- What is Weltrade?

- Weltrade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

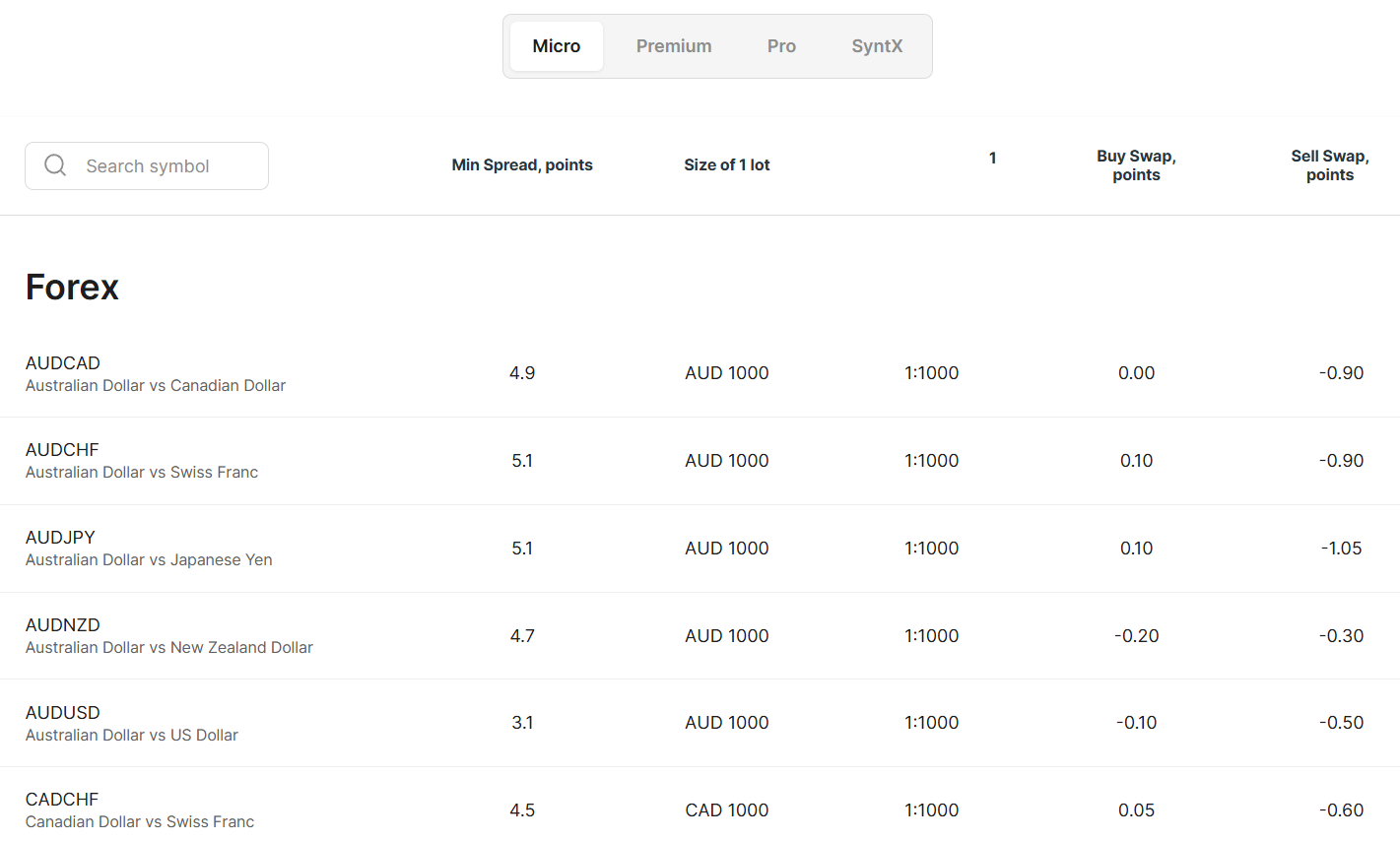

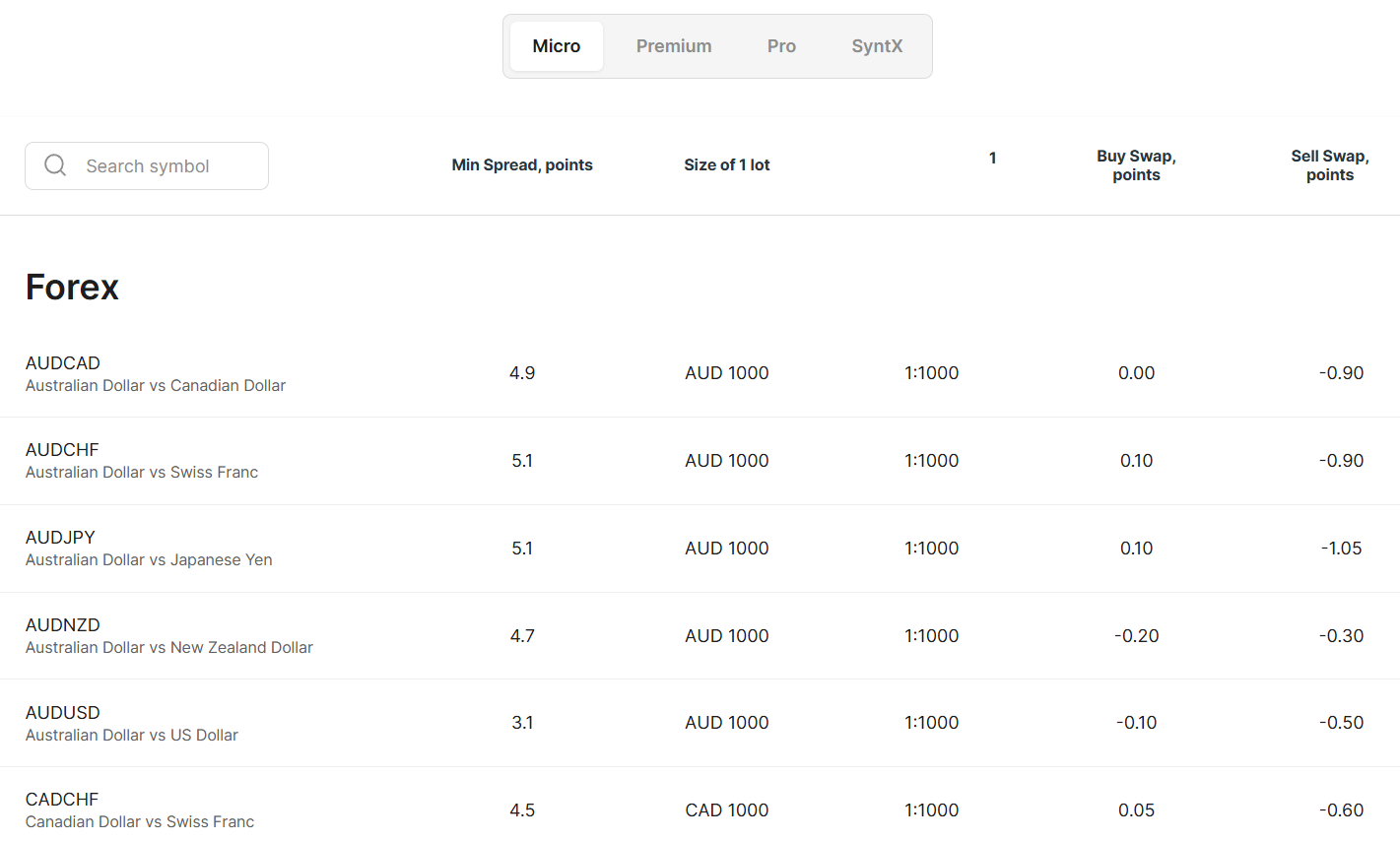

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Weltrade Compared to Other Brokers

- Full Review of Broker Weltrade

Overall Rating 4.5

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Weltrade?

Weltrade is an online Forex trading broker that provides a range of popular trading instruments across various asset classes such as Forex, metals, commodities, index CFDs, stock CFDs, cryptocurrencies, and synthetic indices.

Established in 2006, the company operates under the authorization and regulation of the reputable South African Financial Sector Conduct Authority (FSCA), which ensures compliance with regulatory standards. Besides, the broker is registered and manages subsidiary enterprises in both Saint Lucia and Saint Vincent and the Grenadines, so it offers its services internationally and across the African region, catering to a wider geographical area. It also serves about 60,000 traders around the world in more than 20 regions.

Based on our research, Weltrade is a suitable option for traders at all skill levels as it offers competitive trading conditions, advanced trading platforms, and various funding methods.

Weltrade Pros and Cons

Per our findings, the company has several pros and cons for traders to consider. As an advantage, it provides popular MetaTrader trading platforms, competitive trading services, and a low minimum deposit requirement. Additionally, being a South African broker, it is available to traders from the African region, including countries like Namibia and Tanzania. Additionally, Weltrade offers 24/7 customer support and an extensive selection of educational resources, seminars, and the Weltrade Academy.

For the cons, Weltrade does not hold any top-tier license, yet trading under a South African entity is still considered safe enough. Also, the broker offers a limited variety of trading instruments and markets.

| Advantages | Disadvantages |

|---|

| FSCA regulation and oversee | Limited trading products |

| Low minimum deposit | No top-tier license |

| MT4 and MT5 trading platforms | |

| Variety of funding methods | |

| Suitable for beginners and professionals | |

| Forex education | |

| 24/7 customer support | |

Weltrade Features

Weltrade offers competitive trading solutions that cater to traders of all skill levels. Additionally, users have the chance to engage in the trading of widely recognized financial assets through advanced trading platforms. The key features are summarized in 10 points, covering aspects like Trading Education, Account Types, available Trading Platforms, and more.

Weltrade Features in 10 Points

| 🏢 Regulation | FSCA, FSA, the laws of Saint Lucia |

| 🗺️ Account Types | Micro, Pro, Premium, SyntX |

| 🖥 Trading Platforms | MT4, MT5, TradingView |

| 📉 Trading Instruments | Forex, metals, commodities, index CFDs, Stock CFDs, cryptocurrencies, synthetic indices |

| 💳 Minimum Deposit | $1 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR |

| 📚 Trading Education | Webinars, Seminars, Blog |

| ☎ Customer Support | 24/7 |

Who is Weltrade For?

Weltrade caters to a diverse range of traders by offering various account types and features tailored to different experience levels and trading strategies. Based on our findings and Financial Expert Opinions, Weltrade is Good for:

- Traders from South Africa and the African Region

- Traders who prefer the MT4 and MT5 trading platforms

- Currency trading

- Beginners

- Advanced traders

- Islamic traders

- International trading

- Swap-free trading

- Low fees

- STP execution

- Good trading tools

- 24/7 customer support

Weltrade Summary

In conclusion, Weltrade is a quite good online Forex trading broker that offers competitive trading solutions, advanced trading platforms, and low fees and spreads. Additionally, the broker offers webinars, seminars, and research resources to support traders in expanding their knowledge and staying informed about the market, as well as 24/7 customer support. Another advantage is the low minimum deposit requirement and the availability of different payment methods.

While the broker provides a good trading environment, we recommend carefully reviewing the broker’s offerings, terms, and conditions and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

What we mark at Weltrade is combination of a client-centric approach with advanced technology and a focus on personalized service. Apart of 24/7 multilingual customer support, the broker offers ultra-fast trade execution and competitive trading conditions across various account types, allowing to customize trading conditions.

Another benefit is mainstay on the industry-known MetaTrader 4 and MetaTrader 5 trading platforms, as well as an integration with TradingView, allowing traders to benefit from advanced charting tools, real-time data, and a user-friendly trading experience. As for the trading costs, we find them mainly in line with industry average, yet all are spreaad based accounts, so if you look for trading fees baased on commission charges might you better opt to another Forex Broker.

Consider Trading with Weltrade If:

| Weltrade is an excellent Broker for: | - Looking for broker with low minimum deposit requirement.

- Get access to MT4, and MT5 trading platforms.

- Looking for reputable firm.

- Providing competitive trading conditions.

- Looking for broker with copy trading features.

- Need broker with fast execution.

- Offering a variety of account types.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:10000.

- Need a broker with good education and research tools.

- Providing floating spreads.

- Various strategies allowed.

- Secure trading environment.

- International and the African Region traders.

- Need a broker with 24/7 customer support. |

Avoid Trading with Weltrade If:

| Weltrade might not be the best for: | - Looking for diverse asset classes.

- Need a broker with a Top-Tier license.

- Who prefer to trade with cTrader.

- Prefer MAM or PAMM accounts.

- Need broker with access to VPS Hosting. |

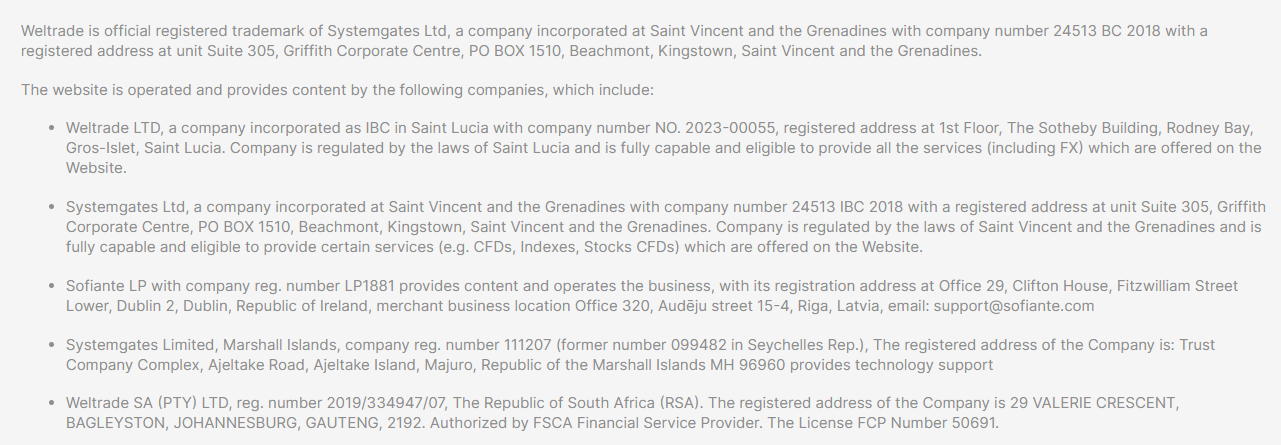

Regulation and Security Measures

Score – 4.3/5

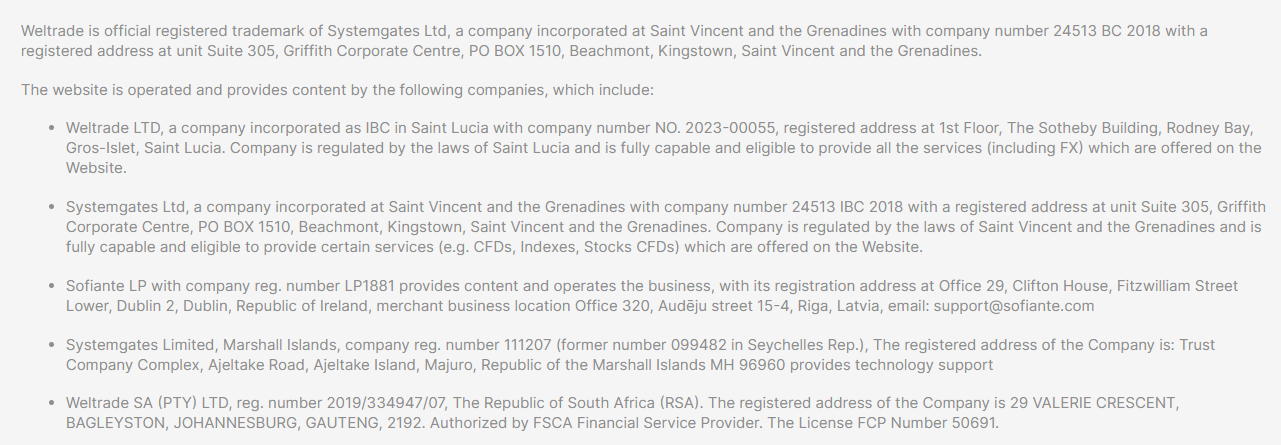

Weltrade Regulatory Overview

Weltrade operates as a regulated brokerage company under the oversight of the South African FSCA. This regulatory authorization suggests that the company operates within the legal framework and is subject to certain industry standards.

Additionally, the broker is registered with the FSA of Saint Vincent and the Grenadines and operates under the laws of Saint Lucia, however, both of these jurisdictions are offshore.

While offshore regulation allows for more flexible trading conditions and higher leverage, it typically comes with fewer investor protections compared to stricter regulatory bodies.

How Safe is Trading with Weltrade?

FSCA plays an important role in ensuring regulatory compliance in the financial services industry. As part of its oversight, the regulatory body requires brokers to keep client funds separate from their accounts, protecting clients, as their funds cannot be used for the broker’s operational purposes.

Additionally, Weltrade provides negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

Yet, the firm is not authorized by a top-tier regulatory body, and its international trading operations are regulated by offshore entities, which offer lower levels of protection compared to top-tier authorities. However, it is still considered a safe option for traders in South Africa.

Consistency and Clarity

Weltrade has been in operation since 2006, which demonstrates a certain level of establishment and continuity in the industry. Over the years, it has built a generally positive reputation among traders, with many praising its fast execution, multilingual customer support, and user-friendly platforms.

However, some reviews also highlight drawbacks such as limited regulatory oversight outside of South Africa and a lack of top-tier licenses. The broker has received various industry awards and maintains a strong presence in social activities, including sponsorships and educational events, which contribute to its visibility and credibility in the trading community.

However, traders should still assess their individual needs, preferences, and risk tolerance to determine whether this broker is the right fit for them.

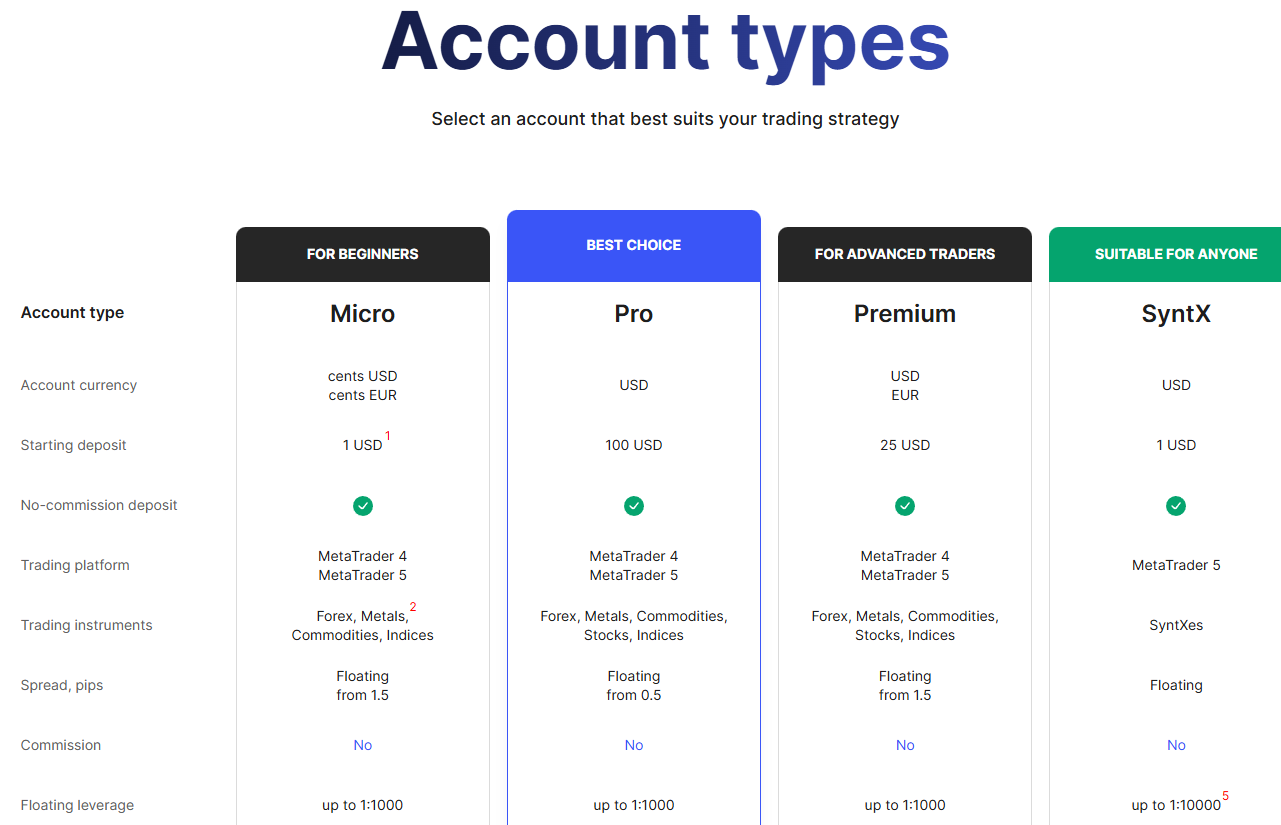

Account Types and Benefits

Score – 4.5/5

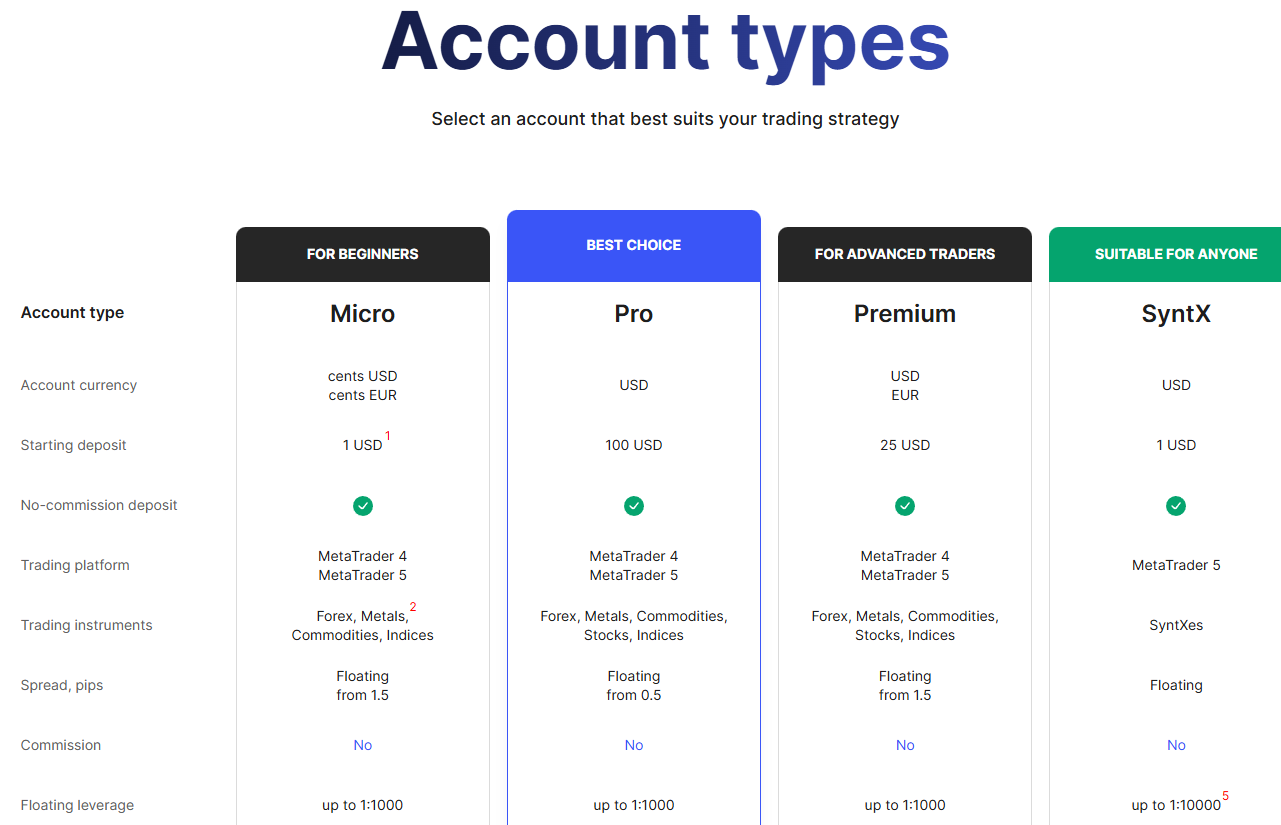

Which Account Types Are Available with Weltrade?

Traders can choose among Micro, Pro, Premium, and SyntX Account types while trading at Weltrade. The initial deposit required for a Micro Account is $1.

Additionally, the broker provides a Demo Account, allowing new and experienced traders to practice strategies in a risk-free environment. Also, swap-free trading is available to the broker’s clients.

Micro Account

The Micro Account is tailored for beginner traders, with a minimum deposit of just $1. It operates in USD cents or EUR cents, allowing micro-lot trading.

Spreads range from 1.5 pips, and there are no commissions. The account is compatible with MetaTrader 4 and MetaTrader 5, making it ideal for those starting in a real trading environment with minimal risk.

Pro Account

The Pro Account is suited for intermediate traders seeking broader market access and improved trading conditions. It requires a minimum deposit of $100 and offers floating spreads starting from just 0.5 pips, with no trading commissions.

Leverage is available up to 1:1000, giving traders more flexibility to increase their trading positions.

Premium Account

The Premium Account is designed for experienced traders who demand faster execution. A minimum deposit of $25 provides floating spreads from 1.5 pips and zero commissions.

The account is available on both MetaTrader 4 and MetaTrader 5. Leverage can go up to 1:1000, making it suitable for high-volume and professional trading.

SyntX Account

The SyntX Account is specifically for trading synthetic indices. It requires a minimum deposit of only $1, with floating spreads and no commissions. Traders can use the MetaTrader 5 platform and enjoy ultra-high leverage up to 1:10000.

This account is a good option for those interested in highly leveraged, non-traditional trading instruments within a controlled environment.

Regions Where Weltrade is Restricted

Weltrade’s services are restricted in certain regions due to regulatory and compliance requirements, including:

- USA

- Canada

- EU

- Belarus

- Russia, etc.

Cost Structure and Fees

Score – 4.4/5

Weltrade Brokerage Fees

Weltrade offers competitive pricing for most trading services. The broker does not charge fees for deposits, however, there might be some charges for withdrawals, depending on the chosen funding method. Therefore, we advise you to thoroughly review the broker’s fee structure and terms and conditions to gain a complete understanding of the applicable charges and their potential impact on trading activities.

The broker offers competitive variable spreads, with an average spread of 1.5 pips for the EUR/USD currency pair in the Forex market.

However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

Weltrade offers commission-free trading across its account types. Instead of charging commissions, the broker incorporates its fees into the spreads, which vary depending on the account type and trading instrument.

- Weltrade Rollover / Swaps

Weltrade imposes swap fees, also known as rollover charges, on positions held overnight, with rates varying based on the trading instrument and account type.

These fees are influenced by factors such as central bank interest rate differentials, market liquidity, and the broker’s markup.

How Competitive Are Weltrade Fees?

Weltrade’s fee structure is generally competitive, especially for traders looking for commission-free accounts with flexible trading conditions.

The broker offers tight spreads on accounts like the Pro account and high leverage options, making it appealing for all levels of traders. While the broker’s fees are not the lowest in the industry, the absence of hidden fees makes it a solid option for traders looking for reliable fee terms.

| Asset/ Pair | Weltrade Spread | FXDD Spread | TastyFX Spread |

|---|

| EUR USD Spread | 1.5 pips | 1.9 pips | 0.8 pips |

| Crude Oil WTI Spread | 12.4 | 5 | - |

| Gold Spread | 31 | 40 | - |

| BTC USD Spread | 43 | 50 | - |

Weltrade Additional Fees

Weltrade does not charge deposit fees, however, withdrawal fees may apply, which vary by method, ranging from 1% to 2% for e-wallets and 4% + $2 for cards.

There are also swap fees on overnight positions, but no inactivity fees, which makes it relatively cost-effective for active traders.

Trading Platforms and Tools

Score – 4.6/5

Weltrade provides access to industry-leading MT4 and MT5 trading platforms, known for their powerful charting tools, automated trading, and broad market coverage.

In addition, the broker integrates with TradingView, allowing traders to analyze markets with advanced tools and place trades directly through the platform.

Trading Platform Comparison to Other Brokers:

| Platforms | Weltrade Platforms | FXDD Platforms | TastyFX Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Weltrade Web Platform

Weltrade offers web trading platforms of both MetaTrader 4 and MetaTrader 5, allowing traders to access their accounts directly from any web browser without downloading software.

These web platforms maintain the main functionalities of the desktop versions, including real-time quotes, advanced charting tools, and order execution, providing a convenient and flexible trading experience across devices.

Weltrade Desktop MetaTrader 4 Platform

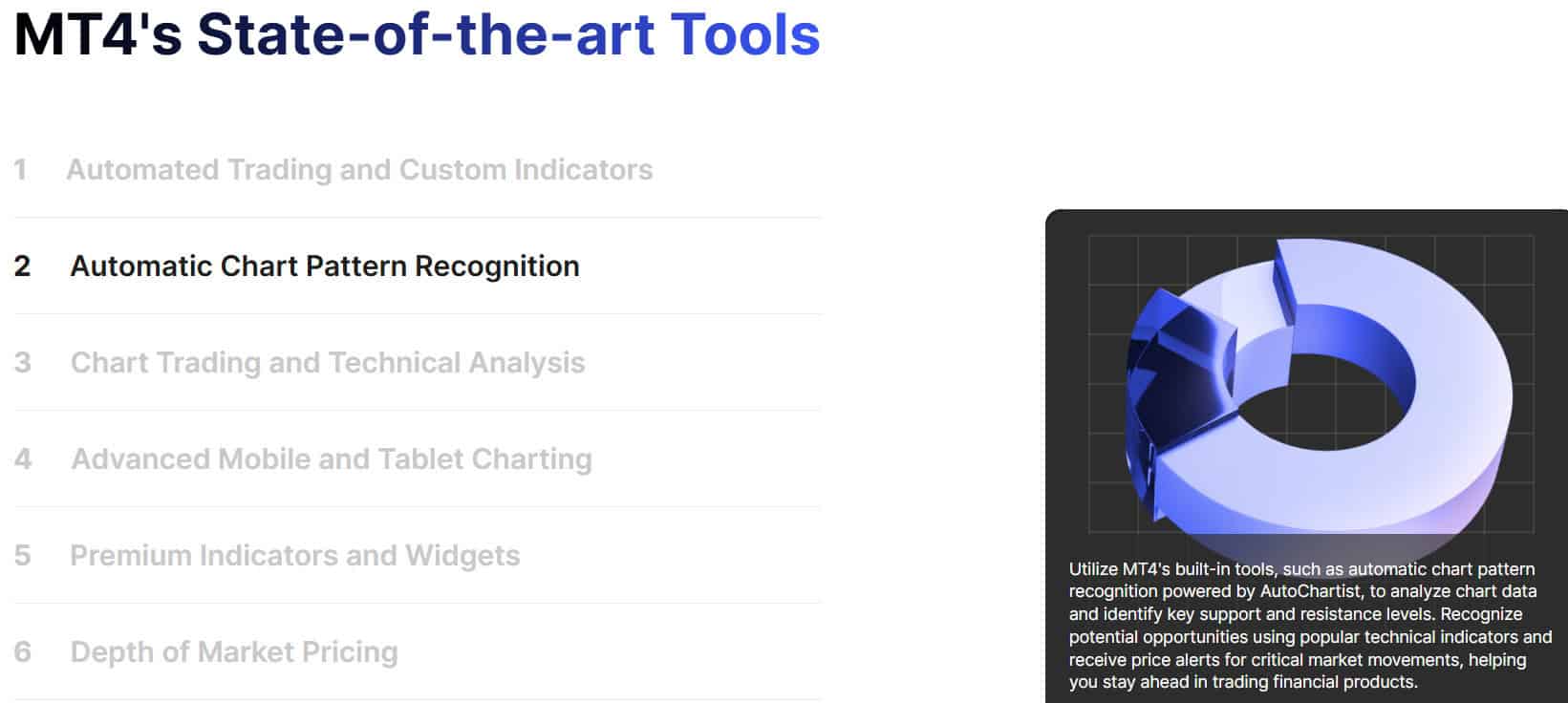

Weltrade’s MetaTrader 4 platform is a powerful tool for traders who need flexibility. The platform supports automated trading with expert advisors, back-testing, and over 2,000 free customizable indicators.

Traders benefit from advanced technical analysis features, including 9 timeframes, unlimited chart windows, and more than 50 built-in indicators. The platform also offers AutoChartist integration for automatic chart pattern recognition and key level identification.

MT4’s intuitive order management system supports various order types, depth of market pricing, and real-time alerts, allowing traders to respond quickly to market movements. Compatible with Windows, macOS, iOS, and Android, the platform delivers a seamless and efficient trading experience across devices.

Weltrade Desktop MetaTrader 5 Platform

The MT5 desktop platform offers advanced trading features for modern traders. It supports automated trading through Expert Advisors, allowing precise and efficient strategy execution. The platform includes an extensive range of technical indicators, charting tools, and one-click trading, along with multiple order types to suit different trading styles.

MT5 also integrates helpful tools like an economic calendar, market depth, and real-time financial news, enabling traders to stay informed and make well-timed decisions. Available on Windows, macOS, iOS, Android, and WebTerminal, the platform ensures a seamless and consistent trading experience across devices.

Main Insights from Testing

From testing the MT5 platform, we found that its speed, stability, and customizable interface are major strengths. The platform handles high trade volumes smoothly, and its intuitive layout allows for easy navigation and personalization.

The platform also stands out for its faster processing times compared to MT4, making it a solid choice for active traders who rely on efficiency and responsiveness.

Weltrade MobileTrader App

Weltrade offers flexible mobile trading options through its own Weltrade mobile app, as well as the popular MT4 and MT5 mobile applications.

The Weltrade app provides a user-friendly interface with real-time market data, secure login features, and customizable notifications, making it easy to trade on the go. Meanwhile, the MT4 and MT5 apps deliver advanced charting tools, technical indicators, and automated trading capabilities.

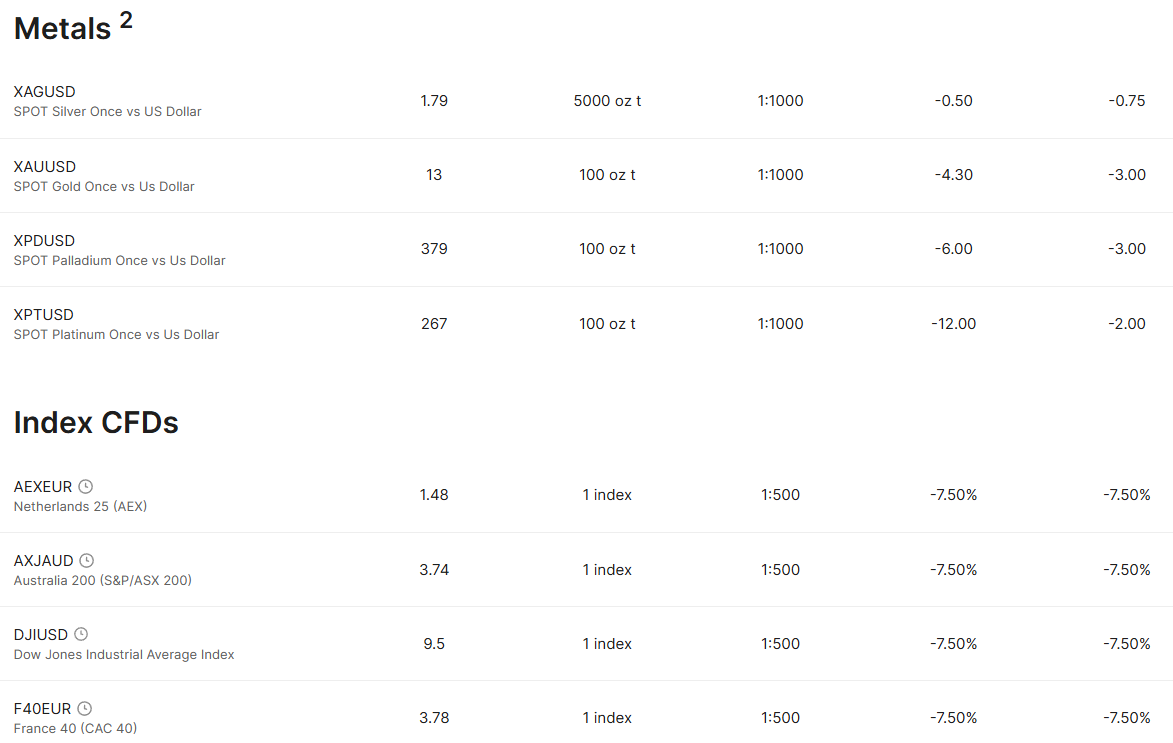

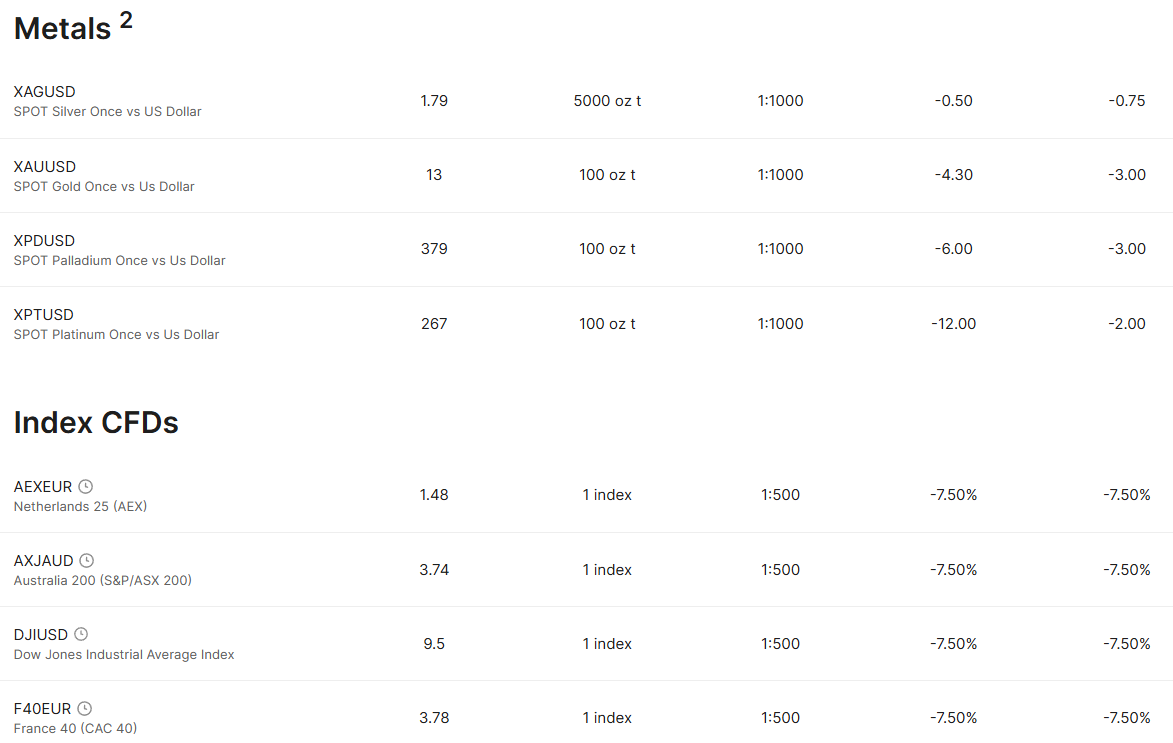

Trading Instruments

Score – 4.3/5

What Can You Trade on Weltrade’s Platform?

On Weltrade’s platform, traders can access over 180 tradable instruments, including Forex, precious metals, commodities, index CFDs, stock CFDs, cryptocurrencies, and synthetic indices.

While the range is not as comprehensive as what other brokers offer, it still provides enough variety for traders to build and diversify their strategies across multiple markets.

Main Insights from Exploring Weltrade’s Tradable Assets

Exploring Weltrade’s tradable assets reveals a focus on key global markets, catering to traders interested in popular instruments like currencies, commodities, indices, and cryptos.

The platform is structured to support both short-term and long-term strategies, offering a user-friendly environment for navigating different asset classes.

Leverage Options at Weltrade

Trading with leverage can be advantageous as it allows traders to access the market with a smaller initial investment. However, you should have a thorough understanding of how the multiplier works and the potential risks involved before engaging in leveraged trading.

- Trades from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- For international trading, the website states the potential for higher leverage of up to 1:10000, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

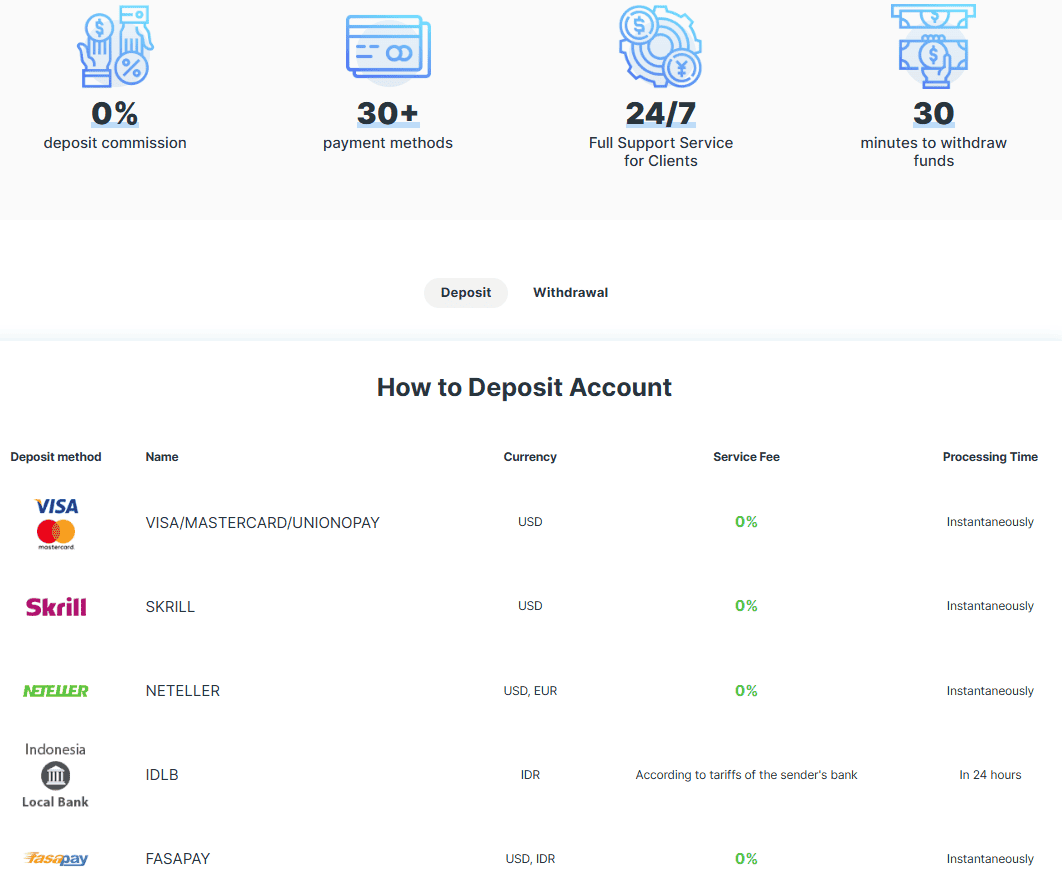

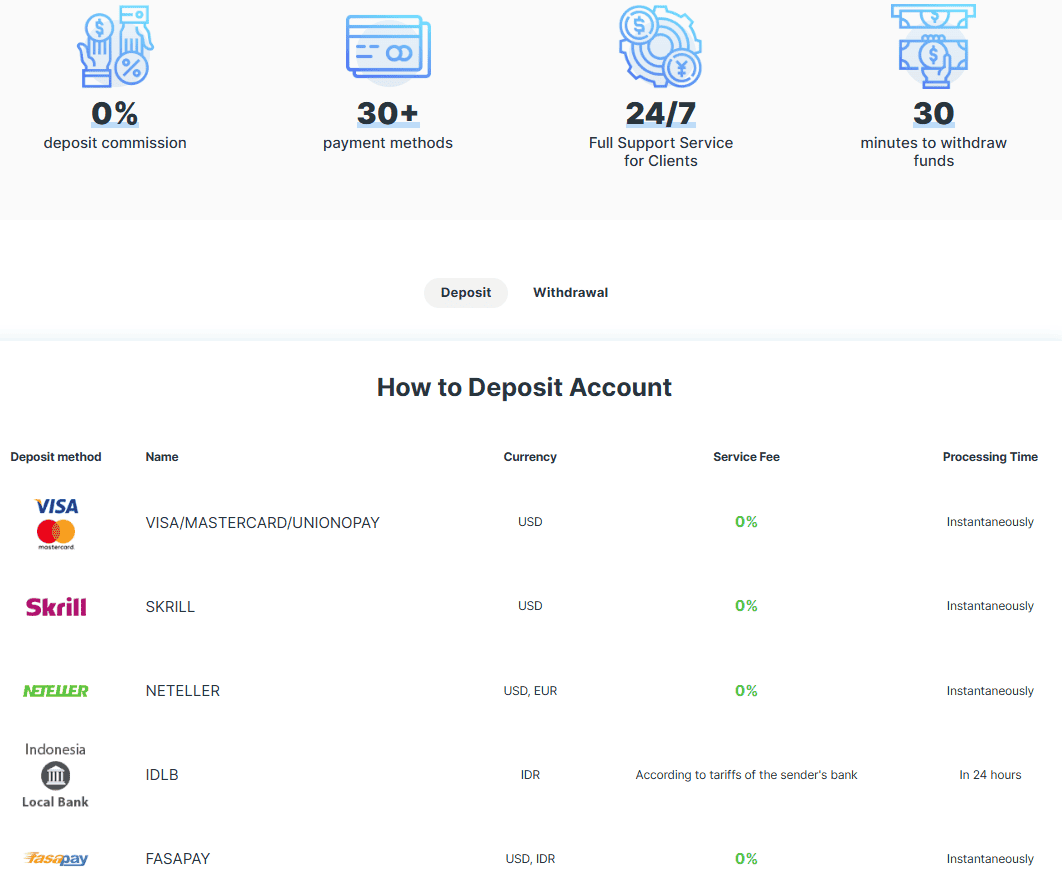

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Weltrade

There are a variety of funding methods available for traders, allowing them to deposit funds into trading accounts, which is a benefit. These include:

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- FasaPay, etc.

However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

Weltrade Minimum Deposit

To open a live trading account with the broker, clients need to deposit $1 as an initial deposit amount for Micro accounts, which is considered a very good offering, yet it is good to check the margins for instruments you wish to trade.

For the Pro account, the minimum deposit amount is $100, for the Premium account is $25, and for SyntX is $1.

Withdrawal Options at Weltrade

As we found, withdrawing funds from your account is easy and fast. Typically, your withdrawal request will be processed within 30 minutes, 24/7.

Customer Support and Responsiveness

Score – 4.6/5

Testing Weltrade’s Customer Support

The broker offers 24/7 customer support via a phone line, live chat, and email, ensuring assistance is available at any time. The support team is capable of helping with technical inquiries, analysis recommendations, general questions, and operational matters.

Contacts Weltrade

Weltrade provides multiple contact options to assist clients worldwide. For general inquiries, traders can reach the team via email at info@weltrade.com. For direct assistance, the broker also provides phone support at +44-20-34116458.

Research and Education

Score – 4.7/5

Research Tools Weltrade

Weltrade provides a range of research and trading tools to support traders in their market analysis and decision-making processes.

- On its website, Weltrade offers calculators such as trading, pip, profit, and Fibonacci calculators, along with an economic calendar to help traders stay informed about upcoming market events.

- The platform also integrates with TradingView, enabling users to access advanced charting tools and indicators for in-depth technical analysis.

- Within the MT4 and MT5 platforms, traders have access to a comprehensive suite of tools, including trading robots, over 38 technical indicators, 44 analytical charting tools, and multiple timeframes.

- These platforms support automated trading through Expert Advisors and offer features like market depth and one-click trading.

- Additionally, Weltrade provides access to MQL5 signals, allowing traders to subscribe to trading signals from experienced providers directly within the MT5 platform.

Education

Weltrade offers a comprehensive educational resource to support traders at all levels. The broker’s Webinars and Seminars provide insights into financial markets and Forex trading strategies, available both live and on-demand for flexible learning.

The Weltrade Blog features articles covering various trading topics, from automated Forex strategies to commodity trading, offering valuable information for traders. Additionally, the broker provides a MetaTrader Guide and Demo Account, equipping traders with the tools and knowledge they need to enhance their trading skills.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options Weltrade

While Weltrade primarily focuses on Forex and CFD trading, it also provides copy trading as an alternative investment option. This feature enables traders, especially beginners, to replicate the strategies of experienced traders automatically, offering a hands-off way to participate in the markets and potentially benefit from expert insights.

Account Opening

Score – 4.5/5

How to Open Weltrade Demo Account?

Opening a demo account with Weltrade is a simple process that allows you to practice trading in a risk-free environment. To get started, visit the Weltrade homepage and click on the “Open Demo Account” button.

You will need to provide some basic information, such as your name, email address, and country of residence. After submitting the form, check your email for an activation link to verify your account. Once verified, you can log in to your area, select your preferred trading platform, choose your account type, and set your desired leverage and base currency.

Weltrade’s demo accounts come with virtual funds, allowing you to explore various trading instruments and strategies without any financial risk.

How to Open Weltrade Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register with Weltrade within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.4/5

In addition to its core trading tools, Weltrade provides additional helpful tools and features to help traders enhance their trading experience.

- Traders can benefit from AutoChartist, a powerful market analysis tool that automatically scans charts to identify potential trading opportunities using pattern recognition. This tool is especially useful for spotting chart formations and key support/resistance levels.

- The broker also offers market sentiment indicators and analytical widgets that help traders stay informed and make well-timed decisions.

These additional features cater to both beginner and advanced traders looking to improve their trading strategies with greater efficiency and insight.

Weltrade Compared to Other Brokers

Weltrade stands out with its beginner-friendly approach, offering accessibility through low entry requirements and user-friendly platforms, including MT4, MT5, TradingView, and its mobile app.

While some competitors provide a broader selection of instruments or more advanced proprietary platforms, the broker balances simplicity with essential trading tools, supportive educational resources, and 24/7 customer support.

Unlike brokers that prioritize institutional-grade services, Weltrade caters well to retail traders looking for a straightforward, commission-free trading environment.

| Parameter |

Weltrade |

FXDD |

Tickmill |

OANDA |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.5 pips |

Average 1.9 pips |

Average 0.1 pips |

Average 1 pip |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

None |

0.2 pips + $2.99 per side |

0.0 pips + $3 |

0.1 pips + $5 commission per 100,000 traded |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, TradingView, Weltrade Mobile App |

MT4, MT5, FXDD WebTrader |

MT4, MT5, Tickmill Trader |

OANDA Web Platform, MT4, MT5, TradingView, fxTrade |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

180+ instruments |

3,000+ instruments |

180+ instruments |

100+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FSCA, FSA, the laws of Saint Lucia |

MFSA, RUC |

FCA, CySEC, FSCA, FSA |

CFTC, NFA, FCA, ASIC, IIROC, MFSA, MAS, FFAJ, BVI FSC |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$1 |

$200 |

$100 |

$0 |

$50 |

$0 |

$0 |

Full Review of Broker Weltrade

Weltrade is an international Forex and CFD broker offering access to over 180 instruments, including Forex, metals, indices, commodities, stocks, and synthetic assets. It supports popular platforms like MetaTrader 4, MetaTrader 5, and TradingView, and also provides its mobile app for flexible trading.

The broker offers various account types with different conditions to suit both beginners and experienced traders, providing leverage up to 1:1000 or higher and no commission on the trades. Traders benefit from useful tools like AutoChartist, webinars, seminars, market analysis, and a copy trading feature.

Weltrade is regulated and provides multilingual 24/7 customer support, making it accessible and user-focused.

Share this article [addtoany url="https://55brokers.com/weltrade-review/" title="Weltrade"]

suck broker, I never get my money back from 2022 till now