In a significant shift in its service offerings, the online trading platform eToro has announced that it will cease supporting long non-leveraged CFD positions for cryptocurrencies in Australia. This change is set to take effect from February 19, 2024.

Following this date, eToro will automatically close any remaining open long non-leveraged CFD positions in cryptoassets at the prevailing market value. This decision marks a notable transition in the company's approach to crypto trading in the Australian market.

For users who wish to close their non-leveraged long CFD positions in cryptoassets before the February 19 deadline, eToro has offered a pathway. Clients can close their CFD positions and subsequently open equivalent positions in real cryptoassets. An added benefit for those making this switch is the absence of overnight fees, which are typically charged on CFD positions.

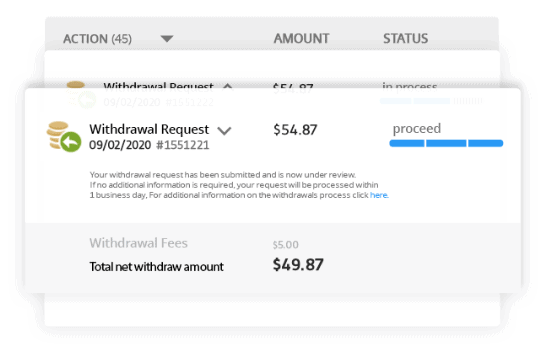

- To ease the transition for its clients, eToro has introduced an incentive. The firm will credit the spread costs incurred when purchasing the real crypto position, up to the amount of the original trade size. This is conditional on the new trade opening within 30 minutes of closing the CFD position. The credited amount will be directly added to the user's account within eight business days.

- The process for transitioning from CFD to real crypto positions involves several steps. Users must log into their eToro account, identify their non-leveraged long crypto asset positions marked with a red CFD symbol, close these positions, and immediately reopen equivalent trades as long positions with 1x leverage. These will then be considered real crypto positions. Any non-leveraged long cryptoasset positions held as CFDs that remain in an account on February 19 will be automatically closed.

eToro has cautioned that the amount invested in the reopened real crypto position can be changed, but the fee reimbursement will only cover up to the original trade size amount. The company has also reminded its clients that real crypto is a non-regulated product without investor protections.

Lastly, eToro highlighted the potential tax implications of these transactions. They have advised clients to consult with tax advisors for more information on how these changes might affect their tax obligations.