- What is Saxo Bank?

- Saxo Bank Pros and Cons

- Awards

- Is Saxo Bank Safe or a Scam?

- Leverage

- Accounts

- Trading Instruments

- Fees

- Spreads

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Saxo Bank.

What is Saxo Bank?

Saxo is a CFD and Forex trading company and is one of the largest and respected European Banks offering banking services and over 65,000 financial products for trading to its clients, including 22,000+ stocks, 190+ FX spot pairs, CFDs on 9,000+ instruments, and more.

The Saxo Group is a multi-asset trading and investment organization with over 30 years of Fintech innovation, a fully licensed regulated European bank under the supervision of Danish FSA. The headquarter is located in Copenhagen and the organization operates in financial centers around the world including London, Paris, Zurich, Dubai, Singapore, Shanghai, Sydney, Hong Kong, and Tokyo.

- Saxo Group spans the globe with a strong unified network through both local sales and organizations allows serving clients in more than 180 countries.

- Firstly Bank was introduced as Midas, and then officially became Saxo Bank A/S when the European Union Directive has been accepted (back in 1996). As well Saxo Bank became the first broker in Denmark that gained approval under this directive.

Saxo Bank Pros and Cons

Saxo Bank is considered a very reliable and solid firm due to its regulation, banking license in Europe, and extra transparency. Trading conditions are good, and the range of instruments is very wide including Options, Futures, Bonds, Forex, and CFD instruments, provided via well-developed trading software and platforms. The costs and spreads are good and low, and account opening is smoothly supported by quality customer service.

For the Cons, the minimum deposit is high, and might not be suitable for beginning traders, also deposit fees might be applicable based on your bank.

| Advantages | Disadvantages |

|---|

| Fully licensed European company with a strong establishment | More suitable for professionals |

| Well-developed trading software and platforms | High minimum deposits |

| Competitive trading costs and spreads | No 24/7 customer support |

| Worldwide coverage through various entities | |

| Wealth management opportunity | |

| Quality customer support | |

Saxo Bank Review Summary in 10 Points

| 🏢 Headquarters | Copenhagen |

| 🗺️ Regulation | DFSA, FCA, ASIC, CBUAE, JFSA, MAS, SFC |

| 💳 Minimum deposit | $5,000 |

| 🖥 Platforms | Proprietary web trading platform SaxoTraderGO and desktop SaxoTraderPRO |

| 📉 Instruments | FX, CFDs, Stocks, ETFs, Futures, Options, Mutual funds and Bonds |

| 🎮 Demo Account | 20-day Free Demo account |

| 💰 Base currencies | Various currencies supported |

| 💰 EUR/USD Spread | 0.9 pips |

| 📚 Education | Trading courses, webinars, video tutorials, podcasts |

| ☎ Customer Support | 24/5 |

Overall Saxo Bank Ranking

Saxo is considered a good brokerage company with safe and favorable trading conditions with transparency. The broker offers a range of trading services with a wide range of trading instruments. As one of the good advantages, Saxo Bank is available in many countries, so traders can sign in also with competitive spreads.

- Saxo Bank Overall Ranking is 9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Saxo Bank | FxPro | Swissquote |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Conditions | Deep Liquidity | Trading Platforms |

Saxo Bank Alternative Brokers

Saxo offers good trading conditions, a range of trading instruments, also low trading spreads, and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to Saxo:

Awards

Overall, the company profile shows positive feedback and operational scores. Besides the numerous clients, it serves and obtains a reputation over the years. The firm constantly shows some of the best results in its performance along with achievements in international recognition.

Is Saxo Bank Safe or Scam?

No, Saxo Bank is not a scam. It is a multiply regulated broker operating under a banking license. It is considered low-risk trading Forex and CFDs with Saxo Bank.

Is Saxo Bank Legit?

Yes, Saxo Bank is a legit and regulated broker in various jurisdictions.

It is definitely a trusted broker, as it is incorporated in Denmark business and is a fully licensed European bank (license no. 1149). Which also runs its service under the supervision and regulation of the Danish Financial Supervisory Authority (FSA).

Therefore, Saxo Bank operations are conducted as an EU-regulated bank and investment firm that falls under the jurisdiction and has all necessary legal requirements, protocols and policies to ensure full compliance and customer protection.

Along with the major registration, Saxo is subject to operate under various worldwide institutions, due to its global presence including Singapore, Dubai, Hong Kong, and more.

See our conclusion on Saxo Bank Reliability:

- Our Ranked Saxo Bank Trust Score is 9 out of 10 for good reputation and service over the years, also for reliable top-tier licenses. The only point is that regulatory standards and protection vary based on the entity.

| Saxo Bank Strong Points | Saxo Bank Weak Points |

|---|

| Sharp adherence to regulations and audit | Regulatory standards and protection vary based on the entity |

| Large European Bank | |

| International proposal | |

| Cross border licenses and global coverage | |

| Negative balance protection | |

| Member of the Danish Guarantee Fund for Depositors and Investors

| |

| Compensation scheme | |

How Are You Protected?

Saxo Bank A/S is subject to stringent financial reporting requirements under EU directives and specific regulations regarding client handling. It is a respected member of the Danish Guarantee Fund for Depositors and Investors which guarantees clients’ deposits of up to EUR 100,000 for cash in the event of insolvency.

Leverage

Together with investment opportunities, there are some instruments that allow leverage trading, while the maximum allowed leverage is determined by the regulators in each geographic region, as well as according to the set levels defined by the trader himself.

Saxo Bank Leverage does not support high-risk trade strategies for the traders’ good. It is true that high leverage increases the risks, thus levels are set to reasonable levels.

- European clients may use 1:30 leverage on Forex instruments

- Dubai and UAE traders entitle to a maximum of 1:30

- Australian clients under ASIC regulation may also apply to leverage up to 1:30

Account Types

Saxo Bank offers three accounts no matter how much client trade, all featuring the same technical capabilities, along with company support.

The difference between them is the price offerings as well as the depth of support from the company, like extended news and research capabilities and preferred customer services. In addition, the bonus offered by the bank is built into the interests, which is part of the service provided to the Premium clients and above.

The new traders can benefit from Saxo Bank’s offer to try out market strategies and familiarise themselves with Demo Account before the real trade practice. While the 20-day free demonstration of their platforms with a simulated $100,000 account to practice with is available to all.

| Pros | Cons |

|---|

| Fast account opening | Account types and proposals may vary according to jurisdiction |

| Three Account types offered | |

| Selection between base currencies | |

| Investment option and professional trading | |

| Free 20 day Demo Account | |

| Daily analysis and exclusive webinars for the VIP account | |

How to Open Saxo Bank Live Account?

Opening an account with Saxo is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

The product choices of Saxo Bank include a truly wide selection of markets including Forex, CFDs, Stocks, ETFs, Futures, Options, Mutual funds, Bonds, and Cryptocurrencies. You can get an instrument you wish to trade, and also provided with competitive pricing.

- Saxo Bank Markets Range Score is 9.2 out of 10 for wide trading instrument selection among Forex, Stocks, CFDs, and more.

Saxo Bank Fees

Saxo Bank fees are good, mainly built into the spread. However, fee conditions are based on the account type you choose depending on the instrument you trade.

Also, consider overnight fee or swap as a trading cost, as in case you hold an open position longer than a day various fees are applicable.

- Saxo Bank Fees are ranked average, low with an overall rating of 8.5 out of 10 based on our testing and compared to over 500 other brokers.

| Fees | Saxo Bank Fees | Tickmill Fees | Capital Index Fees |

|---|

| Deposit fee | Yes | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | No | Yes |

| Fee ranking | Low, Average | Low | Low, Average |

Spreads

Saxo Bank traders can benefit from the tight spreads and low commissions through real-time quotes for currency pairs and other instruments, e.g. EUR/USD at 0.9 pips, US 500 at 0.4 pts, and US Stocks from $6.

Along with very competitive pricing, the broker is one of the large liquidity providers thus getting exclusively fast and low quotes, the bigger account shows spreads from 0 pips.

- Saxo Bank Spreads are ranked low with an overall rating of 9 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower, and spreads for other instruments are very attractive too.

| Asset/ Pair | Saxo Bank Spread | Capital Index Spread | Tickmill Spread |

|---|

| EUR USD Spread | 0.9 pips | 1.1 pips | 0.3 pips |

| Crude Oil WTI Spread | 5 | 7 | 4 |

| Gold Spread | 27 | 0.5 | 20 |

| BTC USD Spread | 6 | - | 12 |

Deposits and Withdrawals

The deposits or withdrawals at Saxo Bank only accept funds originating from a bank account or an account held at a licensed financial institution. Saxo Bank does not accept Third Party Payments, Bankers’ Drafts, Checks, Cash deposits, and remittances from Exchange houses.

- Saxo Bank Funding Methods we ranked good with an overall rating of 8 out of 10. Though minimum deposit is above the average in the industry, fees are average or low also allowing to benefit from various account-based currencies.

Here are some good and negative points for Saxo Bank funding methods found:

| Saxo Bank Advantage | Saxo Bank Disadvantage |

|---|

| Fast digital deposits | Minimum deposit amount is above the average |

| No internal fees for withdrawals | Deposit fee available |

| Multiple account base currencies | |

| Withdrawal requests confirmed within 1 business day | |

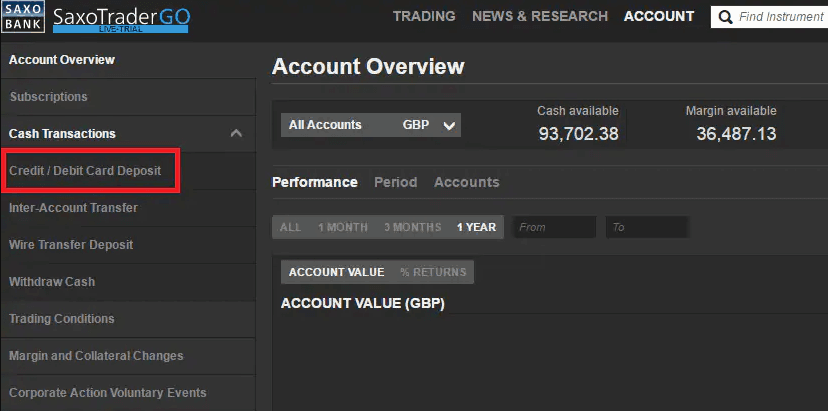

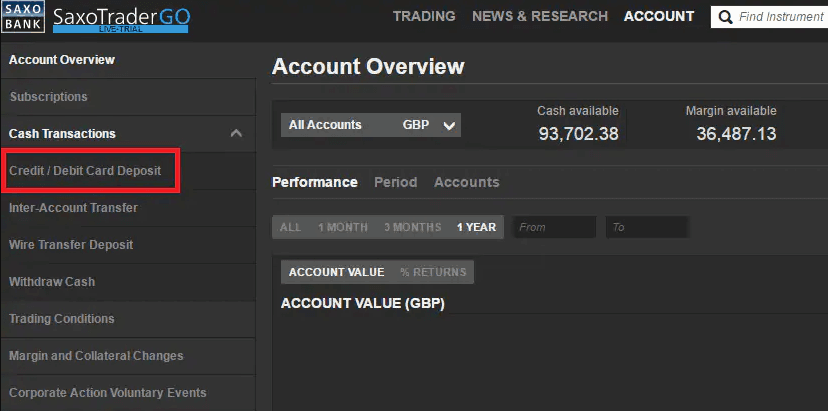

Deposit Options

In terms of funding methods, Saxo Bank offers two payment methods: bank transfer and credit/debit card deposits.

Saxo Bank Minimum Deposit

Saxo Bank minimum deposits and the lowest requirement is $5,000 for Classic Account, apart from that, there are other limitations on funds transactions that may be imposed due to the payment providers’ conditions.

Higher account types will require more money at the start, $200,000 for Platinum and $1M for a VIP account, which concludes Saxo Bank as a true broker more suitable for professionals and bigger-size traders.

Saxo Bank minimum deposit vs other brokers

|

Saxo Bank |

Most Other Brokers |

| Minimum Deposit |

$5,000 |

$500 |

Saxo Bank Withdrawals

Saxo bank withdrawal options are well organized, by far most used Bank Wire is available, also Card payments. For the transaction of withdrawals, there are no fees charged for any withdrawals submitted via the Online Cash Withdrawal Module.

How Withdraw Money from Saxo Bank Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

Saxo Bank trading platforms are designed specifically, with a deep understanding of the importance of a combination of easy interface and powerful capabilities. If you’re looking for good performance and flexibility or an investor who requires an easy platform on the go Saxo Bank offers that solution through two types of its own designed platforms: SaxoTraderGo and SaxoTraderPRO.

- Saxo Bank Platform is ranked good with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers professional trading platforms to its clients, yet market popular platforms arent offered in Saxo platforms range

Trading Platform Comparison to Other Brokers:

| Platforms | Saxo Bank Platforms | Capital Index Platforms | Tickmill Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Desktop and Web Trading Platforms

SaxoTraderPRO is the professional’s choice of a downloadable, fully customized, professional-grade platform for advanced traders. SaxoTraderPRO brings an intuitive, multi-screen platform to Windows and Mac, and also can still have access to mobile and tablet apps.

The platform features configurable workstations and workflows, tailored trade settings, as well a series of advanced functions: enhanced trade ticket, depth trader, time and sales, algorithmic orders, charting package, and option chain for vanilla and touch options.

- SaxoTraderGO is the choice of most traders and investors. An easy-going yet powerful platform that gains awards for its productivity. Fast, reliable, and available across multiple devices, SaxoTraderGO is a web-based application that supports all products and asset classes. A wide range of risk management tools and features allows the execution of trades quickly and intuitively.

Lastly, there is a designed mobile app that allows to you keep track of trading developments, markets, and updates right from your mobile.

Customer Support

Being also a reputable European Bank there is well-established support in more than 180 countries from offices in major financial hubs. Customer service is available through Europe, Asia/Pacific, and Middle East regions also in various languages, so customers are well covered with necessary service.

Saxo Bank provides 24/5 customer support to its clients. Phone lines and Email are also available here.

- Customer Support in Saxo Bank is ranked good with an overall rating of 8.5 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support and live chat |

| Relevant answers | |

| Supporting different languages | |

| Availability of phone lines and email

| |

Saxo Bank Education

Saxo Bank offers mainly proposals for traders with experience and bigger sizes. You will get trading courses, webinars, video tutorials, and podcasts.

Professionals and traders who choose Saxo will definitely enjoy amazing research tools and strategy builders available directly through the platform.

- Saxo Bank Education ranked with an overall rating of 8.5 out of 10 based on our research. The broker provides good quality educational materials, and analysis and also cooperates with market-leading providers of data.

Saxo Bank Review Conclusion

For final thoughts, Saxo Bank is a reliable and regarded broker. Entering the market in 1992, Saxo was a fintech company and has proceeded to become one of the most trusted names in online trading and investing. As a licensed and regulated Danish bank, the Saxo Bank Group brings a trusted offering to trade any cycle in the economy, while covering risks by hedges.

If you are a retail trader, Saxo will be a solution to have the same access and features as an institution or organization. So, overall Saxo Bank is a good choice for traders of bigger size, since the first deposit is higher.

Based on Our findings and Financial Expert Opinions Saxo Bank is Good for:

- Advanced traders

- Professional trading

- Investing

- Traders from Europe

- Broker Bank

- Currency and CFD trading

- STP/OTC execution

- Low spread trading

- Competitive trading fees

- White label solutions

- Global coverage

- Supportive customer support

- Good educational materials

Share this article [addtoany url="https://55brokers.com/saxo-bank-review/" title="Saxo Bank"]

Pozdravljeni

Kako se odzivate na prevarante, ki zlorabljajo vašo registracijsko številko za svoje prevare na

1. Saxodeal-10/2021

2. Daxodeal – 01/2022

(Christopher Brace)?

Hvala za odgovor.

Is this a bank you have telephone numbers in Dubai

Is this a bank

Спасибо… полекзная инфа