Looking Back at 2021

As the sun rose in 2021, the world was still reeling from the effects of COVID-19. Markets were affected, people were under lockdown, many businesses were shutting down. However, there was also hope on the horizon, that a new US president, and an impending vaccine roll-out, would lift the world out of the unusual and dismal circumstance it had suddenly found itself in.

Now, nearing the end of the year, the ‘normal’ life still eludes us. Monumental shifts in 2021 impeded our return to pre-pandemic days. Let’s look at three of them, to see how they affected the markets this year, and how they’re likely to play out in 2022.

Delta, Omicron and on (and on, and on!)

Two years into the pandemic, and the COVID-19 saga still continues courtesy of the Delta and Omicron variants.

While vaccines did play a role in boosting the economy in the first quarter of the year, they were quickly outpaced by the new variants. By mid-2021 the vaccine’s positive effect on economic conditions began to wane.

So what’s it look like for 2022?

The variants continue to create the possibility of forced lockdowns and restricted movements that impede the economy’s ability to return to normal. Many countries had already enforced restrictions on their populations even prior to the emergence of the Omicron variant.

Immunity for entire societies alludes to us, because of variants that require more booster shots but more largely due to the scepticism holding large portions of the global population from taking the vaccines.

As a result, it doesn’t look like the world will be past the pandemic as quickly as we thought it would be at the start of the year.

Inevitable Inflation

A rising cost of living defined consumer spending in 2021.

While expenses like food, fuel, and utilities all increased over the past two years, people now saddled with bigger bills to pay, just weren’t as prepared to spend any money on non-essential items. This in turn fuelled inflation, which registered at 6.8% at the end of November 2021 - the fastest annual hike in inflation since the early 1980s. By the end of November 2021, the Consumer Price Index index stood at a record-breaking high of 278.88.

Inflation didn’t hit the US alone. In Britain, it reached 3% and shot up much higher in many emerging markets.

So the million-dollar question at the end of 2021 is: Will inflation ease in 2022?

Most analysts agree that it will, but have different views on how and why.

Some say the supply chain bottlenecks and lockdowns directly caused by the pandemic are to blame for the high inflation. Their belief is that once the world returns to ‘normal’, and all the post-covid wrinkles are ironed out, inflation will cure itself.

Others are less confident that inflation will correct itself. Their view is that only a Fed intervention to hike interest rates will slow it down. As long as interest rates are this low, they say, and the borrowing costs are so cheap, inflation will persist.

Either way, it’s looking like inflation will decelerate in 2022. As vaccination rates rise, more people will return to work, and their income will go back towards services to help lift shortages on goods and bring the prices back down. Energy prices are likely to hold steady, because of a decrease overall in energy demands and more fuel production.

Should the economy not ‘correct itself’, inflation will be contained largely by the central bankers. History has proven that they know a thing or two about how to use rate hikes to rein in inflation.

A Changing Worker Landscape

The year brought on challenges that were not anticipated but also some unexpected wins.

For many employees disgruntled by long commutes, dreary offices, and disheartening work/life balance, 2021 cemented what had begun at the start of the pandemic lockdowns.

A new work order. One where employees could stay home, work remotely and also be more productive on both the work and home fronts.

After the lockdown, millions of workers quit jobs that were not allowing them to continue to work remotely. Many employers found themselves having to adapt or struggle to keep their businesses staffed.

The pandemic created a mass migration out of the office in 2021, and that trend will continue into 2022.

Studies show both managers and employees are happy with remote working. Employees say they’re more productive at home, that working remotely has improved their working relationship, and work/life balance.

The changing work landscape hasn’t only affected people’s lives, it’s affected markets like real estate, technology, and e-commerce.

One of the most striking impacts has been on real estate. Remote workers are now moving out of pricier city centre rentals and buying homes they can afford to live and work out of in more suburban locales.

Just like expensive, centrally located apartments, office buildings were largely abandoned in favour of more flexible office spaces in 2021. Marcelo Claure, executive chairman of WeWork, said recently that there was more demand for the company’s services than there ever was prior to the pandemic.

These trends are looking to continue next year as the world adapts to this new chapter in worker history. The great office migration.

Looking Forward to 2022

Some of the effects of the pandemic will be with us for many years to come. So say analysts closely follow the stock markets, consumer spending habits, and employment trends.

Variants and booster shots, potential lockdowns, and supply chain challenges all leave the hope of full economic recovery uncertain.

Still, there are many opportunities in 2022 to look forward to.

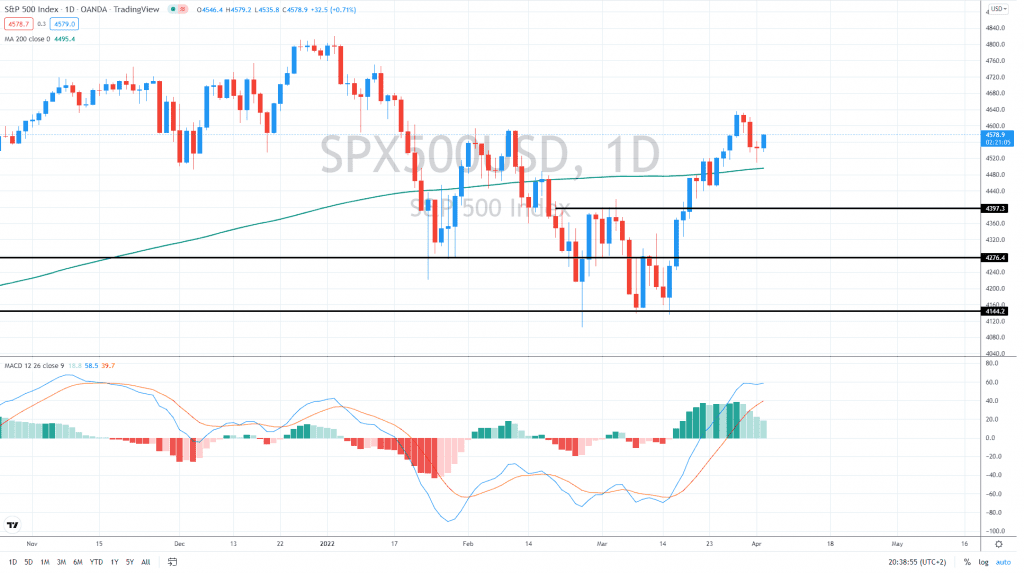

Strong markets will likely continue rallying into the year-end. Perhaps not as high as the last three years, but the forecast is looking at a continuing upward trend. This rosy outlook is based on solid fundamentals, wider spread vaccines, higher savings balance sheets, more consumer spending, and the growth of corporate earnings.

The bad news is that inflation remains high, but this could be addressed with the Fed’s interest rate hike to bring inflation down, in the early parts of 2022, towards its 2% target.

The Fed will very likely start raising interest rates in mid-2022 and this is expected to cause some market volatility.

It’s good to remember that despite the uncertainty and bleak outlook of 2020, the stock market was hot in 2021. All three major indexes – the S&P 500, the Dow Jones Industrial Average and the Nasdaq – set records. This is an encouraging sign for investors indicating that despite the shorter-term impacts of the pandemic on the market, the pitfalls are for the most part short-lived. The longer-term and broader outlook has proven to be positive.