- What is Aurum Markets?

- Aurum Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Aurum Markets Compared to Other Brokers

- Full Review of Broker Aurum Markets

Overall Rating 4.2

| Regulation and Security | 4.1 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Aurum Markets?

Aurum Markets is a Forex and CFD trading brokerage firm that provides a variety of trading instruments in different asset classes, including Forex, CFDs, Precious Metals, Commodities, CFD Indices, and Cryptocurrencies.

Based on our research, the company operates under the authorization and regulation of the reputable South African Financial Sector Conduct Authority (FSCA), which ensures compliance with regulatory standards. Additionally, the broker is officially registered in both Mauritius and Saint Vincent and the Grenadines and holds a license from the Financial Services Commission in Mauritius. This regulatory framework allows the broker to extend its services internationally and throughout the African region.

- Up to early 2025, the broker was operating under the name Cabana Capitals. However, the broker was rebranded and now continues its services under the name Aurum Markets.

Overall, the broker provides competitive trading conditions and a diverse range of trading products through the advanced MetaTrader trading platforms.

Aurum Markets Pros and Cons

Per our findings, the broker has both advantages and disadvantages that are important for traders to consider. For the pros, it offers a competitive trading environment, a low minimum deposit, as well as access to popular trading instruments, and the industry-known MT4 and MT5 trading platforms.

For the cons, the firm does not hold any top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under a South African entity is still considered safe enough. Also, the availability of educational resources is limited, so novice traders might better look for more suitable offerings.

| Advantages | Disadvantages |

|---|

| FSCA regulation and oversight | No 24/7 customer support |

| Low minimum deposit | No top-tier license |

| Trading instruments | Limited learning materials |

| MT4 and MT5 trading platforms | |

| ECN/STP execution | |

| Competitive pricing | |

| Professional trading | |

| Good trading conditions | |

Aurum Markets Features

According to our analysis, the broker offers reliable trading solutions with competitive fees, which is an advantage for all levels of traders. Moreover, the firm’s extensive selection of trading instruments with competitive trading spreads presents an appealing opportunity to traders. We have compiled all the aspects of trading with the broker for a quick observation:

Aurum Markets Features in 10 Points

| 🗺️ Regulation | FSCA, FSC |

| 🗺️ Account Types | Standard and ECN Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Precious Metals, Commodities, CFD Indices, Cryptocurrencies |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Aurum Markets For?

Our findings and the opinions of financial experts indicate that Aurum Markets, due to its appealing trading conditions, can attract a variety of traders. The broker is especially suitable for the following:

- Traders from South Africa and the African Region

- Traders who prefer MT4 and MT5 trading platforms

- Currency trading

- Beginners

- Advanced traders

- Islamic traders

- Swap-free trading

- International trading

- Low fees

- ECN/STP execution

- Good trading tools

- EA/Auto trading

Aurum Markets Summary

Aurum Markets is a trustworthy Forex trading broker that offers competitive trading solutions, advanced trading platforms, low fees and spreads, and access to a diverse range of trading instruments across multiple markets. Another advantage is the low minimum deposit requirement and the availability of different payment methods.

While the broker provides a favorable trading environment, we recommend carefully reviewing the broker’s offerings, terms, and conditions and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Based on our research, we have noticed multiple advantages of Aurum Markets that can attract different traders. First, the broker offers a range of account types, tailored for beginner and advanced traders, providing attractive trading conditions for its novice and more experienced clients. The broker’s trading charges are average, making the broker’s offering attractive for many.

Those traders who prioritize only top-tier regulations might not find Cabana Capital’s regulatory measures strict enough; however, the broker is regulated by the South African FSCA, which ensures the safety and reliability of trades.

Moving forward, the enthusiasts of the popular MT4 and MT5 platforms can access the market with advanced and innovative tools, taking their trading experience to a higher level. As we found, the platforms enable copy trading, offering traders an alternative option for investments and profits. The range of trading products is limited to 80, with access to Forex, CFDs, precious metals, commodities, CFD indices, and cryptocurrencies.

We also found that traders looking for comprehensive education will not find the broker’s proposal satisfactory. They cannot access webinars, extensive courses, a trading glossary, eBooks, and other resources with Aurum Markets. And at last, the broker’s customer support is at a good level, with multilingual assistance available 24/5 through various channels.

Consider Trading with Aurum Markets If:

| Aurum Markets is an excellent Broker for: | - Beginner traders

- Professional traders

- MT4 and MT5 platforms enthusiasts

- Copy traders

- African traders

- Global traders

- Cost conscious clients

- Islamic traders

- Currency and CFD traders

- Cryptocurrency trading

|

Avoid Trading with Aurum Markets If:

| Aurum Markets is not the best for: | - Traders prioritizing top-tier regulations

- Long-term investors

- Clients looking for an extensive range of instruments

- Beginner traders who need comprehensive educational resources

- Clients looking for platforms other than MT4/MT5 |

Regulation and Security Measures

Score – 4.1/5

Aurum Markets Regulatory Overview

Aurum Markets is a legitimate and regulated broker that follows the necessary regulations for offering Forex trading services. Compliance with the regulatory requirements set by FSCA, which is a rather good regulatory body in the financial industry, enhances the safety and confidence of traders who choose to trade with the broker. This regulatory authorization suggests that the company operates within the legal framework and is subject to certain industry standards.

However, the broker also holds an offshore license from the Financial Services Commission of Mauritius (FSC). Therefore, before engaging in trading activities, traders should carefully consider and understand the differences when trading in different jurisdictions.

How Safe is Trading with Aurum Markets?

Based on our research, the FSCA has a substantial weight in the financial services industry. As part of its oversight, it requires brokers to keep client funds separate from their accounts, protecting them. Additionally, Aurum Markets provides negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

Consistency and Clarity

We have reviewed the broker’s development over the years to see how consistent Aurum Markets has been in its services. As we found, the broker is available in more than 79 countries and has over 150k trading accounts opened. Besides, Aurum Markets has also obtained the FSCA license and expanded its services to the African region. Today, the broker is available in Asia, Southeast Asia, East Asia, and Africa.

In addition to its consistent development, Aurum Markets has also been recognized in the financial field and has gained awards for its operations.

However, the research on customer feedback reveals that the clients are not overly satisfied with the broker’s services. Some traders point out the absence of tight regulations, while others report withdrawal issues, which are too many to neglect. We also found positive reviews, pointing out the dedicated customer support, good trading conditions, and advanced platforms.

All in all, the broker shows consistency and transparency in the proposal. Yet, traders should be careful about the differences between the broker’s entities, especially global clients who trade under offshore regulations.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with Aurum Markets?

We found that Aurum Markets offers Standard and ECN Accounts, each offering various account types. These accounts come with unique features such as different leverage, spreads, and minimum deposit requirements, allowing traders to select an account that suits their preferences and expertise.

- The Standard accounts are tailored for beginner or intermediate traders and include Cent, Standard, and Ultra accounts. The leverage availability is the same for all three accounts, up to 1:500. The Cent and Standard accounts require a lower deposit, at $10, while to start an Ultra account, traders need to make a $200 initial deposit.

- The ECN accounts include the Trader, Elite, and Raw ECN accounts. These accounts are suitable for more advanced trading needs, with higher deposit requirements compared to the Standard accounts. For the Raw ECN account, the initial funding is $1,000.

- Additionally, the broker extends swap-free trading options to cater to the diverse needs of its clients. The Islamic account holders can also access free webinars, seminars, and tutorials.

Regions Where Aurum Markets is Restricted

Aurum Markets is available in over 79 countries globally, ensuring that traders worldwide can access the broker’s services. However, due to regulatory restrictions, the broker does not accept traders from the following countries or regions:

- The EU Region

- USA

- Canada

- Belgium

- India

- Iran

- Iraq

Cost Structure and Fees

Score – 4.4/5

Aurum Markets Brokerage Fees

We have carefully reviewed the broker’s fee structure and found that Aurum Markets offers competitive pricing for most trading services. For the Standard accounts, all trading charges are integrated into spreads. The broker charges commissions for its more professional ECN accounts only.

Based on our test trade, the broker offers competitive variable spreads, with an average spread of 1.8 pips for the EUR/USD currency pair in the Forex market. However, spreads can vary based on market conditions, volatility, and liquidity. Spreads also depend on the account type. For more professional accounts, spreads are very low, combined with standard commissions. For more accurate information on spreads for each instrument, traders should consult the broker’s website or contact their customer support for detailed information.

- Aurum Markets Commissions

Aurum Markets offers a spread-based and commission-based fee structure. This system allows diversity, as each trader can choose the more favorable structure based on their trading expectations. As we found, commissions are applied to the broker’s more professional account types, Elite account ($3.5 per side per trade) and Raw ECN ($2.5 per side per trade).

How Competitive Are Aurum Markets’ Fees?

Our research of the broker’s trading costs revealed a transparent and favorable fee structure, with spread- and commission-based account types to meet different needs. As we found, each account offers different spreads that vary from average to low spreads. The commissions also depend on the account type and are much lower for the Raw ECN account, which is a suitable choice for professional clients. All in all, the broker’s fees are cost-efficient and satisfy different clients.

Besides, the broker applies only a few additional fees and seems not to have any hidden charges, which enables traders to calculate all applicable charges before placing a trade. Another point worth attention is the broker’s operation under different entities, which might bring forth differences in trading conditions.

| Asset/ Pair | Aurum Markets Spread | EC Markets Spread | ActivTrades Spread |

|---|

| EUR USD Spread | 1.8 pips | 1.1 pips | 0.5 pips |

| Crude Oil WTI Spread | 1 | 0.45 | 0.03 |

| Gold Spread | 1 | 2.8 | 0.25 |

Aurum Markets Additional Fees

What we found about Aurum Markets‘ additional fees is that the broker does not charge fees for deposits and withdrawals, which is a great advantage. However, additional charges may be incurred during trading activities. The broker can also apply an inactivity fee after the account is dormant for three consecutive months. Therefore, we advise traders to thoroughly review the broker’s fee structure and terms to gain a complete understanding of the applicable charges and their potential impact on trading activities.

Score – 4.3/5

At Aurum Markets, clients can trade through the popular MT4 and MT5 trading platforms. These platforms are widely used in the financial industry and offer a user-friendly interface, advanced charting tools, and a range of technical analysis features.

Additionally, the platforms are accessible on desktop, web, and mobile devices, providing traders with the flexibility to choose the option that aligns with their unique trading preferences and strategies.

| Platforms | Aurum Markets Platforms | EC Markets Platforms | ActivTrades Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Aurum Markets Web Platform

Aurum Markets allows traders to conduct trades through the web version of the popular and demanded MT4 and MT5 platforms. The platforms are available through the browser and do not require any downloads or installations. The web platforms offer good functionality and a diversity of advanced tools and features. The platforms support advanced charting tools, various timeframes, different order types, automated trading, and copy trading, ensuring traders access the same opportunities and advanced trading conditions.

Aurum Markets Desktop MetaTrader 4 Platform

We find the broker’s MT4 platform very functional and equipped with essential tools and features. With Aurum Markets’ MT4 platform, traders can enjoy a full suite of advanced features, including interactive charts, 9 timeframes, more than 30 technical indicators, trading robots, strategy tester, Meta editor, and analytical and trading indicators.

The platform also supports 16 languages, real-time quotes, and an overall user-friendly interface. The platform is available for different operating systems, including Windows and macOS.

Aurum Markets Desktop MetaTrader 5 Platform

The platform offers a variety of trading tools to assist traders in making informed decisions. These tools include technical analysis indicators, charting features, and market research resources. Moreover, advanced features such as algorithmic trading and Expert Advisors (EAs) are also available on the MetaTrader platforms, allowing automated trading strategies. The platform also supports copy trading, ensuring traders make use of alternative investment options. What is more, clients can also access the Virtual Hosting System to elevate the quality of their trades.

The platform is easily reachable through web, desktop, and mobile options and can be downloaded on any device.

Main Insights from Testing

Based on our testing of Aurum Markets’ trading platforms, the broker is a suitable choice for those traders who prefer the popular MT4 and MT5 platforms. The platforms are available in web, desktop, and mobile versions, and ensure seamless operations and access to an extensive selection of features and tools. The MT5 platform might be a more attractive choice for professional traders, whereas the MT4 stands out for its ease of use and simplicity.

However, clients who are looking for a better variety of platforms, such as cTrader, TradingView, and other advanced choices, might find the offering unsatisfactory.

Aurum Markets’ MobileTrader App

Aurum Markets ensures that its traders experience flexibility and functionality through the MT4 and MT5 mobile apps. The mobile versions of the platforms include all the essential features for efficiency and functionality, ensuring that traders experience a high level of trading on the go and do not face restrictions. Thus, clients can access a range of financial assets with competitive fees and advanced tools, making use of charts, trading indicators, multiple timeframes, on-click trading, different order types, and more.

AI Trading

Our research also reveals that Aurum Markets offers a few AI-powered tools for its copy trading features. These features assist traders in identifying trading opportunities and simplify the process of decision-making for traders, especially for less experienced clients.

Trading Instruments

Score – 4.2/5

What Can You Trade on the Aurum Markets Platform?

The broker provides access to popular trading instruments, including Forex, CFDs, precious metals, commodities, CFD indices, and cryptocurrencies. However, we found that the total number of available trading products is 80. Most of the broker’s products are based on CFDs.

In addition to the limited number of trading instruments, the broker also does not support long-term or traditional investments. Traders profit from speculating on the price movements instead of owning the underlying asset. Besides, Aurum Markets does not offer shares, stocks, or ETFs trading.

Main Insights from Exploring Aurum Markets Tradable Assets

Aurum Markets offers only 80 tradable products across a range of assets. The broker concentrates on currency trading, offering over 45 pairs. It also includes the most popular precious metals, gold and silver. From commodities, traders can invest in UK Brent Oil, US crude oil, and US natural gas. In addition, clients interested in investing in indices can access 13 CFD index pairs with instant execution and favorable trading conditions.

Aurum Markets also offers an opportunity for crypto traders, with access to 15 coins, including Bitcoin, Ethereum, Litecoin, Ripple, Dash, Dogecoin, and more. The market for cryptocurrencies is open 24/7.

At last, as the broker operates under several entities, some of the tradable products might be unavailable based on the jurisdiction, or there might be differences in trading conditions.

Leverage Options at Aurum Markets

Leverage is a substantial tool that enables traders to enter the market with limited capital. However, its use can lead to substantial profits or losses. As such, traders should have a comprehensive understanding of how leverage works and its possible consequences before engaging in any trading activities that involve leverage.

Aurum Markets leverage is offered according to the FSCA and FSC regulations:

- Trades from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- International traders may use higher leverage up to 1:500.

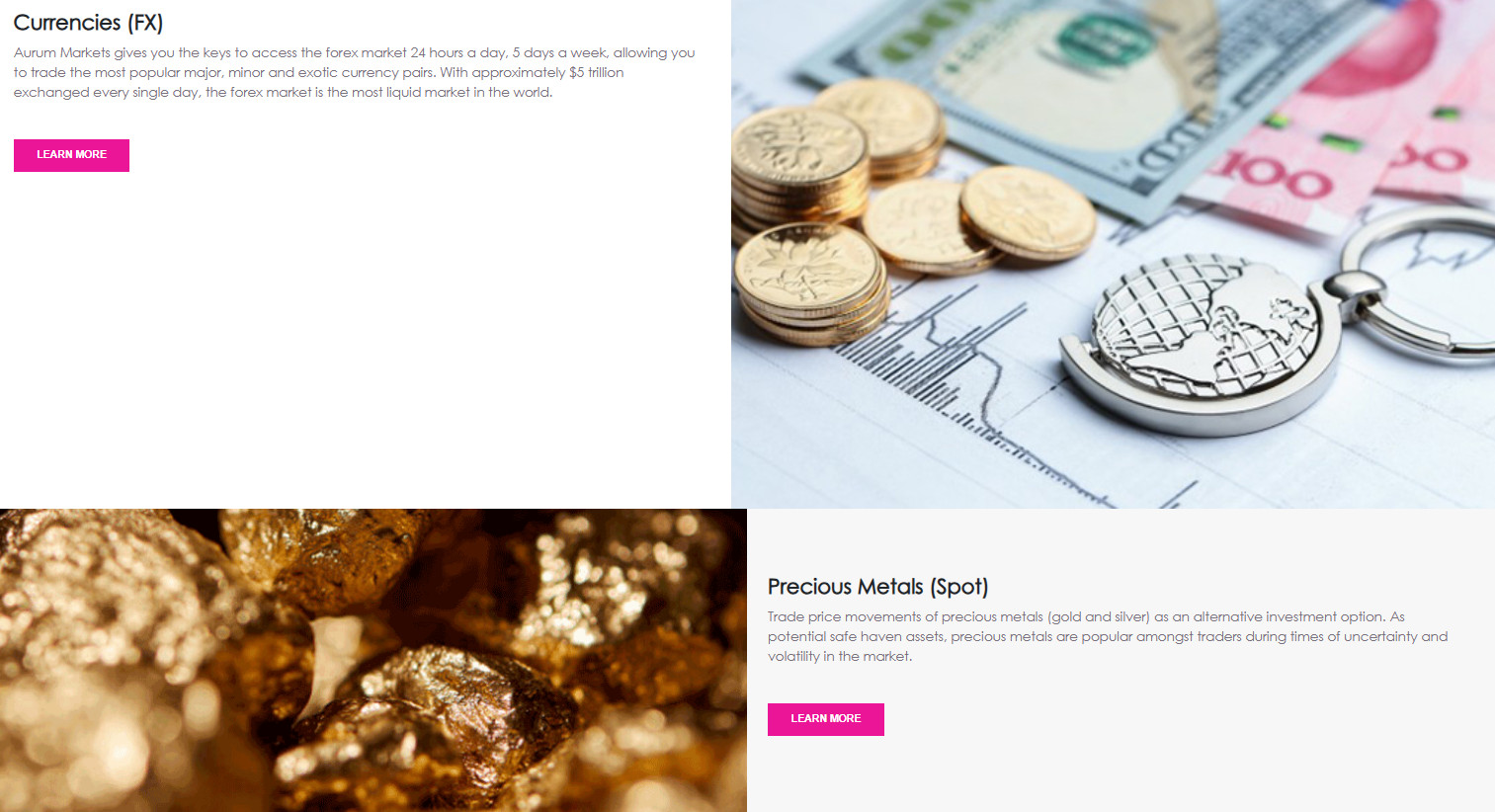

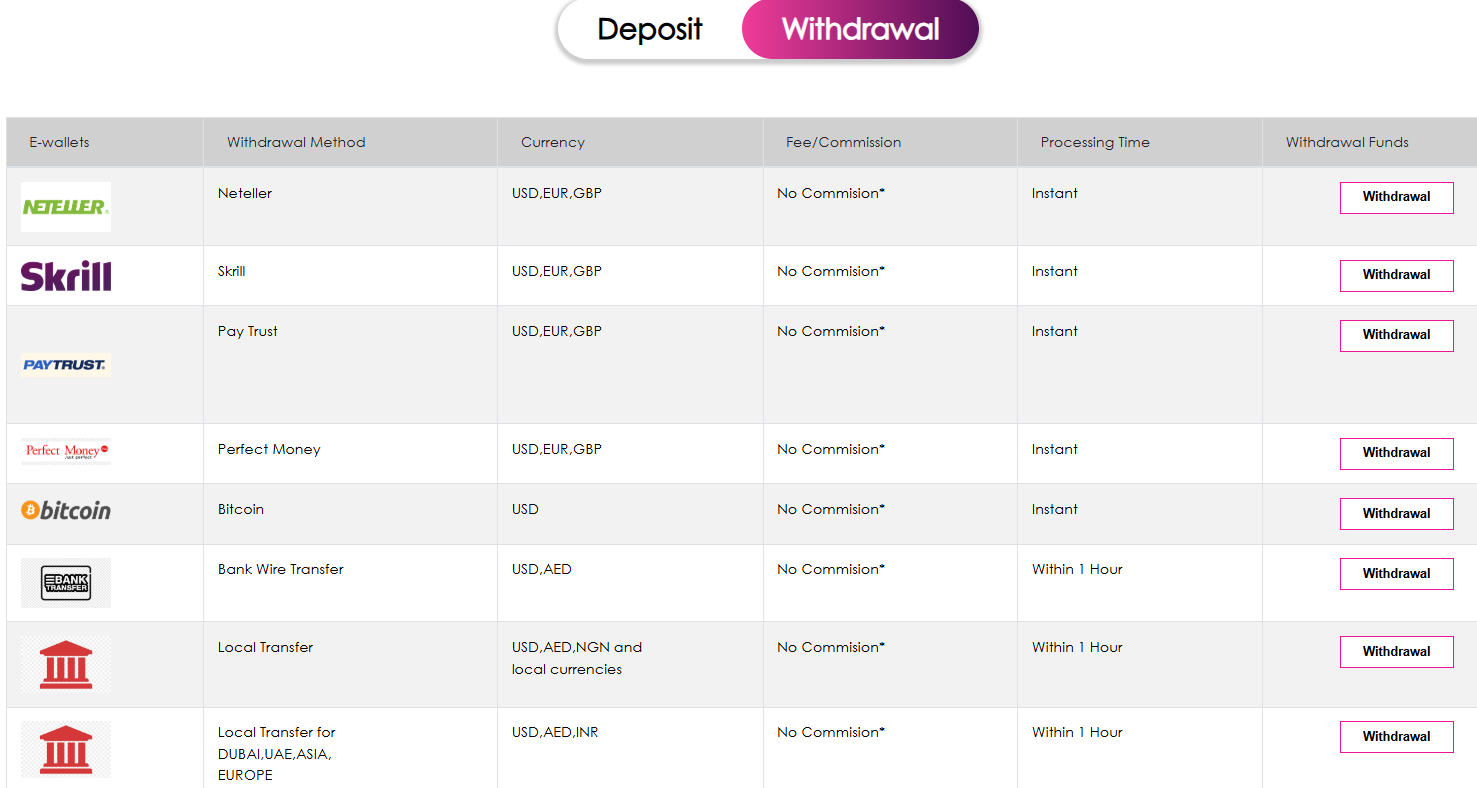

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Aurum Markets

The broker offers multiple funding methods to facilitate deposits and withdrawals for its clients. These include bank transfers, credit/debit cards, and popular e-wallet services. These options ensure flexibility for traders to choose the most convenient and secure method for their financial transactions.

- As we found, all the deposits are instant, except for bank transfers that may take up to 1 business day.

- Besides, the broker does not apply any commissions for deposits and withdrawals.

Minimum Deposit

To open a live trading account with the broker, traders need to deposit $10 as an initial deposit amount for Standard and Cent accounts, which is considered a very good offering. For the Ultra account, the minimum deposit amount is $200, and for the ECN Elite account, it is $500.

The ECN Raw account is suitable for more advanced traders and requires a $1,000 initial funding.

Withdrawal Options at Aurum Markets

As we found, withdrawing funds from the account is easy and fast. Aurum Markets allows clients to withdraw funds using various methods, including bank transfers, credit/debit cards, and e-wallets.

- Based on our research, there are no transaction fees for withdrawals, regardless of the funding method.

- The withdrawal processing is instant for most of the methods. For bank transfers, it might take up to an hour to complete withdrawals.

Customer Support and Responsiveness

Score – 4.5/5

Testing Aurum Markets Customer Support

Aurum Markets provides 24/5 customer support via phone line, live chat, and email. Additionally, the support team includes trading experts to assist with different technical and trading-related issues.

- The broker also has an FAQ section that includes detailed answers to common questions.

- Besides, Aurum Markets is also available on social platforms, including Facebook, X, and YouTube.

Contact Aurum Markets

Based on our testing of Aurum Markets’ customer support, the broker assists its clients through different channels. Traders can choose the most suitable form to communicate with the broker’s team and solve the issues they are facing:

- The broker’s Live chat provides traders with quick answers on different matters, ensuring that they find quick solutions to their trading-related problems and trade without interruptions.

- The broker also offers an email address, which traders can use to direct their questions, suggestions, and complaints: support@cabanacapitals.com.

- The phone line is another option to contact the customer team. Traders can directly speak to the support team and find guidance and assistance: 230 245 8606.

Research and Education

Score – 4.2/5

Research Tools Aurum Markets

Research and analysis tools are an important part of a profitable trading experience. Based on our findings, Aurum Markets’ trading platforms are equipped with extensive analytical tools and features to assist traders in their trading journey.

- Aside from the features available on the broker’s MT4 and MT5 platforms, traders can access the Autochartist. The tools available on Autochartist automate the market analysis process and provide traders with predictions. Traders also get real-time signals based on past and present market trends.

- Traders can also subscribe to the broker and get daily market insights directly in their inboxes.

Education

Research revealed that the broker’s website lacks comprehensive learning materials, seminars, and webinars, providing only some information on how to use MT4. This limitation is a drawback as robust educational resources play a crucial role in the improvement of traders’ skills and knowledge.

- However, we found that Islamic beginner traders have access to various educational materials, including webinars, seminars, and tutorials.

Is Aurum Markets a Good Broker for Beginners?

Aurum Markets offers its clients favorable trading conditions tailored to different trading needs. The variety of the broker’s trading accounts ensures that every trader, from a beginner to a professional one, finds what they are looking for. The broker’s MT4 platform ensures easy navigation, simultaneously providing the essential tools and features for a profitable experience. Aurum Markets also offers a demo account for traders to gain skills in a risk-free environment. In addition, based on the account type, traders can start with a $10 initial deposit. However, those beginner traders who prioritize comprehensive educational resources will have to look for another broker option.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options Aurum Markets

After carefully reviewing Aurum Markets’ instrument proposal, we can draw conclusions that the broker is not suitable for those who are looking for diversification of their portfolios. With only 80 available trading products, the broker provides only the most popular commodities, precious metals, and indices. However, the number of available currency pairs exceeds 45, which is a good variety. Besides, 15 cryptocurrencies will certainly attract crypto traders. However, all the products are available on CFDs, which limits opportunities for traditional traders and long-term investors.

- Anyway, Aurum Markets offers copy trading to those clients who are interested in copying the trades of professionals and earning profits from that.

- Those who favor the PAMM feature can open a PAMM account, select a manager of their choice, and gain profits.

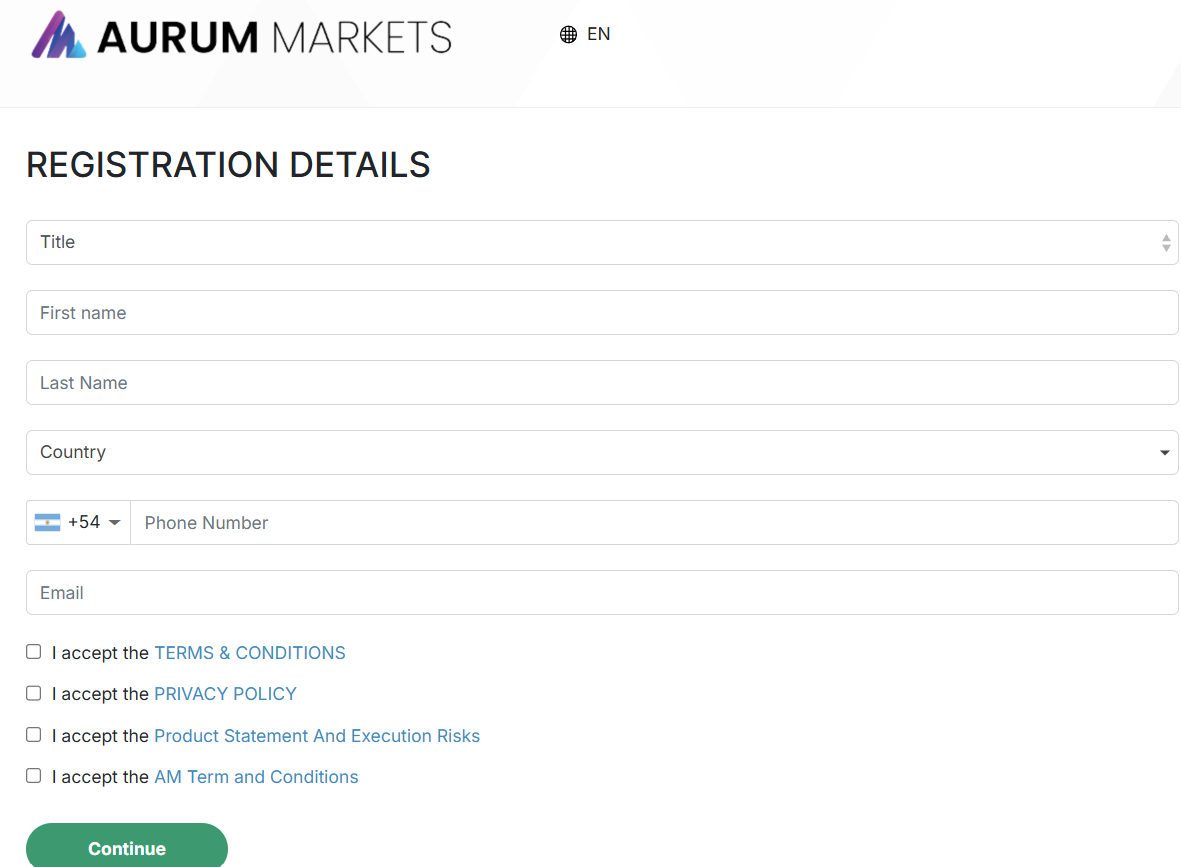

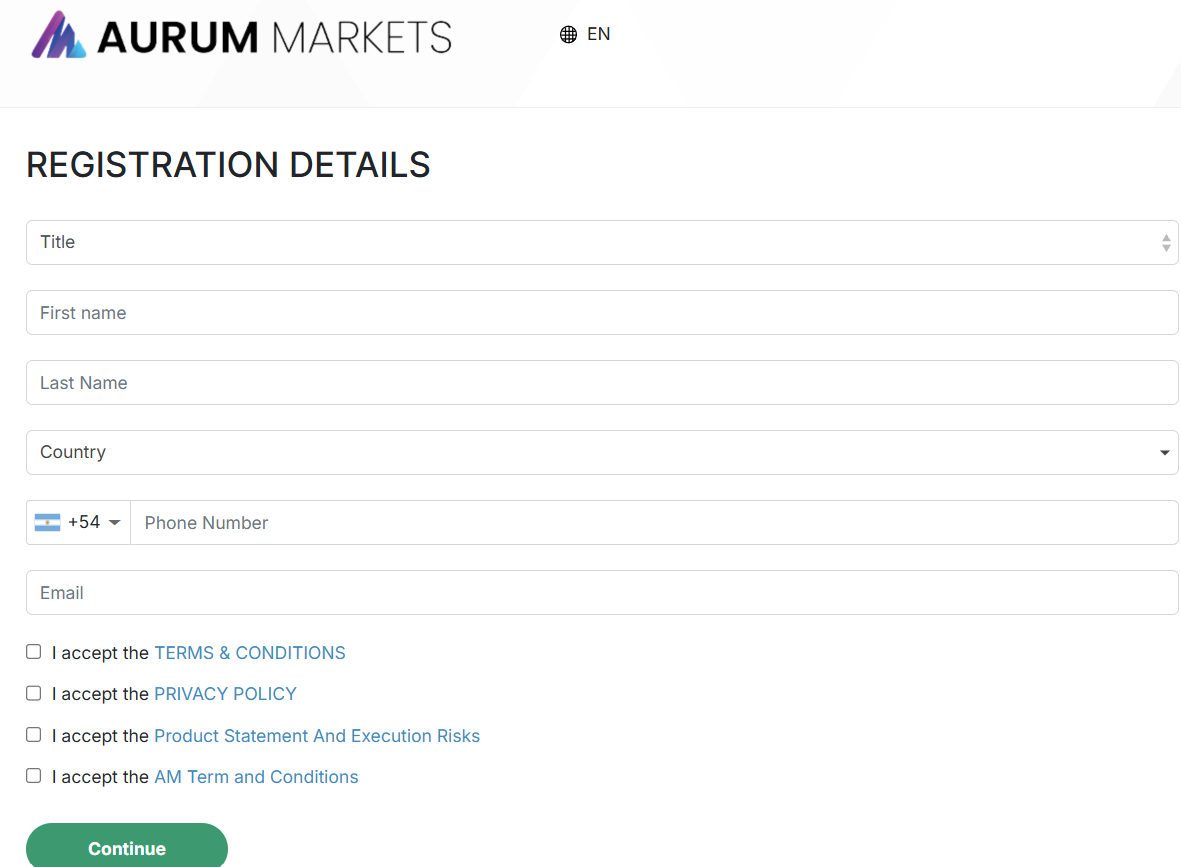

Account Opening

Score – 4.5/5

How to Open a Cabana Capital Demo Account?

Starting the trading journey with a demo account is the right decision, as the demo option enables traders to gain skills and knowledge before diving into trading with real investments. To open a demo account with Aurum Markets, traders should follow the following simple steps:

- Go to the broker’s website and click on the ‘Open demo account’ option.

- Specify the trading account, platform, virtual balance, etc.

- Provide personal information (name, phone number, email).

- Receive the account credentials in your email to access the account.

- Download the MT4 or MT5 platform, or access the web platform and start practicing.

How to Open an Aurum Markets Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register with Aurum Markets within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open Live Account” page.

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow up with the money deposit.

Score – 4.2/5

The availability of additional tools, features, and offerings ensures a better experience with the broker and opens more opportunities for beneficial trading. Here are the additional features traders can find with Aurum Markets:

- The broker’s Cashback Program enables both new and old clients to earn profits if they complete all the requirements, including opening an Ultar account type, depositing a minimum of $100, etc.

- By referring a friend, clients of Aurum Markets can invite and share the referral link with their friends and earn $50 for each referral.

Aurum Markets Compared to Other Brokers

As a last step, we have compared Aurum Markets with other brokers in the market. The purpose is to see where the broker stands and how its services align with the market expectations.

Starting with the comparison of regulatory oversight, Aurum Markets is regulated by an offshore FSC and the South African FSCA. The comparison showed that RoboForex is also regulated by the FSC; however, the latter does not hold additional licenses. Yet, we have also reviewed many tightly regulated brokers holding top-tier licenses from ASIC and FCA, such as Admiral Markets and FP Markets.

Moving forward, the trading charges applied by Aurum Markets depend on the account type and average 1.8 pips for the EUR/USD pair. BCR has a similar offering with an average of 1.7 pips for the popular pair. However, TriumphFX and Admiral Markets have an average spread of 0.6 pips. Moreover, Aurum Markets offers the MT4 and MT5 platforms. Almost all the brokers we reviewed include the MT4 and MT5 platforms. However, many brokers, such as TMGM and FP Markets, also have proprietary platforms.

Our comparison revealed a moderate range of trading instruments (80+) for Aurum Markets. However, TriumphFX has even more limited instrument offerings (64+), whereas RoboForex stands out for its extensive 12,000+ instrument availability. At last, the initial deposit of $10 for Aurum Markets is lower compared to BCR, which requires at least a $300 deposit for account opening.

| Parameter |

Aurum Markets |

BCR |

RoboForex |

TriumphFX |

FP Markets |

Admiral Markets |

TMGM |

| Spread-Based Account |

Average 1.8 pips |

From 1.7 pip |

Average 1.3 pip |

Average 0.6 pip |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission-Based Account |

0.0 pips + $2.5 |

0.0 pips + $3 |

0.0 pips + $4 |

Not available |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4,MT5, |

MT4,MT5, WebTrader |

MT4, MT5, R StocksTrader |

MT4 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4,MT5, TGM app |

| Asset Variety |

80+ instruments |

Over 300 instruments |

12,000+ instruments |

64+ instruments |

10,000+ instruments |

8000+ instruments |

12.000+ instruments |

| Regulation |

FSCA, FSC |

ASIC, BVIFSC, SVG |

FSC |

CySEC, FSC, FSA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, FMA, VFSC, FSC |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Basic |

Basic |

Good |

Good |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$10 |

$300 |

$10 |

$100 |

$100 |

$1 |

$100 |

Full Review of Broker Aurum Markets

Based on our research, Aurum Markets ensures favorable trading conditions for various traders, from beginners to professionals. The first thing we found about the broker is that it has operated in the market since 2017 under the name Cabana Capitals. However, since 2025, it has been rebranded and now operates as Aurum Markets. Despite the name change, most of the broker’s offerings remain the same.

Our findings show that Aurum Markets is regulated by the FSC (Mauritius) and the FSCA in South Africa. However, the broker lacks regulation from a top-tier authority; thus, those traders who prioritize intense regulation might find the broker’s safety measures insufficient.

Aurum Markets offers several account types tailored for different trading needs and expectations. The accounts have either a spread-based or commission-based structure. The minimum deposit requirement for the Standard account is $10.

With Aurum Markets, trades are conducted on the popular MT4 and MT5 platforms that include extensive tools and features. The platforms are available on the web, desktop, and mobile versions, ensuring flexibility and versatility. The broker’s clients can also engage in copy trading and PAMM services and extend investment opportunities.

However, Aurum Markets offers a limited number of instruments (80+) based on CFDs, which can be limiting for those who want to extend their portfolios and explore the market further.

All in all, Aurum Markets can become a good choice for beginner and professional traders if their expectations align with the broker’s offerings.

Share this article [addtoany url="https://55brokers.com/cabana-capitals-review/" title="Aurum Markets"]