ROinvesting Review

Leverage: 1:30

Regulation: CySEC

Min. Deposit: 100 US$

HQ: Cyprus

Platforms: MT4, WebTrader

Found in: 2017

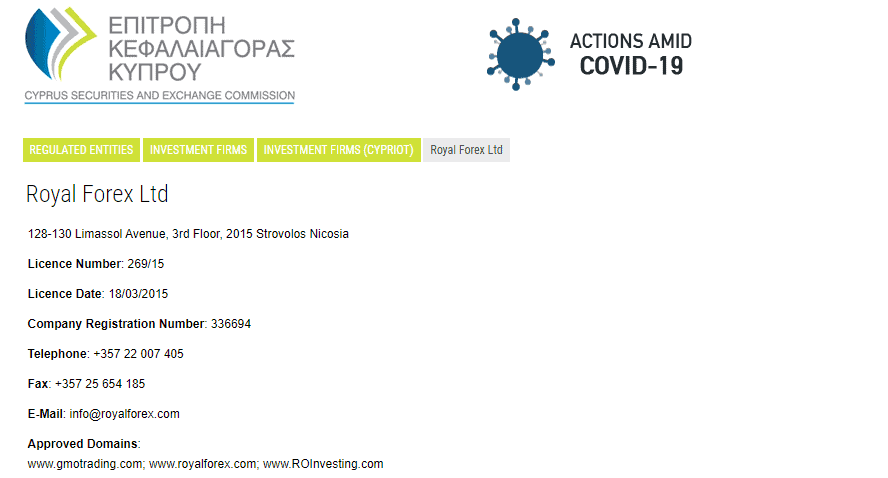

ROinvesting licenses

Royal Forex Ltd - authorized by CySEC (Cyprus) registration no. 269/15 - suspended

Leverage: 1:30

Regulation: CySEC

Min. Deposit: 100 US$

HQ: Cyprus

Platforms: MT4, WebTrader

Found in: 2017

Royal Forex Ltd - authorized by CySEC (Cyprus) registration no. 269/15 - suspended

ROInvesting is a Cyprus-based trading broker established in 2017 that proposes numerous trading opportunities on several trading markets including Forex, Cryptocurrencies, Stocks and CFDs offered with no commission charges and spread from 0.03 pips (Find 0 pip spread forex brokers by link).

Also, ROInvestment is one of the trading names used by Royal Forex Ltd which also operates brands GMO Trading and Royal Forex which are quite popular trading names.

ROInvesting mainstays on innovative technology solutions and trading performance that is based on high-tech analysis tools also ensuring powerful trading performance also with reliable customer service. Along with necessary legislation and safe transactions, ROinvesting adheres to unparalleled standards regulations impose.

Therefore you’re trading with a trustable partner which will treat you fairly, and this is a crucial point as the majority of offshore brokers can not provide reasonable trustability that is the reason we advise avoiding them at all costs. Further, in our ROinvesting review, we will see more of the details and conditions ROinvesting proposes so that you’ll be able to decide whether this broker is good for you.

Roinvesting has easy account opening, good platforms, and an analytic section, and fees and spreads are quite competitive for Currencies

On the negative side, the Commodities fee might be a bit high for first-grade silver accounts, instruments limited to CFDs only and there is no 24/7 support.

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC |

| 🖥 Platforms | MT4 and WebTrader |

| 📉 Instruments | Stocks, Cryptocurrencies, Forex and other 350+ assets |

| 💰 EUR/USD Spread | 28 |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Few base currencies |

| 📚 Education | Education including articles, videos |

| ☎ Customer Support | 24/5 |

Even being a quite new trading brand, ROinvesting already gained some of the reputable awards and has been recognized as a progressive brokerage firm. Some of its recent awards include reputable titles among numerous others.

Besides, ROinvesting is an official CFD Partner of AC Milan, which shares the quality with some of the greatest footballers and the same mentality of being the most advanced financial arena players.

No, ROinvesting is considered safe since is regulated by CySEC.

ROinvesting is a trading name used by Royal Forex Ltd a Cyprus based Cyprus-based and regulated financial investment firm. Its legit status is confirmed by the license received from the local authority CySEC (Read the other CySEC Regulated broker FXPrimus review by link), which also aligned with European ESMA and MiFID directive allowing to offer legit trading service within Cyprus and along with EEA cross boarder services to members. Here you can verify the license of ROinvesting.

To make the story short, a regulated broker means that the company is constantly overseen by the authority. The broker was sharply checked before it receives the license, also aligned its proposal towards safety measures which are also reported and audited on a daily basis. These regulatory measures are designed to protect clients as first, making brokers almost impossible to false data or mislead trading accounts, which is the main purpose of the Forex trading license.

Of course, there are strict money treatment measures as well, while ROinvesting is obliged to keep investors’ money separately from its own funds and use segregated accounts only.

In addition, there is a coverage of the client’s funds in case the brokers goes bankrupt or face unlikely events. Lastly, you, as a client, can ask for the support of the regulatory body in case there is any misunderstanding or breach of rules meaning you are not left on a side with the issue you may have.

Leverage, given by the broker enables trading with a bigger exposure to markets compared to your initial balance. Usually presented as a ratio of leverage levels also adhere to regulatory restrictions, since retail traders may fall into high risk without proper knowledge of how to use tools smartly.

Therefore, because of the involved possible risks, recent regulatory updates from the European regulators and CySEC in particular lowered maximum leverage levels available for retail account holders. Professionals may still request ratios up to 1:200, but only once the status is confirmed.

At the very beginning and to familiarize with ROinvesting platform conditions, you may sign in for Free Demo Account and further select suitable Live account conditions from the offering.

There are three main account types offered by ROinvesting representing Silver Account, Gold Account and Platinum Account. Each is designed to offer the best proposal designed for traders with smaller sizes and offers better conditions as long as your market exposure raises. So the first-grade account features the same custom service, as well as an option to switch to Islamic account conditions available for traders following Sharia laws.

Further on, if you raise your account capital Gold account will include a dedicated account manager for your service and a discount on swaps. A Platinum account will bring even more services with Free VPS use and customized investment conditions and news.

Also, if you’re a professional trader ROinvesting offers you to start with 3 easy steps of a register, deposit and immediate start all brought with fully tailored solutions according to your need.

1. Click ROinvesting Sign In page

2. Register your personal data (Name, email, phone etc.)

3. Confirm access through your email and verify your details with Documents

4. Access the practice account instantly

5. Make your first deposit and select desired account type

Trading with Roinvesting and since broker based on CFDs proposal, the main fee is a spread or a difference between Bid and Ask price. Yet always note, that swaps or overnight charges for positions longer than a day are considered fees too. Besides, there is a currency conversion that is entitled to adjustments as long as your account base currency is different from the one you trade.

| Fees | Roinvesting Fees | ETFinance Fees | OctaFX Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low/ Average | High | Average |

ROInvesting offers 6 categories of instruments that are based on CFDs including Forex, Futures, Index, Shares and Virtual Currencies. Also, ROinvesting proposes trading of cryptocurrencies including popular Bitcoin, Etherium, Ripple and more. So all in all, make sure you understand how CFDs work while you sign in with ROinvesting, since it’s a mainstay, likewise if you wish to trade on another basis you better consider other brokers.

Reinvesting fees and spreads are quite competitive for Currencies and other instruments, yet Commodities might be a bit high for first-grade silver accounts. Eventually, Gold and Platinum account holders will benefit from discounted spread and swaps which is 25% and 50% respectively which is already a quite pleasant fee structure.

For your better understanding let us see EUR USD pair where the Silver account spread is 28 pips, Gold Account offers 20, and Platinum 18. Also, the professional client’s account features different fee structures as well, while the Silver account proposes 25 points for the EURUSD pair. Besides, below you may see more examples also compared with other popular brokers.

For instance, you also may check out and compare Roinvesting fees with its peer BDSwiss.

| Asset/ Pair | Roinvesting Spread | ETFinance Spread | OctaFX Spread |

|---|---|---|---|

| EUR USD Spread | 28 | 70 | 50 |

| Crude Oil WTI Spread | 80 | 30 | 20 |

| Gold Spread | 80 | 37 | 20 |

The money transfer and transparency in the procedure is another important point you should note while selecting a broker to trade with. However, always note various countries apply different rules towards money transfers and available payment methods, so you should always consult with customer service for your convenience.

Eventually, ROinvesting offers a truly wide range of deposit options supporting even popular PayPal in addition to Cards and typical Wire Transfers. So, in particular, you may use for your deposits the following methods:

ROinvesting minimum deposit is 100$, while higher grade or professional accounts will require bigger amounts at the start, also Roinvesting offers free deposits (Read about Alpari minimum deposit).

Yet, be sure to verify deposit fee terms depending on the method of payment and the currency of your trading account, as there you may find a currency conversion fee or a deposit fee according to your jurisdiction.

ROinvesting minimum deposit vs other brokers

| ROinvesting | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Yes, you can withdraw money from the ROinvesting account and submit a withdrawal request at your account area. Typically brokers process withdrawals within 2-3 days, yet allow your payment provider to process transactions too which may add on several additional days. Withdrawal options are the same wide as for deposits including a good range of e-wallets.

The trading platform or the software which you will use with ROinvestment for transactions and the trading process itself is a choice either between WebTrader or a popular industry MetaTrader4.

| Pros | Cons |

|---|---|

| User friendly trading software | None |

| Mainstays at the WebTrader and MT4 | |

| Versions supporting Web, Mobile and Desktop trading | |

| Fee Report | |

| Available of various languages |

The biggest advantage of Web Platform is that there is no need to download the program so you may access trading through any computer browser or device.

Web Platform, however, is a rather simplified version that makes the trading process smooth, featuring all necessary tools for basic analysis, viewing and charting but missing advanced features the desktop version has.

We found the trading platform with its clean and good view for both market analysis and the trading performance itself. Charting is actually very regarded at MT4 with great monitoring capabilities, as well as allowing intuitive surfing which is great for beginning traders as well.

MetaTrader4 desktop platform is available for download and installation on any device including PC and MAC. The installation and specification of the MT4 allow you full customization and safety of your working layout, which is very useful. Besides, specifically, the desktop version is a great feature for professional and active traders, as it’s packed with advanced tools with no limitations over the strategies.

You may use auto trading, set robots via known MT4 EAs, also view fee reports and adjust all the necessary parameters.

Another great and already very needed trading application that allows you to control trading on the go is of course included into the ROinvesting offering. Free and simple to use apps suitable for iPhone and Android devices, also based on the MT4 engine app is also quite comprehensive even with a choice between the charting styles and types, analysis tools and news feed, all available right on your phone.

Considering ROinvesting customer support services, as the broker defines itself as a client-oriented company we would say it is at a sustainable level too. Even though support teams are available Monday to Sunday from 7-17 GMT only, which is also quite common among brokers.

There are various ways to contact the center available including Live Chat, Email, Phone lines, also you may leave to request a message through the Online form and customer support will answer to you at convenience.

What is more, ROinvesting crafted carefully its education materials and runs Learning Center which is suitable for the very beginners designed to direct into the correct path in trading, which is crucial. As well as professionals or trading veterans will find good quality materials to enhance knowledge further.

There are various materials offered including Webinars, Courses, Tutorials, Videos, eBooks and many more. As for the quality of the education, we should admit its good level as well, while beginners will appreciate easy catch of information and advanced traders can find some quality data.

For the research and analysis tools, you will find the Economic calendar, Expiration and Earnings Calendar are also included as tools. News Feed is inbuilt to the trading platform along with Trading Signals provided on a free basis powered by a signal center.

Besides, ROinvesting MT4 is packed with essential and powerful research tools which you may use for your convenience as well as define automated strategy and follow some successful traders if you wish so, all in all bringing your trading capabilities to a quite sustainable and flexible way.

Finalizing ROinvesting Review a broker has a balanced proposal for trading markets, including developed technology, an allowance to trade popular markets all available through industry popular MetaTrader4 (Also check MetaTrader 5).

However, some traders might find it as a limitation that all instruments of ROinvesting are based on the CFD trading model. The broker also supports beginning traders and those who are active or professionals with better conditions, as long as the trading size increases, also with a very well-developed analytic and learning center.

Based on our research ROInvesting lost its license, and previously was warned by various regulations in Europe for its aggressive marketing strategies and not accurate trading practices.

For now, based on our finding RoInvesting license is not active, website is not available and the message on CySEC regulation website states – “Under examination for voluntary renunciation of the authorization”

No review found...

No news available.

I paid an amount of 215 euro. I didn’t wanted to continue so i maked within a hour a redrawal. I had to pay them an amount of 165 euro!!!!

That’s a scam!!

Put down 250 bucks, after one trade that made me an astonoshing 8 buck tried to withdrwal the money and have been denied 3 times. Meanwhile my 256$ are now worth 243, dont know why and still being refused to withdraw the funds…

any institution that works this way is a scam not some fiduciary trusted entety!

Stay away!!!