- What is FXPrimus?

- FXPrimus Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FXPrimus Compared to Other Brokers

- Full Review of Broker FXPrimus

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.4 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is FXPrimus?

FXPrimus is an online FX and CFDs trading provider regulated in multiple jurisdictions. The broker delivers a safe environment with the best execution speeds combined with innovative technology. The broker has gained numerous rewards by being recognized as one of the best Forex providers in the market.

The broker established its offices in Vanuatu, South Africa, and other countries around the world to cover the global needs of their clients. FXPrimus was founded in 2009 and since then has expanded globally building its presence all across Europe, Asia, and Africa with a constantly growing trader base of +300k. Its headquarters is located in Limassol, Cyprus.

- FXPrimus is an ECN (electronic communications network) broker that gives clients direct access to other participants and uses prices from different liquidity providers. Besides, mixed with ECN execution type, FXPrimus is a market maker broker.

FXPrimus Pros and Cons

Overall, our experts find FXPrimus a highly reliable broker with a top-tier regulatory license from CySEC. FXPrimus provides professional education and great research suitable for beginners, it offers a good selection of trading platforms, and all trading styles are accepted. We also marked relatively low trading fees as compared to other brokers in the market which makes the broker a highly attractive option, especially amongst beginner traders.

On the negative side, the product offering is rather narrow and is based on Forex and CFDs only, and spreads for currencies are rather high. Beyond that, the broker trading conditions and offerings vary based on the entity and there’s no 24/7 support. Also, international trading is conducted via an offshore entity which isn’t so good, however, the broker has already proven its solid reputation over the years.

| Advantages | Disadvantages |

|---|

| Founded in Cyprus and operating over a decade | Relatively limited instruments offered |

| Regulated by the CySEC | No 24/7 customer support |

| Global industry awards | The range of the instruments and conditions vary based on the entity |

| Low Deposit Requirement and range of account types | |

| Tight Low Spreads and Low fees | |

| ECN trading option | |

| All trading styles including scalping and hedging supported | |

FXPrimus Features

With a firm presence in the market, good market conditions, and a solid base of over 300K traders, FXPrimus has established a safe and favorable trading environment, suitable for traders of different needs and expectations. We have researched and compiled below the main aspects of trading with FXPrimus for quick consideration:

FXPrimus Features in 10 Points

| 🗺️ Regulation | CySEC, VFSC |

| 🗺️ Account Types | PrimusClassic, PrimusPro, PrimusZero, PrimusDemo |

| 🖥 Trading Platforms | MT4, MT5, WebTrader |

| 📉 Trading Instruments | Forex, Equities, Energies, Precious Metals, Indices, Cryptocurrencies, Stocks |

| 💳 Minimum deposit | $15 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Various base currencies |

| 📚 Trading Education | Available |

| ☎ Customer Support | 24/5 |

Who is FXPrimus For?

Based on our findings and the opinions of financial experts, FXPrimus is considered a good broker for many reasons and aspects of trading. It provides great conditions and advanced strategies, assisting traders in exploring new opportunities.

- Beginning Traders

- Advanced traders

- Traders who prefer MT4 and MT5 platforms

- Currency Trading and CFD Trading

- Raw Spread trading

- Running various Strategies

- EAs trading

- PAMM Trading

- Hedging/Scalping traders

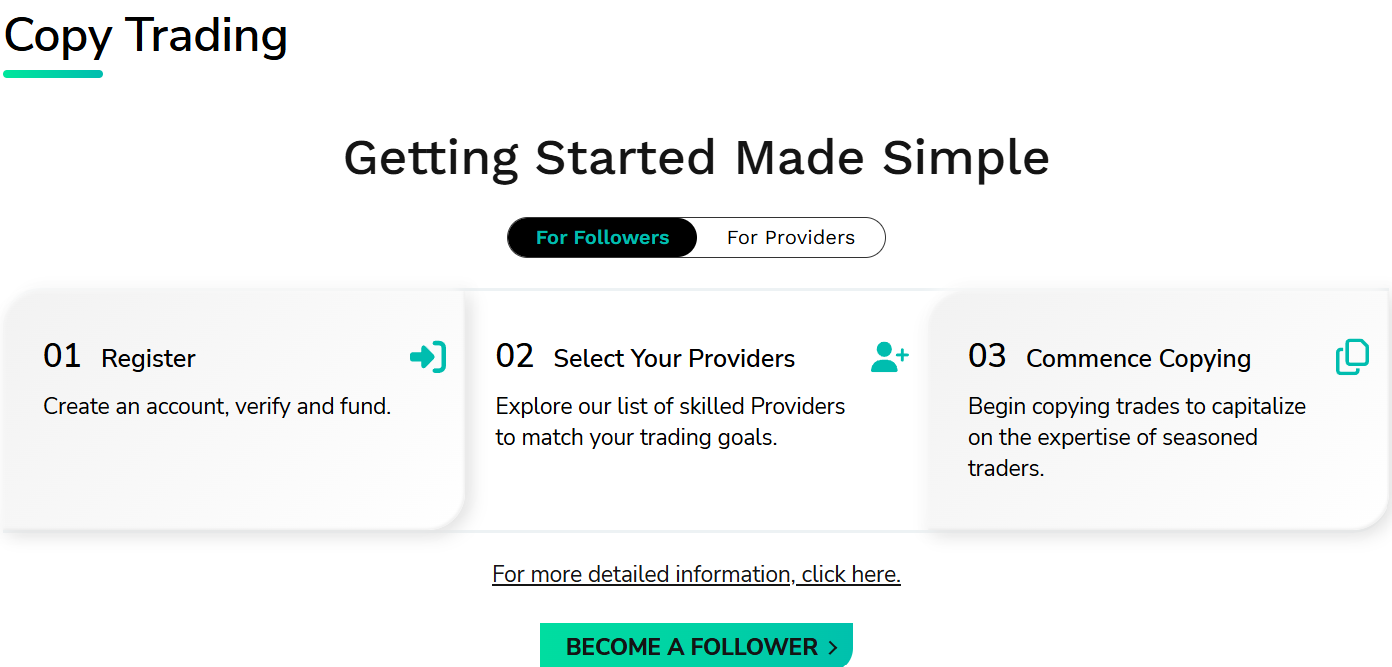

- Copy trading

FXPrimus Summary

Our thoughts on FXPrimus are positive. The broker offers a good range of instruments for trading, along with the option of technological ECN connectivity and raw spreads. Its great selection of platforms, combined with low fees and high leverage, makes it a preferred choice among brokers. We also appreciate that both beginner traders and seasoned professionals can find suitable options for trading, and the broker’s extensive range of tools covers both basic and highly demanded needs.

55Brokers Professional Insights

FXPrimus is a broker for traders looking for reliable company with MetaTrader technology and a good range of trading assets, ECN connectivity. The spreads are in average level with our test with different fee structures available, so overall Broker is suitable for mostly all size or level traders. As Technology, combined with good pricing, and selection of platforms tools attracts traders to FXPrimus, which is confirmed by vast of clients all over the world. With a presence in over 140 countries and availability through different entities, the broker makes its services available globally.

Besides, FXPrimus enables traders to explore advanced trading due to its sophisticated tools and availability of different strategies, which will diversify the trading experience and give access to broader opportunities, including Copy Trading availability, and PAMM accounts offering. However, in terms of educational resources, the broker does not provide enough materials for deeper insights into the market, also some traders like scalpers might find fees to be slightly on higher side if compare to other industry proposals

Consider Trading with FXPrimus If:

| FXPrimus is an excellent Broker for: | - Traders of all experience levels

- Those looking for technology-driven strategies

- Looking for diversity in tradable assets

- Global traders

- Traders looking for reliable trading environment with robust regulatory measures

- Clients looking for a good range of platforms

- Those looking for high leverage options

- Copy Trading enthusiasts

- Traders favoring PAMM accounts

|

Avoid Trading with FXPrimus If:

| FXPrimus is not the best for: | - Traders favoring ultra low fees

- Looking for an extensive range of instruments

- Beginners looking for a comprehensive educational materials |

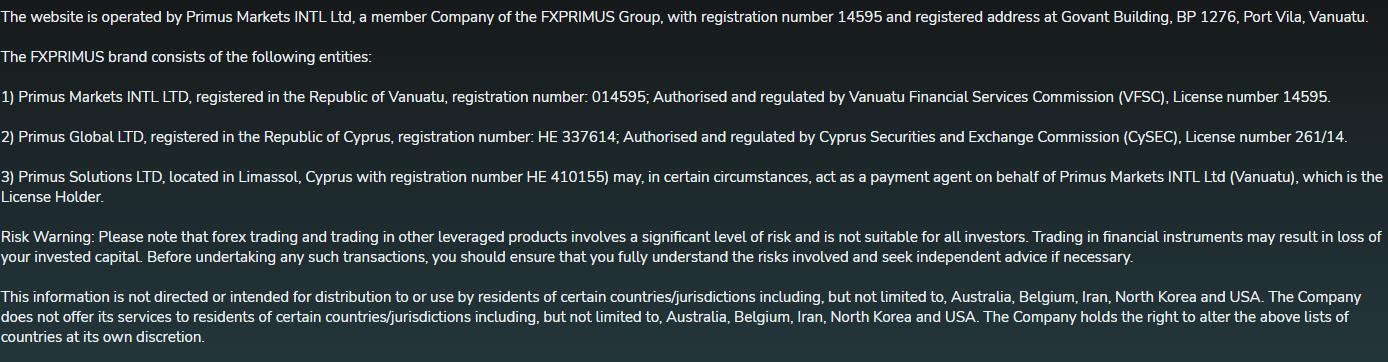

Regulation and Security Measures

Score – 4.3/5

FXPrimus Regulatory Overview

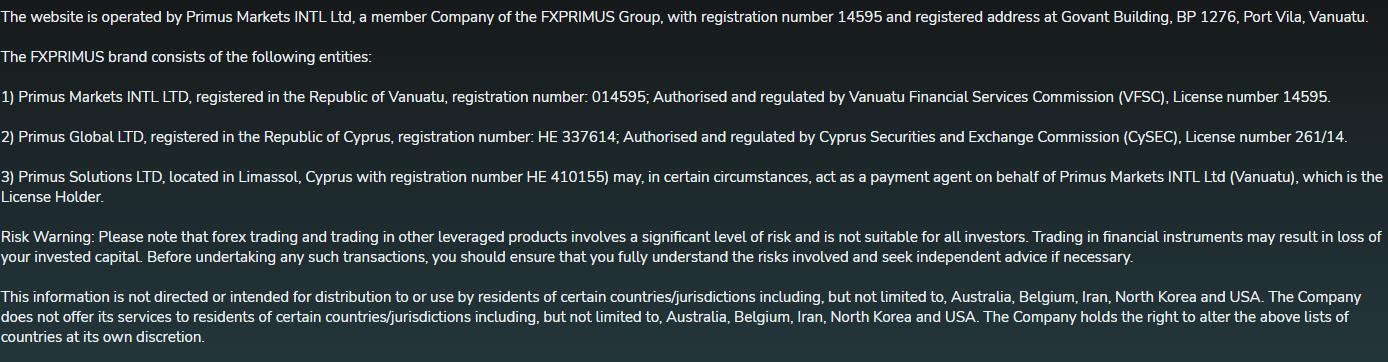

In terms of FXPrimus’s legitimacy and regulation, the broker operates under the brand name Primus Global Ltd. It is part of the FXPrimus Group, a global trading company with various representative offices. With its headquarters in Cyprus, the broker is authorized to provide services to European clients under the regulation of the Cyprus Securities and Exchange Commission (CySEC).

- In addition, FXPrimus serves as an entity authorized by the VFSC (Vanuatu), which is an offshore license that does not demand strict and necessary safety measures. In case the company is solely offshore we do not recommend trading or trusting those firms, however, since FXPrimus is a European broker and duly follows Forex guidelines, it is considered to be a safe trading environment.

How Safe is Trading with FXPrimus?

Investor protection, along with compliance with regulatory rules, is ensured in numerous ways. Brokers are strictly required to keep client funds in segregated bank accounts to ensure their security. These measures are closely monitored and audited by regulatory bodies, emphasizing why regulated brokers are considered safe and, ultimately, the only recommended choice for traders.

- Moreover, all clients trading under Negative Balance Protection are ensured that they will never incur losses exceeding their account balance. As an additional safety measure, FXPrimus has introduced client fund insurance of €2.5 million, provided free of charge to all clients.

Consistency and Clarity

FXPrimus has earned a good reputation during its operation and due to its regulation from a top-tier authority. The broker has a great trader’s army of over 300K traders, and a presence in more than 140 countries, which ensures extra accessibility worldwide. The good thing about FXPrimus, is that the broker is consistent in its development and expands its services constantly. The broker is also transparent in its practices, providing a safe and well-regulated environment to its clients.

Besides, its numerous achievements along with the advanced trading conditions have gained recognition and high appraisal, along with numerous industry awards. At last, going through real feedback from clients, we see that the reviews are mainly positive, along with a small number of reviews when traders indicate that the broker needs to enhance its educational section, and research tools, and expand the range of tradable instruments. All in all, FXPrimus is a good broker with favorable conditions that ensure clients are protected and provided with advanced features for a profitable experience.

Account Types and Benefits

Score – 4.4/5

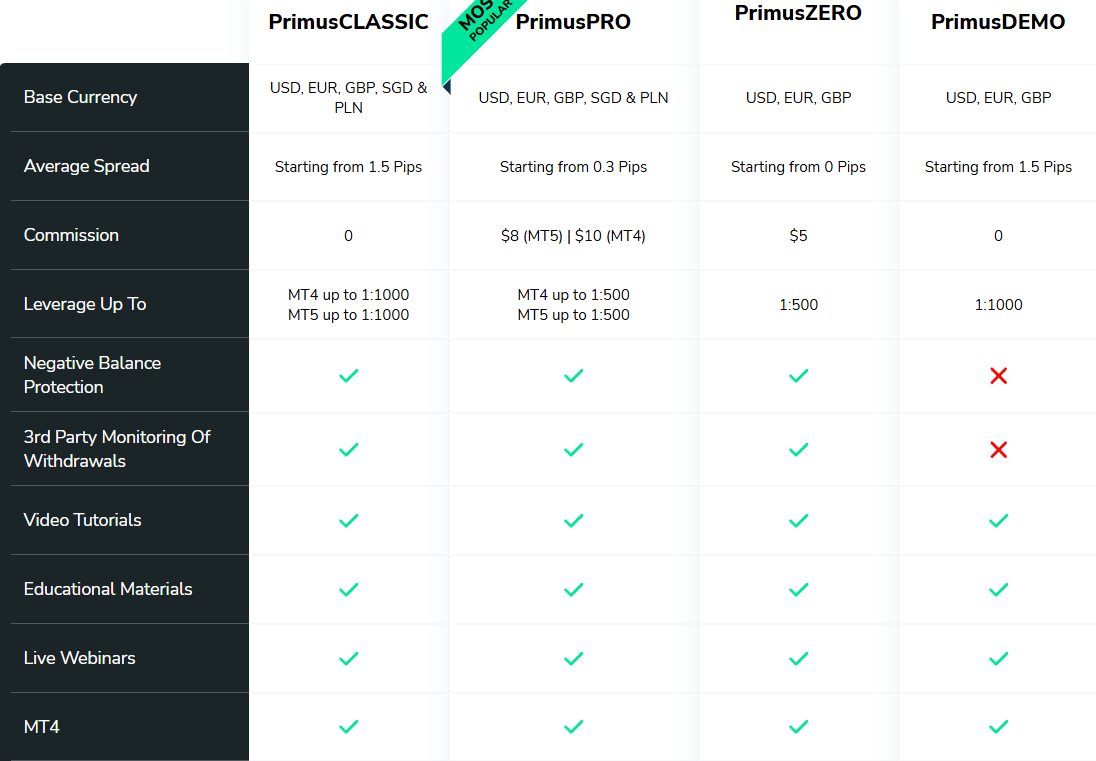

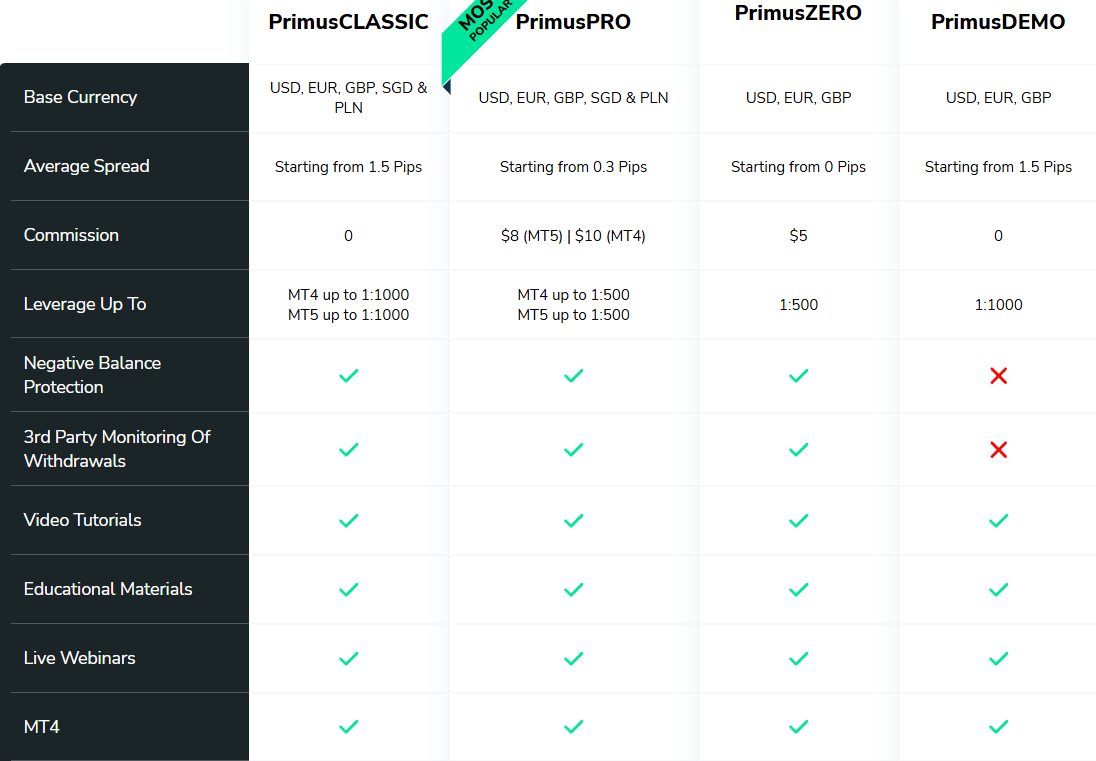

Which Account Types Are Available with FXPrimus?

FXPrimus offers several account types with very different trading conditions, catering to a wide range of traders, from beginners to professionals.

PrimusClassic Account

The PrimusClassic account requires only a $15 initial deposit to start. With this account type, traders gain access to MT4/MT5 platforms, and access to Copy Trading is available only through this account type. The leverage is as high as 1:1000 for the PrimusClassic account, although it also depends on the entity the account is registered with. The average spread for this account is 1.5 pips, and there are no commissions applied, as all the fees are integrated into spreads.

PrimusPRO Account

The PrimusPRO account is more suitable for advanced and high-frequency traders. The minimum deposit is considerably higher and starts from $500. The leverage available is up to 1:500. This account type has a different fee structure, offering fixed commissions of $8 for traders who conduct trades through the MT5 platform and $10 for traders trading via the MT4 platform. The spreads start very low—at 0.3 pips—and depend on the instrument traded. PrimusPro is considered the broker’s most popular account type.

PrimusZERO Account

Another account type is PrimusZero, with a $1000 minimum deposit requirement, coming with conditions excellent for professional traders. It offers leverage of up to 1:500 and a commission-based structure, although it differs from the PrimusPro account, with a lower commission that is fixed at $5, combined with spreads as low as 0 pips. For this account the popular MT5 platform is unavailable. Trades can be conducted through the MT4 platform only.

PrimusDEMO

PrimusDemo is based on the PrimusClassic account, with the availability of the same features and conditions. This is a demo account, thus there is no need for a deposit. The account average spreads are at 1.5 pips, with no commissions, while the leverage can be as high as 1:1000.

Regions Where FXPrimus is Restricted

Due to regulatory restrictions, FXPrimus does not accept clients from certain regions. Below you can see the restricted countries:

- Australia

- Belgium

- Iran

- North Korea

- USA

Cost Structure and Fees

Score – 4.4/5

FXPrimus Brokerage Fees

We found that FXPrimus fees predominantly depend on the account type traders choose. The broker offers spread-based and commission-based account types, with different fees and opportunities. In general, the fees FXPrimus offers are either average or on the lower side and are mostly transparent and clear.

FXPrimus offers one account type – PrimusClassic, that is entirely spread-based, with no commissions added. The average spreads applied to this account are 1.5 pips. For the PrimusPro account, the spreads are lower and start from 0.3 pips, yet the account also incurs fixed commissions.

As we found the broker offers a classic account type that is totally based on spreads, with no commissions. It also offers two more account types that come with different amounts of commissions and enables traders to choose between the options. For the PrimusPro account the spreads start from 0,3 pips with a fixed commission of $8 for the MT5 platform and a commission of $10 if trades are conducted on the MT4 platform.

On the other hand, the PrimusZERO account offers spreads from 0 pips with a $5 fixed commission.

How Competitive Are FXPrimus Fees?

Our research of the broker’s fee structure revealed that the costs mostly depend on the account type and, in some cases, on the platform. The fees are mostly on the lower side. The positive factor about FXPrimus fees is that the broker offers good diversity, with different structures and commissions to suit various traders.

However, traders can become familiar with all the costs for certain instruments after opening an account and accessing the client area, which, in a certain way, prevents them from being aware of all the costs before signing up with the broker. Thus, we recommend traders consider these nuances when making a final decision about the broker’s suitability.

| Asset/ Pair | FXPrimus Spread | FXTM Spread | AvaTrade Spread |

|---|

| EUR USD Spread | 1.7 pips | 1.5 pips | 0.9 pips |

| Crude Oil WTI Spread | 5 pips | 6 pips | 3 pips |

| Gold Spread | 26 | 9 pips | $0.27 |

| BTC USD Spread | 26 | 270 | 0.10% |

FXPrimus Additional Fees

FXPrimus charges a few additional fees, except for the main spreads and commissions that have already been mentioned.

- FXPrimus charges a quarterly fee for inactive accounts. The initial fee charged is $30. For each month after that, while the account is still inactive, the charge will be $10.

- Although FXPrimus does not charge any funding fees, the bank or other funding method clients use may charge their own fees, that are not covered by the broker.

Score – 4.3/5

FXPrimus enables traders to conduct trades on the two popular platforms – MT4 and MT5. Both platforms are possible to download for Windows, Android, and iOS. The MT5 platform is also available for MAC. Besides, the broker enables traders to access WebTrader, which ensures flexibility and ease of trading.

| Platforms | FXPrimus Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

FXPrimus Web Platform

The broker ensures that traders have access to WebTrader, to conduct trading directly through their preferred web browser with no installations required. It works well with any operating system and type of browser and requires only the internet to access the market.

The tools support all types of trading orders, MT4 Execution modes, and enable successful and versatile trading. One-click trading, 30 indicators, 24 graphical objects for technical analysis, and 9 timeframes. In addition, real-time quotes in Market Watch and detailed trading operations history make WebTrader a comprehensive and convenient solution for active traders.

Main Insights from Testing

FXPrimus’s Webtrader is a perfect opportunity to trade without prior installations and downloads from any device, giving traders simple access to their accounts. The WebTrader retains almost all the features of the platform, without restricting traders in their trading. All in all, with advanced features available and ease of access to the market, clients find the web trader a great choice.

FXPrimus Desktop MetaTrader 4 Platform

FXPrimus MetaTrader 4 is an advanced platform, popular among traders at any level. It offers ease of use, sophisticated charting, and technical analysis, allowing automation of trades. The broker’s MT4 platform supports Forex, Futures, Indices, Equities, and other CFD instruments. Traders can add extra features through the MQL portal or custom solutions, enhancing the trader experience. Besides, 9 timeframes, technical analysis tools, and a user-friendly interface further ensure profitable and smooth trading.

FXPrimus Desktop MetaTrader 5 Platform

The MetaTrader 5 platform ensures an innovative trading environment for advanced functionality by supporting CFDs, stocks, futures, and even cryptocurrencies. The MT5 platform stands out for its more advanced insights with 21 timeframes and more technical indicators compared to the MT4 platform. The platform enables EAs, different chart types like line, bar, candlestick, etc., and an MQL5 programming language. MT5 is especially beneficial for traders who employ different kinds of trading strategies.

FXPrimus MobileTrader App

Mobile trading with FXPrimus is supported by the MT4/MT5 platforms, both accessible on iOS and Android devices. Comprehensive trading functions are accessible through mobile applications, such as real-time quotes, interactive charts, and a variety of analytical tools that make it possible for traders to conduct their trades with the same efficiency from the palm of their hands.

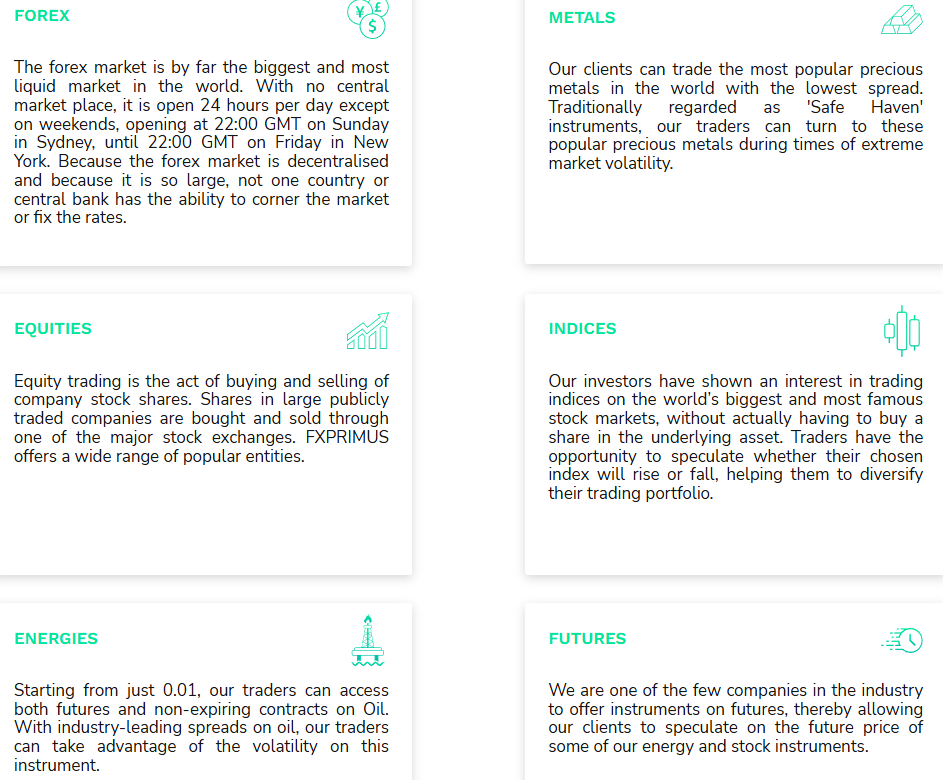

Trading Instruments

Score – 4.3/5

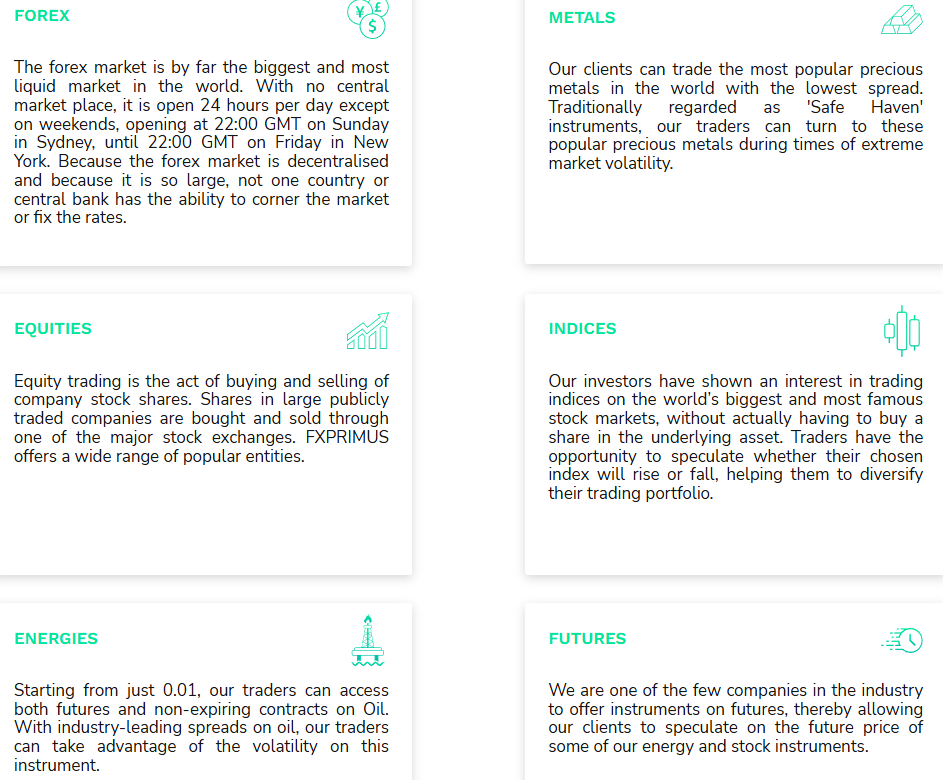

What Can You Trade on the FXPrimus Platform?

FXPrimus provides access to over 200 trading instruments, including Forex, Commodities, Stocks, Energies, Indices, and Cryptocurrencies. While the range of instruments may seem limited compared to some other brokers, it still includes a sufficient variety of popular assets to diversify the portfolio. This, combined with the competitive costs offered by FXPrimus, makes it an appealing option for traders seeking quality over quantity.

Here are all the instruments offered by the broker:

- Forex

- Equities

- Energies

- Precious Metals

- Indices

- Cryptocurrencies

- Stocks

Main Insights from Exploring FXPrimus Tradable Assets

While exploring the broker’s tradable products, we discovered a modest range of instruments offered. However, the asset classes introduced are versatile and enable traders to diversify their portfolios.

Besides, FXPrimus offers traders the option of trading CFDs on the Nasdaq 100 Stock Index. The Nasdaq is the second-largest stock exchange in the world, based in America, and mostly popular for its large stock list.

However, based on our research, all the instruments offered are mainly CFD-based, which limits the chances for traditional investments.

Leverage Options at FXPrimus

Leverage is the tool by which you may trade a large amount of money, due to its capability to increase your initial balance. Leverage may magnify your exposure to markets, yet the probability of profits or losses increases in parallel, which makes it essential to learn how to use leverage smartly.

FXPrimus leverage levels are determined by the regulatory restrictions each authority imposes. Simply it means you should verify with company customer service first which level you are entitled to use, as it may be defined by your residence in one country or another.

- Trading with European FXPrimus under CySEC and MiFID guidelines the maximum leverage level is set to 1:30 for Forex instruments

- A global entity of FXPrimus based in Vanuatu enables you to trade with high leverage up to 1:1000

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at FXPrimus

The wide range of funding solutions offered to clients worldwide enables them to fund their accounts with trust, safety, and confidence. However, it is important to verify the applicable conditions and methods based on your country of residence and the specific FXPrimus entity you are using.

Here are the main available funding methods:

- Bank transfers

- Credit card payments that allow an easy transaction

- E-wallets including Neteller, Skrill, UnionPay, Trust Pay, WebMoney, and many more

Minimum Deposit

The minimum deposit for the PrimusClassic account is $15. For the PrimusPro the initial funding is $500, and for the PrimusZero $1.000.

Withdrawal Options at FXPrimus

In accordance with FXPrimus’s Money-in-Money-out policy, all withdrawals up to the amount deposited will be processed using the same method for funding the account. Any amount exceeding the deposited sum can be withdrawn via alternative methods provided by the company.

- The withdrawal processing time for credit cards and e-wallets is up to 5 minutes. Bank wires take 2-5 working days, while local transfers from 1 to 5 working days.

Customer Support and Responsiveness

Score – 4.4/5

Testing FXPrimus Customer Support

FXPrimus provides quality customer support, efficiently guiding clients through opening an account, trading, and other general services. The support team is available via live chat and email to ensure that clients can contact them through their preferred channel. Besides, FXPrimus supports multiple languages, ensuring that clients from different parts of the world can be supported in their native language.

Contacts FXPrimus

As was already mentioned, FXPrimus has a supportive team to assist clients whenever they need help and guidance. This guidance is supported through the following channels:

- Clients can submit their questions right from the broker’s website by filling out a form and submitting their requests.

- Besides, clients can also send an email to the broker via the provided email address: support@fxprimus.com.

- Live chat is another option, especially if traders are looking for quick answers and solutions.

- FXPrimus also connects with clients through its social media pages, which provide updates and the latest market information via LinkedIn, Facebook, Instagram, Twitter, and YouTube.

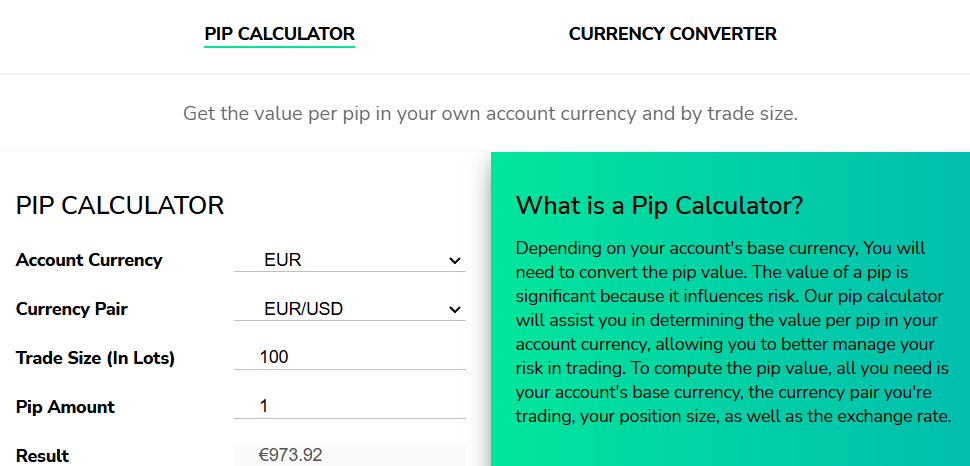

Research and Education

Score – 4.2/5

Research Tools FXPrimus

FXPrimus education and research sections are considerably limited and do not provide what is called comprehensive education and research. However, we have still found a few features and tools that might be helpful for traders:

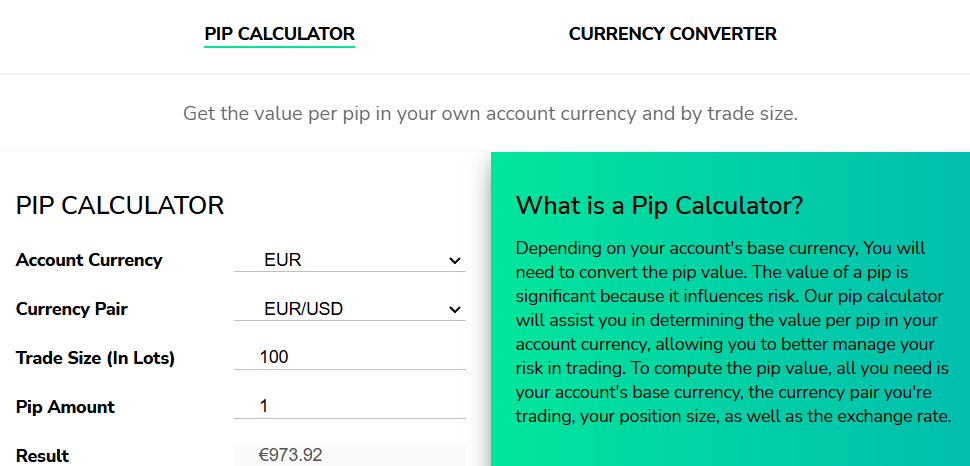

- Pip Calculator assists traders in determining the value per pip in the specific account currency, which will enable traders to better manage risks in trading.

- Currency Converter allows clients to view the most recent currency rates, and convert all major world currencies. Since the value depends on economic conditions, it is essential to know the current exchange rate.

Education

The Education section of FXPrimus is dedicated to articles for both beginner and advanced traders. We cannot say that the broker provides extensive educational resources, but, at least the materials provided will help traders of different levels learn about the market and obtain certain insights.

- The Beginner section includes a good range of articles covering different market-related topics from how to navigate currency markets to how to use various signals.

- Advanced traders have access to comprehensive guides and articles on complex strategies, margin leverage, etc.

- Also, clients have access to a News section that reflects on the important events taking place in the market. However, we found that the section provides limited information.

- Traders who prefer video guides can visit FXPrimus’s YouTube channel, which includes both tutorials and the latest news about the broker.

Is FXPrimus a Good Broker for Beginners?

Generally, FXPrimus offers traders good market conditions, enabling them access to favorable features and tools. This is true for traders of different levels. The fees and costs are average, and the initial deposit for the PrimusClassic account starts only from $15, which is a great offering, especially for traders who prefer to start small. The Demo account is another good thing about FXPrimus which serves both beginner and advanced traders. However, the education resources are limited to articles for both beginners and experienced traders. This might not be enough for novice traders who seek constant guidance and assistance.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options FXPrimus

FXPrimus offers stock trading on the platform using Contracts for Difference, whereby traders can speculate in the movement of stock prices without actual ownership of the instruments. Thus, the clients can trade shares of famous companies from different industries. However, this restricts those traders who look for traditional investments and ownership of real shares.

- However, FXPrimus opens other investment opportunities, through its social trading capabilities together with PAMM accounts facilitating relationships between World Class fund managers and followers. Traders simply need to become followers to gain bigger exposure to the markets.

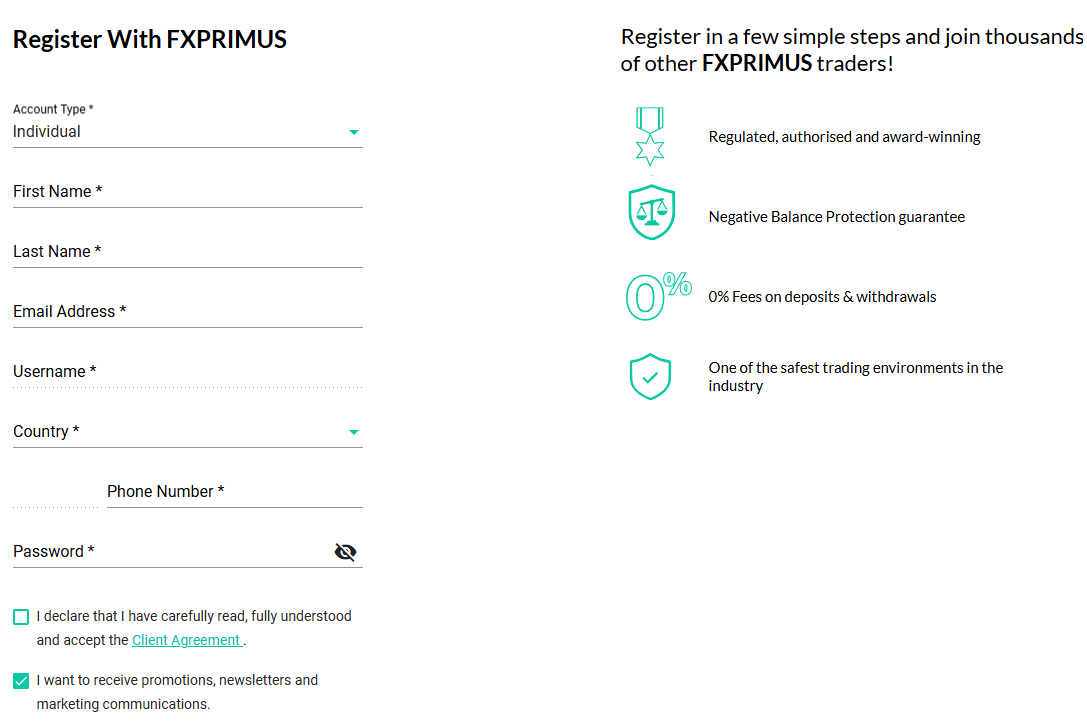

Account Opening

Score – 4.4/5

How to Open a Demo Account?

Opening a demo account with FXPrimus is easy and straightforward. To open the Demo account traders need to choose the ‘Register’ button, and later specify the demo option.

- Fill in the form, providing your name, country of residence, and email

- Create a password

- During the registration process, choose the ‘Demo Account’ option

- Verify your email and get the account credentials

- When the email is verified, use the credentials to enter the FXPrimus client portal

- Download your preferred trading platform

- Start trading

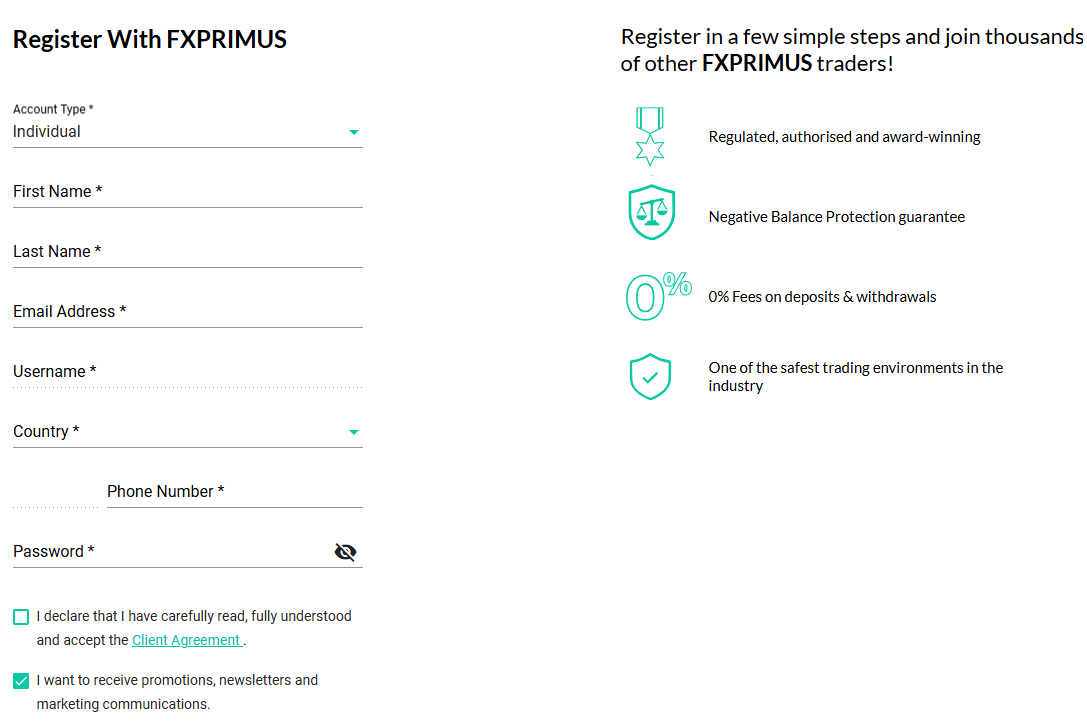

How to Open a FXPrimus Live Account?

Opening a live account with FXPrimus is not very different from the demo account opening, only it will take a little longer, and traders will be required to submit additional documents that will need further confirmation:

- Click on the ‘Register’ button at the top of the page

- Provide personal information (name, email address, and password)

- After filling out the registration form, verify your identity by uploading documents (ID and proof of residence)

- When the account is verified, log in to the FXPrimus client portal to choose the account type, download the preferred platform, and deposit funds.

- Start trading

Score – 4.1/5

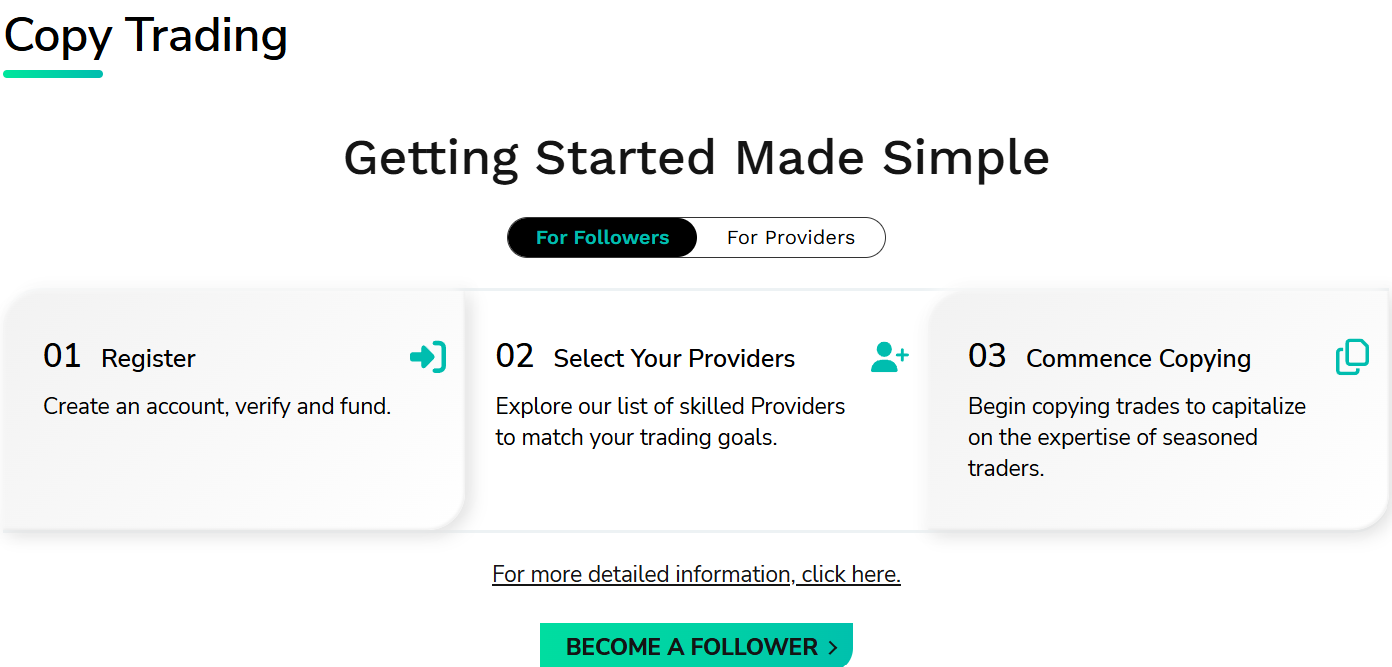

Based on our research all the tools and features of the broker are already integrated on its platforms, enabling traders to conduct good analysis and explore the market with advanced opportunities. Here we will only mention the broker’s Copy Trading offering that will appeal to many traders, especially being helpful for beginner traders to explore more investment chances without much knowledge and indulgence.

- Copy trading enables investors to automatically copy the trades of more experienced traders in real-time. It allows them to mirror the trading of professionals with no need to make individual decisions. Traders can choose from a wide range of providers, selecting one whose trading style matches the most to their trading preferences and expectations. Copy Trading is only available for the broker’s PrimusClassic account.

FXPrimus Compared to Other Brokers

We also compared FXPrimus to several well-regarded brokers in the market with similar offerings and conditions. This gave us an important insight into where the broker is standing.

First, we compared the broker’s regulation: FXPrimus is regulated by CySEC and the VFSC of Vanuatu, while as we compared it to HFM, we found that the broker holds several other licenses from top-tier authorities, including the FCA, CySEC, and FSCA of South Africa. As for the fees, HFM has commission-free accounts but with spreads starting from 1.0 pips, while FXPrimus has spreads from 1.5 pips on its commission-free accounts. FXPrimus also offers two commission-based accounts with different spreads and commission amounts, which gives a variety of choices to traders.

As for trading platforms, FXPrimus supports MT4, MT5, and WebTrader, which can satisfy the trading needs of most types of traders, while IC Markets also offers cTrader as an additional platform for diversification.

At last, in terms of education, we found that XM is way ahead not only from FXPrimus but also from most of the other brokers in the industry, offering wide learning opportunities for traders.

| Parameter |

FXPrimus |

Deriv |

XM |

HFM |

FP Markets |

IC Markets |

FXTM |

| Spread Based Account |

Average 1.5 pips |

Average 0.5 pips |

1.6 pips |

Average 1 pip |

From 1 pip |

From 1 pip |

Average 1.5 pips |

| Commission Based Account |

0.0 pips + $2.5 |

0.0 pips + $0.05 |

Only on Shares Account |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, MT5, WebTrader |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5, XM WebTrader |

MT4, MT5, HFM App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5 |

| Asset Variety |

200+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

10,000+ instruments |

1,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC, VFSC |

MFSA, Labuan FSA, BVI FSC, VFSC |

ASIC, CySEC, FSC, DFSA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

FCA, FSC, CMA |

| Customer Support |

24/5 |

24/7 |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Basic |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

$15 |

$5 |

$5 |

$0 |

$100 |

$200 |

$200 |

Full Review of Broker FXPrimus

FXPrimus is an international Forex broker that provides good protection for traders’ investments due to its tight regulation and different measures of safety, including negative balance protection, aiming to deliver a comprehensive and secure trading experience.

The broker provides access to over 200 instruments across a broad range of assets, including currencies, CFDs, shares, indices, commodities, equities, and cryptocurrencies. The broker also offers the market-popular MetaTrader 4 and MetaTrader 5 platforms, ensuring an advanced trading experience for traders of different preferences. The spreads start at 0.0 pips, and the leverage goes up to 1:1000 for global traders. However, the broker has certain downsides, too, such as the limited educational and research resources that might restrict traders, especially beginners who need guidance and extra assistance. Also, clients should consider the differences in trading conditions between the entities.

Share this article [addtoany url="https://55brokers.com/fxprimus-review/" title="FXPRIMUS"]

A little while ago, I purchased a primus classic account with this primus broker, and I am extremely satisfied. The platform is user-friendly and provides a great trading experience.The customer support team has been extremely attentive and helpful. Choosing this primus broker has been a wise decision, and I’d recommend it to anyone looking for a reliable trading option.

I tried out FXPrimus, an FX trading company, for trading. I liked their platform made it easy for me to trade even though I’m not a pro. My trading experience is not vast, but their user-friendly setup helped me navigate and make sense of things

I’ve had the chance to try out FXPrimus, a forex trading platform. What caught my attention was how user-friendly it is. Even though my trading experience is limited, their setup made it simple for me to get started and grasp the basics.

Good morning I haven’t been able to contact Broker whose name is Alex for all last week. And today Monday. I’ve WhatsApp him and phoned him. Can you please phone me or email me.

Kind regards Richard Lawson

Help

if you mean “small” trading account as in the ability to open a micro order (0.01), then yes you can as FXPrimus’ MT4 account allows 1.0, 0.1 and 0.01 lot sizes in the same account

FXPRIMUS is the WORST BORKER in the world. I was IB in this company. The removed my 80% OF DIRECT CLIENTS from my IB List. NEVER EVER Trade or PARTNER the WWORST BROKER in the world. If some one need PROOF I will email them.

hey is this true because I seen they were partnered with a prop firm called the trading capital

again, anybody can say anything about everyone, where’s the proof?

We are sorry to hear you have had a less than satisfactory experience with FXPRIMUS however we are unable to assist you without factual information, account details and dates of incident in order to investigate the issue. Kindly email us at support@fxprimus.com to investigate the matter otherwise we will consider the comment inflammatory, defamatory and void of substance. With thanks, support team.

Do not use this broker…they fired all the employees in the same day….they loose a few regulators…. Dont use them choose another one

NOT THIS ONE IS ILEGAL

I am a registered user from the Netherlands and now i cannot login anymore to the client area without first being forced to have my account transferred to Primus Markets INTL Limited.

I want to register but the the system requires Latin characters on the names entries and user names assist in that regard thank you

hey Antony, yeah the system uses Latin characters only

Hi there,

I would like to know if its possible to open a small trading account?

To trade with FXPRIMUS click this link and a dedicated account manager will reach you —

To create your account click this link – http://www.fxprimus.com/open-an-account?r=40305877®ulator=vu