- What is FXNovus?

- FXNovus Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

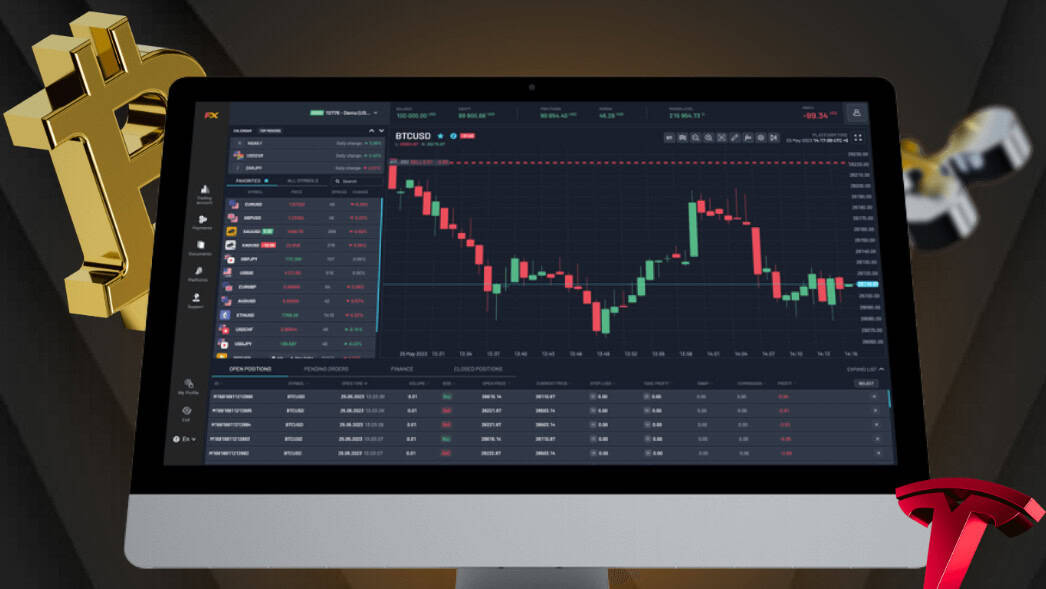

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- FXNovus Compared to Other Brokers

- Full Review of Broker FXNovus

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is FXNovus?

FXNovus is a South African Forex trading broker, offering a range of CFD instruments across Forex, commodities, indices, shares, cryptocurrencies, and metals through its proprietary platform. Founded in 2020, the firm provides leverage of up to 1:400, tiered account options starting from a $250 minimum deposit, and commission-free trading across multiple asset classes.

The company is regulated by the Financial Sector Conduct Authority of South Africa, ensuring compliance with global financial standards, protecting client funds, and promoting fair trading practices.

For its European clients, FXNovus is licensed and supervised by the Cyprus Securities and Exchange Commission, a well-recognized regulatory authority within the EU that enforces strict operational, transparency, and investor protection rules under MiFID II.

Its proprietary platform offers advanced charting tools, real-time market data, and one-click execution, designed to meet the needs of traders at all levels.

FXNovus Pros and Cons

FXNovus offers a range of advantages, including regulation by both the FSCA in South Africa and CySEC in the European Union, providing strong oversight and investor protection across its markets.

Traders benefit from a proprietary platform equipped with advanced charting tools, real-time data, and one-click execution, as well as access to multiple asset classes.

For the cons, FXNovus does not support popular third-party platforms like MT4 or MT5, offers relatively higher spreads compared to some competitors, and lacks social or copy trading features for those who prefer automated or community-driven strategies.

| Advantages | Disadvantages |

|---|

| CySEC and FSCA regulation and oversee | Conditions vary based on the entity |

| Competitive trading conditions | Relatively new to the market |

| Forex and CFD trading | Not available worldwide |

| Suitable for beginners and professionals | |

| African and European traders | |

| Client protection | |

| Diverse account types | |

| Good learning and research materials | |

| 24/7 customer support | |

FXNovus Features

FXNovus provides traders with a comprehensive set of features designed to enhance the trading experience across global markets. The broker offers access to multiple asset classes, all available through its intuitive proprietary platform. Below is a comprehensive list of its main features:

FXNovus Features in 10 Points

| 🏢 Regulation | FSCA, CySEC |

| 🗺️ Account Types | Classic, Silver, Gold, Platinum, VIP Accounts |

| 🖥 Trading Platforms | Webtrader, Trading App |

| 📉 Trading Instruments | Forex, Commodities, Indices, Shares, Cryptocurrencies, Metals |

| 💳 Minimum Deposit | $250 |

| 💰 Average EUR/USD Spread | 2.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, CHF |

| 📚 Trading Education | Education Center, Trading Courses |

| ☎ Customer Support | 24/7 |

Who is FXNovus For?

FXNovus is suited for traders seeking a regulated broker with access to diverse global markets and a user-friendly proprietary platform. According to our findings, the broker is Good for:

- Beginners

- Professional traders

- South African and European traders

- Currency trading

- Good trading strategies

- Swap-free trading

- Competitive trading conditions

- Good research and learning materials

- CFD trading

FXNovus Summary

Overall, FXNovus is a regulated brokerage, providing traders with access to a broad selection of CFD instruments across global markets. The company operates under the oversight of the FSCA in South Africa for its international services and holds a license from the European CySEC to serve clients within the European Union.

Its proprietary platform is designed to deliver a seamless trading experience, featuring advanced charting tools, technical indicators, real-time market data, and one-click order execution.

FXNovus supports a variety of account types starting from a $250 minimum deposit, offers commission-free trading, and provides leverage of up to 1:400 to accommodate a wide range of strategies. With 24/7 customer support and good learning materials, the broker caters to both novice traders looking to learn the markets and experienced traders seeking efficient execution and a secure trading environment.

55Brokers Professional Insights

FXNovus stands out through its combination of strong regulatory credentials, diverse market access, and a proprietary platform tailored for modern traders. Being regulated by the FSCA for international operations and licensed by CySEC for European clients gives the broker a dual-layer of credibility and compliance, good for traders either from Africa region, SA or Europeans alike.

Its proprietary platform offers a streamlined yet powerful interface with advanced charting capabilities, integrated technical analysis tools, and fast execution speeds, overall, trading performance is quite smooth, providing quality capabilitites good for almost any strategy. However, there are no commission accounts; all costs are spread based, also some quotes we find are slightly higher than the average of the industry. With commission-free trading and a tiered account structure designed for different experience levels, FXNovus combines accessibility with professional-grade features, making it a compelling choice for traders who value both security and performance.

Consider Trading with FXNovus If:

| FXNovus is an excellent Broker for: | - Need a well-regulated broker.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:400.

- Offering a range of popular trading instruments.

- Secure trading environment.

- Offering a variety of account types.

- Currency trading.

- Providing competitive trading conditions.

- European trading.

- African traders.

- Need good learning materials.

|

Avoid Trading with FXNovus If:

| FXNovus might not be the best for: | - Need a broker with a Top-Tier license.

- Looking for broker with access to VPS Hosting.

- Prefer MAM/PAMM trading.

- Get access to MT4, MT5, and cTrader platforms. |

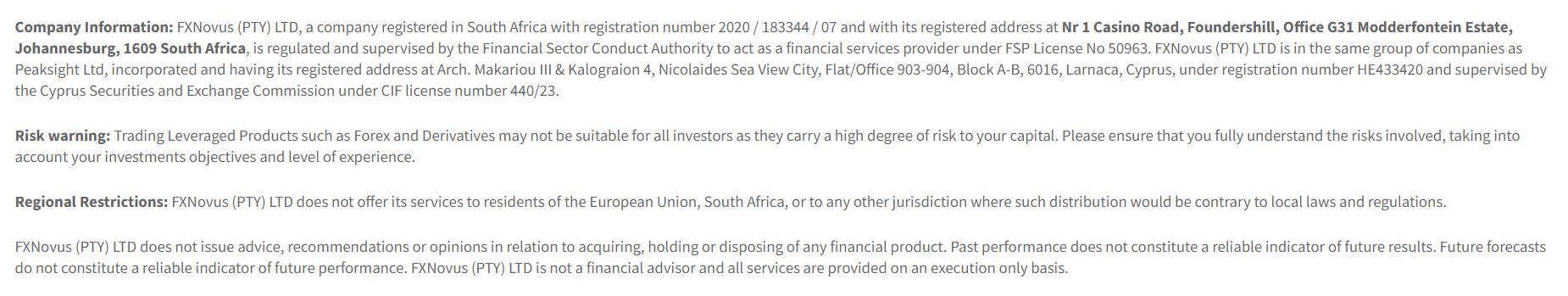

Regulation and Security Measures

Score – 4.5/5

FXNovus Regulatory Overview

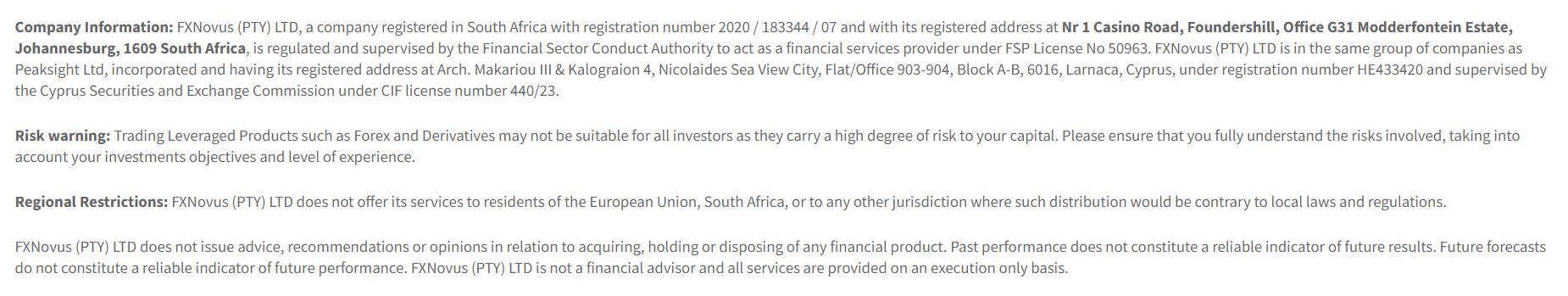

FXNovus operates under a robust regulatory framework, ensuring transparency, compliance, and client fund protection across its markets. The broker is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, which oversees its international operations and enforces strict financial conduct and operational standards.

For its European client base, the broker is licensed and supervised by the Cyprus Securities and Exchange Commission (CySEC), a leading regulatory body within the European Union that implements stringent requirements under the MiFID II directive.

How Safe is Trading with FXNovus?

Trading with FXNovus is considered relatively safe due to its regulation by the FSCA in South Africa and CySEC in Europe, both of which enforce strict compliance, operational transparency, and client fund protection measures.

The broker follows regulatory requirements such as segregating client funds from company assets and operating under internationally recognized financial standards, providing traders with added security and peace of mind.

Consistency and Clarity

FXNovus has built a growing reputation since its establishment in 2020, supported by its dual regulation under the FSCA and CySEC, which reinforces its credibility in both international and European markets.

Trader reviews often highlight the broker’s user-friendly proprietary platform, diverse market offering, and commission-free trading as strong advantages, while some note the absence of MT4 and MT5 and wider spreads on certain accounts as areas for improvement.

The broker’s transparency, operational consistency, and regulatory adherence contribute positively to its image within the trading community. Although relatively new compared to long-standing industry players, FXNovus has been steadily increasing its visibility through active engagement on social media, educational outreach, and participation in industry events.

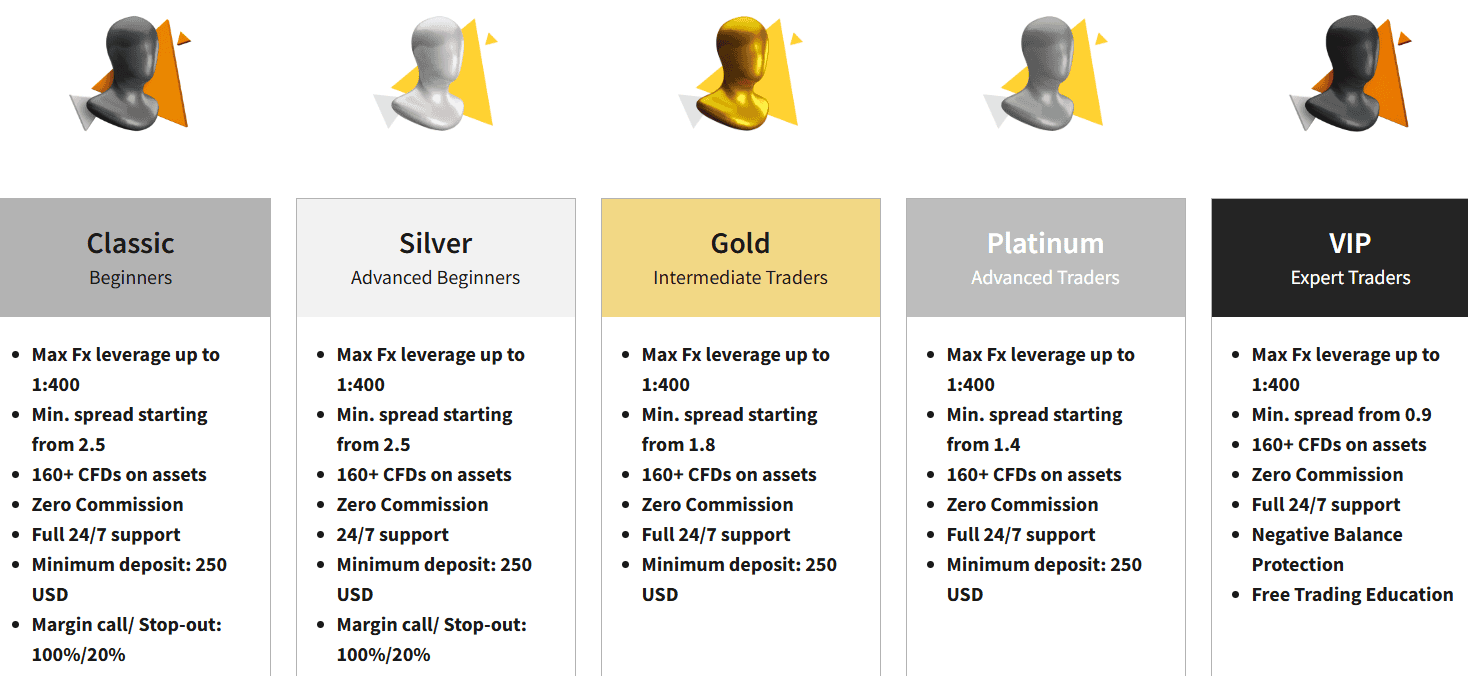

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with FXNovus?

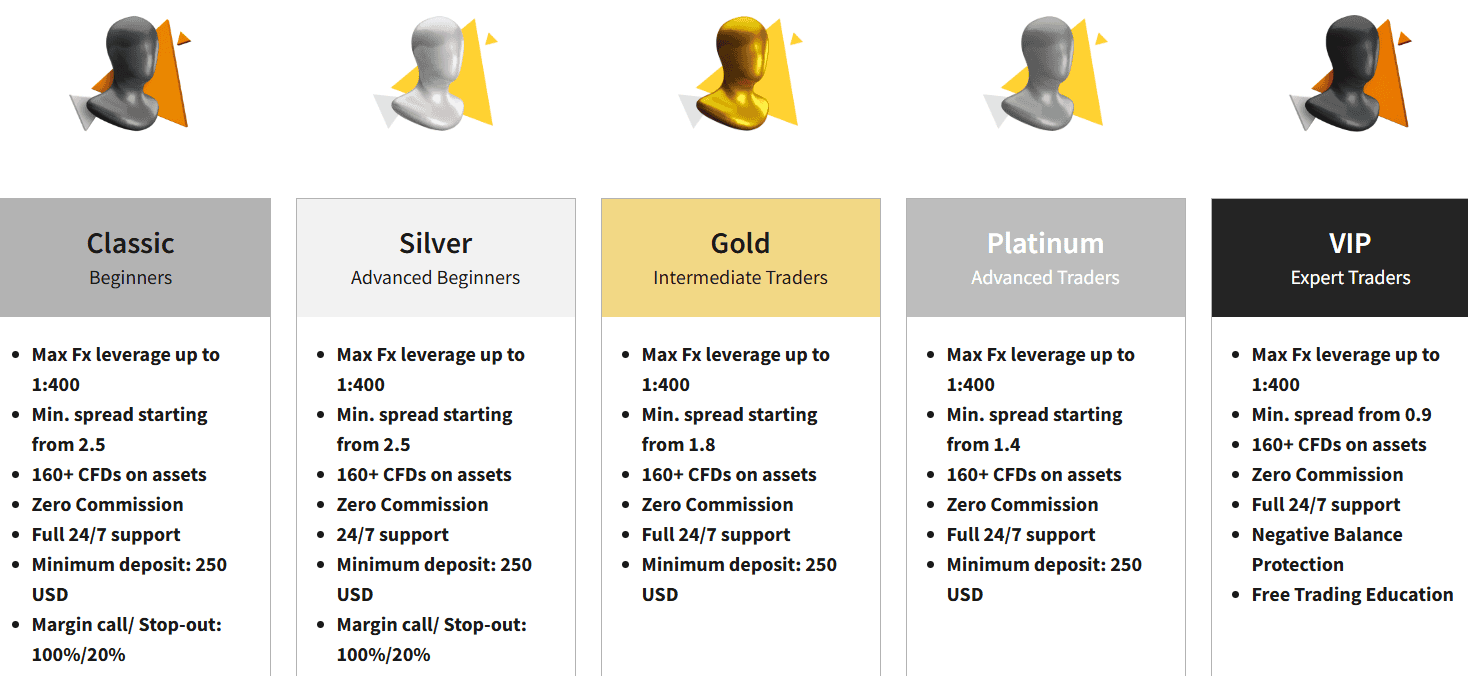

FXNovus offers a tiered account structure designed to suit different trading needs and experience levels, including Classic, Silver, Gold, Platinum, and VIP accounts. Each account provides varying spreads and added benefits, with higher-level accounts offering more competitive conditions and tailored services.

The Classic account serves as the entry-level option, while the VIP account caters to high-volume and professional traders seeking premium features.

In addition to these live accounts, the broker provides a swap-free account option for traders who wish to comply with Sharia principles, as well as a demo account with virtual funds for practice and strategy testing without risking real capital.

Classic Account

The Classic Account with FXNovus is an entry-level option for traders seeking accessible market entry and straightforward trading conditions.

With a minimum deposit of $250, it offers commission-free trading across multiple asset classes. Spreads for major currency pairs such as EUR/USD start from 2.5 pips, providing a transparent cost structure for beginner and casual traders.

The account supports leverage of up to 1:400, enabling flexible position sizing, and is available with a swap-free option for traders adhering to Islamic finance principles.

Regions Where FXNovus is Restricted

FXNovus does not offer its services in certain jurisdictions due to regulatory restrictions and compliance requirements. Excluded countries include:

- USA

- Canada

- Japan, and more.

Cost Structure and Fees

Score – 4.5/5

FXNovus Brokerage Fees

FXNovus maintains a competitive and transparent fee structure, primarily operating on a spread-only model with no added commissions across all account types.

Spreads vary depending on the chosen account type, starting from around 2.5 pips on the Classic account and narrowing to as low as 0.9 pips on the VIP account.

The broker does not charge deposit fees; however, withdrawal fees may vary depending on the payment method used. Traders should also be aware of potential overnight swap charges for positions held open beyond the trading day, unless using a swap-free account.

FXNovus offers variable spreads across its account structure. On the Classic Account, the average EUR/USD spread is 2.5 pips, providing a simple and transparent cost setup for entry-level traders.

Higher-tier accounts, such as Gold, Platinum, and VIP, offer tighter spreads, reaching as low as 0.9 pips for premium clients, allowing for more cost-efficient trading, particularly for high-frequency strategies.

FXNovus does not charge commissions on any of its trading instruments. All costs are incorporated into the spreads, which vary depending on the account type.

FXNovus applies overnight rollover fees on positions held open past the trading day. These charges vary depending on the instrument and market conditions and can be either positive or negative.

How Competitive Are FXNovus Fees?

FXNovus maintains a competitive fee structure by keeping costs simple and transparent. This approach allows traders to clearly understand their expenses and focus on market strategies without unexpected fees.

Overall, the broker’s pricing model positions it as an accessible and cost-efficient option for a wide range of traders.

| Asset/ Pair | FXNovus Spread | IFX Brokers Spread | Earn Spread |

|---|

| EUR USD Spread | 2.5 pips | 1.3 pips | 0.1 pips |

| Crude Oil WTI Spread | 2.8 | 0.03 | 0.027 |

| Gold Spread | 1.4 | 1 | 0.150 |

| BTC USD Spread | 396 | 2.7 | 13.13 |

FXNovus Additional Fees

In addition to spreads, FXNovus applies certain fees, such as overnight swap charges for positions held beyond the standard trading day.

Other potential costs include withdrawal fees, which depend on the chosen payment method, while deposits are typically free. Overall, these additional fees are standard within the industry and are disclosed, allowing traders to plan and manage their expenses effectively.

Trading Platforms and Tools

Score – 4.4/5

FXNovus provides traders with a proprietary WebTrader platform and a mobile app, both designed for seamless and efficient trading across multiple devices.

These platforms feature real-time market data, advanced charting tools, technical indicators, and one-click order execution, allowing traders to monitor and manage positions effectively.

Trading Platform Comparison to Other Brokers:

| Platforms | FXNovus Platforms | IFX Brokers Platforms | Earn Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

FXNovus Web Platform

FXNovus Webtrader platform is a browser-based solution that allows traders to access global markets without the need to download any software.

It offers a user-friendly interface with real-time market data, advanced charting tools, and a range of technical indicators to support in-depth market analysis.

The platform also features one-click order execution, customizable layouts, and secure account management, suitable for both beginner and experienced traders who prefer trading directly from their web browser.

Main Insights from Testing

Testing the broker’s webtrader highlights its efficient performance and practical functionality for daily trading. The platform loads quickly, provides accurate pricing, and allows traders to execute orders seamlessly.

Its built-in tools for charting and analysis are straightforward, helping users make informed decisions without unnecessary complexity. Overall, the Webtrader delivers a reliable and accessible environment suitable for a wide range of traders.

FXNovus Desktop MetaTrader 4 Platform

FXNovus does not offer the MetaTrader 4 platform for desktop trading, instead relying on its proprietary webtrader and mobile platforms to provide a complete trading experience.

FXNovus Desktop MetaTrader 5 Platform

Similarly, the broker does not provide the MetaTrader 5 platform, focusing instead on its proprietary solutions.

FXNovus MobileTrader App

The broker’s mobile app allows traders to access the markets on the go, providing a full-featured trading experience from smartphones and tablets.

The app mirrors much of the functionality of the web platform, including real-time market data, advanced charting tools, technical indicators, and one-click order execution. With an intuitive interface and secure login, the Mobile App enables users to monitor positions, manage accounts, and execute trades efficiently from anywhere.

AI Trading

FXNovus does not currently offer AI-powered tools or automated trading systems on its platform. The broker provides a proprietary webtrader and mobile app, which include a range of analytical tools and indicators to assist traders in making informed decisions.

However, these tools require manual input and do not feature automated capabilities. Traders seeking AI-driven solutions or algorithmic trading features may need to explore other platforms that support such technologies.

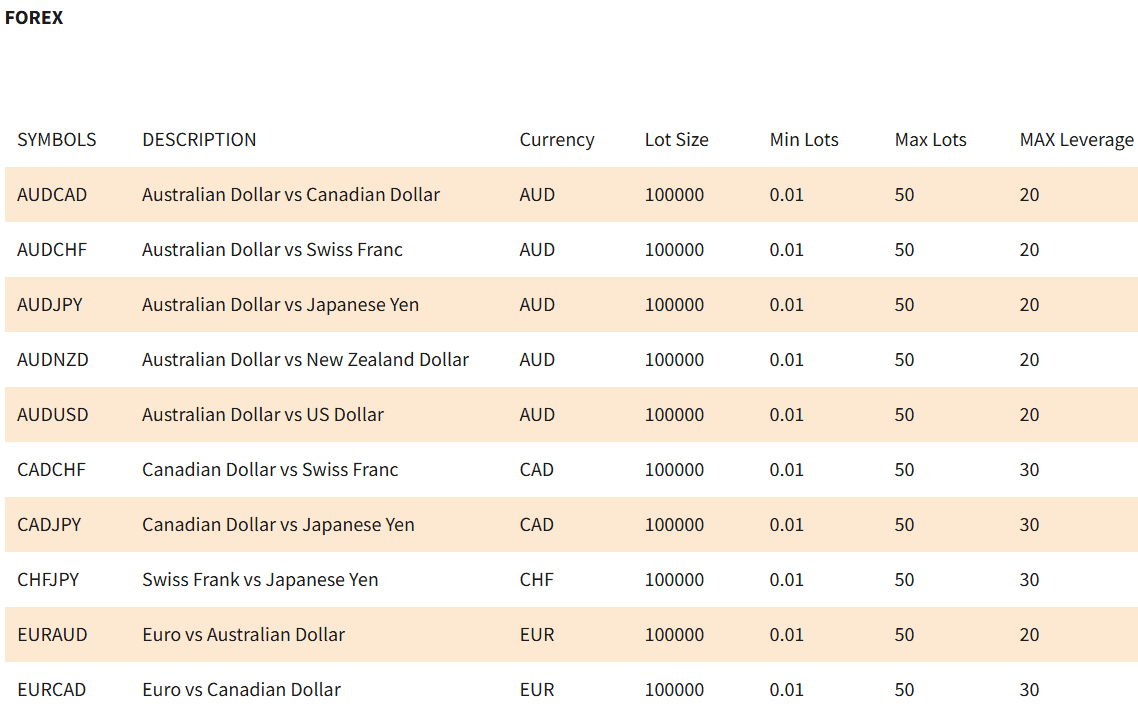

Trading Instruments

Score – 4.5/5

What Can You Trade on FXNovus’s Platform?

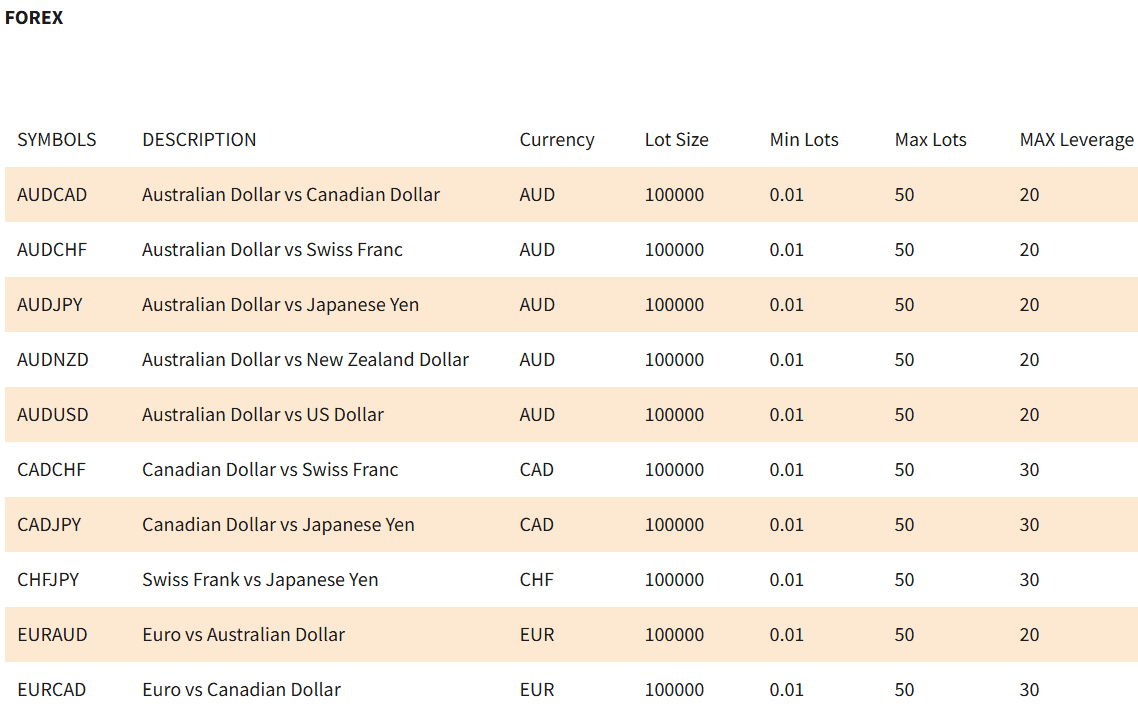

On FXNovus’s platform, traders can access over 160 CFD instruments across multiple asset classes. This includes currency pairs, commodities, global indices, shares, cryptocurrencies, and metals, allowing for diversified strategies within a single account.

The platform provides real-time pricing, charting tools, and technical indicators for all instruments, enabling traders to analyze markets effectively and execute trades efficiently.

Main Insights from Exploring FXNovus’s Tradable Assets

Exploring FXNovus’s tradable assets highlights the broker’s diverse market coverage and flexibility for different trading strategies. Users can quickly access a variety of instruments, monitor price movements, and execute trades with ease.

Leverage Options at FXNovus

Trading with leverage can be advantageous, as it allows traders to access the market with a smaller initial investment. However, you should have a thorough understanding of how the multiplier works and the potential risks involved before engaging in leveraged trading.

- Trades from South Africa and Europe are eligible to use low leverage up to 1:30 for major currency pairs.

- However, the website states the maximum leverage is 1:400.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at FXNovus

FXNovus provides traders with a few convenient deposit options to fund their accounts quickly and securely, including:

FXNovus Minimum Deposit

The minimum deposit to open an account with FXNovus is $250, making it accessible for both beginner and intermediate traders.

Withdrawal Options at FXNovus

FXNovus offers a variety of withdrawal options to provide flexibility and convenience for its clients. Traders can request withdrawals via bank transfers, credit and debit cards, and e-wallets, depending on their location and preferred method.

Processing times may vary based on the chosen method, and the broker ensures secure handling of all transactions. While FXNovus typically does not charge fees for withdrawals, some payment providers may apply their charges.

Customer Support and Responsiveness

Score – 4.6/5

Testing FXNovus’s Customer Support

FXNovus provides 24/7 customer support to assist traders with account management, technical issues, and general inquiries. Support is available through multiple channels, including live chat, email, and phone, ensuring timely and accessible assistance.

The team is knowledgeable about the broker’s platforms and services, helping both new and experienced traders navigate trading processes efficiently and resolve any issues that may arise.

Contacts FXNovus

Traders can contact FXNovus through several convenient channels. For direct assistance, the broker offers phone support at +44 151 265 5514.

Email inquiries can be sent to support@fxnovus.com, where the customer service team is available to address questions, provide guidance, and resolve issues promptly.

Research and Education

Score – 4.5/5

Research Tools FXNovus

FXNovus equips traders with a range of research tools available both on its website and integrated into its platforms.

- These include market news updates, economic calendars, price charts, and technical indicators to support informed decision-making.

- The platform also offers built-in analysis features, enabling users to conduct technical and fundamental research without the need for external resources.

This combination of accessible market insights and in-platform tools helps traders stay up to date with global events and identify potential trading opportunities.

Education

FXNovus provides an Education Center designed to help traders of all experience levels enhance their skills and market knowledge.

The broker offers a variety of courses, tutorials, and guides covering topics such as market analysis, risk management, and trading strategies. These resources are accessible through the website and are structured to support both beginners seeking foundational knowledge and experienced traders looking to refine their techniques.

Portfolio and Investment Opportunities

Score – 3.5/5

Investment Options FXNovus

FXNovus primarily focuses on CFD trading across various asset classes. The broker does not offer traditional investment solutions like managed portfolios or long-term wealth management services.

Instead, FXNovus caters to traders interested in short-term market opportunities and active trading strategies.

Account Opening

Score – 4.4/5

How to Open FXNovus Demo Account?

Opening a demo account with FXNovus is a straightforward process that allows traders to practice trading in a risk-free environment using virtual funds. Here is how you can get started:

- Visit the FXNovus official website.

- Click on the option to open a demo account.

- Fill in the required personal details in the registration form.

- Select your preferred account type and platform settings.

- Submit the form and log in with the provided credentials to start demo trading.

How to Open FXNovus Live Account?

Opening a live account with FXNovus is simple and can be completed online in just a few steps.

Traders start by visiting the broker’s official website and selecting the option to open an account. They are then required to complete a registration form with personal and contact details, choose their preferred account type, and set trading preferences.

As part of the verification process, FXNovus requests proof of identity and proof of address to comply with regulatory requirements. Once the account is verified and funded through one of the available deposit methods, traders can access the platform and begin trading in live market conditions.

Additional Tools and Features

Score – 4.5/5

FXNovus enhances the trading experience with additional tools and features to support informed decision-making.

- The broker integrates Trading Central, a leading market research provider, offering expert analysis, trade ideas, and actionable insights.

- Traders also benefit from advanced chart analysis tools built into the platform, enabling detailed technical studies with multiple indicators, timeframes, and drawing options. These resources help traders identify market trends, assess potential entry and exit points, and refine their strategies for better outcomes.

FXNovus Compared to Other Brokers

Compared to its competitors, FXNovus positions itself as a mid-tier broker with a balanced offering of tradable assets, user-friendly proprietary platforms, and solid regulatory backing from both FSCA and CySEC.

While it provides a good range of research and educational resources, some competitor brokers stand out with more advanced platform options like MetaTrader 4, MetaTrader 5, or cTrader, and in certain cases, access to a far broader selection of instruments.

FXNovus appeals to traders who value simplicity, a straightforward trading environment, and multi-device accessibility, though more specialized or high-volume traders may find other brokers offering tighter spreads, commission-based accounts, or more diverse platform choices.

| Parameter |

FXNovus |

M4Markets |

Earn |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 2.5 pips |

Average 1.1 pips |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

Not available |

0.0 pips + $3.5 per side |

0.0 pips + 0.007% per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Average |

Low/Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Webtrader, Trading App |

MT4, MT5, cTrader |

MT4, MT5, Earn.Broker |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

160+ instruments |

120+ instruments |

950+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FSCA, CySEC |

CySEC, DFSA, FSA |

CySEC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Limited |

Limited |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$250 |

$5 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker FXNovus

FXNovus is a multi-asset online brokerage offering access to over 160 CFD instruments across Forex, commodities, indices, shares, cryptocurrencies, and metals.

Founded in 2020, it operates under the regulation of both the FSCA in South Africa and the CySEC for European clients. The broker provides tiered account options ranging from Classic to VIP, with leverage of up to 1:400 and a minimum deposit requirement of $250.

Traders can use the proprietary WebTrader platform or the mobile app, both equipped with market research tools, chart analysis features, and educational resources.

FXNovus also offers swap-free accounts, a demo account for practice, and supports multiple payment methods for deposits and withdrawals, aiming to deliver a secure and accessible trading environment for traders of varying experience levels.

Share this article [addtoany url="https://55brokers.com/fxnovus-review/" title="FXNovus"]