- What is FXTB?

- FXTB Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FXTB Compared to Other Brokers

- Full Review of Broker FXTB

Overall Rating 4.2

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4/5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 3.6 / 5 |

| Account opening | 4.4 / 5 |

| Additional Tools and Features | 3.8 / 5 |

What is FXTB?

ForexTB (FXTB) is an STP broker based in Cyprus since 2015. FXTB is operated by Forex TB Limited, a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission. The broker offers a good trading experience through its platforms and aims to uphold strict industry regulatory compliance requirements throughout every aspect of its operations.

Therefore, you’re trading with a trustable partner who will treat you fairly; this is a crucial point, as the majority of offshore brokers cannot provide reasonable trustability. That is the reason we advise avoiding them at all costs. Further, in our FXTB review, we will see more of the details and conditions FXTB proposes so that you can decide whether this broker is good for you.

FXTB Pros and Cons

FXTB is a regulated broker with good costs and tailored solutions; account opening is smooth and fully digital. The beginning traders can benefit from free educational tools.

The drawbacks of FXTB include the withdrawal fees and wide spreads associated with standard account levels. The range of instruments is also limited to FX and CFDs.

| Advantage | Disadvantage |

|---|

| Forex and CFDs offered | Only FX and CFDs |

| CySEC regulated broker | Withdrawal fees |

| A mainstay on MT4 and Web Trader platforms | No 24/7 support |

| Fast account opening | Lack of social trading |

| Comprehensive education center | |

| Automated trading | |

FXTB Features

FXTB is an STP Forex broker with high standards of secure trading environments. The offering to the clients is wide as it proposes comprehensive investment opportunities to the world trading community. We have reviewed the main aspects of trading with FXTB and listed them below for our readers:

FXTB Features in 10 Points

| 🗺️ Regulation | CySEC |

| 🗺️ Account Types | Basic, Gold, Platinum, VIP |

| 🖥 Trading Platforms | MT4, Web Trader |

| 📉 Trading Instruments | CFDs on Commodities, Forex, Stocks, Indices, Cryptos |

| 💳 Minimum deposit | €250 |

| 💰 Average EUR/USD Spread | 3.0 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD |

| 📚 Trading Education | Webinars, Courses, eBooks and Research tools |

| ☎ Customer Support | 24/5 |

Who is FXTB For?

Based on Expert Opinion, FXTB has many great features that would elevate the trading experience and assist clients in their trading journey. Here is what FXTB is Good for:

- Currency Trading and CFD Trading

- Beginner and Professional Traders

- Algorithmic or API Traders

- EAs running

- Scalping / Hedging Strategies

- Traders who prefer the MT4 platform

FXTB Summary

FXTB proposes quality trading with flexible conditions, platforms, and instruments. It offers its clients the opportunity to trade multiple financial instruments, including currency pairs, indices, commodities, and shares. Another good point is that FXTB is regulated by the European CySEC aligned with the MiFID directive, meaning the broker falls under protective measures. We recommend choosing a higher account level to get the cheapest withdrawals, the tightest spreads, and free daily signals.

55Brokers Professional Insights

FXTB is somehow a basic Broker with good consistancy and trading conditions provided. Whether novice or veteran, customers can expect the best conditions and a secure trading environment, following serious rules and guidelines imposed by European Trading regulations, while the conditions are suitbale manly for traders who look for spread based accounts with no commission charges and trading popular instruments.

However, the FXTB instrument offer is mainly limited to Forex and CFDs, so if you look for diverse range withh thousands of instruments better check other poposals. We also found that the spreads are slightly higher, which is a negative point for cost-conscious traders. Even though FXTB offers a good account diversity, an advanced platform, and a comprehensive education, the broker might have limited offerings for clients who look for an extensive instrument range, and long-term investments.

Nevertheless, this is a good option for beginners who are looking for an easy-to-navigate platform and a good selection of educational resources, including webinars, a glossary, eBooks, and courses. All in all, we recommend traders choose FXTB as their broker if the services offered meet their trading needs.

Consider Trading with FXTB If:

| FXTB is an excellent Broker for: | - Beginner traders looking for extensive education

- Traders who prefer multiple account types

- Clients who prioritize tight regulations and security

- Those preferring web-based platforms

- Algorithmic trading enthusiasts

- Traders who prefer the MT4 platform |

Avoid Trading with FXTB If:

| FXTB is not the best for: | - Long-term investments

- Stock trading

- Clients looking for a diverse range of platforms

- Traders prioritizing low spreads |

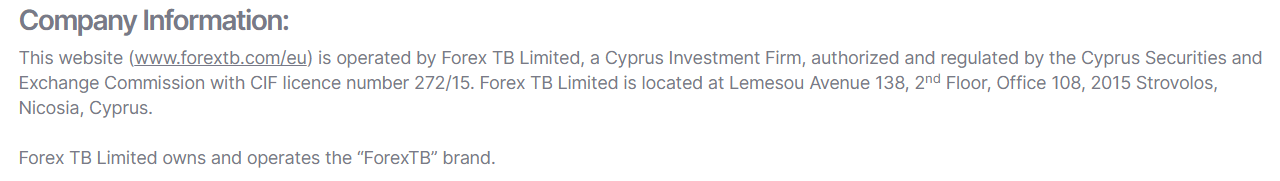

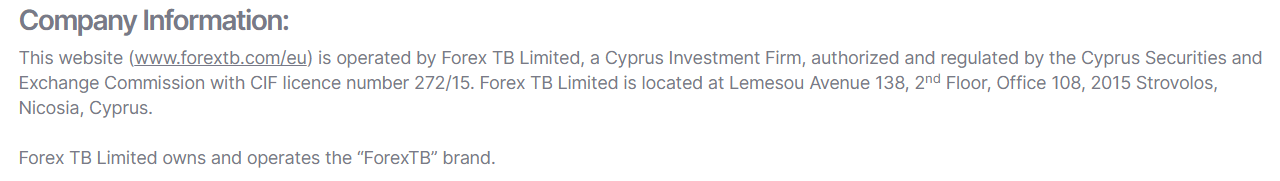

Regulation and Security Measures

Score – 4.3/5

FXTB Regulatory Overview

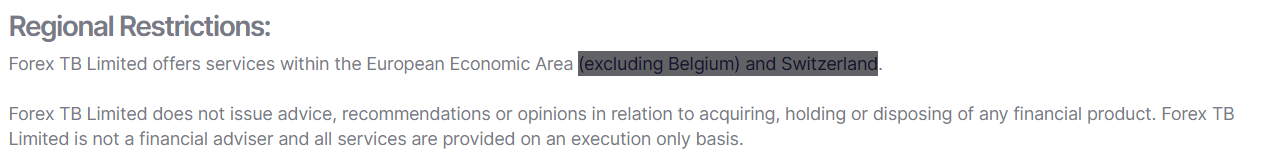

FXTB is operated by Forex TB Limited, a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission with CIF license number 272/15. In simple words, that means the broker is legit and fully authorized to offer its trading solution within Cyprus, the EU, and beyond due to cross-border registrations.

As a regulated company, FXTB is governed by strict rules and regulations that are in place to ensure they continuously comply with their operating conditions during the provision of their services and that are designed to enhance the protection of investors while promoting stable and orderly financial markets.

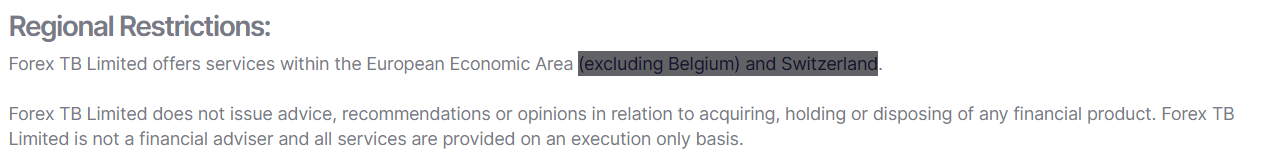

- Forex TB Limited services are available within the European Economic Area, except for Belgium and Switzerland.

The mentioned regulation, CySEC, is a transposition of MiFID European Law, which operates under ESMA and contributes to safeguarding the stability of the European Union’s financial system and enhancing the protection of investors and financial market stability.

How Safe is Trading with FXTB?

All client funds are stored in segregated accounts and are fully insured to give traders extra assurances surrounding the safety of funds. Furthermore, the broker is a member of the Investor Compensation Fund, adding a layer of protection. To ensure clients are prepared to enter the market and make sound decisions, the platform also provides trading support in the form of alerts and charts along with extensive customer service for users.

Consistency and Clarity

FXTB has been operating for about ten years and delivering quality services. The broker ensures a safe trading environment and the security of its clients’ funds. The broker is regulated by one of the best-regarded financial authorities, which imposes strict rules and guidelines for the company. This is the guarantee of a risk-free environment.

We have noticed that the broker has shown consistency in its practices over the years and has demonstrated clarity and transparency in its services. As a part of our research, we also considered feedback from real traders to see where the broker stands. Mostly, the clients express their satisfaction with the broker, pointing out its advanced platform and Web Trader, extensive education and research tools, and devoted customer support. As a negative point, some traders mention the higher spreads, yet they state that the advantages outweigh all the disadvantages. From our side, we will add that customer feedback is important, yet potential clients should conduct their own research to see if the broker’s services meet their trading expectations.

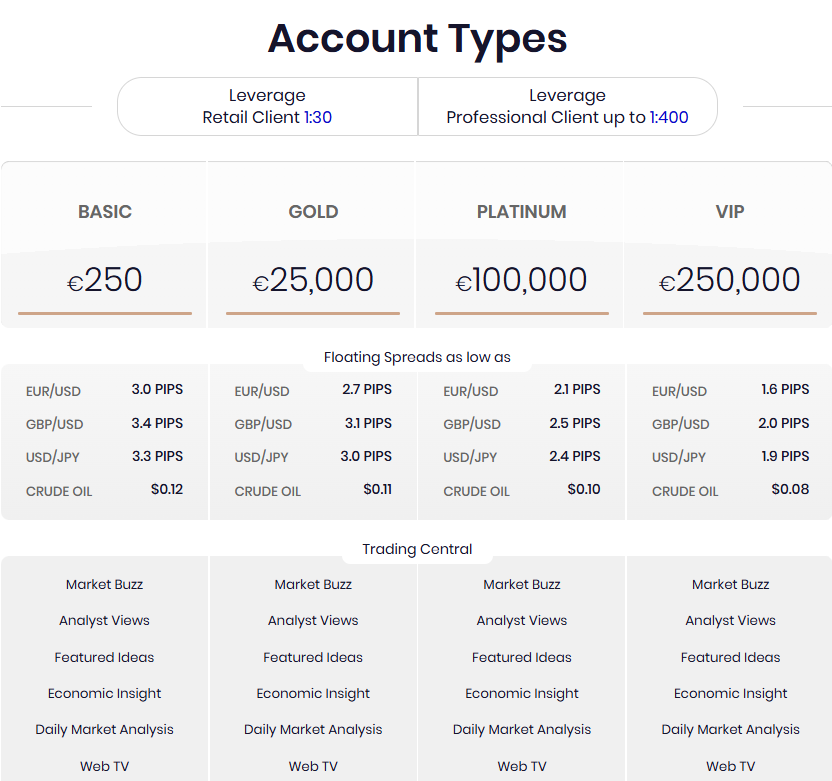

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with FXTB?

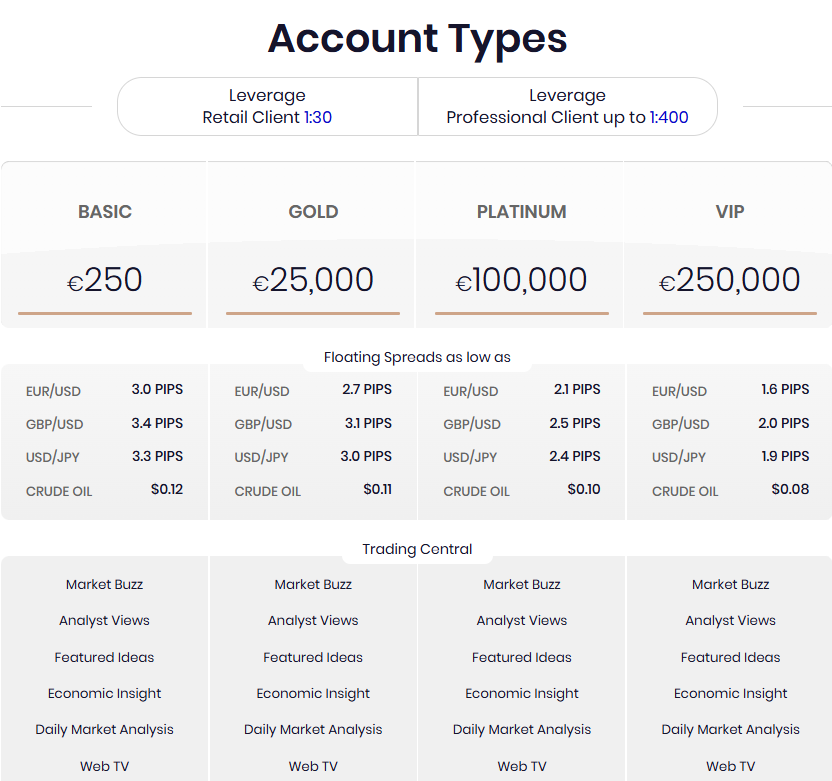

FXTB offers four account types that also define trading conditions. Each suits particular trading needs and proposes a personalized trading experience. The four account types—Basic, Gold, Platinum, and VIP—are designed for different levels of traders, from beginners to seasoned traders.

All accounts feature floating spreads that are mostly higher than the market average. The lowest spreads are available through the broker’s VIP account. The available leverage for retail traders is 1:30, while professional traders can use up to 1:400 leverage ratios.

- The Basic account requires a €250 initial deposit. The spread for the EUR/USD pair is 3.0 pips. The account type enables 1 free withdrawal.

-

The initial deposit for the Gold account is €25,000. Compared to the Basic account, the spreads are lower, starting at 2.7 pips for the EUR/USD pair. Traders can make one free withdrawal per month.

- For the Platinum account, the first deposit is €100,000. This account is more suitable for professionals and features lower spreads, with spreads from 2.1 pips for the EUR/USD pair.

- At last, the VIP account has exclusive features, enabling traders to have more advanced and unique opportunities. To start with the VIP account, traders need to make a €250,000 initial deposit. The more professional the account type is, the more favorable the conditions are, with lower spreads from 1.6 pips for the EUR/USD currency pair. For other instruments, the spreads are also considerably lower.

Regions Where FXTB is Restricted

As we have found, FXTB is available in countries within the European Economic Area. However, we have noticed certain restrictions due to regulations. Here is the list of the countries where FXTB does not offer its services:

Cost Structure and Fees

Score – 4.3/5

FXTB Brokerage Fees

FXTB fees depend mostly on the account type and trading size. We have found that trading costs are slightly higher. FXTB offers floating spreads that integrate all trading costs.

The spreads offered by FXTB are considered higher than the market average. For the Basic account, the spread for the EUR/USD pair is 3 pips. The spreads are lower depending on the size of the trade. For the VIP account, the spreads are much lower—1.6 pips.

FXTB offers only spreads for all its account types, so all trading costs are integrated into spreads. This spread-based fee structure might not appeal to traders who prefer very low spreads combined with fixed commissions for each transaction.

Our research has revealed that FXTB does not charge commissions. All the account types are spread-based, and all the costs are included in spreads.

- FXTB Rollover / Swap Fees

Always consider overnight charges or swaps when you hold the position for longer than a day. It is defined by the instrument you trade and may be visible through a website or platform while trading.

How Competitive Are FXTB Fees?

Our research of FXTB costs revealed the following: the broker offers only a spread-based structure and does not charge transaction fees. As all the fees are included in spreads, they are higher than the market average. For instance, for its Basic account, the spreads start from 3.0 pips, which is considerably higher when compared to the spreads of other brokers. Depending on the account type, the size of the trade, and the instrument traded, spreads are different. Those who choose the VIP accounts will be charged with spreads starting from 1.6 pips. Those clients who prefer a commission-based structure will not find the FXTB proposal favorable.

All this said, we find the broker’s offering transparent and clear, with no hidden fees, which is very important.

| Asset/ Pair | FXTB Spread | AvaTrade Spread | HFM Spread |

|---|

| EUR USD Spread | 3 pips | 0.9 pips | 0.6 pips |

| Crude Oil WTI Spread | $0.12 | 3 cents | 4 cents |

| Gold Spread | 102 points | $0.27 | 0.16 |

FXTB Additional Fees

The broker also charges an inactivity fee. If there are no transactions (deposits, withdrawals, etc.) on the trading account for at least one month or more, FXTB will charge a monthly inactivity fee to keep the account open. Also, FXTB enables its clients to make free withdrawals only once a month (this depends on the account type). So all the other additional withdrawals will be charged.

Trading Platforms and Tools

Score – 4.2/5

FXTB offers the MT4 platform to conduct trades. Also, clients can access Web Trader directly from the broker’s website. They can download the MT4 platform on their desktops or get the mobile version on their phones—for both iOS and Android.

| Platforms | FXTB Platforms | XM Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

FXTB Web Platform

Web Trader enables access to trading software without a need to install or program anything on the PC. Also, it means traders can access trading from any device just by logging in to their trading account through a browser, which gives great accessibility and flexibility.

However, web trading platforms are always limited in terms of customization and a range of trading tools. Of course, regarding their ease of use and easy accessibility, the web platform is great. However, those users who require access to more complex and innovative features had better go for the desktop version.

Desktop MetaTrader 4 Platform

The MetaTrader 4 desktop platform is available for download and installation on any device, including PC and MAC. The installation and specification of the MT4 allow traders customization and safety of their working layout, which is very useful. Besides, specifically, the desktop version is a great feature for professional and active traders, as it is packed with advanced tools and access to multiple strategies. The platform offers traders three separate chart types and over fifty technical indicators, which traders can personally customize.

Main Insights from Testing

Our research showed that FXTB offers access to Web Trader and the MT4 platform. The more recent and enhanced version of the MT4 platform, MT5, is unavailable. Besides, the broker does not give access to other popular platforms, such as cTrader and TradingView, which have become traders’ favorites, too. The available MT4 platform offers good features and tools, but the platform selection is still limited and might not appeal to those traders who are looking for more advanced and innovative features.

FXTB MobileTrader App

Clients can enjoy great flexibility and conduct their trades through the broker’s mobile app. It is the mobile version of the MT4 platform, with various charting capabilities, customization, and full management of the personal account. While the app is simple to use and offers a wide range of tools, it may still lack the full range of innovative features the desktop platform has. Anyway, the mobile app enables clients to conduct trades when they are not at their computers, from anywhere they wish.

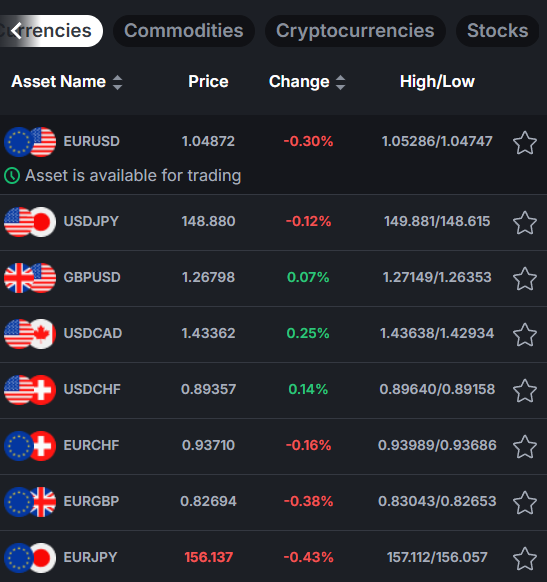

Trading Instruments

Score – 4.3/5

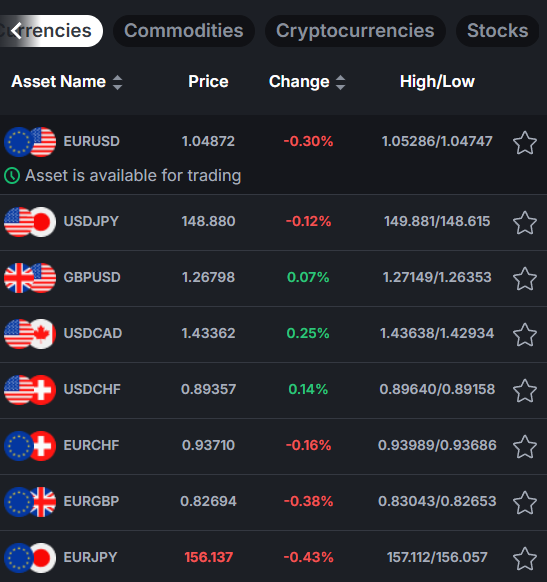

What Can You Trade on FXTB’s Platform?

The FXTB offers over 300 trading instruments to choose from. At ForexTB, you can dive into global markets and trade CFDs on Forex assets, such as EUR/USD and GBP/USD, or trade CFDs on commodities like gold, silver, and crude oil.

Moreover, you can trade CFDs on stocks of world-leading corporations such as Apple, Alphabet, and Facebook, in addition to the popular indices such as NASDAQ, S&P 500, and FTSE 100.

Main Insights from Exploring FXTB’s Tradable Assets

We explored FXTB’s available trading instruments to see what opportunities and diversification options the broker offers its clients. The range of instruments of over 300 is quite favorable, enabling traders to access the most popular and sought-after tradable products. However, this is still a modest offering if we compare it to other brokers that offer several thousand financial products.

Besides, all the available instruments are CFD-based. This eliminates the opportunity for longer-term investments and chances to own real stocks. For those traders who are more interested in expanding their portfolios, FXTB’s instruments offering might be limiting.

Leverage Options at FXTB

FXTB leverage enables traders a bigger exposure to markets. Leverage is a useful tool that allows traders to enter the market with limited capital, yet its use can lead to gains. However, retail traders may fall into high risk without proper knowledge of how to use tools smartly.

Therefore, because of the possible risks leverage entails, recent regulatory updates from the European regulators and CySEC lowered the maximum leverage levels available for retail account holders.

- The maximum leverage for retail traders is 1:30 for major currency pairs and 1:10 for commodities.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at FXTB

Another crucial factor while selecting a broker is how to transfer money to or from your trading account. Regulated brokers adhere to best practices and are controlled by their authority in terms of money management.

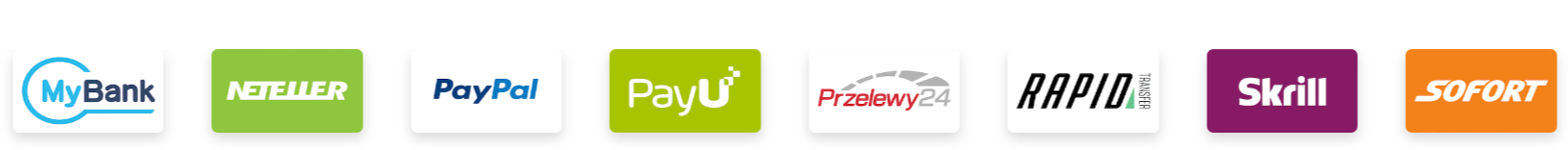

To deposit with FXTB, clients need to log in to their account and click on the Deposit button. There are multiple deposit methods to choose from:

What is also great is that there are no deposit charges; however, traders should always check with their payment provider to be sure there are no intermediary fees. Also, deposit methods can vary based on the client’s residency.

Minimum Deposit

FXTB’s minimum deposit is €250, allowing traders to open a Basic account. Higher-grade accounts will require more deposits, as they are for more experienced clients. We see that the minimum deposit is slightly above the industry average, which, based on our research, is up to $100.

Withdrawal Options at FXTB

For withdrawals, clients need to log in to their account, click on the Banking tab, and then on the Withdrawal tab. After entering the amount they wish to withdraw, they will also fill in other required information.

- FXTB withdrawal charges vary based on the account type. For VIP account holders, every withdrawal is free. Platinum account holders can make 3 withdrawals for free each month. Gold account members can make one withdrawal for free each month. Basic account holders can make one withdrawal for free, with charges each time they withdraw.

Customer Support and Responsiveness

Score – 4.4/5

Testing FXTB’s Customer Support

FXTB Customer Support assists clients through email and phone in various languages. The support team is available from 9 AM to 6 PM (GMT) on weekdays.

- The broker also has an FAQ section, where traders can find answers to the most common and general questions.

Contacts FXTB

We find FXTB customer service supportive and dedicated. The only drawback is that the broker does not provide various options for communication. The only available options are a phone line and an email.

- Traders who prefer assistance through phone can use the provided number: +357 2 222 2353.

- Clients can also send their questions and inquiries to the following email address: info@forextb.com.

- FXTB does not have a live chat, which is a negative thing, as many traders prefer to get quick answers to their problems.

Research and Education

Score – 4.6/5

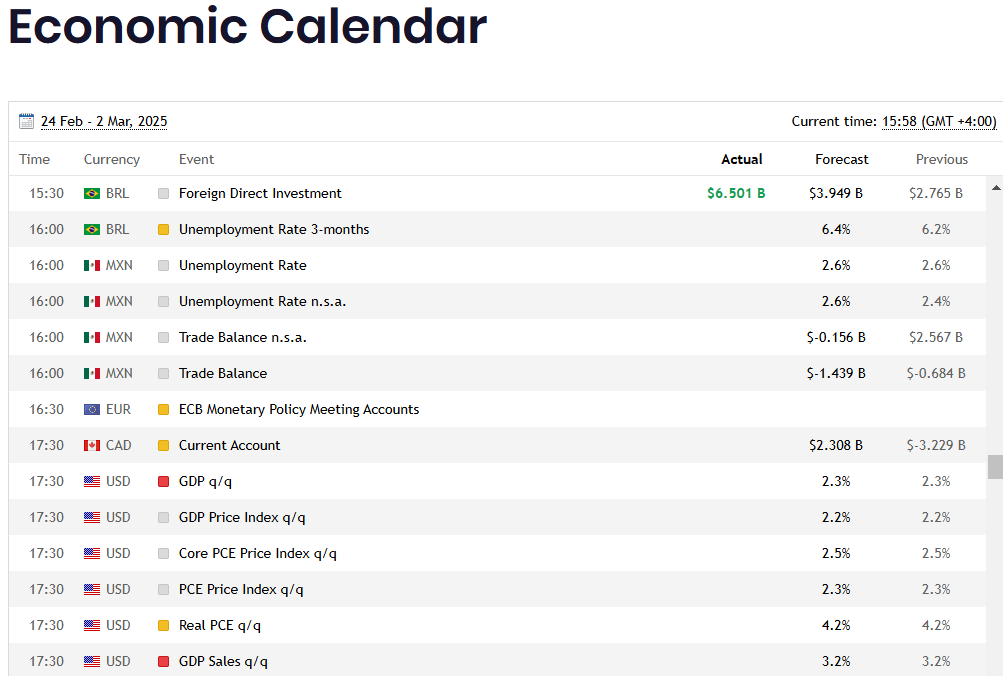

Research Tools FXTB

FXTB offers a comprehensive suite of research tools to provide traders with essential insights into the market. The MT4 platform already includes various innovative research tools that enhance the trading experience. In addition, FXTB offers the following tools available on its website:

- Technical analysis enables traders to study the market using indicators, graphs, and reports. This gives traders essential knowledge to foresee future trends and market changes.

- Fundamental analysis helps traders study different factors and events that impact the overall market. By analyzing the market data, it is possible to see how certain events can affect the market and cause serious changes. Having this knowledge beforehand helps clients make the right trading decisions.

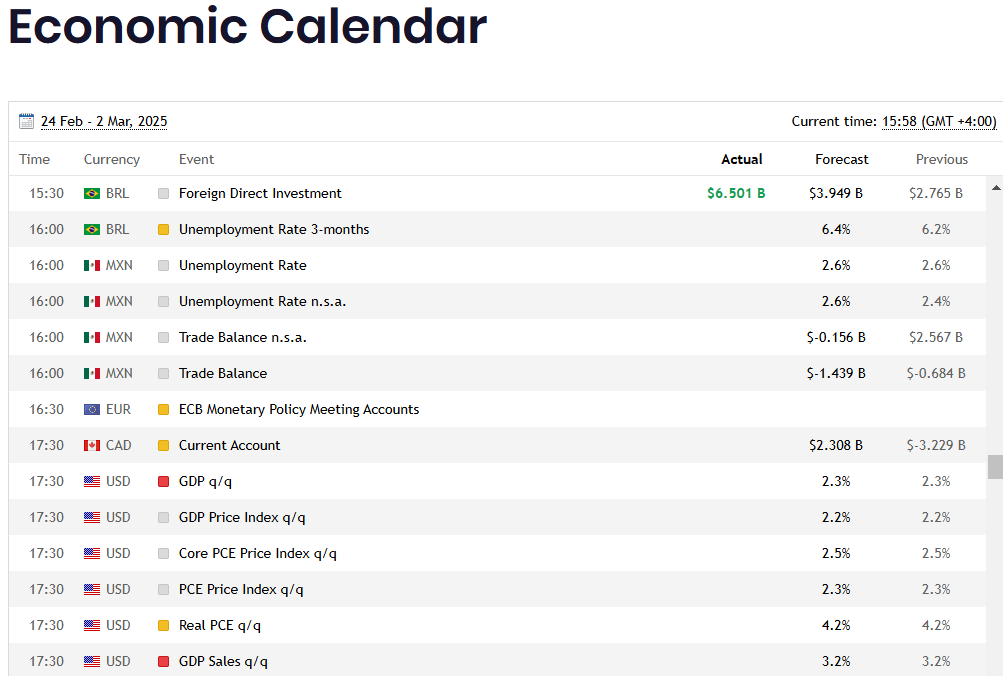

- The economic calendar is an essential tool beneficial for traders of different levels. It helps to stay informed of the major economic events, announcements of global importance, and other significant events powerful enough to impact the market.

Education

We find the FXTB education section comprehensive, including various educational materials and resources that can assist not only beginner traders but also experienced ones.

- Clients can find CFD trading tips, that will help them to navigate the market efficiently. Without the right knowledge and guidance, trading CFDs can be confusing. Thus, the broker assists traders in conducting deep research into the asset they choose to trade for a better and more productive trading outcome.

- The availability of a Glossary aids traders in learning and comprehending key concepts related to FX and trading. The new terminology that comes with forex trading can be overwhelming, especially for novice traders. Having access to a glossary can help with this.

- The eBook section is available for active users only. By logging in to their accounts, clients can access a selection of eBooks on different topics, suitable for beginners and advanced traders.

- At last, the broker offers webinars to their clients to enhance their market knowledge and help them explore the market further. The webinar list can be found on the broker’s website.

Is FXTB a good broker for beginners?

Generally, FXTB is a broker with favorable offerings and can be fit for beginners and expert traders alike. Due to its excellent research and education sections, novice traders can find good guidance and assistance. The availability of webinars, glossaries, eBooks, and trading tips can give them great market and trading knowledge to start without difficulty. However, the initial deposit is higher than the market average. The spreads are also on the higher side, which means that FXTB might not be the first choice for cost-conscious traders.

Portfolio and Investment Opportunities

Score – 3.6/5

Investment Options FXTB

Investment options with FXTB are limited. The broker offers access to over 300 instruments across different assets. However, the trading products are CFD-based, which means that traders cannot rely on long-term investments. Thus, for those looking to diversify their portfolios and invest in real stocks, FXTB is not a good choice.

- Moreover, the broker does not offer alternative options for investments. PAAM or MAM accounts are not available with FXTB. This fact further restricts traders from exploring more opportunities in the market.

- Also, copy trading, which enables beginner traders to copy the trades of professionals, is not available either.

- Thus, we recommend our readers be careful and consider well before opening an account with FXTB, as their investment opportunities will be limited to over 300 CFD-based instruments.

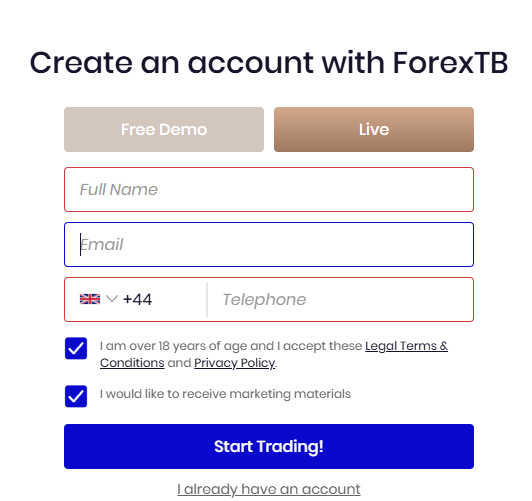

Account opening

Score – 4.4/5

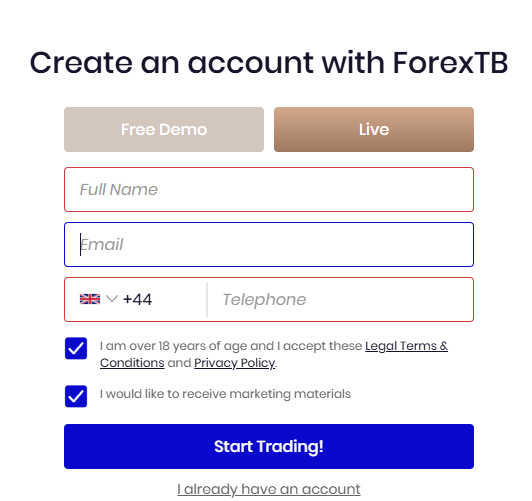

How to open an FXTB Demo Account?

Opening a demo account with FXTB takes minutes and is a quick and simple process. The demo account enables traders to access the market with virtual money, allowing them to practice without risking funds. Here are the few steps to take for a demo account opening:

- Go to the FXTB official website.

- Choose the demo account option.

- Fill out the registration form, providing your name, email address, phone number, and country of residence.

- Create a password.

- Receive the confirmation link via email and confirm it.

- Use your credentials to access your demo account.

How to open an FXTB Live account?

-

An FXTB live account gives access to a good range of financial assets, offering to engage in the market in a safe and regulated environment. Live account opening is a straightforward process. If all the documents and required information are provided, it will take only several minutes. Here is a step-by-step guide:

- Go to the broker’s website and choose a live account option.

- Provide the required personal information (name, email, country of residence, etc.).

- You will be required to create a password for your live account.

- Next, you will be asked to submit certain documents (a valid ID, bank statement, or utility bill).

- Wait until the account is approved and enter using the credentials you received via email.

- Download the MT4 platform or trade via the Web Trader.

Additional Tools and Features

Score – 3.8/5

FXTB includes advanced tools and features in its platforms that help any trader elevate the trading experience and conduct profitable trading. The broker also offers an economic calendar we discussed in the research section, an essential tool for traders to predict market changes.

Other than these mentioned features, you cannot find other additional options. However, in this regard, many brokers have a better selection. So, if you want access to more diverse features, FXTB might not meet your expectations.

FXTB Compared to Other Brokers

At the end of the review, we compare the broker to other good-standing brokers we have already researched. We first compare the broker’s regulation status to others to determine its reliability. In this regard, FXTB is a tightly regulated broker by CySEC. Yet, many brokers, including Pepperstone, Fortrade, and Forex.com, hold multiple top-tier licenses, ensuring double or triple protection.

As for the fee structure, FXTB offers only spread-based accounts, with average spreads starting at 3.0 pips. Fortrade also has a spread-based structure, and its spreads are lower, starting at 2.0 pips. We also found that while FXTB offers the MT4 platform and Web Trader, other brokers like Pepperstone and RoboForex offer additional platforms, offering a better variety.

Our research showed that FXTB’s research and education sections are better than what we can find with TriumphFX or Forex.com. The instrument range is also better than TriumphFX’s 64 tradable products, yet TMGM and RoboForex offer +12,000 trading products across different assets.

| Parameter |

FXTB |

Pepperstone |

RoboForex |

TriumphFX |

TMGM |

Forex.com |

Fortrade |

| Spread Based Account |

Average 3 pips |

From 1 pip |

Average 1.3 pip |

Average 0.6 pip |

Average 1 pips |

From 0.8 Pips |

Average 2 pip |

| Commission Based Account |

No commission |

0.0 pips + $3.5 |

0.0 pips + $4 |

Not available |

0.0 pips + $3.5 |

0.0 pips + $5 |

No commission |

| Fees Ranking |

Average |

Low/Average |

Average |

Average |

Average |

Average |

Average |

| Trading Platforms |

MT4,Web Trader |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4 |

MT4,MT5, TGM app |

MT4, MT5, Forex.com Platform |

Fortrader Platform, MT4 |

| Asset Variety |

300+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

64+ instruments |

12,000+ instruments |

500+ instruments |

300+ instruments |

| Regulation |

CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

CySEC, FSC, FSA |

ASIC, FMA, VFSC, FSC |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

| Customer Support |

24/7 support |

24/7 |

24/7 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent education and research |

Good |

Good |

Excellent |

Good |

Good |

| Minimum Deposit |

€250 |

$0 |

$10 |

$100 |

$100 |

$100 |

$100 |

Full Review of Broker FXTB

Based on our research and the information we revealed about FXTB, this is a good-standing broker in the market, with a solid foundation and years of experience. It offers quality services with access to currencies and CFDs, an advanced platform with great research tools. Its strict regulation by CySEC, following MiFID guidelines, ensures a transparent and trustworthy trading environment. With access to the broker’s MT4 platform and Web Trader, clients can use various learning materials. The availability of several account types provides almost personalized trading conditions.

However, there are also aspects clients need to consider before opening an account with the broker. FXTB’s product offering is limited to Forex and CFDs, and its spreads are higher compared to other brokers. For some traders, these mentioned points are a huge drawback. Anyway, the advanced features, regulatory oversight, and dedicated customer support make FXTB a recommended option for traders.

Share this article [addtoany url="https://55brokers.com/fxtb-review/" title="FXTB"]

It is very convenient to read such reviews about ForexTB broker, which have all the necessary information about trading conditions, regulation, pros and cons, as well as about the withdrawal of money. Yes, the guys have a goal to attract clients, but not by pushing through and empty exorbitant promises, but by real comprehensive service and opportunities, it is seen both in terms of their application work, the speed of order execution, and the work of the technical support service. You can see that the broker is developing and not standing still.

I have been trading here not very long ago, but I really like it. I traded on a demo account and opened a live account a week ago. Broker ForexTB has good analytical resources for Trading Central and Market Buzz. Tell me, who uses it? Are there any results?

I can say that this brokerage company can be even ideal for many brokers if we don’t consider some downsides of this brokerage company. Let’s start with advantages of this broker.

First, it’s regulated by cySEC – a well-known watchdog. So, it means that this company can’t be a scam and it’s the number one news for those seeking reliability in trading. Secondly, the broker is good for those who trade various assets intensively throughout the day because the choice of financial instruments is quite impressive here, while execution is fast and hassle-free as a direct consequence of regulation.

On the other hand, one can’t make the most of the broker after registration because all newly-registered traders are granted a retail status that suggests trading with 1:30 leverage. To trade with 1:400 leverage, the broker’s clients should reach a certain trading turnover. Such a division of clients into retail and professional can be unacceptable for many traders, especially those trade currencies, but on the other hand, some liquid assets, including cryptos and metals don’t require high leverage and it means that it’s possible to trade with this broker profitably being a retail client.

“Dear Aristides

Thank you for your honest feedback and for taking the time to submit your review!”

I have been trading with ForexTB for quite a long time. A lot of new instruments have appeared there. Cryptocurrency is also here. The conditions for it are not worse than other brokers. The technical support works on 5 points. They answer all the queries quickly and very competently, etc. I don’t have a problem with withdrawals, yet. I never saw any delays in withdrawal process.

Thanks for the article with the review of the broker. I would add European geolocation and focus on European traders among the advantages. The only disadvantages of the broker I can mention is not very small spreads, but the advantages of the broker outweigh all the disadvantages.

“Dear Marijn

Thank you for your honest feedback and for taking the time to submit your review!

I trade metals and cryptos with this broker now. I would like to trade major currency pairs too but I think it will become possible in a year or so. It’s because my trading account has a retail status and I can trade currency pairs with 1:30 leverage only. To get 1:400, I need to upgrade to Professional. To do this, I’m expected to demonstrate a very high trading activity and reach a trading turnover set by the broker. I think that the broker did wise by splitting their clients into retail and professionals. It somewhat protects newbies from big losses. I’m interested in trading currencies with 1:400 leverage and I hope to upgrade my account to Professional in a year. However, even with 1:30 leverage it’s possible to earn. You just stick with liquid assets such as cryptos and metals. That’s what I do now. It’s more interesting for me to trade cryptos and metals than currencies, but I need extra income and that’s the reason I want to upgrade my account.

“Dear Marcos

Thank you so much for taking the time to share your experience at Forextb. Please do not hesitate to contact us to our support email support-forextb@forextb.com for any assistance you may need.”

I think that this brokerage company has the only one downside. You can’t trade with higher leverage if you are a retail client. In this case, you can count on 1:30 and no more. To trade with 1:400 you need to become a professional client that suggests reaching a certain trading turnover.

In other regards, this broker is very advantageous. First, it’s regulated by cySEC that automatically excludes any fraud activity on the part of the broker. Secondly, it offers a very good choice of financial instruments. I especially appreciate the choice of cryptos and indices.

By the way, you don’t need high leverage to trade cryptos and metals because these assets are already very liquid, so you can earn on them well being a retail client. It makes sense to opt for the professional status if you intend to trade currencies. In this case, you will learn more with 1:400.

Dear Jari

Thank you for your honest feedback! We are very happy to hear that our services are useful for you!”

Interesting company. I think so because this is the first time I see such a service. ForexTB is my first broker. I read the reviews and realized that this broker can be trusted. I think the main thing is the legality and honesty of the company. If I make a deposit and trade in the financial market, then I must be confident that everything is fine.

I recently opened a real account and will be withdrawing money for the first time. I haven’t done this before.

Tell me what problems may arise if I withdraw money to the card. Or is everything happening fast?

Dear Stanislaw

Thank you for your positive feedback and for keeping us posted! Please do not hesitate to contact us to our support email support-forextb@forextb.com for any assistance you may need.

I had no problem with withdrawing money from ForexTB. As for the speed, it all depends on the method of withdrawing money. For example, if I withdraw money to a card, it can take 1-3 days. If it is an e-wallet, then 24 hours or less.

“Dear Charles

Thank you for taking the time to leave your personal review for ForexTb. Its much appreciated!”

The conditions offered by the broker are relatively good – take into account that the broker is focused more on the European countries, the economy of which is more developed than in other regions. The trading conditions are profitable for the Europeans, the company’s accreditation is reliable and the insurance of the client’s funds is also at a high level. The broker is especially suited for beginner traders from Europe: small leverage is more of a plus for them than a minus. Less leverage means less losses. By European standards the broker is worthy. I like that the registration is done responsibly. It proves the seriousness of the company. For me the minimal deposit is reasonable and allows to apply to everyone.

ForexTB reviews have a lot of positive information in various sources. I will tell you about my own experience. I opened an account at ForexTB a year ago. I cannot say that there are no problems at all. But even taking into account the problems I have a lot more pluses. I am working on MT4 platform. Even the withdrawal fee is very acceptable in comparison with many companies.

Dear Kevin

We are very happy to read that you are satisfied with our services. Thank you for keeping us posted and for choosing us as your trusted broker! Please do not hesitate to contact us at our support email support-forextb@forextb.com for any assistance you might need in the future.

In simple terms this broker is not for scalpers because it doesn’t offer tight spreads. Another thing that you may not like here is that it to trade with best possible trading conditions, you are expected to upgrade your account to “Professional”. To do this, you need to trade a lot, thus reaching a certain turnover. As a result, you can trade with 1:400 leverage and count on negative balance protection.

However, not every trader needs a professional status. As for me, I trade stocks here with a retail status and 1:30 leverage suits me. Moreover, you don’t need higher leverage when trading liquid assets, including metals and cryptos.

Dear Gonzalo

Thanks so much for your detailed review and for giving us your take on how our Brand is operating. We ‘re glad that customers like you are enjoying trading with ForexTB.

Earlier I would hardly join this broker because at that time I didn’t appreciate wide spreads and withdrawal fees. I practiced scalping and assessed brokers accordingly. Over time I realized that long-term trading was more beneficial and shifted to it. By the time I found this broker regulation was the only thing I took into account when evaluating brokers. This cySEC regulated broker certainly meets this requirement, so it’s normal in my eyes.

Dear Liam

We are very happy to hear that you are satisfied with our Brand. Thank you for keeping us posted and for the positive review!

I have recently joined your company. I like the execution, which is a direct consequence of regulation and a very user-friendly platform Webtrader. Perhaps, in a couple of weeks I’m going to make my first withdrawal, so I have a corresponding question. How long does it take to withdraw money using bank transfer?

within a week

I am working with ForexTB recently. I can’t specifically say anything good or bad about this broker. It seems to be a good forex broker, with its pros and cons. I have not noticed any special problems. What I like is the customer service, the support guys are very responsive, they work well, help if necessary. I have already withdrawn a couple of times, so this point has already been checked. If something changes, I will write another review.

Dear Per,

Thank you for taking the time to leave us this positive review. We appreciate you sharing your opinion!

I believe that the ForexTB broker earns the money we pay for commissions and spreads. The thing is that the brokerage’s services are full of supportive measures for traders. The wide range of choices for assets, trading signals, customer support, reliable platform and many other features are more than enough to arrange a stable and growing source of income in trading in the financial markets.

I would highlight the TC Market Buzz app. It delivers so many materials to analyse on a daily basis. I was able to choose a couple of hot assets to catch strong trends. Nice app.

I made up my mind to use this broker to trade stocks. I find it very suitable for this role and I can explain why I stuck with this brokerage company.

You know that stock trading is long-term trading. I can’t imagine stock scalping. It doesn’t make sense. So, when people buy stocks they plan to hold their trades for a long time. Some traders hold their stocks for years. If you take a look at the charts of well-known tech giants, you will see a never-ending uptrend. Yeah, God blessed those folks who managed to buy those stocks at the bottom. They are pretty happy now.

However, for the last time a slew of new promising companies appeared and we can be among the first buyers of their stocks.

When holding trades for a long time, it’s crucial to deal with a regulated company. ForexTB is cySEC regulated. I learned about from ForexTB reviews. Once I came to their site I liked their Webtrader. It’s very suitable for stock trading because it allows to conveniently navigate through assets in the left menu.

Dear Daniel,

Thank you for your positive feedback and for keeping us posted! Please keep our support email support-forextb@forextb.com for future use and feel free to contact us for any queries or issues you may come across.

Thank you for the great information. I now understand why there are so many good ForexTB reviews on the internet. I understand that it is hard for people to trust their money. Especially if it’s new. I didn’t understand anything about Forex trading before and now I have some information. I understand that for trading you need to be able to use indicators and also be able to analyze news. When I read this ForexTB review, I realized that there is a MetaTrader 4 trading platform. I am familiar with this software. I know that this is exactly what a professional trader needs. I want to become a professional trader and I think that I will succeed with this broker!

Dear Roland,

In order to increase your trading knowledge, our inclusive Education section offers traders of all levels, beginners to professionals, a variety of educational materials, which include: analysis, reports, guidelines and new features by Trading Central. Please do not hesitate to contact us at our email support-forextb@forextb.com for any assistance you may need in a future

SCAM BROKER ! WHEN IN POSITION ON PLATFORM FXTB IN PROFIT YOU CANT CLOSE POSITION,

IT SAY NO QUOTES ! WHEN YOU ARE IN LOSS YOU CAN GET OUT OF POSITION YUST LIKE THAT,

MAGIC !

MARKET MAKER, STOP ORDERS HIT 80 PIPS BEFORE ! SO I REALLY LIKE TO SEE MIFID II

PICTURE ON WEBSITE REGULATION ! MAGIC !

Dear Simon, We are very sorry to read this. Forex TB Limited is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission with CIF license number 272/15. Please share your experience by sending an email to our customer support (support-forextb@forextb.com) which works 24/5 and our professional team will assist you as soon as possible.

Thank you!

Je je go shine your suppor,and assist yoour mama with your magic stick !

I saw a lot of advertisements in the Internet for Forex brokers. For some reason I liked ForexTB and decided to open a demo account here. I just wanted to practice and learn new things. I liked working with ForexTB MT4. There were a lot of indicators to analyze and it was easy to open orders. I started to think about opening a real ForexTB account. Minimal deposit is 250 euro, so I can do it. But… I’m a little worried. Can I trust this broker? Is there some kind of license and control here?

Dear Fabio,

Thank you for choosing us as your trusted Broker. Forex TB Limited is a Cypriot investment firm authorized and regulated by the Cyprus Securities and Exchange Commission under CIF license number 272/15. If you have a problem with us, we’d love to contact us at support-forextb@forextb.com

Greetings to all! I have 4 years of ForexTB trading behind me. Despite all the shake-ups in the market, my account is alive and well, which is no small merit of the broker. Actually, that’s why I decided to leave this review. In general, it should be noted that ForexTB has developed in order during this time. There is more freedom, it is immediately felt. Yes, I myself have revised my system in many respects, I have changed a lot of things. For example, he added a comparison of his forecasts before entering the market with signals from their analytical portal. This mixture gave excellent results. If the signals matched, I would open.

There are daily signals, market news, and an education center.

I think that 21 years will be no less successful than the last one. The broker is really good, and the rest depends on the trader.

Dear Fabrizio,

Thank you for taking the time to leave us this positive review. We appreciate you sharing your experience with us and hope that you continue enjoying trading with ForexTB. Always we are aiming to improve our services with the best choice for our clients.

Thank you for choosing us as your trusted broker!

Dear Mason

Thank you so much for leaving such a positive review! We’re always happy to help and really appreciate the time you took to write this review.