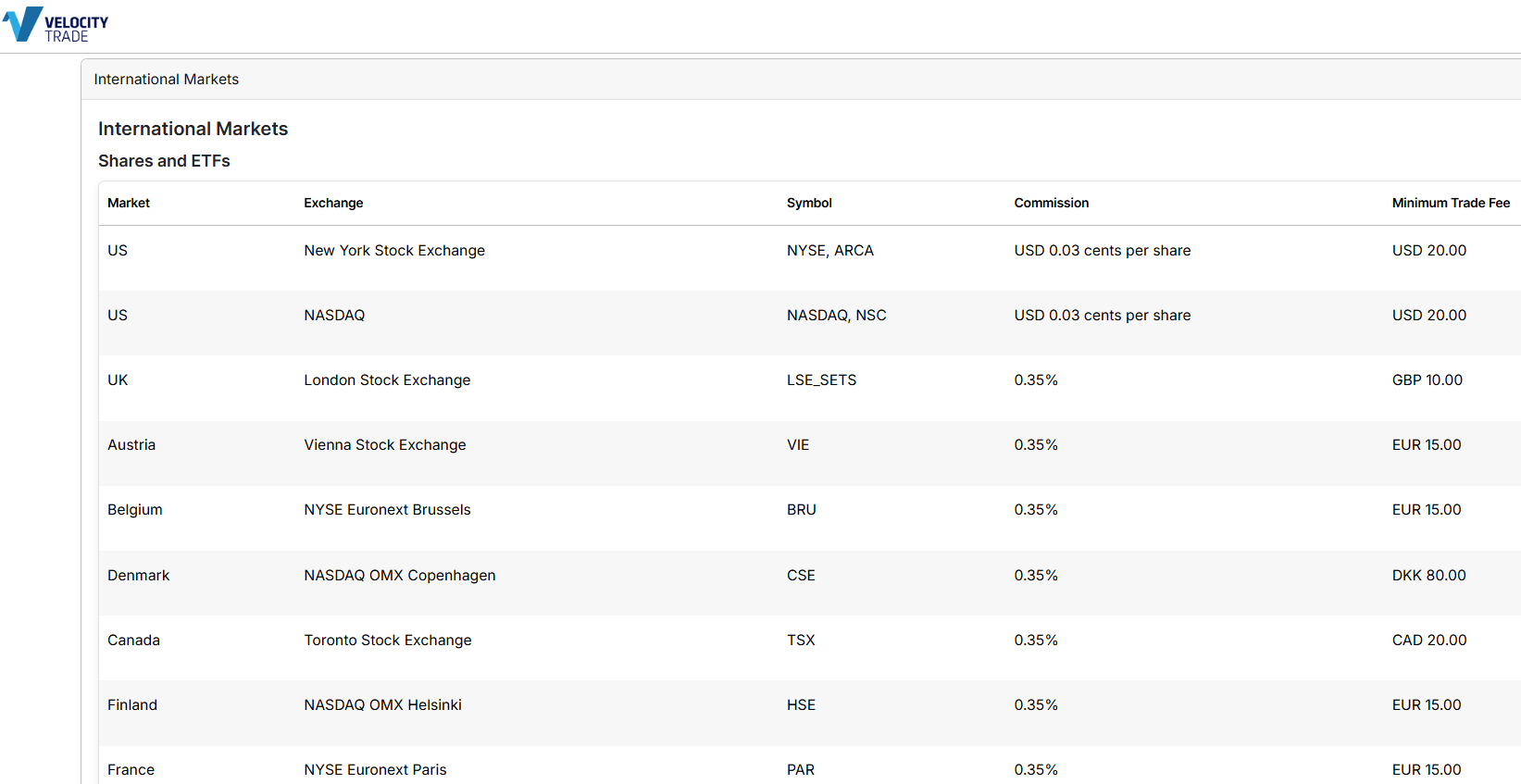

Trading Instruments

Score – 4.4/5

What Can You Trade on Velocity Trade’s Platform?

Velocity Trade’s product range offers over 250 instruments including Forex, Equities, Commodities, Futures, Margin Products, Fixed Income, and Structured Solutions trading through an extensive level of risk management combined with opportunities over traditional models.

Velocity Trade offers trading access to over 40 exchanges, including the US, Australia, Canada, UK, and South African markets which maintain global exposure through the market you desire to trade.

Main Insights from Exploring Velocity Trade’s Tradable Assets

Exploring Velocity Trade’s tradable assets reveals a strong focus on institutional and professional trading, offering a diverse selection across Forex, commodities, and equities.

The broker prioritizes deep liquidity, competitive pricing, and tailored solutions rather than catering to retail traders with an extensive range of assets. While the selection may not be as vast as some retail-focused brokers, the available instruments are designed to meet the sophisticated needs of high-volume and institutional clients, ensuring access to key global markets with professional-grade execution.

Leverage Options at Velocity Trade

Leverage is a useful tool that enables clients to borrow funds from brokers with the aim of capitalizing on their return on investments. However, the multiplier should be taken with caution since it increases the risks.

Velocity Trade leverage levels depend on the entity. Each jurisdiction imposes different restrictions and laws regarding leverage. For more details, you may always contact support or customer service that remains on hand at any step of your trading.

- UK and European traders are eligible to use low leverage up to 1:30 for major currency pairs, 1:20 for minor ones, and 1:10 for Commodities, etc.

- International traders may use high leverage up to 1:100.

Deposit and Withdrawal Options

Score – 4.1/5

Deposit Options at Velocity Trade

Velocity Trade has not specified its available payment options or conditions for deposits. This means that bank wire transfer remains the most common and likely option for funding accounts.

Velocity Trade Minimum Deposit

The minimum deposit required to open a currency trading account with Velocity Trade is $500. This entry requirement is relatively higher compared to many retail brokers, reflecting the firm’s focus on professional and institutional traders.

Withdrawal Options at Velocity Trade

Velocity Withdrawal option is a Bank Transfer, still considered the most used and trusted option. As for fees, the broker does not charge internal fees, but your bank may add on some deposit fees from its side.

Customer Support and Responsiveness

Score – 4.4/5

Testing Velocity Trade’s Customer Support

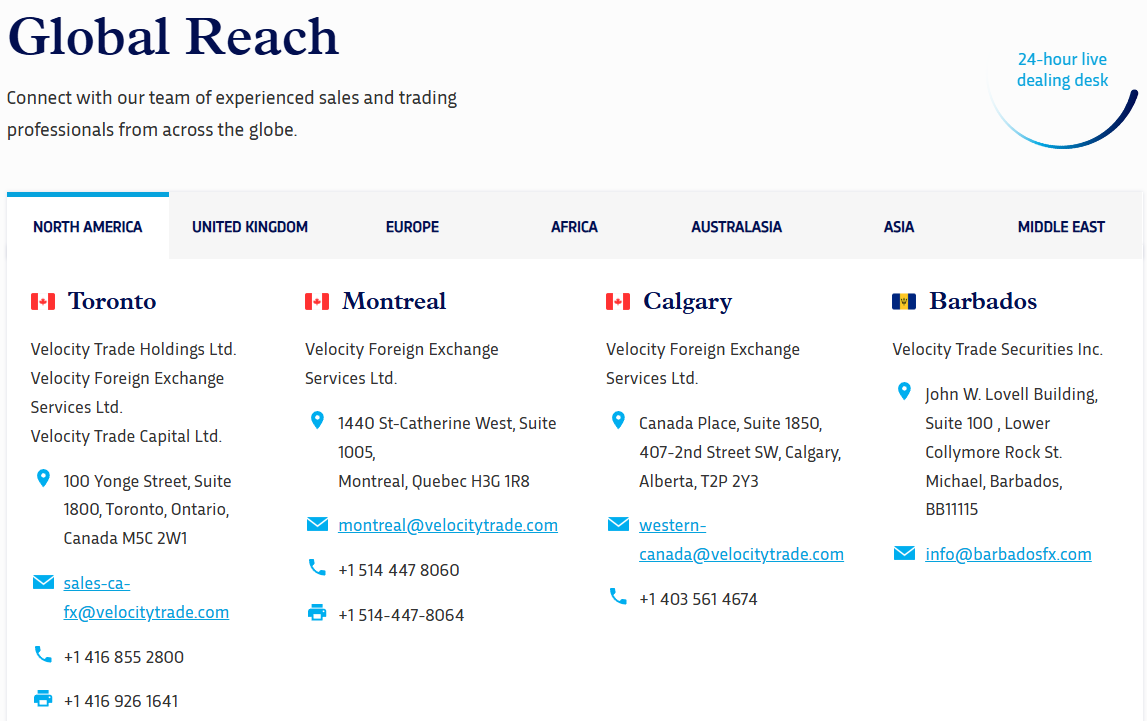

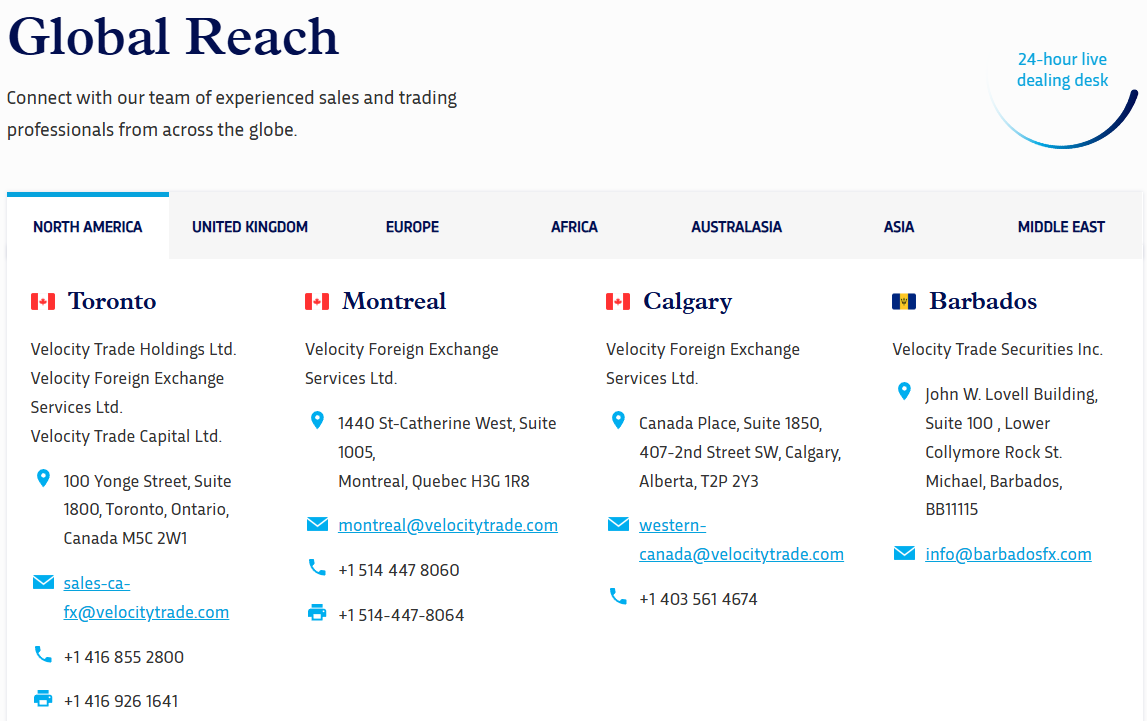

Traders can get in touch with Velocity Trade customer support by selecting the relevant jurisdiction from the homepage which will redirect the trader to the specific jurisdiction’s contact page.

Traders can contact customer support 24/5 via phone, email, or by completing the online request form available on the website.

Contacts Velocity Trade

For direct assistance, traders can call +1 416 855 2800 or send inquiries via email to sales-ca-fx@velocitytrade.com.

Research and Education

Score – 4.3/5

Research Tools Velocity Trade

Velocity Trade offers a suite of research tools designed to support institutional clients in making informed investment decisions.

- Central to these offerings is Velocity Verify, the firm’s proprietary research portal, providing access to comprehensive company valuations and an extensive research coverage archive.

- Additionally, the platform offers original market commentary and differentiated research, particularly focusing on the mining sector, leveraging the firm’s extensive industry contacts across global mining centers.

These resources are integrated seamlessly into Velocity Trade’s platform, ensuring that clients have real-time access to valuable insights and data to inform their strategies.

Education

Velocity Trade’s educational resources are relatively limited, primarily focusing on providing market analysis and tools to support their clients. However, beyond these analytical tools and resources, the broker does not offer a comprehensive educational program, such as tutorials or courses, that are commonly found with other brokers.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options Velocity Trade

Velocity Trade offers a diverse range of investment options, catering primarily to institutional and professional traders. While the broker provides access to the Forex market, it also offers various investment products, including equities, commodities, fixed income securities, and structured financial solutions.

Additionally, Velocity Trade specializes in capital markets services, providing institutional clients with equity research, execution, and advisory services. This broad selection of investment opportunities positions the broker as a versatile financial partner, focusing on tailored solutions rather than standard retail offerings.

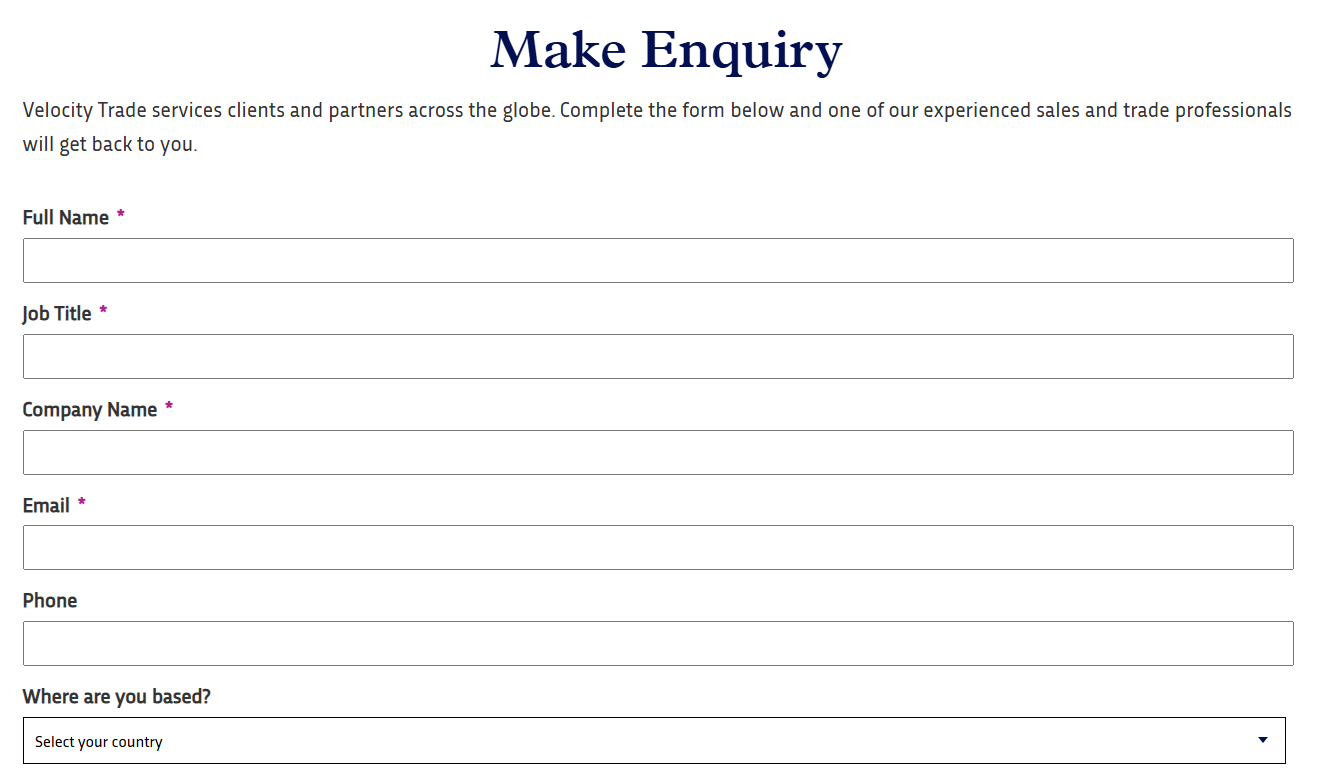

Account Opening

Score – 4.3/5

How to Open Velocity Trade Demo Account?

Velocity Trade does not offer a demo account for practice trading. Clients should open a live account to begin trading with real capital.

How to Open Velocity Trade Live Account?

To open a live account with Velocity Trade, interested traders must complete the online application form on the broker’s website. The process requires submitting personal and financial information, as well as agreeing to the broker’s terms and conditions.

Since Velocity Trade primarily serves institutional clients, the account setup may involve additional documentation for verification purposes. Once the application is processed and approved, traders can fund their account through a bank wire transfer and start trading.

Additional Tools and Features

Score – 4.2/5

Velocity Trade offers API connectivity as one of its key features, enabling clients to integrate custom trading algorithms and automate their strategies.

This tool is particularly useful for institutional traders and professional clients who require high-frequency capabilities and seamless connectivity with the broker’s platform. The API allows for direct access to real-time market data, trade execution, and account management features, providing greater flexibility and efficiency for those looking to enhance their operations.

This integration is part of the broker’s broader suite of advanced tools aimed at delivering a tailored and professional experience.

Velocity Trade Compared to Other Brokers

Velocity Trade stands out as a brokerage focused primarily on serving institutional and professional traders, offering a solid regulatory framework across several global financial authorities. Unlike many of its competitors, who cater to both retail and institutional clients, Velocity Trade’s emphasis is on higher-tier clients, which is reflected in its platform offerings and asset variety.

In terms of platforms, Velocity Trade provides its proprietary V Trader platform, while other brokers on the list offer a wider range of platforms, including well-known names like MT4, MT5, and TradingView. Regarding customer support, Velocity Trade offers consistent availability across the workweek, similar to its competitors. However, when it comes to educational resources, Velocity Trade provides a more limited offering compared to brokers like Saxo Bank or City Index, who provide extensive training and learning materials.

The minimum deposit required at Velocity Trade is also notably higher compared to several other brokers who have a lower or no minimum deposit, making Velocity Trade less accessible for retail traders or beginners. Overall, while Velocity Trade excels in its institutional focus and professional-grade tools, it may not be as suited for retail traders or those seeking comprehensive educational resources.

| Parameter |

Velocity Trade |

Z.com Forex |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1 pip |

Average 1 pip |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

$3 per side per 100,000 units traded |

Not Available |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

V Trader |

Z.com Trader |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

250+ instruments |

50+ currency pairs |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

JFSA, SFC |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Excellent |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$500 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker Velocity Trade

Velocity Trade is a well-established brokerage primarily catering to institutional and professional traders. The broker offers a range of investment options with access to a proprietary platform, V Trader, and API connectivity for algorithmic trading.

While it does not provide a demo account, traders can open a live account with a minimum deposit of $500. The broker charges commissions on trades and offers competitive spreads, particularly in major pairs like EUR/USD. Customer support is available 24/5 via phone and email.

Although educational resources are limited, the focus is on providing sophisticated tools and research for experienced traders. Velocity Trade’s offerings are tailored more to those with a deeper understanding of financial markets, making it ideal for institutional clients and professional traders.

Share this article [addtoany url="https://55brokers.com/velocity-trade-review/" title="Velocity Trade"]

I have been dealing with a Anthony Johnson of 1 Lime Street London Senior Manager at Velocity Trade.

When I requested my account closed and my funds returned I have not received any communication from him or the company!!! smells a bit fishy Can anyone confirm he is genuine!!

this system is a complete scam.

they did not pay my money I deserved.

I have video recordings and system records.

My representative is a swindler named Zuhal.

Bu dolandırıcılara sakın inanmayın paranızı ödemiyorlar.

Dolandırıcıların temsilcisi Türkiye de Zuhal denen bir sürtük.

a scam avoid, once you made a deposit and try to withdraw their IT system all of a sudden experiences “server” problems…

avoid at all costs

Does the company trade Nasdaq?

Is there a demo account ,used in this broker since the platforms don’t show