- What is Lirunex?

- Lirunex Pros and Cons

- Regulation and Security Measures

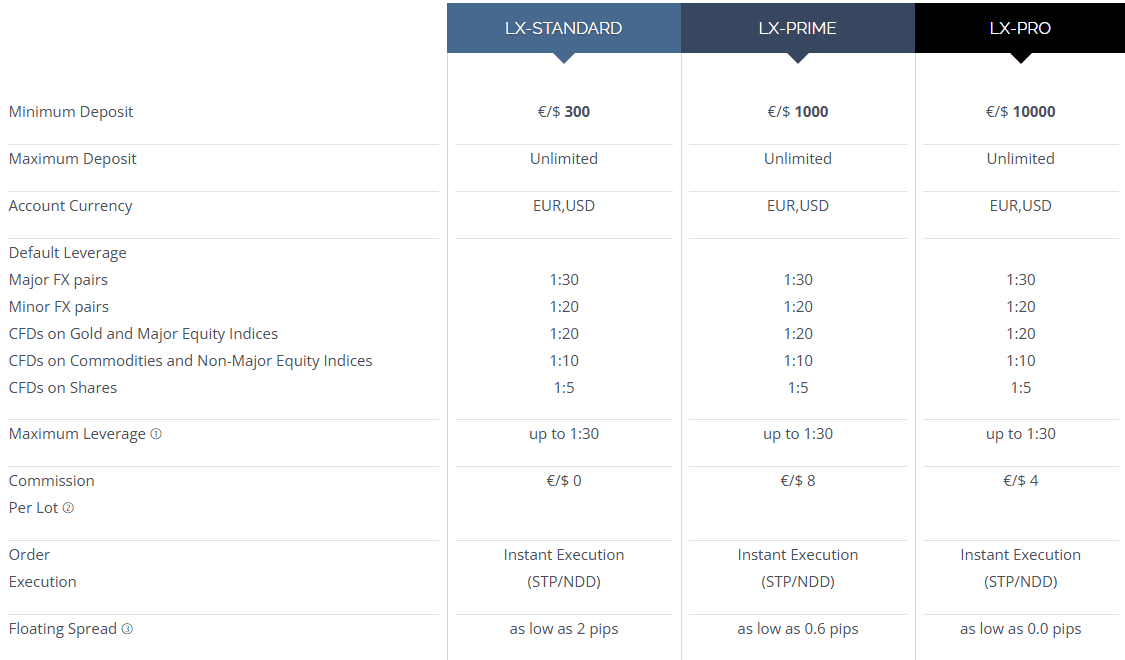

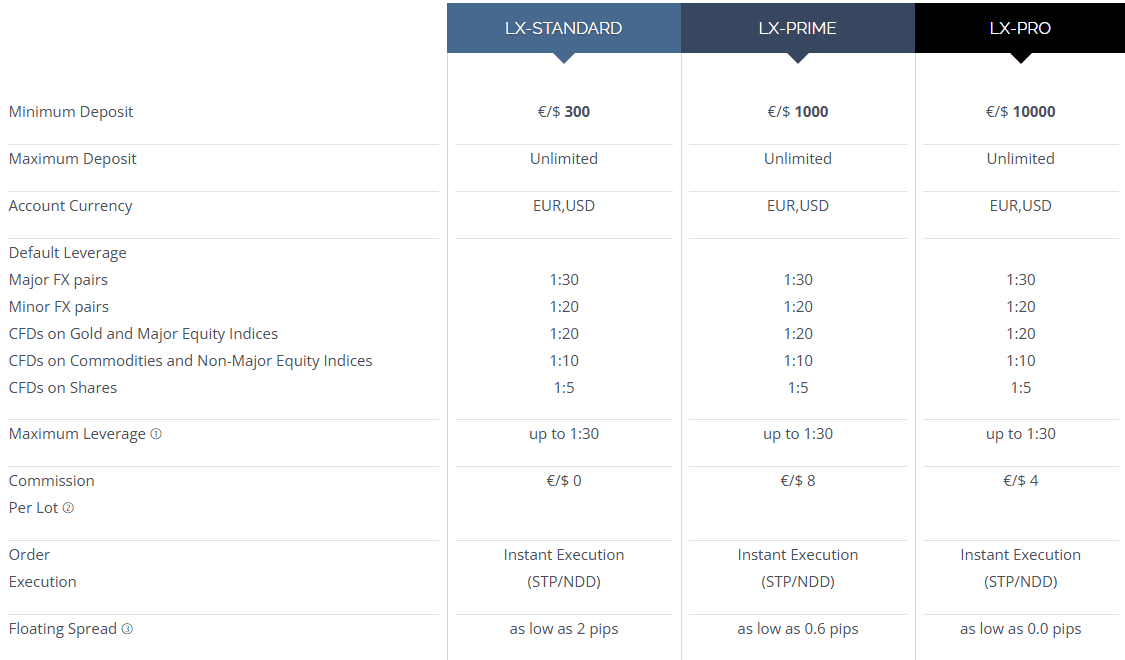

- Account Types and Benefits

- Cost Structure and Fees

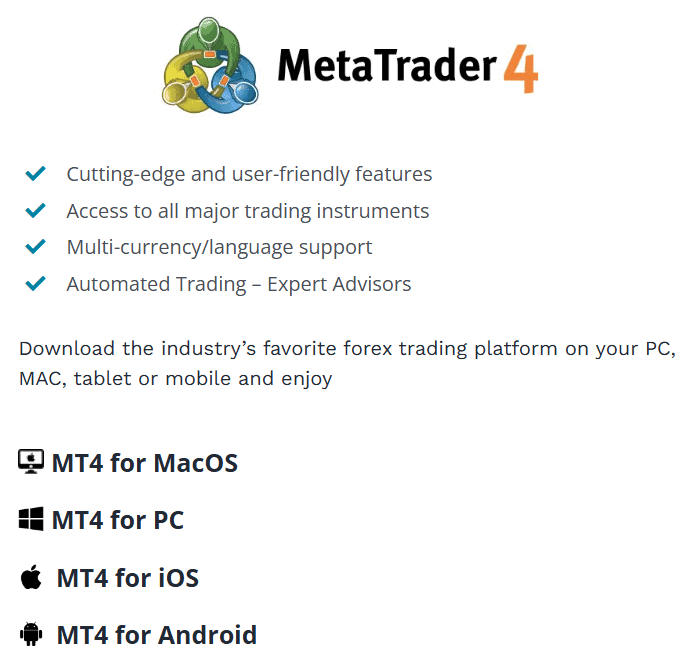

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Lirunex Compared to Other Brokers

- Full Review of Broker Lirunex

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Lirunex?

Lirunex is a Cyprus-based Forex Brokerage company and investment firm offering FX and CFD instruments. With a global presence, Lirunex is dedicated to delivering world-class brokerage services and strives for excellence through its CySEC licensing and supervision.

Yet, the broker also enables the offshore office to cover global exposure. If it were located only in the offshore zone, we would not recommend Lirunex. However, with its European set of operational standards followed by CySEC supervision, Lirunex is considered a safe broker.

Lirunex Pros and Cons

Lirunex is a reliable broker with easy account opening, support for different funding methods, and good trading conditions. It offers an advanced platform, and spreads on the industry average.

From the negative points, the range of the instruments is limited to Forex and CFDs. Also, the broker provides poor educational materials. Besides, the broker has an offshore entity, that does not provide the same rigorous safety measures as the CySEC regulation does.

| Advantages | Disadvantages |

|---|

| CySEC-regulated | Runs an offshore entity |

| Good Establishment | High Spreads for some account types |

| Good Instrument Range and technology offering | Poor Education |

| MetaTrader Broker | Only FX and CFDs |

| Low Fees | |

Lirunex Features

Lirunex can be a favorable option with its good market conditions and reliability it offers. We have compiled the main points of trading with Lirunex to help traders see the main aspects the broker provides more clearly and decide if the broker meets their trading expectations:

Lirunex Features in 10 Points

| 🗺️ Regulation | CySEC, Marshal Islands |

| 🗺️ Account Types | LX-Standard, LX-Prime, LX-Pro |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | FX pairs, CFDs on metals, shares, Indices, Energies |

| 💳 Minimum deposit | $300 |

| 💰 Average EUR/USD Spread | 2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR,USD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Lirunex For?

Our study and the insights of financial analysts indicate that Lirunex is dedicated to providing traders with a safe and good trading environment. It has different trading conditions and tools that can suit the needs of traders of any level. Lirunex will especially be suitable for the following:

- Beginners and Regular size Traders

- FX and CFD trading

- For international Traders

- Trading with different strategies

- MT4/MT5 Traders

- Indices Trading

- EAs Trading

Lirunex Summary

Lirunex offers an opportunity for quality trading to both beginning traders and professionals. What we like at Lirunex offering is a range of account types, quite competitive fee conditions, and good regard from the clients. Despite the fact that Lirunex also runs an offshore entity in the Marshall Islands, its obligations towards European CySEC give a clear state of mind that you’re trading with a reliable firm. Overall, Lirunex combines flexibility, security, and transparency, making it a good choice for traders in search of a reliable and multifunctional broker.

55Brokers Professional Insights

Lirunex provides its clients with a user-friendly environment, offering good market conditions and safety of investments. The broker has quite global presence since provide services to 34 countries, it has good global standing and trust among traders, which is a plus.

As for the trading conditions, we found that Lirunex provides a good range of account types with different conditions and fee structures, while costs are slightly higher than average ot some points, so not on the lowest levels. The instrument availability is a little limited too, with only FX pairs and instruments based on CFDs.

However, our research showed substantial differences in the offerings of the broker based on the entities. Starting from the minimum available deposit to the range of account types, also available spreads and commissions on different instruments vary from entity to entity. This is why we recommend traders carefully view the conditions based on the entity they want to open a Lirunex account with, to avoid unpleasant surprises later.

Consider Trading with Lirunex If:

| Lirunex is an excellent Broker for: | - For clients who prioritize tight regulations

- Prefer MT4/MT5 platforms

-Look for a wide range of account types and different options

- Global traders

- Traders with different levels of experience

- Cost conscious traders |

Avoid Trading with Lirunex If:

| Lirunex is not the best for: | - Traders who look for extensive trading tools

- In-depth research and education recourses

- Those who prefer diversity in platform choice

- Looking for lowest industry costs |

Regulation and Security Measures

Score – 4.5/5

Lirunex Regulatory Overview

Lirunex is the trading name of a Cyprus Investment firm, which is also respectively authorized by the Cyprus Securities and Exchange Commission (CySEC). This ensures that the broker conducts its business with complete transparency, guided by the rules of the regulatory authority. Besides, for any failure in compliance, it could face serious fines, or the revocation of its license, to protect traders and preserve the integrity of the financial markets.

- Also, the broker is regulated in the Marshall Islands, thus enabling global coverage. However, we do not recommend registering under offshore entities due to the higher risks of capital loss.

How Safe is Trading with Lirunex?

CySEC brokers and Lirunex respectively operate clients’ accounts with transparent conditions and offer accounts segregation from the company ones. In addition, in the worst case of the company insolvency, clients are covered by the compensation scheme.

Moreover, as a European regulator, CySEC follows the guidelines of ESMA and the MiFID directives, hence assuring a very high level of protection for traders. Lirunex also has a cross-border license, which by law can offer trading services to clients within the EEA and other permitted regions.

Consistency and Clarity

Our research of the broker showed that Lirunex has a consistent and transparent approach to offering trading services, which is in line with the industry’s standards and regulatory requirements. With its CySEC regulation, Lirunex is transparent in its operations and complies with European law under the ESMA and MiFID directives. We also found that the broker has been constantly enhancing its services and expanding its exposure globally, gaining more and more clients from all over the world.

To find what real clients think about the broker we researched different platforms and concluded that most traders are pleased with the services and market conditions Lirunex provides. Summing up, most clients express positively about the broker’s customer support, quick and prompt withdrawals, and competitive trading conditions. However, we highly recommend carefully researching the broker’s offerings and trading conditions availability in certain entities, as the conditions might vary drastically.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Lirunex?

Lirunex has three main account types – LX-Standard, LX-Prime, and LX-Pro. Each account offers differing conditions, enabling traders to have a good variety and access to the market conditions that suit their needs the most. All three account types enable access to FX Pairs, Spot Metal, Energies, Shares, and Indices. The maximum leverage allowed is 1:30, although it can be much lower for some instruments. Another similarity is the account currency that is EUR, and USD for all the offered accounts.

- An important note is that for its global entity, the account types offered are different, as traders can choose among four account types (there is an additional LX-Cent account). Besides, the initial deposit is much lower, and the available leverage is up to 1:2000. Thus, we recommend traders be careful and take into consideration these aspects of difference.

LX-Standard Account

To start trading with the LX-Standard account traders need to make a $300 initial investment. This account type is spread-based with spreads starting from 2 pips. The account has no commissions, as all the fees are integrated into spreads.

LX-Prime Account

To open an LX-Prime account traders need to make a $ 1,000 deposit, which is higher than the market average. The fee structure for LX-Prime differs from the LX-Standard one, as it is a commission-based offering, with floating spreads from 0.6 pips, and a $ 8 commission per lot.

LX-Pro Account

This account type is for professional traders, offering flexibility, advanced market conditions, and competitive costs. The initial deposit starts from $10,000. Spreads for the LX-Pro account start from 0.0 pips combined with commissions of $4 per lot. All in all, this account is tailored for professionals looking for advanced market experience, high-volume traders, or algorithmic and EA traders.

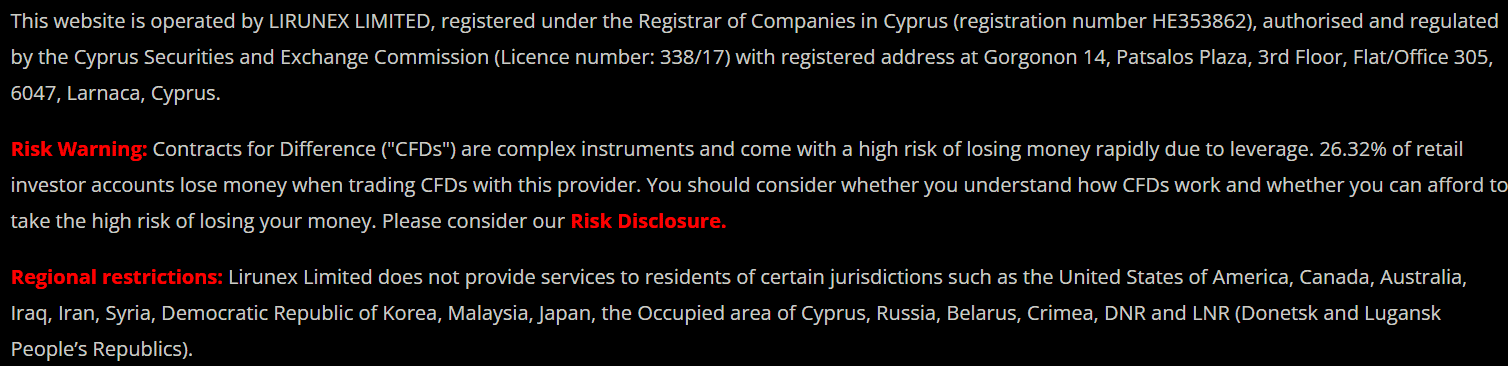

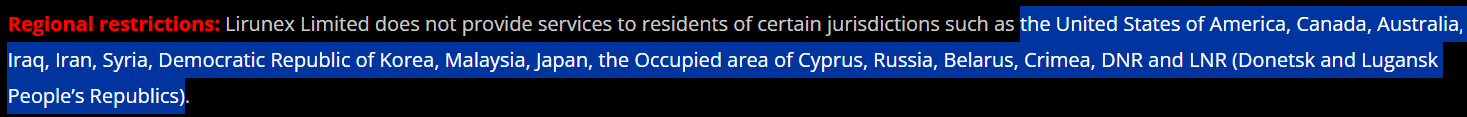

Regions Where Lirunex is Restricted

Lirunex does not offer its services to residents of jurisdictions where such offerings do not comply with the local law or regulatory requirements. Below is the list of the restricted countries:

- The United States of America

- Canada

- Australia

- Iraq

- Iran

- Syria

- Democratic Republic of Korea

- Malaysia

- Japan

- The occupied area of Cyprus

- Russia

- Belarus

- Crimea

- DNR and LNR

Cost Structure and Fees

Score – 4.4/5

Lirunex Brokerage Fees

Lirunex offers a competitive and transparent fee structure suitable for different trading preferences. The broker provides one spread-based account and two commission-based accounts, enabling traders to select the most appropriate pricing model for their strategies. However, it is essential to understand that the trading costs might vary based on the entity. Below, you can get acquainted with the main fees charged by Lirunex:

As was already mentioned, Lirunex offers three account types, one of which (LX-Standard) is completely spread-based, with no additional commissions applied. The average spread for this account is 2 pips, which is slightly higher if compared to the market average. For the commission-based LX-Prime account spreads start from 0.6 pips, while for the LX-Pro account spreads start at 0.0 pips, with added commissions.

Also note, that Lirunex offers floating spreads that may be increased based on the market conditions at specific periods.

Lirunex charges commissions right at the beginning of the transaction and the fee depends on the type of account. For the LX-Standard Account, there is zero commission per lot with all the trading costs already integrated into the spread, making it especially suitable for traders who prioritize simplicity in the fee structure. The LX-Prime Account has a commission of $8 per lot and is better suited for more professional traders who favor raw spreads and precision in costs. And the LX-Pro Account is for high-volume and professional traders with commissions of $4 per lot.

How Competitive Are Lirunex Fees?

The full review of the Lirunex fee structure revealed that although some instruments might have slightly higher spreads than the market average, the general cost structure is quite transparent and free from high hidden fees. Due to clarity and flexibility in pricing, Lirunex will be a cost-effective option to fit the needs of both beginners and professional traders in search of reliable and fair trading conditions.

Besides, the variety of the offered fee structure enables traders to choose the most suitable option, either the spread-based account with zero commissions or one of the two options of the commission-based accounts.

| Fees | Lirunex Fees | Goldwell Capital | Scandinavian Capital Markets Spread |

|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Average |

Lirunex Additional Fees

While trading with Lirunex, there might also be some additional fees applied, which are in line with the market and are incurred by most of the brokers. Here are some of them:

- Lirunex applies inactivity fees of $5 for accounts that have been inactive for 90 days or more. Accounts are considered inactive if there are no trades, deposits, or position activity for the mentioned period. Accounts with a zero balance are further classified as Dormant and may be deactivated by the company at its discretion.

- Lirunex also charges a conversion fee for clients depositing or withdrawing funds in currencies different than the base currency of their trading account. The conversion fee is usually a small percentage of the transaction amount and the company charges this fee due to the cost of converting funds into another currency.

- Traders should also be aware of the swap fees the broker applies, especially for positions held overnight, as swap fees can impact the overall cost or profitability of the trade. Lirunex provides details of swap rates on its MT4/MT5 platforms, thus we encourage traders to check them beforehand.

Score – 4.2/5

We found that Lirunex offers only the MT4 platform to its clients, enabling the desktop installation, web platform, and mobile app versions for more flexibility and accessibility. Clients trading through the offshore entity can also have access to the more advanced MT5 platform. We advise traders to check the platform availability based on the entity before signing with the broker.

Trading Platform Comparison to Other Brokers:

| Platforms | Lirunex Platforms | Pepperstone Platforms | XM Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Lirunex Web Platform

Lirunex enables access to the MT4 web-based platform, offering flexibility and convenience to traders. The platform is easily accessible through any web browser and allows users to manage their accounts and execute trades from any device connected to the internet. The platform’s features are quite basic, allowing access to the main tools, including advanced charting tools and technical analysis, fast execution, and access to a range of instruments enabling beginners and professionals to have a positive experience.

Lirunex Desktop MetaTrader 4 Platform

The Lirunex MT4 platform ensures compatibility with various devices, including PCs, Macs, mobile devices, and tablets. The platform is designed to suit the needs of various traders, offering a simple intuitive interface combined with advanced functionality. Equipped with great trading tools, like customizable charts, and more than 30 technical indicators, MT4 allows deep market analysis and various strategy development.

For those who are interested in EAs, Lirunex does not restrict them from creating their own automated strategy or choosing from the already existing solutions. With multi-order type support, the platform suits simple and intricate trading strategies, meeting the needs of both beginner and professional traders. The multi-device compatibility ensures a smooth transition from desktop, web, and mobile trading for convenience and accessibility. At last, the MT4 trading platform, combined with Lirunex’s high-speed execution, tight spreads, and access to a good number of financial instruments, is a favorable combination for traders who look for advanced conditions combined with safety.

Lirunex Desktop MetaTrader 5 Platform

At the moment the CySEC-regulated entity does not enable trading through the MT5 platform. The MT5 platform can be reached only through the global entity. However, trading through the global entity of Lirunex might not provide the same safety.

Main Insights from Testing

We found that the Lirunex MT4 platform provides an intuitive interface, customizable charts, and more than 30 technical indicators for in-depth market analysis. Besides, traders can use more complicated strategies and Expert Advisors to have an enhanced experience. The platform is compatible across different devices, ensuring accessibility.

We found that the MT5 platform is available only on Lirunex’s global entity, but not under CySEC regulation, which we believe provides higher safety for clients. In our opinion, although MT5 offers a number of advanced features, trading with the global entity cannot be as secure as it would be with the regulated MT4 platform.

Lirunex MobileTrader App

The MT4 Mobile App is available on both iOS and Android devices for traders who want to manage their trades whenever they want. Through the mobile app, traders gain access to real-time price quotes, one-click trading, and full account management. The app is easy to use, offering a user-friendly interface while maintaining all the essential features needed for effective trading. Combining functionality with flexibility, the app becomes a great tool for traders who cannot conduct their trades on the desktop all the time.

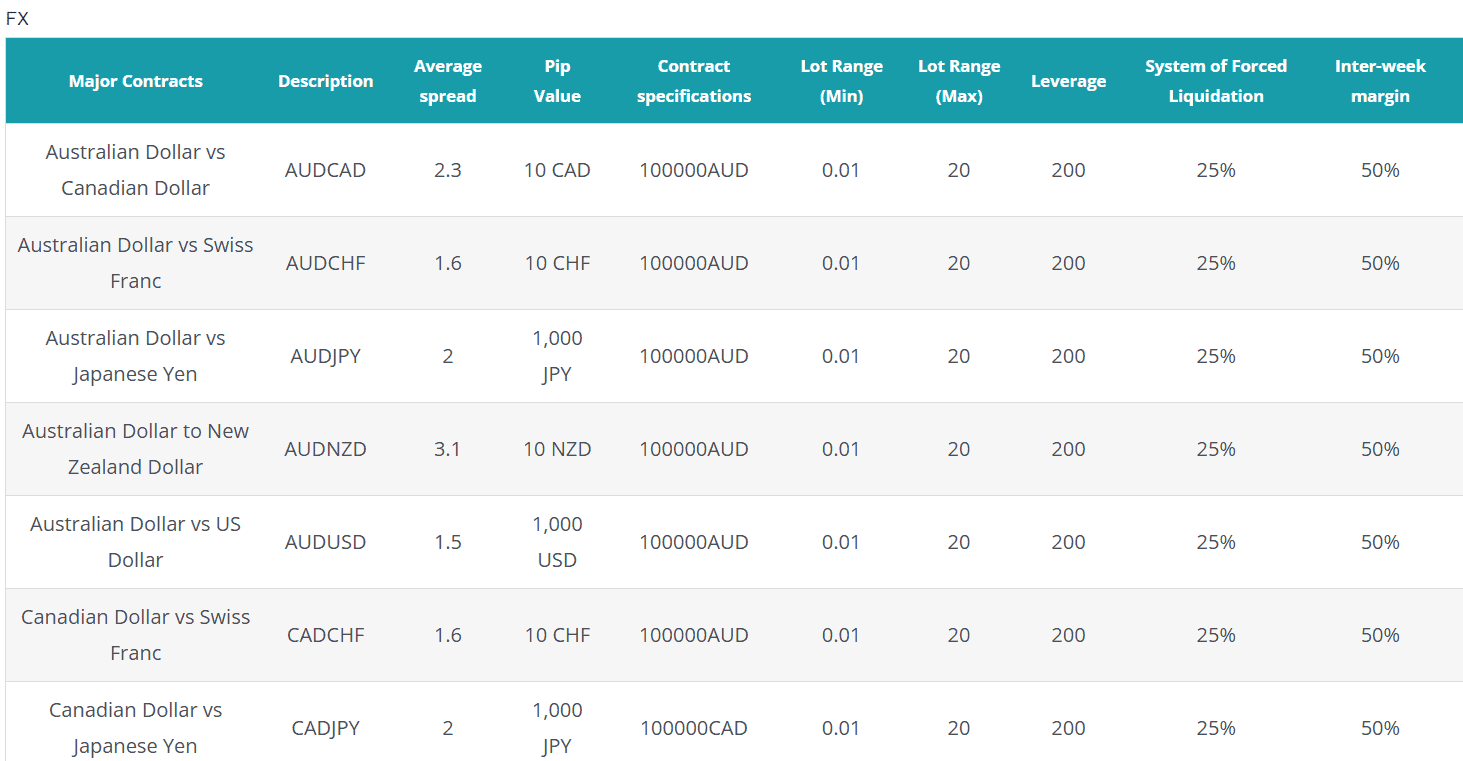

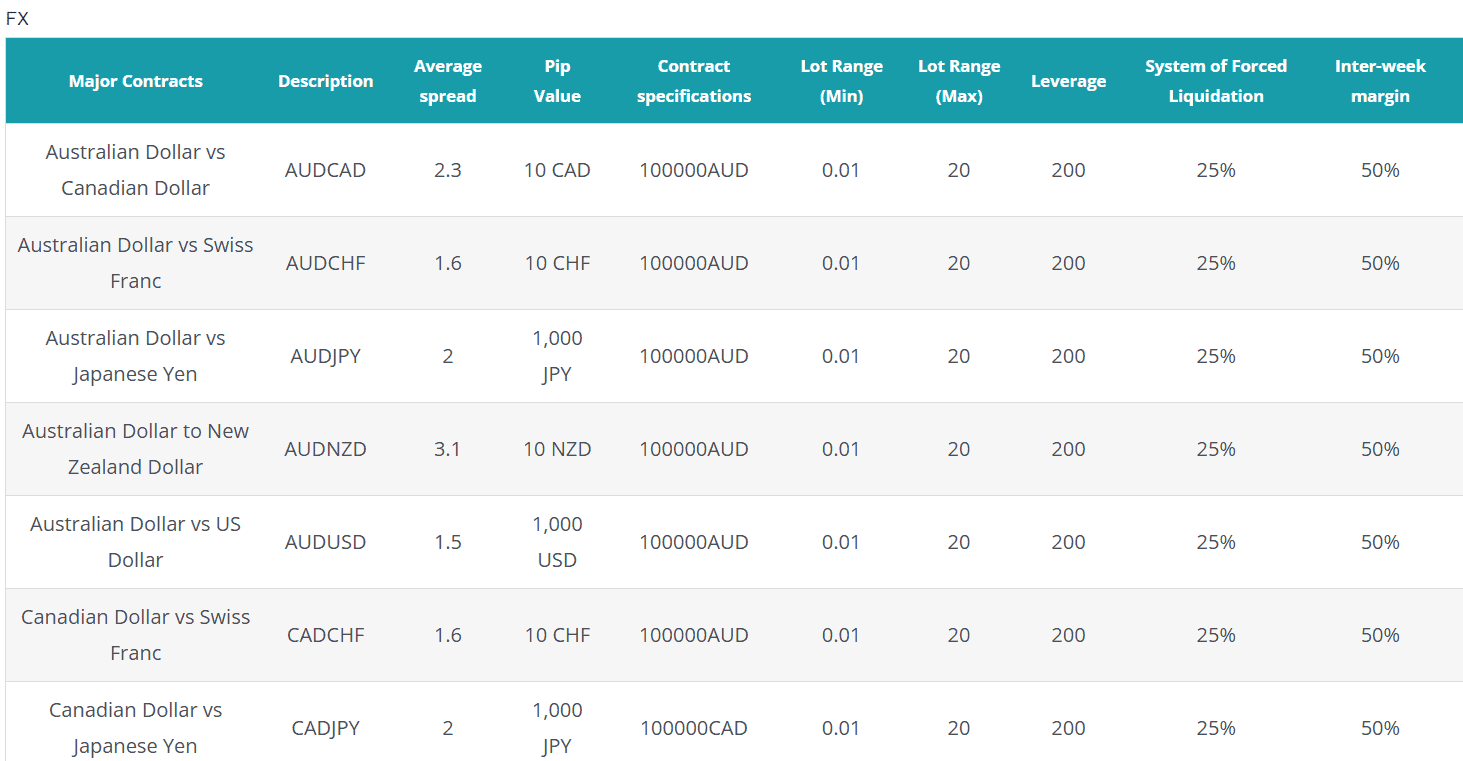

Trading Instruments

Score – 4.3/5

What Can You Trade on the Lirunex Platform?

The trading instruments that Lirunex offers meet different needs and trading expectations of traders giving them access to popular markets, including Forex with a good range of currency pairs, precious metals, agricultural products, and other instruments perfect for portfolio diversification.

The broker also offers indices, granting access to some of the world’s most famous companies. This variety of instruments satisfies the needs of both novice and professional traders. Below is the list of the main instruments traders can access through Lirunex:

- FX pairs

- CFDs on metals

- Shares

- Indices

- Energies

Main Insights from Exploring Lirunex Tradable Assets

Our research on Lirunex tradable assets showed that the broker offers a good selection of trading instruments suitable for traders of any preferences and experience. Traders can access the most popular markets: Forex, precious metals, indices, and shares. We also found that traders through international entities can trade the most popular cryptocurrencies, like Bitcoin, Ethereum, Litecoin, and Dash.

It is evident that the broker’s instrument availability depends on the entity. This is why we recommend considering the broker’s offerings based on the jurisdiction, bearing in mind that the CySEC-regulated entity might hold certain restrictions for some instruments, restraining their availability. At last, the exact number of Lirunex tradable instruments is not readily available on the broker’s website. Yet, we found that the number is less than 1.000 instruments.

Leverage Options at Lirunex

Financial leverage refers to the use of borrowed money to increase investment returns. Essentially, leveraging involves borrowing money to invest in assets, with the goal of earning a higher return on the invested capital than the cost of borrowing. Financial leverage can boost potential returns but it can also increase risks considerably.

Lirunex Leverage levels depend on the entity you are trading with, as well as the account type and your expertise level. Leveraged trading allows better exposure to the market while ratios available to retail traders are:

- 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities for CySEC traders

- For traders under the Marshall Islands regulators, the broker offers high leverage rations up to 1:2000

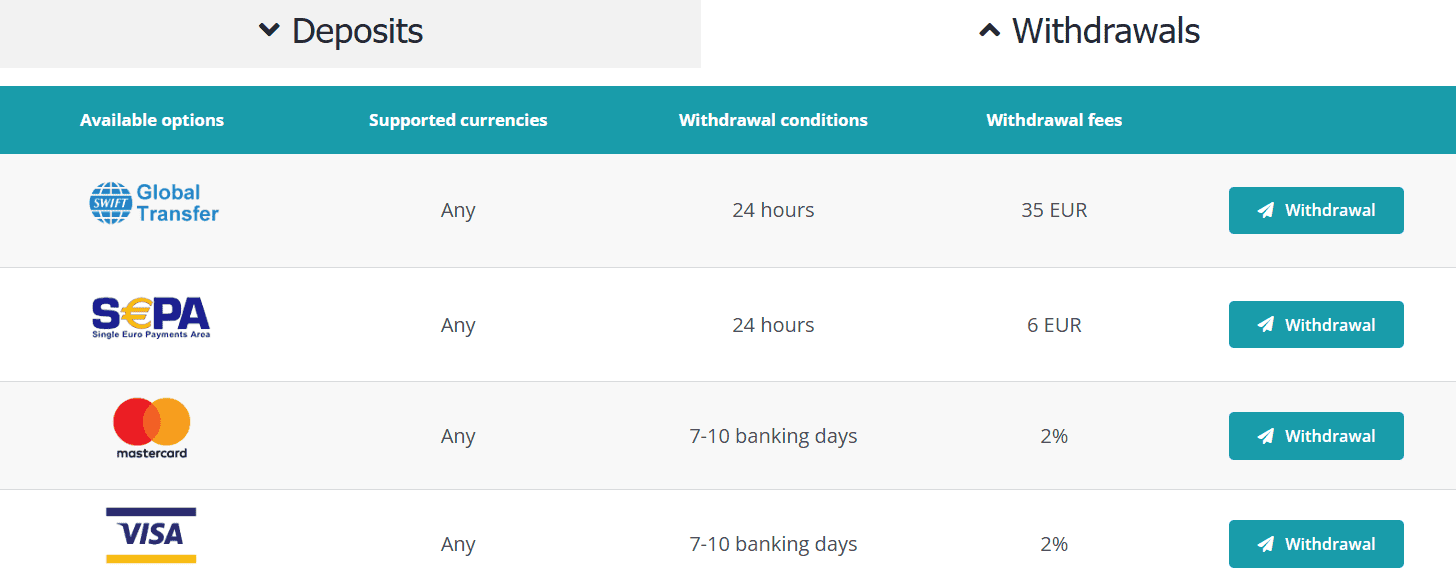

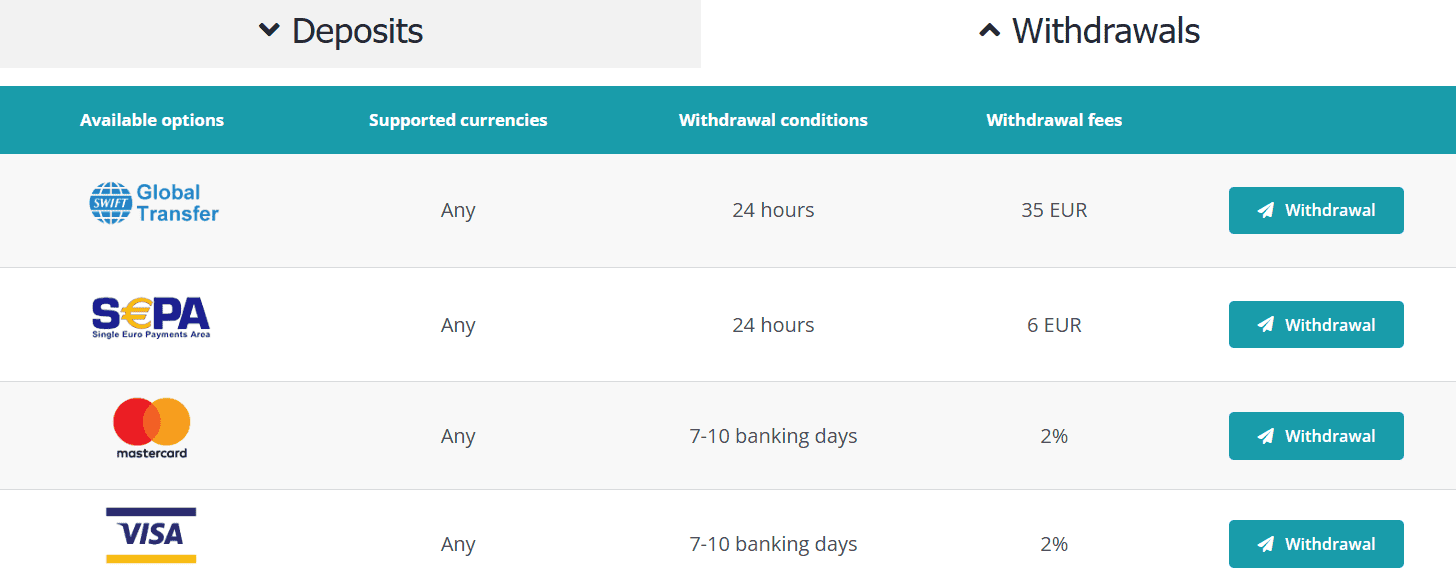

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Lirunex

Lirunex payment methods include Card Payments and Bank Transfers, WebMoney, Sofort, giropay, and several other options. Anyway, traders should know that the availability of the payment method, too, depends on the entity the client is registered with. The international entity gives traders more funding options, like ApplePay, Google Pay, Perfect Money, and bitpay.

Minimum Deposit

As we found, the Lirunex minimum deposit is $300 for its LX-Standard account, which is considered slightly higher than the market average. For the other two account types, the minimum deposit is even higher – $1,000 and $10,000 respectively. However, as in the other aspects of trading with Lirunex, for its global entity, the offering is quite different, and clients can open the LX-Standard account with a $0 minimum deposit. So, please consider this difference and other differences the broker has based on the entity and the rules it adheres to.

Withdrawal Options at Lirunex

For withdrawals, clients should use the same methods they used to make deposits. Withdrawals are processed during 24-hours after the submission of a withdrawal request from Monday to Friday. However, for the funds to reach the clients’ accounts may take longer, based on the third-party provider policy. For Bank withdrawals, it can take 3 to 7 working days to reach the client’s account, whereas for Credit/debit card withdrawals it may be even longer.

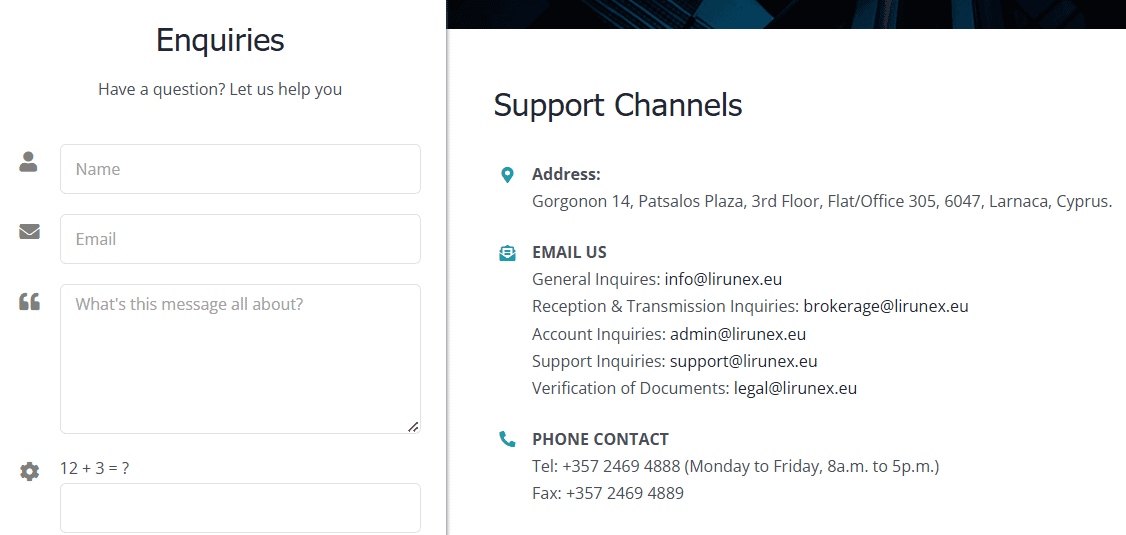

Customer Support and Responsiveness

Score – 4.4/5

Testing Lirunex Customer Support

Lirunex customer support offers comprehensive service with various contact options available during market hours. Lirunex ensures assistance to their clients, be it by phone, email, or one of many other channels such as live chat and an online resource center filled with helpful FAQs and educational materials.

- The FAQ section includes the most essential answers to common questions, guiding clients and giving more information on the nuances of trading with Lirunex.

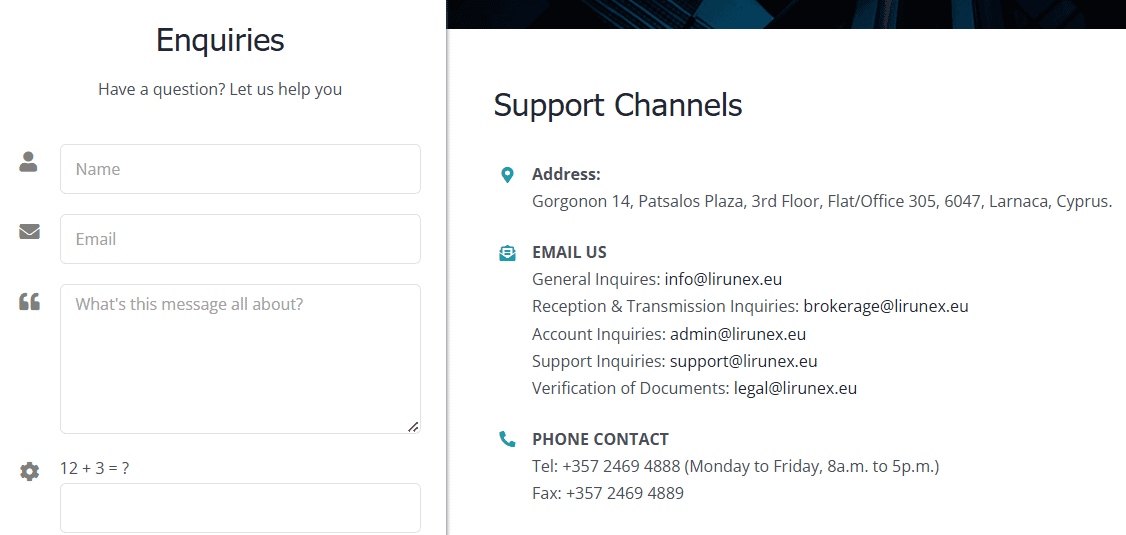

Contacts Lirunex

The Lirunex customer support is quite helpful, enabling traders to find assistance through various channels. The broker also has social media pages, where traders can find up-to-date information on the broker’s operations.

- Clients can direct their Enquiries right from the broker’s website, just indicating their name, email address, and the question they want to find an answer to.

- Also, clients can find help through the phone line by the +357 2469 4888 number from Monday to Friday, 8 a.m. to 5 p.m.

- Besides, Lirunex offers the email option as a part of their customer support. General inquiries should be sent to info@lirunex.eu, for reception and transmission inquiries use brokerage@lirunex.eu, Account Inquiries are directed to admin@lirunex.eu, while Support Inquiries are sent to support@lirunex.eu. With questions in regard to the verification of documents, traders should use the legal@lirunex.eu email address.

Research and Education

Score – 4.3/5

Research Tools Lirunex

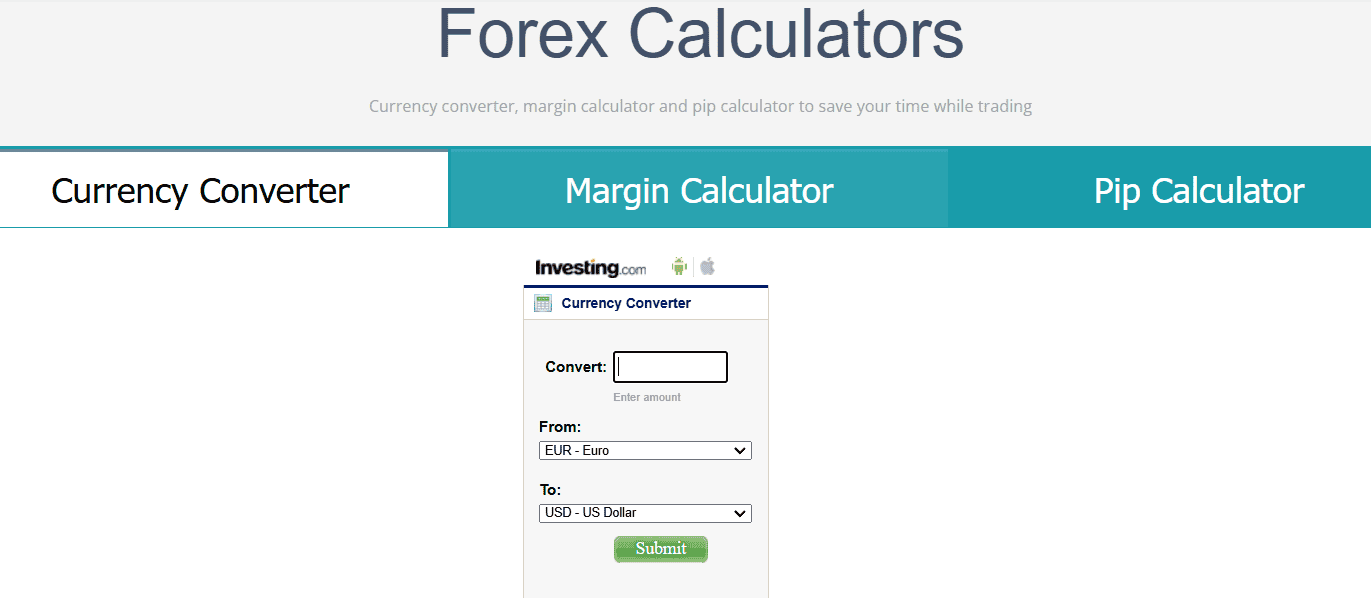

As we found, Lirunex does not offer an extensive research section. Mainly, all the research tools available are already included on the broker’s MT4 platform. However, here are two tools Lirunex offers that can be quite helpful for traders:

- Economic Calendar is a great tool for both beginner and professional traders to take a look at impending important events. Using the Economic Calender is essential, as it informs about events that can evoke market changes and impact the overall trading experience.

- In-depth market analysis provided by experienced professionals can always come in handy for clients. Technical and Fundamental analysis that Lirunex offers can reveal essential opportunities for traders, thus this is also a great tool to use.

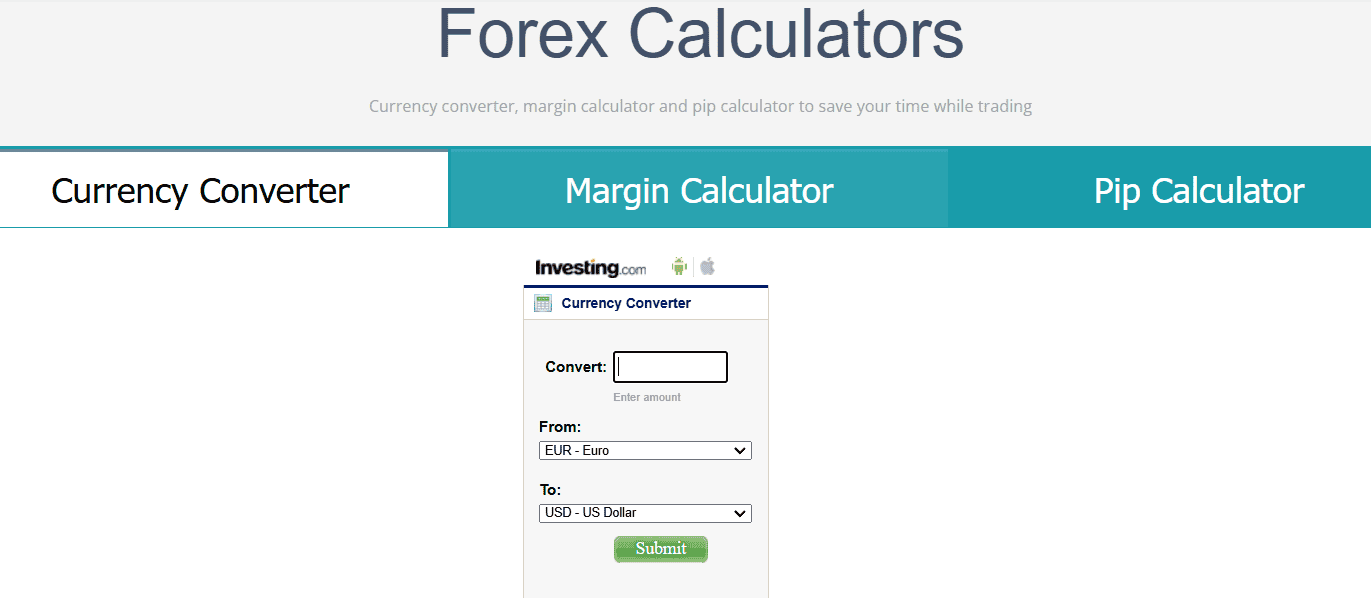

- By offering a currency converter, margin calculator, and pip calculator Lirunex helps its clients to make accurate calculations, by saving their time when trading. These tools simplify the trading process and enable traders to make informed decisions.

Education

The educational materials the broker provides are very basic and might not be very favorable for those traders who are looking for extensive educational resources. Here is what we found on the broker’s offerings:

- The beginner’s guide includes the most essential information on trading, including some terminology, but in a very brief manner. This is not an in-depth and insightful vocabulary that the broker provides, thus might be not satisfactory for beginner traders.

- Also, the broker has a brief section on trading strategies, but again, nothing very informative and extensive that will cover all the questions traders might have on trying different strategies in trading.

Is Lirunex a Good Broker for Beginners?

In our opinion, Lirunex is a good and safe broker that might satisfy and meet the trading needs of different traders. Its conditions and offerings are good and in line with the market average. However, for those beginner traders who need more guidance at the beginning of their trading journey and access to extensive educational resources, like webinars, seminars, trading academy, articles, and an extensive glossary on forex terms, Lirunex might be very limiting and unsatisfying with its restricted resources.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options Lirunex

Lirunex offers its tradable products mainly on CFDs, enabling its clients to speculate on the value of various financial instruments, such as stocks, without actual ownership, thus real stock investment is not available with Lirunex.

- All in all, the broker does not give many options for investment and diversification. However, through its international offering, Lirunex gives access to MAM and PAMM accounts. The accounts are for money managers and professional traders to manage multiple client accounts. With real-time performance reporting, money managers are able to monitor their strategies and give clients insight into the progress of their portfolios.

Account Opening

Score – 4.5/5

How to Open a Demo Account?

Lirunex offers a simple and quick Demo account opening process. Here are several steps to follow and start practicing without risking your funds:

- Click on the ‘Create an Account’ and choose the Demo option

- Fill in the information

- Specify the account preferences

- Access your Demo account and start practicing

How to Open a Lirunex Live Account?

Opening a Lirunex Live account might take a little longer than opening a Demo account, and clients will need to provide documentation as proof of identity and residence. Yet, the process is mostly quick and without complications.

- Visit the broker’s website and choose ‘Create an account’ option

- Fill in the required information

- Verify the identity by providing an ID and proof of address (utility bills, etc.)

- Set the account preferences (choose the preferred account type, base currency, multiplier, etc.)

- Fund the account via the preferred payment method

- Once the verification is completed, enter the platform and start trading

Score – 4/5

We found that additional tools and features are mostly available through the broker’s International entity. For the CySEC-regulated platform, the offerings are limited, including only the basic features. Below you can see the additional features the broker offers through the offshore entity:

- A 30% trading bonus is granted to traders for a specified period if they open an LX-Standard account with at least a $100 initial deposit. Clients will also need to fill in an application form to get the bonus.

- The broker provides FIX API to its professional clients, which enables traders to have full control over the data provided and obtained. One of the main benefits of FIX API is that it delivers fast and reliable execution speeds, crucial for high-frequency and algorithmic trading strategies.

- Lirunex VPS service eliminates most of the problems occurring during trading. It ensures stable and efficient conditions for trading without execution delays, interrupted trading, and overload of CPU.

Lirunex Compared to Other Brokers

By comparing Lirunex to other brokers in the market, we can clearly see the advantages it stands out for and the aspects Lirunex is behind other brokers. Comparing the broker by its safety and reliability, we can say that Lirunex stands as trustworthy when we put it together with brokers without top-tier licenses like RoboForex with only an offshore license by FSC. However, there are still brokers like FP Markets and HFM with more intense regulatory measures.

The instrument range offered by Lirunex with its less than 1,000 tradable products is considerably less in comparison to the same RoboForex and FP Markets with instruments over 10,000. Another aspect we compared is the trading platform availability. Lirunex offers trading via the MT4 popular platform, but still this may limit traders who seek platform diversification and prefer MT5, cTrader, or TradingView platforms.

Another point we viewed is the available research tools and educational resources, that are on a rather basic level. For more insightful educational materials Pepperstone and XM are on an excellent level, assisting traders of different levels to pursue their trading expectations.

| Parameter |

Lirunex |

Pepperstone |

RoboForex |

Exness |

FP Markets |

HFM |

Eightcap |

| Spread Based Account |

From 2 pips |

From 1 pip |

Average 1.3 pip |

From 0.2 pips |

From 1 pip |

Average 1 pip |

Average 1 pip |

| Commission Based Account |

0.0 pips + from $4 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4 |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, HFM App |

MT4, MT5, TradingView |

| Asset Variety |

About 1,000 instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

200+ instruments |

10,000+ instruments |

500+ instruments |

800+ instruments |

| Regulation |

CySEC, Marshall Islands |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Basic |

Excellent education and research |

Good |

Fair |

Excellent |

Good |

Good |

| Minimum Deposit |

$300 |

$0 |

$10 |

$10 |

$100 |

$0 |

$100 |

Full Review of Broker Lirunex

Based on our meticulous research we conclude that Lirunex is a reliable broker that can be a good fit for both novice and professional traders. The broker’s CySEC regulation makes it a transparent and reliable choice for those who prioritize tight regulations and adherence to rules. Besides, we find Lirunex trading conditions quite favorable, too, in line with the market average. With access to the popular MT4 platform and a good diversity of account types with different fee structures, traders have an option for choice. Clients have a choice between spread-based and commission-based accounts, choosing according to their trading preferences.

However, we should also mention some of the broker’s downsides that traders need to keep in mind. First, Lirunex does not offer a good education section, which can be a disadvantage, especially for those who highly depend on good educational resources and guidance from the broker. Another point to mention is the broker’s international entity. The conditions for the offshore platform are more diverse and appealing, whereas the regulation does not provide the same security as the CySEC license does. So, this is important to consider when opening an account with Lirunex.

Share this article [addtoany url="https://55brokers.com/lirunex-review/" title="Lirunex"]

really2 helpful this platforms due they will provide u some guidelines and manual before trading in this platform and easy to monitor it

Platform is easy to use and has all the necessary features I need, including detailed charts and order types

never know that they got islamic account too so maybe next will try to trade in. now, using demo account. easy to use guys no worries.

Seriously bro? I also searching for trading platform woth islamic shariah because more confident to do a trading on that kind of platform. will look up to lirunex soon!

yes they have that concept which it safe to Muslims users to trade there without no hesitate about where the money sources came from.

I’ve been trading with LIRUNEX for a while now, their trading platform is solid and has all the necessary features

this platform is really trusted because there are so many traders’ platform that I’ve tried before and most of them are not really have a sustained profit. but lirunex gives a more profits with low deposit at beginning.

LIRUNEX has been a great partner in my trading journey, their platform is easy to use and they offer some of the lowest fees in the industry, I also appreciate the personalized support I receive from my Relationship Manager.

Those people who confuse with negative and positive feedback here, Lirunex is reputable brokerage platform and they have many staff to process your withdrawal. If there is delay, we complain and they do give pay attention and solve the issue as soonest. I hope this review is good for new beginner.

Happy Trading 😊

When I join this broker, I was making losses and I don’t trust this broker for past two days. Then, one of the staff helped me and teach me to use stop loss function and secured when i trade. I hope one day i become a PRO trader…

I would recommend LIRUNEX to other traders

I appreciate their excellent Customer Support, which is available 24/7 through multiple channels

I’ve been using LIRUNEX for a few months now and I’m really impressed with them, it’s easy to use and offers a wide range of trading tools, the customer service is also top-notch and very responsive

I would highly recommend LIRUNEX to any trader looking for a reliable and trustworthy broker

Customer Support is also excellent – I’ve never had to wait long for a response or solution to any issue

I’ve been trading with LIRUNEX for over a year and I can’t say enough good things about them, their fees are very competitive and their trading platform is extremely user-friendly. I also appreciate the educational resources they offer for traders of all experience levels.

commission and fees are reasonable and competitive, and I appreciate the variety of trading instruments they offer

I’ve been trading with LIRUNEX for a while now and I’ve had a great experience, their platform is very reliable and I appreciate the wide range of investment options they offer, and their research tools are very helpful for making informed trading decisions.

Although their commission and fees are not the cheapest, I think the value they offer is worth it

a good trader broker,very helpful

I recently switched to LIRUNEX and I’M SO GLAD I DID, their customer service team is amazing and always willing to help, trading platform is very intuitive and offers a lot of advanced features.

This is helpful for coming youth generation who is unaware about this broker and to avoid scam broker…👍🏻

I got an issue with my withdrawal, the broker finance quickly take my query and resolved it. Thank you to efficient finance team.

It’s only take a few minutes to open account and fast withdrawal. I will give three star rating.

Lirunex is doing job and follow as per their information on site. Overall ok and no issue.

Pasukan sokongan sangat efisien membantu untuk memulihkan serta menetapkan semula kata laluan akaun trading saya.

Akaun trading yang terbaik. Selamat untuk trading dengan broker ini kerana broker ini mempunyai pelesenan dan peraturan yang betul.

This is legitimate broker.

“This broker is better than my previous broker!

I had bad experience from previous broker’s terms which comes different leverage and hidden fee as per agreed ealier. I decided to give try on this broker which was recommend by my best friend. I am still exploring their service and no issue as of now!”

“Everything was simple and easy

All the withdrawal is handled within 1 days working process. “

When I start trading this broker, I could’t close my trading order in profit because of lack of knowledge as a newbies in trading. Then, one of this broker’s staff helped me to rework on the market analysis and advise me the proper trading order accordingly. Good job and keep good work! Now, my trading runs smoothly and generate in the profit!

The broker is really best place for trading investment. I am engaged with this broker services for almost 2 years. They have improved their service from time to time and there is no lagging in the trading system. I even participate one of the trading contest and i won the prize! Overall, I am satisfied with this broker!

Service and experience overall all ok! In two years of trading experience in Forex, I tried with many brokers scalp are really good! But, this broker are good in terms of scalp at any pair. I will give them 4.5 star.

The trading was easy because they helps us to provide the tips and knowledge. Useful broker service for new trader.

One of the reliable and fast withdrawal broker and was unlikely from my previous brokers. I have receive the fund balance within an hours. There is no hidden fees!

This great app for those new comers and users to a market !

I have deposited 2000USD into my MT4 account and received the 30% bonus as the bonus program of the broker.

First, I have traded only 1.6 lot EU with take profit for 40pips. After that, I have traded 1.8lot GU with the new balance 2700usd and take profit only 35-40pips.It’s very normal trading. I have withdrawn 1315 usd and it was processed. The bonus credit is removed also. then I have trade alittle bit cause didn’t want to take more risk. After that, I continued to withdraw 1300usd but the broker delayed my withdrawal request and rejected the request. The broker said with unlogical reason that I fully margin traded. Trade 1.6 or 1.8 lot with 2500usd balance is fully margin trade ???? Very unlogical. Then they automatic deducted my profit 1296 usd. THIS IS SCAM BROKER THAT WILL AUTOMATIC REJECT YOUR WITHDRAWAL WHEN YOU MADE PROFIT. BROKER ONLY WANT YOU TO LOOSE ALL YOUR FUND. THE STOLEN AND SCAM BROKER!!!

Can someone arrange for a meeting for me.