- Vantage Markets Pros and Cons

- Is Vantage Markets Safe or a Scam?

- Trading Platforms

- Trading Fees

- Spread

- Leverage

- Deposits and Withdrawals

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Vantage Markets.

What is Vantage Markets?

Vantage Markets is a multi-asset broker offering clients access to a nimble and powerful service for trading contract for difference (CFD) on Forex, Commodities, Indices, Shares, ETFs, and Bonds.

With more than 13 years of market experience, Vantage has over 2,000 employees in more than 30 offices globally. The main idea is to create an environment and help worldwide traders to pursue financial goals, thus the broker provides transparent trading, leading market platforms, execution speed, and technology solutions.

- Being a Vantage Forex client you get super-fast Forex trading execution, as well as interbank grade RAW ECN spreads through STP execution.

Vantage Markets Pros and Cons

Vantage Markets is a reliable broker due to its regulations by top-tier FCA and ASIC. Vantage is a popular brand with good trading technology, a range of instruments, and low variable spreads. There is excellent variety between available trading platforms including MT4 and MT5, social trading, investment accounts, and also MAM accounts.

For the Cons, the research section could be better, and also conditions may vary according to regulations and entity.

| Advantages | Disadvantages |

|---|

| FCA and ASIC licensed broker with a strong establishment | Conditions may vary according to regulation and entity |

| Multi-award-winning broker | No 24/7 customer support |

| Wide range of trading instruments including Forex and CFDs | |

| Competitive trading costs and spreads | |

| MT4 and MT5 trading platforms | |

Vantage Markets Review Summary in 10 Points

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, FCA, FSCA, VFSC |

| 🖥 Platforms | MT4, MT5, Protrader, WebTrader, Vantage app, Copy trading platforms |

| 📉 Instruments | Forex, Commodities, Indices, Metals, Shares CFDs, ETFs, and Bonds |

| 💰 EUR/USD Spread | 1.4 pip |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | $50 |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Included with market analysis and trading tools |

| ☎ Customer Support | 24/5 |

Overall Vantage Markets Ranking

Vantage Markets is considered a good broker with safe and favorable trading conditions with transparency. The broker offers a range of trading services with low initial deposit amounts. As one of the good advantages, Vantage Markets is available in many countries, so traders can sign in also with the lowest spreads.

- Vantage Markets Overall Ranking is 8.9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Vantage Markets | Capital Index | Trading 212 |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Platforms | Trading Conditions | Trading Instruments |

Vantage Markets Alternative Brokers

Vantage Markets offers good trading conditions, a range of trading instruments, also low trading spreads, and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to Vantage Markets:

Awards

Vantage Markets has won a variety of awards across a wide range of categories, including Best CFD Broker and Best MT4/MT5 Broker, and Lowest Trading Costs.

Is Vantage Markets Safe or Scam?

No, Vantage Markets is not a scam. The broker provides a transparent and secure Forex and CFD trading environment for all clients, due to its top-tier regulations by FCA and ASIC.

Is Vantage Markets Legit?

Yes, Vantage Markets is a legit and regulated broker. It fully complies with strict financial regulations in each entity it serves, which includes a set of regulations from the Australian ASIC and holding their license for operation. In addition, Vantage UK entity holds a reputable FCA license that oversees the Forex and trading industry through a set of sharp rules and obligations toward safety.

Moreover, Vantage Markets has expanded its operations into South Africa, having secured a regulatory license that enables the firm to offer derivatives products within the local marketplace.

-

In addition to the above, Vantage Markets has established entities serving international clients from offshore branches located in Vanuatu. It is worth noting, though, that trading with offshore brokers is generally not recommended due to regulatory concerns. However, given that Vantage Markets adheres to the well-respected ASIC and FCA licenses, one can deduce that the firm is strictly regulated in its operations.

See our conclusion on Vantage Markets Reliability:

- Our Ranked Vantage Markets Trust Score is 9 out of 10 for good reputation and service over the years, also for reliable top-tier licenses. The only point is that regulatory standards and protection vary based on the entity.

| Vantage Markets Strong Points | Vantage Markets Weak Points |

|---|

| Regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity |

| FCA and ASIC licenses and overseeing | |

| Compensation scheme | |

| Global coverage | |

How Are You Protected?

In accordance with ASIC and FCA Regulatory Guides, the company provides Professional Indemnity Insurance in place which covers the work done by their representatives, employees, and authorized representatives. Moreover, the broker is also strictly audited by auditors and keeps all clients’ funds in segregated trust accounts along with compensation schemes in case of insolvency to ensure money is protected.

Leverage

Due to multiple regulations from various jurisdictions, Vantage Markets falls under particular regulatory restrictions which may apply differences between the offered leverage.

Vantage Markets offers various leverage ratios under different entity:

- The product intervention order issued by ASIC imposes leverage ratio limits ranging from 30:1 to 2:1 on CFDs issued to retail clients.

- The FCA adopts a similar approach to limiting leverage ratio to between 30:1 and 2:1 depending on the volatility of the underlying asset.

- For international traders, a standard account has a leverage of 1:100.

Account Types

Vantage brings an offer through three main types of accounts that are diverse by the options either with costs built on a commission basis or only through the spread. Accounts are accessible from both platforms MT4 and MT5, with leverage depending on which entity you trade, thus which regulation is applicable.

Swap-free accounts are available for traders too. And of course, in the beginning, any trader can open a risk-free demo account with Vantage Markets.

| Pros | Cons |

|---|

| Fast and seamless account opening | Account types and proposals may vary according to jurisdiction |

| Low minimum deposit | |

| Swap-free and Demo accounts are available | |

How to Open Vantage Markets Live Account?

Opening an account with Vantage Markets is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

The market range includes the trade of CFD Forex, Commodities, Indices, Stocks, Metals, Shares, ETFs, and Bonds on MT4/MT5 trading platforms.

- Vantage Markets Markets Range Score is 9.2 out of 10 for wide trading instrument selection among Forex, Stocks, Indicies, and more.

Vantage Markets Fees

Vantage is mainly based on a spread or commission for ECN account: $3.00 commission per lot per trade plus spread cost. 0.3 pips is the average spread cost during peak trading hours. The broker also considers funding fees and other fees like inactivity. Vantage Markets does not charge any additional fees or commissions for CFD indices trading.

Another cost, which you should take into consideration is an overnight fee or swap rate which is paid in case the position is held longer than a day.

- Vantage Markets Fees are ranked low with an overall rating of 8.9 out of 10 based on our testing and compared to over 500 other brokers.

| Fees | Vantage Markets Fees | Capital Index Fees | Tickmill Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | No |

| Fee ranking | Low | Low, Average | Low |

Spreads

Vantage Markets spreads depend on the trading account you choose. The broker offers industry-leading spreads from as low as 0.0 pips on RAW ECN accounts and 0.0 pip on Standard STP accounts. While spreads on major Forex currencies can go below 1 pip during liquid times.

- Vantage Markets Spreads are ranked low with an overall rating of 8.9 out of 10 based on our testing comparison to other brokers. We found low Forex spread, and spreads for other instruments are very attractive too.

| Asset/ Pair | Vantage Markets Spreads | Capital Index Spread | Tickmill Spread |

|---|

| EUR USD Spread | 1.4 pip | 1.1 pip | 0.3 pip |

| Crude Oil WTI Spread | 0.047 | 7 | 4 |

| Gold Spread | 1 | 0.5 | 20 |

| BTC USD Spread | 2.800 | - | 12 |

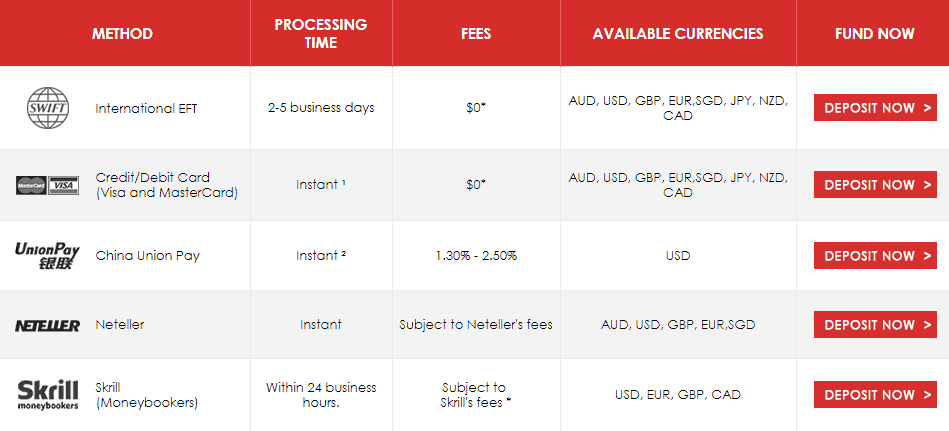

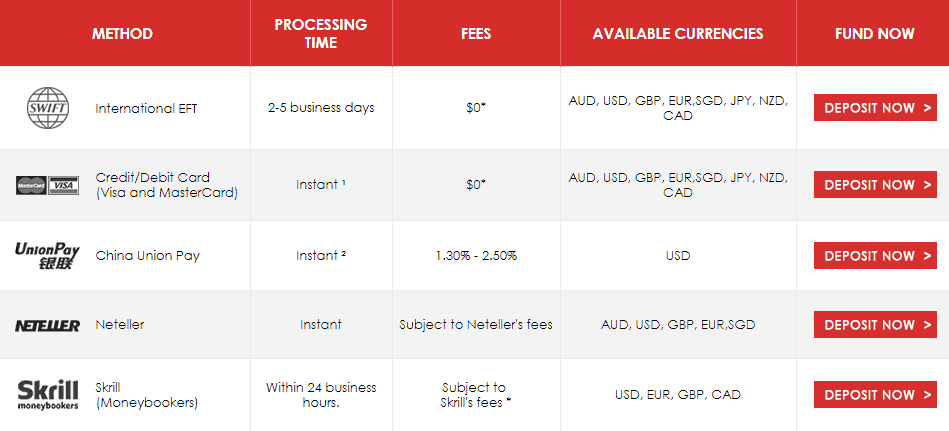

Deposits and Withdrawals

Vantage Markets clients have various options to fund a trading account, including domestic bank transfers, international bank transfers, Skrill, Neteller, Credit/Debit card payments, and more.

- Vantage Markets Funding Methods we ranked good with an overall rating of 9.2 out of 10. The minimum deposit is among average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for Vantage Markets funding methods found:

| Vantage Markets Advantage | Vantage Markets Disadvantage |

|---|

| First deposit is only USD50 | Methods and fees vary in each entity |

| No internal fees for deposits and withdrawals | |

| Fast digital deposits, including Credit/Debit Cards | |

| Multiple Account Base Currencies | |

Deposit Options

In terms of funding methods, Vantage Markets offers many payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- PayPal

- Neteller

- UnionPay

- AstroPay, and more

Vantage Markets Minimum Deposit

The minimum deposit for Vantage Standard and Raw accounts is $50 as a start, which is a good option for beginner or regular-size traders. However, for Pro account, the minimum deposit amount is $10,000.

Vantage Markets minimum deposit vs other brokers

|

Vantage Markets |

Most Other Brokers |

| Minimum Deposit |

$50 |

$500 |

Vantage Markets Withdrawals

Withdraw funds on Vantage supports various payment options and Vantage Markets does not charge internal fees for electronic deposits or withdrawals. However, some additional methods may charge fees, so it is important to note this with your payment provider.

How Withdraw Money from Vantage Markets Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

All Vantage trading accounts are accessible across all devices and all offered platforms, as one of the main aims is to have fast and stable access to the trading account. This includes the enhanced MetaTrader 4, MetaTrader 5, WebTrader, ProTrader, multiple mobile trading apps for iPhone and Android devices, and finally social trading platforms: Vantage Social Trading, ZuluTrade, AutoTrade, and DupliTrade.

- Vantage Markets Platform is ranked excellent with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers popular MT4 and MT5 professional trading platforms.

Trading Platform Comparison to Other Brokers:

| Platforms | Vantage Markets Platforms | Capital Index Platforms | Tickmill Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Desktop and Web Trading Platforms

MT4 and MT5 as market-leading platforms are available with advanced features for the trader’s good, while EAs are allowed for all styles of automated traders, with Trading Central opportunities, Indicators, and Signals, and in addition to Free VPS for 10 standard Forex lots per month. The multi-account managers have the opportunity to customize needs and requirements through MAM or PAMM offerings.

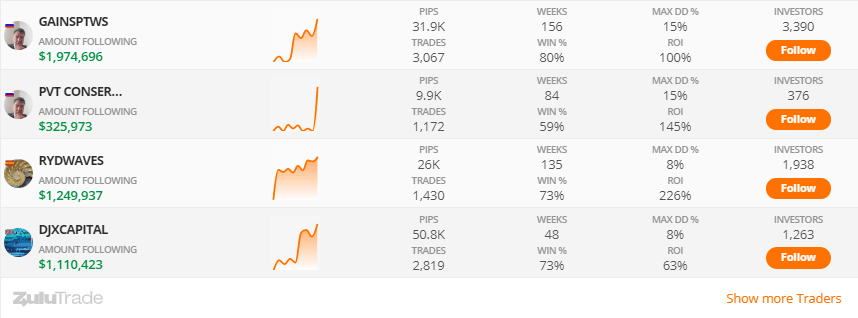

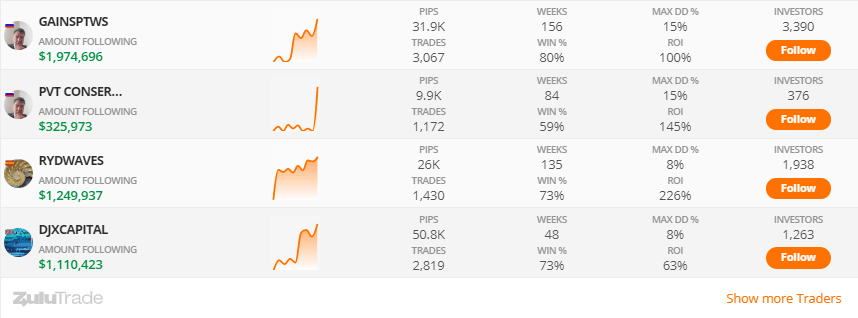

Copy Trading

In addition, Vantage Markets brings an opportunity to automate trading through Myfxbook AutoTrade, which is one of the trusted social trading services, and Zulutrade as one the most popular among the traders’ social trading platforms.

Customer Support

Vantage Markets provides 24/5 customer support to its clients. Phone lines, Live chat, and Email are also available here.

- Customer Support in Vantage Markets is ranked good with an overall rating of 8.9 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of Live chat, phone lines, and email | |

Vantage Markets Education

Vantage Markets offers comprehensive educational materials for all levels of trading experience. The education section includes learning materials, webinars, market news, and analysis, economic calendar, indicators, and many trading tools.

- Vantage Markets Education ranked with an overall rating of 9 out of 10 based on our research. The broker provides very good quality educational materials, and also cooperates with market-leading providers of data.

Vantage Markets Review Conclusion

The final thought upon Vantage Markets review is that the broker is a reliable choice while regulated by two major industry authorities. As an ECN and STP broker, the company stands for a strong reputation and integrity which guarantees all traders trading on the real Interbank Forex market that ensures that Vantage Markets is never the counter-party to the trade.

The broker from many perspectives is a great offer in technology, reliability, customer service, and pricing. Traders of any level can find their benefits with Vantage, like the beginning traders, since the opening of the account is an easy process with a quite small deposit requirement and trading options to choose from, along with provided education.

Based on Our findings and Financial Expert Opinions Vantage Markets is Good for:

- Beginners

- Advanced traders

- Professional trading

- Currency and CFD trading

- Social trading

- ECN/STP execution

- Traders who prefer MT4 and MT5 trading platforms

- Low spread trading

- Competitive fees

- EA trading

- Supportive customer support

- Good educational materials

Share this article [addtoany url="https://55brokers.com/vantage-fx-review/" title="Vantage Markets"]

VANTAGE IS THE WORST BROKER SCAM THAT DECEIVES HIS PARTNERS, BREAKS THE CONTRACT AND DOES NOT PAY MONEY.

I am an affiliate. I work with more than 5 different brokers without any problems, BUT Vantage is the worst broker I have ever worked with. I’ll explain why. I’ve been working with Vantage for over a year on a CPA commission system, for the last 2 months I haven’t been paid my money, supposedly because the clients withdrew a lot of money this month. My manager wrote to me and suggested a solution: they do not pay me my CPA commission for these two months, BUT they offered to transfer absolutely all clients to an IB account at higher rates and recalculate all clients for June and July at the new IB rates. I asked the manager if ALL clients would be recalculated for me under the new IB system, including old clients. My manager said yes.

We signed an agreement on new conditions and after that my manager started lying to me and talking some kind of garbage. The manager began to say that he did not offer to count ALL clients, that only those clients who did not pay out according to the CPA system. The manager began to come up with all sorts of different excuses and so on, so as not to pay me money. Every day they promise to solve my problem and pay me money, this has been going on for more than a month, but they still do not pay money and do not fulfill their terms of the contract that we signed. The funny thing is that now they just deleted my affiliate account and the money has not been paid, and my manager does not respond to messages. I think that I will never see my honestly earned money. I strongly do not recommend working with this broker. All evidence is attached below.

They promised a guaranteed return on my investment but after investing my life savings, I got nothing in return. They seemed legitimate at first, but it was all a scam. I urge people to stay away from fake platforms and not risk their hard-earned money like I did. Report scam to cybertecx net for payout solution

I have been working with Vantage FX for several months straight and didn’t really notice some terrible flaws. However, the recent policy changes of Vantage FX have negative impacted my trading. I’m unable to withdraw my funds. But I have found a good trading platform – TradeEU. The trading conditions are the best and its lowest fees is probably the biggest reason why I love this platform.

T1 Markets is a legit broker for CFD, Forex, and other trading instruments. Capitalix also refers to a good broker because there are various reasons to choose over T1 Markets. However, Capitalix is regulated by CySEC, and the minimum deposit amount is $250. Moreover, advanced research tools are free, and more than 150 assets are available for trading.

I have been working with Vantage FX for several months straight and didn’t really notice some terrible flaws. However, the recent policy changes of Vantage FX have negative impacted my trading. I’m unable to withdraw my funds. But I have found a good trading platform – InvestFW. The trading conditions are the best and its lowest fees is probably the biggest reason why I love this platform.

Vantage FX is undoubtedly the best broker for forex. I have made good money through it. But for the last few months, I have been facing issues with withdrawal. Tried calling customer support many times but didn’t get any satisfactory answer. Distressed with the services, I searched for another Forex broker and found TradeEU. The broker was regulated, I quickly created an account and started trading. After using the platform for over 1 month, here’s my review – The platform is perfect, leverage is good, spreads are lowest and most importantly, the withdrawals are quick. It took only a few hours for withdrawals to credit to my bank account.

Vantage FX is probably the best Forex broker. But from the last 2-3 months, my experience has been below the worst. My withdrawals are struck. Tried contacting customer support, but everything has gone in vain. Then, I get started on TradeEU, and after using it for over a month, from my side it’s above the best.

I discovered this broker for myself not so long ago, but was pleasantly surprised by the work. I trade often, I go to the market almost every day, and given the floating spread, it turned out to be more profitable. An excellent mobile application, it is convenient to track information while being hijacked, it saves time

Vantage FX is undoubtedly the best broker for forex. I have made good money through it. But for the last few months, I have been facing issues with withdrawal. Tried calling customer support many times but didn’t get any satisfactory answer. Distressed with the services, I searched for another Forex broker and found Capitalix. The broker was regulated, I quickly created an account and started trading. After using the platform for over 1 month, here’s my review – The platform is perfect, leverage is good, spreads are lowest and most importantly, the withdrawals are quick. It took only a few hours for withdrawals to credit to my bank account.

Vantage FX is undoubtedly the best broker for forex. I have made good money through it. But for the last few months, I have been facing issues with withdrawal. Tried calling customer support many times but didn’t get any satisfactory answer. Distressed with the services, I searched for another Forex broker and found TradeEU. The broker was regulated, I quickly created an account and started trading. After using the platform for over 1 month, here’s my review – The platform is perfect, leverage is good, spreads are lowest and most importantly, the withdrawals are quick. It took only a few hours for withdrawals to credit to my bank account.