- What is Trade.com?

- Trade.com Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

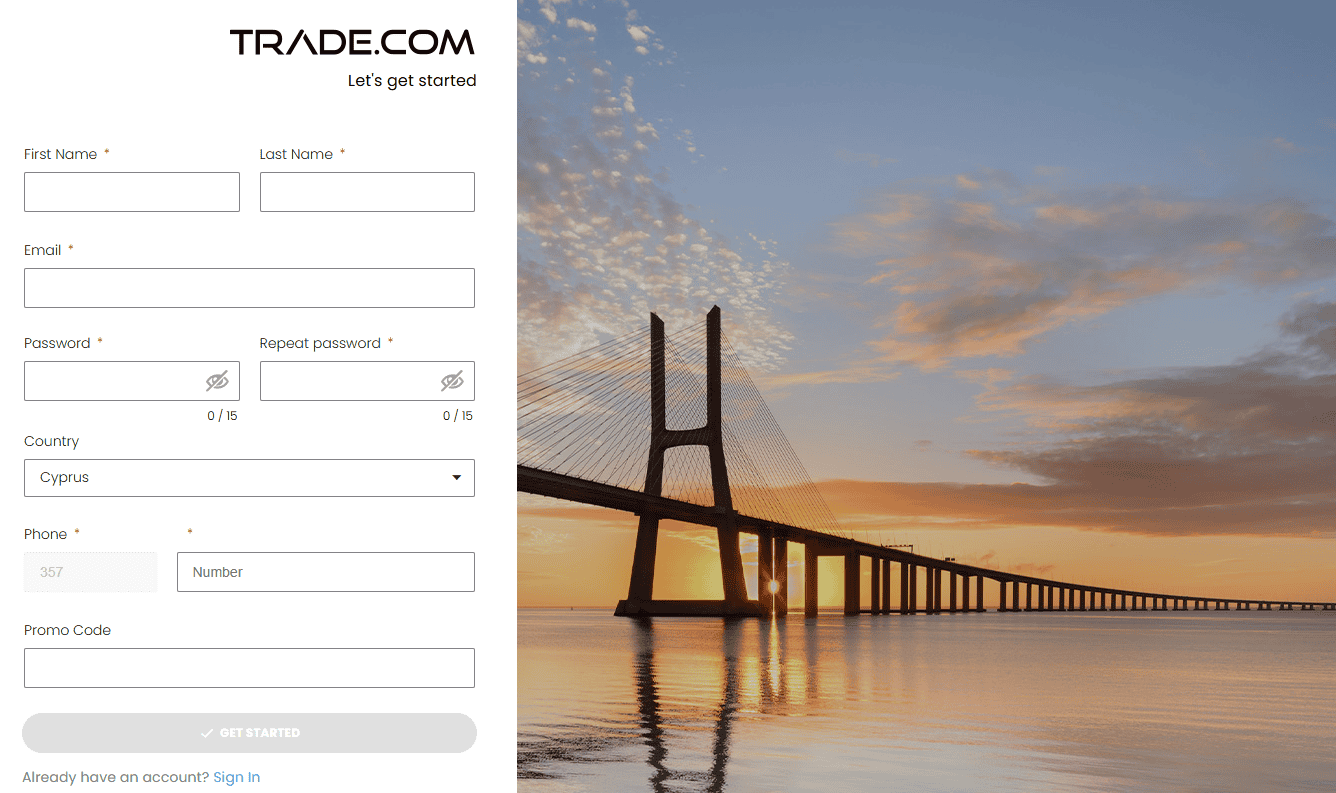

- Account Opening

- Additional Tools And Features

- Trade.com Compared to Other Brokers

- Full Review of Broker Trade.com

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Trade.com?

TRADE.com is a popular and quite large Forex Broker providing access to trade Forex and CFD instruments, with good solutions and a technology base, along with the platform designed by Trade.com that opens secure access to a wide range of products and over 2,100 instruments to select on WebTrader.

- Trade.com is a trading name operated by Leadcapital Markets Ltd, based in Cyprus, authorized and regulated by the Cyprus Securities and Exchange Commission. At the same time, the company serves additional entities regulated in each region in which it operates, allowing international access.

- As we found, Broker also established UK trading regulated by FCA yet is running on a separate website tradecapitaluk.com. While International and Cyprus entities use the main website address.

At the time of its establishment and until now, Trade.com provides quality services to traders that allow joining to trading and cooperation at any level. This being is established by a comprehensive education to learn methods and strategies, through available information and analysis that are affecting global markets, which is a great addition for beginning traders to get started.

Trade.com Pros and Cons

Trade.com is a reputable company operating for many years. It is secure, legit, and licensed by top-tier authorities including FCA, and European CySEC along with international trading. The account opening is easy, the conditions are suitable for regular or professional traders, the commission and costs are low, also the range of instruments is wide. In our review we mainly review the international proposals, so is good to note conditions by the entity may vary.

For the Cons, the proposals vary according to the entity, there is no 24/7 support, and no deep learning materials essential for beginners.

| Advantages | Disadvantages |

|---|

| Well-regulated broker with a strong establishment | Conditions vary according to regulation and entity |

| Popular trading instruments | No 24/7 customer support |

| Globally recognized broker | Limited learning materials |

| Competitive trading conditions | |

| MT4/MT5 Trading Platforms | |

| Suitable for beginners and professionals | |

| Excellent support and research tools | |

Trade.com Features

Trade.com is a multi-asset broker offering a range of instruments, platforms, and account types to suit traders of all experience levels. Here are Trade.com’s main features summarized in 10 key points, covering aspects like Regulation, Platforms, available Account Types, and more.

Trade.com Features in 10 Points

| 🏢 Regulation | FCA, CySEC, FSCA, FSC |

| 🗺️ Account Types | Silver, Gold, Platinum, Exclusive Accounts |

| 🖥 Trading Platforms | Trade.com WebTrader, MT4, MT5, TradingView |

| 📉 Trading Instruments | Forex, CFDs on Cryptos, Commodities, Stocks, Bonds, Indices, ETFs |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1.9 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Trade.com For?

Trade.com is designed to accommodate the needs of traders at every skill level with a broad range of financial instruments and resources. Based on our findings and Financial Expert opinions Trade.com is Good for:

- Advanced traders

- Traders who prefer the MT4 and MT5 platforms

- Currency and CFD trading

- ETF Investing

- UK Traders for separate offering

- European Traders and International Investors

- Variety of strategies

- Competitive conditions

- Good customer support

- Good choice of platforms

- Excellent research tools

Trade.com Summary

Concluding the Trade.com review, we admit a broker that offers financial opportunities to traders of almost any demand. Trade.com Services are ranked quite high along with its diversification between instruments offered, also dedicated account offerings either for CFD and ETF trading.

The broker provides truly attentive support to their clients, through the wide range of local call centers, yet does not offer comprehensive education, but includes advanced research tools and analysis to its offered platforms that highlight its offerings.

55Brokers Professional Insights

Trade.com is among shortlisted reputable brokers operating for many years and quite known in worldwide traders community. The broker offering is safe and favorable condition that might suits vast range of traders styles or various levels.

One of its standout advantages is its global reach, allowing traders from various countries to access quality platforms and benefit from competitive execution and overall high ranked by us trading performance with a wide range of services. Additionally, the broker excels in research tools, so is a good fit for technical traders and those who prefer rely on charts rather than news, these including integration with TradingView, which provides superior charting capabilities, a large library of prebuilt technical indicators, and access to a vibrant trading community.

However, some drawbacks include limited educational resources, which may not be sufficient for complete beginners seeking in-depth learning. Additionally, the conditions can vary depending on the jurisdiction, which may affect the overall experience, while fees are also much better if you trade with higher account type therefore with higher deposit. Despite these limitations, Trade.com remains a solid choice for traders looking for a secure and flexible platform.

Consider Trading with Trade.com If:

| Trade.com is an excellent Broker for: | - Looking for broker with Top-Tier licenses.

- Offering a variety of account types.

- Get access to MT4, MT5, and TradingView platforms.

- Offering a proprietary platform.

- Beginners and professional traders.

- Secure environment.

- Who prefer higher leverage up to 1:300.

- Broker with a variety of strategies.

- Providing services worldwide.

- Offering popular instruments.

- Looking for broker with quality customer service.

- Providing competitive fees and costs.

- Access to PAMM System. |

Avoid Trading with Trade.com If:

| Trade.com might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with cTrader.

- Need broker with the lowest possible spreads.

- Looking for broker offering Copy Trading/Social Trading.

- Need broker offering good educational materials.

|

Regulation and Security Measures

Score – 4.6/5

Trade.com Regulatory Overview

Trade.com is a globally regulated broker, ensuring a secure and transparent environment for its clients. The broker is licensed by multiple regulatory authorities, including the reputable FCA in the UK, the CySEC in Cyprus, and the FSCA in South Africa. These regulations provide oversight and compliance with strict financial standards, offering traders a high level of trust and security.

However, international trading under Trade.com operates through the offshore license issued by the FSC in Mauritius. While this provides access to global markets and maintains essential compliance standards, traders should carefully evaluate the differences in regulatory environments to ensure they align with their specific needs and expectations.

How Safe is Trading with Trade.com?

Trading with Trade.com is considered safe and secure, as the broker operates under a low-risk environment and is regulated by several top-tier financial authorities. CySEC, as part of the European Securities and Markets Authority (ESMA), ensures Trade.com complies with the Markets in Financial Instruments Directive (MiFID), which enforces the highest investor protection standards and financial transparency.

Client funds are safeguarded through segregation in Tier 1 banks, ensuring they remain separate from the company’s operational funds. Additionally, the broker offers a Compensation Fund to protect client investments and provides comprehensive account management services to clarify the processes and associated risks. However, the level of regulation and protection may vary depending on the entity you trade with, particularly for international clients trading under the offshore license.

Consistency and Clarity

Trade.com has established a good reputation in the industry, supported by high scores on review platforms and positive feedback from real traders who praise its user-friendly platforms, competitive spreads, and wide range of instruments. Many traders commend the broker for its responsive customer service and transparent conditions, which enhance trust and client satisfaction.

Additionally, Trade.com actively participates in social and community initiatives, including sponsorships and partnerships, demonstrating its commitment to being a socially responsible broker. The broker has also received industry awards that highlight its innovation and reliability in the financial sector.

However, some traders have expressed different opinions, occasionally raising concerns about the broker’s limited educational resources and the variability in conditions based on the regulatory entity. International traders operating under the offshore license may also experience differing levels of protection. While Trade.com offers numerous benefits, traders should carefully weigh its pros and cons alongside their individual needs to make an informed decision.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Trade.com?

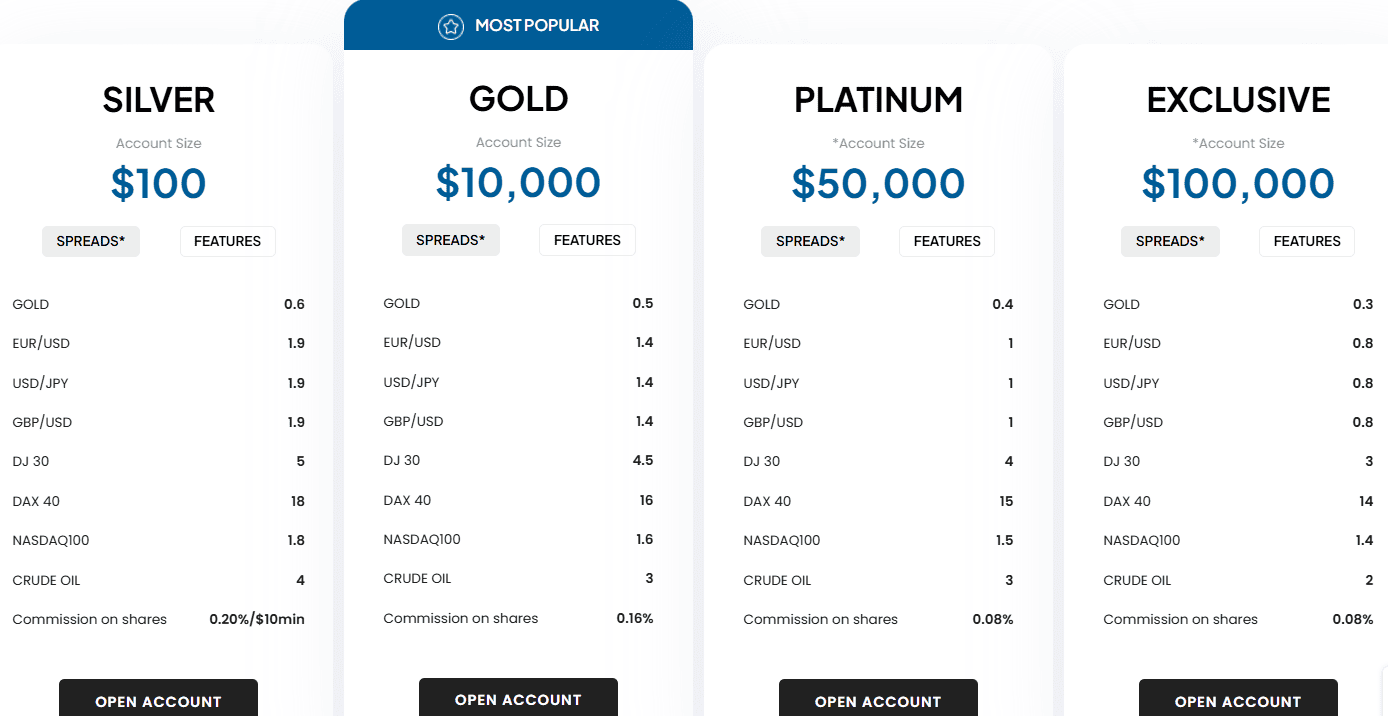

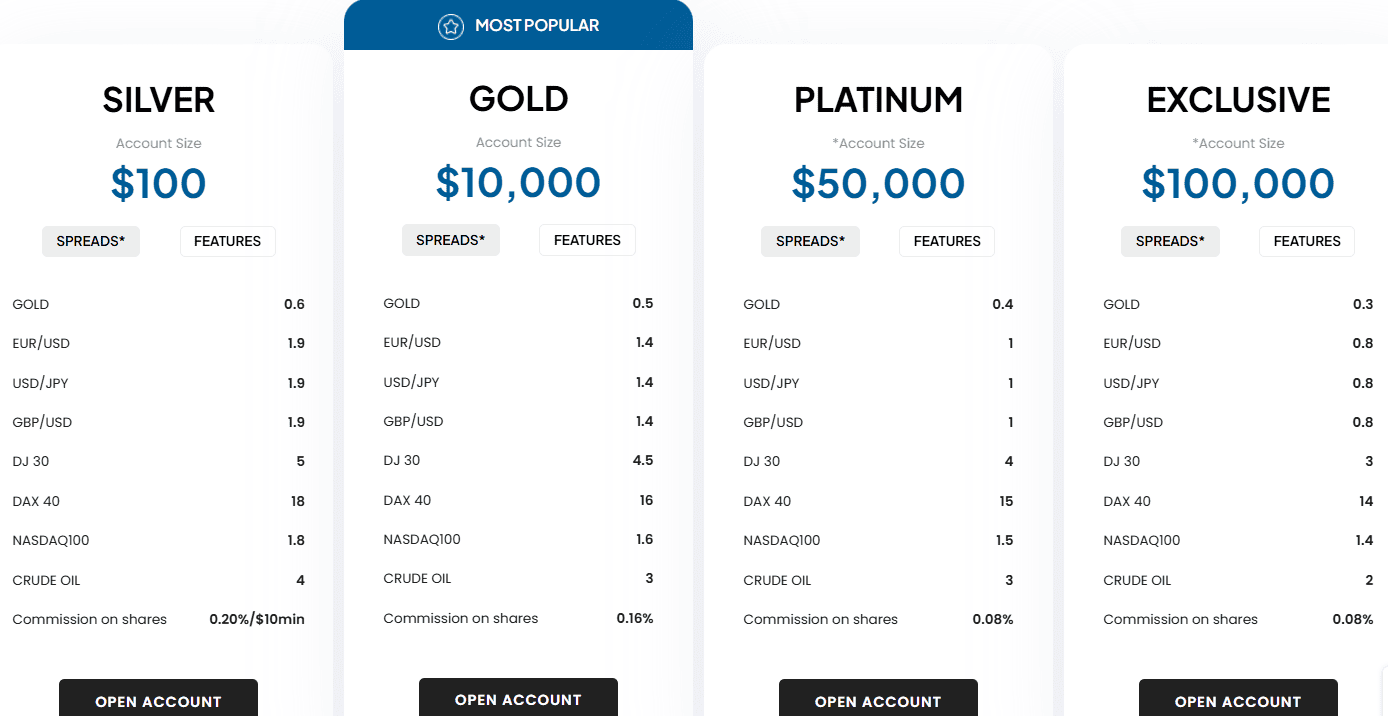

Trade.com has separate offerings for CFD and ETF trading and offers a variety of CFD account types to suit traders of all experience levels, including Silver, Gold, Platinum, and Exclusive accounts. Each account type provides different features, tools, and dedicated account management.

The Silver account has a low minimum deposit, making it ideal for beginners, while the Gold and Platinum accounts cater to more experienced traders with additional benefits like personalized support and conditions. The Exclusive account is designed for professional traders, offering tailored services and exclusive features.

In addition to live accounts, Trade.com also offers a demo account, allowing traders to practice and familiarize themselves with the platform and conditions without risking real money. This is an excellent option for those looking to build their skills or test strategies.

For traders who require special conditions, swap-free accounts are also available. These accounts allow traders to avoid overnight swap charges, making them ideal for those who cannot participate in interest-based transactions, such as traders in Muslim countries who adhere to Sharia law.

Silver Account

The Silver Account at Trade.com is designed for beginner traders, offering a low minimum deposit requirement, starting at $100. This account type provides access to the average EUR/USD Forex spread of 1.9 pips, ensuring affordable conditions.

The account is available on the popular MT4/MT5 and WebTrader platforms, both offering good charting tools, technical analysis features, and an intuitive user interface to facilitate a smooth experience. The account is a great starting point for those looking to explore Currency and CFD trading with flexible conditions and support.

Gold Account

The Gold Account is for more experienced traders who are looking for enhanced conditions. With a higher minimum deposit requirement, typically starting at $10,000, the Gold Account offers spreads, averaging around 1.4 pips for the EUR/USD currency pair.

Additionally, Gold Account holders benefit from dedicated account management, ensuring personalized support and a more tailored trading experience.

Platinum Account

The Platinum Account is for professional traders who demand premium features and optimal conditions. With a higher minimum deposit, starting at $50,000, the account offers averaging around 1 pip on EUR/USD. Platinum Account holders get access to priority customer support and exclusive market insights.

This account also provides advanced tools, including custom trading strategies and enhanced risk management features, making it ideal for traders looking for a more sophisticated and flexible environment.

Exclusive Account

The Exclusive Account at Trade.com is the top-tier offering, tailored to professional traders or institutional clients who require highly personalized services. The minimum deposit for this account is typically $100,000 or more, providing access to ultra-competitive spreads, with an average of 0.8 pips for EUR/USD.

Traders with an Exclusive Account receive priority access to all available platforms, along with market research and expert advice. The account holders also enjoy one-on-one account management, with a dedicated representative available to assist with every aspect of trading, making it perfect for those seeking the highest level of support and resources.

Regions Where Trade.com is Restricted

Trade.com is a globally recognized broker, but it has certain regional restrictions due to regulatory and legal requirements. The broker is not available for traders in some jurisdictions, including:

- USA

- Japan

- Canada

- Spain

- Belgium

Cost Structure and Fees

Score – 4.3/5

Trade.com Brokerage Fees

Trade.com charges fees based on the type of instrument being traded. For CFD trading, the costs are generally built into the spread, while trading shares involves a commission per trade, which can vary based on the selected account type. Commissions are charged when a position is opened, and the amount includes both the opening and closing of the position.

In addition to costs, there are other fees to consider, such as inactivity fees and funding fees, which can affect the overall pricing structure. However, fees may differ depending on the regulatory entity under which your account is held. Despite these additional costs, Trade.com’s overall fees are considered competitive and reasonable.

Trade.com offers floating spreads, which can vary depending on market conditions, account type, and instrument being traded. For major Currency pairs like EUR/USD, the average spread is around 1.9 pips for Silver accounts.

The broker aims to provide tight and transparent spreads overall, that ensures traders can access favorable conditions and manage costs effectively.

Trade.com charges commissions primarily on specific instruments, such as shares. For Silver accounts, the commission on shares is 0.20% of the trade value or a minimum of $10. For Gold accounts, the commission on shares is 0.16% of the trade value.

For Platinum accounts, the commission is further reduced to 0.08%. Similarly, for Exclusive accounts, the commission on shares remains at 0.08% of the trade value. Commissions are charged when a position is opened, and the amount includes both the opening and closing of the position.

- Trade.com Rollover / Swaps

Trade.com applies rollover fees or swaps to positions that are held overnight. These fees are charged or credited depending on the direction of the trade and the interest rate differential between the two currencies involved in a Forex trade. The swap rate is calculated based on market conditions, and it may vary from day to day.

Traders should consider rollover fees, especially for longer-term positions, as these fees can impact the overall profitability of their trades.

- Trade.com Additional Fees

Trade.com has several additional fees that traders should be aware of. The broker charges a $50 monthly fee if there has been no trading activity in the account for 90 days or more. This fee is designed to maintain the account and cover administrative costs.

Regarding deposit and withdrawal fees, the broker currently does not charge any fees for depositing or withdrawing funds, as these fees are covered by the broker. However, traders should keep an eye on any changes to the fee structure to avoid unexpected costs.

How Competitive Are Trade.com Fees?

Trade.com offers competitive fees that make it an attractive choice for many traders, particularly those focused on CFD trading. The broker does not charge deposit or withdrawal fees, which can significantly reduce the cost of trading for many users.

However, while the fees for CFDs are relatively competitive, the spread based accounts are better with higher deposits, those who will trade via Silver account may have slightly higher spread than other industry proposals. Also, traders who focus on shares or stocks may encounter commission costs, which vary by account type and can be higher for less premium accounts. The inactivity fees may also be a consideration for traders who prefer low-maintenance accounts. Overall, Trade.com’s fee structure is reasonable, for the quality of performance overall, though traders should be mindful of the different charges depending on the account type and activity.

| Asset/ Pair | Trade.com Spread | XS Spread | GMI Spread |

|---|

| EUR USD Spread | 1.9 pips | 1.1 pips | 1 pip |

| Crude Oil WTI Spread | 4 pips | 2.3 pips | 1.2 pips |

| Gold Spread | 0.6 pips | 2.1 pips | 0.0 pips |

| BTC USD Spread | 10.01 USD | 520 | - |

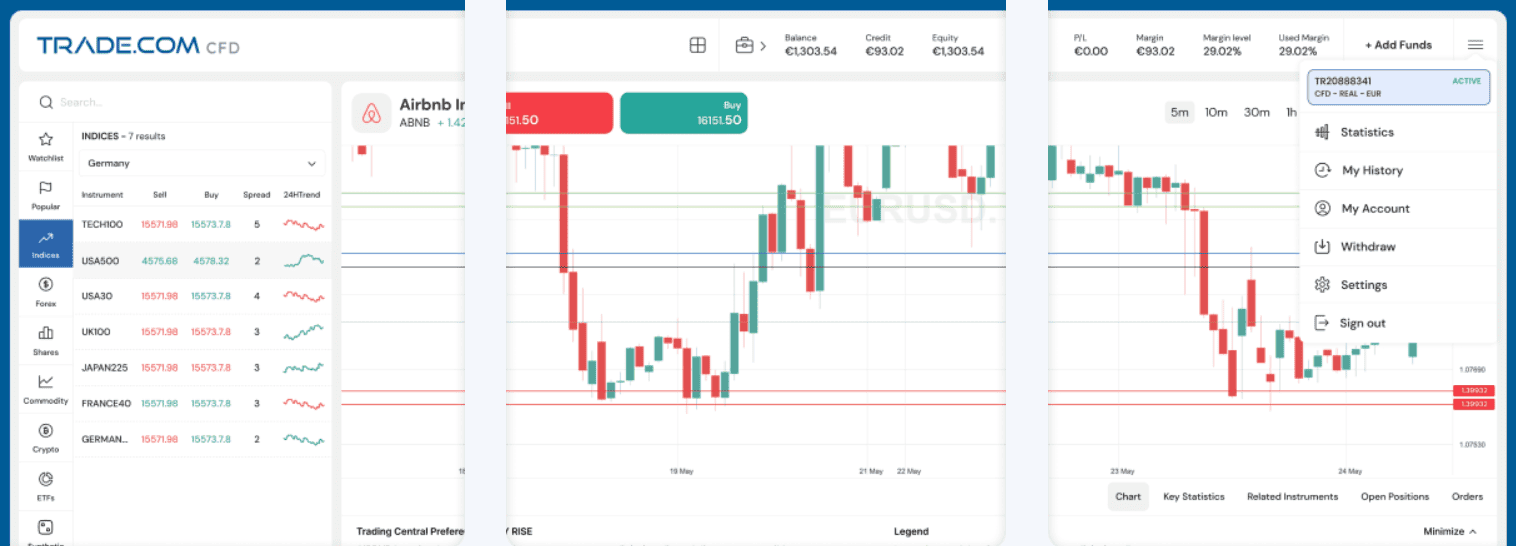

Trading Platforms and Tools

Score – 4.6/5

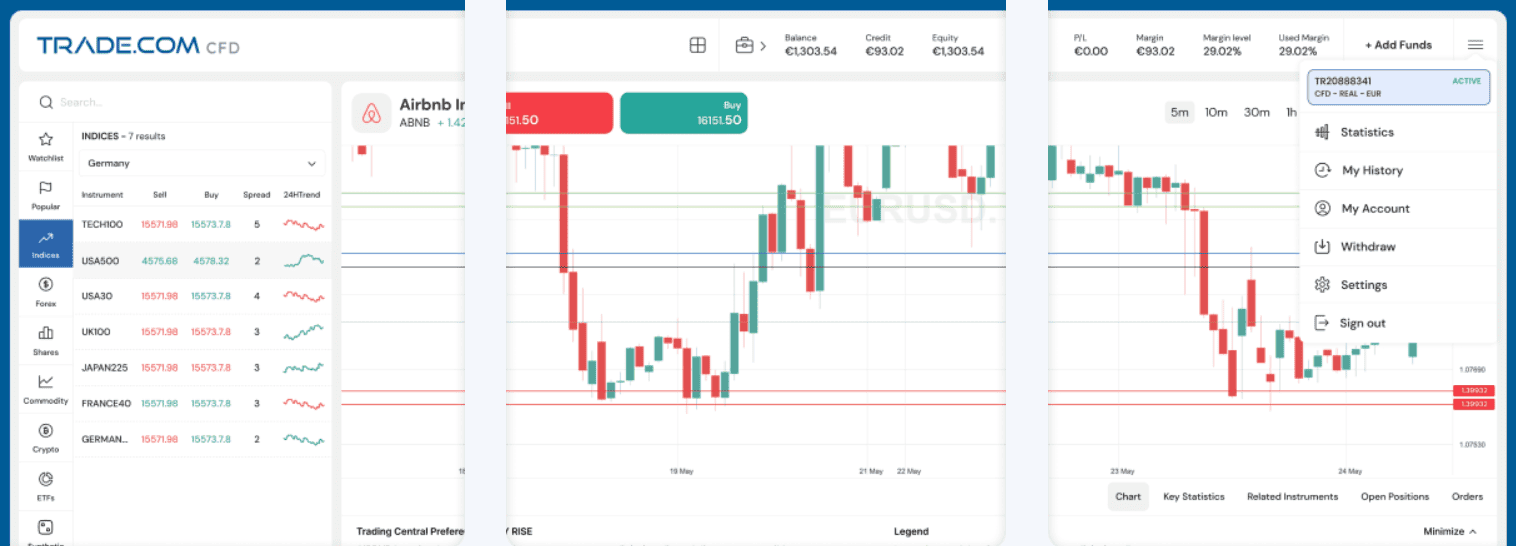

Trade.com provides a versatile selection of platforms to cater to traders of all preferences and experience levels. The broker’s proprietary WebTrader offers an intuitive interface, and a seamless experience directly from the browser, eliminating the need for downloads.

Trade.com also supports popular MT4, available for the EU entity, and MT5, renowned for their robust functionality, including automated capabilities, extensive analytical tools, and customizable charting options.

Additionally, the integration with TradingView allows traders to access advanced charting tools, community insights, and social trading features, enhancing the overall experience.

Trading Platform Comparison to Other Brokers:

| Platforms | Trade.com Platforms | XS Platforms | GMI Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Trade.com Web Platform

Trade.com’s WebTrader platform is designed to provide traders with a seamless and efficient experience. Managing funds and trades is straightforward, with all essential information compiled in one convenient location. The platform features multi-chart display windows, enabling traders to view and compare multiple assets simultaneously, each with fully independent indicators for tailored analysis.

Additional features include in-platform price alerts, real-time balance and account level updates, and a practice account loaded with $10,000 in virtual funds to test strategies risk-free. Built with SSL security, the WebTrader ensures a safe and reliable environment.

Trade.com Desktop MetaTrader 4 Platform

Trade.com’s MetaTrader 4 platform is available for EU entity clients through desktop and mobile interfaces, making it a good choice for traders needing flexibility. As one of the most popular and reliable platforms, MT4 offers a range of customization tools to support specific strategies.

Traders can access multiple asset classes, including Forex, Commodities, Bonds, Indices, Shares, and ETFs, all in one seamless interface. Features such as automated trading, embedded tick charts, and real-time alerts on trading positions enhance efficiency and decision-making. Additionally, the platform provides invaluable online help five days a week, ensuring traders receive support when needed.

Trade.com Desktop MetaTrader 5 Platform

Trade.com’s MT5 platform is a cutting-edge solution for multi-asset CFD trading, offering enhanced speed and efficiency compared to its predecessor, MetaTrader 4, while maintaining a familiar and user-friendly layout. Suitable for traders of all levels, including institutional traders, MT5 provides advanced tools such as superior charting, a strategy tester, and the innovative market depth feature for a clearer view of the markets.

The platform supports automated trading through robots using the new MQL5 language, allowing traders to execute algorithmic strategies effortlessly.

Trade.com MobileTrader App

The Trade.com MobileTrader App offers a flexible and convenient experience, allowing traders to manage their accounts, execute trades, and monitor market movements from anywhere. In addition to the proprietary MobileTrader platform, the broker supports mobile versions of the MT4 and MT5 platforms, giving users access to real-time market data, and automated capabilities on the go.

Enhanced with SSL security and real-time price alerts, the apps cater to all levels of traders for a reliable and efficient experience.

Main Insights from Testing

Testing Trade.com’s mobile apps revealed a smooth and intuitive user experience, with responsive navigation and real-time updates that keep traders connected to the markets. The apps performed well across various devices, ensuring stability and reliability even during high market volatility.

Features like instant notifications, secure login options, and a seamless interface make these apps suitable for both active and occasional traders. Overall, mobile platforms deliver efficiency and convenience, catering to the demands of modern trading.

Trading Instruments

Score – 4.4/5

What Can You Trade on Trade.com’s Platform?

Trade.com provides access to over 2,100 instruments, including Currencies, CFDs on Cryptos, Commodities, Stocks, Bonds, Indices, and ETFs. ETFs and CFDs are offered through separate websites, ensuring clear and organized conditions tailored to each instrument. This comprehensive selection caters to traders with varying interests and strategies, offering flexibility and convenience across multiple asset classes.

Main Insights from Exploring Trade.com’s Tradable Assets

Exploring Trade.com’s range of tradable assets reveals a well-rounded offering that caters to diverse interests. The platform provides access to popular markets such as Forex, where traders can engage with major pairs like EUR/USD, GBP/USD, and USD/JPY.

Additionally, Trade.com features CFDs on Cryptos, including popular digital assets such as Bitcoin, Ethereum, and Litecoin, allowing traders to participate in the dynamic cryptocurrency market. The clear segmentation of instruments and user-friendly tools further enhance accessibility and appeal for traders at all levels. However, the available instruments may differ depending on the entity through which you trade.

Leverage Options at Trade.com

Leverage trading, which is a unique opportunity to trade bigger size compared to your initial balance, offers to maximize your gains. However, you should carefully learn how to use this tool, since the multiplier may work in reverse as well.

We found that Trade.com Leverage offers the following conditions:

- European and UK resident traders can use a maximum leverage of 1:30.

- The international entities offer a high leverage of 1:300.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Trade.com

Trade.com accounts can be funded using several simple and secure methods that allow for instant transfers of funds to or from the account. However, the available methods and conditions may vary depending on jurisdictional rules and imposed regulations, so users should verify these details beforehand.

- Credit/Debit Cards

- Bank Wire

- Skrill

- Neteller

- PayPal, etc.

Trade.com Minimum Deposit

The broker requires a minimum deposit starting at $100 for the Silver account, making it accessible to beginner traders. However, the minimum deposit increases significantly for higher-tier accounts, reflecting the advanced features and benefits they offer.

For the Gold account, the minimum deposit is $10,000, while the Platinum account requires $50,000, and the Exclusive account demands a minimum of $100,000. These varying deposit levels allow traders to choose an account type that aligns with their goals, experience, and budget.

Withdrawal Options at Trade.com

Trade.com offers a range of withdrawal options to ensure convenience and accessibility for its traders. Withdrawals can be processed through popular methods such as bank transfers, credit/debit cards, and e-wallets, though the availability of these options may vary depending on the trader’s location and the regulatory entity.

However, traders should verify specific conditions and processing times for each method, as these may differ. Ensuring that account verification and documentation are complete is essential for smooth and timely withdrawals.

Customer Support and Responsiveness

Score – 4.4/5

Testing Trade.com’s Customer Support

Trade.com provides comprehensive customer support to assist traders with their inquiries and technical needs. The support team is available 24/5, offering assistance through various channels, including live chat, email, and WhatsApp, ensuring quick and efficient responses.

The broker prioritizes multilingual support to cater to its global client base, making it accessible to traders from different regions. Additionally, the FAQ section provides self-help options for resolving common questions. Overall, Trade.com’s customer support is responsive and well-equipped to handle a wide range of trading-related issues.

Contacts Trade.com

Trade.com offers multiple ways for clients to contact their customer support team. Traders can reach out via email at support@trade.com or use the live chat feature available on the website for real-time assistance.

Additionally, a phone number is provided exclusively for the UK entity, which can be reached at +44 (0)20 31 50 23 85. These options ensure that clients receive prompt support to address their needs.

Research and Education

Score – 4/5

Research Tools Trade.com

Trade.com offers a variety of research tools both on its website and platforms to help traders make informed decisions.

- On the website, users have access to market news updates, an economic calendar, and detailed research resources. Additionally, traders can explore in-depth fundamental and technical analysis, along with expert market commentary.

- On the platforms, including WebTrader, and MetaTrader platforms, traders can access diverse charting tools, customizable indicators, real-time market data, and multi-chart windows. These platforms also provide features like a strategy tester for backtesting, price alerts, and automated capabilities. Together, these tools help traders analyze market trends, develop strategies, and manage their trades more effectively.

Education

Trade.com does not provide a comprehensive educational center like some other brokers, which may be a drawback for traders looking for extensive learning resources. However, the platform compensates for this by offering a range of research tools and essential features. These include platforms with inbuilt tools, an economic calendar, intelligent analysis, and access to Trading Central.

Additionally, the platform provides Events & Trade tools that help traders stay up to date with market developments. While the educational content may be limited, these resources offer valuable support for traders to improve their decision-making and enhance their strategies.

Portfolio and Investment Opportunities

Score – 3.5/5

Investment Options Trade.com

Trade.com is primarily a Currency and CFD broker, however, it also provides access to the PAMM (Percentage Allocation Management Module) system, which can serve as an investment solution for those looking to allocate funds to experienced traders.

However, Trade.com does not offer copy trading, which may limit certain investment options for those seeking automated strategies based on other traders’ performance.

Account Opening

Score – 4.5/5

How to Open Trade.com Demo Account?

Opening a demo account with Trade.com is a straightforward process. To start, visit the broker’s website and sign up by providing your basic details, such as name, email address, and phone number.

After registration, you will be able to access the demo account, which comes with virtual funds to practice trading. This allows you to explore the platform, test out various strategies, and familiarize yourself with the tools and features available, without the risk of losing real money. The demo account is ideal for beginners or anyone looking to practice before trading with real funds.

How to Open Trade.com Live Account?

Opening an account with Trade.com is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.6/5

Trade.com offers a range of additional tools and features to enhance the experience.

- Trading Central provides access to leading international research and covers all popular CFD instruments, ensuring traders can make informed decisions. The easy plug-in on MetaTrader allows seamless integration, while its independent analysis offers unbiased insights. The tool is compliant with leading market authorities, ensuring it adheres to high standards. Additionally, traders benefit from invaluable access to online help five days a week, enhancing their experience.

- For enhanced charting and analysis, Trade.com offers integration with TradingView, a powerful tool with a vast library of 100 popular prebuilt technical indicators and studies. Traders can use these indicators in conjunction or display them on different charts. The platform also offers back-testing strategies and the ability to build custom studies and indicators. Moreover, TradingView features powerful charting tools, stock screeners, and an active community, catering to traders of all experience levels.

- MT5 users also benefit from access to platform signals, making Trade.com a comprehensive platform for traders seeking both fundamental and technical analysis.

Trade.com Compared to Other Brokers

Trade.com stands out in several areas when compared to its competitors, though it does have its advantages and drawbacks. One notable advantage is its range of platforms, including WebTrader, MT4, MT5, and integration with TradingView, which offers traders flexibility in their choice of tools. This variety provides a significant advantage over brokers like Xtrade, which only offers WebTrader.

In terms of asset variety, Trade.com offers a solid range of over 2,100 instruments, which is competitive, although brokers like Markets.com and FP Markets have a larger offering. While its educational resources are somewhat limited compared to the more comprehensive offerings from Forex.com and FP Markets, Trade.com’s research tools are comprehensive and include features such as Trading Central, integration with TradingView, and advanced analytical capabilities.

In terms of fees, Trade.com’s spread-based account could be considered less competitive than the more attractively priced options from brokers like Markets.com or GMI, but it does provide commission-based accounts for shares, giving more flexibility for traders. Trade.com also offers solid regulatory oversight, with licenses from FCA, CySEC, and FSCA, ensuring that it meets high standards, though competitors like Forex.com and Markets.com have a broader range of regulatory bodies. Overall, Trade.com provides a balanced option with competitive platforms and assets, though certain competitors may have a slight edge in fees, asset variety, or educational resources.

| Parameter |

Trade.com |

Markets.com |

Forex.com |

FP Markets |

Axi |

Xtrade |

GMI |

| Spread Based Account |

Average 1.9 pips |

Average 1 pip |

Average 1.3 pips |

From 1 pip |

Average 1.2 pips |

Average 2 pips |

Average 1 pip |

| Commission Based Account |

For Shares only (Silver account – 0.20%/$10 min) |

For Stocks Only ($1 per $1,000 trade) |

0.0 pips + $5 |

0.0 pips + $3 |

0.0 pips + $7 |

No commissions, based on fixed spreads |

0.0 pips +$4 |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Average |

Average |

Average |

| Trading Platforms |

Trade.com WebTrader, MT4, MT5, TradingView |

Markets.com Web, MT4, MT5, TradingView, Markets.com Social Trade App |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, Axi Trading App, Axi Copy Trading App |

Xtrade WebTrader |

MT4, MT5, GMI Edge |

| Asset Variety |

2,100+ instruments |

2,200+ instruments |

6000+ instruments |

10,000+ instruments |

220+ instruments |

1,000+ instruments |

70+ instruments |

| Regulation |

FCA, CySEC, FSCA, FSC |

CySEC, FCA, ASIC, FSCA, FSC, FSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, DFSA, FSA |

FSC, FSCA |

FCA, FSC |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 support |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$100 |

$100 |

$100 |

$100 |

$0 |

$250 |

$25 |

Full Review of Broker Trade.com

Trade.com is a well-regulated multi-asset broker that caters to a diverse range of traders with over 2,100 tradable instruments. The broker offers a variety of platforms to suit different styles, including its proprietary WebTrader, the popular MetaTrader 4 and 5 platforms, and advanced integration with TradingView, which features advanced charting tools, prebuilt technical indicators, and a vibrant community.

Additionally, Trade.com offers multiple account types, starting with a minimum deposit of $100 for the Silver account and scaling up to $100,000 for the Exclusive account, providing flexibility for traders with varying capital levels. While spreads are competitive, the fees for some instruments may not be as low as those offered by other brokers.

The broker provides excellent research tools, including Trading Central, however, its educational resources are relatively limited. While Trade.com provides a solid foundation for trading, its educational offerings and asset variety could be further expanded to compete more effectively with top-tier brokers.

Share this article [addtoany url="https://55brokers.com/trade-com-review/" title="Trade.com"]

Do you offer ETFs?

I like leverage trading with this broker, y’all know why? Because leverages here aren’t fixed. They vary from asset to asset, and as you may noticed, even currency pairs have different leverage. As far as I know it is connected with regulations of this broker. It’s convenient, it’s easier to create a good strategy for these conditions.

Trade.com is the broker that will suit for more professional needs. Of course there is an ordinary CFD account that is mostly for beginners.

However if you want to get the full potential from the broker, you have to be a seasoned pro to be able to use all the broker’s services and accounts.

Does somebody know what are the requirements of DMA account?

Hm… DMA account? I may be wrong, but I want to you help you.

As far as I know, there are no any accounts for DMA, as it’s almost the same as ordinary CFD trading. Thus, the broker, probably, didn’t want to make its services hard for perception, and left the same accounts as for CFD trading. However, I highlighted, I may be wrong! You can always ask customer support for a help, and they will describe everything to you in detail.

Oh, Trade.com DMA account is definitely not the same as CFD account.

First of all you get the fastest orders execution of all the accounts that exist in the forex market. This leads to the best pricing for the instruments too.

Speaking of instruments, Trade,com DMA account offers more than 100,000 assets for trading from the global markets.

In this regard Trade,com is a very versatile company.

I really liked the idea of being able to set up an automated bot that will analyze the markets for me and make trading decisions based on the data and the analyses. But I was curious since it seems difficult. Is there a forum or a community where I can ask questions about the process?

I believe that thanks to Trade.com, my trading level will rise to new level.

I already have experience in trading, but to get more opportunities, I opened trading account with Trade.com.

I think so because this broker offers lots of financial instruments.

I only don’t know if I can trust this broker with my personal data. Was there any information leakage from Trade.com?

Not that I know about. I think this issue is quite rare among forex brokers. Maybe it’s because forex brokers have strict rules of compliance to the regulators’ requirements. They include such things also.

Or maybe all those personal data of clients are useless. Because if you, for example, would have my personal data, what would you do with that? You won’t be able to withdraw funds into your payment system. Since brokers have the requirement to withdraw to the same payment method which was used for deposit.

The only thing you could do is to trade on my trading account and make some losses. But what’s the point?

is markets48 yuur trading platform ?

Comment Areawindow.alert(“Valforex is the SCAM, do not trust them”)