- What is Skilling?

- Skilling Pros and Cons

- Awards

- Is Skilling safe or a scam?

- Leverage

- Account opening

- Fees

- Spreads

- Instruments

- Deposits and Withdrawals

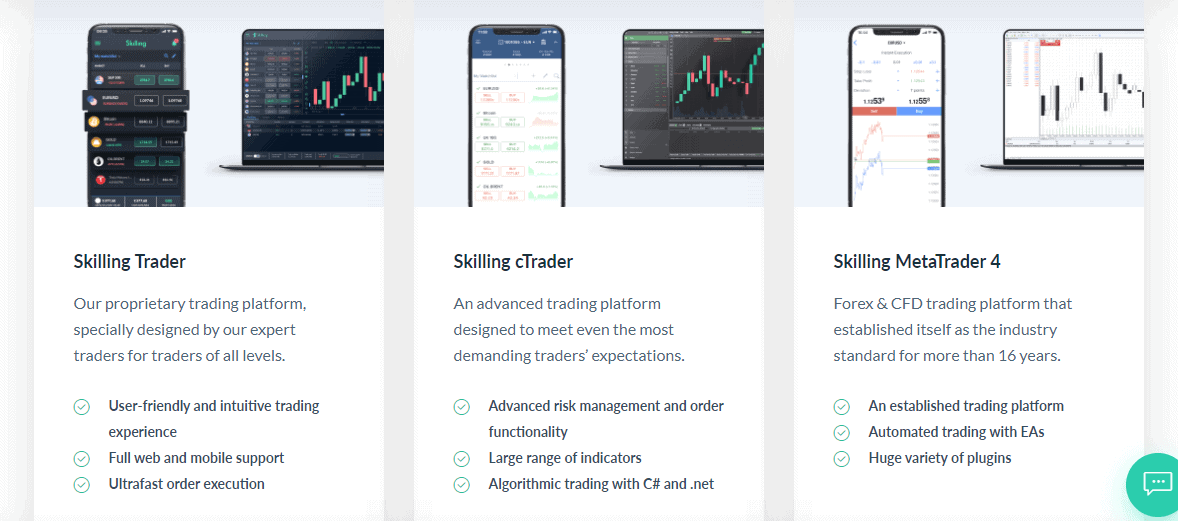

- Trading Platform

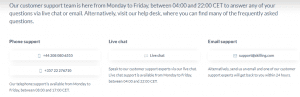

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years experience in Forex Trading check trading offering, fees, platforms, verified regulations, contacted customer service and placed traders to see trading conditions and give expert opinion about Skilling

What is Skilling?

Skilling is a brokerage company based on STP performance and was started as an accessible, simple-to-trade and navigate trading platform allowing either beginners or professionals to engage alike. Founded by a Scandinavian tech team it was first incorporated in Malta and then moved its offices to other destinations.

- While Skilling headquarters in Cyprus, there is also legal branch in Seychelles that enlarges its international proposal.

The broker maintained a balanced trading proposal with over 800 instruments and availability of the popular and powerful trading software including MT4 and cTrader. Besides, Skilling developed its own software Skilling Trader so the technical solutions stand on a good level, where conditions are transparent and allowing traders to focus on performance.

Skilling Pros and Cons

Skilling provides a good range of trading instruments and technical solutions overall allowing low-risk trading. We admit a great range of trading platforms and advanced research tools with easy account opening, fees are on a good level and overall we find trading proposal quite balanced.

On the negative side, there are no multi-currency accounts so fees for funding might be applicable, there is no education, and also international proposal is different from EU regulated one.

| Advantage | Disadvantage |

|---|

| Global Broker with offices in Cyprus, branch in the Malta and Seychelles | No multi-currency accounts |

| Range of instrument including Forex and CFDs | International proposal performed through offshore branch |

| Suitable for both beginners and Professionals | No education provided

|

| MetaTrader, cTrader and proprietary platforms offered | |

| Good technical solution | |

| Advanced range of research tools and analysis | |

Skilling Review Summary in 10 Points

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC, FSC |

| 🖥 Platforms | MT4, cTrader, Skilling Trader |

| 📉 Instruments | Currency pairs and CFDs on Stocks, Indices, Energies, Metals, 10 Cryptocurrencies |

| 💰 Costs | EUR USD 1 pip |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $25 |

| 💰 Base currencies | Several currencies |

| 📚 Education | No education provided. Research tools. |

| ☎ Customer Support | 24/5 |

Overall Skilling Ranking

Overall, Skilling is a good and reliable broker meeting modern safety standards and offering a great service for trading Forex and CFDs. The broker is known for its innovative technology and extremely low spreads as compared to many brokers in the industry.

- Skilling Overall Ranking is 8.6 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry-leading brokers.

| Ranking | Skilling | XM | Dukascopy |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantage | Leverage | Education | Instruments |

Skilling Alternative Brokers

However, Skilling has some disadvantages along with its benefits. The broker has poor educational materials and the instrument range is limited to FX and CFDs. Also, the broker doesn’t provide support on weekends. It is good to consider other brokers as well:

Awards

Skilling for year of its operation gained a good reputation and numerous industry awards recognizing its quality of trading service provided. Besides, Broker is pretty active socially and sponsoring Fulham F.C. as a principal partner bringing up Skilling as recognized Broker.

Is Skilling safe or scam?

Skilling is a safe broker due to its licenses and legal matters, making sure that the company’s operations comply with the relevant trading requirements and internationally recognized financial standards that protect clients.

Our Conclusion on Skilling Reliability:

- Our Skilling Trust Score is 8.2 out of 10 reflecting the broker’s trustworthiness and quality service. Being supervised by a highly reputable regulator, Skilling provides a robust trading environment ensuring traders’ safety

| Skilling Strong Points | Skilling Weak Points |

|---|

| Regulated by CySEC | Not listed on Stock Exchange

|

| Segregated Accounts and annual reports | Global proposal regulated by FSA |

| Negative Balance Protection | |

Is Skilling a regulated broker?

Skilling as first was established in Malta and then moved its headquarters to Cyprus also before its operation received a Forex trading license from CySEC, which also comply its standards and protective measures according to European ESMA.

Also, there is a license from offshore Seychelles, which rather provides just registration than serious regulation, yet additional licenses from reputable authorities make the Skilling operation a reliable one.

Does Skilling accept US clients?

No, Skilling does not accept US traders. In order to operate within the US, brokers must be authorized by NFA or CFTC, since the US watchdogs impose strict rules against international brokers

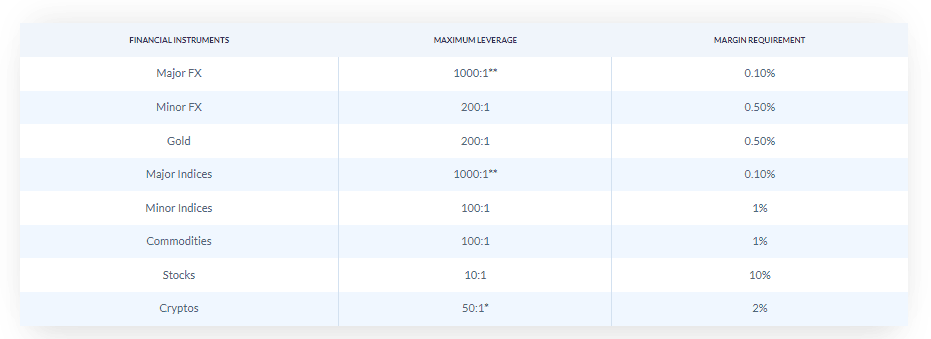

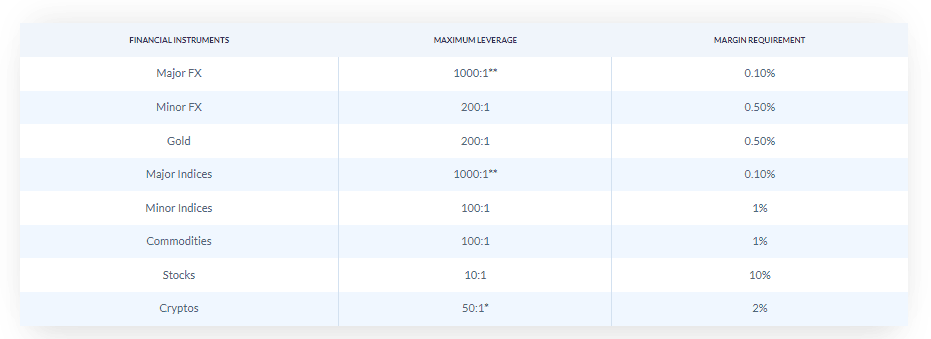

Leverage

Regulated Forex brokers are also known for the option to leverage positions with the potential to increase your gains and profits. Yet, leverage works in both ways making profits and losses bigger likewise. For this reason, worldwide regulations restrict leverage to particular levels.

Skilling Leverage levels are also defined by the entity you will trade through:

- European regulation significantly lower allowed leverage for retail clients for 1:30

- Nevertheless, since Skilling made its proposal global via an international branch located in the Seychelles opening account with that entity will allow you to use higher leverage levels up to 1:1000. Yet, be sure you learn well how to use leverage smartly and manage the high risks involved, see out snapshot finds below for international trading

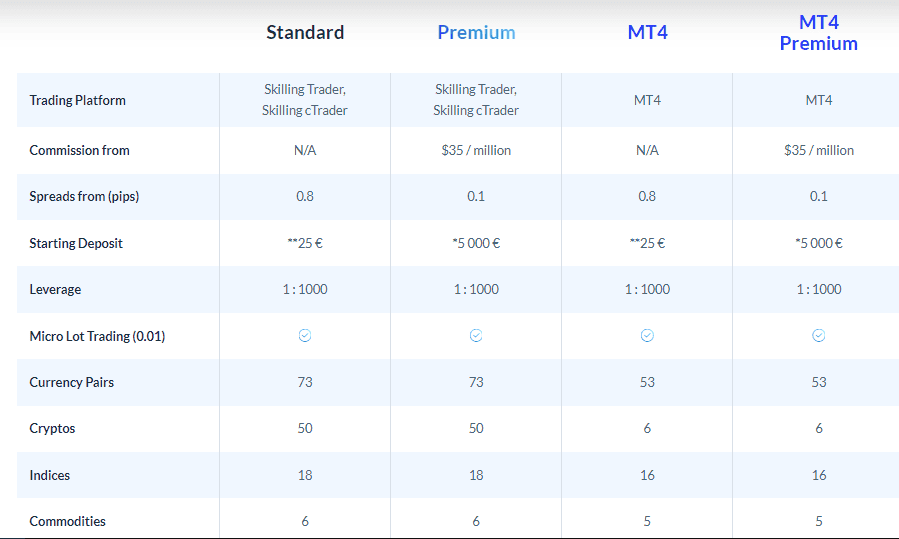

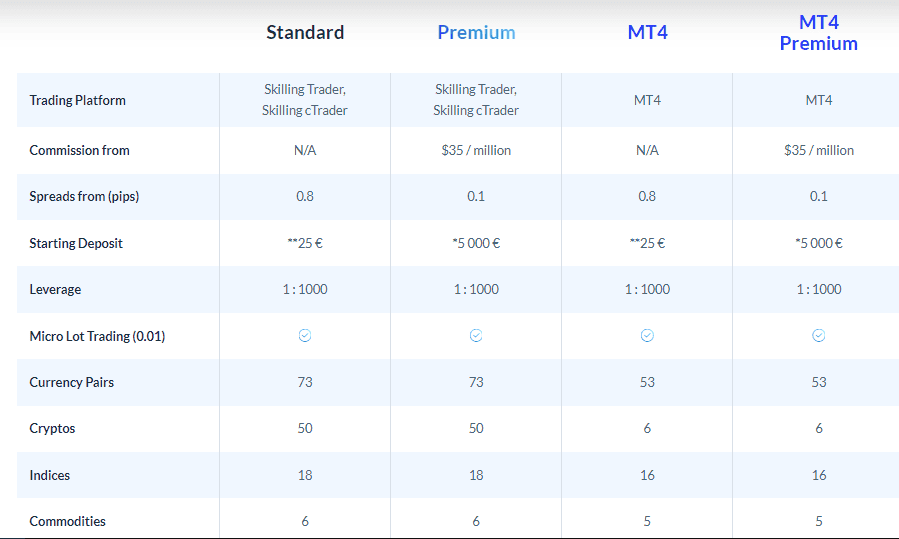

Account types

There are three main groups of Skilling account types — Standard accounts with a spread basis, Premium accounts that are based on ECN Account execution with raw spread offering and commission charge per million traded and MT4 Account. Skilling Login we find quite simple to follow and is accesbile via official website page.

Previously broker gave access through a single account to all the platforms, while now we see Skilling separated accounts by platforms too while Standard and Premium account allow access to cTrader, and Skilling Trader. And MT4 accounts are separated either on Standard or Premium conditions alike, with the difference of fee basis combined into spread or commission basis, which we will cover in detail further in our Skilling Review. Generally, we think it is quite good separating as it might be even better for active trading or day traders.

| Pros | Cons |

|---|

| Fast digital account opening | Account conditions may vary according to regulation |

| Standard Account and Premium Account | |

| Low deposit requirement | |

| All platforms connected to Standard account | |

| Practice Demo Account | |

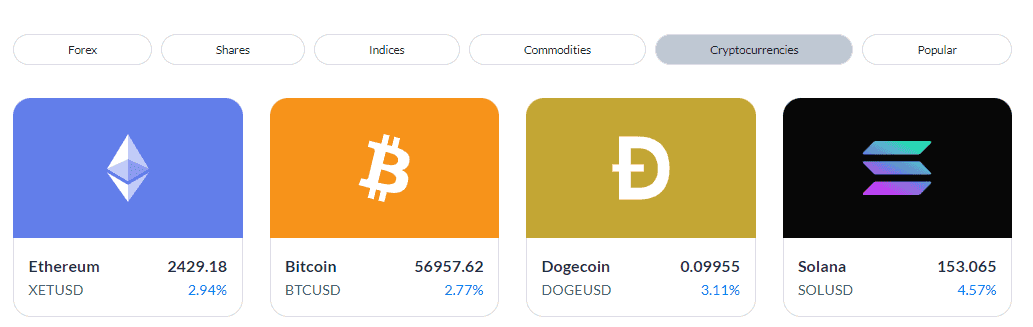

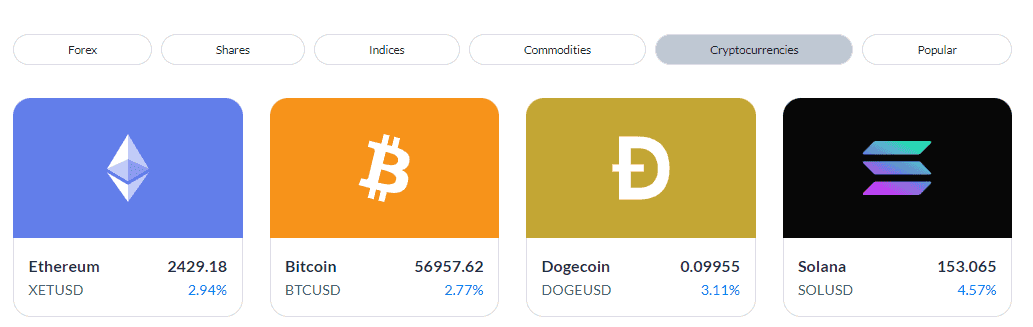

Instruments

The markets that you can trade with Skilling we find quite well presented with over 1200+ markets in range, which include popular currency pairs, including minor, CFDs on Stocks, Indices, Energies, and Metals also including 10 Cryptocurrencies with Ripple, Ethereum, Litecoin, Bitcoin Trading, etc.

- Our ranking for Skilling Instruments is 9 out of 10 for its excellent choice of trading instruments including CFDs and Forex. However, the range may differ depending on the entity also read trading of Futures and Stocks are not presented

Skilling Fees

Skilling trading fees and pricing models are mainly based on spread charges, however, be sure to verify correct conditions as fees are based on the account type you select since Premium accounts fees are based on commission. For other fees we find them well organized with no charges on funding and swap/ inactivity fees are in line with competitors.

- Skilling Fees are rated with an overall ranking of 8.5 out of 10 based on our research and compared to 500 other brokers. Fees are overall good and competitive. See the fee comparison table below:

| Fees | Skilling Fees | AvaTrade Fees | BDSwiss Fees |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low/ Average | Average | High |

Spreads

Standard account conditions, as the majority of traders will go for this selection where all costs are built into a spread and starting from 0.8 pips. Actually, Forex and currency pair fees are competitive compared to the industry where typically EUR USD stands at 1 pip.

A Premium account will offer interbank spreads from 0.1 pips and charges a commission of 30$ per million traded for EURUSD, which is quite good compared to industry competition.

CFD fees

As for the CFD fees, they might be slightly higher if to consider other brokers for Spread basis account, which is Standard, alike you may see below for Gold and Oil spreads. However, depending on the instrument we found some spreads good, some slightly higher, so you better consider all points and see if Skilling is good for you in general, as the quality of a broker is not only about trading costs.

- Skilling Spreads are ranked 7.5 out of 10 based on our research and comparison with other brokers. We found out that the spreads for EUR/USD offered by Skilling are in line with the industry average which is 1.2 pips based on our research, while some spreads like for commodities are slightly higher on our tests. Spreads for other instruments are attractive too.

Comparison between Skilling fees and similar brokers

| Asset/ Pair | Skilling Spread | AvaTrade Spread | BDSwiss Spread |

|---|

| EUR USD Spread | 1 pip | 1.3 pip | 1.5 pip |

| Crude Oil WTI Spread | 10 | 3 | 6 |

| Gold Spread | 59 | 40 | 25 |

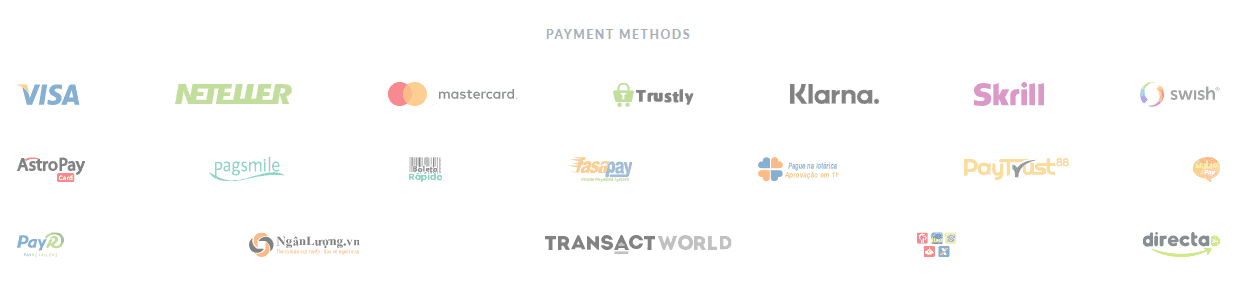

Deposits and Withdrawals

Skilling supports various instant deposits and withdrawal methods also offered with no commission charges, yet it does depend on the jurisdiction and particular method as some fees might be applicable. Besides deposit methods vary according to the regulations as well, while some are available only for international clients so be sure to learn more about money transactions.

- Skilling Funding Methods are ranked 8 out of 10. The broker does offer a great variety of funding methods with low fees and several currency bases. The minimum deposit is in line with the industry average

| Skilling Advantage | Skilling Disadvantage |

|---|

| Fast digital deposits | Deposit fee may be applicable according to your region |

| Small first deposit 100$ | |

| Supporting Account Base Currencies USD and EUR | |

| 0$ free withdrawal

| |

Deposit Options

Skilling typically does not charge any deposit fees or internal charges, also deposits are visual within 1 hour, accept the Trustly or Bank wire which may take up to 3 working days to process the transaction.

- Bank Wire Transfers, Trusly

- Credit Cards, Debit Cards

- e-wallets Neteller and Skrill

International traders will be able to use more methods including fasapay, AtroPay, swish, directa, etc.

Skilling minimum deposit

Skilling Standard account’s first deposit now is offering only 25$ to start, while previously stand on 100$ so is a good step from the broker to make offering more attractive. Yet, Premium account still demand 5000$ at the start so is suitable mainly for professional traders. Also, check on the necessary margin requirements that are usually set for each trading instrument separately.

Skilling minimum deposit vs other brokers

|

Skilling |

Most Other Brokers |

| Minimum Deposit |

$25 |

$500 |

How to make a deposit?

- Select account

- Choose payment method

- You will receive an email confirming the deposit

Withdrawals

Skilling withdrawal options allow to use so far the most used Bank transfers Credit cards, also e-wallets are withdrawal options.

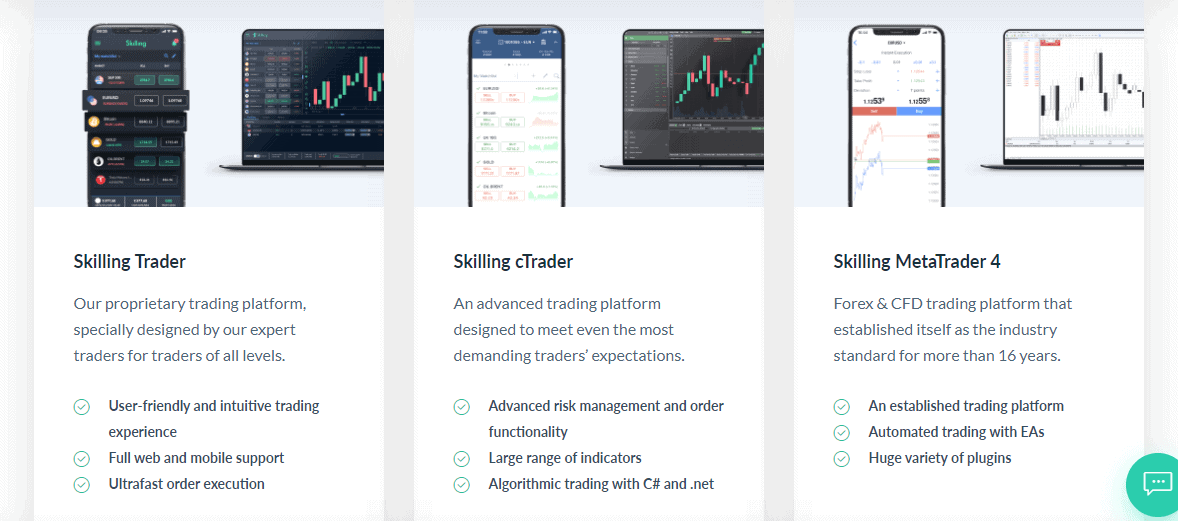

Trading Platforms

Skilling trading platform choice offers good selection between industry leaders MetaTrader4, powerful cTrader, also Skilling Trader proprietary software developed in-house which is quite advanced as well.

- Skilling Trading Platforms range is ranked 8.7 out of 10 based on our research. The broker has a great variety of trading platforms offering industry-leading platforms ensuring both the quality trading experience and the safety of their clients.

| Platforms | Skilling Platforms | XM Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | Yes | No | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Web trading

So the selection between platforms is truly good, as you may choose the most suitable one for your need, while all platforms are available through a single account credential. Yet, the Premium account does not support the MT4 platform.

Skilling Traders is specially designed by expert traders software and is a fully web-based platform, also it has a mobile application allowing you to stay updated on the go. cTrader and MT4 are also supporting Web platforms, but a more comprehensive analysis is recommended for desktop versions.

Desktop platform

MetaTrader4 will be a good choice for any trader since it is the most used software for more than 16 years allowing to run automated trading and has a huge variety of plugins.

Skilling cTrader is good for advanced traders as it is also known for its sophisticated and powerful capabilities, large range of indicators, and professional risk management with an algorithmic trading option via C#.

Mobile Trading Platform

Free and simple-to-use apps suitable for iPhone and Android devices, supporting all offered platforms and allowing you to stay in control whenever you are. All in all, Skilling definitely satisfies all trading demands whatever size or style of the trader you may be, and this is marked as a bit plus within our Skilling Review.

Customer Support

Together with the quite advanced trading conditions, you will get the support that brings customer service in various languages available 24/5, also supporting international phone lines, live chat, and email support. Actually, we test Skilling quite a good ranking for its support quality and response quickly.

- Customer Support in Skilling is ranked 8.5 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, the main drawback is that it is not available during the weekends

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick response and Relevant answers | No 24/7 support |

| Live Chat, Phone lines, emails supported | |

| Various Languages supported | |

Skilling Education

Skilling provides a free Demo account and included some good research tools that are inbuilt into the platforms that you select for trading, also with News Feed. Each of them features different capabilities, so you better place your strategy at the test and see which tools are more suitable for you, but we rank it as a highly good one.

Nevertheless, very beginning traders will not get the necessary education support, learning courses, webinars or fundamental analysis at Skilling, so if you still prefer to trade with the broker we recommend signing for an extensive education course with other providers or checking brokers for beginners.

- Skilling Education is ranked 7 out of 10 based on our testing and compared to other brokers in the industry. The broker does have room for improvement to include multiple educational resource types as well as make them available in other languages too.

Skilling Review Conclusion

Overall, Skilling obtained quite a good reputation and competitive trading conditions. One of the best points in its proposal is a great selection between trading software including industry-leading platforms or a proprietary one.

Professionals will get an advanced proposal with tailored solutions as well, while the support center is quite responsive. However, the only con could be a lack of educational sources and materials, so complete beginners would need to search for webinars and courses somewhere else.

Based on our testing, Skilling is good for:

- Seasoned traders

- Professional traders

- MetaTrader4 Traders

- cTrader Traders

- Good spread Trading

- Cyprus Traders

- Scalping / Hedging Strategies

- Various strategies supported

- High Leverage Trading

- International Access

- Copy Trading

- Forex and CFDs Trading

Share this article [addtoany url="https://55brokers.com/skilling-review/" title="Skilling"]

I initiated a USD transactions and made sure I followed all due process and enough gap totaling 76322 pips, It reflected in my account and to my outmost amazement I couldn’t make my withdrawal, I had reached out severally and no response from anyone. these people shouldn’t be taken serious, you can reach w w w high forest capital ltd dot com, they reliable and will help retrieve any of your money that get stucked.