- GMI Pros and Cons

- Is GMI safe or a scam?

- Leverage

- Fees

- Spread

- Deposits and Withdrawals

- Trading Platform

- Conclusion

Our Review Method

- Our 55Brokers financial experts with over 10 years of experience in Forex and CFD have reviewed and checked the broker’s offerings including fees, spreads, platforms, instruments, and verified licenses, as well as contacted customer support to see conditions and give an expert opinion about GMI

What is GMI Broker?

Global Market Index or GMI is one of the known online leveraged Forex trading providers, that was established in Shanghai and then due to expansion opened several representative offices within China, also in Auckland and enabled office in the financial hub – London.

- GMI has been around since 2009 and is considered one of the largest forex and CFD brokers in the region. The broker is well-regulated and has since attracted over 1 million clients in over 30 countries.

The company profile is determined as a technology-driven brokerage solution along with transparent pricing, cutting-edge systems, multiple customer support and numerous proposals of software. The product offering states a pure ECN, STP connection that brings direct, light-fast connectivity to multiple top-tier liquidity providers with deep liquidity and tailor-made trading solutions.

Is GMI market maker?

No, our research showed that GMI is not a market maker broker. GMI is an ECN and STP broker meaning that the broker provides direct access to other participants in the financial market.

GMI Pros and Cons

Our financial experts consider GMI a reliable broker with good quality trading proposals mainly for professional trading including Institutions and Money managers. We checked that the broker is well-regulated and authorised offering its clients compensation in case they go insolvent. There is a great selection of trading platforms, MT5 bridges, technology and tool available at GMI. There are various options to deposit or withdraw funds.

On the negative side, the broker doesn’t seem to provide educational materials, hence we conclude that it may not be suitable for beginner traders.

| Advantages | Disadvantages |

|---|

| Well-regulated | Lack of Educational Materials |

| STP and ECN models | Not Suitable for Beginners |

| MT4 broker | No Islamic Account |

| Good Reputation | |

| Good Trading Conditions | |

| Low Spreads | |

GMI Review Summary in 10 Points

| 🏢 Headquarters | Shanghai |

| 🗺️ Regulation and License | FCA, VFSC |

| 📉 Instruments | FX, Indices, Cryptocurrencies, CFDs for Crude Oils, Metals and Indices |

| 🖥 Platforms | MT4, Alpine Trader, ClearPro, MTF, Currenex |

| 💰 EUR/USD Spread | 1 pip |

| 💰 Base currencies | USD, EUR, GBP, AUD |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | $25 |

| 📚 Education | Education, Analysis, research |

| ☎ Customer Support | 24/7 |

Overall GMI Ranking

Based on our expert opinion and review, we consider GMI a good and trustworthy broker with reliable conditions and good quality service. We found out that the broker offers competitive trading conditions in terms of high leverage and low spreads. The broker also offers a low minimum deposit with multiple account types to choose from.

- Our GMI Overall Ranking is 8.2 out of 10 based on our test in comparison with other 500 brokers. Have a look at our ranking in comparison with other brokers

| Ranking | GMI | AvaTrade | Pepperstone |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantage | Low Spreads | Education | Instruments |

GMI Alternative Brokers

Yet, we noticed that the broker lacks good education, doesn’t offer a wide range of instruments and mainly are limited to Forex and CFDs. Even though the broker offers low spreads and low minimum deposit, we recommend GMI alternatives to compensate for the shortcomings:

- Pepperstone – Excellent Broker with a Wide Range of Instruments

- AvaTrade – Good Broker with Educational Resources

- FXTM – Good for Beginners and Good Fees

Awards

Apart from the retail traders offering, the GMI brings advanced proprietary software that includes MT4 and MT5 bridges, tailored partnership programs for Institutional traders, Money Managers, White Labels and APIs via the FIX connectivity network.

Indeed, it is obvious that the main pro of GMI is the technology and software, which also was recognized by many awards received for special achievements within the industry and overall ratings.

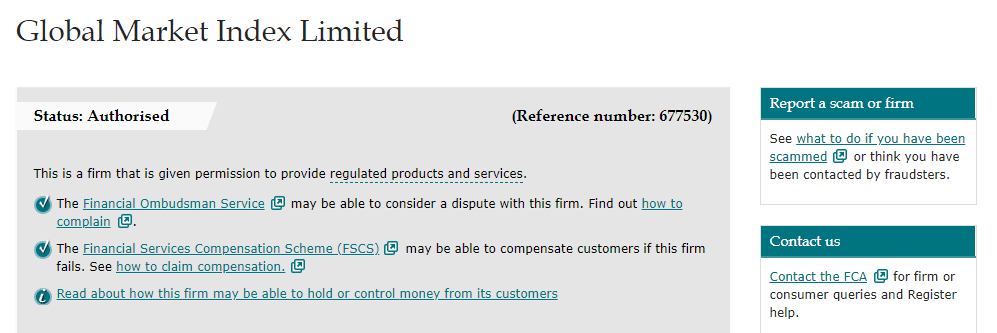

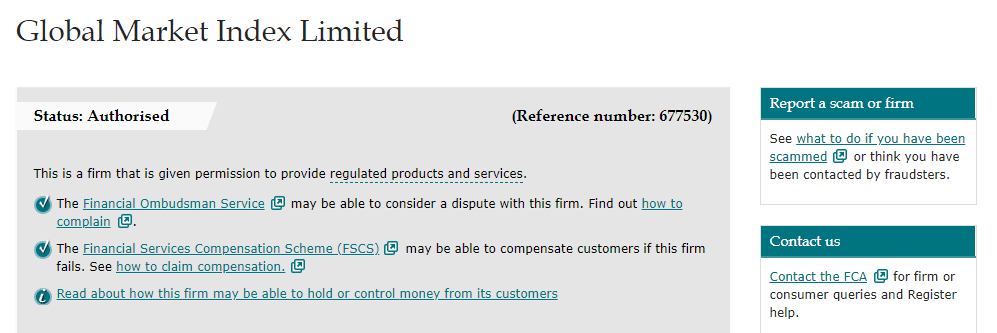

Is GMI safe or scam?

No, GMI is not a scam, our experts consider GMI a trustworthy broker due to top-tier authorization from FCA and trader compensation schemes offered within the FCA framework.

GMI Group of companies includes the firms and entities that are registered in several jurisdictions while using the shortcut-trading name of Global Market Index Limited. GMIUK is a trading name of the Global Market Index that is based in London and authorized by the Financial Conduct Authority.

Other brands include GMINZ a trading name of the company registered in New Zealand, GMIVN a company registered in Vanuatu, and GMI Limited registered in Hong Kong.

Our Conclusion on GMI Relianility:

- Our Ranked GMI Trust Score is 8.3 out of 10 for good reputation and proper operation over several years, as well as top-tier licensing tailored with a compensation scheme. The main drawback is that international trading is available through an offshore license

| GMI Strong Points | GMI Weak Points |

|---|

| FCA regulated | Regulatory standards and protection vary based on the entity |

| Negative Balance Protection | |

| Compensation Scheme | |

| Well-regulated broker with a strong establishment | |

While the broker is regulated by one of the most reputable world authorities UK’s FCA, the traders can keep peace of mind, knowing the broker is fully compliant in regards to the operations and how it manages traders. Furthermore, the client’s funds are secured at all times, kept in leading Banks’ segregated accounts and protected by the compensation schemes in case of insolvency.

What leverage does GMI offer?

Leverage levels offered by GMI of course depend on the regulatory requirements and the entity of GMI you are trading with. This happens due to various safety measures each authority applies in order to eliminate the risks, specifically for retail traders. Therefore, trading with a UK brokerage the set of rules established by the European ESMA and allows only lower leverage levels of:

- up to 1:30 for Forex instruments

- 1:20 for minor currency pairs

- 1:10 for Commodities.

However, if you open an account with Hong Kong or Vanuatu entities levels are jumping to the high leverage up to 1:200 or even 1:300, yet check carefully with customer support under which regulation you particularly will fall.

GMI Account types

There are 4 account types designed by GMI, three of them are MT4 Accounts with STP connection, and the last one is offering ECN bridging technology. The trading accounts were designed through ultra-customizable mode, while you may choose between flexible leverage and trading size along with ultra-tight floating spreads and rapid connectivity to the market. Here are our insights on GMI accounts types:

| Pros | Cons |

|---|

| Fast digital account opening | Account Vary based on Jurisdiction

|

| Low minimum deposit | |

| Demo Account | |

| 4 Account Types | |

Our research showed that each of the accounts is diverse by the initial deposit, and trading size accordingly allowing us to choose the best suitable version along with more competitive pricing built into the spread only or with interbank spread and commission per order.

How to open a GMI account?

- Step 1 – Register an account. Register an account

- Step 2 – Complete the information. Fill in the information requested and select continue.

- Step 3 – Complete registration. Once all information is completed and “KYC” process has been completed you will be able to start trading.

Trading Instruments

Moreover, the GMI’s multi-platforms perform ultra-low latency and FIX API connectivity, while the range of trading instruments includes FX, Indices, Cryptocurrencies, and CFDs for Crude Oils, Metals and Indices. Forex trading includes vast currency pairs that also contain some specials such as FX Minors, which gives an opportunity to gain flexibility by matching strategy for both long and short positions with high investment potential.

- GMI Markets Range Score is 7.6 out of 10 based on our research. The broker market offering is good overall, however, the wider range is only available to certain entities, and instruments are mainly traded on CFD and Forex basis

GMI Fees

GMI apply different costs applied according to the trading account and the volumes you operate. There are options for spread only or commission basis in addition to tailored solutions for traders of a bigger size. Also, consider additional fees like funding fees or inactivity.

- GMI fees scored 7.9 out of 10 based on our testing and compared to other 500 brokers. For Deposits and Withdrawals, there are no fees, however, the broker might charge small fees for account inactivity after a certain period of time. But overall, GMI fees are considered good

| Fees | GMI Fees | XM Fees | BCR Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Average |

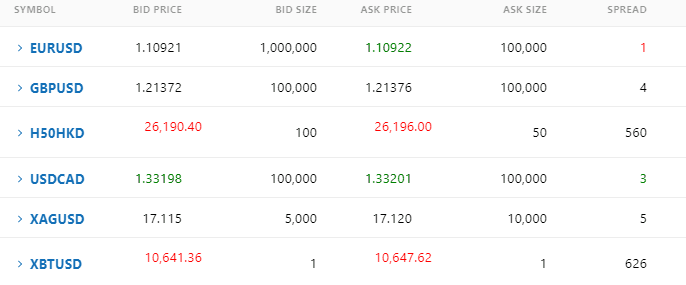

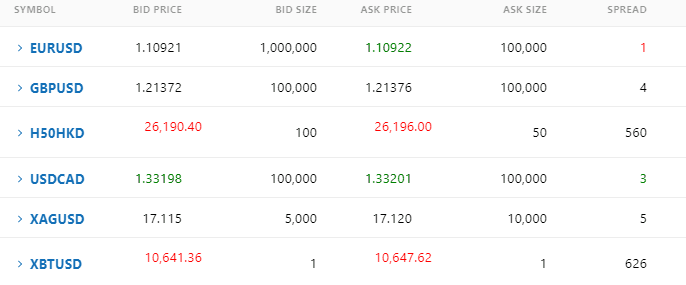

GMI Spread

GMI spreads are considered to be the lowest spread offering in the market based on our research, see below our comparison of some popular instruments. And last, always consider rollover or overnight fee as a cost, which is about -2% for short positions held longer than a day.

- GMI Spreads are ranked 8.2 out of 10 based on our research and comparison to other brokers. The broker’s spreads are lower than that of the industry average with 1 pip for EUR/USD, as well as spreads for other assets are attractive, too

| Asset | GMI Spread | XM Spread | BCR Spread |

|---|

| EUR USD Spread | 1 pips | 1.6 pips | 1.6 pips |

| Crude Oil WTI Spread | 5 | 5 | 4 |

| BTC Spread | 626 pips | 60 | 45 |

Deposits and Withdrawals

In order to start Live trading, of course, you should deposit an initial balance requirement, which is set at different levels according to the account type you chose. Transfer options include various payment methods like Credit and Debit Cards, Bank Transfers and e-payment Skrill.

- GMI Funding Methods were ranked Average rating of 7.8 out of 10. The broker’s funding methods are not diverse but proven and reliable. The minimum deposit is among the lowest ones, and fees are little to none.

| GMI Advantages | GMI Disadvantages |

|---|

| $25 Minimum Deposit | Methods and conditions vary based on entity |

| Free deposits and withdrawals | |

| No Hidden costs | |

| Low Fees | |

Minimum deposit

The GMI minimum deposit amount starts at 25$. Actually, due to the super developed technology of GMI this broker is considered a choice for professionals or active traders.

GMI minimum deposit vs other brokers

|

GMI |

Most Other Brokers |

| Minimum Deposit |

$25 |

$500 |

Withdrawal

GMI does not charge any additional fees for deposits or withdrawals, however, the payment provider may treat the deposits as a cash advance and hence will add extra fees, which require your check on the issue.

GMI Trading Platforms

As technology-driven executions require a sophisticated tool, the GMI provides traders with a choice of 5 platforms. They are divided by connection type while STP supports GMI MT4 and GMI Alpine Trader platforms, and ECN connection is performed via GMI ClearPro, GMI MTF, and GMI Currenex.

- GMI trading platforms are ranked with an average score of 7.5 out of 10 based on our research in comparison to other brokers. We find GMI’s platform range is good since it offers an industry-leading platform like MT4

| Platforms | GMI | Peppertone | XM |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| Own Platform | No | Yes | Yes |

| Mobile Apps | No | Yes | Yes |

Desktop platform

SInce GMI choice of trading software is trully great and very much advanced here we briefly review each of the offered software available ein various versions including Desktop Platform:

- GMI MT4 allows great stability and is the most popular retail world platform. In addition to its powerful chart features and enabled EA trading, the GMI enhanced it by VPS hosting and collocation configuration for smart order routing.

- GMI Alpine Trader is an intuitive interface platform with the ability to trade in fixed dollar amounts with OCO orders and server-based trailing stops pip-by-pip. However, this platform is not available for GMIUK clients.

- GMI ClearPro is an institutional platform with VWAP (Value Weighted Average Pricing) that allows choosing order size, with the interbank daily settlement and one-click order reversal.

- GMI MTF is designed for the ECN venue for multiple asset classes and flexible connectivity, also enhanced by ultra-high order acceptance rate and low latency with no rejections.

- GMI Currenex is an automatic matchmaking system with a wide selection of order types, ESP quote system and a deep liquidity pool. Yet, the platform is not available for GMIUK clients.

Customer Support

Our experts contacted GMI customer support to evaluate the conditions and we got quick and relatable answers. The broker provides multichannel support available in multiple languages. The support is available via Livechat, email, and phone.

- Customer Support in GMI is ranked an overall rating of 8.3 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers

See the pros and cons of customer support:

| Pros | Cons |

|---|

| Quick responses and relevant answers | None |

| 24/7 customer support | |

| Supporting numerous languages | |

| Availability of Live Chat | |

GMI Education

Based on our research, the broker doesn’t provide any educational resources which is a major flaw that draws away beginner traders. However, since Broker mainly focuses on professional trading it is a good choice anyways, as trading tools and research are provided on a great level and also considered an advanced choice of the platforms provided.

For alternatives, you can read our review articles of XM and Trading 212 which have a great collection of educational resources.

GMI Review Conclusion

Overall, concluding our GMI Broker Review we state well-regulated firm, which serves offices in the world’s leading financial centres and offers transparent conditions through technological connectivity. GMI is a great choice for advanced traders and professional trading, provided tools, costs and offering itself is very diverse and designed to meet almost any expectation.

Yet, there are some Cons which are first of all lack of information on the website, no educational support along with a quite high deposit to start, which is 2,000$. However, what is pleasant at GMI very wide diverse platform offering, which brings numerous solutions to almost any demanding trader, beginner or experienced, institutional or retail.

Based on Our findings and Financial Expert Opinion GMI is Good for:

- Professional Traders

- Advanced Traders

- Long term trading

- Investing

- Pattern Trading and Trend Trading

- EAs running

- Copy Trading

- Traders who prefer the MT4 platform

- Currency Trading and CFD Trading

- MAM Trading

Share this article [addtoany url="https://55brokers.com/global-market-index-gmi-review/" title="GMI"]

i’m looking for an old account I had with you guys

I want to withdraw my funds and I can’t receive messages said failed reason unknown?

I paid my tax and the risk amounts they and again I have to pay my abnormal accounts which I did and not my pledge and many excuses and threaten me for money laundering or my account will donate and now recently my timing of payment pledge is up to this month 15th my account will be blocked

I want to withdraw my funds

Member 2408, why cant I make a withdrawal when all fees have been met, no response from customer support, I even sent an email but to no avail cant get a response from GMI.

Why cant I withdraw my funds now since all fees have been met?

Novosti