- What is EXT?

- EXT Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

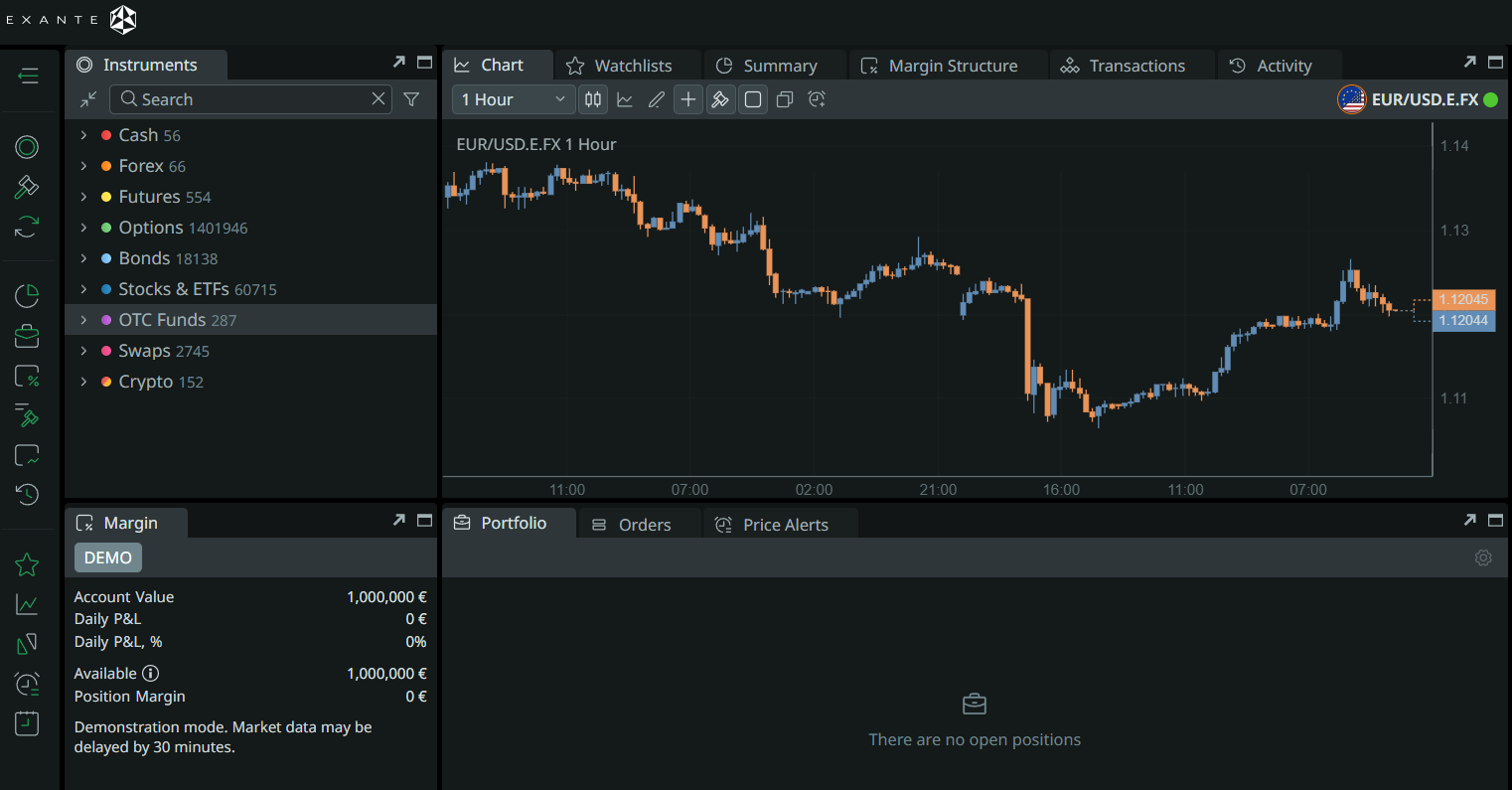

- Trading Platforms and Tools

- Trading Instruments

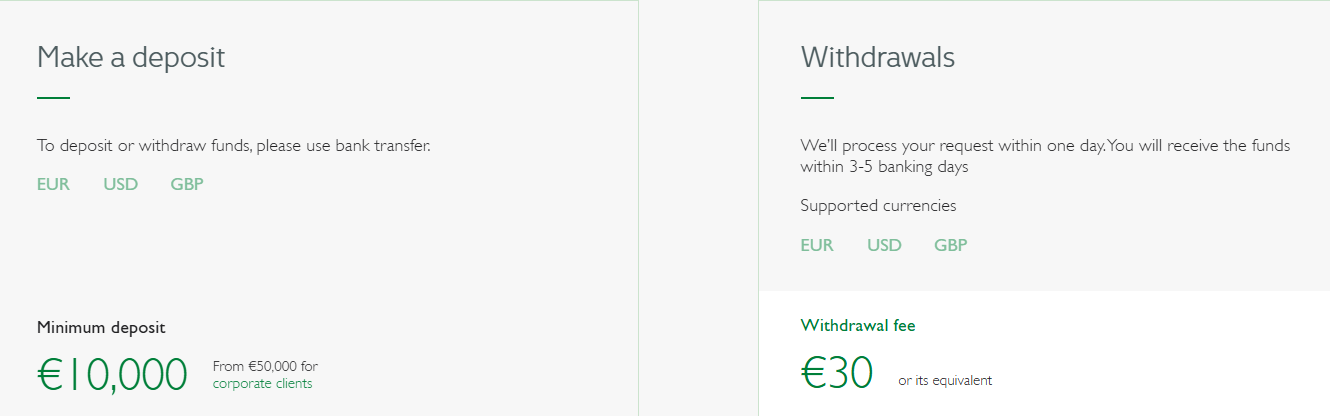

- Deposit and Withdrawal Options

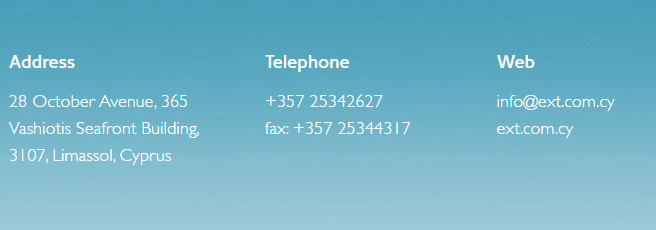

- Customer Support and Responsiveness

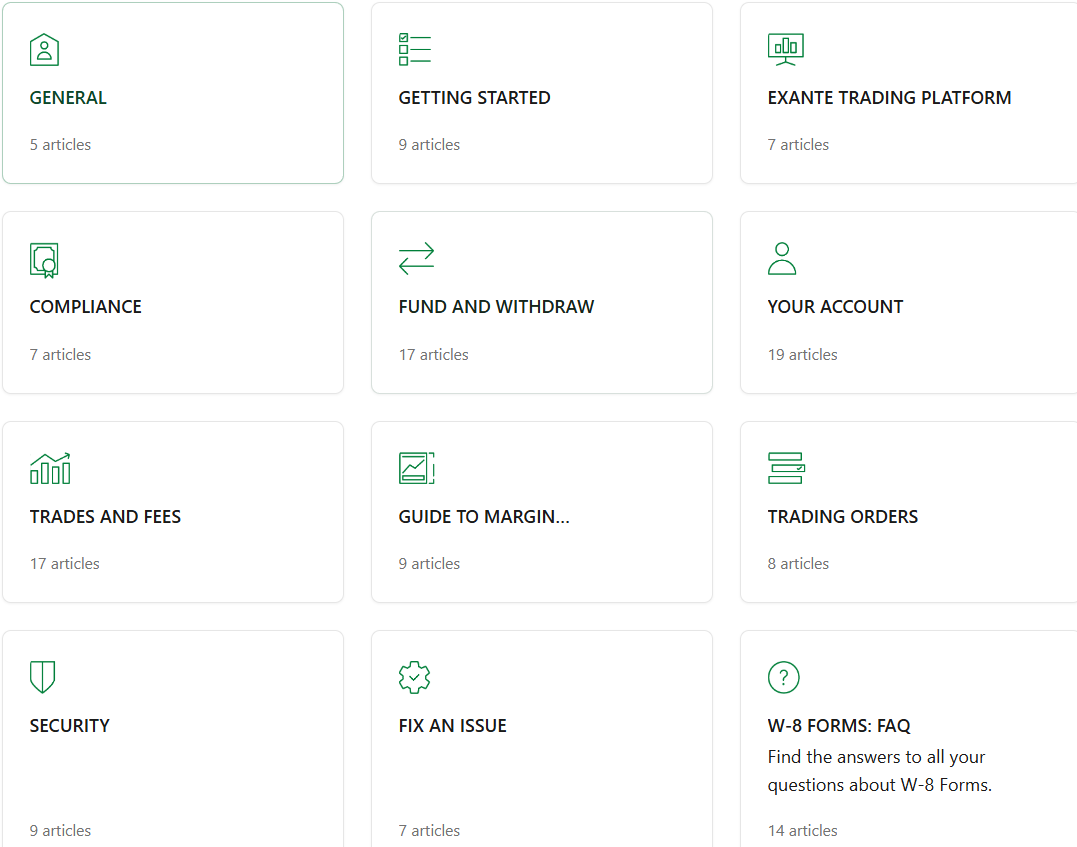

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- EXT Compared to Other Brokers

- Full Review of Broker EXT

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 3.5 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is EXT?

EXT is a European Forex trading company that provides access to more than 600,000 trading instruments on over 50 markets, including Forex, Stocks, ETFs, Metals, Futures, Options, Bonds, and more. It is headquartered in Limassol, Cyprus, and is regulated and authorized by the reputable European regulatory body CySEC.

According to our findings, the broker also holds a regulatory authorization from the Securities and Futures Commission of Hong Kong, allowing it to operate in the Asian and China markets. Additionally, the company has a license from the FCA in the UK, holding an FCA SRO status to carry out activities for a limited period.

Overall, the company provides competitive trading conditions and low spreads, mainly designed for professionals. The broker has also developed proprietary trading platforms that are enhanced with advanced technology and numerous trading tools.

EXT Pros and Cons

When considering EXT as your Forex trading broker, you should carefully consider the benefits and drawbacks. One advantage is that the broker offers Direct Market Access to a wide range of trading instruments through a single comprehensive trading account. Additionally, its customer support is available 24/7, ensuring assistance whenever needed. The expansion to Hong Kong also makes EXT Broker an appealing choice for traders in the Asia-Pacific region.

For the cons, the broker’s website lacks educational materials, which may make the broker unsuitable for traders seeking extensive learning resources. Moreover, the minimum deposit required is higher than the industry average. However, since EXT caters primarily to professional traders, this may not be a significant drawback for its target audience. Also, traders should be aware that trading conditions may vary depending on the entity.

| Advantages | DIsadvantages |

|---|

| European license and oversight | No learning materials |

| Adherence to the MiFID laws | Conditions might vary based on the entity |

| Professional trading | High minimum deposit |

| Competitive spreads | |

| Proprietary trading platforms | |

| Trading instruments | |

| Direct Market Access | |

| 24/7 customer support | |

EXT Features

In our analysis and assessment, EXT is a trustworthy trading broker that caters to a wide range of clients, including retail and professional traders, as well as corporations. The broker’s extensive selection of financial products, with competitive trading spreads and costs, presents an appealing proposal to traders. Based on this, we have considered the main aspects of trading with EXT and made a list for a quick look.

EXT Features in 10 Points

| 🗺️ Regulation | CySEC, SFC |

| 🗺️ Account Types | A Single Account |

| 🖥 Trading Platforms | EXT proprietary platform, HTTP API, FIX API |

| 📉 Trading Instruments | Forex, Stocks, ETFs, Metals, Futures, Options, Bonds, etc. |

| 💳 Minimum deposit | €10,000 |

| 💰 Average EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | GBP, USD, EUR |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/7 |

Who is EXT For?

EXT is a well-established broker, offering carefully developed services to different clients. The broker can meet various trading needs and grant traders vast opportunities to explore the market. Based on our findings and financial expert opinions, EXT is good for:

- Professional trading

- European traders

- Traders from Hong Kong, China

- Currency trading

- Traders from the Asia Region

- Corporate traders

- STP/DMA Trading

- Competitive spreads

- Good trading tools

- Auto trading

- API trading

- 24/7 customer support

EXT Summary

EXT is a reputable and regulated brokerage firm that provides access to a diverse range of trading instruments across multiple markets. The broker’s competitive trading conditions make it an attractive option for individual and corporate clients. Additionally, the availability of the proprietary advanced trading platform and API solutions caters to various trading strategies, appealing to retail and professional traders. Also, EXT’s 24/7 customer support ensures that clients get assistance around the clock, even on weekends.

The broker’s presence in both Europe and Asia provides expanded market opportunities, access to a diverse client base, advanced trading experience, and localized support.

55Brokers Professional Insights

EXT is a reliable broker with over 14 years of experience in the industry. The broker mostly caters to professional traders and stands out for its advanced proposal. EXT operates under different jurisdictions and offers its services to both European and Asian clients.

The broker’s services are various and well-tailored, with access to an advanced proprietary platform, FIX API, and HTTP API. With their complex solutions, the platforms are not suitable for beginner traders. Also, those who prefer MT4 or MT5 retail platforms will not be happy with the broker’s offering.

EXT offers access to an extensive amount of instruments, over 1,000,000 tradable products across Forex, Stocks, ETFs, Metals, Futures, Options, Bonds, etc. The broker enables traditional investments, assisting traders in expanding their portfolios. Also, EXT’s customer support team is available 24/7, ensuring that traders get help whenever they need it. Overall, EXT is a trustworthy broker with an excellent suite of offerings. Before engaging in trades with the broker, we recommend traders research it to determine how it will align with their specific trading expectations.

Consider Trading with EXT If:

| EXT is an excellent Broker for: | - Professional and experienced traders

- Clients looking for an extensive range of instruments

- Clients preferring API trading and customizable solutions

- Traders from the Asia Region

- Traders from Europe

- Clients looking for 24/7 customer support

- Those looking for competitive costs |

Avoid Trading with EXT If:

| EXT is not the best for: | - Beginner traders

- Cost-conscious traders looking for low deposit opportunities

- Those who prefer simple trading platforms |

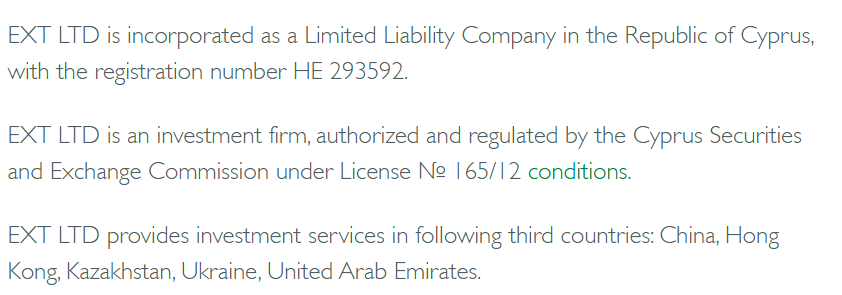

Regulation and Security Measures

Score – 4.5/5

EXT Regulatory Overview

EXT is a legitimate and trustworthy broker, ensuring a low-risk trading environment. It is authorized and regulated by the well-regarded Cyprus Securities and Exchange Commission (CySEC). This regulatory authority imposes strict rules and regulations to ensure high standards in the financial industry. The fact that EXT operates under CySEC regulation instills an additional level of trust and confidence in the broker’s operations. Moreover, the broker has obtained an additional license in Hong Kong, which enables the broker to expand its operations and services in the Asian market.

- The broker’s commitment to compliance with industry standards is evident through its regulation under a respected European authority. The broker also dutifully follows MiFID laws and rules, ensuring transparency and investment protection.

However, before engaging in trading activities, you should consider the variations that can arise when trading in different jurisdictions, even if you are using the same broker.

How Safe is Trading with EXT?

EXT implements various measures to protect its trading accounts. These typically include regulatory oversight, ensuring compliance with applicable rules and regulations. The broker also maintains fund protection mechanisms to keep client funds separate from the broker’s operational funds. Moreover, risk management tools like stop-loss orders and negative balance protection may be provided to help manage trading risks effectively.

- However, we recommend conducting thorough research and examining the broker’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the broker, as trading conditions can vary across jurisdictions.

Consistency and Clarity

Based on our research, EXT has operated for over a decade, providing its services globally. From the start, the broker has provided quality services, constantly enhancing its offerings. The broker focuses more on professional trading and has tailored suitable conditions, including advanced platforms, competitive pricing, and access to multiple markets.

The broker’s offering is clear and transparent, ensuring its clients are protected with strict laws and regulatory measures. Due to its attention to consistency and transparency, EXT has attracted many clients throughout the years, forming a firm client base.

Many traders point out the broker’s reliability, the safe and favorable environment, robust technologies, efficient costs, 24/7 dedicated customer support, and a great diversification of instruments. However, there are also negative experiences, such as delayed withdrawals and the high minimum deposit requirement. Our advice is to consider both the good and negative feedback and conduct additional research to make a final decision on signing up with the broker.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with EXT?

EXT offers its clients a single multicurrency account (Individual or Corporate), which enables access to more than 1,000,000 trading products. Clients can trade Forex, stocks, ETFs, metals, futures, options, and bonds with favorable conditions and in a safe environment. The account suits professional and institutional traders, ensuring access to advanced and innovative trading tools and features. Traders gain access to the broker’s proprietary platform, FIX API, and HTTP API, enabling users to explore the market at a professional level.

There are no account management fees: the broker only charges transaction fees for deposits and withdrawals. It is also possible to customize the EXT account based on the trader’s needs and strategies employed. The support is available 24/7, enabling traders to get help whenever they need it. The trading costs are low, with spreads starting from 0.3 pips.

Regions Where EXT is Restricted

EXT is an international broker with its services available to traders globally. However, due to regulatory reasons, EXT mentions a list of countries and regions where its services are unavailable.

- Russia

- Singapore

- The U.S.

Cost Structure and Fees

Score – 4.4/5

EXT Brokerage Fees

Per our findings, the broker offers competitive pricing for the majority of its trading services. EXT offers both spreads and commissions, depending on the instrument traded. For currency pairs, spreads are applied, while for instruments, such as precious metals, stocks, and ETFs, the broker offers commissions. Overall, the broker’s fees are low and transparent, offering clients a clear picture of the trading charges. The broker also includes a few non-trading fees, such as deposit/withdrawal transaction fees and inactivity fees.

Based on our test trade, EXT provides competitive and variable spreads, with an average spread of 0.3 pips for the EUR/USD currency pair in the Forex market. However, spreads can vary depending on factors such as market conditions, volatility, and liquidity. Therefore, to obtain accurate and comprehensive details regarding spreads, we recommend consulting the broker’s official website or contacting their customer support.

EXT commissions are mostly based on the traded instrument, as well as on the jurisdiction. The commission rates on the brokers’ website include execution, exchange, and clearing fees. The broker mentions approximate commissions on its website, but clients should check the exact rates with the support team.

Socks and ETFs—from $0.02

Metals—from $3

Futures, options—from $1.5

Funds – 0.5%

Bonds—from 9 bps

How Competitive Are EXT Fees?

We have found EXT prices competitive and favorable for professional and institutional clients. The broker’s fee structure depends not on the account type (it offers a single account) but on the traded instrument. For the currency pairs, EXT offers only spreads, starting from 0.3 pips. On the other hand, all the other instruments undergo the commission-based structures. The offered commissions might be subject to changes, so we advise traders to check them with the broker beforehand. Generally, the commissions vary from $0.02 to $3, depending on the trading products. All in all, EXT offers transparent fees that are on the lower side when compared to the market average. In addition to spreads and commissions, traders will face overnight, withdrawal, and inactivity fees.

| Asset/ Pair | EXT Spread | CFI Spread | AIMS Spread |

|---|

| EUR USD Spread | 0.3 pips | 0.4 pips | 1.5 pips |

| Crude Oil WTI Spread | 3 | 2.6 | 1.8 pips |

| Gold Spread | 0.005% | 12 | 1.8 pips |

EXT Additional Fees

In addition to the common spreads and commissions, EXT also applies extra charges.

- The overnight fees are generally applied to Forex pairs and short-term positions. Traders can learn the updated overnight fees in the Client’s Area.

- The broker also incurs an inactivity fee of 50 EUR if the account has not been active for more than six months. Also, the fee is applied if there are no open positions and the account balance is less than 5,000 EUR.

- EXT also applies a 30 EUR fee for withdrawals.

- The broker applies a one-time fee of 90 EUR for trading via the EXANTE Trade Desk.

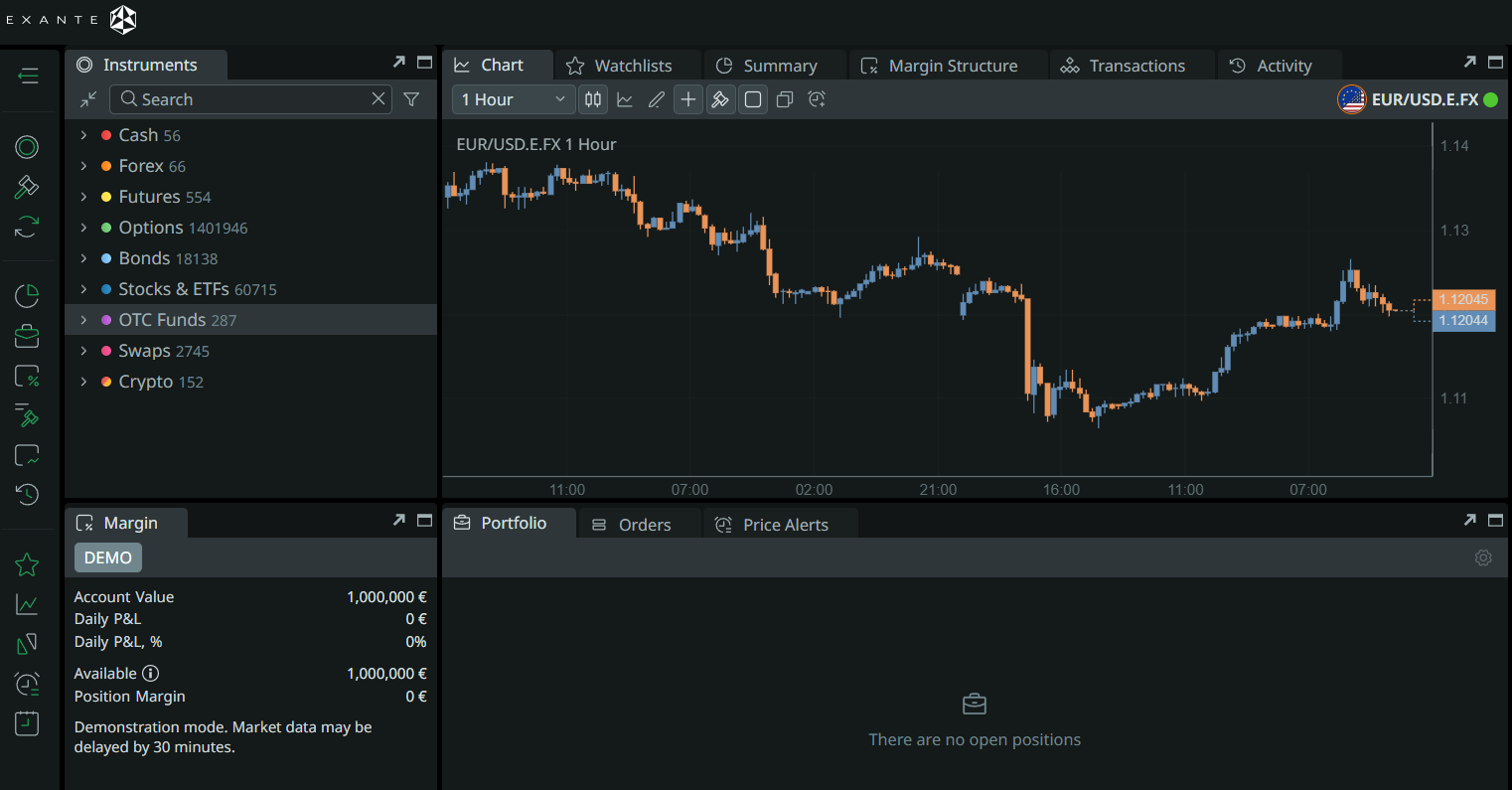

Score – 4.6/5

Traders have access to the broker’s proprietary EXT trading platform, along with HTTP API and FIX API solutions. The platform supports multiple devices, enabling users to trade on the web, desktop terminals operating on Windows, macOS, or Linux, as well as mobile devices such as iOS or Android smartphones.

| Platforms | EXT Platforms | CFI Platforms | AIMS Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

EXT Web Platform

The broker’s web platform enables traders access to a wide range of instruments without the need for downloads or installations. The web platform ensures smooth and instant access to the market. The platform offers a user-friendly interface, cross-platform compatibility, advanced trading tools, live portfolio monitoring, and comprehensive solutions.

EXT Desktop MetaTrader 4/5 Platforms

EXT has tailored its services to meet professional needs and expectations. This is why the broker has come up with more advanced and professional platforms, with complex solutions. Traders who prefer the MT4 or MT5 platforms will not find with EXT what they are looking for.

EXT Proprietary Desktop Platform

The EXT trading platform is an advanced solution to meet the needs of professional clients. The platform enables access to the global market, with an extensive range of trading instruments. Traders can use great trading tools, charts, trading indicators, perfect customization, and extensive features and capabilities. Traders are provided with a safe and reliable environment, with advanced encryption and safe practices. The platform is available in desktop, web, and mobile app forms, enabling diversity and ease of access. The broker has over 1,100 servers worldwide, ensuring low latency and secure data transfers.

EXT HTTP API

We found that the broker’s HTTP API facilitates the development of data-rich financial apps, ranging from intelligent messenger bots and option strategy advisors to mobile apps for market analysis and websites with stock tickers. It serves as a comprehensive market data source, empowering traders to fuel their trading strategies and visualize market quotes effectively.

EXT FIX API

For algorithmic traders, the FIX API presents a valuable opportunity for seamless trading. Supporting a FIX API, it enables data transfer, quote retrieval, and full-scale trading automation. This automation opens up a wealth of opportunities, allowing traders to go beyond the limitations of using only the trading UI and explore the full potential of algorithmic trading.

EXT MobileTrader App

Access to mobile trading is an essential step to more flexibility and liberty while trading. Clients need to have access to their accounts while being on the go. EXT gives traders this opportunity through its mobile app, enabling access to the same range of instruments as the desktop platform provides, combined with advanced tools and capabilities. Traders have access to real-time data, charts, indicators, and trading history at the palm of their hands. Besides, the app is available for iOS and Android devices, making the platform accessible to everyone.

Main Insights from Testing

Our testing of the EXT platforms was a positive experience, enabling us to access advanced platforms, tools, and capabilities. EXT offers its proprietary platform, specifically intended for professional traders. It offers FIX API and HTTP API solutions, taking the trading experience to another level. Clients are free to enter their accounts through web, desktop, or mobile platforms from almost any device. All the platforms provide an extensive range of instruments across multiple platforms, great trading tools, and the safety of trades. However, traders who are looking for popular platforms, like MT4/MT5, cTrader, or TradingView, might not find the broker’s offering a good fit.

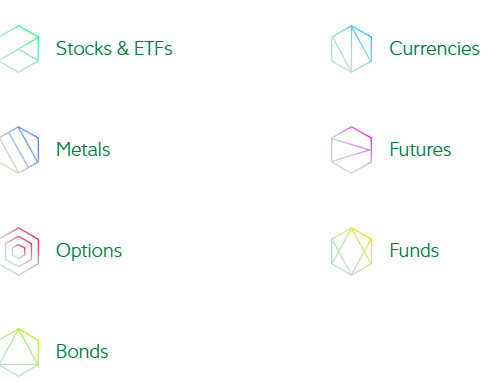

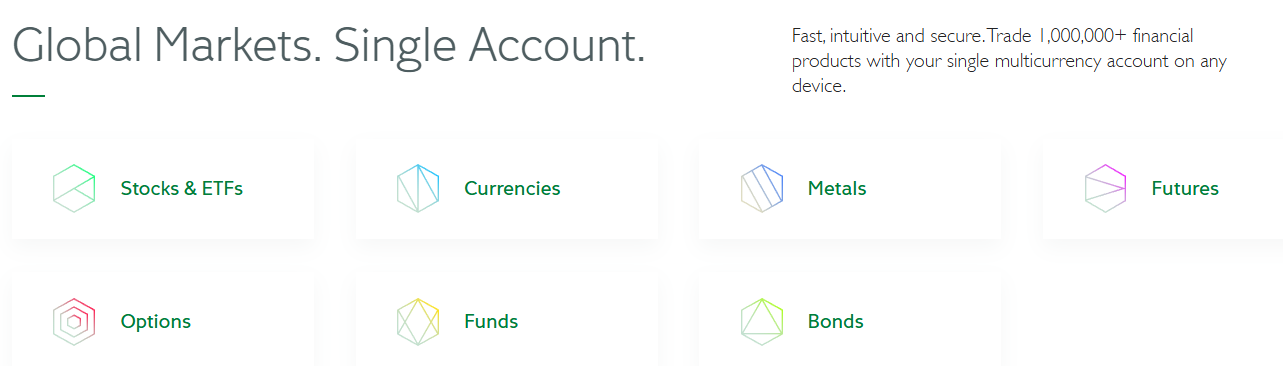

Trading Instruments

Score – 4.7/5

What Can You Trade on the EXT Platform?

EXT offers a vast selection of trading instruments, with access to over 1,000,000 instruments across more than 50 markets. These include Forex, Stocks, ETFs, Metals, Futures, Options, Bonds, and more. However, the availability of specific trading instruments may vary based on the entity or jurisdiction you are trading with.

The broker offers over major, minor, and exotic 50 currency pairs. The broker also offers precious metals, including gold, silver, platinum, palladium, and copper, with competitive prices and excellent trading conditions.

Main Insights from Exploring EXT Tradable Assets

Overall, the broker’s offering of tradable products is impressive. Clients have access to over 1,000,000 instruments, which is rare in the market. Traders can access over 50 forex pairs, precious metals, 40,000+ stocks and ETFs from the global market, over 500 futures, more than 25,000 options, 150+ hedge funds for investments, and 20,000+ corporate and government bonds.

It is obvious that due to this extensive instrument availability, clients can diversify their trading, enhance their opportunities, and explore the market to the maximum. Besides, with EXT, traditional investments are encouraged, and traders can engage in long-term trading.

Leverage Options at EXT

Leverage is a valuable tool allowing traders to participate in the market with less capital. While it can potentially result in significant profits, it can also lead to substantial losses. Therefore, you should thoroughly understand how it operates and the potential consequences associated with its use before engaging in any trading activities involving leverage.

EXT leverage is offered according to the CySEC and SFC regulations:

- European traders can use a maximum of up to 1:30 for major currency pairs.

- Traders may use higher leverage up to 1:500 on many FX pairs under the Hong Kong entity.

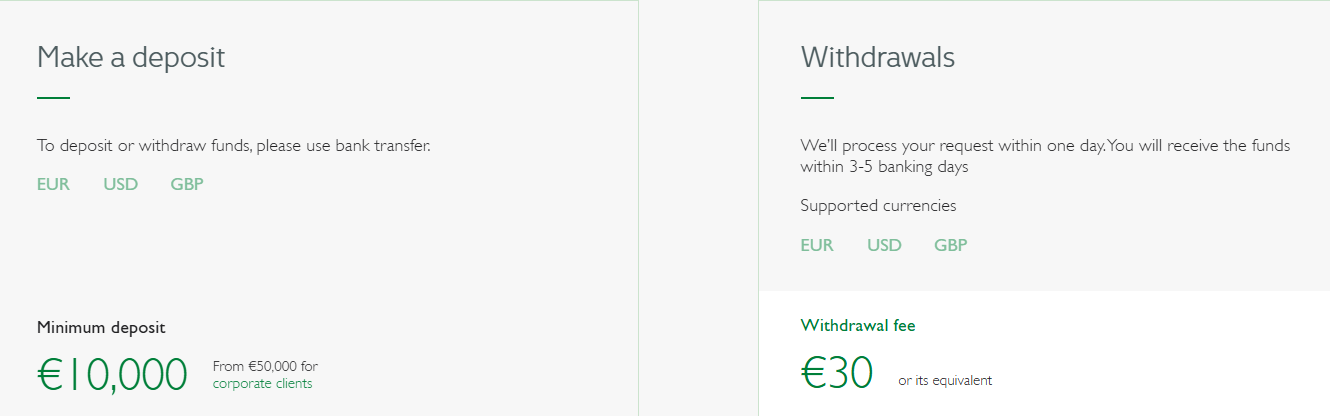

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at EXT

We found that the broker solely offers its clients the option of using Bank transfers as a method to deposit funds into their trading accounts. Bank transfers might take 1-2 business days to process, but are considered a reliable form of money transfer.

Minimum Deposit

To open a live trading account with the broker, clients need to deposit €10,000 as an initial deposit amount for Individual Accounts, which is higher than average. For the corporate account, the first deposit requirement is even higher, starting at €50,000. However, since the broker primarily serves professional traders, this deposit requirement is justified, making it an appealing offering for this target market.

Withdrawal Options at EXT

Based on our analysis, the broker typically processes withdrawal requests within a day, and clients can expect to receive their funds within 3-5 banking days. Also, there is a withdrawal fee of €30 or its equivalent for processing the withdrawal transaction.

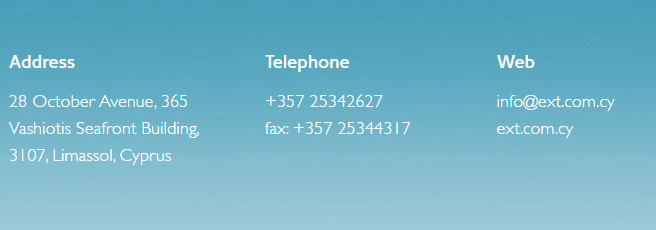

Customer Support and Responsiveness

Score – 4.6/5

Testing EXT Customer Support

The broker offers 24/7 customer service through Phone, Email, and an inquiry form. Also, the support team comprises experienced trading specialists who provide technical support, offer recommendations, address general inquiries, and assist in resolving operational issues for clients.

- The broker also has a Help Center where traders can find articles on the essential aspects of trading with the broker, such as details about account opening, deposits, withdrawals, etc.

Contacts EXT

EXT provides decent customer support 24/7, ensuring that its clients are assisted at all times. Traders can contact the broker through various options, including a phone line, email, or an inquiry form. However, EXT does not provide a live chat, a quick way to find answers, which, for many, is a negative point.

- Clients can contact the EXT support team by using the provided phone number: +357 25342627. However, the contact information may be different based on the entity. Clients can also use the provided fax details to contact the broker: +357 25344317.

- The broker also offers an email address for inquiries, questions, and feedback: info@ext.com.cy.

- Clients can also fill out the inquiry form to contact the broker for details on account opening.

Research and Education

Score – 3.5/5

Research Tools EXT

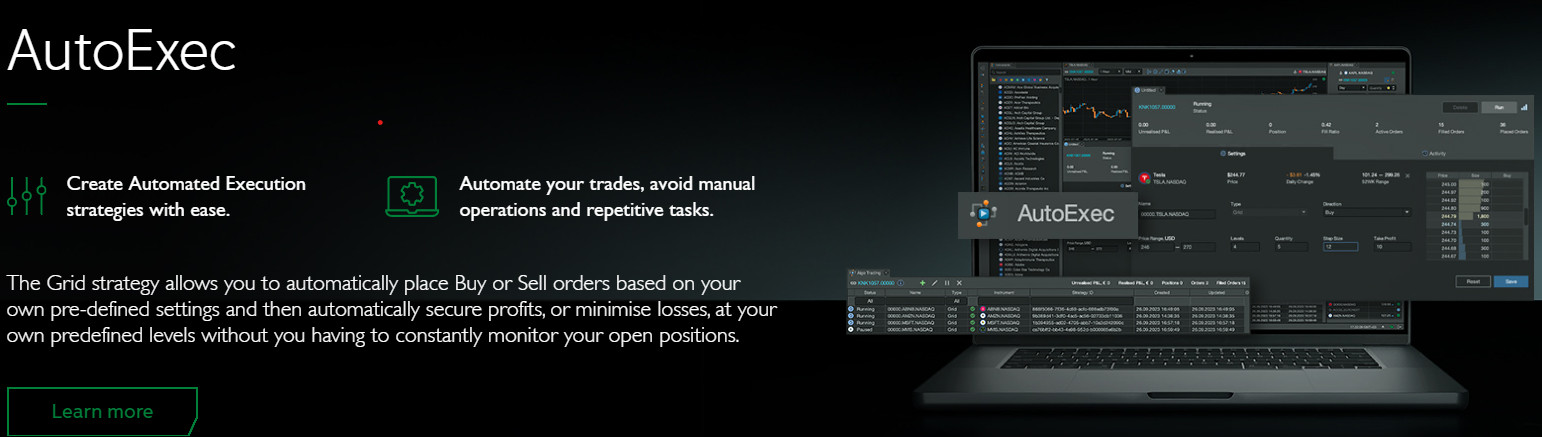

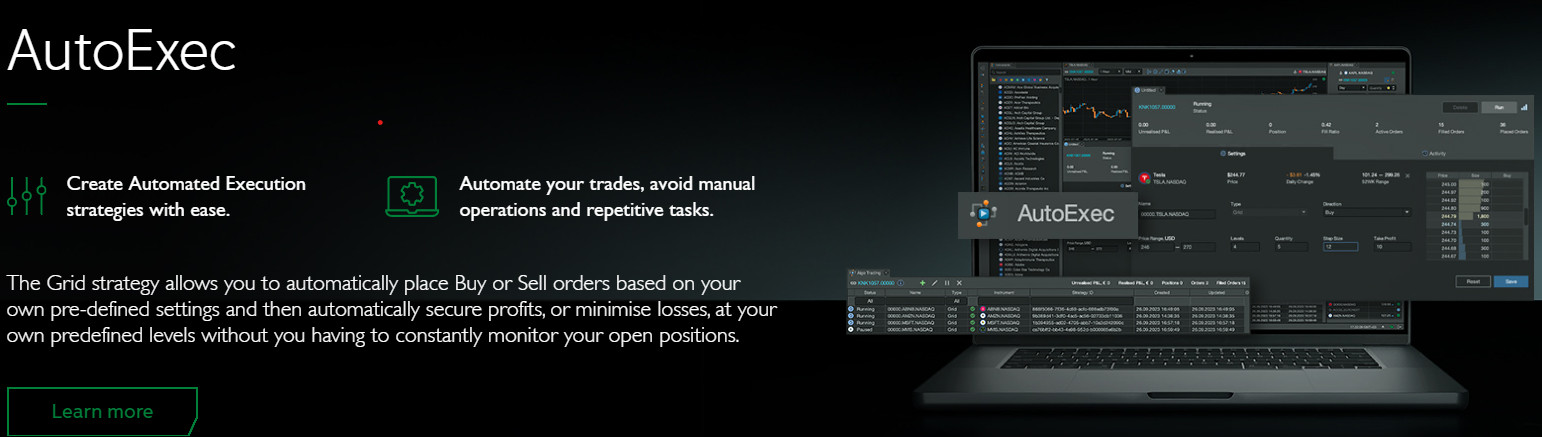

EXT provides its clients with extensive and innovative tools through its professional-grade platforms. Clients can access the FIX API, HTTP API, and AutoExec, enhancing their trading experience and exploring the market with better capabilities. The charting tools, indicators, and other in-depth research features also accommodate a favorable trading experience. However, our research revealed that traders cannot find extra research tools and resources for additional support on the broker’s website.

Education

The broker also falls short in providing educational materials, such as seminars, webinars, articles, a forex glossary, courses, etc. This limited access to educational resources could be a disadvantage for traders who value extensive learning materials to improve their skills and knowledge in the financial markets. Yet, as the broker’s proposal is tailored for more professional and experienced traders, the lack of educational resources might not be too concerning.

Is EXT a Good Broker for Beginners?

Based on our findings, EXT’s focus is on professional clients, as well as banks, wealth managers, family offices, and private investors. The broker offers an extensive range of instruments and access to over 50 markets with its advanced proprietary platform. The platform is intended for more professional use and might not be suitable for beginner traders. Besides, to open an account with the broker, the minimum deposit requirement is $10,000, which is very high for novice traders who want to start small. At last, the lack of educational resources is another reason for beginners to look for another broker option with simpler solutions.

Portfolio and Investment Opportunities

Score – 4.7 /5

Investment Options EXT

We have reviewed the opportunities with EXT to extend portfolios. The broker offers a more than extensive offering of 1,000,000 tradable products, ensuring that clients have a perfect chance to diversify their trading and find opportunities they cannot find elsewhere. Traders gain access to over 40,000 stocks from all over the globe, access to ETFs, 20,000 government and corporate bonds, and more than 25,000 options.

With EXT, traders can engage in traditional and long-term investment and buy and own shares of the global popular markets. Through the broker’s single account, traders can explore the market transparently and effectively.

Account Opening

Score – 4.6/5

How to Open an EXT Demo Account?

The demo account availability with EXT enables traders to practice different strategies with $1,000,000 in virtual funds before switching to live trading. Opening an EXT demo account is quick and simple. When clients register with the broker, the demo account becomes automatically available for them. Here are the steps to follow for registration and demo account setup:

- From the broker’s webpage, sign up by providing your name, email, and password.

- Log in to the Client Area.

- Enter the demo account and start practicing.

How to Open an EXT Live Account?

Opening an account with a broker is quite an easy process, as you can log in and register with EXT within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Fill in the questionnaire.

- Verify personal data by uploading documentation (residential proof, ID, etc.).

- Once your account is activated and proven, follow up with the money deposit.

Score – 4/5

EXT is a broker with advanced features and tools to assist traders and ensure a professional approach. All the main tools and features are available through the broker’s proprietary platform. Also, the proposal includes FIX API and HTTP API, making it even more beneficial for professional traders. We have also found additional offerings that can enhance traders’ experience.

- The AutoExec feature enables traders to create automated execution strategies. Clients can automatically set buy and sell orders without the need to monitor the trades all the time.

EXT Compared to Other Brokers

After reviewing each aspect of trading with EXT, we compared the broker to other reputable brokers in the market. We compared regulation, trading platforms, trading charges, education, product availability, customer support, and other essential points. As to the regulatory status, EXT is regulated and overseen by CySEC and SFC, offering a reliable trading environment. As we found, brokers such as HFM and FP Markets provide an additional layer of safety with their top-tier licenses from ASIC, FCA, and other respected authorities.

Next, we compared the trading platforms of EXT to Deriv and IC Markets. While EXT offers its proprietary platform with FIX API solutions, IC Markets offers popular platforms, including cTrader and MT4/MT5 platforms. Deriv offers an extensive range of platform options, including Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, and SmartTrader.

When it comes to EXT’s trading instruments, the broker stands out for its offering. It offers over 1,000,000 trading instruments, which is a unique proposal, especially compared to Deriv’s 200+ proposal of products.

EXT also offers 24/7 customer support, assisting clients at all times. The same 24/7 support is available with brokers like FP Markets, IC Markets, and Deriv. At last, EXT does include educational resources, which makes the broker unsuitable for beginners. On the contrary, FP Markets has an excellent education section, with various resources and opportunities.

| Parameter |

EXT |

Deriv |

FXTM |

HFM |

FP Markets |

IC Markets |

AIMS |

| Spread-Based Account |

Average 0.3 pips |

Average 0.5 pips |

Average 1.5 pips |

Average 1 pip |

From 1 pip |

From 1 pip |

Average 1.5 pips |

| Commission-Based Account |

From $0.02 to $3 (based on the instrument) |

0.0 pips + $0.05 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.50 |

No commissions |

| Fees Ranking |

Low/Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

EXT Proprietary platform, FIX API, HTTP API |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5 |

MT4, MT5, HFM App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5 |

| Asset Variety |

1,000,000+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

10,000+ instruments |

1,000+ instruments |

2000+ instruments |

| Regulation |

CySEC, SFC |

MFSA, Labuan FSA, BVI FSC, VFSC |

FCA, FSC, CMA |

FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, LFSA |

| Customer Support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

No education |

Good |

Good |

Good |

Excellent |

Good |

Basic |

| Minimum Deposit |

$10,000 |

$5 |

$200 |

$0 |

$100 |

$200 |

$50 |

Full Review of Broker EXT

In conclusion, EXT is a reliable broker with fair practices and adherence to strict rules. The broker is regulated by CySEC and SFC. Also, being a European broker, it follows the MiFID rules.

EXT stands out for its professional proposals. It is mainly directed to banks, wealth managers, family offices, and private investors. EXT offers vast opportunities to professionals and long-term investors, enabling them access to Forex, stocks, ETFs, metals, futures, options, bonds, 1,000,000+ instruments in total. Traders can access the market through the broker’s proprietary platform and use the FIX API and HTTP API. The broker’s platform is available through web and desktop platforms and a mobile app. EXT offers a single multicurrency account, tailored for individuals or corporate purposes.

Based on our findings, the broker does not have an education section. This is probably because EXT focuses on professional-grade services, and its clients are already experienced and skilled enough. Thus, the lack of educational materials and the high minimum deposit of $10,000 make the broker unsuitable for beginning traders, yet may not be a concern for its target professional audience.

Overall, EXT provides a competitive trading environment, great trading conditions, and a good market exposure. We recommend traders consider the differences in conditions between the entities to make sure they are aware of the trading details.

Share this article [addtoany url="https://55brokers.com/ext-review/" title="EXT"]