- What is Eurotrader?

- Eurotrader Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

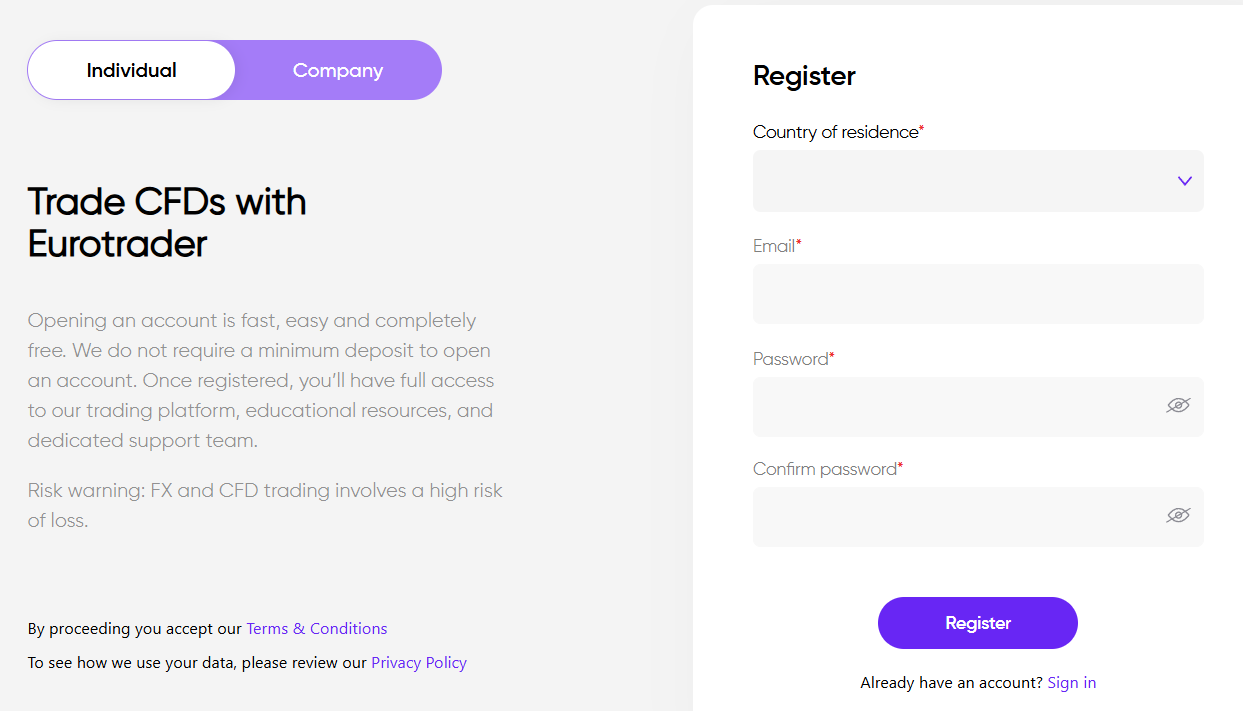

- Account Opening

- Additional Tools And Features

- Eurotrader Compared to Other Brokers

- Full Review of Broker Eurotrader

Overall Rating 4.4

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is Eurotrader?

Eurotrader is a Forex and CFD trading broker, offering traders access to a variety of trading instruments, including Forex, CFDs, Cryptos, Indices, Commodities, and Shares.

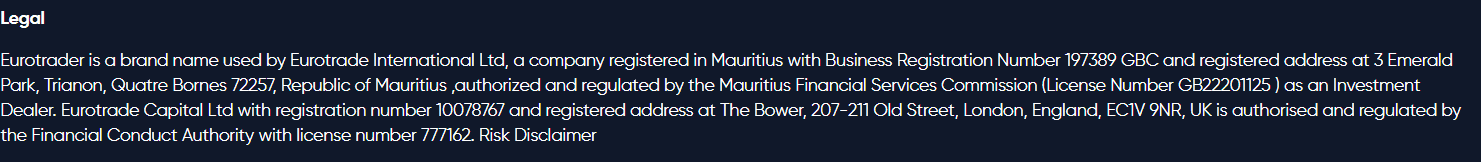

Based on our research, the broker is headquartered in Cyprus and is regulated and authorized by the reputable European regulatory body CySEC. Additionally, the company has a license from the reputable FSCA authority. It also has a presence in Mauritius and Seychelles, being authorized by the FSC and the FSA, respectively. Moreover, the broker holds a top-tier FCA (UK) license; however, the regulatory authority indicates some restrictions on the firm’s financial activities.

In general, the broker offers competitive trading conditions and efficient execution of trades through the advanced MetaTrader trading platforms.

Eurotrader Pros and Cons

Per our findings, the broker presents both pros and cons that are important to consider. On the positive side, Eurotrader offers competitive trading conditions, a low minimum deposit requirement, and access to the well-known MT4 and MT5 trading platforms. Additionally, the firm provides comprehensive learning materials and tutorials, enabling clients to make informed trading decisions.

For the cons, there is no 24/7 customer support available. Also, the brokerage offers a restricted range of financial instruments and markets compared to other Forex brokers.

| Advantages | Disadvantages |

|---|

| European license and oversight | No 24/7 customer support |

| FCA regulation | Limited trading products |

| Good trading conditions | |

| Low minimum deposit | |

| Advanced trading platforms | |

| Competitive pricing | |

| Education | |

| Professional trading | |

Eurotrader Features

According to our analysis, Eurotrader provides reliable trading solutions with competitive pricing, an attractive option for all levels of traders. Moreover, the broker offers access to advanced platforms that allow users to trade well-known financial products. Here are the main aspects of trading with Eurotrader to see how the broker fits with traders’ trading expectations.

Eurotrader Features in 10 Points

| 🗺️ Regulation | CySEC, FCA, FSCA, FSC, FSA |

| 🗺️ Account Types | Raw Spread and Standard accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Cryptos, Indices, Commodities, Shares |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR, USD, GBP |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Eurotrader For?

Eurotrader is a secure trading opportunity, offering great trading services and diverse features and tools for an efficient experience. Based on our financial expert opinion, the broker is especially suitable for the following:

- European traders

- International clients

- Currency trading

- Professionals

- Swap-Free Trading

- Beginners

- Advanced clients

- Competitive spreads and fees

- Good education and trading tools

- EA/Auto trading

Eurotrader Summary

Eurotrader is a trustworthy Forex broker that offers competitive trading conditions, efficient execution, and low trading fees. The broker provides popular MetaTrader trading platforms, which are equipped with advanced features and tools suitable for various levels of traders. Additionally, traders have access to a wide range of educational materials that support them in expanding their knowledge and staying informed about the market.

Overall, we found that the firm provides a good trading environment, however, there are drawbacks as well, such as trading within offshore zones and the absence of 24/7 customer support. Therefore, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Our research on Eurotrader revealed a reliable trading opportunity for traders of different levels. The broker is tightly regulated by some of the most respected authorities in the financial world, including the top-tier FCA and CySEC.

The broker offers various account types with different fee structures and conditions so that clients can choose the one best suited for their trading volume, expectations, and needs. With the broker, trades are conducted on the popular MT4 and MT5 platforms, packed with advanced and innovative capabilities. Also, clients can access features such as copy trading, PAMM accounts, and free VPS.

The education and research sections are also quite impressive, serving both beginner and advanced traders with a wide range of learning resources. Traders have access to a demo account, 24/7 dedicated customer support through multiple channels, and different bonus opportunities.

All in all, trading with Eurotrader will ensure a safe and positive experience, enabling traders to expand their portfolios in a favorable environment.

Consider Trading with Eurotrader If:

| Eurotrader is an excellent Broker for: | - Beginner traders

- Professional traders

- Clients from Europe

- International traders

- MT4 and MT5 platform enthusiasts

- Cost-conscious traders

- Copy traders

- Those looking for PAMM account opportunities

- Swap-free trading

- Clients looking for an access to a wide range of assets

- Commission-free trading

|

Avoid Trading with Eurotrader If:

| Eurotrader is not the best for: | - High-volume or institutional traders

- Traditional investors

-Traders looking for MAM accounts

- Clients prioratizing24/7 customer support |

Regulation and Security Measures

Score – 4.7/5

Eurotrader Regulatory Overview

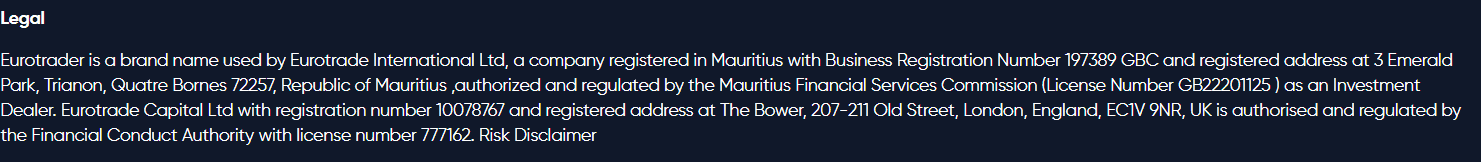

Eurotrader is a trustworthy broker ensuring a low-risk trading environment. It is authorized and regulated by the top-tier FCA in the UK, as well as by the well-regarded Cyprus Securities and Exchange Commission (CySEC) and FSCA in South Africa.

Thus, the broker is a legitimate and regulated brokerage firm that holds the necessary licenses and follows regulations for offering Forex trading services. The broker’s compliance with industry standards is assured by its regulation under reputable authorities, which ensures compliance with established financial and industry standards.

- However, the broker is also regulated in offshore zones. Therefore, traders should conduct their research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy.

How Safe is Trading with Eurotrader?

According to our findings, Eurotrader adheres to certain industry standards and compliance requirements, which include client fund protection and segregation from company funds. Moreover, the broker offers additional protections, such as negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

- However, conduct thorough research and carefully examine the firm’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the broker, as trading conditions can vary across jurisdictions.

Consistency and Clarity

Since its establishment in 2018, Eurotrader has offered consistent and constantly developing services to please its clients worldwide. The broker has acquired top-tier licenses and established its services in different regions to be available to not only European clients but also global customers.

All in all, the transparent trading conditions, including fees, favorable platforms, and a selection of available instruments, make the broker a trustworthy choice for many. The reviews of real clients show the broker’s credibility, pointing out good customer support, favorable fees, prompt deposits and withdrawals, and fast trading executions. However, along with the positive feedback, some traders share their negative experiences of withdrawal delays and unexpected account terminations.

Besides, the broker operates under several entities, including offshore ones; thus, the trading conditions may be different, and the protection measures may not be the same for all the entities.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Eurotrader?

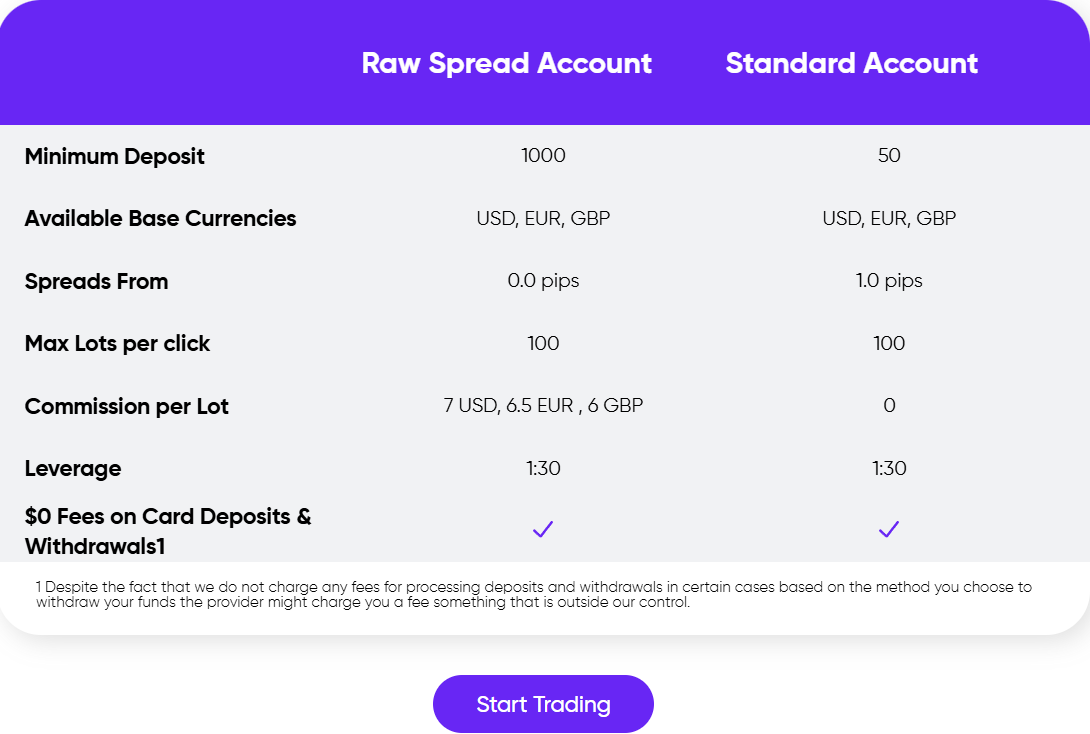

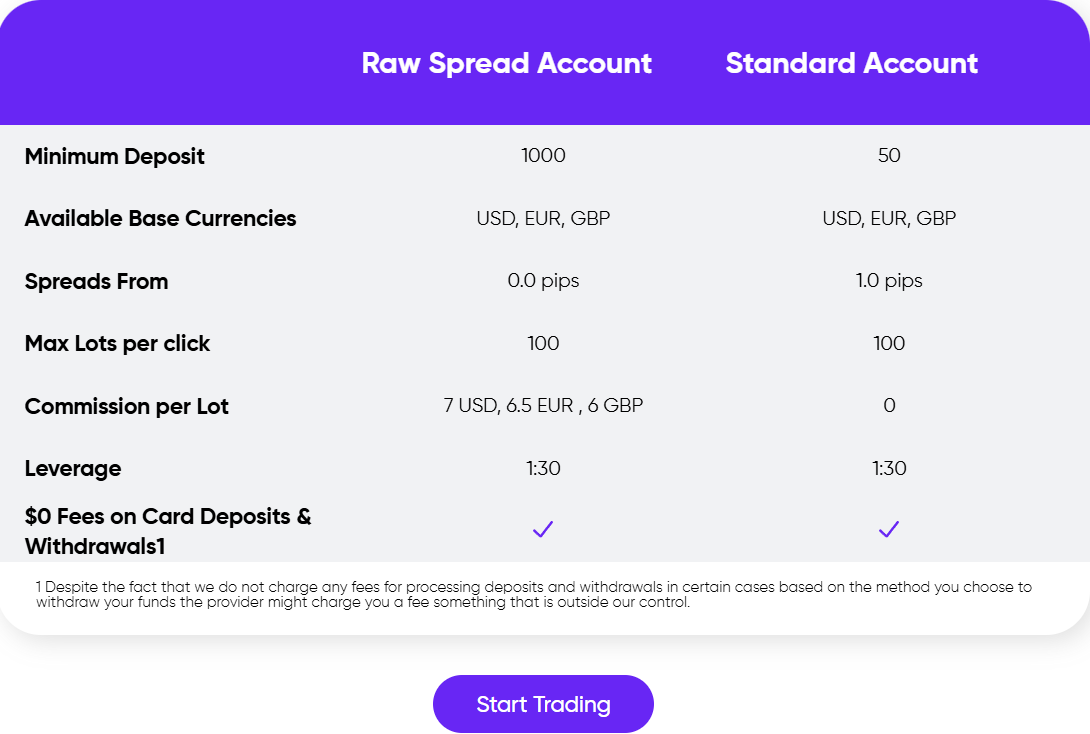

Per our research, the broker offers Raw Spread and Standard Accounts tailored to meet the needs of traders. The accounts differ in fee structure, deposit requirement, trading volume, and other aspects, giving traders an opportunity to choose an account that meets their trading style the most.

However, both account types have certain similarities, such as access to the same range of instruments, availability of MT4 and MT5 platforms, and the leverage opportunity of up to 1:30 for European traders.

- The Standard account has a $50 deposit requirement, ideal for cost-conscious or beginners who want to start with smaller investments. The account type is spread-based, with an average spread of 1 pip for the EUR/USD Forex pair.

- On the other hand, the Raw Spread account, as the name suggests, applies raw spreads from 0.0 pips, combined with a $7 commission per lot. This account type is more suitable for advanced traders, and the initial funding requirement is higher, starting at $1,000.

- In addition, Eurotrader offers Swap-Free accounts for religious purposes. The Swap-free account does not apply any commissions, and spreads start from 1.1 pips. The minimum deposit is $50.

The initial deposit requirement for a Standard account is $50. Additionally, international entities offer Swap-Free accounts for religious purposes.

Regions Where Eurotrader is Restricted

Due to its multiple regulations, both in the European region and globally, Eurotrader offers its services to a large list of countries. However, due to regulatory restrictions, the broker is not available for residents of certain countries, as well as countries included in sanction lists. Besides, the availability of services depends on the entity under which clients are registered.

The Eurotrader’s services are not available in the following countries:

- The United Kingdom

- The United States

- Canada

- Japan

- Australia

- Belgium

Cost Structure and Fees

Score – 4.4/5

Eurotrader Brokerage Fees

After examining the broker’s fee offering, we found that Eurotrader provides competitive pricing for most trading services. The broker offers two main account types, and the trading structure depends on the accounts, either a spread-based or commission-based structure. Those clients who prefer raw spreads combined with fixed commissions for each trade can choose the Raw Spread account. The Standard account, on the other hand, offers spreads that integrate all the trading costs.

Based on our test, the broker provides competitive spreads with an average spread of 1 pip for the EUR/USD currency pair in the Forex market for the Standard account. The raw Spread account offers spreads from 0.0 pips, combined with transaction fees.

However, spreads can vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

Eurotrader offers only one commission-based account, the Raw Spread account. It offers spreads from 0.0 pips, combined with fixed commissions of $7 (6.5 EUR or 6 GBP). The commission-based account is a good fit for more professional clients looking for fixed and predictable fees for each trade.

Eurotrader also applies swaps for positions held open overnight. The long swaps for the EUR/USD pair are -6.76, and the short swaps are 2.43. However, the swaps are changeable, so we recommend checking them on the broker’s website for updated details. Besides, swaps are different for each instrument, so checking is essential.

How Competitive Are Eurotrader Fees?

Based on our research, Eurotrader offers competitive fees for most of its instruments. The fees are based on the account type, the instrument traded, and the entity.

The broker offers spread and commission-based accounts, each with its own conditions and applicable charges. The average spread for the standard account is 1 pip, which aligns with the market average. The applied commissions are also average, at $3.5 per side per lot. Eurotrader also applies a swap fee for overnight positions. Swaps are different for each instrument, so it is better to check before placing a trade, especially since they can change due to market conditions.

All in all, the broker has a transparent fee structure with no hidden fees. Clients should also confirm the applicable charges for the entity they are signing with, as the costs may differ from jurisdiction to jurisdiction.

| Asset/ Pair | Eurotrader Spread | XTrend Spread | Fortrade Spread |

|---|

| EUR USD Spread | 1 pips | 0.2 pips | 2 pips |

| Crude Oil WTI Spread | 0.030 | 0.024 | 0.04$ |

| Gold Spread | 0.35 | 0.07 | 0.45$ |

Eurotrader Additional Fees

As we have found, the broker does not impose deposit and withdrawal fees. However, there might be additional charges imposed by the payment provider.

- The broker does not charge inactivity fees for accounts dormant for less than six months. After being dormant for six consecutive months, there is a monthly fee of $25.

Score – 4.3/5

At Eurotrader, you can trade through the advanced MT4 and MT5 platforms, which are known for their strong features, intuitive interface, advanced charting tools, and extensive trading capabilities.

Additionally, they are accessible on desktop, web, and mobile devices, allowing users to select the option that suits their individual trading preferences and strategies.

| Platforms | Eurotrader Platforms | XTrend Platforms | Fortrade Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Eurotrader Web Platform

Eurotrader offers its clients the option of a webtrader. The availability of WebTrader eliminates the need for downloads and installations. As we have found, the platform includes all the essential tools for an advanced trading experience. Traders have access to extensive analytical tools, including charts and graphical objects, and can enjoy ultra-fast execution.

Yet, the most important feature of the broker’s web-based platform is its flexibility, enabling traders to access their accounts from any browser, just with internet connectivity.

Eurotrader Desktop MetaTrader 4 Platform

We found that the broker offers a range of advanced charting tools, analytical technologies, trading signals, technical indicators, and other features through the popular MT4 platform. Also, the MetaTrader 4 platform offers automated trading capabilities, empowering traders to detect market movements and improve their market entry and stop-loss strategies.

The MT4 platform has a user-friendly, easy-to-use interface, enabling even inexperienced traders to navigate the platform without difficulty. The MT4 platform is available through web, desktop, and mobile apps, ensuring better accessibility.

Eurotrader Desktop MetaTrader 5 Platform

The Eurotrader’s MT5 platform includes all the features of the MT4 platform, plus it includes more innovative features, ensuring a better trading experience. Clients have access to a greater number of charts and graphical objects. MT5 is available for web, desktop, and mobile trading and can be downloaded for all the essential operating systems.

The platform offers charting and analytical capabilities, built-in indicators, multiple timeframes, algorithmic trading, and various strategies, such as hedging. The platform also enables backtesting, optimization, customization capabilities, and more. Besides, with MT5, traders have access to a larger number of tradable products.

Eurotrader MobileTrader App

Eurotrader enables its clients to conduct trades on the MT4 or MT5 mobile apps. This mobility allows users more flexibility and easier access to their accounts from anywhere in the world. The apps are compatible with both iOS and Android systems and are easily accessible. They include all the essential tools and features for profitable training; thus, users are not restrained when making trades through their phones. Those who prefer mobile trading will appreciate the easy-to-use interface, one-click trading, great charting and indicators, and other capabilities.

Main Insights from Testing

Like many other brokers, Eurotrader offers its clients the opportunity to conduct trades on the popular retail MT4 and MT5 platforms. Traders can enter their accounts through web, desktop, and mobile apps, ensuring flexibility and versatility. All the platforms are easily downloadable and have all the essential tools and features for an efficient experience. Although the broker does not offer other advanced alternatives, such as cTrader or TradingView, the offering is still good and can satisfy beginners and professional users.

Trading Instruments

Score – 4.4/5

What Can You Trade on the Eurotrader Platform?

Eurotrader provides access to popular instruments, such as Forex, CFDs, Cryptos, Indices, Commodities, and Shares. The firm enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

Traders gain access to more than 50 currency pairs, can speculate on market changes of the most popular stocks, gain access to global indices, trade cryptocurrency CFDs, and more.

Main Insights from Exploring Eurotrader Tradable Assets

As we have found, the broker offers about 2,000 tradable products across a good range of financial assets. This range enables traders to diversify their trades and explore the market further. Although the broker offers an impressive number of instruments, all the products are on CFDs. This means those who prefer long-term investments will not be able to take advantage of this proposal.

All in all, the broker offers major, minor, and exotic Forex pairs, a total of 50 in number. Clients can also trade CFD stocks of such popular companies as Amazon, NVIDIA, Apple, Ferrari, and others. Besides, Eurotrader offers popular cryptocurrencies, including Bitcoin, Litecoin, Ethereum, Ripple, etc. Also, clients have access to global indices and popular commodities like gold, silver, and oil.

Yet, as the broker operates under different jurisdictions, we advise traders to carefully consider the instrument availability for each entity before opening an account.

Leverage Options at Eurotrader

Leverage can be beneficial for traders as it enables them to enter the market with a smaller initial investment. However, they should understand the associated risks before participating in leveraged trading.

Eurotrader leverage is offered according to CySEC, FCA, FSCA, FSC, and FSA regulations:

- European, South African, and UK residents are eligible to use a maximum of up to 1:30 for major currency pairs.

- International clients may use higher leverage up to 1:1000, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Eurotrader

Eurotrader offers a variety of payment methods for traders to deposit funds into accounts, including wire transfers, credit/debit cards, and e-wallets. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

- The broker does not apply deposit or withdrawal fees. However, we advise considering transaction fees that can be incurred from the side of the payment provider.

- All the deposit methods are instant. However, bank wires generally take from 1 to 5 working days.

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $50 as an initial deposit amount for the Standard account type. For the Raw Spread account, the minimum deposit requirement is $1,000.

Withdrawal Options at Eurotrader

Based on our analysis, the withdrawal process is both convenient and swift. The broker does not charge fees for withdrawals. However, for withdrawal requests without any prior activity will be applied a $2 fee.

- The minimum withdrawal amount is $10.

- Withdrawals will take up to 1 working day for all payment methods.

Customer Support and Responsiveness

Score – 4.6/5

Testing Eurotrader Customer Support

The broker offers 24/5 customer support via live chat, email, and phone line. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- Eurotrader has an FAQ section, where everyone can find answers to general trading issues, account-related questions, funding, and more.

- The broker is also active on social platforms, providing essential and updated information on the market and its activities through Facebook, LinkedIn, X, and Instagram.

Contacts Eurotrader

Eurotrader provides dedicated and helpful customer support through different channels. Clients can choose the most comfortable option for communication with the support team:

- Live chat support is perhaps one of the quickest ways to get relevant answers and solutions to urgent issues.

- The call-back service is another convenient option, as traders can choose a suitable time when the support team can call them.

- Clients who prefer to direct their questions, issues, and suggestions via email can use the provided address: support@eurotrader.com.

- Besides, the broker provides a phone number for those who need to speak to a customer agent directly: +44 20 80047430.

Research and Education

Score – 4.4/5

Research Tools Eurotrader

Eurotrader offers two advanced platform options, which include all the essential tools and features for deep market research and analysis.

The platforms’ research capabilities are also complemented by additional tools available on the broker’s website:

- The Economic Calendar is one of the most demanded tools to learn about upcoming market events, changes, and movements. It helps clients make informed decisions based on the current market situation.

- The broker also offers an all-in-one calculator, which traders can use to calculate pips, risks, and profits.

Education

As to the educational resources, the broker offers a variety of learning materials such as platform tutorials, video courses, eBooks, and more. These resources are all designed to enhance the knowledge and skills of traders.

- The eBooks cover everything about trading, from the basics to complicated strategies. This is a great way to acquire deep knowledge of the market.

- Video courses provide essential knowledge from professional coaches.

- Clients will also learn market terminology from A to Z, getting to know the complicated terms and expressions and turning them into comprehensible knowledge.

Is Eurotrader a Good Broker for Beginners?

Generally, after reviewing all the aspects of trading with Eurotrader, we can conclude that the broker can be a good first trading choice for beginner traders. It offers easy-to-use yet advanced platforms, a good instrument range, competitive costs, a low minimum deposit of $50, and a demo account to practice before engaging in live trading.

Besides, the broker’s education and research sections are good and equipped with materials for every kind of trader. The 24/5 customer support delivers dedicated services to clients through multiple options.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options Eurotrader

Although Eurotrader offers a good selection of financial assets, it still does not provide long-term trading and traditional investment opportunities. However, we have found that traders have alternative investment options with the broker.

- PAMM accounts, as the name suggests, Percentage Allocation Management Module, enable account managers to manage multiple accounts simultaneously, and the profits are based on the percentage. The PAMM account is available through the MT4 platform.

- Through the Copy Trading feature, advanced traders are able to build a substantial follower base. Clients can copy their profitable trades and gain profits. This way, the signal providers not only earn income but also gain popularity among fellow traders.

Account Opening

Score – 4.5/5

How to Open a Eurotrader Demo Account?

The demo account feature is beneficial for different traders to practice their skills and try new strategies before trading with real funds. By choosing the demo account, traders learn how to navigate the platform, test new strategies, and discover which markets meet their trading potential.

Here are the main steps to open a demo account with Eurotrader:

- Go to the broker’s website and choose the ‘Demo account’ option.

- Start the registration process by filling out the form.

- Provide the required information (name, email address, country of residence, and password).

- After completing the registration process, clients will be directed to the Eurotrader dashboard, where they will choose the demo version and indicate the account currency, trading platform, and leverage.

- Then, the broker will send the account credentials to the provided email address.

- After downloading the referred platform, clients can use the credentials to access their accounts and start practicing.

How to Open a Eurotrader Live Account?

Opening an account with the broker is quite an easy process, as you can log in and register with the broker within minutes. Traders should click on the ‘Register’ button and proceed with the guided steps:

- Start the registration process.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 4/5

We have already discussed Eurotrader’s trading tools and features, including those in the broker’s platform and research section. However, the broker offers a few unique opportunities that will elevate the trading experience of clients.

- Eurotrader includes in its proposal Trading Central, to provide its clients with additional trading alerts, detailed analysis, coverage of 1,000+ markets, risk ratings, short, medium, and long signal choices to match the trading strategy.

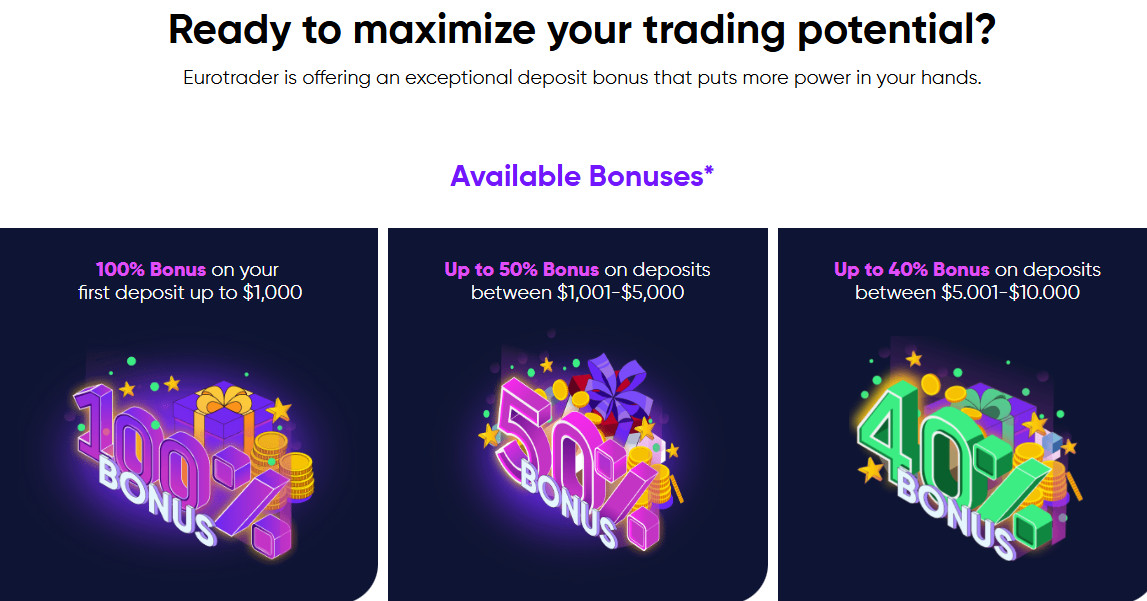

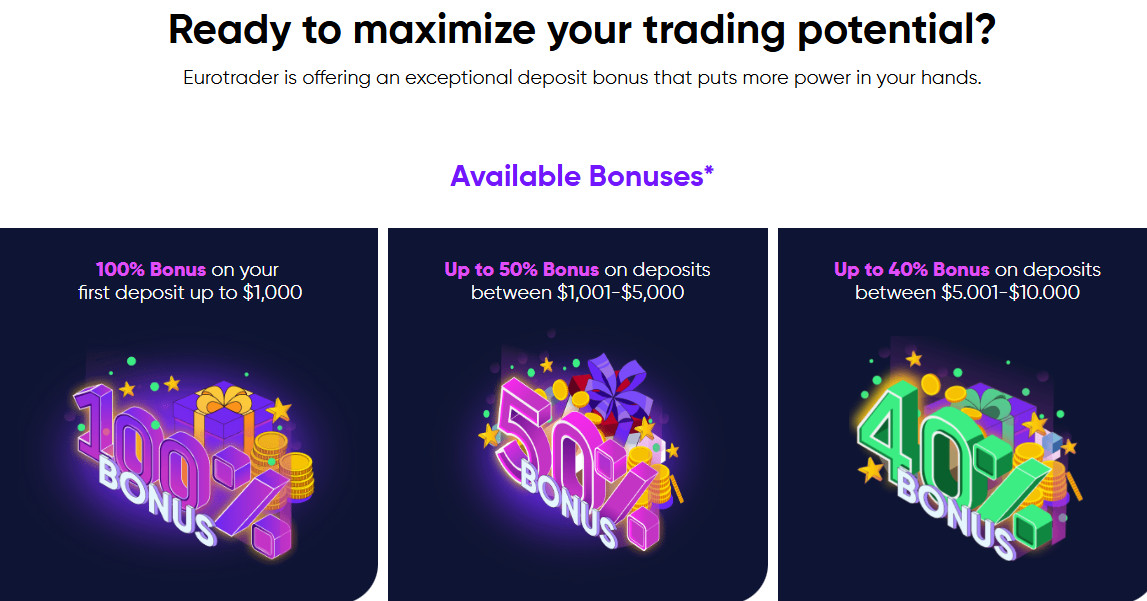

- The broker offers a 100% bonus for deposits up to $1,000, a 50% bonus on deposits from 1,001 to 5,000, and a 40% bonus for deposits between $5,001 to $10,000.

Eurotrader Compared to Other Brokers

We have compared Eurotrader to other brokers to understand where it stands in the market. As we have found, Eurotrader holds multiple licenses, ensuring the broker’s credibility and adherence to strict rules. Like Forex.com, Eurotrader holds licenses from the FCA and CySEC. However, Forex.com holds another top-tier license from ASIC, offering extra protection for its clients.

Then we compared the broker’s trading charges and found that they were average. Admirals offers spreads from 0.6 pips, whereas Forex.com’s spreads are at 1.3 pips. Eurotrader offers 1 pip for the EUR/USD pair, which is an average proposal.

Almost all the brokers we reviewed offer trading through the MT4 and MT5 platforms, including Eurotrader. In this respect, Forex.com offers more diversity with its Forex.com Web Trader and TradingView. Like OneRoyal, Eurotrader also includes over 2,000 tradable products across multiple markets. The best offering is from Admirals, with over 8,000 instruments. The most modest offering is from Tradeview, with only 200 available products. The broker also offers a good educational section. In this respect, Admirals and Forex.com also stand out, while XS has limited resources. The minimum deposit is on the lower side with a $50 initial requirement. All the other brokers offer cost-conscious options, with the exception of Tradeview, which has a higher deposit requirement.

| Parameter |

Eurotrader |

Admiral Markets |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread-Based Account |

Average 1 pip |

From 0.6 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission-Based Account |

0.0 pips + $3.5 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, Admiral Markets app |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

2,000+ instruments |

8000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

CySEC, FCA, FSCA, FSC, FSA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$50 |

$1 |

$100 |

$0 |

$50 |

$250 |

$1000 |

Full Review of Broker Eurotrader

We have reviewed all the aspects of trading with Eurotrader and drawn the following conclusions. The broker is tightly regulated by one of the best-regarded financial authorities, the FCA. It also holds a license from another respected authority, CySEC, as well as additional licenses from FSCA, FSC, and FSA.

The costs offered by Eurotrader are competitive, mostly average, or low for some instruments, with 1 pip spreads for the EUR/USD pair. For the commission-based account, there is a fixed $3.5 transaction fee for each trade.

Trades are conducted through the popular MT4 or MT5 platforms, giving traders access to innovative tools and features. Traders can trade multiple assets, 2000 tradable products in total, and expand their portfolios and experience. However, the instruments are on CFDs, which restricts long-term investment options.

Another advantage of the broker is its educational section with video courses, trading terms, eBooks, access to Trading Central, and much more. Besides, access to a demo account and the initial low deposit make the broker a favorable choice for beginner traders. Eurotrader also offers a bonus program to encourage its clients in their trading journey.

However, since the broker operates under multiple entities, traders should consider the differences between them before opening an account.

Share this article [addtoany url="https://55brokers.com/eurotrader-review/" title="Eurotrader"]