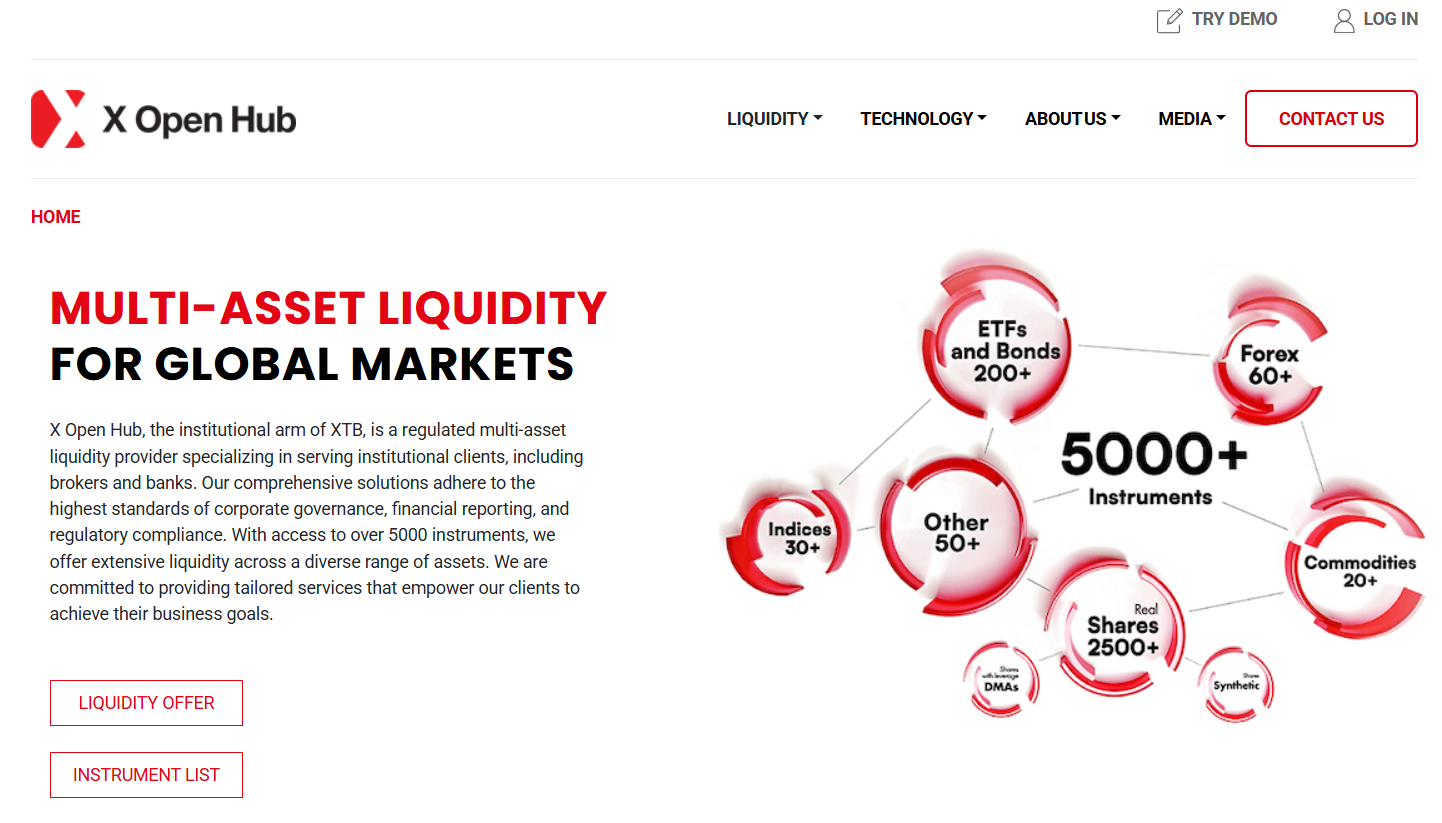

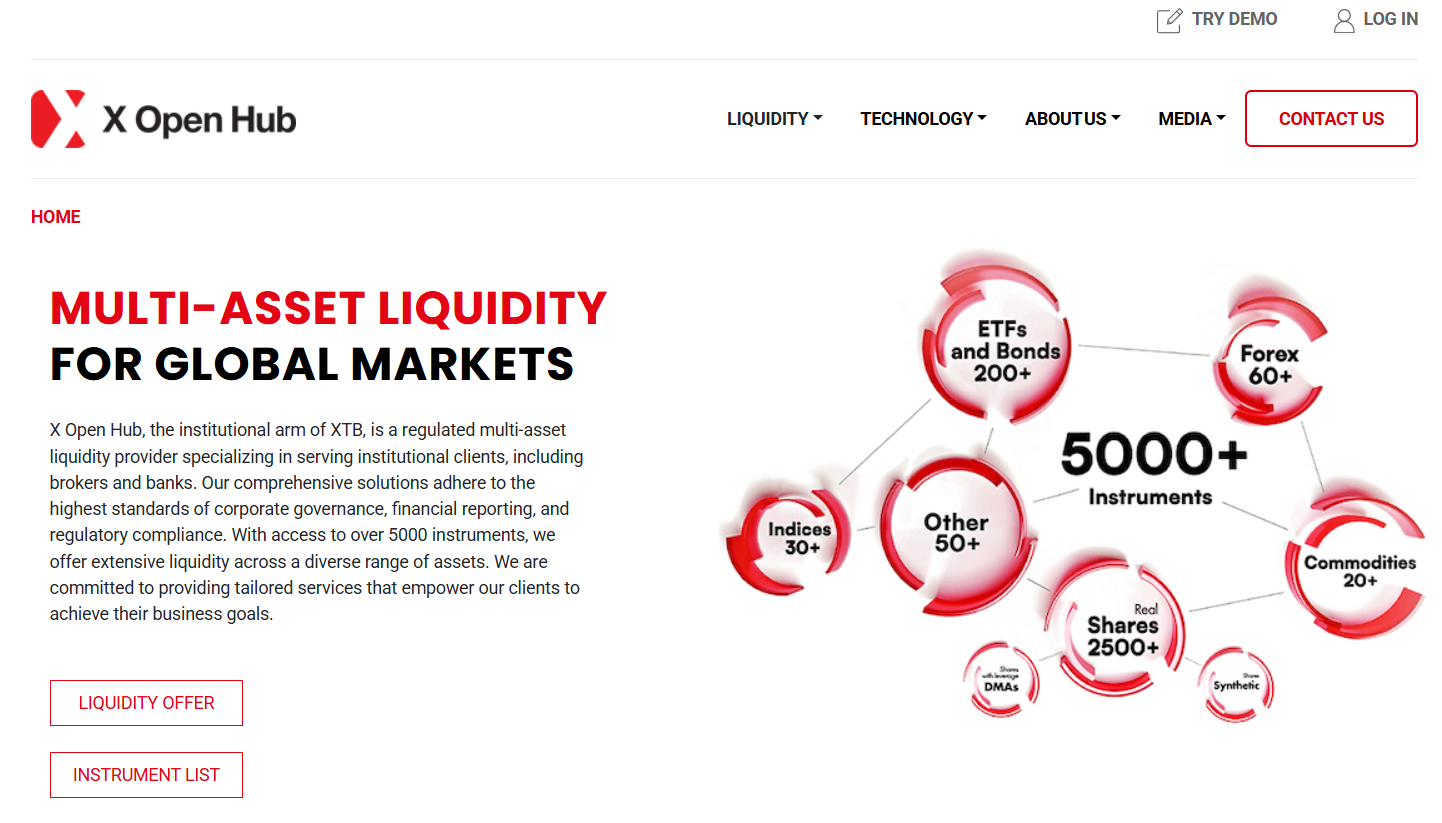

- What is X Open Hub?

- X Open Hub Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

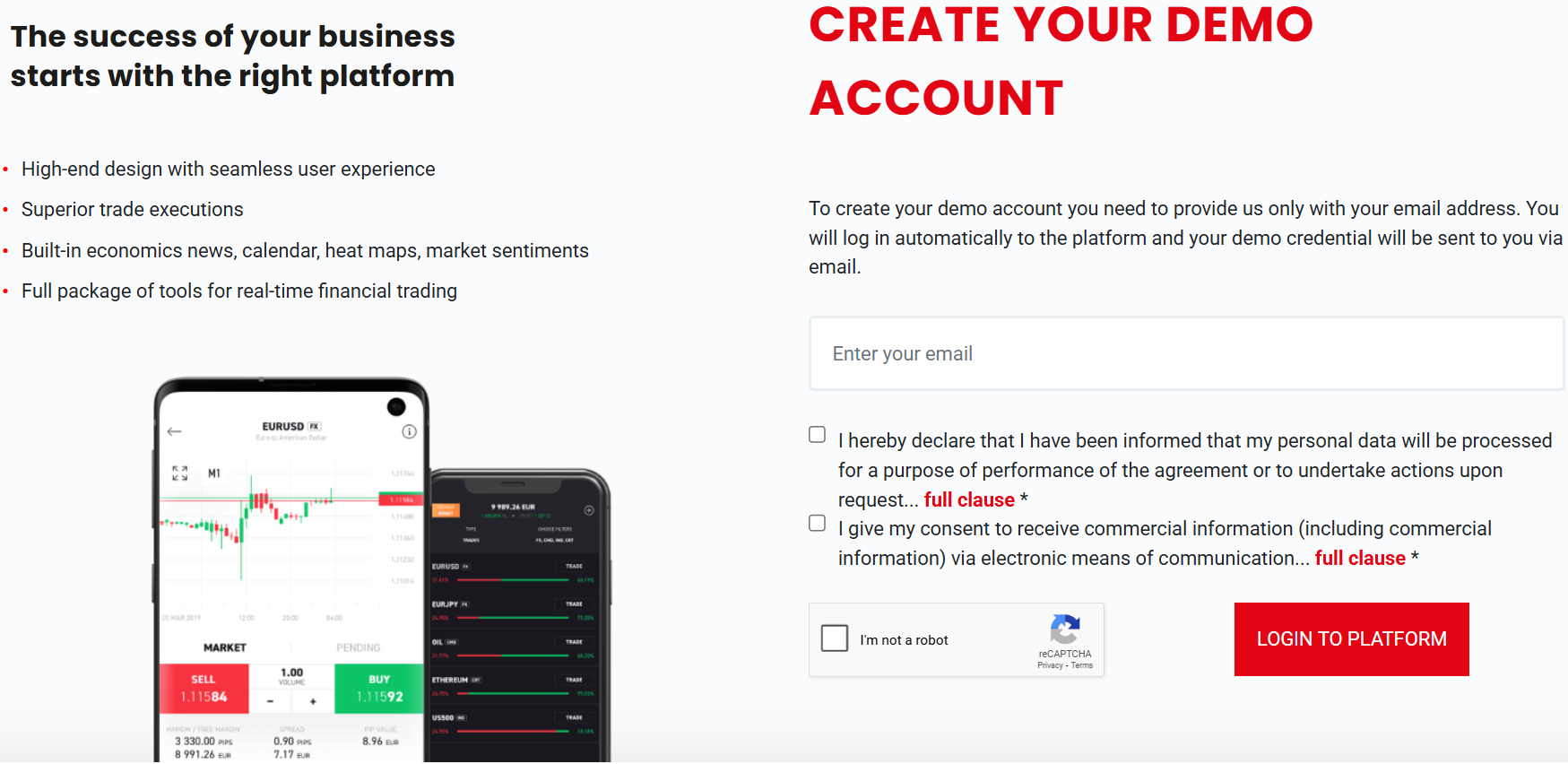

- Account Opening

- Additional Tools And Features

- X Open Hub Compared to Other Brokers

- Full Review of Broker X Open Hub

Overall Rating 4.7

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.7 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.7 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is X Open Hub?

X Open Hub is a multi-asset FX and CFD provider with the core mission of delivering liquidity and trading technology to financial institutions and retail firms worldwide. The X Open Hub is the trading name of XTB Limited, a broker headquartered in London. The operational and technology centers are also based in Warsaw, Poland.

- The company, along with its group activities has proven strives and achievements in many ways, while delivering the ultimate level of solutions to retail or institutional clients and was also awarded numerously.

- To provide tailored liquidity, the broker heavily invested and developed the technology, which delivers low-latency execution with improved pricing and tight spreads.

Indeed, computer technology has changed the way financial assets are traded, thus X Open Hub delivers access to Robust IT Departments in the largest banks and brokerage houses working 24/5 directly connected to stock exchanges, ECN banking systems, and other STP brokers.

X Open Hub Pros and Cons

Our experts find X Open Hub a good broker with a strong background and top-tier regulation for transparency. Its model provides great conditions for institutional, professional traders, banks, and brokerages. The costs and spreads are among the lowest in the industry and there are numerous supported platforms, software, APIs, and trading solutions.

For the negative points, X Open Hub is not designed for regular or small-size traders, is a solely tailored solution.

| Advantages | Disadvantages |

|---|

| Good Reputation | Only Forex and CFDs |

| Great technical solutions, tools, and platforms | No 24/7 support |

| Low Spreads | Conditions vary based on entity |

| FCA regulated | |

| Client Protection | |

| Popular trading instruments | |

| Competitive trading conditions | |

X Open Hub Features

X Open Hub offers a comprehensive suite of solutions for institutional clients, ensuring a secure and efficient environment. The key features are summarized in 10 points, covering aspects like education, account types, and available platforms.

X Open Hub Features in 10 Points

| 🏢 Regulation | FCA, CySEC, KNF, FSCA, DFSA, FSA |

| 🗺️ Account Types | Standard Account |

| 🖥 Trading Platforms | MT4 White Label, XOH Trader |

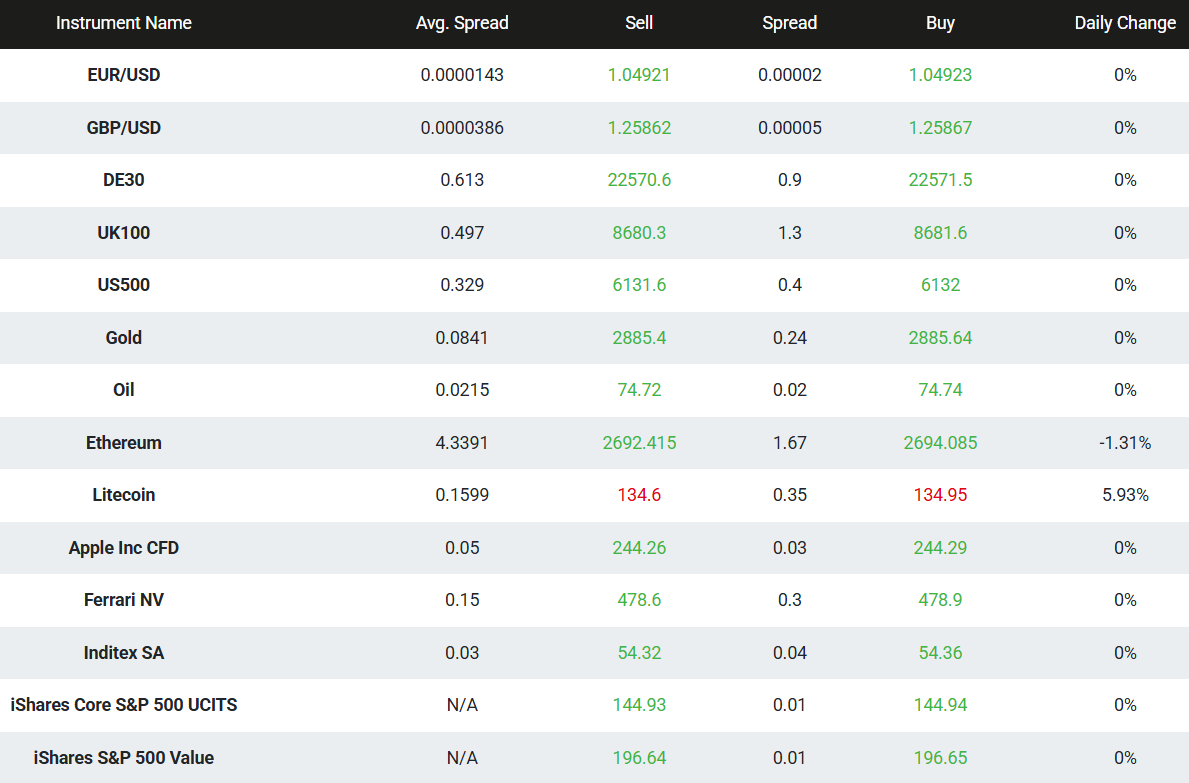

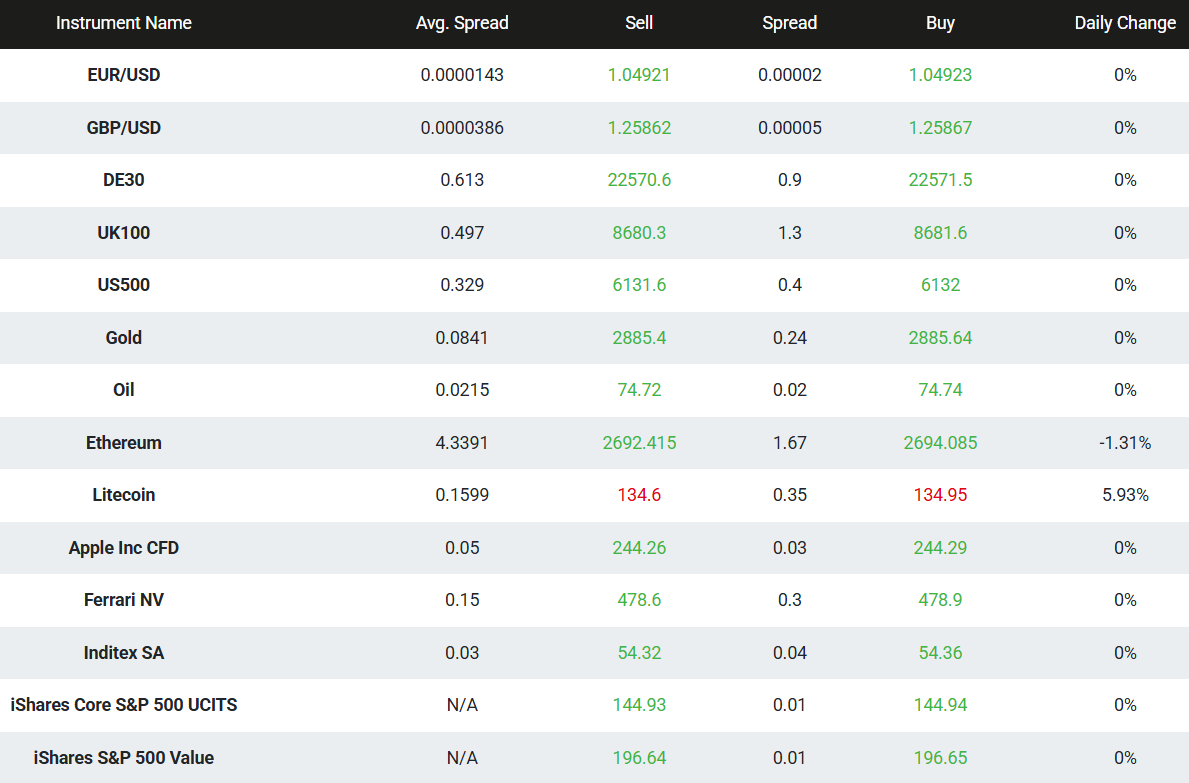

| 📉 Trading Instruments | 5000+ instruments including Forex, Indices, Cryptocurrencies, Commodities, Shares and ETF |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 0.14 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Two Levels of Education for Beginner and Advanced Traders |

| ☎ Customer Support | 24/5 |

Who is X Open Hub For?

X Open Hub provides cutting-edge technology, deep liquidity, and flexible solutions to help businesses enhance their operations. Whether you seek multi-asset trading, risk management tools, or white-label solutions, the broker offers a robust platform to meet institutional needs. Based on our findings X Open Hub is Good for:

- Professional Traders

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer the MT4 platform

- Currency and CFD Trading

- Suitable for a Variety of Strategies

- White-label solutions

X Open Hub Summary

Overall, X Open Hub operates with full compliance according to the FCA regulation and established business offerings. The company provides ultimate technology solutions with access to deep liquidity on multi-assets mainly for institutional clients, start-ups, and brokers.

Among the company proposal’s process is not only the comprehensive features of technology-driven solutions with the NDD model but also one of the leading and competitive pricing models designed for institutions or STP/ECN Brokers that are brought by the selective liquidity providers, which is worth consideration.

55Brokers Professional Insights

X Open Hub is a top-tier institutional provider, offering deep liquidity, advanced technology, and tailored solutions for brokers, banks, and hedge funds. The broker stands out with its fast execution, customizable environment, and access to a wide range of financial instruments, including Forex, indices, commodities, and cryptocurrencies. The company is more suitable for professional traders or those of the bigger size due to its high rankings and great technology it provide. Besides tarding costs are very and very good.

With a strong focus on institutional clients, the broker also has powerful risk management tools and white-label solutions, allowing businesses to scale efficiently. Its proprietary XOH Trader platform further enhances trading operations with seamless integration and cutting-edge analytics, with tools and technical part at greatt level which we enjoy and most of traders will do too.

The only gap, might be thatt Broker can be too complex for beginners, yet still suitable one.

Consider Trading with X Open Hub If:

| X Open Hub is an excellent Broker for: | - Need a well-regulated provider.

- UK and European traders.

- Secure environment.

- Access to popular instruments.

- Institutional clients and financial companies.

- Providing proprietary platform.

- Offering Copy Trading.

- Access to MAM solutions.

- Offering services worldwide.

- Providing competitive conditions.

- Looking for broker with no minimum deposit requirement.

|

Avoid Trading with X Open Hub If:

| X Open Hub might not be the best for: | - Who prefer 24/7 customer service.

- Beginner traders.

- Need broker with access to VPS Hosting.

- Looking for cTrader platform. |

Regulation and Security Measures

Score – 4.7/5

X Open Hub Regulatory Overview

X Open Hub is a fully regulated trading technology provider, operating under multiple financial authorities to ensure transparency and security for its institutional clients. The broker is authorized by reputable regulators, including the FCA in the UK, the Cyprus CySEC, the Polish KNF, the FSCA in South Africa, and the Dubai DFSA.

These regulatory licenses demonstrate X Open Hub’s commitment to compliance, investor protection, and maintaining high operational standards in the global financial markets.

Additionally, one of its international entities is regulated by the FSA in Seychelles, an offshore jurisdiction that provides more operational flexibility but may offer different levels of investor protection compared to top-tier regulators.

How Safe is Trading with X Open Hub?

Trading with X Open Hub is considered safe due to its strong regulatory framework and institutional focus. Client funds are held in segregated accounts, providing an extra layer of security. Additionally, X Open Hub offers advanced risk management tools and institutional-grade liquidity, reducing exposure to market volatility.

Overall, X Open Hub’s regulatory status, risk controls, and focus on institutional clients contribute to a secure environment.

Consistency and Clarity

X Open Hub has built a strong reputation in the institutional trading space, backed by regulatory compliance, advanced technology, and positive client feedback. The broker is recognized for its deep liquidity, fast execution, and institutional-grade solutions, making it a preferred choice for brokers, banks, and hedge funds.

Trader reviews highlight its customizable trading infrastructure and seamless API integration, though some note that it primarily caters to institutional clients rather than retail traders. Over the years, X Open Hub has received industry awards for innovation and excellence in technology, further solidifying its credibility.

Additionally, the broker actively engages in financial industry events, sponsorships, and partnerships, demonstrating its commitment to market development and professional collaboration.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with X Open Hub?

X Open Hub offers a Standard Account tailored for institutional clients, featuring tight spreads, deep liquidity, and ultra-fast execution. The account offers flexibility on markups on the influence charts or swaps, fully customizable settings and client support, reporting tools and no security group limitations along with integrated systems alike IB, MAM, multi-asset, flexible netting, and gross management diversify the front-end offer.

While the broker does not cater to retail traders, it provides a Demo Account, allowing potential clients to explore the platform, test strategies, and evaluate its infrastructure in a risk-free environment.

The Demo Account includes real-time market data and simulates live conditions, making it a valuable tool for firms assessing X Open Hub’s capabilities before committing to a live trading setup.

Standard Account

The Standard Account at X Open Hub offers access to deep liquidity, advanced technology, and a wide range of instruments. The account ensures cost-efficient trading and does not impose a minimum deposit requirement, allowing flexibility for institutional clients based on their specific needs.

Traders can access the platform via XOH Trader, MT4 platform, and API solutions, which provide fast execution, seamless integration, and a fully customizable environment. With over 5,000 tradable assets, including Forex, indices, commodities, and equities, the Standard Account caters to professional traders and financial institutions seeking a high-performance solution.

Regions Where X Open Hub is Restricted

X Open Hub operates in multiple regions globally, however, it has some restrictions based on local regulations. The provider is restricted in countries with stricter financial regulations or where it does not hold the necessary licenses to operate, including:

Cost Structure and Fees

Score – 4.7/5

X Open Hub Brokerage Fees

X Open Hub’s fees are defined by the account type and services used, and built into both spreads and commissions. Since the broker does not cater to retail traders, its fee structure is tailored to high-volume trading and institutional partnerships.

Additionally, there are no deposit fees, but withdrawal fees may apply depending on the payment method. Swap fees are charged for holding positions overnight. Also, X Open Hub may charge a flat inactivity fee after a certain period of account dormancy.

X Open Hub offers competitive floating interbank spreads, designed to meet the specific requirements of each investor or institution. The average EUR/USD spread is 0.14 pips, making it a cost-effective choice for high-volume and institutional traders.

With tight spreads and deep liquidity, X Open Hub ensures efficient trade execution and minimal slippage, even during high market volatility. Additionally, the broker provides advanced pricing tools and customizable solutions, allowing institutions to optimize their conditions based on their specific strategies and needs.

X Open Hub applies a commission-based fee structure, with rates varying depending on the trading volume, asset class, and client agreement. For Currency trading, commissions typically start from $3.50 per lot per side.

Other instruments, such as indices, commodities, and shares, have different commission rates, which are customized based on institutional client needs. Since X Open Hub focuses on high-volume and institutional trading, clients can negotiate personalized commission structures to suit their specific requirements.

- X Open Hub Rollover / Swaps

X Open Hub applies rollover fees for positions held overnight, reflecting the interest rate differential between the traded currency pairs or other financial instruments. These swap rates vary depending on market conditions, liquidity provider rates, and the specific asset being traded.

Traders and institutions can view the applicable swap rates directly on the platform, ensuring transparency in overnight financing costs.

- X Open Hub Additional Fees

In addition to the standard commissions and rollover fees, X Open Hub may charge additional fees depending on specific account types, services, and activities. These include withdrawal fees, which vary based on the chosen payment method, as well as an inactivity fee of €10 per month for accounts that remain dormant for 12 months.

As X Open Hub primarily caters to institutional clients, the broker’s fee structure is flexible and customizable to accommodate the unique needs of each business. For a comprehensive understanding of all potential fees, clients should consult X Open Hub directly for personalized details.

How Competitive Are X Open Hub Fees?

X Open Hub offers competitive fees that are particularly attractive to institutional clients and professional traders. By focusing on high-volume and tailored trading, the broker’s transparent commission structure ensures that clients pay only for what they use, without hidden costs.

The broker’s fees are designed to provide value for money, especially for those trading larger volumes or requiring specific liquidity solutions. Clients benefit from customized pricing models that align with their needs, helping institutions optimize their overall cost efficiency.

| Asset | X Open Hub Spread | Saxo Bank Spread | Swissquote Spread |

|---|

| EUR USD Spread | 0.14 pips | 0.9 pips | 1.7 pips |

| Crude Oil WTI Spread | 0.0214 | 5 | 5 |

| Gold Spread | 0.0841 | 18 USD Cents | 28.6 |

| BTC USD Spread | 52.3983 | 308 USD | 101 |

Trading Platforms and Tools

Score – 4.5/5

X Open Hub offers its proprietary XOH Trader platform, designed to deliver a customizable and user-friendly experience for institutional traders. In addition, X Open Hub provides a white-label solution for MT4, allowing brokers to brand and use the MT4 platform while benefiting from X Open Hub’s liquidity.

For clients who prefer to trade on MT4/MT5, the broker offers liquidity solutions to ensure access to competitive pricing, tight spreads, and fast order execution, providing a seamless experience for those utilizing these popular platforms. With advanced technology and robust liquidity, X Open Hub supports traders in optimizing their strategies across multiple platforms.

Trading Platform Comparison to Other Brokers:

| Platforms | X Open Hub Platforms | Saxo Bank Platforms | Swissquote Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own PLatorms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

X Open Hub Web Platform

The XOH Trader Web platform is an intuitive, browser-based solution that combines ease of use with advanced features. The platform offers an advanced charting system with powerful tools that cater to the needs of professional traders. It includes unique features like templates, overlay charts, personalized chart views, and detached and floated charts.

In addition, the platform provides a live market sentiment indicator, which displays the ratio of long versus short positions of all traders. This tool is invaluable for helping traders make informed decisions about when to enter or exit the market.

For those focused on stock trading, the stocks scanner allows users to search for stocks by industry, country, and share data such as market capitalization, earnings per share, beta, ROIC, dividend yield, and Return on Equity, among other essential performance metrics.

X Open Hub Desktop MetaTrader 4 Platform

X Open Hub offers MT4 white-label solutions that allow brokers to easily launch their own MetaTrader 4 platform with full liquidity and a wide range of available instruments from the extensive liquidity pool.

Brokers can quickly roll out an MT4 white label with a full suite of asset groups, giving their clients an enterprise-level experience from day one. Moreover, X Open Hub ensures fast, fully automatic, and reliable execution within the MT4 environment, supported by Smart B-Book Executors, delivering ultra-low latency and a comprehensive multi-asset feed to enhance conditions for the clients.

X Open Hub Desktop MetaTrader 5 Platform

While X Open Hub does not directly offer the MT5 platform, it provides liquidity solutions for brokers who use MT5, enabling them to access competitive pricing and tight spreads on this popular platform. By offering liquidity for MT5, X Open Hub ensures that brokers and their clients can enjoy fast, reliable execution with a wide range of asset classes.

X Open Hub MobileTrader App

The XOH Mobile App offers traders a fully functional, on-the-go experience. With the mobile app, users have complete access to account management, advanced charting tools, and other essential features required for real-time financial trading.

The mobile platform enables traders to stay up-to-date with market developments, analyze key data, and make informed decisions, all from the convenience of their mobile device.

Main Insights from Testing

Testing the XOH Mobile App reveals a smooth and responsive user interface, offering a seamless experience across both Android and iOS devices. The app features quick order execution, real-time market data, and customizable alerts.

While the app provides essential tools for efficient trading, including portfolio management and trade history, its intuitive layout ensures easy navigation. Overall, it stands out for its accessibility, reliability, and efficient performance, making it a good choice for traders seeking mobility and convenience.

Trading Instruments

Score – 4.7/5

What Can You Trade on X Open Hub’s Platform?

X Open Hub provides access to a diverse range of over 5,000 products, allowing traders to engage in multiple asset classes. The platform offers Forex, Indices, Cryptocurrencies, Commodities, Shares, and ETFs, catering to various strategies and investment preferences.

Whether trading major currency pairs, speculating on global indices, or investing in commodities like gold and oil, X Open Hub ensures deep liquidity and competitive pricing. Additionally, the availability of a broad selection of shares and ETFs enhances portfolio diversification, making it a comprehensive solution for institutions and professional traders.

Main Insights from Exploring X Open Hub’s Tradable Assets

X Open Hub provides a diverse selection of instruments, catering to a broad range of investment preferences. The platform supports both traditional and modern asset classes, allowing traders to access global financial markets efficiently. In the cryptocurrency sector, the platform provides access to popular digital assets, including Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash.

With multi-asset availability, traders can diversify their portfolios across different sectors, reducing risk and increasing opportunities. Additionally, X Open Hub ensures tight spreads and deep liquidity, making it a competitive choice for institutions and professional traders seeking access to a wide range of markets.

Leverage Options at X Open Hub

While trading with X Open Hub, you are also offered the option to use leverage, which can increase your potential gains by multiplying your initial account balance. Particularly multiplier levels depend on some factors, including prof level in trading itself, on the instrument you trade, as well as defined by the regulatory restrictions.

- Since X Open Hub is a UK and FCA-authorized firm it demands a lower leverage level the maximum you may use as a retail trader goes to 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities.

- European clients may also use 1:30 leverage on Forex instruments.

- International entities may be entitled to a higher 1:500.

And of course, always learn how to use leverage correctly, as leverage may increase potential losses together with great opportunities it offers.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at X Open Hub

In terms of funding methods, X Open Hub offers two payment methods to conveniently and securely fund your account:

X Open Hub Minimum Deposit

X Open Hub does not impose a minimum deposit requirement. Deposit amounts are typically determined based on the specific agreements between X Open Hub and its partners.

Since the broker focuses on providing liquidity and solutions to financial institutions, requirements may vary depending on the scope of services and trading volumes.

Withdrawal Options at X Open Hub

X Open Hub provides a few withdrawal options, including bank wire transfers, and other payment solutions, depending on the institutional client’s agreement. While the broker does not charge deposit fees, withdrawal fees may apply based on the selected payment method and the financial institution processing the transaction.

Bank wire transfers are the most common method, but availability may vary depending on the region and partnership terms.

Customer Support and Responsiveness

Score – 4.7/5

Testing X Open Hub’s Customer Support

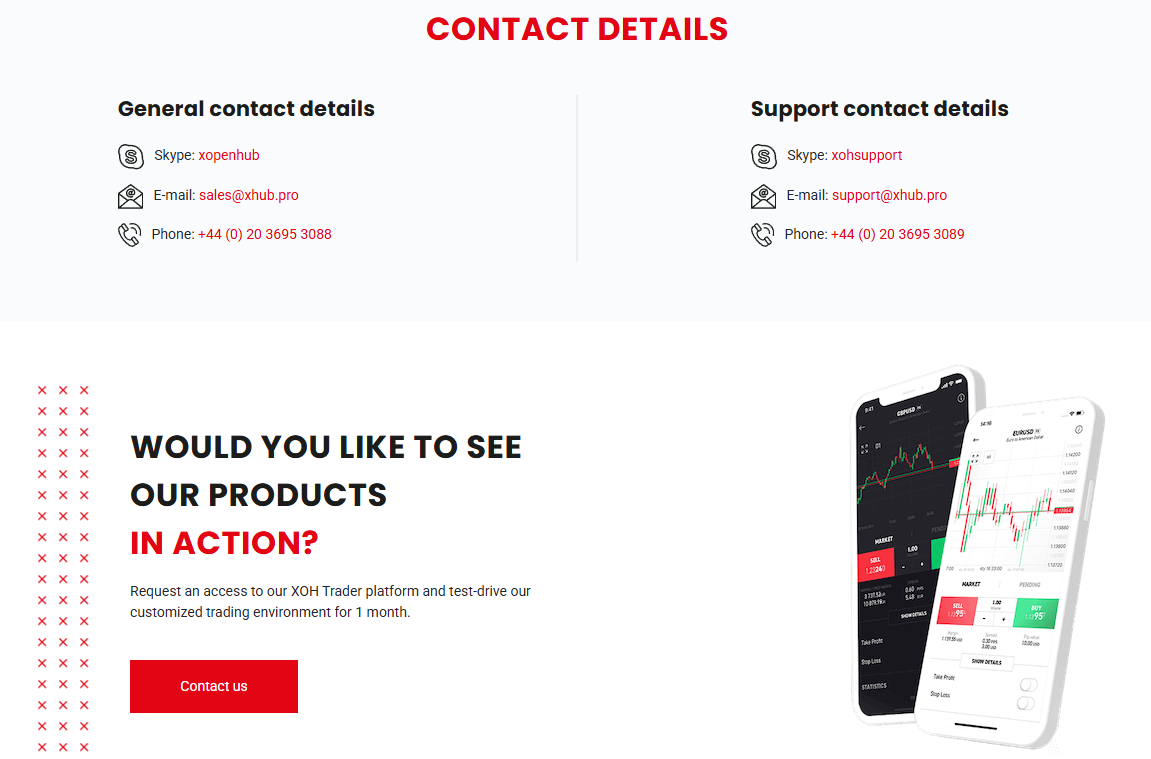

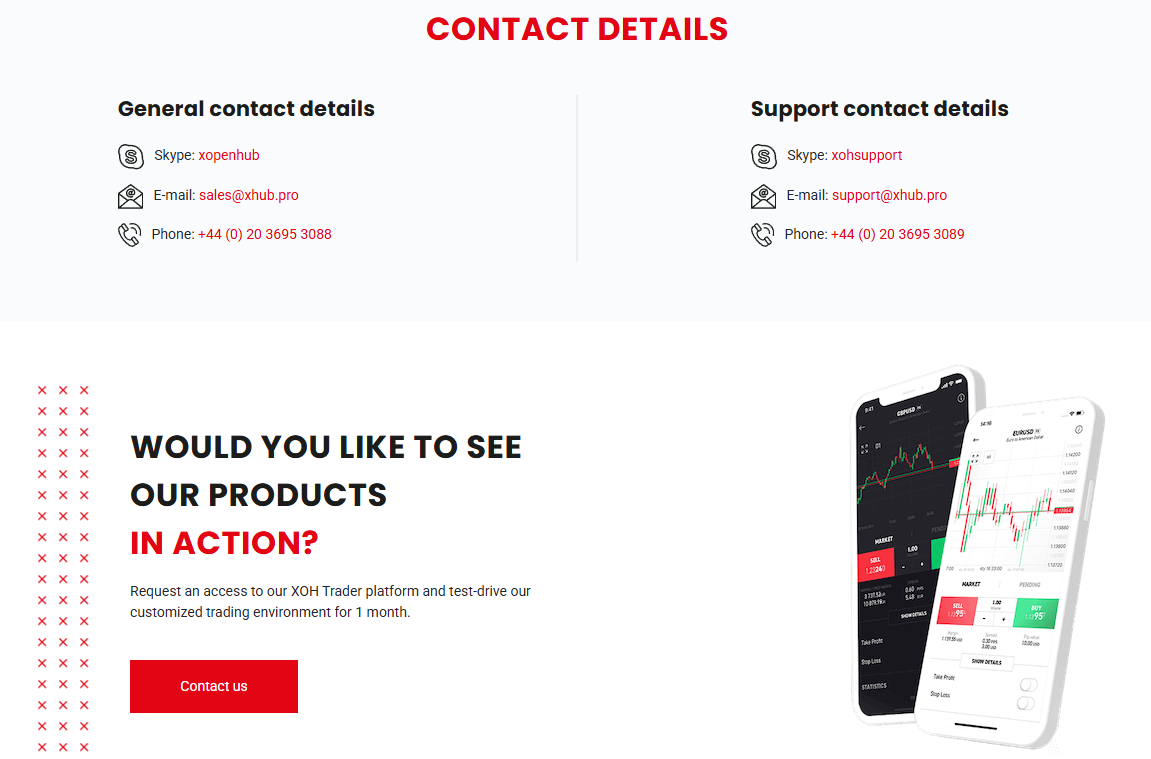

X Open Hub provides professional customer support tailored to institutional clients, ensuring prompt assistance for any technical or operational inquiries. The broker offers multilingual 24/5 support through email, Skype, and phone, allowing clients to reach out conveniently.

Additionally, dedicated account managers are available to provide personalized guidance and solutions. Since X Open Hub primarily serves banks, brokers, and hedge funds, its support team is well-versed in handling complex institutional trading needs, platform integration, and liquidity management.

Contacts X Open Hub

To get in touch with X Open Hub, clients can reach their team via email or phone. For general inquiries, you can contact them at sales@xhub.pro or call +44 (0) 20 3695 3088. For support-related matters, the support team is available at support@xhub.pro or by calling +44 (0) 20 3695 3089. These contact options provide clients with direct access to X Open Hub’s team for any questions or assistance they may need.

Research and Education

Score – 4.4/5

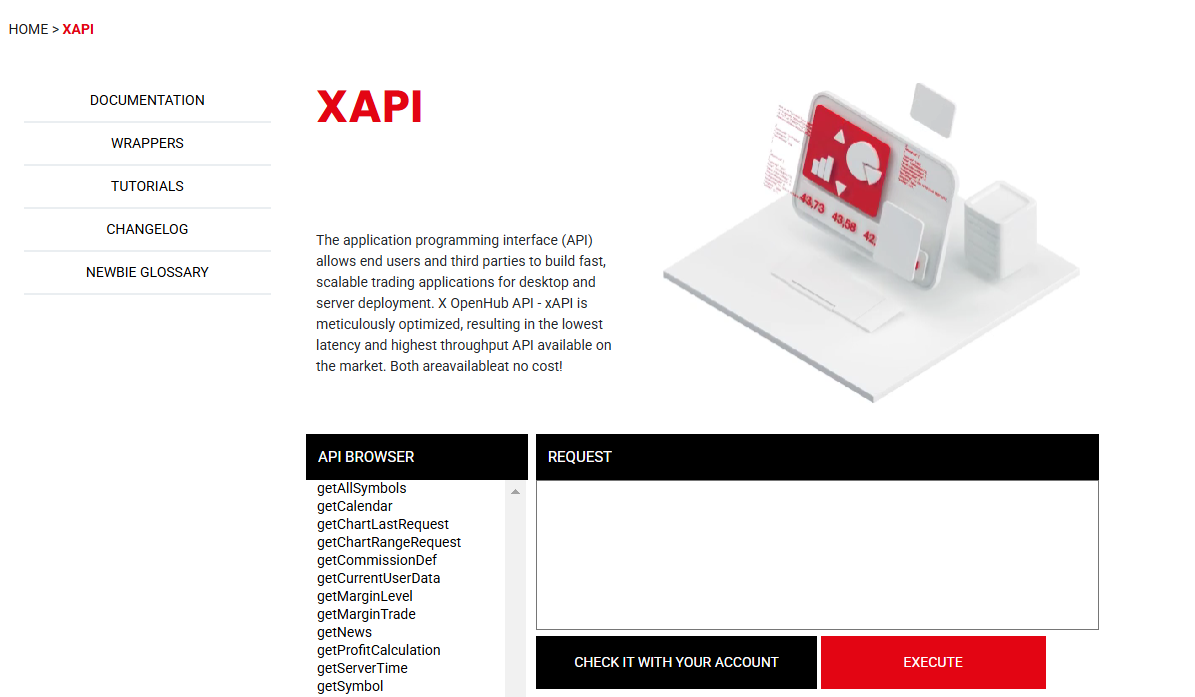

Research Tools X Open Hub

X Open Hub offers a variety of research tools designed to assist traders in making informed decisions, both on its website and platforms.

- On the website, traders can access market news, analysis, and performance reports.

- On the platforms, traders benefit from advanced features such as charting tools, custom indicators, and real-time market data.

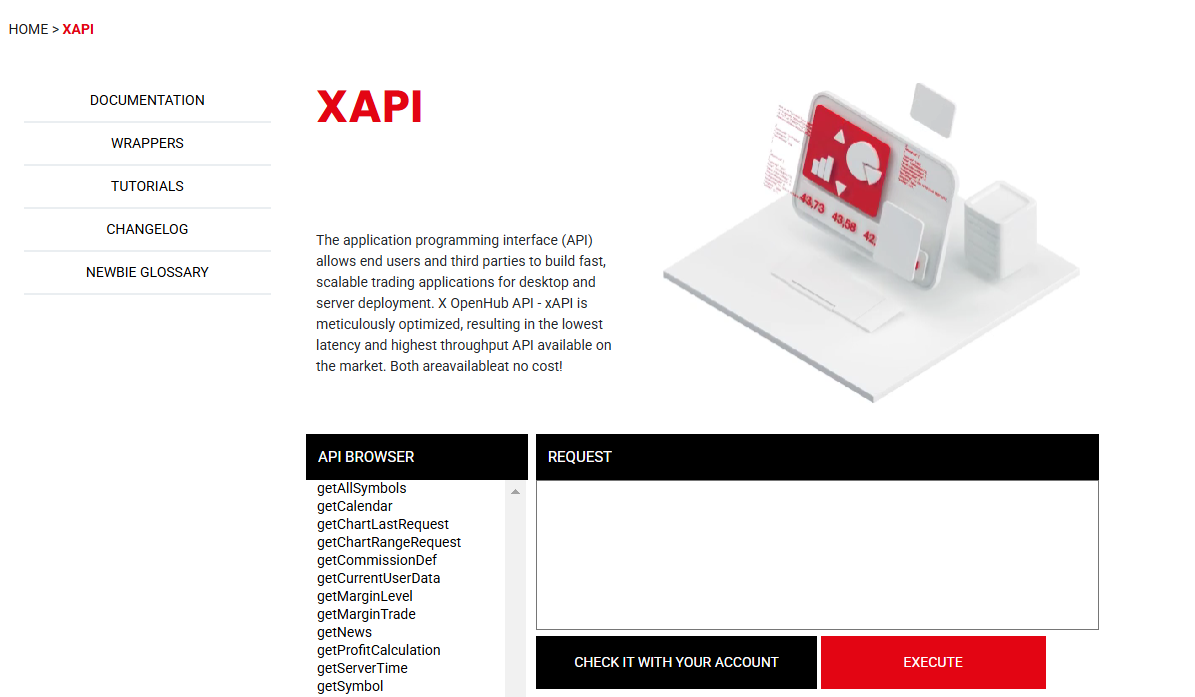

- The broker also offers the xAPI, a powerful tool that allows the integration of trading data with third-party applications, enabling clients to perform custom analysis and research.

- Other tools available on the platforms include market sentiment indicators, stock scanners, and automated features, all of which enhance the experience and provide comprehensive insights into the market.

Education

Additionally, the company offers educational resources to help you better understand the market and the finance industry, which is a significant advantage, as developing skills at each stage of trading is essential.

The educational materials are divided into two levels: one for beginners and one for advanced traders, providing detailed content across various categories to cater to different needs. This structured approach ensures that traders at every experience level have access to relevant resources to enhance their skills and expertise.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options X Open Hub

X Open Hub primarily focuses on Forex trading, offering a wide range of currency pairs. However, it also provides investment solutions like copy trading and MAM solutions to cater to different strategies and investor needs.

In addition, X Open Hub extends its services to institutional clients, offering tailored solutions to meet the specific needs of large-scale traders and institutions. These diverse investment options make X Open Hub a flexible platform for clients looking for comprehensive trading and investment solutions.

Account Opening

Score – 4.7/5

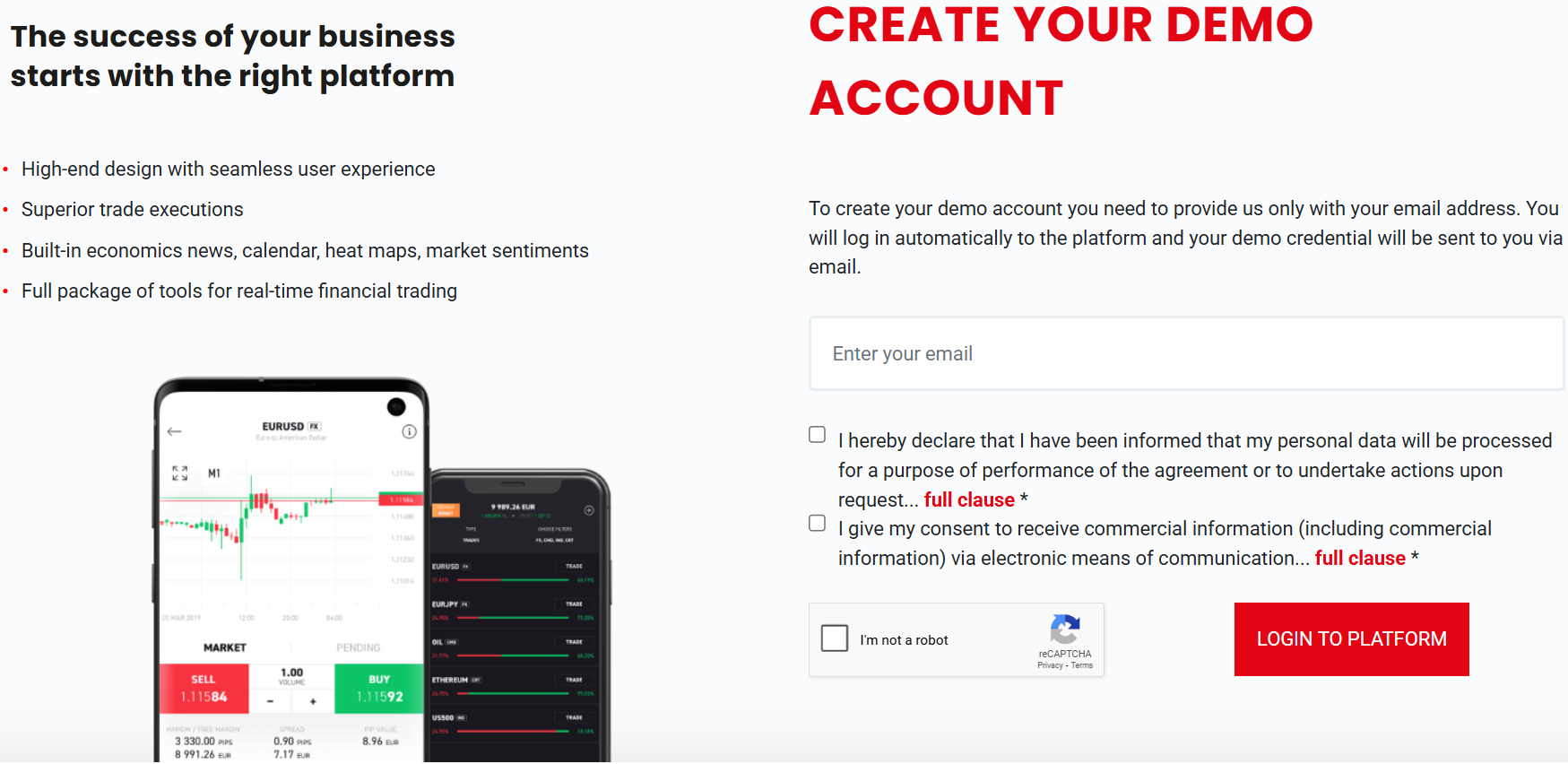

How to Open X Open Hub Demo Account?

To open a demo account with X Open Hub is a simple and quick process. Start by clicking the “Try Demo” button on the website. You will be prompted to provide only your email address.

Once you have submitted your email, you will be automatically logged into the platform, and your demo account credentials will be sent directly to your inbox. This enables you to begin practicing with real-time market conditions in a risk-free environment.

The demo account allows you to familiarize yourself with the platform’s features and tools, helping you build confidence and skills before you move to live trading.

How to Open X Open Hub Live Account?

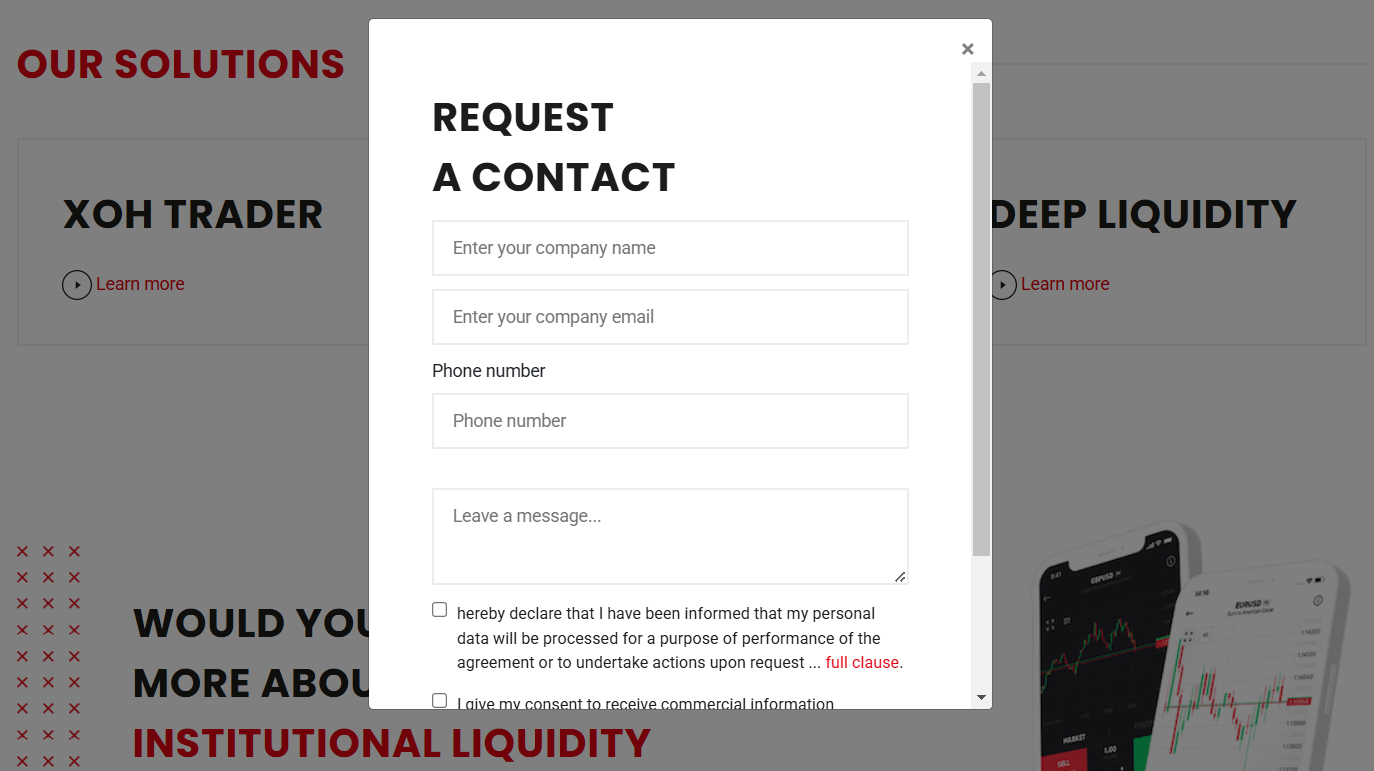

To open a live account with X Open Hub, you need to follow a simple process:

- Start by requesting a contact via the website. You will be prompted to fill out a form with basic details, including your name, email, and phone number.

- After the initial contact, you will need to provide identification documents to verify your identity. This is a standard procedure to ensure compliance with regulatory requirements.

- Once your documentation is reviewed and approved, your live account will be activated.

- You can then proceed to fund your account using one of the available payment methods.

Once your account is set up and funded, you can begin live trading on the platform with access to a range of tools, features, and instruments offered by X Open Hub.

Additional Tools and Features

Score – 4.4/5

X Open Hub offers a few additional tools and features designed to enhance the trading experience for traders.

- These include economic calendars, which provide up-to-date information on global economic events, allowing traders to stay informed on potential market-moving events.

- Additionally, customizable dashboards allow users to tailor their environment, while backtesting features enable users to test strategies before executing them.

- X Open Hub also offers access to ZuluTrade, a social trading platform that enables users to follow successful traders, ranked by ZuluRank, a proprietary performance evaluation algorithm. By following these top traders, users can automatically copy their trades, which are then executed in their broker accounts. The platform includes a customizable account management suite, allowing users to fully manage their accounts with advanced risk management features.

X Open Hub Compared to Other Brokers

X Open Hub stands out in the brokerage industry as a liquidity provider that specializes in catering to institutional clients, offering a range of flexible services suited for high-volume traders and financial institutions.

One of its key advantages is its highly competitive and transparent pricing structure, which includes low spreads and commission rates, especially for institutional clients looking for liquidity and tailored solutions. The platform’s asset variety is vast, offering 5000+ instruments, which positions it similarly to larger brokers.

However, unlike many of its competitors that offer a wide range of platforms, X Open Hub’s primary solutions include MT4 White Label and XOH Trader, which may be more limited for individual retail traders seeking advanced tools. While competitor brokers like Saxo Bank and Swissquote offer a broader range of platforms and a significantly larger asset range, X Open Hub’s focus on providing liquidity and customizable solutions for institutional clients may be seen as both a strength and limitation depending on the type of trader.

Additionally, while the broker offers no minimum deposit requirement and competitive commissions, its focus on the institutional side means retail traders may find fewer tailored options compared to brokers like CMC Markets or Saxo Bank, which provide more user-friendly platforms and educational resources suited to retail traders.

| Parameter |

X Open Hub |

Spreadex |

Saxo Bank |

Dukascopy |

Swissquote |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.14 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 0.28 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

For Forex (commission of $3.50 per lot per side) |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

For Stock and ETF (commission of $3 per trade) |

$5 per $1 million traded in MT4/MT5 Accounts |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4 White Label, XOH Trader |

Spreadex Web Platform, TradingView |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

JForex, MT4, MT5, Binary Trader |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

5000+ instruments |

10,000+ instruments |

71,000+ instruments |

1200+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

FCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FINMA, FCMC, JFSA |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$100 |

$1,000 |

$0 |

$0 |

Full Review of Broker X Open Hub

X Open Hub is a white-label and liquidity solutions provider that caters primarily to institutional clients, offering robust platforms, including MT4 White Label and its proprietary XOH Trader.

It delivers access to over 5000 instruments, including Forex, indices, cryptocurrencies, commodities, stocks, and ETFs, with a strong emphasis on liquidity for high-volume traders. The broker provides competitive pricing with low spreads and commissions, ideal for institutional traders.

In addition to its diverse asset offerings, X Open Hub also offers various advanced tools like market sentiment indicators and stock scanners, helping users make informed decisions. The platform’s mobile and web applications allow for seamless account management, charts, and real-time features. X Open Hub also offers educational resources for traders at different experience levels, although it is more focused on serving institutions.

Share this article [addtoany url="https://55brokers.com/x-open-hub-review/" title="X Open Hub"]

Si può utilizzare PayPal per acquistare criptovalute?

I have opened an account with XOH with 100 dollar. With the accounts manager lovely discussion that if you invest more funds and then you can trade in Gold with huge profit. They will give you assurance that they will take responsibility to get better profits of 50 to 100 dollar profit in a day. Then will inform that your margin level is done, please try to deposit some without wasting your time. So you do not get time to think of it and I have invested 800 dollars. Next day I did not have any fund in my account. These are fraud people, please do not invest with them and lose your hard earned money. This is my personal request.

Can I open an account here in Nigeria, and hope my finances are safe. Tx as I wait for ur reply