- What is Noor Capital UK?

- Noor Capital UK Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

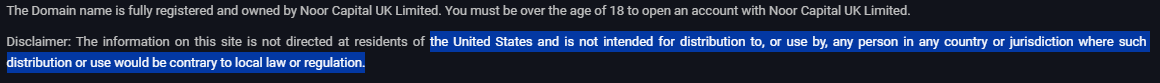

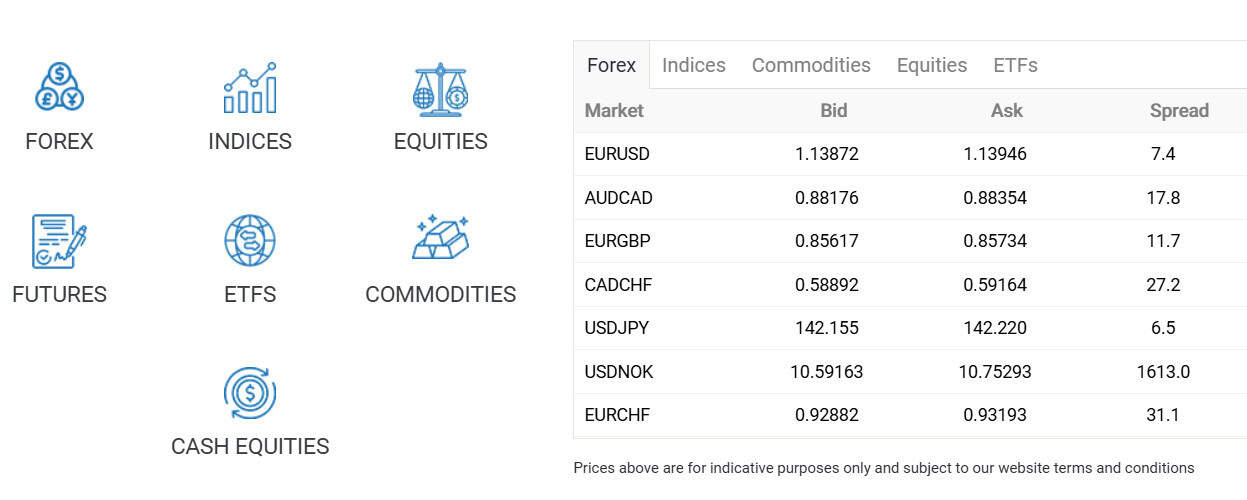

- Trading Instruments

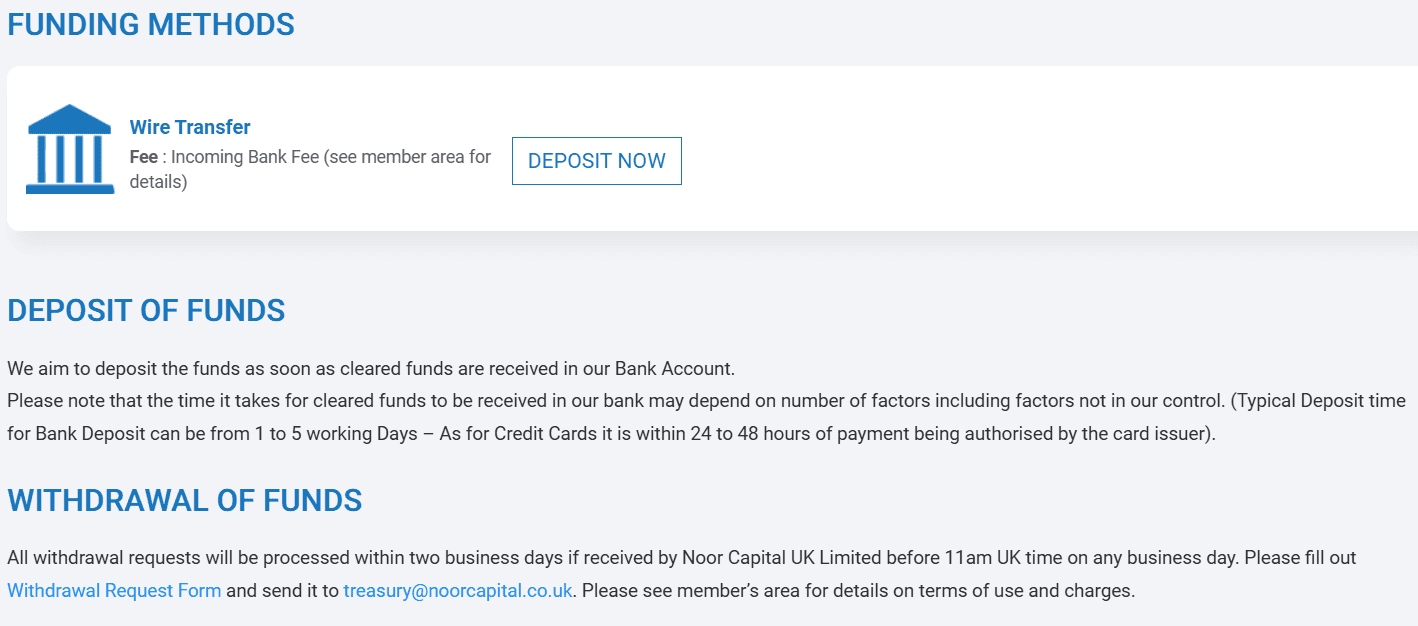

- Deposit and Withdrawal Options

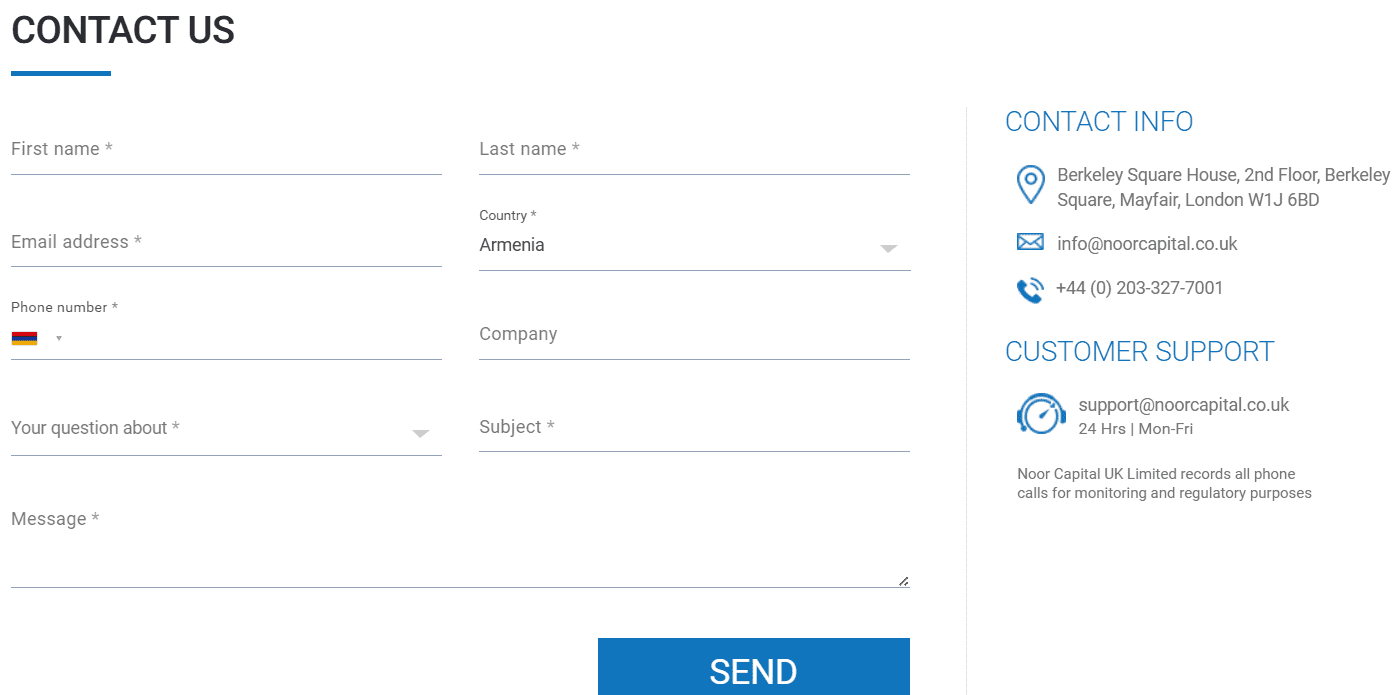

- Customer Support and Responsiveness

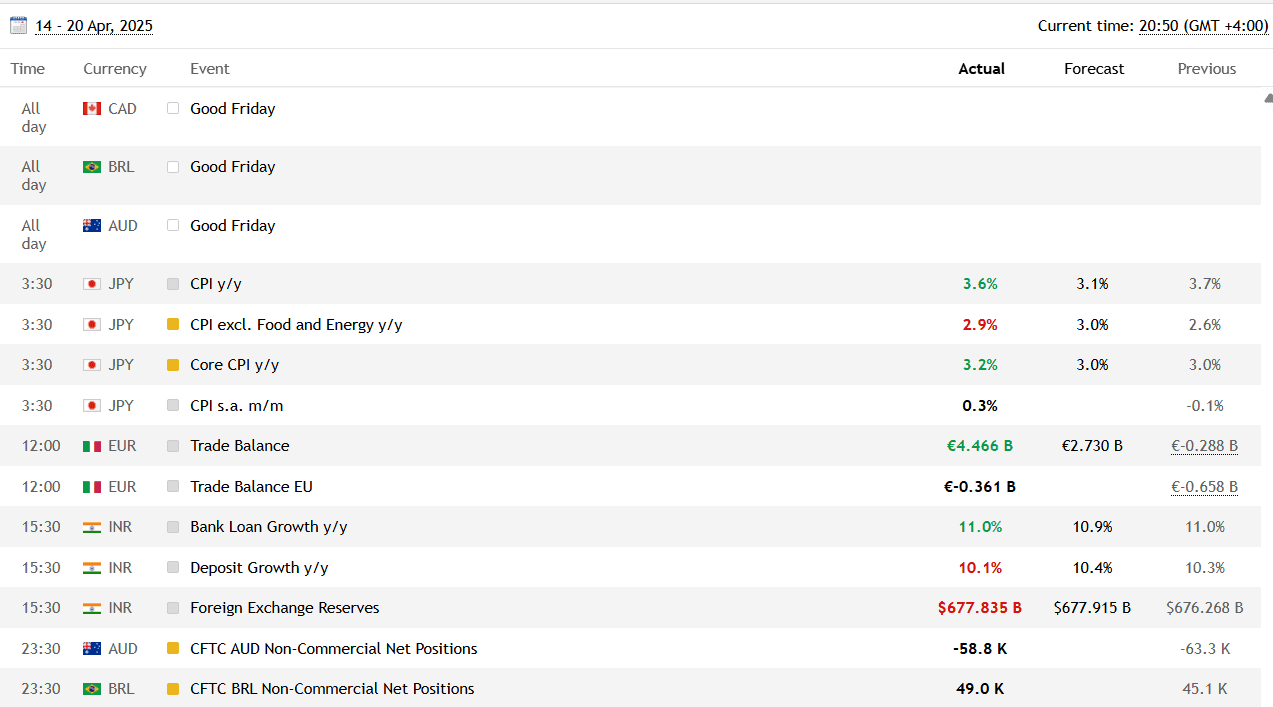

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Noor Capital UK Compared to Other Brokers

- Full Review of Broker Noor Capital UK

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Noor Capital UK ex House of Borse?

Noor Capital UK is a UK-established brokerage firm that has operated since 2001 and currently offers a wide variety of markets, including Forex, CFDs, commodities, indices, ETFs, and equities. The broker was formerly named House of Borse; however, in 2023, Noor Capital, a financial firm from Abu Dhabi, acquired 100% of the shares of House of Borse Limited, and as a consequence, the broker adopted the trading name Noor Capital UK Limited.

Based on our research, the broker’s proposal is specifically designed and suited for professional and corporate clients, as the company allows access to Tier 1 banks and institutional liquidity through ECN/DMA connectivity.

Overall, Noor Capital UK is a trustworthy Forex and CFD broker, as being authorized and regulated by the top-tier Financial Conduct Authority (FCA) ensures that the broker’s operations are secure and reliable.

Noor Capital UK Pros and Cons

According to our findings, the broker offers a fully digital and easy account opening process. Another advantage is that it operates within an ECN trading environment and charges relatively low commission-based fees. Moreover, traders can access the popular MetaTrader platform for their trading activities.

For the cons, the broker may not be an ideal choice for novice traders due to the high minimum deposit amount and a lack of comprehensive educational materials. Additionally, it does not offer 24/7 customer support.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | No 24/7 customer support |

| MT5 | High minimum deposit |

| Available for UK traders | Limited educational and research materials |

| Professional and institutional trading | |

| ECN/DMA trading model | |

| Competitive spreads | |

| Fast Execution | |

Noor Capital UK Features

Noor Capital UK is the new trading name of the formerly known House of Borse. The broker is regulated by the well-respected FCA, providing secure trading services and a reliable environment. The broker gives access to a wide range of tradable instruments and the market-popular MT5 platform, available via desktop, web, and mobile app. Combined with three account types, low/average spreads, and favorable solutions, Noor Capital UK is a good choice. Below are the main aspects of trading with Noor Capital UK:

Noor Capital UK Features in 10 Points

| 🗺️ Regulation and License | FCA |

| 🗺️ Account Types | Silver, Gold and Platinum |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, CFDs, commodities, indices, ETFs, equities, futures |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 7.4 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | EUR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Noor Capital UK For?

Based on our findings and financial expert opinions, Noor Capital UK offers a good selection of services, enabling different traders to find what they looking for. Our research showed that the broker is good for the following:

- Traders from the UK

- Traders who prefer the MT5 trading platform

- CFD and currency trading

- Professional traders

- Institutional trading

- DMA/ECN execution

- Competitive spreads

- White Label solution

- EA/Auto trading

- Good trading tools

Noor Capital UK Summary

Noor Capital UK is an attractive opportunity for trading in case you are a professional or a corporate client. The broker provides a low-risk ECN trading environment, as well as the ability to trade through the advanced MT5 platform, which offers a wide range of trading tools and features. Besides, Noor Capital UK is a reliable and safe broker due to its regulations from the reputable FCA.

However, beginner traders may be stuck with a high minimum deposit, and obviously, the broker’s proposal is tailored with specified trading conditions suitable for larger traders.

In general, Noor Capital UK offers a reliable and competitive trading environment; however, we recommend researching and evaluating the broker’s services and offerings and determining if they suit your trading requirements.

55Brokers Professional Insights

Noor Capital UK was formerly known as House of Borse, as the company been acquired and retained its regulation under the FCA and continues to offer similar services as before, with little change to its trading conditions. Overall, the company proposal is mainly suited to professional traders, large scale traders and portfolio management, that is why little to none education is available, also conditions are tailored to this purpose too.

Noor Capital UK offers a good selection of tradable products across 6 asset classes, reasonable commissions, and overall transparency. Clients can conduct their trades through the popular MT5 platform, equipped with advanced trading tools, analysis capabilities, and market depth, which is good for high volume trading with excellent execution. However, the broker does not offer any research and educational resources, or alternative software so if this is what you need other Broker might suit your needs better. Besides, with a high minimum deposit requirement, Noor Capital UK is more suitable for advanced traders or those operating higher volumes.

Consider Trading with Noor Capital UK If:

| Noor Capital UK is an excellent Broker for: | - Professional traders and institutional clients

- Clients looking for tight regulations

- ETF traders

- MT5 enthusiasts

- Traders from UK

- Auto traders

- Traders who are looking for FIX API availability |

Avoid Trading with Noor Capital UK If:

| Noor Capital UK is not the best for: | - Beginner or retail traders

- Cost-conscious traders

- Global traders

- Clients who prefer platforms other than MT5

- Beginner traders looking for extensive educational materials |

Regulation and Security Measures

Score – 4.5/5

Noor Capital UK Regulatory Overview

Noor Capital UK is regarded as reliable and trustworthy, as it is regulated by the reputable FCA (UK). The FCA implements stringent regulations and guidelines to ensure that the broker adheres to elevated standards of operation. The broker focuses on meeting regulatory requirements and undergoes thorough monitoring. This commitment ensures a safe and secure trading environment, boosting traders’ confidence. With top-tier regulation and a low-risk ECN trading environment, House of Borse aims to provide a reliable and trustworthy trading experience.

- Noor Capital UK Limited, the trading name of House of Börse Limited, operates under MiFID II, which strives to protect investors and boost competitiveness in the. The broker follows the guidelines defined by MiFID II to ensure compliance with the set rules and the safety of its clients.

How Safe is Trading with Noor Capital UK?

Being an FCA-regulated firm eventually means a lot, as the broker complies with strict standards of operation with high capitalization and sharp safety measures.

In addition, we found that the FCA consistently monitors and audits every trade executed by Noor Capital UK. Clients’ funds are kept separate from the company’s funds and held in reputable Tier-1 banks, ensuring their protection.

Consistency and Clarity

Noor Capital UK was founded in 2001, and back then it was known as House of Borse. The broker had a long history of operation, providing high-standard services with favorable and advanced conditions. In 2023, House of Borse was acquired by an Abu Dhabi broker, Noor Capital, regulated in Abu Dhabi and enjoys the popularity and satisfaction of clients. After the acquisition, House of Borse was renamed, but it retained its FCA license, continuing to follow strict rules and guidelines.

Based on our findings, Noor Capital UK is a secure broker that has been consistent throughout its history, with a good reputation and positive feedback from clients. Many point out tight spreads, advanced tools, and dedicated customer support. However, there are also negative reviews; some are even hinting at the broker being a scam. Our advice is to regard the advantages and disadvantages carefully, see how the broker meets your trading expectations, and make an informed decision.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Noor Capital UK?

Our research revealed that the broker offers different account types based on trading volumes, with Silver, Gold, and Platinum options available. These accounts provide better trading costs through commission charges. The accounts are tailored for professional and institutional clients.

Additionally, Noor Capital UK offers a swap-free trading account. Besides, for less experienced clients, a standard account type is available.

- The Silver account is for traders with less than $100 million monthly trading volume. This is considered an entry-level account with a $7 commission.

- The Gold account requires up to $1 billion monthly trading volume and offers a reduced commission of $6 due to higher trading volume.

- The Platinum account is for more than $1 billion monthly volume and requires a $5 commission for those clients who show the highest trading volume.

- The Standard account offers trading with no commissions, with access to FX, Indices, Commodities, and Equities with low spreads, and through the popular MT5 platform.

Regions Where Noor Capital UK is Restricted

Noor Capital UK accepts traders from many countries; however, due to specific jurisdictions and regulatory rules, there are certain countries where the broker’s services are restricted. Noor Capital UK does not reveal the whole list of the limited countries. On its website, it only mentions the USA.

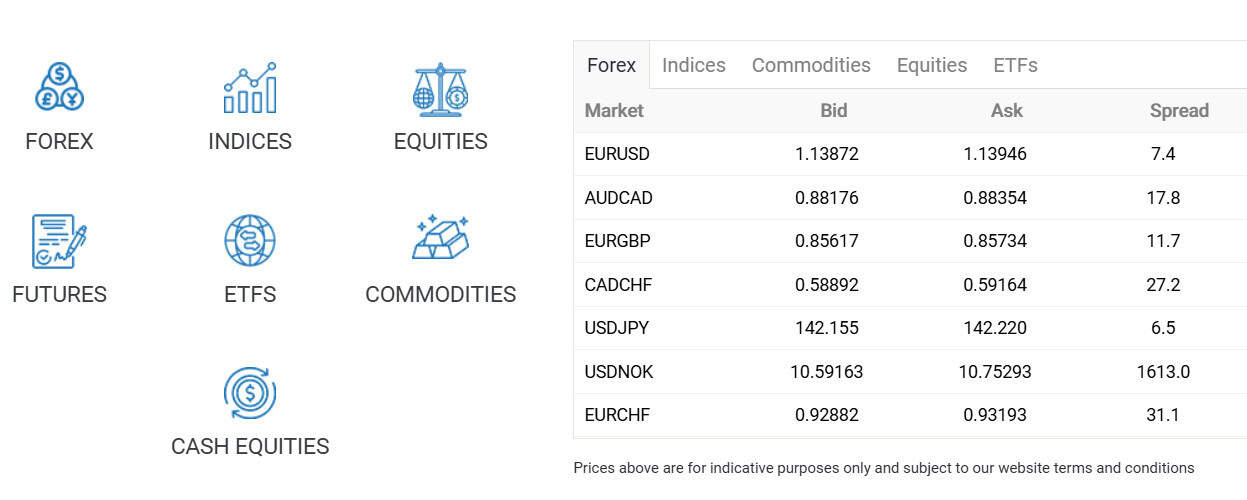

Cost Structure and Fees

Score – 4.4/5

Noor Capital UK Brokerage Fees

In terms of fees, we found that the broker’s fees are built into a commission charge. There is also a single spread-based account with no commissions. We also recommend that clients consider Noor Capital UK’s overnight policy, which applies when a trading order is held for more than one day. In such cases, a rollover fee, swap, or overnight fee will be applied to the position.

Noor Capital UK applies spreads for only one of its accounts. All the other accounts are only commission-based. Based on our research, the standard spread-based account spreads for the popular EUR/USD pair are 7.4 pips, the gold spread is 49.0 pips, and for UK Oil, spreads are estimated at 28.4.

- Noor Capital UK Commissions

Noor Capital UK offers different commissions based on the account types. Each commission-based account, depending on the trading volume, has a specified commission. The silver account offers a $7 commission. For the Gold account, the commission applied is lower—$6—while the Premium account with the highest volume acquires a $5 commission. This fee solution is better suited for professional or institutional clients with high trading volume. For beginner traders, commission-based accounts are not recommended.

How Competitive Are Noor Capital UK Fees?

Based on our research, Noor Capital UK is a suitable broker for professional and advanced traders, as well as for institutional clients. Its offerings are not favorable for cost-conscious or beginner traders. Spreads are very high, estimated at 7.4 pips for the EUR/USD pair, which will not be a good offering for novice or intermediate traders. The commission-based accounts require very high trading volume. The commissions applied are in line with the market average.

Despite the fact that the broker is recommended only for professionals, its fees are transparent, and clients can easily find the defined commissions and spreads applied for each account type. Our advice is to be careful, determine if Noor Capital UK’s offering meets your trading expectations and needs, and only then sign in with the broker.

| Asset/ Pair | Noor Capital UK Spread | Fortrade Spread | Varianse Spread |

|---|

| EUR USD Spread | 7.4 pips | 2 pips | 1 pips |

| Crude Oil WTI Spread | 28.4 | 0.04$ | 0.05 |

| Gold Spread | 49.0 pips | 0.45$ | 0.22 |

Noor Capital UK Additional Fees

Based on our research, Noor Capital UK does not impose an inactivity fee. The broker also does not apply deposit or withdrawal transaction fees, which is an advantage, as clients are charged only the main trading fees, such as spreads and commissions. There are no hidden fees, either. Thus, clients are aware of the applicable charges before they start trading, with no later surprises.

Score – 4.2/5

Noor Capital UK provides traders with access to the widely recognized MetaTrader5 (MT5) trading platform. The platform is highly customizable, with improved trading performance and an even better charting and analysis toolbar than MT4. With its innovative solutions, the platform is a great fit for professional and institutional clients. Traders can enter MT5 by installing it on their desktop or via the web and the mobile app.

| Platforms | Noor Capital UK Platforms | Fortrade Platforms | Varianse Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | Yes |

| Own Platform | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Noor Capital UK Web Platform

Clients can easily enter Noor Capital UK’s web platform through the browser and manage their accounts. The web platform includes all the essential analysis tools and features, enabling clients to perform their trades with ease and efficiency. They gain access to a wide range of time frames, graphical objects and charts, technical indicators, and deep market analysis. Also, clients gain access to a good selection of tradable products across various assets. In other words, the web platform gives traders flexibility, more freedom, and a comprehensive set of tools to enjoy a great trading experience.

Noor Capital UK Desktop MetaTrader 5 Platform

Noor Capital UK’s MT5 platform includes powerful tools and features that enable traders to explore the financial market with ease and success, with access to all the major trading instruments. The platform provides technical and fundamental analysis tools. Besides, with MT5, it is possible to manage positions quickly and efficiently, together with Expert Advisors (EAs) for the automatic placement of orders. Clients can also enjoy one-click trading, various order types, advanced charting, graphs, and technical indicators. The platform is available on iPhone, iPad, and Android devices with no charge, and of course, suitable for all kinds of devices like PC, MAC, etc.

Main Insights from Testing

Based on our testing, we have found that the broker offers a single trading platform—MT5. This is the newest version of the popular MT4 and enables clients to access more advanced and innovative tools. Yet, the platform is a better fit for professional clients. On the other hand, clients who prefer the simpler MT4 option will be disappointed. Noor Capital UK does not provide platform alternatives. However, the MT5 is available on desktop, web, and mobile, enhancing the accessibility of the accounts.

Noor Capital UK MobileTrader App

Noor Capital UK offers an easy-to-use mobile app for iOS and Android devices. Traders have a chance to monitor their trades 24/7, enjoying flexibility and freedom at the same time. The mobile app enables its users to access a good range of financial instruments, technical indicators, charts, trading history, real-time quotes, multiple trade orders, and easy deposits and withdrawals. Trading from the palm of the hand is the quickest and easiest way for traders to get access to their accounts and manage their trades from anywhere in the world, without affecting performance.

Trading Instruments

Score – 4.6/5

What Can You Trade on the Noor Capital UK Platform?

Noor Capital provides traders with a range of popular markets to choose from, which include over 200 financial instruments, including Forex, CFDs, Metals, Commodities, ETFs, and Equities.

Traders have access to major, minor, and exotic—more than 60—forex pairs. Noor Capital UK provides the most essential commodities, including gold and silver, and such energies as UK and US oil.

Main Insights from Exploring Noor Capital UK Tradable Assets

Based on our findings, Noor Capital UK offers an average selection of tradable products, including the most essential and popular instruments. It enables enough diversity and flexibility to enhance and expand portfolios. In addition to a good range of Forex pairs, metals, and energies, the broker also enables access to Europe, Asia, and the UK’s popular indices and equities from global markets.

However, the products are mainly FX and CFDs, which limits the opportunities for longer-term trades and real investments. The lack of stocks, shares, and bonds means traders cannot make traditional investments, limiting their portfolios. Yet, Noor Capital UK is a transparent broker with well-defined fee structures, trading volumes, and trading conditions, and is certainly most suitable for professionals with higher trading volumes and substantial market experience.

Leverage Options at Noor Capital UK

As for the leverage levels, Noor Capital UK allows traders to multiply their trading positions. However, leverage should be used wisely, as it can lead not only to more gains but losses, as well, if the market works against you.

Noor Capital UK leverage is offered according to the FCA regulations:

- UK traders can use low leverage up to 1:30 for major currency pairs and 1:10 for commodities.

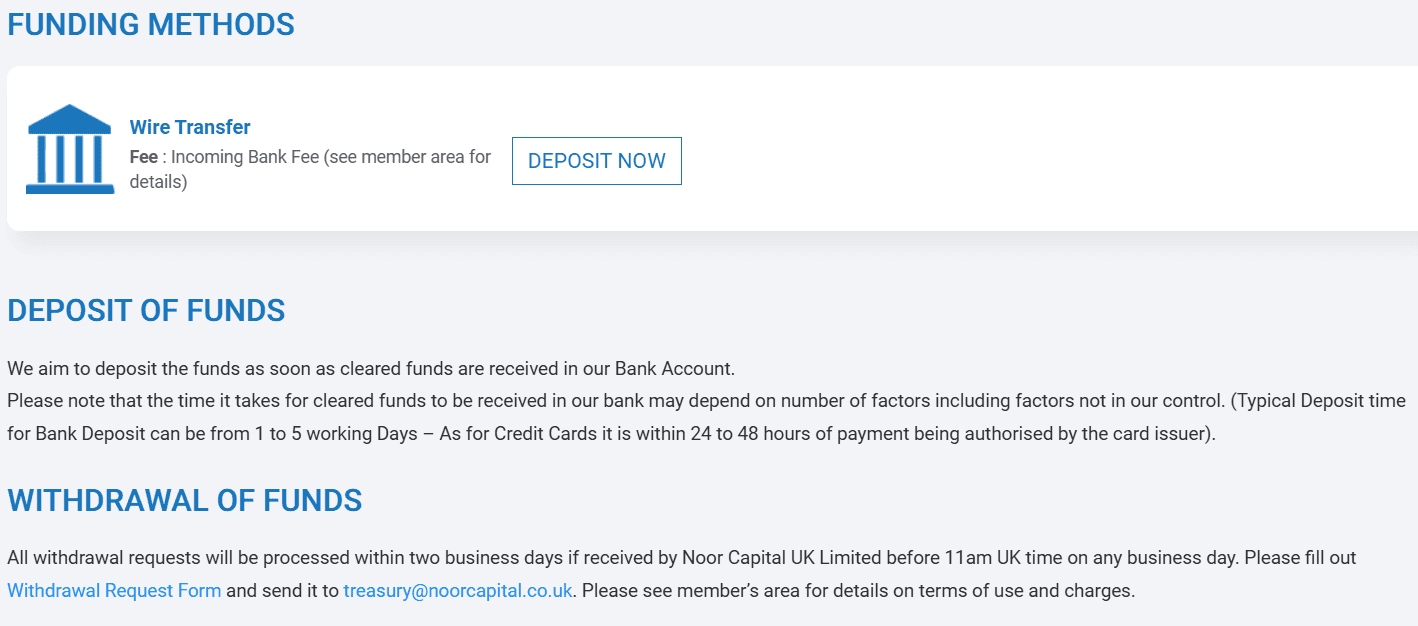

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Noor Capital UK

We found that at Noor Capital UK, clients can deposit funds into trading accounts through bank wire or credit/debit cards. To deposit or withdraw funds, clients should log in to the Client Area. For the deposits to reach the account through the bank transfers, it will take 1 to 5 working days. For credit cards, the deposit processing time is 24 to 48 hours.

Minimum Deposit

The broker does not specify the minimum deposit amount, enabling clients to fund their accounts based on their trading needs. However, the accounts offered by the broker are tailored for high-volume traders, and to be able to explore the market, the initial amount can be higher (from $5000) and not suitable for beginner traders, considering that Noor Capital UK is for professional and corporate clients.

Withdrawal Options at Noor Capital UK

With Noor Capital UK, withdrawals are processed through the same methods as deposits. All withdrawal requests are generally processed within two business days. To start the withdrawal process, clients should go to the client area, select Withdraw Funds in the menu tab, specify the amount and withdrawal method, and complete the electronic request.

Customer Support and Responsiveness

Score – 4.6/5

Testing Noor Capital UK Customer Support

We have also reviewed the broker’s customer support section to see how Noor Capital UK assists its clients when they need guidance.

The broker supports traders through several options: email, phone calls, and WhatsApp messaging.

- Clients also have access to an FAQ section, where they can find answers to all the essential questions.

Contacts Noor Capital UK

Based on our testing, Noor Capital UK delivers dedicated and quick support via different channels.

- The quickest way to contact the broker is through its WhatsApp chat. Traders get quick and on-point answers.

- Those clients who prefer direct contact through a phone call can use the provided number: +44 (0) 203-327-7001.

- Traders can also send an email with their request or question to the provided email address: info@noorcapital.co.uk.

- Besides, the broker is social, providing multiple social channels for traders to follow. Noor Capital UK has social pages on Facebook, X, LinkedIn, and YouTube.

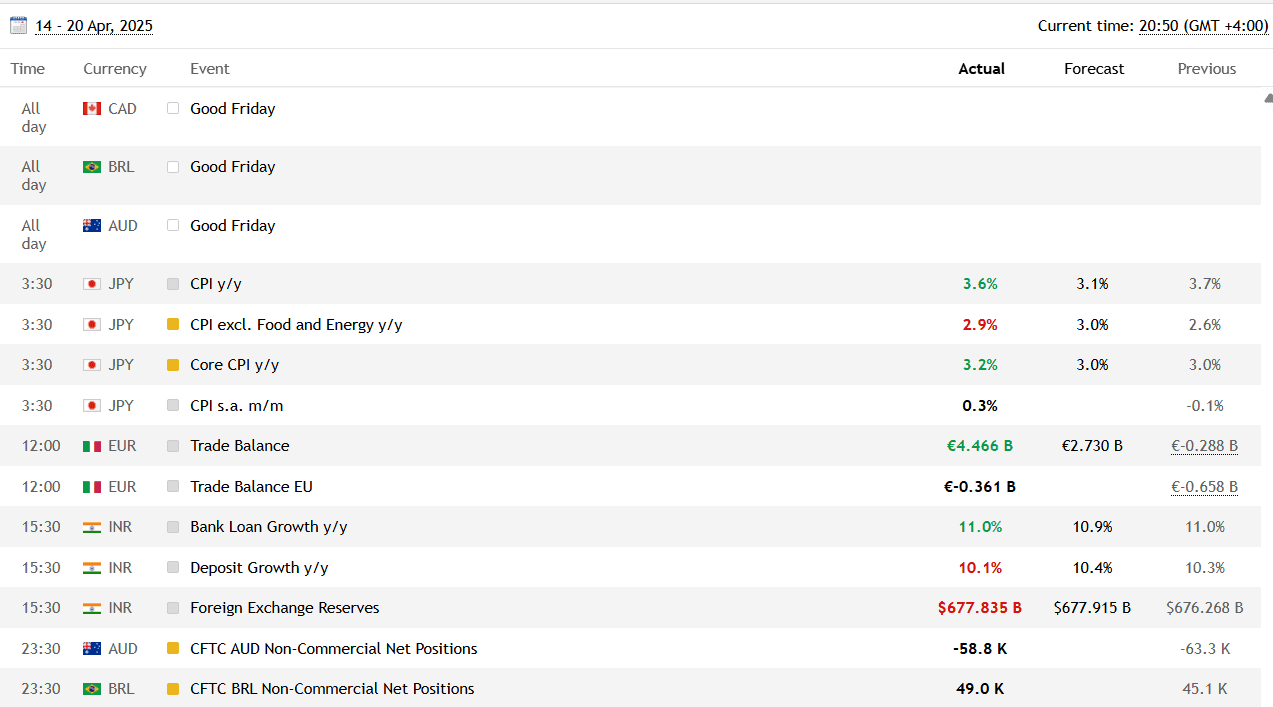

Research and Education

Score – 4.2/5

Research Tools Noor Capital UK

Noor Capital UK includes advanced trading tools in its MT5 platform. However, there are not many additional research tools available through the broker’s website. Here is what we found that can enhance clients’ trading knowledge and give them a market perspective:

- Noor Capital UK’s Economic Calendar is an essential research feature that gives insights into the market and informs traders about important upcoming events. By accessing the Economic Calendar, clients will be aware of the market changes and make informed decisions.

- The trade cost guide helps traders calculate commissions and other trading costs. It is crucial to have this knowledge and be able to calculate the possible trading costs.

Education

Noor Capital UK is primarily directed at offering its services to professional and institutional clients. This is the reason that the broker does not include any educational resources, as professional clients have enough market knowledge and experience and do not need guidance and assistance in this respect. Thus, beginner traders will not find a trading academy with extensive courses, video tutorials, or webinars.

Is Noor Capital a Good Broker for Beginners?

Based on our research of the broker’s education section, beginner traders will not find the broker’s proposals appealing. The broker does not have an education section, and research tools are very scarce. Besides, Noor Capital UK trading accounts require high trading volume, not suitable for cost-conscious traders. In addition, although there is no specified minimum deposit requirement, clients need to make a substantial investment to be able to meet the broker’s requirements.

Portfolio and Investment Opportunities

Score – 4.1 /5

Investment Options Noor Capital UK

We have also reviewed the broker in regard to the opportunities it gives to expand portfolios. Noor Capital UK provides 200 tradable products across different financial markets, enabling traders a variety and access to the major instruments. However, this number cannot be considered an extensive offering, as many brokers have a better selection of instruments. Besides, the broker does not offer real stocks and shares, thus limiting the chances for traditional investments and ownership of real assets.

The good news is that Noor Capital still has alternative ways to invest, which include:

- Copy trading is a good way to explore the market further by copying more professional clients without the need to engage in the trades. As a result, traders get profits for mirroring already existing trades.

- The broker also offers a PAMM solution, which is another way to diversify trades.

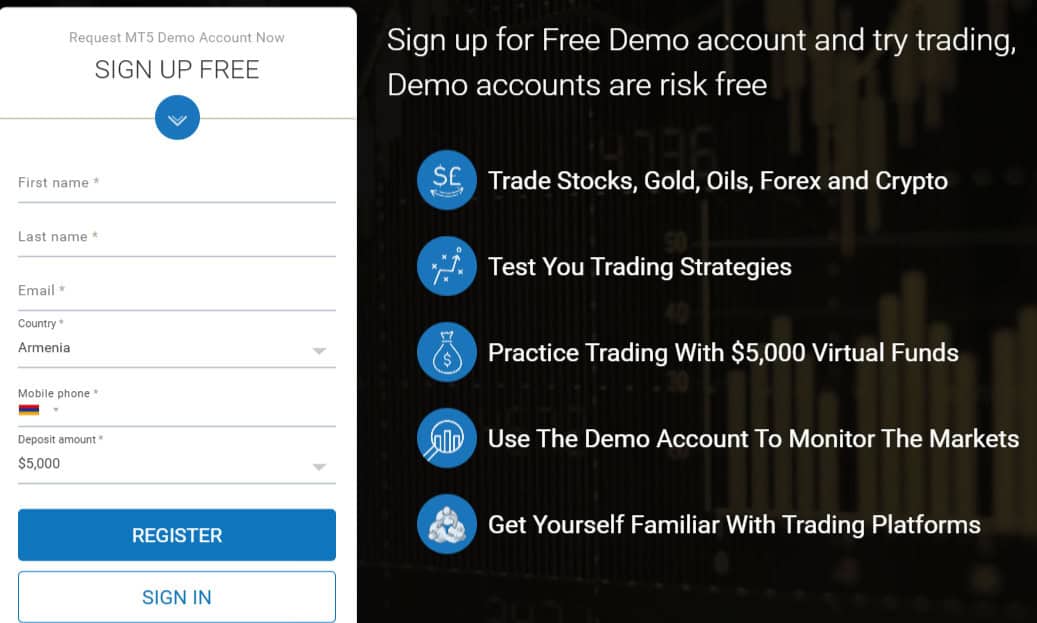

Account Opening

Score – 4.6/5

How to Open a Noor Capital UK Demo Account?

Noor Capital UK enables traders to access a demo account with a $5000 virtual fund. The account is available for 30 days and enables traders to practice their skills, test new trading strategies, and familiarize themselves with the trading platform in a risk-free environment.

Here are the main steps to open a Noor Capital UK demo account:

- Go to the broker’s website and choose the demo account option.

- Fill out the registration form with the required information.

- Submit the form and receive a confirmation letter in your email.

- Use the provided credentials and access the MT5 platform.

- Start practicing.

How to Open a Noor Capital UK Live Account?

Opening a live account with Noor Capital UK is a seamless task. Generally, it will take minutes to follow the opening account or sign-in page and proceed with the guided steps.

- Select and click on the “Account Opening” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 4/5

Based on our research, there are not many additional tools and features, with all the essential ones already available through the broker’s trading platform. We still want to mention the following:

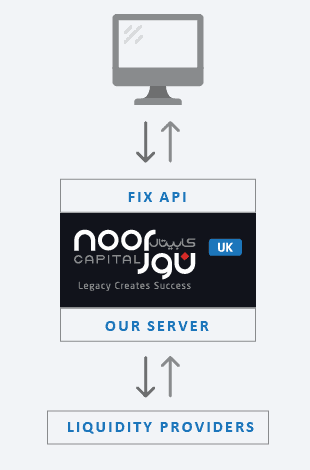

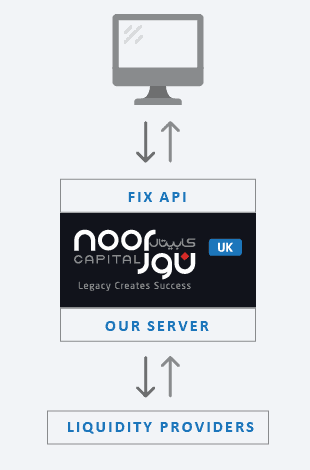

- Noor Capital UK enables FIX API access for its professional and high-frequency traders. FIX API ensures direct connectivity to the market with low latency. Traders can send orders for execution to the pricing engine directly for a wide range of instruments.

Noor Capital UK Compared to Other Brokers

As a final note, we have also compared Noor Capital UK to other brokers in the market to see how its offerings align with similar market offerings. We have found that the broker is tightly regulated by the FCA, which is one of the strictest and most respected authorities in the financial world.

As Noor Capital UK is tailored for professional clients, its offerings might differ from average proposals, especially when we compare the broker’s fee structure. The broker mainly concentrates on commission-based trading. Commissions on average are $3.5 per side per lot, which is in line with other brokers such as Pepperstone or Exness. As to the trading platform, Noor Capital UK offers only the popular and advanced MT5 platform through desktop, web, and a mobile app. However, other brokers like Fortrade and RoboForex have a more extensive platform selection or offer their proprietary platforms.

Although Noor Capital UK has a good selection of trading instruments with more than 200 products, there are still brokers with way better offerings, such as RoboForex with a proposal of 12,000+ instruments across various assets.

At last, we also compared the broker’s education. As Noor Capital is designed for professionals and institutional clients, it does not include educational materials. On the other hand, Fortrade and Pepperstone include comprehensive education targeted at beginner traders.

| Parameter |

Noor Capital UK |

Pepperstone |

RoboForex |

Exness |

FP Markets |

Fortrade |

Varianse |

| Spread Based Account |

Average 7.4 pips |

From 1 pip |

Average 1.3 pip |

From 0.2 pips |

From 1 pip |

From 2 pips |

Average 1 pip |

| Commission Based Account |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $3 |

No commission |

0.0 pips + $3.5 for FX and Metals |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Low/ Average |

Average |

Average |

| Trading Platforms |

MT5 |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

Fortrader Platform, MT4 |

MT4, cTrader |

| Asset Variety |

200+ instruments |

Over 1,200 instruments |

12,000+ instruments |

200+ instruments |

10,000+ instruments |

300+ instruments |

200+ instruments |

| Regulation |

FCA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

FCA, ASIC, IIROC, NBRB, CySEC, FSC |

FCA, FSC, LFSA |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Not provided |

Excellent education and research |

Good |

Fair |

Excellent |

Excellent |

Limited |

| Minimum Deposit |

No minimum deposit |

$0 |

$10 |

$10 |

$100 |

$100 |

$500 |

Full Review of Broker Noor Capital UK

In conclusion, after reviewing every aspect of trading with Noor Capital UK, we can state that the broker is considered safe and adheres to serious rules defined by the FCA and MiFID II that intensely protect clients’ funds. The broker was formerly called House of Borse and had been present in the market since 2001. Yet, in 2023, the company was acquired by another well-regarded firm based in Abu Dhabi—Noor Capital—and after the acquisition, it adopted the name Noor Capital UK. However, in this process, the company retained its FCA license.

The broker is a good choice for professionals who engage in high-volume trading via an advanced MT5 platform with commission-based solutions. The commissions vary from account to account based on the trading volume: the higher the volume, the lower the commission. There is also a single spread-based account; however, the spreads charged are much higher than the market average.

As Noor Capital UK offers tailored conditions for professionals, it does not include educational materials or research tools. This means that Noor Capital is not the best choice for beginner clients. However, its services and conditions are appealing to institutional or high-frequency clients, and Noor Capital UK can become a trusted choice for those who are looking for similar offerings.

Share this article [addtoany url="https://55brokers.com/house-of-borse-review/" title="Noor Capital UK"]

We did not open or agree to open an account with House of Borse. When the charge appeared on my statement we called the company and told them we did not open an account the person said thee transaction would be reversed and would not be charged. As yet that has not happened so we are going to dispute the charge and will wait for a refund/reversal of the charge or continue our complaint process by declaring the transaction a fraud and file a complaint with the licensing and proper authorities.