- What is Hirose Financial?

- Hirose Financial Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Hirose Financial Compared to Other Brokers

- Full Review of Broker Hirose Financial

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.7 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 3.8 / 5 |

What is Hirose Financial?

Hirose Financial is a Forex trading provider offering a range of FX trading instruments to over 200,000 clients worldwide.

Hirose Financial UK is a trading company established as an enhancement of the FX services of Hirose Tusyo Japan, incorporated in 2004. The company is considered one of the biggest and most awarded OTC brokers in Japan.

The UK operations started back in 2010. Additionally, the Global Group offers financial services in Hong Kong and Malaysia, ensuring wider coverage of its services.

- The broker also provides deep liquidity and advanced solutions to institutional clients. The broker offers advanced trading experience individually tailored for each client.

Hirose Financial Pros and Cons

Hirose Financial uses advanced trading technology, offering non-dealing desk (NDD) execution to enable traders to trade Forex instruments, particularly currencies, on its platforms. The broker employs the use of two leading industry platforms, MT4 and LION Trader (ActTrader).

The broker executes orders through 15 liquidity providers fed into an aggregator, while the charge is incorporated into the variable spread without any commission charges, making it a convenient option.

One disadvantage is that Hirose Financial does not provide 24/7 customer support to its clients. Additionally, the broker offers a limited number of trading instruments on its platforms, which may not be sufficient for traders looking for a diverse range of assets to trade.

| Advantages | Disadvantages |

|---|

| FCA license and oversight | No 24/7 customer support |

| Regulated broker with competitive trading fees and spreads | Limited number of trading instruments |

| No commission fees | |

| Access to MT4 trading platform | |

| Funds protection | |

| Fast execution | |

Hirose Financial Features

Hirose Financial is a well-regulated broker that offers traders competitive spreads and fees as well as safe trading conditions. The broker is suitable for different trading needs and expectations. To see how the broker’s offerings align with your trading style, you can see the list of the main features of the broker compiled in one place:

Hirose Financial Features in 10 Points

| 🗺️ Regulation | FCA, FSA (Japan), Labuan FSA |

| 🗺️ Account Types | Meta Trader 4 account, LION Trader account |

| 🖥 Trading Platforms | MT4, LION Trader |

| 📉 Trading Instruments | Forex, Binary Options, Commodities |

| 💳 Minimum deposit | $20 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | GBP, EUR, USD |

| 📚 Trading Education | Trading manuals, essential trading components, technical analysis overviews, economic indicators |

| ☎ Customer Support | 24/5 |

Who is Hirose Financial For?

We have carefully reviewed Hirose Financial’s offerings to see who the broker is favorable for. Based on our Financial Expert Opinions, the broker will be the most attractive for the following:

- Traders from the UK

- Beginners

- Advanced traders

- Professional trading

- Institutional clients

- Currency trading

- Competitive spreads and fees

- Traders who prefer the MT4 trading platform

- Scalping/Hedging strategies

- NDD/OTC execution

- Good customer support

- EA/Auto trading

- Good educational and research materials

Hirose Financial Summary

Hirose Financial Review presents a subsidiary company established on Japan’s expertise and success, which offers financial investment services with market execution and a range of leading competitive offerings. The broker offers attractive conditions for beginner traders, along with a great choice between platforms, education, and a simple cost system with all charges included in the spread. Yet, professional traders will also find their benefits due to the transparent operational policy and comprehensive tech proposals with competitive trading costs.

In general, traders have provided positive feedback on Hirose Financial’s trading conditions and services. However, we recommend doing their own research before choosing to sign up with the broker to ensure it is the right choice for them.

55Brokers Professional Insights

One of the points noticable is Hirose Financial long history of operation with over 200,000 active clients over the year, which is good proof of stability and good performance of the Broker. It has necessary and tight regulations, great for traders from Asia region and UK, also some additional licenses that allows international clients to join in to trading.

As for the trading performance, since Brokekr is long long-standing proposal of course, it provides a prooved MT4 platform also its designed LION Trader, which we find quite packed with good tools and providing good execution of trades. In addition, based on our findings, Hirose Financial provides separate services for institutional traders, offering access to more advanced and professional MaxxTrader and Lucera platforms with innovative solutions and technologies, which i another big plus.

Trading costs are also on a good level, while depending on the platform too, some might be more competitive. Yet, the fee structure is solely spread based, in case you prefer commission accounts maybe better check other proposals. Also, the number of trading instruments is limited to over 50, so mainly popular instruments and pairs that are most traded, if looking for thousands of instruments then other broker is your choice too.

Consider Trading with Hirose Financial If:

| Hirose Financial is an excellent Broker for: | - Beginner traders

- Traders from the UK

- Professionals

- Institutional clients

- MT4 platform enthusiasts

- Clients who prefer spread-based trading

- Traders prioritizing top-tier regulation and protection measures

- Novice traders looking for education resources

|

Avoid Trading with Hirose Financial If:

| Hirose Financial is not the best for: | - Traders looking for a wide range of tradable products

- Traders looking for high leverage

- Traders looking for diverse platform opportunities

- US traders

- Long-term investments |

Regulation and Security Measures

Score – 4.5/5

Hirose Financial Regulatory Overview

Hirose Financial is the trading name of Hirose Financial UK Ltd., which is authorized and licensed by the Financial Conduct Authority (FCA). Hirose Financial is a legit and regulated broker. It is considered a safe broker, as among the top priorities of any authorized company is the safety of the client’s funds, along with the protected operational standards.

- The broker is also regulated by the Kinki Finance Bureau of the Ministry of Finance in Japan as a financial service provider.

- The company also holds a license from the Labuan Financial Services Authority (Labuan FSA). The latter is based in Malaysia, ensuring a reliable and safe environment.

How Safe is Trading with Hirose Financial?

Hirose follows strict safety measures towards client funds by keeping them in segregated accounts. Also, when trading with the UK branch, every client is covered by the Financial Services Compensation Scheme (FSCS), which, in case of the company’s insolvency, can cover traders’ investment loss up to £85,000.

Consistency and Clarity

Hirose Financial is a well-regulated broker that complies with strict laws and guidelines. The broker has been in the market for years and has more than 200,000 active traders worldwide. The broker continuously enhances its services and safety measures, providing a safe and competitive environment for its clients. The broker has also earned multiple awards for its dedication to high-quality services.

We have also checked real customer feedback and found that the broker has high ratings, with mostly positive reviews. Traders indicate the broker’s trustworthiness, dedicated customer support, favorable trading conditions, and adequate education. In addition, some reviews point out certain areas for improvement, such as the withdrawal process and the inconsistency of spreads at times of market volatility.

All in all, Hirose Financial is a reliable broker choice, proven by years of market presence and consistency of its offerings.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Hirose Financial?

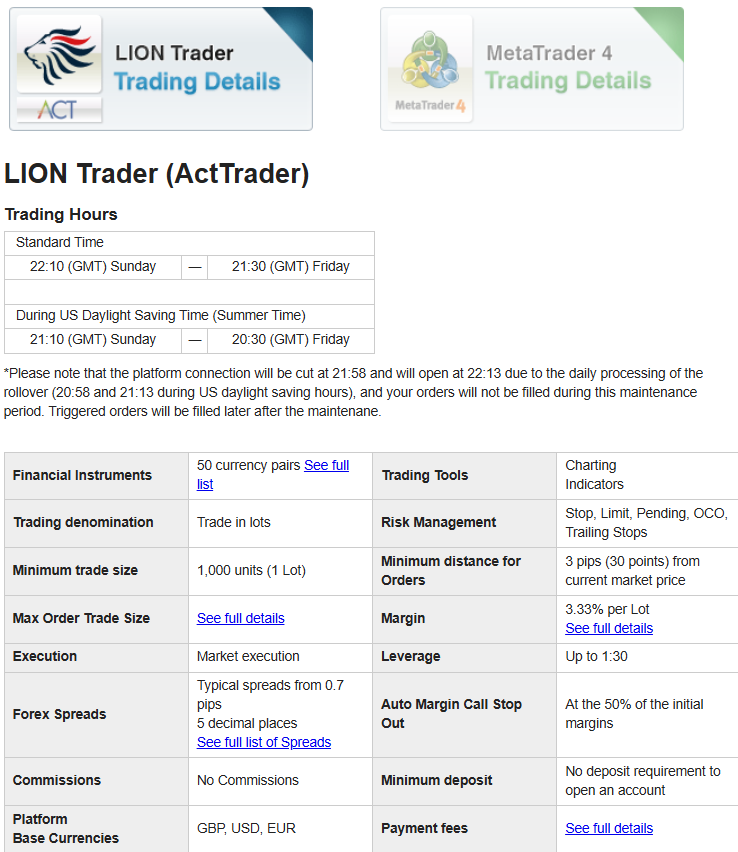

Hirose Financial provides its clients with two trading accounts, MetaTrader4 and LION Trader, which differ based on the platform used. Each account type comes with its own conditions regarding margin calls, leverage, spreads, and other factors. The base currencies for both accounts are GBP. USD, EUR. Besides, there is no minimum deposit requirement for any of the accounts. Besides, we found that the maximum leverage is 1:30. At last, both account types enable the demo version to practice before switching to live trading.

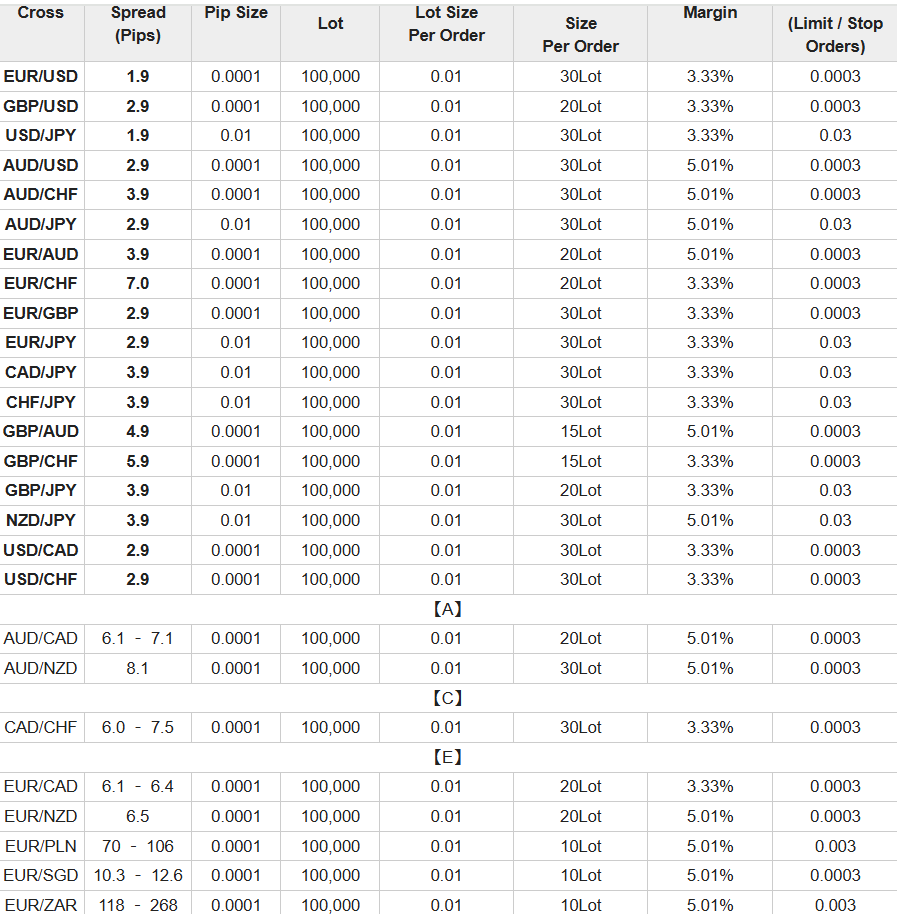

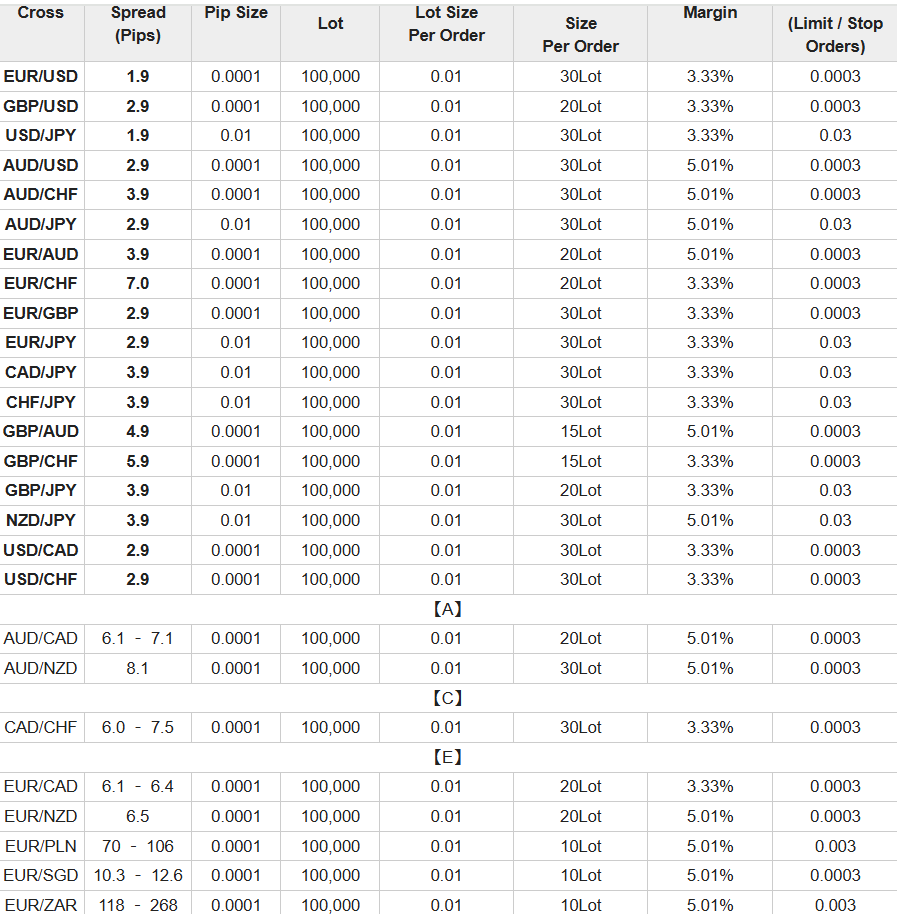

- The LION Trader account enables access to over 50 currency pairs, with an average spread of 0.8 pips. All the costs are included in the spreads.

- Through the MetaTrader 4 account, traders can access 46 currency pairs, which is a little less in number compared to the ones offered by the LION Trader account. The spreads for this account type are higher, with the typical spreads being at 1.9 pips.

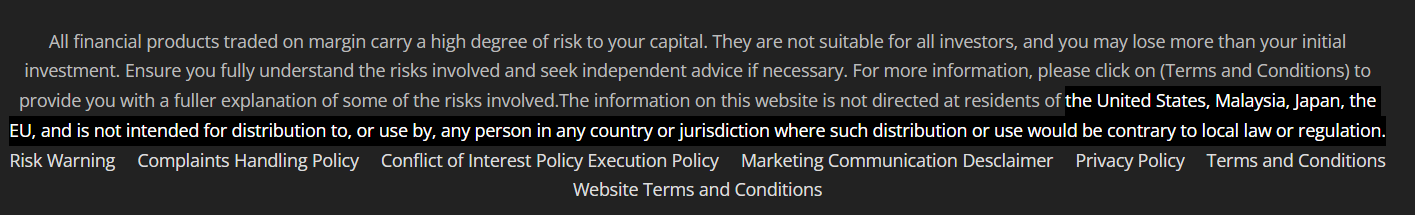

Regions Where Hirose Financial is Restricted

Hirose Financial is a well-established broker that provides its services to clients from a wide range of countries. The availability of the services also depends on the broker’s entity.

In general, based on regulatory restrictions, the broker does not accept as clients residents from the following countries:

Cost Structure and Fees

Score – 4.4/5

Hirose Financial Brokerage Fees

Hirose Financial costs are built into a competitive spread that varies according to the account type and platform, while the broker consistently stays at a tight and low spread strategy with no hidden costs. The MetaTrader 4 and LION Trade Accounts’ costs are all built into variable spreads with no commissions.

Hirose Financial offers a spread-based fee structure with no additional transaction fees. All the trading costs are included in variable spreads. Spreads depend on the account type, platform, and the instrument traded. The LION Trader account offers an average spread of 0.8 pips for the EUR/USD pair. The MetaTrader 4 account applies higher spreads in comparison. To the EUR/USD pair, the average spread is 1.9 pips.

- Hirose Financial Commissions

Hirose Financial’s fee structure is spread-based, with no commission fees. For clients looking for very low spreads, combined with fixed commissions for each trade, Hirose Financial’s cost solution might be disadvantageous. However, the spread-based structure is favorable for beginner or intermediate traders.

- Hirose Financial Swap Fees

It is worth noting that there may be additional costs to consider, such as the swap fees, charged if a position is held for longer than a day. The swap fees dpened on the instrument tarded and on the market conditions. We advise traders to check swap fees before placing a new trade.

How Competitive Are Hirose Financial’s Fees?

Based on our research and testing, Hirose Financial offers quite competitive and transparent fees. The good part is that the broker publicly represents all the applicable fees based on the trading account, platform, and tradable products. Besides, there are no hidden fees, and the fee structure is clear and simple.

As we have found, Hirose Financial’s fees are mainly spread-based, with no transaction fees. The LION Trader account offers much lower spreads, starting from 0.8 pips. However, advanced clients prioritize tight spreads combined with fixed commissions for each trade might not find a fit at Hirose. At last, clients should consider the differences between the entities, as each entity has its specific conditions that may vary based on jurisdiction.

| Asset/ Pair | Hirose Financial Spread | JustMarkets Spread | BP Prime Spread |

|---|

| EUR USD Spread | 0.8 pips | 0.6 pips | 0.3 pips |

| Crude Oil WTI Spread | - | 4 cents | 0.01 |

| Gold Spread | 25 | 0.16 | 0.01 |

Hirose Financial Additional Fees

Hirose Financial generally does not charge additional fees. For instance, the broker charges an inactivity fee for accounts that have been dormant for a while. The monthly inactivity fee for the account maintenance is $50. If the account has been inactive for 180 calendar days or more, it might be automatically deactivated.

- We have also tried to find out if there are deposit or withdrawal fees. Based on our findings, the broker does not charge deposit or withdrawal fees. However, for international bank transfers, there might be fees charged from the bank’s side.

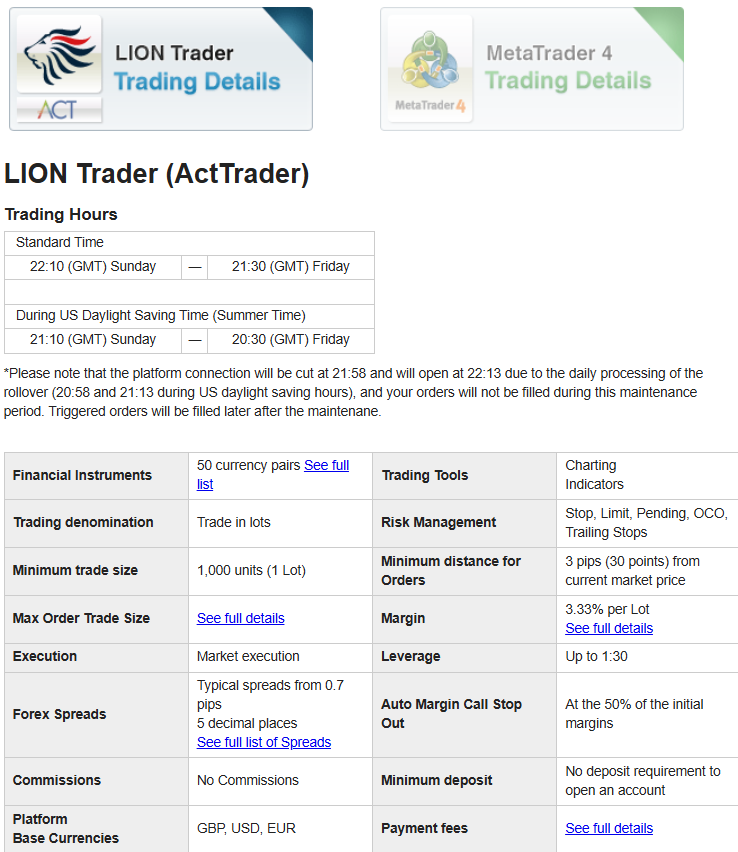

Score – 4.4/5

Hirose Financial offers its clients access to two popular trading platforms, MetaTrader 4 and LION Trader (ActTrader). Both platforms offer innovative solutions and a favorable environment for efficient trading. The broker’s trading accounts depend on the trading platforms; thus, each platform offers different trading conditions. including the number of trading instruments, spreads, and other features. For its institutional clients, Hirose Financial offers more advanced and professional platforms (MaxxTrader and Lucera).

| Patforms | Hirose Financial Platforms | EC Markets Platforms | BP Prime Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Hirose Financial Web Platform

Clients of Hirose Financial can trade via a web platform through its LION Trader platform. Traders can access the web platform through a web browser without the need for installation. It enables great flexibility and ease of access to the trading account. The web platform offers all the essential features of the desktop platform, ensuring efficient trades. Multiple charts, drawing tools, technical indicators, and timeframes. Also, traders can benefit from real-time market data, trade history, and different trading styles, including hedging and scalping.

Hirose Financial Desktop MetaTrader 4 Platform

MT4 is a widely used trading platform that offers advanced charting capabilities, technical analysis tools, and the ability to use automated trading strategies. While MT4 does not require too much introduction, apart from its advanced charting features and indicators that are fully customized, MT4 supports the most progressive area for automatic trading through the MQL4 language and thousands of EAs to choose from.

Trading instruments include 46 currency pairs through a margin of 0.33% and a typical spread of 1.9 pips. There are also a few versions of MT4 accessible by PC or Mobile App.

Hirose Financial Desktop MetaTrader 5 Platform

Hirose Financial does not offer the MT4 platform’s more advanced version, the MetaTrader 5 platform. The latter includes more innovative features and capabilities. The platform is also slightly complex in comparison to the simpler and easier-to-use MT4. However, the enthusiasts of the MT5 platform will not find what they are looking for with Hirose Financial.

Hirose Financial LION Trader Platform

LION Trader (ActTrader) is a proprietary trading platform developed by Hirose Financial. It offers a user-friendly interface and a range of trading tools, including advanced charting, market analysis, and risk management tools. LION Trader is also available as a web-based platform and mobile app. This platform is good for scalpers and hedging, with access to 50 currency pairs with convenient and cost-efficient conditions. Moreover, traders can use Expert Advisors to automate their trades.

Main Insights from Testing

After carefully reviewing the broker’s available platforms, we estimate Hirose Financial’s trading platforms as efficient and easy to use. The broker offers the popular MT4 platform, with the full range of its advanced tools and features. It also offers its own proprietary LION Trader platform, available through web, desktop, and mobile versions. The platform allows access to more tradable products than the MT4 platform does. All in all, both platforms are suitable for an efficient, insightful, and beneficial trading experience.

Clients looking for different platforms, such as MT5, cTrader, or TradingView, might find the offering unsatisfactory.

• Also, institutional clients have access to more professional platforms, including MaxxTrader and Lucera.

Hirose Financial MobileTrader App

Hirose Financial also offers the mobile version of its MT4 and LION Trader platforms, with full functionality. The mobile apps bring trading right into clients’ phones, enabling them quick and easy access to their accounts. With interactive charts, built-in technical indicators, risk management tools, price alerts, trading history, and multiple other features, traders can combine flexibility with efficiency. The mobile app is available for iOS and Android devices.

AI Trading

As AI trading solutions are becoming more and more widespread, we have also tried to find out whether the broker offers AI services or bots. Our research showed that the broker does not currently include any AI tools, although it fully supports automated trading.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Hirose Financial Platform?

Hirose Financial offers various trading instruments for its clients to choose from, mainly focusing on Forex instruments such as currency pairs. In addition to Forex instruments, Hirose Financial also offers trading in commodities, including gold and silver, as well as several indices and binary options.

The broker also offers cryptocurrencies (Bitcoin only) with up to a 1:400 leverage ratio, low spreads, and ultra-fast execution.

However, it is worth noting that the range of trading instruments available at Hirose Financial is relatively limited compared to some other brokers in the market.

Main Insights from Exploring Hirose Financial Tradable Assets

Based on our findings, Hirose Financial does not include an extensive number of instruments. The range of Forex pairs is attractive, with over 50 currency pairs available; however, the broker offers a limited number of commodities (only gold and silver trading). Under the Labuan Financial Services Authority, Hirose Financial clients can access binary options.

- However, our research reveals that the broker concentrates mostly on currency trading. Traders who are looking for diverse products and hope to expand their portfolios will find the broker’s offering unfavorable and limited.

- The broker also does not support long-term and traditional investments.

Leverage Options at Hirose Financial

Hirose Financial enables its clients to use leverage to magnify their profits. However, together with its unique opportunities, leverage increases risks too. Thus, it is essential to use it smartly. As Hirose Financial is a UK-regulated broker, it allows lower leverage levels for retail traders.

Hirose Financial leverage is offered according to FCA regulation:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs and 1:10 for Commodities.

- Under its Labuan FSA entity, traders can use leverage up to 1:400.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Hirose Financial

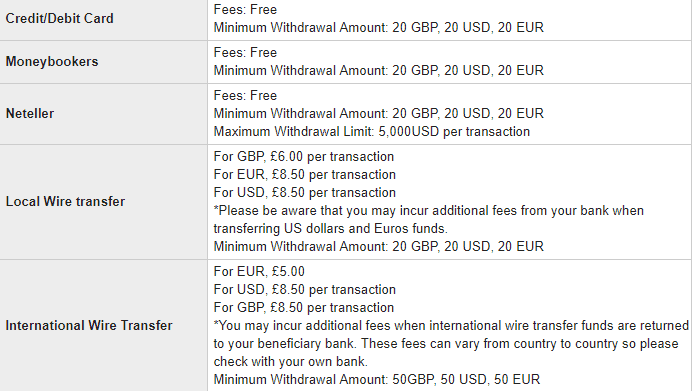

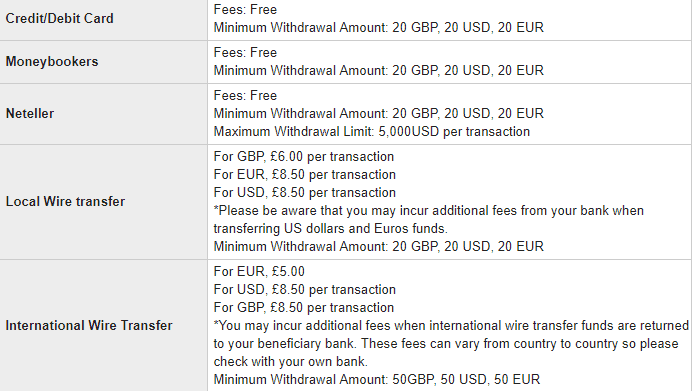

- Hirose Financial provides multiple methods for funding the accounts with convenience and ease. Payments can be made in GBP, EUR, and USD. The funding methods include credit/debit cards, Skrill or Neteller transfers, and bank wire transfers.

- As we have found, the broker does not apply deposit or withdrawal charges. However, for the bank wire transfers, there are certain transaction fees from the bank’s side.

- Besides, the available funding method depends not only on the entity but also on the account type and platform. The LION Traders enables deposits through e-wallets and bank wire transfers. The MetaTrader 4 platform offers deposits via bank wire transfers only.

Minimum Deposit

Hirose Financial’s minimum deposit is $20 for e-wallets. For Bank wire transfers, the minimum requirement is $50.

- The processing time for e-wallets is up to 15 minutes. The Bank wire transfer can take from 2 to 3 days.

Withdrawal Options at Hirose Financial

Hirose Financial withdrawals are processed via an online form request and are only eligible by using the same method used for deposits. Typically, there are no fee charges for withdrawals, yet local or international wire transfers may require an additional processing fee.

- The withdrawal process generally takes up to 5 business days.

Customer Support and Responsiveness

Score – 4.5/5

Testing Hirose Financial Customer Support

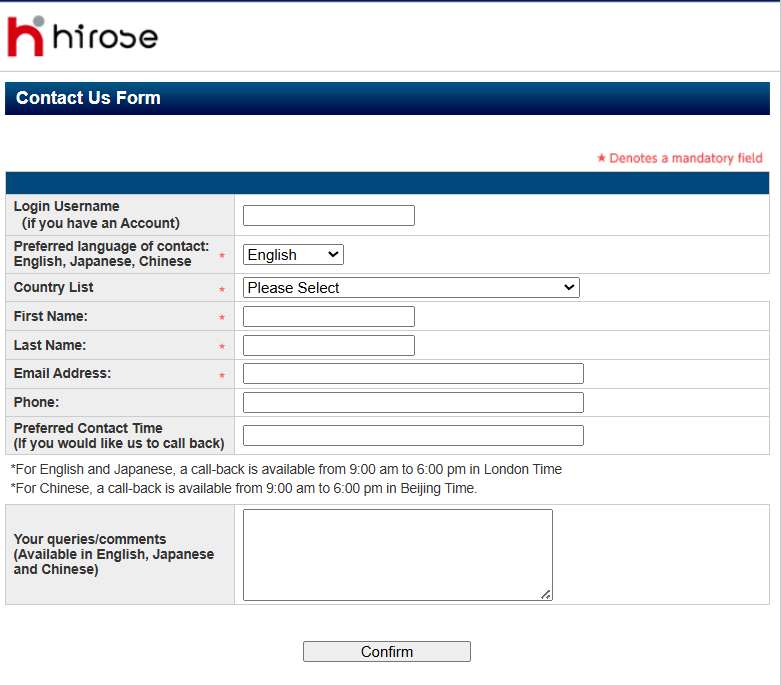

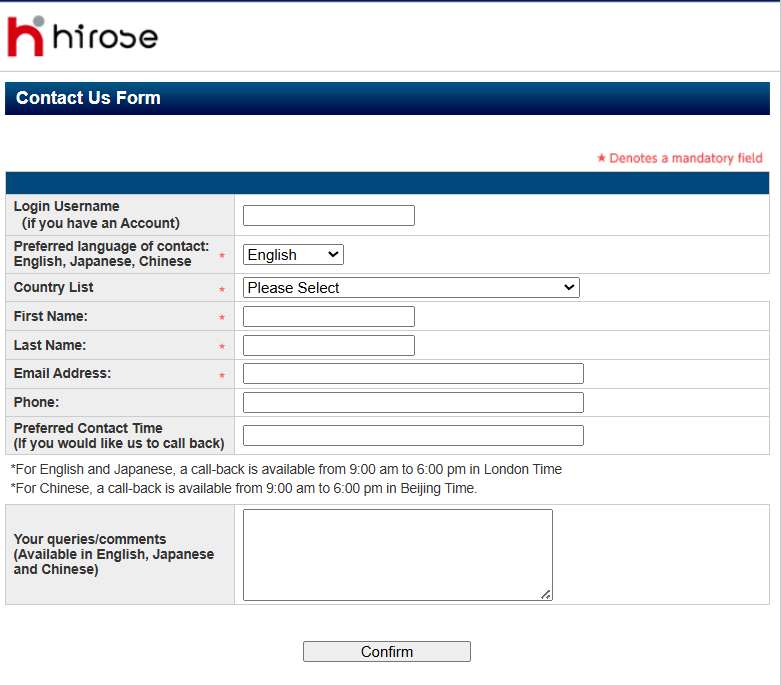

Hirose Financial offers multilingual 24/5 customer support through live chat, phone, and e-mail. The support team consists of trading experts who are available to assist traders with various matters such as technical support, analysis advice, general inquiries, and operational issues.

- The FAQ section provides essential information on trading accounts, platforms, deposit and withdrawal processes, and many other trading-related topics.

Contact Hirose Financial

Based on our testing of Hirose Financial, the broker provides its clients with dedicated assistance when they face trading-related issues. Clients can find help through the following channels:

- Live chat is a quick and easy way to find almost instant answers to any question or issue. This is the preferred support method for many clients.

- Traders can also reach the broker by using the provided email address: info@hiroseuk.com.

- Hirose Financial also provides phone assistance via the following number: +44 (0)20 3089 3880.

- Also, traders can use the Online Contact Us Form.

Research and Education

Score – 4.2/5

Research Tools Hirose Financial

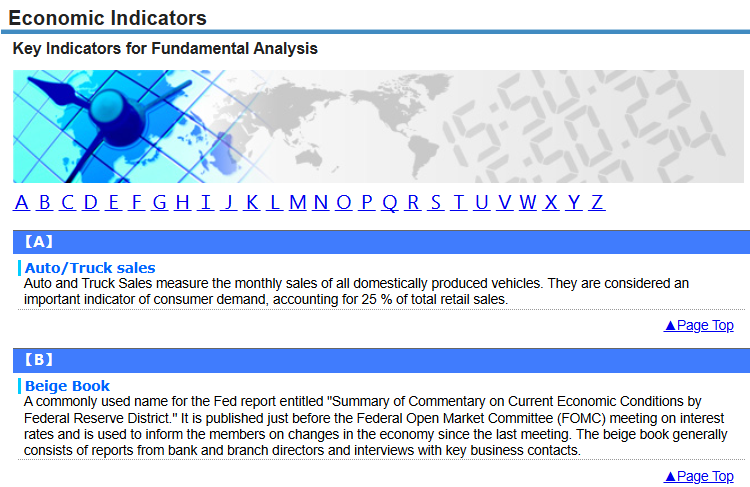

By analysing the broker’s research section, we assume that traders of any level can find benefits and the necessary tools at Hirose Financial. The broker provides essential research tools and features not only through its LION Trader and MT4 platforms, but also on its website. We have found the following research tools on the broker’s website that can enhance the trading process and enable more in-depth analysis.

- The technical analysis section includes various technical indicators so that traders can choose the most suitable ones for their trading strategies. The section includes Accelerator/Decelerator Oscillator, Alligator, Accumulation/Distribution, and many more for traders’ access and use.

- The broker also provides key economic indicators for fundamental analysis, allowing traders to be aware of the market movements and economic changes.

Education

Hirose Financial’s educational materials include trading manuals, essential trading components, a glossary, and a demo account to improve skills.

- The broker provides trading manuals for its LION Trader and MT4 platforms, available for free downloads. Traders can learn how to navigate the platform to benefit from their experience with Hirose Financial.

- The trading glossary includes essential terms and concepts that are explained in easily comprehensible language.

- The Forex Guide section is for beginner traders to assist them in making their first steps in trading.

Is Hirose Financial a Good Broker for Beginners?

Based on our research and review of Hirose Financial, the broker is a favorable choice for beginner traders. It offers suitable conditions for novice traders to start trading with ease and convenience. Its easy-to-use platforms ensure that new traders do not face any technical issues and navigate without difficulty. Besides, traders can practice through the demo account before switching to the live account. The trading costs are also beginner-friendly, offering average spreads with no commissions.

In addition, the first deposit requirement is only $20, which makes the offering perfect for cost-conscious traders. And at last, the educational and research resources are rather satisfactory, enabling traders to gain substantial knowledge on trading.

Portfolio and Investment Opportunities

Score – 3.7 /5

Investment Options Hirose Financial

We have carefully analyzed the broker’s investment opportunities to see how they can help traders diversify their trading and expand their portfolios. However, we found that the broker mainly focuses on currency trading, offering over 50 pairs. It also offers gold and silver trading, and for some regions, crypto and binary options are available.

- However, the range of instruments is very small, and traders looking for more opportunities should try another broker.

- Besides, alternative investment options, such as copy trading, MAM, or PAMM features, are also unavailable at this point.

- As the broker does not offer stocks, shares, or ETFs, it is not a suitable choice for long-term investors either.

Account Opening

Score – 4.5/5

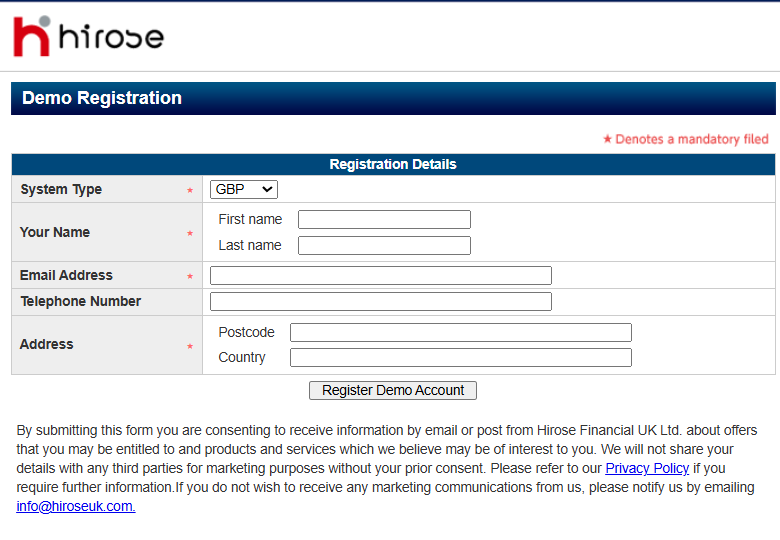

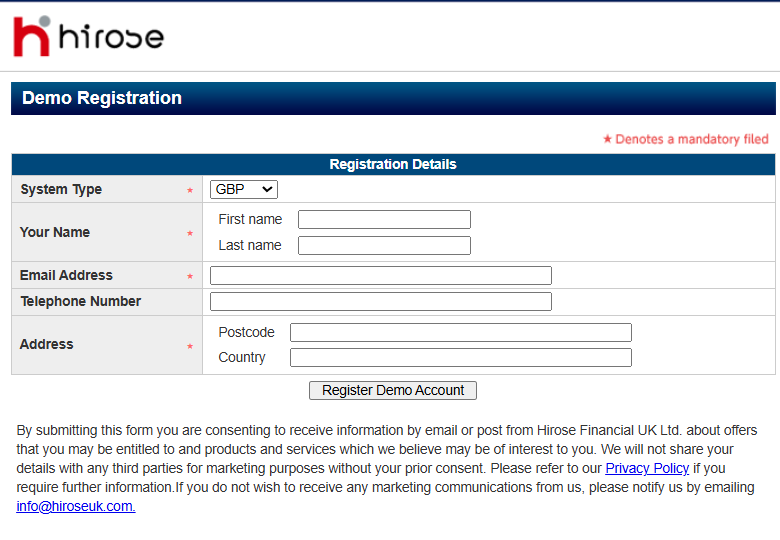

How to Open a Hirose Financial Demo Account?

A demo account is a perfect opportunity for traders to gain trading skills or practice new strategies in a risk-free environment. With Hirose Financial, opening a demo account takes only several steps:

- Go to the broker’s website and choose the free demo option.

- Select either the LION Trader or MetaTrader4 options for a demo account.

- Start a demo registration by providing your name, email, phone, address, and country.

- Submit the form and receive the demo account credentials.

- Download one of the platforms and use the account credentials to sign in.

- Start trading with $100,000 available virtual funds.

How to Open a Hirose Financial Live Account?

Opening an account with Hirose Financial is a straightforward process. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page

- Enter the required personal data (name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.8/5

We have assessed the broker’s available features and tools, describing the most essential of them in the research and education sections. The broker offers great analysis tools in its platforms. In addition, clients can access economic indicators and trading analysis on the broker’s platform.

- However, traders looking for extra features, such as FIX API, free VPS, MAM or PAP accounts, or other opportunities, including bonuses and promotions, will need to look for another broker with a better scope of offerings.

Hirose Financial Compared to Other Brokers

As a part of our review, we have compared Hirose Financial’s different aspects of trading to those of other brokers. First, we compared the regulatory oversight of different brokers with similar offerings.

As we have found, Hirose Financial holds licenses from the top-tier FCA, Japan’s FSA, and Labuan FSA. The well-respected authorities ensure the broker’s compliance with strict rules and guidelines. From the brokers we reviewed, Admiral Markets and Forex.com are the ones with an FCA license. Their credibility is ensured further by the licenses from ASIC, CySEC, NFA, IIROC, CIMA, and other equally reputable authorities.

As to the broker’s trading charges, it offers competitive spreads that include all the trading costs. Xtrade also offers a spread-based structure, while XS, OneRoyal, and others provide commission-based accounts with very low spreads and fixed commissions of an average of $3 per trade.

We have also made a comparison among the available trading platforms. Hirose Financial offers the popular MT4 platform and an alternative, LION Trade. Traders can access over 50 trading instruments through its platforms, which is a small number compared to most other brokers. For instance, Forex.com offers 6000+ instruments and a wider choice of trading platforms, including MT4, MT5, Forex.com Web Trader, and TradingView.

At last, compared to XS, Hirose Financial has better educational materials, allowing beginner traders access to learning materials, guides, glossaries, and more.

| Parameter |

Hirose Financial |

Admiral Markets |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread-Based Account |

Average 0.8 pip |

From 0.6 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission-Based Account |

No commissions |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

LION Trader, MT4 |

MT4, MT5, Admiral Markets app |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

50+ instruments |

8000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

FCA, FSA (Japan), Labuan FSA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$20 |

$1 |

$100 |

$0 |

$50 |

$250 |

$1000 |

Full Review of Broker Hirose Financial

Hirose Financial is a tightly regulated broker by several respected authorities, the FCA, the FSA (Japan), and the Labuan FSA. The broker’s strict adherence to laws protects its clients and ensures the safety of their funds.

As we have found, Hirose Financial offers two main trading accounts based on the platforms: LION Trader and MetaTrader 4. Each platform has its own conditions; however, both offer a spread-based structure. The average spreads for the LION Trader are 0.8 pips, which is on the lower side. The MetaTrader 4 account offers higher spreads, on average 1.9 pips. There are no commissions, and all the fees are integrated into spreads.

Further, Hirose Financial does not offer a diverse range of tradable products or financial assets. Instead, it mainly concentrates on currency pairs. It also offers a few popular instruments, such as gold and silver, binary options (not all entities), and Bitcoin trading, unavailable under the UK entity. All in all, this small number of products limits the opportunities for clients who want to expand their portfolios.

Hirose Financial offers a good education section. It also includes a few additional research features. The availability of a demo account is another advantage for beginners to gain practice and skills. At last, the customer support is dedicated, prompt, and helpful. Traders can reach the broker through live chat, email, phone lines, and an online form.

All in all, Hirose Financial is a favorable broker if it aligns with the client’s trading expectations. However, it is essential to remember that there are differences between the entities, including varying account types, instrument availability, trading tools, and many others.

Share this article [addtoany url="https://55brokers.com/hirose-financial-review/" title="Hirose Financial"]