- What is Forex.com?

- Forex.com Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Forex.com Compared to Other Brokers

- Full Review of Broker Forex.com

Overall Rating 4.7

| Regulation and Security | 4.9 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.8 / 5 |

| Additional Tools and Features | 4.7 / 5 |

What is Forex.com?

FOREX.com is a multi-regulated global Forex and CFD trading provider offering its clients a wide range of trading instruments, including Forex, Indices, Shares, Stocks, Cryptocurrencies, and more.

- Founded in 2001, the company today supports customers in 21 countries across 6 continents with a global presence across North America, Europe, and Asia Pacific, providing offices, while headquartered in New Jersey (US), Canada, the UK, Hong Kong, and Australia. The company is a part of GAIN Capital Holdings, Inc. a publicly traded company providing online trading solutions. In its turn, all divisions of GAIN Capital Holdings. Inc. are separate but affiliated subsidiaries of StoneX Group Inc.

Throughout highly developed platforms, Forex.com has developed its own platform for trading, which now is one of the best options for trading performance, as clients obtain access to the world’s most popular currencies and other trading instruments along with powerful tools that are constantly updated.

Overall, through the years of successful operation and its global spread, Gain Capital and one of its brands Forex.com obtained great results and world recognition, also through the powerful trading solutions that it offers and constantly develops.

Forex.com Pros and Cons

Forex.com is a sharply regulated and trustable broker with a well-established parent company GAIN Capital listed in Stock, and good for Investment purposes. Broker is truly widely presented traders from almost any country in the world may open an account with the broker, alike Forex.com India may sign in with an international branch and traders from other countries may check under which regulatory conditions the account will fall. Account opening is smooth and fully digital, there is a great range of markets and instruments, good Cryptocurrency trading, and professional trading platforms with education and research.

For the Cons, trading fees for Forex CFDs might be slightly higher but on average, there is no 24/7 support and multi-currency accounts.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | No multi-currency accounts |

| Globally recognized and awarded | No 24/7 customer support |

| Professional trading environment and investment in innovation | |

| Great range of trading instruments, and competitive trading conditions | |

| Suitable for both beginners and professionals | |

| Based on MetaTrader and proprietary technology | |

Forex.com Features

Forex.com is a well-regulated Forex broker that offers traders access to a wide range of markets while ensuring a secure and reliable trading environment. Here is an overview of the key features offered by Forex.com:

Forex.com Features in 10 Points

| 🏢 Regulation | FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

| 🗺️ Account Types | Standard, RAW Spread, MetaTrader, Spread-Only, RAW Pricing, Corporate, IRA Accounts |

| 🖥 Trading Platforms | MT4, MT5, Forex.com Web Trader, TradingView |

| 📉 Trading Instruments | Forex, Indices, Shares, Stocks, Cryptocurrencies, Commodities, Gold, Silver |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR , USD, GBP, PLN, CHF |

| 📚 Trading Education | Online Trading Courses, Learning Materials, Lessons, Glossary, Platform Tutorials, Technical Analysis, etc. |

| ☎ Customer Support | 24/5 |

Who is Forex.com For?

Forex.com’s robust offerings make it a versatile broker suitable for traders of all skill levels and strategies. Based on our findings and Financial Expert Opinions Forex.com is Good for:

- Beginners in Trading

- Advanced traders

- Professional Trading

- Traders who prefer MT4 and MT5 trading platforms

- Currency and CFD trading

- Low spread trading

- Zero commission trading

- Competitive trading fees

- Tight spreads

- Variety of trading strategies

- Supportive customer support

- Excellent Forex education and research

Forex.com Summary

Overall Forex.com is a global leader in online trading and is highly regarded by numerous traders. Apart from the well-reputed and respected international standing of GAIN Capital Holding, which Forex.com is part of, solid financial backup is proven by the vast number of companies behind numerous regulations worldwide.

There are also numerous benefits in both technical and operational parts, including innovative broker functional tools, together with excellent customer support and comprehensive educational materials.

55Brokers Professional Insights

Forex.com is a highly reputable firm with a truly global presence and Forex.com being a part of a huge Financial Holding is very secure being regulated almost by all top-tier and international regulators with a worldwide presence. The company background is solid which is great for all types of traders especially those looking for long-term trading relationships. Trading conditions are at a good quality level too with favorable trading solutions and transparency, offering professional-grade tools and insights to enhance trading performance.

With a strong emphasis on transparency, the platform provides advanced analytics, real-time market data, and expert commentary to support informed decision-making so the Broker might suit beginning traders and those who look for advanced tools in its glossary available. Also, due to its background and strong structure Broker might suit traders of large size, Institutional trading, and various options too.

Consider Trading with Forex.com If:

| Forex.com is an excellent Broker for: | - Need broker with worldwide presence.

- Carrying Top-Tier licenses and highly secure Broker

- Looking for broker with MT4 and MT5 trading platforms.

- Good range of trading tools and insights available.

- Offering VPS hosting.

- Need broker with a wide range of trading instruments.

- Looking for good education and research tools.

- Providing either spread-based or commission-based accounts.

- Need broker with diverse trading accounts.

- Good broker for novice traders and professionals.

- Access to user-friendly trading platforms.

- Need broker with a variety of trading strategies.

- Broker with investment options. |

Avoid Trading with Forex.com If:

| Forex.com might not be the best for: | - Who prefer 24/7 customer support.

- Need multi-currency account balances.

- Looking for broker with higher leverage access.

- Need broker offering PAMM or MAM accounts.

- Broker with lowest fees.

- Looking for fixed spreads.

- Who prefer copy trading feature.

|

Regulation and Security Measures

Score – 4.9/5

Forex.com Regulatory Overview

Forex.com is a well-regulated broker, ensuring a secure and transparent trading environment for its clients worldwide. It operates under the oversight of several Top-Tier regulatory bodies, including FCA in the UK, CFTC and NFA in the US, the Australian ASIC, CySEC in Cyprus, and others.

This strong regulatory framework enforces compliance with strict financial standards, such as the segregation of client funds and robust risk management practices. As we have already mentioned, Forex.com is a part of StoneX Group Inc. (NASDAQ: SNEX), a publicly traded company with strong corporate governance, financial reporting, and industry lead.

How Safe is Trading with Forex.com?

Forex.com is a trusted financial service provider incorporated in the US according to all the strictest laws and requirements. For its global presence and truly wide operation in world financial centers, the broker is a part of international holding withholds regulations by various reputable authorities worldwide including FCA(UK), IIROC (Canada), CFTC (USA), ASIC (Australia), and CySEC (Cyprus).

However, trading conditions vary depending on the specific entity under which the broker operates, and it also holds an international license under offshore regulation. Therefore, traders should carefully review the terms and conditions associated with their chosen entity to understand the applicable trading conditions and other regulatory safeguards.

Consistency and Clarity

Forex.com is recognized for its consistency and reliability being among the most trusted and secure Financial firms for years Broker operates, has multiple regulations from numerous top-tier regulators, and also is a Publicly traded company. The Broker offers a robust trading environment backed by decades of industry experience. As one of the longest-standing Forex brokers, it delivers stable platform performance, ensuring minimal downtime and efficient trade execution. Traders frequently highlight Forex.com’s reliability, praising its transparent pricing, responsive customer support, and wide range of trading tools.

However, some reviews also mention areas for improvement, such as occasional platform lags during high-volatility periods or slightly higher spreads compared to some competitors. Overall, Forex.com’s commitment to maintaining trust and operational excellence makes it a preferred choice for traders seeking consistency and clarity in trading.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Forex.com?

Forex.com offers a range of account types tailored to different trader needs, with variations depending on the regulatory entity.

- For clients under the International entity, options include the Standard Account, which provides spread-only pricing ideal for beginners, and the Raw Spread Account, designed for experienced traders with ultra-tight spreads and a small commission per trade. Additionally, MetaTrader Accounts are available for both MT4 and MT5 platforms, offering access to diverse tools and features.

- For traders in the US, Forex.com offers Spread-Only Accounts, RAW Pricing Accounts, and options for MT4 and MT5, as well as Corporate and IRA Accounts.

- In the EU, the offerings include the Standard Account, Raw Spread Account, and MT5 Accounts, along with Corporate Accounts for business clients. For traders in the UK, Forex.com offers Standard Accounts, MT4 Accounts, and Corporate Accounts.

Each account type is designed to meet specific trading preferences, ranging from basic spread-only pricing to advanced features and tools for professional traders, with options for Demo trading and Swap-free accounts to accommodate diverse needs.

Standard Account

The Standard Account at Forex.com is designed for traders who prefer a straightforward and accessible trading experience. With spread-only pricing and tight spreads as low as 0.8 pips for EUR/USD, it is ideal for beginners or those who want to avoid additional commissions on their trades. The minimum deposit amount is $100.

The Standard Account is available across multiple platforms, including Forex.com’s proprietary platform and MT4, giving traders flexibility in their trading approach. Additionally, Demo accounts are available for those who want to practice and test strategies without risking real capital.

RAW Spread Account

The Raw Spread Account is ideal for more experienced traders who seek tighter spreads and are comfortable with paying a small commission per trade. This account offers ultra-low spreads, starting from as low as 0.0 pips on major currency pairs, allowing traders to benefit from highly competitive pricing.

By offering a commission-based structure, a $5 commission per $100k traded, the Raw Spread Account is ideal for scalpers, algorithmic traders, and anyone looking to trade with minimal market impact.

With access to trading platforms MT4 and MT5, as well as essential trading tools, this account type is perfect for those seeking greater precision and control in their trading strategies.

MetaTrader Account

The MetaTrader Account provides traders with access to the popular MT4 and MT5 platforms, known for their variety of charting, automated trading capabilities, and user-friendly interface. These accounts are ideal for traders who prefer the flexibility and customizability offered by MetaTrader’s wide range of tools, including expert advisors, indicators, and scripts. It offers variable spreads as low as 1.0 pips, with a minimum deposit of $100.

The MetaTrader Account is suitable for both beginner and professional traders, offering a seamless trading experience with real-time market data, multiple order types, and high-level charting features.

Corporate Account

Available in the US, European, and UK entities, the Corporate Account is designed for businesses and institutional traders looking to manage multiple accounts under a single entity. This account type provides tailored solutions for corporate clients, offering access to a wide range of markets and competitive pricing.

The minimum initial deposit required is $100, though it is recommended to deposit at least $2,500 for greater flexibility and better risk management when trading the account.

The account offers competitive spreads, typically starting from 1.0 pips, depending on the account type and market conditions. This account is available on multiple platforms, including Forex.com’s proprietary platform, and MetaTrader platforms, giving businesses the flexibility to choose the platform that best suits their trading needs.

IRA Account

The IRA Account is for US-based traders who want to trade Forex within a tax-advantaged retirement account. This account allows individuals to trade a wide range of markets, while enjoying the benefits of tax-deferred growth or tax-free withdrawals, depending on whether it is a Traditional or Roth IRA.

The account offers access to competitive spreads, typically starting from 1.0 pips, and is available on Forex.com’s proprietary platform as well as MT4 and MT5. With a minimum deposit requirement of $100, the IRA Account provides traders with the flexibility to manage their retirement savings.

Regions Where Forex.com is Restricted

Forex.com is restricted or unavailable in several regions due to regulatory requirements and local laws governing Forex trading, also various entities may be able or not accept some clients, we advise to refer to Forex.com Customer Service for clarification.

Some of the countries where Forex.com is restricted include:

- Belgium

- North Korea

- Iran

- Syria

- Cuba

- Sudan

Cost Structure and Fees

Score – 4.6/5

Forex.com Brokerage Fees

Forex.com charges brokerage fees primarily through spreads, which vary depending on the account type and market conditions. In addition to spreads, Forex.com may charge fees for certain services, such as overnight financing/swap rates, withdrawals depending on the method, and account inactivity after a certain period.

While the broker offers competitive pricing, we recommend traders review the specific fee structure for their chosen account type and trading platform to understand the full scope of costs involved.

Forex.com offers variable spreads that depend on the market traders wish to trade, with the added benefit of reducing costs by up to 15% through cash rebates. The broker is known for providing some of the tightest spreads in the industry. For standard accounts, the spreads typically start at 0.8 pips.

As we found, the average spread for EUR/USD is 1.3 pips on the Standard account. Additionally, Forex.com offers commission-based accounts via Raw Spread Account, where spreads can start from 0.0 pips, and a small commission per trade is charged.

Forex.com charges commissions primarily on the Raw Spread Account, where traders benefit from ultra-tight spreads starting from 0.0 pips. This account type includes a small commission of $5 per $100k traded, ensuring transparent pricing and optimal execution.

For other account types, such as the Standard Account and MetaTrader Accounts, Forex.com does not charge a separate commission, as the fees are embedded within the spread.

For the US entity, the RAW Pricing Account incurs a commission of $7 per $100k traded. Additionally, Stock CFDs are the only asset class that requires a one-time commission fee for opening and closing trades.

Also, Commissions vary by market, for most US stocks, the fee is 1.8 cents per share, while for UK, EU, and Asian stocks, it is 0.08% of the consideration. A minimum commission of 10 units of the stock’s base currency applies across all regions.

- Forex.com Rollover / Swaps

The broker applies rollover fees or swap rates, for positions held overnight. These fees are calculated based on the interest rate differential between the two currencies in the traded pair and are charged or credited depending on the direction of the trade.

For example, traders holding a long position in a currency with a higher interest rate than the counter currency may earn a rollover credit, while those holding positions in the opposite direction incur a rollover charge.

How Competitive Are Forex.com Fees?

Forex.com provides competitive fees designed for a variety of trading styles and experience levels. The broker offers tight spreads on its accounts, ensuring cost-effective trading. For traders seeking ultra-low spreads, accounts with commission-based pricing are available, while those preferring simplicity can choose commission-free accounts where costs are embedded in the spread.

Additionally, the broker applies transparent fees for trading Stock CFDs, with regional variations to suit different markets. However, a potential drawback is that certain fees, such as higher minimum charges for specific markets, may not be ideal for traders with smaller budgets or those looking to minimize upfront costs.

| Asset/ Pair | Forex.com Spread | FxPro Spread | IC Markets Spread |

|---|

| EUR USD Spread | 1.3 pips | 1.4 pips | 0.82 pips |

| Crude Oil WTI Spread | 3.5 | 39.04 cents | 0.027 |

| Gold Spread | 71 cents | 36.49 cents | 1 pip |

| BTC USD Spread | 100.0 | 30$ | 42.036 |

Forex.com Additional Fees

Besides standard fees, the broker also charges additional fees for certain services and account activities, which vary based on factors such as account type, transaction methods, and the duration of positions held.

- Forex.com applies an overnight fee, also known as a swap fee, which should be factored in if you hold positions overnight or for an extended period. These fees are calculated as a percentage combined with interbank exchange rates, and they vary depending on the specific instrument being traded. For example, the swap fee for holding a EUR/USD position overnight is typically -2.5% for a long (buying) position and 2.5% for a short (selling) position, although rates may fluctuate based on market conditions.

- In addition, the broker charges an inactivity fee of $15 per month if no trading activity occurs or no open positions are held for 12 months or more. These fees are transparently displayed, allowing traders to plan their strategies and manage costs effectively.

- Also, withdrawal fees may apply, with $25 charged for withdrawals within the US and $40 for international wires, including Canada. However, no fees are charged for withdrawals exceeding $10,000.

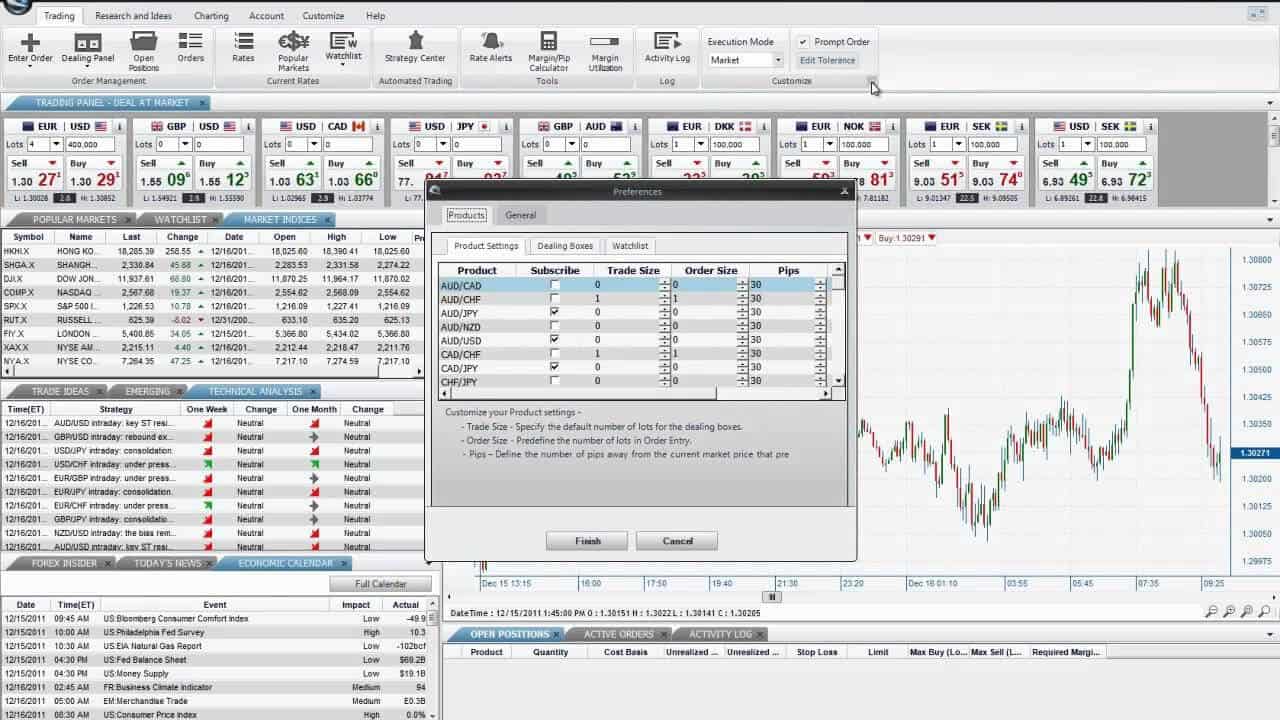

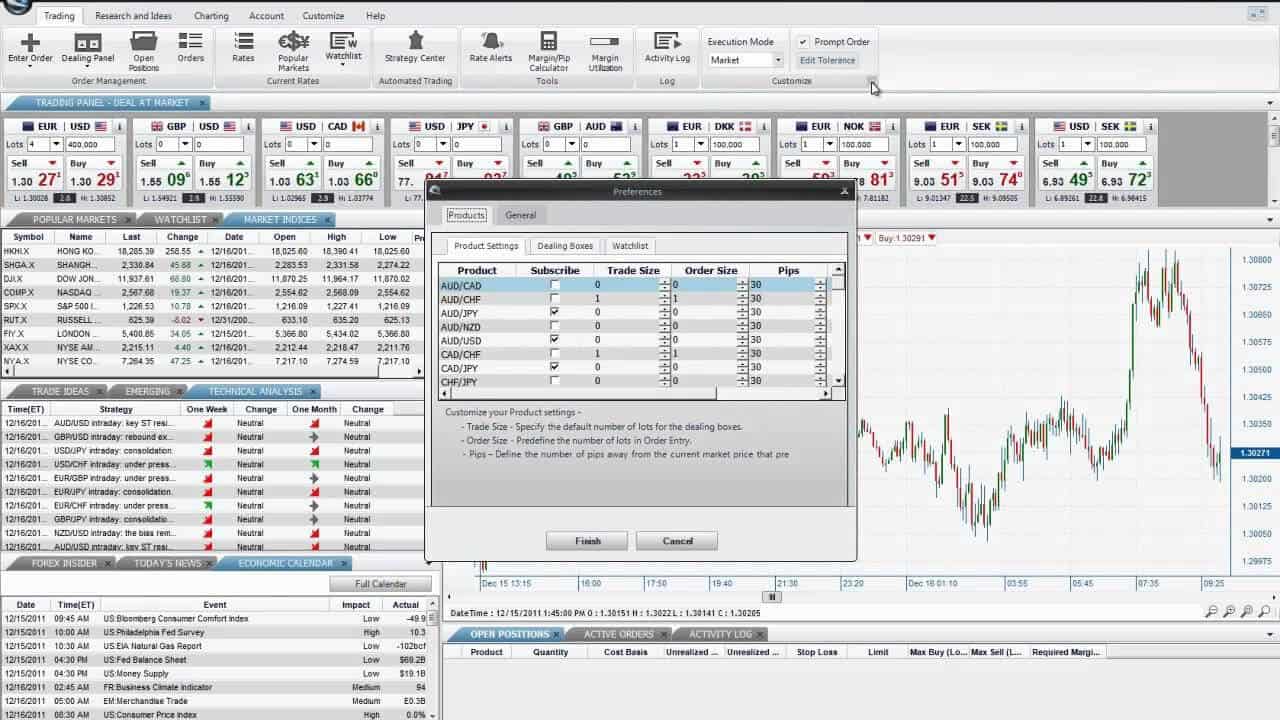

Trading Platforms and Tools

Score – 4.4/5

Forex.com offers a variety of trading platforms and tools designed to cater to different trader needs, with the selection varying based on the entity. The broker provides a proprietary platform, known for its user-friendly interface and multiple charting tools, along with MetaTrader 4 and MetaTrader 5, which are popular for their customizability and automated trading features.

Additionally, the broker integrates with TradingView, giving traders access to powerful charting and analysis tools within a seamless interface. With a focus on performance, 100% of trades are executed in less than one second, ensuring fast and reliable order execution.

These platforms present powerful developed trading tools (70+ technical indicators) and signals while using instant or market execution, as well ability to set user-defined price tolerance. Besides, Forex.com constantly adds on new developments alike now there are AI Trading Tools with Capitalise.ai available for auto trading and research purposes too.

Trading Platform Comparison to Other Brokers:

| Platforms | Forex.com Platforms | FxPro Platforms | IC Markets Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | Yes |

| Own Platform | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Forex.com Web Platform

Forex.com’s proprietary web platform provides traders with a robust and intuitive trading experience directly through their browsers. The platform offers over 80 technical indicators, over 50 drawing tools, 14 time intervals, multiple chart types, and real-time market data.

In addition to its web platform, the broker also offers MT4 and MT5 on the web, allowing traders to access these widely used platforms with full functionality, including advanced charting, automated trading, and a variety of technical indicators. This flexibility ensures traders can use the platform that best meets their needs, whether on Forex.com’s proprietary platform or the MetaTrader options.

Forex.com Desktop MetaTrader 4 Platform

The MetaTrader 4 desktop platform available on Forex.com offers a versatile trading experience for users. With 30 in-built indicators and 9 timeframes, traders can perform in-depth technical analysis and develop personalized trading strategies. The platform also provides access to thousands of free and paid indicators, allowing traders to enhance their charting and decision-making processes.

Additionally, the platform includes 24 analytical objects, such as trendlines, channels, and Fibonacci tools, enabling traders to identify key market patterns. Known for its speed and reliability, MT4 also supports automated trading through Expert Advisors, giving traders the flexibility to execute trades even when they are away from their desks.

Forex.com Desktop MetaTrader 5 Platform

The MT5 desktop platform is equipped with enhanced tools for technical analysis and trading flexibility. MT5 includes 38 in-built indicators and 21 timeframes, providing traders with more options to analyze market movements across different periods.

In addition, the platform offers access to thousands of free and paid indicators, further expanding analytical capabilities. With 24 analytical objects such as trendlines, channels, and Fibonacci tools, MT5 empowers traders to refine their strategies and make informed decisions.

The platform also supports EAs, making it ideal for traders who wish to automate their strategies or trade while away from their desks. With its broader range of features and customizability, the MT5 delivers a powerful platform for traders looking to take their trading to the next level.

Forex.com MobileTrader App

Forex.com’s MobileTrader App offers traders the flexibility to manage their trades and monitor the markets on the go. Designed for seamless performance, the app provides quality execution with one-swipe trading, allowing users to enter and exit positions quickly and efficiently.

It also integrates advanced TradingView charting and analysis tools, giving traders access to 80+ indicators, 11 chart types, and 14 timeframes. The app includes real-time trade and order alerts, ensuring traders stay updated on market movements and never miss an opportunity.

Moreover, the app offers full account management features, allowing users to manage their balance, view trade history, and make deposits or withdrawals directly from their mobile devices.

Main Insights from Testing

Our testing reveals that the app delivers a smooth and efficient trading experience with features like one-swipe trading for quick order execution. It integrates advanced charting and analysis tools from TradingView, allowing traders to make informed decisions on the go.

Real-time alerts keep users updated on market movements, and full account management features offer complete control over their trades, balances, and transactions. Overall, the app offers convenience and reliability for traders looking to stay connected and manage their trades anytime, anywhere.

Trading Instruments

Score – 4.6/5

What Can You Trade on Forex.com’s Platform?

On Forex.com’s platform, traders have access to thousands of trading instruments, including over 80 Forex pairs, indices, more than 5,500 shares, stocks, commodities, cryptocurrencies, and precious metals like gold and silver.

For the US entity, the range of instruments includes Forex, stocks, futures, and futures options.

However, the availability of certain instruments can vary depending on the regulatory environment. For instance, cryptocurrency trading is not available in the UK due to local regulations.

Main Insights from Exploring Forex.com’s Tradable Assets

With a wide range of tradable assets, Forex.com is an appealing choice for many traders. Popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin are available for trading too, providing an exciting opportunity for those looking to diversify their portfolios beyond traditional assets.

While the advantage of an extensive range of markets with competitive trading conditions that the broker offers, some asset classes, such as futures (except for the US entity) or bonds, are not available, which may be a drawback for traders seeking a more comprehensive trading portfolio.

Moreover, the availability of instruments can vary by region due to regulatory restrictions. For example, some products like cryptocurrencies may not be available in specific markets, such as the UK. Also, futures and futures options trading are only available to the US entity.

Leverage Options at Forex.com

Leverage as a popular tool is widely used by brokers and traders and allows the trading of larger capital compared to the initial capital. However, high leverage may impose trades quickly in reverse as well. Thus, traders should use multiplier levels smartly and learn how to do it correctly for a particular instrument.

Forex.com leverage ratios will vary according to the trader’s residence, as well as under which authorization account is open:

- The US clients may use a max of 1:50 leverage to Forex instruments

- European entities are set to only 1:30

- Australian clients may use 1:30 for Forex instruments

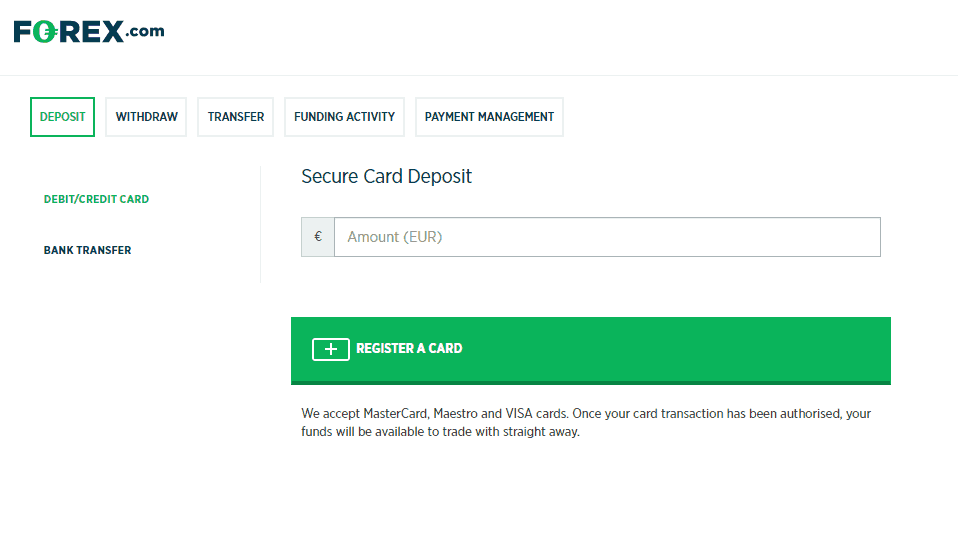

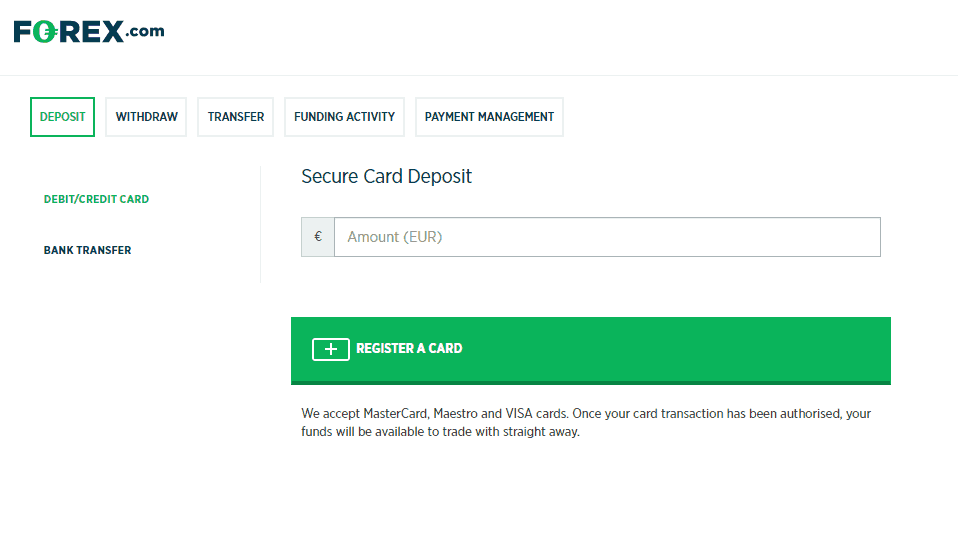

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Forex.com

Forex.com offers a few funding methods, including credit/debit card payments, wire transfers, and e-wallets. The availability of specific funding options may vary depending on the entity and regulatory rules. Therefore, traders need to check the broker’s regulations to confirm whether a particular method is accessible for their region.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

Forex.com Minimum Deposit

The minimum initial deposit for Forex.com is $100, but there is a recommendation to deposit $2,500 to allow flexibility, a full range of instruments, and better risk management.

Withdrawal Options at Forex.com

Withdrawal options at Forex.com include convenient methods such as bank transfers, card payments, and e-wallets. The processing time varies by method, with credit/debit card withdrawals typically processed within 24 hours and wire transfers taking up to 48 hours.

Certain withdrawals, like those exceeding $10,000, are fee-free. However, wire transfers within the US incur a $25 fee, while international wires, including those to Canada, cost $40. Clients should review the specific terms and conditions of their region, as withdrawal fees and processing times may differ based on the entity and regulatory requirements.

Customer Support and Responsiveness

Score – 4.6/5

Testing Forex.com’s Customer Support

Forex.com offers dedicated 24/5 customer support through Phone lines, Live chat, and Email. The support covers almost the globe due to the broker’s presence and coverage of major destinations. While email and phone support are reliable, email responses can be slower, and phone support is better suited for complex queries.

The broker also provides a comprehensive FAQ section, covering topics such as account management, platform features, and trading tools, providing answers to common questions without needing direct support.

Contacts Forex.com

Forex.com provides several ways to get in touch for assistance or inquiries. Customers can reach their support team via live chat or email at support@forex.com. Additionally, the broker offers phone support with specific contact numbers depending on your region. For the US, you can call 1-877-367-3946 or 908-731-0750, and for international clients, the number is 1-908-315-0653.

Comprehensive details about contact methods and availability can also be found on their official website, including access to their extensive FAQ section, which addresses common issues and queries.

Research and Education

Score – 4.8/5

Research Tools Forex.com

Forex.com offers a wide range of research tools, enhancing traders’ ability to analyze the markets. For those using the web platform, the broker provides real-time market data, advanced charting tools, and access to economic calendars, news, and analysis. The platform includes features like customizable chart settings, various technical indicators, and drawing tools.

- Traders can also integrate TradingView, which is available on the platform for advanced charting. TradingView offers a variety of technical analysis tools, including multiple indicators, customizable charts, and real-time data.

- For MetaTrader users, both MT4 and MT5 platforms come with built-in research tools such as a wide selection of technical indicators, analytical objects, and timeframes. These tools allow for in-depth market analysis, giving traders the flexibility to apply different strategies.

Education

Another strong point is Forex.com’s comprehensive educational resources, which are designed to support traders at all experience levels. Their online trading courses cover a variety of essential topics, from platform tutorials to advanced technical analysis, helping traders understand market behavior and refine their strategies.

- The educational materials include a comprehensive glossary of trading terms, making it easier for beginners to familiarize themselves with the industry language.

- In addition to written guides, Forex.com offers webinars hosted by industry experts, providing real-time insights into market trends, trading strategies, and platform usage. These webinars allow traders to ask questions and interact with professionals, enhancing their learning experience.

Is Forex.com a good broker for beginners?

Yes, Forex.com is a good broker for beginners due to its user-friendly platform and educational resources designed to help new traders get started. The broker offers a range of tutorials, online courses, and webinars that cover fundamental trading concepts, platform usage, and technical analysis.

Additionally, its Demo accounts allow beginners to practice trading without risking real money. The platform’s intuitive design and customer support options further enhance the experience for novice traders.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options Forex.com

Forex.com is primarily a Forex broker, but it offers a few investment options tailored to different trader needs. While it does not provide PAMM, MAM accounts, or Copy trading services, it offers wealth management services for clients in the United States and various Investment opportunities, providing additional opportunities for portfolio diversification.

These investment choices enable traders to explore a variety of strategies, however, availability may vary based on region and regulatory requirements.

Account Opening

Score – 4.8/5

How to Open Forex.com Demo Account?

Opening a demo account with Forex.com is a straightforward process that allows you to practice trading with virtual funds before committing to real capital. Here is how to do it:

- Go to the Forex.com website and navigate to the demo account section.

- You will need to fill out a registration form with some basic details such as your name, email address, and phone number. You may also be asked for your country of residence.

- Choose the trading platform you wish to use.

- Choose your demo account’s preferred features, such as the initial balance, and the type of market you’d like to practice trading in.

- If you are using a platform like MetaTrader, you will be prompted to download the platform on your desktop or mobile device.

- After completing the setup, you can begin trading with virtual funds.

Forex.com offers these demo accounts to give new traders an opportunity to practice, as well as to help experienced traders test strategies without financial risk.

How to Open Forex.com Live Account?

Opening an account with Forex.com is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.7/5

For the additional tools, Forex.com provides a variety of tools and features categorized as AI and Premium Trading tools that enhance the trading experience. These selections include:

- Among these, the Pivot Points Calculator stands out, helping traders identify key levels of support and resistance, which can be crucial for making informed trading decisions.

- In addition, the platform offers various charting tools that include popular indicators such as Moving Averages, RSI, and Bollinger Bands to assist in technical analysis.

- Forex.com also provides Trading Central, a powerful tool providing comprehensive market analysis, technical indicators, and trade ideas. This service gives traders valuable insights into potential market movements and helps improve decision-making processes.

- Another excellent feature is Capitalise.ai, which is a user-friendly auto-trading strategy builder that allows traders of all ability levels to create, backtest, and simulate trading strategies using plain English commands. It also offers notifications and other advanced features to refine automated strategies.

- Performance Analytics is another AI tool that helps traders better understand their trading psychology and patterns. Users can set trading plans, track discipline, and analyze their performance to improve decision-making.

- Active Trader Program is tailored for high-volume traders, this program offers exclusive benefits, including cash rebates (up to 15% reduction in trading costs), dedicated Relationship Managers, VIP event access, and reimbursement for wire transfer bank fees.

- API Trading is ideal for traders using custom algorithms or systems. It allows for automated strategy execution with full market access and historical data for technical analysis. The API is compatible with multiple programming languages, including Python, C++, and VB.NET.

- MetaTrader Expert Advisors (EAs): A suite of over 20 EAs is available to Forex.com MetaTrader users, offering professional-grade tools to optimize trading strategies. These EAs are provided by FX Blue and come pre-integrated.

- MetaTrader VPS Hosting is for uninterrupted trading. Forex.com offers VPS hosting to run Expert Advisors around the clock. This service is especially valuable for those relying heavily on automated strategies.

However, the tools and features available on Forex.com may differ depending on the entity a trader uses, due to regional and regulatory variations. Traders should check the specific offerings available in their region.

Forex.com Compared to Other Brokers

One of the main points at Forex.com is that the broker is highly reputable and heavily regulated, also its trading conditions are of good quality with constant development and the addition of new services like AI Trading tools. The broker is well-regulated across multiple jurisdictions, its competitors like XM or FXTM also maintain robust regulatory compliance, yet are not publically traded which is considered lower. Forex.com aligns with its competitors by offering a solid selection of trading platforms, including TradingView integration, which enhances charting and analytical capabilities. However, the absence of cTrader, a popular platform among many traders might be a drawback for some traders.

The extensive asset variety and high-quality educational resources make it a compelling choice for traders across experience levels. However, its fees are generally considered average compared to brokers like IC Markets or Pepperstone, which offer more competitive costs and spreads. In terms of customer support, Forex.com’s 24/5 availability may be a limitation when compared to brokers like XM and FP Markets, which provide 24/7 assistance.

Overall, Forex.com stands out for its diverse platforms, account types, and comprehensive educational resources, also great reputation and solid background but may not fully satisfy traders looking for the industry’s lowest fees or round-the-clock customer service.

| Parameter |

Forex.com |

FXTM |

XM |

FP Markets |

IC Markets |

Pepperstone |

eToro |

| Spread Based Account |

Average 1.3 pips |

Average 1.5 pips |

1.6 pips |

From 1 pip |

From 1 pip |

Average 0.7 |

Average 1 pip |

| Commission Based Account |

0.0 pips + $5 |

0.0 pips + $3.5 |

Only on Shares Account |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Low/ Average |

Low |

Average |

| Trading Platforms |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5, XM WebTrader |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary |

| Asset Variety |

6000+ instruments |

1000+ instruments |

1,000+ Instruments |

10,000+ instruments |

1,000+ instruments |

1,200+ instruments |

2,000+ instruments |

| Regulation |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

FCA, FSC, CMA |

ASIC, CySEC, FSC, DFSA |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

| Customer Support |

24/5 |

24/5 |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Excellent |

Good |

Excellent |

Excellent |

Good |

Excellent |

Good |

| Minimum Deposit |

$100 |

$200 |

$5 |

$100 |

$200 |

$0 |

$200 |

Full Review of Broker Forex.com

Forex.com is a well-established broker catering to traders of all levels, offering a robust selection of platforms such as MetaTrader 4/5, TradingView integration, and its proprietary Web Trader. With access to thousands of instruments, the broker provides significant opportunities for portfolio diversification. Forex.com is heavily regulated across multiple jurisdictions, ensuring security and transparency for its clients.

Additionally, the broker excels in educational resources, providing comprehensive online courses, webinars, platform tutorials, technical analysis guides, and research materials to support trader development.

While its fees are not the lowest, Forex.com remains a strong choice for traders seeking platform variety, a wide asset range, and high-quality educational materials. These features make it a dependable broker for both beginners and experienced traders.

Share this article [addtoany url="https://55brokers.com/forex-com-review/" title="Forex.com"]

Offers two distinct account types to cater to different trading styles and experience levels

I am filing to report the scam did by company registered and regulated by FSA authority, I invested 600 USD and earned the profit of USD 1418, when i tried to withdraw the amount, company is not paying the amount and forcing me to take on total i deposited of USD 600, whereas they are not giving my profit. they are not giving any satisfactory reason or proof for anything, they are scamming me.

The company information is 10 trade regulated by Regulated – FSA Seychelles Financial Services Authority with license number SD082 Service

Scam, don’t waste your time and your money. I was scammed getting my money back was possible with the help of curtis howard 270 @ gmail . com, contact him if you are having problems withdrawing your money from your investment broker.

Hello it’s me, I am also visiting this web page on a

regular basis, this website is really good and the users are in fact sharing pleasant

thoughts.

hello!,I like your writing very a lot! share we communicate more about your post on AOL?

I need an expert in this house to solve my problem. May be that is you!

Having a look ahead to look you.

Clown service, STAY AWAY!

Honestly I have been trading on multiple platforms for many years now and this is the worst experience by far. They don’t have the pairs that they advertise, when you ask why they get pissy with you. Then they send you liquidation emails for no reason. When I emailed to find out why, 2 days later I am still waiting on a reply. I hope these clowns go out of business soon. Time to withdrawal my money!

I’ll immediately snatch your rss as I can’t to find your e-mail subscription link or newsletter service.

Do you have any? Please allow me realize in order that I may subscribe.

Thanks.

Hey Ms. Chyzh clients from Colombia allow to participate in the trading platforms ? ive been having a headache looking for trust worthy brokers and i hope that this is it and i will have to look further no more!

Does forex.com support South Africa would like to join if it’s one of the countries that is supported. Thanks

Does forex.com support South Africa would like to join if it’s one of the countries that is supported. Thanks

Forex.com doesn’t provide the MT5 platform. I mean I haven’t seen it available as an option at their website. Unless, I’m missing something. But overall, this broker is a very very good broker and lives up to its hype.

I suspect I’ve been scammed by Sunny Forex on the MT5 platform.

How can I get information about this firm – like toll free phone number and contact person other than their online customer service?

Hi I would like to Request because I was invested USD 10K in MT4 Account HK make trading which is my one year hard working money but now I has withdraw Since Tuesday 07-04-21 Night Around 10 pm but still I have received my Money and broker also not reply my message so please can you give me some Advice to how to withdraw my money from my MT4 Account please???

Can I invest from JAMAICA?

Hi,

Is Kenya within your allowed areas?

can i get the contact details about forex coz i wanted to invest in this company

Does forex.com give leverage or do you have to request I deposited $1000 on Friday and leverage appears to be 1:1 not 1:40

do you have nasdaq 100

Can you Please explain a bit more about the Overnight Fee.

You state that there is an overnight fee of -2.5% and 2.5% depending on if you are trading Long or short.

But what is the -+2.5% fee based on? Is it the Lot size or If I was using TradingView platform, is the the Trade Value?

Thanks

Hi, I’m Indian and based in oman. Can I trade forex from on forex.com mt4 platform from oman??

Do forex. Com allow expert adviser or robotic trades???

Oman is not restricted on Forex.com platform, so you will be able to open an account. You are given the option to open a Forex.com account and trade yourself or open an account with MetaTrader 5 and trade with the help of the software.

Is Nigerian allow to take part in the trading platform ? Can I be allowed to start the trade with the minimum amount stipulated ($50) Sir ?

Dear Lawal,

Unfortunately, Nigeria is one of the restricted countries that Forex.com does not work with. You can check other regulated brokers with a small minimum deposit that accept Nigerian residents https://55brokers.com/forex-broker-reviews/