- What is VT Markets?

- VT MarketsPros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

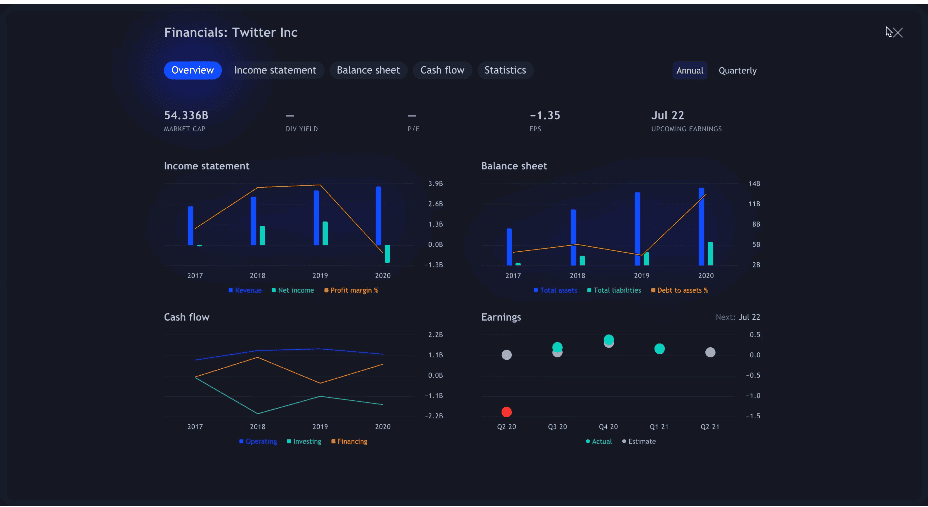

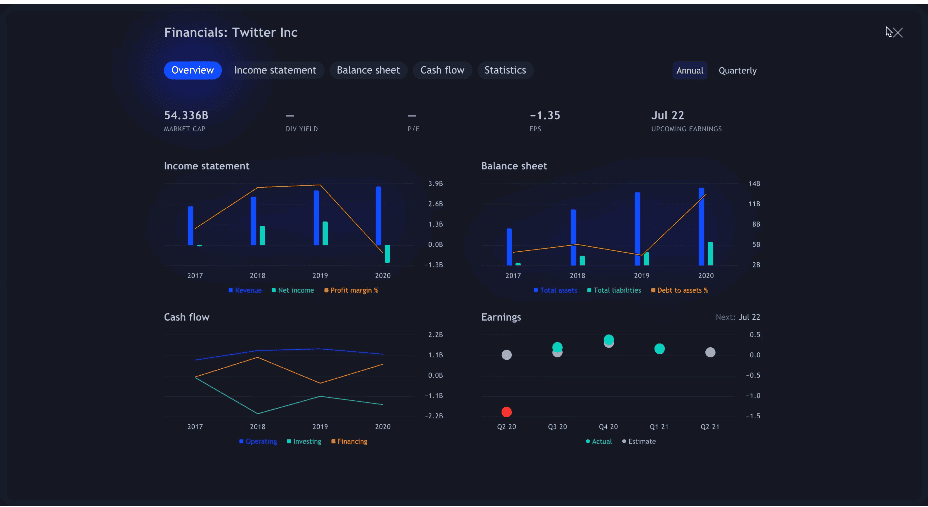

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- VT Markets Compared to Other Brokers

- Full Review of Broker VT Markets

Overall Rating 4.4

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is VT Markets?

VT Markets is an Australia-based subsidiary of VT Markets LLC (VIG) and a popular Forex and CFD Broker that offers its clients a wide range of products and gives them access to the most popular and liquid markets, including forex, indices, energies, metals, soft commodities, and shares via CFDs. The broker offers easy and transparent market access and helps clients pursue their financial goals.

- VT Markets is a subsidiary of Vantage, a major Australian investing and financial services provider.

Founded in 2015, VT Markets adheres to the concept of “Innovation makes the difference” and has applied for advanced technical services in the retail FX market to provide clients with a superior trading experience, including true ECN accounts with raw spreads, mobile trading/payments, and a powerful client portal.

VT Markets Pros and Cons

VT Markets is considered a reliable broker due to its regulation by top-tier ASIC. The broker offers good trading technology, a range of instruments, low variable spreads, and a leveraged trading opportunity. There is excellent variety between available platforms, including MT4 and MT5, PAMM, and MAM accounts.

On the other hand, VT Markets doesn’t offer cryptocurrency trading, and there are limited education tools. The support is 24/5, which for many traders is a downside, too.

| Advantages | Disadvantages |

|---|

| Multiply regulated broker with a strong establishment | Support is not available 24/7 |

| Good Reputation | Only Forex and CFDs

|

| Low Spreads | Conditions vary based on the entity |

| Competitive trading conditions | Demo Account valid for 90 days

|

| ASIC regulated | |

| Negative Balance Protection | |

| Choice between MT4, MT5, Mobile App and TradingView | |

| High Leverage Trading up to 1:500 | |

VT Markets Features

VT Markets is a constantly growing broker with good market conditions, a variety of platforms and account types, and, most importantly, is tightly regulated by one of the strictest authorities – ASIC. We have reviewed the main aspects of trading with VT Markets, and here is what it looks like:

VT Markets Features in 10 Points

| 🗺️ Regulation | ASIC, FSC, FSCA |

| 🗺️ Account Types | Standard STP, Raw ECN |

| 🖥 Trading Platforms | MT4, MT5, WebTrader, TradingView |

| 📉 Trading Instruments | Currency pairs, Commodities, Indices, ETFs, CFD Shares, CFD Bonds |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | Several currencies offered |

| 📚 Trading Education | Included |

| ☎ Customer Support | 24/5 |

Who is VT Markets For?

Based on Our findings and Financial Expert Opinions VT Markets gives many advantages to traders, enabling access to a wide range of quality services and offerings. The broker is good for:

- Professional Traders

- EAs running

- Copy Trading

- Traders who prefer the MT4 or MT5 platforms

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- MAM Trading

- PAMM Trading

- High Leverage Trading

VT Markets Summary

Overall, our impression of VT Markets was positive. The broker continuously strives to ensure its service is better and competitive. Being an ECN broker, the company stands for strong integrity and great execution through its numerous liquidity providers and the Interbank Forex market. Backed up by top-tier ASIC regulation, the broker provides trading with high leverage ensuring traders’ safety. The safety is further ensured by the provided negative balance protection.

55Brokers Professional Insights

VT Markets is a regarded broker since stands on the background of Broker operating for many years. VT Markets trading technology is good quality, packed with innovations, tight spreads, and constantly expanding offering of trading instruments which is a plus too. Traders have a chance to choose between some of the most popular platforms in the market – MT4, MT5, and TradingView, providing great tools for charting and enabling great variety for both retail and professional traders. Traders who prefer various strategies including News trading or Swing trading will find it pretty at easy too.

VT Markets is available in more than 160 countries, thus having an excellent global reach that is fascinating to many traders. All in all, VT Markets is a good option for traders seeking advanced tools, strong regulatory oversight, and access to wider financial assets. The availability of PAMM and MAM accounts further expands investment opportunities for traders, enabling them to diversify their portfolios.

Consider Trading with VT Markets If:

| VT Markets is an excellent Broker for: | - Traders who prioritize tight regulatory overview

- Beginner traders

- Those who prefer the MT4/MT5 platforms

- TradingView enthusiasts

- Cost-conscious traders

- Traders looking access to MAM and PAMM accounts

- Algorithmic Traders

- Clients from the South Africa region

|

Avoid Trading with VT Markets If:

| VT Markets is not the best for: | - Clients seeking extensive educational resources

- Those who look for 24/7 support

- Investors looking for real stocks |

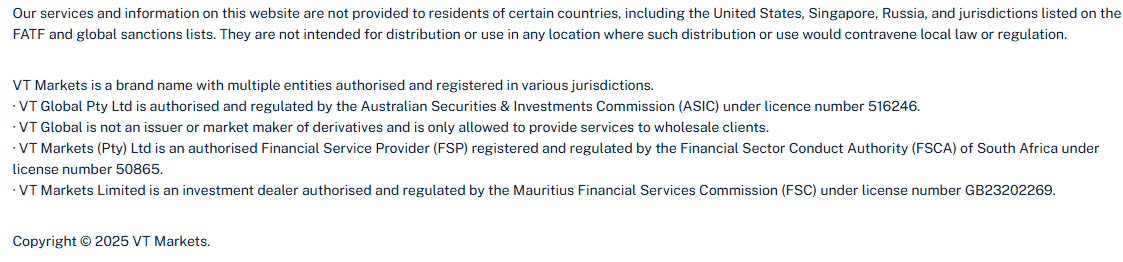

Regulation and Security Measures

Score – 4.6/5

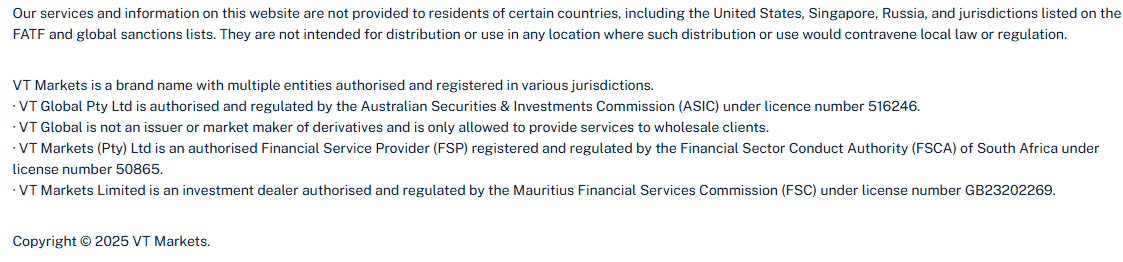

VT Markets Regulatory Overview

VT Markets is an established Australian broker that operates according to the world-known regulation Australian Securities and Investments Commission (ASIC). ASIC is known to be one of the most capable regulatory bodies, which ensures adherence to rules and guidelines and ensures a safe and reliable trading environment.

VT Markets also holds a license from FSCA, which is known as South Africa’s most rigorous regulator, overseeing South Africa’s financial market and ensuring fair practices. In addition, VT Markets holds a license from the Mauritius Financial Services Commission (FSC) that serves global clients. Of course, we never recommend trading with offshore brokers, however, since VT Markets also has reputable licenses from ASIC and FSCA, it means the broker is sharply regulated in terms of its operation.

How Safe is Trading with VT Markets?

Following ASIC Regulatory Guides, the company provides Professional Indemnity Insurance. This insurance covers claims due to breaches of professional duties, offering an additional layer of financial security to clients. Also, clients’ funds are held in segregated accounts with Australia’s AA-rated Commonwealth Bank of Australia (CBA).

- Besides, all client information with VT Markets is safe: payments are processed and encrypted through SSL (Secure Sockets Layer) and protect the client’s safety.

Consistency and Clarity

As we reviewed VT Markets, we found a reliable and trustworthy broker with fair practices, operating under tight regulations. The broker in its almost ten years of providing financial services has constantly enhanced its offerings and increased its global exposure, accepting clients from 160+ countries. Besides, real customer feedback shows that clients are mostly pleased with the services the broker provides, pointing out its user-friendly interface, competitive fees, and advanced tools. However, some clients state that the educational section needs approval, while others point out some issues with withdrawals. Nevertheless, these are individual experiences, both positive and negative, and need to be considered and measured equally.

Also, among other advantages we have already mentioned, VT Markets has earned many awards for its successful operation and quality technology in categories such as the Fastest Growing Broker, Best Customer Service, and Best Mobile App.

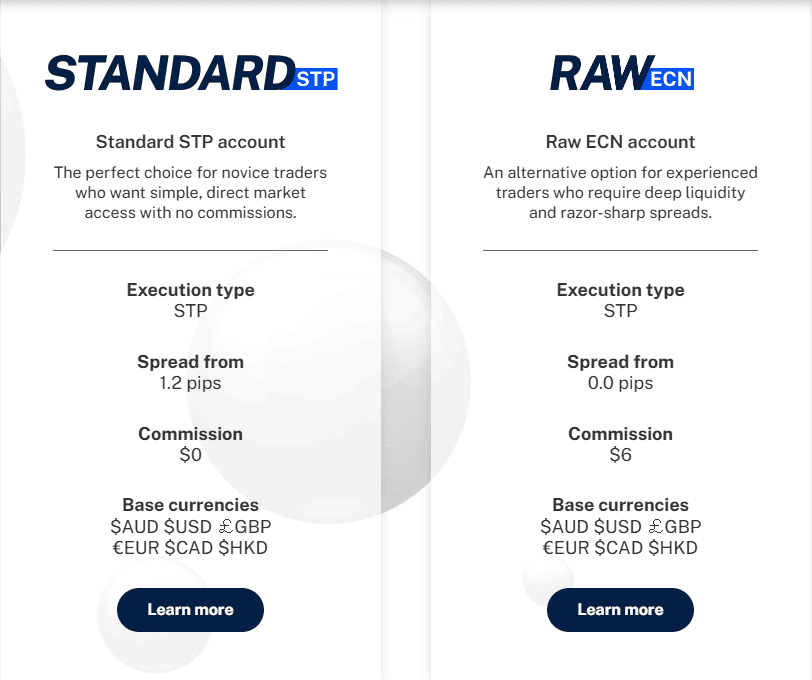

Account Types and Benefits

Score – 4.4/5

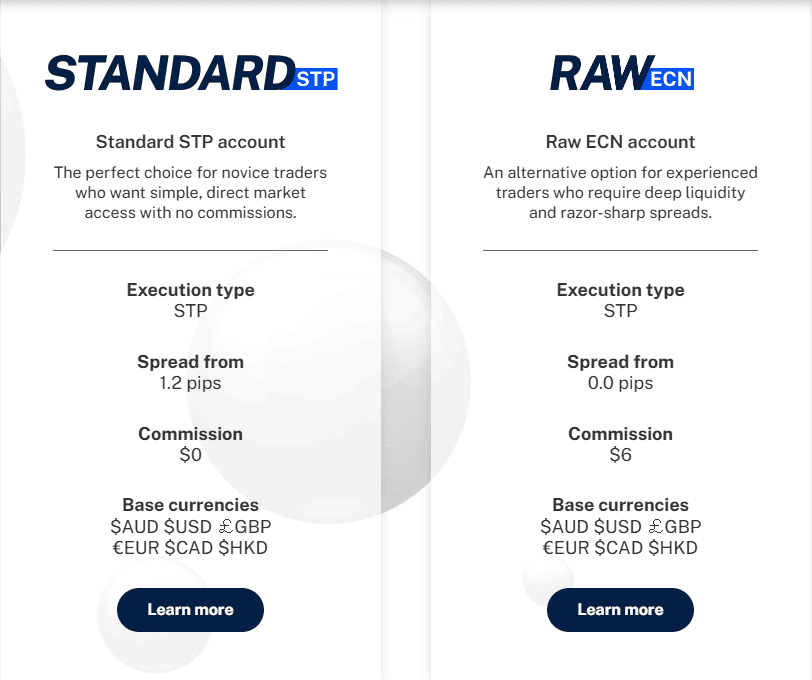

Which Account Types Are Available with VT Markets?

VT Markets offers two account types with STP and ECN execution models, available through MT4 or MT5 platforms. The broker also offers a Cent account. The STP and ECN accounts both have a $100 minimum deposit requirement, enabling a trading bonus, and other advantages. Yet the accounts have different fee structures – spread-based and commission-based, which ensures diversification for traders with different preferences.

Standard STP Account

The Standard STP account is a spread base account, with no commissions applied. The average spread for the account is 1.2 pips. The account supports advanced strategies, good features, and innovative tools, with fast execution, enabling different traders to benefit from the conditions offered.

Raw ECN Account

We found the Raw ECN account more suitable for professional traders, who can benefit from the extra fast execution, cutting-edge technologies, and advanced features the account provides. This account type has spreads starting from 0.0 pips, with a $6 commission per round turn. This fee structure is especially preferable for experienced traders who favor narrow spreads and fixed transaction fees.

Cent Account

The Cent account offers traders better trading conditions, with a lower $50 initial deposit opportunity, access to Forex, Gold, Silver, and Oil, and availability of MT4/MT5 platforms. Due to smaller trade sizes, clients are able to practice with minimum inputs and gain trading experience, which makes the account an attractive option for beginner traders.

Regions Where VT Markets is Restricted

VT Markets does not accept residents from certain countries due to certain regulatory restrictions. Also, VT Markets does not supply its services to the jurisdictions listed on the FATF and global sanctions lists. Here is the list of the countries that the broker does not offer its services to:

- United States

- Singapore

- Russia

- Iran

- Myanmar

- Democratic People’s Republic of Korea

Cost Structure and Fees

Score – 4.4/5

VT Markets Brokerage Fees

VT Markets spreads and commissions depend on the account traded. The two accounts provided are spread-based and commission-based, thus, this difference is tailored for traders preferring different fee structures, to meet every trading expectation.

Spreads differ based on the account type. For the spread-based account type – Standard STP, the average spread is 1.2 pips. For the commission-based account spreads start from 0.0 pips, and there is a fixed commission added.

A $6 per round turn commission is applied for the commission-based account, As we found, the cost is in line with the market average. Remember, that commissions depend on the account type traders choose.

- VT Markets Rollover / Swap Fees

The broker also charges swap fees for the positions held overnight. To check the exact amount of both long and short swaps (as they are changeable), clients can go to the Specification section on the MT4/MT5 platforms. Swap fees depend on the instrument traded and are influenced by market changes.

How Competitive Are VT Markets Fees?

VT Markets fees are competitive and in line with the market average. The broker offers average spreads of 1.2 pips for its Standard STP account, and a commission of $6, which is again equal to the market average.

In fact, VT Markets’ fees are quite transparent, however, to check fees for every instrument separately, and enter the swap rates, traders need to be registered with the broker first and have access to the Meta Trader platform. This is a downside, as traders cannot learn all the fee specifications from the broker’s website before signing in with the broker. Yet, despite this inconvenience, VT Markets still offers clarity in its practices, and based on our findings, offers no hidden fees.

| Asset/ Pair | VT Markets Spread | BlackBull Markets Spread | XM Spread |

|---|

| EUR USD Spread | 1.2 pips | 0.8 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 pips | 7․3 pips | 3 cents |

| Gold Spread | 30 | 1.2 pips | 0.27 pips |

VT Markets Additional Fees

While trading with VT Markets, it is essential to be aware of the additional fees it applies, besides the standard spreads and commissions. For instance, for withdrawals, there is a fixed $20 for each wire transfer (the first one is free). For other withdrawal methods, too, there are certain charges applied, such as 0.2% of the withdrawn amount. The good news is, that VT Markets does not charge an inactivity fee for the dormant accounts.

Score – 4.5/5

VT Markets offers a good range of trading platforms, including the popular MT4 and its newer MT5 version. In addition, the broker gives access to TradingView, Mobile app, and webtrader.

| Platforms | VT Markets Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

VT Markets Web Platform

The VT Markets enables its traders to trade via WebTrader with fast and stable access to MT4 trading accounts straight from any web browser. No downloads and installations are needed, and the webtrader can be accessed from any device. The platform is intuitive and easy to use, and traders get to use almost all the trading tools and features that are available through the desktop platform. VT Markets’ webtrader allows flexibility, continuous connectivity to the market, and access to a good range of features and analytical tools for a positive outcome.

VT Markets Desktop MetaTrader 4 Platform

The VT Markets MT4 is an advanced platform with fast execution and good functionality. The platform enables access to 400+ instruments, including forex pairs, commodities, share CFDs, bonds, and indices. Powered by the official MetaQuotes, it provides great flexibility and is one of the most popular platforms in the industry. The platform is equipped with a good range of customized charting options and indicators, ensuring great analysis and market insights.

VT Markets Desktop MetaTrader 5 Platform

The VT Markets MT5 platform is the enhanced version of the MT4 platform, with advanced tools, and enhanced performance. The platform ensures extra fast execution, tight spreads, and advanced charting tools. Traders can access more than 1,000+ trading products and enjoy unlimited watchlist charts, 21 timeframes, and one-minute historical quote data. Enabling algorithmic trading, MT5 also includes trading alerts that keep traders updated.

TradingView Platform

The VT Markets TradingView platform is considered a good replacement for MetaTrader, offering a good range of advanced charts, social trading opportunities, and powerful analytical functions. With instant execution, ultra-low spreads, and extremely deep liquidity TradingView becomes a perfect alternative platform for traders with access to more than 1,000 asset classes. Equally accessible on either mobile or desktop with the same functionality provided, TradingView is great for traders of every level.

Main Insights from Testing

Many traders prefer conducting trades on either MT4 or MT5 platforms. However, we found VT markets’ TradingView platform an equal alternative to the MetaTrader platforms, offering even more intense charting tools, instruments, and deep analysis. The platform can meet the needs of both advanced and novice traders, due to its flexible and simple interface, combined with innovative solutions. Besides the range of the available instruments is wider, as compared to the MetaTrader platforms, allowing more diversity in trading.

VT Markets MobileTrader App

The VT Markets app is an award-winning platform, offering a great variety of trading features, over 1000 trading instruments with precise analysis and market insights. It supports informative guides, and videos, therefore being suitable both for beginner traders and experienced ones. Real-time alerts and signals keep users updated on the market changes. The application also offers great promotion opportunities and makes trading on the go even more favorable.

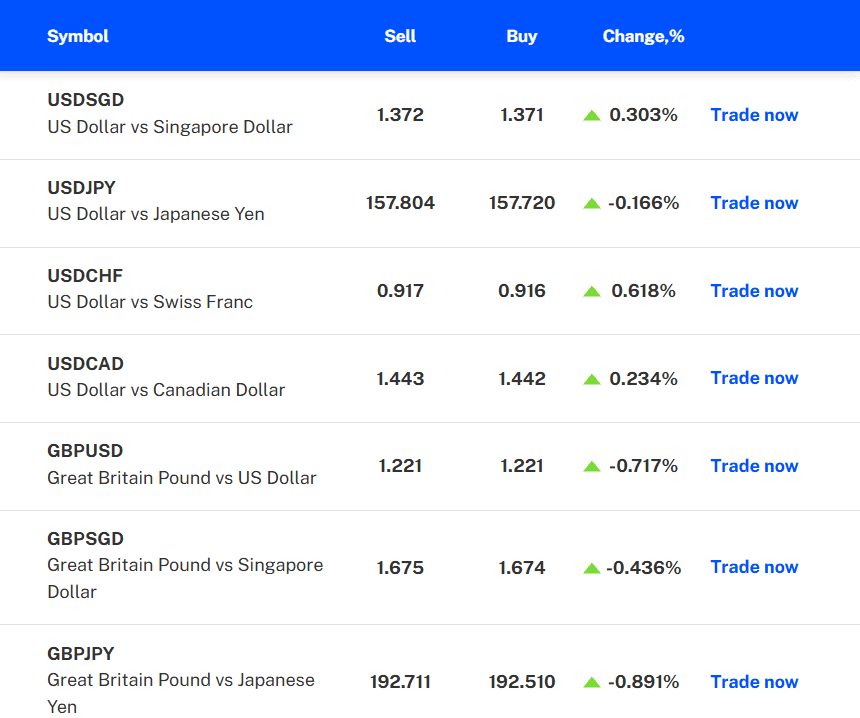

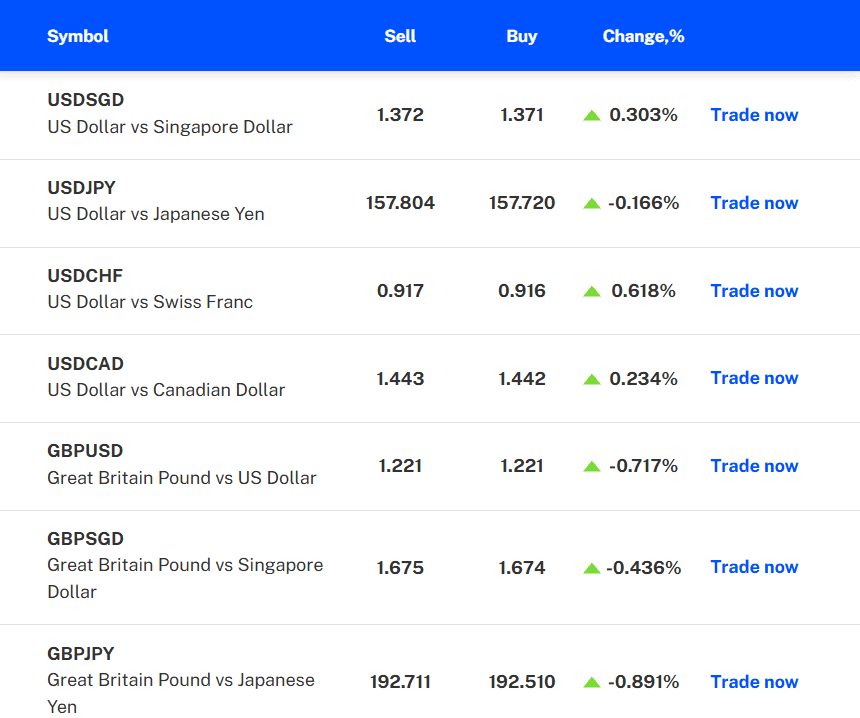

Trading Instruments

Score – 4.4/5

What Can You Trade on the VT Markets Platform?

VT Markets offers a good range of instruments across different markets, including Currency pairs, Commodities, Indices, ETFs, CFD Shares, and CFD Bonds. The offering depends largely on the trading platform, as based on the platform traded the range of instruments is different. Overall, the broker enables access to 40 Forex pairs, Global Indices (S&P 500, Dow Jones Industrial Average (DJ30), and DAX 40 (GER40)), and CFD bonds, including FEI EURIBOR Futures, FGBL Euro – Bund Futures, etc.

Main Insights from Exploring VT Markets Tradable Assets

During our research, the first thing we noticed was that different platforms offer different ranges of trading instruments. For instance, with MT4 traders have access to a considerably limited number of instruments (over 400 products), while the TradingView and the broker’s app offer up to 1000 instruments, which is quite an impressive number and surely ensures a great variety to explore the market. However, it is important to mention that all the available products are on CFDs, which limits investment opportunities in real stocks and shares.

Besides, the offering can vary from one entity to another, which means traders should be careful and consider each offering separately and in great detail.

Leverage Options at VT Markets

Leverage is a well-known instrument, which multiplies the initial capital clients are trading with and can be a handy tool to magnify potential gains when used smartly. However, always note that high leverage can work in reverse, too.

Due to multiple regulations from various jurisdictions, VT Markets falls under particular regulatory restrictions which may apply differences between the offered leverage. Therefore, trading through the global/offshore entities of VT Markets traders may enjoy high leverage levels up to 1:500 for major currency pairs and Indices. For the Australian clients, the leverage is lower:

- 30:1 for forex

- 20:1 for stock index CFDs

- 1:100 on Bond CFDs

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at VT Markets

VT Markets clients have various options to fund a trading account, including domestic bank transfers, international bank transfers, and e-wallets. Here is the full range of methods clients can choose from:

- Credit/Debit card

- Unionpay transfer

- Mobile Pay

- Skrill

- Neteller

- Fasapay

- Vietnam instant bank wire transfer (Vietnam clients )

- EU bank transfer (the EU clients )

- Thailand instant bank transfer (Thailand clients )

Minimum Deposit

We found that the broker requires a $100 minimum deposit for both of its account types ( Standard and Raw) and a $50 minimum deposit for the Cent account.

Withdrawal Options at VT Markets

Generally, the broker offers different withdrawal methods, including international wire transfers, credit/debit cards, and e-wallets, such as FasaPay, Skrill, Neteller, etc. Yet, due to regulatory requirements, the withdrawal method should be the same as the deposit method.

- The withdrawal processing time varies and mostly depends on the method used. After the broker approves the withdrawal, e-wallets will take 1-3 days for the payment to arrive.

- For credit/debit card or wire transfers, withdrawals usually arrive within 3-7 working days.

Customer Support and Responsiveness

Score – 4.4/5

Testing VT Markets Customer Support

Our experts found out that VT Markets provides multiple support that increases the trading experience and makes it a smooth process. You can reach out customer team through live chat, or email.

- The broker also has a Help Center that includes answers to many questions that clients might have while trading with the broker (from account opening to deposits/withdrawals).

Contacts VT Markets

VT Markets mainly provides a live chat and offers an email address to direct a trading-related issue to the support team.

- Based on our research, the live chat slightly lacks in providing precise answers to simple questions, as compared to many other brokers with instant and detailed answers.

- The broker also provides an email address – info@vtmarkets.com for any issues and questions. However, traders receive answers within 1-3 working days, which is not the best option in case traders have an urgent problem to solve.

- At last, VT Markets is social, with a presence on FB, IG, YouTube, and Linkedin, where clients can find the latest updates from the broker.

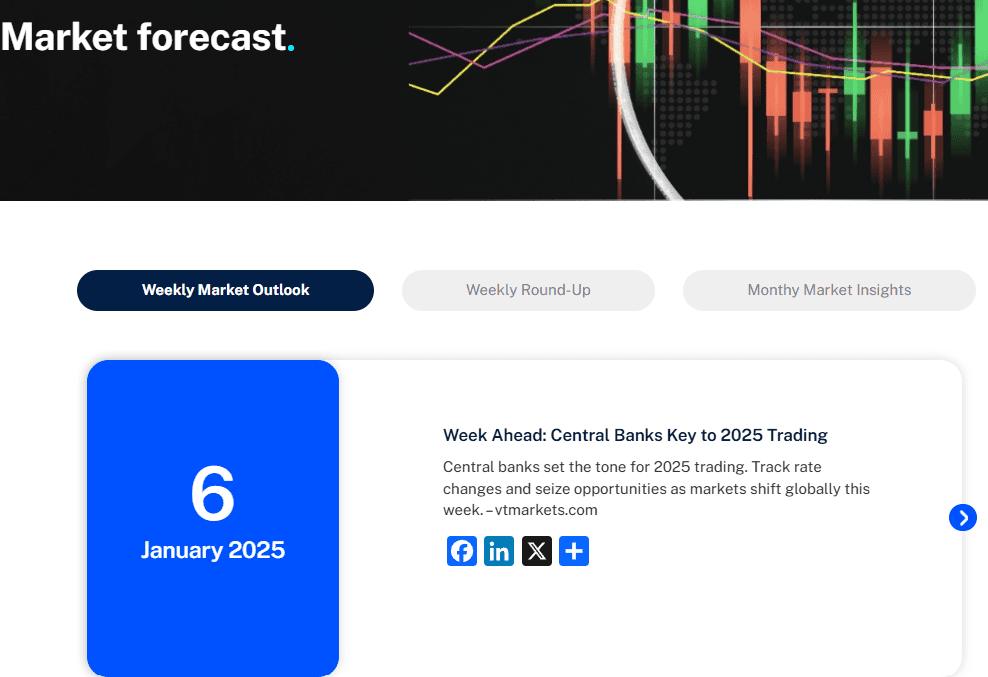

Research and Education

Score – 4.2 /5

Research Tools VT Markets

We found that VT Markets provides its clients with quite limited educational materials and research tools which is, in our opinion, a major drawback. VT markets research tools are already built into the platforms and available for a free use. Here is what the broker offers as additional research means:

- Daily Market Analysis helps traders to stay informed about the latest developments in the market, learn updates on each instrument, and thus plan future steps in trading based on these changes and market movement.

- Market Forecast provides clients with insights into potential market movements. It often includes elements like technical analysis, fundamental analysis, and expert opinions on different asset classes. Traders can get weekly and monthly market insights.

Education

Although VT Markets does not provide extensive educational materials, there are still a few useful resources that can be of help to its clients, specifically for beginner traders.

- We found the Glossary provided by VT Markets consisted of useful terms, very detailed, and certainly useful for novice traders who need an explanation of foreign terms at any step of their trading journey.

- The Learn Forex section includes useful articles and guides on essential, trading-related topics, that will provide traders with crucial knowledge on the Forex market.

- VT Market also provides Courses for Beginner and Intermediate traders, from what Forex is to understanding more complex strategies and risk management techniques.

Is VT Markets a good broker for beginners?

Based on what we found when researching the broker, it can be an option for beginner traders. Although the educational section is not very extensive, with an absence of a good range of materials and webinars, it still provides useful resources, such as a detailed glossary, and courses for beginner and intermediate traders, also, the Help Center can assist novice traders, guiding them gently into the market and trading with VT markets. All in all, the availability of the demo account, Cent account with a lower minimum requirement, great trading platforms, and average and transparent fees can be a good start for a beginner.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options VT Markets

As we found, VT Markets offers instruments only based on CFDs. This means, that clients cannot engage in real stock trading and traditional investment, limiting opportunities for portfolio enhancement. However, with VT Markets there are still ways for investments and exploring the market in new ways.

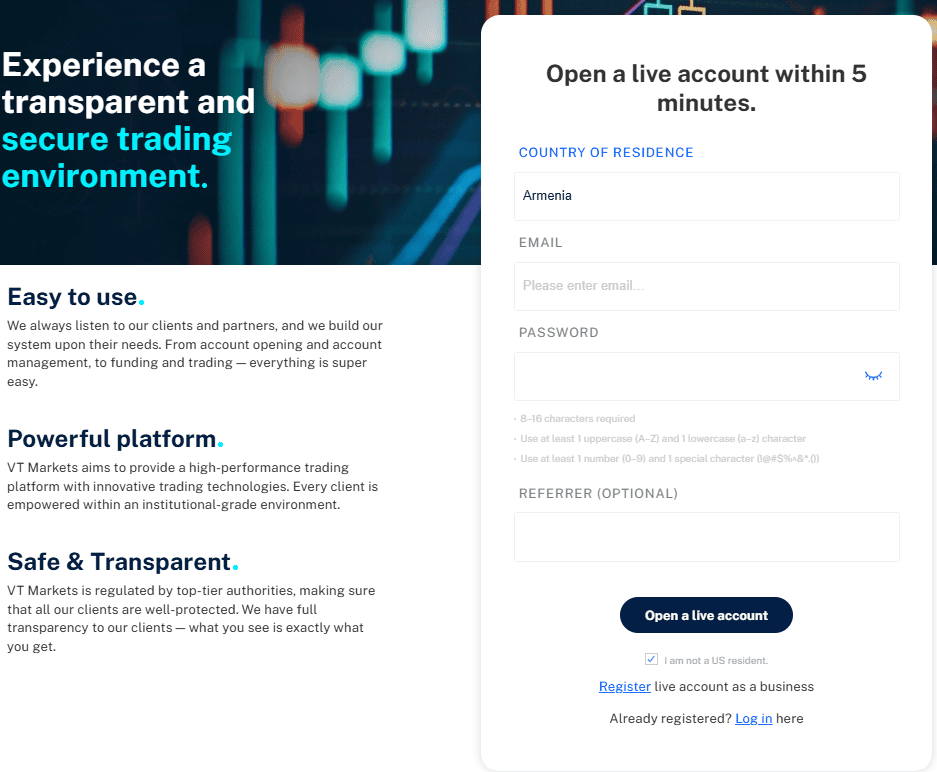

Account Opening

Score – 4.5/5

How to Open a Demo Account?

Opening a Demo account with VT Markets will help clients practice trading and gain knowledge and skills, before engaging in real trading with real funds. Here are the main steps to start with a Demo account:

- On the broker’s website, find the ‘Demo Account’ option

- Fill out the registration form by supplying the required information (name, email address, etc.)

- Create a password

- Choose the account settings according to your trading preferences (platform, account type, leverage)

- Submit the form and receive the demo account credentials by email

- Download the platform, use the account credentials to sign in and start trading

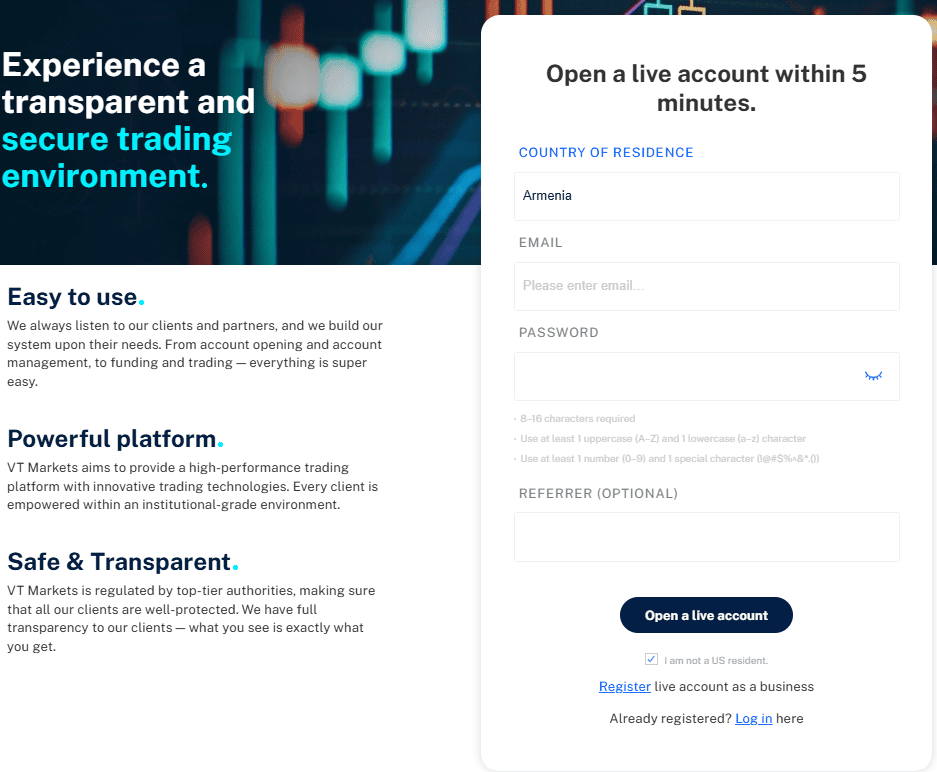

How to Open a VT Markets Live Account?

Opening a live account is also a simple process, yet, in contrast to the demo account opening, traders also need to provide documents for account verification which can take a little longer while the broker reviews the provided documents and approves the account.

- Choose the ‘Trade now’ button on the broker’s website

- Fill out the registration form, and choose the option ‘Open a live account’

- Fill in your personal details

- Provide your residential information

- Answer trading-related questions

- Choose account type and account currency

- Upload documents to prove your identity and address

- Wait until the documents are reviewed

- Once approved, your account will be ready

Score – 4.1/5

VT Markets also offers a few additional tools and features that will be favorable for traders to use:

- Economic Calendar provides actionable, real-time economic data of market events that shape the market and cause economic changes. Traders gain access to economic data from more than 30 countries from all over the world.

- Market Buzz enables access to more than 35,000 tradable assets including over 300 currencies, thousands of stocks, 50 indices, etc.

- Welcome Bonus enables traders to get a $50 Welcome bonus for the initial deposit and $20 for all subsequent deposits. However, the first deposit must be at least $500 to qualify for the 50% bonus.

VT Markets Compared to Other Brokers

We compared VT Markets to different well-regarded brokers to see if its offerings are in line with the market. When we compared VT Markets with Admiral Markets in regard to its regulation, we found that both are regulated by tier-one authorities like ASIC, with Admiral Markets extending its oversight to FCA and CySEC. In contrast, we found that RoboForex does not hold a top-tier license, thus lacking the same reliability as the other two.

Regarding platforms, VT Markets offers MT4/MT5 platforms, TradingView, and a mobile app, while Fortrade provides only its proprietary platform and mobile app, thus limiting opportunities for those who prefer the popular platforms. In this regard, VT Markets is a better option with a broader range of platforms.

In terms of fees, VT Markets offers competitive spreads starting from 0.0 pips on ECN accounts, while Admiral Markets’ fee structure is more complex, combining tight spreads with a commission-based model that is different for each instrument. Lastly, education and research resources are also essential; however, VT Markets offers only basic education, while Pepperstone and Fortrade provide excellent education that will be beneficial for every type of trader.

| Parameter |

VT Markets |

Pepperstone |

RoboForex |

Exness |

Fortrade |

HFM |

Admiral Markets |

| Spread Based Account |

1.2 pips |

From 1 pip |

Average 1.3 pip |

From 0.2 pips |

Average 2 pips |

Average 1 pip |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

| Commission Based Account |

0.0 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

No commission |

0.0 pips + $3 |

0.0 pips + from $0.02 to $3.0 |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Average |

Low/ Average |

Low/Average |

| Trading Platforms |

MT4, MT5, Trading View, Mobile App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5 |

Fortrader Platform, MT4 |

MT4, MT5, HFM App |

MT4, MT5, Admiral Markets app |

| Asset Variety |

1000+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

200+ instruments |

300+ instruments |

500+ instruments |

8000+ instruments |

| Regulation |

ASIC, FSC, FSCA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Excellent education and research |

Good |

Fair |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$100 |

$0 |

$10 |

$10 |

$100 |

$0 |

$1 |

Full Review of Broker VT Markets

VT Markets is regulated by the ASIC and FSCA, and follows strict regulatory compliance, supplying negative balance protection, and robust execution. It is owned by Vantage International Group, which further cements its reputation.

VT Markets is a good broker for professional traders, traders who favor algorithmic trading, and users of EAs, MAM, or PAMM trading accounts. With its competitive MT4, MT5, and TradingView platforms, tight spreads, and over 1000 tradable products available, it is a good option for those clients looking for advanced tools and leverage up to 1:500. However, VT Markets probably is not the best option for traders who rely heavily on extensive educational resources or require 24/7 customer support.

Overall, VT Markets is an attractive option for professional traders, South African clients, and generally investors looking for profitable investment opportunities.

Share this article [addtoany url="https://55brokers.com/vt-markets-review/" title="VT Markets"]

I just couldn’t leave your web site prior to suggesting that I actually loved

the usual information an individual provide in your visitors?

Is going to be back continuously in order to check out new posts

Hi All traders,,, vtmarkets broker has done SCAM with me and my friends also ,,,,, He close my account No. 8421582 , my fund about 2900 gbp in the account but they close and disalbe mt4 also ,,, It was a good broker , I always reffered to couple of friends and family members,,,, but they SCAM 2900 gbp , this amount is big amount for me , I will post to every forex forums until I get back this my amount , if VTmarkets will return my amount , I promise that I will delete this post from all forums ,, until i will post on weekly base.