- What is Orbex?

- Orbex Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

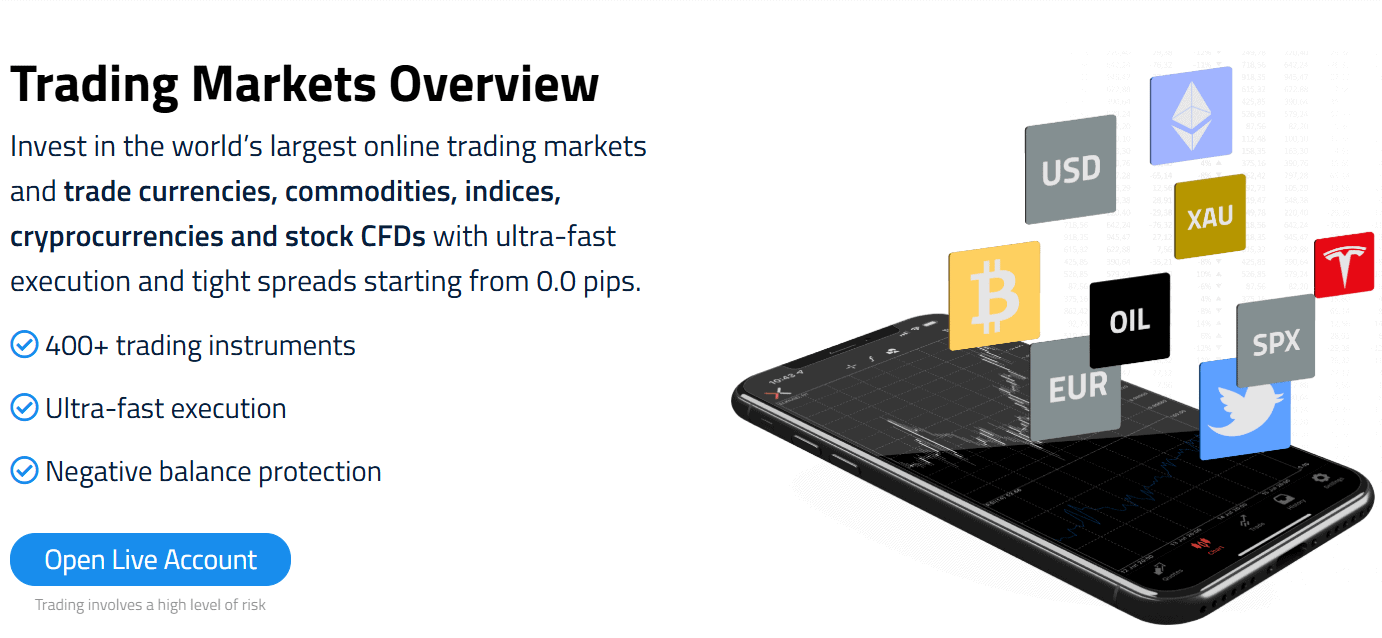

- Trading Instruments

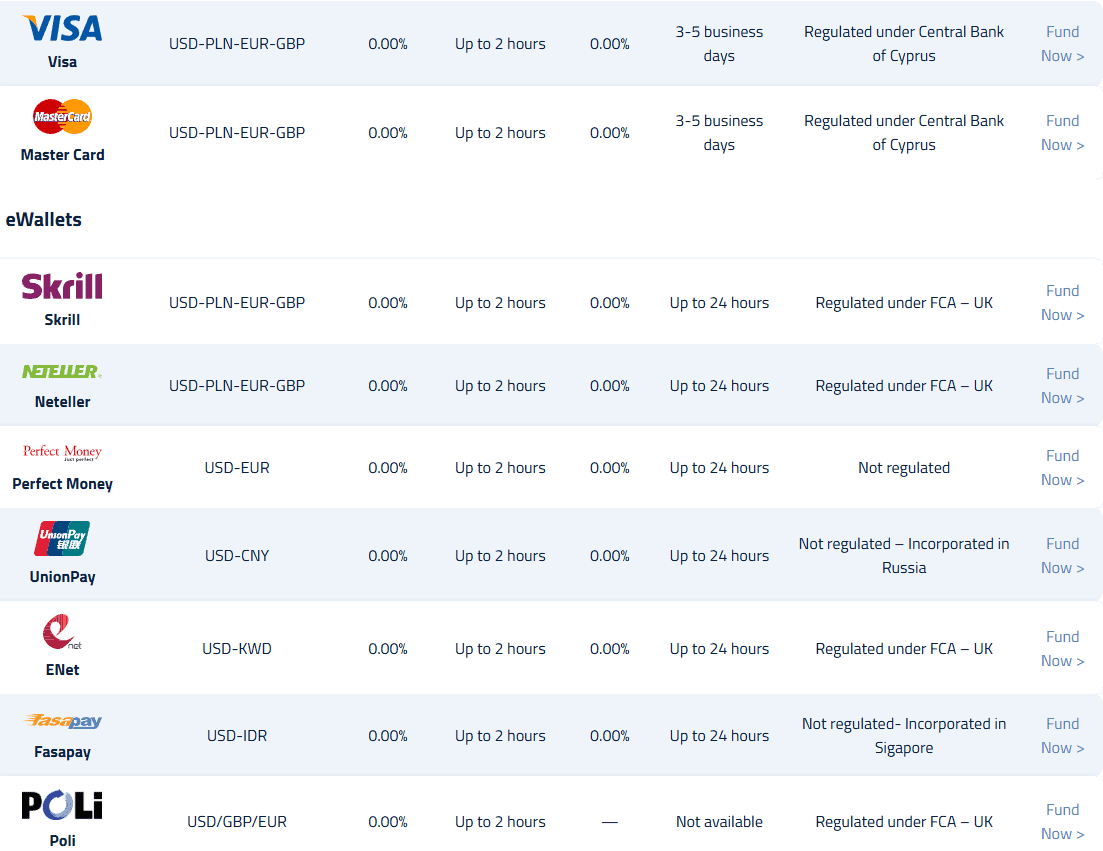

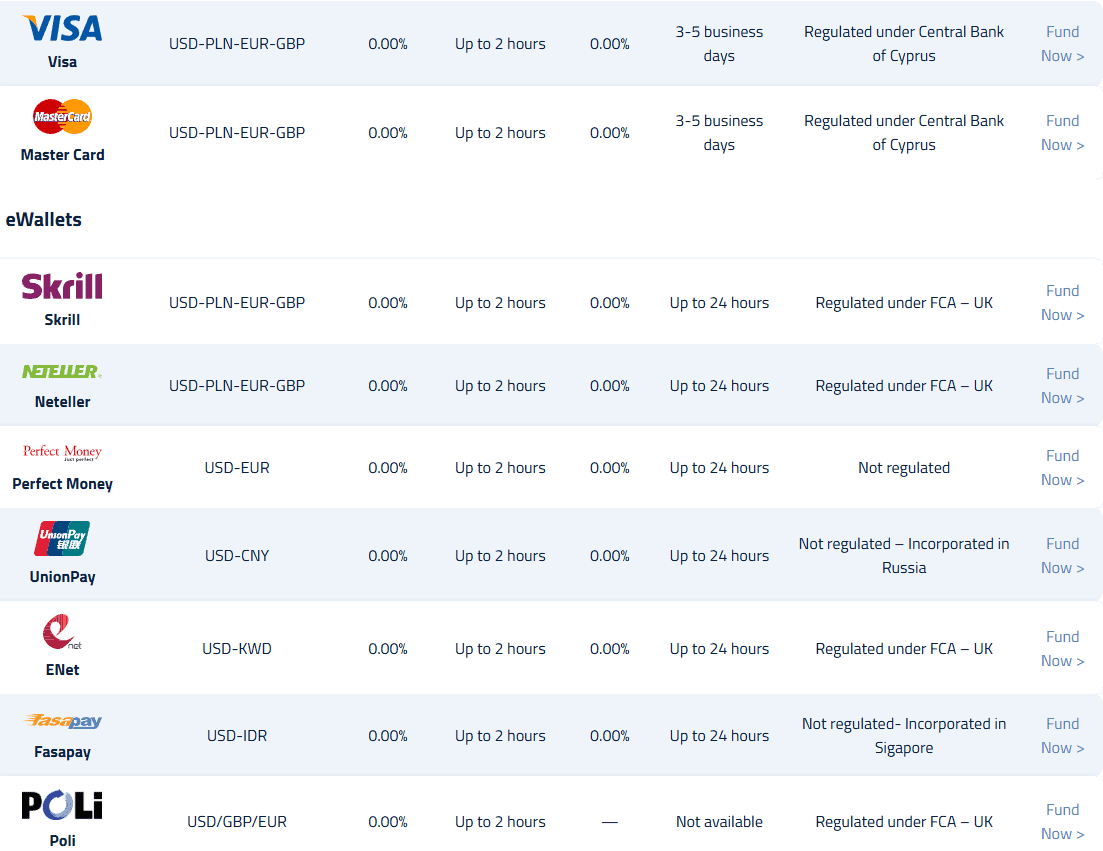

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

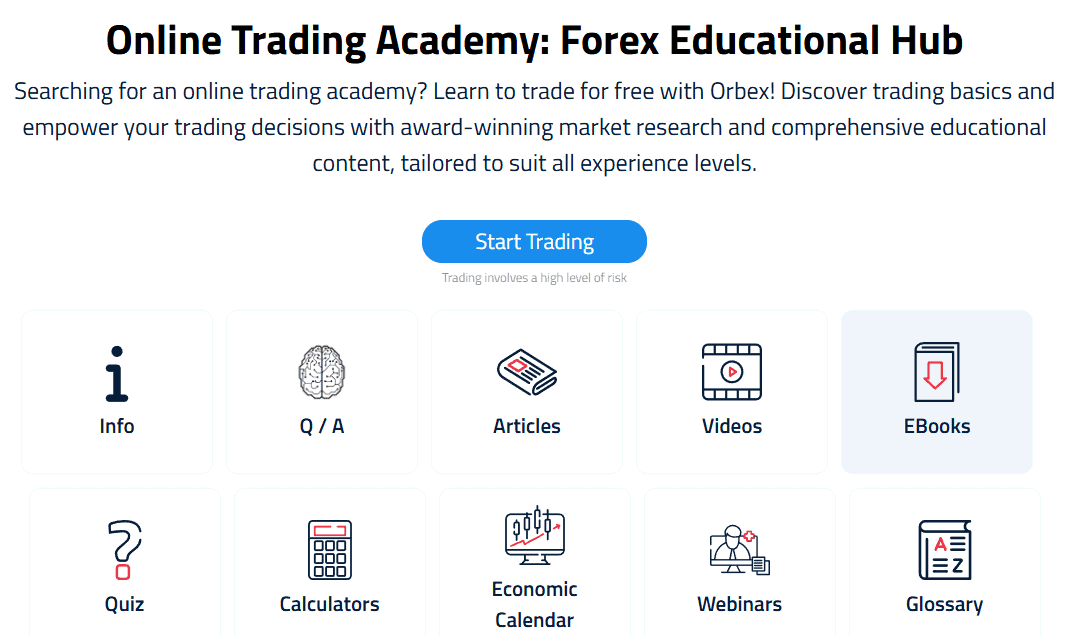

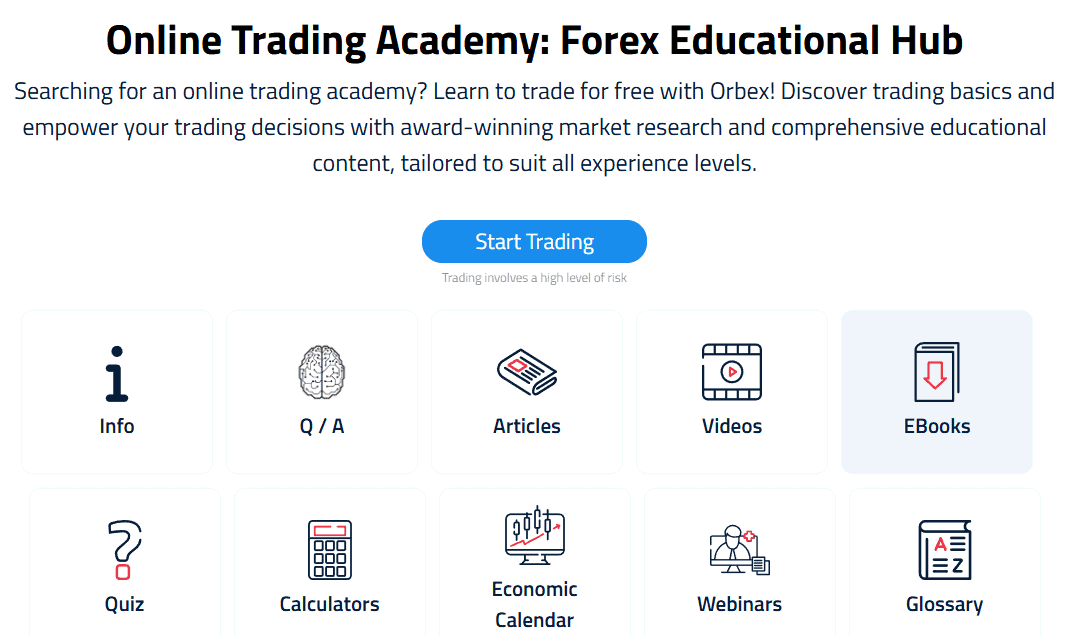

- Research and Education

- Portfolio and Investment Opportunities

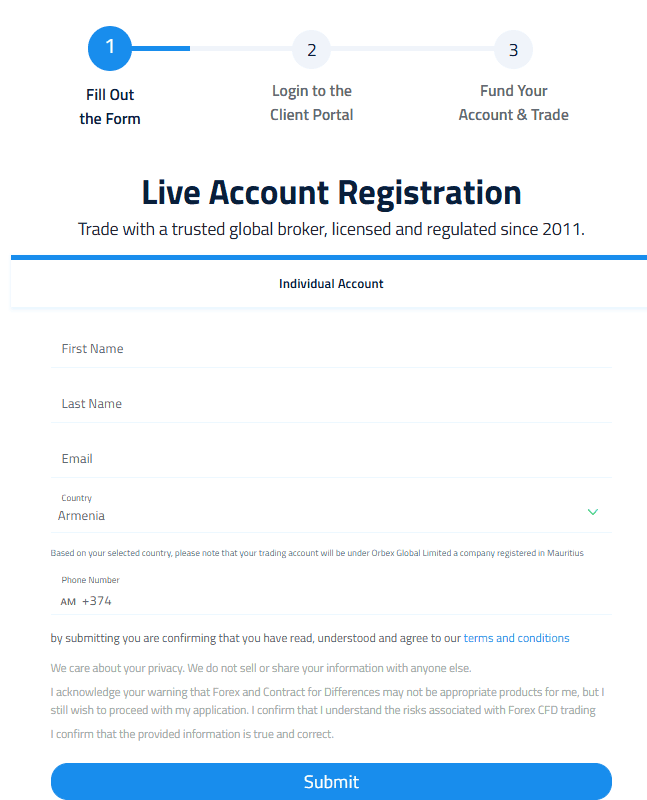

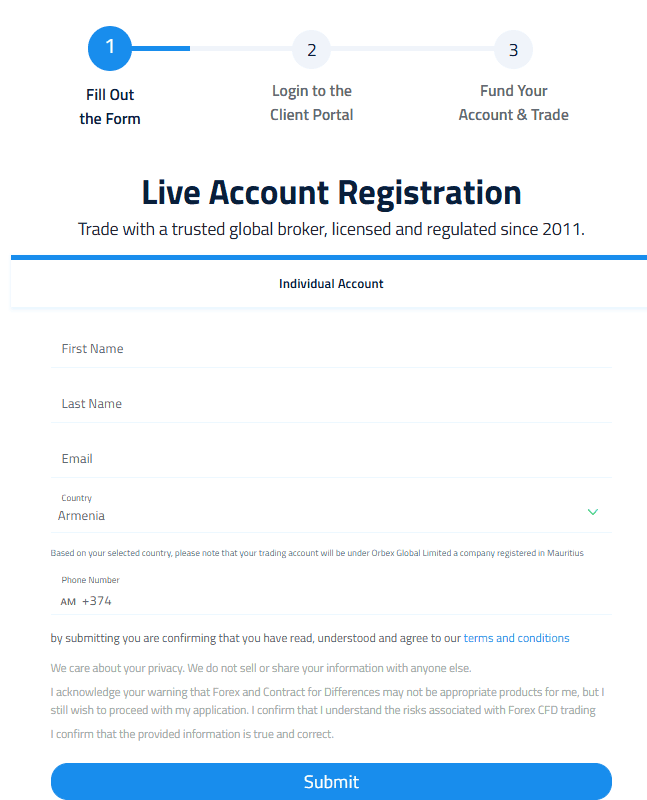

- Account Opening

- Additional Tools And Features

- Orbex Compared to Other Brokers

- Full Review of Broker Orbex

Overall Rating 4.2

| Regulation and Security | 4.1 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.1 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is Orbex?

Orbex is an established Forex and CFDs trading company that has been operating since 2011. The broker is a mainly Cyprus-based company that offer trading via EU separate site with multiple international offices for interantional trading and proposal. Since its inception, Orbex has stood out with a successful operation history, offering competitive trading conditions backed up by a sophisticated technological background, a full range of trading services, multi-asset trading, and educational resources.

In addition, Orbex serves representative offices in the MENA regions, in Kuwait and Jordan, making its offering even beyond with an expansion to trading services. Also, Orbex expanded its horizons with an international proposal as the broker opened an entity in Mauritius with access to high leverage and received a local financial license from MFSC.

Orbex Pros and Cons

Based on our expert research, Orbex is a reputable CFD broker that provides excellent trading conditions with sophisticated tools. We also marked among the broker’s offerings a great choice of MT4 leading-edge trading platform with fast online account opening and a free demo account. Among other benefits, the broker provides relatively low spreads with no commissions charged for deposit/withdrawal processes.

In terms of negative aspects, the broker no longer holds CySEC regulations and has a limited asset portfolio, offering only Forex and CFD instruments. Another disadvantage is that its customer support is available only on working days.

| Advantages | Disadvantages |

|---|

| CFDs trading

| Support not available 24/7 |

| Regulated Broker | Only CFD products |

| Great trading tools and education free of charge | |

| Social trading options | |

| MT4 platform | |

| Fast account opening and free Demo account | |

| No commission deposits and withdrawal options | |

Orbex Features

Orbex is a Cyprus-registered broker with over a decade of presence in the market and is praised for its trustworthy and advanced services. The broker has quite appealing conditions, that will diversify trading experience for any trader. Besides the costs are quite competitive, great for cost-concious clients. Below take a quick look at the main aspects of trading with Orbex:

Orbex Features in 10 Points

| 🗺️ Regulation | MFSC, FSA, SVG |

| 🗺️ Account Types | Starter, Premium, Ultimate |

| 🖥 Trading Platforms | MT4, MT5, Orbex mobile app |

| 📉 Trading Instruments | Forex, Commodities, Stocks, Cryptocurrencies, Indices |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR |

| 📚 Trading Education | Free education with Trading Academy |

| ☎ Customer Support | 24/5 |

Who is Orbex For?

Based on Our findings and Financial Expert Opinion, Orbex has many great offerings and features that will attract traders of different levels. Here is what Orbex is mostly good for:

- Beginning Traders

- Professional Traders

- Algorithmic or API Traders

- EAs running

- Copy Trading

- Scalping / Hedging Strategies

- Traders who prefer the MT4 and MT5 platforms

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

- High Leverage Trading

Orbex Summary

Orbex is a reliable company with good standing as an international broker and offering its services in the MENA region. There is a range of account types, comprehensive platform features, and numerous free tools allowing a better trading environment.

In addition, there is a choice between the flexible or floating spreads, OTC or ECN connection, as well as strategies to choose from. The beginner traders can benefit from free educational tools, while the professionals are supported by dedicated tailored services. The only gap for now is operations solely via International entities, thus certain protection levels might not be available. Also, residents from EU countries might not be able to open accounts.

55Brokers Professional Insights

Orbex has been in the market since 2011, acquiring a strong international presence and loyalty from clients which is definitely a plus. The broker has been constantly enhancing its offerings, by adding new features and tools, as another plus. Whereas in the past it offered only the MT4 platform, now traders have also access to the MT5 platform, equipped with many innovative tools suitable for complex strategies. Performance of trading is on a good level too, execution is smooth so trading of various strategies very welcomed at Orbex.

Yet, there are no much of additional tools provided, although they’re good in the platforms provided, those traders looking for something extra to enhance trading to another level might look other proposals too.

As for the education there is good bunch of webinars, seminars, forex glossary, articles, educational videos, ebooks, quizzes, and many more, that makes the broker an excellent choice for beginners, who seek guidance and support in their trading journey. While Orbex demonstrates transparency in its offerings, it still lacks when it comes to regulation from reputable authorities too. This is a crucial factor that traders shouldn’t overlook when choosing a broker, as tight regulatory oversight ensures protection and trust.

Consider Trading with Orbex If:

| Orbex is an excellent Broker for: | - Traders who look for diverse account types

- Prefer availability of various fee structures

- Favor the MT4/MT5 platforms

- Look for extensive education and research

- Prioritize dedicated customer support

- Look for transparency in overall offering

|

Avoid Trading with Orbex If:

| Orbex is not the best for: | - Traders who prioritize top-tier regulations

- Who are looking for great diversity of instruments

- EU traders

|

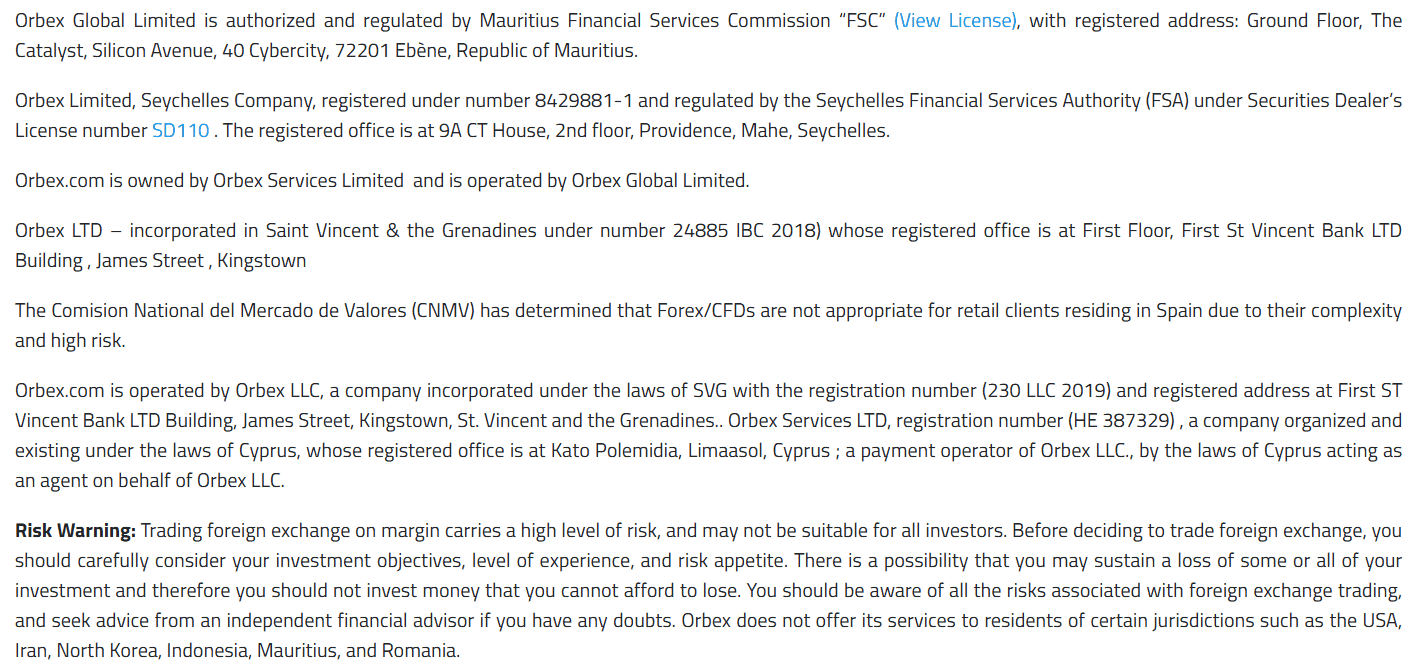

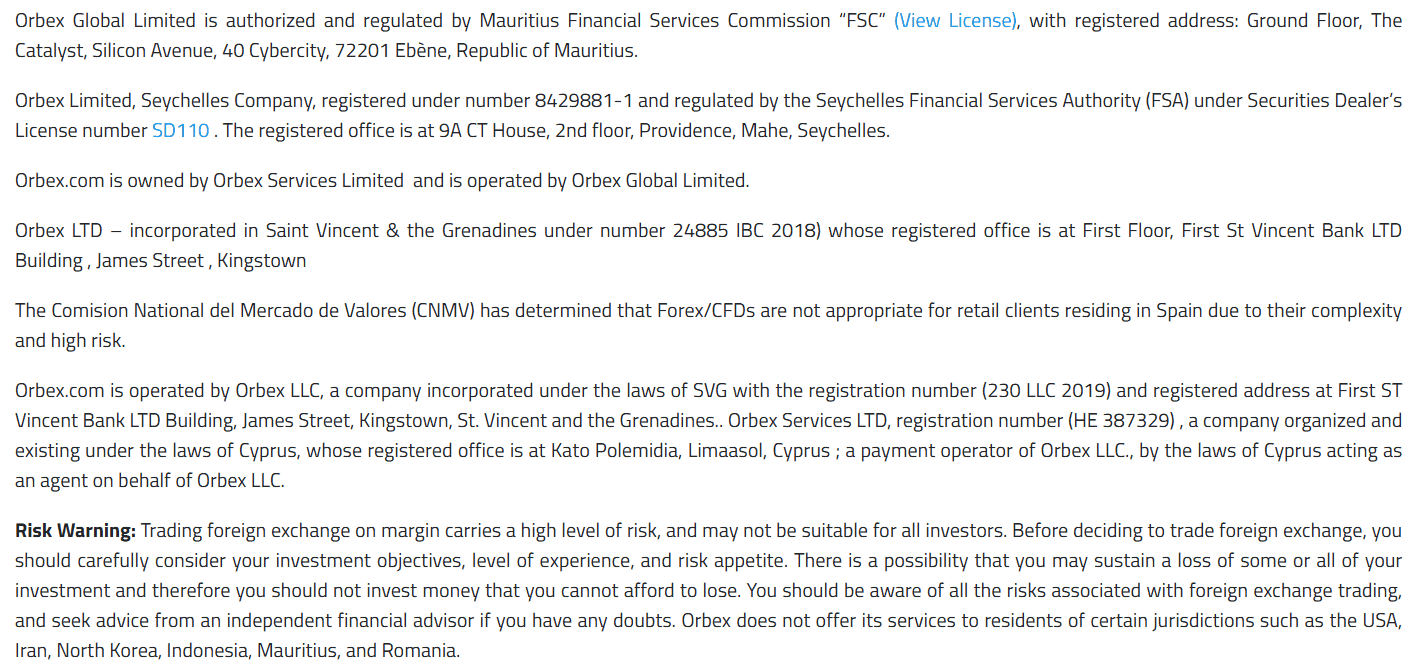

Regulation and Security Measures

Score – 4.1/5

Orbex Regulatory Overview

Orbex is a fully licensed and regulated Investment Firm with a good reputation, previously operated under CySEC and ESMA regulations.

- The regulation mentioned adheres to MiFID European Law, which operates under ESMA and contributes to safeguarding the stability of the European Union’s financial system and enhancing investor protection and financial market stability.

- For now, the MFSC, FSA, and SVG regulations remain active, so we advise European clients to double-check availability and regulatory status in case they are interested.

FSC Mauritius is considered an offshore zone. Despite this fact, FSC has recently updated its policy and requires higher capitalization and standards for brokerage businesses.

How Safe is Trading with Orbex?

Orbex employs advanced technologies and ensures a secure online forex trading environment. For one, clients’ data is encrypted and securely backed up, keeping them safe. Besides, all client funds are held in segregated accounts, separate from the company’s operational funds. Also, Orbex is a member of the Investor Compensation Fund, which means the broker offers extra protection for its clients.

Consistency and Clarity

Orbex is a well-regarded broker that has been in the market for many years now, and has earned its own place due to the safe environment and favorable conditions it offers. Although at the moment the broker does not hold any top-tier license, it still stands as a transparent option that excels in some of the aspects of trading.

What we liked the most about the broker, is its constant development and expansion of tools and features which shows that the broker is constantly enhancing its offerings. Besides, multiple awards Orbex has earned during its operation are proof that the broker has a good standing and is well-regarded by traders. By going through the reviews from real traders, we found that the feedback is mostly positive, especially pointing out excellent education and research, and responsive customer support. However, traders still have concerns about the broker’s regulation and the withdrawal process. Overall, Orbex is consistent in its operations and development of its services, with segregation of funds in place as a safety measure, so clients can conduct their trades in a safe environment.

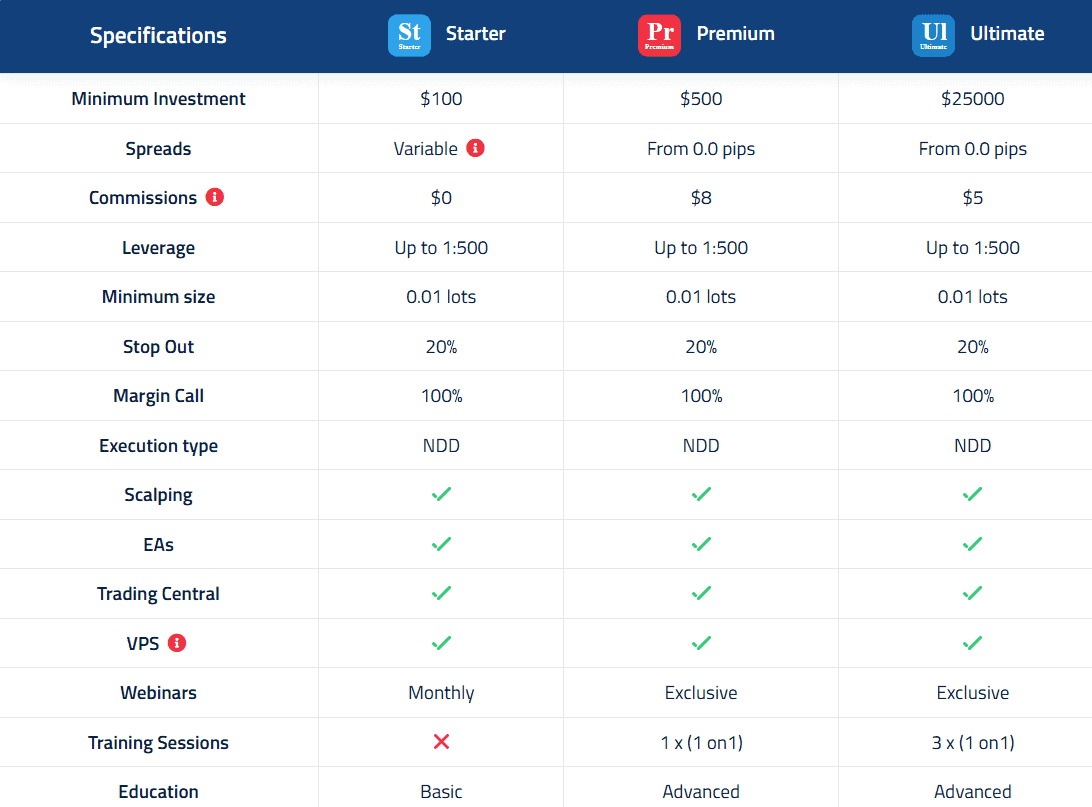

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Orbex?

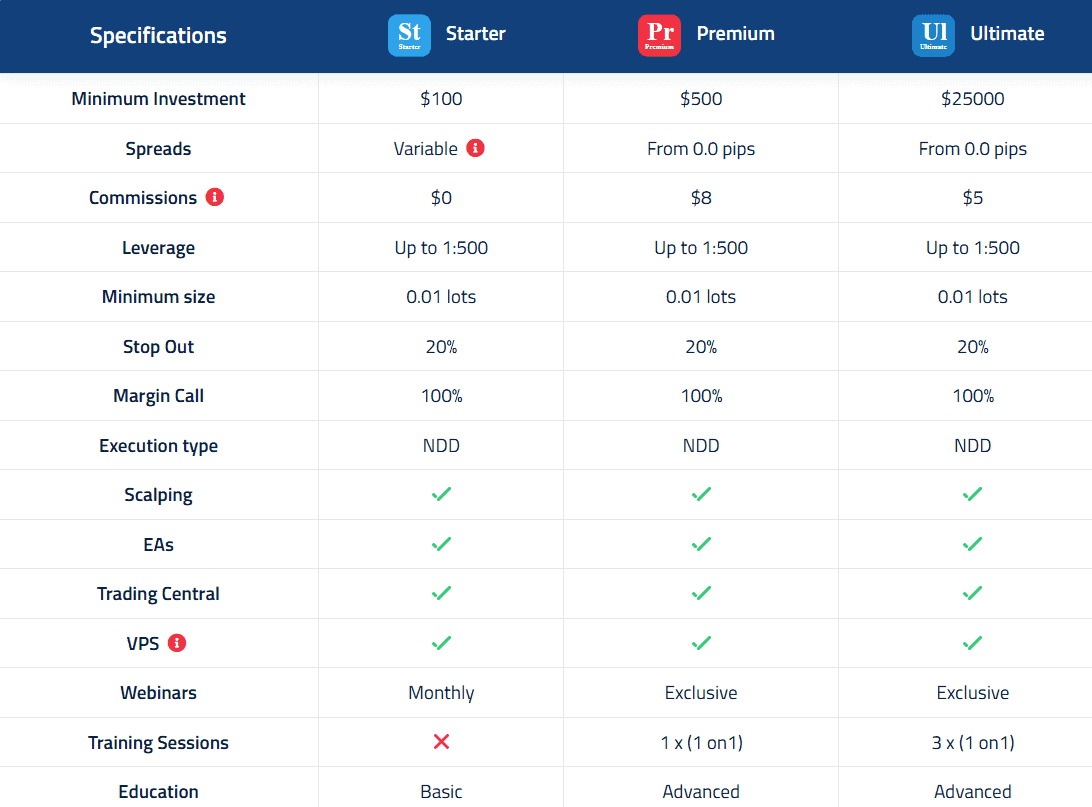

Orbex offers a good range of account types, each with a different fee structure and varying conditions, all with an NDD execution. This enables traders to choose one of the account types—Starter, Premium, or Ultimate—according to their preferences and trading expectations, ensuring positive trade outcomes. Although conditions for each account are mostly different, there are still some common features, such as leverage as high as 1:500.

Starter Account

To open a starter account clients need to deposit an initial $100. Spreads for this account are variable with an average of 1.5 pips for EUR/USD. All the fees are included in spreads, thus the account type includes no commissions. The starter account enables many enhanced features such as VPS, EAs, Trading Central, and basic education with the availability of monthly webinars.

Premium Account

Orbex’s Premium Trading Account features raw forex spreads from 0.0 pips at $8 commission per lot, and flexible trade sizes from 0.01 lots. The minimum deposit for this account is $500, which is a little higher than the market average, intended for middle-sized traders. One of the advantages of this account type is its exclusive access to more enhanced and extensive educational materials and tools.

Ultimate Account

To open Orbex’s Ultimate Trading Account clients need to make a deposit of $25,000, thus is suitable for traders of larger size. This account type is more suitable for professionals, offering more advanced opportunities. The account features raw forex spreads from 0.0 pips with a $5 commission per lot, and flexible trade sizes from 0.01 lots. Ultimate account is equipped with advanced tools and features, with exclusive access to webinars, and other great educational and research tools.

Swap Free Islamic Account

Orbex also enables Swap-free accounts which are modified so they can comply with Islamic religious beliefs. Swap-free account users are able to hold their positions for an unlimited time, without the need to pay any swap charges.

Regions Where Orbex is Restricted

Due to regulatory limitations, Orbex is restricted in a number of countries, including EU countries. Here we have compiled all the regions and countries that are the main focus of Orbex and residents of which can easily sign in with the broker:

- Kenya

- Ghana

- South Africa

- Uganda

- Nigeria

- Tanzania

- Rwanda

- UAE

- Saudi Arabia

- Kuwait

- Qatar

- Oman

- Egypt

- Bahrain

- Jordan

Cost Structure and Fees

Score – 4.4/5

Orbex Brokerage Fees

We have revealed that the Orbex pricing structure mainly depends on the kind of account selected. In this respect, the major difference is between the spread-based Starter Account and two others with commissions as a primary charge. Altogether, the cost structure is transparent, and the costs and fees are clearly mentioned on the website, so that clients can easily determine the main charges that will be applied, without hidden fees.

Orbex offers only one completely spread-based Starter account. The account integrates all the fees in spreads without imposing additional transaction costs. We find the spreads for this account in line with the market average. The average spread for EUR/USD is 1.5 pips, while the Gold average spread is 3.5 pips. As for the commission-based accounts, spreads start from 0.0 pips with commissions.

Orbex imposes commissions for two of its account types – Premium and Ultimate accounts. For Premium accounts, the commission is $8 with spreads starting from 0.0 pips. For the Ultimate account, Orbex applies $5 commissions combined with spreads from 0.0 pips.

Orbex also applies swap fees for overnight positions. For EUR/USD, the long swaps are -7.825, while the short swaps are 1.663.

How Competitive Are Orbex Fees?

Based on our research, we find Orbex fees quite competitive and in line with the market average offering. What is good about Orbex costs, is their transparency. The broker clearly states its spreads, commissions, and swap rates, which gives clarity and predictability to traders. Besides the spread- and commission-based accounts give clients more options to choose the one that meets their trading preferences the most. Usually, the spread-based structure is more favorable for beginner traders, while more professional clients tend to choose one of the commission-based accounts with a fixed fee and spreads from 0.0 pips. At last, Orbex fees mainly depend on the account type and the instrument traded, so our advice is to look for more info about the certain instrument on the broker’s website, which is easily available.

| Asset/ Pair | Orbex Spread | RoboForex Spread | Forex.com Spread |

|---|

| EUR USD Spread | 1.5 pips | 1.3 pips | 1.3 pips |

| Crude Oil WTI | 3.5 | 6.1 cents | 3.5 |

| Gold Spread | 3.5 pips | 1.8 pips | 71 cents |

| BTC USD Spread | 1904 | - | 100.0 |

Orbex Additional Fees

All in all, Orbex does not apply many additional fees, only standard ones that are common across the market. Below you can see what additional fees you will be charged with Orbex:

- Orbex applies Inactivity fees for accounts that have been inactive for 6 months. These accounts are classified as dormant and are subject to maintenance and administration fees of 20 USD.

- Generally, Orbex does not charge deposit and withdrawal fees. However, deposits under $50 are subject to payment processor fees.

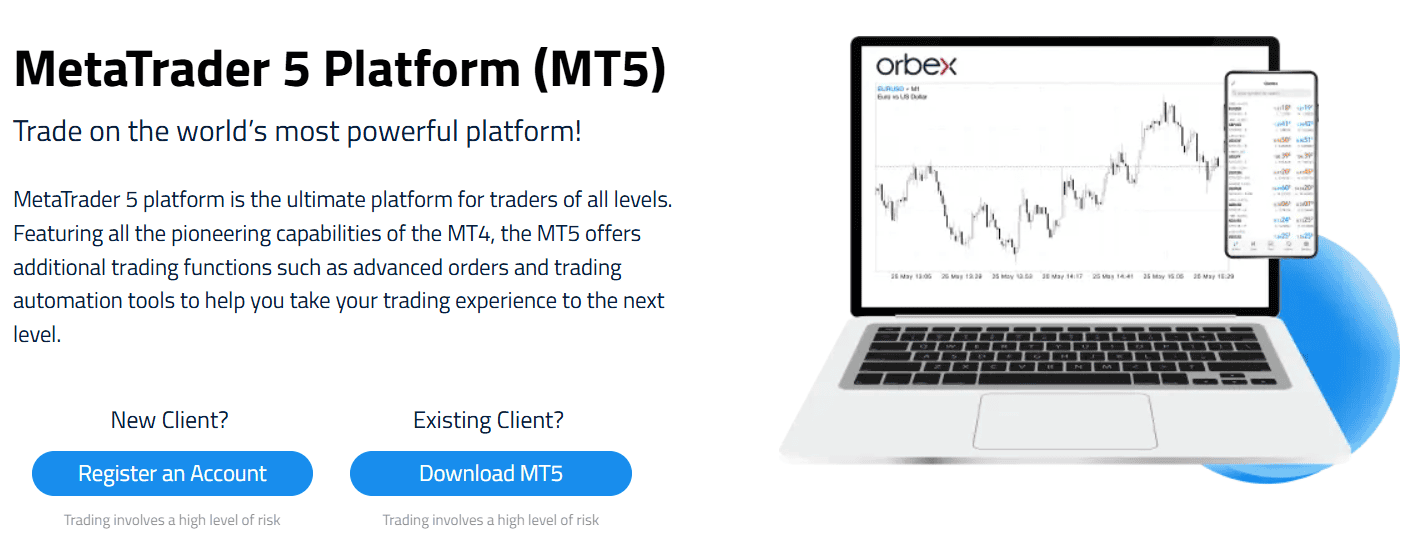

Score – 4.4/5

Orbex offers the most popular trading platforms among traders: MT4 and MT5. Both platforms are available through a web trader, desktop, and mobile app, which diversifies the offering and gives traders a variety of choices.

| Platforms | Orbex Platforms | XM Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Orbex Web Platform

Orbex Web Terminal is based on the browser, which enables secure trading without the need to download or install any software. The web terminal is available for both the MT4 and MT5 platforms with full features, including advanced charting tools, technical indicators, and real-time market access. Traders easily access their accounts, from any device connected to the internet. Thanks to the user-friendly interface, Orbex Web Terminal ensures a smooth trading experience both for beginners and more advanced traders.

Orbex Desktop MetaTrader 4 Platform

The Orbex MT4 is a powerful and intuitive platform, providing all the features and tools for a smooth trading experience. The platform includes advanced research tools for easy and in-depth analysis of the markets. It includes 30 technical indicators, customizable charts, and the option to create custom expert advisors and technical indicators. With 4 pending order types, 9 timeframes, and extra advanced features, the MT4 platform is a great choice for traders of different experience levels. The execution is accurate and fast, minimizing slippage and maximizing trading efficiency. The platform is available for both macOS and Windows, providing easier accessibility for every trader.

Orbex Desktop MetaTrader 5 Platform

Up to lately, Orbex hasn’t been offering an MT5 platform. At present the broker gives access to an innovative and efficient MetaTrader 5 that meets the needs of a wide range of traders, especially granting new possibilities to professionals. We found that MT5 comes in with 38+ technical indicators and 44 analytical charting tools, ensuring deep market analysis.

What we liked about the MT5 platform is the main focus on innovation and automation. The available advanced order types and robust trading robots will automate even complex strategies. The indicators, EAs, and backtesting within the platform are especially favorable for advanced traders who heavily rely on data-driven decisions. At last, with its fast execution, advanced features, and tools, MT5 can take the trading experience to the next level.

Main Insights from Testing

Based on our insights, both the MT4 and MT5 platforms are great offerings that will meet the needs of different traders. The Orbex MT4 platform is better suited for beginner and intermediate traders, providing ease of use, necessary tools, and fast speed of execution. The MT5 with its innovative solutions is great for advanced traders, providing enhanced features like technical indicators, a good number of charting tools, and full automation opportunities via Expert Advisors. All in all, the Orbex desktop platforms are an excellent choice for those who prefer the efficiency of the Meta platforms.

Orbex MobileTrader App

The Orbex Mobile App is a simple solution to trade on the go, available for download both in the App Store and Google Play. Setting up and managing the trading account is easy. Moreover, the application offers access to quality support with live chat. Besides, traders can keep up with daily market insight from expert researchers at Orbex and be ahead of the latest trends, making well-informed decisions anytime and from anywhere.

Trading Instruments

Score – 4.6/5

What Can You Trade on the Orbex Platform?

Based on our findings, Orbex offers CFD online trading with more than 400 tradable instruments, including Forex pairs, Commodities, Stocks, Cryptocurrencies, and Indices that are provided with deep liquidity from tier-1 banks through reliable and fast execution. With Orbex traders gain access to 60+ Forex pairs, over 200 Stock CFDs, 10 popular world biggest indices, and futures.

Main Insights from Exploring Orbex Tradable Assets

As our research revealed, Orbex has a good offering of 400 tradable instruments, including over 60 forex currency pairs, commodities such as gold, and oil, and stocks on CFDs thus provide diversification and market exposure.

Although we find the offering quite good, this is still an average range as there are brokers with a more intensive selection of instruments. Besides, the broker offers mainly CFD-based trading, which further limits traders from exploring traditional investments with real ownership of assets. Yet, access to various markets, combined with tight spreads, rapid execution, and account type diversity, makes Orbex a versatile broker serving traders of all levels.

Leverage Options at Orbex

Leverage is the possibility of loaning that may increase the trading size and potentially magnify profits. It is always defined by the regulatory restrictions in each jurisdiction. We found that Orbex offers pretty good conditions for high-leverage trading for all its clients through its MFSC entity.

- Orbex gives traders the opportunity to trade with up to 1:500 leverage and place bigger positions with relatively little capital.

- The leverage for cryptocurrencies is 1:2 and for Indices the maximum leverage is 1:100.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Orbex

Another crucial factor while selecting a Forex broker is to see how to transfer money to or from your trading account. Obviously, regulated brokers adhere to best practices and are regulated by their authority in terms of money management. We saw that Orbex offers a variety of ways for funding which is a great plus.

Here are the main deposit options that Orbex offers:

- Neteller

- Credit/ Debit cards

- Skrill

- WebMoney

- fasapay

- Wire Transfer

Minimum Deposit

The minimum deposit for Orbex depends on the account type you choose to trade. For the Starter account type, it is $100, for Premium $500, and for the Ultimate, it’s $25,000. Also, note that the conditions and strategies vary depending on the account type.

Withdrawal Options at Orbex

Orbex has a rule regarding withdrawals that traders should remember. They can withdraw as much as has been deposited, by using the same funding method. Afterward, the profits can be withdrawn separately by another method. The withdrawal process for credit/debit cards usually takes 3-5 business days. For eWallets, the withdrawal time is 24 hours.

Customer Support and Responsiveness

Score – 4.4/5

Testing Orbex Customer Support

Another positive aspect of Orbex is its dedicated customer service. The broker provides around-the-clock customer service during working days. Orbex service is available via emails, live chat, and international phone lines and is ready to answer in various languages through its service centers.

- It also has a Help Center section that includes the most essential questions regarding trading.

Contacts Orbex

Orbex’s customer support is helpful and quick, assisting clients through a variety of channels.

- Perhaps, the quickest way to get an answer is the Live chat Orbex offers. However, more complicated issues should be directed by mail or solved by a phone call.

- Orbex offers many different phone numbers and email addresses, each for a different kind of inquiry. Traders can easily find the contact information on the broker’s website. General requests to the support team can be made using the support@orbex.com email address. The global phone number provided is +442035198140.

- In addition, clients can send a Trading Query right from the broker’s website, by filling in the simple form and the question. These kinds of inquiries usually get quick answers.

Research and Education

Score – 4.6/5

Research Tools Orbex

Orbex generally offers research tools through its advanced trading platforms and via the additional tools and features it provides in its research section, while mainly we categorize them as typical tools most Brokers offer. Some of the main research opportunities provided are as follows:

- We find the broker’s Macroeconomics section an invaluable tool that provides traders with essential insights about global economic developments and the impact of the changes on the market. This section reflects upon key economic indicators, policies, and trends that can shape the market market.

- The Research Overview section includes important resources such as daily market updates, and technical and fundamental analysis. This section is an important source of information for traders who want to stay informed and refine their strategies based on informed decisions.

Education

Orbex offers a rich educational section available for all users for free. Orbex clients have access to such resources as live webinars, e-books, and e-courses, to help them make better-informed decisions. However, based on the chosen account type, traders can have access to more extensive education (for Premium and Ultimate accounts).

Orbex’s Trading Academy includes the following resources:

- Insightful articles, suitable for every trader

- Trading Hub that is suitable for traders of different experience, and includes tailored resources, tools, and services.

- Detailed videos that touch every aspect of trading with Orbex.

- A wide range of eBooks, such as Beginner’s guides, Risk Management Guide, and other eBooks will assist traders in different aspects of trading.

Is Orbex a Good Broker for Beginners?

Based on the extensive research we conducted, we have concluded that Orbex is a great broker for beginner traders. It is equipped with all the necessary trading tools and features, favorable trading conditions with competitive fees and different fee structures, a demo account, and popular platforms. The only concern traders have about Orbex is its regulation, as the broker is not overseen by a top-tier regulatory authority. This absence of rigorous rules might be a negative point for traders who prioritize tight regulations.

Portfolio and Investment Opportunities

Score – 4.1 /5

Investment Options Orbex

As to Investment opportunities with Orbex, there is a certain restriction, as the broker mainly focuses on CFD trading. This means traditional investments in stocks and shares, where traders own the underlying assets, are not available. However, there are still other investment opportunities Orbex offers its traders through PAMM accounts.

- Orbex PAMM accounts are an innovative solution for investors and professional traders who are looking for new investment opportunities. It allows investors to allocate their funds to professional traders called PAMM managers, who trade on behalf of the investors.

Account Opening

Score – 4.6/5

How to Open a Demo Account?

A demo account opening is a quick process, comprised of only filling out a registration form. Here are the main steps for a demo account opening:

- Choose the ‘Try Free Demo from the broker’s website

- Fill in the name, residency, phone number, and email address

- Choose the platform, account type, base currency, and the initial virtual fund amount

- Submit the application form

- Once verified, you can start trading

How to Open an Orbex Live Account?

To open an Orbex live account clients should be 18 or older. There are several simple steps to complete in order to open a live account. See below:

- Fill in the Instant Registration form and click “Continue”

- The broker will then email you a verification link to your email address

- Click on the link and proceed with the activation of My Orbex (Member area)

- Set your password for the My Orbex area and access it to complete the registration form

- Upload the required documents

- Proceed with depositing funds

- Then receive the Trading Account login details and start trading

Score – 4.2/5

Orbex offers good tools and features on its trading platforms, and this is mainly all what Broker offers, there are no extensive range of Extra Trading tools like other Brokers offer. Especially the MT5 platform is equipped with innovative solutions that take trading to another level. Yet, Orbex also offers a few additional tools on its website that are easy to access and assist traders in their strategies.

- VPS or Virtual Private Server, is a virtual computer with full functionality and is connected to the trading account 24/5, ensuring undisturbed and uninterrupted trading.

- Economic Calendar is an essential tool that can be beneficial for any trader, regardless of experience level. The calendar is a great tool that keeps traders informed about essential economic events, that are likely to impact the market.

- FIX API is an advanced technology for the real-time information exchange of financial data. Brokers that provide FIX API technology offer a substantial service of connecting traders and tier-1 liquidity providers. This means that trades are executed with no latency and precision.

Orbex Compared to Other Brokers

While comparing Orbex with other brokers, we find that the broker excels in its own ways, targeting different trader needs. The first essential aspect we compare is the broker’s regulation. We found that Admiral Markets offers a better regulatory framework, with tight regulations, while Orbex holds only offshore licenses. However, one of the best aspects of Orbex is its advanced educational resources which also ensures that the broker is favorable for beginners who look for guidance and assistance. On the contrary, Exness provides only basic educational resources.

Although Orbex offers a competitive fee structure with average spreads and commissions, FP Markets and Eightcap stand out for low pricing with tight spreads. In terms of leverage availability, the broker offers a multiplier as high as 1:500, although Exness is known for its up to 1:2000 leverage. As for instruments, Orbex has an average of 400+ tradable products, while RoboForex is still the go-to option for traders with its 12,000+ available instruments. At last, while Orbex offers the popular MT4/MT5 platforms with enhanced tools and features, we found that FP Markets provides unique platforms that enable more opportunities and diversity for traders.

| Parameter |

Orbex |

Pepperstone |

RoboForex |

Exness |

FP Markets |

Admiral Markets |

Eightcap |

| Spread Based Account |

From 1.5 pip |

From 1 pip |

Average 1.3 pip |

From 0.2 pips |

From 1 pip |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

Average 1 pip |

| Commission Based Account |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $4 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + from $0.02 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/Average |

Average |

Low |

Low/ Average |

Low/ Average |

Low/Average |

| Trading Platforms |

MT4, MT5, Orbex app |

MT4, MT5, cTrader, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4, MT5, TradingView |

| Asset Variety |

400+ instruments |

Over 1,200 instruments instruments |

12,000+ instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

800+ instruments |

| Regulation |

MFSC, FSA, SVG |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

|

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent education and research |

Good |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$100 |

$0 |

$10 |

$10 |

$100 |

$1 |

$100 |

Full Review of Broker Orbex

In conclusion, our research of Orbex demonstrates that it is a valid, internationally recognized broker, especially in the MENA region, offering diversified and competitive trading solutions. As such, Orbex is particularly appealing for its wide range of account types, and comprehensive platforms featuring advanced tools and conditions. Orbex gives a good choice of fee structure, variable spreads, and fixed commissions.

Despite its strengths, the broker operates only as an international entity. Although the broker has established itself as a reliable broker, earning a huge community of traders, it does not hold a top-tier license, and it might not be a good suit for traders who prioritize rigorous regulations.

However, due to its flexibility, high leverage availability, and access to strategies like scalping and hedging, Orbex is an excellent choice among professional traders. What we find especially great about the broker is its extensive education, suitable for both beginners and experienced traders. Besides, Orbex constantly enhances and expands its features, which is also a positive point for a broker, showing Orbex’s aspiration for growth and development.

Share this article [addtoany url="https://55brokers.com/orbex-review/" title="Orbex"]

Can one operate a pamm account with you?

Can one operate a pamm account with you?

And what is the minimum deposit?

First of all I would like to highlight that although I’m an EU citizen my trading account was opened in Mauritius. I traded with the company for more than a month and the things were going alright and managed to make some around E2000, but than it started to loose money so I decided to open a sub account in case the spreads were changed.

but when I sent a withdrawal request for some of the funds I received an email that after an internal investigation suggested that the strategy used is not allowed so all the profits and loses were cancelled. So I woke up to O balance in my account, bare in mind that initial deposit was E500.

all I used was an Expert Advisor and their term and conditions specified that EAs, hedging and scalping are allowed.

before you sign up with them think if it’s worth to take the risk!! if you manage to make profits they can always take advantage of Art 9 of their terms and conditions which are unclear in regards your trading strategy.

I raised a complaint with them and they refuse to give me a Case Reference number which states no one actually taking this serious.

Dear Ramona Alina,

We are deeply sorry for your experience. And although these events were highly unfortunate, we would like to stress that we have no bias against our clients, since as you mentioned; all trades were canceled, including the losing ones, and you were able to withdraw the initial balance. That being said, your account was automatically flagged for using an abusive trading technique and we were forced to act accordingly.

Furthermore, regarding the use of EAs, we would like to point out that these run on the client’s end and we have no control over their behavior. And generally, we do encourage the use of any resources that would help our clients perform better, as long as they are legitimate, except when the trading behavior is deemed abusive.

At Orbex, we pride ourselves on our healthy and thriving trading community, which you are welcome to join again at anytime as long as you adhere to our trading conditions.

Sincerely,

The Orbex Team