- What is Global Prime?

- Global PrimePros and Cons

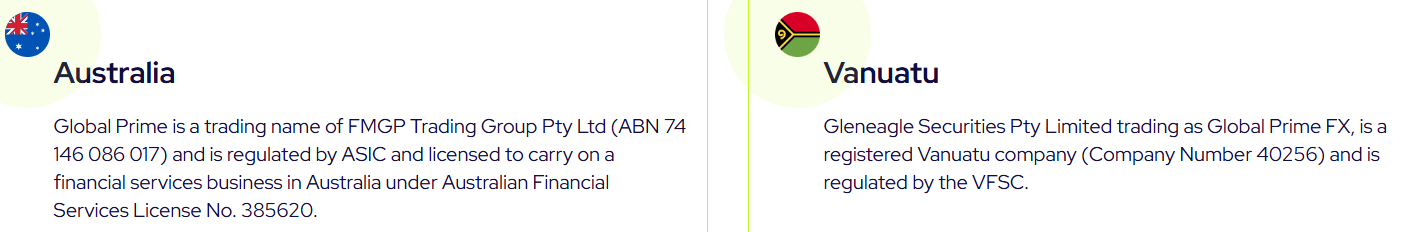

- Regulation and Security Measures

- Account Types and Benefits

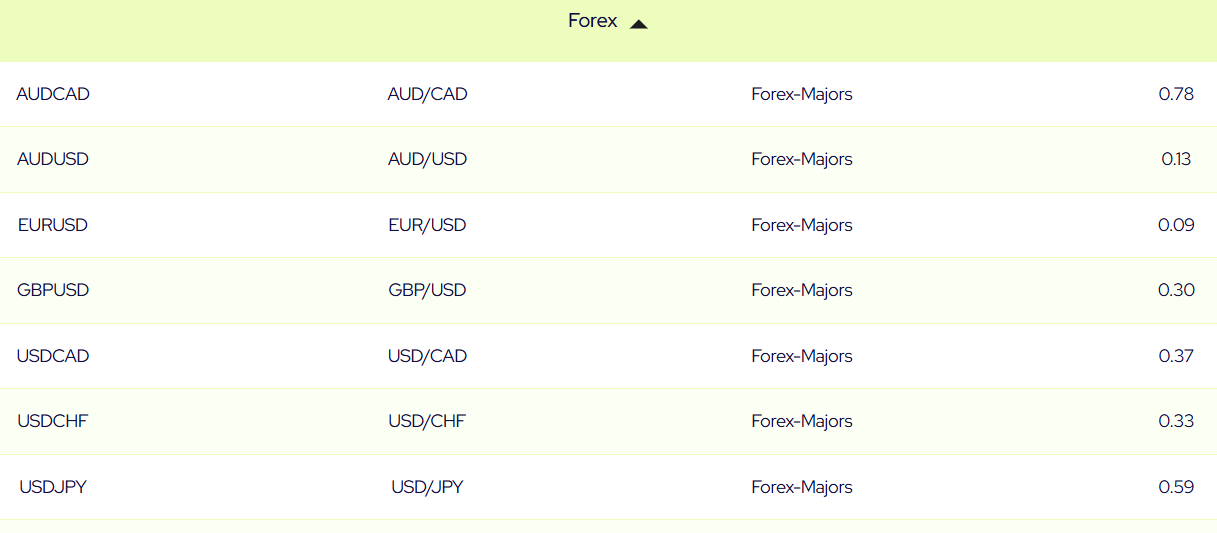

- Cost Structure and Fees

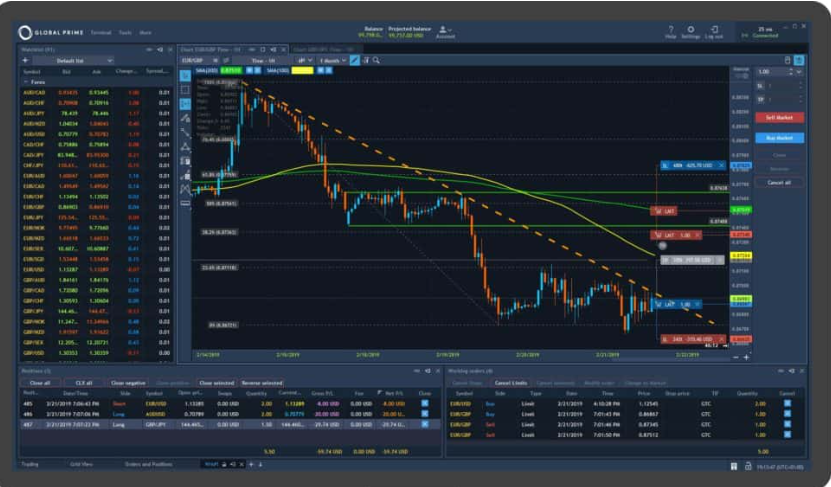

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

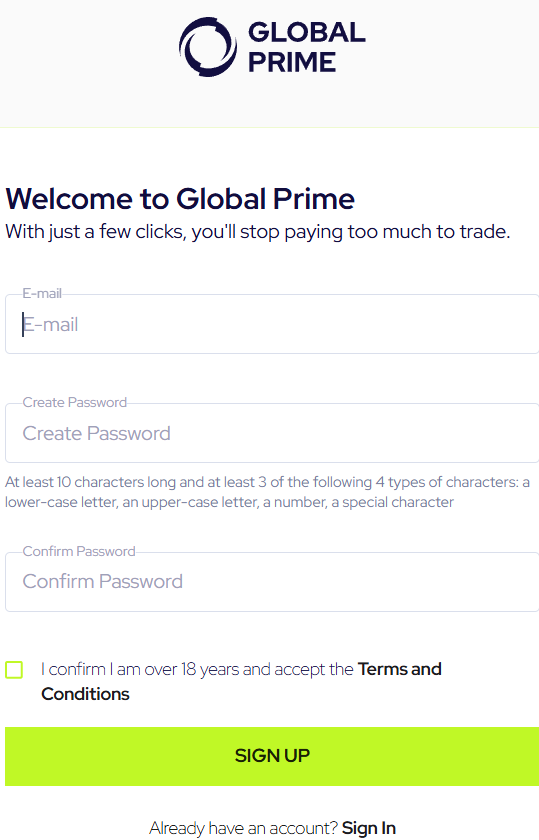

- Account Opening

- Additional Tools And Features

- Global Prime Compared to Other Brokers

- Full Review of Broker Global Prime

Overall Rating 4.3

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 |

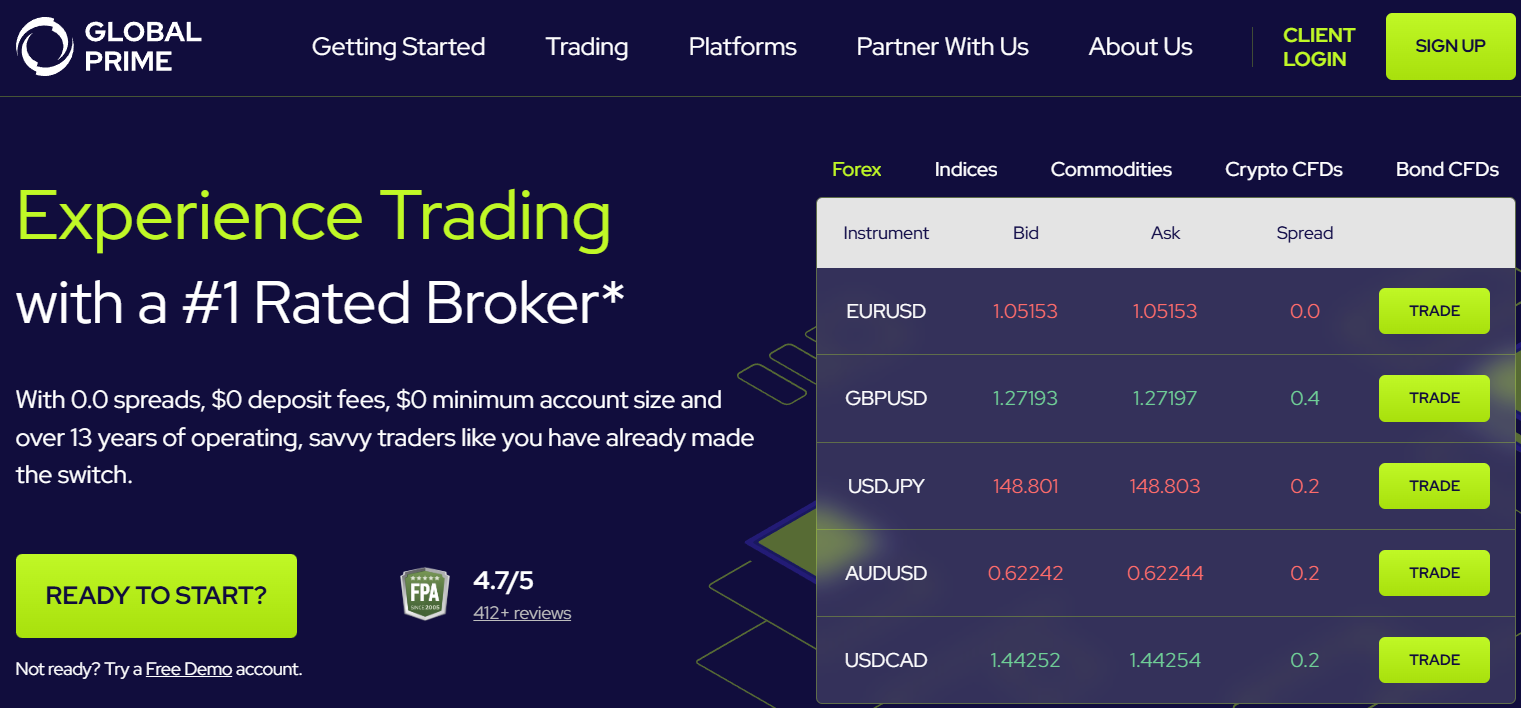

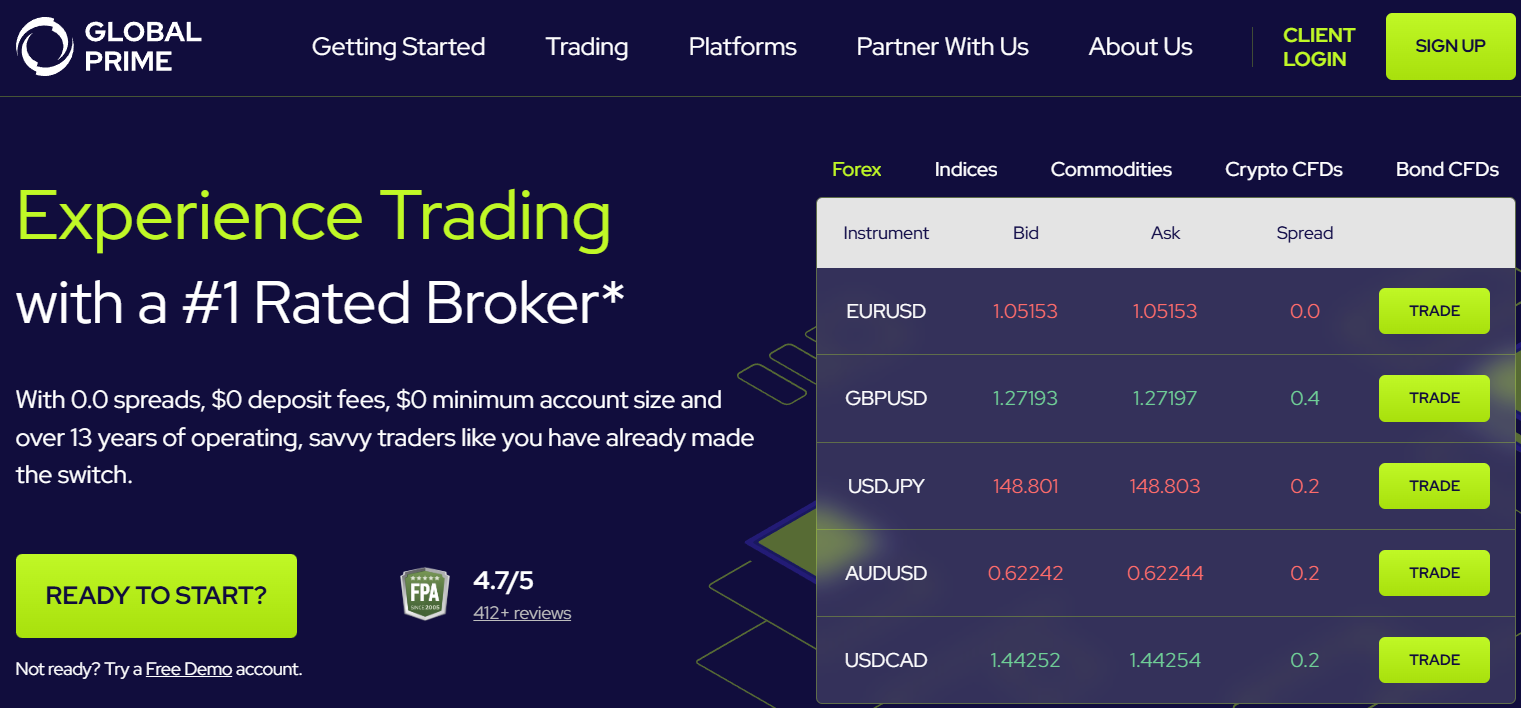

What is Global Prime Forex?

Global Prime is an Australian broker that provides Forex and CFD trading and specializes in low-latency access to tier-1 bank connectivity. The company proposes a regulated trading environment with a sophisticated execution model based on ECN connectivity, bringing powerful platforms and copy trade capabilities, all with tight spreads.

From the beginning of its operation, back in 2010, until now, Global Prime has served clients from over 120 countries, used 20 liquidity providers to guarantee the best quotes, and traded huge volumes across continents.

Global Prime Pros and Cons

Global Prime is a reliable broker with comprehensive trading proposals and an advanced range of instruments suitable for professional traders with low commission charges and low spreads while providing ECN connectivity powered by auto trading and good research tools. Also, the broker offers 24/7 support to its clients.

For negative points, the proposal might not suit beginning traders; it lacks education. Besides, the market range is strictly limited to FX and CFDs, and conditions vary depending on the jurisdiction since the broker runs offshore entities.

| Advantages | DIsadvantages |

|---|

| Highly regulated broker | Runs Offshore Entities |

| Global Trading service | Conditions and protection vary according to the entities |

| Good Forex and CFD Insturments | |

| Low Spread and Commissions | |

| Competitive Trading Conditions | |

| FIX API Trading | |

| 24/7 support | |

Global Prime Features

While researching the main aspects of trading with Global Prime, we have noticed that the broker’s overall offerings are favorable and meet different trading needs. Based on our findings on the broker, we have come up with a list that includes the main features and peculiarities of the broker Global Prime:

Global Prime Features in 10 Points

| 🗺️ Regulation | ASIC, VFSC, FSA |

| 🗺️ Account Types | Standard, Raw |

| 🖥 Trading Platforms | MT4 |

| 📉 Trading Instruments | Forex, CFDs on Cryptocurrencies, Commodities, Shares, Bonds, and Indices |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 0.9 Pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, AUD, GBP, EUR, CAD, SGD, JPY |

| 📚 Trading Education | Research tools, trading guides |

| ☎ Customer Support | 24/5 |

Who is Global Prime For?

We have conducted detailed research on the broker to find who can benefit the most by trading with Global Prime. Based on our financial expert opinion, Global Prime is good for the following:

- Beginners

- Professionals

- FIX API Traders

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Those who prefer the MT4 platform

- Share CFD Trading

- Bonds CFD Trading

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

Global Prime Summary

Global Prime provides a good balance between trading offerings with beneficial conditions and low spreads. The broker has profitable offerings for clients of different levels. Being a regulated Australian broker is a great advantage as it provides safety and security, keeping its clients’ investments safe. Traders of any style can enjoy trading with Global Prime in a reliable environment with ECN technology. In addition, clients have access to the market’s popular MT4 account, where they can trade a range of financial assets with low spreads.

55Brokers Professional Insights

Our experts remained satisfied with Global Prime, considering it a good broker with favorable conditions and service suitable for traders of different styles either beginners or traders with stable strategy and high trading volume. The broker ensures global coverage with low spreads, offering ECN low-latency connectivity to interbank rates. Clients have access to a wide range of financial assets, with over 150 trading instruments. We also noticed an impressive range of deposit methods, which enables clients from different regions to choose the most favorable option.

However, we couldn’t help but notice some of the broker’s drawbacks—the broker lacks decent educational resources, which is a negative point, especially for beginners. Also, the market range is limited to FX and CFDs, narrowing investment opportunities for clients. Another important aspect clients should consider is the availability of an offshore entity: the conditions may vary from entity to entity, so our advice is to be careful and conduct your own research.

Consider Trading with Global Prime If:

| Global Prime is an excellent Broker for: | - Both beginner and professional traders

- MT4 platform enthusiasts

- Currency traders

- FIX API traders

- Active traders who seek tight spreads

- Traders who value transparency in the fee structure

- Traders looking for various strategies

- Bond trading |

Avoid Trading with Global Prime If:

| Global Prime is not the best for: | - Traders looking for good educational resources

- Clients who prefer the MT5 platform

- Traders who prefer fixed spreads

- Long-term investors

- Those looking for a wide range of trading products |

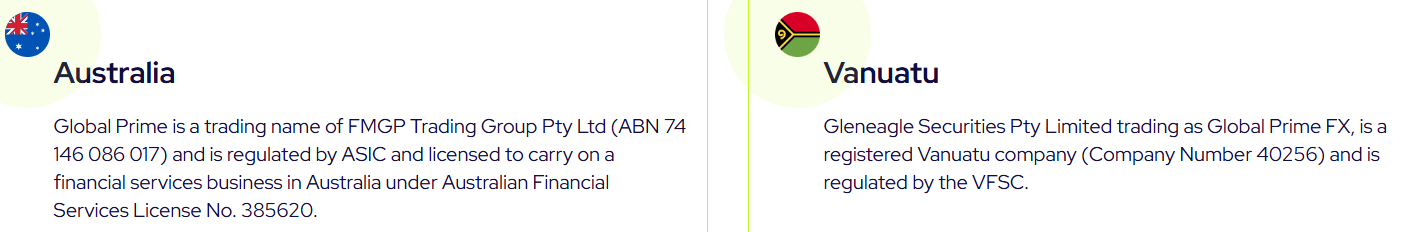

Regulation and Security Measures

Score – 4.3/5

Global Prime Regulatory Overview

Global Prime is a regulated broker holding an ASIC license, ensuring traders’ safe trading environment and good protection. This is necessary to guarantee market integrity and propose tailored trading capability with a safe trading environment. You may read more about Why trade with ASIC brokers by the link.

- Additionally, Global Prime has expanded beyond its borders with offshore operations in Vanuatu and holds the VFSC license. However, trading with an offshore entity carries a high level of risk that should be considered carefully.

- All in all, the broker’s good reputation and reliability have been proved by a decade of proper operation, execution, and integrity. Being licensed by a top-tier regulator, Global Prime ensures safe trading and good client protection.

How Safe is Trading with Global Prime?

Trading with Global Prime clients can be sure their investments are kept under necessary rules, under ASIC protection and oversight. Besides, the regulator constantly oversees the broker’s trading conditions, ensuring they comply with the market requirements.

- Also, the firm may be heavily fined if any violence or misleading operation is detected. This never happens with unregulated firms, as the latter do not follow strict rules. For this reason, trading with a broker under a world-recognized authority is the correct approach in the broker choice.

Consistency and Clarity

Based on the information gathered through our research, Global Prime has been around for over a decade, offering its services to global clients. The broker has managed to gain many clients from different countries and regions. Its license from the well-regarded authority—ASIC—is a good ground for clients to feel comfortable and protected.

Besides being consistent in its operations, we have also noted the growth of the broker over the years and the tendency to get better in its offerings. On Global Prime’s website, we have noticed many new offerings marked as coming soon. The broker is preparing to offer a selection of popular trading platforms—MT5, cTrader, and TradingView. This is a positive tendency and speaks about the development of the broker.

We have also reviewed real feedback from traders to find that clients point out the broker’s transparent practices, dedicated customer support, and fast execution. Yet, some point out the lack of proper education and unsuitability for beginner traders. Our advice is to consider real feedback but also conduct additional research to see if the broker meets your trading expectations.

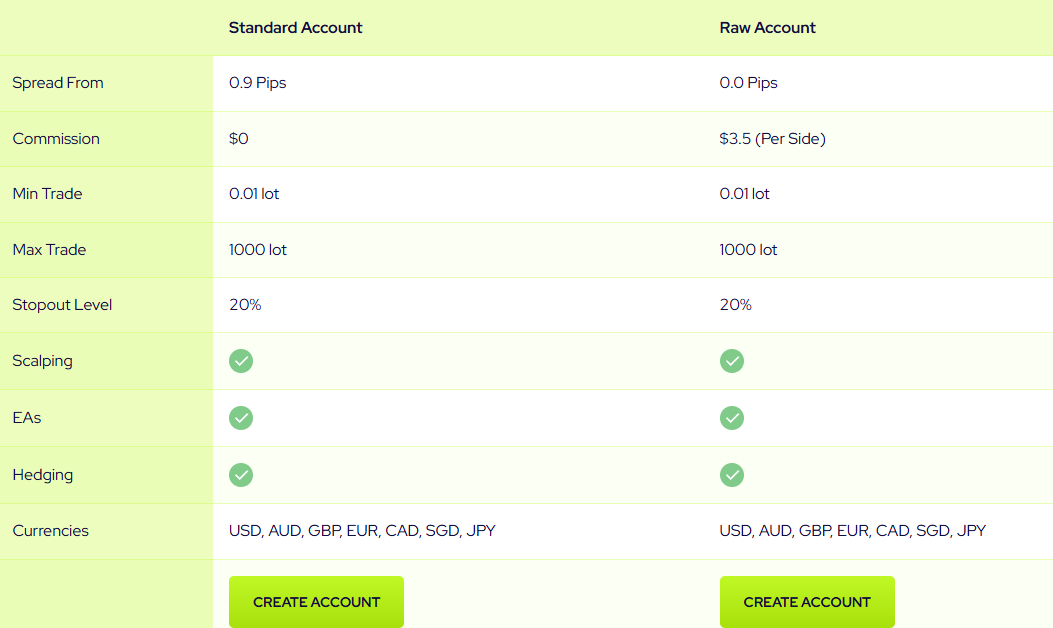

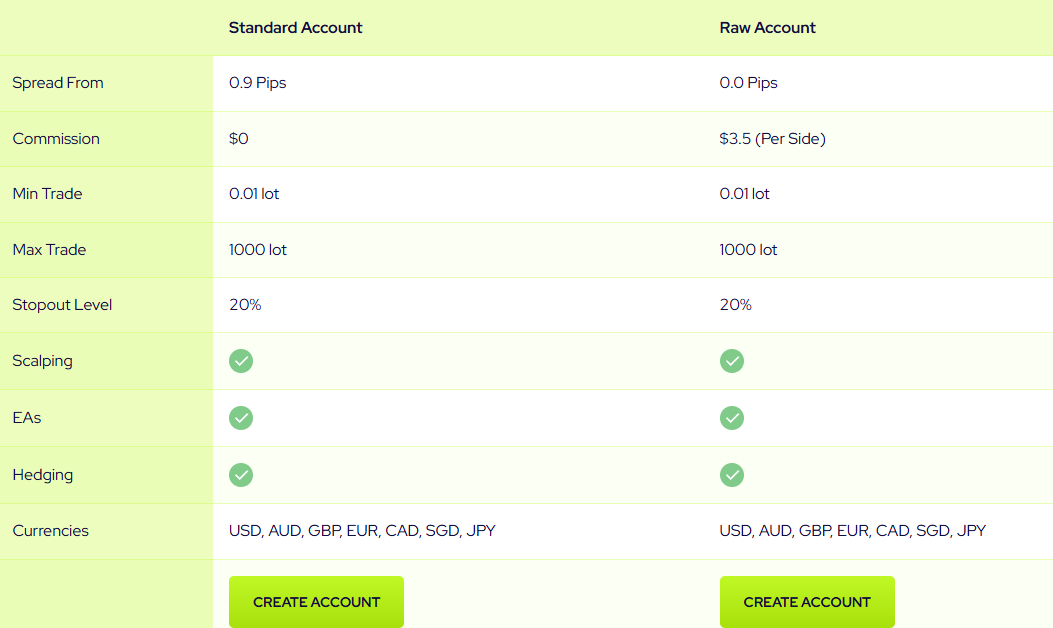

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Global Prime?

Global Prime offers its clients two main account types—Standard and Raw — that come with different fee structures and different trading conditions. The accounts give access to over 150 trading instruments across various assets, enabling traders to explore the market. The account base currencies are the same for both accounts — USD, AUD, GBP, EUR, CAD, SGD, and JPY.

Standard Account

The Global Prime’s Standard account has a spread-based structure and offers floating spreads starting from 0.9 pips. There is no commission for this account type, as all the costs are already calculated into spreads. The standard account is better suited for beginner or intermediate traders looking for cost-efficient options and simple solutions.

Raw Account

With its commission-based structure, the Raw account is a more favorable option for advanced traders who prefer very low spreads with fixed transactions per trade. The Raw account charges a spread from 0.0 pips, with a fixed $3.5 commission per side per trade.

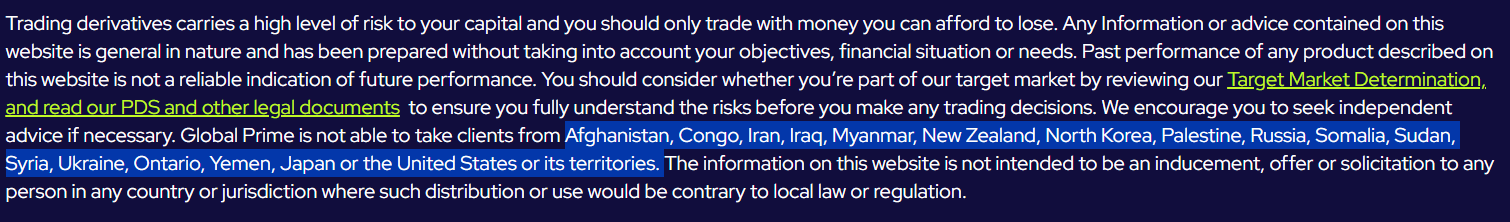

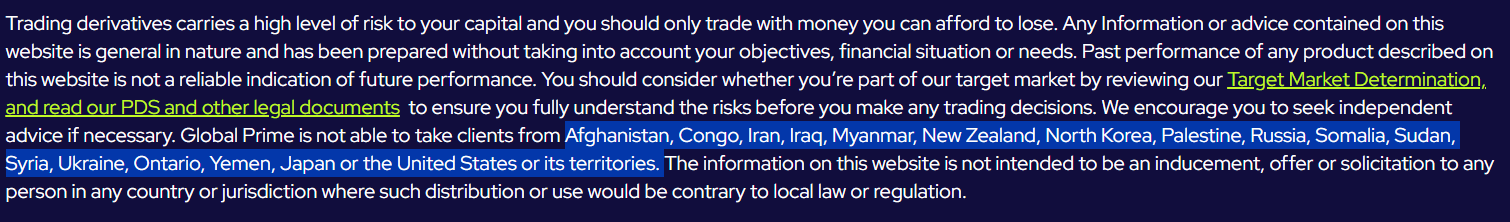

Regions Where Global Prime is Restricted

Global Prime is an international broker with global coverage. However, due to certain regulatory restrictions, the broker lists the countries and regions it does not accept clients from. Here is the list of the mentioned countries:

- Afghanistan

- Congo

- Iran

- Iraq

- Myanmar

- New Zealand

- North Korea

- Palestine

- Russia

- Somalia

- Sudan

- Syria

- Ukraine

- Ontario

- Yemen

- Japan

- United States

Cost Structure and Fees

Score – 4.3/5

Global Prime Brokerage Fees

The research on the Global Prime fees has shown us competitive and transparent fees that are mostly lower or in line with the market average. The broker offers two types of fee structures: spread-based and commission-based. This variety enables traders to choose the most favorable fee structure based on the account type. The Standard account is spread-based, while the Raw account applies fixed transaction fees for every trade.

Global Prime offers low or close to the market average spreads. For the Standard, account spreads include all the costs and start from 0.9 pips. This is considered a favorable offering and very suitable for cost-conscious traders. This structure is most beneficial for beginner traders who look for lower trading costs, efficiency, and simplicity. For the Raw account, spreads start from 0.0 pips but come with fixed transaction fees.

With Global Prime, commissions are applied to the Raw account only. The account comes with raw spreads from 0.0 pips and a commission fee of $3.5 per side per trade. This fee structure is usually favored by more advanced traders looking for low spreads and fixed charges for each trade.

- Global Prime Rollover / Swap Fees

Global Prime also charges fees for the positions held overnight. The broker mentions its long and short swaps for the following pairs:

AUD/SGD long—-2.038, short—0.292

XBR/USD long—-4.5, short—2.4

AUD/USD long—-0.94, short—-1.94

How Competitive Are Global Prime Fees?

We tested Global Prime fees to find a transparent offering with clearly mentioned spreads and commissions. The two types of fee structures enable traders to choose the most suitable structure they can benefit from. As we have found, the spreads for the Standard account are low. It gives perfect cost-efficiency to traders to get exposure to the market with low costs and no hidden fees. The commissions charged for the Raw account are also average and give complete clarity to clients.

Global Prime also charges swap fees. The broker mentioned its long and short swaps for several instruments. The swap fees for other products are marked as ‘coming soon’. This means Global Market intends to indicate swap fees for all the instruments it proposes, allowing more clarity to users.

| Asset/ Pair | Global Prime Spreads | Land-FX Spreads | AvaTrade Spreads |

|---|

| EUR USD Spread | 0.9 pip | 0.9 pips | 0.9 pips |

| Crude Oil WTI Spread | 1.6 pip | 1.5 pips | 3 cents |

| Gold Spread | 00.91 | 2.0 pips | $0.27 |

Global Prime Additional Fees

We have found that Global Prime does not have many non-trading fees. Among the most frequent additional fees clients face in forex trading are the deposit and withdrawal fees. The good news is that Global Prime does not charge them. What is more, the broker does not charge an inactivity fee either. However, the inactive accounts are closed after three months of inactivity.

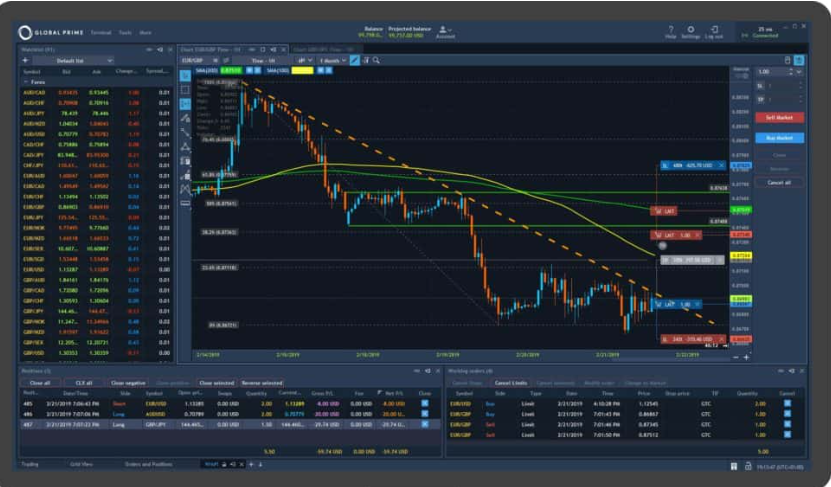

Score – 4.2/5

Global Prime offers one of the most popular platforms in the market—MetaTrader 4. The platform is available through multiple devices, including PC, Mac, and Android. The broker also allows access to the accounts via WebTrader for MetaTrader 4. Based on the information provided on Global Prime’s website, it will include more platforms in its offering soon.

Trading Platform Comparison to Other Brokers:

| Platforms | Global Prime Platforms | Land-FX Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | No | No | Yes |

| Mobile App | Yes | Yes | Yes |

Global Prime Web Platform

Global Prime allows its clients access to their accounts through the MT4 web platform. The platform enables trading directly from the browser without prior downloads and installations. This is a quick and flexible way to access your trades from any device. Besides the flexibility the web platform allows, it includes some of the most essential features and tools for profitable trading. Although the desktop platform still allows more diversity, the web platform is an excellent way to gain quick access to the market.

Global Prime Desktop MetaTrader 4 Platform

Global Prime’s MT4 platform offers traders a user-friendly trading experience, balancing simplicity with advanced tools. Due to the ease of navigation in the platform, even newer traders can successfully execute trades and manage accounts. Advanced traders, on the other hand, have full access to charts and extensive technical indicators. Global Prime’s MT4 also has automated trading capabilities via Expert Advisors (EAs), where traders can execute their algorithmic strategies. The Global Prime’s MT4 enables its users to trade with ease from a desktop, laptop, smartphone, or tablet.

Global Prime Desktop MetaTrader 5 Platform

For now, Global Prime provides only the MT4 platform to conduct trades. However, our research of the broker’s platforms revealed that the broker is planning to introduce some of the most popular and sought-after platforms in the market—MT5, cTrader, and TradingView. Although there is no indication of when the new platforms will be ready for clients to use, we consider it a good point that the broker strives to extend its offerings.

Global Prime MobileTrader App

Global Prime offers the mobile version of the MT4 platform to its clients, offering extra flexibility and versatility. Traders can easily watch markets, place trades, and oversee their accounts using their phones. The mobile platform has many features the desktop platform offers, including charts, trading indicators, and live pricing. The mobile app availability guarantees that Global Prime clients quickly react to market movements anywhere and anytime.

Main Insights from Testing

Our testing of Global Prime’s platforms has shown that the broker’s MT4 platform is available in different versions — web, mobile, and desktop — offering traders flexibility and ease of use. Clients can enter their accounts from the browser or mobile or conduct trades by installing the platform on their desktops. The MT4 platform itself is equipped with advanced charting tools and technical indicators and allows its users to explore the market to the fullest.

As we have found, Global Prime is going to introduce new platforms that will surely bring more diversity to trading.

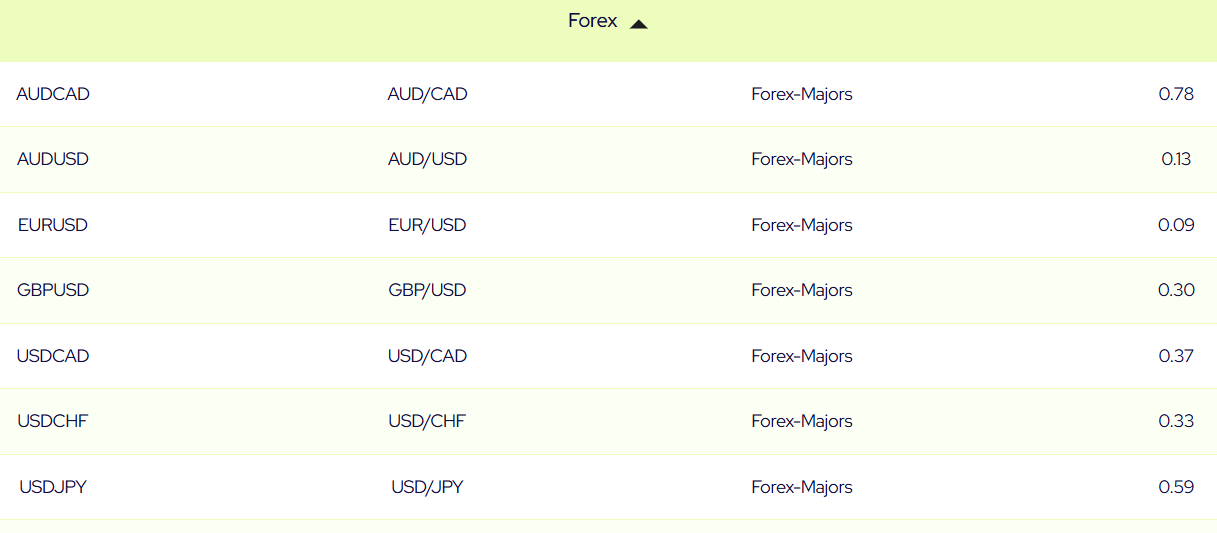

Trading Instruments

Score – 4.4/5

What Can You Trade on the Global Prime Platform?

What Can You Trade on the Global Prime Platform?

Global Prime offers access to a range of trading instruments, including Forex, cryptocurrencies, indices, shares, commodities, and bonds at competitive pricing. The overall range of available trading products is over 150 across the mentioned assets. Although Global Prime offers a good variety of financial assets, the number of available instruments is not very extensive. Other popular brokers in the market offer a better diversity of instruments, which enables clients to further explore the market.

Main Insights from Exploring Fortrade Tradable Assets

Global Prime offers its clients a good variety of forex pairs, including major, minor, and exotic currencies. Global Prime also enables access to 35 crypto coins, including Bitcoin, Ethereum, DOGE, and others. Among the available commodities are gold, silver, platinum, copper, etc.

However, the broker offers mainly forex and CFDs, which narrows the choice for clients who want to experience traditional investments. Besides, the available range of instruments is limited when compared to other brokers with similar standing in the market. However, Global Prime still offers all the essential instruments for trading with low spreads and good conditions. Also, the instrument availability depends on the entity, so we encourage traders to check carefully before opening an account with the broker.

Leverage Options at Global Prime

Global Prime leverage levels strictly vary depending on the entity. Australian traders’ options are limited since the broker put restrictions on the leverage usage, even though ASIC was once known as one of the most popular financial hubs offering high leverage.

- Clients trading under the ASIC entity get exposure to maximum leverage of 1:30

- While international clients can get access to high leverage up to 1:400

Leverage is indeed a powerful tool that can help you gain exposure to a specific market and bigger returns; however, it should be approached with caution since it is a risky venture that can lead to capital loss.

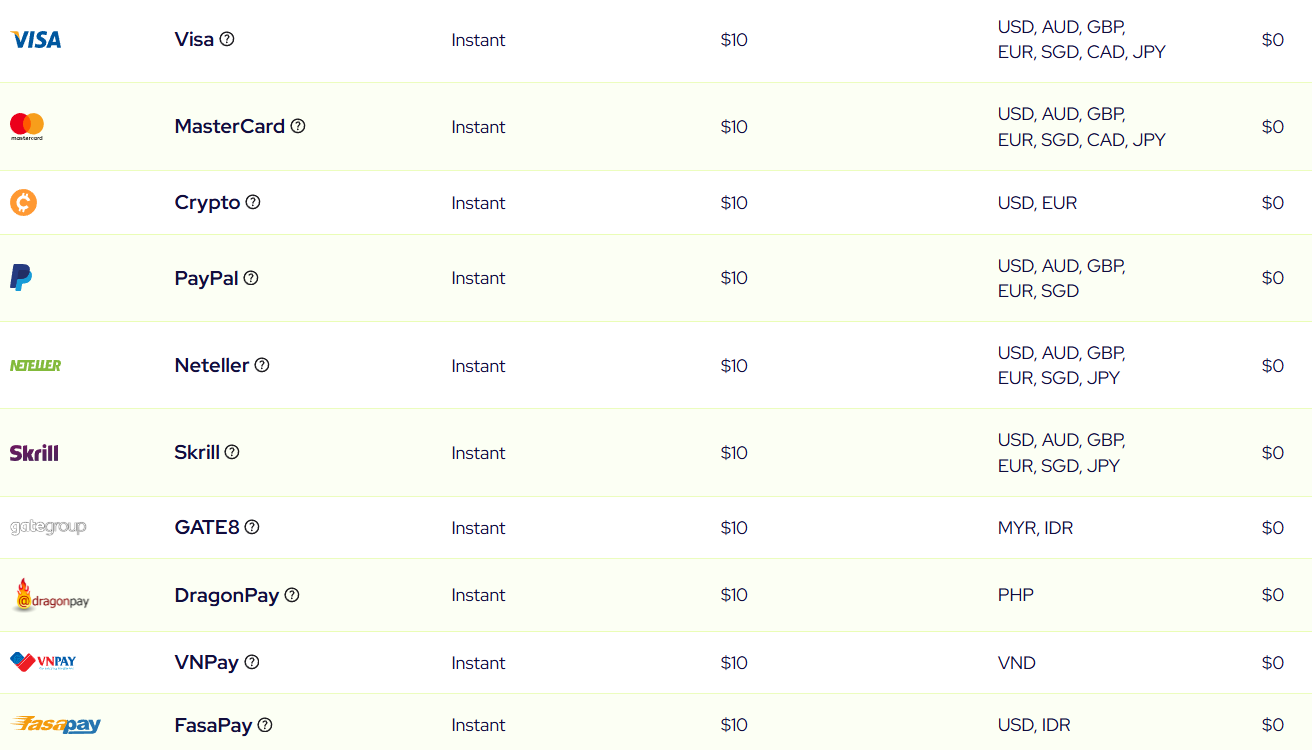

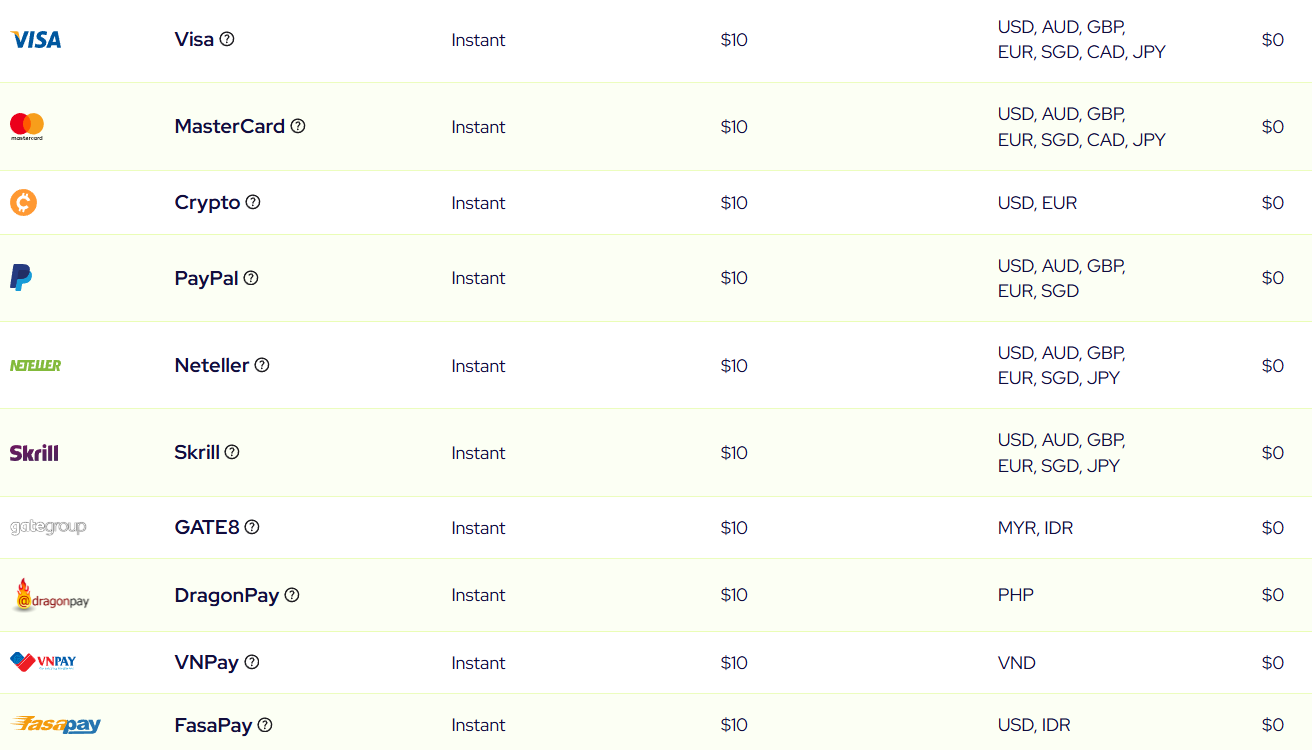

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Global Prime

Global Prime enables its clients to open an account with their choice of base currency between USD, AUD, EUR, GBP, JPY, and SGD, making money deposit or withdrawal more convenient. Also, traders can choose the most suitable option, either to pay with credit/debit cards, PayPal, Skrill, Neteller, Fasapay, Jeton Wallet, Perfect Money, or Cryptos.

- Global Prime offers an impressive range of funding methods, enabling clients to find the most suitable option. There are either no fees or very small ones.

- Residents from the Philippines, Thailand, Malaysia, Indonesia, and Vietnam can make payments from their local bank accounts.

Minimum Deposit

As we have found, there is no minimum deposit requirement, and traders can deposit as much as they want. However, for some methods, the minimum advised amount is $10. The maximum recommended amount for a deposit is $25.000, as some methods might not process more than that all at once.

Withdrawal Options at Global Prime

The requested withdrawals are processed on the same day. However, based on the payment method, the time of the reflection on the trader’s account varies. Clients can withdraw their funds via bank wire, credit or debit card, Skrill, and Neteller.

- There are no withdrawal fees. However, if clients use an intermediary bank, there might be a fee of $15 to $25. Thus, the minimum withdrawal amount is $30.

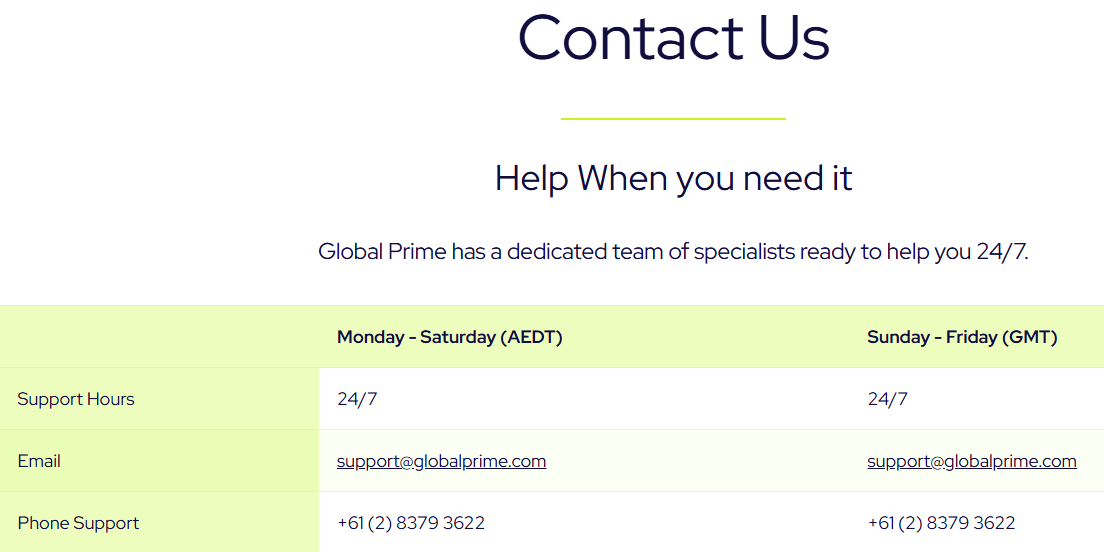

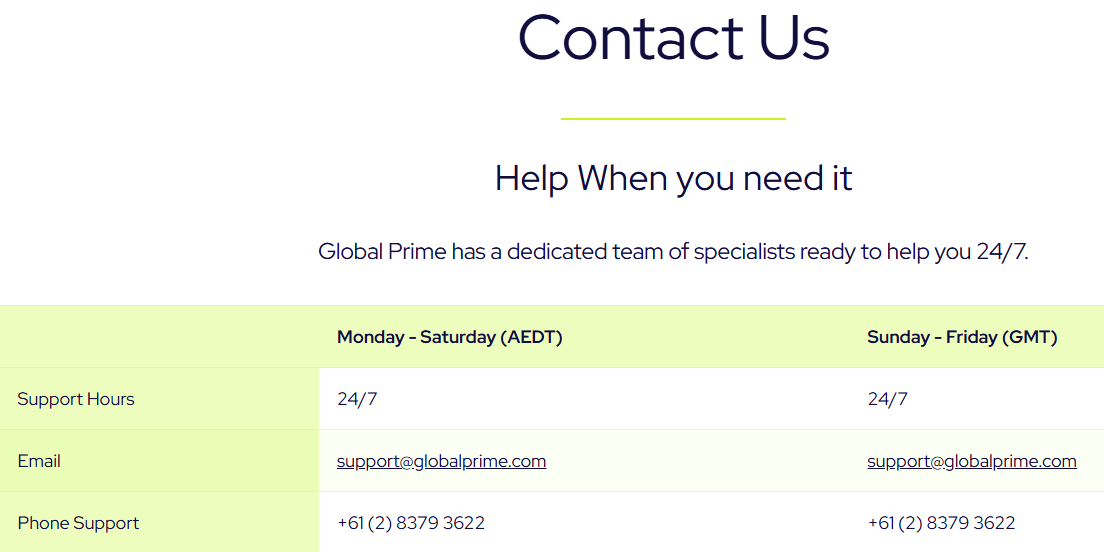

Customer Support and Responsiveness

Score – 4.3/5

Testing Global Prime Customer Support

For traders, it is crucial to have support and assistance when they come across an issue or have a question while trading. Global Prime Customer Support is available 24/7, offering comprehensive customer care that can be reached via email, phone, or live chat.

- Global Prime also has an FAQ section, where the most essential and common questions have answers.

- Besides, the broker is social and available on different platforms, including FB, IG, YouTube, and X. Here Global Prime shares updated information about its operations and the overall market changes and news.

Contacts Global Prime

We find Global Prime Customer Support helpful and dedicated, providing quick and satisfying answers. Clients can contact the support team through the following channels:

- LiveChat is the quickest way to get answers. Our test showed that the answers were prompt and detailed.

- Clients who prefer to contact the Global Prime team through email can use the following address: support@globalprime.com.

- For phone support, the broker provides a phone number: +61 (2) 8379 3622.

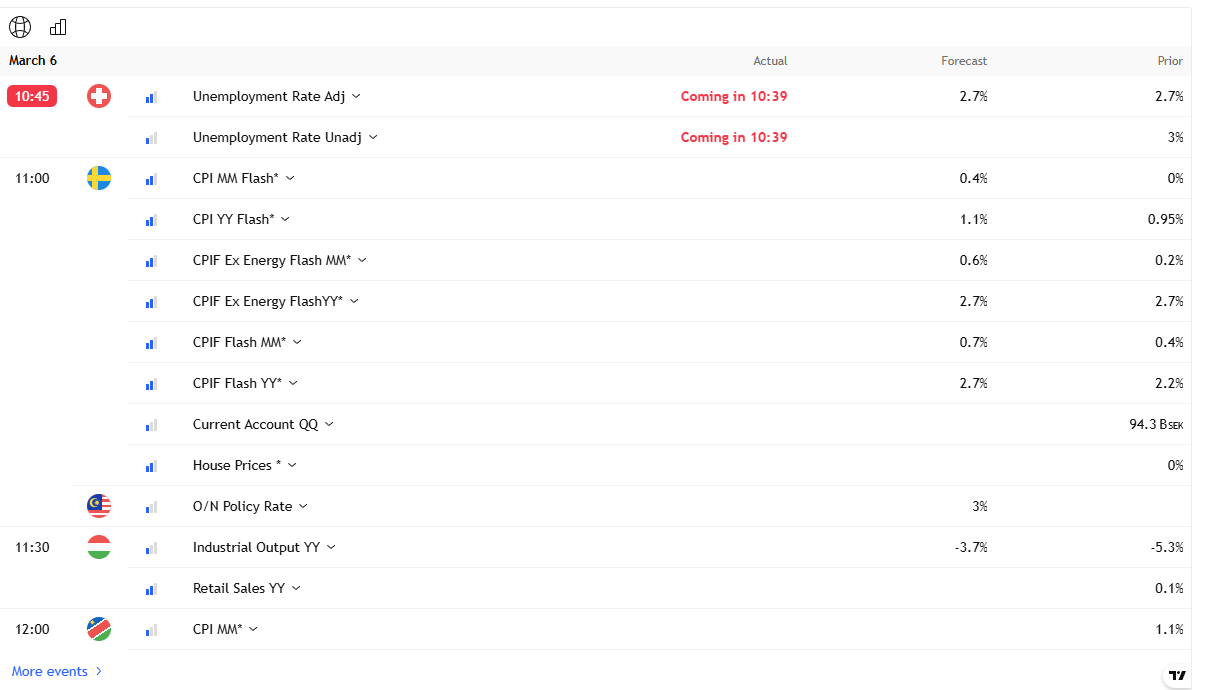

Research and Education

Score – 4/5

Research Tools Global Prime

Global Prime does not offer a very intensive research section on its website. Most research tools clients can find on the broker’s MT4 platform range from advanced charts to market depth. There are only a few additional research tools that will help traders get more insight into the market.

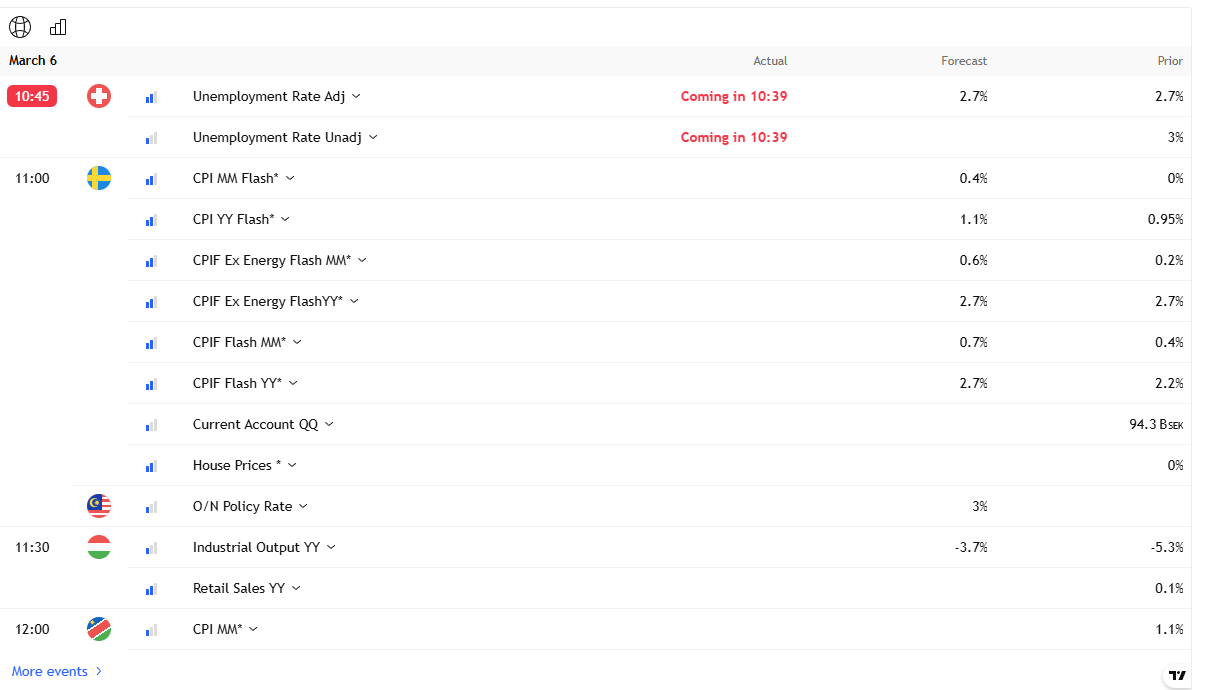

- Global Prime offers various trading calculators, including pip, swap, profit/loss, margin calculators, and a currency converter. These tools will give essential information on the market and help traders make informed decisions.

- The Economic Calendar is another important tool that informs traders about the coming global and economic occurrences that have the power to influence the market and make changes.

Education

The education section of Global Prime does not provide intensive materials that would help traders of different levels. We only found short and modest guides on the following topics: Forex for beginners, Forex traders’ biases, Forex faux pas, trading strategies, and trading plans.

- Global Prime also offers a glossary of forex terms. We found it helpful and quite inclusive, with the most essential terms that traders need to be aware of. The knowledge of forex vocabulary helps clients find their way in the market easily and not get confused in difficult and foreign terms.

Is Global Prime a Good Broker for Beginners?

Based on our research of the broker, we have concluded that it offers favorable conditions for traders of different experience levels. With a simple yet advanced platform, quite low spreads, and transparent trading fees, we can easily say that Global Prime is a favorable broker for those who want to start trading with confidence, supported by reliable execution and tight regulation. On the other hand, traders who need comprehensive educational resources and great research tools will not find what they are looking for with Global Prime, as the broker does not include comprehensive materials. Thus, beginners either need to find alternative sources for education and guidance in the market or find another broker that meets their needs.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options Global Prime

Global Prime’s offerings are based on Forex and CFDs. Clients can trade a good amount of assets without owning them. This offering can be good for beginner traders who need access to the main instruments and are just starting to explore the market. However, more advanced traders try to diversify their trading and explore their opportunities. In this case, the restriction of involving in long-term trading or engaging in real stock trading might narrow down the choices.

The good thing about Global Prime is that it has alternative investment options that enable traders a change and opportunities for diversification.

- Through the GP Copy trading traders who wish to share their strategies will be connected to follower traders who will mirror their successful trades. The services are free of charge, but there is a certain requirement to meet ( trade at least 2.5 lots of FX/Metals per account)

Account Opening

Score – 4.5/5

How to Open a Global Prime Demo Account?

Opening a demo account with Global Prime is a good idea, as it will enable you to practice trading and gain market knowledge before engaging in real trading. There are only a few steps to take to settle your demo account:

- As the first step, clients need to register with the broker by providing an email address and password.

- The account credentials will be sent via email, and you can log into your account.

- From there, go to the Accounts section and choose the ‘Demo’ version on the pop-up window.

- Also select platform, base currency, and leverage.

- You can start trading with your virtual 10,000 funds.

How to Open a Global Prime Live Account?

The live account opening with Global Prime is a quick and easy process that differs from the demo account opening by applying more security measures and the check of identity.

Here is a step-by-step guide on live account opening:

- Visit the broker’s website and choose the ‘Ready to start’ button

- Fill out the registration form by providing your email address and password

- When the account is approved, log in and choose parameters for trading, including platform, account type, currency, etc.

- Afterward, verify your identity by providing a valid ID and a proof of residency

- After the broker views the documents and approves them, your account will be ready

- Make deposits and start trading

Score – 4.2/5

When it comes to additional features, Global Prime offers a few great tools that will elevate the trading experience and outcome. Here are the most essential ones listed below:

- Global Prime VPS allows trades to be connected 24/7 without interruptions because of technical issues. Clients who trade more than 20 lots of FX or metals during 30 days get a complimentary VPS sponsored by Global Prime.

- The broker also enables access to AutoChartist, which monitors the market on behalf of the clients and alerts them about the price changes. AutoChartist also offers fundamental and technical analysis, detailed charts, news, and market updates.

Global Prime Compared to Other Brokers

At the end of our review, we compared Global Prime to other reputable brokers in the market with similar offerings. Global Prime offers good protection via its ASIC regulation, similar to the security level of XS and OneRoyal. However, the latter holds additional licenses from CySEC, which gives an added level of protection.

As to the fee structure, Global Prime stands out for its clarity and transparency, offering low spreads and fixed commissions. As we have found, Forex.com and Xtrade have higher spreads and overall trading costs. However, Global Prime offers only the MT4 platform, while Tradeview, XS, and OneRoyal offer more diversity and opportunities to choose among platforms.

However, Global Prime also lacks in a few aspects, such as education, whereas Forex.com has an excellent educational section, and Xtrade and OneRoyal offer good educational materials, beneficial for beginner traders.

| Parameter |

Global Prime |

Spreadex |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread Based Account |

Average 0.9 pip |

Average 0.6 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission Based Account |

0.0 pips + $3.5 |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4 |

Spreadex Web Platform, TradingView |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

150+ instruments |

10,000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

ASIC, VFSC |

FCA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

No minimum deposit |

$0 |

$100 |

$0 |

$50 |

$250 |

$1000 |

Full Review of Broker Global Prime

We have found that Global Prime is a reliable broker suitable for any type of trader. The broker holds a license from the reputable ASIC, ensuring a secure and reliable trading environment. Besides, during its operation, Global Prime has built a favorable reputation and gained clients from more than 120 countries. The broker offers the popular MT4 platform and is planning to introduce additional platforms in the near future.

Aside from the advantages, Global Prime has a few disadvantages, like insufficient educational materials and limited market coverage with a focus on FX and CFDs. Besides, trading terms vary based on the entity. Despite the mentioned drawbacks, our professional opinion is that Global Prime is a secure and efficient broker and may be a good fit for traders if its offerings meet their trading expectations.

Share this article [addtoany url="https://55brokers.com/global-prime-forex-review/" title="Global Prime"]

They will leave you in financial ruins, luckily they have loopholes and you can get back what you lost. Look us up and you have a good chance of getting the peace of mind you deserve.

GLPrimeTrade is a phishing website. Please be aware. I got into a crypto scam via Instagram scammer. The scammer disguised himself as a crypto trader and recommended this website for trading. After I deposit crypto to my account on GLPrimeTrade, I discovered that I couldn’t withdraw out.

Leave this website before it is too late. https://glprimetrade.com/

Not Global Prime.

Global Prime notified me less than 48 hours before the ASIC Product Intervention Order took effect (which significantly reduced retail traders leverage), resulting in me losing nearly $15,000 in my account.

ASIC announced the change 5 months ago. but I was told about it on Thursday afternoon. They said I could either deposit $100,000 to cover the leverage reduction that would take place in the next couple of days, or my account would easily go into margin call and pretty much all my open trades would be closed.